-

CENTRES

Progammes & Centres

Location

Nuclear energy in India: Small may not be beautiful

In 2004, the target set for nuclear power capacity was 20 GWe (gigawatts electric) by 2020. In 2007, the government stated that this target could be doubled with the option of international cooperation through the 123 nuclear agreement that was to be signed with the United States in 2008. In 2009, the Nuclear Power Corporation of India Limited (NPCIL) said that it aimed for a capacity of 60 GWe by 2032 including 40 GWe of PWRs (pressurised water reactors) and 7 GWe of PHWRs (pressurised heavy water reactors) all powered by imported uranium. Projections in the draft energy policy of 2011 are more modest with 12 GW nuclear power capacity in 2022 and 34 GWe in 2040 even under the ‘ambitious’ scenario. In 2021, the government stated in the Parliament that nuclear power generation capacity would increase to 22,480 MWe (megawatts electric) by 2031. In 2022, nuclear power capacity stands at 6,885 MWe. Consistence under-performance of the nuclear industry in meeting capacity targets have led experts from the Department of Atomic Energy (DAE) to refer to capacity targets as aspirational.

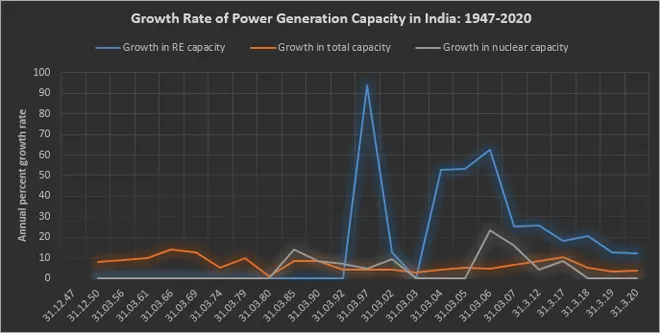

In 2020, nuclear energy accounted for 10 percent of global electricity generation, which is much lower than the peak of over 17.45 percent in 1996. In India, the share of nuclear generation has not exceeded 4 percent since nuclear generation began in the early 1970s. In 2002, nuclear power generation in India touched a peak of 3.7 percent of total generation which was substantial improvement from a share of about 1.8 percent in the early 1990s. In terms of capacity addition, the nuclear power sector has the slowest growth rate amongst fuels despite ambitious targets, strong protection, and generous budgetary allocations. Commentators have offered a range of reasons from huge upfront capital investment, cost escalations, technological problems to opposition from local populations to explain the slow pace of capacity addition in the nuclear sector.

Between 2002 and 2006 nuclear capacity grew by over 23 percent and by over 9 percent between 2006 and 2017 but capacity has not grown since 2017. This is in stark contrast to renewable energy (RE) capacity that started at 32 MWp (megawatt peak) in 1992 and increased to over 100,000p MW in 2021. This is not difficult to explain because unlike nuclear energy, RE enjoys the unanimous support of the global investment community and that of domestic policy makers and receives financial and non-financial incentives across the value chain. More importantly the decentralised modular nature of RE, particularly solar energy, with investments in the range of INR 40-50 million has attracted even small private sector players which in turn has contributed to the growth in RE capacity. In this context, it is not surprising that the debate over the future of nuclear power in India has shifted to reactor size, specifically over whether reactors with a substantially smaller power output labelled small modular reactors (SMRs) are a better choice to increase the rate of capacity addition.

Globally, there are about 50 SMR designs and concepts at different stages of development. Argentina, South Korea, China, Canada and Russia have advanced state funded programmes with operational plants. Private companies often with state assistance based in industrialised countries including the USA, and the UK are also in the race to commercialise SMRs. Reactors that dominate the SMR experiment today are PWRs, the predominant nuclear technology deployed today. The long record of operation and the licensing experience, SMRs based on PWR technology have a substantial head start. As the components of PWR technology based SMRs are like those in larger reactors, the licensing process is expected to be straight forward for developers. There are SMR initiatives that are experimenting on old technologies that were not actively considered after the 1970s. These include pebble-bed reactors and molten salt reactors. Other SMR concepts focus on the nuclear waste problem by trying to burn or transmute various isotopes in spent fuel. Yet another SMR concept is a nuclear battery or fuel for a lifetime that would not require onsite refuelling throughout its commercial life.

A nuclear reactor is qualified as “small,” when its capacity is less than 300 MWe which is about one-third the capacity of a standard nuclear reactor. The choice of a cluster of SMRs over one large reactor involves two competing economic principles: economies of scale and economies of mass production. Building five SMRs of 200 MW capacity will cost more than building one 1,000 MW nuclear reactor. But this loss in economies of scale is expected to be made up in economies of mass production. The argument is that if there is demand for several SMRs, unit cost will be reduced contributing to an overall reduction in cost of building nuclear reactors. India’s nuclear industry which consists mostly of small reactors challenges this assumption.

Out of India’s 23 nuclear power reactors, 18 have a capacity of less than 300 MWe which means that most are “small” reactors. The small size of India’s nuclear reactors has meant that India’s total nuclear power capacity is low compared to the number of nuclear power reactors. For example, the 10 largest nuclear islands of China consist of 43 nuclear reactors with total capacity of 45.6 GWe. All the reactors in these nuclear islands have capacity of 1,000 MWe barring the oldest reactor that has a capacity of 600 MWe. With double the number of reactors compared to India, China has more than six times the nuclear capacity of India. A better example is South Korea. It has 24 nuclear power reactors, just one more than that of India, but the total nuclear power capacity of South Korea is 23.15 GWe, more than three times that of India. India’s small reactors has not necessarily meant lower costs, nor has it meant fewer experts employed per reactor. It has in fact reduced the contribution of the nuclear sector to overall power generation and consequently not contributed substantially to reduce carbon dioxide emissions. It also increased the tariff for nuclear power as costs could be spread over larger capacity. The assumption that additional costs incurred by SMRs can be offset through economies of mass production remains to be tested because as of 2022, there are no mass orders for SMRs. Though Westinghouse’s AP 1,000 reactors made in USA and China were based on the concept of modular construction they have had huge cost overruns and schedule delays. Even if the SMR concept does take off and supply chains for modular construction of SMRs are established, they are likely to be based outside India. This would mean import of SMRs which would mean higher cost and outgo of foreign exchange.

SMRs are expected to reduce the long lead times for nuclear power plant construction but new features introduced in SMRs may initially increase time required for licencing. SMRs are promoted as a complement to RE-based power generation but this goes against the logic of nuclear power generation. Nuclear power generation has high fixed costs and low variable cost, which makes nuclear power suitable for baseload power generation at reasonable tariff. Responding to RE variability would mean operating at partial loads which will increase cost and potentially lead to technical risks. For example, if SMRs are operated at low power during the day when solar power generation is available and increased in the evening when solar generation falls, the result will be wide temperature difference (from 450°C to 1,600°C) between the two modes of operation. This could potentially lead to crack formation in uranium oxide fuel leading to rupture of the cladding surrounding the fuel and eventual leakage of fission products. This would put the reactor in the dangerous zone.

Since the 1950s when nuclear power generation was established, the size of the reactors has increased from 60 MWe to more than 1,600 MWe, with corresponding economies of scale in operation. Competition from RE has pushed the nuclear industry to reverse this trend to become as small and as nimble as RE. Enormous expertise in the engineering of small power units built for naval use (up to 190 MW thermal) and as neutron sources can assist the nuclear industry in producing SMRs that strike the right balance between economies of scale and economies of mass production. But until then, the 700 MWe PHWR that is mostly indigenous, safe, and reasonably economic to build and operate is the bird in the hand for the Indian nuclear industry compared to many SMRs that are still in the bush.

Coal India Ltd (CIL) said it does not foresee any shortage of dry fuel for power producers till March 2022 as it is focusing on ramping up production to secure a stock of about 70 mt by end of the current fiscal. Around 100 mt of pithead stock, which was carried forward from the last fiscal, was “not desired” but it helped the miner meet requirements when coal demand went up a few months ago. According to CIL, the last quarter saw “high” output, and issues related to the production of Central Coalfields Ltd and Bharat Coking Coal Ltd are also getting resolved. Jharkhand CM had in July asked CIL for immediate payment of INR560 bn outstanding dues in lieu of government land allotted to it for mining.

According to the Union Coal Ministry, India’s coal production increased by 10.35 percent to 67.84 mt in November from 61.47 mt in November 2019. This comes in the backdrop of fuel stocks at coal-fuelled power projects building up after depleting to 7.23 mt on 8 October. India’s power plants burn around 1.85-1.87 mt of coal every day to generate electricity. The depleted fuel stocks at power plants had led to concerns about a possible electricity shortage. This assumes significance given that coal-fuelled power projects totalling 202.22 gigawatts (GW) remain the mainstay of India’s power generation and account for more than half of India’s power generation capacity. India has the world’s fourth-largest reserves and is the second-largest producer of coal. While CIL’s annual production target is 660 mt for the current financial year, the coal off take is expected to be 740 mt.

Gujarat’s production of electricity from the coal-fired thermal power plants halved in October as private sector plants struggled to generate power due to spiralling prices of imported coal. As per the Central Electricity Authority (CEA)’s report, state’s thermal coal-based electricity generation declined by 56 percent to 3,465 GWh (gigawatt hours) in October 2021 from 7,877 GWh during the same month last year. Steep reduction in power generation by private sector plants, including those run on imported coal, brought down the overall electricity generated from the coal-based power plants in October. Private sector’s generation from coal plunged 70 percent to 1,858 GWh from 6,142 GWh. The generation stood at only 32 percent of the targeted generation of 5,839 GWh for October 2021, according to the report.

Telangana Chief Minister (CM) has urged Prime Minister (PM) to stop auctioning of four coal blocks in Singareni coal mines in Telangana as proposed by the union coal ministry. The CM stated that Singareni Collieries Company Limited (SCCL) is producing 65 million tonnes (mt) of coal every year and plays a key role in catering to the needs of thermal power plants in Telangana, Andhra Pradesh, Maharashtra, Karnataka and Tamil Nadu states. The CM urged the PM to instruct the union coal ministry to stop the auction of JBROC-3, Sravanpally OC, Koya Gudem OC-3 and KK-6 UG Block under the union ministry’s trench 13, as it would adversely impact the needs under Singareni jurisdiction for coal. The CM also requested the PM to allocate these blocks to SCCL.

India’s coal import registered a decline of 26.8 percent to 15.75 mt in October over the same month a year ago. The country had imported 21.50 mt of coal in October 2020. However, coal import in October was up 6 percent as compared to 14.85 mt imported during September 2021. Of the total import in October 2021, non-coking coal was at 9.47 mt, against 14.46 mt imported in October last year. Coking coal import was at 4.05 mt, lower than 4.92 mt imported in October 2020.

The central government has undertaken 14 railway projects spread across Eastern Indian states to augment the process of coal transportation. The total cost incurred will be INR220.67 bn (US$2.97 bn). This project will reduce the time and cost incurred in the transportation of the dry fuel and will evacuate up to 410 million tonnes per annum (mtpa). The projects will span over a distance of about 2,680 km covering Jharkhand, Odisha and Chhattisgarh, the largest coal-producing states. The new railway lines, will provide better connectivity and reach for the transportation of coal. Moreover, CIL is infusing an estimated INR142 bn (US$1.91 bn) for the first-mile connectivity (FMC) projects by 2023-24, in two phases for its 49 FMC projects. CIL has placed the rapid loading system in 19 of its mines constructing 21 additional railway sidings at an estimated investment of INR33.70 bn across four of its subsidiaries. These fresh and existing projects, will be commissioned by 2023-24. The company is aiming to move about 555 mt of coal per year through mechanised means by FY24.

China’s coal output hit a record high in November as Beijing urged miners to ramp up production to ensure sufficient energy supplies in the winter heating season. China, the world’s biggest coal miner and consumer, produced 370.84 mt of the dirty fossil fuel last month, as per the data from the National Bureau of Statistics. That compares to a previous record of 357.09 mt set in October and was up 4.6 percent from the same period last year. For the first 11 months of 2021, output reached 3.67 billion tonnes, up 4.2 percent on last year.

China’s thermal coal futures dropped 5.6 percent after the state economic planner signalled further regulations for prices of the dirty power-generation fuel. The most-active Zhengzhou thermal coal futures contract, for January delivery, was 819.6 yuan (US$128.31) a tonne. It has lost more than 58 percent from a peak of 1,982 yuan a tonne in mid-October following a slew of government interventions to tame the red-hot prices. The National Development and Reform Commission (NDRC) has summoned key coal miners for advices on improving coal prices mechanism. The NDRC has organised several meetings with coal miners and distributors, as well as power firms and legal experts since late October, aiming to set a coal prices target. Some coal miners at top mining regions, Shanxi, Inner Mongolia and Shaanxi, have caped prices at 900 yuan a tonne for 5,500 kilo calorie under regulators’ pressures.

The World Bank has urged Indonesia to drop a policy forcing miners to supply a set amount of subsidised coal to its state power company, which it said has encouraged the use of the dirty fuel in electricity generation. The Southeast Asian country is the biggest exporter of thermal coal globally and amongst the top ten greenhouse gas emitters. Indonesia has a so-called Domestic Market Obligation (DMO) policy whereby coal miners must supply 25 percent of annual production to state utility Perusahaan Listrik Negara (PLN), at a maximum price of US$70 per tonne, well below current market prices. The policy has effectively subsidised coal-fired power plants, the bank said.

Australia can phase out coal-fired power by 2043 even as electricity demand soars, the energy market operator said in a draft plan for electricity investments that will be needed to achieve net zero carbon emissions by 2050. The base case for the Australian Energy Market Operator (AEMO)’s plan sees a rapid transformation of the National Electricity Market (NEM) with major investment in renewable generation, energy storage, back-up generation and transmission as coal plants are retired. According to the AEMO, the plan would require A$12 billion (US$8.6 billion) in network investments. The market operator expects electricity consumption from the grid will nearly double to 330 terawatt hours (TWh) as transport, heating, cooking, and some industrial processes are electrified over the next three decades.

24 December: India’s crude oil imports in November rose to their highest level in 10 months as refiners stocked up to boost runs in anticipation of strong demand in the world’s third-largest oil consumer and importer. Crude oil imports last month rose 7.5 percent versus October and were also 0.5 percent higher than a year ago at 18.37 million tonnes (mt), the Petroleum Planning and Analysis Cell (PPAC) data showed. The relatively high imports corresponded with the country’s crude processing hitting its highest level since February 2020 during the same month refiners operated at full capacity in hopes of a steady uptick in demand. The share of Middle Eastern oil in India’s overall crude imports rebounded to a 16-month high in November as refiners shunned costly Brent-linked long haul grades. India’s Reliance Industries Ltd, owner of the world’s biggest refining complex, imported 6 percent more oil in November than a year earlier at about 1.24 million barrels per day (bpd), according to data from shipping and industry sources. Meanwhile, India’s fuel consumption fell last month after scaling a seven-month peak in October, as demand eased after the festive season. Oil product imports dropped 26.6 percent to 3.49 mt from a year earlier, while exports jumped 26.8 percent. Of the 5.15 mt of exports in November, diesel accounted for 2.78 mt.

24 December: Indian Oil Corporation (IOC) is setting up a new crude oil pipeline system with a nameplate capacity of 17.5 million tonnes per annum (mmtpa) from Mundra (Gujarat) to Panipat (Haryana). IOC will also build 9 crude oil tanks of 60,000 kilo litres each at Mundra, which, apart from meeting operational requirements, will also help in enhancing crude oil storage capacity in the country. The total estimated cost of the project is INR 90.28 bn. IOC said it is implementing a project for capacity expansion of Panipat refinery from 15 mmtpa to 25 mmtpa, along with the installation of Polypropylene Unit and Catalytic Dewaxing Unit with targeted completion in the second quarter of the 2024-25 financial year. The new pipeline system and crude oil tank storage will help meet the enhanced need of crude oil requirement due to the expansion of the Panipat refinery. The crude oil pipeline project is expected to be completed in synchronization with the commissioning of Panipat refinery expansion. IOC operates a network of more than 15,000-km long crude oil, petroleum product and gas pipelines. IOC added 337 km of additional pipeline length during the year 2020-21 and plans to continuously expand the network in line with growth in business. The company achieved a throughput of 76.019 million metric tonnes during 2020-21. IOC’s existing pipeline network has a throughput capacity of 94.56 million metric tonnes per annum of oil and 21.69 million metric standard cubic meters per day of gas. Projects under implementation will further increase the length of the pipelines network to about 21,000 km, and throughput capacity to 102 million tonnes per annum.

24 December: Indian Oil Corporation (IOC) and a joint venture of Adani’s gas arm and Total of France — Adani Total Gas Ltd — have bid for maximum number of licenses to retail CNG (compressed natural gas) to automobiles and piped cooking gas to households in the latest city gas bidding round. IOC bid for 53 out of 61 geographical areas or GAs that received bids in the 11th city gas licensing round that closed on 15 December, according to bid details made public by the sector regulator — Petroleum and Natural Gas Regulatory Board (PNGRB). Adani group had originally ventured into city gas business in a joint venture with IOC but it later tied up with Total. PNGRB had bid out 65 GAs including Jammu, Nagpur, Pathankot and Madurai in the latest licensing round. Four GAs in Chhattisgarh did not receive a single bid. PNGRB had last week stated that as much as INR800 bn investment is envisaged in setting up city gas infrastructure in the 61 GAs. In the last city gas distribution (CGD) bidding round – the 10th CGD bidding round, 50 GAs were authorised for the development of CGD network. In the present round, 215 districts clubbed into 65 GAs are being offered. Bids were received for 61 GAs, according to PNGRB.

27 December: India’s Adani Group is preparing to ship the first coal cargo from Australia’s most controversial mine, after battling a seven-year campaign by climate activists and defying a global push away from fossil fuels. The Carmichael mine in outback Queensland state is likely to be the last new thermal coal mine to be built in Australia, the world’s biggest coal exporter, but will be a vital source of supply for importers such as power plants in India. The coal will be exported from a terminal at Abbot Point, which Adani bought for US$2 billion in 2011 and renamed North Queensland Export Terminal. Analysts said it made sense for Adani to dig the mine to help it make back the massive investment on the coal terminal, which has run nearly half empty since Adani acquired it.

25 December: The country’s coal production is expected to record a “sizeable leap” in 2022 with increased output mainly from Coal India and captive mines, providing adequate firewall against any possible dry fuel shortages like the one witnessed in the latter half of this year. While coal supplies have stabilised in recent times, efforts are on to further improve the fuel dispatches and a top government official said power plants are now receiving slightly more coal compared to their requirements. Coal Secretary Anil Kumar Jain said the increase in coal output would be on account of more production from Coal India Ltd (CIL), captive coal blocks auctioned between 2015-2020 and commercial mines put on sale last year. In the last financial year, CIL dug out about 596 million tonnes (mt) of coal, he said. In the ongoing fiscal, the output is likely to be upped to 640 mt. The captive coal mines that were put on sale post cancellation of blocks by the Supreme Court produced 63 mt last fiscal. In the current financial year, their production is likely to be scaled up to 90 mt. According to the secretary, captive coal blocks are expected to produce 120 mt in the next financial year. CIL accounts for over 80 percent of the domestic coal production.

25 December: The Goa State Pollution Control Board (GSPCB) has deferred a decision over Mormugao Port Trust (MPT)’s request for coal-handling at mooring dolphins 1, 2 and 3. It has also decided to deliberate on a proposal by the South West Port Ltd (SWPL) for uniform coal-handling distribution of around 0.5 mtpm (million tonnes per month), with a 5 percent variation on monthly handling throughout the year while maintaining the total annual handling to 5.5 mt. The SWPL had approached the board for relaxation on the monthly handling cap on coal/coke within the overall permissible quantity of 5.5 mtpa (million tonnes per annum). Following an earlier deliberation, the GSPCB’s members had agreed to grant 10 percent leverage during the monsoon months while maintaining the conditions imposed in the previous consent for coal/coke handling in the fair season, and limiting this to 5.5 mtpa.

26 December: REC Ltd said that Meghalaya and Assam have become front-runners in terms of firming up their proposals under the Revamped Distribution Sector Scheme (RDSS), meant for the revival of distribution companies (discoms). Accordingly, their state-level Distribution Reforms Committee (DRC) and State Cabinet have approved the proposals, including Action Plan and DPR, for consideration under the scheme. These proposals would now be put forward to the Monitoring Committee set up by the Ministry of Power for approval. It is noteworthy that RDSS has an outlay ofINR3037.58 bn with an estimated budgetary support from central government of INR976.31 bn, which would be available till FY2025-26. Key interventions envisioned under this programme include providing support to discoms to undertake activities for ensuring 100 percent system metering, implementing prepaid smart metering, energy accounting, and implementing infrastructure works for loss reduction, as well as for modernization and system augmentation aimed at improving the quality and reliability of power supply.

25 December: A record 15692 Megawatt (MW) of power was successfully supplied by the Madhya Pradesh government owned electricity distribution companies (discoms). The state’s power demand shot up to 15692 MW, which was met by the three discoms and this was the highest ever power supply in the state’s history, MP Power Management Company Public Relations Officer Pankaj Swami said. The surge in electricity demand was due to the agriculture load as the Rabi season is underway, he said.

24 December: Employees of the Department of Electricity in Puducherry who formed Joint Action committee to protest the Centre’s move to privatise distribution of power staged a demonstration. The protesters carrying banners took out a procession through main thoroughfares and held the demonstration at the Head Post office in the heart of the town. The central government was making the move to open up distribution of electricity in the Union Territories including Puducherry. The panel had planned to submit a petition to the Lt Governor at the end of the procession but the participants were stopped at the post office by the police. Puducherry does not have an Electricity Board and the distribution of power is being done here through the Department of Electricity. Several political parties have expressed strong protest against the Centre’s decision to privatise power distribution. The Puducherry government purchases power from central power generating undertakings to meet the local requirements. A Power Corporation was started in Karaikal to generate power to meet the local needs.

22 December: The Union power ministry was working on resource adequacy plan guidelines to ensure 24×7 power supply to the consumers. The ministry was also discussing some bigger reforms to make discoms viable and was working on steps like de-regulating the sector or making regulation adaptability more industry friendly. Resource adequacy is the ability of a utilities’ reliable capacity resources (supply) to meet the customers’ energy or system loads (demands) at all hours The factor that affects supply is the availability of sufficient dispatchable capacity resources in order to meet the demand. A focus on 24×7 power can be ensured if discoms properly have resource adequacy in place. There are a few private players who are working in this direction. Working on resource adequacy plan guidelines so that discoms can be integrated at the state level and then more at national level. The advantage will be lesser resource requirement, the ministry said.

27 December: Prime Minister (PM) Narendra Modi embarked on a visit to Mandi, also known as ‘Chhoti Kashi’, and inaugurated and laid the foundation stone of hydropower projects worth INR110 bn that will help boost the state’s economy and provide additional power to the states. One project that has been lying pending for around three decades will prove to be beneficial for Delhi, which will be able to receive around 500 million cubic metre water supply per year. Modi has constantly focussed on fully utilising the untapped potential of the resources available in the country and one of the steps in this regard has been to utilise optimally the hydropower potential in the Himalayan region. Modi laid the foundation stone of the Luhri Stage 1 Hydro Power Project. The 210 MW project will be built at a cost of over INR18 bn. It will lead to generation of over 750 million units of electricity per year. Modi laid the foundation stone of Dhaulasidh Hydro Power Project. This will be the first hydropower project of Hamirpur district. The 66 MW project will be built at a cost of over INR6.8 bn.

24 December: Oil India Ltd (OIL) has become the latest entity to join the green hydrogen rush by initiating the process of setting up a 100 kW green hydrogen plant at its pumping station No. 3 in Jorhat district of Assam. Though a small pilot as compared to more ambitious projects planned by its oil sector siblings, OIL’s proposed plant is significant as it will deploy AEM technology for the first time in the country and will be first such project in the northeast. Electrolysers based on AEM technology provide a compact and affordable solution for producing high-quality hydrogen for running backups etc. These electrolysers are compact and can be stacked for higher capacity needed for running pumping stations, petrol pumps or blending with natural gas to make the fuel cleaner.

24 December: After witnessing cloudy skies this year, the country’s renewable energy sector is expected to boom with a likely investment of over US$15 billion in 2022 as the government focuses on electric vehicles, green hydrogen, manufacturing of solar equipment as well as achieving the ambitious 175 GW renewable capacity target. India, which has an installed renewable energy generation capacity of a little over 150 GW, aims to reach 175 GW in 2022. Out of the total mix, 100 GW would be from solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydro power projects. During the 2014-2019 period, renewable energy programmes and projects in India attracted investments of US$64.4 billion, as per REN21 Renewables 2020 Global Status Report. India aims to have 500 GW of installed renewable energy (RE) capacity by 2030.

22 December: Indian Institute of Technology, IIT Guwahati researchers, have developed a cost-effective perovskite solar cell to produce electricity from sunlight. The perovskite-based semiconducting devices are considered the most promising due to their low-cost, ease of manufacturing as roll-to-roll devices, high material availability and easy recyclability. The devices developed can achieve power conversion efficiency as much as 21 percent. Currently, inorganic solar cell (Silicon-based) is a significant player in the market. However, this technology requires high-temperature processing, resulting in the high price of solar panels. Further, the recycling of solar panels is hazardous and complicated.

22 December: Construction of Unit 6 of the Kudankulam Nuclear Power Plant (KKNPP) in Tamil Nadu has been formally launched by pouring the first concrete in the foundation slab of the reactor building, according to Rosatam State Corporation of Russia. The first two power units demonstrated sustainable operation at the nominal power level, while the power units of the second stage were being constructed, that is, work is under way at Unit 3 to prepare for installation of the reactor pressure vessel. The equipment for the top-priority installation at Units 5 and 6 was being supplied and the construction process was being supported by working documentation, Rosatam said. As part of India-Russia nuclear cooperation, Rosatom is scheduled to construct six units of VVER-1000, light-water reactors at Kudankulam. In December 2014, both sides announced a decision for the construction of at least 12 more units in India. JSC ASE is the general designer and supplier of equipment from the Russian side. The General Framework Agreement for construction of KKNPP Units 3 and 4 was signed on April 10, 2014, following which negotiations began between India and Russia for construction of Units 5 and 6, and an agreement was reached for these units to be built in the same design as those of the second stage. Russia is building the KKNPP under an Inter-Governmental Agreement of 1988 and follow-on agreements in 1998 and 2008. Unit-1 joined the grid in October 2013 and Unit-2 was connected to the grid in August 2016.

28 December: Malaysia’s state energy firm Petronas said that it anticipates the recovery in oil demand from the impact of the coronavirus pandemic to remain fragile and uncertain in the next few years. It said industry players were optimistic about economic recovery but remained cautious. After 2024, Petronas said it foresees a positive outlook for drilling rigs activity while continuing to enhance and upgrade capability. It also expects a steady outlook for fabrication of fixed structures and subsea facilities as it continues efforts to monetise its oil and gas resources.

27 December: China’s oil consumption is expected to keep growing for a decade on robust chemical demand, reaching a peak of about 780 million tonnes (mt) per year by 2030, a research institute affiliated with China National Petroleum Corp (CNPC) said. Last year, the research group, called the CNPC Economics & Technology Research Institute (ETRI), said that China’s oil demand would peak at 730 million tonnes per year by around 2025. In its latest report, the ETRI said diesel fuel, gasoline and kerosene consumption are forecast to peak sometime around 2025 at about 390 mt per year. The strong petrochemical demand will support rising consumption through to 2030. Overall oil demand will fall after 2030 as transportation consumption declines amidst the electrification of vehicles while chemical demand remains stable during the period, the ETRI said.

23 December: Global oil demand roared back in 2021 as the world began to recover from the coronavirus pandemic, and overall world consumption potentially could hit a new record in 2022 – despite efforts to bring down fossil fuel consumption to mitigate climate change. Gasoline and diesel use surged this year as consumers resumed travel and business activity picked up. For 2022, crude consumption is expected to reach 99.53 million barrels per day (bpd), up from 96.2 million bpd this year, according to the International Energy Agency. That would be a hair short of 2019’s daily consumption of 99.55 million barrels.

23 December: Aker BP has reached an agreement to acquire Lundin Energy’s oil and gas related activities for around NOK 125bn (€12.4bn), and to merge them with its exploration and production (E&P) operations to create a listed E&P company focused on the Norwegian Continental Shelf (NCS). The new company will be the second largest listed oil company on the NCS:

22 December: Indonesian state-energy company PT Pertamina said that ensuring fuel supply was its “top priority” as workers plan a ten-day strike, just when fuel demand typically increases as people travel for year-end holidays. As it seeks to short up supplies, the company has issued a tender seeking up to 1.2 million barrels of high speed diesel (HSD) for January delivery. It is unclear how many of Pertamina’s workers are expected to strike or why negotiations failed, but the union said the strike could end earlier than expected if its demands are met.

22 December: Sri Lanka plans to settle US$251 mn in oil import dues owed to Iran by bartering tea, a Sri Lankan minister said, amidst dwindling foreign reserves. Sri Lanka has to meet about US$4.5 bn in debt repayments next year, starting with a US$500 million international sovereign bond in January, but the country’s foreign reserves had dwindled to US$1.6 bn at the end of November, latest data from the central bank showed.

25 December: Russia has doubled the purchases of natural gas from Turkmenistan this year amidst rising global demand. Russia this year stands to import about 10 billion cubic metres of gas from Turkmenistan, Russian envoy to Ashgabat Alexander Blokhin said. That’s nearly twice the amount imported in 2020. This year’s volumes were on par with the period before 2016, when Russia halted gas imports from the ex-Soviet Central Asian nation amidst pricing disputes and a slump in global prices. Moscow resumed the purchases of Turkmen gas in 2019 when it signed a five-year contract envisaging annual deliveries of 5.5 billion cubic metres. Turkmenistan is overwhelmingly dependent on exports of its vast natural gas reserves, and Russia’s 2016 move to halt supplies dealt a heavy blow to the Turkmen economy. China has replaced Russia as the top export destination for the Turkmen gas. Turkmenistan’s President Gurbanguly Berdymukhamedov said the country annually supplies 40 billion cubic metres of gas to China. Earlier this year, China’s state-owned CNPC started work to set up new wells at Turkmenistan’s giant natural gas fields in exchange for future gas supplies. Under the deal with CNPC, Turkmenistan will pay for its services by supplying 17 billion cubic metres of gas a year for the period of three years to a total of 51 billion cubic metres of gas. Turkmenistan also has been working to build a pipeline that would pump gas to Afghanistan, Pakistan and India.

25 December: Uzbekistan launched its first gas-to-liquids plant, a US$3.6 billion project to extract value from domestically produced gas and reduce its dependency on imports of oil products. The UzGTL plant in the Southeastern Qashqadaryo province will produce 1.5 million tonnes (mt) a year of synthetic liquid fuels, such as kerosene, diesel, liquefied petroleum gas and naphtha from natural gas, production director Kidirbay Kaypnazarov said. Uzbek President Shavkat Mirziyoyev said the plant would refine gas worth US$500 million into products valued at US$1.5 billion from the first quarter of 2022. It will reach full capacity by the end of next year. The plant will consume 3.6 billion cubic metres of gas per year from the nearby Shurtan gas field and processing plant, where the authorities also launched a project to triple output.

23 December: Asian liquefied natural gas (LNG) prices jumped, despite tepid Asian demand, as upside risk in European gas market remains a key driver directing price movement. The average LNG price for February delivery into Northeast Asia rose to US$48.3 per metric million British thermal units (mmBtu), up US$5, or 11.5 percent from the previous week. Demand in Asia remained muted with buyers avoiding the spot market due to soaring prices and as high inventory levels amongst utilities in Japan and China exceed multi-year highs. European spot gas prices hit another all-time high this week after the Yamal pipeline that normally brings Russian gas to heat homes and power electricity generation in Germany reversed direction and started to flow into Poland. Prices fell as expectations of the arrival of several LNG gas tankers helped offset low exports from Russia. At least ten cargoes of LNG have recently been diverted from Asia to head west drawn by Europe’s record high prices amidst supply concerns ahead of peak winter demand. Pacific LNG freight spot rates fell over 26 percent week-on-week to US$117,500 per day, according to data intelligence firm Spark Commodities on muted Asian demand. Prices had hit a record high of US$374,500 per day in November.

28 December: China, under fire for approving new coal power stations as other countries try to curb greenhouse gases, has completed the first 1,000 megawatt (MW) unit of the Shanghaimiao plant, the biggest of its kind under construction in the country. Its operator, the Guodian Power Shanghaimiao Corporation, a subsidiary of the central government-run China Energy Investment Corporation, said that the plant’s technology was the world’s most efficient, with the lowest rates of coal and water consumption. Located in Ordos in the coal-rich Northwestern region of Inner Mongolia, the plant will eventually have four generating units, and is designed to deliver power to the eastern coastal Shandong province via a long-distance ultra-high voltage grid. China is responsible for more than half of global coal-fired power generation and is expected to see a 9 percent year-on-year increase in 2021, International Energy Agency (IEA) report said. Beijing has pledged to start reducing coal consumption, but will do so only after 2025, giving developers considerable leeway to raise capacity further in the coming four years.

24 December: Japan’s Shikoku Electric Power Co Inc said it had invested more than 10 billion yen (US$87 million) to buy a 15 percent stake in the Vung Ang two coal-fired power plant project in Vietnam, despite the global trend to move away from coal. The Japanese utility has paid between 10 billion and 20 billion yen to Japanese trading house Mitsubishi Corp to buy the stake.

22 December: Electricity supply from the 300 MW Lake Turkana wind power plant has been cut off indefinitely after a section of the 220kV Loiyangalani-Suswa electricity line clashed. This has raised fears of a power shortage and rationing in the country in the coming days following the incident where four towers collapsed in the Longonot area of Mai Mahiu. Already, Kenya Power company has warned of a pending power shortfall as its engineers moved in to access the damage. Already, engineers from the power company and the Kenya Electricity Transmission Company (KETRACO) have embarked on repairing the damaged sections. Following the incident, Kenya Power issued a statement to assure electricity consumers that normalcy would be restored in the coming days. The company noted that the incident had led to the switching off of the Turkana power plant that is connected to the Suswa substation resulting in a generation shortfall.

24 December: Japan’s industry and land ministries have selected three consortiums, all led by Mitsubishi Corp, as the operators for three offshore wind power projects in Akita, northern Japan, and Chiba, near Tokyo, they said. The announcement is the second set of results of government auctions for offshore blocks under a new law to promote wind power as Japan aims to boost renewable power capacity to help achieve its 2050 goal of becoming carbon neutral. The winner of the 391 megawatts (MW) wind farm

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.