-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Soumya Bhowmick, Roshan Saha and Pratnashree Basu, “India and Australia: From 4000 nautical miles to 22 yards”, ORF Occasional Paper No. 219, October 2019, Observer Research Foundation.

There are manifold aspects to enhancing bilateral ties between India and Australia. For one, the two countries share a long history of military cooperation dating back to the First World War. Bilateral cooperation in various domains have lasted over the past century, and in November 2014, the two signed a benchmark deal to enhance their defence relationship[1] when Indian Prime Minister Narendra Modi visited Australia. Modi’s trip was preceded two years earlier by the ‘Asian Century White Paper’, a document released by the Australian Government providing a roadmap for broader relations with Asian countries, including India.[2] The second phase of India’s Look East Policy also expanded to include Australia with a prime focus.[3] In the subsequent years, various other agreements were signed by India and Australia covering different aspects of their relationship (see Table 1).

Table 1: Recent Agreements between India and Australia

| Events | Agreements |

| In 2017, during then Australian Prime Minister Malcolm Turnbull’s state visit to India, six bilateral agreements were signed between India and Australia.[4] |

● Cooperation in Combating International Terrorism and Transnational Organized Crime ● Promotion and Development of Cooperation in Civil Aviation Security ● Cooperation in the field of Environment, Climate and Wildlife ● Cooperation in Sports ● Cooperation in the field of Health and Medicine; ● Implementation arrangement between ISRO and Geoscience Australia on Cooperation in Earth Observation and Satellite Navigation. |

| In 2018, during the Indian President’s maiden visit to Australia, five Memorandums of Understanding (MoUs) were signed.[5] |

● Cooperation to deliver services to the differently-abled ● An agreement between Invest India and Austrade to facilitate bilateral investment ● To foster scientific collaboration and innovation between the Central Mine Planning and Design Institute, based in Ranchi, and the Commonwealth Scientific and Research Organisation, based in Canberra ● Cooperation in agricultural research and education between the Acharya N.G. Ranga Agricultural University, Guntur, and the University of Western Australia, Perth ● Joint PhD agreement between the Indraprashta Institute of Information Technology, Delhi, and the Queensland University of Technology, Brisbane. Additionally, in January 2019, during the Australia-India Educational Council Meeting (AIEC), several MoUs were signed, underlining the efforts by both sides to encourage academic collaboration.[6] |

Source: Ministry of External Affairs, Government of India and ANI, Sydney, Australia

In recent years, a renewed debate regarding the unfolding economic and maritime dynamics in the Indo-Pacific – a term which in itself demands a reimagining of maritime geographies comprising the Indian and Pacific Oceans – has necessitated a more invested approach not only by the littoral countries but external powers such as the US as well. India and Australia, as fellow democracies with a shared interest in the protection and preservation of freedom of navigation and overflight in the Indo-Pacific, are natural partners in this regard. The Indo-Pacific region has the potential to facilitate connectivity and trade between India and Australia.

Despite the recent changes in the governments of both Australia and India, the commitment remains to strengthen commercial and security ties between the two sides. The report, An India Economic Strategy to 2035,[7] submitted to the Australian Government by Peter N. Varghese in 2018 recommends the raising of India to their “top three export markets, to make India the third largest destination in Asia for Australian outward investment, and to bring India into the inner circle of Australia’s strategic partnerships, and with people-to-people ties as close as any in Asia.” Indeed, there are huge untapped areas for enhancing bilateral trade and FDI.

It would do both countries well to utilise current innovations in digital trade; such digitisation of economic activities have changed the landscape of trade, enhancing associations between economies and, in particular, South-South flows.[8] Even as the participation in soaring international trade flows have so far been restricted to only a few leading nations,[9] India and Australia can expand their trade networks by rethinking their products, assets, and organisational structure. The latter includes digital technologies, including digitisation of the maritime links within the two countries and also the rest of the world. Apart from trade, the trilateral dynamics between ASEAN, Australia and India is evident in policy areas such as maritime security, climate change, energy security, law enforcement, governance and the politics of security institutions.[10]

McKinsey’s Connectedness Index[a] ranks Australia at 27 and India at 30 with scores of 9.7 and 8.5 (out of 100) respectively.[11] Such low scores suggest much scope for improvement of both countries in terms of their connectedness with the world markets. Against the backdrop of China’s ambitious One Belt One Road (OBOR) project to increase global physical connectivity, the Australian High Commissioner to India recently stressed upon the joint financing of infrastructure between India and Australia in the Indo-Pacific to strengthen the economic order in the region.[12] Conversely, finding the scope for India-Australia networks will not only enhance efficiency in productivity and profitability, but also produce viable infrastructure and business environments.

The Modi government’s flagship programme, ‘Make in India’ launched in 2014, aims to convert India into a manufacturing hub focusing on export-oriented growth. The scheme is designed to attract foreign direct investment (FDI) for physical infrastructure, and use such growth to ameliorate domestic unemployment and income inequality. A study[13] by the Lee Kuan Yew School of Public Policy, National University of Singapore (NUS) found that FDI inflows into India’s manufacturing sector dropped from USD 9.6 billion in 2014-2015 to USD 8.4 billion in 2015-2016, and FDI inflows into the same sector dropped from 35 – 40 percent of total FDI in 2011-2012 to 23 percent of total FDI in 2015-2016. This is because most of the FDI is absorbed in the services sector in which India enjoys an established comparative advantage. Statistics from India’s Ministry of Commerce and Industry[14] indicate that there is a fall in the FDI inflow from Australia to India from US$ 518.64 million in 2010-12 to US$ 260.49 million in 2016-18.

Both India and Australia are competing to attract FDI in the global market.[15] While Australia’s Ease of Doing Business[b] rank fell from 14 in 2017 to 18 in 2018, India’s improved from 100 in 2017 to 77 in 2018.[16] Indian investment in Australia is underdeveloped as well. This has been recognised in Varghese’s report to the Australian Government in 2018[17] which identifies the potential for large-scale Indian direct investment in Australia to address the security of supply in the domains of India’s energy and infrastructural needs.

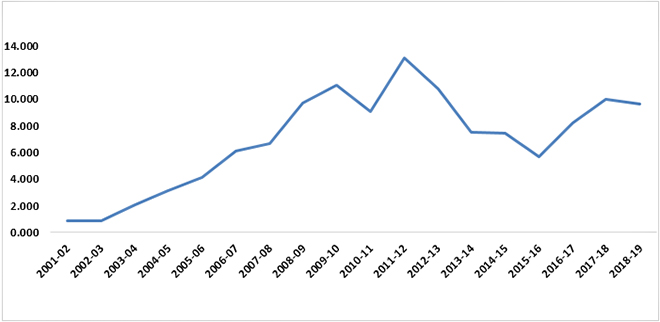

India’s trade deficit with Australia has been increasing since 2001-02[18] (see Figure 1). A particularly significant rise in the deficit was recorded in 2011-12, just after the negotiations for an India-Australia Free Trade Agreement was launched; it is also a contentious issue in the ongoing RCEP negotiations.[19] While policymakers are concerned about the impact of burgeoning trade deficits, there are certain caveats in place. The nature of goods being imported is important to understand the effects of such trade deficits. Imports of intermediate inputs would enhance the export-competitiveness of domestic firms and boost the ‘Make in India’ campaign, in addition to curbing cost-push inflation in the domestic economy.

However, if final consumption goods are imported, the effects would be contradictory, with gains for consumers at the cost of producers in the import competing sector. This would have implications for domestic employment and is a major argument usually made by critics of FTAs. To circumvent this problem, India-Australia cooperation in trade and connectivity can exploit the increasing disaggregation of production processes or the Global Value Chains (GVCs). Identifying complementarities in production processes and engaging in trade to facilitate them will help integrate the two economies in a mutually beneficial manner (see Table 4).

Figure 1: India’s trade deficit with Australia (In US$ billions)

New Delhi and Canberra’s partnerships in the global technology ecosystems will have positive bearings on the opportunities for firms in reducing entry costs in the GVCs and enhancing productivity. For example, exploring technological advancement in the Australian agri-business is of paramount importance to India. The Australian Trade and Investment Commission reports:[20] “Australia is an ideal long-term partner to help improve the quality, safety, availability and nutritional value of Indian food production. From farming practices through food processing, supply and distribution to consumers, the Australian agribusiness sector has the research and development (R&D) capacity, experience and technical knowledge to help India’s food industry improve supply chain productivity and sustainability and meet the challenges of shifting consumption patterns.” Since a majority of Indian workforce (54.1 percent according to the 2011 population census)[21] are engaged in agriculture and allied activities but their contribution to GDP is not commensurate, partnerships with Australia in the fields of R&D, technical knowledge and sustainability practices would provide long-term benefits for India.

Digitising the value chains would mean shifting from a linear model of information flow (i.e., from supplier to producer to distributor to consumer, and back), to a model where the instruction flow is multi-directional.[22]This will reduce costs and increase the ease of doing business. It has to be understood, however, that digital trade in the GVCs will be redundant in the absence of international agreements and consensus on the uses of internet and data.[23]

Technology is a game changer[24] in the field of agriculture which will help resolve issues along the value chain that are currently affecting Indian agriculture. It will aid in tracking the produce from the farm to the table, reducing wastage and ensuring food safety in the process. Further, digitisation of the supply chain will enable monitoring data on volume, prevailing prices and inventory levels and therefore resolve issues related to price discovery.[25] However, digitisation of agricultural supply chains would require technological literacy amongst farmers, which is a major shortcoming in India. There are also associated costs with such a move as technological intervention will act as a disruption in the archaic agricultural systems in India. The electronic National Agricultural Market (e-NAM) scheme of the government of India is trying to introduce digitisation in agriculture. Therefore, a more integrated Indo-Australian approach towards digitising the supply chain management is extremely important for long-term benefits for both nations. Australia already has an established advantage in this field.

The report to the Australian Government in 2018[26] has highlighted immense potential in areas such as education, mining and resources, agribusiness, tourism, energy, health, infrastructure and financial services sectors. These sectors could drive bilateral investments and trade. Therefore, it is imperative to understand the nature of trade between the two countries and analyse the trade deficit numbers. Trade deficits are not necessarily bad[27]and should not restrict the two countries from exploiting the existing potential. Over the period 2010-11 to 2018-19, Australia’s share in India’s total trade has been around two to three percent.[28] Notwithstanding the large share of China, these figures indicate that Australia has been among India’s top 25 trading partners. The dominance of Indo-Pacific countries in India’s trade profile (10 out of 25)[29] reflects the presence of India in the region’s value chain factory.[30] Fostering deeper integration between India and Australia will provide the necessary impetus to the immense growth potential of the trade blocs in this region.

The Centre for International Economics (CIE) has created an econometric model[31] to predict the impacts of trade liberalisation agreements between India and Australia. The size of gains from trade will depend upon several factors; foremost are the relative size of existing trade and investment barriers, the contribution of exports and imports to GDP, and the extent and composition of bilateral trade.[32] This opens up new areas to consider in the aspect of Indo-Australian trade deals.

Australia has followed a policy of trade liberalisation since the foundation of the General Agreement on Tariffs and trade (GATT) in 1948, to the formation of the World Trade Organization (WTO) in 1995 and more recently, the negotiations for a Regional Comprehensive Economic Partnership (RCEP). For its part, India only began to integrate itself into the world economy in the 1990s, during a period of economic reforms. Up until that time, India had been part of various trade negotiations, of which only the Asia-Pacific Trade Agreement of 1976 came to fruition. All other agreements between India and its trading partners have been negotiated after 2002, with the Indo-Nepal Free Trade Agreement being the first one.

Any removal of trade barriers between the two countries will give greater gains to Australia. This is primarily because Australian exporters have greater access to the lucrative Indian market, than the other way around. However, expansion of trade between the countries will nurture the economies of scale that would in turn help in increasing the long-term benefits over the short-term costs.

Moreover, India, along with Vietnam, is one of the fastest growing trade partners[33] of Australia. These factors suggest that there will be gains from trade for both partners. But this is going to benefit Australia more because they will be able to exploit the opportunities in India that were previously unavailable to them. The value of India’s trade intensity index with Australia is also greater than 1 over the years (see Table 2), reflecting the importance of Australia as a trading partner relative to the rest of world. The trade intensity index (TII)[34] is largely driven by the share of imports from Australia. The value of import intensity index (III)[35] is also greater than the values of export intensity index (EII), but less than 1.[c] These indicate that there remain opportunities for India to expand its exports with Australia.[36]

Table 2: India’s trade indices with Australia

| Year | Import Intensity Index | Export Intensity Index | Trade Intensity Index |

| 2008 | 0.349 | 0.063 | 2.230 |

| 2009 | 0.394 | 0.059 | 2.420 |

| 2010 | 0.226 | 0.050 | 1.560 |

| 2011 | 0.229 | 0.059 | 1.720 |

| 2012 | 0.206 | 0.054 | 1.470 |

| 2013 | 0.176 | 0.058 | 1.290 |

| 2014 | 0.198 | 0.074 | 1.440 |

| 2015 | 0.232 | 0.106 | 1.670 |

| 2016 | 0.275 | 0.094 | 1.660 |

Source: Ghosh et al. (2018)

Australia enjoys comparative advantage in agriculture and processed food sectors, i.e., sectors where India has imposed trade and non-trade barriers. However, the bulk of Australian exports to India are in three sectors: non-ferrous metals, coal, and other minerals.[37] Similarly, the services sector is affected by the so-called “low base effect”,[38] or the existence of relatively low levels of trade in certain sectors such as agriculture and services. Owing to non-trade barriers such as Sanitary and Phyto-Sanitary (SPS) measures,[d] some of the products where Australia has a genuine comparative advantage are not exported in substantial amounts to India. Removal of trade barriers would lead to an increase in the exports of these commodities, although the increasing number of disputes at the WTO[39] with regard to the Australian sector can act as a serious impediment.

According to DFAT (2019),[40]Australia’s relatively lower share of services trade with India (4.3 percent)[e] can be attributed to legislative barriers such as licence requirements. India has imposed higher barriers to services trade, maritime trade, telecommunication and other business sectors vis-a-vis Australia. As a result, when trade barriers are eliminated by trade agreements, the services sector might become more competitive than was apparent and more substantial trade could commence after liberalisation. In this context, the importance of digital infrastructure in India again comes to the fore while moving towards trade structures involving intangibles such as IT and services.

Exports from Australia, such as wheat, textiles and clothing, vegetables and fruits, forestry and communication services are likely to increase by 2.7, 9, 9.4, 9.7 and 3.5 percent, respectively by 2020.[41] Although these predictions had been made as part of a feasibility study for the Australia-India FTA in 2008 by CIE, the results provide an indication of the direction and magnitude of trade. Similarly, for India, the results indicate an increase in exports of wheat, minerals and energy, metal, machinery and other manufacturing products by 4.8, 8.2, 9, 0.9 and 1.3 percent, respectively.[42] These results reiterate that the gains are likely to be larger for Australia than India when looked at from the point of view of exports and imports.

The dilemma in creation of trade blocs often arises from the contrasting views of the stakeholders.[43] The booming agribusiness in Australia is expected to take up a substantial amount of the Indian market space. In fact, there is a growing fear that the RCEP will worsen the domestic production of Indian dairy and agriculture sectors which are lagging behind in competition with Australia and New Zealand.[44] However, given the surge in trade protectionism across the globe— with US-China trade wars and Brexit talks—the RCEP initiative will be the largest trade bloc in Asia and the biggest FTA that India will ever participate in.[45] On a macroeconomic scale, experts such as Natraj and Sahdev (2019)[46] believe that such short-term costs will be overpowered by the long-term benefits and the only way to promote ‘Make in India’ is by participating in the Asian value chains that begins or ends in India.

If the gains from any trade deal with Australia are going to be skewed, why would India want to participate in such a deal? Unequivocally, India’s national interests supersede other benefits; at the same time, however, there is a need to examine the nature of trade between the two countries. Scholarly efforts have been made towards this, and while many[47] of them have been highly skeptical about the worsening of trade deficits following a trade deal, others[48]offer a more holistic understanding of the impacts of an FTA. These are spread across the production and consumption sectors of an economy. Unless an empirical estimate of production gains (or losses) vis-à-vis consumption losses (or gains) is arrived at, it would be fallacious to interpret a widening trade deficit due to an FTA as necessarily “bad”.

A key argument in favour of a trade deal is its impact on the value chain. With growing fragmentation of production processes across the world, it is important to analyse the composition of intermediate goods in the total volume of trade between two countries. A higher share is likely to indicate the bilateral import of cheaper inputs which enhance the competitiveness of the export sectors.

Table 3: Share of intermediate goods in total exports (%)

| Year | Australia’s Exports | India’s Exports |

| 2005 | 49 | 45 |

| 2006 | 50 | 46 |

| 2007 | 49 | 43 |

| 2008 | 59 | 42 |

| 2009 | 48 | 37 |

| 2010 | 63 | 39 |

| 2011 | 68 | 40 |

| 2012 | 68 | 39 |

| 2013 | 79 | 34 |

| 2014 | 82 | 30 |

| 2015 | 72 | 23 |

| 2016 | 79 | 24 |

| 2017 | 83 | 21 |

| 2018 | 83 | 26 |

Source: OECD Statistics (TiVA database)

Table 3 suggests that the share of intermediate goods in Australia’s total exports to India has been increasing, while that of India’s has been decreasing. This does not imply that the volume of exports from India to Australia have gone down; rather, it shows the integration of Australian exports into India’s production processes. The year 2015 saw the steepest decline in the share of intermediate goods in India’s total exports to Australia. In the same year, total exports to Australia grew by 17.28 percent.[49] There was an increase in the share of final goods in India’s total exports to Australia. These figures increased to 35.65 percent during 2017-18. Therefore, as discussed earlier, a rise in trade liberalisation is going to increase the flow of exports from Australia to India (and vice versa). Depending upon the type of goods flowing between the two countries, the welfare effects are going to vary. Since the share of exports to India from Australia is dominated by the presence of intermediate products, it is tantamount to a reduction in the cost of production. This is going to make Indian exports more competitive in the world markets. Although the trade deficit with Australia has been widening, it need not necessarily be viewed with suspicion; instead, it is important to conduct a deeper analysis of potential commodities to be traded.

Table 4: Sector-wise share of intermediate goods (%)

| Agriculture (share of intermediate goods) | Mining (share of intermediate goods) | Manufacturing (share of intermediate goods) | ||||

| Year | Imports from India | Imports from Australia | Imports from India | Imports from Australia | Imports from India | Imports from Australia |

| 2005 | 64 | 69 | 89 | 100 | 44 | 11 |

| 2006 | 60 | 51 | 96 | 100 | 44 | 12 |

| 2007 | 71 | 56 | 94 | 100 | 40 | 12 |

| 2008 | 57 | 52 | 92 | 100 | 42 | 15 |

| 2009 | 51 | 40 | 98 | 100 | 33 | 9 |

| 2010 | 46 | 60 | 84 | 100 | 39 | 12 |

| 2011 | 44 | 50 | 84 | 100 | 39 | 15 |

| 2012 | 48 | 28 | 86 | 100 | 39 | 17 |

| 2013 | 56 | 39 | 99 | 100 | 33 | 24 |

| 2014 | 57 | 48 | 98 | 100 | 29 | 34 |

| 2015 | 52 | 28 | 98 | 100 | 22 | 34 |

| 2016 | 50 | 45 | 95 | 100 | 23 | 52 |

| 2017 | 54 | 37 | 99 | 100 | 20 | 42 |

| 2018 | 52 | 67 | 98 | 100 | 25 | 41 |

Source: OECD Statistics (TiVA database)

Furthermore, data shows that imports of intermediate goods from Australia are dominated by the mining and quarrying sector. Entire imports of mining and quarrying products are in the form of intermediate goods, essentially depicting the nature of the commodity traded in this sector. Bilateral exports in the agriculture sector are also dominated by intermediate goods (see Table 4).

In the manufacturing sector, however, the share of intermediate goods is relatively low. Therefore, Australian imports into India would have differential impacts on the domestic economy depending upon the relative share of products in India’s import basket. As mining is one of the major import items from Australia to India, it is expected to occupy a majority share in the value of total imports; conversely, its share in India’s trade deficit is also likely to be high. However, since 100 percent of the imports of mining and quarrying products are of an intermediate nature, the trade deficit vis-à-vis Australia might not be as detrimental to the economy as perceived to be. More recently, allowing 100 percent FDI under the automatic route for the sale of coal, coal mining activities including associated processing infrastructure, will further boost the mining sector. This is in addition to the present 100 percent FDI in coal and lignite mining sector for captive consumption by the power projects, under the recent proposal by the Government of India.[50]

In the same vein, imports of manufacturing are dominated by final products and the implications are different. Higher imports of manufacturing products imply declining market share of domestic firms and, in turn, loss in employment. However, it could lead to efficiency gains as scarce resources would be diverted from the inefficient sector to other more efficient ones. These efficient sectors would observe an increase in demand due to larger market access and demand from Australia, owing to the trade agreement, and can drive employment and efficiency gains further in the long term. However, given the trends in manufacturing sector trade, both countries should harness the trade potential of manufacturing intermediates which remain relatively unexplored.

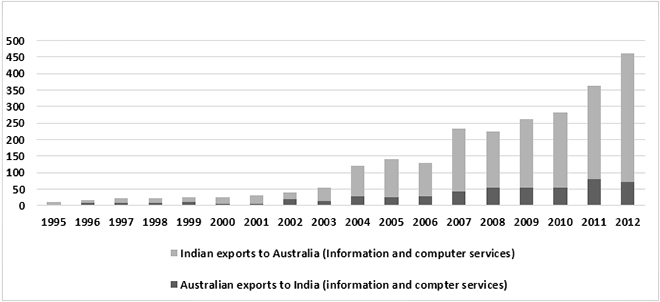

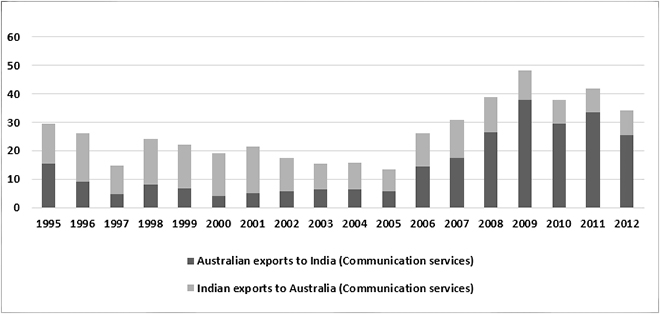

Information and Communication technology (ICT) services are one of India’s major export products and a potential area where complementarities might exist between the two nations. Within export of services, India exports a relatively higher amount of information and computer services to Australia; Australia has been exporting a relatively higher amount of communication services to India after 2006.

Figure 2 (A): Bilateral export of information and computer services (in US$ million)

Figure 2 (B): Bilateral export of communication services (in US$ million)

As mentioned earlier, however, the share of services trade is still low. It is in India’s interests to exploit the pool of human capital, and expand its exports of services.[51] This is where its comparative advantage has gradually evolved and where India would benefit from maximum liberalisation. However, existing barriers to trade in services (such as restrictions in FDI and licensing requirements) have hampered services trade. The accommodative stance taken by the Indian government towards FDI, with new avenues gradually opening up for foreign investors[52] is a positive sign for Australian investors. At the same time, Australia and India need to negotiate agreements on Mode 4[f] of trade in services.

This is a debatable issue in the ongoing RCEP negotiations as well, where India’s overall trade deficit is increasing over the years (to begin with, India has huge trade deficits with most of the RCEP members). While the negotiating partners in RCEP have been insisting India to open up its goods market, there is reluctance in acceding to India‘s demand for liberalisation in services.[53]The domestic industry in India is also wary about China’s participation in the RCEP[54] that might weaken the competitiveness of Indian products in the trade bloc while providing easier access of Chinese goods to the Indian markets.

Any agreement with Australia on services trade must take into account the abovementioned factors. Domestic policies in India must resonate with these as well, and facilitate larger trade in services. With the dominance of intermediate goods and huge potential in the services sector, especially information and communication technology, trade agreements with Australia could bode well for both economies. It will further strengthen their strategic and political convergences with respect to the Indo-Pacific.

There is a certain ambiguity regarding India’s position in Australia’s strategic imagination. In this respect, the urge on Australia’s part to form “broader habits of cooperation”[55] is complementary with India’s intent of developing maritime partnerships with countries beyond its immediate maritime neighbourhood. Collaborative efforts between India and Australia should be at the helm of facilitating trade in the region.

The Indo-Pacific accounts for 60 percent of global maritime trade[56] that transit through the region. It opens up a plethora of opportunities for harnessing commerce in this region. Indeed, regional cooperation between the Indo-Pacific countries is often looked at for smoothening FDI flows, trade cooperation and even combating climate change.[57] Maritime cooperation is of utmost importance in reshaping the trade structure in the Indo-Pacific, with focus on liner shipping networks, port infrastructure, operational efficiencies, enhancing maritime performance in terms of new technology and digitalisation, decreasing carbon emissions, maritime piracy, and supply chain integration.[58] Regional integrations and reliable international bandwidth is key to unlocking the logistical ease in the Indo-Pacific that could be mutually beneficial for the countries involved.

For the better part of its post-independence history, India has demonstrated a decidedly continental approach,[59] largely neglecting its immediate ocean space. In recent years, India has increasingly shown the intent and willingness to not only develop its maritime capabilities but to engage and expand the horizon of its maritime outlook. The shift from the coinage ‘Asia-Pacific’ to ‘Indo-Pacific’, among other factors, also acknowledges the role and position of India.

While there are varying interpretations of the eastern and western extent of the Indo-Pacific, the opinion in Canberra views it as comprising the eastern Indian Ocean and the western Pacific Ocean.[60] The region is home to aspiring economies that are negotiating ways of approaching the dynamics unfolding in the region, a large part of which has to do with the gradual yet definitive influence that Beijing is projecting—politically, economically and militarily. In recent years, Australia has shown more enthusiasm about engaging with the region, especially since 2012-2013 when the Indo-Pacific construct was identified as a critical theatre for Australian security; as a corollary, the role of India as Australia’s strategic partner was acknowledged.[61]

The term ‘Indo-Pacific’ has gained currency over the last decade with the US’ rebalancing towards Asia, the growing presence of China in the immediate neighbourhood, and the concurrent rise of India as a more engaged country than it earlier was. New coalitions of states are being created,[62] with complex interactions that often cannot be classified as entirely cooperative or entirely conflicting. For instance, China’s expansive OBOR project has elicited mixed responses: many countries are wary of the actual intent and ambition of China; yet a number of countries have been unable to discount the promise of infrastructure and connectivity offered by OBOR. Although neither India nor Australia are members of the OBOR—primarily due to concerns over security and unsustainable debt burden—they are not, in any sense, less encumbered by the dynamics posed by OBOR in the Indo-Pacific. This has only added to already existing tenuous circumstances.

Opinion in Australia has been divided over where and how to draw the balance[63] between economic engagement with China, on one hand, and a military-diplomatic balancing against China, on the other. In October 2018, the release of an MoU between the Government of the State of Victoria and the National Development and Reform Commission of the People’s Republic of China on Cooperation within the Framework of the OBOR initiative led to disquiet in Australia. The federal government stressed that aspects covered under the MoU fall within the purview of the federal government and that Australia stood firmly against participating in the OBOR. Officials in the state of Victoria, on the other hand, claimed that the move would be beneficial for the creation of jobs and business opportunities.[64] This, together with allegations in recent years of Beijing’s involvement in Canberra’s domestic affairs,[65] is symptomatic of the differences of opinion within Australia’s political establishment regarding the country’s relationship with China.

A similar debate is prevalent in India. The country is not keen on identifying itself as a party to endeavours that may be viewed as being solely aimed at containing China; at the same time, it aims to maintain its position on matters related directly to its national interest. Indeed, India has stood firm on its opposition to OBOR, as the inclusion of the China-Pakistan Economic Corridor (CPEC) in OBOR are in contravention to India’s sovereignty. (CPEC, as designed, will pass through parts of the Indian union territory of Jammu and Kashmir, which according to India, is unlawfully occupied by Pakistan.)

In the short term, it is unlikely that geopolitical developments will escalate to overt conflict. Even so, the Indo-Pacific littorals recognise the need to strengthen institutional cooperation mechanisms to preserve international norms. As Varghese notes, “an ‘engage and balance’ strategy is the best alternative to the dead end of containment.”[66] The role of the US is of particular importance as it has recently been a driver of efforts towards bringing similarly aligned states in counterbalancing China. The evolving relationship between New Delhi and Washington has helped close the gap in terms of potentials for Indian engagement within the Indo-Pacific.[67] India—and to a greater extent, Australia—have developed ties with the US which have diversified over the years, and this stands to have a positive impact on ties between New Delhi and Canberra especially with regard to geopolitical pulls in the region. It is in this context that regional convergence frameworks such as the Quadrilateral Dialogue (or the ‘Quad’ comprising the US, Japan, India and Australia) need a clearer vision of areas of collaboration. While India has been reticent about the grouping, the Quad offers the potential to be a singular platform for the larger areas of cooperation in these waters. Being geographically more proximate than the US or Japan, India and Australia can emerge as leading forces for the Quad. In this sense, India and Australia can work bilaterally as well as push for multilateral efforts that focus on the wider connotations of the Indo-Pacific, moving beyond rhetoric and measures that are solely centred on balancing China. Tiptoeing around the China conundrum will make it increasingly more difficult for the two countries to undertake constructive measures.

Besides collaboration through institutional mechanisms such as the Quad, bilateral naval cooperation has evolved as an important aspect of partnership in terms of strategic collaboration in the maritime sphere. For instance, Australia has participated in the MILAN exercises as well as the bilateral AUSINDEX exercises. The 2019 edition of the exercise included more than 1200 personnel from Australia and focused on interoperability, anti-submarine warfare, incorporating maritime patrol and reconnaissance aircraft.[68] Graham writes that the defense establishment in Australia is looking to re-establish a forward military presence[69] which had declined since the 1990s. The Indo-Pacific Endeavour exercises, submarines and vessels patrolling the South China Sea and a naval Base in Papua New Guinea are efforts worth mentioning in this context. New Delhi’s participation in the International Fleet Review marked a significant move towards deepening bilateral naval ties. The fourth edition of the India-Australia Maritime Dialogue took place in 2018[70] with discussions on Maritime Domain Awareness, cooperation in Humanitarian Assistance and Disaster Relief (HADR) and Search and Rescue (SAR), collaboration in scientific research and cooperation in regional Indian Ocean Forums. While the Dialogue has not had a prominent run so far, expectations are higher now in pursuing maritime engagement in areas of shared interest.

The two countries should also explore concrete engagements through multilateral frameworks.[71] The ASEAN Outlook on the Indo-Pacific released in June 2019[72] has been supported by the US, Australia, Japan and India who acknowledged the centrality of the organisation in the region. Indeed, this acknowledgement is vital for the constructive engagement of countries which are not in geographical proximity to the region. As a regional organisation, ASEAN remains significant and it must be involved in any concerted engagement in the Indo-Pacific. The release of the Outlook by ASEAN in itself marks a significant development as the first such instance of validation of the narrative supporting maritime freedom and security – a position which the organisation was previously unwilling to formally declare.

Other frameworks offer additional platforms for maritime cooperation: the ASEAN Regional Forum, the Indian Ocean Naval Symposium (IONS), and the Indian Ocean Rim Association (IORA). In both IORA and IONS, Australia has played prominent roles[73] in the finalisation of the IONS Charter, highlighting illegal fishing practices through the Perth Communiqué. The services of an Information Fusion Centre (IFC) – set up in India – which links all coastal radar chains of countries dotting the Indian Ocean was offered by New Delhi to IORA member states. The IFC began work in December 2018 and is expected to be a hub of maritime data[74] contributing directly to the enhancement of maritime domain awareness, exchange of White Shipping information in addition to the development of expertise in minimising maritime security issues with all communication and procedures taking place virtually.

Canberra’s intent in enhancing ties with New Delhi has been apparent over the course of the past decade[75] while relations have received a boost under the current political dispensation. For deepening bilateral ties, both countries would need to better articulate and expand the scope of their strategic partnership in the maritime domain, and avoid viewing their bilateral engagement through the lens of containing China. While a disassociation of strategic attitudes from balancing against Beijing is perhaps not entirely possible, particularly for Australia, both countries would do well to seek constructive opportunities which can contribute to tangible forms of engagement. For bilateral ties to reach critical mass, the sustenance of political will is imperative. The two should also identify commonalities in their foreign policy approaches which they can leverage to adopt measures that will deliver.

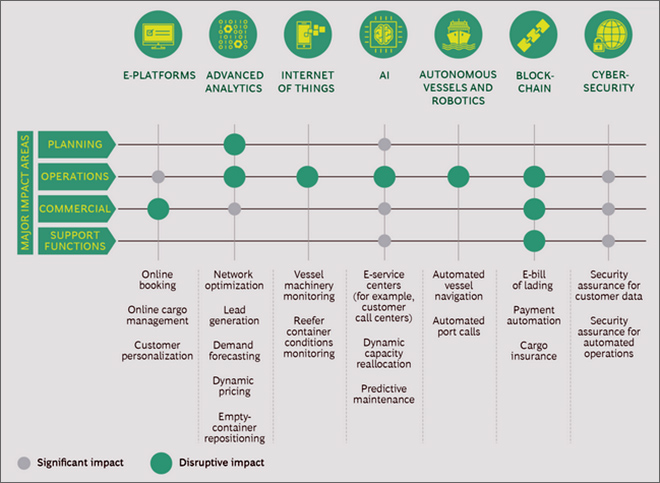

Maritime interactions are also being influenced by advances in science and technology[76] as shipping lines explore the role of digital services and automation and work towards de-carbonising logistics. These processes will act as enablers for maritime commerce; there will be temporary disruptions, however, as in any significant progress.

Collaborations in the digital space pose a wealth of opportunities, ranging from the streamlining of operations and management of seaborne freight to the use of blockchain technology[g] in the maintenance of networks of transactions among relevant stakeholders such as container carriers, port authorities and customs officials. Blockchain can prove revolutionary in automating trade and easing the credit and supply chain processes.[77] Although at a global level, this technology is still not fully developed, it has the potential to become the future of international trade architecture and completely change how the shipping industry functions.

Taking this technology forward, a trade platform called ClearWay intends to collaborate and automate cross-organisational business processes, and at the time of its launch various port operators from 230 marine gateways, ocean carriers, freight operators and custom authorities from countries such as Australia were already participating in the process along with other nations in Europe, Middle East and Asia.[78] Australia’s proactive stance in developing blockchain technology can fill up employment opportunities for the skilled youth in India where blockchain is the fastest growing demanded skill set, with job growth rates of 2000-6000 percent.[79] There is no denying that blockchains will revolutionise the Indian shipping industry towards lower costs and improved economies of scale, but again there exists a growing concern[80] whether India will be able to unlock its human capital and train its workers in blockchain literacy.

There is a clear opportunity for Australian technology companies in partnering with Information & Technology companies in India[81] which are looking to diversify access to funds, accelerating growth and boosting innovation. Specific areas of collaboration include cyber-security, finance and the IoT (Internet of Things) along with up-skilling in Social, Mobile, Analytics, and Cloud (SMAC). In all of these areas, bilateral efforts would complement Australia’s involvement, feeding directly into India’s ‘Digital India’ drive. India lags far behind even smaller nations of the Indo-Pacific littorals when it comes to the application of technology and digital processes; there is room for Australia to get involved. There is potential for bilateral collaboration in areas of defence technology and cyber-security as well. Both these areas offer opportunities for capacity-building, defence research and the identification of technologies[82] such as technical know-how related to the use of nano-materials and sensors, that are required and could be utilised by both militaries.

Figure 3: Impact of digital trends on container shipping

Technology and the pace with which it is evolving have the ability to transform maritime commerce with the aim to make it more agile in terms of operations and flexibility. Container shipping is one of the first sectors to begin entering the digital space with the adoption of technologies that more effectively monitor vessels, offer predictive maintenance, security assurance of client data, and automated payments,[83] among others which would result in significant shifts in container operations.

The absence of adequate measures or ambiguity regarding systematisation of approaches are creating obstacles in the transition process from limiting manual interventions to the employment of digital measures. While there needs to be a better understanding of the functions and resultant impact of digital technology in comparison to the requirements of businesses, the fact remains that this understanding has to move in tandem with ongoing developments. In an industry which has generally been perceived as being unwieldy, especially when it comes to the use of technology, currently, millions of dollars’ worth of investments[84] is being funneled into startups that aim to overhaul the methods and approaches by which business is conducted.

The drive for Digital India in contemporary times may remain unfinished if the focus is not shifted towards leveraging digital technology to enhance trade competitiveness. Table 5 shows the lopsided digitalisation of India’s exports which is biased towards exports of digital services such as computer programming, consultancy activities; information service activities and telecommunications.[85] The value added by digital services to total exports of India in 2014, excluding exports of digital services themselves, is only US$ 5.9 billion as compared to US$ 34.2 billion in the US. The value is also in sharp contrast to India’s own value added by digital services to total exports in 2014 (including exports of digital services) at US$ 51.863 billion. For Australia, there is lesser gap between the values, indicating parity in digitalisation of exports in a homogenous sense, i.e., value added by digital services to exports, including exports of digital services is relatively at par with the value added by digital services to exports, excluding the exports of digital services.

Banga (2018)[86] suggests designing a Digitally Informed Foreign Trade Policy platform with the objective of improving India’s digital infrastructure for overall trade. This can be viewed in terms of enhancing digital content of exports, building digital skills in trade sectors, promoting use of digital technologies in manufacturing exports, and using big data analytics to inform foreign trade policy to improve trade competitiveness. This is the way forward to curb information asymmetries in the international markets, thus rendering them more efficient in the long run. The need to create policy space for trade and investment agreements between Canberra and New Delhi should be given its due importance with respect to stronger bandwidths and bilateral data flows.

Table 5: Value added by digital services to total exports: 2007-2014

|

Value Added by Digital Services to Total Exports (US$ billion) |

Value Added by Digital Services to Total Exports (excluding exports of Digital Services) (US$ billion) |

|||||

| Countries | 2007 | 2014 | % Change | 2007 | 2014 | % Change |

| USA | 38.603 | 58.509 | 52 | 23.865 | 34.230 | 43 |

| India | 35.534 | 51.863 | 46 | 2.829 | 5.948 | 110 |

| Australia | 3.587 | 5.730 | 60 | 2.824 | 4.346 | 54 |

Source: Research and Information System for Developing Countries (RIS)

India’s Ministry of Information and Technology aims to create over US$ 1 trillion in economic value from the digital economy by 2025, by leveraging on digital ecosystems in various sectors.[87] The Minister of Information Technology claims that “Digital India is also an opportunity for people in digital space to do business in India. The size and scale that India offers is a big business opportunity for global companies.”[88] Against the backdrop of growing importance of the Indo-Pacific and the stress on Digital India, this paves the way for a symbiotic relationship between India and Australia through complementarities in digital trade and investments.

In India, great interest is expended on the logistics sector which is also in tandem with the government’s push for the establishment of improved port infrastructures and port operations. Maersk, the world’s leading container carrier and holding the majority market share in India, has established a “startup partnership group”[89] with seven Indian tech startups under its “OceanPro” accelerator programme geared towards the development of innovation in smart technologies to streamline maritime commerce. The programme is also expected to position New Delhi as a hub[90]for technology solutions related to container logistics. In terms of infrastructure, especially shipping, hinterland connectivity and multimodal logistics, India has plenty of room for improvement. Australia, for its part, holds a competitive advantage[91] in this regard with world-class transport infrastructure services.

With technological expertise and knowhow in design, construction and maintenance efficiency services, Australia can contribute in the upgrade of logistics infrastructure. In terms of Overseas Development Assistance (ODA) as well, the recently announced South Asia Regional Connectivity Initiative (SARIC)[92] is set to focus on connectivity infrastructure and energy. The AUD 25 million SARIC programme will be rolled out over a period of four years and signals Australia’s intent to catch up on its involvement in South Asia.

This paper has four inter-related contentions. First, the changing landscape of economic and strategic diplomacy between India and Australia can be leveraged by harnessing the comparative advantages of goods and services, formation of trade blocs, underpinning strategic collaborative efforts in the Indo-Pacific, and digitising the value chains involved. Second, India should not be over-cautious about its trade deficits with Australia. Rather, it is more important to address other equally pertinent issues such as the nature of commodities being traded and their subsequent effects on the producers, consumers and governments. As a corollary principle, trade deficits should not dictate the terms of negotiations for a trade deal. India should instead focus on the trade in intermediaries, especially in the manufacturing sectors.

It cannot be overemphasised that it is important to concentrate on various other underdeveloped and undervalued sectors such as agriculture, education, tourism and services. Allowing New Delhi’s demand for liberalisation of services, duly noting the need for digital infrastructure to facilitate this, will be beneficial for the trading partners in the region.

Third, enhancing maritime connectivity in the Indo-Pacific is of utmost importance in the face of India and Australia’s efforts at strengthening bilateral ties. The two countries should promote people-to-people, business-to-business and people-to-business interconnectedness in the region. Not only is the Indo-Pacific important from the perspective of commerce, but also for the geopolitics and geo-strategy.

Finally, the drive for Digital India, Canberra’s drive for digital innovations to fit into the fourth industrial revolution,[93] along with the global upsurge in digital infrastructure—especially the advent of blockchain technology—are highly complementary in increasing access in the maritime spaces, bringing down costs and augmenting the feasibility of trade opportunities between India and Australia.

Authors’ Note: We thank the two anonymous reviewers for their valuable comments on an early draft of this paper. The authors would also like to thank Dr. Nilanjan Ghosh, Director, ORF Kolkata, for his useful inputs and support on this project.

[a] Based on goods, service, finance, people and data flow values and intensity.

[b] The World Bank’s ‘Doing Business’ project provides objective measures of business regulations for local firms in 190 economies and selected cities at the subnational levels.

[c] A value greater than 1 indicates that the share of Partner country in the Home country’s export, import or total trade is larger than the Home country’s share with the rest of the world.

[d] According to the WTO, the SPS measures set out the basic rules for food safety, animal and plant health standards. Article 20 of the General Agreement on Tariffs and Trade (GATT) allows governments to act on trade in order to protect human, animal or plant life or health, provided they do not discriminate or use this as disguised protectionism.

[e] As compared to Australia’s share of services trade with the US (14.3 percent), China (11.2 percent), UK (7.7 percent), Singapore (5.7 percent) and New Zealand (6.1 percent) at 2018 values.

[f] WTO terminology for cross-border mobility of skilled labour and professionals.

[g] Blockchain technology is a decentralized, distributed record of transactions stored in a permanent and almost unalterable way using cryptography. Blockchains rely on a peer-to-peer network beyond the control of a centralized authority. Authentication of transactions is achieved through cryptographic means which determines the rules of ledger updation that allows participants to collaborate without having to rely on a single trusted third party.

[1] Aditi Malhotra, “Modi’s Visit to Australia”, The Wall Street Journal, November 18, 2014.

[2] “As it happened: Australia in the Asian century“, ABC News, October 29, 2012.

[3] Purusottam Bhattacharya, Saikat Sinha Roy and Anindyo J. Majumdar, “India and Australia: The Look East-Look West Impulsion,” in Power, Commerce and Influence: India’s Look East Experience, edited by Rabindra Sen, Tridib Chakraborti, Anindya J. Majumdar and Shibashis Chatterjee, Lancer Books, New Delhi, 2009.

[4] “List of MoUs/Agreements exchanged during the State visit of Prime Minister of Australia to India (April 10, 2017)”, Ministry of External Affairs, Government of India.

[5] ANI,“India, Australia exchange five MoUs”, Business Standard, November 22, 2018.

[6] “7 agreements/MoUs were signed between Indian and Australian Institutions in the 4th Australia-India Education Council Meeting (AIEC),” Press Information Bureau, Government of India, January 7, 2019. Accessed at: https://mhrd.gov.in/sites/upload_files/mhrd/files/lu4165.pdf

[7] Peter N. Varghese, An India Economic Strategy to 2035 (Department of Foreign Affairs and Trade, Australian Government, 2018).

[8] James Manyika, Susan Lund, Jacques Bughin, Jonathan Woetzel, Kalin Stamenov and Dhruv Dhingra, Digital Globalization: The New Era of Global Flows (Mckinsey Global Institute, 2016): 1-23

[9] Ibid.

[10] ASEAN-India-Australia: Towards closer engagement in a New Asia, ed. William T. Tow and C.K. Wah (Institute of Southeast Asian Studies, 2009).

[11] Supra note 8.

[12] Elizabeth Roche, “Australia urges India to play a greater role in shaping regional trade order”, Livemint, June 12, 2019.

[13] Khee Giap Tan, Sasidaran Gopalan, Jigyasa Sharma and Tan Kong Yam, Inaugural 2016 Ease of Doing Business Index on Attractiveness to Investors, Business Friendliness and Competitive Policies (EDB Index ABC) for 21 Sub-National Economies of India (Asia Competitiveness Institute, National University of Singapore, 2016).

[14] “FDI Statistics”, Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry, Government of India.

[15] Supra note 7.

[16] “Doing Business”, The World Bank.

[17] Supra note 7.

[18] “Export Import Data Bank”, Department of Commerce, Ministry of Commerce and Industry, Government of India.

[19] Nilanjan Ghosh, “The costs of India’s participation in the RCEP”, Observer Research Foundation, January 24, 2019.

[20] Agribusiness – Food Value Chains(Australian Trade and Investment Commission, Australian Government, 2017).

[21] M. Venkatanarayana and Suresh V. Naik, “Growth and Structure of Workforce in India: An Analysis of Census 2011 Data“, Munich Personal RePEc Archive (May 2013).

[22] Global Value Chain Development Report 2019: Technological Innovation, Supply Chain Trade, And Workers In A Globalized World, ed. David Dollar, Emmanuelle Ganne, Victor Stolzenburg and Zhi Wang (World Trade Organization, Institute of Developing Economies, Organisation for Economic Co-operation and Development, Research Center of Global Value Chains, World Bank Group, China Development Research Foundation, 2019): 1-7.

[23] Ibid.

[24] Debashish Mukherjee, “Agriculture a fertile ground for digitization“, Livemint, December 19, 2016.

[25] Ibid.

[26] Supra note 7.

[27] Robert Z. Lawrence, “Five Reasons Why the Focus on Trade Deficits Is Misleading,” Peterson Institute of International Economics Policy Brief 18, no. 6 (March 2018).

[28] Supra note 18.

[29] Ibid.

[30] Yasuyuki Sawada and Fahad Khan. “’Factory Asia’ and Growing Global Value Chains”, BRINK, August 7, 2017.

[31] Centre for International Economics, Australia, Economic Modelling for the Australia–India FTA Feasibility Study (September 2008).

[32] Ibid.

[33] Sam Clench, “South China Sea tensions loom over Scott Morrison’s crucial visit to Vietnam”, News Corp Australia, August 22, 2019.

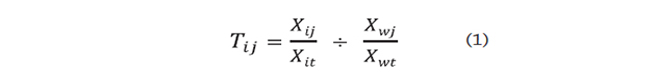

[34] TII estimates whether the value of trade between two countries is greater or smaller than would be expected on the basis of their importance in world trade. It is the ratio of intra-regional trade to the share of world trade with the region, calculated as follows:

Where Xij and Xwj represent the values of country i’s exports and of world exports to country j and where XitandXwt, are country i’s total exports and total world exports, respectively. An index of more (less) than one indicates a bilateral trade flow that is larger (smaller) than expected, given the partner country’s importance in world trade.

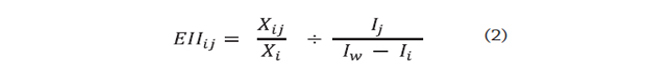

[35] EII is defined as the ratio of export share of a country/region to world exports going to a partner country. It is calculated as follows:

Where Xij= value of exports of country/region i to country/region j,

Xi= value of the exports of country/region i to the world,

Ij= total imports of country/region j,

Iw= total imports of world, and Ii= total imports of country/region i.

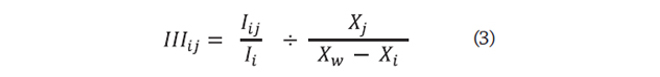

Meanwhile, III is defined as the ratio of import share of a country/region to the share of world imports from a partner country. It is calculated as follows:

Where Iij = value of imports of country/region i to country/region j,

Ii = value of the imports of country/region i to the world,

Xj = total exports of country/region j,

Xw = total exports of world, and Xi= total exports of country/region i.

[36] Nilanjan Ghosh, P. Pal, J. Chakraborty and R. Ray, “China-India Relations in Economic Forums: Examining the Regional Comprehensive Economic Partnership”, Observer Research Foundation Occasional Paper, No. 162 (New Delhi, 2018).

[37] Supra note 31: 41-42.

[38] Ibid.

[39] PTI Melbourne, “Australia steps up sugar trade fight with India, seeks WTO probe”, The Hindu Business Line, July 12, 2019.

[40] Composition of trade, Australia (Directorate of Foreign Affairs and Trade, Australian Government, 2019).

[41] Supra note 31.

[42] Ibid.

[43] Nilanjan Ghosh, “Regional Comprehensive Economic Partnership: Issues and Concerns for India,” in 25 Years of WTO and India: A Retrospective, ed. Prabir De et al. (EEPC India, Forthcoming publication, 2019).

[44] “SJM asks India to quit RCEP talks, says pact will hurt farm, dairy sectors”, The Hindu Business Line, January 10, 2019.

[45] G. Nataraj and Garima Sahdev, “RCEP: India must stop being a naysayer”, The Hindu Business Line, January 7, 2019.

[46] Ibid.

[47] Centre for Monitoring Indian Economy Pvt. Ltd.

[48] Nilanjan Ghosh, A. Konar and S. Pathak, “India’s FTAs with East and Southeast Asia: Impact of India-Malaysia CECA on the Edible Oil Value Chain”, Observer Research Foundation Occasional Paper, No. 73 (New Delhi, 2015).

[49] Supra note 18.

[50] “Cabinet approves proposal for review of FDI policy on various sectors”, Press Information Bureau, Government of India, August 28, 2019.

[51] Supra note 43.

[52] Net Desk, “Budget 2019 as it happened | PAN and Aadhaar to become interchangeable”, The Hindu, July 5, 2019.

[53] Supra note 43.

[54] Subhayan Chakraborty, “RCEP meet: India, China refuse to budge on tariffs, services trade”, Business Standard, Ausgust 2, 2019.

[55] “High Commissioner’s Address at NDC: Indo-Pacific Security Paradigm- Australia’s Choices”, Australian High Commission, New Delhi, May 8, 2017.

[56] Dipanjan Roy Chaudhury, “India treads a fine line in Indo-Pacific region“, The Economic Times, June 28, 2019.

[57] Prabir De, “Navigating the Indo-Pacific Cooperation“, The Economic Times, March 11, 2019.

[58] Ibid.

[59] C. Raja Mohan, Samudra Manthan: Sino-Indian Rivalry in the Indo-Pacific (Oxford Publications, 2013).

[60] David Scott, “Australia’s embrace of the ‘Indo-Pacific’: new term, new region, new strategy?” International Relations of the Indo-Pacific 13, no. 3 (2013): 425–448.

[61] Supra note 7.

[62] Samir Saran, “Is Indo-Pacific a viable geostrategic project?” Observer Research Foundation, July 25, 2019.

[63] David Scott, “Australia’s embrace of the ‘Indo-Pacific’: new term, new region, new strategy?” International Relations of the Indo-Pacific 13, no. 3 (2013): 425–448.

[64] Jack Kilbride, “What’s in Victoria’s controversial One Belt One Road agreement with China?” ABC News, November 12, 2018.

[65] Euan Graham, “Responding to China’s not-so-secret influence campaign”, The Interpreter, Lowy Institute, March 20, 2019.

[66] Peter Varghese, “The geopolitics of Australia’s India economic strategy”, The Strategist, October 5, 2018.

[67] Frederic Grare, “The India Australia Strategic Relationship Defining Realistic Expectations”, Carnegie Endowment for International Peace (March 2014).

[68] “AUSINDEX 2019 commences in India”, Department of Defence, Australian Government, April 9, 2019.

[69] Infrastructure, Ideas, and Strategy In the Indo-Pacific, ed. Dr. John Hemmings (London: Asia Studies Centre, The Henry Jackson Society, 2019).

[70] “India-Australia Maritime Dialogue”, Media Centre, Ministry of External Affairs, Government of India, November 2, 2018.

[71] Supra note 69.

[72] ASEAN Outlook on the Indo-Pacific, ASEAN, June 23, 2019.

[73] Nilanthi Samaranayake, “A US view on Australia’s role in the Indian Ocean”, The Interpreter, Lowy Institute, September 27, 2019.

[74] “Information Fusion Centre – Indian Ocean Region”, Indian Navy.

[75] Shishir Upadhyaya, “Australia Expands Its Maritime Power in the Indian Ocean”, The Diplomat, March 19, 2019.

[76] N. Rana and U. Majumdar, “Redefining the heart of logistics”, The Economic Times, September 11, 2018.

[77] Emmanuelle Ganne, Can Blockchain revolutionize international trade? (World Trade Organization Publications, 2018).

[78] Ibid: 42.

[79] Tanvi Ratna and Nitin Sharma, “The importance of blockchain for India” Livemint, November 6, 2018.

[80] Navin Gupta, “Has India missed the Blockchain tech Express?” Livemint, July 15, 2019.

[81] “Digital economy to India”, Australian Trade and Investment Commission, Australian Government.

[82] Sameer Patil, “An amplified India-Australia security”, Gateway House, June 27, 2019.

[83] Camille Egloff ,Ulrik Sanders , Jens Riedl , Sanjaya Mohottala and Konstantina Georgaki, “The Digital Imperative in Container Shipping”, Boston Consulting Group, February 2, 2018.

[84] Hugh R. Morley, “Ready or not, digitalization on the way for shipping“, IHS Markit, February 6, 2018.

[85] Rashmi Banga, Is India Digitally Prepared for International Trade? (Research and Information System for Developing Countries, 2018).

[86] Ibid.

[87] Varun Aggarwal and Venkatesh Ganesh, “Digital economy a $1-trillion opportunity for India“, The Hindu Business Line, February 20, 2019.

[88] Ibid.

[89] India Special Correspondent, “Maersk looks to Indian tech startups for innovation,” JOC.com, March 26, 2019.

[90] Ibid.

[91] Supra note 7.

[92] Dipanjan Roy Chaudhury, “Australia announces regional connectivity initiative in S Asia with India as pivot“, The Economic Times, January 9, 2019.

[93] Simon Blackburn, Michaela Freeland and Dorian Gartner, “Digital Australia: Seizing opportunities from the Fourth Industrial Revolution,” Mckinsey & Company, May 2017.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Soumya Bhowmick is a Fellow and Lead, World Economies and Sustainability at the Centre for New Economic Diplomacy (CNED) at Observer Research Foundation (ORF). He ...

Read More +

Roshan Saha was a Junior Fellow at Observer Research Foundation Kolkata under the Economy and Growth programme. His primary interest is in international and development ...

Read More +

Pratnashree Basu is an Associate Fellow with the Strategic Studies Programme. She covers the Indo-Pacific region, with a focus on Japan’s role in the region. ...

Read More +