-

CENTRES

Progammes & Centres

Location

Direct air carbon capture and storage (DACCS) technologies extract carbon dioxide (CO2) directly from the atmosphere and store it permanently in deep geological formations or use it for food processing and synthetic fuel production. When CO2 is stored underground it achieves negative emissions but when it is used in synthetic fuel production CO2 is re-emitted into the atmosphere when the fuel is burnt but there is reduction in overall CO2 emission.

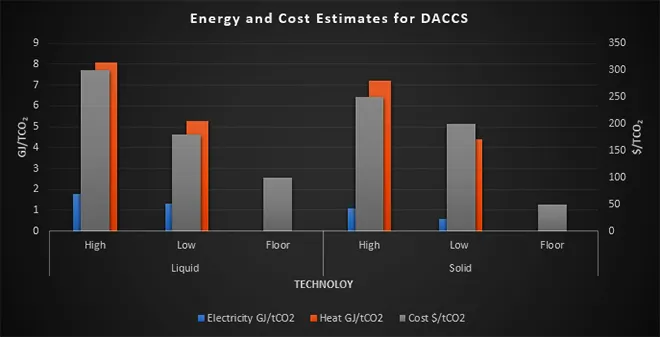

Liquid air capture technologies are based on using water solutions containing hydroxide sorbents with a strong affinity for CO2, such as sodium hydroxide, calcium hydroxide, and potassium hydroxide that remove CO2 from air and return the rest of the air to the atmosphere. Solid direct air capture technologies, currently at the research stage, use solid sorbent filters such as amine materials bonded to a porous solid support. A wider range of solid sorbents such as ionic membranes, zeolites, solid oxides that chemically bind with CO2 are being investigated. When the filters are heated, they release the concentrated CO2, which can be captured for storage or use. Both solid and liquid capture technologies could be fuelled by renewable energy sources, such as geothermal, solar, and wind, while solid direct air capture could be powered by recovering waste heat, which would reduce lifecycle emissions considerably.

The CO2 in the atmosphere is much more dilute than the flue gas from a power station or a cement plant. This contributes to the higher energy needs and costs for direct air capture relative to other CO2 capture technologies and applications. CO2 needs to be compressed at a very high pressure to be injected into geological formations. This increases both the capital cost of the plant—due to the requirement for additional equipment such as a compressor—and the operating costs—to run the compressor. If the plant is located close to storage or utilisation site, the need for long-distance CO2 transport is eliminated thus reducing cost.

Orca, the world's largest direct air capture plant constructed by Swiss company Climeworks and Icelandic company, Carbfix, started working in Iceland in August 2021. Climeworks will capture 4,000 tonnes of CO₂ a year, roughly equal to annual emissions of about 250 US residents or 870 western cars and Carbfix will pump the CO2 deep into the ground, turning it into stone forever. Climeworks’ goal is to capture 1 percent of annual global CO₂ emissions, more than 300 million tonnes (mt) by 2025. Of the 16 installations, Climeworks has built across Europe, Orca is the only one that permanently disposes of the CO₂ rather than recycling it. Fifteen direct air capture plants are currently operational in Europe, the United States, and Canada. Most of these plants are small and sell the captured CO2 for use such as for carbonating drinks. However, the first large-scale direct air capture plant is now being developed in the United States by a Carbon Engineering and Occidental Petroleum partnership. The plant will capture up to 1 mt CO2 each year for use in enhanced oil recovery and could become operational as early as 2023.

Orca cost US $10-15 million to build, including construction, site development and storage. Climeworks is backed by a group of private investors, as well as Swiss bank, Zuercher Kantonal bank. It also has debt financing commitments from Microsoft Corp.’s climate innovation fund. The main challenge for the plant is the cost of its service. While still unprofitable, the bulk of Climeworks’ revenue comes from corporate customers including Microsoft, Stripe, Shopify, and Swiss Re. In addition, 8,000 private customers wanting to purchase carbon offsets have also signed up paying as much US $ 1,200/tonne of CO₂. For bulk purchases, such as those made by Bill Gates, the cost is closer to US $ 600/tonne.

Climeworks aims to get that cost down to US $200-300/tonne by 2030, and to US $100-200/tonne by 2035, when its operations are at full scale. The price of carbon at EU ETS (European Union Emission Trading System) is at around 60 euro/tonne (US $ 70/tonne) and it is expected to touch US $100/tonne soon. This suggests that Climeworks’s future price may become competitive for carbon offsets in the future.

This ambitious up-scaling of DACCS will require appropriate regulatory and policy intervention. Policy instruments and financial incentives supporting negative emission technologies are almost absent at a global scale, but the USA has initiated tax credit support for carbon capture technologies. A plant of Orca’s size is eligible for US federal tax credits equal to about US $ 35/tonne of CO2 (tCO2) used in enhanced oil recovery and US $50/tCO2 storage. It is also eligible for the California Low Carbon Fuel credit, if the CO2 is used to produce low-carbon transportation fuels. These credits traded at around US $ 180/tCO2 in 2019.

Given the current level of CO2 emissions approaching 40 GtCO2/yr (giga tonnes of CO2 per year) and the limited success of global mitigation efforts, large-scale removal of CO2 from the atmosphere may be unavoidable. Compared to other sequestration options, capturing CO2 directly from the air presents several advantages. It can address distributed emissions, such as those from transport, aviation and intensive industrial sectors that account for almost 50 percent of total emissions. Modular DACCS plants will allow for rapid scaling. DACCS technologies have limited land and water footprint. Studies have found that deploying DACCS significantly reduces mitigation costs, and that it complements rather than substitutes other negative emission technologies. The key factor limiting DACCS deployment is the rate at which it can be scaled up.

According to recent modelling studies, DACCS scale-up rates of 1.5 GtCO2/yr would require considerable sorbent production and up to 300 EJ/yr (Exajoules per year) of energy input by 2100. In 2100 it is estimated that DACCS could require around 50 EJ/yr of electricity, that is more than half of today’s total production (and about 10–15 percent of the global generation projected in 2100) and 250 EJ/yr of heat, representing more than half of today’s final energy consumption globally. To avoid additional infrastructure and pipelines to meet the energy needs of DACCS plants, they need to be co-located close to industrial facilities where waste heat is recovered, but this will limit the decentralization advantage of this technology.

Models that assume that DACCS can be deployed at scale, conclude that if DACCS is not available for various reasons, it could lead to a global temperature overshoot of up to 0.8°C. The conclusion of these studies is that DACCS should be developed and deployed alongside, rather than instead of other mitigation options.

Source: Realmonte, G. et al, “An inter-model assessment of the role of direct air capture in deep mitigation pathways”, Nature Communications, Vol. 10, 2019

Source: Realmonte, G. et al, “An inter-model assessment of the role of direct air capture in deep mitigation pathways”, Nature Communications, Vol. 10, 2019In a sign that economic activity is fast returning to normal levels after getting badly affected during the peak of second wake in April-May period, the country’s largest power exchange, Indian Energy Exchange (IEX) has reported a 37 percent growth in the volume of electricity traded at the exchange in July, 2021. The total volume of electricity traded at the exchange stood at 7322 million (mn) kWh in July 2021, 37 percent higher than the same month last year. Along with a pick up economic activity, competitive power prices coupled with flexible procurement and a diverse spectrum of market segments have enabled the exchange to increase trading of electricity. Besides, the exchange is also providing participants to accrue significant financial savings by securing electricity from the platform. According to the power demand data published by the National Load Dispatch Center, the national peak demand on 7 July at 200.6 Giga Watt (GW) was the highest ever, registering a 17.6 percent year on year (YoY) increase while the energy consumption at 125.5 billion (bn) kWh grew 10.6 percent on a YoY basis. During the month, India's manufacturing Purchasing Managers Index (PMI) rose to a 3-month high at 55.3. With easing of lockdown restrictions, economic activities as well as power consumption accelerated. While the increase in power demand has been contributing to the electricity volume growth at IEX, the Exchange's role as the most flexible, competitive, and transparent platform for power procurement for the distribution utilities and industries has been the most key aspect towards its increasing role and impact.

The turnaround in the power transmission and distribution sector in the past one year in Jammu and Kashmir (J&K) has helped in achieving reliable, quality, and sustainable electricity supply. The Union Territory (UT) dedicated seven new power infrastructure projects worth INR 101.1 million to the public. The new projects target four districts of the Kashmir Valley - Pulwama, Bandipora, Ganderbal and Budgam—and would benefit 30,400 households. The UT’s power sector had not seen any development for the past three decades, and further strengthening of the infrastructure will help the government's aim of providing uninterrupted supply to households even in the rural areas. Hardly any work was done in the past three decades to strengthen the power infrastructure in the J&K UT and the administration inherited a plethora of problems confronting the power generation, transmission, and distribution sectors. The government is incurring huge losses in the power sector because people are not paying their bills.

In a major reform initiative, the government proposes to delicense the power distribution sector allowing competition in the supply of last-mile electricity connectivity to consumers. The proposed changes will be part of the New Electricity Amendment Bill which the government proposes to introduce and pass during the coming monsoon session of Parliament. The bill will replace Electricity Act, 2003 which earlier delicensed power generation sector. According to ministry of Finance, a framework will be put in place to give consumers alternatives to choose from amongst more than one distribution company. As per the ministry there is a need to provide choice to consumers by promoting competition and breaking monopolies existing in the power distribution sector. The power ministry earlier wanted to introduce a provision for separation of carriage and content operation in the distribution sector as part of a plan to break the monopoly of discoms. Under this, while carriage or transmission aspect of distribution operation would have been retained with existing discoms, content or actual supply of electricity to households and others would have been freed for competition offering choice to customers to choose their electricity supplier. However, in the absence of requisite support from states to the move, the proposal was dropped.

As part of the Centre’s policy to implement an advanced real-time data acquisition system across the country, Telangana’s power discoms are preparing to deploy the new system that is expected to ensure uninterrupted and quality power supply to the consumers. Telangana’s discoms Northern Power Distribution Company of Telangana Ltd (NPDCTL) and Telangana State Southern Power Distribution Company Ltd (TSSPDCL) have been mandated to implement the new technology RTDAS across the grids in the state.

According to the ministry of power, the average power supply per day was 22.17 hours in rural areas and 23.36 hours in cities during June 2021. As per independent surveys, the availability of power in rural areas has gone up from an average of 12 hours in 2015-16 to 20.50 hours in the year 2020; and in the urban areas, the availability of power has gone up to 22.23 hours. Under the Saubhagya scheme, as of 31 March 2021, all the states have reported 100 percent electrification of all the willing un-electrified households, identified before 31 March 2019. The present installed generation capacity in the country is around 384 GW, which is more than sufficient to meet the power demand in the country. The government has received a proposal from one of the states for a uniform power tariff throughout the country. The government is promoting competition through power exchanges. Most of the time, there is one rate for the power traded in the power exchanges for all the buyers in the country. Efforts are being made to increase the share of power purchases through power exchanges.

India’s power consumption grew nearly 17 percent in the first fortnight of July to 59.36 billion kWh and returned to pre-pandemic level mainly due to easing of lockdown curbs and delayed monsoon, according to power ministry data. Power consumption during 1-14 July last year was 50.79 billion kWh. Power consumption was recorded at 52.89 billion kWhs in the first fortnight of July in 2019. Thus, consumption of power has not only grown YoY but also returned to pre-pandemic level. In July 2020, power consumption recovered to 112.14 billion kWhs, but remained lower than 116.48 billion kWhs in the same month of 2019 (pre-pandemic level). Recovery in power demand and consumption in the first fortnight of July is mainly due to delayed monsoon and surge in economic activities amidst easing of lockdown restrictions by states. The commercial and industrial power demand and consumption got affected April onwards this year due to lockdown restrictions imposed by states. Amidst decline in the number of daily COVID-19 positive cases across the country and easing of lockdown restriction by the states, the commercial and industrial demand of power would rise from July onwards.

Amidst rising mercury and humidity level, Uttar Pradesh (UP) created a record of supplying 25,032 Mega Watt (MW) power. UP claimed that the discoms (distribution companies) are supplying power up to 24,000 MW for the past one month. The transmission capacity of the state has been increased up to 26,000 MW till date and by the end of current financial year it will cross 28,000 MW.

NTPC has achieved 100 billion kWhs of cumulative generation in the current financial year, indicating improved performance and an increase in demand for power in the current year. Last year the group generation had crossed 100 billion kWhs on 7 August 2020. NTPC Korba (2600 MW) in Chattisgarh is the top performing thermal power plant in India with 97.61 percent Plant Load Factor (PLF) between April to June 2021, as per the data published by Central Electricity Authority (CEA). The 37-year-old, NTPC Singrauli unit 4 (200 MW) in Uttar Pradesh, achieved 102.08 percent PLF, highest in the country, from April to June 2021.

Hitachi ABB Power Grids in India announced commissioning of a 1,800-km-long 6 GW ultra-high voltage direct current (UHVDC) transmission link from Raigarh to Pugalur. The 800 kilovolt (kV) transmission link has the capacity to meet the electricity needs of more than 80 million people. It stretches from Raigarh in Central India to Pugalur in the southern state of Tamil Nadu. The link strengthens grid resilience and stabilizes the power infrastructure by combining traditional and renewable power generation. It enables further development and integration of sustainable energy, supporting the government's goal of reaching 450 GW of renewable energy by 2030.

As per the Power Ministry providing quality and reliable power supply round-the-clock is a key factor for accelerated growth of the economy. The power sector has witnessed tremendous growth over the past few years in the areas of generation, transmission and distribution. With a total installed generation capacity of 384 GW, the country has transformed from a power deficit to a power surplus country. Transmission network has been expanded to connect the whole country into one integrated grid with inter-regional transfer capacity of over 100,000 MW. Under the Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and Integrated Power Development Scheme (IPDS) for strengthening the distribution system, 2,798 new substations have been set up, 3,930 substations have been upgraded and 2.5 crore meters had been provided, amongst others. The revamped distribution sector scheme was the largest of its kind in the power sector and that there are enough funds to meet the requirements of the states/discoms for distribution system strengthening and modernisation. While calling for a major technological push by discoms, the scheme envisages extensive use of Artificial Intelligence (AI) and Information Technology (IT) for system generated energy accounting to enable energy audit and modernisation of distribution infrastructure for loss reduction as well as improvement in reliable power supply. Amongst others, the scheme provides for separation of agricultural feeders and discoms should also take advantage of KUSUM Scheme for separation and solarisation of the agricultural feeders. The target of the scheme is to bring down the Aggregate Technical and Commercial (AT&C) losses to 12-15 percent at the all India level as well as to reduce the gap between Average Cost of Supply (ACS) and Average Revenue Realised (ARR) to zero by 2024-25.

Delhi Power Ministry has accepted its Goa counterpart’s dare to debate the merits of the Delhi power tariff model versus the one in place in Goa. If the AAP comes to power, the first 300 kWhs of power consumed by domestic households would be free, while also promising 24x7 uninterrupted power supply, on the lines of the Delhi government.

Japan has been largely forgotten as a source of demand for energy commodities, overshadowed by the rapid rise of China, but the country’s new electricity generation targets will shake the market up. For many years Japan has been viewed as a largely steady source of demand for liquefied natural gas (LNG) and thermal coal used in power generation, with small variations in the volumes imported on a year-by-year basis. Australia supplies about two-thirds of Japan's thermal coal requirements, with imports of 70.7 million tonnes (mt) in 2020, out of a total of 105.2 mt. Japanese utilities have long favoured Australian thermal coal for its higher energy value and lower impurities compared to other grades available on the seaborne market. If Japan does meet its target of reducing coal from the 32 percent share of power generation in the 2019 fiscal year to just 19 percent by 2030, this implies a reduction of total annual imports to around 62.6 mt, assuming total power generation remains at current levels.

A homemade bomb exploded at an office of Myanmar’s state electricity provider, injuring at least seven people in the latest example of opponents of the military-installed government turning to violence after their peaceful protests were suppressed with deadly force. Offices and staff of EPC (Electric Power Corp) have been targeted when the government decided to crack down on customers who are not paying their bills by cutting off their service. When the government threatened to cut off electricity, opposition activists hoped the non-payment protest would continue, with people adopting alternatives such as cooking gas, generators and solar panels. In practice, however, many people felt they could not afford to lose their electricity supply, particularly apartment dwellers who depend on it to power pumps that supply their water. Instead of pressuring users, activists have gone after the electricity suppliers, the electricity company and their employees, whom militants have warned not to cut off electricity.

Rescuers used helicopters and water cannon in a fitful fight to save a Turkish power plant from being engulfed by deadly wildfires. Experts warn that climate change in countries such as Turkey increases both the frequency and intensity of wildfires.

According to Brazil’s national power grid operator (ONS) severe drought is likely to push the country’s power generation capacity to its absolute limit by November, as hydroelectric plants struggle with the water shortages. Latin America’s biggest economy is facing its worst drought in almost a century, which is disrupting hydroelectric dams – Brazil’s main source of power generation. Despite the stretched power system, the ONS did not forecast power shortages for consumers.

The Spanish government is considering additional measures to lower rapidly ballooning electricity bills as power prices neared record highs, alarming consumer groups. Consumer protection group Facua has demanded that the government act swiftly to cut prices through a permanent value-added tax reduction, a 50 percent subsidy for low-income families and a cap on what utilities can charge. The government agreed to cut the value-added tax rate on electricity to 10 percent from 21 percent when the average monthly price is above a certain threshold. It also suspended during the third quarter a 7 percent tax on the value of electricity generation, which utilities ultimately pass on to the retail market. Average day-ahead electricity price in Spain and Portugal reached a record €106.57 (US $ 126 or INR 9,218) per megawatt-hour, according to OMIE, the Iberian electricity market operator. More than half of the price consumers pay in Spain is made of taxes and mandatory contributions. The rise in electricity prices has coincided with a new formula for calculating household consumption based on the hours of the day, which has upset many Spaniards who believe it is pushing up rates.

Germany lifted its forecast for electricity consumption in 2030 by at least 9.3 percent due to the roll-out of electric vehicles, tougher climate targets and the abandonment of oil or gas as a fuel. The higher electricity consumption would be triggered by a faster adoption of electric vehicles, with 14 million cars now expected on the road by 2030 up from a previous forecast of 10 million. In addition, about 6 million heat pumps would be installed in buildings, which would also need more electricity. Utilities have been asking for realistic targets on which to place their planning, arguing earlier official forecasts were too low as they were based on expectations for more energy efficiency. The German Association of the Energy Industry (BDEW) assumes consumption of 700 billion kilowatt hours (700 million kWhs) in 2030.

12 August: Revenue earned by the government in the form of VAT (Value Added Tax) on petrol in the first quarter of this financial year is 98.92 percent more than last year’s first quarter. Rise in VAT collection on petrol was more than the collective rise of diesel and petrol, which is 51.68 percent and 40.54 percent more respectively this year in comparison to last year’s first quarter. Finance Minister (FM) Jagdish Devda said, in 2020-21 till June, VAT of INR5.19 billion was collected on petrol, INR9.2 billion on diesel and INR107.93 was collected as VAT from liquor. In 2021-22 till June this year, INR10.33 billion was earned as VAT from petrol, INR13.95 billion from diesel and INR1.51 billion from liquor. The yearly increase from last year to this year for the period was 98.92 percent on petrol, 51.68 percent on diesel and 40.54 percent on liquor. FM also ruled out any reduction in tax, pointing that the state government fixes the rates considering its financial needs to carry out development. The rise in VAT collection on petrol is many times more when compared to the financial year 2019-2020 and 2020-2021. The increase in percent in VAT collection for the whole year in 2020-21 compared to 2019-20 was 22.39 percent on petrol, 15.88 percent on diesel and 26.14 percent on liquor. Overall, the yearly government revenue on petrol, diesel and liquor increased in the last two years despite pandemic and lockdowns to control the spread of coronavirus.

Source: The Economic Times

11 August: Moody’s Investors Service said earnings for state-owned oil firms Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL) and Hindustan Petroleum Corporation Ltd (HPCL) will grow over the next 12-18 months as a gradual easing of pandemic restrictions drives a rebound in economic activity and fuel demand. While earnings stability of marketing operations will help to offset low refining margins, rising fuel demand will in turn increase refinery throughput. The combination of better demand and improving fuel cracks will also support an improvement in Asian refining margins from current levels, it said. Demand for petroleum products in India declined substantially in April and May 2020 following a nationwide lockdown to control the spread of coronavirus. This led to a drop in capacity utilisation for most refiners in the fiscal year that ended on 31 March (FY21). Rebound in fuel demand and gradual recovery in refining margins will drive earnings improvement. Stating that earnings stability of marketing operations will help to offset low refining margins, the rating agency said this primarily because of the oligopolistic structure of the fuel retailing industry in India where IOC, BPCL and HPCL together control 90 percent of the fuel retailing network. At the same time, all three companies are ultimately owned by the government, which ensures a stable industry environment without any severe competition. Moody's said capital spending by the three refiners will remain high on strong demand for petroleum products and government efforts to boost investment spending to support economic growth.

Source: The Economic Times

12 August: Goa Chamber of Commerce and Industry (GCCI) has written to Chief Minister (CM) Pramod Sawant asking for Value Added Tax (VAT) on piped natural gas (PNG) for industrial use to be reduced from 12.5 percent to 3 percent. GCCI president Ralph De Sousa said the rate of VAT on natural gas in Goa is more than four times that levied in Maharashtra, and double the rate of other states such as Gujarat and Haryana. The sharp difference between the VAT levied in Goa and in the neighbouring states will put Goa’s industrial units at a disadvantage, said GCCI. It has also called for the inclusion of natural gas under the goods and services tax (GST) regime. GSPCB (Goa State Pollution Control Board) has recommended compressed natural gas (CNG) and liquefied natural gas (LNG) as alternatives, but unlike furnace oil and petcoke, which are taxed under the GST regime, natural gas and CNG are taxed under VAT. Since there is no VAT credit available on PNG, it would have a cascading effect on the final cost to consumers as well as make the products less competitive against those from other states. Gujarat and Haryana charge 6 percent VAT on natural gas while Maharashtra levies a rate of 3 percent on natural gas for industrial use.

Source: The Economic Times

15 August: Although India’s total installed renewable energy generation capacity crossed the 100 GW-mark in an incredible achievement, experts feel that the expansion and addition of new coal-based power plants is negating its climate actions. India is now fourth in the world in terms of installed renewable energy capacity. It has set an ambitious target of 175 GW of renewable energy capacity by 2022. India’s coal consumption should peak in the next few years and there needs to be a clear phaseout plan for coal power which includes rehabilitation of affected communities and restoration of degraded land, Nandikesh Shivalingam, director, Centre for Research on Energy and Clean Air said. While India is expanding its renewable energy capacity, it is also expanding its coal power plant fleet.

Source: The Economic Times

17 August: The UP (Uttar Pradesh) government’s decision to reduce cross-subsidy charges on procuring power through power exchanges will help the industry to bring down its operational costs, the Indian Energy Exchange Ltd (IEX) said. The Uttar Pradesh Electricity Regulatory Commission (UPERC) in a tariff order dated 29 July, 2021 announced reduction of up to 64 paise per unit in the cross-subsidy charges on procuring power through power exchanges, IEX said. Energy marketplace IEX enables almost 4,500+ commercial and industrial consumers located across India to leverage open access through the exchange platform to procure electricity at attractive prices and accrue operational efficiency as well as the financial savings.

Source: The Economic Times

11 August: The high court (HC) commenced the final hearing in a batch of petitions filed by renewable energy companies having power purchase agreements (PPAs) with the state government. The power companies had moved the high court challenging the single judge order directing them to negotiate the power tariffs with Andhra Pradesh Electricity Regulation Commission (APERC). The government, through a GO in 2019, had constituted a price negotiation committee to review power tariffs in the state. It proposed to reduce power tariffs as per prevailing market prices and formed the committee to negotiate the same with power generation companies. The power companies moved the high court challenging the GO, contending that the PPAs cannot be reviewed as they were finalised through a competitive bidding. They also argued that formation of the price negotiation committee was in violation of Electricity Act. Considering the arguments, the high court set aside the GO and directed the companies to negotiate power tariffs with the APERC. The court also directed to pay the tariff derived by the state government subject to outcome of APERC proceedings over fixation of tariffs. The companies again moved appeal petitions challenging the order.

Source: The Economic Times

14 August: India is shining in energy transition by treading a strong renewable energy path post-2015 Paris Agreement as it witnesses a step-up in investments in solar energy. Additionally, there’s a significant slowdown in investments in thermal power plants. Just a few days ago, the Ministry of New and Renewable Energy announced that the total installed renewable energy capacity in India, excluding large hydropower, has crossed the milestone of 100 GW or 100,000 MW, about 26 percent of the total capacity, a turning point in the history of renewables as India is celebrating 75th Independence Day. Coincidently, this milestone came at a time when the Intergovernmental Panel on Climate Change (IPCC) report was launched citing the need for urgent climate actions collectively to keep global warming under 1.5 degrees. The IPCC report paints an even bleaker picture of a planet at risk of seeing dramatic changes in its fundamental parameters which have made human civilisations possible, if emissions from fossil fuels and other sources are not immediately contained. India has taken several initiatives, including setting up of the International Solar Alliance, for raising the domestic renewable energy target to 450 GW by 2030 and putting in place an ambitious National Hydrogen Mission and continuing efforts to decouple its emissions from economic growth. With the total installed renewable energy capacity reaching 100 GW, India now stands fourth in the world in terms of installed renewable capacity, fifth in solar and fourth in wind in terms of installed capacity. While Gujarat, Maharashtra, Chhattisgarh and Karnataka have stated their intention not to build further coal and expand their generation through renewables, Climate Trends Director Aarti Khosla said that given India’s commitment to achieve 450 GW by 2030 a rationalisation of coal use is now a must. According to Central Electricity Authority (CEA) projections, instead of 40 percent, India will have 63 percent of installed capacity from non-fossil fuel sources by 2029-30. Now, India has a target of installing 175 GW of wind and solar energy by 2022. If achieved, that would be close to 50 percent of India’s current total installed power capacity.

Source: The Economic Times

12 August: Kolkata-based mining and minerals group Atha plans to exit their clean energy business by selling 365 MW assets spread across seven states. The proposed deal is likely to value the assets at an enterprise value of INR20 billion, multiple people aware of the development said. Atha has 200 MW assets in Tamil Nadu, 15 MW in Telangana, 20 MW in Karnataka, 50 MW in Maharashtra and the rest is in Rajasthan and Madhya Pradesh. The bids are expected to be in by 25 of this month. In 2017, Atha Group companies – Narbheram Vishram and NVR Energy had won the bid to supply 200MW of solar power to Tamil Nadu Generation and Distribution Corporation (TANGEDCO), out of the 2000 MW capacity sought to be developed by TANGEDCO. The 60-year old Atha Group is diversified into iron-ore mining, power & steel and Calcined petroleum coke, besides renewable energy. Acme Solar had sold 400 MW assets to PE fund Actis and 100 MW assets to Malaysia’s state-run oil and gas company, Petroliam Nasional Bhd (Petronas) last year. India’s renewable energy (RE) capacity addition is expected to improve to 10.5 GW to 11 GW in financial year 2021-22 led by a strong project pipeline of about 38 GW, according to ratings agency ICRA. India added a total solar and wind power capacity of only 4,908 MW in 2020, the lowest in the past five years, according to Bridge to India. In 2015, the government had declared an ambitious target of 175 GW from renewables by 2022.

Source: The Economic Times

11 August: The Ministry of New and Renewable Energy (MNRE) said it has launched a loan interest subvention scheme in association with UNIDI and GEF to provide financial assistance for innovative waste to energy bio-methanation projects. The industrial organic waste-to-energy bio-methanation projects are generally capital intensive and financially sensitive to both operating costs, including waste availability, and revenue, particularly biogas yield and its utilisation scenario.

Source: The Economic Times

11 August: The Tamil Nadu government is set to provide allocation for climate change mitigation efforts in the revised state budget for the financial year 2021-22. The Department of Environment, Tamil Nadu said that the budget which is to be presented in the house is likely to have a good allocation for working on the climate change and warnings from experts on the erosion of the Tamil Nadu coastline. Chief Minister M K Stalin in his inaugural address in an international seminar on 'Ensuring food and nutrition security in the context of climate change and the Covid-19 pandemic', organized by the MSSRF, said that the state government identifies climate change as a major issue to be tackled effectively with all the resources. The report on the Intergovernmental Panel on Climate Change (IPCC) has stated the possibility of extreme weather in Tamil Nadu creating major threat to the coastline in the state. NASA in its study based on IPCC report has warned that Chennai as one of the 12 coastal cities in India may be submerged underwater by the end of the century. The Tamil Nadu government has already prepared a report to revise the state action plan on climate change following suggestion from the union environment ministry. The Tamil Nadu State Action Plan on Climate Change (TNSAPCC 2.0) was prepared with the support of a German agency and now is being revised with state-specific impacts and vulnerability following the intervention of the Union Environment ministry.

Source: The Economic Times

11 August: The huge investments being made by companies in the solar energy sector have opened up great opportunities for permanent employment in Uttar Pradesh (UP). The UP government’s Solar Energy Policy 2017 is not only dispelling darkness from every village of the state, but also creating plethora of opportunities for people to earn their living from it. According to the government, in the last four and a half years, solar power projects of 1,370 MW capacity have been commissioned while projects of another 417 MW capacity are under construction. Big investors are coming forward to invest in solar energy sector in the state. Besides, several investment proposals for solar power projects are currently under government’s consideration. With these efforts, thousands of people have got employment in solar energy projects in UP while power supply has become more regular in rural areas and the environment is also benefiting with increasing use of renewable solar energy. The business of solar panels, solar lights, solar batteries and solar cookers has also picked up in the state, providing jobs to thousands of people. The Solar Energy Policy 2017 provides open access to companies for the establishment of solar park and third-party sale of solar energy.

Source: The Economic Times

11 August: US (United States) investment bank Goldman Sachs lowered its oil demand forecast for China for the next two months, citing rising concerns over the impact of the next wave of COVID-19 infections. The Wall Street bank, which had already cut expectations last month for emerging market demand because of the Delta variant, now expects a demand hit of a million barrels per day (bpd) in China, it said in a note. However, the bank said the net impact from Delta on its global oil demand forecast remained moderate and lowered demand forecast for next two months to 97.8 million bpd from 98.4 million bpd realized in July. China’s latest surge of COVID-19 cases entered its fourth week with the highly infectious Delta variant detected in more than a dozen cities since 20 July. Oil prices dipped as analysts cut forecasts for fuel demand in China following mobility curbs over the spread of coronavirus, offsetting a bullish outlook for US fuel demand. Goldman projects the oil market deficit to shrink to 1 million bpd in coming weeks as the Delta impacts peak, but expects the demand hit to be transient while supply shortfalls persist.

i: Reuters

11 August: An oil spill off Russia’s Black Sea coast over the weekend spread over an area of nearly 80 square kilometres and was much larger than initially thought, scientists at Russia’s Academy of Sciences (RAN) said. A leak occurred as the Greek-flagged Minerva Symphony tanker took on oil at the Yuzhno-Ozereyevka sea terminal near Novorossiysk in southern Russia, the Caspian Pipeline Consortium that owns the terminal said. The consortium, which transports oil from Kazakhstan, said the spill had spread over 200 square metres and involved 12 cubic metres of oil. It said the spill was quickly contained and posed no threat to people or wildlife. Deputy Prime Minister Viktoria Abramchenko ordered the state environmental watchdog to assess the scale and impact of the spill.

Source: The Economic Times

11 August: US (United States) President Joe Biden’s top aides are pressuring OPEC (Organization of the Petroleum Exporting Countries) and its oil-producing allies to boost production in an effort to combat climbing gasoline prices that they see as a threat to the global economic recovery. Biden’s national security adviser Jake Sullivan criticized the world's major oil producers, including Saudi Arabia, for what he said were insufficient crude production in the aftermath of the global COVID-19 pandemic. OPEC+ has been gradually easing a record output cut of 10 million barrels per day (bpd), about 10 percent of world demand, made in 2020 as oil use and prices recover from the pandemic-induced slump. As of July, the cut had been eased to about 5.8 million bpd.

Source: The Economic Times

11 August: Bangladesh has announced to have discovered a new gas field containing a probable reserve of about 68 billion cubic feet worth over US $148 million. The Bangladesh Petroleum Exploration Company (BAPEX) made the discovery in Sylhet region, some 240 kms northeast of Dhaka, state minister for Power, Energy and Mineral Resources Nasrul Hamidst said. BAPEX said that they plan to launch a 3D survey soon to assess the real position as they expect to extract up to 13 years at 10 million cubic feet per day from the virgin field. The field was primarily discovered in June but preferred to make the announcement public after assessing its probable reserve and extraction prospects. Bangladesh previously discovered 27 gas fields, with the latest one being in the southwestern coastal district of Bhola in October 2017, the biggest one so far, having hundreds of billions of cubic feet reserves. Currently, 20 gas fields are operational in Bangladesh with the supply of 2,300 million cubic feet gas per day (MMcf/d) against a national demand of 3,500 MMcf/d, a situation that prompted the government to import 600-800 MMcf/d liquefied natural gas (LNG). Bangladesh Oil, Gas and Mineral Corporation said the previously discovered 27 gas fields contained a cumulative original recoverable gas reserve of around 28 trillion cubic feet.

Source: The Economic Times

11 August: China’s national oil and gas pipeline operator PipeChina said it had begun construction on a 1.26 billion yuan (US $154 million) natural gas pipe project that will supply Zhangjiakou, one of the venues for the 2022 Winter Olympics. Beijing will be the official host of the Games, taking place in February, but some skiing and snowboarding events will take place in Zhangjiakou, some 170 km (105 miles) northwest of the capital. The gas pipeline project will feature six branch lines of a major Shaanxi-Beijing trunkline that will each run 173.7 km to Zhangjiakou, PipeChina said.

Source: The Economic Times

11 August: Exxon Mobil Corp has begun marketing US (United States) shale gas properties as it ramps up a long-stalled program that aims to raise billions of dollars to shed unwanted assets and reduce debt taken on last year. Three years ago, the top US oil producer set a goal of raising US $15 billion from sales by December 2021. More recently, it promised to accelerate lagging sales to whittle a record US $70 billion debt pile. The company's XTO Energy shale unit is seeking buyers for almost 5,000 natural gas wells in the Fayetteville Shale in Arkansas. The assets are amongst gas projects with declining production and market value Exxon is selling as it focus on newer ventures in Guyana, offshore Brazil and Texas’s Permian Basin. Exxon acquired the Fayetteville assets in 2010 for US $650 million during a shale boom that would change the US energy landscape, leading to an oversupply of gas that pushed prices to record lows and last year. This led Exxon to reduce the value of its US oil and gas holdings by US $17.1 billion.

Source: The Economic Times

17 August: Japanese trading house Sumitomo Corp said it has agreed to sell its 12.5 percent stake in the Rolleston thermal coal mine in Australia to its partner Glencore PLC for an undisclosed sum. Glencore will own 100 percent of the mine after the deal, Sumitomo said. The move comes in line with the Japanese company's policy to tackle climate change, which was revised in May and included a goal to cut its thermal coal output to zero by 2030, Sumitomo said. Sumitomo’s remaining interest in thermal coal mines is a 37.13 percent stake in the Clermont mine in Australia, but the company plans to keep its stake as the mine life is expected to end by 2030, Sumitomo said.

Source: The Economic Times

16 August: China’s coal output dipped 2.8 percent in July from a month earlier, hitting the lowest level since May 2019, as stringent mine safety checks across the country curbed production in the face of soaring prices and increased demand from power plants. The world's biggest coal producer and consumer churned out 314.17 million tonnes (mt) of coal, compared with 323.19 mt in June and down 3.3 percent from July last year, National Bureau of Statistics (NBS) data showed. Over the first seven months of the year, coal output was 2.26 billion tonnes (bt), up 4.9 percent year-on-year. The government is striving to strike a balance between increasing supplies to cool record coal prices and improving mine safety. China has granted extensions of trial operations at 15 coal mines, totalling 43.5 mt, and resumed production at 38 open-pit coal mines in the major mining hub of Inner Mongolia, with annual capacity of 66.7 mt.

Source: The Economic Times

17 August: IKEA, the world’s biggest furniture brand, is branching out into selling renewable energy to households, starting with home market Sweden in September. Ingka Group, the owner of most IKEA stores worldwide, said households would be able to buy affordable renewable electricity from solar and wind parks, and track their usage through an app. Ingka’s partner Svea Solar, which produces solar panels for IKEA, will buy the electricity on the Nordic power exchange Nord Pool and resell it without surcharge. Households will pay a fixed monthly fee plus a variable rate. IKEA, which also sells solar panels for households in 11 markets, said those buyers would be able to track their own production in the app and sell back surplus electricity. Ingka said the plan was to offer electricity from solar and wind parks five years old or less, as a way to encourage the building of more parks.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.