-

CENTRES

Progammes & Centres

Location

On Wednesday, July 29th, the US House of Representative’s antitrust subcommittee summoned the CEOs of four tech giants – Mark Zuckerberg of Facebook, Jeff Bezos of Amazon, Tim Cook of Apple and Sundar Pichai of Google – to testify at a historic hearing to determine whether the companies had abused their vast market power by misusing data and stifling competition to dominate the market. Since June, the subcommittee had been gathering testimonies from smaller competitors about the alleged monopolistic practices of big tech, and July 29th marked the first time the CEOs were summoned together for a congressional hearing.

At the hearing, a 15-member panel of democratic and republican lawmakers presented evidence and posed nuanced questions ning Amazon’s use of seller data to develop competing products, Facebook’s acquisition of Instagram in an apparent bid to retain market dominance, Google’s alleged theft of content from smaller businesses, Apple’s preferential treatment of some developers on its AppStore, and even the companies’ “liberal bias” that saw conservative voices reportedly being stifled on online platforms. While all CEOs invariably denied accusations of engaging in anti-competitive practices, the hearing was significant as it threw light on the subcommittee’s year-long investigation into big tech. It also showed that formal antitrust cases may be imminent against some companies and that lawmakers are actively contemplating new regulations in this space. The subcommittee is expected to publish its report in the coming months.

Similar antitrust investigations against big tech are increasingly being seen in other parts of the world as well. The European Union has already fined Google on three separate occasions since 2017, the most recent being March 2019, when it imposed a €1.5 billion fine for antitrust violations in the online advertising market. In July 2019, the European Commissioner for Competition launched a formal investigation into Amazon’s use of sensitive seller data in breach of EU competition rules. The Competition Commission of India, in January 2020, had also begun looking into the anti-competitive practices of Amazon and Walmart-owned Flipkart, while South Korea’s Fair Trade Commission is preparing a similar investigation against Google and Korean search engine Naver.

In a separate development in the US, President Donald Trump on Thursday, August 7th, issued executive orders that would see social media apps TikTok and WeChat being banned in the country if they are not sold by their Chinese parent companies to a US company within 45 days. The orders describe these apps as security concerns as they are prone/open to data requests by the Chinese government, which could threaten the US’ national security, foreign policy and economy. President Trump’s orders largely follow India’s example in banning 59 Chinese apps in June (including TikTok and WeChat), followed by another 47 apps in July, citing concerns that these apps had been stealing and surreptitiously transmitting user data to servers located outside India. Microsoft is already in talks to purchase TikTok, though Chinese authorities have also expressed outrage over the “kidnapping” of Chinese apps.

The 20th century dictum: never waste a good crisis.

The 21st century correction: if it’s China tech, let the crisis-opportunity pass.

As Microsoft— the world’s third most-valuable company after Saudi Aramco and Apple—gets ready to buy the US, Australia and New Zealand assets of TikTok’s parent company ByteDance, it might be living in paradigms of the past, where you identify a rising sector you’re not present in, focus on a good brand, undertake a due diligence, buy and ride. Apart from the several problems in such a model, particularly in a rapidly-moving technological paradigm or amid constantly-changing consumer preferences, Microsoft’s track record of such acquisitions, Hotmail in 1997 for instance, has not been sparkling. If the purchase goes as reported, TikTok could become a millstone around its neck and Microsoft will end up salvaging the Chinese company but eroding its own value.

There are five reasons for this.

First, being a Made in China product, TikTok is already a political reject, as will several other apps from this aggressive nation trapped in a medieval mindset. Led by India, now the US has also banned TikTok; other countries, notably in Europe, will follow.

Second, as a result of this political rejection, the speculative value of the company, between $20 billion and $50 billion, will crash within months.

Third, there is no point buying country-limiting assets of TikTok when the ban is because of the underlying technology the product carries. Microsoft saying that the deal will be subject to a “security review” only serves to transfer the risk of the underlying technology from China to the US.

Fourth, questions arise about data. If Microsoft plans to ensure that “all private data of TikTok’s American users is transferred to and remains in the United States”; where will the data of users in other countries, including India, be transferred to?

And fifth, the value of a tech brand or a social media brand is fleeting. TikTok is not a Coca Cola or a Disney. Like MySpace or Yahoo, it could get relegated to history faster than the videos loops it carries.

TikTok is a Made in China crisis, best left to implode.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

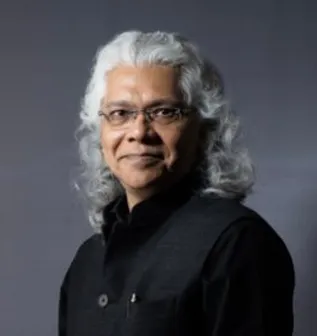

Gautam Chikermane is Vice President at Observer Research Foundation, New Delhi. His areas of research are grand strategy, economics, and foreign policy. He speaks to ...

Read More +

Arjun Jayakumar was an Associate Fellow at ORF. He works with ORFs Cyber Initiative part of the larger Technology and Media team.

Read More +