-

CENTRES

Progammes & Centres

Location

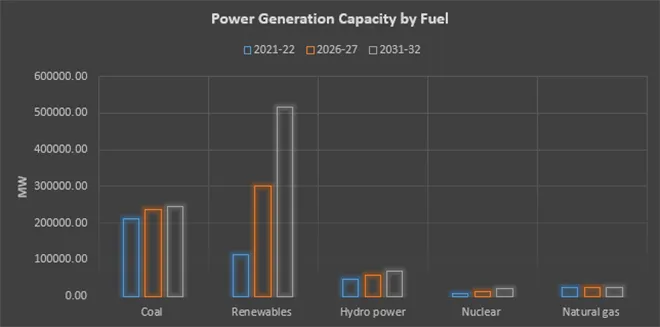

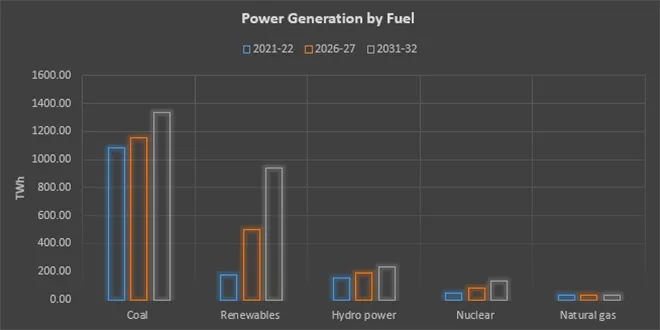

The draft National Electricity Plan of the CEA (central electricity authority) released in September 2022 (NEP 2022) for public consultation contains a review of developments in 2017-22, detailed capacity addition plans for 2022-27 and projections for 2027-32. Conventional capacity addition in 2017-22 was 30,667 megawatt (MW) which was 40 percent short of the planned capacity addition of 51,561 MW. The primary reason for the shortfall in capacity addition was the lockdown on account of the pandemic. As on 15 September 2022, installed power generation capacity was 404,132.96 MW with coal contributing 210,699.5 MW or 52.14 percent, hydropower contributing 46,850.17 MW or 11.5 percent of total capacity, natural gas contributing 24,856.21 or just over 6 percent of capacity and nuclear energy accounting for 6780 MW equivalent to 1.6 percent of power generation capacity. Renewable energy ([RE] solar, wind, biomass, and other new renewable energy sources) accounted for 114,437.37 MW (in July 2022) or 28.3 percent of capacity, making it the second largest after coal. Coal and natural gas generated 1114.75-terawatt hour (TWh) or 74 percent of power generation in 2021-22 followed by RE which contributed 178.34 TWh or 11.9 percent of power generation. Hydropower contributed 154.64 TWh or 10.36 percent of power generation while nuclear energy contributed 47.110 TWh or 3.15 percent of power generation.

The NEP 2022 projects coal-based power generation capacity of 25,580 MW and gas-based power generation capacity of 370 MW that are under constriction to come online by 2027. This would mean that coal-based power generation capacity will increase to 236,279.5 MW but its share in total capacity is expected to fall to 37.9 percent. Capacity addition of 370 MW will marginally increase the share of natural gas in power generation to 6.2 percent. Though 10,903 MW of hydropower capacity is expected to be added the share of hydropower capacity will fall to 9.2 percent by 2027. Around 1580 MW of pumped hydropower capacity is expected to become operational by 2027 while nuclear energy is expected to double in capacity adding 7000 MW and its share in power generation capacity is expected to increase to 2.2 percent. RE is expected to add 187,909 MW of capacity with solar making the largest contribution of 132,080 MW, followed by wind with 40,500 MW. Biomass-based power generation is expected to contribute 2318 MW and pumped storage 2700 MW. The overall share of RE in power generation capacity of 302,346 MW or 48.5 percent will be larger than that of coal if it materialises by 2027. In terms of generation, coal will continue to be the largest with 1158 TWh or 58.8 percent of generation and RE with an anticipated generation of 503 TWh is expected to make up 26.4 percent of total generation by 2027. The share of gas in power generation is projected to remain marginal at 35 TWh or just 1.7 percent and the share of nuclear generation increase to 82 TWh or 4.1 percent. The share of hydropower in generation at 189 TWh is expected to fall marginally to 9.6 percent.

The total power generation capacity is expected to increase by about 40 percent from 622,899 MW in 2027 to 865,941 MW by 2032. The largest capacity addition of 214,020 MW is expected from RE with about 69 percent contributed by solar photovoltaics (PV). Offshore wind power generation capacity of about 10,000 MW is expected to come onstream by 2032. Overall, RE is expected to account for about 60 percent of power generation capacity by 2032 estimated at 516,361 MW. The share of coal-based power generation capacity is expected to fall from about 37 percent in 2027 to 28.3 percent in 2032. No additional gas-based power generation capacity is expected after 2027 and the share of natural gas in power generation is expected to fall to just 2.9 percent by 2032. With 68,641.17 MW the share of hydropower is also expected to fall to 7.9 percent by 2032 (from 9.6 percent in 2027). Projections for nuclear power are optimistic with additional capacity of 8000 MW coming onstream by 2032. This will increase nuclear power generation capacity to 22,480 MW and its share in total power generation capacity is expected to increase to 2.5 percent (from 2.2 percent in 2027). Total power generation is expected to increase to 865,941 TWh by 2032 of which coal is projected to account for the largest share of 1333.8 TWh or about 50 percent. Generation from RE is expected to touch 938 TWh equivalent to 34.8 percent of generation. Generation from hydropower of 231.8 TWh is expected to account for 8.7 percent of total generation in 2032. Generation of 134 TWh of power from nuclear generators is projected to increase to 5 percent of total generation.

Projections by the draft NEP 2022 for power generation capacity are in line with the goal of installing 500 GW (gigawatts) of non-fossil-based power generation capacity by 2030. As projected by NEP 2022, overall power generation capacity is expected to increase by over 114 percent in 2022-2032. In this period, RE power generation capacity is expected to increase by over 351 percent, nuclear by over 230 percent, hydropower by over 46 percent, coal by over 16 percent and gas by just 1.5 percent. Though coal-based power generation capacity is expected to slow down, coal will continue to make the largest contribution to power generation even by 2032. This is made possible by increasing the PLF (plant load factor) of coal-based power plants from 55 percent in 2026-27 to over 62 percent in 2031-32. Total carbon-dioxide emissions from power generation is expected to increase from 910 MT (million tonnes) in 2020-21 by about 30 percent to 1180 MT by 2031-32 though the emission factor from power generation is expected to fall to 0.441 kg (kilogram)/kWh (kilowatt hour). Increase in non-fossil fuel-based capacity by 2030 and the consequent decrease in emission factor rest on the substantial increase in RE based power generation and to a lesser extent on nuclear power. RE will require financial resources as well as natural resources such as land and minerals on an unprecedented scale. The key challenge for policy will be to ensure availability of financial and natural resources, redesign the market to accommodate zero marginal cost power from RE and invest in battery and other forms of energy storage to strengthen energy security.

ONGC (Oil and Natural Gas Corporation) has inked gas sale agreements with GAIL (India) Limited and Assam Gas Company Ltd (AGCL) to monetise its upcoming field at Khubal in North Tripura district. Under the agreement, GAIL and AGCL will receive 50,000 standard cubic metres of gas each from Khubal Gas Gathering Station (GGS). Once it starts production, Khubal will be the tenth producing field of ONGC in Tripura. Khubal GGS will have a capacity to process 0.44 mmscmd (million metric standard cubic meters per day) of gas for which the process of construction has already been started.

Reliance Industries Limited (RIL) expects prices of natural gas in India to rise again in October but wants government-dictated caps to go, in a bid to align domestic rates with global energy prices. The conglomerate expects the price cap for its KG-D6 gas sales to rise over the current US$9.92 per million metric British thermal units (mmBtu). After remaining a loss-making provision for several quarters, RIL’s gas exploration business has begun reaping rewards of a global surge in energy prices that have already pushed the rates to a record high. The government sets gas prices every six months based on international rates. The price of gas from old or regulated fields was more than doubled to a record US$6.1 per mmBtu from 1 April, and that for difficult fields like those in deep sea to US$9.92 per mmBtu. Rates are due for a revision in October. It is anticipated that the price of gas from old fields of ONGC will be hiked to about US$9 per mmBtu and the cap for difficult fields will rise to double digits. RIL produced about 19 mmscmd of gas from its newer fields in the eastern offshore KG-D6 block in the April-June quarter. The KG-D6 block lies in deep sea and so gets a price equivalent to that for difficult fields. But this rate remains disconnected with global prices. RIL got a price of US$22.48 per mmBtu for 0.7 mmscmd of gas it produces from coal-bed methane (CBM) from blocks in Madhya Pradesh.

Mahanagar Gas cut the prices of kitchen fuel piped natural gas (PNG) and automobile fuel compressed natural gas (CNG), following an increase in allocation of domestically produced natural gas from the government. The price of PNG has been reduced by INR4 per standard cubic metre (scm) to INR48.50 per scm, while that of CNG by INR6 a kilogram (kg) to INR80 per kg. After the rate revision, CNG usage will help a vehicle owner save 48 percent on fuel costs in the financial capital, Mahanagar Gas Ltd (MGL) said.

For the fifth time in 2022, prices of CNG and domestic PNG will once again increase in Mumbai from the midnight of 2 August. CNG will now be available at INR86/kg, which is an increase of INR6 and domestic PNG will be available for INR52.50/scm, an increase of INR4. The last hike was on 12 July.

Along with high commercial LPG cylinder rate, the price of natural gas supplied by government owned natural gas explorer and producer GAIL (India) Limited has also been hiked. Natural gas prices have rallied 18 percent to US$10.5 per mmBtu. The latest hike in prices is three-and-half times that of the rate city gas companies paid for domestic supplies at March-end and nearly six times that of last August. GAIL supplies the gas, a blend of domestic and imported LNG, at a uniform rate to city gas companies, which are expected to pass on the increase to consumers of CNG and piped kitchen fuel.

Creating a history, CNG is more expensive than petrol and diesel. Green Gas Limited (GGL), the Indian oil subsidiary has hiked CNG price by INR5.3 per kg in Lucknow and Unnao. From 6am (1 August), consumers have to pay INR96.10 per kg in the state capital and INR97.55 per kg in Unnao. Currently, petrol price is INR96.57 per liter and diesel cost INR89.76 per litre. This is the third hike of CNG price in the current financial year. In July, CNG cost was INR90.80/kg for Lucknow and INR92.25 for Unnao. In May, GGL hiked price by INR2 following which CNG cost was INR87.80 per kg in Lucknow and Unnao. In April, the CNG cost was INR84.25 per kg in both cities.

Profit at GAIL (India) Limited will be hit as it rations gas sales after supplies are cut under its long-term deal with a former unit of Russian energy giant Gazprom amid high spot prices. GAIL, India’s largest gas distributor and operator of pipelines, imports 14 million tonnes per annum (mtpa) of liquefied natural gas (LNG) under various long-term deals. Of this, about 2.5 mtpa, or up to 39 LNG cargoes were to be supplied this year by Gazprom Marketing and Trading Singapore (GMTS), now a unit of Gazprom Germania. Since the end of May, GMTS has missed delivery of eight LNG cargoes to GAIL and is not certain about future supplies as it is securing the fuel for Europe, Jain said. GAIL has cut supplies to fertiliser and industrial clients besides reducing operations at its petrochemical plant at Pata, northern India, by over 50 percent to avoid purchase of costly spot LNG. The firm is also advancing delivery of some of its overseas LNG cargoes through time swaps and has chartered ships to bring in some of its US (United States) LNG that it was planning to trade. GAIL has deals to import 5.8 mtpa LNG from the US. GAIL is also scouting for long term LNG deals to secure supplies, although its previous tender for a 10-year 0.75 mtpa deal failed.

Central UP Gas Limited (CUGL), the company which supplies PNG to houses in the city has launched a drive to stop gas supply to the houses which have not cleared their dues. CUGL authorities said that there are over 70,000 gas connections in the city of which 5,000 consumers have not cleared their dues. The CUGL is reeling under financial crisis due to non-payment of dues. The billing is done once in two months and the CUGL customers get their gas bills bi-monthly.

Norwegian natural gas exports hit a record high of 128.4 billion crowns (US$13.26 billion) in July as prices and demand in Europe surged amid disruption of Russian supplies. Natural gas revenues were four times higher than for July last year, while the volume of gas sold rose by 5.7 percent to 10.2 billion cubic meters (bcm), Norway’s statistics office said. European gas prices spiked following Russia’s invasion of Ukraine at the end of February and a subsequent drop in Europe’s imports of Russian gas. Norway, western Europe’s largest oil and gas supplier, has adjusted its gas production to sell more gas for exports, instead of re-injecting it back into the ground to pump more oil.

Germans are facing a new tax on natural gas use that could cost the average household several hundred euros a year and is aimed at rescuing importers slammed by Russian cutbacks tied to the war in Ukraine. The tax on gas that is used to heat homes in winter and generate electricity is set to take effect in October and run through the beginning of April. It will not show up in utility bills until November or December. The gas tax will raise money to compensate importers of Russian gas, whose contracts with city utilities do not permit them to pass on the costs of surging natural gas prices. Russia has sharply cut back supplies of natural gas that costs less under long-term contracts, forcing importers to purchase much more expensive gas on the spot market to fulfil their obligations.

Centrica Plc has signed a 7 billion pound (US$8.47 billion) agreement with US -based Delfin Midstream Inc to buy LNG from 2026, Britain’s largest energy supplier said. Countries across Europe are seeking to diversify their energy supplies following Russia’s invasion of Ukraine and a drop in gas flows from Russia to Europe. Centrica, which owns British Gas, said the 15-year deal would be worth around 7 billion pounds and involve buying 1 million tonnes (MT) of LNG per annum on a free on board (FOB) from the Delfin Deepwater Port off the coast of Louisiana from 2026. Britain is home to three of the largest LNG terminals in Europe—two terminals at Milford Haven and another at the Isle of Grain—where the super chilled fuel is converted back into gas. The US became the world’s top exporter of LNG in the first half of 2022 and is on course to exceed a pledge to provide Europe with more supplies of gas and help to break its dependence on Russian fuels. Centrica signed an agreement with Norway’s Equinor in June for an additional 1 bcm of gas supplies, enough to heat 4.5 million homes over the next three winters.

Bulgaria’s energy ministry will launch a tender for LNG to prevent shortages during the peak demand winter season, caretaker Prime Minister Galab Donev said. Bulgaria consumes about 3 billion cubic meters (bcm) per year of gas, one third of which goes to heating utilities. Industry uses most of the rest. At present, the country receives about 1 bcm a year from Azerbaijan and buys the remainder on spot markets, where prices have surged. State gas provider Bulgargaz in response is seeking regulatory approval for a 60 percent increase in gas prices for August to 152 euros (US$154.72) per megawatt hour. Donev set up a task force to deal with the issue of gas supplies and said his government would not need external consultants for the job. The previous government had secured seven shipments of US LNG from October to April, in total about 1 bcm of gas, but has left Donev’s government to decide by 19 August whether to confirm them.

Germany needs to reduce its gas consumption by more than any other European Union (EU) member state in order to achieve the bloc’s agreed savings target of 15 percent. Germany must somehow find a way to save 10 bcm of natural gas between the beginning of August and March next year in order to reach the bloc’s target, the equivalent to the average annual gas consumption of 5 million four-person households, reveals the analysis carried out by dpa news agency using EU Commission data. Due to its high level of gas consumption, Europe’s largest economy is required to make greater savings than any other EU state, making it responsible for almost a quarter of the gas savings across the bloc. Economy Minister Robert Habeck has indicated that Germany was already on track to deliver a 14-15 percent reduction in consumption compared to the past year. However, last week Habeck also stressed that Germany would be attempting to reduce its consumption by more than the agreed 15 percent minimum.

France will have filled out 100 percent of its strategic gas reserves by 1 November, government energy transition minister Agnes Pannier-Runacher said, as European countries prepare for fewer energy supplies coming through from Russia. Brussels is urging European Union member states to save gas and store it for winter, fearing Russia will completely cut off flows in retaliation for sanctions over Russia’s invasion of Ukraine. European Union countries—bracing for further cuts in Russian gas supply—approved a weakened emergency plan to curb demand, after striking compromise deals to limit reductions for some countries. Energy Ministers agreed that all EU countries should voluntarily cut gas use by 15 percent from August to March, compared with their average annual use during 2017-2021.

Austria has made progress in weaning itself off Russian natural and boosting gas storage, the government said. Environment Minister Leonore Gewessler said dependence on Russian gas had fallen to less than 50 percent from up to 80 percent previously, which had made Austria one of the countries in Europe most exposed to Russian gas flows. Around 55 percent of the country’s annual consumption was now in storage, the Minister said. The government had allowed other companies to use the storage capacity at Haidach that went unused by Russian company Gazprom.

Italy has filled over 70 percent of its gas storage capacity as of 26 July, the Ecological Transition Minister said. Rome has said it aims to have the country’s gas storage system filled to at least 90 percent of capacity by the end of this year.

France is against setting uniform targets for the reduction of gas consumption in Europe amid a looming energy crisis, French energy ministry said. The European Commission proposed that all EU countries should cut their gas use from August to March by 15 percent. The target would initially be voluntary, but would become mandatory if the Commission declared an emergency.

The Czech Republic’s gas stores are 80 percent full, Prime Minister (PM) Petr Fiala said, as the country and other EU member states continue to boost storage to protect against risks of a halt to Russian supplies. The EU aims to have gas storage facilities across the bloc 80 percent full by 1 November, but its efforts have been hit by temporary outages or reduced capacity via Nord Stream 1, a major pipeline carrying Russian gas to Europe. Fiala said that Czech gas storage levels were at a record level. The Czech Republic was nearly fully dependent on Russia for gas before Moscow’s invasion of Ukraine in February pushed it to seek alternative supplies. Industry Minister Jozef Sikela said the country had secured 3 bcm of annual gas capacity—roughly a third of consumption—through an LNG terminal in the Netherlands. It has been filling stores primarily through Norwegian and LNG sources, he said. The EU has urged its member states to curb gas use to help fill storage ahead of winter and has warned that a full cut-off of Russian gas is likely. However, an EU plan to cut gas use by 15 percent from August has faced resistance from some states.

Algeria, Nigeria, and Niger have signed a Memorandum of Understanding (MoU) to build a natural gas pipeline across the Sahara desert, Algeria’s Energy Minister Mohamed Arkab said. The three countries agreed in June to revive decades-old talks over the project, a potential opportunity for Europe to diversify its gas sources. The Trans-Saharan gas pipeline is an estimated US$13 billion project that could send up to 30 billion cubic metres a year of supplies to Europe.

The US became the top LNG exporter in the first half of 2022, the Energy Information Administration (EIA) said. US LNG exports rose 12 percent to average 11.2 billion cubic feet per day (bcfd) in the first half of the year compared with the second half of 2021, the EIA said. Increased LNG export capacity, higher prices, and demand, particularly from Europe, helped boost exports. LNG exports have been growing dramatically over the last several years as countries worldwide seek to diversify away from dirtier coal plants. However, it takes several years to build new facilities; the US is not expected to add substantial new capacity until at least 2024. About 71 percent of US LNG exports went to the European Union and Britain during the first five months of this year, EIA said.

Russian state gas company Gazprom said that European gas prices could spike by 60 percent to more than US$4,000 per 1,000 cubic meters this winter, as the company’s own export and production continues to fall amid Western sanctions. Gas flows from Russia, Europe’s top supplier, are running at reduced levels this year, after one route was shut when Moscow sent troops into Ukraine in February and after sanctions triggered a dispute about the Nord Stream 1 pipeline’s equipment. Gas prices have surged as a result.

Australia’s Santos Ltd bought a company that owns an approved underground pipeline route that could transport natural gas from its planned Narrabri project, aiming to supply the domestic market around mid-decade. Australia’s second-largest independent gas producer said it would work with infrastructure developers and owners to build the pipeline, which Hunter Gas Pipeline has previously said would be valued at AUD1.2 billion (US$817 million). Australian Competition and Consumer Commission (ACCC) recommended restrictions on exports of LNG to avert a gas supply shortage, which the government is reviewing. The Narrabri project is in the state of New South Wales (NSW), Australia’s most populous state, which depends on gas from neighbouring states for all its of its supply.

Japanese trading houses Mitsui & Co and Mitsubishi Corp have cut the value of their stakes in the Sakhalin-2 LNG project in Russia by 217.7 billion yen (US$1.66 billion) following Moscow’s move to seize control of the project. Russian President Vladimir Putin signed a decree on 30 June to create a company to take over the rights and obligations of the Sakhalin-2 oil and gas project, raising the stakes in an economic war with the West. The Japanese government plans to support the trading companies in their attempts to stay in the Sakhalin-2 project. Japan imports about 10 percent of its LNG from Russia, mainly from Sakhalin-2.

23 August: Chennai Petroleum Corporation Limited (CPCL) said it has formed a joint venture (JV) with its parent company Indian Oil Corporation (IOC) and others to build a 9 MMTPA (million metric tonnes per annum) refinery at a cost of INR315.80 billion (US$3.95 billion) in southern Tamil Nadu state. CPCL, in which National Iranian Oil Company has about 15 percent stake, was operating a small refinery at the Cauvery Basin at Nagapattinam, where the new plant will be located. The new refinery will come up after dismantling the existing 1 MMTPA refinery, according to CPCL, and will produce liquefied petroleum gas, BS VI quality gasoline, diesel and aviation turbine fuel.

21 August: After almost 15 years, Oil India Limited (OIL)’s Khagorijan oil field in eastern Assam’s Dibrugarh started operation. Assam Chief Minister (CM) Himanta Biswa Sarma attended the ceremonial function of resumption of Khagorijan oil field of OIL at Rohmoria, operations of which were suspended since November 2007 due to administrative and environmental issues. According to the CM, four wells were drilled after oil was discovered in the area in November 1998 and production started in December 2004, including in Khagorijan located 1.8 km from the Brahmaputra. Due to severe erosion of Brahmaputra river, various local organisations of Khagorijan area obstructed OIL’s operations in that area. After prolonged blockade by the local organisations, the OIL suspended all its operations in November 2007.

17 August: Karnataka Police are mulling establishing fuel pump stations run by prisoners across the state on lines of Andhra Pradesh, the prison department confirmed. The department has already sent a proposal to open the fuel pump stations in the premises of five state prisons adjacent to the national and state highways. After implementing this project, the department will replicate this in other places. In the first phase, the pumping stations will be opened in Parappana Agrahara Central Prison of Bengaluru, Central Prisons of Mysuru, Ballary, Belagavi and Dharwad. The land of half an acre has already been identified. Shivamogga, Kalaburagi and Vijayapura Central Jails will also have petrol bunks in the later stages. The department wants to utilize the vacant land for commercial purposes. Undivided Andhra Pradesh state was the first to start the stations on the property of prisons run by prisoners. Presently, 26 fuel stations are being run by the prisoners through the department in Andhra Pradesh and Telangana states.

17 August: The United States (US) and other nations in the world may not appreciate India buying Russian oil, but they have accepted it, as New Delhi has not been defensive about its stand but made them realise the obligation the government has to its people amidst “unreasonably high” oil and gas prices, External Affairs Minister (EAM) S. Jaishankar has said. Oil prices are “unreasonably high” and so are the gas prices. A lot of traditional suppliers to Asia are diverting to Europe because Europe is buying less oil from Russia, he said. India has raised oil imports from Russia after the Ukraine war despite criticism from the West and continues to engage with Moscow for business. Indian government said in June that India’s crude oil imports from Russia had jumped over 50 times since April. In May, Russia overtook Saudi Arabia to become India’s second-biggest supplier of oil behind Iraq as refiners snapped up Russian crude available at a deep discount following the war in Ukraine. Indian refiners bought about 25 million barrels of Russian oil in May.

17 August: India’s demand for petroleum products like petrol and diesel will grow by 7.73 percent in 2022, the fastest pace in the world, an OPEC (Organisation of Petroleum Exporting Countries) report said. India’s demand for oil products is projected to rise from 4.77 million barrels per day (bpd) in 2021 to 5.14 million bpd in 2022, the report said. For 2023, the OPEC projected a growth of 4.67 percent in India’s demand to 5.38 percent. This, however, will be lower than 4.86 percent growth in China. India is the world’s third largest oil importing and consuming nation behind the US and China. The demand for petroleum products in India is supported by the healthy economic growth of 7.1 percent, continuing economic reopening amid ease of COVID restrictions and easing of trade-related bottlenecks supporting both mobility and industrial sector activity. The report said the oil demand will see a dip in the third quarter (July-September) due to the arrival of the monsoon but will pick up the following quarter on the back of the festival and holiday season.

18 August: Oil and Natural Gas Corporation (ONGC) signed a Heads of Agreement (HoA) with global oil giant ExxonMobil Corp for exploration of oil and gas in the deep sea on the country’s east and west coasts. ONGC, the nation’s top oil and gas producer, has been in talks with ExxonMobil for several months to explore a partnership.

17 August: Coal Minister Pralhad Joshi said that the government will make available more than 107 coal blocks for commercial mining through the auction route in the near future. Joshi said that the Indian economy is growing at a very fast pace and coal-based power generation has recorded a 16.8 percent increase this year and production of domestic coal has gone up by 22 percent. By the year 2030 India’s coal requirement will be 1.5 billion tonnes. So far, the government has allocated 43 coal mines, since the launch of commercial coal mining in India by Prime Minister Narendra Modi in June 2020. Once fully operational, these coal mines are expected to generate employment for 31,954 persons directly and indirectly. The successful bidders include MP Natural Resources, Mahanadi Mines and Minerals, Dalmia Cement (Bharat), Assam Mineral Development Corporation, BS Ispat and Jindal Steel and Power. Joshi said the Coal Ministry is targeting a coal production of 900 MT (million tonnes) in FY23, and the target for Coal India (CIL) comes to 700 MT. The all-India domestic coal production in FY22 stood at 778.19 MT compared to 716.083 MT in FY21 with the growth of about 8.67 percent.

23 August: The Tamil Nadu Generation and Distribution Company (TANGEDCO) is set to segregate agricultural power lines across the state to reduce the power line losses. Tangedco’s power line losses are currently pegged at 13.5 percent. According to TANGEDCO, 99 agricultural feeders will be segregated from transformers and other feeders, and the cost for the project is estimated to be about INR5.34 bn. The power utility will also be replacing old lines for a distance of 206.50 km with an expenditure pegged at INR154.1 mn and new poles may also be installed for this. TANGEDCO is expecting to reduce the power line transmission losses from the present 13.5 percent to 11.92 percent, in a gradual manner, through the segregation of feeders as well as new lines for power transmission.

19 August: The Andhra Pradesh (AP) government maintained that it owed no money to the power generators for electricity purchased through the power exchanges. Power System Operation Corporation Limited (POSOCO), a Government of India enterprise, has asked three power exchanges—IEX, PXIL and HPX— to restrict electricity trading by 27 discoms (distribution companies) in 13 states having outstanding dues towards gencos (generating companies). AP was listed as one of the states that had outstanding amount to the gencos. Over the past few months, the state has been purchasing about 40 million units of electricity per day through the power exchanges for meeting its needs, AP Transco said. The overall electricity demand in the state is about 180-190 million units per day but there has been a shortfall of about 40-45 million units. To tide over this, the state has been regularly purchasing power through the exchanges. With the POSOCO imposing restrictions on electricity trading, the state may find it difficult to procure required power to overcome the shortage.

23 August: Hindustan Petroleum Corporation Limited (HPCL) commenced its Cowdung to Compressed Biogas Project at Sanchore, Rajasthan. The plant, the first such under HPCL’s Waste-to-Energy portfolio, is proposed to utilise 100 tons of dung per day to produce biogas, which can be utilised as automotive fuel. The project is proposed to be commissioned in a year’s time. The project is being developed under GOBAR-Dhan scheme launched by Government of India in April 2018 as a part of the Biodegradable Waste Management component under the Swachh Bharat Mission (Grameen) to positively impact cleanliness and generate wealth and energy from cattle and organic waste.

22 August: Emphasising on the need to promote solar projects, UP (Uttar Pradesh) Chief Minister (CM) Yogi Adityanath set the target of generation of 22,000 MW of solar power in the next five years and asked the officials to formulate a new solar energy policy keeping the future needs in view. He said though efforts were being made for the last few years, more planned efforts were required to achieve self-reliance in the energy sector. The CM said that under the guidance of Prime Minister Narendra Modi, the UP government was working on a plan to develop Ayodhya as a ‘model solar city’. The CM emphasized on the need for a conducive environment for private sector investment in the field of solar energy generation and said that a single window system could be introduced for timely completion of projects. The CM said that public awareness should be increased to promote installation of solar power plants on rooftops. The CM said a solar cell should be constituted in districts under the chairmanship of the chief development officer and registration of all solar projects should be made mandatory. The CM added that prisoners should be trained in making solar energy equipment.

21 August: Oil and Natural Gas Corporation (ONGC) has embarked upon a journey to generate electricity on a utility scale by tapping steam gushing from the earth’s bowels at Puga, a remote valley located at an altitude of over 14,000 feet, off the road to Chumar on the de-facto border with China. This will be India’s first geothermal energy project, and also the world’s highest. It will boost Ladakh’s potential to emerge as one of the country’s clean energy bowl by expanding the area’s horizon beyond solar or wind power. ONGC started drilling its first well for the project and encountered high-pressure steam at 100 degrees Celsius with a discharge rate of 100 tonne geothermal energy per hour. This has made the crew confident about the project’s viability.

20 August: Solar and wind potential in India are likely to face a negative trend in the future due to climate change, according to a new study by Pune-based Indian Institute of Tropical Meteorology. The researchers used state-of-the-art climate models devised by the Intergovernmental Panel on Climate Change (IPCC) to analyse the wind and solar projections for the renewable energy sector over the Indian subcontinent. The seasonal and annual wind speed is likely to decrease over North India and increase along South India. The southern coast of Odisha and the southern Indian states of Andhra Pradesh and Tamil Nadu show promising potential for wind energy in the climate change scenario, the study said.

18 August: Solar capacity installations in the country rose by 59 percent to record 7.2 gigawatt (GW) during first half of 2022, according to Mercom India Research. In January-June or H1 of 2021, the country had added 4.5 GW solar capacity, the research firm said. The solar installations in April-June period of 2022 also increased by 59 percent to over 3.9 GW compared to 2.4 GW installed in second quarter of 2021. India’s cumulative installed solar capacity now stands at 57 GW. Cumulative large-scale solar PV installations in Rajasthan reached almost 13 GW as of June 2022, and the state accounted for almost 27 percent of the total installations in the country. In the first half of 2022, Rajasthan and Gujarat were the top states for large-scale solar, accounting for 53 percent and 14 percent of installations, respectively, followed by Maharashtra with 9 percent. Multiple government agencies announced tenders for about 9 GW in Q2 2022, which was 8 percent higher year-on-year.

17 August: Global commercial real estate developer CapitaLand Investment is mulling to set up a 30 MW solar power farm in Tamil Nadu in its efforts to have green/sustainable buildings. The company is set to double its built-up space to about 40 million square feet by 2024-25 and also get into the data centre segment.

23 August: A Peruvian judge admitted a US$4.5 billion lawsuit against Spanish oil firm Repsol SA, eight months after an underwater oil pipeline owned by the company caused a spill of over 10,000 barrels into the Pacific Ocean. The civil lawsuit seeking US$3 billion for environmental damage and US$1.5 billion for damages to locals and consumers was filed by Peru’s consumer protection agency Indecopi. The spill took place in January at Repsol’s La Pampilla refinery, located an hour north of capital Lima. Repsol initially blamed the incident on anomalous waves triggered by an underwater volcanic eruption near the island of Tonga, but has since shifted blame to an oil tanker.

22 August: Venezuela’s state oil and gas company PDVSA has restarted gasoline production at the country’s second largest refinery after repairing a breakdown. The Cardon refinery’s naphtha reformer, with a capacity of 45,000 barrels of oil per day, produces high-octane components for gasoline and is key to the country’s gasoline supply. The reformer suspended production at the end of June to undergo maintenance that extended beyond the 21 days originally scheduled.

18 August: Military-ruled Myanmar plans to import Russian gasoline and fuel oil to ease supply concerns and rising prices, the latest developing country to do so amid a global energy crisis. Russia is seeking new customers for its energy in the region as its biggest export destination, Europe, will impose an embargo on Russian oil in phases later this year. Fuel oil shipments are due to start arriving from September. In addition to political turmoil and civil unrest, Myanmar has been hit hard by high fuel prices and power cuts, prompting its military leadership to turn to imports of fuel oil that can be used in power plants. Petrol prices have surged about 350 percent since the coup in February last year to 2,300-2,700 kyat (US$1) per litre. In the past week, petrol stations have shut down in various parts of the country because of shortages.

17 August: Australia’s Santos Limited said it will move ahead with developing a US$2.6 billion Alaskan oil project in a surprise decision that caused the energy producer’s shares to fall despite it posting a record first-half profit. The company decided to go ahead with the Pikka project in Alaska after failing to sell down its stake and also flagged it would sell a smaller than expected stake in its prized PNG LNG asset in Papua New Guinea. That meant it would fall short of a target set in February to reap up to US$3 billion from asset sales this year. Santos indefinitely delayed approval for its Dorado oil and gas project in Australia due to rising costs, shipyard backlogs, stressed contractors, and reworking of project plans.

17 August: United States (US) Oil reserves held by 50 large companies rose by 13 percent over the 5 years ended in December, according to an Ernst & Young report, with mergers and acquisitions contributing most of the recent gain. Oil reserve estimates, which signal the direction of crude output, climbed to 31.8 billion barrels at the end of last year after plummeting in 2020 as the COVID-19 pandemic forced energy companies to curtail activity. US reserves were still lower than 2019 levels of 32.5 billion barrels, according to the analysis, which used estimates from 50 publicly traded companies holding the largest US oil and gas reserves. The upswing in reserves last year was primarily due to larger independent oil and gas companies buying private energy companies and acquiring other reserves. The studied group of companies spent US$94 billion to acquire proved and unproved properties.

23 August: Norway plans to maintain its current high gas production level until the end of the decade as Europe plans to ditch Russian imports over Moscow’s invasion of Ukraine, its Energy Minister Terje Aasland said. The Nordic country is expected to produce some 122 billion cubic meters (bcm) of gas this year, according to official forecasts made in May, an increase of 8 percent from 2021, possibly beating a record set five years ago. The Norwegian Petroleum Directorate predicted in January that gas output would be at 118 bcm—lower than the current level in 2026—the furthest year out forecast by the regulator.

23 August: Germany hopes Canadian liquefied natural gas (LNG) will help ease its shift away from Russian gas imports, Chancellor Olaf Scholz said, a day after Canada played down the economic viability and speed of setting up new export terminals. Scholz and Canadian Prime Minister Justin Trudeau in Newfoundland announced a “hydrogen alliance” aimed at accelerating efforts to export the clean fuel to Germany by 2025. Trudeau left the door open for new LNG projects from Canada’s Atlantic coast, but he emphasized the economic difficulties of such projects, which would take years to complete as the world races to cut its dependence on fossil fuels. Canada has two LNG projects planned on its Pacific coast: Shell-led LNG Canada is due to begin operating in 2025, and Woodfibre LNG, a subsidiary of Pacific Energy Ltd, is expected to be completed in 2027.

23 August: European prices of liquefied natural gas (LNG) have hit a record discount to gas prices at the Dutch TTF hub, which rose sharply as the news of another planned maintenance on the main Russian pipeline to Europe put markets on edge. Gazprom’s announcement of a three-day maintenance outage on the Nord Stream 1 pipeline to Germany from 31 August is supporting a hefty risk premium on European gas prices. Prices were already high with the pipeline currently limited to 20 percent of capacity. LNG cargoes for October delivery into Northwest Europe on an ex-ship (DES) basis were seen priced at US$60.183 per million metric British thermal units (mmBtu) on 22 August, according to S&P Global Commodity Insights. That marked a record discount of US$24/mmBtu to the TTF contract for October delivery.

18 August: Croatia will invest 180 million euros (US$182.32 million) to build a new gas pipeline and more than double capacity at its liquefied natural gas (LNG) terminal in a bid to secure gas supplies, the government said. European countries, which have heavily relied on Russian gas supplies, are trying to diversify gas supplies following Russia’s invasion on Ukraine. A new gas pipeline, estimated to cost 155 million euros, will connect the towns of Zlobin and Bosiljevo in northwestern Croatia. The LNG capacity on the northern Adriatic sland of Krk will increase to 6.1 billion cubic meters (bcm) of gas annually from 2.6 billion bcm. Energy Minister Davor Filipovic said the government has made a strategic decision to secure gas supplies but also to position itself as an energy leader in the region.

20 August: China’s coal imports from Russia jumped 14 percent in July from a year earlier to their highest in at least five years, as China bought discounted coal while Western countries shunned Russian cargoes over its invasion of Ukraine. China brought in 7.42 million tonnes (MT) of coal from Russia last month, data from the General Administration of Customs showed. That was the highest monthly figure since comparable statistics began in 2017, up from 6.12 MT in June and 6.49 MT in July 2021.

18 August: Britain is turning to old coal-fired power units as a “last resort” in case other sources cannot provide enough electricity through the winter as the country faces a wider energy crisis. Several European governments have requested that back-up power be made available from idled coal plants or those due to close due to lower gas flows from Russia as a result of disputes triggered by its invasion of Ukraine. Britain’s National Grid said it had signed contracts with power generators Drax Group and EDF to extend the life of four coal-fired power units at two plants for the upcoming winter. The available capacity will only be used a last resort to ensure security of supply if needed, National Grid’s Electricity System Operator (ESO) said, adding that negotiations continue with a third generator for a fifth coal unit.

23 August: High temperatures and drought have deepened the energy crisis in Europe this summer, affecting electricity production at a time when the European economies are already facing unprecedentedly high oil and gas prices. In France, Europe’s largest producer of nuclear power, several plants along the Rhone and Garonne were forced to reduce output because river temperatures were too high to cool the plants. This further reduced the power supply after the shutdown of a dozen of the country’s 56 nuclear plants for planned maintenance. Norway, Europe’s No.1 electricity exporter with a hydroelectricity output of 137.9 TWh (terawatt hour) last year, is preparing a framework for limiting electricity exports.

19 August: The Swedish government unveiled a plan to subsidise electricity bills for households and businesses to ease the pain of soaring electricity costs. Households and companies will both be compensated with at least 30 billion Swedish crowns (US$2.9 billion), Swedish Prime Minister Magdalena Andersson announced. Electricity prices in southern Sweden hit a record high of 7.68 crowns per kilowatt hour. Analysts expect the electricity prices to soar even higher during the coming winter, making new relief package necessary.

19 August: Danish, Finnish and Swedish transmission system operators (TSOs) urged Norway to rethink its plans to more tightly regulate its power production which ultimately could limit power exports. High demand and low precipitation have resulted in low water levels in Norway’s hydropower reservoirs, pushing domestic electricity prices to record highs and prompting some politicians to call for a halt to exports.

22 August: The US (United States) government will spend more than US$500 billion on climate technology and clean energy over the next decade under three recently enacted laws, an analysis by non-profit RMI found. Solar and wind power will have the biggest growth from 2021 levels, US government’s Energy Information Administration estimated in March 2022 Solar and wind power will have the biggest growth from 2021 levels, EIA estimated in March 2022. But study authors said climate action needed to speed up.

19 August: At a row of greenhouses around 50 km (30 miles) from Taiwan’s capital Taipei, vanilla farmer Tseng Tien-fu is installing dozens of solar panels, part of the island’s plan to meet its renewable energy goals without sacrificing scarce farmland. Tseng, who exports most of his crop to Japan, is expanding his business to meet demand from elsewhere and government payments for solar energy will reduce any risk to his livelihood while he waits for the slow maturing plants to develop. The use of “distributed” solar panels—installed on walls and rooftops—has become increasingly popular in regions where land is at a premium. Taiwan provides generous subsidies for rooftop panels, and the government is also obliged to buy the surplus electricity they produce, providing Tseng’s greenhouses with a vital new earning opportunity. Tseng’s shift to solar is part of a wider attempt to solve one of the biggest challenges facing Taiwan as it strives to meet its renewable energy targets.

17 August: South Africa’s Tiger Brands will soon roll out solar power at its manufacturing sites, kicking off a multi-million rand investment into sustainable energy, the country’s biggest food producer said. Demand for sustainability has multiplied in the past few years as shareholders increasingly expect companies to take steps toward greater transparency and use cleaner energy. Onsite solar power and other renewable energies will be installed at 35 manufacturing sites across South Africa by 2030, beginning with four sites, which will generate 2 megawatt (MW) of power, providing at least a third of their power usage, Tiger Brands said. Solar power generation at these four sites is expected to go online between the last quarter of this year and the first quarter of 2023.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.