-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Andrea Marcello Bassi, Georg Pallaske and Marco Guzzetti, “Post-COVID-19 Recovery: Harnessing the Power of Investment in Sustainable Infrastructure,” ORF Issue Brief No. 426, December 2020, Observer Research Foundation.

Introduction

Certain investments in infrastructure have brought about negative consequences, including deforestation, air and water pollution, and poor climate resilience. In recent years, calls for sustainable infrastructure have grown. The COVID-19 pandemic has only heightened awareness regarding the challenges in maximising scarce public resources. The massive economic fallout of the pandemic has made it imperative to focus on necessary and well-designed investments. Indeed, GDP growth in the first quarter of 2020 declined and was consistently negative, even among the biggest economies like the US (-4.8 percent), the Eurozone (-14.4 percent), and China (-34.7 percent)[1]. Overall, the global GDP per capita is expected to decline by 4.2 percent in 2020 compared to the reduction of 1.6 percent during the global financial crisis of 2009.[2]

At the same time, COVID-19 brings an opportunity in the form of recovery packages. If countries aim to recover in the shortest possible time, any investment supported by recovery packages has to be sustainable. With climate change and the bleak global macroeconomic outlook, there are hardly any second chances available that do not have the potential to create further crises.

One potential consequence of a recovery package is that it could cause an increase in debt that will, in turn, constrain future budgets and project financing. The combination of higher costs and reduced revenues will negatively affect budget availability for current and future investments in climate change adaptation and resilience. Even more critical challenges may emerge in the future if resources are not available for infrastructure maintenance, which is expected to increase due to climate change. The risk of stranded assets[a] is becoming increasingly tangible across the world.

Although measures to address the socio-economic challenges brought by COVID-19, such as economy-wide lockdowns, led to reduced carbon emissions, in the long term the pandemic will not slow down climate change and its related hazards.[3] Further, if new investments are not channelled to low-carbon infrastructure, it will result in a lock-in effect that will make it even more difficult for countries to fulfil their commitments to the Paris Climate Agreement as outlined in their Nationally Determined Contributions (NDCs).

Countries must utilise their economic stimulus to facilitate a green recovery. Investing in sustainable solutions, especially in infrastructure, will provide an opportunity to stimulate economic growth while increasing climate resilience and curbing expected losses.

Climate Change Impacts

Between 1970 and 2012, climate-related disasters were responsible for almost 2 million deaths and US$ 2.4 trillion in economic losses at the global level.[4] Climate change affects infrastructure in different ways and the impacts depend both on geographical context and the type of infrastructure. (See Table 1).

Table 1: Impacts of climate change on critical infrastructure

| Infrastructure type | Climate change impact | Main climate drivers | Affected output indicators | Impacts of sustainable infrastructure |

| Roads | Stormwater runoff from roads | ● Precipitation | ● Stormwater management cost | ● Reduced risk of traffic disruptions and accidents |

| Effect of precipitation on road lifetime | ● Precipitation |

● Depreciation of roads ● Cost of road construction and maintenance ● Road-related energy use ● Energy-related emissions ● Social Cost of Carbon |

● Reduced road management cost ● Reduced damages from flooding ● Improved service delivery despite growing climate change-related pressures |

|

| Weather effects on accident rates |

● Precipitation ● Temperature |

● Number of accidents ● Economic cost of accidents |

● Reduced risk of traffic disruptions and accidents | |

| Energy | Impact on load factor |

● Coal: Temperature ● Gas: Temperature ● Nuclear: Temperature ● Biomass: Temperature ● Hydro: Precipitation ● Wind: Wind speed ● Solar: Temperature |

● Electricity generation ● Revenues from electricity generation ● Fuel expenditure ● Energy-related emissions (for fossil generators) ● Social Cost of Carbon ● Cost of air pollution |

● Improves energy security assessments by indicating future losses incurred from extreme events ● Provides a more holistic perspective on the energy portfolio and future investment needs to maintain energy security and support economic growth ● Enables targeted investments in infrastructure before impacts such as power cuts or energy scarcity occur |

| Impact on thermal efficiency | ● All thermal generators: Temperature |

● Fuel use ● Fuel expenditure ● Fuel use ● Fuel-related emissions ● Social Cost of Carbon |

||

| Impact on grid efficiency | ● Temperature | ● Revenues from electricity sales | ||

| Buildings | Stormwater harvesting yield | ● Precipitation |

● Water use in buildings ● Water cost |

● Improved understanding of local, climate related impacts on buildings, enabling adaptation ahead of time, thereby generating savings on economic (e.g. energy cost, maintenance cost, capital cost of repairs), social (e.g. reduced impacts of heat stress, reduced vulnerability of flooding related health hazards) as well as environmental (e.g. reduced emissions, reduced water and air pollution) level. |

| Effect of temperature on load factor rooftop solar PV | ● Temperature |

● Solar PV generation ● Electricity cost ● Emissions from electricity use ● Social Cost of Carbon |

||

| Heating Degree Days | ● Temperature |

● Heating energy expenditure ● Heating energy use ● Energy use-related emissions ● Social Cost of Carbon |

||

| Cooling Degree Days | ● Temperature |

● Cooling energy expenditure ● Cooling energy use ● Energy use-related emissions ● Social Cost of Carbon |

Source: Bassi, A.M., L. Casier, G. Pallaske, O. Perera, and D. Uzsoki, 2018[5] – Bassi, A.M., G. Pallaske, and M. Stanley, 2019[6] – IISD. 2020a[7]

Analysts use Causal Loop Diagrams (CLDs)[b] to identify and analyse the systemic impacts of climate change on infrastructure.[8] In the energy sector, for instance, climate trends can influence electricity generation, both directly (e.g. with temperature affecting the efficiency of fuel combustion) and indirectly (e.g. with temperature affecting demand, and transmission losses). There are further impacts, e.g. on capacity, with the risk of floods (e.g. for power plants located near rivers) and droughts (e.g. for hydropower). Overall, the vulnerability of infrastructure to climate change is clear, with the potential increase in required investments in the future, due to higher damage and reduced efficiency.

In 2017, global GDP accounted for more than US$70 trillion, 20 times larger than it was in 1967.[9] The economic growth was accompanied by an increase in debt, which amounted to more than US$230 trillion in the third quarter of 2017. Such high debt slows economic growth and reduces the potential for investments. Climate change has only heightened the economic challenges, as losses associated with extreme weather events increased between 1990 and 2017.[10] By 2060, it is expected that due to climate change, the global annual GDP will decline by 1.0/3.3 percent compared to a no-damage baseline.[11] The impacts of climate change on the financial sector have been estimated between US$2.5 trillion and US$24.2 trillion,[12] while GDP losses from labour productivity could be greater than 6 percent in most regions.[13] The outlook is not encouraging when considering the current debt and the projected, climate-induced reduction in revenues (e.g. via impacts on GDP) and higher expenditure (e.g. via infrastructure damage).

It is estimated that the difference of limiting global warming to 1.5°C instead of 2°C would save the world some US$20 trillion in economic losses by the end of the century.[14] Rebuilding or repairing damaged infrastructure could therefore lead to budgetary failure in most developing countries: if a government has to face higher payments to replace damaged infrastructure due to more extreme climate events, it also has to deal with increased expenditure or debt, leading to a decrease in the provision of public services—such is not a desirable outcome.[15] One way to decrease expenditure or to prevent debt increase is by investing in climate-resilient infrastructure, which would reduce vulnerability and costs.[16]

The Impact of Covid-19

As of the end of November 2020, the recorded global cases of COVID-19 surpassed 60 million infections and 1.4 million fatalities, covering 191 countries and regions.[17] Yet COVID-19 is not only a health crisis; it is a massive economic disaster as well. The data on GDP performance of major economies gathered during the first four months of 2020 has shown that the current economic crisis will be worse than the financial crisis of 2008-2009, even rivalling the Great Depression of the 1930s.[18] The United States (US), for instance, is expected to see its GDP decline by 4.3 percent in 2020, with unemployment rate reaching 6.9 percent in October.[19],[20] In Europe, meanwhile, GDP in 2020 is expected to decline by 7 percent, with EU27 unemployment rate at 7.5 percent in September 2020.[21],[22]

Japan, for its part, has experienced a decline in real GDP by more than 40 percent during the first four months of 2020.[23] Meanwhile, China, which experienced a 6.8-percent contraction in the first quarter of 2020, grew by 3.2 percent in the second quarter of 2020.[24]

According to estimates by the International Monetary Fund (IMF), global GDP per capita will decline by 4.2 percent by the end of 2020.[c] [25] Forecasts predict that nearly all countries will show negative growth in their GDP this year, and by the end of 2021, GDP per capita will still be lower than pre-pandemic levels in most countries.[26] This will hurt deeper in developing countries, which have less resources and social welfare programmes, to begin with. Studies project that more than 850 million people—majority of them in the poorer economies—risk falling into poverty as a direct consequence of the pandemic.[27]

The pandemic produced both supply shocks and reduced demand at the global level.[28] For example, as of June 2020, 72.3 percent of domestic workers in 137 countries have experienced a reduction in working hours or lost their job during the pandemic.[29] Some sectors have been hit harder than others; for instance, the average stock price change in both the aviation and holiday service sectors has been massive: -40 percent and -36 percent, respectively.[30] Forecasts show that because of physical-distancing norms, 14 percent of consumer spending will be put at risk during 2020 in the US alone.[31] Overall, by 2023 the amount of losses from consumer spending will amount to $84 billion. The pandemic is also likely to increase the costs of doing business, the country’s risk, and public costs, especially in developing countries.[32] However, such forecasts will depend on the severity and the duration of the COVID-19 crisis.

Fiscal supports—such as tax reliefs, monetary transfers to affected people, and credits to vulnerable firms—are needed to encourage the post-crisis economic recovery.[33] Macro-economic measures are being designed to mitigate the severity of the current economic recession to pre-pandemic levels.

However, economic recovery is at risk due to key unpredictability; in particular, five potential uncertainties have been identified as the major factors that will influence medium-term scenarios:[34] the true number of cases to date; pathways to herd immunity; seasonality of transmission; the effectiveness of public health interventions; and adherence to public health measures.

Consequences for infrastructure

The infrastructure available around the globe has been crucial in the response to the COVID-19 pandemic[35] – from communication systems that minimise impacts on business to water services that allow people good hygiene practices. Global economies, especially emerging markets, were already suffering from significant infrastructure gaps and could not respond effectively to the pandemic.[36] Nevertheless, countries that already experienced major outbreaks in the past had infrastructure in place that allowed them to contain the COVID-19 pandemic. For example, South Korea, which suffered an outbreak of MERS in 2015,[d] developed an effective system of contact-tracing that was used to delay the spread of COVID-19.[37]

Governments must decide whether to increase infrastructure spending to stimulate national economies or to invest in other areas. As past experience indicates, when economic growth decreases, public investments decline as well.[38] Further, before the COVID-19 crisis, the levels of both public and private investments in the OECD countries were still below the 2008 pre-crisis baseline.[39] In some countries, the quality of local infrastructure has declined and current gaps in infrastructure can create an obstacle to socio-economic recovery and resilience-building in entire regions. At the same time, the infrastructure demand was already high before the pandemic, not only for new construction projects but also to maintain existing services.

The pandemic has increased interest in investing in digital infrastructure, healthcare facilities, transport connectivity, welfare, and adaptation of public services to the health crisis. Nonetheless, governments and international institutions are mobilising to invest heavily and kickstart the economy after the pandemic—i.e., investment for economic growth, and not to build resilient infrastructure. The US and the EU have announced US$2 trillion and EUR759 billion in stimulus packages, while the IMF Rapid Credit Facility approved disbursements to more than 30 countries and further debt relief grants.[40] The question is whether these will address the underlying vulnerability of infrastructure to climate change, and allow infrastructure services to be resilient and more effective.

In this context, governments will be required to support their economies post-crisis and invest in sustainable infrastructure, a necessary stimulus area.[41] If sustainability is not a key goal of such investments, medium- to long-term costs will increase, further exacerbating the vicious cycle represented by the growth of deficit and debt.

Concerning current commitment and actions, the Energy Policy Tracker[42] indicates that 54 percent of all announced investments are carbon-intensive. Only 35 percent can be defined as “clean”. Among these, some countries and institutions already announced financial support to sustainable infrastructure. For example, the UK approved GBP 1.3 billion of investment in housing and infrastructure projects to enhance a green economic recovery, while the African Development Bank Group approved a EUR 225-million loan to finance Egypt’s Electricity and Green Growth Support Program (EGGSP).[43]

‘Building back better’

The COVID-19 pandemic has encouraged the delineation of what could be the “new normal”. For example, consumers are accelerating the adoption of digital channels; 75 percent of first-time consumers are planning to use digital services post-COVID.[44] The health crisis has also led to the widespread adoption of remote working; such transition generated substantial values of different aspects, from increased operational efficiency to improved employee satisfaction.

Further, the COVID-19 crisis reduced energy demand around the globe. Restrictions on movement caused a reduction in the demand for transport and changed consumption patterns, resulting in an estimated carbon emission reduction in 2020 in the range of –2 percent to –7 percent.[45] Such a reduction, however, is expected to be only temporary and still inadequate to achieve the targets set by the Paris Climate Agreement, which would require to decrease global annual carbon emissions by around 7 percent each year to limit global climate change to a 1.5°C warming.[46]

Indeed, the COVID-19 crisis provides an opportunity to address climate change while supporting economic recovery; investments in climate-resilient infrastructure will play a crucial role in realising it. Overall, when 1 percent of national GDP is invested in infrastructure, the economic benefits increase by 0.4 percent during the same year and by 1.5 percent after four years.[47] In other words, investments in sustainable infrastructure can encourage innovation and efficiency in key sectors such as energy and transport supporting growth, as well as supporting equity.[48] Infrastructure is linked to major sources of climate emissions, from energy to transport; sustainable infrastructure can curb GHGs emissions and promote climate resilience. It represents a mutually beneficial solution, especially for those countries that are still building much of their basic infrastructure. It is worth noting that sustainable infrastructure must be supported by efficient institutional capacity and policies.

Most countries are likely to support infrastructure projects to boost economic recovery from the COVID-19 crisis. Particularly, sustainable infrastructure can generate substantial benefits in the medium term while supporting climate-resilience in the long term. For instance, low- and middle-income countries could experience a new benefit of more than US$4 trillion from investing in climate-resilient infrastructure.[49][50] In other words, a return of US$4 is associated with every US$1 dollar spent on green infrastructure. While upfront capital investments can be substantially higher for sustainable infrastructure, and operations costs similar, studies have shown that benefits accrue indirectly in the form of savings in public expenditure. For instance, reductions in air pollution from the transition towards renewable energy generate savings in healthcare expenditure, as do investments in sanitation and waste management infrastructure. Improved drainage and climate-resilient road infrastructure have been shown to generate savings in maintenance costs, while reducing disruptions in infrastructure service delivery such as flooded roads or accidents which generate induced savings on societal level.

Studies also show that sustainable infrastructure is paramount in safeguarding environmental quality, for example by reducing pollution runoff from roads into surface waters, which in turn improves water quality while reducing the risk of health hazards on humans and animals alike. Consequently, sustainable infrastructure generates benefits across sectors and actors, indicating that the distribution of benefits is more equitable and goes beyond the sole purpose of service delivery, which is at the core of conventional infrastructure assets.

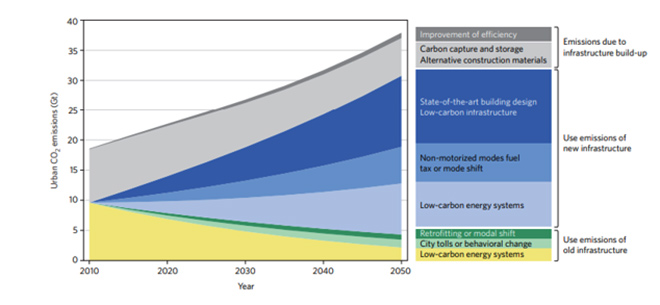

Investments in infrastructure will play a major role in supporting economic recovery; guaranteeing their environmental sustainability will also be important for climate mitigation goals. As the OECD[51] highlights, the quality of the post-COVID-19 investments in infrastructure projects will have to be associated with a low-carbon economy. This is so that short-term emergency responses can be aligned with long-term economic and environmental goals of international obligations, like the Paris Agreement or the Sustainable Development Goals. For example, urban planning and transport pricing applied to new infrastructure could decrease future energy use of cities by a quarter relative to the business-as-usual scenario, especially in Asia and Africa.[52] Such measures, combined with existing infrastructure options, could reduce carbon emissions associated with infrastructure use from 45 to 68 percent, as shown in Figure 1.

Figure 1: Carbon reduction from different infrastructure uses[53]

Integrating new technologies into infrastructure projects can also significantly decrease costs and improve functionality. Innovations that could reduce costs and minimise environmental damage while boosting profits include 5G, artificial intelligence, cloud computing, renewables, and 3D printing.[54] For example, if Climate Information and Early Warning Systems (CIEWS) were used to modernise National Meteorological and Hydrological Services to reduce losses from disasters, they would produce a return in investments ranging from USD 2 billion to USD 36 billion per year.[55]

To be sure, technological innovations have to be accompanied by innovation in new institutional and governance mechanisms . This is already evident when it comes to planning for sustainable development, or the SDGs. The current structure of institutions leads to sectoral/thematic/departmental optimisation, rather than the formulation of strategies and investments that support a full-system optimisation.

An example of an emerging strategy that will require a rethinking of governance mechanisms is ecosystem-based adaptation (EbA). EbA can reduce the physical impacts of climate change on businesses, also in combination with infrastructure[56] and requires close collaboration between local planners and national authorities, as well as the integration of knowledge of ecology, climate change, infrastructure and local development. For instance, hydropower companies can rely on upstream cloud forests for water production, while mangrove ecosystems can protect from sea levels rise. EbA approaches can also provide co-benefits, such as carbon sequestration, water quality, and improved community livelihoods.

Nevertheless, EbA are rarely included within climate risk strategies, despite their proven contribution to decreasing adaptation costs to climate change, also within infrastructures. The quality and the climate-resilience of services delivered by infrastructure systems can also benefit from women empowerment: the importance of women as stakeholders across different sectors must be recognised. In an ideal scenario where women play a role in labour markets identical to that of men, 26 percent of the global annual GDP could be added by 2025[57] —this could address the financial gap in climate action. To begin with, 70 percent of the global healthcare staff are women, whose experience could help build a more efficient response to COVID-19, in turn strengthening health systems.[58]

The economic response to the current health and economic crisis has just begun. National governments and supranational institutions like the European Commission are defining economic response packages. To guarantee simultaneously the socio-economic and environmental sustainability of such packages, it will be important to align the economic recovery goals with climate ambitions. If climate targets will not be achieved, the impacts of climate change will be severe, from annual declines of global GDP up to 3 percent compared to a business-as-usual scenario, to substantial increases in the frequency and severity of disaster events that could severely damage critical infrastructure.[59],[60] Methods have to be defined to support development and infrastructure planners in formulating sustainable projects. A starting point is strengthening Environmental Impact Assessments (EIA) for project-level analysis and Strategic Environmental Assessments (SEA) for policy formulation and assessment. These should be carried out for all types of projects.

At the same time, more work is required to fully integrate the outcomes of EIA and SEA in project finance assessments. The same can be said for gender and health assessments. Organisations like the Green Climate Fund (GCF) are moving in this direction, requiring project proponents to assess their project against various criteria that cover social, economic, environmental and financing indicators. Organisations like IISD instead are developing methods and models to implement such assessments. The Sustainable Asset valuation (SAVi) method and models are an example.[61][62][63]

Fossil fuels and carbon-intensive sectors will have to be excluded from the response packages as well as from quantitative easing programs.[64] Furthermore, environmental regulations should not be weakened for the purpose of speeding up investments. Transparency in recovery packages will also have to be ensured. Since spending on infrastructure will be part of recovery strategies, it will have to be also environmentally sustainable to promote climate mitigation and adaptation plans.

Conclusion

As countries make efforts to recover from the economic fallout of the COVID-19 pandemic, they face the risk of creating recovery packages that fail to focus on low-carbon strategies. While these measures might deliver short-term economic growth, they could exacerbate climate change and result in persistent environmental and public finance crises.

Sustainable infrastructure projects will play a critical role in economic recovery across the world, post-COVID-19. These projects will spur economic activity, support GDP growth, and enable employment creation. Investing in the environmental sustainability of infrastructure will provide countries with opportunities to respond adequately to the current economic crisis while ensuring their long-term commitments to climate goals.

About the Authors

Andrea M. Bassi is Founder and CEO, KnowlEdge Srl (Italy) and a Senior Associate at the International Institute for Sustainable Development (Switzerland). His research focuses on green economy and green growth, using Systems Thinking and System Dynamics as underlying methods to inform policy making at national and sub-national level.

Georg Pallaske is a Project Manager at KnowlEdge Srl (Italy) and a Ph.D. candidate in System Dynamics at the University of Bergen (Norway). He works primarily on customisation and validation of System Dynamics models, and their integration with other modeling platforms, including GIS.

Guzzetti Marco is a Junior Sustainability Analyst at KnowlEdge Srl (Italy). His research focuses on sustainable economy and development, using spatial models to map and value ecosystem services.

Endnotes

[a] Assets that become unavailable, or not utilised before the end of their lifetime.

[b] CLDs are a schematic representation of the key variables of a system, and how these are interconnected with one another to form the key drivers of change, or feedback loops, of such systems.

[c] During the global financial crisis of 2008-2009 the global GDP per capita fell by 1.6 percent.

[d] Middle East respiratory syndrome coronavirus (MERS-CoV) is a zoonotic virus, meaning it is transmitted between animals and people. Since 2012, it has infected 27 countries in Asia, Africa, and the Middle East, leading to more than 850 deaths. Retrieved from the article of the World Health Organization. Accessed on 2020/11/26.

[1] Economonitor. 2020. The Impact of Coronavirus on the Global Economy. June. .

[2] Ibid

[3] Le Quéré, C, R.B Jackson, M.W Jones, A.J Smith, S Abernethy, R.M Andrew, A.J De-Gol, et al. 2020. “Temporary reduction in daily global CO 2 emissions during the COVID-19 forced confinement.” Nature Climate Change 1-7.

[4] World Meteorological Organization (WMO), Press Release Number: 998.

[5] Bassi, A.M., L. Casier, G. Pallaske, O. Perera, and D. Uzsoki. 2018. The Sustainable Asset Valuation of the Southern Agricultural Growth Corridor of Tanzania (SAGCOT) Initiative: A focus on irrigation infrastructure. Geneva: International Institute for Sustainable Development (IISD).

[6] Bassi, A.M., G. Pallaske, and M. Stanley. 2019. An Application of the Sustainable Asset Valuation (SAVi) Methodology to Pelly’s Lake and Stephenfield Reservoir, Manitoba, Canada. Geneva: IISD.

[7] IISD. 2020a. Sustainable Asset Valuation Tool: Materials management infrastructure. Geneva: IISD.

[8] Probst, G., and A.M. Bassi. 2014. Tackling Complexity: A Systemic Approach for Decision Makers. Sheffield: Greenleaf Publishing.

[9] Robbins, R.H. 2018. ” An anthropological contribution to rethinking the relationship between money, debt, and economic growth.” Focaal, 2018(81) 99-120

[10] Mühlhofer, E. 2019. Risk assessment and framework ideas for early warning and climate information projects supported by the GCF. Zurich: ETH.

[11] Dellink, R, E Lanzi, and J Chateau. 2019. “The sectoral and regional economic consequences of climate change to 2060.” Environmental and Resource Economics, 72(2) pp.309-363.

[12] Goldstein, A, W.R Turner, J Gladstone, and D.G Hole. 2019. “The private sector’s climate change risk and adaptation blind spots.” Nature Climate Change, 9(1) pp.18-25.

[13] Matsumoto, K.I. 2019. “Climate change impacts on socioeconomic activities through labor productivity changes considering interactions between socioeconomic and climate systems.” Journal of Cleaner Production, 216 pp.528-541.

[14] Burke, M, W.M Davis, and N.S Diffenbaugh. 2018. “Large potential reduction in economic damages under UN mitigation targets.” Nature, 557(7706) pp.549-553.

[15] Bachner, G, and B Bednar-Friedl. 2019. “The effects of climate change impacts on public budgets and implications of fiscal counterbalancing instruments.” Environmental Modeling & Assessment, 24(2) 121-142.

[16] GCA Adapt. 2019. A Global Call for Leadership on Climate Resilience. Global Center on Adaptation and World Resources Institute.

[17] Johns Hopkins University, Coronavirus Resource Center, COVID-19 Dashboard by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University. Accessed on 2020/11/26.

[18] Economonitor. 2020. The Impact of Coronavirus on the Global Economy. June.

[19] International Monetary Fund. 2020. World Economic Outlook: A Long and Difficult Ascent. Washington, DC, October.

[20] FRED Economic Data. 2020. Accessed on 2020/11/26.

[21] International Monetary Fund. 2020. World Economic Outlook: A Long and Difficult Ascent. Washington, DC, October.

[22] Eurostat. 2020. September 2020 Euro area unemployment at 8.3% EU at 7.5%.

[23] Economonitor. 2020. The Impact of Coronavirus on the Global Economy. June.

[24] Li, X, and D Chu. 2020. China’s GDP up 3.2% in Q2, becomes 1st major economy to return to growth in wake of COVID-19. July 16.

[25] Economonitor. 2020. The Impact of Coronavirus on the Global Economy.

[26] Economonitor. 2020. The Impact of Coronavirus on the Global Economy.

[27] UN News. 2020. Impacts of COVID-19 disproportionately affect poor and vulnerable: UN chief. June 30.

[28] Economonitor. 2020. The Impact of Coronavirus on the Global Economy.

[29] ILO. 2020. “Impact of the COVID-19 crisis on loss of jobs and hours among domestic workers.” International Labour Organization. June 15.

[30] McKinsey&Company. 2020a. “Covid-19: Briefing Materials.”

[31] S&P Global Ratings. 2020b. Economic Research: A U.S. Recession Takes Hold As Fallout From The Coronavirus Spreads.

[32] McKibbin, W, and R Fernando. 2020. “The Global Macroeconomic Impacts of COVID-19: Seven Scenarios.”

[33] Economonitor. 2020. The Impact of Coronavirus on the Global Economy.

[34] McKinsey&Company. 2020c. “Covid-19: briefing materials.” June 1.

[35] Contreras, C.C. 2020. Sustainable Infrastructure in a Post Covid Era. June 24.

[36] Abadie, R. 2020. COVID-19 and infrastructure: A very tricky opportunity. May 15.

[37] Sharma, A., Borah, S.B. and Moses, A.C.. 2020. Responses to COVID-19: The role of governance, healthcare infrastructure, and learning from past pandemics. Journal of Business Research, 122, pp.597-607.

[38] Abadie, R. 2020. COVID-19 and infrastructure: A very tricky opportunity. May 15.

[39] OECD. 2020. OECD Policy Responses to Coronavirus (COVID-19) – The territorial impact of COVID-19: Managing the crisis across levels of government. June 16.

[40] IISD. 2020b. ENVIRONMENTAL, SOCIAL, AND GOVERNANCE TARGETS OF THE MARCH 2020 ECONOMIC STIMULUS. June 4. .

[41] Nelson-Jones, M, C Wilson, and H Bassford. 2020. Partners from DLA Piper’s global infrastructure team consider the future of infrastructure after the COVID-19 crisi. April 28.

[42] energypolicytracker.org. 2020.

[43] IISD. 2020c. COVID-19 FINANCIAL RESPONSE TRACKER.

[44] McKinsey&Company. 2020c. “Covid-19: briefing materials.” June 1.

[45] Le Quéré, C, R.B Jackson, M.W Jones, A.J Smith, S Abernethy, R.M Andrew, A.J De-Gol, et al. 2020. “Temporary reduction in daily global CO 2 emissions during the COVID-19 forced confinement.” Nature Climate Change 1-7.

[46] World Economic Forum. 2020a. The COVID-19 recovery can be the vaccine for climate change. June 09.

[47] World Economic Forum. 2020b. How sustainable infrastructure can aid the post-COVID recovery. April 28.

[48] New Climate Economy. 2016. The sustainable infrastructure imperative: financing for better growth and development. The 2016 new climate economy report.

[49] World Economic Forum. 2020b. How sustainable infrastructure can aid the post-COVID recovery. April 28.

[50] Hallegatte, S, J Rentschler, and J Rozenberg. 2019. Lifelines: The Resilient Infrastructure Opportunity. Sustainable Infrastructure. Washington, DC: World Bank.

[51] OECD. 2020. OECD Policy Responses to Coronavirus (COVID-19) – The territorial impact of COVID-19: Managing the crisis across levels of government. June 16.

[52] Creutzig, F, P Agoston, J.C Minx, J.G Canadell, R.M Andrew, C Le Quéré, G.P Peters, A Sharifi, Y Yamagata, and S Dhakal. 2016. “Urban infrastructure choices structure climate solutions.” Nature Climate Change, 6(12) 1054-1056.

[53] Ibid

[54] World Economic Forum. 2020b. How sustainable infrastructure can aid the post-COVID recovery. April 28. .

[55] WMO. 2015. Valuing Weather and Climate: Economic Assessment of Meteorological and Hydrological Services. Geneva: Geneva.

[56] Goldstein, A, W.R Turner, J Gladstone, and D.G Hole. 2019. “The private sector’s climate change risk and adaptation blind spots.” Nature Climate Change, 9(1) pp.18-25.

[57] World Economic Forum. 2019c. We can solve climate change – if we involve women. September 16.

[58] World Economic Forum. 2020d. Why we need women’s leadership in the COVID-19 response. April 3.

[59] Dellink, R, E Lanzi, and J Chateau. 2019. “The sectoral and regional economic consequences of climate change to 2060.” Environmental and Resource Economics, 72(2) pp.309-363

[60] IPCC. 2018. Summary for Policymakers. In: Global Warming of 1.5°C. Intergovernmental Panel on Climate Change.

[61] Bassi, A.M., L. Casier, G. Pallaske, O. Perera, and D. Uzsoki. 2018. The Sustainable Asset Valuation of the Southern Agricultural Growth Corridor of Tanzania (SAGCOT) Initiative: A focus on irrigation infrastructure. Geneva: International Institute for Sustainable Development (IISD).

[62] Bassi, A.M., G. Pallaske, and M. Stanley. 2019. An Application of the Sustainable Asset Valuation (SAVi) Methodology to Pelly’s Lake and Stephenfield Reservoir, Manitoba, Canada. Geneva: IISD.

[63] Bassi, A.M., O. Perera, L. Wuennenberg, and G. Pallaske. 2018. Lake Dal in Srinagar, India: Application of the Sustainable Asset Valuation (SAVi) methodology for the analysis of conservation options. Geneva: International Institute for Sustainable Development with support of the MAVA foundation, EMSD and GIZ.

[64] Greenpeace. 2020. “Coronavirus recover: a free ride for polluters“.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Andrea M. Bassi is Founder and CEO KnowlEdge Srl (Italy) and a Senior Associate at the International Institute for Sustainable Development (Switzerland). His research focuses ...

Read More +

Georg Pallaske is a Project Manager at KnowlEdge Srl (Italy) and a Ph.D. candidate in System Dynamics at the University of Bergen (Norway). He works ...

Read More +

Marco Guzzetti is a Junior Sustainability Analyst at KnowlEdge Srl (Italy). His research focuses on sustainable economy and development using spatial models to map and ...

Read More +