-

CENTRES

Progammes & Centres

Location

India’s Foreign Trade Policy 2023 realigns itself with the country’s rising economic ambitions

Ambitious in scale and harmonised with the underlying economy, India’s Foreign Trade Policy 2023 (FTP2023) charts out a course to increase India’s exports to US$ 2 trillion by 2030. That’s approximately the size of Italy’s 2022 GDP or India’s 2014 GDP. The 2.6-fold jump in exports between 2023 and 2030 charts an annual growth rate of 14.8 percent. These projections are marginally higher than India’s GDP growth expectations till the end of this decade as it becomes the world’s third-largest economy, crossing Germany in two years and Japan in four. Stepping back, it reimagines the India growth story through exports and powers exports built over trust and engagement with entrepreneurs and businesses.

The big picture as envisioned by the Union Minister of Commerce and Industry, Piyush Goyal, is as clear as the vision he attributes to Prime Minister Narendra Modi. It is also comforting to see the several arms of the government working together, using a similar approach—engaging with exporters like they do with taxpayers, for instance. The focus on exporters to export, rather than on bureaucrats to report, is also in tune with the larger policy actions of the government. Eliminating the need for a manual interface by using information technology is a work in progress, which began with the Income Tax Department and must trickle down to all compliance-managing ministries. Manual scrutiny of importers and exporters in FTP2023, for instance, would be the exception rather than the rule. Likewise, the certificates of origin issued by the government’s “designated agencies” will give way to a self-certifying mechanism; this, the policy states, will reduce transaction costs.

Eliminating the need for a manual interface by using information technology is a work in progress, which began with the Income Tax Department and must trickle down to all compliance-managing ministries.

As in the time before the Statement on Industrial Policy 1991, when everything was restricted until allowed, the ‘Free’ unless regulated clause turns everything open, and makes clear what is prohibited, restricted, or limited to state trading enterprises. However, although the policy is integrated in terms of linkages with other policy arms, there seems to be some dissonance in communication—the policy points to a web link (“Downloads”) to get a list of items limited to state trading enterprises, but an average analyst won’t be able to find it.

Geographic specialisation and e-commerce

A geographic specialisation incentive, in tune with the One District One Product scheme, has been embedded into the FTP2023. Towns that produce goods worth INR 750 crore (US$ 91 million) or more will get notified as towns of export excellence (TEE). These towns will have priority access to export promotion funds. This policy expects to boost exports of handlooms, handicrafts, and carpets. Designating four new towns (Faridabad, Mirzapur, Moradabad, and Varanasi) as TEEs to the existing 39 takes the total to 43, a number that has the potential to multiply. Read along with the policy’s aim to catalyse districts to become products-specific export hubs by removing bottlenecks, it hopes to link small enterprises and farmers with global markets. We don’t know how the latter will play out; whether farmers will join the growth bandwagon or stay shackled to the past remains to be seen.

A geographic specialisation incentive, in tune with the One District One Product scheme, has been embedded into the FTP2023.

Keeping e-commerce export target estimates of US$ 200-300 billion by 2030 in mind—a range so large that it becomes meaningless—FTP2023 lays out a roadmap to establish e-commerce hubs and their backend processes, such as payment reconciliation, book-keeping, returns policy, and export entitlements. This needs deeper and more serious thought and the document points to an incoming “comprehensive e-commerce policy.” To deliver future-ready e-commerce, India needs a future-ready and adaptive policy. FTP2023 recognises this.

Assuming a 12-percent nominal GDP growth over the next seven years (7-8 percent real growth plus 4-5 percent inflation rate), India’s GDP should rise from US$ 3.31 trillion to US$ 7.3 trillion by 2030. During this period, FTP2023 talks about increasing exports from US$ 760 billion to US$ 2 trillion. In other words, not only are exports expected to rise, but their share as a percentage of GDP is also expected to increase, from 23 percent to 27 percent. This 4-percentage point rise is possible. But much depends upon how India negotiates international politics to become a hub of global exports and how much India can benefit from the disruption of supply chains, as corporate refugees shift from China to India. For the world’s fifth-largest economy, 27 percent is a competitive number—the global average is 28.9 percent, that of the United States (US) 10.9 percent, China 20.0 percent, and Japan 18.4 percent; Germany at 47.0 percent is an outlier.

Irrespective, increasing the percentage of exports in the GDP in an economy that is the world’s fastest-growing needs two pillars. First, the composition of exports. The top three exports from India—petroleum products, precious stones, and drug formulations—will face a challenge from those below (iron and steel, or gold); they will also face pressures from more value-added manufactured items such as automobiles and mobile phones. The structural change could also include e-commerce as an important contributor.

Just as the geopolitical chessboard of imports has made Russia India’s top exporter of oil, it is not impossible to imagine a future where, after the US and the European Union (EU), new export markets may widen, notably to Southeast Asia, West Asia, and Africa.

And second, the direction of exports. Just as the geopolitical chessboard of imports has made Russia India’s top exporter of oil, it is not impossible to imagine a future where, after the US and the European Union (EU), new export markets may widen, notably to Southeast Asia, West Asia, and Africa. And then, there is an entire group of smaller countries that could collectively add weight to and influence the direction of India’s e-commerce exports; for instance, South America,. The US$ 2-trillion export target by 2030 may look audacious today, but given India’s growth aspirations and the underlying policies carting this growth, this number is visible and possible.

Finally, as Commerce Minister, Mr Goyal also oversees the Department for Promotion of Industry and Internal Trade, where some excellent initiatives are underway. The Jan Vishwas (Amendment of Provisions) Bill, 2022, for instance, decriminalises several business compliances and makes doing business in India easier. The Commerce Ministry, therefore, is a catalyst for change in both internal and external trade. Looking at both these changes together, we can expect the creation of a virtuous cycle—ease of doing business should attract domestic and global capital, capital should create jobs and growth, and a large part of that will find its way into exports, which in turn should attract more capital for expansions of capacity or new plants. If these projections reach fruition, Mr Goyal can celebrate with laddoos; if breached, he can add pedhas—and both can bring weight to exports.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

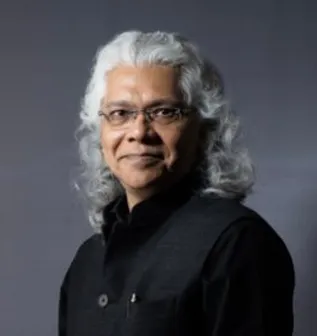

Gautam Chikermane is Vice President at Observer Research Foundation, New Delhi. His areas of research are grand strategy, economics, and foreign policy. He speaks to ...

Read More +