-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Rishi Kant and Himanshu Khushwaha, “Promoting Efficiency in Power Generation in India: The Role of Imported-Coal-Based Plants,” ORF Issue Brief No. 568, August 2022, Observer Research Foundation.

Introduction

Beginning in early 2020, the lockdowns that governments implemented to arrest the pandemic led to the disruption of supply chains across the globe. The sharp reduction in electricity demand, and the associated slowdown in industrial and commercial activity, had a massive impact on the power sector.

Following the Covid-19 second wave in the middle of 2021, as economies started recovering, there was sudden rise in power demand. Most countries were unable to cope with the surge, leading to outages in countries such as India, China, and the United States (US).[a],[1] In February 2022, the eruption of the Russia-Ukraine conflict disrupted the supply of oil and gas, causing a steep increase in gas prices and accentuating the power crisis.[b],[2]

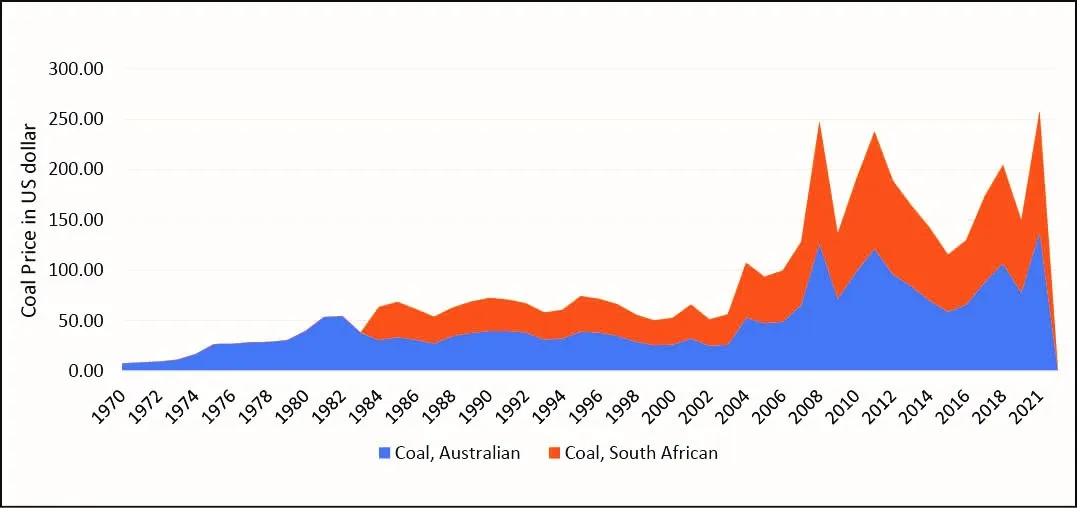

This forced many countries to fall back on coal for their energy requirements, raising the price of coal to historic figures. As seen in Figure 1, in 2021, the international price of Australian coal reached a historic high of 138.05 $/mt, while that of South African coal almost leveled its previous peak in 2008, at 119.84 $/mt.[3] Prices remain elevated in 2022, with the spot price of coal at Australia’s Newcastle port breaching $ 400 a ton in June 2022.[4]

Figure 1: International Coal Price of Australian and South African Coal (in $/mt)

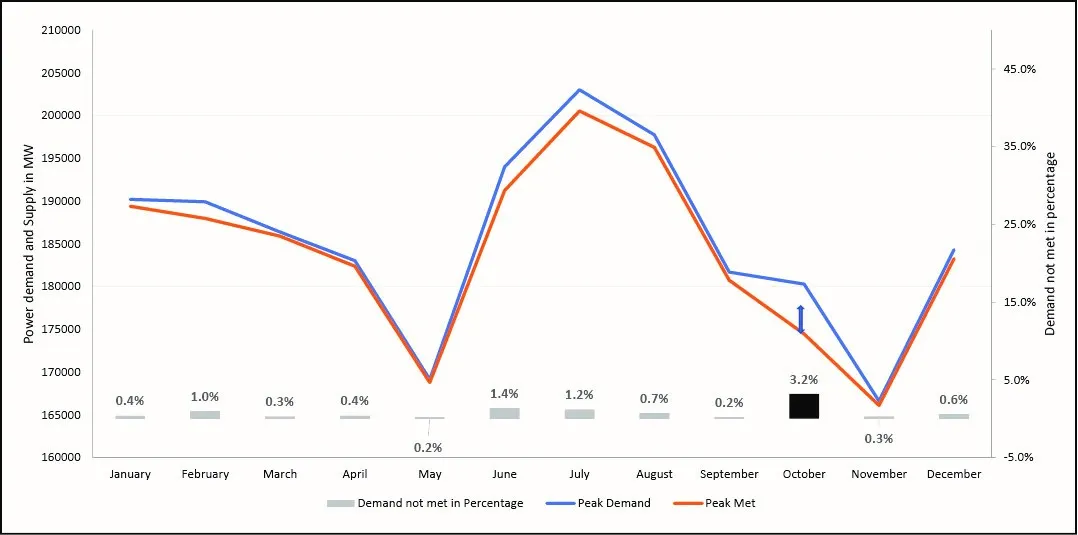

India has not been immune to these developments and is suffering gaps in power supply. A number of states across the country are resorting to scheduled ‘load-shedding’ to meet the increased power demand associated with the revival of the economy and an abnormal surge in temperatures.[c] As shown in Figure 2, peak power demand outpaced peak power supply during the summer period in India.

Figure 2: Power Demand and Supply in India (2021)

The continuous increase in demand for electricity post-lockdown has placed massive pressure on the power generation plants, most of which are operating on coal. While geopolitical events led to the disruption of imports, India’s domestic coal supply also declined because of the pandemic-induced lockdown and disruptions in coal and gas extraction and transportation from domestic mines on account of heavy rains.[5] In 2020-21, the production of coal dropped to 716 million-tonnes (MT), or 2 percent less than that in 2019-2020.[6] Many gas- and coal-based power plants were forced to operate at less than their optimum capacity. A number of imported-coal-based (ICB) plants also ceased their operations, as they did not have regular supplies of imported coal and incurred huge losses due to the high cost of imported coal and shrinking margins.

Despite Coal India Limited achieving its highest coal production of 777.31 MT (Provisional) in FY 2021-22,[7] the year 2022-23 witnessed disruption in coal supply to the power plants due to lack of availability of required rakes from the Indian Railways (IR) and shortages in explosives required for the blasting of mines to extract coal.[8] It came at a time when India’s power demand reached an all-time high of over 210 Gigawatts (GW) (around 1,500 hours) on 9 June 2022, and with no end in sight to the heatwave.[9]

This brief examines the issues and concerns of a category of coal-based plants in India—i.e., imported-coal-based (ICBs). It analyses their present status and the reasons for their deficient performance, and offers policy suggestions to address the challenges they face.

Imported Coal-Based (ICB) Plants in India

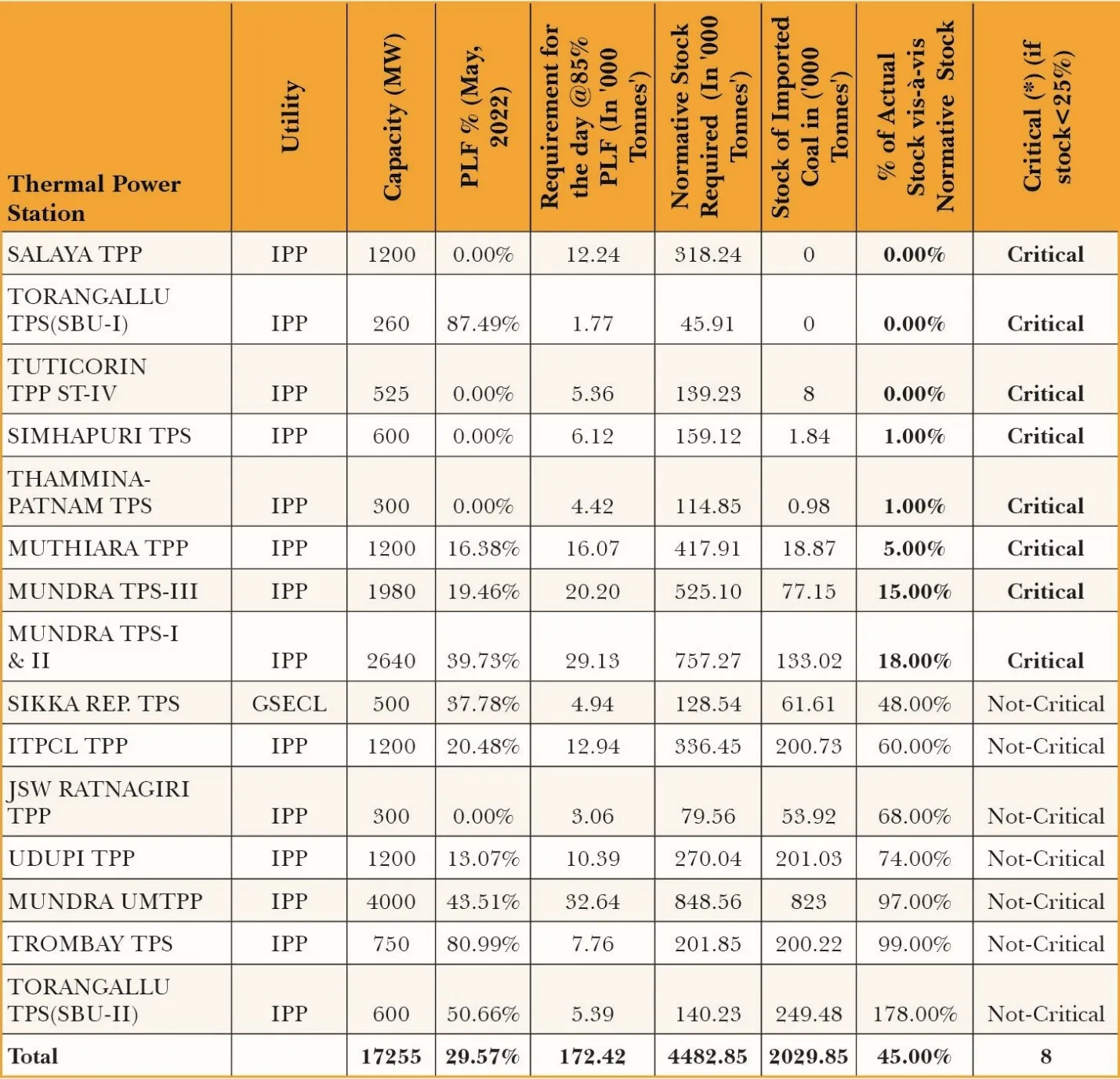

After 1991, the Indian government began liberalising the power sector and undertook policy reforms to attract private investment. Since then, a number of private coal-based power plants have come into existence in various parts of the country. One such group of coal-based plants comprises those operating entirely on imported coal. At present, the cumulative capacity of these imported-coal-based (or ICB) plants is around 17,255 megawatts (MW), or more than 8 percent of the country’s total coal-based power plant capacity of 210,699.50 MW.[10] At the time of writing this brief, there were 13 ICB plants operating mostly in the coastal regions of the country, with the Mundra Ultra Mega Thermal Power Plant in Gujarat having the highest installed capacity (4,000 MW), followed by Mundra TPS-I&II (2,640 MW), and Mundra TPS-III (1,980 MW), also in Gujarat.

As seen in Table 1, of the total capacity of ICB plants of 17,255 MW, most of them run at less than their full capacity. The average coal stock, based on the normative requirement measured at 85 percent Plant Load Factor (PLF)[d] for many is less than the national average of 39 percent. A low PLF for a power plant indicates that it is not being used to its optimal capacity, resulting in an increase in the per-unit cost of the power produced. Moreover, eight plants with combined capacity of more than 7,000 MW are in the ‘critical’ category, owing to their low coal stock.

Table 1.: Status of Plants Operating on Imported Coal (as of June 2022)

ICB plants help meet the power demand of the southern and west-coast states such as Gujarat and Tamil Nadu. Moreover, some ICB plants such as Mundra UMPP have Power Purchase Agreements (PPAs) with states like Punjab, Haryana, Rajasthan, and Gujarat, helping these states supplement their supply during the power-intensive agriculture sowing season.

Ensuring that these ICB plants remain operational helps relieve the Indian Railways of pressure for additional rakes, as the supply of coal to southern states through railways often involves a high turnaround time. Power supply supplemented through these ICB plants helps optimise the railways rakes and divert them to plants having low coal stocks, especially in the hinterlands. ICB plants also fill the shortages during the monsoon periods, when coal mining operations are disrupted and transportation of coal becomes difficult.

The Global Scenario

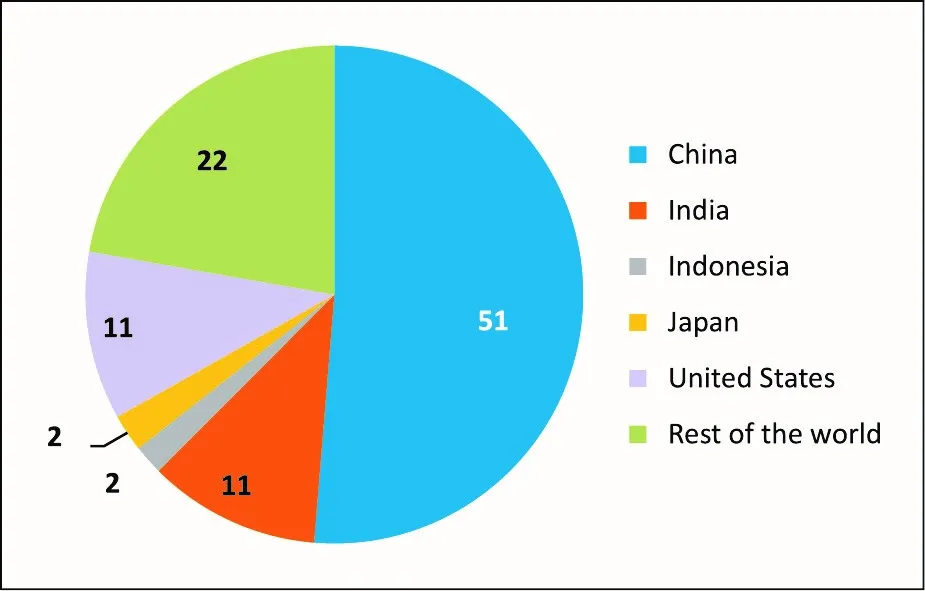

China, India, and the United States own the biggest fleet of coal-based plants in the world: China accounts for 51 percent, and India and the US each make up 11 percent. Countries like Japan and South Korea, meanwhile, despite having no commercially viable coal reserves, are among the largest consumers of coal for power generation and are dependent on imports.

Figure 3: Coal-Fired Power Capacity, Select Countries, Global Share (%) as of June 2022

According to the International Energy Agency (IEA), global power generation from coal increased by nine percent in 2021[11] and is expected to remain elevated due to the ongoing Russia-Ukraine conflict. Many European countries are likewise leaning toward coal for electricity generation as a result of gas supply disruptions. There seems to be a global shift towards coal-based power generation primarily because of ongoing geo-political developments and rising energy demand.

Table 2: Additional Coal-Fired Power Capacity, Select Countries (2021)

As seen in Table 2, China added 25.2 GW of new coal-based power capacity in 2021, accounting for 56 percent of global additions that year—the highest in the world.[12] It was the result of the relaxation on restrictions on new coal plant permits, and increased lending to big coal-intensive projects.[13]

Issues and Challenges Faced by ICB Plants

ICB power plants are facing chronic supply-side bottlenecks and financial constraints, thereby hindering their ability to operate at optimum capacity. As the price of imported coal rose to an all-time high due to reasons mentioned earlier in this brief, the input costs for ICB plants increased, and their margins came down. Compounding their challenges are the huge dues from distribution companies (discoms) to the power generating companies. Indeed, the situation is precarious as many ICB plants are finding it difficult to finance even their working capital needs, as investment in general in the coal-based power generation is becoming scarce. They also have to compete with alternative, renewable energy which is acquiring financing, especially from the private sector, at highly competitive prices.

Notably, significant proportions of funding for coal-based plants in India come from government-owned non-banking finance companies such as the Power Finance Corporation (PFC), Rural Electrification Corporation (REC), and Life Insurance Corporation (LIC); commercial banks have stayed away. All these have put severe strain on the functioning of ICB plants, with some of them eventually going bankrupt. Of the total 17,500 MW plant capacity across ICB plants in India, 2,500 MW were undergoing proceedings before the National Company Law Tribunal (NCLT) for their inability to repay their debts.[14] The depreciation of the Rupee in recent months has made the import of coal even more expensive for these power plants, raising their operating costs. Interest rates are also increasing, making the already scarce credit to ICBs even costlier.

Acknowledging the constraints being faced by the ICB plants, the Government of India (GoI) decided in 2022 to refinance the plants.[15] The Ministry of Power (MoP) has requested the Reserve Bank of India (RBI) to open a separate window for these plants to enable them to finance their working capital requirements.[16]

In the past few years, the GoI has attempted to reduce the country’s dependency on imported coal and meet the energy requirements through coal from domestic mines. As a result, India’s imports of non-coking coal used in the power sector, fell by a good 60.87 percent from 58.09 MT during the period April-January 2021 to 22.73 MT in April-January 2022.[17] More recently, however, rising power demand amidst constrained availability of domestic coal has made the strategy untenable. It was with this realisation that the importation of coal was made duty-free by the government in 2022[18] for both blending purpose in the Domestic Coal-Based (DCB) power plants and for use exclusively for ICB plants.

Reviving imported-coal-based plants will help meet the growing energy needs of India. While these imports will impact India’s current accounts as global prices of coal increase, the country’s impressive export performance in both Merchandise and Services sectors will mitigate the pressure. Besides, one of the reasons for excess pressure on coal-based plants, are non-operational gas-based plants. Therefore, to the extent imported coal is to replace the gas imports, there will not be any additional import burden.

It also worth mentioning that diesel generator (DG) sets—which are costlier and polluting—have long been used as backup in power outages. The cost of generation for a DG set can range from INR 16 per unit to INR 40 per unit—[19] far higher compared to that of ICB plants. Moreover, imported diesel puts greater burden on the country’s trade balance than coal.

This brief argues that ICB plants can supplement efforts for ensuring uninterrupted power supply during the unprecedented high demand for power the country is currently facing, which even renewable sources such as solar and wind cannot guarantee in the short run. Solar power, for example, is prone to vagaries of climate.[20]

The government has difficult choices to make in the absence of alternatives to coal-based power and, at the same time, amidst lack of capacity to replace imported coal with domestic sources to meet excess demand. As power plants have a limited capacity to absorb the high cost of imported coal, the choice is to either go powerless or buy power from the power exchange.[e] While going without power is not worth considering, purchasing power from the power exchange is even more prohibitive than importing coal. According to estimates, NTPC’s fuel cost will go up to INR 7-8 per kilowatt hour from importing coal, thereby increasing power tariffs by 50-70 paisa per unit for the consumer. This, however, will still be less than the cost of power purchased from the power exchange.[21] Due to the present pressure of the electricity supply and high demand, the power exchange was witnessing high clearing price, and thus the Central Electricity Regulatory Commission (CERC) was forced to put a price cap on the power exchange and further has to extend it till September 2022.[22]

High imported coal price will ultimately lead to some increase in the final electricity price. However, such pass-through, if done in a transparent and prudent manner, may be less burdensome and could face less resistance. Towards this end, an understanding has been reached between certain states to remove the ceiling on imported coal—this will aid the State government and ICB plant operators to avoid disputes and will ensure that the pass-through of coal cost is done properly. This will reduce the excess burden of the increase in cost resulting from high global coal prices on the plant operators.[23],[24] It will provide a clear market signal to ICB plants and enable them to undertake short- and long-term risk mitigation strategies.

To deal with the volatility in global coal prices, ICB power plants must disclose their future coal needs in consultation with the Ministry of Power so that planning can be done and possible causes of volatility can be addressed in advance. ICB plants, in turn, can address specific risks by undertaking the systematic importation of coal throughout the year in suitable quantities and explore the option of long-term contracts for the supply of coal, as well as the acquisition of coal mines overseas to hedge against price volatility risks.

On the policy front, ICB plants should diversify their sources of imported coal to manage volatility. At present, Indian ICB plants import half of their coal needs from Indonesia, for reasons of both proximity and price. Yet, such an approach leaves the plants vulnerable to country-specific risks. Indeed, in January 2022, Indonesia imposed a ban on the export of coal, putting at risk the power supply to states such as Gujarat, Andhra Pradesh, Karnataka, and Tamil Nadu, where these ICB plants are located, as well as other states having Power Purchasing Agreements (PPAs) with them.[25] According to conservative assessments by the Institute of Energy Economics and Financial Analysis, this would imply a risk of losing an estimated 45 billion units (BU) of annual generation at 65-percent plant load factor.[26]

Moreover, during times of geo-political crises or tensions, trade routes could get blocked, making it necessary to guard against dependency on a single source. In this regard, India’s diplomatic missions in coal-exporting countries can be required to provide information in anticipation of any crucial policy changes likely to emerge in the source country that can have consequences on its coal imports, or of any looming geo-political crisis that can affect future shipments. This can rightfully be made a part of India’s energy diplomacy.

Conclusion

Amidst rising energy demand and a declared commitment to provide electricity to all, India must explore all possible options for power generation. While the government is keen for the country to transition to clean energy, coal-based power generation will continue to be a mainstay of India’s energy basket, at least for the medium term. According to the Central Electricity Authority, India’s reliance on coal for power generation is expected to fall from 53 percent of installed capacity in 2021 to 33 percent in 2030. In this regard, ICB plants will form an integral element during this transition and therefore should remain operational.

This brief has argued that ICB plants have certain features that make them useful in meeting India’s energy demand. First, the specific coal consumption of these plants is low, implying that they generate more energy per unit of coal. Second, the plants are designed to operate on imported coal, which has higher gross calorific value than what is available domestically. Domestically produced coal have high ash content and a low calorific value, raising operational, transport and maintenance costs. Thus, the same quantity of imported coal produces more energy, compared to domestic coal. Being located mostly on the coasts, ICB plants also give additional benefits in reducing the reliance on the Indian Railways, as these can be fed directly by sea.

India must address the working capital requirement of its ICB plants. The rising costs of inputs faced by ICB plants, on account of high international coal prices, are putting extreme pressure on them even as high interest rates hamper their financial planning. In a situation where private and banking institutions are not as keen to invest in coal-based ventures, finding adequate working capital is becoming onerous for ICB plants.

According to the International Energy Agency (IEA) ,[27] India is likely to witness the highest rise in energy demand over the next 20 years. While the country has embraced the idea of clean renewable energy on a global stage, its current demand for electricity can only be met by addressing the concerns surrounding coal-fired power plants. The goal of going green might be a medium- to long-term strategy that should be diligently pursued to avoid future crises. In the short term, however, focus should be on making coal-based plants work efficiently; ICB plants are crucial in this regard.

References

Brady Dennis and Steven Mufson, “Key nations agree to halt funding for new fossil fuel projects.” The Washington Post, May 27, 2022.

Sanjay Dutta, “CIL moves to import coal for first time as power demand tops 210 GW.” The Times of India, June 9, 2022.

K Bharat Kumar, “India’s changing goal posts over coal.” The Hindu, May 31, 2022.

P B Jayakumar, “India to replace 30,000 MW thermal power capacity with renewable energy by 2025-26.”, Fortune India, June 1, 2022.

Mihir Mishra, “Ministry seeks funds for coal-fired power plants, but banks set to say no.”, The Indian Express, June 10, 2022.

Endnotes

[a] These three big economies are all dependent largely on coal for electricity, and similarly faced spurts in electricity demand as the massive 2021 Covid-19 wave was slowing down.

[b] Russia is a major exporter of oil and gas. In 2021, Russian crude and condensate output reached 10.5 million barrels per day, comprising 14 percent of the world’s total supply.

[c] A ‘heat wave’ is a period of abnormally high temperatures, more than the normal maximum temperature that occurs during the summer season in the North-Western parts of India. It typically occurs between March and June, and in some rare cases even extend till July.

[d] The Central Electricity Regulatory Commission defines Plant Load Factor as a percentage of energy sent out by the power plant corresponding to installed capacity in that period.

[e] A Power Exchange is a platform on which power is transacted i.e., bought and sold. There are two power exchanges in India: Indian Energy Exchange Limited (IEX) and Power Exchange of India Limited (PXIL).

[1] I “Covid-19 impacts on electricity,” IEAParis, January, 2021.

[2] “Energy Fact Sheets: Why does Russian oil and gas matter?,” IEAParis, March, 2022.

[3] World Bank Commodity Price Data (The Pink Sheet), annual prices, 1960 to present, nominal US dollars, (annual series are available in nominal and real dollars), World Bank, July 5, 2022.

[4] “Asia coal prices hit record on hot global competition for fuel,” Bloomberg News, June 27, 2022.

[5] “India staring at power crisis after rains hit coal movement, generation at private plants down,” The Economic Times, October 10, 2021.

[6] “COMPANY WISE PRODUCTION OF RAW COAL DURING LAST TEN YEARS,” Ministry of Coal (Govt. of India), July, 2022.

[7]“Major Statistics-Production and supplies- Reforms and achievements of ministry of coal since 2014,” Ministry of Coal (Govt. of India), July, 2022.

[8]“Major Statistics-Production and supplies- Reforms and achievements of ministry of coal since 2014,” Ministry of Coal (Govt. of India), July, 2022.

[9]“India’s peak power demand touches new high of 210,793 MW,” ETNOW,June 10, 2022.

[10] “National Power Portal,” Ministry of Power (Govt. of India), July 2022.

[11] Igor Todorovic, “IEA: Global coal output to rise 9% in 2021 to all time high” Balkan Green Energy News, December 21, 2021.

[12]“Boom and Bust Coal 2022 Tracking the Global coal Plant pipelines,” Global Energy Monitor, April 2022.

[13]“China dominates 2020 Coal plant development,” Global Energy Monitor Brief, February 2021.

[14]ZeeBiz Webteam,“Government to invite bids for power from 8,000 megawatt thermal capacities without PPA” Zee Business, June 2, 2022.

[15] “Power Ministry asks PFC, REC, to provide short term loans to imported coal-based plants,” The Economic Times, May 11, 2022.

[16] Rituraj Baruah, “Govt may ask RBI for power project window,” Mint, May18, 2022.

[17] “India’s Coal import falls 23% as domestic production rises,” The Economic Times, March 26, 2022.

[18]Amit Dave, “India removes import duty on coking coal anthracite,” Reuters, May 21, 2022.

[19]“Backup Power-Re-evaluating the cost economics of DG sets,” Power Line, January 6, 2018.

[20] Phred Dvorak, “Can Solar power compete with coal? In India, its gaining ground,” Mint, February 20, 2022.

[21] Raveena K Sethia, Shreeyash U Lalit, Aribba Siddique, “Power Exchanges in India- Overview and way forward,” IJPIEL, December 22, 2021,

[22] Sarita C Singh, “CERC extends price cap on power exchanges till September 30,” The Economic Times, July 1, 2022.

[23] Rishi Ranjan Kala, “Gujarat removes $110/t ceiling on imported coal price in PPAs,” Business Line, June 13, 2022.

[24] CERC extends price cap on power exchanges till September 30 – The Hindu BusinessLine

[25] Willy Kurniawan, “Indonesia bans coal exports in January on domestic power worries,” Reuters, Jaunary 1, 2022.

[26] Vibhuti Garg, “IEEFA Updates: How Indonesia’s coal export ban could impact India,” Institute for Energy Economics and Financial Analysis, January 13, 2022.

[27]“India has the opportunity to build a new energy future,” IEA, February 9, 2021.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Rishi Kant is an Indian Economic Service officer currently posted as Deputy Economic Adviser with the Ministry of Agriculture and Farmers Welfare. He holds Masters ...

Read More +

Himanshu Khushwaha obtained his Masters degree in Economics from the TERI School of Advanced Studies in New Delhi. He has worked as a Consultant with ...

Read More +