-

CENTRES

Progammes & Centres

Location

From 1972 to 2002, the journey of GIC — from nationalisation to a general insurance monopoly to opening up to private competition and finally to become a reinsurer — mirrors the direction of India’s overall economic path over three decades.

Image Source: Prashant Menon — Flickr/CC BY-NC-ND 2.0

The following is a chapter from the book 70 Policies that Shaped India: 1947 to 2017, Independence to $2.5 Trillion.

Find the book here.

If life insurance could be nationalised, why not non-life insurance? And with that idea, Parliament, on 20 September 1972, passed the General Insurance Business (Nationalisation) Act <1> (GIBNA) for the “acquisition and transfer of shares of Indian insurance companies and undertakings of other existing insurers.” Amongst its objectives: to serve better the need of the economy, to develop the general insurance business in the best interests of the community, to prevent concentration of wealth and to regulate and control the industry. In one stroke, Parliament nationalised the general insurance business of 55 Indian companies and the undertakings of 52 foreign insurers. The next month, these 107 companies were amalgamated into four separate companies — National Insurance Company Ltd, Oriental Insurance Company Ltd, New India Assurance Company Ltd and United India Insurance Company Ltd — with geographical equity embedded into the structure by placing their head offices at Kolkata (then, Calcutta), New Delhi, Mumbai (then, Bombay) and Chennai (then, Madras) respectively. On 22 November 1972, General Insurance Corporation (GIC) was incorporated to control and run the business of general insurance. The government transferred all its shares of the four companies to it, turning GIC into a holding company. Following the formation of the Insurance Regulatory and Development Authority on 19 April 2000 through an Act, <2> an amendment ended the monopoly of GIC over the general insurance business. The amendment to the Act — General Insurance Business (Nationalisation) Amendment Act — turned GIC into a reinsurer, <3> removed its supervisory role over the four subsidiaries and transferred the shares vested with it back to the government. From 1972 to 2002, this journey of GIC — from nationalisation to a general insurance monopoly to opening up to private competition and finally to become a reinsurer — mirrors the direction of India’s overall economic path over three decades. As with the nationalisation of life insurance, the government’s main objective seemed to have been “pooling in of people’s money and mobilising them to invest in key sectors,” <4> which the government deemed important from the point of view of development. In other words, financial repression of citizens to support socialist and political objectives.

READ: 70 Policies — Nationalisation of Life Insurance, 1956

<1> General Insurance Business (Nationalisation) Act, 1972, Ministry of Law and Justice, Government of India, 20 September 1972, accessed 8 January 2018.

<2> Chapter 49: Insurance Regulatory Development Authority of India.

<3> Ibid., Chapter III, Clause 9 (1).

<4> Arjun Bhattacharya and O’Neil Rane, “Nationalisation of Insurance in India,” Centre for Civil Society, 397, accessed 8 January 2018.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

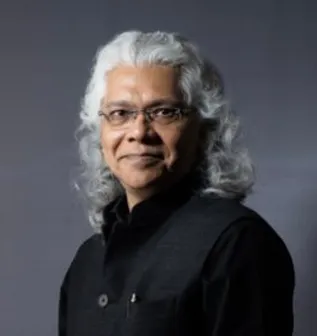

Gautam Chikermane is Vice President at Observer Research Foundation, New Delhi. His areas of research are grand strategy, economics, and foreign policy. He speaks to ...

Read More +