-

CENTRES

Progammes & Centres

Location

Quick Notes

The Energy Conservation (Amendment) Act was passed by the lower house of the Indian parliament in August 2022. The act is designed to amend the Energy Conservation Act, 2001 and the revised provisions have been welcomed by most stakeholders and consumers. Climate activists see the provision that enables the central government to impose the use of non-fossil fuels on energy consumers as an important provision that will help India meet its climate goals. The amendment that allows the central government to implement a carbon trading scheme is generally seen as positive, but some observe that it is ambiguous. Climate advocates have also welcomed powers conferred on the central government to mandate energy conservation standards for buildings, appliances, and vehicles. The amendment that empowers the state electricity regulatory commissions (SERCs) to adjudge penalties and to make regulations for discharging their functions has offered some comfort to the concern that the central government is appropriating powers of state governments over regulations on electricity. The expansion of the governing council of the bureau of energy efficiency (BEE) under the act to include members from six ministries, departments, regulatory institutions and members from industries and consumer groups was welcomed by most stakeholders.

Energy conservation is often used interchangeably with energy efficiency. Though they are closely connected, they are not the same. Energy conservation means using less energy (such as turning off the lights when leaving the room) whilst efficiency means using energy wisely (using light emitting diode (LED) lamps instead of fluorescent lamps to get the same amount of lighting). Energy conservation improves the energy use efficiency of existing energy capital stock. This often means technological change using substantial capital investments through which new technologies diffuse into the capital stock (such as incorporating a sensor device that automatically turns off the light when there is no one in the room). Such diffusion requires either expansion or replacement investment. Expansion investment, by definition, expanded the existing capital stock (such as investment in new power generation capacity), enabling increased production levels and increased total energy use, but at a lower level of energy intensity, assuming new capital is more efficient than existing capital. Replacement investment directly replaces retired capital and includes the investment spent on retrofitted capital (such as replacing existing fluorescent lamps with LED lamps). Consequently, replacement investment does not expand the capital stock. It does not increase total energy use but enables a faster decrease in energy intensity than does expansion investment, assuming new capital is more efficient than old capital.

Energy intensity is a measure to assess the energy efficiency of a particular economy. It is calculated by taking the ratio of energy use (or energy supply) to gross domestic product (GDP), indicating how well the economy converts energy into monetary output. The smaller the energy intensity ratio is, the lower the energy intensity of a particular nation. Low energy intensity represents the efficient use of energy to generate wealth.

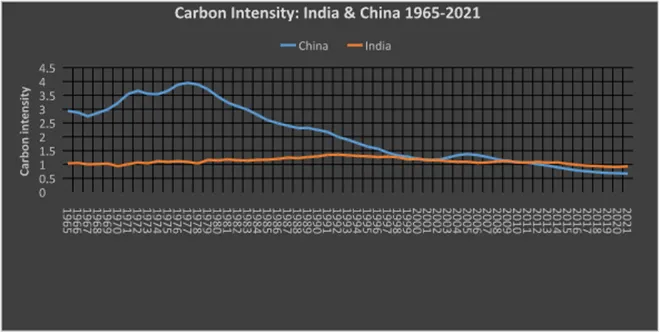

Carbon intensity is the carbon emission per unit of energy consumed, which reflects the energy mix used to produce wealth. Low carbon intensity signals either low energy consumption (as in the case of poor households/regions/countries) or an economy that consists of high efficiency in energy use or the dominance of low energy activities such as services).

In the light of the above, key provisions of the amended act, barring the power given to the central government to mandate energy efficiency standards on devices, focus on reducing carbon intensity rather than on energy conservation or energy efficiency. Essentially, the energy conservation amendment act is used as a vehicle to meet India’s commitment to reduce the carbon emissions intensity of its GDP (gross domestic product) by 45 percent by 2030, from the 2005 level and achieve about 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030 as communicated in its updated nationally determined contribution (NDC).

Between 1970-90, commercial energy consumption in India grew at an average of 5.7 percent whilst the economy grew at an average of about 4.3 percent. In this period, a substantial increase in infrastructure building, especially for power generation, increased industrial energy consumption; investment in electrical equipment and motor cars increased middle-class household electricity, petroleum, and gas consumption. These developments contributed to an increase in CO2 emission intensity, but since the early 1990s when India partially opened its economy, India’s CO2 emission intensity has shown a declining trend. This was mainly driven by a decrease in energy intensity.

Between 1990 and 2019, India’s GDP increased more than six-fold, whilst total final energy consumption increased only by a factor of 2.5 (or GDP grew more than twice as fast as energy consumption). This means that India has required less energy to produce an additional unit of economic output over the years. According to government data, India’s CO2 intensity in 2021 was 28 percent lower than the CO2 intensity in 2005. Structural shift away from traditional biomass (firewood, animal dung etc.) as fuel for cooking in Indian households was one of the key drivers of the increase in energy use efficiency. Although millions of Indian households continue to use biomass as their primary fuel for cooking, the share of energy derived from biomass in final energy consumption fell from 42 percent in 1990 to 18 percent in 2019 as households shifted to LPG (liquid petroleum gas) or piped natural gas. The switch from biomass with a very low conversion efficiency (5-10 percent) to high efficiency petroleum-based fuels enabled economic activity growth without commensurate growth in energy consumption. The decline in the share of biomass in India’s energy basket was responsible for 60 percent of the decline in energy intensity.

The second driver of improvement in energy intensity was the shift in the structural composition of growth in favour of the services sector, which is less energy intensive than growth dominated by industry. Nearly 90 percent of total value‐added growth in India in the period 1990‐2017 came from sectors in the lowest energy intensity category, including large retail service sectors, business, and financial services. The third driver of the improvement in energy intensity in India was technical efficiency of production and consumption processes. Relatively high energy prices, price sensitivity amongst consumers, and a young capital stock contributed to technical efficiency in energy use. The general wave of economic efficiency improvements that occurred after liberalisation in the early 1990s also contributed to the improvement in technical efficiency in manufacturing processes in India.

The fourth factor, a rather perverse one, is India’s slow pace of industrialisation and the consequent low per person energy consumption that has a limited energy intensity and carbon intensity. In 2019-20 (pre-covid), India generated 1381 terawatt hours (TWh) of electricity. Divided equally between a population of over 1.395 billion, it amounts to a per person electricity consumption of just under 1000 kilowatt hours (kWh) which is lower than the world average of 3316 kWh in 2020. India is the only country in the G20 group that has energy consumption below the world average. Low energy consumption, or more accurately, low incomes that limit energy consumption at the household level, has meant poor quality of life for millions of households, especially in rural India. This, in turn, has contributed to lower energy and carbon intensity.

The new provisions introduced in the energy conservation amendment act aim to facilitate the substitution of fossil fuels with renewables at the supply end though this is not consistent with the concept of energy conservation. As the factors that have so far contributed to lowering energy intensity and consequently reducing carbon intensity (shift away from biomass to modern cooking fuels, shift away from manufacturing to services, gains in industrial energy efficiency, and low per person energy consumption) are unlikely to continue, increase in the share of non-fossil fuels at the expense of fossil fuels becomes important to reduce carbon emission intensity. However, India’s decarbonisation goals are not necessarily consistent with its industrial policies such as “make in India” and “self-reliance”. Development of an industrial base at this late stage, even if it is for the manufacture of climate-friendly goods, may increase energy intensity, countering the effort to reduce carbon intensity.

Oil and Natural Gas Corporation (ONGC) is seeking a minimum US$17 price for the gas it plans to produce from coal seams in its Bokaro CBM (coal-bed methane) block in Jharkhand. ONGC invited bids for the sale of 0.20 million metric standard cubic meters per day (mmscmd) of gas it plans to produce from the Bokaro CBM block by the year-end. In March, Reliance Industries Ltd (RIL) sold CBM gas from a Madhya Pradesh block for over US$23 per million metric British thermal units (mmBtu) to firms, including GAIL (India) Ltd, GSPC, and Shell. RIL sold 0.65 mmscmd of gas from its CBM block SP-(West)-CBM-2001/1 at a US$8.28 premium over prevailing Brent crude oil prices. Whilst the government every six months fixes the price of natural gas produced from conventional fields every year, the pricing of gas from coal seams, called CBM, is free or market-determined. ONGC said the gas would be available for sale from 15 December. ONGC holds an 80 percent stake in the Bokaro CBM block whilst the remaining 20 percent is with Indian Oil Corporation (IOC). GAIL (India) Ltd will provide pipeline connectivity for the gas to be transported to users. E-auction will be held on 20 July.

Mahanagar Gas Limited (MGL) announced yet another increase in the retail price of compressed natural gas (CNG) and piped natural gas (PNG) in the megapolis to the tune of INR4/kg (kilogram) and INR3/scm (standard cubic meter) respectively. The distributor attributed the continuing price increases to rising input gas costs and the rupee fall. The company has been sourcing gas from overseas to meet the shortfall in domestic gas allocation. Accordingly, MGL has increased the retail price of CNG by INR4/kg to INR80 and that of domestic PNG by INR3/scm to INR48.50, in and around Mumbai. The Centre had increased the price of domestic and imported natural gas by over 110 percent from 1 April.

GAIL (India) Ltd plans to liquefy natural gas for easy transportation and sale in areas that are not connected with the pipeline grid, helping the nation boost the use of the cleaner fuel. Prime Minister wants to raise the share of cleaner fuel in the country’s energy mix to 15 percent by 2030 from the current 6.2 percent as India aims for net zero carbon by 2070. To meet that objective, companies are investing billions of dollars in building gas infrastructure, including liquefied natural gas (LNG) import terminals, pipelines, and setting up LNG fuelling stations. GAIL will be setting up portable liquefaction units on a pilot basis at two sites for liquefaction of natural gas. It is easy to transport gas in a liquid form to areas where the pipeline network is not developed. Easy transportation of gas will also aid in setting up LNG fuelling stations and bunkering in the country. Indian companies are setting up 50 LNG fuelling stations along a 6,000-km network of highways linking the four main metropolitan areas. The country plans to raise the number to 1,000 in the next few years.

The Petroleum and Natural Gas Regulatory Board (PNGRB) has fined H-Energy Private Ltd (HEPL) – a part of real estate giant Hiranandani group – for delays in laying a pipeline from Jaigarh in Maharasthra to Mangalore in Karnataka, via Goa, to carry natural gas to users. HEPL was granted a licence to lay the 635-kilometer Jaigarh-Mangalore natural gas pipeline (JMPL) on 28 June 2016. The line with a capacity to carry 17 mmscmd of gas was supposed to be commissioned by 27 June 2019, the PNGRB said in an order. Jaigarh is the port where HEPL is setting up a floating terminal to import LNG. In the order, PNGRB said HEPL had admitted to not starting work on the laying of the pipeline at a progress review meeting held on 12 April 2018. In 2019, HEPL submitted to PNGRB that whilst there is no visible physical progress, the pipeline project will be completed by May 2023. The order said subsequent follow-ups didn’t yield any tangible results and HEPL in September 2020 sought force majeure for two years beginning March 20, 2020, due to the pandemic and projected completion of the pipeline by May 2025. The regulator, however, taking into account the outbreak of COVID-19, agreed to a time extension beyond 31 March 2021 subject to the satisfactory completion of remedial actions and progress of the pipeline.

Hungary and Romania are in talks to increase the capacity of a natural gas pipeline interconnector that straddles their borders to more than 3 billion cubic meters (bcm) of gas per year, Hungarian Foreign Minister Peter Szijjarto said. Szijjarto said the planned expansion of import capacity via Romania would enhance the security of supply and offer a route for possible future imports from Greece, Turkey, or Azerbaijan. He said the interconnector could carry 2.6 bn bcm of gas per year to Romania and 1.7 bcm per year to Hungary, which would initially increase to 2.5 bcm and later to more than 3 bcm. Under a long-term deal with Russia’s Gazprom signed last year, Hungary receives 3.5 bcm of Russian gas per year via Bulgaria and Serbia and a further 1 bcm via a pipeline from Austria. The deal runs for 15 years. Russia has promised to continue gas shipments to Hungary and that Gazprom will fulfill its contractual obligations to the country, Szijjarto said. Hungary is about 85 percent reliant on Russian gas imports.

The Polish cabinet has backed legislation loosening gas trading rules, extending tariff protection for consumers, and contingency planning for grid operators to allow for a swift reaction if the energy crisis deteriorates. Proposed measures include a suspension of the rules obliging gas companies to trade fuel on the Warsaw exchange if a gas crisis is declared, an extension of tariff protection for 7.1 million small consumers, including households, until 2027, and contingency planning for gas storage and transmission operators.

According to Norway’s oil and energy ministry, the government has approved expansion plans for the country’s second largest gas field, Ormen Lange, and development plans for the Frosk and Tommeliten A discoveries. The Ormen Lange phase 3 extension is expected to increase gas extraction by up to 40 bcm, with start-up in 2025, the ministry said. The ministry said that the field, operated by Shell (SHEL.L) and located in the Norwegian Sea, will increase gas recovery from 75 percent to 85 percent. Separately, the ministry also approved plans for developing the petroleum discoveries Frosk and Tommeliten A in the North Sea.

Swiss businesses would be first to have energy rationed in the event of supply shortages, Energy Minister Simonetta Sommaruga said. Landlocked Switzerland gets its gas via trading hubs in neighbouring countries in the European Union, so disruptions there would also affect Switzerland. Switzerland has a relatively low demand for gas, which covers around 15 percent of total energy consumption. Around 42 percent of gas is used to heat households, and the rest in industry and in the service and transport sectors.

Germany has prepared a facility to impose a levy on all gas consumers to help suppliers grapple with soaring gas import prices, according to a draft law amendment. In late May, Germany passed a law to enable the state to ensure energy supply in the event of market failure because of Russia’s invasion of Ukraine and reductions to the Russian gas exports on which it relies heavily.

Natural gas has started flowing from Spain toward Morocco through a pipeline that stopped flowing in November amid a diplomatic row between Morocco and Algeria. Algeria decided last year not to extend a deal to export gas through a pipeline running through neighbouring Morocco to Spain, halting nearly all of Morocco’s gas supply as relations between Rabat and Algiers worsened. In April, Algeria warned Madrid not to re-export Algerian gas supplies to its Southern neighbour after energy minister Teresa Ribera confirmed plans to reverse the Maghreb Europe pipeline’s flow and begin exporting natural gas to Morocco. In March, Spain angered its main gas supplier Algeria by supporting a Moroccan plan to offer autonomy to Western Sahara, prompting Algiers to suspend its 20-year-old friendship treaty with Madrid and causing a diplomatic crisis.

Germany may not be able to have at least two LNG terminals start operation by the end of the year as hoped for, as their construction has not started yet. Germany’s LNG projects had long languished as supply via pipelines was cheaper than LNG, but as Germany rushes to phase out Russian energy imports, Berlin’s plans for LNG terminals are picking up speed. Timm Kehler, managing director of the Zukunft Gas lobby, said the pace of building and expanding capacity must be accelerated in order to achieve a capacity of 13 bcm of natural gas via the LNG terminals in the coming year.

Greece has been in talks with Italy to see whether it can store gas in the neighbouring country as part of efforts to secure supplies if Russian flows are disrupted, Greece’s energy regulator said. European Union (EU) countries and lawmakers last month clinched a deal on a law to fill gas stores ahead of winter as part of their efforts to build a supply buffer. Greece has no gas storage facilities and it would need to store enough gas in other states to cover 15 percent of its annual use, which came in at about 7 bcm last year. Greece has said it will ramp up purchases of LNG, use spare coal-fired generation capacity and switch four gas-fired power plants to diesel in case Russia cuts supplies. Greece currently has one facility off Athens which can store 225,000 cubic meters of LNG and regasify it. Its gas operator DESFA will lease a floating storage unit which is expected to anchor close to the LNG facility next month to boost its storage capacity by 130,000 cubic metres, DESFA said.

According to Italian Prime Minister Mario Draghi, large investments in gas infrastructure in developing countries are needed as leaders of the Group of Seven rich democracies unveiled energy and infrastructure financing projects. He said it should be possible to reconvert such infrastructure to hydrogen, to reconcile “short term needs with long term climate needs”.

According to an EU official, there are no plans at the moment to hold an extraordinary summit of EU leaders in July to discuss ways to deal with rising gas prices. He said Italian Prime Minister Mario Draghi had suggested a July summit, in internal meetings with EU leaders, to discuss a proposal to cap prices on Russian gas.

Africa must act quickly to profit from its vast reserves of natural gas that the world will only want until it can shift towards lower carbon technology, the International Energy Agency (IEA) said. IEA said Africa could be in a position by the end of the decade to export some 30 bcm to Europe, which is currently hungry for gas because it is trying to reduce its reliance on Russia.

Qatar Energy signed a deal with Eni on the Gulf Arab state’s North Field East expansion, the world’s largest LNG project, following on from an agreement with TotalEnergies. Qatar is partnering with international companies in the first and largest phase of the nearly US$30 billion expansion that will boost Qatar’s position as the world’s top LNG exporter. Qatar Energy CEO (Chief Executive Officer) Saad al-Kaabi said Eni would own 25 percent of a new joint venture, giving it a 3.12 percent stake in the expansion that is expected to deliver its first gas in early 2026.

Trinidad and Tobago’s sales of LNG to Europe have doubled so far this year to 40 percent of the total, Energy Minister Stuart Young said, as demand continues growing amid a reduction of Russian gas supplies. Trinidad’s LNG exports declined to 7.9 million tonnes (MT) last year after the country, the largest producer of the fuel in Latin America, had to shut one of its flagship project’s liquefaction trains due to a lack of natural gas output. The government is pushing for gas producers, including Shell Plc, BP, and Woodside Energy, to bring new offshore production online later this year. But a decision has not yet been made on whether to restart the inactive LNG train. According to the BP Statistical Review of World Energy, Trinidad’s gas output has dwindled in the last decade amid obstacles to developing its expensive offshore reserves. The country is planning offshore, shallow-water, and onshore licensing rounds through 2023 to reverse the decline. As gas producers rush to contribute more output, the future of the 15 MT per annum Atlantic LNG project – led by BP, Shell, Repsol, Suez LNG, and state-controlled NGC Trinidad – depends on a move to restructure ownership of its three active trains, which has not been completed. In 2014, Trinidad exported over 14 MT of LNG, according to Refinitiv Eikon data.

Ottawa is evaluating options to help restore German gas supplies as a crucial Nord Stream 1 pipeline part is stranded in Canada due to Russian sanctions, the Canadian Natural Resources Ministry said. Gazprom’s Nord Stream 1 pipeline has been forced to reduce capacity as it waits for the turbine, which is being serviced in Canada. Sanctions on Russia make it impossible for German equipment supplier Siemens Energy to receive the pipeline part, the company said. Russia has said the pipeline is delivering less gas to Europe due to the slow return of Siemens-made equipment from Canada.

Gas consumption will contract slightly this year due to high prices and Russian cuts to Europe, with only slow growth over coming years as consumers switch to alternatives, the International Energy Agency (IEA) said. The IEA chopped its forecast for global gas demand by more than half in its latest quarterly report on gas markets. It now expects growth of just 3.4 percent by 2025, an increase of 140 bcm from 2021 levels, which is less than the 175 bcm jump in demand registered in 2021 alone. The IEA chopped its forecast for global gas demand by more than half in its latest quarterly report on gas markets. It now expects growth of just 3.4 percent by 2025, an increase of 140 bcm from 2021 levels, which is less than the 175 bcm jump in demand registered in 2021 alone. Whilst Russia has cut supplies to Europe and European nations have pledged to wean themselves off Russian gas, the impact quickly rippled throughout the world. European nations are trying to make up the shortfall by importing more liquefied natural gas shipped by tanker, which the IEA said is creating supply tensions and leading to demand destruction in other markets. It warned that the scramble for LNG risked not only causing economic harm to other more price-sensitive importers but pushing up prices and thus contributing to additional revenues for Russia.

Japan’s Industry Minister Koichi Hagiuda said he would again ask the United States (US) and Australia to boost the output of LNG and ensure a stable supply to the country when he meets his counterparts in Sydney. Hagiuda, who had asked US and Australian energy ministers for alternative supplies following the Ukraine crisis, will travel to Sydney to attend the energy ministers meeting by the Quad, which includes the United States, Japan, Australia, and India. Resource-poor Japan is facing a historic energy security risk as tensions with Moscow intensify, heightening the threat of gas supply disruptions at a time when global supply is tight, and spot prices are sky-high. Analysts said that Japan needs to prepare for a potential loss of investment participation and LNG supply from the Sakhalin-2 gas and oil project in Russia’s far east.

The Australian government proposed extending its gas security policy until 2030 to ensure the mechanism is available to help domestic reserve gas and prevent a supply crunch that would cause wholesale power and gas prices to rise. The extension would ensure the availability of the so-called Australian Domestic Gas Security Mechanism (ADGSM) whilst checks are made to improve the existing process, Resources Minister Madeleine King said. The current domestic gas security mechanism requires east coast suppliers of LNG to hold back some exports for the domestic market, but the trigger would not help solve immediate shortages as it involves an annual review.

17 July: India’s gasoline and diesel sales during the first half of July dropped from last month as seasonal rains curtailed demand in the world’s third-biggest energy consumer, which could help keep a lid on oil prices. The three biggest retailers sold 1.28 million tonnes (MT) of gasoline during 1-15 July, down about 8 percent from the corresponding period in June. Diesel sales fell almost 14 percent from last month. The retracement in India’s fuel demand adds pressure on the price of oil amid rising pessimism about a global economic slowdown that dragged it below US$100 a barrel for the first time since early April. The softening of demand could also add to a supply glut in the region that’s curtailing the profits from processing gasoline and diesel. Fuel consumption in India typically declines during this time of the year because of the monsoon rains that last until September. It hampers trucking and construction activities, weighing on demand for diesel, the country’s most-used petroleum fuel. Sales of liquefied petroleum gas, a cooking fuel, rose 8.3 percent from June, whilst aviation fuel fell 6.7 percent.

19 July: Indraprastha Gas Ltd (IGL) said it is ready to meet any additional demand for CNG (compressed natural gas) in Gurugram district in Haryana through its network, and there was no shortage in the district. The company said all the 15 CNG stations of IGL in the district were operating 24×7, selling over one lakh kg of fuel per day in Gurugram. The IGL network’s current installed capacity in Gurugram is enough to meet an additional 50 percent demand for CNG. The company said IGL is working towards augmenting its retail infrastructure in Gurugram with five more CNG stations. In addition, the compression capacity at the existing CNG stations is being enhanced to cater to the increasing demand for CNG.

13 July: Prime Minister (PM) Narendra Modi inaugurated the 533km-long Bokaro-Angul gas pipeline section into Jharkhand and Odisha during the airport inauguration at Deoghar. The gas pipeline is a part of the Pradhan Mantri Urja Ganga project. The Bokaro-Angul pipeline section covers 243 km in Jharkhand and 290 km in Odisha in 11 districts and has been built at an investment of INR25 bn. The total Jagdishpur-Haldia & Bokaro-Dhamra pipeline network, including the Bokaro-Angul pipeline section, can carry 16 mmscmd (million metric standard cubic meters per day) of natural gas, which is environment-friendly, convenient, and economic fuel. This pipeline section shall supply gas to industries such as power, fertilizer, steel, refractories, chemical, food processing, cold storage, and so on. In addition, it will also supply gas to City Gas Distribution networks in 11 districts, namely Bokaro, Ramgarh, Ranchi, Khunti, Gumla, Simdega in Jharkhand, and Sundergarh, Jharsuguda, Sambalpur, Deogarh and Angul in Odisha.

17 July: Vedanta expects to bring into operation two coal blocks in Odisha in this fiscal and is working out a plan to fast-track the operationalisation of another coal mine in the eastern state. Vedanta is focusing on the long-term security of coal, especially when thermal power plants and the non-regulated sector have witnessed supply shortages in the current and the last year. The company bagged the Jamkhani coal block in 2019 and the Radhikapur West coal block in 2020 in auctions. Jamkhani coal block is in proximity to the company’s Jharsuguda aluminium smelter. It is one of the most attractive coal blocks for the company’s Jharsuguda plant in terms of location, annual capacity, reserves, and readiness to produce. Vedanta had emerged as the highest bidder for the Radhikapur West coal block, located in Angul district, Odisha at about 190 km from the company’s Jharsuguda Aluminium Smelter. The coal block is optimal for the Jharsuguda smelter given its logistical location and annual capacity. The mine has total reserves of 312 million tonnes (MT) and an approved per annum extraction capacity of 6 MT.

14 July: The state government initiated the process of issuing a formal order for importing coal from foreign countries in a move that was fraught with chances of a hike in power tariff in the near future. Uttar Pradesh Power Corporation Limited (UPPCL) confirmed that the government had granted its nod to the procurement of coal from foreign shores in the eventuality of a coal crisis, especially in August when monsoon rains result in flooding of coal mines in India. The state government’s move follows the Centre’s approval of importing coal to meet the exigency. In May, the Centre had asked the states to immediately start importing coal to meet power requirements and to lift coal by road as failure to do so may lead to shortages in states during the monsoon. Union Power Minister R K Singh had even written to chief ministers of all states, which did not start the process of coal import. The power ministry has expressed its concern with the UP that the tender process for coal import has neither been started nor completed. He has also asked to lift the entire quantity of coal offered to the state by coal companies through RCR (road-cum-rail) mode to build coal stocks. According to the arrangement, the UP government will procure 5.5 lakh tons of imported coal which would be enough to fuel the coal-fired thermal power plants for August and September. This will cost the state exchequer INR11 bn. President, UP Rajya Vidyut Upbhogta Parishad, Avdhesh Verma said the state government has agreed to bear the cost of the imported coal so that it does not translate into a tariff hike. UP stares at the possibility of a coal shortage after Coal India Limited restricted its supply.

14 July: Rating agency Icra said it expects prices of domestic coal to remain high in the ongoing quarter as well, given the supply challenges of the dry fuel during monsoon. The domestic e-auction premium on coal increased by more than 400 percent in May, thereby adversely impacting the cost structure of the base metal companies and margins. Power cost, it said, has risen substantially for domestic base metal companies, owing to lower availability of linkage coal to non-power sectors and elevated coal prices in both international and domestic markets.

13 July: Home Minister Amit Shah said that a nation’s development is impossible without proper policy making for the mining sector. The present government has made several policy reforms to make India self-reliant in the coal sector and the fastest growing economy of the world. Shah said with 8.2 percent growth, India is at present one of the fastest growing economies in the world, and the coal and mine sector of the country is contributing considerably to the present economic growth. Reforms undertaken by the present government has resulted in eliminating deep-rooted corruption existed in coal block allotments. Prime Minister Narendra Modi has always prioritised ensuring reforms in the mining sector so that it can further contribute to the country’s overall economic growth. Since 2014 when Modi became prime minister, the government has always considered mines, minerals, and coal sectors as priority sectors. Corruption had deepened its roots in the coal sector for decades; there were court cases regarding allocation in the earlier governments, CAG raised questions, and many allocations had to be cancelled. The Modi government has brought transparency, removed barriers, and taken care of environmental concerns related to the coal sector whilst formulating policy. The sole purpose of the formulation of policies, reforms, and changes for the coal sector by the Modi government was that India should become self-reliant in the mines, minerals and coal sector, and these sectors should become a strong pillar of our economy. Coal production which was 566 million tonnes (MT) in 2013-14, reached 777 MT in 2021-22.

19 July: The Joint Electricity Regulatory Commission (JERC) has directed the UT (Union Territory) administration to expedite the smart grid pilot project and submit the progress report to the commission in one month. These directions came in the recent power tariff petition order issued by JERC. The UT electricity department submitted before the Joint Electricity Regulatory Commission (JERC) that the monthly billing system was not implemented in the city due to acute shortage of staff and upgrade of software. In 2019 and again in 2020, JERC directed the UT electricity department to shift from a bimonthly billing system to a monthly billing system.

16 July: Punjab Chief Minister (CM) Bhagwant Mann said around 51 lakh households in the state would receive zero electricity bills and asserted that the promise of 300 units of free power had been implemented from 1 July. The AAP (Aam Aadmi Party)-led government had earlier announced that it would provide 300 units of free electricity to every household from 1 July. Giving 300 units of free electricity was one of the major polls promise of the AAP during the Punjab assembly elections. Party’s national convener Arvind Kejriwal had promised free electricity of up to 300 units per household in the state in June last year. Kejriwal had also promised a waiver of pending electricity bills and a round-the-clock power supply in the state. In April, Mann said if electricity consumption exceeds 600 units in two months, then a consumer will have to pay for the entire power usage. But scheduled castes, backward castes, below-poverty-line households and freedom fighters will be charged just for over 600 units, the CM clarified. Punjab has a two-month billing cycle for power supply.

13 July: The Delhi power department released a standard operating procedure (SOP) having online and offline forms for consumers who want to avail benefits of its subsidy scheme after 1 October. Delhi CM (Chief Minister) Arvind Kejriwal in May announced that from 1 October, power subsidy would be provided to only those consumers who specifically demand it. The released SOP will be implemented to seek consumers’ replies whether they want to avail of a power subsidy. He had said that there were many people who felt they could pay their power bills without the subsidy and the money thus saved could be spent on developing schools and hospitals in the city. Domestic consumers who use up to 200 units of electricity in a month get 100 percent subsidy. Such consumers number around 30.39 lakh. Further, the Kejriwal government provides 50 percent subsidy (up to INR800) to over 16.59 lakh consumers who use 201-400 units per month.

13 July: India is poised to add 27,000 circuit kilometres of inter-state power transmission networks by 2024 as it has already added 6,500 circuit kilometres or almost one-fourth of the target. The power transmission network expansion has been planned to keep in mind the goal of having 500 GW of non-fossil fuel-based electricity generation capacity in the county. The inter-state transmission link plays an important role in power generation capacity addition. Experts are of the view that transmission links to evacuate power from projects, especially renewables, should be set up much before the generation capacity is added. The power ministry had said that all Inter-State Transmission System (ISTS) lines had been mapped on the portal of the PM GatiShakti National Master Plan (NMP), which was launched in October 2021 to push infrastructure development in the country. Also, it had informed that 90 percent of under-construction ISTS lines have been integrated to the portal, and the remaining 10 percent are to be integrated after finalisation of the route survey by respective transmission service providers. PM GatiShakti NMP portal provides “one-click comprehensive view” to steer and simplify the planning and implementation process by reducing time and cost of implementation in power transmission projects. The power ministry said that in addition to 27,000 circuit kilometres by 2024, India would need to build transmission lines to evacuate 180 GW generation capacity, which will ultimately help the country to realise its goal of having 500 GW of renewable energy by 2030.

13 July: The Delhi government has again urged the Union power ministry to allow it to retain its existing share of 728 MW in the Dadri-II power plant to ensure there is no electricity shortage in the national capital. In a letter to the ministry, the government said the power purchase agreements executed between its power distribution companies and NTPC Ltd for a committed supply of 728 MW from its plants, including Dadri II, were valid till 30 July 2035. The ministry, in its June 28, 2022 order, reallocated around 500 MW of power to Haryana and the remaining 228MW to Delhi, and the arrangement is valid till 31 October 2022. The ministry said this April that the then Delhi Power Minister, Satyendar Jain, had surrendered power from 11 central generating stations, including Dadri stage-II, with immediate effect. The Delhi government, however, contends that the entire scenario of power requirement has changed this year.

13 July: The Rajasthan government will issue over 4.88 lakh new and pending agriculture power connections in the next two years, Chief Minister (CM) Ashok Gehlot said. He said that his government is committed to providing cheap electricity to farmers along with an uninterrupted power supply in the state. He said that due to efficient power management of the state government, there was a minimum power cut in the state despite the scorching heat.

16 July: West Bengal is aiming to take its renewable energy generation to 20 percent of the total installed capacity by 2030. At present, the renewable energy share of the total installed capacity is 5 percent, Nandini Chakravorty, the principal secretary of the Non-conventional and Renewable Energy Sources Department, said. She said rooftop solar panels had been installed in 1,954 schools in the state, and work was underway to add another 1,890 schools to the list.

19 July: Iran is increasing supplies of a key crude grade that Venezuela is using to boost its aging refineries’ productivity and free domestic oil for exports, documents showed. The two US (United States)-sanctioned countries have strengthened energy cooperation in recent years, swapping Venezuelan heavy oil and other commodities for Iranian gasoline, condensate, refinery parts, and technical assistance. The exchange has grown since May, when state companies from both nations struck a contract to revamp Venezuela’s El Palito refinery after earlier work at the country’s largest facility. Venezuela’s state-run oil company PDVSA is set to receive 4 million barrels of Iranian Heavy crude this month, an increase from 1.07 million barrels imported in June and a volume like May, when a supply contract with Iranian state firm Naftiran Intertrade Co (NICO) was signed, one of the documents showed. PDVSA is refining the Iranian crude at facilities craving suitable crude to increase the output of motor fuels. The supply also is allowing the state-run company to free its lightest grades for blending and exporting. The Middle Eastern oil is expected to help PDVSA recover stocks of its flagship exportable grade, Merey, the Venezuelan crude preferred by Asian refiners, after falling to about 1 million barrels in early July, according to the documents. PDVSA also has continued importing about 2 million barrels per month of Iranian condensate, helping boost the output of exportable blends. Venezuela’s oil exports in June fell to the lowest level since October 2020 amid repairs at the country’s main oil port and delays in authorising shipments following contract changes imposed by PDVSA demanding cargo prepayment.

13 July: The global oil market is “walking a tightrope” between scarce supply and the possibility of a recession, the International Energy Agency (IEA) said, with higher prices and worsening economic conditions already taking a toll on demand.

13 July: France is talking to Abu Dhabi about importing fuel and diesel for the coming winter season, TotalEnergies Chairman and CEO (Chief Executive Officer) Patrick Pouyanne said. Pouyanne told the French Senate this was a response to the Russia/Ukraine conflict, which has impacted Russian energy supplies to Europe.

13 July: The United States (US) and Australia understand Japan’s repeated requests for higher liquefied natural gas (LNG) output and stable supply, industry minister Koichi Hagiuda said. If Japanese companies show any interest in signing new purchase agreements for LNG or in investing in LNG projects, the government will actively support them through public finance and other measures to help strengthen Japan’s LNG procurement capabilities, Hagiuda said. Resource-poor Japan is facing a historic energy security risk as tensions with Moscow intensify, heightening the threat of gas supply disruptions at a time when global supply is tight and spot prices are sky high.

18 July: Poland will develop new types of coal subsidies for consumers and boost imports to make sure it has enough fuel for the heating season amid shortages and surging prices. The European Union’s largest coal producer, dependent on the fuel for some 80 percent of its electricity generation, in April, banned imports of coal from Russia in response to Moscow’s invasion of Ukraine. In an unusual move, Prime Minister Mateusz Morawiecki has also ordered two state companies to import 4.5 million tonnes (MT) of coal by the end of October to supply households amid the shortages caused by sanctions on Russia. Russian coal imports have mostly been used by individual households and heating plants in smaller towns. Poland imported more than 8 MT of Russian coal in 2021 but the country’s shortfall is as high as 11 MT due to declining local production.

13 July: Indonesia, the world’s biggest exporter of coal used in power plants, will be able to increase output to help meet demand from countries that have lost supplies from Russia, its energy ministry said. Indonesia’s target for coal output this year is 663 million tonnes (MT).

13 July: Germany will completely stop buying Russian coal on 1 August and Russian oil on 31 December, marking a major shift in the source of the country’s energy supply, Deputy Finance Minister Joerg Kukies said. Russia previously supplied 40 percent of Germany’s coal and 40 percent of its oil, he said.

13 July: Plans in Europe to place a small number of coal plants on temporary standby would add 1.3 percent to EU (European Union) emissions annually, even in the worst-case scenario where they run at the highest levels, energy think tank Ember said. Germany, Austria, France, and the Netherlands have recently announced plans to enable increased coal power generation if Russian gas supplies suddenly stop. The analysis finds that 14 GW of coal-fired plants has been placed on standby, adding 1.5 percent to the EU’s total installed power generation capacity (920 GW).

18 July: The UK (United Kingdom) government launched a review into Britain’s electricity market, seeking ways to lower costs for consumers contending with soaring energy prices. Proposals out for initial consultation include potential changes to the wholesale electricity market in an effort to stop volatile gas prices from setting the price of electricity when renewable power is much cheaper. Under the current system, the cost of producing electricity from gas-fired power stations is usually the benchmark for setting the wholesale electricity price that helps to determine how much people pay for their energy. Benchmark wholesale British gas prices are trading about three times higher than a year ago, pushing up wholesale electricity prices by similar levels. The government said it would also look at offering incentives for consumers to use electricity when demand is lower or when high levels of wind or solar power are being generated.

17 July: Saudi Arabia and Iraq have signed an electric power grids deal to boost economic cooperation. The deal was signed between Saudi Energy Minister Prince Abdulaziz bin Salman Al Saud and Iraqi Oil Minister Ihsan Abdul Jabbar. Abdulaziz said that apart from enhancing bilateral economic ties, the signing of the deal will help establish Saudi Arabia as a regional hub for electric power grids and attract investment in the country’s electricity generation projects.

13 July: European power grid network ENTSO-E will connect to the Baltic states’ grids within 24 hours if the countries were to be disconnected by Russia, Lithuanian power grid operator Litgrid said. In June, European grid operators were ready to implement immediately a long-term plan to bring the Baltic states, which rely on the Russian grid for electricity, into the European Union (EU) system if Moscow cuts them off. Litgrid Chief Executive Rokas Masiulis said Lithuania was aiming for an agreement to decouple the Baltic States from the Russian power grid in early 2024, compared to a previous plan for end-2025. He said governmental discussions with Estonia and Latvia on the matter had started and that the European Commission was also involved. Masiulis said an underwater power link between Poland and Lithuania can only be completed in 2027-2028, not in 2025 as previously planned, due to a shortage of materials. Three decades after splitting from the former Soviet Union and 17 years since joining the European Union, the Baltic states of Estonia, Latvia, and Lithuania still depend on Russia to ensure stable power supplies. A project backed by €1.6 billion (US$1.61 billion) of EU funding to upgrade their infrastructure is in place to disconnect them from the grid by 2025.

18 July: Canada launched consultations on a plan to cap and cut greenhouse gases from the oil and gas sector, its largest and fastest-growing source of emissions, outlining two options to help achieve Prime Minister Justin Trudeau’s climate promises. But the proposal faced immediate backlash from Alberta, Canada’s main oil-producing province, which said the federal government could not act unilaterally to meet emissions targets. Canada’s Liberal government aims to cut emissions 40 percent to 45 percent below 2005 levels by 2030 and target net-zero emissions by 2050. To achieve this, policymakers need to enforce a sharp reduction in pollution from the oil and gas sector, responsible for 27 percent of the country’s emissions. The carbon price in Canada is currently set at C$50 a tonne and is set to ramp up to C$170 a tonne by 2030.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.