-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Jackline Kagume, “Gender Parity in the Entrepreneurship Cycle in Kenya,” ORF Special Report No. 191, June 2022, Observer Research Foundation.

Introduction

Promoting equitable gender representation and participation in economic, political, social, and cultural spheres of society is amongst the progressive advancements made by the Constitution of Kenya, adopted in 2010. The State is required to take legislative and other measures including affirmative action programmes to redress historic disadvantages suffered by any community.[1] Based on the constitutional imperative, the achievement of gender parity in all sectors of the economy is a fundamental national aspiration. However, the country is yet to fully realise this goal, owing to various normative and legal barriers that are particularly disadvantageous for women.

The Global Gender Gap Index ranked Kenya at 95 out of 156 countries, and last in the East Africa Community (EAC) region,[a] in 2021. The index measures countries’ efforts to close gender gaps in economic participation and opportunity, educational attainment, political empowerment, and health and survival.[2] Kenya’s average performance was reported across the four sub-indicators including the economic participation and opportunity pillar, where Kenya was ranked 84th overall and last in the EAC region.

Economic participation is defined as an individual’s engagement in work, and the access to economic resources that results from that participation.[3] Various financial, social, and health benefits accrue from this participation, in turn improving the overall well-being of the individual. In Kenya, entrepreneurship is the primary source of employment for a significant section of the population, and therefore, their means for economic and labour force participation.[b]

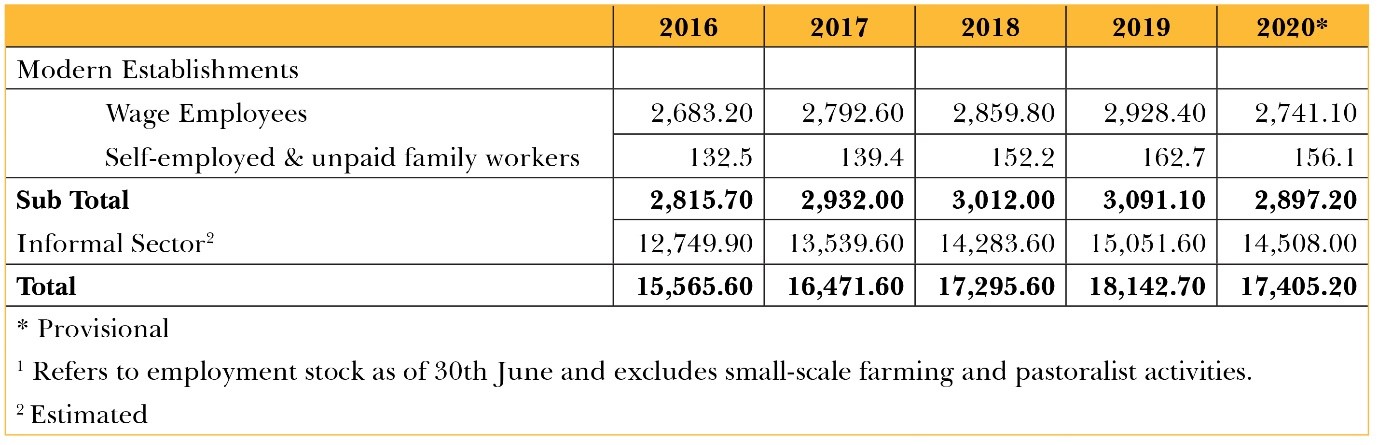

According to recent data from the Kenya National Bureau of Statistics (KNBS),[c] out of the total number of employed persons in 2020, 14.5 million were in the informal sector while only 2.9 million were in modern (formal) establishments.[4] The modern sector comprises both wage employees and the self-employed, while the informal sector covers mainly small businesses where employment is mostly casual and not based on any contractual arrangements.[5] Evidently, the majority of small businesses fall in the informal sector category. Understanding gender dimensions in both sectors is critical for the design of appropriate policies to achieve gender parity.

Table 1: Total Recorded Employment, 2016-2020

Gender Parity in the Entrepreneurship Cycle

The entrepreneurship cycle in Kenya is regulated by several statutes including the Companies Act, Business Registration Service Act, and the Partnerships Act.[6] Besides the primary legislation on registration and operation of businesses, most of the enterprises are subject to the Micro and Small Enterprises Act, the tax law regime of the country, and various other laws at the sub-national or county level enacted to regulate business operations in those jurisdictions. The broad regulatory framework has different requirements for compliance at the national and sub-national levels, often translating to processes for compliance that are tedious and prohibitive.

All formal enterprises are registered at the Registrar of Companies in adherence to established legislation. Conversely, a large number of businesses in the informal sector are unregistered or unlicensed and operate without formal structures. The formal registration of an enterprise is important for several reasons. First, it provides legal recognition of the enterprise which helps access to capital from banks and private investors. Registration demonstrates credibility and creates an assurance of accountability for the investors. Second, upon registration, the enterprise acquires a separate legal identity from the business owner, which means the owner gets separate legal protection. Where liability arises from the enterprise, the owner is not held personally liable. Third, registration facilitates business continuity, which is crucial for the sustainability of the enterprise where the owner, for whatever reason, is no longer present.

However, business registration in Kenya is an expensive and cumbersome process, especially for women as shown in the following data and subsequent analysis. The data released annually in the Economic Survey on economic participation is not fully disaggregated by gender, perhaps due to the challenges in collecting and compiling data on informal enterprises. In formal wage employment, where disaggregated data is available, the gender divide is 1.7 million men representing 63 percent of the total and 1 million women, equivalent to 37 percent of all wage employees.

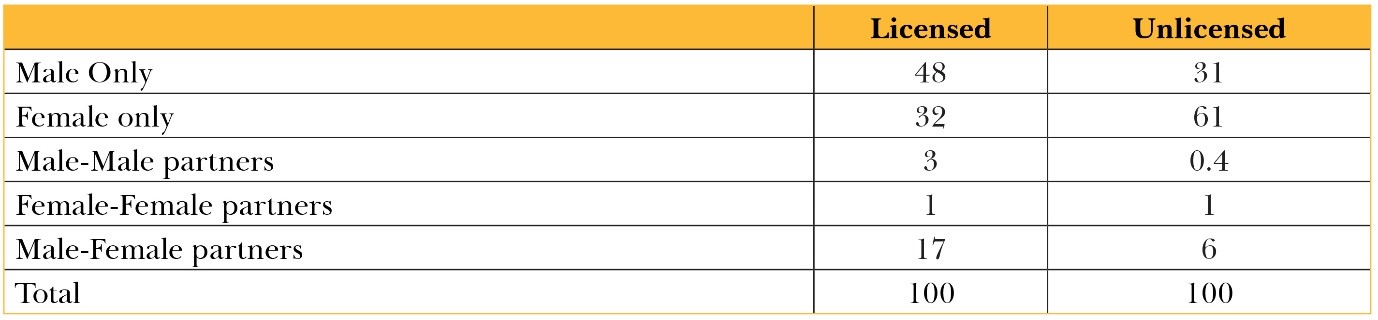

To bridge this data gap and provide more comprehensive information on the evolving nature of small businesses, the KNBS carried out a national survey on Micro, Small, and Medium Enterprises (MSMEs) in the country in 2016, which revealed the unique gender dynamics in the registration and management of enterprises in Kenya.[7] In terms of incorporation and registration, the survey found that 47.9 percent of the licensed establishments were owned by males and the highest number of unlicensed MSMEs are female-only owned at 60.7 percent.

Table 2: Ownership of MSMEs, by Licensing Status (%)

The survey also found that the characteristics of the business vary according to gender, education, and training of the owner. Women are dominant in unlicensed businesses that are mostly micro and informal.[8] Basic awareness and literacy of the business registration process could be one of the factors contributing to the gender differences in registration. The high number of unlicensed female SMEs could be an indicator that men are more aware of the business registration requirements and benefits.

Another limiting factor for women could be the often bureaucratic registration processes. Given that other societal and family obligations are borne by women, more men are able to attend to these procedures, often located at government premises. Lastly, the other constraint might be the lack of access to other property that could be converted or help facilitate access to cash for business registration. Historical gender inequalities in terms of property ownership exacerbate the inequality problem by hindering access to funding which is necessary for business establishment and formalisation.

Business operations refer to the various processes that sustain the running of an enterprise, including the supply of goods and services and engagement with customers. The nature of operations depends on many factors, including the dynamics of the industry where the small business operates. Businesses largely make profits through the sale of goods or the supply of services. The Government of Kenya (GoK) is the largest single consumer of various goods and services. With a KES 669.6 billion allocation for ministerial development expenditure—or USD 6.2 billion for the FY 2021/22—the GoK is a major player and facilitator of entrepreneurship in the country. The government procures goods and services through an elaborate public procurement system detailed in the Public Procurement and Assets Disposal Act. Based on the scale of enterprise facilitated by the government, public procurement data is an effective indicator of the nature of enterprises doing business with the government, their industry, and gender disparities in business operations, if any.

In partial compliance with the constitutional requirement for the implementation of affirmative action programmes to redress past discrimination and facilitate access to economic opportunity, Kenya implemented the Access to Government Procurement Opportunities (AGPO) Programme in 2013. The programme has played a critical role in supporting the operations of a significant number of small and medium enterprises owned by women, youth, and persons with disabilities to participate in government procurement opportunities.[d]

Oversight of the public procurement system in Kenya is a function of the Public Procurement Regulatory Authority (PPRA). Amongst other roles, the PPRA is tasked with monitoring and reporting on the preference and reservations scheme by procuring entities. The Authority is required to keep a comprehensive disaggregated database that indicates the number of disadvantaged groups that have benefited from the AGPO programme. Despite the notable aim of the legal requirement, however, anecdotal evidence shows that the preference scheme has mostly been successful in expanding access to low-value contracts, as opposed to infrastructure-related high-value contracts.

Data provided by the PPRA for FY 2019-20 indicates that while 36 percent of all contracts by procuring entities were reserved for the AGPO scheme, the total value of those contracts represented less than 2 percent of the total value of all government contracts.[9] This partly affirms the notion that the preference scheme has not facilitated access of the beneficiary enterprises to high-value sectors. With women enterprises being a major beneficiary of this preference scheme, it has been observed that these firms mostly engage in the smaller government contracts mainly for the supply of smaller items and services. This could be attributed to high competition in the uptake of higher-value contracts, further reinforced by the limited financial resources available to women.

The management of enterprises entails the coordination of activities for the efficient operation of a business. It is an essential component of the entrepreneurship cycle, given the significant role of management in ensuring the overall success of an enterprise. Gender parity in the management of an enterprise is crucial for diversity and inclusion in decision-making, from planning to execution of the business ideas. Various studies indicate a strong correlation between gender equity and organisational success; diversity is also critical for balanced problem solving and analytical thinking.[10]

Research by McKinsey further demonstrates that a strong correlation exists between organisational diversity and financial performance.[11] The research showed that companies that were ranked in the top 25 percent in terms of gender diversity are 27 percent more likely to outperform their national industry average in terms of profitability. Partially, the reason attributed to this is that enterprises that actively create and promote diversity are more committed to integrating a variety of perspectives and accommodating diverse leadership skills which can enhance business growth.

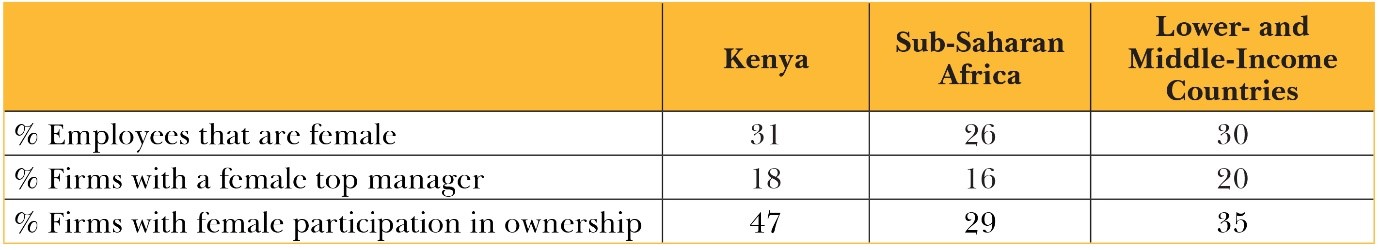

In the Kenyan context, the 2018 World Bank Enterprise Survey showed that female participation in top management and ownership in Kenya is higher than the Sub-Saharan average and that of lower-middle-income countries, but still significantly lower than male participation.[e],[12] One of the reasons for the disproportionate male participation in top management and ownership of firms is the similarly disproportionate career progression between men and women. While most men advance in their careers undeterred, women often take long career breaks due to family obligations. In some communities in Kenya, the professional advancement of women is discouraged in fear of what is described as “negative family consequences”.[f] In part, these beliefs discourage the aggressive pursuit of leadership by women, which is reflected in the statistics on female participation in employment and management.

Table 3: Female Participation in Employment, Top Management, and Ownership (2018)

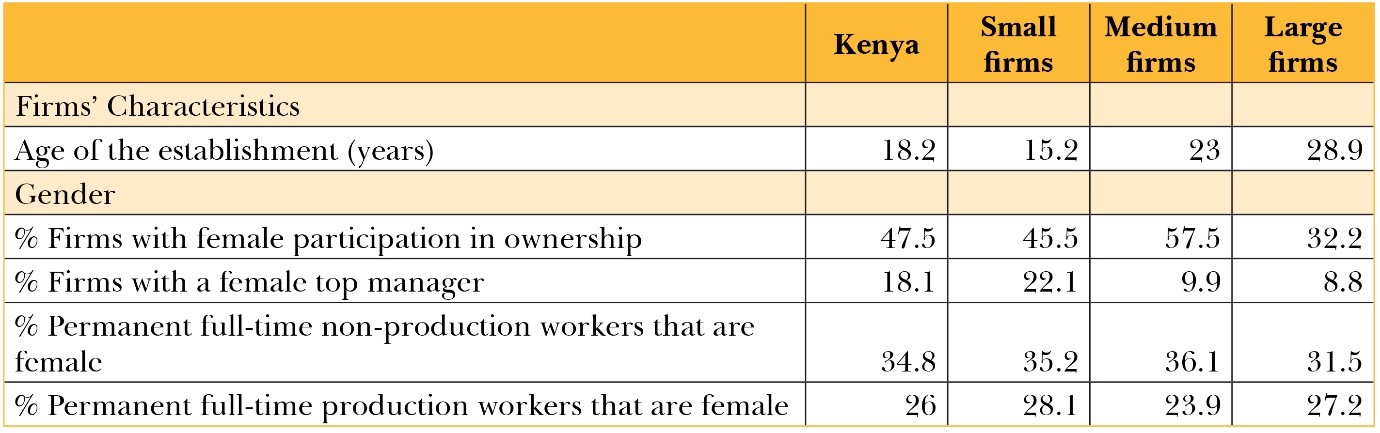

The World Bank Survey also found that women’s ownership and management of enterprises is higher in small and medium firms but lower in large firms,[g] thus suggesting a lack of gender parity in the management of most firms in Kenya. The constraints to female career progression highlighted above also contribute to the lower number of female top managers in larger firms as opposed to smaller firms. The data suggests that challenges at each stage of the entrepreneurship cycle reinforce gender inequalities, and is also reflected in the ownership and management of different enterprises. For instance, the fact that most unlicensed enterprises are female-owned, bears consequences for access to finance and limits the scope for growth and expansion of the firms.

Table 4: Firms’ Characteristics, by Gender (2018)

The KNBS MSME report found that in the five years preceding the survey, 54.9 percent of businesses that eventually closed down were female-owned.[13] This could be attributed to various challenges including financial constraints and competing societal obligations largely borne by women.

The main reasons provided for the closure of enterprises in general (both male- and female-owned) were a shortage of operating funds and declining incomes. Specific reasons adduced to the closure of women-owned enterprises were mostly social and biological obligations, including the provision of prenatal and post-natal care.

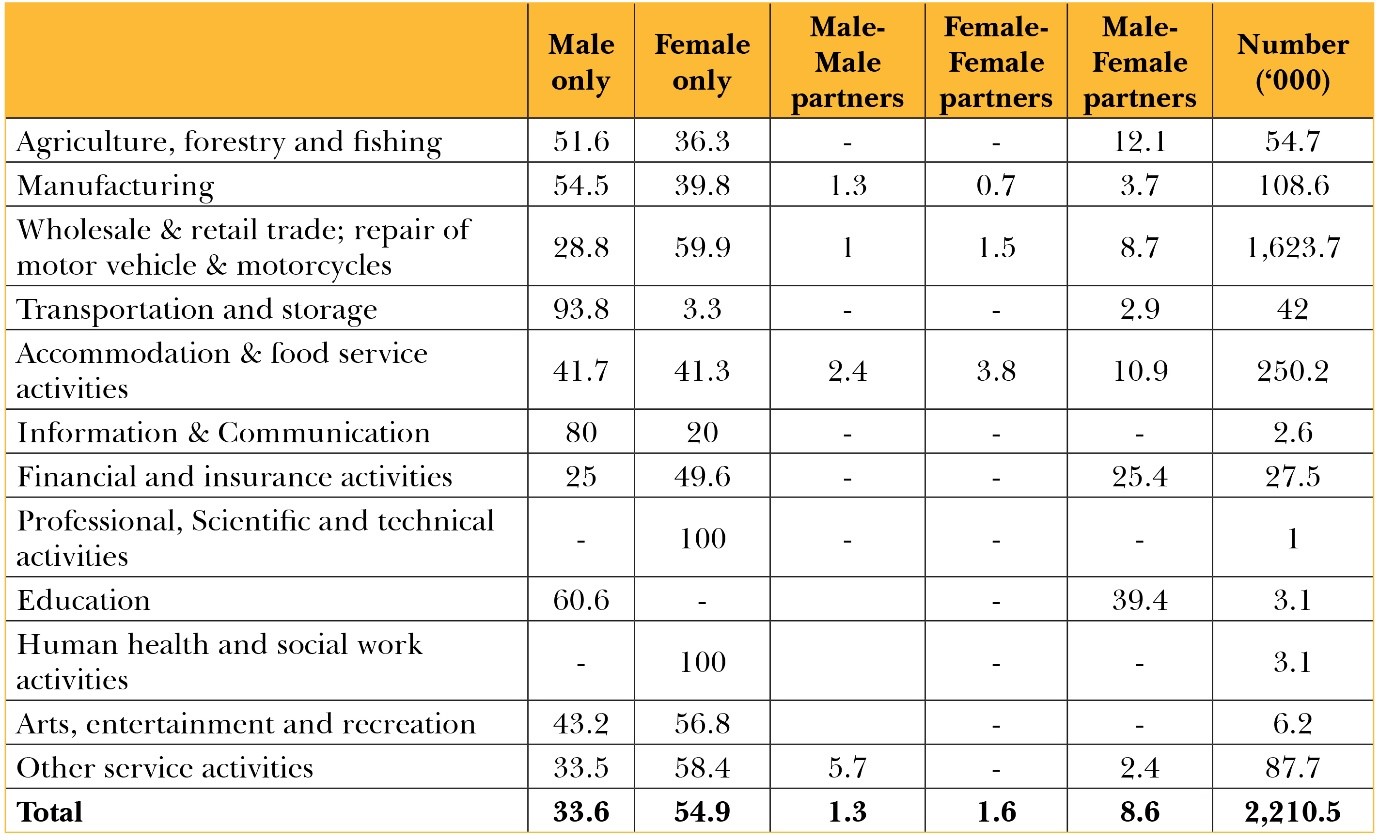

Table 5: Distribution of Closed Enterprises, by Ownership and Activity

Constraints to Gender Parity in Entrepreneurship

Data from various studies and surveys underscore several barriers to gender parity across the various stages of the entrepreneurship cycle. The following paragraphs discuss these factors in turn.

Recommendations and Conclusion

Achieving gender parity in the entrepreneurship cycle requires effective measures to address the constraints. The challenge of lack of formalisation and access to capital could be mitigated by designing innovative lending schemes that address the needs of micro and small enterprises. The government should provide incentives to lending institutions that make consideration for special interest groups and advance credit facilities that spur the business growth of MSMEs. Similarly, to facilitate easier access to capital, sufficient alternatives for collateral should be provided to substitute the traditional property.

With regards to overlapping regulation and the resulting multiple licenses, better coordination amongst the relevant government agencies must be employed. The different categories of licenses offered should be integrated into a single permit at a reasonable cost. Notably, the Government of Kenya has been lauded[14] for the efficient implementation of the “Huduma Kenya Programme”[15] which integrates different government services into one platform, enhancing access to government services. While a few business-related services are offered at Huduma Centres and accessible on the e-Citizen portal,[16] neither of the platforms provides a fully integrated system for business services. This should be reviewed to include business registration services and the requisite licenses.

Further, the e-Citizen platform should integrate both national and county government services for faster and more efficient access to facilitate payment of licenses. At present, only four of the 47 counties have linked their services to the digital platform. The national and county governments should undertake initiatives to raise awareness and build literacy on the use of the existing virtual service delivery platforms including easier access to business services on the digital platforms.

Finally, the underlying factors aggravating the lack of access to markets should be explored further. Government should invest in research that will examine the constraint and whether there are real gender disparities around market access. This data would form useful indicators for the formulation of appropriate policies. A separate solution that could be facilitated by the government to address the challenge of markets is the actual expansion of markets through technology.

Jackline Kagume is a lawyer and the current programme lead for the Law and Economy Programme at the Institute of Economic Affairs (IEA) Kenya.

[a] Behind Rwanda, Burundi, Tanzania and Uganda. South Sudan was not ranked in the Index.

[b] The labour force participation rate refers to the percentage of all the people of working age who are employed or actively seeking employment.

[c] The Kenya National Bureau of Statistics (KNBS) is the principal government agency tasked with the mandate to collect, process, and disseminate statistical data and maintain a comprehensive national socio-economic database.

[d] The implementation of the AGPO follows the legal requirement that at least 30 percent of government procurement opportunities be set aside specifically for enterprises owned by these groups.

[e] The finding states that only 18 percent of firms in Kenya have a female top manager implies that the remaining firms have a male top manager. Similarly, 47 percent of firms have female participation in ownership implying that 53 percent of firms have male participation in ownership.

[f] These communities believe that women in management are unsuitable partners in the family unit.

[g] Only 32.2% of large firms had female participation in ownership compared to 57.5% of medium firms and 45.5% of small firms. On the second indicator regarding firms with a female top manager, small firms recorded the highest percentage of the presence of a female top manager at 22.1% and this number decreased with the growing size of the firms. Large firms had the lowest presence of a female top manager at 8.8%.

[h] In Kenya, the MSME Report found that a majority of enterprises (80.6 percent) reported family or personal savings as the main source of start-up capital[h]. Bank financing was only reported at 5.6 percent and special purpose government funds at 0.1 percent.

[1] Government of Kenya, The Constitution of Kenya, Article 27: Equality and freedom from discrimination, Nairobi: Kenya Law, 2010.

[2] Global Gender Gap Report, The Global Gender Gap Index 2021 Rankings, World Economic Forum, Geneva:WEF, 2021.

[3] Australian Government, Australian Institute of Health and Welfare, The health and welfare of Australia’s Aboriginal and Torres Strait Islander peoples, Economic Participation, Housing and Community Safety, Canberra: AIHW, 2015,

[4] Kenya National Bureau of Statistics, Economic Survey, Employment, Earnings and Consumer, Nairobi: KNBS, 2021.

[5] Kenya National Bureau of Statistics, “Economic Survey” 2021, 88

[6] Government of Kenya, Business Registration Service Act, Nairobi: Kenya Law, 2015,

[7] Kenya National Bureau of Statistics, Micro, Small and Medium Enterprises Basic Report, Nairobi: KNBS, 2016,

[8] Kenya National Bureau of Statistics, “Micro, Small and Medium Enterprises Basic Report”, 152

[9] Public Procurement Regulatory Authority, Annual Reports, Nairobi: PPRA, 2019.

[10] Harvard Division of Continuing Education, Why Gender Equity in the Workplace is Good for Business, 2020.

[11] Mckinsey &Company, “Women in the Workplace”, September 27, 2021.

[12] The World Bank, Enterprise Survey Kenya Country Profile, Nairobi: WBG, 2018.

[13] Kenya National Bureau of Statistics, “Micro, Small and Medium Enterprises Basic Report”, 102

[14] Huduma Centre wins Top UN Award for Service Delivery”, The Standard, May 11, 2015.

[15] Government of Kenya, “Huduma Kenya Programme”, 2022.

[16] Government of Kenya, “Digital Payments(E-Citizen)”, 2022.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Jackline Kagume is a lawyer and the current programme lead for the Law and Economy Programme at the Institute of Economic Affairs (IEA) Kenya.

Read More +