Quick Notes

Global crude prices: Upward momentum dominates

Global Price Trends in the first quarter of 2021

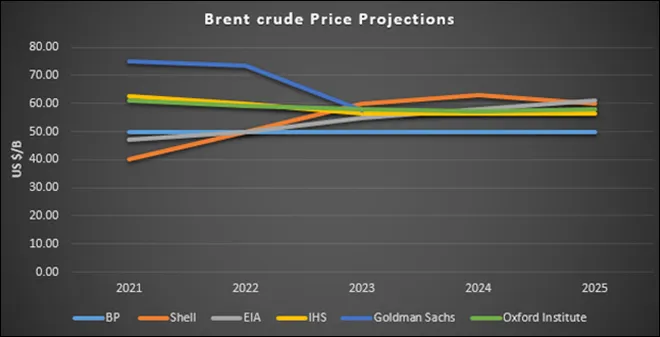

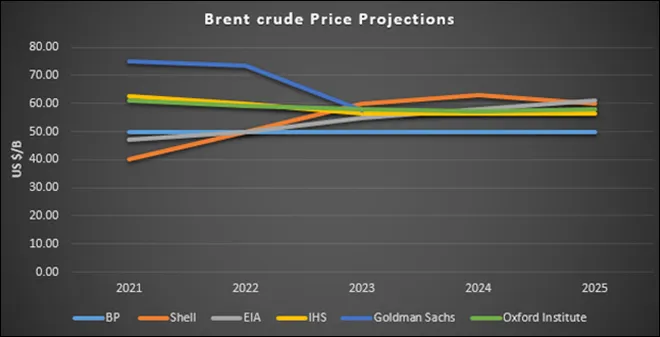

January 2021 opened with optimism for oil markets with Brent crude price increasing to US $57/ barrel (b) from less than US $50/b in December 2020. Supply reductions by (Organisation of petroleum exporting countries (OPEC) and its allies, increased demand for oil on account of cold weather in Europe along with a global increase in demand following signs of economic recovery boosted crude prices. The average Brent price in February touched US $62/b which increased to US $65/b in early March. After reaching a high of nearly US $70/b in mid-March, it fell to US $63/b in the first half of April but bounced back to US $68/b in May and US $72/b in June. Oil prices increased by the end of June to over US $75/b mainly on account of the reduction in United States (US) crude stockpiles notwithstanding trader and investor concerns about transportation curbs in some countries as COVID-19 cases surged. While the highly contagious variant of the coronavirus is said to be spreading in many countries, prompting new lockdowns or movement restrictions in many countries, hopes of a broader recovery in demand for oil remain intact.

Demand Revival

In the first two months of 2021, waves of optimism over the success of vaccination, revival of economic growth followed by oil demand recovery, and effective OPEC+ (14 OPEC member countries and 10 non-OPEC countries that coordinate their oil supply policies with OPEC) actions to maintain market supply restrictions pushed prices close to US $70/b around mid-March. However, a deadly second wave of COVID-19 in India and third waves in many parts of Europe, Asia, and South America returned prices to the US $60/b range by the end of the first quarter, following expectations of demand decline. In terms of future projections, most analysts agree that bulk of the demand recovery will occur in the second half of 2021. European leaders’ statement that it may be possible to vaccinate the whole of Europe by September 2021 also boosted hope for demand recovery. According to projections by the International Energy Agency (IEA )and Energy Information Administration (EIA), global demand may reach 96.5-97.0 million barrels per day (mb/d) by the end of 2021. This would mean an increase of 5.4 -5.7 mb/d or a 60-70 percent restoration of demand reduction during 2020.

Actions of OPEC Plus

In the first quarter of 2021, OPEC+ supply restrictions of about 8 mb/d were in place. Most of the reductions were from producers in the Middle East. Anticipating weaker demand, OPEC+ decided in January to delay a further easing of cuts and Saudi Arabia surprised with an additional 1 mb/d supply reduction in February and March. Following a meeting of the OPEC+ Technical Committee at the end of March, OPEC's forecast for demand growth for 2021 was lowered by 0.3 mb/d from 5.9 mb/d to 5.6 mb/d. At the same time, the world oil supply growth was raised by 0.2 mb/d up to 1.6 mb/d. At the OPEC+ meeting in April, a decision was made to increase production by 1.15 mb/d from May within a three-month timeframe. In this period, Saudi Arabia is also expected to gradually ease its voluntary production cut of 1 mb/d. The increase in production in Saudi Arabia is partly due to increase in domestic oil consumption in Saudi Arabia in summer which means a reduction in exports. Analysts expect that OPEC restrictions of about 8 mb/d could reduce to 6 mb/d by the end of July. Overall, OPEC+ is expected to take a more flexible approach to market management and decide on output levels based on global developments in demand and supply.

Decline in US Shale Production

According to analysts, one key factor driving up crude prices is the scale and pace at which US shale production declined in response to the decrease in oil prices following the first wave of COVID-19. According to the Oxford Institute of Energy Studies (OIES), between March and May 2020, output declined by 2.4 mb/d and as of January 2021, it recovered by only 0.9 mb/d to 7.6 mb/d compared to its pre-shock levels of 9.1 mb/d. According to King Abdullah Petroleum Studies and Research Centre (KAPSARC), US shale growth will be rather limited or even decline in 2021. Given increased uncertainty over access to capital, reduced investor enthusiasm for the shale sector and with climate change considerations featuring high in President Biden’s administration as well as in companies’ agendas, the output response could be smaller and subject to longer lags. But higher crude prices could provide an incentive to increase production by the US shale industry. For now, US companies operating in shale prospects seem committed to pledges made to keep production flat and instead use any price gain to pay down debt or to boost investor returns. If they stick to those plans, OPEC+ may start to reclaim the market share it has steadily lost to the US and others since 2016.

Return of Iran to the Market

Regarding Iran, one view is that the lifting of Iranian sanctions under a new deal with the US could potentially increase global crude supplies and potentially exert a downward pressure on crude prices. Some experts contest this view because, according to them, it is based on the flawed assumption that Iranian sanctions successfully removed Iranian oil from markets. Though Iranian oil production and exports are nowhere near its peak, Iranian oil is said to be entering the market. According to the IEA, China never completely stopped its purchases of Iranian oil. Iran’s estimated oil sales to China in the fourth quarter of 2020 were at 360,000 b/d up from an average of 150,000 b/d shipped in the first nine months of last year. OPEC also reported that Iran's crude oil output increased in March by 6.3 percent after prospects of a new deal improved. OPEC data showed that Iran’s average output in 2020 had amounted to 1.985 mb/d down from 2.356 mb/d in 2019 and 3.553 mb/d in 2018. Major Asian clients in China, India, and elsewhere are eager to take Iranian volumes based on their very low-price settings and attractive credit terms. Analysts expect that if sanctions on Iranian oil exports are removed, the country will not only see higher export volumes, but also stop selling its crude at a discount. Iranian oil export potential is estimated to be about 2 mb/d, twice its current exports estimated at 1 mb/d. Even if Iran manages to export oil at its full potential eventually, many analysts believe that this will not push down prices substantially.

Commodities Super-cycle

In the last few months, the price of many commodities (copper, crude oil, etc.) has surged, and this has fuelled expectations amongst some analysts that a new commodity ‘super-cycle’ may be in the making. In the short term, a weakened dollar, supportive central banks, and government spending on post-pandemic recovery programmes that have pumped in US $14 trillion into the global economy have fuelled consumption of everything from iron ore and corn to energy. This has initiated inflationary expectations that have increased the attractiveness of commodities as a hedge against inflation.

International banks including JPMorgan, Goldman Sachs, and Barclays have either reiterated their long-term bull case for oil or increased their forecasts for oil prices. According to JP Morgan, the odds of oil prices spiking above US $100/b in the coming years have narrowed due to limitations on US shale’s ability to meet a looming US $650 billion capex shortfall. While US shale has been able to respond quickly to deficits and higher oil prices in the past, this time is seen to be different given the financial condition of the industry due to bankruptcies and the greater ownership of shale assets by oil majors that must keep a closer eye on investor returns. US oil output is around 2 mb/d lower than its pre-COVID-19 peak at 11 mb/d. After back-to-back oil busts, some national oil producers and international exploration companies have scaled back drilling budgets to conserve cash and avoid a new supply glut. These reductions may have gone too far and led to a tightening of crude supplies exerting upward pressure on prices.

The Indian crude basket has increased from US $54.79/b in January 2021 to US $71.98/b in June, which is an increase of over 31 percent. Overall, it does not appear that crude prices will fall from the US $60-70/b range in 2021 or 2022 which means continued high retail prices for motorists in India.

Source: Oil Market Quarterly Review, April 2021, KPMG

Source: Oil Market Quarterly Review, April 2021, KPMG

Monthly News Commentary: Coal

Coal sector liberalisation takes off

India

Coal Block Auctions for Commercial Mining

According to the Central government, the second tranche of commercial coal mines' auction has received tremendous response which is reflected in around 50 mine specific tender documents being purchased by bidders till date. Many other prospective bidders are in the process of registration and purchase of tender documents from the auction portal. The ministry launched the auction process for coal mines under the Coal Mines (Special Provisions) Act and the Mines and Minerals (Development and Regulation) Act earmarked for sale of coal on 25 March 2021. According to the ministry, this tranche paves the way for liberalisation of Indian coal sector enhancing efficiency, competition and private sector participation leading to development of a vibrant coal market, boosting economic growth, and employment generation.

Domestic Production and Demand

Offtake from CIL (Coal India Ltd) fell more than a fifth in April as the second wave of the pandemic left several contract workers battling the deadly infection. The fuel offtake from India’s largest coal miner fell to 54.13 million tonnes (MT) as against a target of 68.89 MT. This dip in offtake has led the coal ministry to closely monitor the situation to ensure availability of the fossil fuel at thermal plants across the country given coal is the mainstay of India’s power generation mix. CIL has a total of 259,000 employees and 83,000 contract workers. The official said 5,470 employees, and their families, have been affected by the pandemic in addition to 122 contract workers. Meanwhile, the company’s coal stocks have also declined by 12.21 MT in one month to 87.12 MT by April-end as curbs in several states to contain the spread of COVID-impacted coal offtake.

CIL arm Central Coalfields Ltd (CCL) has recorded 112 percent increase in production at 4.84 MT in April. The Jharkhand-based subsidiary had recorded 2.28 MT coal output in April 2020. As far as coal offtake was concerned, it recorded a 122 percent increase in April 2021 to 6.56 MT against 2.96 MT in the corresponding month of the previous fiscal. CCL has mining operations in Chatra, Latehar, Ramgarh, Hazaribag, Bokaro, Ranchi, Giridih, and Palamu districts of Jharkhand.

CIL allocated 42.51 MT of coal in 2020-21 under spot e-auction scheme, registering a year-on-year increase of 42.5 percent. CIL had allocated 29.83 MT of the dry fuel in 2019-20. Fuel allocation by CIL under the scheme also increased to 5.30 MT in March, from over 2.53 2 MT in the corresponding month of 2019-20. Coal distribution through e-auction was introduced with a view to providing access to coal for such buyers who are not able to source the dry fuel through the available institutional mechanism. The purpose of e-auction is to provide equal opportunity to all intending buyers for purchasing coal through single window service. CIL, which accounts for over 80 percent of domestic coal output, is eyeing 1 BT of production by 2023-24.

Rest of the World

China

China’s coal production slowed in April to the lowest level since July 2020, curbed by ongoing safety inspections at major coal mines following several accidents across the country. China churned out 322.22 MT of coal last month, down 1.8 percent from the same period a year ago, data from the National Bureau of Statistics showed. Output over the first four months of the year reached 1.29 BT (billion tonnes) up 11.1 percent on year. Physical thermal coal prices had soared by 20 percent over the month to 10 May, prompting at least three leading Chinese coal pricing indexes to suspend daily price assessments to try to stabilise the market. The jump followed worries over increasing demand for coal for power generation and industrial activity amid tepid domestic output and stringent imports restrictions for Australian coal. China’s April power consumption rose 13.2 percent from the same period last year to 636.1 billion kWh. According to the statistics bureau production of coke used in steelmaking rose 2.4 percent in April to 39.34 MT with year-to-date output rising 7.4 percent to 158.62 MT.

EU Coal Phase out

Poland’s plan to extend the life of a coal mine in Turow until 2044 could mean the region will not get access to the European Union (EU)’s flagship green transition fund. The aim is to protect communities most affected as the EU overhauls its economy to become climate neutral by 2050. Poland, which employs more than half of Europe’s coal industry workforce, is in line for the biggest share of the fund. Turow supplies coal to a nearby electricity plant.

The Czech government has sent back a recommendation to phase out coal by 2038 to a state commission to examine an earlier exit after a split over the target in the ruling coalition. The central European country uses coal for just under half its electricity production but is seeking to cut that sharply in coming decades as part of a decarbonisation drive. The country’s largest utility, majority state-owned CEZ, announced a plan to shut most of its coal-fired power plants by 2030, cutting the proportion of coal in its production mix to 12.5 percent from 36 percent in 2020. Considering soaring emission allowance prices, the commission will look at alternatives for an earlier exit than the recommended 2038 date and assess the impact on the domestic energy market.

Divestments

Britain wants to broker a global agreement to stop the cross-border financing of coal projects when it hosts a major climate conference in November. Britain currently generates 2 percent of its electricity from coal, down from 40 percent in 2020, and it plans to completely phase out coal as a power source by 2024. According to environmental campaigners, the British financial institutions play a major role in funding coal mines and coal-fired power stations elsewhere in the world. Coal remains widely used for electricity and other industrial purposes in China, where carbon emissions to continue rising until 2030.

Malaysia’s Malayan Banking Bhd (Maybank) will no longer finance new coal activities as part of a five-year strategy that will also see the bank committing 50 billion ringgit (US $12 billion) in sustainable financing. Maybank’s announcement comes after criticisms from a coalition of non-governmental organisations (NGOs) in Malaysia and Indonesia for funding coal plants despite making environmental, social and governance (ESG) commitments. A growing number of global banks have been exiting coal financing in recent years amid pressures from green groups and a global energy transition. Last year, smaller rival CIMB Group Holdings Bhd committed to phase out coal from its portfolio by 2040. It was the first banking group in Malaysia and Southeast Asia to do so. Maybank coal financing comprises only 0.2 percent of its total portfolio.

News Highlights: 26 May – 1 June 2021

National: Oil

India’s petrol, diesel sales drop 17 percent in May on Covid-19 lockdowns

1 June: India’s petrol and diesel sales fell by about 17 percent in May from a month ago as restrictions clamped to curb the world’s worst outbreak of coronavirus infections stifled demand. Sales of petrol -- used in cars and motorcycles -- fell to 1.79 MT in May, the lowest in a year, according to the preliminary data of state-owned fuel retailers. While the consumption was almost 13 percent higher than demand in May 2020, it was 28 percent lower than pre-COVID levels of 2.49 MT. Demand for diesel—the most used fuel in the country—fell to 4.89 MTin May 2021, down 17 percent from the previous month and 30 percent from May 2019. Sales volume of cooking gas LPG (liquefied petroleum gas) fell 6 percent year-on-year to 2.16 MTin May 2021 but was 6 percent higher than 2.03 MTsold in May 2019. LPG was the only fuel to have registered growth during the lockdown last year as the government gave free cylinders as part of the COVID-19 relief package. Declining fuel sales reduced crude intake by refiners, reducing the operating run rate by 85-86 percent.

Source: The Economic Times

Petrol price rises again after hitting century mark in Mumbai

1 June: After a day’s pause, fuel prices increased once again reaching new highs across the country with petrol crossing INR 100 per litre mark in several cities. Accordingly, the pump prices of petrol and diesel increased by 29 paise and 26 paise per litre to INR 94.23 and INR 85.16 per litre respectively in Delhi. In the city of Mumbai, where petrol prices crossed INR 100 mark for the first time ever, the fuel price rose again by 28 paise per litre to reach new high of INR100.47 per litre. Diesel price also increased in the city by 28 paise per litre to reach INR 92.45 a litre, the highest amongst metros. Across the country as well, petrol and diesel prices increased but the quantum varied depending on the level of local taxes in different states.

Source: The Economic Times

Assam to export oil to Bangladesh, Myanmar in few years: CM

28 May: The Numaligarh Refinery Ltd (NRL), which was commissioned as per the provisions of the 1985 Assam Accord, would increase its capacity from the existing 3 million metric tonnes (mmt) to 9 mmt, besides bringing 6 mmt crude oil to Assam from Odisha, Chief Minister (CM) Himanta Biswa Sarma said. He said that after NRL brings the crude oil from Paradeep in Odisha through pipeline, it would be refined in Assam, and then the oil would be exported to Bangladesh, Myanmar and other Indian states. He said the crude oil from Paradeep would substantially raise the capacity of the three refineries in Assam Bongaigaon, Guwahati, and NRL. Earlier, Assam’s crude oil used to be sent to Barauni, but now 6 mmt crude oil would come to the state.

Source: The Economic Times

India’s oil industry struggles to predict when demand will recover

27 May: Indian energy demand is taking a big hit as COVID-19 runs rampant across the country. But uncertainty around when the virus wave will subside and the lack of a unified government response has left the oil industry in the dark as to how quickly consumption might pick up again. Diesel and petrol, which account for more than half of oil consumption in India, are bearing the brunt of localised lockdowns. Sales of the two fuels at the three biggest retailers are about a third lower so far in May compared with pre-virus levels two years earlier. That’s not as bad as April 2020, however, when demand nearly halved. This time round, more factories have remained open and cargo movements between states haven’t been as badly affected. Indian refiners were hoping to keep processing rates reasonably high this year, encouraged by low stockpiles and export opportunities, even as consumption dropped. May shipments of clean fuels like gasoline and diesel are set to be the highest since January 2020, according to oil analytics firm Vortexa.

Source: The Economic Times

National: Gas

Indian consortium may get to remain invested in Iranian gas field

31 May: India may continue to pursue investment opportunity in the Farzad-B gas field in Iran, even though ONGC Videsh Ltd (OVL) lost the development rights of the block that it discovered over a decade ago to local firm Petropars Group. Reports from Iran indicate that months the after ejecting India from the ambitious US $1.8 billion project, Tehrann has now brought in Petropars Group to develop the gas field in the Persian Gulf. The oil ministry said that Indian consortium including IndianOil, Oil India, and OVL, which bagged the exploration contract for Farzad-B in 2002, may remained invested in the upstream project as equity partners with other local and international entities even without operatorship or development rights. India and Iran were initially targeting concluding a deal on Farzad-B field development by November 2016 but later mutually agreed to push the timeline to February 2017. The deadline to wrap up negotiations was later targeted for September 2017. But, with deal stuck over pricing of gas. Sanctions delayed the process thereafter and despite visits of ministers from both sides no agreement could be reached. OVL pushed for the deal with a sweetened offer that included investment of close to US $11 billion.

Source: The Economic Times

National: Coal

CIL’s coal offtake jumps 38 percent to 55 MT in May

1 June: Coal India Ltd (CIL) said its coal offtake rose by 38 percent to 55 MT in May on the back of revival of fuel demand from the power sector. As coal supplies surged ahead to 55 MT in May, CIL recorded a whopping 15 MT increase in volume terms against comparable month last year, logging close to 38 percent growth. Even compared to pre-COVID May 2019, the growth was 5.8 percent when the company's off-take was 52 MT, it said. With the appetite for coal signalling healthy recovery, CIL’s supply to power sector at nearly 44 MT in May this year was up by 41 percent. The company supplied around 13 MT more to power plants compared to May last year. CIL’s total coal off-take for April-May was 109.2 MT, clocking a growth of 38 percent compared to 79 MT in the same period year ago. The supply to power sector registered a 38 percent growth. CIL has liquidated 25 MT of coal out of its inventory during April-May period. The company which began FY'22 with close to 100 MT stock at its pitheads reduced it to 74.3 MT at the end of May this year. CIL produced 42.1 MT in May and 84 MT in April-May period of the current fiscal. The company is confident of ramping up the production even at short notice when the demand peaks to even higher levels especially with the coal seams exposed. CIL has recorded the second highest over burden removal growth of 17 percent, in more than a decade, last year. CIL accounts for over 80 percent of domestic coal output.

Source: The Economic Times

National: Power

Goa government to set up 13 machines to allow 24x7 power bill payment

1 June: Goa Power Minister Nilesh Cabral said that the department will install 13 first-of-its-kind any time payment machines (ATPMs) for electricity consumers who want to pay their bills physically. Cabral said that it is a 24-hour, 365-days system. One such machine has already been commissioned at the electricity department, Panaji, and the remaining 12 will be installed in the next three months, he said. He said that even after the department started accepting online payments, there was a demand from the people for physical payment facilities. Four such machines were installed at Panaji, Margao, Ponda and Mapusa four years ago, but they were non-functional, he said. To educate the consumer on the working of the machine, a video has been uploaded on the electricity website, he said. He said that if a consumer pays more money then it will be adjusted in the next bill.

Source: The Economic Times

India’s May electricity use down 10.4 percent from April

1 June: India’s average daily electricity use in May fell 10.4 percent from April, analysis of government data showed, as states imposed lockdowns to rein in a devastating second wave of coronavirus infections. Average power generation fell to 3,664 billion units in May from 4,074 billion in April, the analysis of data from federal grid regulator POSOCO showed, with output beginning to increase in the last week of the month. Electricity use in India generally peaks in May, as more people turn to air-conditioning amid sweltering temperatures at the height of the summer season and industrial activity rises. Government had said the recovery in power demand in late 2020 was a sign the economy was beginning to recover from its worst slump in decades. Industries and offices account for half of India's annual electricity consumption. More than three-quarters of states reported lower electricity use in May than April, the data showed. India’s power use rose more than 7.2 percent in May over last year, when a nationwide lockdown was imposed. Strict lockdowns in the southern states of Kerala and Karnataka, the northern state of Rajasthan, city state Delhi, and Sikkim in the northeast pushed electricity use to levels lower than the corresponding period last year, the data showed.

Source: The Economic Times

Power consumption sees 8.2 percent growth in May amid slow recovery in commercial, industrial demand

1 June: Power consumption in the country witnessed an 8.2 percent year-on-year growth in May at 110.47 billion units, indicating slow recovery in commercial and industrial demand of electricity, according to power ministry data. The slower pace of recovery in industrial demand of electricity in May can be attributed to local lockdown restrictions imposed by states to curb the spread of coronavirus amid the second wave of the pandemic, experts believe. Moreover, the two cyclones that hit the east and west coast of the country in May resulted in power outages and lesser consumption due to rains in different areas of the country during peak summer season. The power consumption in the entire month of May last year was 102.08 billion units due to the impact of the lockdown imposed to curb the COVID-19 and had witnessed a year-on-year fall of nearly 15 percent in May 2020. Power consumption was 120.02 billion units in May, 2019. Therefore, power consumption in May this year has not recovered as fast as it should have been, in view of lower base in 2020. Last year, the government had imposed a lockdown on 25 March 2020 to contain the spread of coronavirus. The lockdown was eased later in a phased manner, but had hit the economic and commercial activities and resulted in lower commercial and industrial demand for electricity in the country. Power consumption in April, 2021, saw year-on-year growth of nearly 40 percent to 118.08 billion units. Power consumption in April, 2020, had dropped to 84.55 billion units from 110.11 billion units over the same month in 2019, mainly due to fewer economic activities following the imposition of lockdown by the government in the last week of March, 2020, to contain the spread of deadly COVID-19. Similarly, peak power demand met or the highest power supply in a day also slumped to 132.73 GW in April last year from 176.81 GW in the same month in 2019, showing the impact of lockdown on economic activities.

Source: The Economic Times

Free power to farmers in Andhra Pradesh for next 30 years

31 May: The state government has decided to continue to provide free power for agriculture for the next 30 years. The power utilities of Andhra Pradesh are currently supplying free power to more than 18 lakh agricultural services. The state government is developing necessary power infrastructure to continue the scheme for the next 30 years. As part of this, the government will exclusively set up a 10,000 megawatts (MW) solar power plant for making the free power scheme a permanent one. The state government already spent about INR 17 billion on upgrading agriculture feeders to supply 9-hour free power in two spells during day. State Energy Minister, Balineni Srinivasa Reddy, said that it is a historic decision taken by Chief Minister YS Jagan Mohan Reddy to continue the free power scheme for the next 30 years.

Source: The Economic Times

AIPEF demands scrapping of bidding for discoms in UTs

27 May: All India Power Engineers' Federation (AIPEF) demanded scrapping of ongoing bidding for discoms (distribution companies) in Union Territories (UTs) citing serious flaws. The Federation has particularly mentioned the ongoing bidding of discoms in Chandigarh and Dadra Nagar Haveli Daman Diu. AIPEF claimed that the government is exploiting the crisis of the pandemic to put forth its policy of privatisation of the power sector, and the draft National Electricity Policy 2021 that conflicts with the Electricity Act 2003 should be withdrawn. In the case of UTs, no guidelines are issued by Government of India for competitive bidding under Section 63 of the Electricity Act 2003 for a discom. The Centre is pushing the competitive bidding of privatisation of electricity wing of Chandigarh and Dadra Nagar Haveli Daman Diu. Privatisation of discoms is not allowed by competitive bidding when the competitive bidding guidelines are non-existent and have not been issued, AIPEF said. The decision of the central government last year that the distribution function in all the UTs should be privatised is an executive decision of the home ministry and this should not overrule the provision of Electricity Act 2003 in a matter relating to the privatisation of electricity, it said. In Chandigarh, the commercial and domestic consumers are the main source of earnings for discoms as the agriculture load is less than 1 percent, AIPEF noted adding that in both cases, it is high revenue, low loss system with financial surplus utilities.

Source: The Economic Times

National: Non-fossil fuels/ climate change trends

Suzlon bags order to set up 252 MW wind power project in Gujarat

1 June: Suzlon Group, a clean energy solutions provider, said it had secured an order for developing a 252 MW wind power project from CLP India. The project is located in Sidhpur, Gujarat and expected to be commissioned in 2022, the company said. CLP’s wind energy project in Sidhpur, Gujarat is their largest renewable project at a single site. A project of this size can provide electricity to about 1.83 lakhs households and curb about 8.28 lakh tonnes of carbon dioxide emissions per year.

Source: The Economic Times

Goa CM launches solar-based electrification programme for remote villages

31 May: Goa Chief Minister (CM) Pramod Sawant launched solar-based electrification programme for rural households in the state. This project will bring electricity through renewable energy to areas in Goa where grid connectivity is not feasible. The solar PV-based home lighting systems for households was inaugurated only two days after the agreement was signed between Convergence Energy Services Ltd (CESL) and Goa Energy Development Agency (GEDA).

Source: The Economic Times

SECI invites bid for 1.2 GW ISTS-connected wind power projects

27 May: The Solar Energy Corp of India (SECI) has invited bids for setting up 1,200 MW ISTS-connected wind power projects in India under tariff-based competitive bidding. The last date for submission of bids is 6 July 2021. The projects will be set-up on a build-own-operate basis for an aggregate capacity of 1,200 MW and SECI will enter into a power purchase agreement with the successful bidders selected for a period of 25 years. The tender document said that the bidder will have to submit a single bid offering a minimum capacity of 50 MW and a maximum of 1,200 MW and added that the projects have to be quoted in multiples of 10 MW only.

Source: The Economic Times

Power ministry to set up a National Mission on use of biomass in coal based power plants

26 May: The power ministry will set up a National Mission on use of biomass in coal based thermal power plants to address the issue of air pollution due to farm stubble burning and to reduce carbon footprints of thermal power generation. The ministry said that this would further support the energy transition in the country and our targets to move towards cleaner energy sources. The duration of the proposed National Mission would be a minimum five years.

Source: The Economic Times

International: Oil

US sells off Iranian crude oil seized off coast of UAE

1 June: The US has sold some 2 million barrels of Iranian crude oil after seizing an oil tanker off the coast of the United Arab Emirates (UAE), court documents and government statistics show. The Iranian crude oil showed up in new figures released over the weekend by the US EIA, raising the eyebrows of commodities traders as Tehran remains targeted by a series of American sanctions. The oil came from the MT Achilleas, a ship seized in February by the US off the coast of the Emirati port city of Fujairah. US court documents allege the Achilleas was subject to forfeiture under American anti-terrorism statues as Iran's paramilitary Revolutionary Guard tried to use it to sell crude oil to China. The US has identified the Guard as a terrorist organisation since the administration of former President Donald Trump. The US government brought the Achilleas to Houston, Texas, where it sold the just over 2 million barrels of crude oil within it for US $110 n, or at around US $55 a barrel, court documents show. The money will be held in escrow amid a court case over it.

Source: The Economic Times

Sri Lanka fears oil spill from burning container ship

27 May: Sri Lankan authorities fear a possible oil spill from a Singaporean container ship on fire off the country’s western coast as the upper deck of the vessel was completely destroyed. Firefighters are trying to control the fire around the engine room and prevent an oil spill, as the vessel has nearly 300 tonnes of fuel in its tank. But Sri Lankan authorities, including the Marine Environmental Protection Authority (MEPA), were preparing to mitigate damage in the event of an oil spill.

Source: The Economic Times

Abu Dhabi sells US $2 billion in bonds despite oil rebound

26 May: Abu Dhabi sold US $2 billion in seven-year bonds in its first foray into the international debt markets this year, raising cash for state coffers despite a recent rebound in oil prices. The oil-rich emirate sold the bonds at 45 basis points (bps) over US treasuries. That was tightened from initial guidance of 70-75 bps over treasuries after the debt sale received over US $6.9 billion in orders. The United Arab Emirates, where Abu Dhabi is the capital, was hit hard by the COVID-19 pandemic and last year's crash in oil prices, but a rebound in global crude demand as economies re-open has reduced the urgency to borrow for budget purposes. The budget, however, is based on an oil price assumption of about US $46 per barrel versus roughly US $50 per barrel last year.

Source: The Economic Times

International: Gas

Eni, BP in talks over oil and gas assets in Algeria

1 June: BP and Eni are in talks over the future of their oil and gas assets in Algeria as the two groups increase efforts to refocus their businesses to tackle falling margins, rising debt and climate pressures. Europe’s top energy companies are cutting back their oil and gas portfolios to keep only the assets most likely to be profitable and redeploy capital for a transition to clean energy as uncertainty mounts over future demand for fossil fuel. BP and Eni are in early-stage talks for the Italian group to take over BP's assets in Algeria. The sides are exploring an outright sale as well as an option for BP to receive stakes in Eni assets around the world, possibly in its flagship liquefied natural gas (LNG) development in Mozambique. The deal would help BP to dispose of its Algerian assets after its failure since 2019 to sell its 45.89 percent stake in the In Amenas natural gas plant. BP also holds a 33 percent stake in the In Salah gas plant. In Algeria, as in Angola, international groups that operate or own stakes in oil and gas fields earn fixed royalties based on the output from fields, in what are known as production sharing agreements (PSAs). As part of the strategy, the companies aim to focus operations on the most profitable fields, such as the Gulf of Mexico in the case of BP, and Egypt’s giant offshore Zohr gas field for Eni. Eni has signed a series of deals with BP in Africa, including stake sales in the Nour and Shorouk fields in Egypt and a big commercial contract for LNG from Eni's Coral South project in Mozambique.

Source: The Economic Times

French energy giant Total suspends gas-linked cash payments to Myanmar army

27 May: French energy giant Total said that Myanmar’s army would no longer receive cash payments linked to a pipeline it operates through a joint venture with the military, following February’s military coup. Total said the decision was made at a 12 May meeting of shareholders of Moattama Gas Transportation Company Limited (MGTC), a unit that includes the French firm, Chevron, and a military-controlled energy company. Total said it would continue to produce gas so as not to disrupt electricity supply in either country.

Source: The Economic Times

EU countries seek to prolong bloc’s funding for gas projects

27 May: European Union (EU) countries will seek to prolong EU support for cross-border natural gas projects, a stance at odds with the European Commission’s plan to end such funding, according to a draft document. The EU is rewriting the rules in line with its climate change goals, as it seeks to reach zero net greenhouse gas emissions by 2050. The Commission proposed new TEN-E rules in December, which excluded dedicated oil and gas infrastructure. EU member states, who must approve the final rules, look set to challenge that position via a proposal drafted by Portugal. The draft, seen by Reuters, said projects in Malta and Cyprus that currently have PCI status should retain it until those countries are fully connected to the European gas network. The proposal said that until 2030 investments to retrofit gas pipelines to carry hydrogen should be allowed to continue carrying natural gas blended with hydrogen.

Source: The Economic Times

International: Coal

Indonesian state utility to retire coal power plants gradually

28 May: Top thermal coal exporter Indonesia is planning to retire its coal-fired power plants gradually, in a phased move towards becoming carbon neutral, an official from the country’s state utility, Perusahaan Listrik Negara (PLN), said. The first phase of that will see the closure of three coal-fired power plants by 2030 with a combined capacity of 1.1 GW. Those are the Muara Karang plant in the capital Jakarta, Tambak Lorok power plant in Semarang, the largest city in Central Java, and a gas and coal-fired power plant in Gresik, a regency in East Java. In 2035, PLN aims to retire its conventional power plants which have a total capacity of 9 GW. The final phase of coal retirement will see its "ultra supercritical" coal power plants shut by 2056. Despite the push for greener energy consumption, President Joko Widodo last year urged ministers to accelerate plans to build plants for upgrading the country's coal downstream sector.

Source: The Economic Times

Poland to take over coal assets from its utilities in 2022

26 May: The Polish government will complete its takeover of coal assets from state-run utilities— PGE, Enea and Tauron in the second or third quarter of 2022, the state assets ministry draft document said. Poland generates most of its electricity from polluting coal, but under rising pressure from the European Union (EU) and with carbon emission costs surging, it has encouraged more investment in low emission sources. The government plans to take over the coal assets owned by its utilities, except from hard coal mines, and then transfer them to a new state-owned company. The coal assets are associated with high levels of debt and their continued use has weighed on the financial results of the state-run energy groups.

Source: The Economic Times

International: Power

Spain plans regulation to curb consumer energy bills

1 June: Spain’s government is expected to approve draft legislation to limit the windfall profits hydro and nuclear plants make as rising C0

2 prices drive up electricity bills, the economy ministry said. The preliminary bill is part of a wider pledge by the ruling Socialists and left-wing party Unidas Podemos to curb energy prices to protect end-consumers. The government estimated the measures cost utilities between €800 million (US $976 million) and €1 billion in lost income, but would reduce consumers' electricity bills by around 5 percent, depending on CO

2 prices. The energy pool price has surged since the beginning of the year, reaching an average of 52 euros per megawatt hour, a roughly 90 percent rise year-on-year, Spanish investment firm Alantra said, as CO

2 prices have risen 40 percent. Shares in Spain’s utilities or companies with the highest exposure to hydro and nuclear power fell on reports of the plan, which coincides with the implementation of a new power tariff scheme from next month. The new system, unusual in Europe, splits retail power prices into time bands, which the government hopes will reduce annual bills, but consumer associations say would be confusing for households.

Source: The Economic Times

Mozambique launches construction of US $1 billion power plant, transmission line

1 June: Mozambique began construction of gas-to-power plant and transmission line projects worth US $1 billion in the southern province of Inhambane as the government aims to boost energy supply. Upon completion, the gas-to-power Temane Thermal Power Plant will have a capacity of 450 MW.

Source: The Economic Times

Iran bans cryptocurrency mining for four months amid power cuts

26 May: Iran has banned the energy-intensive mining of cryptocurrencies such as Bitcoin for nearly four months, President Hassan Rouhani said, as the country faces major power blackouts in many cities. The blackouts have been widely criticised by Iranians. The government has blamed the power cuts on cryptocurrency mining, drought and surging electricity demand in summer. Iran has accepted crypto mining in recent years, offering cheap power and requiring miners to sell their bitcoins to the central bank. The prospect of cheap power has attracted miners, particularly from China, to Iran.

Source: The Economic Times

International: Non-fossil fuels/ climate change trends

Sudanese bank launches first green sukuk for renewable energy

1 June: A Sudanese bank launched an investment fund offering what it said was the country’s first green

sukuk—or bonds compliant with Islamic banking principles—aimed at financing renewable energy for commercial use. The 4.75 bon Sudanese pounds fund (US $11.3 million) launched by Sanabel, a subsidiary of the Bank of Khartoum, aims to finance the production of 55 megawatt hours per day, according to its prospectus, for industries such as agriculture and mining. More than 60 percent of Sudan’s population does not have access to electricity, and the country does not produce enough to cover current consumption, according to United Nations estimates. Power cuts have grown more frequent over the past year, while diesel for generators is often scarce and more expensive after recent subsidy cuts.

Source: The Economic Times

Australia’s carbon emissions drop 5 percent in 2020

31 May: Australia’s carbon emissions fell by 5 percent in 2020 with growth in wind and solar energy, a hit to transport from coronavirus lockdowns, and a rise in carbon capture at the huge Gorgon LNG project, the government said. Emissions fell by 26 million tonnes (mt) to 499 mt of carbon dioxide equivalent (CO

2-e) in 2020 from the previous year, the Department of Industry said. That put the country's emissions at 20 percent below 2005 levels, compared with its target under the Paris Agreement to cut emissions by 26 percent to 28 percent below 2005 levels by 2030 to help curb global warming. However, Australia, the largest per-capita emitter amongst the world’s richest nations, has refused to set a more ambitious target for 2030, unlike countries such as the US and Japan. The power sector remained Australia’s biggest polluter, accounting for one-third of emissions, even with a 4.9 percent drop in emissions due to a decline in coal-fired and gas-fired generation. Emissions from the transport sector, the third-largest polluter, fell 12 percent as COVID-19 lockdowns kept cars off the roads and planes on the ground. Emissions from liquefied natural gas (LNG) plants, which had grown over the previous four years with the start-up of new LNG plants, fell as a long-delayed carbon capture and storage project at the Gorgon LNG plant cranked up, the government said.

Source: The Economic Times

IEA’s urgent fossil fuel warning earns mixed reception from producers

A stark appeal by the world's top energy body to stop investment in new fossil fuel projects by next year has met a mixed reception from the world's top producers - from guarded praise and pledges to cut back on coal to outright defiance. The International Energy Agency (IEA) said in its "Net Zero by 2050" report that investors should not fund new oil, gas and coal supply projects beyond this year if the world wants to reach net zero emissions by mid-century and meet the goals of the 2015 Paris Agreement on climate change. Its findings aim to encourage ambitious climate targets from countries attending the United Nations' Climate Change Conference (COP26) in November in Glasgow, Scotland but has yet to garner a full commitment from any country. The world’s seven largest advanced economies agreed to stop international financing of coal projects that emit carbon by the end of this year and phase out such support for all fossil fuels.

Source: The Economic Times

California and US agree to allow big offshore wind power farms

26 May: California and the US government announced an agreement to open up areas off the state's central and northern coasts to massive wind energy farms. The pact that would float hundreds of turbines off the coast of Morro Bay and Humboldt Bay was touted as a breakthrough to eventually power 1.6 million homes and help the state and federal government reach ambitious climate change goals through clean energy production. The announcement is part of President Joe Biden’s plan to create 30 GW of offshore wind energy by 2030. California set a goal to produce all electricity by 2045 through renewable energy resources and zero-carbon generating facilities.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: Oil Market Quarterly Review, April 2021, KPMG

Source: Oil Market Quarterly Review, April 2021, KPMG