-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Alexis Crow, “Keynes’s ‘Vision 2030’: Social Aspects of GenAI and the Future of Work,” ORF Special Report No. 236, December 2024, Observer Research Foundation.

Introduction: Keynes’s Vision 2030

In 1930, English economist John Maynard Keynes famously posited that by 2030, people would be working a 15-hour work week (or an average of three hours per day).[1] Writing during the Great Depression, Keynes made his forecast at a time of deep “economic pessimism”, and in his lectures described a “new disease” of “technological unemployment”, according to which investments designed to “economise” the use of labour would unfold at an increasingly rapid pace.[2] According to Keynes, there would be only a “temporary” phase of maladjustment, after which people will be able to step into a time of leisure and “economic abundance”.

Nearly a century since, elements of Keynes’s prognostication seem to be rather accurate. In advanced and developing economies alike, a sense of economic insecurity (or pessimism) pervades households, and bouts of high inflation—and concerns surrounding the path of monetary policy normalisation—continue to stymie decision-making for investors as well as executives. Added to that, the sensationalism around the latest wave of automation—that of generative artificial intelligence, or GenAI[a]—leaves many observers concerned not only for the future of their own professions (thus fearing “technological unemployment”[3]), but also for the “economic possibilities of our grandchildren”.

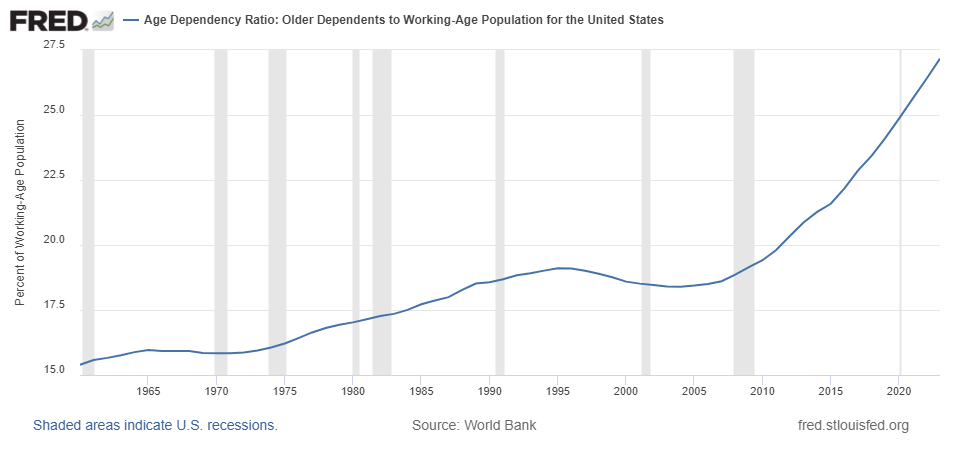

Where Keynes was short-sighted was that the hours saved from “the increase of technical efficiency” have not been wholly directed towards leisure activities.[4] Rather than generating pervasive abundance, successive waves of automation have resulted in deep socio-economic inequalities. As economies have structurally shifted from ‘old’ manufacturing and industrial-led growth to ‘new’ services activity, the spread between income, wealth, and opportunity for blue-collar workers and white-collar workers has widened.[5] Faced with a shortfall in retirement savings, many workers within advanced economies take on multiple jobs to make ends meet. Even for those at the higher part of the income distribution, a rising dependency ratio in many countries (including the United States) means that working hours saved might be directed toward care for the aged or for children (or ‘non-market work’)—rather than pure leisure time.

Figure 1: U.S. Age Dependency Ratio (1960 - 2023)

Source: St. Louis Fed[6]

GenAI—the earliest iterations of which emerged over 50 ago[b]—is unique within economic history, as it has the potential to disrupt tasks and even entire professions for both blue- and white-collar workers. Indeed, our current sense of economic pessimism is tinged with automation anxiety—as some traditional capital holders are fearful of “robots coming for their jobs.”

Early data suggests that some of the macroeconomic effects of GenAI might be overstated, and thus, certain fears could be unwarranted. Nevertheless, as successive waves of automation—including GenAI—continue to reduce ‘market work’ hours, this carries with it certain implications for truly sustainable investment. As will be discussed in detail later in this article, the capacity for GenAI to distort the relationship between the human person and work means that now, more than ever, the onus of responsibility lies squarely upon capital holders to reinvest in the skills that cannot be automated. These include: critical judgment, adaptability, agility, communication, and—one crucial trait of leadership—the ability to motivate teams, and to nurture the leaders of tomorrow. By nurturing the skills which cannot be automated, investors and executives can serve as stewards of human capital amidst the ever-changing patterns of demand in the world of work.

Measuring the Macroeconomic Impacts of GenAI: ‘Hype’ or Hysteria?

In scoping the potential macroeconomic impacts of GenAI—that is, in understanding the impact of this technology on growth and productivity—it is important to do so with a dose of humility, as current forms of GenAI are still nascent. Although one GenAI platform was one of the fastest-growing apps in history,[8] and even despite a rapid spike in companies’ investments in GenAI over recent years, the ways in which the deployment of GenAI yields significant productivity gains for the higher end of the skill distribution remains to be seen.

Work by Brynjolfsson, Li, and Raymond shows that the deployment of large language models (LLMs)—an important ‘class’ of GenAI—within a customer support centre leads to the highest productivity gains for the lowest-skilled workers, and diminished productivity levels for the highest-skilled workers.[9] In such an industry ripe for the saturation of GenAI, the use of LLMs can help move workers up the experience curve—for example, by providing employees with ways to express empathy.[10] Crucially, however, Brynjolfsson et al. find that this does not lead to an increase in productivity for workers at the top part of the skills distribution. Said another way, AI has the potential to democratise qualities found at the highest-skilled part of the distribution, and to extend ‘easy to learn’ tasks resulting in productivity gains for the least-skilled.

In considering the various ways in which GenAI can boost total factor productivity (TFP)—whether through pure automation, labor augmentation (or ‘task complementarity’), or a deepening of automation—early research shows that the gains (especially for the top part of the skills distribution) appear to be modest.[11] One estimation for tasks currently exposed to AI posits TFP gains of about 0.71 percent over the next decade.[12] GenAI can also generate ‘new tasks’: these include, for example, excessive social media and deep fakes. As Daron Acemoglu points out, although these have the potential to increase GDP, these classes of GenAI may also have an inherently negative social value attached.[13]

In considering the investment effects of the spend on GenAI on GDP, to date, the impact again might be relatively slender. Beyond the spend of the hyperscalers—and hence the developers of GenAI—early data shows that the capital stock investment by end users is not colossal.[14] Over time, if the productivity gains from implementing classes of GenAI prove to be less than substantial, is it possible that there will be a pullback in investment on behalf of some end users?

Regardless, for global investors, GenAI adjacency certainly offers alluring investment targets. Data centre (DC) demand—and the power generation to serve GenAI—is naturally blossoming: While some of the world’s largest investors are headlong in the space,[15] other specialist property firms offer the ability to deploy capital to DCs that serve the current sensationalism over GenAI—but crucially, which have the potential to serve quantum computing to meet patterns of demand in the future.[16]

Beyond GDP

Deployment of some of the tools of GenAI might have meaningful social welfare gains, but may not necessarily show up in substantial GDP growth over time. For example, GenAI can be used to enhance professions of essential tradespeople—including plumbers and electricians—by enhancing their diagnostic work. Here, the deployment of technology is labour-augmenting and GenAI has the potential to render the human component of work even more efficacious.

The application of GenAI in the healthcare industry also holds material promise—even the gains from simplifying and codifying patient records can be revolutionary in a healthcare system as cumbersome as that of the US, for example. The use of GenAI to improve precision and accuracy in diagnosis (coupled with proper training of the use of such tools)[17]—as well as potentially to help in drug development[18]—present notable opportunities to enhance social welfare within advanced and emerging economies alike. All of this suggests that true social benefits might ultimately be accrued from the application of GenAI to less alluring sectors than the current frenzy surrounding the use of LLMs by certain segments of the digital world.[19]

The Gender Gap in GenAI

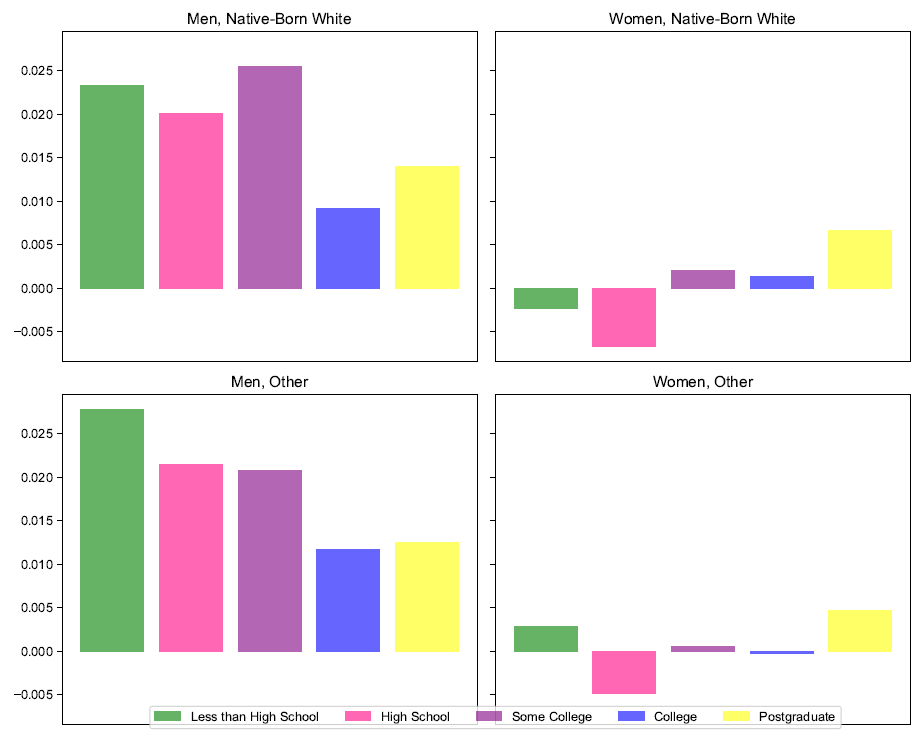

As previously stated, in a break from economic history and successive waves of automation, GenAI has the potential to disrupt the skills base and parts of, or entire professions for blue-collar as well as white-collar workers. In a striking calculation, an April 2024 study by Acemoglu posits that on a demographic basis, the wages of white, native-born women may be potentially the most exposed to the effects of GenAI in the US. This gender gap in GenAI emanates from both the supply side as well as the demand side.

Figure 2: U.S. Total Wage Effect of Exposure to AI, by Gender

Source: Daron Acemoglu, NBER[20]

This is because, in the US labour market, previous waves of automation and companies’ investments into TFP were deployed in heavy industrial and manufacturing sectors, from the 1970s onwards—which ultimately rendered dangerous jobs safer (which were predominantly occupied by male workers) and indeed which also replaced certain tasks with machines. Certainly, a neglect to reinvest in skills by those replaced by machines has been a contributing factor to social ruptures within society today.

As the female labour force participation rate has climbed in services sectors such as healthcare and hospital management, certain legal services, and financial analysis—the advent of GenAI[21] and its application to such sectors might result in negative wage effects for this part of the clerical class. By implication, executives might need to make a concerted effort in reinvesting in management training for women in order to advance their representation within senior levels of an organisation.

Recent research also shows that beyond labour supply, there may actually be a demand-side problem contributing to a gender gap in AI. Analysis by one industry body in the US—deploying a survey from the New York Federal Reserve—provides evidence of an “economically and statistically significant” gap between men and women in using GenAI.[22] Within a recent 12-month period, 50 percent of the men surveyed reported deploying GenAI, against 37 percent of women who did so. This carries with it certain ramifications for policy on the ways in which to reduce this gap over time.[23]

Revaluing the Human Dignity of Work

One aspect of GenAI which requires particular consideration is that of the human aspect of work. Throughout economic history, successive waves of technological innovation have spurred enhancements in industrial productivity, but have often resulted in an imbalance in the relationship between labour and capital. Writing in the nineteenth century, German economist and historian Karl Marx forewarned of the negative consequences resulting from capital gaining a firm hand over labour—and the potential for social combustion amidst the declining share of labour income (and potential exploitation) of workers around the globe. An excess of capital over labour can exacerbate existing income inequalities, and has the potential to create vast inequalities in wealth.

Looking beyond the purely material realm, at a human level, capital has the potential to obfuscate the relationship between the human person as the ‘object’ versus the ‘subject’ of work. Problematically, an excessive role of capital in work can render the human purely as an ‘object’—rather than the ‘subject’ of work—thus, potentially sublimating the value of ‘human capital’ and personal qualities pertaining to the ‘subject’ of work.[24] But—recognising that GenAI impacts white-collar workers now as well (indeed, entire professions, such as that of a passive index portfolio manager, for instance, might be exposed)—capital holders are no longer immune from automation effects. The human element of their work might also be under duress.

Reinvesting in Skills Which Cannot Be Automated

The implications of GenAI’s potential to distort the traditional relationship between the human person and work is that now, more than ever, the onus of responsibility lies squarely upon capital holders to reinvest in the skills which cannot be automated. Such skills include critical judgment, adaptability, agility, communication, and—one crucial trait of leadership—that of motivating teams.

For a technical profession such as accounting, for example, this means reinvesting in the ‘social aspects’[25] that make the work distinctive from tasks that can be fulfilled by a machine. For some tax preparers, this may mean an expansion into wealth management. For investment professionals tasked with scrutinising a specific asset, transaction, or portfolio composition, this means doubling down on enhancing the exercise of critical judgment and understanding of context. While such analyses can be augmented by the use of LLM or data analytics, the underlying value of an asset must ultimately be determined by those with a degree of business and global acumen that cannot be automated.

As Fig. 2 shows, for predominantly male management teams, this might entail an explicit commitment to reinvest in the leadership development and support for female talent to rise to the upper ranks. For organisations as a whole, an exercise of well-directed investment into specific programmes in business schools and executive education might be in order.

All of this requires humility: for the hubris of capital holders historically has (in part) emanated from the fact that their own positions were not jeopardised by their own investments in capital. Now, the impetus placed on capital holders to reinvest in human capital should extend not only to those early in the skill development spectrum—who, as data shows, in some professions may be more impacted by the proliferation of GenAI—but also, for themselves. Such reinvestment rests upon an implicit understanding that in an age of ever more information, intelligence does not necessarily equate with wisdom. This might be an age of ‘intelligent economies’, but the ability to inculcate true wisdom might distinguish the new ‘haves’ from the ‘have nots.’

There may not yet be a market mechanism in place to incentivise reinvestment into the skills which cannot be automated. Ultimately, as stewards of human capital, executives and investors deploying GenAI should reinvest in skills and management training for those most likely to be disrupted by these investments. As one prominent investor recently opined, the “single best investment” he has made is investing in people.[26]

Perhaps most importantly, a renewed emphasis on investing in the skills which cannot be automated represents a meaningful recognition of the human aspect in the dignity of work. Leisure time, it is not: but such a focus on enhancing critical skills might underpin the happiness which comes from the fulfillment of one’s vocation, rendering one adaptable and agile amidst the ever-changing demands in the world of work.

Alexis Crow is Chief Economist, PwC US; Visiting Fellow, ORF; and Senior Fellow, Columbia Business School. She serves on the advisory board for Faith in Action in the World Economic Forum.

The views expressed here are entirely those of the author, and not necessarily of ORF or of PwC.

Endnotes

[a] Generative AI models generate high-quality images, text, audio, synthetic data, and other types of content. These models often learn to create this new content based on the patterns and relationships in datasets of existing content. Very big models trained on very large amounts of data are called foundational models, most of which are large language models (LLMs) trained on natural language and predicting the next word.

[b] The roots of GenAI can be traced back to a simple model called a Markov chain, named after mathematician Andrey Markov. Markov assigned a statistical method to random processes – iterations of which have been used in word prediction programmes. See: https://news.mit.edu/2023/explained-generative-ai-1109

[1] J.M. Keynes, “Economic Possibilities for Our Grandchildren,” http://www.econ.yale.edu/smith/econ116a/keynes1.pdf

[2] Keynes, “Economic Possibilities for Our Grandchildren”

[3] Keynes, “Economic Possibilities for Our Grandchildren”

[4] Nicholas Crafts, “The 15-hour Week: Keynes’ Prediction Revisited,” Economica, July 13, 2022.

[5] David Autor, “Polanyi’s Paradox and the Shape of Employment Growth,” National Bureau of Economic Research, September 2014,

https://www.nber.org/system/files/working_papers/w20485/w20485.pdf

[6] World Bank, “Age Dependency Ratio: Older Dependents to Working-Age Population for the United States,” https://fred.stlouisfed.org/series/SPPOPDPNDOLUSA

[7] Daron Acemoglu, “Don’t Believe the AI Hype,” Project Syndicate, May 21, 2024, https://www.project-syndicate.org/commentary/ai-productivity-boom-forecasts-countered-by-theory-and-data-by-daron-acemoglu-2024-05

[8] Siladitya Ray, “Threads Now Fastest-Growing App In History—With 100 Million Users In Just Five Days,” Forbes, July 10, 2023, https://www.forbes.com/sites/siladityaray/2023/07/10/with-100-million-users-in-five-days-threads-is-the-fastest-growing-app-in-history/

[9] E. Brynjolfsson et al., “Generative AI at Work,” National Bureau of Economic Research, April 2023.

[10] Brynjolfsson et al., “Generative AI at Work,”

[11] Iñaki Aldasoro et al., The Gen AI Gender Gap, BIS, July 2024, https://www.bis.org/publ/work1197.pdf

[12] Daron Acemoglu, “The Simple Macroeconomics of AI,” National Bureau of Economic Research, May 2024.

[13] Acemoglu, “The Simple Macroeconomics of AI”

[14] Acemoglu, “The Simple Macroeconomics of AI”; Goldman Sachs Research, “Gen AI: Too Much Spend, Too Little Benefit?,” June 25, 2024, https://www.goldmansachs.com/images/migrated/insights/pages/gs-research/gen-ai--too-much-spend,-too-little-benefit-/TOM_AI%202.0_ForRedaction.pdf

[15] H. Takeuchi, “Blackstone CEO sees a Continuing ‘Golden’ Moment for Private Credit,” Nikkei Asia, October 3, 2024, https://asia.nikkei.com/Editor-s-Picks/Interview/Blackstone-CEO-sees-a-continuing-golden-moment-for-private-credit

[16] CogNovum, “Building Tomorrow’s Data Centers Today,” https://www.cognovum.com/

[17] See N Agarwal et al., NBER, https://www.nber.org/papers/w31422; and discussion of Agarwal et al. in David Autor, “AI could actually help rebuild the middle class,” Noema, February 12, 2024.

[18]“Embracing Generative AI in Health Care,” The Lancet 30, July 2023, https://www.thelancet.com/journals/lanepe/article/PIIS2666-7762(23)00096-0/fulltext

[19] Acemoglu, “The Simple Macroeconomics of AI”

[20] Acemoglu, “The Simple Macroeconomics of AI”

[21] Lindsay Kohler, “The Gendered Impacts of AI on Women’s Careers,” Forbes, May 20, 2024.

[22] Iñaki Aldasoro et al., “The gen AI Gender Gap,” BIS Working Papers No. 1197, July 2024, https://www.bis.org/publ/work1197.pdf

[23] Aldasoro et al., “The gen AI Gender Gap”

[24]Pontifical Council for Justice and Peace, “Compendium of the Social Doctrine of the Church”.

[25] Acemoglu, “Don’t Believe the AI Hype”

[26] Nishant Kumar, “Ken Griffin Says He’s ‘Very Anxious’ About Trump’s Tariff Policy,” Bloomberg, November 19, 2024.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Dr Alexis Crow is Partner and Chief Economist of PwC US. A global economist who focuses on geopolitics and long-term investing, she works with the ...

Read More +