-

CENTRES

Progammes & Centres

Location

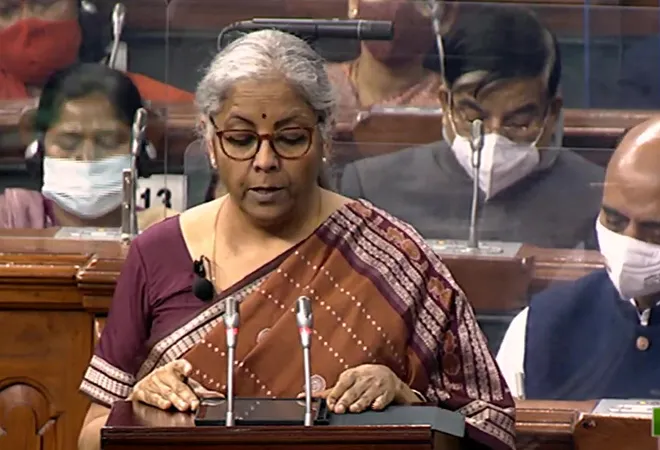

Finance Minister Nirmala Sitharaman budget remains unassuming in grand announcements, matter of fact in its outlook, and deglamorised in form—just the way a Union Budget ought to be

This brief is a part of the Budget 2022: Numbers and Beyond series.

As one overarching idea from ancient India lays the philosophical base for Finance Minister Nirmala Sitharaman, her Budget 2022 addresses two core concerns modern India faces — growth, and its conjoined twin, welfare. “The king must make arrangements for Yogakshema (welfare) of the populace by way of abandoning any laxity and by governing the state in line with Dharma, along with collecting taxes which are in consonance with the Dharma,” Sitharaman quoted from the Shanti Parva of the Mahabharata. In the 21st century, India’s policymaking fraternity and political expectations remain where they were 5,000 years ago and does not allow for wealth creation without wealth redistribution. Like her predecessors, Sitharaman’s Budget rides these two parallel tracks. The government’s goal, she said in a short speech, complements “the macro-economic level growth focus with a micro-economic level all-inclusive welfare focus.”

And yet, this budget is one that will enable growth. The Opposition will hate it. Private enterprises, large or small, will love it. And the markets, after a few volatile fluctuations, will settle down and accept that even if global markets are in turmoil, the underlying in India is getting stronger. According to the IMF, India will grow by 9 percent in calendar year 2022; the Economic Survey expects India to grow by 8.0-8.5 percent in FY 2022-23.

In the 21st century, India’s policymaking fraternity and political expectations remain where they were 5,000 years ago and does not allow for wealth creation without wealth redistribution.

The biggest driver of economic growth will be public capital investments. Even though India emerges as the world’s fastest-growing post-pandemic economy, there will be a lag between existing capacity utilisation and a new investment cycle that will expand capacities. It is clear that in the interim, the heavy lifting will have to be done by taxpayers. In that spirit, the Budget proposes to raise capital expenditure by 35.4 percent to more than INR 7.5 lakh crore (US$100 billion), in 2022-23, or 2.2 times more than in 2019-20. This investment, Sitharaman stated, is necessary to crowd-in private investment: “Public investment must continue to take the lead and pump-prime the private investment and demand in 2022-23.”

This means not only that Sitharaman is putting money where the government’s intentions are but is listening to economic actors with skin in the game on the ground and having public policy conversations through the Budget. Less than three months ago, Aditya Birla Group Chairman, Kumar Mangalam Birla, had forecast that the coming decade will see major capital investments from the private sector. He gave this an elegant label: “Capex Mahotsav”. Sitharaman is possibly hearing these voices and igniting fiscally the lamp of this potential Mahotsav. You may say that US$100 billion is not enough and you could be right. But within the constraints of welfare politics, she has done well.

Less than three months ago, Aditya Birla Group Chairman, Kumar Mangalam Birla, had forecast that the coming decade will see major capital investments from the private sector.

No economy can grow without an efficient transport and logistics system. Here, the Budget leans on and complements the seven engines of Prime Minister Narendra Modi’s National Master Plan for Multi-modal Connectivity, also called Gati Shakti. This includes roads, railways, multimodal transport, multimodal logistics parks, urban transport and connectivity, ropeways and capacity building for infrastructure, each of which is a growth catalyst.

On the macro side, Budget 2022 forecasts a fiscal deficit of 6.4 percent for 2022-23. This is 40 basis points lower than budgeted estimates for 2021-22 and 50 basis points short of the revised numbers. With the Made in China pandemic continuing, the possibility of a 10 to 20 basis point breach in 2022-23 cannot be wished away. But what’s happening outside the Budget brings hope. The GST collections for January 2022 stood at more than INR 1.4 lakh crore, the highest-ever. In other words, growth has returned and is rising. If expenditure management is made efficient, there could even be a reduction than a rise in the final fiscal deficit number. Of course, as we all know, all major economies led by the G20 have given a moral goodbye to the sanctity of fiscal deficit. Almost every country is in breach and India will not carry this burden alone.

Budget 2022 plugs an important regulatory loophole around crypto-currencies in a two-part policy initiative. Several investors have put their money in crypto currencies that are nothing more than an idea controlled by private entities. Unhappy will be the nation that outsources its currency to private folks. On the one hand, she has announced a digital Rupee, to be launched in this fiscal year, through the Reserve Bank of India’s Central Bank Digital Currency. With this, India will increase the velocity of money in the economy, power its currency management system, and add to growth. Simultaneously, Budget 2022 has placed a huge 30 percent tax on virtual digital assets, taken away all deductions, removed setting off of losses in digital assets against any other income, and added a 1 percent tax deducted at source. One way to look at this is a legitimisation of such investments. The other way is to make taxation so high that it doesn’t make sense.

Budget 2022 has placed a huge 30 percent tax on virtual digital assets, taken away all deductions, removed setting off of losses in digital assets against any other income, and added a 1 percent tax deducted at source.

Among other things, one part of the Budget went uncelebrated. In recent years, Sitharaman said, “over 25,000 compliances were reduced, and 1,486 Union laws were repealed.” The repealed laws are out in the public domain, but the 25,000 compliances are not, and we wait for the notified list. But if we take this reduction as given, it is a huge step towards ease of doing business, one that will power economic growth further. Our scepticism comes from the fact that most business compliances are executed at the level of state governments, not Union government, even though both are linked to each other legislatively. Getting state governments to clear up this regulatory cholesterol will take some doing. The Union government could begin with BJP-governed states.

Once upon a time, the Union Budget was the dominant annual policy document of the Union government. The budget speech became a looked forward to policy collective with Finance Minister Manmohan Singh’s 1991-92 budget and a mega media event over the years. Since 2014, the budget speech has become more business-like. As per the needs of the 21st century economic actors, policymaking has become an annual flow of ideas rather than a stock in a single document. In that continuum, Sitharaman’s Budget 2022 exudes a new confidence of growth. It remains unassuming in grand welfare announcements. It is matter of fact in its outlook. It is deglamorised in form. Just the way a Union Budget ought to be.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Gautam Chikermane is Vice President at Observer Research Foundation, New Delhi. His areas of research are grand strategy, economics, and foreign policy. He speaks to ...

Read More +