I. Introduction

The prolonged COVID-19 pandemic has resulted in frequent economic disruptions across the world. Except for China, most principal economies continue to suffer losses in terms of Gross Domestic Product (GDP) and employment. In turn, economic losses, especially in low and middle-income countries such as those in Sub-Saharan Africa and Latin America, heightened debt accumulation.

Estimates by the International Monetary Fund (IMF) show that the first wave of the pandemic in early 2020 caused African economies to contract by 3.2 percent that year.[1] The second-round impact will likely be in sovereign credit rating downgrade as economies bear the effects of declining fiscal revenues and foreign exchange receipts, accompanied by widening fiscal deficits and rising debt-to-GDP ratios. Countries that incur more debt to mitigate the pandemic shock could reach unsustainable debt levels. Apart from finding additional sources of financing, African countries need a suspension of credit assessment by international agencies until production and supply chains return to pre-COVID levels. Indeed, there were seven sovereign debt defaults in 2020: Argentina, Ecuador, Lebanon, Zambia, and Belize defaulted once, and Suriname defaulted twice. The last time these many defaults happened was in 2012, after the 2008 global financial crisis.[2]

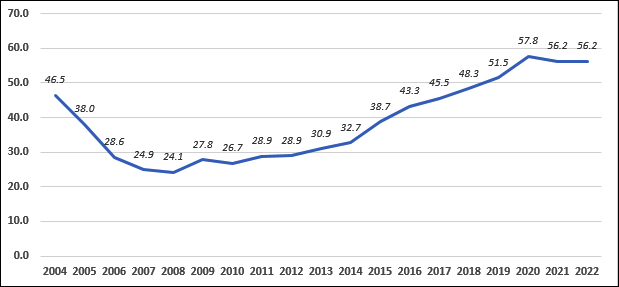

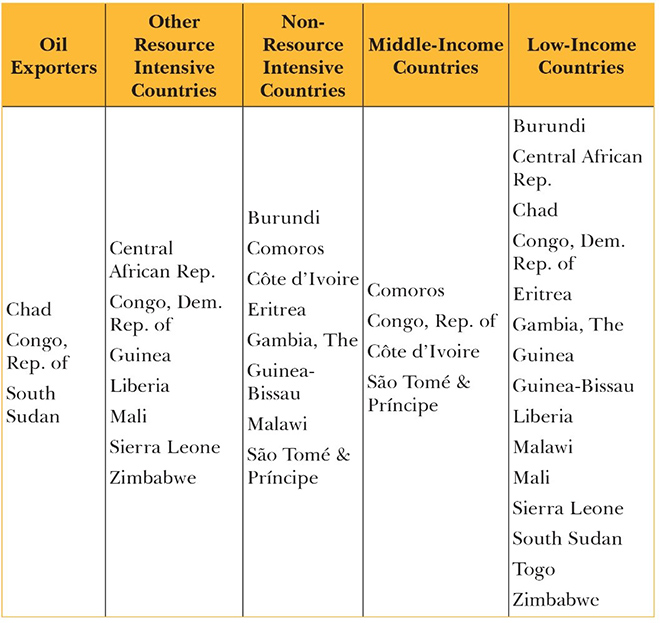

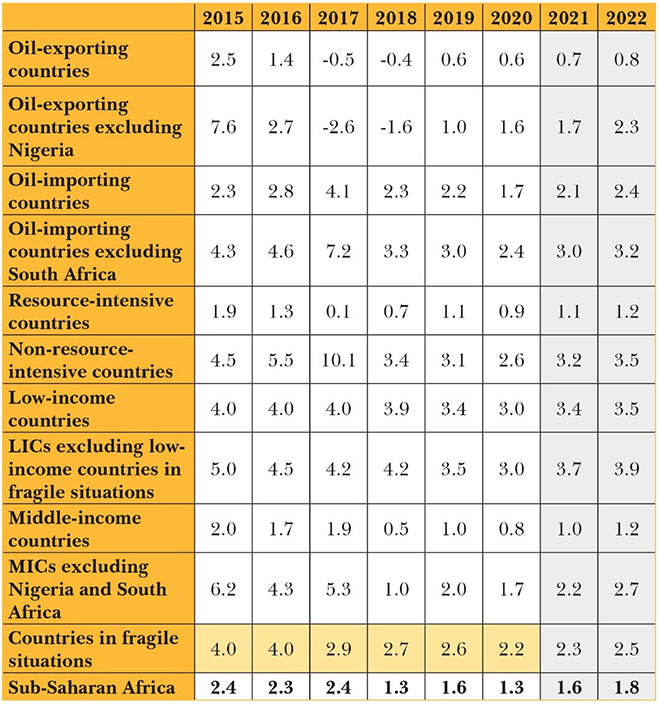

To be sure, mounting debt-related woes existed in many economies even in the early 2000s. Debt relief measures in that decade coincided with a commodity price boom, helping many economies stabilise the government balance. Rising global growth helped other economies to reduce their debt, with increase in output and exports. The 2008 crisis halted this streak. Central banks across the world adopted an easy money policy and flooded their economies with massive liquidity to tide over the crisis. Ensuring easy liquidity had an adverse effect on global debt accumulation across countries.[3] A global financial market flush with funds would obviously look for creditors; in this case, it led to a steady increase in debt accumulation all over the world. Sub-Saharan Africa was no exception. Figure 1 shows that cumulative debt accumulation in the region declined until 2008, only to increase again, surpassing the 2004 figure of 46.5 percent of GDP.

FIGURE 1: Government Debt in Sub-Saharan Africa (as % of GDP)

Fiscal year data; 2021 and 2022 data are IMF estimates.

Data Source: AFR Regional Economic Outlook Database, IMF

Following the 1990s debt crisis, major creditor countries and multilateral organisations initiated a Multilateral Debt Relief Initiative (MDRI) for the outright forgiveness of debts owed by a group of 36 low-income countries, of which 29 were African.[4] The gain in terms of debt reduction in Sub-Saharan Africa till 2008 (Figure 1) is a result of that.[5]

External and domestic borrowing in Africa continued to increase after 2008 – a period that also witnessed a stagnation of other forms of external development financing, including official development aid.[6] Most of these Sub-Saharan African countries operate below their potential tax revenue generation, accelerating the rate of debt accumulation.

As these countries are unable to attract private capital inflows to narrow their financial gaps, the debt tends to accumulate faster, potentially impacting development. There are two opposing views on this. The first one, led by the lenders, warns about a debt crisis and advocates for containing accumulation and increasing the capacity to service debt by increasing domestic revenue and rationalising public expenditure.[7] The second view is from the borrowers’ side, often referred to as the Dakar Consensus of 2019.[8] It emphasises that African debt risks are not higher than those of other geographical regions and therefore the current problem needs innovative solutions that lie with both lenders and borrowers. Some African countries are opposed to standard remedies like expenditure cuts that hamper long-term growth. These expenditure reductions, according to this view, often incapacitate countries facing special needs like civil war, political insecurity, and environmental crises.[9]

However, to explain that African countries’ debt profile is less risky than emerging and advanced countries by using debt-GDP ratios can be too simplistic. Countries like Japan, the US, and the UK mostly borrow in their own currencies from their domestic resources with much lower rates of interest, and therefore their debt servicing burden is lower. Most of Africa’s debt are external, with relatively higher interest rates and shorter durations and carrying substantial exchange-rate risks.[10] Therefore, the risk comparison by debt-GDP ratios may be misleading.

Multilateral lenders in Sub-Saharan Africa include the IMF, the World Bank, and the African Development Bank. Among governments, the Paris Club countries[11] have been big contributors. In recent times, however, African countries have started to seek financing from non-Paris Club governments as well as private creditors. Most of these come with shorter maturity periods and higher interest rates, increasing the cost of external debt service. This leads to a riskier debt profile.[12]

After 2000, China’s presence as a lender in Africa grew, and estimates say financiers from China committed USD 153 billion to African public-sector borrowers between 2000 and 2019. China’s annual lending commitment peaked in 2013, the year the flagship Belt and Road Initiative (BRI) was launched, but tapered down after that, until 2019. Today, cumulative Chinese lending to the continent remains the highest among the bilateral lenders and is expected to rise again in post-pandemic times.[13]

After a brief discussion on the current Debt Service Suspension Initiative (DSSI) and the Common Framework (CF), this paper identifies broader trends in Sub-Saharan Africa debt accumulation and studies the specific cases of Angola, Kenya, and Zambia. It makes an assessment of both, China’s role as bilateral lender, and that of Bretton Woods Institutions as multilateral lenders. The paper offers a macro roadmap towards Sub-Saharan African debt resolution.

II. Debt Service Suspension Initiative (DSSI) and Common Framework (CF)

To cushion debt-related blows to low-income economies, the G20 decided to float a Debt Service Suspension Initiative (DSSI) in 2020. There are 73 countries eligible for a temporary moratorium on debt-service payments for bilateral loans. The moratorium was initially offered up to December 2020 but was later extended to December 2021.[14] In November 2020, the Paris Club joined the initiative, and the G20 further endorsed a programme called Common Framework for debt treatment beyond the DSSI (Common Framework, or CF) to support low-income countries.[15]

The DSSI has had limited success in fulfilling its intended objective. With 46 of the 73 eligible countries participating, the moratorium requested for debt amounts to USD 5 billion, which is around 10 percent of the total external debt-service (TEDS) scheduled in 2020 for all 73 countries. Full participation could potentially cover USD 12.2 billion in debt in 2020, and another USD 9.25 billion in the first half of 2021.[16]

However, the prevalence of debt distress is not limited to these 73 countries alone. There are, by UN definition, 105 developing economies. Around two-thirds of the 73 covered by the suspension initiative have a sovereign credit rating of “non-investment grade”. Adding the other 32 low-income developing countries in that grade completes the global base of vulnerable and risky debts. In the period between 2021 and 2025, estimated TEDS payments on external public debt at risk (risky-TEDS) will cross the USD 598-billion mark for this group of 73 vulnerable countries. Of this total amount, USD 311 billion (more than 50 percent) of debt service payments have to be made to the private creditors.[17]

However, these private creditors are not yet part of the DSSI. CF has been floated to provide a partial solution to that, as the framework seeks to restructure debt on a case-by-case basis involving all creditors. However, only 73 DSSI countries are eligible, leaving out several middle-income vulnerable countries.[18]

A few countries are apprehensive of losing access to global financial and debt markets – if there is a subsequent downgrade in ratings. The short-term and temporary nature of the moratorium is another reason behind limited participation in the DSSI.

Indeed, debt relief from DSSI for Sub-Saharan African borrowers has been timely but the relief volume remains less than intended. Of the 37 eligible countries, 30 benefitted from moratorium. Though potential savings of Sub-Saharan Africa from DSSI were initially estimated at USD5.5 billion in May-December 2020, the actual figure hovers around USD1.8 billion. The participation was initially hindered by lack of clarity on borrowing costs and/or sovereign credit ratings. Before the pandemic, spreads for frontier economies in Sub-Saharan Africa were comparable to the B-rated countries.[19] Since then, the gaps with B-rated countries have widened sharply.

Another reason for the limited participation is that eligibility for debt restructuring under CF requires the debtor country to have an IMF-supported programme. In early 2021, three Sub-Saharan countries requested debt treatments under the CF. Ethiopia sought a flow rescheduling, and Chad and Zambia requested debt restructurings with NPV (net present value) reductions.[20]

III. Trends in Debt Accumulation in Sub-Saharan Africa

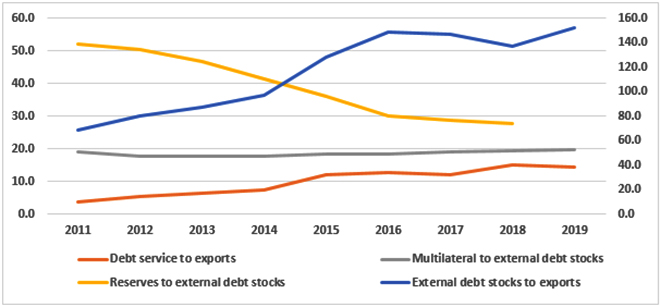

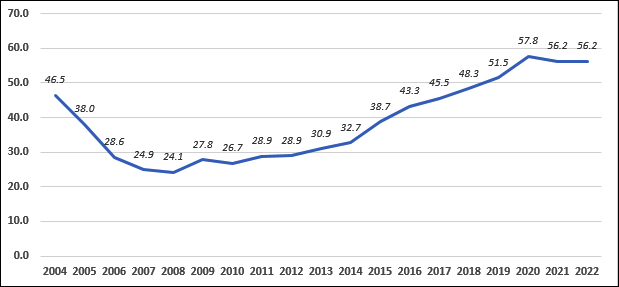

In 2019, the Sub-Saharan countries’ external debt stocks-to-exports ratio stood at 152.3 percent. Reserves to external debt stocks[21] plummeted to 27.8 percent in 2019. Multilateral loans to total external debt stocks remained around 20 percent, but debt service to exports went up to 14.3 percent in 2019 from 3.8 percent in 2011. While the share of multilateral debt in total external debt remained stagnant, total external debts soared. This is the region that needs substantial long-term debt support (Figure 2).

FIGURE 2: Debt Ratios of Sub-Saharan Africa, excluding High-Income Countries (in percent)

Based on available data; some data points are not available.

* High-income countries are excluded while using debt accumulations in low-and middle-income countries.

* External debt stocks to exports ratio is measured on the secondary axis.

Data Source: International Debt Statistics, 2021, World Bank

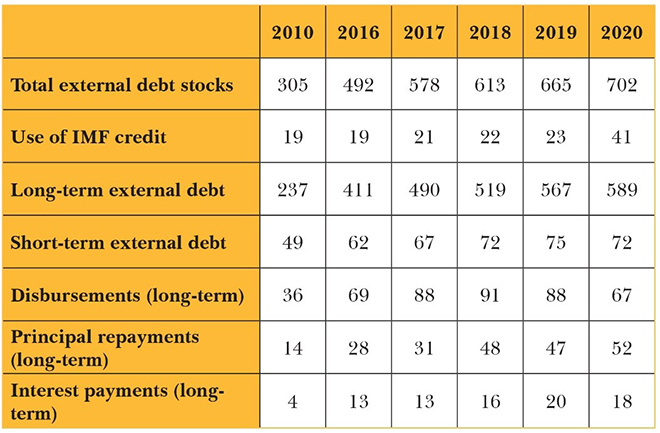

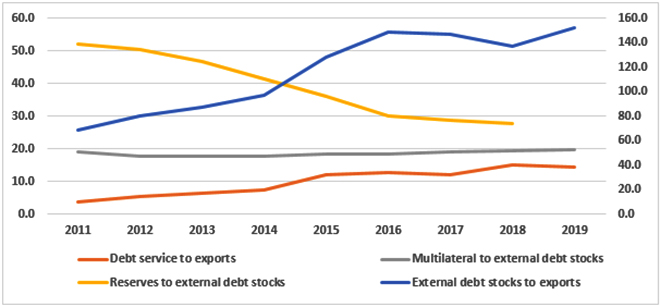

Total external debt stocks ballooned from USD 305 billion in 2010 to USD 702 billion in 2020. Long-term external debt rose from USD 237 billion in 2010 to USD 589 billion in 2020. Short-term external debt increased from USD 49 billion in 2010 to USD 72 billion in 2020 (Table 1). Though the outflows in terms of principal repayments and interest payments may look manageable, this extreme rise in debt stock implies that some countries in the region may struggle to repay their debts.

TABLE 1: External Debt in Sub-Saharan Africa (2010-2020, in USD billion)

Data Source: International Debt Statistics 2022, World Bank

Investment and aid from the global North to Africa slowed down after the 1997 Asian financial crisis. Developed economies started to rethink their investments in developing and least developed regions. China then emerged as the new financier – promising to offer rapid, flexible, and large “no strings attached” loans.[22] The BRI, initiated in 2013, further enhanced Chinese investments on building infrastructures across the African continent.[23]

In the 2018 China-Africa Cooperation Forum, China announced an additional USD 60 billion to be disbursed over three years as concessional loans, grants, and trade and development finance. As of May 2020, China has disbursed some USD 38.7 billion.[24] Around 19 percent of external debt repayment by different African governments went to China in 2018. Chinese loans accounted for more than one-fourth of total external loans in African countries with high debt distress. These countries included Kenya (27 percent), Zimbabwe (25 percent), Zambia (26 percent), Cameroon (32 percent), Republic of Congo (45 percent), and Djibouti (57 percent).[25] Multilateral financial organisations and some African states requested China to waive some of these debts. Though China selectively cancelled some of the African debts and postponed a few in 2020, the country has so far resisted the idea of blanket debt forgiveness.[26]

China is part of the DSSI programme, and between 2000 and 2018 wrote off a total USD 3.8 billion global debt, of which USD 1.7 billion was owed by heavily indebted poor countries (HIPCs).[27] Incidentally, some individual African countries, such as Angola, are in the process of renegotiating the terms of past debt agreements with China.[28]

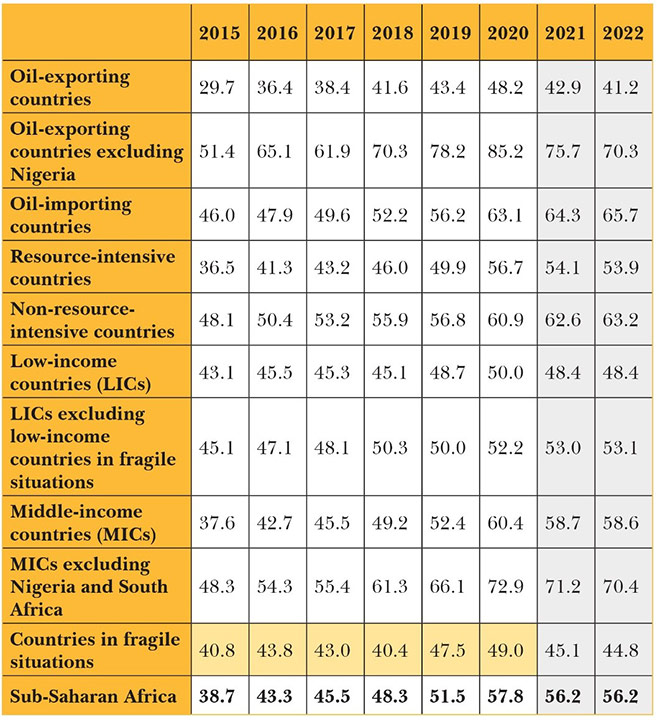

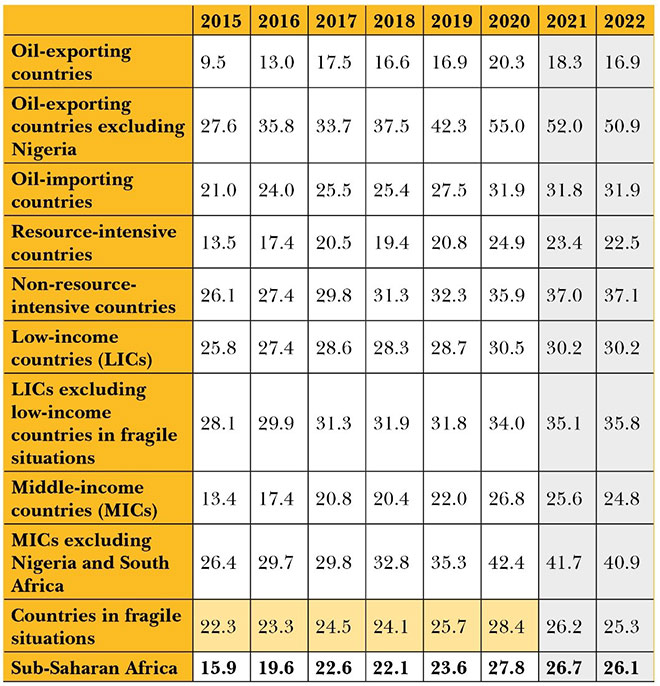

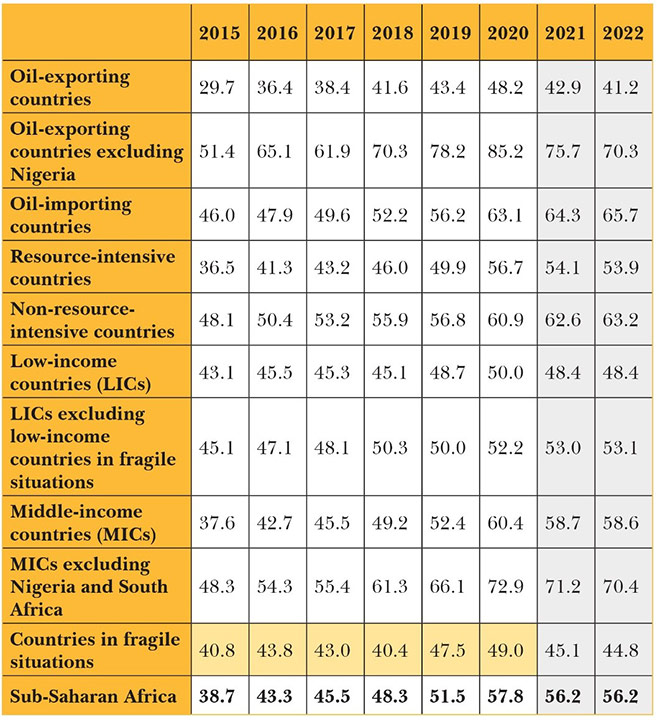

Government debt in Sub-Saharan Africa rose to 57.8 percent of GDP in 2020. Oil-exporting countries excluding Nigeria, as a group, had the highest amount of government debt at 85.2 percent of GDP in 2020. Middle-income countries (MICs) excluding Nigeria and South Africa had government debts at 72.9 percent of GDP; oil-importing countries at 63.1 percent of GDP; and countries in fragile situations had government debt of 49.0 percent in 2020 (Table 2).

TABLE 2: Government Debt across Different Groupings in Sub-Saharan Africa (as % of GDP)

Fiscal year data; 2021 and 2022 data are IMF estimates; for details of country groupings see Appendix 1.

Data Source: AFR Regional Economic Outlook Database, IMF

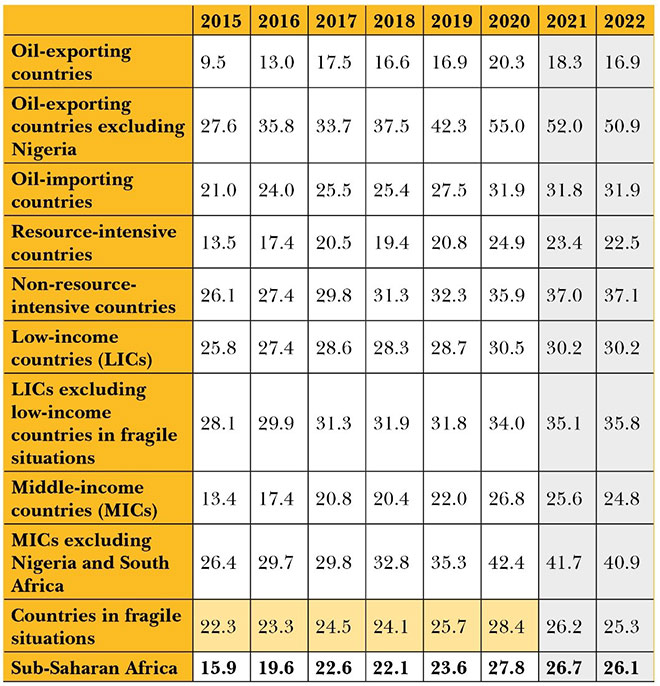

External debt contributes substantially to this government credit burden. The pattern remains the same: oil-exporting countries excluding Nigeria, MICs excluding Nigeria and South Africa, non-resource intensive countries, and countries in fragile situations owe the most to the external creditors (Table 3).

TABLE 3: External Debt, Official Debt, Debtor Based across Different Groupings in Sub-Saharan Africa (as % of GDP)

Fiscal year data; 2021 and 2022 data are IMF estimates; for details of country groupings see Appendix 1.

Data Source: AFR Regional Economic Outlook Database, IMF

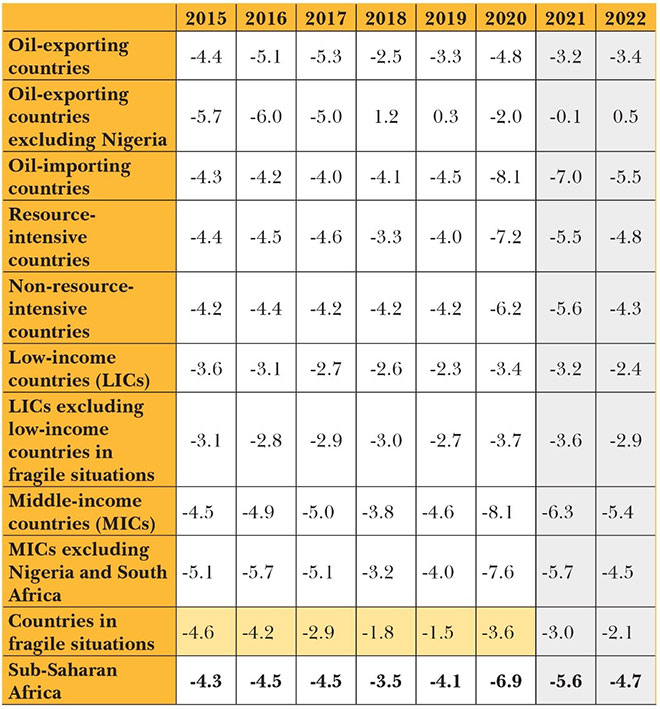

Ideally, debt accumulation is addressed by improving fiscal balance, enhancing current accounts, and attracting foreign direct investments (FDI). Failure to do so makes government debt, particularly external debt, unsustainable. Unfortunately, the countries in Sub-Saharan Africa are showing all the tendencies of unsustainability. Deteriorating overall fiscal balance, current account balance, and net FDI are the primary factors behind this current debt accumulation.

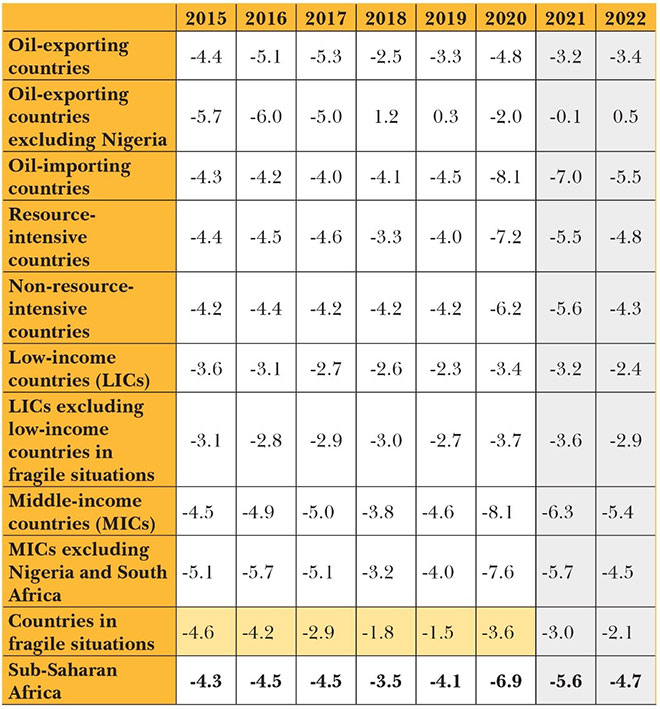

Overall, the average fiscal balance of Sub-Saharan Africa shows a negative value of -6.9 percent of GDP. Oil-importing countries and middle-income countries show high negative values in their fiscal balance. This shows that it is not only the low-income, fragile countries that are in distress but also a few middle-income countries (Table 4).

TABLE 4: Overall Fiscal Balance, Including Grants, across Different Groupings in Sub-Saharan Africa (as % of GDP)

Fiscal year data; 2021 and 2022 data are IMF estimates; for details of country groupings see Appendix 1.

Data Source: AFR Regional Economic Outlook Database, IMF

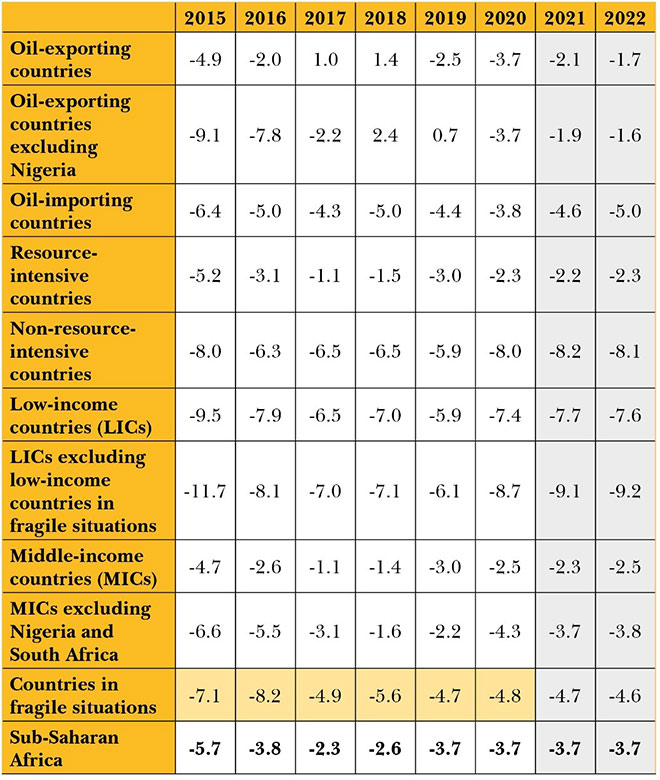

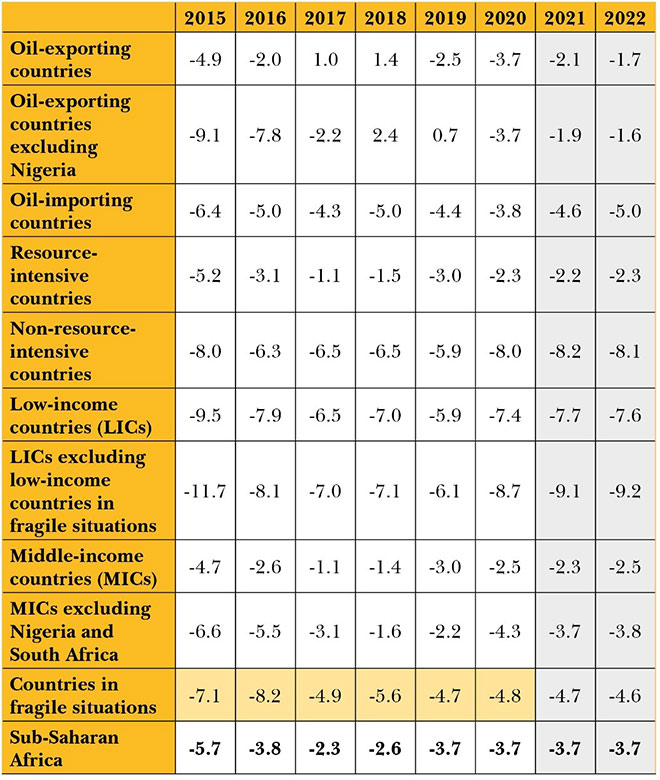

Countries in fragile situations[29] have negative external accounts (including grants) at -4.8 percent of GDP in 2020. However, the alarming trend is that low-income countries (LICs) excluding the fragile countries run a high negative external current account at -8.7 percent of GDP. Non-resource-intensive countries run external current accounts of -8.0 percent of GDP in 2020 (Table 5).

TABLE 5: External Current Account, Including Grants across Different Groupings in Sub-Saharan Africa (as % of GDP)

Fiscal year data; 2021 and 2022 data are IMF estimates; for details of country groupings see Appendix 1.

Data Source: AFR Regional Economic Outlook Database, IMF

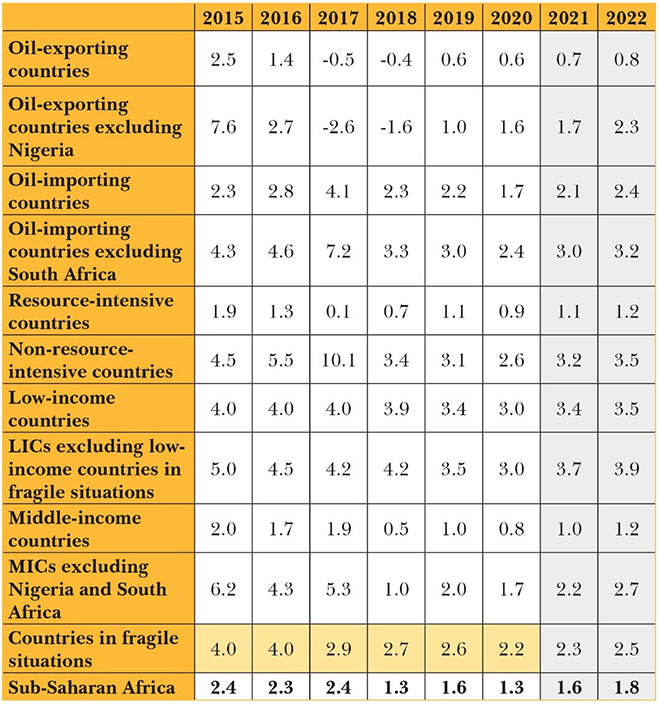

FDI is a supplementary source of repairing overall economy and debt burden. The situation is not encouraging in this front, however. Given the low level of GDP in most of the countries in Sub-Saharan Africa, an overall average of 1.3 percent of GDP seems inadequate to make any difference in halting debt accumulation (Table 6).

TABLE 6: Net Foreign Direct Investment across Different Groupings in Sub-Saharan Africa (as % of GDP)

* Fiscal year data; 2021 and 2022 data are IMF estimates; for details of country groupings see Appendix 1.

Data Source: AFR Regional Economic Outlook Database, IMF

With a few exceptions like Nigeria and South Africa, most countries in Sub-Saharan Africa appear to be going through a vicious cycle: set in a textbook low-level equilibrium trap, these countries are unable to kickstart their economies to improve output and, thereby, fiscal balance. A persistent low-development environment is compelling these economies to borrow externally. Their failure to improve exports and attract FDI are pushing them deeper into the debt trap. The countries with natural resources may try to improve their situation by utilising their assets. However, the volatility of international commodity prices could create hurdles.

The long-term solution to debt distress lies in rapid economic growth, better fiscal management, and attracting FDI. In all these counts, the SSA countries are lagging. Therefore, moratoriums alone cannot be a sustainable solution. The imperative is debt restructuring, which should be designed according to the specific needs of a particular country.

Impact of COVID-19 Pandemic in Sub-Saharan African Debt

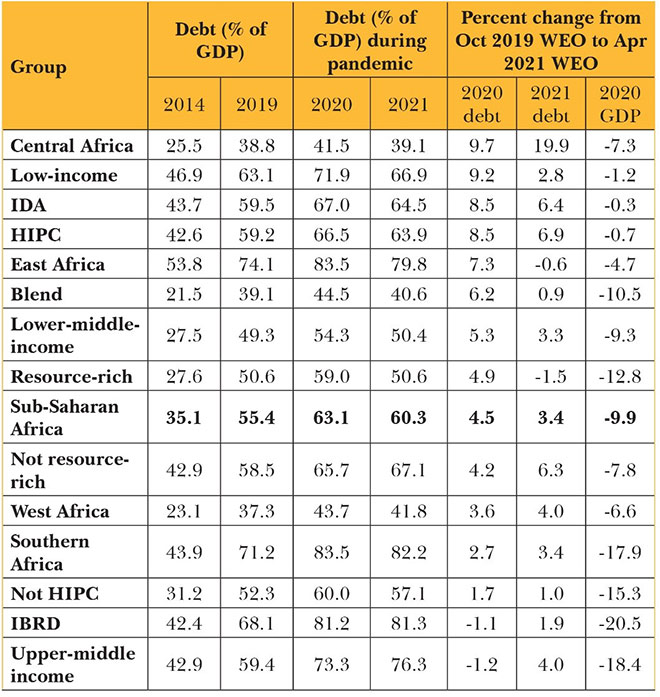

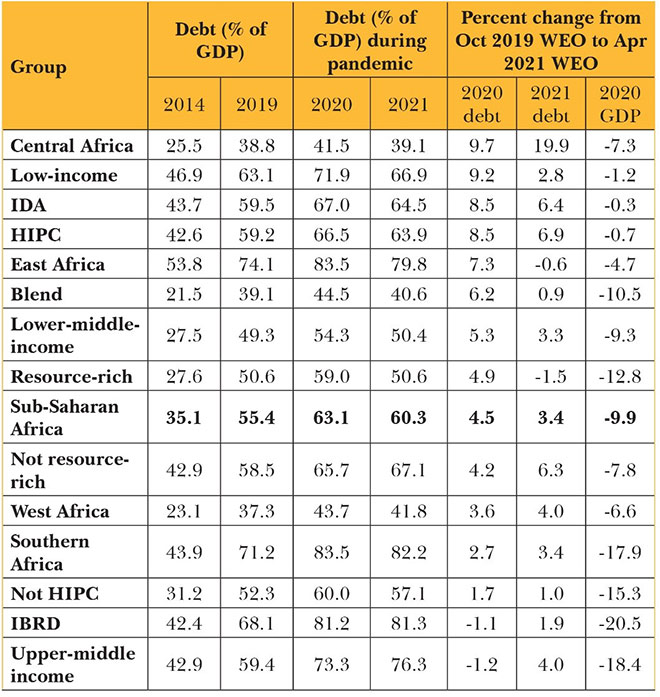

As expected, the pandemic put upward pressure on debt accumulation across the African continent. GDP in Sub-Saharan Africa was 9.9 percent less in April 2021, compared to October 2019.[30] The debt situation particularly aggravated for the low-income and HIPC countries in both 2020 and 2021. East African countries and Southern African countries were afflicted by debt aggravation during this period. The countries that are not resource-rich were also negatively affected. The countries on IBRD assistance, non-HIPC, and upper middle-income countries suffered the most in terms of GDP loss in 2020 (Table 7).

TABLE 7: Impact of Pandemic on General Debt, by Country Groupings

* IDA = International Development Association, World Bank; HIPC = Heavily indebted poor countries; IBRD = International Bank for Reconstruction and Development; Blend = Countries eligible for IDA funding based on per capita income but simultaneously deemed credit-worthy by the markets; WEO = World Economic Outlook (IMF publication)

Source: International Monetary Fund (IMF), 2021

The debt burden of Sub-Saharan Africa in 2020 increased by 4.5 percent more than the earlier projections. Non-HIPC countries and upper-middle-income countries retained access to credit market by creating a combination of private and official creditors. HIPC countries, however, were largely pushed out of private debt markets and were left to rely on unplanned borrowing from official creditors. As metal prices had been more stable and higher than international oil prices, top metal-exporting countries in Africa incurred less debt than others in this period.[31]

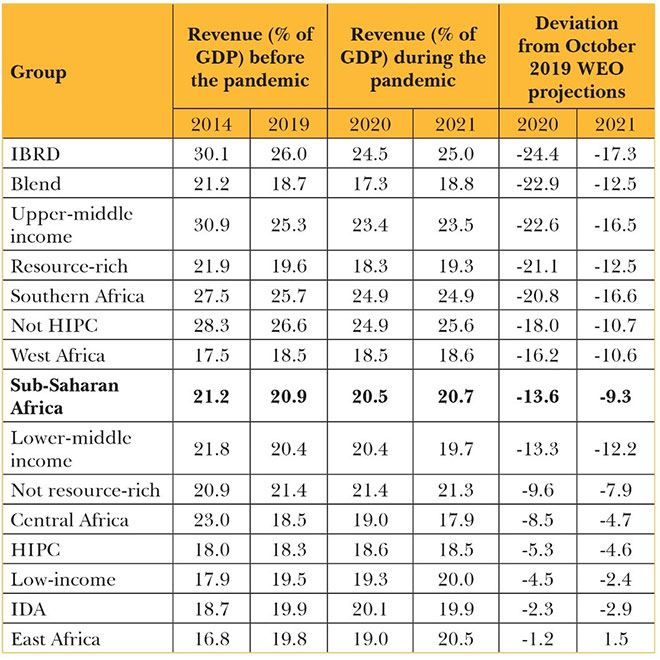

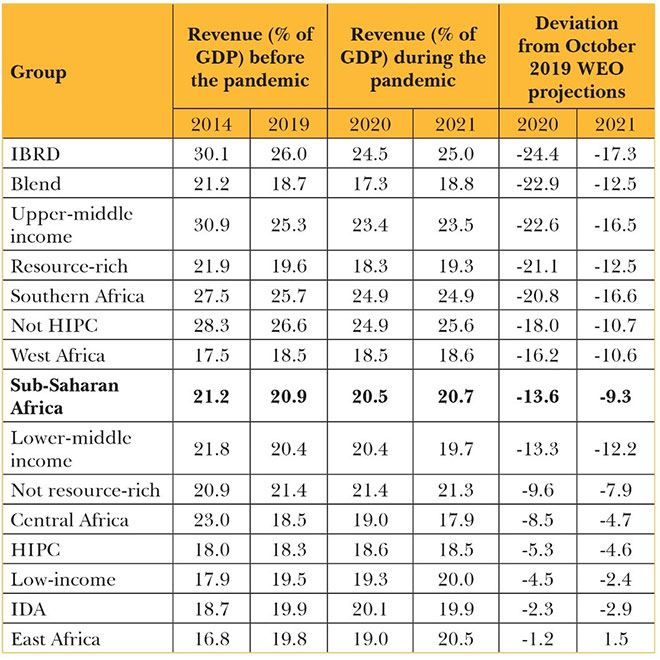

The pandemic has also brought a negative fiscal balance for all African countries. As trade decreased and unemployment increased during the lockdown and restrictive periods of the pandemic, revenue dropped across the board.

TABLE 8: Impact on Revenue, by Country Groupings

* IDA = International Development Association, World Bank; HIPC = Heavily indebted poor countries; IBRD = International Bank for Reconstruction and Development; Blend = Countries eligible for IDA funding based on per capita income but simultaneously deemed credit-worthy by the markets; WEO = World Economic Outlook (IMF publication)

Source: International Monetary Fund (IMF), 2021

On average, SSA countries lost 9.3 percent of revenue projected in 2020. IBRD-supported countries, blend countries, upper-middle-income and resource-rich economies were among the worst sufferers in 2020 in terms of revenue (Table 8).

Government revenue is one of the most important instruments for paying off debt. Therefore, in the longer run, any loss of revenue during the pandemic may make repayment difficult and the debt burden unsustainable for many of these countries.

IV. Debt Accumulation and Impact on Development: Case Studies

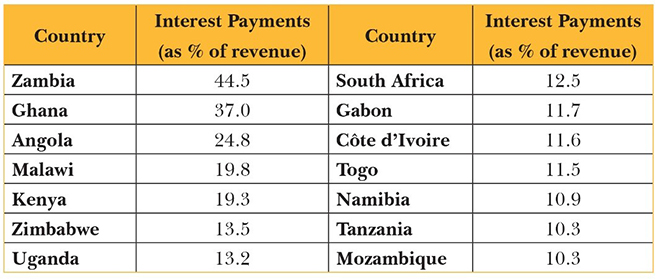

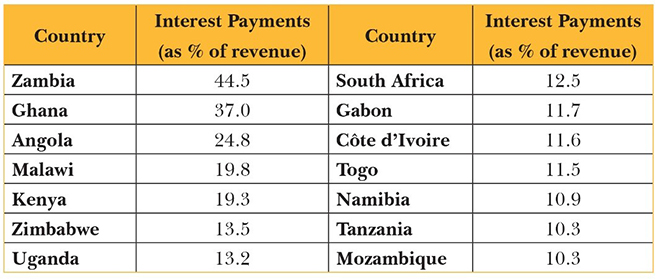

Debt sustainability signals “a country’s ability to meet its external obligations in full, without future recourse to debt rescheduling, or relief or the accumulation of arrears over the medium or long term and without compromising economic growth”.[32] Debt distress then emerges when the country finds it difficult to make the interest payments.

Debt suspension can provide only short-term relief. Lack of government revenue growth can make sovereign debt burden unsustainable. In Sub-Saharan Africa, some of the countries have relatively higher interest payments burden, as percentage of revenue. Zambia tops the list with an interest payments burden of 44.5 percent of total revenue. (Table 9).

TABLE 9: Sub-Saharan Africa Countries with the Highest Interest Payments Burden

* Zimbabwe and Tanzania figures are 2018 data; rest are 2019 figures.

Data Source: World Bank

Case Study 1: Zambia

Debt situation

Zambia defaulted on its sovereign debt commitment in 2020. Public debt stock rose to a massive 104 percent of GDP in September 2020 and was projected to rise slightly in 2021. It may then decline in the medium term if the country’s Economic Recovery Programme succeeds. To achieve debt sustainability, Zambia will need to stop accumulating debt, increase domestic revenues, cut down unnecessary public spending, and create a stronger institutional public financial management framework.

Recent economic developments

Real-GDP contraction in Zambia was 4.9 percent in 2020, after a 4-percent growth in 2018 and 1.9-percent growth in 2019. Private consumption and investment weakened substantially in 2020, mainly due to falling global demand for copper. Copper is Zambia’s main export, driven by global demand from emerging green industries like electric vehicles.

Before the pandemic, the country was in the middle of high inflation, widening fiscal deficits, unsustainable debt, dwindling foreign exchange reserves, and very tight liquidity. Amidst the COVID-19 outbreak, inflation increased to 17.4 percent in 2020 and was expected to remain above the target range of 6 to 8 percent in 2021. Foreign exchange reserves diminished with an average 1.6 months of import cover in 2020 and was projected to remain depressed in 2021 – mainly because of copper price and output fluctuations, rising public debt repayments, and heightened non-oil imports. The government’s effort to increase public investments by adopting expansionary fiscal policy in a falling revenue scenario resulted in rising fiscal deficit, at 11 percent of GDP in 2020. This led to further debt accumulation.

Outlook and risks

The economy of Zambia is projected to expand by a modest 1 percent in 2021, followed by a 2-percent expansion in 2022. The expansion is dependent on recovery in mining, tourism, and manufacturing. Possible future waves remain the underlying risk to this overall positive outlook. Non-performing loans (NPLs) in the banking sector is another. NPLs are expected to rise, leading to a contraction in bank liquidity and subsequent dampening of private sector activity. There have been sizeable job losses in services (30.6 percent), manufacturing (39 percent), personal services (39 percent), and tourism (70 percent). As a result, poverty is expected to rise in the medium term.

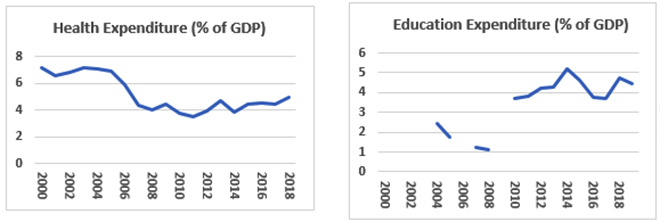

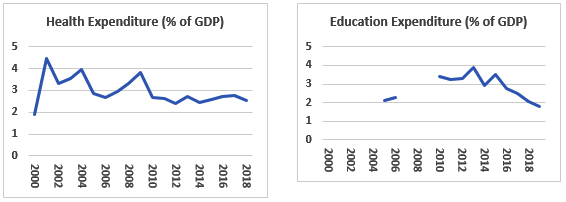

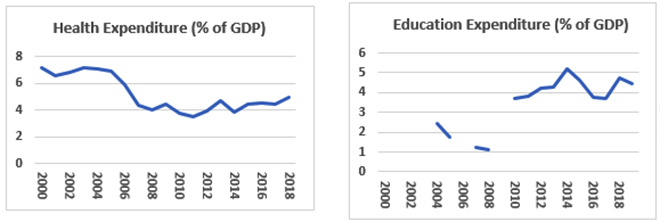

Impact on health and education expenditures

Zambia’s expenditure on healthcare and education had already stagnated at a lower level even before the pandemic. Continuing debt accumulation is expected to adversely impact its public spending and development expenditures like health and education are likely to be hit.

References:

- African Economic Outlook 2021, African Development Bank.

- Country Report: Zambia, EIU

Data Source: World Bank

Case Study 2: Angola

Debt situation

Angola depreciated its currency in 2019, and that has been the principal contributor to the rise in public debt. Around 80 percent of the debt is external. Depreciation was done to mitigate the impact of lower international oil prices, as Angola is an oil-driven economy. Before the pandemic, macroeconomic reforms were undertaken, and IMF re-profiled interest and principal repayments under DSSI for Angola and considered the country’s public debt as sustainable. However, the IMF assessment can still go wrong. The reform also made little difference to the standard of living for most of the population.

Recent economic developments

The economy has been in recession since 2016, contributing hugely to the rise in debt-to-GDP ratio from 57.1 percent in 2015 to 120.3 percent in 2020. Estimated real-GDP contraction in 2020 was 4.5 percent. Oil exports usually account for 95 percent of the country’s total export. A reduction in oil exports culminated in widening fiscal deficit at 4.5 percent of GDP in 2020. Current account deficit was an estimated 2.1 percent of GDP in 2020 from a surplus of 6.0 percent in 2019. Inflation was higher at 24.6 percent in 2020. Lower oil exports also hampered Angola’s effort to implement the country’s first cash transfer programme for 1.6 million poor families. Unemployment rate increased to 34.0 percent in the third quarter of 2020, with youth unemployment increasing to 56.4 percent from 54.2 percent in the third quarter of 2019. Estimated poverty incidence in 2019 was 40.6 percent and the pandemic has only worsened it.

Outlook and risks

Due to the pre-pandemic reforms, a V-shaped recovery is expected. GDP is projected to grow at 3.1 percent in 2021. Recovery in international oil prices in 2020 increased the country’s fiscal revenues. Inflation is projected to decrease to 14.9 percent in 2021. Real risk to Angolan economy comes from the possibility of international oil prices going down. On the positive side, if oil price recovery continues then the budget deficit can reduce to 2.2 percent of GDP and the current account can achieve a surplus of 4.0 percent of GDP in 2021.

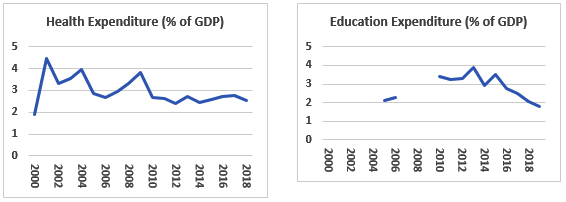

Impact on health and education expenditures

Angola’s health expenditure as percentage of GDP started dropping in 2009 and has remained below 3.0 percent since. Education expenditure, as percentage of GDP also started falling after 2013—a trend that continues till date. If more cuts on public spending are adhered to as part of the reform, these expenditures are likely to go down in the near future. This will have adverse long-term impacts on the economy.

References:

- African Economic Outlook 2021, African Development Bank.

- Country Report: Angola, EIU

Data Source: World Bank

Case Study 3: Kenya

Debt situation

Public debt rose to 72.0 percent of GDP in 2020 from 61.0 percent in 2019, due to infrastructure-related public investment, debt management challenges, and the pandemic. IMF considers Kenya as high risk of debt distress, and prescribes growth-friendly reforms, external financial assistance, concessional credit, and debt restructuring. Other prescriptions include widening tax net, formalisation of informal sector, and deepening of financial markets.

Recent economic developments

Kenya’s GDP is estimated to contract by 1.4 percent in 2020 from a growth of 5.4 percent in 2019. The country’s export basket is dominated by tea and horticultural products. While agriculture is likely to support future growth, structural weaknesses in industry and services may pull the economy down. Inflation was estimated to ease at 5.1 percent in 2021 due to subdued aggregate demand. Fiscal deficit is expected to rise to 8.3 percent of GDP, mainly because of revenue shortfalls and pandemic income losses. Current account deficit is likely to reduce to 5.4 percent of GDP. Foreign exchange reserves dwindled to USD 7.8 billion in November 2020. That provides 4.8 months of import cover. Around 2 million people are estimated to fall into poverty and about 900,000 lost their jobs in 2020.

Outlook and risks

The economy is slated to grow by 5.0 percent in 2021 and 5.9 percent in 2022. Recovery will be dependent on timely availability of external finance, debt service relief, and debt restructuring. As a positive sign, inflation is estimated to remain within the target range of 2.5 percent to 7.5 percent. However, failure to secure external finance, further disruption and closure in the economy, global growth slowdown, and disruptive social conditions before 2022 elections are some of the major risks that Kenya faces in the near future.

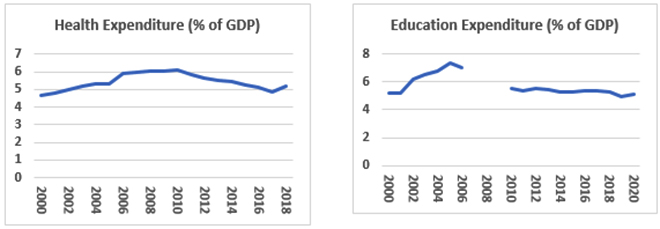

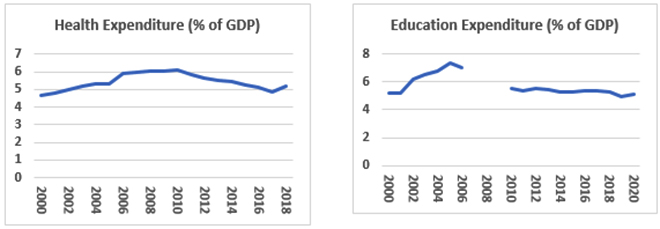

Impact on health and education expenditures

Kenya’s health expenditure, as percentage of GDP, started falling after 2010 and has stagnated around 5 percent in recent years. Government expenditure on education, as percentage of GDP, has been stagnating also around 5 percent – a more than 2-percentage point fall from 7.3 percent in 2005. Quest for external finance, if comes with conditional reform prerogatives, has the potential to put further downward pressure on these developmental expenditures.

References:

- African Economic Outlook 2021, African Development Bank.

- Country Report: Kenya, EIU

Data Source: World Bank

These case studies, complemented with the analysis in the earlier sections of this paper, reveal certain important patterns around debt accumulation in Sub-Saharan African countries.

- Government debt started piling up before 2020. The pandemic aggravated the problem and acute debt stress appeared in some countries.

- The genesis and pattern of such debt stress, however, are not the same for all countries. General problems of dwindling revenue, fiscal balance and current account balance deepened. However, there are separate reasons for debt stress triggers: for example, in Angola’s case, the 2019 currency depreciation played a big role in its rising debt burden.

- There are common elements in macroeconomic indicators: the worsening of fiscal and current account balance; dwindling foreign exchange reserves; and falling aggregate demand. There are differences, too. For example, in Kenya’s case, inflation is expected to ease due to low demand while for Zambia, inflation is rising way beyond the target range.

- The search for a higher growth path by investing more in physical infrastructure with the help of external debt could fail if utilisation of debt is not managed well. Indeed, this has been the story of Kenya.

- Due to the heterogenous economic situations in these countries, immediate relief and resolution of debt burden requires a country-by-country approach, rather than a one-size-fits-all structural adjustment programme as enshrined in financial assistance packages of the IMF and the World Bank.

- As the countries struggle to repay debt, expenditures on long-term developmental indicators like health and education suffer. Since the 2008 financial crisis, the amounts spent on these indicators have either decreased or stagnated.

- If a debt-ridden country concentrates more on repaying existing loans (mostly by its export earnings) than on developmental spending, then it is bound to affect the long-run economic growth. The deeper an economy gets trapped in a lower level of output, more debts will keep accumulating. Sub-Saharan Africa has currently reached that stage. Resolution of debt, therefore, is important to break this vicious cycle.

Past studies have shown that initially, debt stock contributed significantly to African growth. However, unsustainable debt accumulation eventually decelerates growth. Proper utilisation of available debt stock determines the growth impact. If not properly utilised, debt service can exert a negative influence on contributions of domestic resources on growth. Once the debt pile-up becomes unsustainable, it is likely to increase poverty in the long run. Therefore, a stable macroeconomic environment is a prerequisite to proper utilisation of external funds.[33]

Any loan ceases to be ‘developmental’ if it is commercially motivated or extended to satisfy the donor’s interest. The relationship between ‘developmental’ loans and economic growth, therefore, remains controversial. There are two views on this subject. For scholars of the liberal school of thought, the relationship is positive. More radical commentators, however, point out that borrowing is inimical to economic growth and development if lending conditions are not ‘soft’. According to these analysts, there are exploitations associated that include donor access to recipient nation’s decision-making process, direct transfer of resources through repatriation, imposition of dysfunctional and inappropriate economic policies, and high interest rates. Moreover, high levels of borrowing may lead to “aid dependence”.[34] Indeed, oil-exporting countries and Heavily Indebted Poor Countries (HIPC) have been major contributors to the rapid debt accumulation in Sub-Saharan Africa. These are the same countries who were earlier beneficiaries of debt relief programmes.[35]

Historically, Sub-Saharan Africa has been afflicted by high export dependence, high concentration of few commodities, low and declining terms of trade, subsequent instability in export earnings, and a chronic balance of payments crisis. The non-mainstream commentators may have been correct in underlining certain side-effects of debt accumulation all these years.

Conflicts and political instability also play crucial roles in debt accumulation. Mentioned less, but similarly important, is military expenditure—it exerts an upward pressure on debt in the countries that are affected by conflict. Therefore, peacebuilding and reduction in military expenditure can be potentially beneficial to reducing debt burden and promoting economic development in Africa.[36] Certain parts of the continent are facing threats in this regard as a series of military takeovers occurred in 2021 in Guinea, Sudan, Chad, and Mali. It was one of the biggest concentration of coups in the world in years. In the beginning of 2022, the military seized power in Burkina Faso after ousting the country’s democratically elected government.[37] These changes in governance structures can potentially drive debt accumulation in these countries.

V. The Role of Monetary Systems

The question of finding appropriate fiscal interventions to mitigate debt accumulation is related to the respective monetary policies of individual countries. Wide-ranging diversity in monetary system makes monetary policy of countries dependent on external factors. A dependent monetary policy cannot work in tandem with any fiscal policy and would blunt the effect of any fiscal policy in any individual country.

In turn, this diversity can be attributed to colonial legacy. In colonial Africa, various monetary arrangements and monetary unions existed – mostly linking metropolitan currencies with the currencies of colonies. Immediately after decolonisation of the continent, France tried to maintain the currency unions based on the CFA franc.[38] With measures like greater representation in governing boards and offering currency guarantee on French franc reserves, France wished to maintain its strong influence on these erstwhile colonies. Britain, on the other hand, did not make such efforts and the countries, after gaining independence, largely created their own central banks and currencies. However, quite a few of these former British colonies chose to remain in the sterling area for the ease of payment regulations. While franc zones remained institutionally supported monetary union, the sterling areas were more of a loose arrangement based on preferential payments regulations.[39]

Former French colonies are still grouped in two CFA franc currency unions – the West African Economic and Monetary Union (WAEMU)[40] and the Central African Economic and Monetary Community (CAEMC).[41] Former British colonies, however, now have independent monetary policies and separate currencies, with the exception of the British protectorates in Southern Africa. A similar general trend was observed in most of the former Spanish and Portuguese colonies, though there are a few exceptions. Equatorial Guinea joined the CAEMC in 1985, Guinea-Bissau joined WAEMU in 1997, and Cape Verde linked its currency to the Euro. Both CFA francs currently have a fixed exchange rate to the Euro.

A third monetary conglomeration in Africa is called the Common Monetary Area (CMA), earlier known as the Rand Monetary Area. South African currency is the pivot of this monetary union, and Namibia, Lesotho and Eswatini are other constituents. Botswana was part of the CMA but later decided to withdraw. Monetary policy is effectively controlled by South Africa in this zone, but smaller members have the right to issue their own currencies. Namibia and Lesotho have their own currencies – fully backed by prescribed rand assets. Eswatini is not part of this mechanism. Currencies of these three countries are convertible to rand at one-to-one rate, though these are not considered legal tenders in South Africa.[42]

In this way, colonial legacies continue to affect present monetary systems in Africa and make it diverse and difficult to manage. Pegging a country’s currency to Euro, for instance, may have some benefits like currency stability and less volatility. However, that also hinders the independence of monetary policy in that country. Countries in the CFA franc zone do not have their own central banks, nor do they possess access to 65 percent of their own monetary capital reserves. Norms of the monetary union requires countries to maintain 65 percent of total reserves in the operations accounts in CFA franc. Though South Africa continues to show willingness to accommodate smaller countries in the CMA, the monetary policy of the union solely rests with the South African central bank.[43]

Excessive external monetary dependence and linkages can sabotage efforts to effectively deal with the current debt burden and future debt accumulation. Expecting the Sub-Saharan African countries to tackle debt accumulation without the help of metropolitan capital would be less than fair.

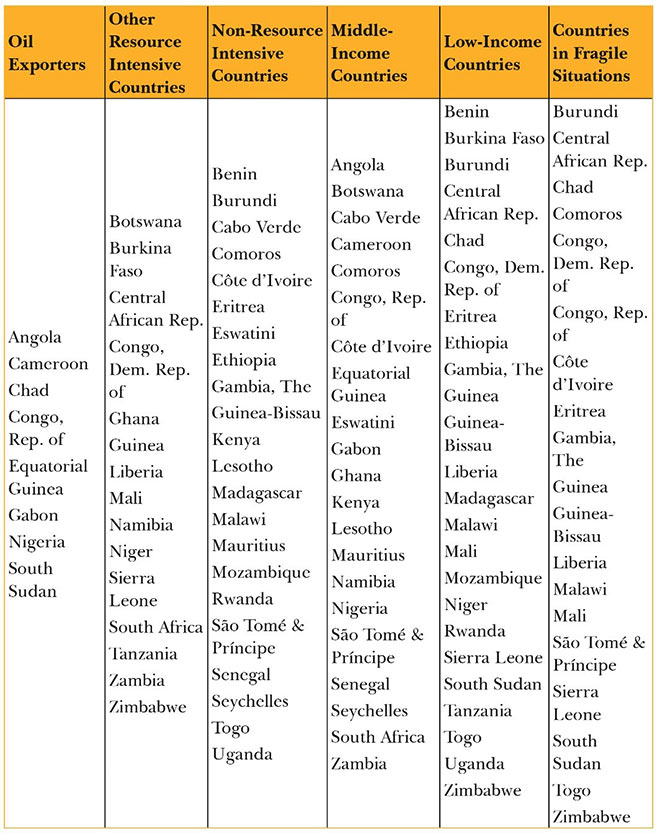

VI. The China Factor

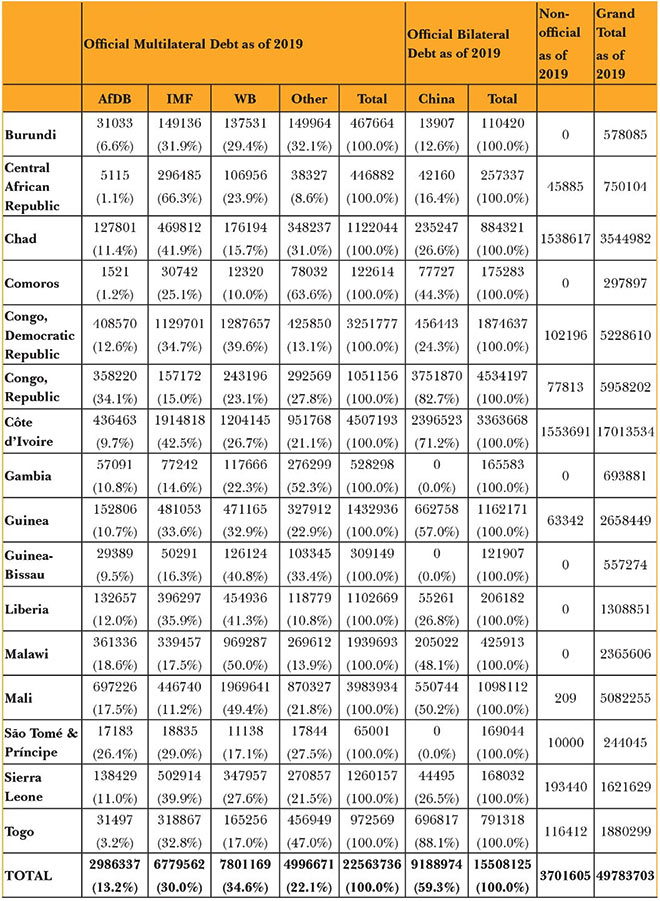

China will play a crucial role in the subject of debt accumulation in Sub-Saharan Africa given the size of its bilateral lending in the region. Therefore, it is important to assess the China factor in pondering any broad roadmap for debt resolution. The countries in fragile situations are chosen as a sample grouping—a fairly representative group of different sets of countries (Appendix 2). There are 19 countries in this group; Eritrea, Sudan, and Zimbabwe are excluded from the DSSI as these are currently in arrears with either the IMF or the World Bank.[44] The remaining 16 countries are considered.

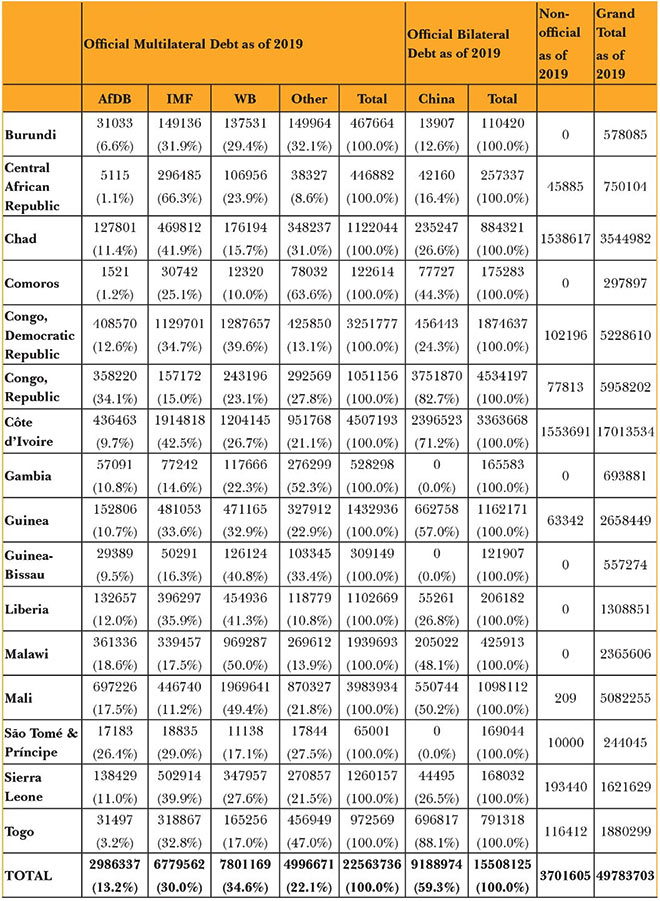

Latest available data (2019) of total debt (outstanding and disbursed) of these countries are summarised in Table 10. Official multilateral debt and official bilateral debt are shown, along with the percentage to total in each category. Chinese bilateral debt figures are shown in both absolute and percentage terms.

TABLE 10: Total Debt (Outstanding & Disbursed) of the Countries in Fragile Situations in Sub-Saharan Africa, as on 2019 (in USD thousands and %)

* AfDB = African Development Bank, IMF = International Monetary Fund, WB = World Bank

Data Source: International Debt Statistics, 2021, World Bank

The following are the key findings of this analytical exercise.

- In multilateral debt, the Bretton Woods institutions (IMF and World Bank) are the dominant lenders to these countries in fragile situations. The African Development Bank (AfDB) contributes 13 percent of total multilateral debts for these countries.

- Credit disbursal spread of AfDB, IMF, and WB across these countries is fairly even and consistent with their overall contributions – 13.2 percent, 30.0 percent, and 34.6 percent, respectively. Therefore, access to multilateral finance is unbiased for these countries. Multilateral loans or grants are not directed to any particular resource-rich group of countries.

- China is the dominant lender in the category of official bilateral debt. The country lends 59.3 percent of total official bilateral debt to these countries.

- China’s credit disbursal is less even among the countries in this group. Apart from Comoros and Malawi, most of China’s debt disbursals are concentrated to oil- and natural resource -rich countries. The island nation of Comoros has its own strategic importance in the Indian Ocean region.[45]

As China grew to become the largest bilateral financier in Africa, two opposing views have emerged. The first is critical of Chinese infrastructure deals and the lack of transparency in Beijing’s lending practices. This view accuses China of wielding “debt trap diplomacy”. It highlights the issue of “hidden debt”, as China’s estimated underreported debt to lower- and middle-income countries is pegged at USD 385 billion.[46]

These observers argue that with the help of its USD 1-trillion projects under the BRI, China is aiming to support infrastructure projects in strategically located developing nations. Beijing chooses financially weaker countries so that it can exploit the debt leverage for strategic influence and equity stakes in those projects. The case of Sri Lanka’s Hambantota Port is often cited to support this argument.[47] At the same time, however, even some of these critics of Chinese lending policy recognise that China has re-negotiated, restructured and waived parts of its African debt portfolio over the years.[48]

The other view on Chinese lending argues that it is local government mismanagement and existing macroeconomic imbalances that are to be blamed in most cases, rather than China’s so-called ‘debt trap diplomacy’.[49] Even in the case of a defaulting country like Zambia (with high amounts of loans from China), it is argued that overriding individual incentive of principal agents (people in government) for a common good (infrastructure projects) have led to a textbook-case of a “tragedy of the commons”.[50] Since China waived the debt owed by Zambia earlier, there is also a “moral hazard”[51] side– where frequent bailouts encourage the borrowers to ignore the default risks. China’s “fragmented authoritarianism” is partially blamed for Zambia’s plight that stemmed from the lack of coordination between the recipient firms and the lender. In this line of argument, failure is more a result of “an error of judgment” than a conscious conniving design to trap the country in debt. Moreover, Zambia is treated as a clear outlier among African borrowers with high Chinese loan commitments.[52]

The reality lies somewhere between these two positions. Government and private lenders of China have made mistakes in Africa, some of them with catastrophic consequences. However, there is little evidence that those were part of a deliberate game plan.

All big lenders, including the Bretton Woods institutions, will have to adjust if they are serious about averting a debt crisis in Sub-Saharan Africa. In the recent past, Argentina negotiated its debt with the IMF in more equal terms.[53] Unfortunately, most of the Sub-Saharan African countries lack a similar political heft.

Ideally, the objective of all international lenders and investors in Sub-Saharan Africa – bilateral and multilateral – should be to provide more lending alternatives at easier terms. African countries can then decide which loans to take. Despite the recent launch of B3W (Build Back Better World) by the G7 countries designed to provide alternative to Chinese BRI loans, current developmental loan choices for African countries remain limited. Unless the choices improve qualitatively and quantitatively, the region will remain at risk of a debt crisis.

VII. Conclusion

Debt accumulation in Sub-Saharan Africa went down significantly till 2008 due to various multilateral debt relief initiatives, only to rise again after the 2008 financial crisis. The pandemic, as a vicious external shock, made many of these countries vulnerable as debt servicing commitments rose substantially. Debt relief initiatives like DSSI and CF have indeed provided some immediate relief. However, their impact remains limited due to less than expected participation and partial resistance by the lenders to restructure. Though the imperative is wider restructuring with selective full waivers, little progress has been seen in that direction.

Dwindling levels of overall fiscal and current account balances, and net FDI acted both as drivers and consequences of this debt accumulation. As short-term and long-term debt piled up, interest payments burden touched unsustainable levels for some countries. Zambia has already defaulted in 2020, and others might follow.

In the last decade, external debt mounted but multilateral debt stagnated. This implies a rise in bilateral and private debt accumulation, China being the largest contributor. Though rising debt is a general trend in Sub-Saharan Africa, the triggers of mounting accumulation are different for each individual country. Reasons vary, from fiscal profligacy to structural deficiency, to currency depreciation and political instability. This means a one-size-fits-all approach, as in the form of structural adjustment programmes, will be futile.

As debt servicing requirements go up, the countries sacrifice their basic human development expenditures for interest payments. Lower output levels then creates a cycle of debt accumulation. The countries experiencing conflict or political instability spend even more on avoidable spending like military expenditure. All these have devastating adverse impacts on development and long-term growth. If Africa is to achieve the sustainable development goals (SDGs), then the cycle of low output and high debt needs to be broken. That will only be possible through the permanent resolution of existing debt.

It is imperative now that overall adjustments and customisation in lending norms are implemented in Sub-Saharan Africa, where borrowing choices are extremely limited. Given easier lending choices and selective full waivers, the countries in this region can have a fair chance of averting the prospect of a debt crisis and embarking on a more sustainable development path.

REFERENCES

African Development Bank (AfDB) (2021), “African Economic Outlook 2021: From Debt Resolution to Growth: The Road Ahead for Africa”, https://www.afdb.org/en/documents/african-economic-outlook-2021

Economist Intelligence Unit (EIU), “Country Reports”, https://country.eiu.com/All

International Monetary Fund (IMF), “AFR Regional Economic Database”, 2021, https://www.imf.org/external/datamapper/datasets/AFRREO

International Monetary Fund (IMF), “Fiscal Monitor”, April, 2021, https://www.imf.org/en/Publications/FM/Issues/2021/03/29/fiscal-monitor-april-2021

Joseph Stiglitz and Hamid Rashid, “Averting Catastrophic Debt Crises in Developing Countries: Extraordinary challenges call for extraordinary measures”, Policy Insight No. 104, Centre for Economic Policy Research (CEPR), July 2020, https://cepr.org/sites/default/files/policy_insights/PolicyInsight104.pdf

Wang Youming, “Call for China to boost role in G20 debt relief politically driven”, Global Times, July 7, 2021, https://www.globaltimes.cn/page/202107/1228097.shtml

World Bank (WB), “International Debt Statistics”, https://datatopics.worldbank.org/debt/ids/

APPENDICES

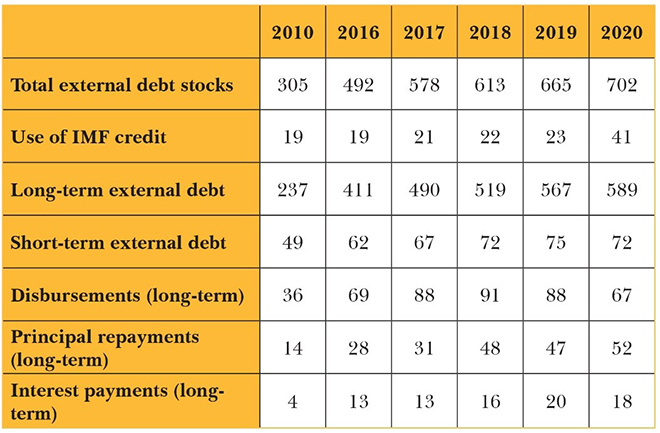

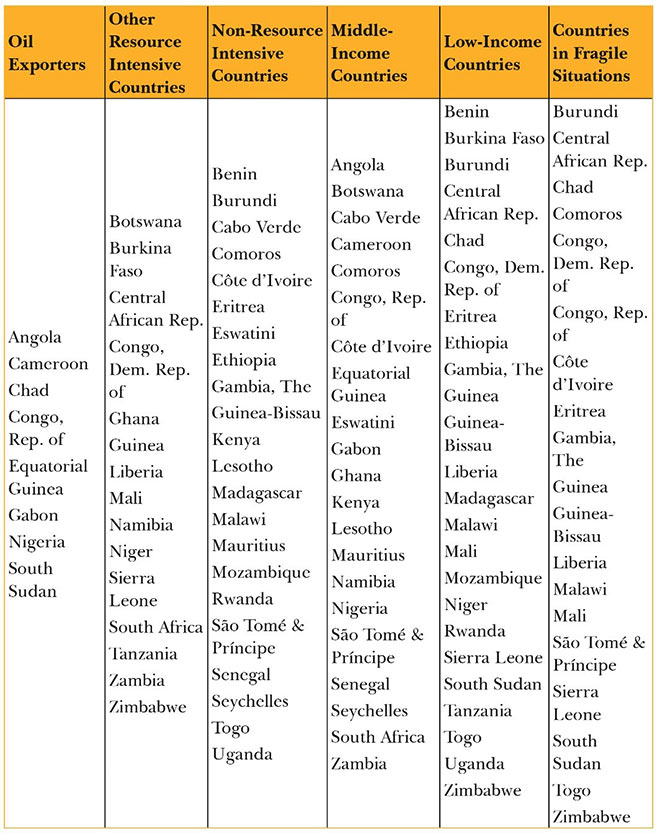

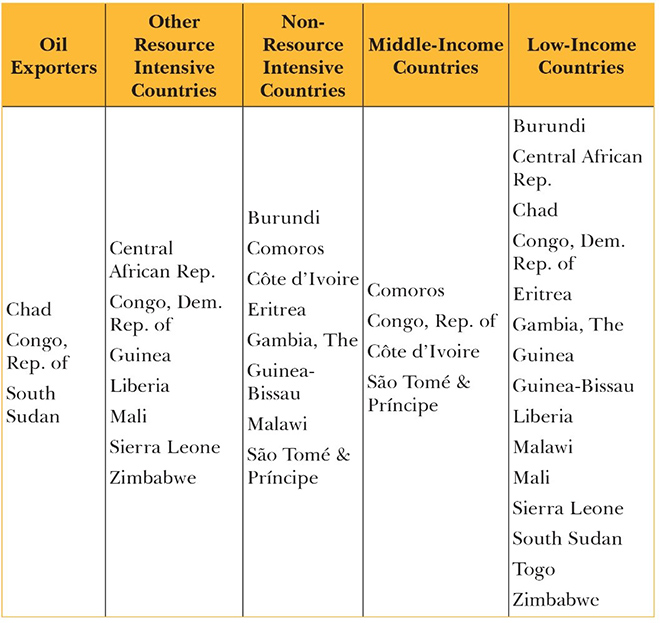

Countries in Sub-Saharan Africa are categorised in groupings based on resource and income in IMF debt database. Income criteria are the same as applied in the World Bank Atlas method.

APPENDIX 1: Sub-Saharan Africa: Member Countries of Groupings

Source: Regional Economic Outlook: Sub-Saharan Africa, IMF, April 2021

APPENDIX 2: Characteristics of the Countries in Fragile Situations in Sub-Saharan Africa by Groupings

Source: Regional Economic Outlook: Sub-Saharan Africa, IMF, April 2021

Endnote

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

PREV

PREV