-

CENTRES

Progammes & Centres

Location

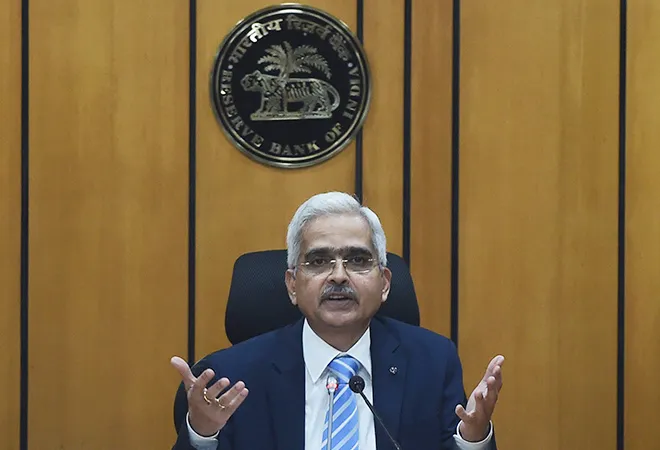

The RBIs decision to hold the repo rate at 5.15 per cent mirrors the timidity of the Finance Minister in the budget proposals presented for FY 2021. Both are twins born of the same mother of policy paralysis and dwindling vision.

Admittedly going on decreasing the repo rate when banks refuse to play ball and transmit the reduced rates to consumers has limited returns. The purpose of reducing the repo rate is to make loans available at cheaper rates to final consumers for houses, cars and education. Banks have refused to play ball and customers face interest walls as high as 10 percentage points above the repo rate of 5.15 per cent – the intervening margin is jam for our inefficient banks.

Lets’ not forget that the crisis today is of low demand. Industry and individuals – at least those who are serious about repaying their loans- see no future in borrowing at between 10 to 15 per cent to invest in an economy growing at 9 per cent in nominal terms.

Only those who have an unbeatably revolutionary product, like the Tesla car in the auto sector or the Jio infotainment and communication sector or those who are part of the massive “government-industrial complex” which extends beyond the formal public sector, will borrow, undeterred, because they can reasonably hope to push existing players out of the market and enhance market shares; push administered prices up to suit them or tweak regulations to boost their top and bottom lines.

Sadly, the nature of this privileged beast is such that there are a mere handful of such companies and products in the market. The rest of us can only hope to keep our noses above water and hope for low double digit growth in our top line. This is the aspiration of the average Indian businessperson – retailers, wholesalers and small and medium industry. And it is this lot who have been terribly disappointed both by the budget and now by the RBI monetary Committee’s decision to hold the interest rate level.

It is good that the RBI has taken more substantive steps to enhance liquidity in the market – by cutting back on the amount of money banks are forced to keep in reserve with the RBI as a kind of guarantee to safeguard ability to servie the debt on its books to depositors. By freeing higher proportions of Bank assets to be used where they earn optimum risk weighted returns, rather than be dragooned into supporting the bottomless appetite of the government for public dent, the RBI has supported cheaper credit.

A more “daring” move is to allow additional leeway – an additional year – to real estate and MSME units to restructure outstanding debt as on January 1, 2019 and thereby stave off the debt being classified as stressed.

The success of such relaxations depends crucially on the thousands of bank managers who must now sift the chaff of irresponsible and commercially doomed borrowers from the grain of the few whose balance sheets are in a mess for no fault of theirs.

Using discretion wisely is easier said than done. But one cannot micromanage such exercises. It is good that the RBI chose to give this benefit to real estate – the biggest employer of unskilled labor after agriculture and to the MSMEs who have suffered the most from ourinstitutional evolution to a “banked business architecture” because of the GST – as opposed to one bed rolled earlier by cash.

Specific parts of the government are pulling together to make FY 2021 qualitatively better than the previous fiscal. But it remains a somewhat fragmented game plan heavily dependent on well-meaning individuals taking the right decisions.

What remains missing is the grand institutional push required to recapture the highlands of 8 per cent growth. That can happen only with a major overhaul of the way public resources are allocated and used and a make-over in the incentives available for business to invest and grow.

Only deep reform of the style and substance of government regulation- along the lines, instinctively captured by Prime Minister Modi, as early as May 2014 – in the meme “more governance less government” can unleash the animal spirits which have remained caged by lazy administration of a well-conceived theme for revival.

Liberalizing agriculture; privatizing the burgeoning public sector and professionalizing government can no longer be ignored if high growth with equity is an objective.

This commentary originally appeared in The Times of India.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Sanjeev S. Ahluwalia has core skills in institutional analysis, energy and economic regulation and public financial management backed by eight years of project management experience ...

Read More +