-

CENTRES

Progammes & Centres

Location

Quick Notes

The emissions gap report of the United Nations Environmental Programme (UNEP) for 2022 observes that the new and updated nationally determined contributions (NDCs) submitted in 2022 promise to reduce global greenhouse gas (GHG) emissions in 2030 by only 0.5 gigatons of CO2 equivalent (GtCO2e), compared with emissions projections based on mitigation pledges at the time of COP26. Global GHG emissions in 2030 based on current policies are estimated at 58 GtCO2e. According to the report, the emissions gap in 2030, if all unconditional NDCs are implemented fully, is 15 GtCO2e annually for a 66 percent chance of staying below 2°C pathway and 23 GtCO2e for the same chance of staying below 1.5°C pathway. If conditional NDCs are fully implemented, each of these gaps is reduced by about 3 GtCO2e.

World average per person GHG emissions (including land use, land use change & forestry, LULUCF) were 6.3 tCO2e in 2020. The USA per person emission was far above the average at 14 tCO2e and India far below at 2.3 tCO2e. A number of countries in the developing world have per person emissions far below the world average and these countries have not contributed to ongoing changes in the climate and their disastrous consequences.

The UNEP report devotes only a few pages to the issue of the financing gap – what was promised by rich countries to poor countries and what was delivered – which is among the root causes of the emissions gap. The UNEP report observes that globally at least US$4-6 trillion must be invested annually for reducing carbon emissions and limiting average temperature increases to 1.5°C-2°C. This is only 1.5-2 percent of the global financial assets under management but about 28 percent of additional resources to be allocated annually. The report does not demand finance from developed countries in the same manner as it demands climate action from all countries but instead calls on the market to enable financial flows with six suggestions: (i) improve the efficiency of financial markets with clear taxonomies (ii) introduce carbon pricing through carbon taxes and cap and trade mechanisms (iii) nudge financial behaviour by bridging information asymmetries (iv) create markets for low carbon products by pushing innovation through public finance (v) mobilise central banks to support greening like the Reserve Bank of India which requires commercial banks to lend to priority sectors such as renewable energy (RE) or the central Bank of Bangladesh that has introduced a minimum credit quota of 5 percent for RE (vi) set up climate clubs and cross border financial initiatives with sovereign guarantees.

The call on the market to mediate climate finance by the UN appears to go against the call in article 2 of the Paris Agreement (PA) for “making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development in support of a global transition towards sustainability” and more importantly article 9 of the PA that stipulates that “developed countries shall provide financial resources to assist developing countries to help them reduce GHG emissions and adapt to a changing climate”. The two clauses of the PA are unclear on what counts as “financial resources that assist developing countries”. This ambiguity is exploited to the fullest extent by developed countries to claim that adequate assistance has been provided to developing countries.

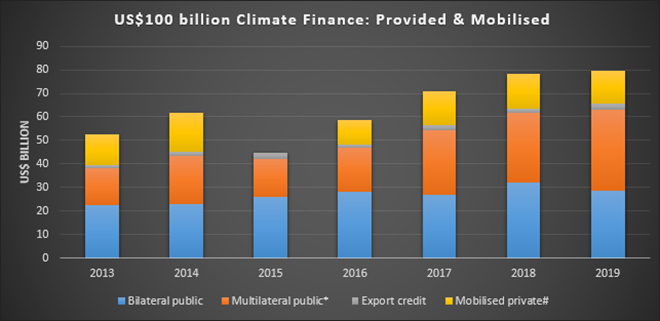

The US$100 billion a year by 2020 promised by rich nations to poor nations to help them adapt to climate change and mitigate further rises in temperature at the United Nations climate summit in Copenhagen in 2009 is often used to make the case for the financing gap. But developing countries require much more. According to the 2018 IPCC (Intergovernmental Panel on Climate Change) study, developing countries’ climate finance requirements stood at US$600 billion per year between 2020-50 in additional investments for the energy sector alone. The report, however, revealed that the required increase in annual climate finance flows would need to be at least 590 percent. The analysis describes this huge requirement as necessary for fulfilling the internationally agreed climate objectives by 2030 and averting the impacts of climate change.

India’s intended NDC (nationally determined contribution) document submitted to UNFCCC (United Nations Framework Convention on Climate Change) in 2015 estimated that US$2.5 trillion (2014-15 prices) is needed for climate change actions till 2030. As per the report prepared by the department of economic affairs in 2020, the cumulative cost of financing India’s NDCs till 2030 under the scenarios envisaged, specifically for the energy, adaptation and forestry sectors stands at US$5.26 trillion, US$1.83 trillion, and US$161.90 billion, respectively. In total, at least US$7-8 trillion will be required by 2030. If India were to achieve carbon neutrality by 2070, the cost requirements are expected to increase further.

Globally the dominant mode of climate financing is still the conventional instrument of debt financing. Of the total climate finance flows in 2019-20, about 61 percent, or US$385 billion was raised as debt. Further, most of this debt was formed by project-level market rate debt, with a small share of US$47 billion, or 12 percent, extended at low-cost project level debt. Equity formed 33 percent and grants 6 percent of the total climate finance mobilised in 2019-20.

According to the OECD (Organisation for Economic Co-operation and Development), member countries contributed US$80 billion in climate finance to developing countries in 2019, up from US$78 billion in 2018. It reported that most of this money came from public grants or loans, transferred either from one country to another directly, or through funds from multilateral development banks (MDBs).

Oxfam’s Climate Finance Shadow Report 2020 contested these claims. It estimated that 80 percent of all reported public climate finance in 2017-18 was not provided in the form of grants, but mostly as loans and other non-grant instruments. Around half of this was non-concessional, offered on ungenerous terms requiring higher repayments from poor countries. Oxfam calculated that the ‘grant equivalent’–the true value of the loans once repayments and interest are deducted–was less than half of the amount reported.

A discussion paper by the Ministry of Finance (MOF), Government of India observed that public grants and grant-equivalent public financing flows from developed countries allowing for some flows of private capital backed by concessionary public flows, counted by their grant equivalent terms, and not by the face-value should be termed climate finance. According to the paper, it was problematic that developed countries want financial flows ‘leveraged’ or ‘mobilised’ by them, and flows from international institutions such as the MDBs, as the major source contributing to the US$ 100 billion a year goal. The paper argued that it was difficult to define what constitutes mobilised finance, identify what the climate related component of private flows would be, and clearly attribute the source country for such flows.

According to a report by climate policy initiative, the tracked green finance flow into India in 2019-20 was nearly US$44 billion, per year less than a fourth of India’s needs. Domestic sources continue to account for about 85 percent of green finance in India. Of these the private sector contributed about 59 percent, and public sector flows were evenly distributed between government budgetary spends (central and state) and public sector units at approximately 54 percent and 46 percent respectively. Public sources of official development assistance (ODA) and other official flows accounted for 60 percent of international finance in the last two years. Green finance accounted for only about 3 percent of total foreign direct investment to India.

The Kyoto Protocol negotiated at the third Conference of Parties (COP3) in December 1997 agreed to differentiated targets that were not based on any standardised formula but rather on complex negotiations on multiple issues. Article 4 of the protocol even allowed groups of countries to negotiate a redistribution of their collective GHG emission limits.

The protocol also confused the temporal dimension in the climate issue attempting to account for past damage which is stored in existing stock of CO2 in the atmosphere through current liabilities which is carried in the flow of CO2. Past damage was caused by industrialised countries while current and future damage flows come from developing countries. The Kyoto Protocol neither assigned specific responsibility for the stock of CO2 to affluent nations nor did it contain any gradation in liability for the current flow of CO2 from developing nations. The ambiguity in defining and allocating responsibilities in UNFCCC and Kyoto Protocol has meant that political power in climate negotiations is not derived from their consistency but from their multi-interpretability.

Even if the climate change issue is restricted to the present and the future, simulations using various combinations of burden sharing arrangements have consistently found that in terms of the total stock of CO2 in the atmosphere, at least 50 percent would have originated in affluent countries even by 2100. The early colonisation of the atmosphere by developed nations and their continued occupation of carbon territory even by 2100 limits the room for manoeuvre by developing nations. If stocks of CO2 did not exist in the atmosphere current flows of CO2 would not be a problem irrespective of whether the flows are coming from developed or developing nations.

Sterlite Power’s Mumbai Urja Marg Transmission Limited (MUML) has commissioned 400 kV (kilovolt) Banaskantha, Kansari and Vadavi Transmission lines in Gujarat. The high voltage transmission line will help in the evacuation of around 1000 (megawatt) MW of renewable power from the pooling station at Bhuj in northern Gujarat to the national grid. The transmission line, which has been commissioned 4 months ahead of schedule, will significantly augment the available power transmission capacity of the state, taking it from 9300 MW to 11200 MW. Against India’s renewable capacity of 90 GW, Gujarat’s contribution stands at around 12 GW. On the back of its strong energy infrastructure, Gujarat aims to establish more than 67 GW of renewable energy by 2030.

In an attempt to popularise the option of voluntary surrender of subsidy, TANGEDCO (Tamil Nadu Generation and Distribution Corporation Limited) has decided to incentivise the scheme by allowing the households with the bi-monthly consumption of up to 500 units (kWh-kilowatt hour) to enjoy the 50 percent subsidy for the second 100 units. The state government hiked the tariffs for electricity consumption for all sectors from 10 September and the base price per unit for domestic consumers was increased to INR4.50 from INR2.5. Consuming above 400 units will attract INR6 per unit up to 500 units and the unit price will increase for every 100 to 200 units till 1000 units. TANGEDCO is yet to submit a petition in this regard to the Tamil Nadu Electricity Regulatory Commission (TNERC) and the scheme will be introduced only after the nod from the regulatory body.

Energy Efficiency Services Limited (EESL) has announced the completion of installation of 30 lakh smart meters across India under the government’s Smart Meter National Programme (SMNP). As part of the programme, the company has installed around 30 lakh smart metres in Rajasthan, Uttar Pradesh, Haryana, NDMC-Delhi, Bihar, and the union territory of Andaman. The company has signed agreements with the state-designated agencies and utilities in these regions for the large-scale deployment of smart metres. It further aims to install a total of over 47 lakh smart metres by December 2023. Most recently, EESL completed the installation of over 10.5 lakh prepared smart metres in Bihar. The company has also installed around 11.57 Lakh smart metres in Uttar Pradesh, over 1.24 Lakh smart metres in Rajasthan, over 5.3 lakh smart metres in Haryana, around 64,000 smart metres in NDMC Delhi, and over 74,000 smart metres in Andaman. The prepaid smart metres will optimise the operational performance of distribution companies (discoms) by increasing billing and collection efficiency, reducing operation and maintenance costs and enhancing quality of service, along with providing consumers with Demand Side Management (DSM) options.

The Uttar Pradesh Power Corporation Limited (UPPCL) is set to refund the excess amount which they had charged under stock issue rate from new power consumers. The decision was taken a day after the UP electricity regulatory commission (UPERC) served a notice on UPPCL including five discoms (distribution companies) under Section 142 of the Electricity Act, 2003 for charging extra from consumers for new connections.

Mizoram will introduce prepaid smart power metres from December as a part of the Centre’s Revamped Distribution Sector Scheme (RDSS). The state power department has already started the process to replace old post-paid power metres with prepaid smart metres to improve operational efficiencies and financial sustainability. The department has received over INR1.7 billion (bn) (US$20.7 mn) from the Centre for the installation of prepaid smart metres, which would be used by all consumers across the state from December. The government has urged consumers to clear their dues and adjust their contracted load based on their total consumption during peak hours. Prepaid smart metres will have to be kept in open spaces so that they get a signal. Once the prepaid system is in place, the task of disconnecting and reconnecting will be performed from the control centres, and consumers will be able to recharge based on their needs. The prepaid system will reduce the manpower required for billing, and is expected to reduce billing errors and power loss, and increase revenue.

In a major relief to farmers desirous of enhancing the electricity load of their tube-wells, the Punjab government has extended the date of the Voluntary Disclosure Scheme (VDS) for enhancing load till 23 October. This is for the second time that the Punjab Government has extended the deadline, in view of the keen interest shown by the farmers. Punjab State Power Corporation Limited (PSPCL) said that the VDS scheme was launched on 10 June for 45 days (till 24 July) by slashing fees for load enhancement on tube wells from existing INR4750 to INR2500 (US$58 to 30) per BHP.

Electricity Minister V Senthil Balaji justified the latest hike in power tariffs claiming that the charges are still cheaper in Tamil Nadu compared to other states. He said that the tariffs for the MSME sector had been increased marginally at 23 percent compared to the 61 percent hike for the sector during the previous AIADMK rule. He said the introduction of peak hour charges to LT connections would not have a major impact and added that 14 states had already levied peak-hour charges for LT consumers. The minister said they could achieve a minimal impact on the general public even after the tariff revision with an additional release of INR40 bn (US$486.6 mn) as subsidy from the state government apart from INR96 bn (US$1.17 bn) released last year. He said that the conversion of overhead lines to underground cables in the entire Greater Chennai area would be completed in a year.

Delhiites can avail the free electricity scheme from October only if they opt for it, Chief Minister (CM) Arvind Kejriwal announced. He said people can now give a missed call or send a WhatsApp message on 7011311111 to avail the free electricity scheme. With this move, the option to get the Delhi government’s power subsidy will no longer be available by default and every year, power consumers will be given an option to continue with power subsidy or not. At present, those whose power consumption is less than 200 units do not have to pay any electricity charges. Those whose consumption is up to 400 units get a 50 percent subsidy. He clarified that the free electricity scheme will continue for those who demand and apply for it. He said both physical and electronic methods will be available for people to apply for a subsidy. The government had decided a few months earlier that subsidy will be given to those only who will demand and apply for it. Around 90 percent of power consumers in the national capital pay their electricity bills online. In the physical method, consumers can fill up a form attached with their power bill and submit it at designated collection centres and the subsidy will continue from 1 October, the chief minister said. Those consumers who have got their phone numbers registered for bill payment will be sent messages for applying to get subsidy. The system has been improved so that it does not crash due to a rush of applicants and the government is planning ways like holding camps to inform people about the new arrangement, he said. Under the free electricity scheme of the AAP (Aam Aadmi Party) government, domestic consumers in Delhi using up to 200 units of power per month are given 100 percent subsidy. Those consuming up to 400 units are provided 50 percent or up to INR800 (US$9.7) as subsidy.

The average demand for power in UP (Uttar Pradesh) almost doubled between 2012-17 and April-September 2022 with the peak demand touching an all-time high of 26,589 MW on 9 September, the state government informed the UP assembly. Energy Minister Arvind Kumar Sharma said that during 2012-17 – when Samajwadi Party was in power – the average peak demand for power was around 13,598 MW. Likewise, the average minimum demand was 5,685MW. This rose to 24,969 MW between April-September 2022, a rise of around 83 percent in comparison to 2012-17. The minimum demand, too, rose to 11,017 MW, an increase of around 94 percent. He said that while the state government tried its best to meet the demand, the outages occurred because of inclement weather conditions and dilapidated electricity infrastructure. He said that for better management and maintenance of electricity equipment, the rate of variable damage has been reduced by 0.42 percent this year. Also, around 1.6 lakh converters were changed between 18 April-September 2022, he said. He said the unprecedented rise in electricity demand was not just due to delayed rains and less than average rainfall but also because of the extreme heat that prevailed this summer. He said that to meet the historic demand for power, the coal-fired thermal power plants were run at 73.31 per cent Plant Load Factor (PLF) against a PLF of 55.51 percent a year ago.

India expects annual electricity demand to grow at an average of 7.2 percent over five years ending March 2027, a draft government plan showed, nearly double the growth rate of over 4 percent seen during the five years to March 2022. The Central Electricity Authority (CEA), an advisory body to the federal power ministry, said in a draft plan India’s power demand would reach 1,874 billion units during the year ending March 2027, compared with over 1,320 billion units in 2021/22. India would add a power generation capacity of 165.3 gigawatt (GW) over five years ending March 2027, most of which would be renewable energy, according to the plan. That would represent a 41 percent increase from the current installed capacity of 404.1 GW.

ONGC Tripura Power Corporation Limited (OTPC) has planned to establish one more 360 MW power unit at its Palatana plant in Tripura’s Gomati district. Currently, the OTPC, one of the subsidiary companies of ONGC is successfully running two power generation units with a combined capacity of 726 MW. Seven Northeastern states are receiving power from the OTPC’s Palatana plant. OTPC is also in talks with the state government for the enhancement of old power plants and new power units.

The Supreme Court (SC) set aside the 2008 verdict of the Appellate Tribunal for Electricity cancelling the licence of Jindal Steel and Power Limited (JSPL) to distribute electricity to industrial consumers in the Jindal Industrial Park and two villages of Raigarh district in Chhattisgarh. The appellate electricity panel had set aside the order, passed on 29 November 2005, the Chhattisgarh State Electricity Regulatory Commission granted a power distribution licence to JSPL. The verdict rejected the contention of government authorities that as per the rules, a power distributor is supposed to supply electricity to an entire municipal area and the private company here was providing electricity to a few villages and some industrial units hence, its licence was rightly rejected. Hence, the contention of the state electricity board that the ‘minimum area of supply’ must comprise the ‘entire’ Municipal Council or a Municipal Corporation or a Revenue District is not correct, it said.

Authorities in Pakistan are scrambling to protect a vital power station supplying electricity to millions of people against a growing threat of flooding. Both the government and UN Secretary General Antonio Guterres have blamed climate change for the extreme weather that led to the flooding that submerged huge areas of the nation of 220 million. The electricity station in the district of Dadu in the southern province of Sindh, one of the country’s worst affected areas, supplies power to six provincial districts.

Abu Dhabi Offshore Power Transmission Company has secured more than US$3.2 bn in financing with export credit agencies and banks for an offshore electricity transmission project, the Japan Bank for International Cooperation said. The financing is to build and operate a high-voltage direct current offshore power transmission system linking two offshore production facilities owned by state-controlled oil giant Abu Dhabi National Oil Company (ADNOC) to Abu Dhabi’s onshore grid. Japan Bank for International Cooperation (JBIC) provided US$1.201 billion for the direct current transmission project. ADNOC and JBIC signed a memorandum of understanding in November to cooperate on decarbonization, energy transmission and energy efficiency.

South African power utility Eskom implemented Stage 6 power cuts early, its worst level touched for the second time this year although a “total blackout” was not imminent, its Chief Executive Officer (CEO) Andre de Ruyter said. The last time Eskom resorted to Stage 6, which means at least six hours without power a day for most South Africans, was in June. It had previously done so during a power crisis in December 2019. The cash-strapped utility has been struggling to keep the lights on in Africa’s most industrialised economy as regular power cuts curb economic growth and fuel public frustration as Eskom seeks a new 32 percent tariff hike. Eskom, which gets most of its electricity from ageing coal-fired power plants prone to breakdowns, plans to cut about 6,000 megawatts (MW) of power in a staggered manner to prevent a catastrophic collapse of the national electricity grid. Currently, there were unplanned load losses of 15,630 MW, about a third of Eskom’s total nominal capacity of just over 45,000 MW. The utility earlier appealed to the public to help conserve electricity as it moved to its highest level of power cuts, only the third time since Eskom started what it calls “loadshedding” following a chronic power crisis that started more than a decade ago. After an urgent board meeting, Eskom intends to go to the market to procure an extra 1,000 MW from independent power producers, although it was unclear when this would become available, Ruyter said.

South Africa’s Eskom will reduce planned power cuts after sufficient progress was made in replenishing emergency generation reserves, the utility said. Eskom’s ageing power stations run mostly on coal and are highly prone to faults resulting in frequent outages which constrain economic growth. South African President Cyril Ramaphosa’s government has tried to reform Eskom to make it more efficient, but progress has been slow. Having implemented cuts of up to 4,000 MW, Eskom said it will reduce these to Stage 3 cuts of up to 3,000 MW. Thereafter Stage 2 will be implemented. Stage 2 cuts mean that homes and businesses without their own generators will not have power for two to four hours a day.

Thailand’s Gulf Energy Development Pcl has invested US$409 mn in a 49 percent stake in Jackson Generation, a 1,200 MW gas-fired power project in Illinois, its first expansion into the United States (US). The Gulf is acquiring the stakes from its long-term Japanese partner, J-Power and joins other Thai firms in investing in US energy, including miner Banpu Pcl, owner of Denver-based BKV, which in May bought natural gas properties from Exxon Mobil for US$750 mn. Gulf currently has total capacity of 9.4 gigawatt (GW) with a target to reach 14.5 GW by 2027, most of it in Thailand. South Africa’s Eskom will reduce planned power cuts after sufficient progress was made in replenishing emergency generation reserves, the utility said.

Puerto Rican government workers tried to restore power amid growing frustration over the slow response from the main energy provider, with about 40 percent of the island still without electricity more than a week after Hurricane Fiona hit services. Puerto Rico grid operator LUMA Energy said power had been restored to 59 percent of its roughly 1.5 million customers following the 18 September arrival of Fiona, at the time a Category 1 hurricane that caused almost all of the island’s roughly 3.3 million residents to lose power.

The European Commission is preparing for power cuts and other emergencies within the European Union (EU), amid concerns over the conflict in Ukraine and a possible energy crisis within the bloc. Falling Russian fossil fuel exports to the bloc have pushed several EU states to put into effect emergency plans that may lead to rationing as they race to find alternative supplies. The EU is preparing for two scenarios. In the first scenario, only a small number of member states are affected by an incident such as a blackout and other EU states can supply power to the affected members. But if a large number of states are hit at the same time, the bloc’s countries would have to cap their emergency aid deliveries to other members and the Commission could cover the needs through its strategic reserve.

Ireland will likely extend a grant scheme to help businesses pay for soaring energy bills beyond its initial expiry date at the end of February if energy prices are not falling, Deputy Prime Minister Leo Varadkar said. The government introduced the €1.25 (US$1.24) bn temporary scheme in the budget, providing most businesses with up to 40 percent of the increase in electricity or gas bills up to €10,000 (US$9908) per month.

Europe’s transmission system operators (TSOs) and electricity exchanges have called for the EU to change the mechanism used for raising the power market price ceiling, Finland’s grid operator Fingrid said. The cost of electricity in Europe has soared this year as Russian gas supplies dwindled while other power sources such as nuclear and wind also faltered, raising the risk of blackouts during the coming winter. Fingrid said the grid operators and exchanges had sent a common letter to the European Commission and the EU agency for the cooperation of energy regulators (ACER). ACER said it would like to review the mechanism after two rises of the price ceiling this year. In May, the cap rose by €1,000 to €4,000 (US$990.8 to 3963) per megawatt hour (MWh), after an April French power price spike.

The Czech government will look at putting a limit on industrial electricity bills at the same time as it caps prices for households and state institutions to help them get through the energy crisis, Finance Minister Zbynek Stanjura said. Stanjura said the government was likely to set a maximum end price that households can be charged for electricity. Stanjura said compensation for power producers amid caps was also unlikely as they would still cover costs and keep reasonable profits. In the state sector, the government wants to ensure supplies at reasonable prices for places like schools, hospitals or other public institutions, Stanjura said. Stanjura said legislation to mandate electricity producers to sell a certain amount to the state, less than 20 percent of their output, would be necessary.

Finnish power grid operator Fingrid started up two backup power plants to balance the country’s electricity system and prevent blackouts while repairs were made at a reactor seen as crucial to ensure reliable power supplies this winter. Grid operator Fingrid also asked the electricity market for more short-term power, with extra supply coming at an “exceptionally high” price of €5,000 per megawatt-hour (MWh), it said. Regular wholesale power prices in Finland were at around €500 per MWh early. Fingrid later said the two reserve power plants, Huutokoski and Forssa, were no longer needed and were shut down.

11 October: LPG cylinder blast incident has turned out to be a bad turn of fate for the auto-rickshaw drivers. With tightening of noose against the illegal but flourishing trade of filling up of LPG gas in auto-rickshaws by the enforcement agencies, their business has been badly affected. In the past two days, almost all the illegal gas filling outlets have shut down fearing backlash by the police and administration, which has forced these auto-rickshaw drivers to take to the LPG filling stations. Jodhpur has two LPG fuel stations, of which one falls out of the city area. In these two days, the entire onus of supplying gas has fallen on the remaining filling station, which on normal days has only 700 litres of average demand per day. The city has about 5,000 auto-rickshaws running on LPG and there are also some LPG four-wheelers also. This sudden turn of events has pointed to the flourishing illegal LPG filling trade, with these auto-rickshaws being their potential customers. Sharing the economics behind this illegal trade, a rickshaw driver said that the gas is available at INR111.50 per litre at the filling station while the illegal gas fillers charge them somewhere between INR 90-100 depending upon the price of the cylinder.

10 October: India’s monthly fuel demand in September was at the lowest since November 2021, government data showed. Total monthly fuel demand in September fell 3.6 percent from August, although it was up 8.1 percent when compared with September 2021. Consumption of fuel, a proxy for oil demand, totalled 17.18 million tonnes (MT) in September, up from 15.89 MT a year earlier, data from the Petroleum Planning and Analysis Cell (PPAC) of the oil ministry showed. Sales of diesel, or gas oil, rose about 13.4 percent year-on-year to 6.26 MT but dropped 1.4 percent month-on-month to a one-year low. Sales of gasoline, or petrol, were 8.8 percent higher from a year earlier at 2.83 MT. Preliminary sales data showed gasoline and gasoil sales by Indian state refiners rose sharply in September from a year earlier, signalling a pick-up in industrial activity ahead of the festive season from October. Cooking gas or liquefied petroleum gas (LPG) sales increased 3.5 percent to 2.45 MT, while naphtha sales fell 6.4 percent to 1.08 MT. Indian state refiners plan to lock in more of their crude supplies in term deals, worried that tighter Western sanctions on Russia, including from the EU, could curb future supplies in already tight markets.

11 October: India is offering 26 blocks or areas for finding and producing oil and gas in a mega offshore bid round, upstream regulator DGH (Directorate General of Hydrocarbons) said. Simultaneously, 16 areas for prospecting for coal-bed methane (CBM) are also being offered in a separate round. Out of the 26 blocks, 15 areas are in ultra-deepwater, 8 in a shallow sea and 3 blocks are on land. The bid rounds are being held under the 2016 policy, called the Hydrocarbon Exploration and Licensing Policy (HELP), which was promulgated on 30 March 2016. DGH said the 16 CBM blocks being offered in the special bid round are spread over Madhya Pradesh (4), Chhattisgarh, Telangana (3 each), Maharashtra, Odisha (2 each), Jharkhand and West Bengal (1 each).

10 October: Chief Minister (CM) M K Stalin inaugurated Tamil Nadu’s first liquefied, compressed natural gas (LCNG) station set up by AG & P Pratham near Manthangal village in Ranipet district. The new facility would transform Ranipet and Vellore districts and surrounding areas into a gas-based ecosystem and fuel industrial growth. The company is developing city gas distribution networks in six districts — Kancheepuram, Chengalpet, Vellore, Ranipet, Tirupattur and Ramanathapuram — besides South-East Chennai. The company has launched 27 CNG (compressed natural gas) stations in Kancheepuram and Chengalpet districts and South-East Chennai, three in Ramanathapuram district and 14 in Vellore and Ranipet districts. The company plans to launch 22 more CNG stations in the state by March 2023. The company is working aggressively at the grassroots level to realise the government’s vision of migrating towards a gas-based economy. The company has authorizations to develop CGD networks across 12 geographical areas covering 34 districts across 8 percent of India and 64 million people in the states of Rajasthan, Andhra Pradesh, Tamil Nadu, Karnataka and Kerala. In its 12 geographical areas, the company is developing and operating CNG stations for vehicles, piped natural gas to homes, industries and commercial establishments.

11 October: Following the directions of National Green Tribunal (NGT) earlier, the district administrations of East Jaintia Hills District once again promulgated prohibitory orders banning rat-hole coal mining in the district. District administration said that the prohibitory order under Section 144 of CrPC was issued also against illegal transportation and dumping of coal in noncompliance with the directions issued by the NGT earlier. In April 2014, NGT banned indiscriminate and hazardous rat-hole coal mining in Meghalaya. Many workers got trapped in the illegal and unsafe mines and subsequently died – five in May/June last year but only three bodies were retrieved from the flooded coal mine after hectic efforts for over 27 days in East Jaintia Hills district; in December 2018, in a major tragedy in the same district, 15 migrant miners from Assam died inside in an abandoned coal mine. The 15 miners, whose bodies were never found, had been stuck in the coal mine at a depth of nearly 370 feet after a tunnel was flooded with water from the nearby Lytein river.

11 October: The power ministry said that the government is considering electricity transmission for renewable energy capacity of about 233 gigawatt (GW), across the country. All five regional grids in India were synchronised into the national grid by December 2013. The remote Leh region was connected to the national grid in January 2019 through the 220 kV (kilovolt) Srinagar-Leh Transmission system. The national grid transmission system has added transmission lines of 1,71,149 circuit kilometres (ckm) since 2014-15 and transmission capacity of 6,03,916 megavolt-ampere (MVA) since 2014-15. At present, the installed capacity of the national grid is 404 GW and the peak demand met is 216 GW. Integrated transmission network that allows the power to be generated anywhere.

7 October: To avoid raising rates in the fiscal year 2022–2023 and to give consumers relief, the Assam cabinet decided to extend a power purchase subsidy of INR1.9 bn to a state-owned utility. The cabinet approved the proposal to give the subsidy to Assam Power Distribution Company Limited (APDCL). The government’s contribution of INR2.85 bn to the Assam State Electricity Board (ASEB) Pension Fund, which will help 20,000 retirees, was also approved by the cabinet.

5 October: Delhi Lieutenant Governor (LG) VK Saxena has ordered an inquiry into the power subsidy scheme of the Arvind Kejriwal-led Delhi government, intensifying the war of words between the two sides over yet another flagship scheme of the AAP government. Kejriwal hit back, saying AAP’s “free electricity guarantee” has been received “very well” by the people of poll-bound Gujarat. Saxena has asked Chief Secretary Naresh Kumar to submit the inquiry report within seven days. Saxena’s move followed multiple complaints filed at the LG Secretariat which raised issues of “impropriety and discrepancies” in the scheme. The Chief Secretary would also probe the non-implementation of power subsidy payments to consumers through Direct Benefit Transfer as ordered by the Delhi Electricity Regulatory Commission in 2018. The complainants include eminent lawyers and jurists who have alleged a “massive scam” in the subsidy scheme. According to the complaints, the AAP government has been accused of allowing BSES discoms (distribution companies) to settle their outstanding through subsidy reimbursements instead of recovering the dues of INR212 bn allegedly owed by them (discoms). It was also alleged that the discoms were allowed to charge Late Payment Surcharge (LPSC) at a rate of 18 percent from consumers while they themselves paid LPSC at 12 percent to the Delhi government-owned power generation companies.

11 October: Suzlon Group announced that it has bagged an order for the development of 144.9 megawatt (MW) of wind power projects for Aditya Birla Group. Suzlon will install 69 units of wind turbine generators (wind turbines) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 2.1 MW each. The project is located at sites in Gujarat and Madhya Pradesh and is expected to be commissioned in 2023. Suzlon wind turbines typically range over 70-80 percent on domestic content and are manufactured in the country through a thriving domestic value chain, it claimed. Green power from the project will go for captive use for their manufacturing facilities and other needs, thereby helping create a sustainable and Aatmanirbhar Bharat. A project of this size can provide electricity to 0.94 lakh households and curb 3.72 lakh tonnes of CO2 (carbon dioxide) emissions per year.

10 October: EKI Energy Services welcomed the government’s stance on carbon credits and said that carbon credits and its trade is an imperative for climate positive plans. Union Minister for New and Renewable Energy R K Singh said that the government is taking measures to make India a market for carbon credit which will be utilised to meet the country’s NDC (Nationally Determined Contribution) goals. India has submitted its updated NDC under the Paris Agreement to the UN Framework Convention on Climate Change, emphasising that it is a step forward towards its long-term goal of reaching net zero by 2070. According to the updated NDC, India now stands committed to reducing the emissions intensity of its GDP by 45 percent by 2030, from the 2005 level, and achieving about 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030.

9 October: Prime Minister (PM) Narendra Modi declared Modhera in Gujarat’s Mehsana district as India’s first 24×7 solar-powered village. He said that Modhera was known for the Sun temple, now it will also be known as a solar-powered village. Making Modhera the country’s first round-the-clock solar-powered village involved developing a ground-mounted solar power plant and more than 1,300 rooftop solar systems on residential and government buildings.

7 October: Tata Power said it plans to develop around 10,000 MW of renewable energy capacity, mainly solar energy, in the next five years in Rajasthan, and also build a robust electric vehicle charging infrastructure. Participating in the ongoing Invest Rajasthan summit in Jaipur, it stated that it plans to develop up to 8,000 MW of utility scale projects, 1,000 MW of solar rooftop and 1,50,000 solar pumps in the next five years in the state. Tata Power, along with its fully-owned subsidiary Tata Power Solar, will expand its presence in the state to generate clean energy through solar power. Rajasthan is an important state for Tata Power’s renewable business. It presently has a portfolio of 4,939 megawatt peak (MWp). To date, Tata Power has commissioned 2,066 MW in Rajasthan and around 2,873 MW capacity of solar projects are under construction, which will be completed in the next 12-24 months. With respect to solar pumps, Tata Power plans to set up around 1,50,000 pumps in the next five years in the state. The company has so far installed nearly 21,600 solar pumps in Jaipur, Hanumangarh, Ganganagar, Jalore and Bikaner. Tata Power through its rooftop services has a cumulative installed capacity of 65 MW in Rajasthan.

6 October: The growth in wind and solar power capacity restricted the expansion in fossil fuel electricity generation in India by 3 percentage points in the first half of 2022, according to a UK-based energy think tank report. The report said renewables met all of the rises in global electricity demand in the first half of 2022, preventing any growth in coal and gas generation. However, it said the use of coal in India rose 10 percent because of a sharp rebound in electricity demand from the lows early last year when the Covid-19 pandemic struck hardest. In China, the growth in wind and solar led to a three reduction in fossil fuel power. In the US (United States), it slowed down the rise in fossil fuel power from 7 percent to just 1 percent. In the EU (European Union), fossil fuel power rose by 6 percent but it would have been 16 percent without growth in wind and solar, the report said.

10 October: Hungary and Serbia have agreed to build a pipeline to supply Serbia with Russian Urals crude via the Druzhba oil pipeline as Belgrade’s shipments via Croatia fall under EU (European Union) sanctions, the Hungarian government said. The EU agreed on new restrictions against Russia over its war against Ukraine, which include an oil price cap for Russian seaborne crude deliveries to third countries. Serbia gets its oil via the JANAF oil pipeline from Croatia. Hungary, which is largely reliant on Russian oil and gas, has been the most vocal critic of sanctions against Russia in the EU, saying the measures drove up energy prices.

10 October: Saudi Aramco has told at least seven customers in Asia they will receive full contract volumes of crude oil in November ahead of the peak winter season. The producer is keeping supplies to Asia steady despite likely production cuts by tapping on inventories. The full supply allocation comes despite a decision by the Organization of the Petroleum Exporting Countries (OPEC) and its allies including Russia, known as OPEC+, to lower their output target by 2 million barrels per day (bpd). Saudi Energy Minister Abdulaziz bin Salman had said the real supply cut would be about 1 million to 1.1 million bpd. Analysts expect Saudi Arabia, the United Arab Emirates and Kuwait to shoulder much of the production cuts because other OPEC+ members are falling behind output targets. Consultancy FGE expects the Saudi oil production target to fall by around 550,000 bpd in November from the previous month.

10 October: The head of QatarEnergy, who is also Qatar’s Energy Minister, Saad al-Kaabi said the company wants to speed up the development of two oil wells it discovered off the Namibian coast with joint venture partners earlier this year. Saad al-Kaabi said drilling work is expected for 2023 to get a better understanding of deliverability and capacity, but did not indicate when the two oil finds will be brought into production. The discoveries could make Namibia, the southern neighbour of OPEC member Angola, another oil producer along the African Atlantic coast.

10 October: Oil prices fell, snapping five days of gains, as investors took profits after a report on slowing economic activity in China, the world’s biggest crude importer, re-ignited concerns about falling global fuel demand. Brent crude futures for December settlement fell by as much as 1.1 percent, and was last down 39 cents, or 0.4 percent, at US$97.53 a barrel. West Texas Intermediate crude for November delivery declined by as much as 1.1 percent and was last at US$92.27 a barrel, down 37 cents, or 0.4 percent. Services activity in China during September contracted for the first time in four months as COVID-19 restrictions hit demand and business confidence, data showed.

5 October: The OPEC+ alliance looks set to make deep cuts in the amount of oil it ships to the global economy, which would reduce supply in an already tight market, despite pressure from the United States (US) and other countries to pump more. Energy Ministers from the OPEC cartel, whose leading member is Saudi Arabia, and allied non-members, including Russia, are meeting in person at the group’s Vienna headquarters for the first time since the start of the COVID-19 pandemic in early 2020. The potential cuts could help Russia weather a looming European ban on its oil exports by forcing oil prices up. They’ve dropped to about US$90 a barrel from US$120 three months ago due to fears of a global recession. OPEC+ is considering cuts of one million to two million barrels per day, with several sources saying cuts could be closer to two million.

11 October: Spain’s cabinet approved a new energy-saving plan which aims to cut the country’s natural gas consumption by up to 13.5 percent by March as part of Europe’s efforts to reduce its dependence on Russian supplies. The plan also calls on Spain to increase its capacity to export gas to other European Union member states. It includes measures to increase by 18 percent Spain’s ability to send gas by pipeline to France across the Pyrenees mountain range, and an expansion in loading capacity for boats carrying gas to other EU countries, among them Italy. The EU (European Union) has asked member states to cut gas use from August to March by up to 15 percent, although for some countries less exposed to Russian energy dependence the figure is lower, as in the case of Spain, which agreed to cut use by 7.0 percent. But under the new energy-saving plan approved, Spain aims to reduce its gas consumption by between 5.1 percent and up to 13.5 percent during this period.

10 October: Malaysia’s Petronas said it has declared force majeure on gas supply to one of its liquefaction terminals, Malaysia LNG Dua, due to a pipeline leak caused by soil movement at the Sabah-Sarawak Gas Pipeline. Japanese trading house Mitsubishi Corporation, which owns a stake in Malaysia LNG, said that Malaysia LNG, majority owned by Petronas, has declared force majeure on LNG (liquefied natural gas) supplies to its customers following the pipeline leak. Petronas said that the pipeline leak had affected its delivery commitments to some of its contracted LNG buyers, and the company was in discussions to “identify suitable mitigation efforts”. It was also conducting an evaluation of the Sabah-Sarawak Gas Pipeline to ensure its integrity and safety. With a total LNG capacity of 25.7 million tonnes per annum, the Malaysia LNG project is one of the largest LNG facilities in a single location in the world, according to Mitsubishi.

11 October: Metallurgical coal prices in top steel producer China rose to their highest in more than three months, shrugging off weakness in the broader ferrous market, as concerns grew over tightening supply. Coal companies in Shanxi, China’s top coal producing province, plan to suspend production ahead of the ruling Communist Party congress beginning 16 October, traders said. Flood warnings in key coal supplier Australia also added to the supply concerns, analysts said. The most-traded January coking coal on the Dalian Commodity Exchange DJMcv1 rose as much as 2.1 percent to 2,233 yuan (US$310.60) a tonne, its strongest since 30 June.

11 October: The head of one of Australia’s largest electricity companies warned of soaring power prices in 2023. Jeff Dimery, chief executive of Alinta Energy, revealed that based on current projections, retail electricity prices could increase by 35 percent over the next 12 months. Dimery said the country was “out of time” to implement policies to support investment in renewable energy capacity to replace outgoing coal-fired power plants. Dimery voiced concerns about the amount of development needed to guarantee the supply of electricity as Australia transitions away from fossil fuels. In the lead-up to May’s general election, Climate Change and Energy Minister Chris Bowen promised electricity prices would fall by 2025 under a Labor Party government.

5 October: German utility EnBW and Fluence Energy unveiled a cooperation under which the US (United States) energy group will supply a 250 megawatt (MW) battery-based storage system that will strengthen network stability in Europe’s top economy. Fluence will supply the storage system, to be completed in 2025, to EnBW’s grid division TransnetBW, enabling the reduction of operating costs and network interventions as well as lowering the need for traditional network reinforcement. TransnetBW is one of Germany’s four high-voltage transmission system operators, which also include Elia’s 50Hertz, Dutch Tennet and Amprion, which is part-owned by RWE.

10 October: Power generation from renewables fully covered Greece’s electricity demand over a few hours, for the first time in the history of the country’s electricity system, its independent power transmission operator IPTO said. IPTO said that renewables accounted for 100 percent of the power generation for at least five hours, reaching a record high of 3,106 megawatt hour (MWh). The share of Greek renewables from solar, wind and hydro stood at 46 percent of the country’s power mix in the eight months to August this year, from 42 percent in the same period in 2021, according to Greece-based environmental think-tank The Green Tank. Greece aims to attract about 30 billion euros in European funds and private investments to upgrade its electricity grid and more than double its green energy capacity to account for at least 70 percent of its energy mix by 2030. It plans to have 25 gigawatt (GW) of installed renewable energy capacity from about 10 GW but analysts said Athens might reach that target sooner. IPTO has been investing in expanding the country’s power grid to boost power capacity and facilitate the penetration of solar, wind and hydroelectric energy.

7 October: Australian software mogul Mike Cannon-Brookes was named chairman of clean energy start-up Sun Cable, which is seeking to secure funds for a proposed A$30 billion-plus (US$19.3 billion-plus) solar power export project. Singapore-based Sun Cable plans to supply solar power from Australia to Singapore and eventually Indonesia through the world’s longest subsea high voltage cable, linked to a 17-20 gigawatt (GW) solar farm, as well as an energy storage facility of up to 42 gigawatt hour (GWh) in Australia’s Northern Territory.

6 October: TotalEnergies will start offering biofuels as a bunkering fuel to its customers in Singapore from next year, a senior executive at the French energy giant said, as the company seeks to reduce its emissions in shipping. The move would reduce greenhouse gas emissions from shipping by 20-25 percent, Vice President Marine Fuels Louise Tricoire said. The shipping industry accounts for nearly 3 percent of the world’s CO2 (carbon dioxide) emissions and the International Maritime Organization (IMO) is seeking to halve the industry’s greenhouse gas emissions by 2050 from 2008 levels. This target will require rapid development of zero- or low-emission fuels and new designs for ships.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2022 is the nineteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.