Abstract

In response to their experience of western colonialism, countries like China and India have sought to develop their own, indigenous and autonomous technology base. China, in the last 30 years, has succeeded in this endeavour, becoming a major manufacturing power and adopting policies to develop and market its own technologies. Such success, however, is not without critics. Developed countries, especially the US which is its principal trading partner, accuse China of serious breaches of international norms including IP theft, forced technology transfer, and the provision of state subsidy to domestic companies. Even as the US had initially sought to integrate China into the world order, today it is a strategic competitor. A “decoupling” of the US and Chinese economies, with its attendant disruption could have grave consequences for the global economy.

I. Introduction

Like most developing countries, China regards technology and self-reliance as two key pillars of modernisation. Unlike most, however, China has historically sought to not only catch up with the advanced countries, but to surpass them. Indeed, in the last 30 years, China has emerged as the leading manufacturing power in the world. Today China’s aim is to avoid the so-called ‘middle income trap’: when an economy is developed to the point when it loses its low-cost advantage, yet is not developed enough to transition to a higher value, innovation-based economy, resulting in stagnation at the middle-income level.

China is making a major push towards promoting innovation to occupy a higher position in the global value chains and become a producer of high-end components and products. It has set itself a target of becoming the world leader in a range of areas such as renewable energy, artificial intelligence (AI), quantum computing, electrical vehicles (EV), pharmaceuticals, biotechnology, digitised manufacturing and the Internet of Things. The rapidity of China’s economic growth, and the scale of its technology acquisition and innovation strategy has led to alarm in countries like the United States. The last decade has seen a crescendo in criticisms of China’s technology acquisition processes: the accusations are that Beijing engages in forced technology transfer and outright IP theft. Trade sanctions and acrimonious conversations on degrees of decoupling have ensued.

China needs to maintain a relatively high growth rate because although it has made huge economic and social development gains, its market reforms are incomplete and its per capita income is only about a quarter of the average for high-income countries. Poverty has yet to be eliminated even as its population is rapidly ageing. It needs a law-based system to protect intellectual property (IP), labour mobility and land transfer. Though China has come a long way in creating the institutional framework of a knowledge-based economy, it still has some distance to go. In this endeavour, China faces a fundamental challenge from the US which, while remaining far ahead in technology and military power, is becoming increasingly concerned about China’s growing clout in the technology domain. The US views China’s advances to be predatory and inimical to America’s self-interest and in the past two years, Washington has taken a number of steps to block these activities—from outright denial of technology, to lobbying against its use by other nations and preventing Chinese students from pursuing certain courses of study in the US.

US concerns are not without basis. By most accounts, the rise of China as an industrial economy has been nothing short of spectacular. In 30 years, China has risen to become a global manufacturing powerhouse through its industrial policy of “digestion, absorption, and re-innovation of imported technologies”.[1] Today it faces an innovation imperative, or “the need to acquire and develop new technologies in order to overcome the structural challenges facing middle-income states and continue its international ascent.”[2]

All rising states seek to acquire new technology through three means: ‘making’, ‘transacting’ and ‘taking’. Making involves supporting domestic producers through subsidies, tax credits and barriers against foreign competition. Transacting is obtaining technology through purchasing or licensing technology from a foreign vendor. Taking is through “non-transactional” means which can range from open source information, personnel trained abroad, foreign consultants, to straightforward espionage and lax Intellectual Property Rights (IPR) compliance.[3] These innovation activities of a rising state can have two strategic effects on a dominant state: First, a negative security externality or significant impairment of its security environment. Second, a challenge to its preferred international order or negative order externalities.[4]

This seems to fit the current situation between the US and China: the US feels that China presents an existential challenge to both its security and its preferred world order. US President Donald Trump may have posed the question in the simple arithmetic of the trade imbalance with China, but behind it has emerged a bigger issue of China’s quest to become a major technological power. Criticisms of China’s industrial policy has become insistent and louder: it tilts the playing field against western companies, compels them to share technology, and, on occasion, resorts to thievery. The US always had rules for strategic technology exports, but in the last two years, these have been applied to Chinese companies in a more stringent manner. At the same time, Chinese students are being denied the right to study certain subjects. It seems that in the matter of China, the US political establishment has arrived at an unusual consensus between the “loud state” and the “deep state”.[5]

II. The ‘Ganchao (Catch up and Surpass)’ Strategy

Throughout the 19th and 20th centuries, industrialisation—at the heart of which lay technological prowess—was seen as crucial to modernisation. Over time, even as the phenomenon of globalisation may have changed the orthodox logic that equates industrialisation with modernisation, the salience of technology remains. Industrialising countries have historically been protective about the technologies they develop.[6] In the 19th century, Britain made sure to not export certain kinds of machinery and skilled labour. In the 20th century, too, technology was not freely traded, especially as they related to defence. In the 1950s, newly independent countries saw technology as key to both modernisation and national defence. This process played itself out in various ways in different countries who found themselves facing extremely restrictive technology export regimes. Some, like India, licensed technology from abroad, along with parallel programmes of domestic technology absorption and development which never quite fructified. Countries like South Korea, on the other hand, relied on foreign loans to build select industries whose owners were chosen by the government and which later evolved into the chaebols.[a] In the early 1980s, the country would launch a major national R&D programme focusing on private R&D and workers training.[7]

From ‘humiliation’ to power

The case of China and Xi Jinping’s “ganchao (catch up and surpass)” strategy has been different.[8] The revolutionaries who overthrew the Qing Empire in the early 20th century were motivated with the idea of making the republic rich and powerful again after “a century of humiliation”. Marxism and Maoism gave the goal its own notions, linking the imperatives of modernisation and technology acquisition to military power. In the Xi era the same goal has been translated to the “China Dream” of National Rejuvenation, with its corollary “Strong Military Dream” of becoming a militarily powerful country.

Earlier, during the period of the new republic’s socialist industrialisation, it was the Soviet Union that provided the initial template for China. In those years, Soviet assistance led to “one of the largest transfers of capital equipment in history.” [9] New industries came up, including machinery, aircraft, cars, trucks, tractors, petroleum mining and refining, precision instruments, and chemicals. Since a large focus was on building China’s military power, the Soviets transferred technology of their latest fighters, submarines, tanks, artillery and ballistic missiles.[10] Mao Zedong, driven by ideology, sought to accelerate the process through his Great Leap Forward campaign. This, however, would prove cataclysmic, precipitating a famine that would lead to the deaths of tens of millions.

The ganchao theme resurfaced in ‘Four Modernisations’, the plan outlined in 1975 by Zhou Enlai, the first Premier of the People’s Republic of China. The plan, focusing on agriculture, industry, national defence, and science and technology, aimed at making China a great power by 2000. Zhou’s ideas would later be taken up by Deng Xiaoping when he became the paramount leader in 1980. Under Deng—who had a particular appreciation for science and technology, having seen how the Soviet assistance had transformed the country in the 1950s—China undertook market reforms, transformed its industrial policy, and opened up its economy. Investment on S&T was enhanced, Chinese scholars were sent abroad to seek new ideas, and foreign specialists were encouraged to visit China. The focus in the early 1980s was once again on leapfrogging development in high technology; in 1983 a Key Technologies Program was established to encourage work in fields like Information Technology, automation and bioengineering.[11] These measures helped foster a culture that encouraged the private sector to play a bigger role in the economy. It soon became evident that Beijing was intent on turning national champions like Lenovo and Huawei into the formidable global firms that they would eventually become.[12]

It was the same period when China worked to lure foreign investment and promote exports by establishing four Special Economic Zones, the most successful of which was that in Shenzhen. In 1988, China began developing national science and technology parks under the Torch programme to commercialise R&D products. These High-Technology Industry Development Zones (HIDZ) were granted subsidies and tax exemptions and sought both domestic and foreign investments, with most of them growing into high-tech industrial belts and science parks with universities and research clusters. Beginning with six, China now has some 146 high-tech industrial clusters which altogether contribute 12 percent to its GDP.[13]

Japan was a country of particular interest for Four Modernisations. By 1978, Japan was the world’s third largest economy, the world’s leading export power and technology leader, a non-Western country that had closed its technology gap with the West. Deng Xiaoping wooed Japan assiduously and in the 1977-1988 period, it became China’s second most important trade partner after Hong Kong. Japan also began providing Overseas Development Assistance (ODA) and in the next quarter century, China would become either first or second top recipient. In the 1979-2008 period, Japan’s ODA to China was $1.5 billion per annum, or roughly 0.25 percent of its GDP. This assistance along with private investment played a significant role in developing China’s infrastructure and modernising its technology.[14]

Till the 1980s, China relied on technology that it had acquired from the Soviet Union some three decades earlier. Thereafter it sought several strategic acquisitions such as that of a passenger airliner through the McDonell Douglass (MD) -82 deal, the German mag-lev[b] railway technology, as well as high-speed railway technology from Germany, France and Japan. China also acquired a range of military technologies from Russia and Ukraine and reverse-engineered them successfully.

Mastering Innovation

The railway industry is an early example of how the process played out. China’s early experiments with mag-lev system, bought from Germany, did not pan out. The MD-82 airliner did get made in China, but the project failed to trigger a domestic airline manufacturing industry. The State Council decided to promote High Speed Railways (HSR) over mag-lev and the 2004 Mid-to-Long Term Railway Development Plan decided on a Beijing-Shanghai line, along with three more HSR lines. China solicited bids for 200 high-speed train sets; it received bids from train makers like Alstom of France, Siemens of Germany, Bombardier and a Japanese group led by Kawasaki Heavy Industries. The state-owned train builders, China North Car (CNR) and China South Car (CSR) leveraged the desire for market share by European and Japanese companies to obtain technology and then beat them in developing it further. In 2010, CSR President Zheng Changhong admitted as much. In an interview with China Pictorial, he said CSR “followed a path from absorbing foreign technology to the genesis of independent technological innovation.” [15] He said China introduced high-speed rail technology in 2004 obtained from Siemens, Bombardier, Alstom and Kawasaki Heavy Industries and later began to “independently develop high speed CRH trains”. According to Zheng, for every yuan of “introduced” technology, the company put in three yuan to absorb it. CSR had invested “a huge amount in laboratories and testing equipment” and a total of 10,000 scientists and technicians worked in 14 research institutions in the company’s EMU projects.[16] Today, China has the world’s largest high-speed railway network and is a world leader in this technology.

In December 2005, China issued a National Medium and Long-Term Science and Technology Development Plan Outline (2006-2020) which formed the basis of subsequent strategies in this area to move towards acquiring competitive and advanced capabilities. Under this plan, China acquired foreign technology and disseminated it to domestic enterprises by setting up state- and enterprise-level research centres. Thereafter, the Chinese companies moved first, into the re-innovation mode.

The global economic crisis of 2008 pushed China’s ambitions both in the area of science and technology, and territorial expansion. While the developed world suffered, China rode out the crisis and, indeed, gained from it. In October 2010, China announced that it was developing seven strategic emerging industries to reorient the country’s economic development model: new energy vehicles, new materials, high-end manufacturing, pharmaceuticals and biotechnology, next-generation IT, and energy-efficient environment technology. These were then incorporated into the Five-Year Plan for Strategic Emerging Industries (SEI) which provided the key policy measures.[17]

The central government drafted the guidelines and principles while the local governments handled implementation. The leadership role was played by the National Development and Reform Commission (NDRC) and its provincial affiliates, the Development Reform Commissions (DRCs) as well as the Ministry of Finance which managed the funds for SEI development. The Ministry of Industry and Information Technology (MIIT) and its provincial affiliates developed the specific plans for the SEIs. The Ministry of Science and Technology and its local offices coordinated with other agencies in SEI development, especially in promoting domestic innovation and tech development. The State Intellectual Property Office (SIPO) focused on protecting IPR within the SEIs.[18] While this was the formal structure of the new thrust to innovation, there was an equally important informal web of industrial espionage, forced technology transfer, and hidden subsidies coordinated by intelligence agencies.

Xi Era

Xi Jinping’s ascent to leadership in 2013 was another decisive turning point. Xi, viewed as one of the strongest leaders China has ever had since Deng, put forward the vision of a “China Dream” of national rejuvenation at a time when the economy was surging. The broad thrust of Chinese policy became visible in the 2013 announcement of the Belt and Road Initiative (BRI) that has begun to pour funds into developing infrastructure and connectivity with over 70 Asian, African and European countries. Another aspect of Xi’s policies was the 2014 announcement of a $ 150-billion National Integrated Circuit Industry Investment Fund (NICIIF) to promote chip design, production, packaging and testing its semiconductor industry where it was earlier dependent on the US. Despite having manufacturers and corporations like Huawei, ZTE or Alibaba, Tencent, Baidu and Xiaomi, China is still dependent on the US and other countries for its integrated circuits.

How this has worked was seen in the example of Tsinghua Unigroup. Tsinghua Holdings Corp, a wholly owned subsidiary of Tsinghua University (the so-called “MIT of China”) has a 51-percent stake in Tsinghua Unigroup, a computer software and hardware maker; the remaining 49 percent is held by an asset management firm led by Zhao Weiguo, who has been, by most accounts a major force in building up China’s semiconductor industry. Tsinghua Unigroup was partly funded to the tune of $ 1.6 billion by China’s NICIIF, And Intel had a 20-per-cent stake worth $ 1.5 billion in the company. However, this did not help when in 2015, Tsinghua Unigroup made a $ 23-billion bid for US-based company Micron Technology, the world leader in manufacturing memory chips. The US watchdog, the Committee for Foreign Investment in the United States (CFIUS) turned down the offer. [19]

Xi capped his “catch up and surpass” strategy in May 2015 when a ten-year action plan for promoting manufacturing called “Made in China 2025” (MIC2025) was unveiled. It was billed as a three-step strategy to transform China into a manufacturing power by 2049. [20] Nine areas were designated as priorities: improved manufacturing innovation, integrating technology and industry, strengthening the industrial base, fostering Chinese brands, enforcing green manufacturing, and promoting breakthroughs in ten key sectors.[c]

In line with this, the State Council set up 17 national-level demonstration zones across the big cities such as Beijing, Shanghai, Shenzen, Wuhan, and Chengdu. Unlike the US’ Silicon Valley, these zones received financial incentives, investment support and special assistance from provincial and central governments. Companies of varied sizes were encouraged, as well as startups in the area of EVs, AI, automation and drones. This led to a surge of Chinese ”unicorns”.[d] However, Silicon Valley still remains way ahead of China when it comes to attracting global talent.[21]

China set steep goals for MIC2025. For example, it wanted its commercial aircraft to supply 10 percent of the domestic market and account for 20 percent of the global market by 2025. After the MD-82 experience, China took up the ARJ21, a 90-seat jet partially based on the McDonnell Douglass project. Six of the aircraft are now in service. The latest version is the C919, a long-haul liner which completed its first voyage in May 2017 and will only get into service by 2021 and even then only 50 percent of its components would be Chinese-produced. It runs on engines from CFM, a joint venture between a US and French companies. [22] This is the story in a number of other areas that similarly remain dependent on Western technology.

To be sure, however, China has succeeded in taking control of a large proportion of the world’s supply chain. [23] In the past, China was often one element in a supply chain where higher value and high-tech items came from other suppliers (such as Germany, Taiwan or Japan). Today many of those items are also being sourced from Chinese companies.

An emerging example is the case of batteries used in electrical cars “by far the most lucrative part of an EV.” [24] China is already the world’s largest EV market. Its lithium-ion battery production capacity is orders of magnitude greater than those of its competitors in Europe and North America. Part of its success was achieved in keeping out foreign manufacturers till it attained this status. Further, it has been working to take control of the world’s supply chain of cobalt, a vital battery component by buying mines in places like the Democratic Republic of Congo. [25]

Such successes can be attributed to the successive and systematic laying out of plans, including the 13th Five-Year Plan 2016-2020, called the “Internet Plus” plan, which focused on semi-conductors, chip materials, aviation equipment and satellites. Under the plan, spending on R&D would go up to 2.5 percent per annum as compared to the 2.1 in the previous plan. [26] Just a year later in July 2017, the State Council issued its AI development plan, whose strategic goals were to reach world levels in technology development by 2020. In the next five years, by 2025, China expects to make breakthrough in AI theory, “and parts of technology and application will be at a world leading level.” AI would become the driving force of China’s “industrial upgrading and economic transformation.” [27]

As the Chinese economy continues to surge, however, a pushback has come from countries that accuse China of erecting barriers while itself accessing their markets and technologies. These activities are largely violative of trade rules set by the World Trade Organization (WTO); in certain instances, they are clearly illegal.

III. China’s Contentious Leapfrog

Industrial and political espionage was a feature of the Cold War. However, the source of chagrin for the US was the surge of Chinese covert operations following its opening up to the West. In the mid-1990s, a Select Committee of the US Congress chaired by Christopher Cox investigated Chinese commercial and military espionage in the 1990s. The Final Report was issued in January 1999 and a redacted version was issued in a declassified form in May of the same year. [28]

Stealing

Perhaps the most damaging parts of the report dealt with China’s theft of US thermonuclear weapons design information. The report also charged that the PRC had stolen US missile technology and proliferated it to other countries and also gotten US satellite manufacturers to part with missile design information without legal sanction. The report said that the loosening of technology control regimes in the wake of the collapse of the USSR had been partly responsible for some of the lapses like enabling China to obtain high-performance computers that could be used for design, modeling, testing and maintaining advanced nuclear weapons as well as for R&D relating to missiles, satellites, submarines and aircraft. The report concluded that the PRC had “mounted a widespread effort to obtain US military technologies by any means—legal or illegal.” [29]

In the 1990s, the US’ focus was on the possible loss of its military technology often obtained by China through straightforward orthodox espionage. With the explosion of the world wide web over the next decade. China created “the great firewall” to prevent external intrusion, while becoming a major player in penetrating the networks of other countries in search of information and technology.

In 2010, the internet security company Mandiant issued the first of its M-Trends Reports based on its study of methods of how networks were penetrated and data exfiltrated. It identified the companies, defence contractors and institutions that had been compromised, and concluded that not only was the bulk of the hacking activity “linked to China”, but that given the scale of the operations and the target of the attacks, the attackers were “state sponsored.”[30]

In 2012, the Director of the US National Security Agency, General Keith Alexander said that cybercrime had led to “the greatest transfer of wealth in history.”[31] China was named as the biggest culprit. In another report that same year, Mandiant said, “the groups conducting these activities are based primarily in China and that the Chinese Government is aware of them.” They pinned down the primary group involved, the 2nd Bureau of the PLA General Staff Department’s 3rd Department also known as Unit 61398. The report said that this group has stolen “hundreds of terrabytes of data” from at least 141 organisations spanning 40 major industries.”[32] Much of the operations between 2006-2012 were on entities relating to Information Technology, transportation, high-tech electronics, financial services, engineering services, satellites and telecom, chemicals, energy, scientific research, aerospace, healthcare and metals and mining.

In a 2012 testimony before the US House Committee on Foreign Affairs, Larry Wortzel, a Commissioner with the US-China Economic and Security Review Commission quoted media reports of how China has extracted huge volumes of data relating to the F-35 through cyber espionage. Likewise, Lockheed Martin, Northrop Grumman, British Aerospace had all experienced penetrations from Chinese hackers. Wortzel also cited a manufacturing newsletter noting that since 2008, there had been at least 58 defendants charged in the federal courts relating to Chinese espionage, all mainly in areas relating to defence. [33]

Research & Development

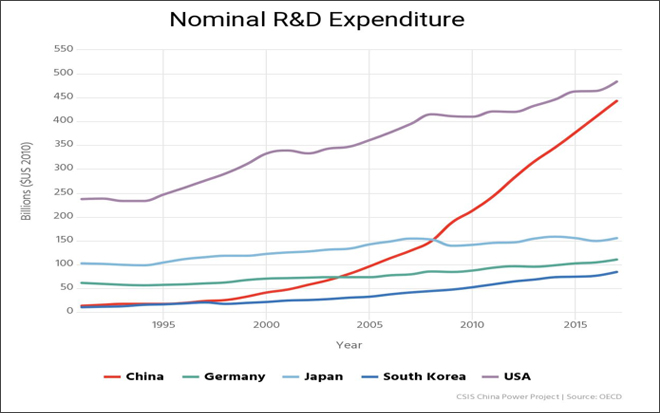

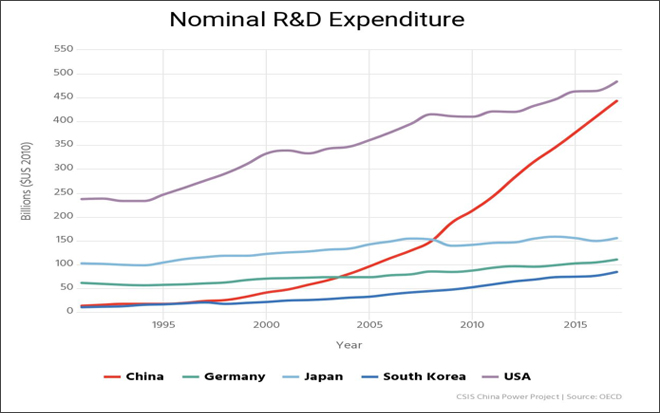

Following the lead of countries like South Korea and Japan, China also began to invest heavily in R&D. In January 2018, citing the biennial Science & Engineering Indicators report of the US National Science Foundation, columnist Robert J Samuelson declared “China has become–or is in the verge of becoming—a scientific and technical superpower.” The report provides data on R&D, innovation and engineering in the US, and compares them with other countries. [34] China is the 2nd largest spender in R&D after the US, accounting for 21 percent of the global total which is $ 2 trillion. China’s expenditure has been going up by 18 percent every year, as compared to the four-percent annual increase of the US. An OECD report says that China could overtake the US in R&D spending by 2020.[35] Indeed, China has increased its technical work force five times since 2000 to 1.65 million. It also has more undergraduate degrees in science than any other country and the numbers are only continuing to grow. China has also overtaken the US in the total number of published scientific journals. Technical papers have increased dramatically, even if their impact, as judged by citation indices, may not be that high.[36]

Figure 1. Comparative National R & D Expenditure

Sending students abroad to pick up expertise in a variety of areas was an important aspect of the opening up of the country in the 1990s. This trend has largely continued and China still sends more students abroad than any other country. According to figures from the United Nations Scientific and Cultural Organisation (UNESCO) some 801,000 Chinese students went abroad in 2014-2015, of which more than one-fourth (26.5 percent) took up business management; another 19.7 percent studied engineering, and 12.4 percent math and computer science. The majority of these students enroll in universities in English-speaking countries.[37]

Earlier, the return rate of Chinese students was as low as 14.3 percent in 2002. It steadily climbed up over time, peaking at 85.4 percent in 2013. The rate again dropped to 78.1 percent in 2015. Analysts point to various reasons for this decline in return rates, including visa difficulties and shrinking job markets.[38] Since 2008, China has taken measures to attract its researchers and scholars back to the country. For example, the Thousand Talents Plan targets scientists below the age of 40 and who had obtained their doctoral degrees from prestigious foreign universities. The government offers a sum of 500,000 RMB ($80,000) to those who enroll in the programme, as well as research grants ranging from 1-3 million RMB ($150,000- $300,000). [39] The funding for the programme has been growing; in 2011, China awarded 143 scientists out of the 1,100 who applied, and in 2016, 590 from 3,048 applicants.

One scholar, Linsen Li, a 30-year old Chinese specialist in advanced batteries in an MIT post-doctoral programme was offered $ 65,000 in salary, $ 900,000 as research grant and $ 250,000 to purchase a house. Li reluctantly returned home because he could get no teaching offers in the US. [40]

At the same time, China has also become a more attractive destination for foreign students and now occupies the third slot after the US and UK. This is viewed as an important adjunct of Chinese policy to develop world-class institutions. The government spends massive amounts to not only attract students, but to offer them scholarships. Some 40 percent of new international students received some form of funding from the Chinese government in 2015.[41]

Two programmes have been developed to attract foreign scholars. One would have them work for more than nine months a year in China for three consecutive years. An amount of RMB 1 million would be provided to each researcher and a total of RMB 3-5 million research grant through the employer to those engaged in basic science research. A second programme was more ambitious and aimed at luring Nobel laureates, winners of Turing Award or Fields Medal and their equivalents, and other top scholars from countries like the US, UK, Canada and Australia.

To be sure, the money or the number of research papers by themselves do not automatically translate into leadership. The US remains the world leader in investment in basic research (17 percent as against China’s 5 percent.) It also remains the leader in top quality research, attracting the best and the brightest of international students and in its ability to translate basic research into revenue-generating intellectual property. However, China has been investing huge amounts into key areas in which they aim to become world leaders in the next decade or so. One of these is AI, where the government and the private sector are taking serious steps. In certain areas of technology, China is feeding off US research and researchers. It is well known, for example, that the leaders of Chinese AI research like Baidu have had an AI research lab in the US since 2014, and Huawei had promised $ 1 million for AI research to University of California, Berkley. The Chinese company CETC has partnered with the University Technology of Sydney in AI projects.

According to one study, Chinese universities and labs are climbing the ranks of leading AI research centres across the world. In 2014 and again in 2018, Tsinghua University for instance, was ranked number 2, behind only Carnegie-Mellon in the number of papers published in top AI conferences. In 2018, Peking University (No 5), Chinese Academy of Sciences (No 12), and Nanjing University (No 14) also entered the list of the top 15 institutions. [42]

Another study by the same institution noted that China-born researchers comprised a relatively small proportion of the topmost tier AI research, “but a substantial portion of the upper tier research.” A majority of these upper tier researchers (59 percent) did so in US institutions, while 33 percent studied in China. A majority of these China-born researchers attended graduate school in the US and worked there after graduation. The study noted the pull of Chinese companies towards attracting their talent back to their homeland, the restrictions on visas and prosecutions of Chinese-born scientists, and concluded that it was too early to say what impact these developments will have on the US.[43]

Civil-Military Fusion (CMF)

In the 1980s, China placed defence as the fourth and last pillar of its modernisation. Schemes like Project 836 sought to promote civilian technology that would benefit the economy. In other words, what the Chinese leadership is seeking is to leverage the advances in its universities, civilian laboratories and research institutions to advance its military capabilities. The first reference relating to “civil military integration” was given in China’s 2015 White Paper that spoke of the need for coordinated plans at all civilian and military levels. [44]

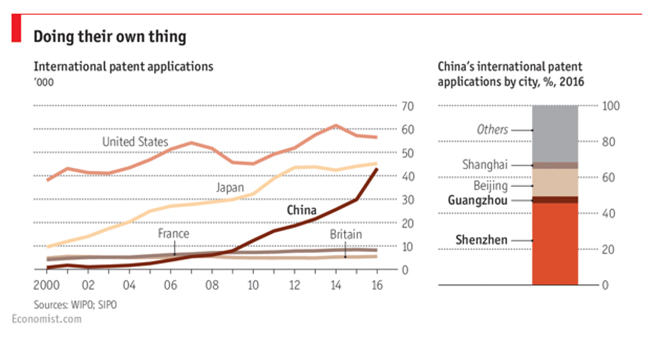

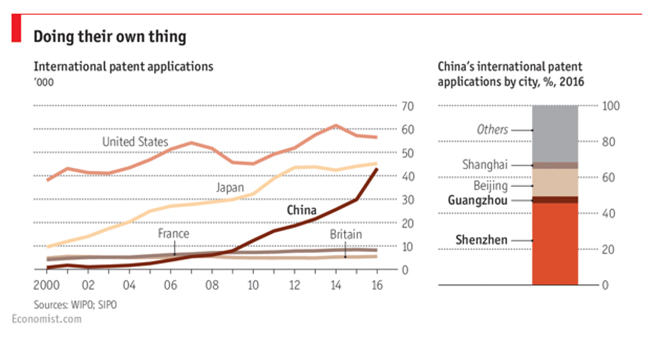

Figure 2: Number of Patent Applications, China vs. Others

Subsequently, a Central Commission for Integrated Military and Civilian Development (CCIMCD) was set up in January 2017, chaired by President Xi Jinping himself. Behind this effort is the understanding that in China, innovation often takes place in universities, private sector companies and labs and there is need to yoke them to the national security effort.

Transactions

As these plans have unfolded, the world has seen a surge of Chinese investments abroad, many of them aimed at acquiring technology companies focusing on areas targeted by MIC2025. The US, the largest recipient of these investments, got some $ 180 billion between January 2005 to January 2019: the biggest share were channelled to real estate ($54.1 billion) and finance ($25.9 billion), and other significant deals were made in technology ($21. 7 billion), and transportation ($22.2 billion). As Table 1 shows, the investments have plunged since 2016 because of the American pushback.

Table 1. Chinese investments in the US (2012-2018)

| Year |

Value (in US$ billions) |

No. of deals |

| 2012 |

9 |

13 |

| 2013 |

15.9 |

21 |

| 2014 |

18 |

30 |

| 2015 |

14.58 |

35 |

| 2016 |

54.1 |

61 |

| 2017 |

24.6 |

28 |

| 2018 |

9.7 |

17 |

Source: AEI China Investment tracker

Despite having made these deals with the US, China was still unable to make the kind of transactions it had sought. To begin with, all foreign investments in strategic sectors in the US are required to go through a screening process by the inter-agency Committee on Foreign Investment in the United States (CFIUS); the system is aimed at preventing foreign companies, Chinese or any other, from acquiring technologies which the US deems strategic. In 2005, for instance, the committee blocked the acquisition of Unocal by the Chinese oil major CNOOC. In 2012, a Chinese company was asked to divest from a wind farm that was located close to a US naval facility. In 2015, CFIUS shot down the Tsinghua Unigroup’s $ 23-billion bid for Micron Technology. In 2016, then President Barack Obama disapproved the acquisition of US assets of German company Aixtron by a Chinese buyer.

Also in 2016, pressure from the CFIUS shot down a $2.8-billion deal through which Philips NV would sell its LED business to a Chinese venture-capital firm. The same year, Fairchild Semiconductor International turned down a bid from China Resources Microelectronics Ltd and Hua Capital management because it did not get a CFIUS approval. Beijing-based Unisplendour Corp also withdrew from a deal to purchase a 15-percent stake worth $3.78 billion in Western Digital Corp because CFIUS said it would first need to investigate the transaction. [45] In July 2016, Zhongwang, a state-supported enterprise made a bid for Aleris, a US company that manufactures rolled aluminium products for the aerospace and automotive industries. China is the largest producer of aluminium in the world. But the US acquisition would have taken into a different league in making aluminium products. In 2017, CFIUS disallowed the deal.[46] (Subsequently, India’s Aditya Birla Group company Novelis emerged as a buyer in 2018).

In early 2018, the US blocked Broadcom’s $ 105-billion acquisition of wireless chip giant Qualcomm amidst fears of China. This despite the fact that Broadcom’s key units are in the US and the company is headquartered in Singapore. CFIUS told Broadcom that if the deal went through, Huawei and other Chinese telecom giants could displace Qualcomm as leaders in developing faster and higher capacity 5 G networks. This was not a matter of China getting control of the company or its technology, but that in foreign hands, the company could become less efficient.[47]

Even at this stage, however, the Chinese have been able to bypass the CFIUS scrutiny by using novel avenues like bankruptcy courts and venture capital firms that backed startups. In one instance in 2017, a Hong Kong-based steel magnate was able to purchase ATop Tech, a bankrupt firm whose main product was a ground-breaking automated chip designer. Chinese investments in US startups shot up from $ 2.3 billion in 2014, the year before the MIC2025 was announced, but in 2015 it went up to $9.9 billion, only to decline in 2016. The year still saw the approval of 165 deals. [48]

In January 2018, a Pentagon report said that China planned to transform its economy through “a national focus on technology and indigenous innovation with a goal of import substitution.” The report by the Department of Defense’s Defense Innovation Unit (DIU), which was created in 2015 to help the US military make faster use of technologies, said that China intended to “displace the US in key industries” through its policies of promoting domestic champions through state subsidies and limiting access to the Chinese market to foreign companies. [49]

This was different from the experience of Europe.[50] In the period 2016-2018, nearly two dozen high-tech companies were taken over by the Chinese in Europe. Among these were Sygenta, the Swiss company that supplies one-fifth of the world’s pesticides and a large proportion of its seeds; KrausMaffei, maker of robotics, plastics and rubber; Kuka, a German global leader in factory automation (bought by a Chinese bidder, Midea Group); and Bioproducts Laboratory of UK, a biotherapeutics company, was taken over by Creat, a Chinese investment company. Chinese companies also kept their focus on the automobile sector. They bought majority shares in Daimler and the electrical car maker Borgward of Germany, and purchased Volvo Trucks (Volvo cars had been bought earlier). Additionally, CATL, China’s dominant battery maker invested in the German state Thuringia to make lithium-ion batteries battery. The other area of attention was semiconductors. In 2017, Imagination Technologies of UK which makes graphics processors was bought by a Chinese company, Dialog; another British company was bought by Tsinghua and Semiconductor Global Switch a data centre developer by a Chinese group. Netherlands was another place where Chinese companies sought out and bought semiconductor makers like NXP and Wingtech. In 2018, Tsinghua also bought the French smart chip component maker Linxens.

Though EU has steadily tightened its restrictions, it remains open to Chinese investment. A European Commission document issued in March 2019 termed China in far less hostile terms than the US was doing. It said China was both a cooperation and negotiating partner, as well as “an economic competitor in pursuit of technological leadership and a systemic rival promoting alternative models of governance”.[51]

Israel has emerged as another important alternative to the US for high tech. Israel’s thriving high-tech sector has attracted investments from the US and Europe, but now China has emerged as a significant player and could overtake the US as Israel’s single largest source of investment in the coming period.[52] In October 2019, US pressure compelled Israel to create a mechanism to screen investments by Chinese companies. [53]

IV. The US Response

It is clear that concerns over China’s behaviour are not recent, and their roots can be traced to as early as the mid-1990s. In the 2000s, critics of Chinese activities began to focus on Beijing’s economic espionage. In 1996, the US had passed the Economic Espionage Act to punish intentional appropriation of a trade secret, whether through copying, downloading or uploading, transmitting or receiving or buying them.

The concerns led to the creation of an independent and bipartisan commission to look into the scale and scope of the theft of American intellectual property (IP). The commission—which comprised of former civil servants, business leaders, politicians and academics—found that the US was losing hundreds of billions of dollars per year in stolen intellectual property. It said that China was responsible for 70 percent of the problem. It said that a “core component of China’s growth strategy is acquiring science and technology,” and while it did this by legal means like imports, licensing and joint ventures, it also took recourse to illegal means. As a result, “an extraordinary number of Chinese in business and government entities are engaged in this practice (of IP theft)”.[54]

Immediately thereafter, the Obama Administration took a number of steps to address the issue. In 2014 the US indicted five members of PLA unit 61398 on charges of economic espionage. It added a section 1637 to the 2015 National Defense Authorisation Act that empowered the President to sanction foreign entities and expanded the authority of the International Emergency Economic Powers Act (IEEPA). It also passed the Defend Trade Secrets Act in 2016 to strengthen the Economic Espionage Act, the National Cybersecurity Protection Act of 2014 and a slew of other laws and executive orders to check cyber espionage.

The Obama Administration, however, did not use the authorities provided for in the legislations. Instead in September 2015 during Obama’s state visit to China, the two sides signed what amounted to a ceasefire agreement. The hacking of US sites declined significantly, only to resume towards the end of 2017. Even before this happened, FireEye/ Mandiant said in its M-Trends report of 2018 that China would be willing to violate the agreement for strategic reasons. They had observed groups “potentially preparing operations against revolutionary technologies” such as AI and advanced batteries. [55]

For these reasons, the response to MIC2025 was lukewarm. This was summed up in 2017 by a report of the US Chamber of Commerce on Made in China 2025; the report was subtitled, ‘Global Ambitions Built on Local Protections’. The report acknowledged China’s imperative to develop a more innovative economy through greater R&D investments and economic efficiency. It noted that plans like MIC2025 were putting the US and Chinese economies on a path of separation, rather than integration, in critical commercial areas. According to the report, China needed “to kick-start market reforms, liberalise its investment regimes, and reduce subsidies and other distortions in the domestic economy”.[56]

Concerns were being expressed through other channels as well. A January 2017 report of the US President’s Council of Advisors on Science and Technology noted that China was making a “concerted push” to reshape the semiconductor market in its favour “using industrial policies backed by over one hundred billion dollars in government directed funds.” The report said that China did not have many semiconductor foundries, “but all are at least one-hand-a-half generations behind the state of the art in volume production.” China used various tactics ranging from subsidies to forcing domestic customers to buy only from Chinese semi-conductor suppliers, forcing transfer of technology in exchange for access to the Chinese market; and finally, it stole intellectual property. Further, China does not have any domestically owned memory chip companies producing at a commercial volume. Therefore, the path China has adopted is “acquisition of global players (or divisions of them) in the United States, Europe or Japan.” [57]

Even as tensions between the US and China on trade and technology had been brewing since 2010, Xi and the Chinese leadership were blindsided by the arrival of Donald Trump. Trump initially raised the issue of the trade deficit between the two countries, but it soon it became clear that the US was now challenging China’s entire industrial policy including its policies of technology acquisition and its state-backed investment incentives and subsidies.

The Great Wall of Trump

President Trump initially posed the China challenge in the simple arithmetic of the trade imbalance between the two countries, demanding that Beijing set it right. But behind it emerged a bigger issue of China’s quest to become a major technological power. The stage was set by the issuance of the US National Security Strategy in December 2017 which made a dramatic shift in US policy towards China from engagement to competition. The document’s section on promoting American prosperity spoke of the need to protect the US national security innovation base. Observing that “every year competitors such as China steal US intellectual property valued at hundreds of billions of dollars,” it vowed not only to protect US IP, but also to “reduce economic theft by non-traditional intelligence collectors”. The latter, presumably referred to foreign students working in the STEM fields. To this end, it would tighten visa procedures. [58]

In his March 2018 report on Chinese trade practices, USTR Robert Lighthizer focused on Beijing’s “Made in China 2025” industrial policy. To attain the goals set by MIC2025, the report said, China was sponsoring the hacking of American businesses and commercial networks, instituting unfair trade policies that included subsidising favoured Chinese industries with government capital, and requiring Western firms to give up trade secrets when they partnered with Chinese firms.[59] In September of the same year, China issued a White Paper as a rejoinder to this report. The document dismissed the US actions, which included two rounds of tariffs, as “trade bullyism”, and announced the imposition of retaliatory tariffs.[60] Two months later, the USTR updated the March report and said that “China fundamentally has not altered its acts, policies and practices….”

Analysts like Lorand Laskai have noted that China was not looking to join the ranks of technological powers like the US, Japan or Germany, “but to replace them altogether.” [61] In that sense it is “the real threat to US technological leadership.” He noted that where supply chains for high-tech products span continents, what China was seeking was to take charge of the entire global high-tech supply chain.[62]

The response was obvious in US legislation in 2018. The first was the Foreign Investment Risk Review Modernisation Act (FIRRMA) that expanded the scope of review and authority of the CFIUS. The expanded definition covered investments in properties in sensitive areas, and non-controlling investments in critical infrastructure and technologies.[63] The second was the National Defense Authorisation Act (NDAA) for FY 2019 which specifically prohibited US government agencies from procuring components and equipment from Chinese firms like Huawei, ZTE, Hytera Communications, Hikvision Digital and Dahua Technology Co.[64] The NDAA also enacted the Export Controls Act of 2018 (ECA) to enhance protection of US technology resources by imposing greater restrictions on exports, especially to China, of key emerging and foundational technologies. It also expanded the definition of what constituted “national security” as a reason for controls.[65]

A White House report[66] of June 2018 detailed the steps China has taken to protect and promote its domestic industries and put foreign competitors at a disadvantage through subsidies, cyberespionage and forced IP transfer. It said that the Chinese sought to capture the emerging high-technology areas that will drive future growth and aid the advancement of defence industries.[67]

In November 2018, the Bureau of Industry and Security of the US Department of Commerce sought public comment on establishing criteria to identify emerging technologies that were essential for US national security. These, a notice said, could relate to conventional weapons, intelligence collection, WMDs or counter-terrorism applications.[68] The Trump Administration also stepped up its scrutiny of Chinese activity in the US. The Department of Justice set up a new China Initiative within its National Security Division (NSD) composed of FBI specialists and attorneys to handle “Chinese trade theft cases” and bring those involved to justice. The NSD would also enhance its review of investment and licences in the US infrastructure and telecommunications industry, and the Foreign Agent Registration Act’s work to prevent covert efforts to influence American opinion.[69]

In the period 2013-2016, the DOJ did not charge anyone with spying for China. Since the beginning of 2017 however, when the Trump Administration took charge, several people had been charged and convicted for IP theft.[70] In July 2019, FBI Director Christopher Wray told the US Senate Judiciary Committee that his organisation had more than 1,000 active investigations into possible IP theft in the US, most of them involving China. He also pointed to the role of universities in creating a pipeline of IP heading back to China.[71] In 2019, the National Institutes of Health and the FBI began a major effort to detect and check scientists who they claimed were stealing the work of biomedical research facilities across the US. At last count, 71 institutions, including the top tier medical schools in the US were investigating 180 individual cases and, not surprisingly, most of the instances they uncovered involved scientists of Chinese descent. The result has led to the firing or resignation of some dozen scientists.[72]

Going for the jugular

Given their global profile, it was not surprising that the US would target Chinese telecommunication giants like Huawei and ZTE. The US crackdown began with ZTE, a Huawei rival, which was brought to its knees in April 2018 and then given an unexpected reprieve by Trump in mid-2018. Then in October 2018, the US banned American companies from exporting technology to Fujian Jinhua Integrated Circuit, China’s key memory chip producer which was accused of stealing technology from Micron Technology. The company has halted production from the beginning of 2019 and is seeking to sell its state-of-the-art fabrication facility in China. As for Huawei, it had come into the cross-hairs of the US as far back as in 2012 when a Congressional report issued in October that year said that the two top Chinese companies Huawei and ZTE were national security threats because they facilitated the stealing of information from the US on behalf of the Chinese government.[73]

On May 15 this year, Trump passed an executive order, ostensibly to secure American ICT supply chains on grounds that foreign adversaries were creating and exploiting vulnerabilities in ICT and services in the US.[74] Essentially, the order authorised the Commerce Secretary to create import regulations to protect the US against the threats. Trump’s order did not mention Huawei or China by name. That happened a week later, when the Federal Register announced that the Bureau of Industry and Security had amended its Export Administration Regulations by adding Huawei to its “Entities List,” along with 68 non-US affiliates of the company located around the world.[75] Though the US had begun campaigning against Huawei around the world alleging that its 5G technology would facilitate espionage, President Trump told a meeting convened in the White House to sanction Huawei that China’s technical prowess was the issue: “Unless we stand up now, there’s not going to be a chance to do it in the future.” [76]

On 28 January 2019, the US Justice Department announced a 13-count criminal indictment against Huawei, two affiliates and its CFO Meng Wangzhou, whose extradition the US is seeking from Canada. The charges go back ten years and are related to bank and wire fraud and also violating US sanctions on Iran. In response, the Chinese foreign ministry accused the US of using “its government power to discredit and crack down on specific Chinese companies in an attempt to stifle their operations.” [77] In June, in an addition to the Entities List, the US listed five Chinese institutions making supercomputers, or supercomputer components. Among these was Sugon, a major provider of data centres and computers in China and a leading manufacturer of computer systems. The company was dependent on American companies, including Intel, AMD, and Nvidia for its chips.[78]

In October 2019, the US Department of Interior grounded hundreds of its drones, pending an investigation into the programme. The Chinese company DJI dominates the global drone and drone component market, and 121 of the 800 or so drones of the DOI are made by it. [79] According to one report, 79 percent of drones sold in North America are made by DJI. The US is worried that the drones—which are used for emergencies, firefighting, border management and law enforcement in the US—can relay information back to China. A bill banning the use of China-made drones has been approved unanimously by the House of Representatives Committee on Homeland Security last month. A Senate version, The American Drone Security Act, was introduced in September. [80]

These actions suggested that technology had emerged as a new and distinct element in the US pushback against China—besides the South China Sea and the trade war. The Trump Administration did make moves to bolster US technology but its overall policy has not been helpful. In February this year, Trump issued an executive order, “On maintaining American Leadership in Artificial Intelligence,” but say critics, the Administration’s policies on immigration are proving to be the biggest hurdle in promoting AI since the majority of AI talent in the US is foreign born. [81]

Even as the US tightened the technology and visa restrictions relating to China throughout 2018 and 2019, the trade negotiations between the two countries remained on a roller coaster. Talks of agreement would give way to an escalation of hostility the next. In August 2019, the action and counter-action reached the point where Trump said that he would order US companies to cease doing business with China. (Officials would later clarify that he did not order them to leave China and had no plans to invoke emergency powers to compel them.)[82] At the end of September 2019, media reports said that the Trump Administration was considering delisting Chinese firms from US stock exchanges as part of a wider move to limit US investment in Chinese companies.[83]

V. The Future: Who Controls Technology?

This paper opened with a reference to the principle that the innovation activities of a rising state had effects on the dominant one. At one level, the dominant state feels that its security environment is being impaired; at another, it perceives a challenge to its preferred international order. Both these seem to have come together in the case of China and the US. A key undercurrent of concern in the US relates to how many of these technologies can enhance Beijing’s rising military capabilities. In turn, such military threat perception relates more to its hegemony in the western Pacific areas close to China, and less to its domestic territory.

Compounding US fears is that its historical lead in technology owing to its best-in-class universities, could now be slipping. In October 2019, Michael Brown, director of the DIU said that the US was behind China in many critical technologies. In the list of areas where China had a significant edge were 5G networks, drones, batteries, hypersonic systems, wind, solar energy and cryptocurrency.[84] One reason for this is that China has been investing heavily in select areas. One such is Artificial Intelligence (AI), with investors pouring in some $ 4.5 billion in AI companies between 2012-2017. Putting up fierce rivalry with the US giants Google, Microsoft, Apple and IBM are China’s Alibaba, Tencent and Baidu who too, are investing in emerging technologies. [85] Indeed, as the DIU report cited earlier notes, China has made important advances through innovation in many areas, some of which have clear military applications. These include quantum communications, the Sunway TaihuLight supercomputer that is the fastest in the world using Chinese designed and made microprocessors, a semi-autonomous cruise missile using AI, consumer drones, and autonomous and electrical vehicles.[86]

To deal with an “offset strategy with Chinese characteristics,” the US launched what is called its 3rd offset strategy in 2014 to identify and develop technologies which will continue to give it a technological edge in the battlefield. Robert Work, a US defence official who has championed this, has spoken of “collaborative human-machine battle networks that synchronise simultaneous operations in space, air, sea, undersea, ground and cyber domains.”[87] AI would enable a delegation of decision-making to machines and provide both a defensive and offensive edge. As for negative order externalities, given that the US under Trump is itself challenging the world order it had once shaped,[e] this undermines the US itself since an important element of the US hegemony has been its ability to harness willing allies and partners in providing legitimacy to its preferred order.

For now, China has been shown a mirror and the reflection it sees is not particularly reassuring. What it reveals is that China’s technology industry is heavily dependent on global component suppliers, especially from the US. While China has used its domestic market to advance areas like e-commerce, e-payment or AI, it has not made comparable progress in core technologies, whether they relate to computer operating system and chips, car and aero engines, or precision bearings. Although it has invested heavily in promoting its high-tech sector, China remains at the lower rungs, as the US, Japan, Germany and Taiwan have kept their lead. In 2018, China spent $ 291.58 billion on R&D, an 11.6-percent increase from 2017 placing it just behind the US in terms of spending. A lot of this, however, is in applied research; the country still lags in basic research. In semiconductors, for example, China imported $ 260 billion worth in 2017, mainly from the US, as domestic suppliers can handle only five percent of the annual demand.[88]

According to Jay Huang Jie, former Intel Managing Director in China, the country was at par with peers in chip design, its problem was the 10-year gap in the ability to manufacture ICs.[89] This was confirmed in a report by Everbright Securities, which said that China’s leading chip production firm Semiconductor Manufacturing International Corp. is about two generations behind the word leader Taiwan Semiconductor Manufacturing Corp (TMSC). As it is, many key US, Japanese, and German suppliers have stopped dealing with Huawei. [90] Likewise, despite massive investments, the country’s drive to become an aviation power continues to suffer from a lack of expertise in avionics, materials, aerodynamics, and most importantly, engines. Estimates are that China’s jet engine technology is about 20-30 years behind that of its competitors. But Beijing is doubling down on its effort and had invested nearly $ 15 billion, for example, to establish the Aero Engine Corporation of China (AECC) to build turbofan engines to power the Comac C919, China’s domestically developed airliner and its new stealth fighters. It has not been easy. [91]

China has now tactically shrouded its plans by playing down MIC2025 and the Thousand Talents programme. Yet, it has no choice but to move ahead on the technology front; to pause now could lead to a stagnation, which in itself could be politically disastrous for the ruling Communist Party of China. Across various statements, Xi Jinping continues to exhort Chinese scientists and engineers to press ahead in developing core technologies.[92]

China as ‘Real Threat’ to US Hegemony

Ever since the US decided that China was seeking to challenge “American power, influence and interests and attempting to erode American security and prosperity”, it shifted gears, and today the world is witnessing an epic contest between a rising power and an established one. Till recently, the US sought to engage China and bring it into the ambit of the world order it had created and dominated for many decades. Today, no matter what the outcome of their trade negotiations, the US and China will be engaged in intense geopolitical and technology competition. What does the future look like in these circumstances?

As discussed earlier, China is not looking to join the ranks of technological powers, but to replace them altogether. Just what this could imply could be seen through the experience of the US itself as the dominant global technology power. Though the US keeps a wary eye on strategic resources and supply chains, it has not quite sought to “capture” them. Instead, it created a system of tight control of certain militarily critical and dual-use technologies. Some of these are simply not available for export, while other dual use ones, require an elaborate structure of licensing and end-use certifications. Equally important, the US has created a web of relationships with allies and partners that promote both technology trade and security. During the Cold War, the Coordinating Committee for Multilateral Export Controls (COCOM) prevented leakage of strategic technology to the Soviet Union or China. This was succeeded by the Wassenaar Arrangement, the Nuclear Suppliers Group (NSG), the Missile Technology Control Regime(MTCR) and the Australia Group which have a both, regulatory and technology denial function. In the post-Cold War era, China became a member of the MTCR and NSG, but not the important Wassenaar Arrangement. Through separate embargoes, in any case, conventional arms and dual use goods and technologies are denied to China by the US and EU.

The US also has an Entities list of individuals, companies, institutions who pose “a significant risk” to US national security. Some of these are denied technology outright, while others require licensing. In other instances, dealing with some of the entities can make you liable to penalties under US law.

Beyond this, the US has sought to maintain a strict regime of IPR protection to preserve the comparative advantage of its businesses and corporations through the country’s peerless R&D centres and universities. Historically, the US government has been more keen to safeguard technology, rather than export it. Because of its focus on maintaining its massive lead in military capabilities, the US has constrained technology exports through its various exports control regimes rather than promote them. In this way it is different from other countries, including high-tech exporters like France, Germany and the UK.

China inherited the Soviet system where IPR meant little. Subsequently, though its obtained technology through a variety of both, legal and illegal means. Though it has begun tightening up its IPR rules, they are not quite there yet. It is only following the US tariff actions that China’s Supreme People’s Court opened its Intellectual Property Court in Beijing. This has 30 judges from IP tribunals in 10 provinces across the country. [93]

The Chinese economy has yet to reach the status where it has the ability to exercise the kind of controls that the US does with technology and IPR. It has, in the past, hit out through the blunt instruments of trade boycotts, as in the case of Lotte of South Korea, or the denial of rare earths to Japan. It has threatened to impose a similar ban on the US, but has not carried it out. More recently it has declared its intention to create an “unreliable entities list” of foreign companies which its Ministry of Commerce said “do not comply with market rules, violate contracts, block or cut supplies to Chinese firms with non-commercial purposes….” China has been careful to pitch this as a move to protect the rules of international commerce, rather than Chinese security. [94] Actually, future Chinese technology controls could look no different than those enforced by the US.

In the near to medium term, China is unlikely to make too restrictive a regime for its technologies because it is at the stage where it must create an economy based on innovation and technology with access to markets in the affluent west, to stay out of the Middle Income Trap. Therefore, whether it is aviation or semiconductors, or electrical and smart vehicles, aerospace, computers, pharmaceuticals virtual and augmented reality and 5 G networks systems, China’s interest is in marketing them in the affluent markets in the US and Western Europe. To this end, it has launched the Belt and Road Initiative which is an effort to build up the Europe-Asia link. As Bruno Maçães has pointed out, the EU-Asia trade in goods is “by far the most important flow axis in global trade”, observing that Eurasian trade links are less developed than the Trans Pacific or Trans Atlantic ones, and thus have the highest potential for growth. [95]

This contest will, of course, manifest itself in the two countries. But it will also play itself out in the realm of emerging markets, groupings like the ASEAN and the European Union, as well as multilateral institutions. One element of this will be markets which will be crucial for China in the face of the restrictions, if not closure of the vital US market. The second will be the US ability to choke off Chinese high-tech exports through lobbying and, possibly, sanctions based on the third country application of US law. The third is Beijing’s ability to reach out to large countries and potential markets like India and Brazil which worry about skewed trade and investment policies of China and offer them attractive terms.

Fortunately for China, as of now, the US has played a lone hand. By simultaneously opening multiple fronts on the trade issue, some against friends and allies, it has actually weakened its own hand. For the US, there are other important issues relating to taking on China’s challenge in the realm of emerging technology. Former NSA Tom Donilon says that “defensive protectionism” of the Trump Administration is not the way to compete with China. The US historical experience showed that the way to do this was through renewed heavy public investments in science and technology. The analogy he and many other American analysts give is that of the moon shot.[96] A comprehensive report from the Council on Foreign Relations says that slowing down China is not enough, the US needs to do much more at home. It must restore federal funding for R&D, attract and educate an S&T workforce, support tech adoption in the defence sector and bolster technology alliances and ecosystems.[97]

VI. Conclusion

The world stands at a juncture where there is a cleaving of the global technological order into two technospheres: the Chinese and the American. Analysts have speculated that an all-out rivalry will be “immensely costly, disruptive and destructive.” [98] They call on the two sides to work out ways of establishing and enforcing rules to ensure that the conflict is “somewhat bounded”, and work out common rules on emerging technologies.[99]

A group of US and Chinese experts issued a joint statement following a meeting in Shanghai in October 2019 in which they said that there were options beyond the extreme ones that would either compel China to carry out wholesale reforms to a converging of economic models, or a damaging decoupling. They felt that there was a third option which would allow countries autonomy to design their own industrial policies, social standards and tech systems and use tariff and non-tariff means to protect their turf without imposing asymmetric burdens on foreign actors. [100]

As it is, given the vast supply chains that were created in the era of globalisation, any process of decoupling will not happen easily and both sides may equally turn out to be losers. If the ambitions of Chinese companies like Huawei or DJI are blunted, so will those of US corporations like Apple, Intel, Qualcomm, Micron Technology, Broadcom and Boeing who have substantial sales in China.[101] Indeed, China’s share of sales of half a dozen top US companies dealing with semiconductors is more than 50 per cent. And in another eight, it is over 25 percent. [102]

Many US technology companies are linked to Chinese component makers, and, according to the Wall Street Journal, tech startups building hardware such as electric scooters and robotics depend on Chinese parts. [103] As an S&P Global report notes, “it is very difficult to replicate China’s well developed and integrated technology supply chains elsewhere.” [104] US moves to delist Chinese firms from US exchanges and banning the US government from including Chinese equities in pension funds, are bound to affect the Chinese economy. There are some 156 Chinese companies with a market capitalisation of $1.2 trillion as of February 2019. Implementing these measures would not only be a huge escalation in the trade and tariff fight, but also end up disrupting US exchanges.[105]

Another example of a no-win situation is the tightening of US rules against immigration. China is bound to lose from the tightening of rules regarding visas to Chinese researchers, but the steady choking of the talent and energy of the 350,000 or so Chinese students in the US (or one-third of all international students), will also affect American science and engineering programmes.[106]

Releasing the interim report of the Congress-mandated AI commission, Eric Schmidt warned that US innovation would be hurt if it chose to disengage from Beijing on technology. He bluntly noted that on AI, the US was “dependent upon Chinese researchers and Chinese students.”[107] The report said the US needed to protect its interests from Chinese espionage, but that it “could lose access to valuable markets, an important talent pool, and the research now being generated by labs in China.”[108]

According to one calculation, China’s tech industry is 42 percent as powerful as that of the US today but is moving rapidly and could reach parity with the US in 10-15 years. China has its weak spots, especially in semi-conductors and its sales abroad are still small. However, in the dynamic areas like e-commerce and internet, the gap between the US and China is smaller; China’s unicorns and its Venture Capital activity, too, compares favourably with that of the US. [109]

China will reach the top ranks of technology powers because: a) it has the will and determination to do so; b) its political system has demonstrated an ability to focus the resources of its society, if need be, by coercion; and c) it has already been able to create a technology ecosystem that could now well be self-sustaining. The US might be able to slow down China, but not stop it.

The competition no longer appears to be related to technology alone. The American approach to China has rapidly changed through the Trump presidency. It began as an insistent complaint on trade and tariff issues, but the US National Security Strategy and the National Defense Strategy shifted the paradigm of their relationship. While Trump remains focused on the trade issue, Vice President Mike Pence and Secretary of State Pompeo have undertaken a more ideological attacks on China. Beginning with a major speech at the Hudson Institute in Washington DC on October 30, Pompeo plans to give a series of speeches on the “China challenge” in the coming months. At the Hudson speech, after outlining all the bad things the CPC led China was doing, Pompeo said that the US wanted a prosperous China that is at peace with its own people and neighbours, a China where business is transacted “on a fair set of reciprocal terms that we all know and understand,” a liberal China that respects the basic human rights of its own people. [110]

Essentially this is a China that is integrated into the world order as the US sees it; this is, however, unlikely to happen in a China led by the Communist Party. In fact, the Chinese response has been a call by the CPC to the Chinese people for a protracted struggle, much in the way of the anti-Japanese war of the 1930s. [111]

What kind of a world power China is shaping up to be is something that the US can decide through diplomacy and, if needed, hard-headed negotiations as well to a state of what Andrew Erickson terms as “competitive co-existence”. [112] So far, the US has worked by itself to deal with China’s trade and industrial policies. The all-or-nothing approach is fraught with risks. Working with Japan, the EU, India, Indonesia and Brazil would give the effort a broader base and make it look less like an “America First” effort to contain China. The competition will not go away, but China and the US can be pushed along a direction that will ensure that they do not fall into the Thucydides Trap.

Endnotes

[a] The Korean term for family-owned conglomerates.

[b] Magnetic-levitation train system

[c] IT, high end CNC, aerospace equipment, ocean engineering equipment and high-end vessels, high end rail transportation, energy saving and new energy cars, electrical equipment, farming machines, new materials and biomedicine and high-end medical equipment.

[d] Private companies with a value of about $ 1 billion or so

[e] The US led in creating multilateral institutions like the World Bank and IMF, as well as the NPT and the WTO. But since the 1980s, there has been another streak of opinion in the US which has led to its refusal to ratify the UNCLOS, walk out of the Paris Climate Change Agreement, trash the Trans Pacific Partnership and the Iran nuclear deal and walk out of UN bodies like the UNESCO and the UN Human Rights Council and walk away from a clutch of arms control treaties with Russia.

[1] The National Medium and Long Term Program for Science and Technology Development 2006-2020: An outline, The State Council, People’s Republic of China, accessed May 3, 2019

[2] Andrew B Kennedy and Darren J Lim, “The innovation imperative: technology and US-China rivalry in the 21st century,” International Affairs 94: 3(2018) 553-572

[3] Ibid.

[4] Ibid.

[5] S. Jaishankar cited in Raisina Dialogue, in Twitter Thread by Tanvi Madan, January 9, 2019, accessed October 30, 2019

[6] The following paragraphs are based on Baldev Raj Nayar, India’s Quest for Technological Independence: Policy Foundation and Policy Change (New Delhi, Lancers, 1983) 2 vols. Vol 1 chapter on “Dependence, development and technology,” 1-84.

[7] Sungchul Chung, “Excelsior: The Korean Innovation Story”, Issues in Science and Technology Vol xxiv No1 Fall 2007, accessed on June 14, 2019.

[8] Julian Baird Gerwitz, “China’s Long March to Technological Supremacy: The roots of Xi Jinping’s Ambition to ‘Catch Up and Surpass’”, Foreign Affairs, August 27, 2019, accessed on September 19, 2019

[9] John W Garver, Chinas Quest: The history of the foreign relations of the People’s Republic of China (New York, OUP, 2016) 54.

[10] Ibid 55-7

[11] Evan Osnos, “Green Giant: Beijing’s crash program for clean energy”, The New Yorker, December 13, 2009.

[12] Gerwitz, “China’s Long March”

[13] “China’s high-tech innovation catching up with Silicon Valley”, August 6, 2016, see website of the State Council, accessed on September 19, 2019

[14] Garver, China’s Quest 366; See also Evgeny B Kovrigin, “Thirty years of Japan’s Official Aid to China (the 1980s-2000s), The Seinan Law Review vol 45 no 2 (Seinan Gakuin University Institutional Repository 2012) 36-69, accessed on August 16, 2019

[15] “Era of ‘Created in China’: An interview with CSR President Zheng Changhong”, China Pictorial, accessed on August 31, 2019

[16] Ibid

[17] “China’s Strategic Emerging Industries: Relevant Government Players”, The US China Business Council, August 2012, accessed on September 9, 2019.

[18] “China’s Strategic Emerging Industries: Policy, Implementation, Challenges, & Recommendations”, The US China Business Council, March 2013, accessed on August 6, 2019.

[19] Email communication with Dr Aravind Yelery August 27, 2019

[20] “‘Made in China 2025’ plan issued”, May 19, 2015, accessed on June 9, 2019.

[21] Meng Jing “Where is China’s Silicon Valley”?, South China Morning Post, August 12, 2017, accessed June 6, 2019.

[22] Amanda Lee, “China’s aviation industry has a steep climb to ‘Made in China 2025’ goals”, South China Morning Post, October 29, 2018, accessed on September 11, 2019.

[23] Anjani Trivedi, “China to World: We don’t need your factories anymore”, Wall Street Journal, October 18, 2016, accessed on October 3, 2018.

[24] Trefor Moss, “The key to electric cars is batteries and one Chinese firm dominates the industry”, Wall Stret Journal, November 3, 2019, accessed on November 5, 2019.

[25] Ibid

[26] “China lays out ‘Internet Plus’ policy to become tech leader”, Reuters, March 5, 2016, accessed on August 6, 2019.

[27] Press Notice, The State Council, “New Generation of Artificial Intelligence Development Plan”, State Council Document [2017] No 35, July 8, 2017, accessed on June 11, 2019.

[28] Select Committee of the United States House of Representatives, “US National Security and Military/Commercial Concerns with the People’s Republic of China,” (Washington DC GPO, redacted version May 1999) 3 vols. See all-volume overview vol. 1 pp i-xxvii,

[29] https://www.govinfo.gov/content/pkg/GPO-CRPT-105hrpt851/pdf/GPO-CRPT-105hrpt851.pdf, accessed on September 21, 2019

Ibid p xxxiv

[30] Mandiant, MTRends: The advanced persistent threat (Mandiant, 2010) pp 1-2, 10, https://www2.fireeye.com/rs/fireye/images/PDF_MTrends_2010.pdf?, Accessed on September 22, 2019

[31] Emil Protalinski, “NSA: Cybercrime is ‘the greatest transfer of wealth in history’”, ZDNet, July 10,2012 https://www.zdnet.com/article/nsa-cybercrime-is-the-greatest-transfer-of-wealth-in-history/, accessed on September 28, 2019

[32] Mandiant, “APT1: exposing one of China’s cyber espionage units,” Mandiant n.d., https://www.fireeye.com/content/dam/fireeye-www/services/pdfs/mandiant-apt1-report.pdf, accessed on August 27, 2019

[33] Testimony of Dr Larry M Wortzel before the House Committee on Foreign Affairs on March 28, 2012 at a hearing on “Investigating the Chinese Threat: Military and Economic Aggression,” https://www.uscc.gov/sites/default/files/Wortzel_2012%203%2028_HFAC_Testimony_Cyber_Espionage.pdf, accessed on September 12, 2019

[34] National Science Board, “Science & Engineering Indicators 2018,” https://www.nsf.gov/statistics/2018/nsb20181/, accessed on September 12, 2019

[35] Barbara Casassus, “China predicted to outspend the US on science by 2020,” Nature, 12 November 2018, https://www.nature.com/news/china-predicted-to-outspend-the-us-on-science-by-2020-1.16329, accessed on September 6, 2019

[36] Jeff Tollefson, “China declared world’s largest producer of scientific articles,” Nature, 18 January 2018 https://www.nature.com/articles/d41586-018-00927-4. The report cites the study of the US National Science Foundation. Accessed on September 26, 2019.