-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

THE PROBLEM

The global telecommunications industry has spent trillions of dollars in building a robust Internet network comprising fiber optic cables, radio and microwave towers for terrestrial communications, and undersea cables for connecting countries and continents. This capacity is augmented by massive and distributed network of data centres built by large companies and Content Delivery Networks (CDNs) to provide users with fast and reliable Internet services.

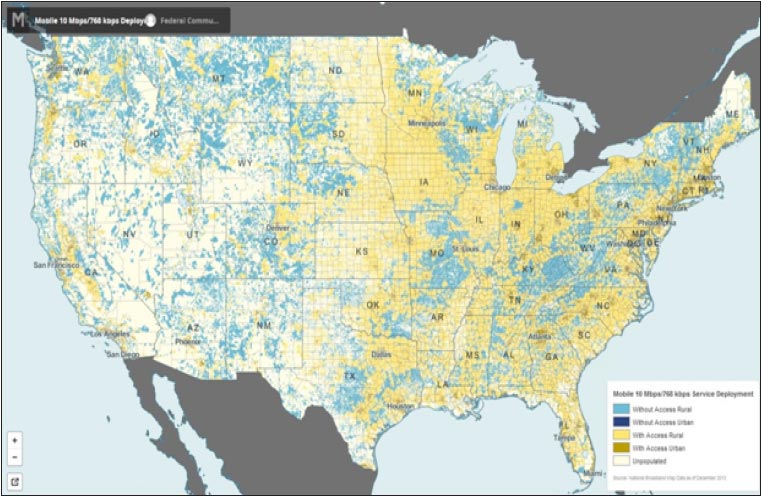

While the existing network is massive, huge populations remain unconnected: Over four billion people or two-thirds of the world’s population still do not have access to Internet. In India, around four of every five people lack this resource, now regarded as basic as water. Even in the United States, considered the birthplace of the Internet, full coverage has yet to be achieved, with over 10 million people left out of the global digital net. Of those who are connected, around 17 percent (including over half of the rural populations) are lacking high-speed broadband.

The situation is caused by both economic and technological factors. For one, rural markets have lower ARPUs (Average Revenue Per User) than urban ones. Expanding connectivity to these rural areas would entail significantly large telecom. backhaul infrastructure since mobile and backhaul infrastructure since mobile and microwave towers have limited range, in the order of a few square-kilometres and tens of km, respectively.

THE DIGITAL NERVOUS SYSTEM

The telecommunications network is a hierarchical system that can be examined as partially similar to the human nervous system. It has three major parts: the core, the backhaul, and the access networks. The core and backhaul are similar in function to those of the human central nervous system, and the access is similar to the peripheral nervous system.

The core, much like the human brain, processes most signals and coordinates their transmission and reception to and from the various parts of the body. The backhaul operates like the spinal cord, collecting signals from smaller networks (or the nerve systems) and connecting them to the core (or brain). The access connects individual users to local cell towers similar to nerves connecting individual muscles and organs.

The network, though, differs from the nervous system in the mode of transmission at various levels. Unlike the nervous system which uses mainly wired connections (nerves) to transmit information, telecom network uses a combination of wireless and wired connections. The access network relies to a high degree on wireless (2G/3G/LTE) communication connecting users/devices to local cell towers while the backhaul relies on a mix of optical fiber network to connect large cities and microwave towers to connect smaller towns. The choice of technology for transmission is driven by three important factors: cost, capacity and convenience.

The biological analogy broadly ends within a telecom operator's network. Internet companies often rely on CDNs to host their data in multiple locations inside and outside a country to provide their services in a consistent manner. These CDNs coordinate with telecom networks to connect to individual users. Since there are multiple telecom operators and CDNs in a single country, coordination between them happens through Internet exchange points located in major cities.

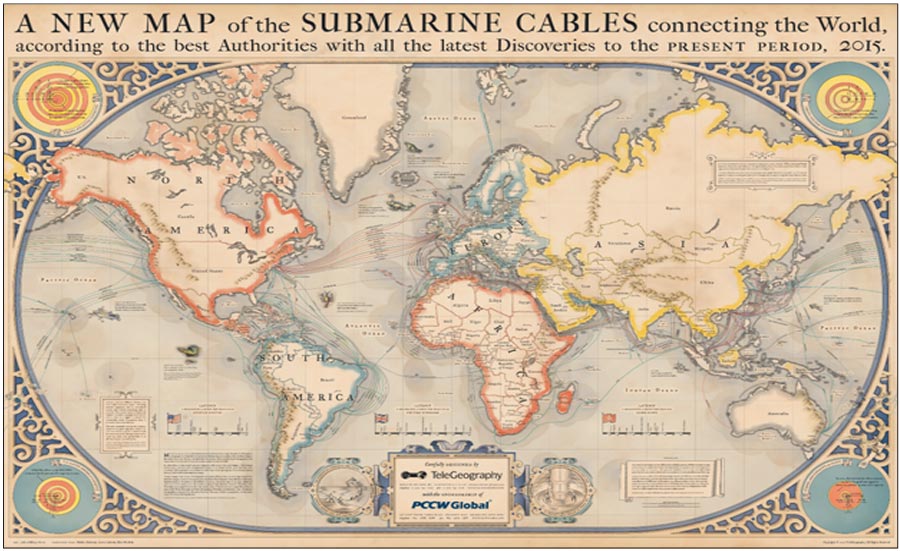

Figure 1: Submarine Cable Map 2015

Source: TeleGeography

For international communications, a network of undersea cables connects countries and continents. It is estimated that the 263 undersea cables currently in operation carry 95-99 percent 4 of the global Internet traffic.

THE DIGITAL DIVIDE

The United Nations estimates that around half of the world's population live in sparsely populated 5 rural areas. Urban areas, by their very nature, provide a more reliable market for telecom operators: users are more densely packed and there is dependable infrastructure like power, roads, and skilled manpower. Moreover, the disparity in income levels renders rural areas less attractive for the industry, as the calculations in ARPUs favour the more upwardly mobile urban markets.

The challenges in building a rural network, however, are not only about lower ARPUs but also of higher capital and operational expenditure. The causal factors include unreliable power, remote location, and security. The first two barriers have been partly solved by relying on offgrid power and by establishing microwave towers every 20-30 km (instead of fiber optics) but the third problem of security is yet to be solved, and theft remains a significant threat especially in developing countries. For rural communities, therefore, the presence of telecom services is less a result of technology making economic sense, and more of regulations mandating operators to provide connectivity.

Figure 2: US Mobile Broadband Map

Source: 2015 Broadband Progress Report, US FCC

The Copenhagen Consensus Center estimates that increasing mobile internet coverage in developing countries from the current 21 percent to 60 percent would add some $22 trillion to their 6 economies. A World Bank study estimates that ever y 10-percent increase in broadband penetration would add around 1.38 percent to GDP in developing countries. These studies also show that it is not only governments and corporations that can participate in providing internet services, but international development aid agencies and non-government organisations (NGOs) as well.

THE CASE FOR SATELLITE INTERNET

Imagine a satellite as a bent pipe which sends water from one point to another. There are broadly two categories of communication satellites based on how they transmit data: direct broadcast and bidirectional. A direct broadcast satellite (for instance, for DTH TV services) receives signals from a ground station and broadcasts those signals to many users. A bidirectional satellite (voice/ data) on the other hand, transmits and receives signals from both the user and the ground station.

How can a single satellite cater to so many users? They have an inherent advantage of heightmeaning, they can cover areas (footprint) as large as millions of square km unlike the current generation of cell towers which have a coverage of only five to ten sq km. They also do some level of signal processing such as strengthening the signal so that the individual user can send or receive a clear signal with a simple setup (smaller dishes and transceivers).

Other factors which distinguish communication satellites are their altitude/orbits of operation (Low Earth-LEO; Medium Earth-MEO; Geosynchronous-GEO) and frequency of operation (S, C, X, Ku, Ka, V bands).

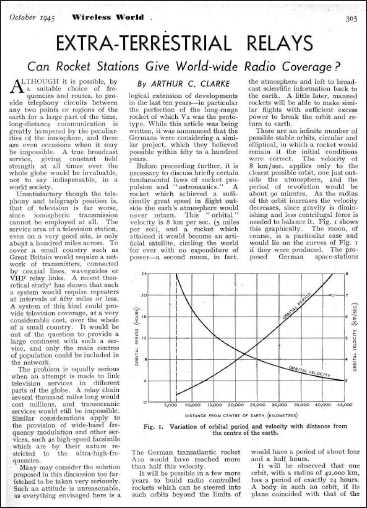

British science-fiction writer and futurist, Arthur C. Clarke, was one of the earliest proponents of a communication system through satellites. In his 1945 article in Wireless World, he advocated for a geostationary satellite constellation to be launched by modifying the unused V2 8 rockets produced during the Second World War. A decade and half later, in 1963, then US President John F. Kennedy made the first satellite call to his Nigerian counterpart through the Syncom 2 satellite.

Figure 3: Arthur C. Clarke's 1945 article

Source: lakdiva.org

Satellites have been used in the telecom industry since the 1960s. The mid-90s and later years saw a surge in efforts to build low earth orbit communication satellite constellations, famously led by Teledesic, a company backed by Bill Gates, as well as various other companies such as 9 Iridium, Globalstar, Odyssey, and ICO. Teledesic, the most ambitious among them, planned on launching a constellation of 840 satellites (later scaled down to 288) to provide speeds as high as 720 Mbps for downlink and 100 Mbps for uplink in Ka-band. These projects had eventually failed for technological and economic reasons, some of which will be discussed in later sections of this paper.

Why have satellites not replaced fiber optic? Satellites have an inherent disadvantage of capacity. Since they were hard to build and launch and have to rely on solar power or batteries, powerful satellites cannot be made, beyond a point, with existing technology. They are ideally suited to increase the coverage area and augment, instead of replace, terrestrial networks.

PRESENT STATUS

The current class of satellite Internet services can be broadly classified into two categories based on their end-use: Individual users and Inst i tut ion al (E nter pr is e/Gover nment/ Military). Most of the companies that operate these services rely on custom-built geostationar y satellites with a large capacity (throughput) and footprint which cost a few hundred million dollars, weighing a few tonnes and taking years to manufacture.

Since these satellites are distant (over 35,000 km), the Internet beamed has very high latency, ranging from 300 ms to over 1,000 ms, making them unsuitable for average users who mostly use social media, email, IM and other services 10 which need low latencies.

Moreover, since GEO satellites are stationary relative to Earth, the end users need to have their VSAT (very small aperture terminal) dish antennae placed in a fixed position and angle (line of sight) relative to the satellite. These technical constraintscombined with high capital expenditure for building and launching these constellationsmean most users are institutional customers with specialised applications like in the Defense, Oil & Gas, and Shipping and Aviation industries. Some of the companies operating in this area include Hughes, ViaSat (Exede), Gilat, Inmarsat, Intel- Sat, EutelSat and SES.

A relatively new constellation is by O3B, which has developed and launched 12 satellites to operate in the Medium Earth Orbit (8,000 km) in Ka-band. They have achieved a latency of under 150 ms and a capacity of 84 Gbps per eight 11 satellites. O3B primarily provides backhaul network to mobile operators with services in remote areas. For example, Bharti-Airtel avails O3B's satellites to provide connectivity in Timor-Leste.

PROPOSED LEO CONSTELLATIONS

The last nine months saw a renewed interest in the satellite industry as multiple LEO satellite constellations have been proposed. These satellites belong to the small satellite class and cost a fraction of geostationary satellites to produce and launch. Since they are located around an altitude of 1,000 km from Earth, they have smaller coverage footprint and hence would need hundreds of such satellites to provide global coverage. Furthermore, as speed of light is around 40 percent higher in space (over silica glass) and since satellites need far fewer hops (lesser repeaters/routers), they can have latencies better than fiber for long-distance communications. The following are some of the publicly known ventures in this area:

ONEWEB

OneWeb, founded by Greg Wyler of O3B, had 12 announced their plans in January 2015. It proposed a constellation of around 650 small satellites which would beam Internet in non-GEO Ku-band to the entire planet including the oceans and airspace. On the user end, OneWeb has developed low-cost ($250) terminals which are solar-powered to receive these signals and provide Internet through 3G, LTE and WiFi to surrounding areas. They choose to position their constellation at an altitude of 1,200 km, which is a clean section of the LEO relatively free of space junk.

The best part of their proposal is the promised quality of Internet. The entire constellation has a capacity of 10 Terabits per second with each 13 satellite having a throughput of 8 Gbps. Since they are 35 times closer to Earth compared to GEO sats, they propose to provide connections to the enduser at latencies under 30 ms and speeds as high as 50 Mbps to the receivers.

OneWeb currently owns the global license for non-Geo Ku-band spectrum issued by ITU. They plan on launching from 2018, making their constellation fully operational by 2019 which coincides with the ITU deadline.

The costs associated with the venture are disruptive. OneWeb has recently finalised Airbus Defence and Space as their primary satellite supplier in a round closely competed for by four other companies. Airbus shall build units at per unit cost of under 0.5 million USD (close to USD 0.35 million) at a rate of four per 14 day. OneWeb has also placed the largest commercial launch order in history through Arianespace's Soyuz rockets and Virgin Galactic's Launcher One. The overall cost of the venture is projected to be around USD 2 Billion of which USD 0.5 Billion has been raised by a group of investors including Qualcomm, Virgin Group, Airbus, Hughes Networks, Coca Cola, 15 IntelSat, Total Payand Bharti Airtel.

SPACEX

T he most ambitious proposal for LEO constellation has been made by Elon Musk-led 16 Space Exploration Technologies (SpaceX). They are well known globally for their role as one of the lowest-cost LEO launch service provider and for their recent efforts in building rapidly reusable rockets.

SpaceX envisions creating a LEO constellation consisting of over 4,000 satellites. Although not publicly disclosed, Elon Musk explained the details in a SpaceX Seattle forum. These satellites, though falling in the smallsat class by weight, would have capacities similar to current high throughput satellites. The co n s te l l at i o n wo u l d p r ima r i l y p rov i d e infrastructure for long-distance communications (targeting over 50-percent share) and partly to individual users (targeting 10-percent share). Since they are similarly positioned as OneWeb's constellation, they would provide Internet services at fiber quality latency (under 20-30 ms) with speeds as high as 1 Gigabit per second through Ground terminals costing USD 100-300. They have filed for the same non-Geo Ku-band with the ITU and are preparing to launch their first phase by 2019 and become fully operational in 12-15 years.

OTHER LEO VENTURES

LeoSat, meanwhile, has plans to launch 120-140 high-power Ka-band satellites into LEO and are primarily targeting enterprise services such as 4G backhaul for telecom operators, connectivity for Oil & Gas and Maritime industries with speeds as 17 high as 1.2 Gbps per client. The satellites would each have a throughput of 10 Gbps, flying in polar orbits at an altitude of 1,400 km.

Yaliny is a startup based in Russia that is proposing a LEO constellation of 135 small sats which would coordinate with 40 ground-based 18 gateways to be built by them. Users can connect to Internet anywhere in the world by carrying smartphone-size transceiver and would be charged USD 10 per month for unlimited data. They differ from other proposals as they plan on using gateways built by them outside a country's territory, which may potentially lead to regulatory challenges along the way.

KEY INNOVATIONS

The following are some of the key innovations which make the proposed LEO constellations technically and economically feasible compared to earlier plans of the last few decades:

LAUNCH COSTS AND AVAILABILITY

Smallsats were mostly launched as secondary payload since there was a lack of dedicated launch service. Currently, with many companies building smallsats not just for communication but also earth imaging (like Skybox, Planet Labs, Black Sky, Urthecast) dedicated launch vehicles are being developed and, in turn, increasing opportunities for secondary payloads.19

In 2011 the US National Aeronautics and Space Administration (NASA) made the decision to phase out its space shuttle program, and introduce the Commercial Orbital Transportation Services (COTS) program which allows private companies to compete in providing cargo services. This new program caused launch costs to drop significantly. Currently, LEO launch costs are around USD 4,000/kg, compared to over USD 10,000/kg in the late 90s and early 2000s.20

With SpaceX in the advance stages of developing rapidly reusable rockets, it would cut costs and improve launch availability by orders of magnitude (10-100 times).21 In India, the Indian Space Research Organisation (ISRO) is exploring the feasibility of a similar system through their Reusable Launch Vehicle - Technology Demonstration Program.

SMALL SATELLITES

The Moore's Law observed in the electronics industry, which is now driven to a large extent by the exponential adoption of smartphones, has led to significant miniaturisation and increase in capabilities of small satellites. As described by Chris Anderson, curator of the TED global conferences, the 'peace dividend' of the smartphone wars is now allowing startups to build these smallsats and cubesats with off-the- shelf electronics.22 For example, Planet Labs, a startup founded by a small team of ex-NASA engineers, has built cubesats by initially using commodity smartphone hardware and have now launched over a hundred satellites to map the earth's surface.

Figure 4: Cube Sats of Planet Labs deployed from the ISS for Earth Imaging.

Source: Steve Jurvetson/Flickr

The current generation of satellites use custom-built hardware and takes a few years to manufacture. Standardising hardware and bringing production line efficiency in their manufacturing will further bring down costs and improve reliability. As Elon Musk in the Seattle SpaceX forum said to this effect, "The satellite industry is going through a phase similar to the computing industry where PCs and small servers have made Mainframe computers obsolete by bringing modularity and scalability."

ANTENNA

Conventional antenna are sensitive to Line of Sight (especially in Ku and Ka band) i.e., they can operate in a specific angle and position relative to the satellite. This is suitable for Geostationary satellites as they are at a fixed position but a constantly moving LEO sat has to have complex ground terminals where the antenna has to mechanically steer constantly to seek the signal.

Phased-array antenna, on the other hand, are solid state, electronically steered antenna with flat shape and simple setup which can switch between passing satellites in milliseconds. This technology has seen a drop in its costs and both OneWeb and SpaceX rely on these antenna for their compact ground terminals which cost around USD 100 to 300. For example, companies such as Phasor and Kymeta are developing such antenna using metamaterials, which have no moving parts and can electronically steer and acquire signals.

AMPLIFIERS

Amplifiers play a crucial role in the energy budget of the satellite and strength of its output signal. Solid-state power amplifiers which are now increasingly based on Gallium-Nitride (GaN) provide high performance at low power. With increasing adoption of GaN SSPAs in the computing and defence industry, there has been significant drop in their costs.

OTHER ACCESS TECHNOLOGIES

Multiple approaches have been proposed by private companies to beam internet from the sky.23 Other than LEO constellations, there are broadly three parallel efforts. Google is building a network of high-altitude balloons, as part of Project Loon, which rely on stratospheric winds to navigate.24 These balloons will carry telecom payload to provide 3G/LTE connectivity directly to users. Taking advantage of their height, each balloon can cover an area of 5,000 sq km unlike the low five to 10 sq km for cell towers. With increasing accuracy in controlling their position and orientation, these balloons can communicate with each other at distances as long as 80 km per pair and in chains of ten or higher, meaning that lesser backhaul infrastructure would be needed to connect remote areas.25

Facebook, meanwhile, is testing a dronebased access network which will beam a mixture of radio and satellite links to ground receivers through which users can connect.26 Google has also shown interest in drones, with its acquisition of Titan Aerospace. As Google is taking a new role as an MVNO (mobile virtual network operator), with Project Fi, drones and balloons will augment its reach and help in its roaming success.27

Another emerging approach is to use White Space to provide broadband service particularly in rural areas. White Space is the free and unused spectrum that is increasing as TV broadcasting moves from analog to digital transmission. Transmission happens over UHF spectrum, meaning towers can be spaced at longer distance (10 km). Phone users, however, cannot yet connect directly and instead rely on WiFi hubs which can receive these signals. Google and Microsoft (4Afrika Initiative) are two of the major companies which are testing this technology, with a focus on Africa. 28, 29

Unlike satellites constellations which have idle capacity over oceans, these ventures can target coverage areas more accurately. By ensuring interoperability with satellites, they can augment their capacity and reach, instead of simply competing for market share with LEO constellations.

REGULATORY ENVIRONMENT

The regulatory body at the global level for launching and operating satellites is the International Telecommunication Union (ITU).30 It seeks to keep satellite communications free of interference and prevent congestion of orbital slots.

The system practices dual-sovereignty where the ITU issues global spectrum licenses on firstcome, first-served basis and the national telecom regulators (like FCC in the US, TRAI/DeitY in India) issue domestic landing rights for operation over their territory. Usually, landing rights are granted on the principle of reciprocity in satellite markets between the host country and the home country of the satellite and becomes easier if both are members of the World Trade Organization (WTO).

Recently, the ITU has received six applications to build Internet beaming constellations in the Ku and Ka bands, signaling a satellite Internet gold rush.31 SpaceX has filed an application with the FCC to launch and operate two satellite prototypes in the US by 2016. Since OneWeb owns the global spectrum rights to operate in the non-Geo Kuband, it would be interesting to observe how the spectrum sharing mechanism would evolve with SpaceX. With US deregulating restrictive export controls for commercial satellites and components in 2014, it would improve satellite manufacturing and promote greater competition in satellite communication.32

In India, the Department of Electronics and Information Technology (DeitY) is mandated to issue licenses to Internet Service Providers (ISPs) that rely on the national INSAT constellation to beam Internet to VSAT terminals. Since most users are institutional customers with specialised needs, there has been no regulations prepared yet for a scenario which involve many users and satellite Internet providers.

At the local level, the proposed LEO constellations (except for Yaliny) plan on partnering with domestic telecom operators to deliver their services, a model similar to Google's Project Loon. It is a logical move in the short run, as the existing telecom operators would have gained the necessary spectrum rights and are compliant with domestic laws.

THE CASE OF INDIA

In India, the world's second largest telecom market,33 Internet penetration is estimated to be still around 20 percent although rural and urban teledensity stand at 45 percent and 148 percent, respectively.34 Broadband (> 0.5 Mbps - TRAI definition) access is much lower at one in every 16 people. Over 90 percent of Indian Internet users connect to, and 65 percent of the traffic flows through wireless networks.35 These numbers are no different compared to sub-Saharan Africa because telecom networks in developing nations today are predominantly built for voice (2G) and not data communications.36 Although average revenue per user (ARPU) in rural ($1.5) and urban ($22. 5) areas vary, lack of connectivity can be attributed largely to high CapEx (costly backhaul) and OpEx (off-grid diesel power) of existing technologies.37

The Indian government is developing BharatNet as part of the Digitial India program, a revamped and larger version of the National Optical Fiber Network (NOFN) which plans on providing fiber optic connectivity to most of the 2.5 lakh Gram Panchayats (moderate-size villages).38 The estimated cost of the project stands at $ 12 Billion, with around 75 percent of the cost going into laying the optical fiber to connect 2.26 lakh GPs. Of the rest, 20,000 GPs would be connected wirelessly and 3,000 through satellite Internet. At the village level, community WiFi would be provided to local institutions such as schools, post offices, health centres, along with cable Internet to households.

The Indian government can take proactive steps to augment the capacity and reach of BharatNet by following open standards in integrating them with private Internet ventures to ensure interoperability. ISRO can launch more Geostationary satellites (like the INSAT) to increase the throughput over its territory. This would allow traffic to be diverted from low altitude systems for applications such as video, news and less interactive content which would need low latency connections. These Geostationary satellites can also be used to empower community-defined broadcasting services like Outernet.39 Other models such as building small satellite platforms in highly elliptical orbits (like Molniya) can be explored to improve performance over specific regions.

IMPLICATIONS

Peter Diamandis opens his book, 'Abundance', with the story of aluminium.40 When the King of Siam visited Napoleon III in the mid-1800s, Napoleon was served his meals in gold utensils while the honored guest was served in aluminium utensils. A metal which is the third most abundant element in the Earth's crust, was the most valuable metal in the world till the 19th century. Humans could not develop a technology to extract pure aluminium efficiently from its natural ore until electrolysis was invented. Today, with this advancement in metallurgy, aluminium has become one of the cheapest and most accessible metal the world over.

Smartphones today provide the cheapest option ($ 30-35 Android) for an individual user to connect to the internet. In 2014, the number of smartphone owners have crossed the two-billion mark and every year, a billion smartphones are being added around the world.41 This trend is going to remain for the foreseeable future courtesy the Kurzweil curve.42 Terrestrial communications powered by a robust network of fiber optic cables and cellular towers have vastly increased the quality and capacity of Internet services in the last decade but have not yet solved the problem of access. Satellites, balloons and drones "which cannot compete with these networks in terms of capacity" are best suited to augment their range.

The abundance created by a combination of cheap smartphones and global service coverage can bring three billion new minds onto the Internet in the next five years. These exponential changes in technology have the potential of effecting fundamental changes in the way people communicate, empathise, feed, educate and trade. After all, information has become one of the bedrocks of modernity and democracy.

Endnotes

1. Internet Society: Global Internet Report 2015, http://www.internetsociety.org/globalinternetreport/

2. The Indian Telecom Services Performance Indicators Report October - December 2014, http://www.trai.gov.in/ WriteReadData/PIRReport/Documents/Indicator_Reports%20-%20Dec-14=08052015.pdf

3. 2015 Broadband Progress Report: FCC, https://www.fcc.gov/reports/2015-broadband-progress-report

4. Messages in the Deep BuiltVisible, https://builtvisible.com/messages-in-the-deep/

5. World Urbanization Prospects by UN DESA's Population Division 2014, http://www.un.org/en/development/ desa/news/population/world-urbanization-prospects-2014.html

6. Post-2015 Consensus: Infrastructure Assessment by Auriol Fanfalone, http://www.copenhagenconsensus.com/ publication/post-2015-consensus-infrastructure-assessment-auriol-fanfalone

7. Economic Impacts of Broadband by Christine Zhen-Wei Qiang and Carlo M. Rossot to with Kaoru Kimura by : World Bank 2009, http://siteresources.worldbank.org/EXTIC4D/Resources/IC4D_Broadband_35_50.pdf

8. Extra Terrestrial Relays and V2 for ionosphere research by Arthur C Clarke: Wireless World February 1945, http://lakdiva.org/clarke/1945ww/

9. Dr. Lloyd Wood's satellite constellations: University of Surrey, http://personal.ee.surrey.ac.uk/ Personal/L.Wood/constellations/

10. RuMBA White Paper on Satellite Internet 2011, http://www.rumbausa.net/downloads/rumba-satellite-wppress. pdf

11. O3B Networks Latency and Throughput, http://www.o3bnetworks.com/latency-throughput/

12. The New Space Race by Ashlee Vance: Bloomberg Business, 23 January 2015, http://www.bloomberg.com/ news/features/2015-01-22/the-new-space-race-one-man-s-mission-to-build-a-galactic-internet-i58i2dp6

13. Honeywell Aerospace Press Release March 2015, https://aerospace.honeywell.com/en/about/mediaresources/ newsroom/oneweb-selects-honeywell-as-a-key-partner

14. Airbus Defence and Space June 2015, http://airbusdefenceandspace.com/newsroom/news-and-features/airbusdefence- and-space-selected-to-partner-in-production-of-oneweb-satellite-constellation/

15. OneWeb's Big Announcement Should Quiet Doubters by Peter B. de Selding: SpaceNews 25 June 2015, http://spacenews.com/news-analysis-onewebs-big-announcement-should-quiet-doubters/

16. Elon Musk's Next Mission: Internet Satellites By Rolfe Winkler and Andy Pasztor: Wall Street Journal 7 Nov 2014 (Paywall), http://www.wsj.com/articles/elon-musks-next-mission-internet-satellites-1415390062; Revealed: Elon Musk's Plan to Build a Space Internet by Ashlee Vance, Bloomberg Business 17 January 2015

17. Why LeoSat's Leaving Internet for the Masses to OneWeb by Peter B. de Selding: Spacenews, 17 March 2015, http://spacenews.com/proposed-leosat-constellation-aimed-at-top-3000/

18. Yaliny: Technology, http://yaliny.com/technology/

19. The ups and downs of smallsat constellations by Jeff Foust; The Space Review, 22 June 2015, http://www.thespacereview.com/article/2776/1

20. Is SpaceX Changing the Rocket Equation? By Andrew Chaikin: Air & Space (Smithsonian), January 2012

21. Reusability: The Key to Making Human Life Multi-Planetary:SpaceX 10 June 2015, http://www.spacex.com/ news/2013/03/31/reusability-key-making-human-life-multi-planetary

22. A Conversation With Steve Jurvetson, Space Investor and Rocket Maker by Nick Bilton: New York Times 17 March 2014, http://bits.blogs.nytimes.com/2014/03/17/qa-with-steve-jurvetson-space-investor-and-rocketmaker/?_ r=0

23. Sky-Fi: The Economist, 9 April 2015, http://www.economist.com/news/science-and-technology/21647957- number-companies-have-bold-ambitions-use-satellites-drones-and-balloons

24. Google I/O 2015 - Engineering for the Stratosphere, https://www.youtube.com/watch?v=8IwazMmHWvc

25. Expanding the Reach of Wireless Internet Around the Globe: Mike Cassidy MIT EmTech 2015, http://www.technologyreview.com/emtech/digital/15/video/watch/mike-cassidy-project-loon/

26. Meet Facebook's Stratospheric Internet Droneby Tom Simonite: MIT Technology Review 30 July 2015, http://www.technologyreview.com/news/539756/meet-facebooks-stratospheric-internet-drone/

27. Project Fi Review by Nathan Olivarez-Giles: The Wall Street Journal, 7 July 2015, http://www.wsj.com/ articles/project-fi-review-google-masters-wi-fi-calling-but-needs-better-phones-1436285959

28. Microsoft Research: Dynamic Spectrum and TV White Spaces, http://research.microsoft.com/enus/ projects/spectrum/default.aspx

29. White Space - The next Internet disruption by Lyndsey Gilpin: Tech Republic, 12 March 2014, http://www.techrepublic.com/article/white-space-the-next-internet-disruption-10-things-to-know/

30. Regulation of global broadband satellite communications: ITU Apr 2012, http://www.itu.int/ITUD/ treg/broadband/ITU-BB-Reports_RegulationBroadbandSatellite.pdf

31. Signs of a Satellite Internet Gold Rush in Burst of ITU Filings by Peter B. de Selding: Spacenews, January 2015, http://spacenews.com/signs-of-satellite-internet-gold-rush/

32. Export control reform (almost) reaches the finish line by Jeff Foust: Space Review May 2014, http://www.thespacereview.com/article/2521/1.

33. IBEF: Indian Telecommunications Industry, http://www.ibef.org/industry/indian-telecommunications-industryanalysis- presentation

34. TRAI: The Indian Telecom Services Performance Indicators Report October - December, 2014, http://www.trai.gov.in/WriteReadData/PIRRepor t/Documents/Indicator_Repor ts%20-%20Dec- 14=08052015.pdf

35. Mary Meeker: Internet Trends 2015 KPCB (Slide 169), http://www.kpcb.com/blog/2015-internet-trends

36. Ben Evans: Mobile is Eating the World (Slide 9, 10), http://ben-evans.com/benedictevans/2015/6/19/ presentation-mobile-is-eating-the-world

37. Telecom expansion in rural areas by Ruchita Saxena: Live Mint 6 January 2013, http://www.livemint.com/ Industry/d5kpIF8iGLa9OpAS1UdNdL/Telecom-companies-go-slow-on-rural-expansion.html

38. Report of the Committee on National Optical Fibre Network (NOFN), March 2015, http://dot.gov.in/ sites/default/files/rs/Report%20of%20the%20Committee%20on%20NOFN.pdf

39. The plan to beam the web to 3 billion unconnected humans by Klint Finley: Outernet Wired article 27 July 2015, http://www.wired.com/2015/07/plan-beam-web-3-billion-unconnected-humans/

40. Abundance by Peter Diamand is and Steven Kotler, Free Press 2012, http://www.abundancethebook.com/aboutthe- book/

41. Ben Evans: Mobile is Eating the World (Slide 4), http://ben-evans.com/benedictevans/2015/6/19/presentationmobile- is-eating-the-world

42. The Law of Accelerating Returns by Ray Kurzweil, 7 March 2001, http://www.kurzweilai.net/the-law-ofaccelerating- returns

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Vignan Velivela is a Research Intern at Observer Research Foundation's Centre for Resources Management. ...

Read More +