On the first day of this month, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI), in its third bi-monthly monetary policy meeting for 2018-19, has increased the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 6.50 percent, and consequently the reverse repo rate under the LAF is adjusted to 6.25 percent and the bank rate to 6.75 percent.

This has been ostensibly done to meet “the objective of achieving the medium term target for consumer price index (CPI) inflation of 4 percent within a band of +/- 2 percent, while supporting growth”. Retail inflation, as measured by the year-on-year change in the CPI, shot up to 5.00 percent in June this year. With the wholesale price index (WPI) also rising in tandem to 5.77 percent in the same month, the inflationary expectation is quite high in the economy. So, under the current inflation targeting framework of the RBI, this rate hike has been widely expected. As usual, apprehensions are also expressed from certain quarters, specifically from industry, about the dampening effect of this rate hike on industrial credit and subsequently on investment and growth.

The RBI currently follows an “inflation targeting” regime, under which the rate of interest is increased whenever inflation is on the higher side and future expectation of high inflationary environment prevails. To provide a brief background, in an inflation targeting regime, the central bank publicly announces target inflation level and then uses rate of interest as the policy instrument to keep inflation around that target level.

The mainstream theoretical premise of the inflation targeting framework is as follows. Higher rate of interest makes the cost of capital higher and as a result takes out certain amount of money supply from the system. As this monetary contractionary exercise continues, less amount of money – compared to the amount before the rate hike – are available for existing consumption basket of goods and services, which in turn suppresses the overall price level. Therefore, the standard reaction of a central bank to inflation or expected future inflationary macro environment under this framework is to increase interest rate immediately.

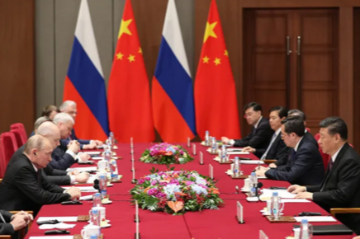

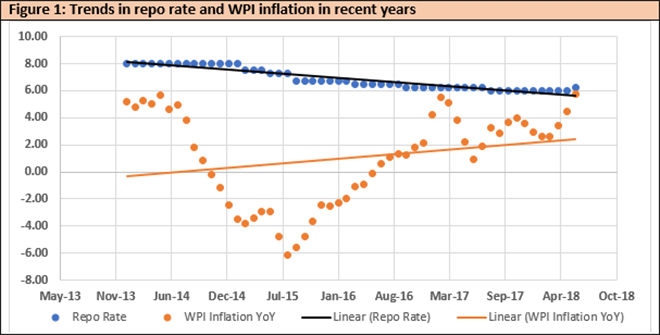

Figure 1: Trends in repo rate and WPI inflation in recent years

* WPI inflation rate calculations are done by the author.

* WPI inflation rate calculations are done by the author.

Data Source: dbie.rbi.org.in

However, under inflation targeting framework headline inflation measured by the WPI is not considered, rather core inflation measured by the CPI is considered to make subsequent changes in the monetary policy in India. This is explicitly mentioned in each and every monetary policy statement issued. The most important reason for doing so is that bulk of the consumers in the economy have to confront consumer retail prices of goods and services, not wholesale prices. Another crucial factor is that the WPI calculation does not consider the prices of different consumer services, but the CPI does.If we compare the trends in repo rate (which works as the RBI’s ‘signal rate’ to the market) and WPI inflation rate (measured as the month-wise year-on-year growth rate of the price index), then certainly the MPC’s decision to increase the rates looks justified. Respective linear trendlines in the scatter diagrams of repo rates and WPI inflation rates indeed show an inversely proportional relationship – as interest rates decrease the WPI inflation tends to increase. This conforms to the standard theory that lower rates induce higher inflation in the economy.

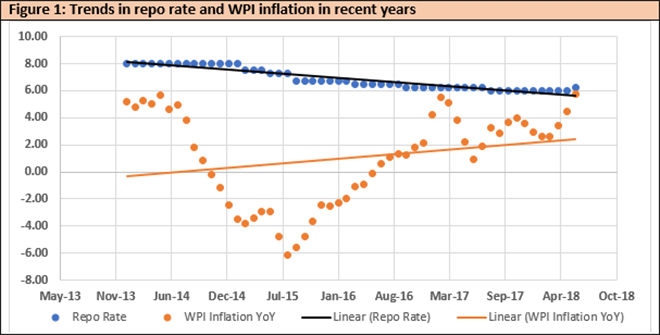

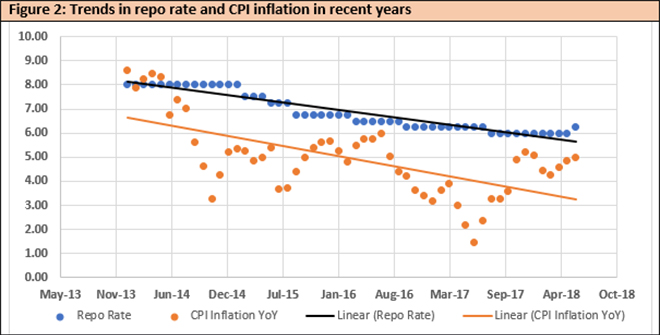

Figure 2: Trends in repo rate and CPI inflation in recent years

Data Source: dbie.rbi.org.in

Data Source: dbie.rbi.org.in

This may come across as a baffling phenomenon, but a deeper look at economic facts can prove that it is not. India, in the recent past, experienced a prolonged period when both food prices and international crude prices were on the lower side. MPC statement on August 1, 2018 itself identified these two among the five factors which will shape the inflation outlook in immediate future. Recent inflationary tendencies in the economy can also be attributed, to a great extent, to the larger-than-average increase in agricultural minimum support prices (MSPs) and an increasing tendency in international crude oil prices.Interestingly, linear trendlines of repo rate and CPI inflation show a directly proportional relationship, as can be seen in Figure 2. In spite of repo rates going down consistently, core inflation captured by the CPI dipped considerably in the past few years. So, the standard theory of inflation rising with lower interest rates does not seem to hold in reality, rather the opposite is happening in this case.

Both fuel and cereal do not have any close substitutes, making their demands price-inelastic. In other words, the amount of (basic) food consumed and petro products used in the economy remain largely the same in the short run, irrespective of the change in their prices. So, nothing much can be done when food and/or oil prices rise. Precisely for this reason some economists describe inflation as a ‘non-monetary’ phenomenon – more dependent on exogenous (outside the system) variables like food and oil prices than endogenous (within the system) monetary variables like rate of interest and money supply. So, external shocks are more likely reason behind inflation than anything else.

The contradictory trends of prices measured by WPI and CPI vis-à-vis repo rates, as shown in Figure 1 and 2, perhaps lend credence to these ‘non-mainstream’ inflation explanations.

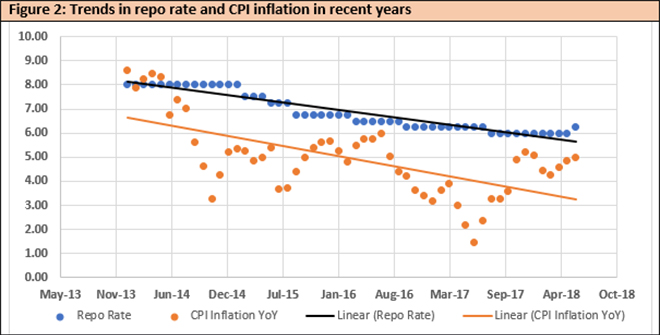

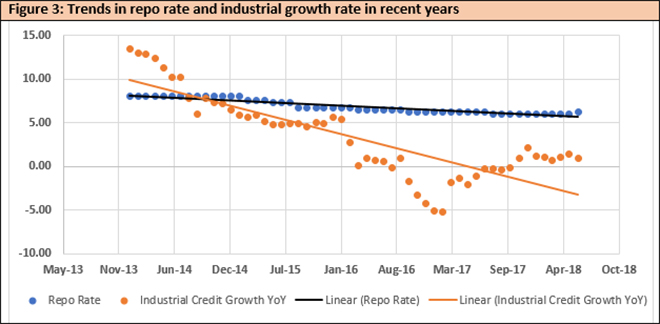

Figure 3: Trends in repo rate and industrial growth rate in recent years

* Month-wise industrial credit growth rates are calculated year-on-year by the author.

* Month-wise industrial credit growth rates are calculated year-on-year by the author.

Data Source: dbie.rbi.org.in

If manufacturers and producers of the economy expect inadequate consumption demand in the economy, they will naturally refrain from making any further expansion and investment for obvious reasons. When that results into decelerated industrial credit growth, it cannot be revived by simple monetary measures like lowering the interest rates or lending rates further. Revival of industrial credit growth crucially hinges upon the revival of consumption demand in the economy, which in turn is difficult to revive by any monetary instrument. That requires some amount of fiscal intervention.Similarly, plotting the scatter diagrams of repo rates and corresponding month-wise year-on-year industrial credit growth rates show that it is largely futile to assume that a higher rate of interest always acts as a dampener to industrial credit growth. In fact, Figure 3 clearly shows that it does not. In recent years, despite interest rates generally falling down industrial credit growth rates plunged substantially. This primarily implies that there has been a distinct lack of demand for industrial credit.

Therefore, under current economic circumstances there are rational grounds for scepticism about the efficacy of inflation targeting and about the apprehension that higher rate of interest will immediately hamper industrial credit offtake and subsequently dampen economic growth. Real reasons behind inflation and poor industrial credit growth are somewhat different in reality.

Repo rate is the rate at which the RBI lends money to the commercial banks if there is a shortfall of funds by repurchasing the securities floated by the commercial banks to the central bank, conversely reverse repo rate is the rate at which the RBI borrows money from the commercial banks. The bank rate is the rate at which the RBI provides loans to the commercial banks with no collateral.

In India, headline inflation is defined to be the overall inflation in the economy as measured by the WPI while the core inflation is measured by the CPI - taking into account a dynamic consumption basket consisting of commodities like food items, energy products etc. and various consumer services.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

* WPI inflation rate calculations are done by the author.

* WPI inflation rate calculations are done by the author. Data Source: dbie.rbi.org.in

Data Source: dbie.rbi.org.in * Month-wise industrial credit growth rates are calculated year-on-year by the author.

* Month-wise industrial credit growth rates are calculated year-on-year by the author. PREV

PREV