Introduction

Since the outbreak of the Russia-Ukraine war, there have been appeals and policy advice from various quarters—both in the West and domestically—for New Delhi to abandon its long-standing ties with Moscow and join “Team America”.[1] However, India has remained cognisant of securing its geopolitical and geostrategic interests through its dealings with Russia.

For context, on 5 December 2022, the G7, Australia, and 27 European nations imposed a price cap on Russian shipborne exports of crude oil to curtail Moscow’s ability to bankroll the Ukraine war and maintain stable prices worldwide. The price cap, following a European Union (EU) ban on purchasing seaborne Russian crude oil, was set at US$60 per barrel, with a review to be held every two months starting in mid-January 2023.[2]

Russia is now the world’s most heavily sanctioned country, with restrictions imposed to block its access to the international financial system and bank accounts needed to fund its war efforts. Export controls were also implemented to restrict Moscow’s ability to import products needed to equip a modern military, such as computer chips.[3] At present, over 30 nations, including the US, the UK, Canada, Australia, Japan, and the EU states are involved in this unprecedented punitive effort, applying price caps on Russian energy exports, freezing Russian Central Bank assets, and restricting Russia’s access to SWIFT, the leading system for international financial transfers.[4]

Given Russia’s economic resilience amid such economic restrictions and India’s continued dependence on Russia for its defence and energy requirements, this issue brief assesses the economic rationale for New Delhi to continue to maintain ties with sanctions-afflicted Moscow.

A Resilient Russia

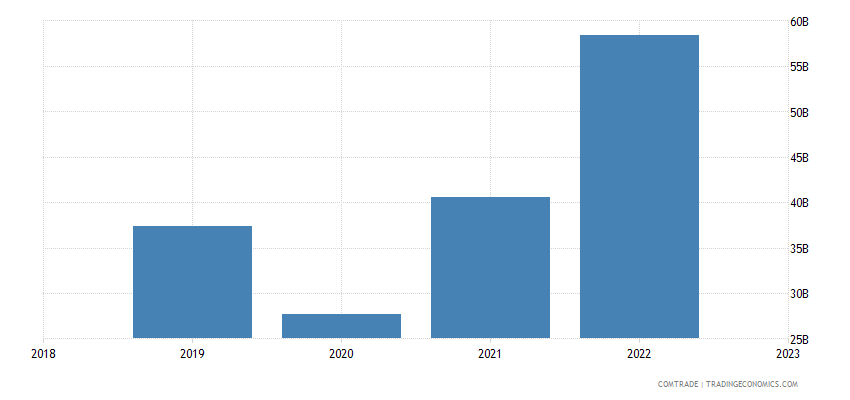

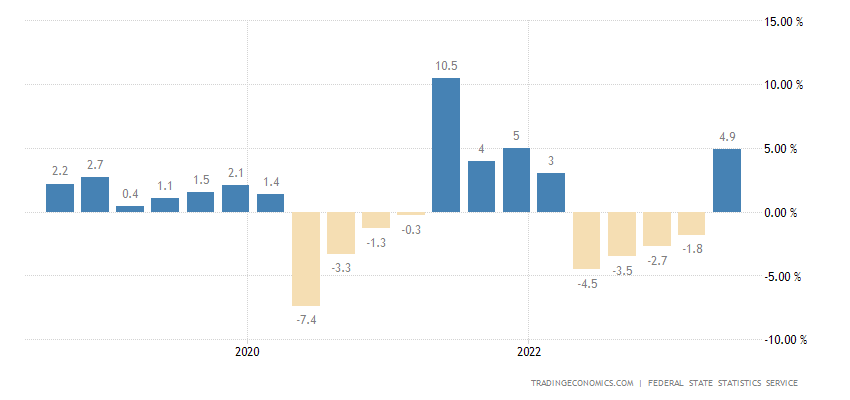

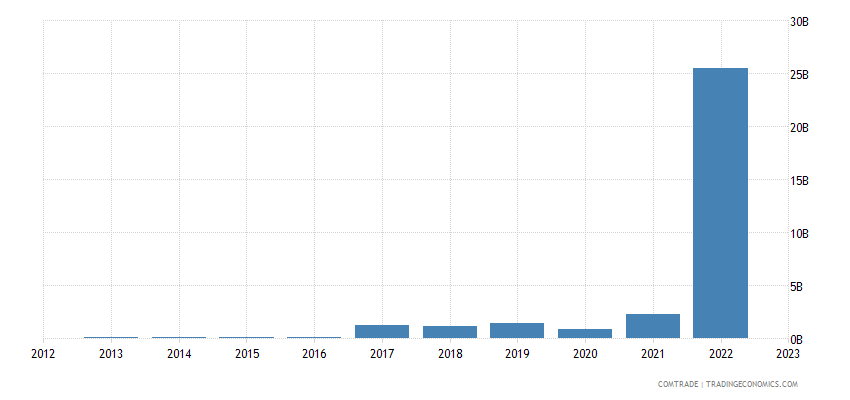

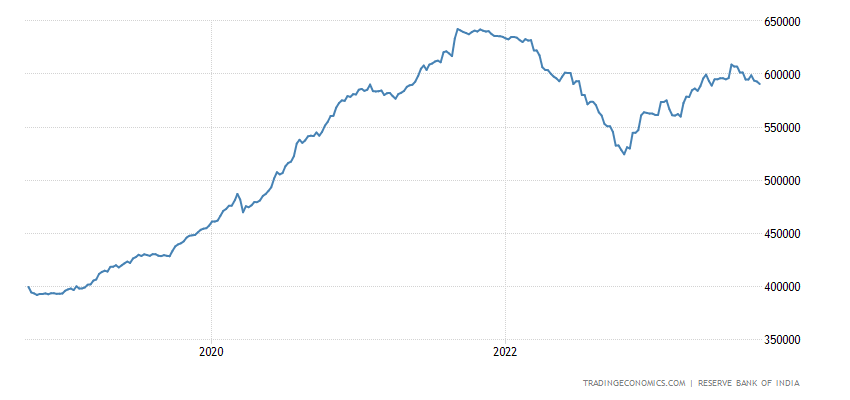

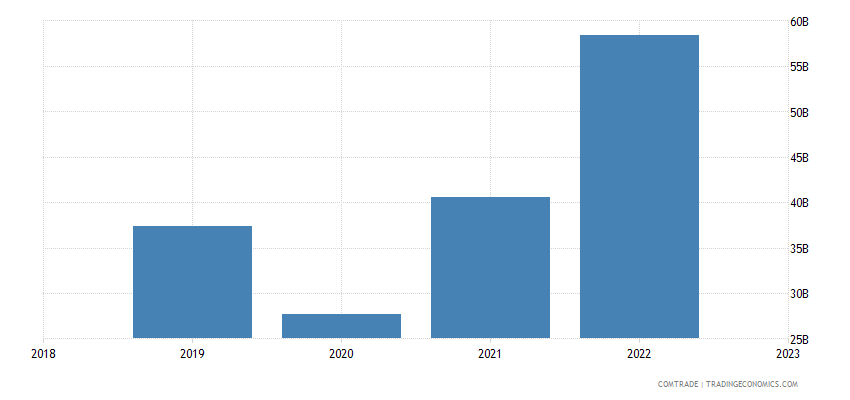

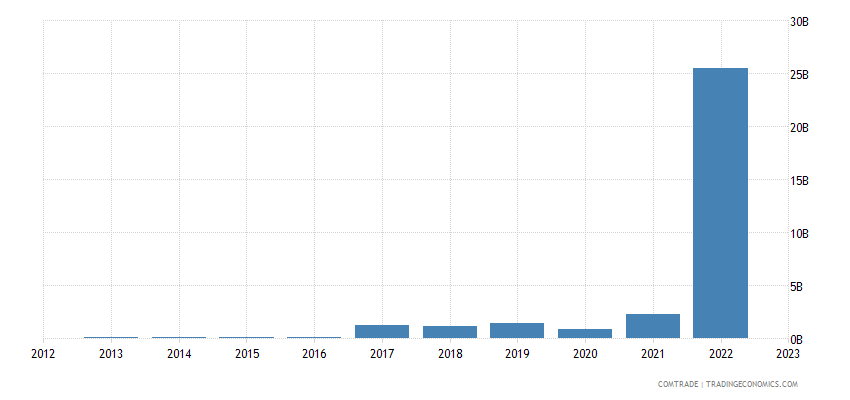

Despite the Russian economy shrinking in 2022 amid the sanctions, Moscow’s fiscal revenues have increased (see Figure 1). This was mainly driven by elevated energy prices and Russia’s efforts to reorient exports to alternative buyers such as China and India (see Figure 2). China alone purchased US$50.6 billion worth of crude oil from Russia between March and December 2022, a 45 percent increase over the corresponding period in 2021 (see Figure 3). Coal imports by China swelled 54 percent to US$10 billion, while natural gas imports, including piped gas and liquefied natural gas (LNG), ballooned 155 percent to US$9.6 billion.[5]

Figure 1: Russia’s tax revenue since January 2018

Source: CEIC[6]

Figure 2: Price of Russian Urals crude oil

Source: Trading Economics[7]

Figure 3: China’s imports of crude oil from Russia (2019-2022)

Source: Trading Economics[8]

Moscow has also been importing billions of dollars worth of machinery, electronics, base metals, vehicles, ships, and aircraft from China (see Figure 4).[9] Chinese car brands such as Havel, Chery, and Geely have witnessed a massive expansion in their market share, from 10 percent to 38 percent, following the departure of Western brands, and that share is likely to increase further in 2023.[10] In the consumer electronics space, Chinese brands, which accounted for roughly 40 percent of the Russian smartphone market at the end of 2021, have captured the industry, with a 95 percent market share.[11] Since being excluded from SWIFT, Russian firms have increasingly utilised the Chinese yuan as a medium for their swelling trade with China. Russian banks have also increased transactions using the yuan to protect themselves from Western sanctions.[12]

Figure 4: Russia’s total imports from China

Source: CEIC[13]

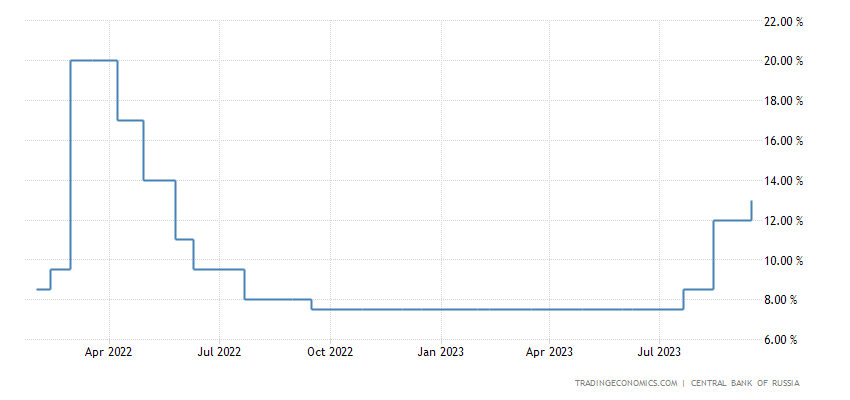

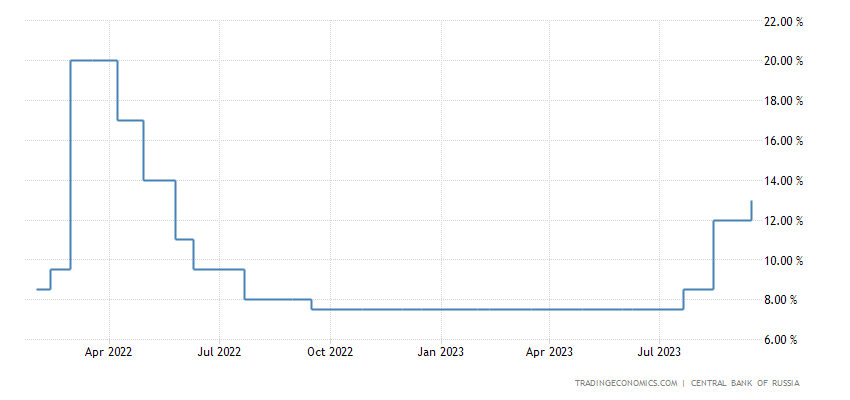

When Western sanctions were imposed on Russia after the Ukraine war began, there were fears in Moscow of financial disarray, a Ruble crash, and cash shortages (see Figure 5). However, fears of economic ruin and a bank run, much like those that had occurred after Russia’s 1998 debt default, did not materialise. This was partially because Russia’s central bank immediately closed markets, restricted currency exchange, and increased interest rates to 20 percent (see Figure 6).[14] Additionally, Russia had many years to bolster its resilience against sanctions after the annexation of Crimea in 2014.

Figure 5: US Dollar to Russian Ruble chart (September 2021-September 2023)

Source: Xe[15]

Figure 6: Bank of Russia interest rate (January 2022-October 2023)

Source: Trading Economics[16]

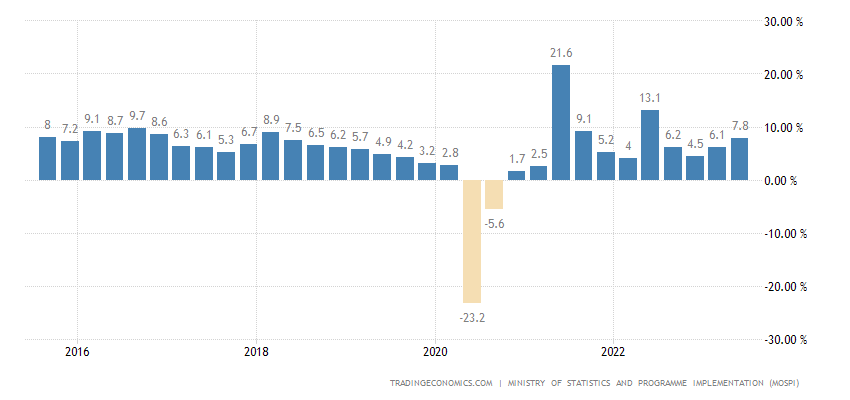

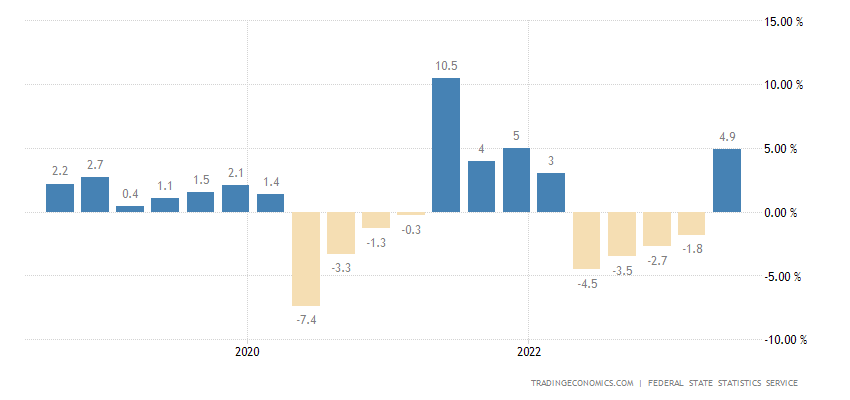

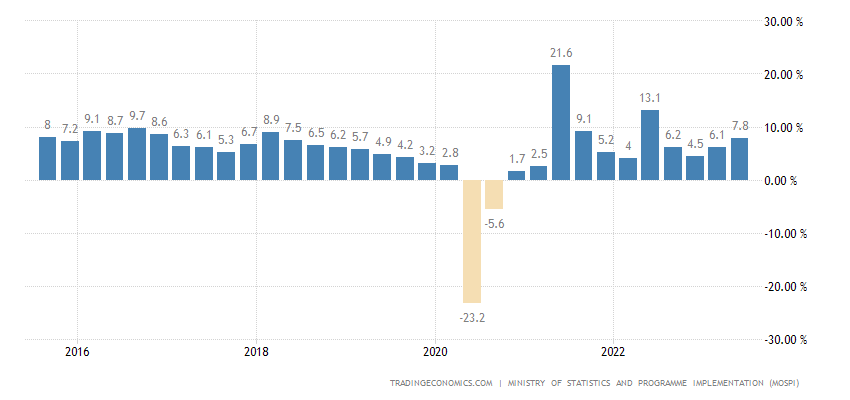

Russia’s economic structure has also bolstered the country amid the ongoing sanctions. Mostly unchanged from the Soviet era, state-owned companies account for roughly two-thirds of the gross domestic product (GDP), while small and medium-sized enterprises constitute only a fifth of the GDP. Although this structure is not growth-friendly, it can act as a stabiliser during adverse circumstances, as was seen during the COVID-19-induced shutdown (see Figure 7).[17]

Figure 7: Russia’s GDP growth rate (year-on-year)

Source: Trading Economics[18]

A Dependent India

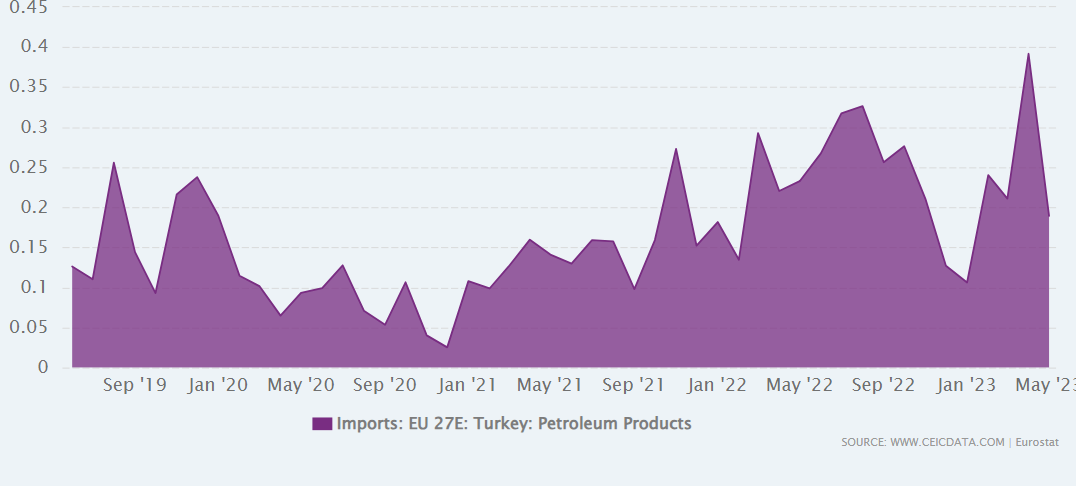

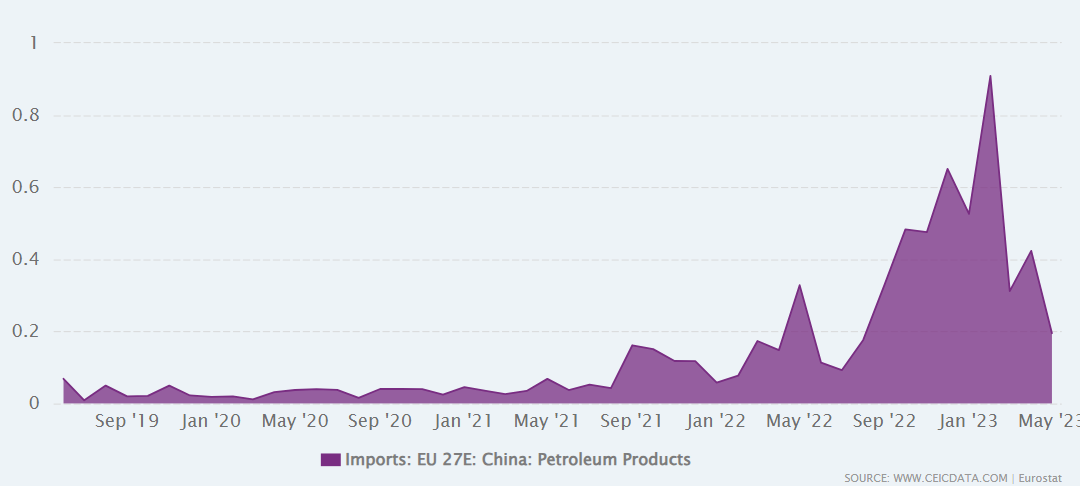

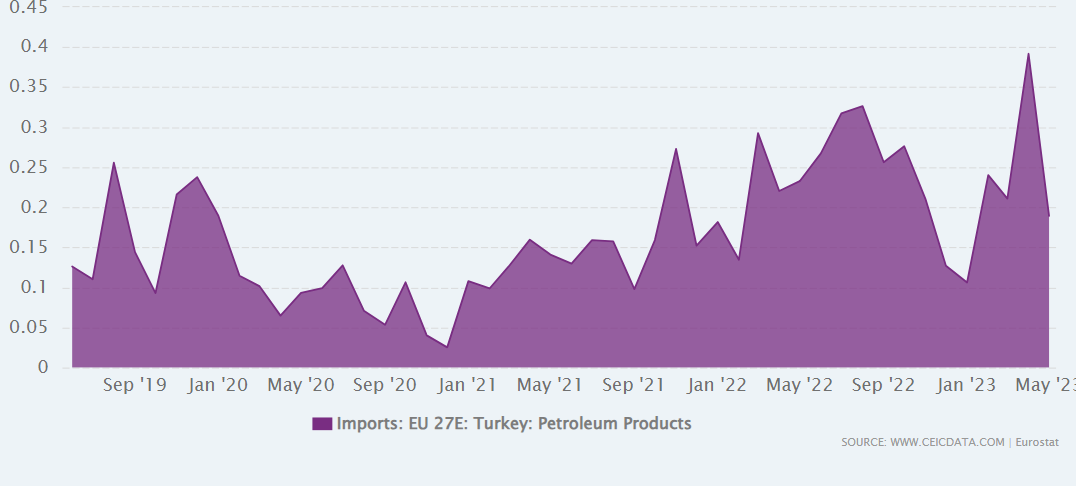

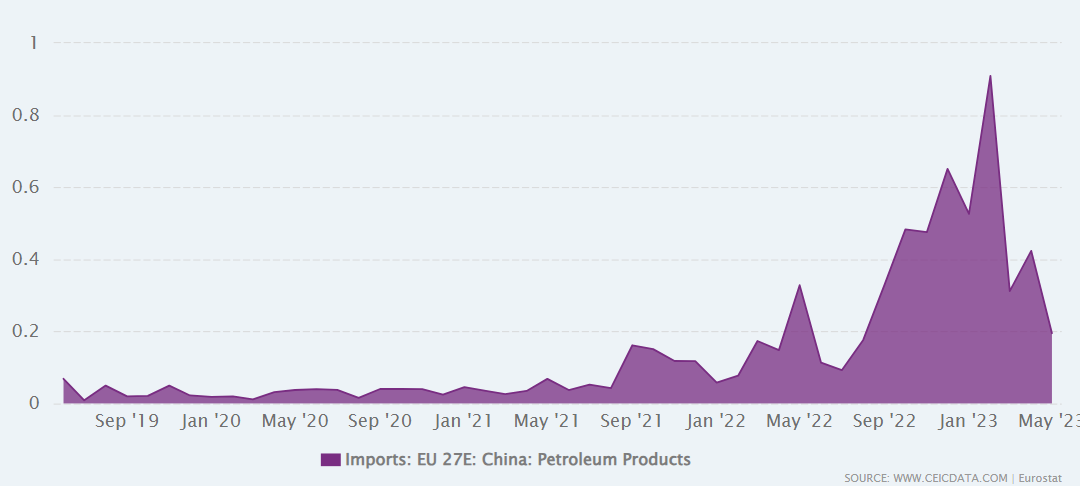

Despite the Western sanctions, the EU remains the largest “indirect” importer of Russian oil.[19] Indeed, the EU has been buying refined petroleum products from close allies of Russia, such as Türkiye (see Figure 8) and China (see Figure 9), which have consequently increased imports of sanctioned Russian oil, effectively bypassing the G7 price cap.

Figure 8: The EU’s imports of petroleum products from Türkiye (in € billion)

Source: CEIC[20]

Figure 9: The EU’s imports of petroleum products from China (in € billion)

Source: CEIC[21]

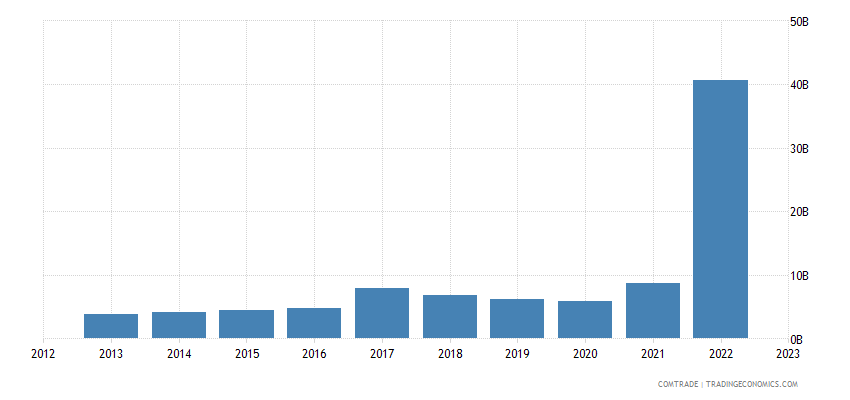

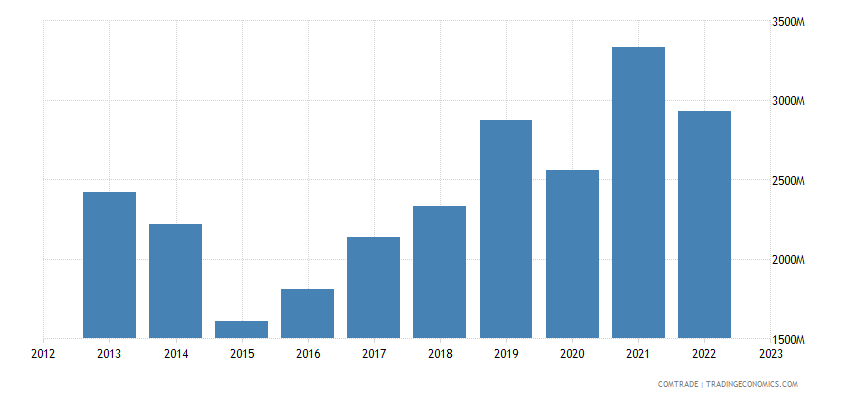

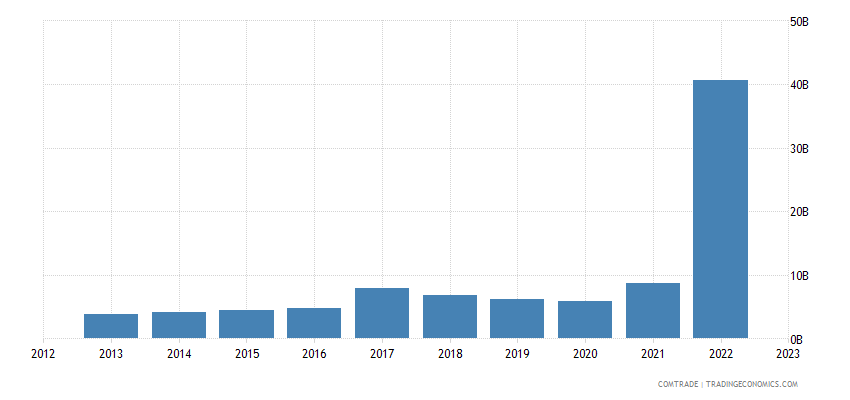

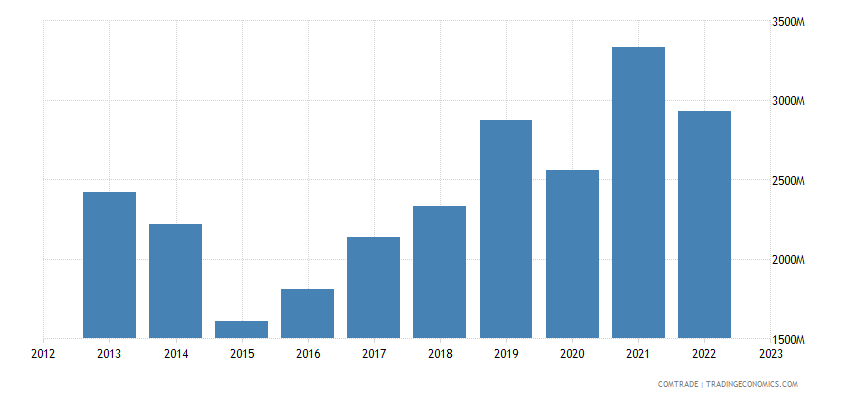

At the same time, Russia also continues to export LNG to Europe[22] As such, India likely feels justified in importing Russian oil even amid extensive Western sanctions on Moscow—and Western pressures on New Delhi to stop doing so—to restrict inflation and promote economic growth, with “mineral fuels, oils, distillation products” dominating Indian imports from Russia since the start of the Ukraine war (see Figure 10 and Table 1). Notably, over the five-year period preceding the war, gems and jewellery constituted the single largest category of Indian imports from Russia.[23]

Figure 10: India’s crude oil imports from Russia (2012-2022)

Source: Trading Economics[24]

Table 1: Top 10 categories of India’s imports from Russia in 2022 (in US$ million)

| Indian Imports from Russia |

Value |

| Mineral fuels, oils, distillation products |

33,970 |

| Fertilizers |

2,730 |

| Pearls, precious stones, metals, coins |

1,290 |

| Animal, vegetable fats and oils, cleavage products |

907.82 |

| Iron and steel |

324.47 |

| Commodities not specified according to kind |

245.91 |

| Machinery, nuclear reactors, boilers |

163.75 |

| Paper and paperboard, articles of pulp, paper and board |

158.00 |

| Inorganic chemicals, precious metal compound, isotope |

92.21 |

| Rubbers |

91.52 |

Source: Trading Economics[25]

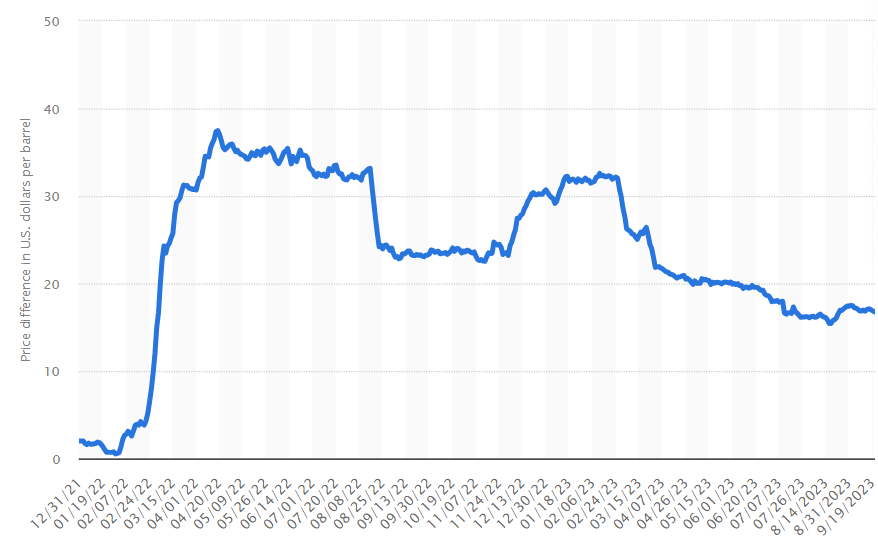

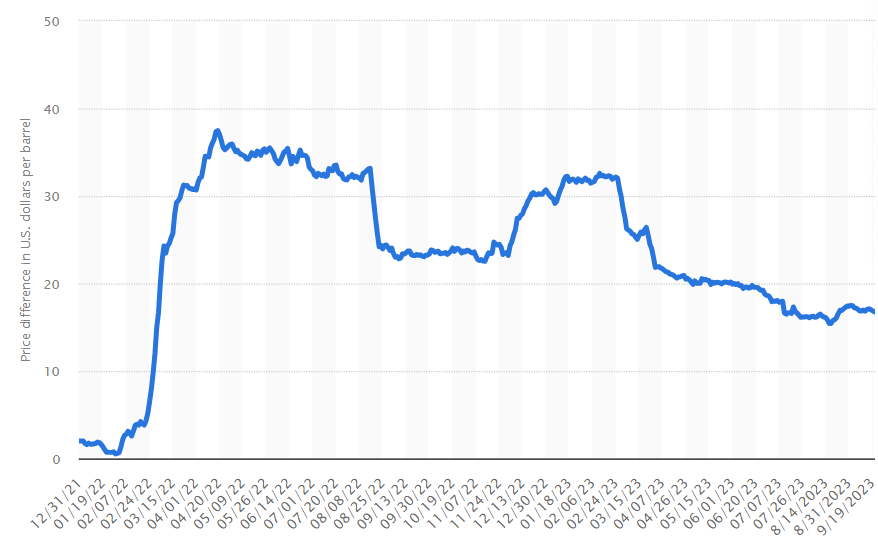

India has already stated that it will continue to import Russian crude oil near or above the US$60-a-barrel price cap implemented by the G7 as it navigates external economic risks (see Figure 11).[26]

Figure 11: Price discount of Urals crude oil to the benchmark Brent

Source: Statista[27]

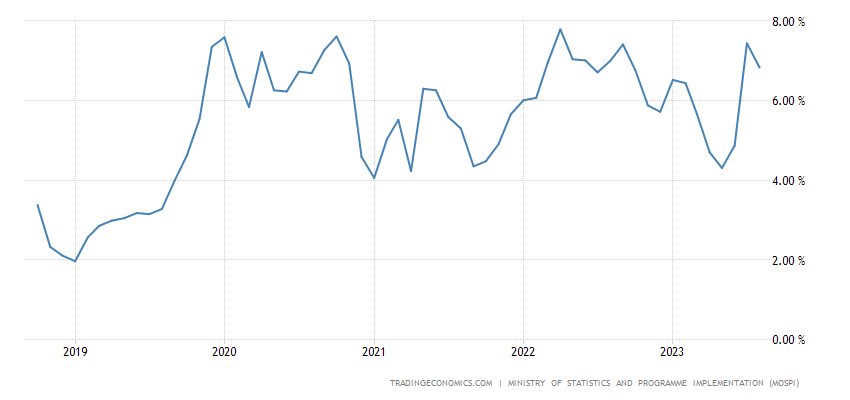

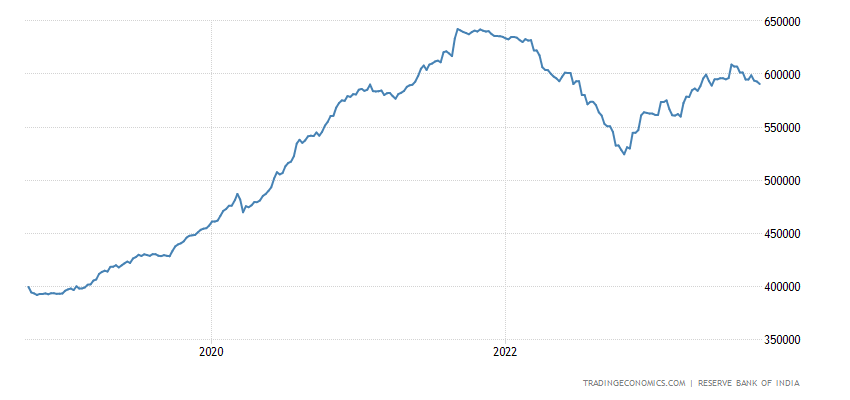

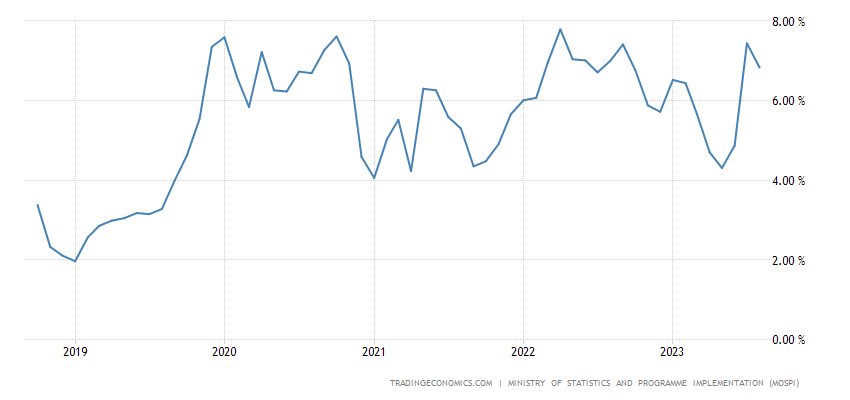

An increase in crude oil prices would indeed widen India’s current account deficit and strain the country’s foreign exchange reserves, which, in turn, would exert a downward pressure on the Indian rupee’s value in global currency markets (see Figure 12). Though the Indian economy and its growth trajectory have remained largely resilient (see Figure 13), prevailing geopolitical uncertainties may impede economic activity and obstruct the growth momentum of Asia’s third-largest economy, which could manifest in weaker corporate earnings and lower spending by households. The inflationary effects of dearer imports will be felt across 35 crore Indian households, particularly those in the lower- to middle-income groups (see Figure 14). The strain will manifest in elevated fuel prices and the cost of daily products, as firms can be expected to transfer most of the increase in raw material prices to households via higher product prices.

Figure 12: Time series of India’s forex reserves (in US$ million) over the five-year period ending on 29 September 2023

Source: Trading Economics[28]

Figure 13: Annual growth rate of India’s GDP (Q3CY16-Q2CY23)

Source: Trading Economics[29]

Source: Trading Economics[29]

Figure 14: Consumer price index-based inflation rate in India (over the five-year period ending in August 2023)

Source: Trading Economics[30]

Indian importers who have absorbed more than half of Urals seaborne exports in recent months are willing to pay higher prices to Russia because these would still be lower than those quoted by alternative sources.[31] The importers are also factoring in increasing competition from Beijing, which is also eager to mop up more Russian crude due to rebounding domestic demand in China. Indeed, Russia became India’s single largest supplier of crude oil in 2022 as the Western sanctions barrage against Moscow prompted the latter to seek new markets.[32]

New Delhi is also extremely dependent on Moscow for a range of military hardware. Over 60 percent to 70 percent of India’s conventional arsenal is of Soviet or Russian origin.[33] Additionally, the two countries have cultivated close military manufacturing relationships over the years. For example, over nearly two decades, India and Russia have jointly manufactured the BrahMos supersonic cruise missile, which can be launched from ships, aircraft, or shore-based launchers.[34] At the same time, there is also the possibility of the hypersonic BrahMos cruise missile, the BrahMos-II, having the same specifications as the hypersonic variant of Russia’s Tsirkon missile, with trials expected to begin in five or six years.[35] If the BrahMos-II programme succeeds, it will demonstrate the resilience of Russia’s defence industry and India’s determination to maintain strategic autonomy.[36] In any case, Russia has been more willing than any Western country to share certain military technologies with India, while also demonstrating that it can supply India with high-technology weaponry at prices significantly lower than any Western supplier.[37] Given the close engagement, any change in ties with Russia will result in significant financial and strategic costs for India.

Key Period in the India-Russia Relationship

The current phase in India-Russia bilateral relations demonstrates that a relationship of equality can avoid the trap of wanting to impose oneself on the other. Indeed, in April 2023, Indian External Affairs Minister S. Jaishankar described India-Russia ties as among the “steadiest” in global relations, arguing that the relationship has recently garnered much focus, not because it has altered, but because it has not.[38]

Signs are emerging that Washington is reconciling with New Delhi’s stance of pursuing ties with Moscow in its self-interest, even as India strengthens its strategic partnerships with the US and other Western countries.[39] Indeed, New Delhi is indicating that this pattern should not be interpreted as a zero-sum game. The US seems to be accepting this, even if reluctantly, with President Joe Biden inviting Prime Minister Narendra Modi for a state visit in June 2023, followed by Biden attending the G20 Summit in New Delhi in September 2023.

Even former US Defence Secretary Jim Mattis recently expressed that Washington should be patient with New Delhi vis-à-vis the latter’s ties with Moscow. Asserting that India does not support Russia’s invasion of Ukraine, he added that New Delhi is “moving in the right direction,”[40] and noted the need for India to continue to grow its economy, as the alternative would be characterised by social unrest and reduced national strength.

To be certain, Indian ambitions are development-focused and New Delhi is unlikely to accept a mere balancer’s role in the Indo-Pacific, regardless of how it is perceived by Washington and its allies. Russia’s offer to utilise its huge oil export revenues from India to invest in the latter’s manufacturing industry for export to the former, the agreement to adopt the Russian financial messaging system for cross-border payments, the acceptance of Indian RuPay cards and UPI in Russia and Russia’s MIR cards and Fast Payments System in India, and the operationalisation of the Maritime Corridor connecting Vladivostok and Chennai point to the eagerness of both nations to implement the required foundations for a massive expansion of India-Russia trade and economic ties, which has already seen an upswing in the past decade (see Figure 15).[41]

Figure 15: India’s imports from Russia (2013-2022)

Source: Trading Economics[42]

India is keen to increase its exports to Russia (see Figure 16 and Table 2), while Russia wants to fast-track talks on a free trade agreement (FTA) and work toward an investment protection pact.[43]

Figure 16: India’s exports to Russia (2013-2022)

Source: Trading Economics[44]

Table 2: Top 10 Indian exports to Russia in 2022 (in US$ million)

| Indian Exports to Russia |

Value |

| Pharmaceutical products |

430.59 |

| Organic chemicals |

284.49 |

| Machinery, nuclear reactors, boilers |

272.95 |

| Electrical, electronic equipment |

179.04 |

| Iron and steel |

160.42 |

| Fish, crustaceans, molluscs, aquatic invertebrates |

126.88 |

| Coffee, tea, mate and spices |

116.51 |

| Miscellaneous chemical products |

112.36 |

| Inorganic chemicals, precious metal compound, isotope |

99.60 |

| Miscellaneous edible preparations |

92.31 |

Source: Trading Economics[45]

Conclusion

Russia accounted for 33 percent of India’s oil imports in October 2023.[46] That figure is up from less than 2 percent in January 2022, just before the Ukraine war began.[47] At that time, India mainly depended on West Asia for its oil.[48] This increasing reliance on Russian crude oil has caused India’s trade deficit with Russia to become its second-largest after its shortfall with China.[49] Indeed, the deficit with Russia has expanded sevenfold, from US$4.86 billion in January-April of FY2021-22 to US$34.79 billion during the same period in FY2022-23.[50] As such, New Delhi has expressed a desire to reduce—or at least restrict—this trade deficit.[51]

Given that Russia remains a resilient power on the world stage, New Delhi must focus its ties with Moscow toward furthering a multipolar world order,[52] especially since India has made its most significant strides toward realising its true potential, both economically and strategically, in the post-Cold War era.

Endnotes

[1] Marziya Sharif, “US lawmaker calls for India to join ‘team America’, abandon China-Russia axis,” The Siasat Daily, April 13, 2023, https://www.siasat.com/us-lawmaker-calls-for-india-to-join-team-america-abandon-china-russia-axis-2567510/.

[2] “G7 price cap on Russian oil: what are the main elements,” Reuters, December 5, 2022, https://www.reuters.com/business/energy/g7-price-cap-russian-seaborne-crude-oil-main-elements-2022-12-05/.

[3] “No economic 'knockout' yet from West's sanctions on Russia,” The Economic Times, February 22, 2023, https://economictimes.indiatimes.com/news/international/world-news/no-economic-knockout-yet-from-wests-sanctions-on-russia/articleshow/98159502.cms.

[4] “No economic 'knockout' yet from West's sanctions on Russia”

[5] Laura He, “How China is helping to prop up the Russian economy through the war in Ukraine,” CNN, February 26, 2023, https://edition.cnn.com/2023/02/22/economy/china-russia-economic-ties-ukraine-intl-hnk/index.html.

[6] “Russia Tax Revenue,” CEIC, accessed November 23, 2023, https://www.ceicdata.com/en/indicator/russia/tax-revenue#:~:text=Russia%20Tax%20Revenue%20was%20reported%20at%20231.424%20USD,Jan%201996%20to%20Aug%202023%2C%20with%20332%20observations..

[7] “Urals Oil,” Trading Economics, accessed September 28, 2023, https://tradingeconomics.com/commodity/urals-oil.

[8] “China Imports from Russia of Crude Oil,” Trading Economics, accessed September 28, 2023, https://tradingeconomics.com/china/imports/russia/crude-oil-petroleum-bituminous-minerals.

[9] United States, Congressional Research Service, China’s Economic and Trade Ties with Russia, Washington, D.C.: Congressional Research Service, 2022, crsreports.congress.gov/product/pdf/IF/IF12120

[10] “The market share of European and Japanese cars in Russia fell to 6%,” Autostat, February 20, 2023, https://www.autostat.ru/infographics/53937/.

[11] “China is helping to prop up the Russian economy. Here’s how,” Counterpoint, February 26, 2023, https://www.counterpointresearch.com/about/in-the-press/china-helping-prop-russian-economy-heres/.

[12] Elena Fabrichnaya and Alexander Marrow, “Exclusive: Russia's Sberbank to issue yuan bonds in 2023 if opportunity arises,” Reuters, June 14, 2023, https://www.reuters.com/markets/rates-bonds/russias-sberbank-issue-yuan-bonds-2023-if-opportunity-arises-2023-06-14/.

[13] “Russia Total Imports from China,” CEIC, accessed November 23, 2023, https://www.ceicdata.com/en/indicator/russia/total-imports-from-china.

[14] Phillip Inman and Mark Sweney, “Russia’s central bank doubles interest rates and closes stock market as rouble plunges,” The Guardian, February 28, 2022, https://www.theguardian.com/business/2022/feb/28/russia-central-bank-rates-rouble-sanctions-economy-ukraine.

[15] “US Dollar to Russian Ruble Exchange Rate Chart,” Xe, accessed September 28, 2023, https://www.xe.com/currencycharts/?from=USD&to=RUB&view=2Y.

[16] “Russia Interest Rate,” Trading Economics, accessed September 28, 2023, https://tradingeconomics.com/russia/interest-rate.

[17] Brendan Cole, “Russia's Resilient Economy Sees Putin Get the Last Laugh,” Newsweek, February 23, 2023, https://www.newsweek.com/russia-economy-resilient-sanctions-putin-last-laugh-1782655.

[18] “Russia GDP Annual Growth Rate,” Trading Economics, accessed September 28, 2023, https://tradingeconomics.com/russia/gdp-growth-annual.

[19] Lauri Myllyvirta, Hubert Thieriot, Andrei Ilas, Oleksii Mykhailenko, Financing Putin’s war: Fossil fuel imports from Russia in the first 100 days of the invasion, Helsinki, CREA, 2022, https://energyandcleanair.org/publication/russian-fossil-exports-first-100-days/

[20] “European Union Imports: EU 27E: Turkey: Petroleum Products,” CEIC, accessed November 23, 2023, https://www.ceicdata.com/en/european-union/eurostat-trade-statistics-by-sitc-european-union-turkey/imports-eu-27e-turkey-petroleum-products.

[21] “European Union Imports: EU 27E: China: Petroleum Products,” CEIC, accessed November 23, 2023, https://www.ceicdata.com/en/european-union/eurostat-trade-statistics-by-sitc-european-union-china/imports-eu-27e-china-petroleum-products.

[22] “Europe continues buying Russian LNG, says Novatek CEO,” TASS, February 6, 2023, https://tass.com/economy/1572207.

[23] Confederation of Indian Industry, India-Russia Trade and Investment Relations, New Delhi, Confederation of Indian Industry, 2017, https://www.ciiblog.in/india-russia-trade-and-investment-relations-2/

[24] “India Imports from Russia of Crude Oil,” Trading Economics, accessed September 28, 2023, https://tradingeconomics.com/india/imports/russia/crude-oil-petroleum-bituminous-minerals.

[25] “India Imports from Russia,” Trading Economics, accessed September 28, 2023, https://tradingeconomics.com/india/imports/russia.

[26] “India Oil Imports: India talks tough on Russian oil imports, says will look for best deal,” The Economic Times, April 16, 2023, https://economictimes.indiatimes.com/news/economy/foreign-trade/india-may-buy-russian-crude-past-cap-if-opec-cuts-boost-costs/articleshow/99534220.cms.

[27] “Difference between Urals and and Brent oil price from December 31, 2021 to September 20, 2023,” Statista, accessed November 23, 2023, https://www.statista.com/statistics/1298092/urals-brent-price-difference-daily/.

[28] “India Foreign Exchange Reserves,” Trading Economics, accessed September 29, 2023, https://tradingeconomics.com/india/foreign-exchange-reserves.

[29] “India GDP Annual Growth Rate,” Trading Economics, accessed September 29, 2023, https://tradingeconomics.com/india/gdp-growth-annual.

[30] “India Inflation Rate,” Trading Economics, accessed September 29, 2023, https://tradingeconomics.com/india/inflation-cpi.

[31] “Russian oil prices soar amid falling freight rates, strong demand,” Reuters, February 23, 2023, https://www.reuters.com/article/russia-oil-exports-idUSL8N3525NN.

[32] Irina Slav, “State Department Says India Is Buying Russian Crude Below Price Cap,” OilPrice.com, March 2, 2023, https://oilprice.com/Latest-Energy-News/World-News/State-Department-Says-India-Is-Buying-Russian-Crude-Below-Price-Cap.html.

[33] “More than 60-70% of India armed forces equipped with Russian origin weapons: Indian envoy,” The Economic Times, July 11, 2020, https://economictimes.indiatimes.com/news/defence/more-than-60-70-of-india-armed-forces-equipped-with-russian-origin-weapons-indian-envoy/articleshow/76903811.cms?from=mdr.

[34] Apart from India’s army, navy, and air force, the BrahMos missile shall also be operated by the Philippine Marine Corp, which is in the process of receiving deliveries of the missile. Philippines had signed a USD 375 million contract in 2022, for three batteries of BrahMos anti-ship missiles.

[35] “Hypersonic BrahMos-II missile may include technology from Tsirkon missile — CEO,” TASS, August 1, 2022, https://tass.com/defense/1487641.

[36] Aditya Bhan, The Hypersonic Potential of India-Russia Military-Technical Cooperation, Kolkata, Observer Research Foundation, 2022, https://www.orfonline.org/expert-speak/hypersonic-potential-of-india-russia-military-technical-cooperation/

[37] Sumit Ganguly, “Why India has been soft on Russia? Here are some strong reasons,” The Economic Times, April 18, 2022, https://economictimes.indiatimes.com/news/how-to/why-india-has-been-soft-on-russia-here-are-the-strong-reasons/articleshow/90873069.cms.

[38] S. Jaishankar, “Remarks by External Affairs Minister, Dr. S. Jaishankar at the "India-Russia Business Dialogue"” (speech, New Delhi, April 17, 2023), Ministry of External Affairs, Government of India, https://www.mea.gov.in/Speeches-Statements.htm?dtl/36496/Remarks_by_External_Affairs_Minister_Dr_S_Jaishankar_at_the_IndiaRussia_Business_Dialogue.

[39] Anjana Pasricha, “India, Russia to Strengthen Trade Ties,” Voice of America, April 23, 2023, https://www.voanews.com/a/india-russia-to-strengthen-trade-ties/7062526.html.

[40] “US needs to show strategic patience with India on Russia: Ex-defence secy Mattis,” The New Indian Express, April 27, 2023, https://www.newindianexpress.com/world/2023/apr/27/us-needs-to-show-strategic-patience-with-india-on-russia-ex-defence-secymattis-2569929.html.

[41] M.K. Bhadrakumar, “Pivotal Moment in India-Russia Relations,” NewsClick, April 26, 2023, https://www.newsclick.in/pivotal-moment-india-russia-relations.

[42] Trading Economics, “India Imports from Russia”

[43] “India, Russia Working On Investment Protection Pact: Russian Deputy Prime Minister Denis Manturov,” Outlook, April 18, 2023, https://www.outlookindia.com/business/india-russia-working-on-investment-protection-pact-russian-deputy-prime-minister-denis-manturov-news-279319.

[44] “India Exports to Russia,” Trading Economics, accessed September 29, 2023, https://tradingeconomics.com/india/exports/russia.

[45] Trading Economics, “India Exports to Russia”

[46] “India's appetite for Russian oil reduces, share slips to lowest in 9 months as OPEC gains,” ET EnergyWorld, November 23, 2023, https://energy.economictimes.indiatimes.com/news/oil-and-gas/indias-appetite-for-russian-oil-reduces-share-slips-to-lowest-in-9-months-as-opec-gains/105428988.

[47] Toru Tsunashima, “India's dependence on Russian oil soars to 30%,” Nikkei Asia, April 23, 2023, https://asia.nikkei.com/Business/Markets/Commodities/India-s-dependence-on-Russian-oil-soars-to-30.

[48] Phil Rosen, “India could rely on Russia for half its oil imports soon as Moscow continues to sell cheap barrels,” Markets Insider, April 25, 2023, https://markets.businessinsider.com/news/commodities/russian-oil-india-exports-fuel-energy-sanctions-ukraine-war-moscow-2023-4.

[49] Tina Edwin, “India's trade deficit with Russia rises a whopping 674% in H1 on discounted oil buys,” Money Control, November 10, 2022, https://www.moneycontrol.com/news/business/economy/indias-trade-deficit-with-russia-rises-a-whopping-674-in-h1-on-discounted-oil-buys-9489011.html.

[50] Shreya Nandi, “India's trade deficit with Russia grows seven-fold to $34.79 billion,” Business Standard, April 18, 2023, https://www.business-standard.com/amp/economy/news/india-s-trade-deficit-with-russia-rose-nearly-seven-fold-last-year-123041800865_1.html.

[51] “India and Russia should resolve trade imbalance: Jaishankar,” The Statesman, April 17, 2023, https://www.msn.com/en-in/news/other/india-and-russia-should-resolve-trade-imbalance-jaishankar/ar-AA19XQAE.

[52] “India-Russia committed to multipolar world,” The Times of India, April 18, 2023, https://timesofindia.indiatimes.com/videos/news/india-russia-committed-to-multipolar-world-eam-jaishankar-at-india-russia-business-dialogue/videoshow/99567212.cms.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PDF Download

PDF Download

Source: Trading Economics

Source: Trading Economics

PREV

PREV