-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Heric Thomas and Innocent P. Wawa, "Harnessing Technology for Agricultural Development in Africa: Lessons from Tanzania", ORF Issue Brief No. 301, July 2019, Observer Research Foundation.

Introduction

Agriculture in Africa drives economic development and gross domestic product (GDP), growth of industry, and global trade, while enhancing the quality of life and job creation, among others. The agricultural sector accounts for 32 percent of GDP growth, 80 percent of foreign currency inflows and 60 percent of workforce in Africa.[1] The sector is mainly dominated by smallholder farmers who grow varied crops for both cash and domestic consumption utilities.[2] However, although the contribution of the sector in terms of employment and income generation is clear, its long-term ability to maintain this status remains relatively low. The average annual growth rate in many African countries has historically been less than six percent.[3] This means that the path to the six-percent annual growth rate from 2003 to 2012 and from 2015 to 2025 promised by African leaders in 2003 and 2014 under the Comprehensive African Agricultural Development Program (CAADP) has never been achieved. This may largely be due to the fact that the sector is confronted by fragmentation and limited innovative capacity.

In a way, many countries in Africa have put in place Science, Technology and Innovation (STI) policies aimed at boosting their agriculture sector. However, the formulation and implementation of such policies have focused on the supply side of knowledge—i.e., investing more on science and research (public R&D)—while neglecting the demand side (i.e., agriculture sectors).[4]

Evidence of investing in R&D in order to improve the agriculture sector of Africa is seen in various development goals and plans of action made by these countries. For one, in the Lagos Plan of Action, African countries agreed to commit funding of the R&D activities to a maximum of one percent of GDP in 1980, raising it to three percent of GDP by the year 2000—a commitment also made by developed countries. Analysts have compared such investment and observe that African countries are trying to match the R&D investment levels of the richest countries. Yet, contrary to expectations, only a few African countries such as Tanzania have been able to achieve one percent.[5] Assumed outcomes in terms of technology upgrade to farmers have never been realised. This is because the solutions/technology from R&D are mostly not demand-driven, thus making it difficult for farmers to adopt them.

To improve the agricultural sector in Africa, there is a need to rethink the existing institutional arrangement. African countries need to shift from public sector to private sector-led agricultural transformation by investing more in technology upgrade than in R&D. The policymakers need to understand that technology comes first, and that the focus of STI policies should be more on technology and producers rather than on science and researchers. In addition, the African policymakers need to understand that the demand side is more crucial for supporting technology upgrade—always achieved through learning by doing, using and interacting supported by strong and effective extension systems.

Following the above realisation, African countries need strategies that can support technology upgrade among producers. One of the known strategies is the use of Global Value Chains (GVCs) which has been explained as a “full range of activities carried out by different firms/producers that form part of the network located in different countries but coordinated by a lead firm through provision of guidelines on the quality standards of the products to be produced.”[6]

GVCs in technology upgrade among producers

Empirical studies have shown that the interactions between global buyers and local producers in developing countries within a GVC often stimulate technological upgrade among local farmers.[7] There are several ways that the participation of local producers in GVCs provides them with opportunities to learn and improve their technological capabilities. For the local producers to enter the GVCs, they are required to meet stringent international standards related to production, product quality, and delivery as well as meeting any other quality requirements imposed by lead firms. Consequently, in an attempt to meet these requirements, the local producers must learn and innovate. This is stimulated by the lead firms through direct investments into local producers by providing them training and explicit technology transfer.

Furthermore, farmers can upgrade their technologies by interacting with other GVC actors through meetings, seminars, workshops or other linkages that are available within the network. Such interactions tend to result in greater diffusion of knowledge, technology, and know-how to the local producers and may lead to spillovers to the rest of the economy. The technology acquired through GVCs often support product upgrade: farmers moving from simpler products towards more sophisticated ones, either through introducing new products or improving the old.[8]

One such case is the trade of fresh temperate vegetables, such as peas and beans, which were produced in Kenya and sold in the United Kingdom (UK). The business relied on complex relationships whereby small traders bought produce at the farm gate or in wholesale markets in Kenya and channeled them through import agents in the UK, who then resold them on wholesale markets. However, the UK Food Safety Act placed a requirement on the import agents to show “due diligence” in the manufacture, transportation, storage and preparation of food. Thus, in meeting these standards, upgrading quality systems and procedures were enforced on the Kenyan producers through regular monitoring. New products were also developed through cooperation between exporters, importers and producers. Consequently, an emphasis on quality and freshness resulted in greater coordination of leaning along the value chain and products qualified the standards required by the food safety law of the UK.[9]

Another study was carried out on smallholder farmers that were producing French beans in Madagascar, which were sold to supermarkets in France, Belgium, UK and Netherlands through Lecofruit, a foreign direct investment (FDI) company that operates in Madagascar.[10] The study found that Lecofruit had signed a yearly contract in advance with most clients in Europe in which the delivery conditions and product standards are specified for the year (minimum quantity, prices, time of delivery, and payment dates). In meeting food safety and agricultural health standards imposed by European super markets, Lecofruit first trained farmers on how to make compost using a mixture of manure, vegetables and fertilisers. In addition, one extension agent was assigned to every 30 farmers and that five or six assistant agents per extension agent were to be resident in the villages during the crop production cycle. On average, each smallholder farmer was to be visited more than once every week by one of the firm’s representatives, who would sometimes carry out specific activities themselves, for example, applying pesticides on the crops, so as to ensure that it is rightly done because the contractors would only pay for the products that fulfilled the quality standard agreed upon. Lecofruit also hires private auditors, which come to Madagascar to follow-up on these conditions and for inspection, at least once a year. The high quality-control requirements are perceived to have triggered the necessity of building the technological capabilities of the farmers.[11]

These two cases have described the way GVCs facilitated technology upgrade in Africa that in turn influenced improvement in production efficiency among farmers. The cases help explain how GVCs can promote technology upgrade among farmers in Tanzania to support production and poverty alleviation.

Hass avocado in Kilimanjaro region: Historical background

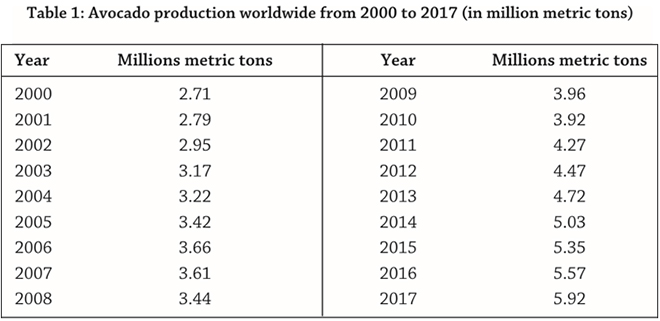

Avocado trees were introduced in Kilimanjaro in the late 19th or early 20th century by German missionaries for various purposes including for food, medicines, animal feeds and timber.[12] Until the early 2000s, there were no improvements in avocado varieties in the region, with many trees having reached the old age of a hundred. Beginning in the year 2000, farmers adopted new and improved avocado varieties. Before that, farmers were pruning avocado trees intensively to feed cattle and goats. The value of avocado fruits increased after the beginning of international trade. Statistics shows that increase in global demand of avocados resulted into increase of production from 2.71 million metric tons in 2000 to 5.92 million metric tons in 2017.[13] Since then, farmers started treating avocados as a source of new business rather than merely food and animal feed.

It was not until 2007 when smallholder farmers in Kilimanjaro were informed by both the government of Tanzania and an export agent called Africado about the high demand of the hass avocado variety in the European markets. Markets for hass avocados were abound in France, Belgium, German, Holland, UK and Spain. Smallholder farmers were advised to adopt the hass varieties to benefit from the available markets abroad, and many were keen on it. However, Africado informed smallholder farmers about the requirement of certification from Good Agricultural Practices (GAP), the International Management System of Hazards Analysis and Critical Control Points (HACCP) and the ISO 9000 management standards system for food products exported to Europe.

Under traditional farming systems, the avocado producers do not follow good agricultural practices as there is not much emphasis on standards and grading system from the Tanzania Bureau of Standards (TBS) and Tanzania Food and Drugs Authority (TFDA). For example, harvesting is done manually by shaking the branches of the avocado tree, forcing the fruits to fall down. The problem with this method is that when the avocado hits the land surface, it cracks and deforms. After harvesting, farmers then use polythene bags for packaging, rendering the products vulnerable to easy spoilage. The marketing is also unhygienic: the fruits are spread on the ground on top of a thin layer of grass, and sometimes smeared with clay soil to prolong shelf life.

A set of technological capabilities among smallholder producers of the hass avocado are required in order to enhance the market competitiveness of the product. These are related to irrigation, manure and fertiliser application, mulching, pests and diseases control, chemical application, harvesting, and pre- and post-harvest handling. This process has not been a single-time activity, but rather repeated several times. It therefore called for a need for having in place a network of several actors ranging from extension services, R&D, universities, development supporters, logistics, quality assurance, input supplies, policies and regulations.

Training smallholders in hass avocado farming

The hass avocado variety was introduced in Kilimanjaro, Tanzania by the Africado Company Ltd. from South Africa by importing planting materials and seedlings. However, most farmers had no skills and knowledge on how to grow and manage the hass variety. In response, a company called Africado in collaboration with experienced researchers on horticulture from the Tengeru Research Institute and Sokoine University of Agriculture (SUA) took initiatives to build the capacity of the smallholder farmers—including trainings on site selection, planting, irrigation, mulching, pests and diseases control, pruning, compaction, pre- and post-harvest handling.

These collaborations between Africado, Tengeru Research Institute and SUA gave farmers access to improved seeds, new skills, farming equipment and extension service support. Other actors like the Catholic churches also helped disseminate information on the hass avocados through seminars. Furthermore, training is imparted to farmers through different mechanisms such as workshops, demonstration model farms and information manuals. On-farm trainings were also conducted, and farmers were taken to the Tengeru Research Institute.

Training on good farming practices

The farming and harvesting of hass avocados must adhere to Global Good Agricultural Practices (Global GAP) standards for safeguarding producers and consumers as per regulations of the European Union (EU). Through farm training, most farmers learnt by observing different functions performed by the Africado agents in collaboration with extension officers. For example, in planting; farmers learnt that the space required should be 5m by 6m, therefore increasing tree population to more than 120 trees per acre. and increasing productivity to an average of 100kg per tree.

Farmers are required to follow the standards set by the international market for Hass avocado. Fruits produced must have the following qualities:

| Fact Box 1: During farming, the research officers from Sokoine University of Agriculture and Tengeru impart education to farmers on the negative effects of using chemicals and the importance of using masks, gloves and dustbin to reduce direct contamination. Furthermore, before harvesting, Africado undertakes moisture testing in all areas where the hass avocados are grown. The maximum moisture required for harvesting is 70 percent. The Maximum Residue Level (MRL) is also conducted before harvesting to test chemicals and other diseases. Furthermore, before harvesting, external auditors from European Union often come to Tanzania to inspect whether or not the standards are being implemented by farmers. They do this by sampling some farmers for auditing. The farmers are given 28 days to do so. Later, the agents from Africado make a followup and send a report to auditors showing improvements that farmers have |

Africado trained the farmers in using cutter and iron poles hooked with clippers for harvesting the avocados. For trees that are shorter or with low hanging fruits, harvesting is done through handpicking using cutters. Hygiene is also being given importance. For example, harvesting tools such as trails and clippers are cleaned thoroughly. Africado staff inspect the picking of the fruits at outgrower farms to ensure compliance with hygiene requirements set by the International Food Safety Standards. Pickers are required to keep their fingernails short, and to be checked for any respiratory diseases such as tuberculosis. During the survey, most farmers were found with banners demonstrating farm hygiene during farming and harvesting.

After harvesting, the avocado fruits are collected in plastic crates with carrying capacity of 60 and transported to the packaging house for weighing, washing, brushing, treating with fungicide in water and sizing and re-weighing. They are then refrigerated in the rooms kept at 60 degrees C, ready for export. The packaging materials are imported from Kenya as there is no company that manufactures them in Tanzania. AfriCert has a contract with the buying supermarket chains for certification of the products including field inspection and pack house approval using Global GAP standards. In sizing and grading of avocado, Africado uses trails that are numbered. For instance, trails with number 8, 10, 12, 14, 16, 18, 20 22 and 24 are classified into the first-class avocados, while those with 26, 28, 30 32 and 34 are labeled “second-class”. During sorting, a special machine for grading is used in which every fruit must pass in and commanded to trail size, based on the quality reached. The machine provides percentages of the kind of avocado harvested in a certain area. For instance, some of the machine show that 80 percent of the avocado fruits harvested in area “A” are regarded as first-class, which command a higher price. Meanwhile, about 80 percent of those harvested in area “B” are categorised as second-class.

Product upgrading among avocado farmers

This section describes the smallholder farmers’ application of technology in terms of farming improvement and product upgrading.

Africado acknowledges that smallholder farmers are capable of preparing the farm, planting, pruning, fertiliser application, pest management, pruning and disease control. The farmers’ capabilities have been improved significantly. Moreover, the frequency of inspections per year has been reduced. This was proven by farmers when they were asked to rate the inspection frequencies per year. (See Figure 1.)

Figure 1

Source: Field Data, 2017

The acceptance of avocado fruits by meeting the grades required by the export agents demonstrated that there was product upgrading among the farmers. The farmers were asked to state the extent to which their fruits had been rejected because of failure to meet the grades required by Africado. About 20 percent said they had experiences of being rejected because the grades were not met, and this happens especially during their first time. Meanwhile, 80 percent said their products had never been rejected since they started.

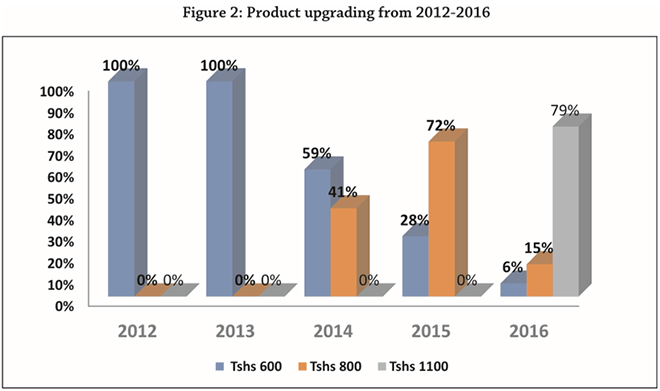

It was found that most farmers in 2016 improved their products to the extent of meeting all the standards required, such as producing green fruit with no fractures and dots and were organically rich. Most farmers also had succeeded to move from second-class to first-class. That was especially proven by the price records set in the years 2012-2016. In 2012 and 2013, 100 percent all avocados were sold at Tshs 600 per kg (a kilo can have three or four avocados). According to Africado, the fruits were graded C. In 2014 to 2015, the price changed from Tshs 600 to Tshs 800—i.e., decrease in % in blue bar and an increase in brown bar. i.e from grade C to B. Finally, in 2016, 79% of producers were upgraded to A. This was an evidence of product upgrading among smallholder farmers. (See Figure 2.)

Source: Field Data, 2017[/caption]

The farmers product upgrading is also witnessed among those who succeeded in getting certified to GLOBALG.A.P. For instance, according to Africado, in 2014, 26 farmers received certificates from GLOBALG.A.P. In 2015, the number increased to 228 farmers and in 2016 all the farmers had been certified. The farmers even outperformed those from countries such as Mexico and South Africa.

Sustainability question from the GVCs experience of agricultural sector in Tanzania

It was found out that the smallholder farmers operated under a high degree of monitoring and control by Africado. In this case, the capacity building imparted by Africado to smallholder farmers concentrated mainly on learning about new production practices, sorting and grading of their products. The farmers had limited capacities in processing fruits to create end-products with much higher market values. The implication is that if farmers remain focused solely on the production of avocado without upgrading into other activities such as processing, there will be no sustainability. This is because if Africado sourced avocados from other suppliers apart from farmers in Kilimanjaro, then the market of avocado produced by those smallholder farmers will most likely collapse. Therefore, to ensure sustainability, it is crucial for smallholder farmers to build their capacities into higher value chain activities.

The next level of capacity building required is the ability of smallholder farmers to process avocado into other products such as avocado oil (for use in the manufacturing of cosmetic products like shampoo and skin lotion). Capacity building in other areas such as labeling, entrepreneurship and marketing, would also be required. For instance, the Small Industries Development Organization (SIDO) has conducted trainings for women producers of avocado in processing, entrepreneurship, marketing, packaging and labeling. Although processing is still at small scale, these women have become capable of manufacturing cosmetic products from hass avocado and selling them to major cities including Dar es Salaam. Some quantities are exported by traders to other countries such as Zambia and DRC. All products from these women have been quality-certified by TBS and possess a bar-code.

Conclusion

This brief demonstrates the way GVCs have supported technology upgrade among small producers of avocado in Tanzania. This was through the ability of GVCs to facilitate training among smallholder farmers and other system actors. This has given farmers the capability to produce the quality and quantity of products needed by the market. Farmers have been able to upgrade their avocado in terms of shifting from simple products to more sophisticated ones by adopting new and improved Hass avocado variety as well as upgrading their capabilities from grade “C’’ to “A’’.

This analysis has implications on the STI policy formulation and implementation in the African context. It is argued that given the fact that technologies in Africa are weak, the formulation and implementation of the STI policies should focus more on the demand side of the knowledge (i.e., agriculture sectors). Since there is little achievement (if at all there is any) in investing in research and development activities to support technology upgrade, there are cases that have recorded successful stories in investing in the demand side—achieved through learning by doing, using and interacting. The cases from Kenya, Madagascar and the one from Tanzania described by this brief reflect the best practices that can be replicated in other countries in the continent.

Endnotes

[1] A. A. Adenle, et al., “The Era of Sustainable Agricultural Development in Africa: Understanding the benefits and constraints.” Food Reviews International 34(5) (2018): 411-433

[2] Xinshen Diao et al., “The role of agriculture in African economic development: What do we disagree on?.” Towards Agricultural Change (2012): 77

[3] A.M. Kalibata, “Agriculture in a changing world”. Ministry of Agriculture, Uganda (2006).

[4] Bitrina Diyamett, “The Utility Value of Research and Development (R&D): Where does Tanzania Stand?”. STIPRO (November 2011)

[5] Rod Coombs et al, Economics and Technological Change (Rowman & Littlefield, 1987)

[6] Carlo Pietrobelli, et al., “Global Value Chains Meet Innovation Systems: Are There Learning Opportunities for Developing Countries?.” World Development, 39(7) (2010).

[7] Gary Gereffi, "The Governance of Global Value Chains." Review of International Political Economy 12, No. 1 (2005).

[8] Ibid

[9] C. Dolan, “Governance and Trade In Fresh Vegetables: The Impact Of UK Supermarkets On The African Horticulture Industry.” Journal of Development Studies, 37(2) (2000)

[10] B. Minten, et al., “Global retail chains and poor farmers: Evidence from Madagascar.” World Development, 37(11) (2009)

[11] H.A. Mwakalinga, “A Report on Avocado Value Chain Mapping in Siha and Njombe Districts”. UNDP (2014)

[12] Ibid.

[13] “Avocado Production Worldwide”, Statista, 2017.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Heric Thomas is Researcher at the Science Technology and Innovation Policy Research Organization (STIPRO) in Dar es Salaam.

Read More +

Innocent P. Wawa is Assistant Researcher at the Science Technology and Innovation Policy Research Organization (STIPRO) in Dar es Salaam.

Read More +