-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Manish Thakre, “Enhancing Access to Urban Climate Finance: Learnings from Four Cities in India,” ORF Issue Brief No. 711, May 2024, Observer Research Foundation.

Introduction

India is vulnerable to climate risk. Of its population of 1.4 billion, 590 million reside in urban areas, which contribute nearly 70 percent of its gross domestic product (GDP). Urbanisation in India is projected to increase from 31 percent in 2011 to 40 percent by 2036.[1] India ranked sixth among the 10 most climate-affected countries in the Global Climate Risk Index 2016. It also accounts for about 7 percent of global greenhouse gas (GHG) emissions.[2]

Worldwide, by 2030, climate and natural hazards are projected to cost cities around US$314 billion annually, driving 77 million people into poverty.[3] India has already lost about US$80 billion over the past 20 years due to extreme climate events.[4] As UN Secretary-General António Guterres has noted, “Cities are where the climate battle will largely be won or lost.”[5]

For effective climate solutions, urban local bodies (ULBs) must play a catalytic role. However, urban climate finance (UCF) remains a massive roadblock, despite notable advancements in urban climate resilience.[6] Globally, 21 percent of climate funds are directed towards adaptation and resilience; of these amounts, a mere 10 percent reaches the local levels.[7]

To meet its nationally determined contributions (NDCs) under the 2015 Paris Agreement, India requires green finance of approximately US$2.5 trillion between 2015 and 2030 or US$170 billion per year.[8] However, given that its GDP in 2023 was only US$3.73 trillion,[9] it can only provide a fraction of the need and most of the financing will have to come from external sources.

Tracked green finance for India in FY2020 was US$44 billion per annum, barely one-fourth of its need. Of this, finance for the adaptation sector stood at barely US$5 billion.[10] A 2024 study by the non-profit research group, Climate Policy Initiative (CPI), showed that just six of India’s 28 states[a] will require a combined annual adaptation investment of US$5.5 billion between 2021 and 2030.[11]

ULBs face challenges in both capacity and funding for climate-resilient projects.[12] Within ULBs, these barriers include lack of “awareness, political priority, capacity, institutional structures and tools.” [13],[14] Externally, beyond the ULBs’ influence, challenges include “detrimental national regulation, unattractive risk-return profiles of climate projects, political and economic risks, and inadequate financial mechanisms.”[15],[16]

The aim of this brief is to understand the key conditions and means by which some ULBs have been able to access UCF despite the challenges. Perhaps, there are lessons from these innovating ULBs that others can learn. Though each ULB has a unique context, following good practices could aid them in finding effective solutions to their UCF-related concerns.

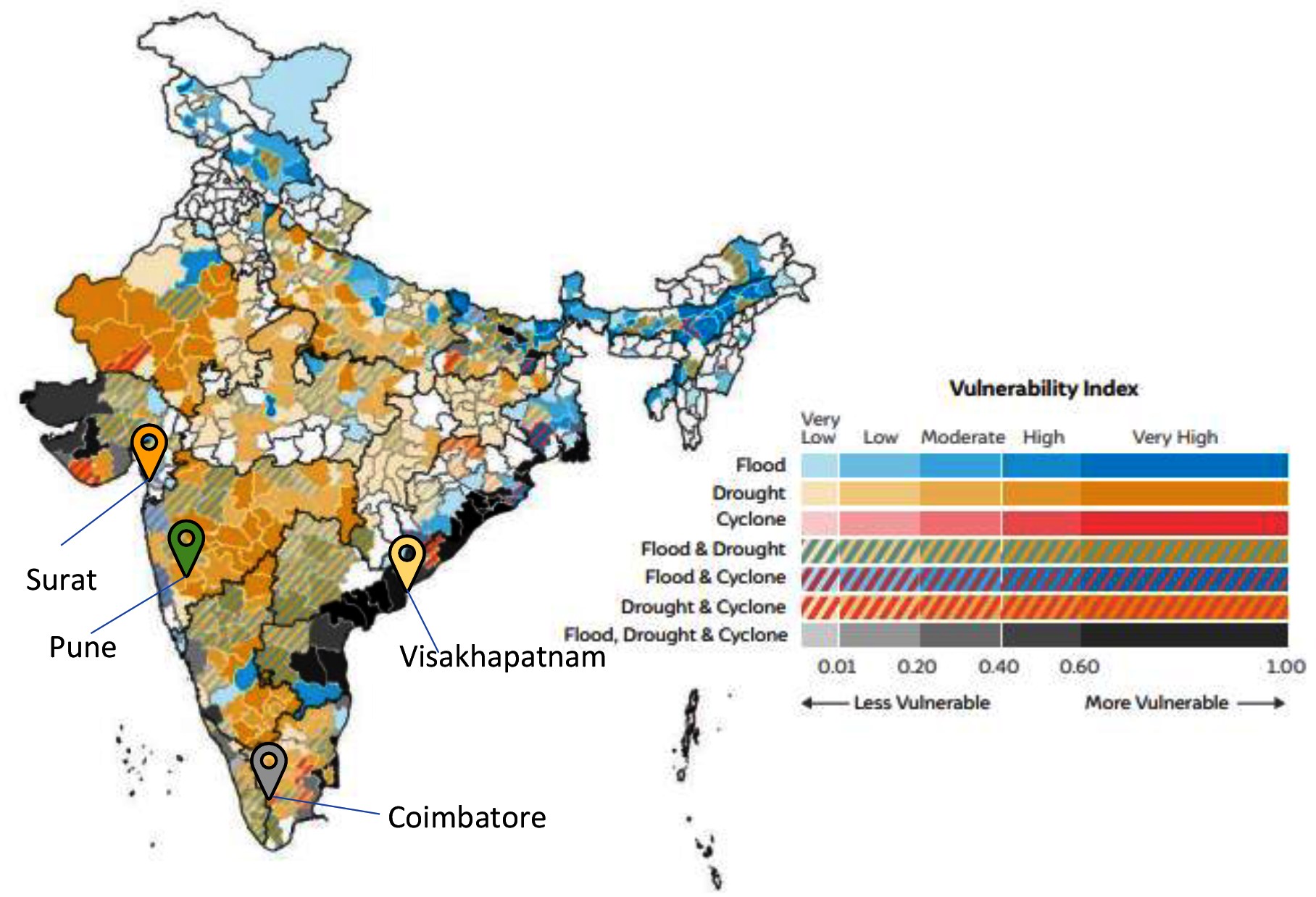

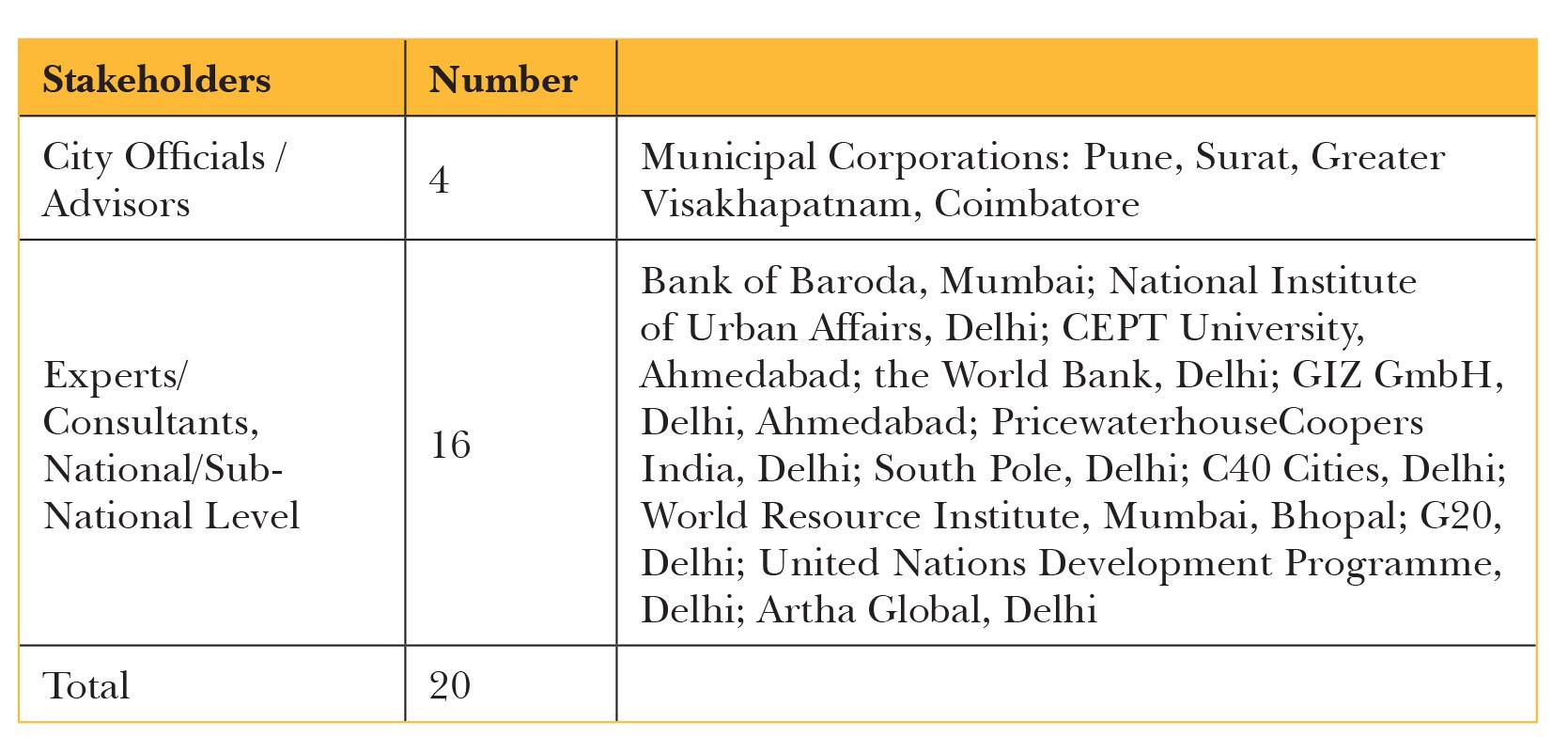

The research methodology involved conducting interviews with experts, ULB officials, and a literature review. Initially, experts were consulted to identify ULBs utilising UCF for climate-related projects. Subsequently, out of a total of 17 ULBs, four large ones—Coimbatore City Municipal Corporation, Pune Municipal Corporation, Surat Municipal Corporation, and Greater Visakhapatnam Municipal Corporation—were selected to achieve a comprehensive understanding of UCF access within diverse urban contexts (Map 1). Interviews were conducted with 20 stakeholders to delve into the challenges in UCF access, the most critical factors, and potential opportunities (Table 1).

To ensure that the interviews were effective, guidelines were adopted based on feedback, particularly considering that ULB officials might not be well-versed in UCF-related lexicon. Thus, separate sets of questions were asked of ULB officials and experts. The questions posed to city officials covered types of climate change-related challenges, projects they have implemented or are implementing to address them, how they managed funding for these projects, challenges in accessing UCF and how they overcame them, and what needs to be done for ULBs to effectively access UCF. Experts were asked to discuss challenges and opportunities in accessing UCF, and why some ULBs are better able to do so.

Map 1: Cities’ Location Vulnerability (Hydro-met disasters) Map

Source: Mohanty[17]

Table 1: Stakeholders Interviewed

This brief was developed through a systematic analysis of interview data. Conclusions were drawn from multiple interviews, with the caveat that those responses were their personal views, and not their organisations’.

Understanding Definitions and UCF in India

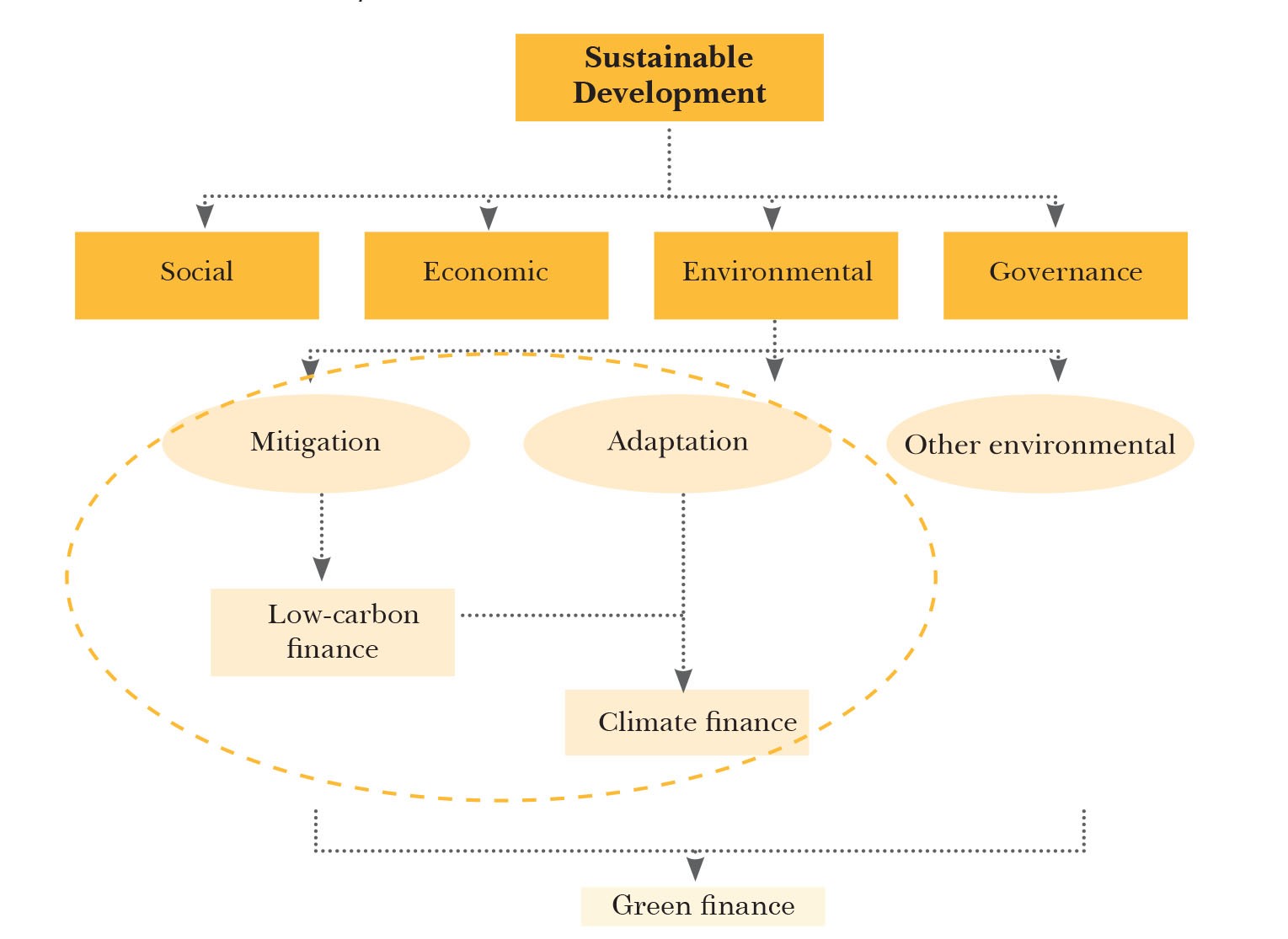

At the annual Conference of the Parties (COP28) in Dubai in 2023, it was noted that “there is no agreed definition of climate finance”.[18] According to the Capacity Building Module prepared by sustainability company South Pole for CapaCITIES, a global agency that assists climate-resilient city development, to support the CapaCITIES programme in India, climate finance is “the environmental aspect of finance initiatives that focus on investments related to mitigation and adaptation of climate change” (See Exhibit 1).[19] It is a component of sustainable finance, in turn defined as encompassing “a variety of institutional frameworks and policy measures”[20] intended “to draw investments from the private sector and address the environmental, social, economic, and governance components of sustainable development.”

Exhibit 1: Climate/Sustainable Finance

Source: South Pole[21]

CPI’s definition is similar: “UCF refers to resources directed to activities limiting city-induced GHG emissions or aiming to address climate-related risks faced by cities, contributing to resilience and low carbon development.”[22]Top of Form

Accessing UCF in India

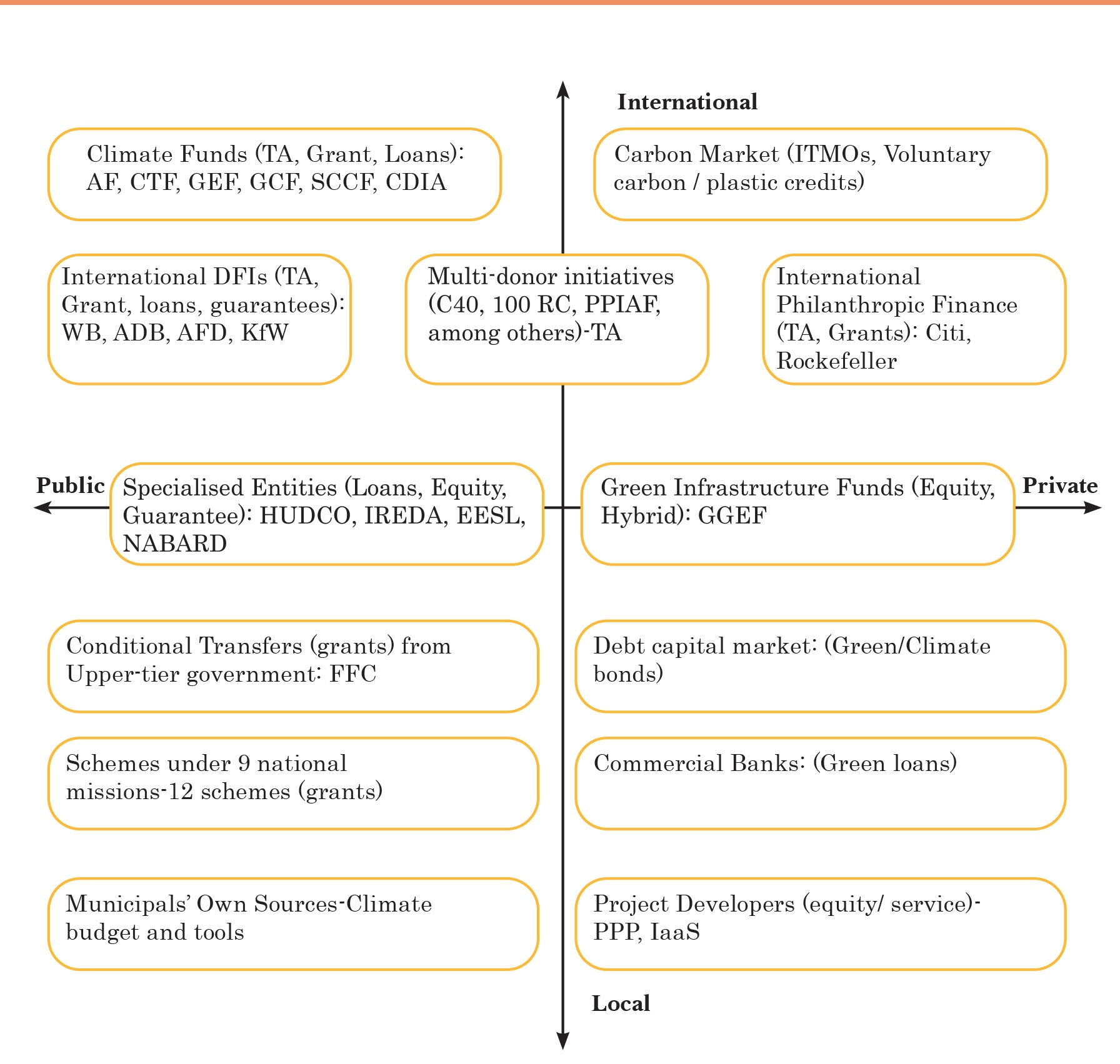

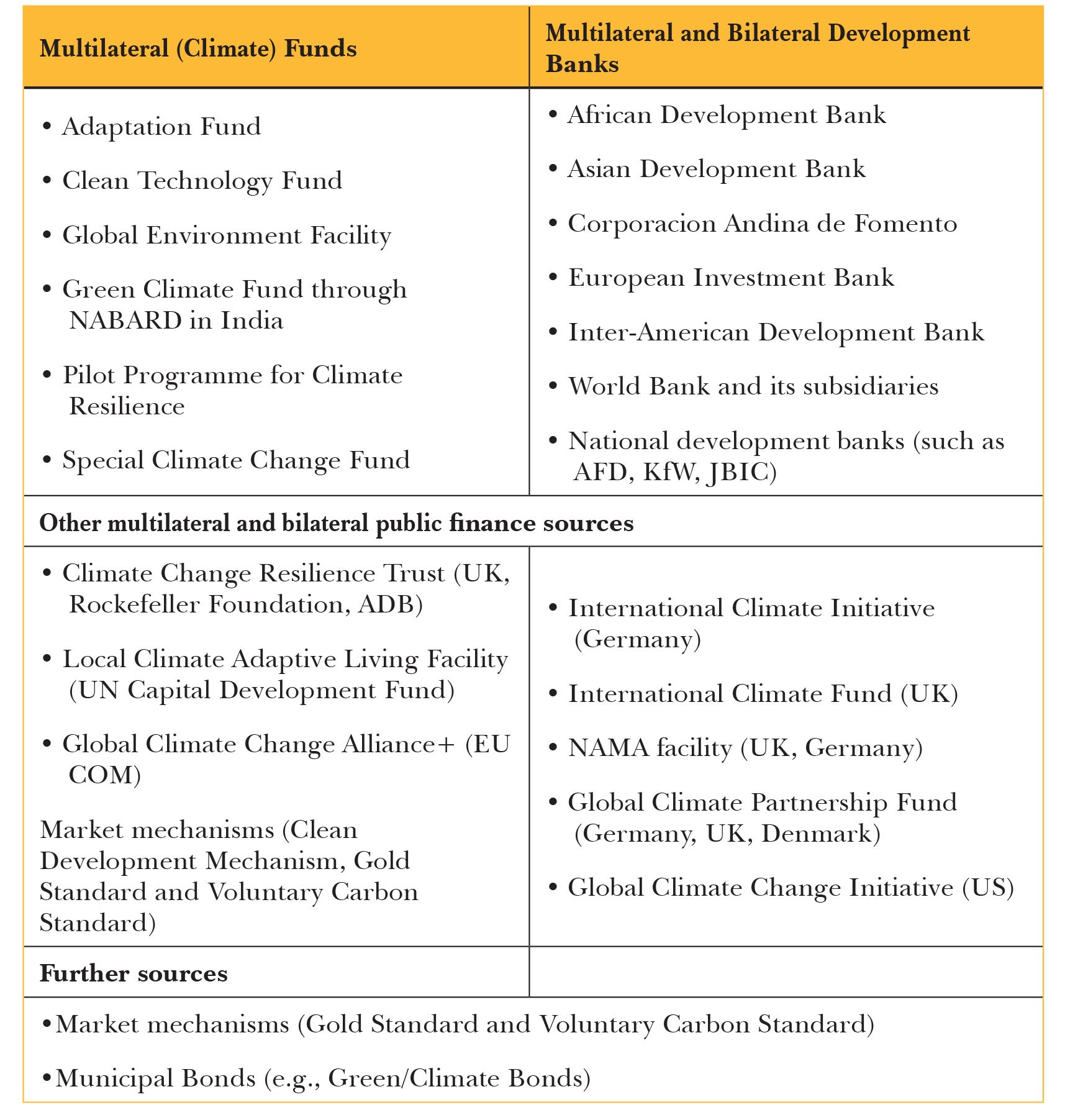

Exhibit 2: Sources of Climate Finance in Cities

Source: South Pole[23]

UCF for Indian cities goes through a variety of channels (Exhibit 2).[24] Indeed, the broad spectrum of funding sources makes it challenging to precisely track the flow of funds and assess their real impact on the ground, also making the categorising of specific projects under the climate finance umbrella a complex task.[25] Separately, the lack of integration of climate change-related expenditure with the national budget requires attention and resolution.[26],[27]

While public sources contribute large amounts to climate finance, well-established international funds also drive climate action in Indian cities (Table 2). These funds, however, are typically not directly accessible for ULBs. They go through accredited implementing entities, often international organisations such as UN agencies and development banks.[28] ULBs have accessed climate funding by collaborating on joint proposals with these implementing entities.

The Niti Aayog report on ‘Reforms in Urban Planning Capacity in India’ outlines some of the internal and external challenges ULBs face and makes recommendations on how to overcome them. These include empowering mayors and standing committees for effective urban planning, sanctioning additional lateral entry posts for town planners, and utilising the ‘National Urban Learning Platform’ for capacity building.[29]

Table 2: International Sources of UCF

Source: NIUA[30]

Various reports, both by the government and other entities, have discussed challenges and required reforms at the ULB level. The Ministry of Housing and Urban Affairs (MoHUA) 2022 report emphasises professionalising urban planning and management capacities, calling for a comprehensive approach that encompasses funds, functions, and functionaries across different tiers of urban governance. It emphasises raising the capacity of the entire urban planning ecosystem, communicating the value of planned urban development as an engine of growth to stakeholders, and implementing visible change projects.[31]

Similarly, the ‘Annual Survey of India’s City Systems (ASICS) 2023’ report by Janaagraha, a non-profit working to improve the quality of urban Indian life, emphasises enhancing urban governance. It advocates an open cities framework with participatory budgeting for localised problem-solving, improving city governments' financial stability through predictable transfers and revenue enhancement, enabling large-scale urban infrastructure financing through robust financial reporting frameworks and municipal borrowings, implementing digital grant management tools for efficient fund transfers and project monitoring, and adopting modern human resource management strategies to enhance organisational effectiveness in city governance. [32]

The Reserve Bank of India’s (RBI) ‘Report on Municipal Finances’ highlights challenges such as lack of consolidated data on local government finances, resource constraints, and the need for effective governance. It suggests strategies such as standardised accounting practices, establishing municipal debt markets, exploring land-based financing mechanisms, and leveraging web-based e-governance systems.[33]

The literature also emphasises opportunities for ULBs to access UCF. It stresses that ULBs must establish robust governance structures and strategies to enhance climate planning and financial management. In cases where ULB revenues are insufficient, they can attract additional revenues and investment capital through new financing instruments, such as land value capture and bonds. Financial intermediation can also play a key role in pooling risks and channelling international funds directly into projects. Creating conducive conditions for ULBs to engage in climate projects and raise the requisite finance to execute them is also crucial.

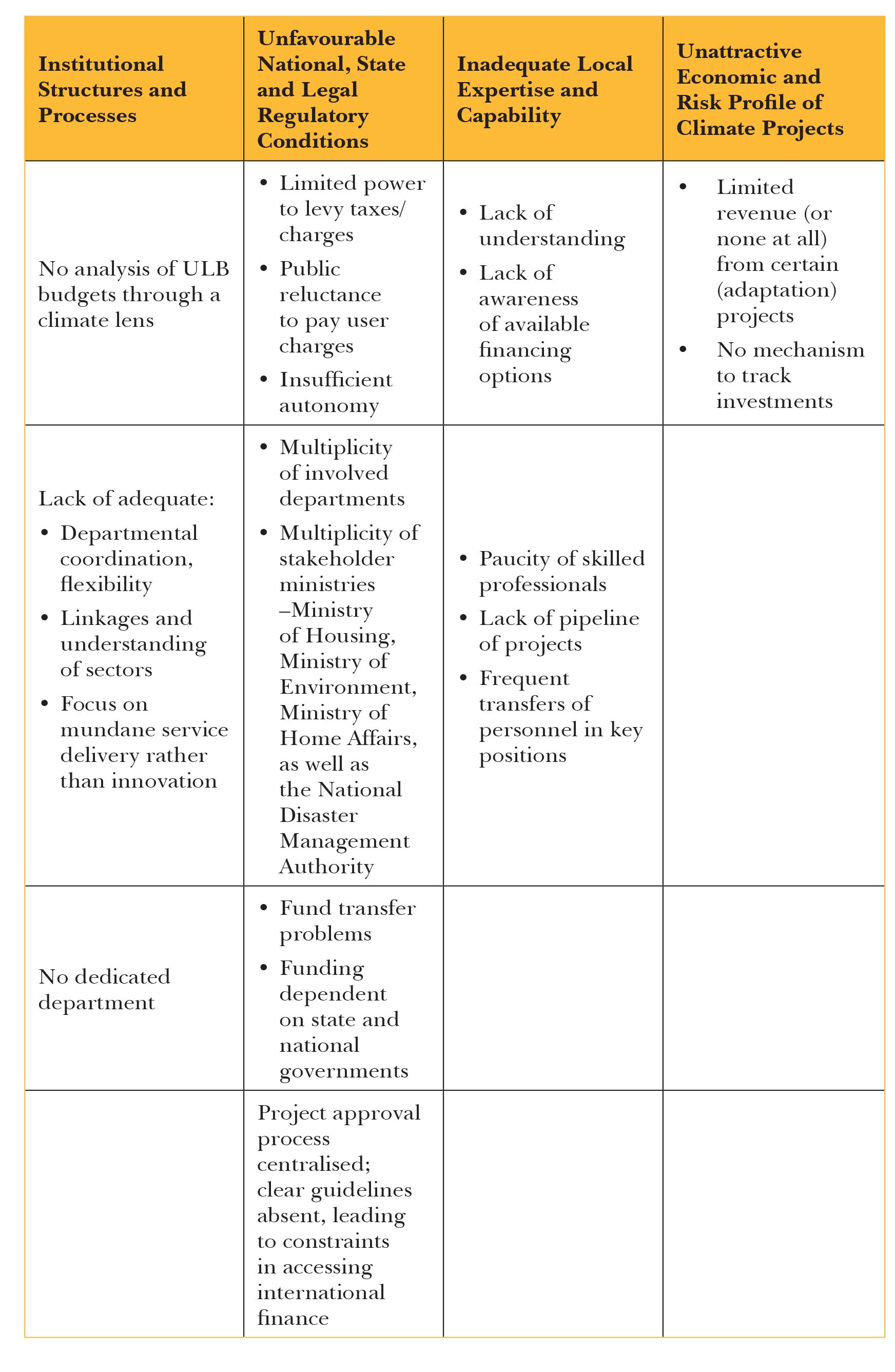

Challenges in Accessing UCF

The main challenges are listed under four broad heads in Table 3.

Table 3: Key Challenges

Officials interviewed at the four relatively successful ULBs acknowledged that their corporations, too, had been affected by the climate crisis, and that in recent years, the intensity has increased, causing significant social and economic losses. These losses have in turn impacted their capacity to invest in new or upgraded infrastructure. Additionally, rapid expansion of cities increases pressure on them to keep up with the growth and deliver effective infrastructure and services to residents. Funding for such infrastructure and services, however, is difficult to obtain.

Successful Strategies

Despite challenges, these four ULBs have leveraged diverse funding sources from the Centre and their respective state governments, from multinational development banks, bilateral agencies, and their own revenues. They have also raised finance through market borrowings, municipal bonds, and public–private partnerships (PPPs). According to those interviewed, the following were the key facilitating factors.

Early sensitisation through strategies and plans: The ULBs of Pune and Surat participated in the Rockefeller Foundation's ‘100 Resilient Cities Network’ programme that helped them formulate their first city resilient strategy. Similarly, Visakhapatnam’s ULB learnt from the United Nations Development Programme (UNDP), while Coimbatore’s, from the global cities network International Council for Local Environmental Initiatives (ICLEI) and from Germany’s leading development agency GIZ. Coimbatore’s ULB has set up a City Climate Alliance, which, apart from state-level experts, had the support of GIZ and ICLEI to sensitise its staff on climate, help in detailed project report (DPR) preparation and building synergies with other departments in common areas of climate interventions, such as urban forests.

Links with Global City Networks: These four ULBs are part of global networks such as the Global Resilient Cities Network, the Asian Cities Climate Change Resilience Network (Surat and Pune), the ICLEI (Visakhapatnam and Coimbatore), and the Global Covenant of Mayors for Climate and Energy (Pune). This sensitises them to climate actions, facilitates learning from good practices, exposure visits, receiving grants for pilots and capacity building, and preparation of DPRs. The exposure has also taught them to incorporate issues such as local community participation, children and gender inclusion, social and environmental safeguards into their climate projects.

Entrepreneurial Leadership: Two of the four ULBs (Surat and Visakhapatnam) reported that their corporation’s leaders (both mayor and commissioner) motivated and encouraged them by sharing global good practices. They welcomed national-level assessments, such as the Climate Smart Cities Assessment Framework (CSCAF) designed by the National Institute of Urban Affairs (NIUA) and MoHUA. It gave the staff insights into the components of climate actions, risk and vulnerability assessments, GHG inventories, the need for climate actions plans (CAPs) and more.

It was also felt, however, that more than leadership, sustained engagement and institutionalisation of processes made the difference. Making systemic changes and boosting capacities across the ecosystem were more important than the role of individual climate champions.

Tapping financing and market borrowings: These four ULBs have borrowed from the market to finance their climate projects. For example, Vishakhapatnam’s ULB financed its recent project on supply of recycled water to industries through loans from a public sector bank, issue of municipal bonds (it has a credit rating of AA), and apportioning some money from its budget. Pune and Surat have also funded past infrastructure projects via municipal bonds, while Coimbatore is planning on floating a green bond.[34]

Readiness to seek external expertise: These ULBs were open to hiring consultants and engaging technical institutions for support on climate projects. They encouraged the lateral entry of experts into the corporation (Visakhapatnam and Coimbatore), using project management consultants for cost-effective and timely delivery. They have drawn advisers from bodies such as GIZ and ICLEI (Coimbatore) to support planning, execution, and management of projects.

State-level institutional support for project preparation: Coimbatore’s ULB has enlisted the support of the Tamil Nadu Urban Infrastructure Financial Services Ltd[35] (TNUIFSL) to help prepare DPRs and structure projects.[b] This is one example of how expert agencies are guiding and supporting ULBs in venturing into new and complex climate projects.

‘Metabolism’[c] management: These ULBs prioritised projects related to urban metabolism such as water supply, waste and wastewater management, sanitation and public health. They facilitated river rejuvenation (in Pune and Surat), creation or expansion of green spaces, starting projects using renewable energy, and introducing dedicated bus corridors or electric buses (in Pune, Surat, and Visakhapatnam).

Leveraging relevant national and state schemes: These ULBs have successfully leveraged funding opportunities from national programmes such as the Atal Mission for Rejuvenation and Urban Transformation, the Smart Cities Mission, the Swacch Bharat Abhiyan, and the National Clean Air Programme.

Acquiring capacity building support: Institutions such as ICLEI and Global Covenant of Mayors for Climate and Energy (GCOM) have been funding training of ULB officials on how to prepare DPRs and CAPs. The NIUA also provides ULBs technical support. The Pune Municipal Corporation is currently preparing its CAP with the support of both GCOM and NIUA.

Informal climate budgeting: India has yet to introduce any institutionalised accounting mechanism to track climate investment at the ULB level. As of yet, there are no accounting codes to integrate climate actions into budgeting. However, these four ULBs are informally doing so. Surat and Visakhapatnam have begun categorising projects that have a climate angle. In its CAP, Pune has listed doing so as one of its agenda points. Surat is revising its budget accounting codes, adding a couple of additional columns which allow for ‘greening’ and ‘resilience’ to be built into the budget system.

Recommendations for Accessing UCF

3.1 Focus on Planning: ULBs must enhance resilience against climate extremes by developing visionary roadmaps with short, medium, and long-term plans. ULB officials interviewed stressed the importance of training staff in scenario planning by envisioning exercises to set climate goals and targets. Guidance in preparing CAPs can help prioritise sectors, interventions, and funding sources. Continuous engagement with non-state actors[46] is crucial to integrate climate action into routine operations and foster interdepartmental convergence.

Specialist planners may not be essential in the coming years, as their role is being supplanted by geographic information systems (GIS) and visualisation techniques. Such advances are making it easier to train non-planners in urban planning through capacity building programmes. A couple of states have already carried out such training.

3.2 Enhance DPR Preparation Skills: ULBs must invest in programmes to enhance officials’ project report preparation skills, climate management skills, and holistic urban planning. Training should cover the entire climate finance ecosystem, from project preparation to implementation, rather than being limited to short workshops. Programmes should focus on teaching officials to design and deliver ambitious CAPs, to interpret climate data, identify co-benefits, build decision-making networks and PPP models, and advocate for resource allocation.[47]

Project preparation relies on robust data. Early sensitisation in strategies and plans helped Surat, Visakhapatnam and Pune understand this need and work towards fulfilling it. Surat's ability to continuously review, monitor, and analyse services are due to the data it has available, partly drawn from the NIUA-led CSCAF.

Evaluated on the CSCAF scale, Surat, Visakhapatnam, and Pune achieved four-star ratings, while Coimbatore got three stars.[48] Taking part in this assessment has enhanced these ULBs’ understanding of key data points for CAP and DPR preparation. However, many other ULBs still lack sufficient data, and even when they have it, do not know how to use it.[49]

Other kinds of training are also needed. Procurement officials at ULBs, for instance, should be trained to develop a climate-friendly procurement system. They should learn to use the full potential of a web-based e-governance system for procurement, that improves ULB operational efficiency and enables sustainable urbanisation.[50] Not doing so will ultimately result in higher costs, while early compliance will yield good returns on investment.[51] Mainstreaming the notion of green public procurement (GPP) will require skilled professionals to set standards, develop bid documents, and monitor and evaluate projects.[52]

3.3 Enhance metabolism management capacity: Projects such as water supply, sanitation, waste management, and public health should be prioritised when accessing climate finance. ULB officials need customised training to understand how critical services and infrastructure can be made climate-resilient. ULBs should have a holistic, long-term financing plan.

Many reforms for local administration have been suggested by experts, including performance enhancement and adopting e-governance.[53] State governments should support devolving more powers to ULBs, establishing municipal cadres, and enhancing capacity through training. Pilot projects with ULBs will help them learn on the job how to build capacities in project management and resource mobilisation.

ULBs should explore land-based finance to attract private investment and amend their master plan rules to enable climate-sensitive planning and enhancing of their credit ratings. They should consider implementing PPP models, increase e-governance and citizen participation, and improve taxation systems.

Conclusion

Accessing UCF remains a challenge for ULBs in India. However, some ULBs have managed to do so through strategic approaches, such as early sensitisation, entrepreneurial leadership, seeking out diverse financing sources, being open to external expertise, and leveraging national and international schemes. Their success offers valuable insights for other ULBs.

Addressing these challenges calls for a multifaceted approach. It should include establishing dedicated climate action departments, integrating climate budgeting mechanisms, carrying out comprehensive capacity building, enhancing data collection and utilisation, fostering collaboration with non-state actors, and leveraging global networks.

Manish Thakre is a consultant specialising in Climate Action, Resilience, and Inclusive Urban Development. Executive MSc in Cities, London School of Economics and Political Science (LSE).

Endnotes

[a] These are Odisha, Tamil Nadu, Kerala, Haryana, Himachal Pradesh, and Goa.

[b] TNUIFSL, a public limited company, manages trust funds and provides financial and investment advisory services to urban bodies from concept to commissioning.

[c] The concept of ‘urban metabolism’ arises from the fact that, like natural organisms, cities also draw energy from external sources and release unwanted byproducts. Food, water and fuel are some urban metabolic inputs, while pollution and garbage are outputs.

[d] The Coalition of Finance Ministers for Climate Action, set up on 13 April 2019, brings together finance ministers of 90 countries to secure a just transition to low-carbon resilient development.

[e] C40 Cities is a global network of mayors of 96 cities who have united to confront the climate crisis. The Indian cities include Jaipur, Mumbai and New Delhi.

[1] Auguste Tano Kouamé, “View: India urbanisation critical for getting developed tag,” The Economic Times, January 26, 2024, https://economictimes.indiatimes.com/news/economy/infrastructure/view-india-urbanisation-critical-for-getting-developed-tag/articleshow/107155247.cms?from=mdr

[2] GIZ, Climate Smart Cities,2022, https://www.giz.de/en/downloads/20190114_CSC%20project%20level.pdf

[3]World Bank Group, Investing in Urban Resilience: Protecting and Promoting Development in a Changing World, 2016, Washington DC, World Bank, 2016, http://hdl.handle.net/10986/25219

[4] Abinash Mohanty and Shreya Wadhawan, Mapping India’s Climate Vulnerability – A District Level Assessment, New Delhi, Council on Energy, Environment and Water, 2021, https://www.ceew.in/sites/default/files/ceew-study-on-climate-change-vulnerability-index-and-district-level-risk-assessment.pdf

[5] UNFCCC, Cities Are Where the Climate Battle Will Largely Be Won or Lost, October 11, 2019, https://unfccc.int/news/guterres-cities-are-where-the-climate-battle-will-largely-be-won-or-lost

[6] UN-HABITAT, Cities and Climate Change at COP28, UN-HABITAT Engagement, 30 November to 12 December 2023, https://unhabitat.org/sites/default/files/2023/11/brochure_un-habitat_engagement_at_cop28_.pdf

[7] UN-HABITAT, “Cities and Climate Change at COP28, UN-HABITAT Engagement”

[8]Climate Policy Initiative, Landscape of Green Finance in India, 2022,

https://www.climatepolicyinitiative.org/publication/landscape-of-green-finance-in-india-2022/

[9]“GDP of India: Current and historical growth rate, India's rank in the world,” Forbes India, December 4, 2023, https://www.forbesindia.com/article/explainers/gdp-india/85337/1

[10]Climate Policy Initiative, “Landscape of Green Finance in India”

[11] Climate Policy Initiative, Financing Adaptation in India, 2024, https://www.climatepolicyinitiative.org/wp-content/uploads/2024/02/Financing-Adaptation-India_reportannexes.pdf

[12]Dennis Tänzler, Annica Cochu, and Rainer Agster, Challenges and Opportunities for Urban Climate Finance - Lessons Learned from eThekwini, Santiago de Chile and Chennai: cities fit for climate change, 2017, https://www.giz.de/de/downloads/giz2018-0013en-cfcc-challenges-opportunities-urban-climate-finance.pdf

[13]“Challenges and Opportunities for Urban Climate Finance- Lessons Learned from eThekwini, Santiago de Chile and Chennai”

[14]National Institute of Urban Affairs, “Assessment to Action,” https://niua.in/csc/assessment-to-action.html

[15]“Challenges and Opportunities for Urban Climate Finance- Lessons Learned from eThekwini, Santiago de Chile and Chennai”

[16]National Institute of Urban Affairs, “Assessment to Action,”

[17] “Mapping India’s Climate Vulnerability - A District Level Assessment”

[18]Amitabh Sinha, “Let us clearly define climate finance, says India at COP28 meet,” The Indian Express, December 9, 2023, https://indianexpress.com/article/world/climate-change/let-us-clearly-define-climate-finance-says-india-at-cop28-meet-9060555/

[19] South Pole, Module I: Climate Finance for Cities - Capacity Building Module, 2021, https://www.capacitiesindia.org/wp-content/uploads/2020/11/171023_1-Module-I_Climate-Finance-1.pdf

[20] “Module I: Climate Finance for Cities”

[21] “Module I: Climate Finance for Cities”

[22] “Module I: Climate Finance for Cities”

[23] “Module I: Climate Finance for Cities”

[24] “Module I: Climate Finance for Cities”

[25] Divya Singh, Climate Finance Architecture in India, Centre for Budget and Governance Accountability, 2017, https://www.cbgaindia.org/wp-content/uploads/2017/12/Climate-Finance-Architecture-in-India-1.pdf

[26]Gopalika Arora, Climate budgeting: Unlocking the potential of India’s fiscal policies for climate action, 2023, https://www.orfonline.org/expert-speak/climate-budgeting/

[27]“Climate Finance Architecture in India”

[28]“Challenges and Opportunities for Urban Climate Finance - Lessons Learned from eThekwini, Santiago de Chile and Chennai”:

[29] Government of India, Ministry of Housing and Urban Affairs, First Report of the High-Level Committee on Urban Planning

[30] National Institute of Urban Affairs, https://niua.in/csc/assessment-to-action.html

[31]Government of India, Ministry of Housing and Urban Affairs, First Report of the High-Level Committee on Urban Planning, Envisioning and Realising a New Future for Indian cities- Pathways to Amrit Kaal

[32]Janaagraha, Annual Survey of India’s City-Systems (ASICS) 2023, Janaagraha Centre for Citizenship and Democracy, 2023, https://www.janaagraha.org/resources/asics-2023/

[33]Reserve Bank of India, Report of Municipal Finance, 2022, https://m.rbi.org.in/scripts/AnnualPublications.aspx?head=Report%20on%20Municipal%20Finances

[34] “Coimbatore Corporation plans to adopt Green Municipal Bonds to reduce carbon footprint in city,” The Hindu Bureau, May 23, 2023, https://www.thehindu.com/news/cities/Coimbatore/coimbatore-corporation-plans-to-adopt-green-municipal-bonds-to-reduce-carbon-footprint-in-city/article66884865.ece

[35] Tamil Nadu Urban Infrastructure Financial Services Limited, http://tnuifsl.com/aboutus.asp

[36] Elizabeth Gogoi, Rhea Cordeiro, and Divya Prakash Vyas, Scoping Study for a Cities Climate Change Programme, Oxford Policy Management and Shakti Sustainable Energy Foundation,https://www.opml.co.uk/files/Publications/a4901-shakti/a4901-cities-scoping-report.pdf

[37]“Scoping Study for a Cities Climate Change Programme”

[38]“Scoping Study for a Cities Climate Change Programme”

[39] Coalition of Finance Ministers for Climate Action, Strengthening the Role of Ministries of Finance in Driving Climate Action: A Framework and Guide for Ministries of Finance, 2023, https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2023/06/Strengthening-the-role-of-Ministries-of-Finance-in-driving-climate-action.pdf

[40] Reserve Bank of India, Report on Currency and Finance: Towards a Greener Cleaner India, 2022-23, https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/RCF03052023395FAF37181E40188BAD3AFA59BF3907.PDF

[41] Gopalika Arora, “Climate budgeting: Unlocking the potential of India’s fiscal policies for climate action,” Expert Speak, Terra Nova, April 26, 2023.

[42] “Civic body plans separate climate budget from next year,” Indian Express, February 8, 2024, https://indianexpress.com/article/cities/mumbai/bmc-climate-budget-next-year-9141428/

[43] The City of New York, “Mayor Adams Celebrates Launch Of New York City’s First Climate Budgeting Process,” April 30, 2024, News, Office of the Mayor, NYC.

[44]Shruti Narayan and Catrin Robersten, “How Cities Can Factor the Climate Crisis in Budgets,” Hindustan Times, February 7, 2024,https://www.hindustantimes.com/opinion/how-cities-can-factor-the-climate-crisis-in-budgets-101707313201411.html

[45]Leaders in Climate Change Management, https://www.lccmindia.org/

[46]Radhika Khosla and Ankit Bhardwaj, Urbanization in the time of climate change: Examining the response of Indian cities, Wiley Interdisciplinary Reviews: Climate Change10, no. 1, 2019,https://doi.org/10.1002/wcc.560

[47]“Scoping Study for a Cities Climate Change Programme”

[48]National Institute of Urban Affairs, Cities Readiness Report: CSCAF 2.0., 2021, https://niua.in/csc/assets/pdf/key-documents/Cities-Readiness-Report.pdf

[49]Shreyans Jain and Rajashree Padmanabhi, A Snapshot of Urban Green Finance in Two Indian Cities: Case Studies of Hyderabad and Kolkata. Cities Climate Finance Leadership Alliance, 2021,https://www.climatepolicyinitiative.org/wp-content/uploads/2021/11/CCFLA-Indian-cities-report_FINAL-1.pdf

[50]“Report of Municipal Finance”,

[51]Jagan Shah, “Green procurement can make Indian cities healthy and liveable,” Eco Business, March 24, 2023, https://www.eco-business.com/opinion/green-procurement-can-make-indian-cities-healthy-and-liveable/

[52]“Green procurement can make Indian cities healthy and liveable”

[53]Isher Judge Ahluwalia, Building Capacity, In Ricky Burdett, Philipp Rode, Priya Shankar, and Shan Vahidy (Eds.), Governing urban futures (pp. 39–40), 2014, London, England: LSE Cities, https://lsecities.net/wpcontent/uploads/2014/11/GoverningUrbanFutures_newspaper_screen.pdf

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Manish Thakre is a consultant specialising in Climate Action, Resilience, and Inclusive Urban Development. Executive MSc in Cities, London School of Economics and Political Science ...

Read More +