-

CENTRES

Progammes & Centres

Location

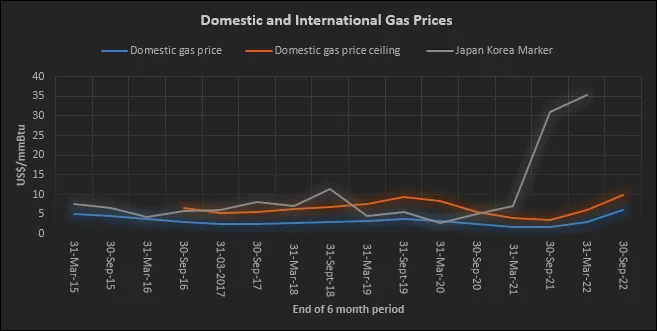

On 31 March 2022, the Indian government increased the price of domestic gas from US$2.9/mmBtu (metric million British thermal units) to US$6.10/mmBtu, an increase of over 110 percent. The government also increased the price ceiling for deep water, ultradeep water, high temperature, high-pressure gas to US$9.92/mmBtu from US$6.13/mmBtu, an increase of over 61 percent. Commentary on the upward revision of prices ranges from its impact on the profitability of domestic producers to using higher gas prices as motivation for shifting to non-fossil fuels. The broader policy implications are an increase in energy security and a possible increase in consumption that could contribute toward the policy goal of making India a gas-based economy by increasing the share of natural gas in India’s primary energy basket to 15 percent by 2030.

Source: PPAC

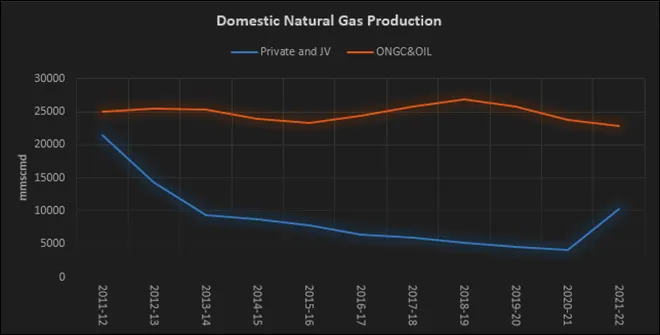

Source: PPACDomestic production of natural gas particularly production by private and joint venture (JV) companies increased substantially even before the announcement of price revisions. Though net domestic natural gas production fell from 46,453 mmscmd (metric million standard cubic meters per day) in 2011-12 to 33,131 mmscmd in 2021-22, it is roughly 10 percent more than the pre-pandemic production of 30,257 mmscmd. Whilst production from state owned companies fell from 25,726 mmscmd in 2019-20 to 22,774 mmscmd in 2021-22, production from private and JV companies increased by more than 128 percent from 4531 mmscmd in 2019-20 to 10,357 mmscmd in 2021-22. LNG (liquefied natural gas) imports increased from 17,997 mmscmd in 2011-12 to 31,906 mmscmd in 2021-22.

Import of LNG has meant dealing with wild volatility in pricing. The Japan-Korea marker price for LNG, the benchmark for Asian spot LNG imports fell to about US$2/mmBtu in April 2020 on account of pandemic influenced economic slowdown, but increased to over US$35/mmBtu in March 2022, an increase of over 1650 percent following the crisis in Ukraine and the related natural gas supply risks. If India sourced 25 percent of LNG at a spot price of over US$35/mmBtu, it would cost more than US$9.8 billion. However, if this demand is met with domestic gas, even if from complex deep-water fields, the cost would be less than a third. The other side of the argument is that domestic producers have effectively subsidised imports through lower production which has not only meant substantial revenue loss, but also loss in domestic job creation.

Price control on natural gas in India has been equivalent to rent control and the effect has been no different from urban rental housing - shortages. It simulated demand without helping supply. Exploration for oil & gas does not follow a utility function in the sense that an increase in investment does not necessarily mean an increase in supply as it is in other industries. Exploration for gas is a game of chance and probability that requires a large appetite for risk. Hydrocarbons beneath the ground are depleting resources and therefore the marginal cost of bringing additional supplies into the market almost always exceeds the average costs. The current approach that does not consider the marginal cost of bringing in additional supply has stifled risk taking and discovery. Under the controlled price regime, the gap between revenues and replacement costs has widened over time and has become a disincentive for producers to commit new reserves to purchase contracts for fear of getting locked into an ‘old’ price. Even if regulated prices are set at a high level and allowed a wide margin for flexibility, it cannot approximate marginal prices nor can it provide investments in marginal areas where higher risks are involved.

Coal, oil, and, natural gas industries were all born vulnerable to market instability and thus were subject to regulation world-wide. Whilst interventions in the coal industry were originally demanded by coal workers and that in the oil industry demanded by the oil industry, interventions in the natural gas sector were always demanded by consumers of natural gas, given its status as a natural monopoly at the point of sale. India is not an exception to this rule. Since production of natural gas began almost three decades ago, the industry has been subject to continuous compensatory regulation skewed in favour of consumers. As a result, a host of unproductive distortions in resource allocation have been created within and outside the sector.

Regulation in the natural gas sector has consisted mostly of incremental decisions influenced heavily by existing patterns of gas consumption. Those industries that have preferential access to natural gas have used it in a manner that is economically inefficient because the price signals they have received is misleading. Those industries without access to gas, but willing to pay higher prices use other fuels instead thereby distorting the market for products produced with them. In the short run, those with access have benefitted, but in the long run all consumers have suffered because of the reluctance of prospective suppliers to bring gas to the market and because the bargaining process created by regulation has resulted in expectation of higher prices for new gas rather than what would have been required under competitive conditions.

In the context of reforming the energy sector, the former Prime Minister of India Manmohan Singh commented that it is difficult to implement policies that are ‘manifestly obvious’ because of ‘competitive politics’ and ‘fractured mandates’. Competitive politics and fractured mandates have meant that ‘policies’ that govern the energy sector today are merely a set of incremental decisions, some taken by the government, some by the players in the industry, but all heavily influenced by the existing patterns of energy supply and consumption.

Unlike subsidies that disappear from public minds and require no ongoing political process, control of prices and access to natural gas must be done again and again, and thus more visible and more accessible to political interests. In such a regime, business entities have been placed in an uncomfortable position of fighting for a position of preference with the government rather than competing with others to bring additional supplies at the lowest possible prices. In the long run, this has reduced the country’s very capacity to attain the very goals on behalf of which the system is established, to assure plentiful supplies of energy at the lowest possible cost over the longest possible time.

Source: PPAC for domestic Price, BP for JK Marker

Source: PPAC for domestic Price, BP for JK MarkerAccording to Ministry of Steel, India is leaning toward continuing to import coking coal from Russia, seeming to buck a global trend to shun Moscow over its invasion of Ukraine. India plans to double imports of Russian coking coal, a key ingredient in making steel. The country had imported 4.5 million tonnes (MT). Vessels carrying at least 1.06 MT of coking coal, mainly used for steelmaking, and thermal coal used primarily for electricity generation, are set to deliver the fuel to Indian ports this month, the most since January 2020, data from consultancy Kpler showed. Russia, typically India’s sixth-largest supplier of coking and thermal coal, could start offering more competitive prices to Chinese and Indian buyers as European and other customers spurn Russia because of sanctions. India’s coal imports from Russia in March could be the highest in more than two years, data from research consultancies showed, as Indian buyers continue buying the fuel from a market that is now increasingly isolated by sanctions. Vessels carrying at least 1.06 MT of coking coal, mainly used for steelmaking, and thermal coal, used primarily for electricity generation, are set to deliver the fuel at Indian ports in March, the highest since January 2020, consultancy Kpler data showed. As per Indian consultancy Coalmint, about 870,000 tonnes of Russian coal have already delivered or are expected to be delivered at Indian shores until March 20, the highest since April 2020.

Tata Steel Ltd is looking at alternative markets for imports of coal as it faces uncertainties with its Russian suppliers and bankers, amid the Russia-Ukraine conflict. The geopolitical situation after Russia’s invasion of Ukraine has also opened up steel export opportunities in Europe, following a supply vacuum of 45 MT of the metal left by Russia and Ukraine in the continent. Tata Steel will look at alternative markets for coal imports to de-risk. There is a lot of uncertainties with Russian suppliers and bankers at present. The steelmaker used to buy 10-15 percent of its coal requirements from Russia for use in pulverised coal injection.

Coal India Limited unit, the Mahanadi Coalfields Limited (MCL) has become the largest coal-producing company in the country. The company has crossed 157 MT in coal production in the financial year 2021-22. And, on 12 March, the company produced 7.62 lakh tonne of dry fuel. The company claimed that it is the highest production in a day during the current financial year.

The Gujarat high court (HC) asked the state government what are the modalities and its plans to phase out the use of coal and lignite in industrial units to curb air pollution in the state, and how can it reduce their use. The court asked what are the government’s plans to persuade industry to switch to CNG (compressed natural gas) and PNG (piped natural gas) from coal. The court asked the state government for its stance on how the use of coal as a fuel can be done away with. The government submitted that it cannot be phased out all of a sudden, but over a long period. The Union government has come up with the ‘National Coal Gasification Mission’ for use of coal. The court asked if coal is an approved fuel and if it is a policy, to what extent can the court use its writ jurisdiction to direct the government to delete coal as a fuel from its notification and stop its use. The court questioned why the government does not promote the use of gas in place of coal. It sought details on production and consumption of CNG and commented that its order to Morbi’s ceramic units to shift from coal to gas yielded good results in the area. The court inquired about the use of lignite, of which 1.19 lakh million tonnes (MT) is used every day in Gujarat. The state submitted that lignite causes more pollution than coal, but is the cheapest fuel available. It was also submitted that the government plans to stop the use of lignite in a phased manner. Seeking the government’s response to its plan to phase out coal and lignite, the court recorded the government’s submission that lignite is worse than coal. It questioned while coal is creating so much problem for the ecology, why the government permits the use of lignite and why it should not be done away with at the earliest.

At a time when efforts are on for gradual phasing out of coal, India’s largest thermal power producer, the NTPC Ltd, has decided to make coal and associated operations in Jharkhand as clean as possible. As part of the move, the coal and power major has started operating on a part of Asia’s longest conveyor belt—21km long and 12-feet wide—to ferry coal from its Pakri-Barwadih mines in Hazaribag to the Banadag railway siding. From the Banadag railway siding, coal is transported to various destinations across the country. As per the Public Relations Executive (corporate communications) at NTPC Hazaribag, the conveyor belt will reduce pollution by trucks — both in terms of gaseous emissions and dust. This is the first time that the NTPC is using a conveyor belt to transport coal from its coal mine to the railway siding. So far, 6.5km of the total length is operational and owned by Thriveni-Sainik Mining Pvt Ltd, a mining partner of NTPC. The remaining 14.5km is owned by NTPC and trial runs are on. To manage the curves on the 21km route, 10 transit points have been added. The length of the belt has been reduced, thereby increasing its efficiency. Each transit point has coal stacking facilities.

According to Rystad Energy, Coal prices could cross US$500 per tonne in 2022, underpinned by soaring gas prices which may lead European countries to turn to coal. The European Union leaders gathered to forge a joint response to Russia’s invasion of Ukraine, with differing views on how far to go with economic sanctions, how quickly to cut Russian energy imports, and whether or not to let Ukraine join their bloc swiftly. Adding to supply concerns, Australia declared a national emergency in response to devastating floods along its east coast which affected coal producing regions of the country.

China is expected to see its coal output to grow further in 2022 after hitting a record last year, an industry body forecast, as the country will need to consume more of the dirty fossil fuel to power its economic growth. The world’s second-largest economy and its biggest coal consumer churned out a historically high 4.07 billion tonnes in 2021 after Beijing sought to tame the runaway coal prices and to ease a nationwide power crunch in the second half of the year. China's coal output will maintain a moderate increase in 2022, said China National Coal Association (CNCA), an industry body mainly representing Chinese coal miners, in a report. The national coal association did not give a forecast of coal output level in 2022. It expected some big and modern coal mines in northern and north-western China to add production capacity this year and production efficiency at coal mines to improve.

China’s coal output rose 10.3 percent in the first two months of 2022 from a year earlier, after Beijing encouraged miners to ramp up production for the winter heating season, with demand also receiving a boost from Indonesia’s export ban. The world’s biggest coal miner and consumer produced 686.6 MT of the dirty fossil fuel during January-February period, up from 617.59 MT in the same period in 2021, the National Bureau of Statistics said. China urged state-owned coal miners to increase output ahead of the festival and ordered them to operate normally during the holidays to ensure market supply and cool prices. Indonesia, China’s largest overseas coal supplier, imposed a shock ban on shipments on 1 January. This boosted demand for China’s domestic coal as seaborne shipments were delayed and regional benchmark prices surged. China’s output is expected to stay at a level of more than 12 MT a day in the near-term, as Beijing strives to ensure sufficient energy supply amidst a global price surge and supply disruption in the wake of Russia’s invasion of Ukraine. However, surging domestic cases of COVID-19, especially in the top mining region of Inner Mongolia, are challenging coal production and transportation. The major coal shipping railway connecting Datong and Qinhuangdao, with annual transportation volume at 421 MT, is expected to carry out annual maintenance in April. China’s most-active thermal coal contract for May delivery rose more than 4 percent in early trade before easing to 2.8 percent.

Global mining giant Anglo American Plc announced the sale of its remaining shareholding in Thungela Resources, completing its exit from the South African coal business. Under pressure from investors to exit coal businesses worldwide, the owner of gold, platinum, and diamond mining companies, Anglo American hived off its entire stake in its South African coal mines into Thungela and distributed most of the shares to its shareholders through an initial public offering in June, barring 8 percent.

A South African court upheld a complaint by activists that poor air quality in the coal belt is a breach of constitutional rights, giving the environment minister a year to enforce a clean air plan drawn up a decade ago. South Africa’s coal belt, east of the capital Pretoria and main city Johannesburg, is home to an estimated 3.6 million people as well as a dozen Eskom coal-fired power stations and some Sasol petrochemical plants. A 2019 study, for the state-owned Council for Scientific and Industrial Research, showed more than 5,000 South Africans die annually in the coal belt because the government has failed to fully enforce its own air quality standards, and that a quarter of households there have children with asthma. South Africa’s coal industry, the world’s fifth largest, employs 90,000 miners, generates 80 percent of the country’s electricity and supplies the feedstock for about a quarter of the country’s liquid fuel for vehicles, all at a time of soaring unemployment and frequent blackouts.

The Dutch government said energy company Onyx Power had decided to keep its coal-fired power plant in Rotterdam open longer than previously planned. The government said Onyx had changed its mind over a deal announced in November, in which it would close the plant within a few months in return for a subsidy of €212.5 million (US$235.7 million). The Rotterdam site is one of the four coal-fired plants in the Netherlands, all of which are due to be shut down by 2030. Current regulations cap production of the coal-fired plants at 35 percent of their capacity.

The Polish government has adopted draft legislation that will allow a ban on imports of Russian coal. Sanctions in the EU (European Union) as a rule have to be agreed by the whole trading bloc, and Brussels could potentially punish countries acting unilaterally. Russia dominates Polish coal imports, accounting for about 20 percent of domestic use. Some 9.4 MT of Russian coal was imported to Poland in 2020 and used mostly to heat individual households.

In the early stages of sanctions drafting against Moscow, one idea gained traction in Brussels - a ban on the import of Russian coal - until the EU’s biggest economy Germany struck it down. However, it included a ban on coal. The measure would also have been in line with EU climate policy, which has long targeted coal as among the most polluting energy sources that must be phased out. However, Germany, the EU country most reliant on coal imported from Russia, objected. Germany’s economy ministry said that Berlin had reduced its dependence on Russian coal and hoped to cease all coal imports by the autumn. In 2020, Berlin was by far the EU's largest importer of coal from Moscow, especially thermal coal used to generate electricity, data from the EU think tank Bruegel based on statistics from Eurostat show.

12 April: India’s busiest ports at Kandla in Gujarat and Mumbai are further clogged with LPG (liquefied petroleum gas) import vessels as the state-owned oil companies refuse to go beyond a small list of ports that have been designated by the government to give freight subsidies for bringing in the cooking fuel from overseas. Under the PDS Kerosene and Domestic LPG Subsidy Scheme of 2002, the government has categorised ports at Kandla, Mumbai, JNPT, Jamnagar, Hazira, Mangalore, Kochi, Chennai, Haldia, and Vizag as 'Designated Ports' for giving ocean freight subsidy. This subsidy is not available for imports done at other ports and so there is a clamour to get the ships only at these ports. The oil industry and the petroleum ministry have made a case for expanding the list of designated ports, but the Finance Ministry shot down the proposal.

8 April: India is considering joining the International Energy Agency (IEA)’s second initiative this year for a co-ordinated release of 120 million barrels of oil from emergency reserves of member countries to calm global oil prices. India is an IEA associate and not a full member as it does not have the mandated 90 days reserves. IEA members hold emergency reserves of 1.5 billion barrels under public ownership. The 120 million barrels amount to 8 percent of those stockpiles. This is equivalent to 4 million barrels a day for 60 days against a daily global supply of approximately 100 million barrels before the pandemic. India has a daily consumption of 4.5 million barrels per day of crude and has a stockpile of 39 million barrels, or roughly 8-9 days supply, spread across three locations. The coordinated drawdown is the second this year after the 1 March decision to release 62 million barrels. Such collective action under the banner of IEA, which was formed in 1974, had earlier been taken in 2011, 2005, and 1991 since IEA.

7 April: Niti Aayog has recommended that the government extend oilfield contracts with companies without seeking alterations to the terms of the original agreement, a proposal that can help end a six-year-old legal dispute over renewal of Vedanta’s Rajasthan block, the country’s largest on-land oilfield. The Aayog has also not supported the current policy of the government seeking 10 percent additional profit petroleum from the contractor during the extended period. If the Oil Ministry agrees to Aayog’s recommendation and proposes a change in the policy to the Cabinet, it can end the long-drawn dispute with Vedanta.

7 April: The Union government is exploring "all viable options" to procure crude oil at affordable rates, the Finance Ministry said on 7 April. However, the Ministry’s review report painted a rather dire picture, saying the rise in imports in March because of a 20 percent month-on-month increase in crude oil prices "does not portend well for the economy in the year ahead". India’s procurement of discounted crude oil from Russia has drawn criticism from the US (United States). According to reports, President Joe Biden’s administration has been left disappointed by some of India’s reaction to Russia's invasion of Ukraine and has warned it against aligning itself with Russia.

11 April: Global energy giant Shell will foray into retailing LNG (liquefied natural gas) for long-haul transportation like trucks, with its first filling station coming up in Gujarat this year as it bets big on the Indian gas market. Shell operates a 5 million tonnes a year LNG import facility at Hazira in Gujarat and has a small network of petrol pumps. It is now looking at the LNG for trucks/buses market as a growth avenue. While the first site is likely to be an exclusive LNG retail outlet, the company may in the future look to co-locate the LNG refuelling facility within petrol pumps. The government is pushing the use of LNG as fuel for long-haul transportation. It is targeting 50 stations in Gujarat, Andhra Pradesh, Karnataka, Kerala, Tamil Nadu, and Rajasthan in next three years and ultimately 1,000 outlets. LNG, which is natural gas super-cooled to liquid form, has much less carbon footprint than diesel. Besides environmental benefits, it is also cheaper on long-haul routes.

11 April: Revenues from natural gas production by companies like Cairn India, Focus Energy, and Oil India Ltd has increased nearly four-fold in 2021-22 in the state compared to 2018-19. In 2018-19, the state produced 708 million cubic metres (MCM) of natural gas for a revenue of INR1 bn. In 2021-22, natural gas production hit a record 1,570 MCM, fetching the state government INR3.84 bn in revenues. Most of the gas has been produced from Barmer and Jaisalmer regions, while the maximum quantity has come from Cairn India’s Rageshwari field in Barmer at about 1,320 MCM. The gas from Cairn is supplied to Gas National Grid and to various consumers. The gas produced by Focus and Oil India is supplied to Ramgarh power plant. Gas production from ONGC’s Manoharpur Tibba has stopped for the past two years. The company is setting up a dehydration unit to revive production.

11 April: JSPL has plans of setting up a coal gasification plant—the second in the country—at its Raigarh plant in Chhattisgarh. The company is already using the coal gasification technology to produce steel at its plant in Angul, Odisha. The 2 million tonne per annum production capacity plant, inaugurated in 2018, holds the distinction of being India's first and the only plant producing steel from 'swadeshi' coal using the coal gasification technology. The company said coal is converted into syngas which can further be used for producing power, petrol, diesel, and other petroleum products. Syngas can be also used in sponge iron making, by the glass and ceramic industry and even in cooking. Further, India can produce the cheapest hydrogen through the coal gasification route, the company said.

8 April: The Union Cabinet approved a policy that will let firms run by the Central or state governments to surrender non-operational mines without penalty, in a move that would allow the country to auction them off to help boost output. Companies will be able to surrender the mines without forfeiting bank guarantees under a one-time three-month window, the government said. More than 60 percent of the 73 coal mines allotted to state firms were non-operational as of December 2021, with 19 of those missing deadlines to start production.

12 April: India is likely to face more power cuts this year as utilities' coal inventories are at the lowest pre-summer levels in at least nine years and electricity demand is expected to rise at the fastest pace in at least 38 years, analysts said. Power cuts could stifle industrial activity in Asia’s third largest economy, just when economic activity was starting to recover after months of COVID-related lockdowns. The shortage of electricity as a percentage of demand has shot up to 1.4 percent over the last week, a Reuters analysis of government data showed, higher than the 1 percent deficit in October, when India last faced a serious coal shortage, and the 0.5 percent shortfall in March.

10 April: The 2.64 percent hike in electricity rates that was cleared by the Madhya Pradesh Electricity Regulatory Commission (MPERC) on 31 March has come into effect. The three power distribution companies (discoms) had, incidentally, sought an 8.71 percent hike to tide over revenue deficit, MPERC secretary Gajendra Tiwari said. As per the new tariff plan post the hike, a consumer using up to 30 units of electricity per month will have to pay INR3.34 per unit against INR3.25 earlier, while those in the 32-50, 51-150, and 151-300 unit slabs will also have to pay more. There are around 16.6 mn electricity consumers in Madhya Pradesh.

9 April: NTPC Limited has no debts to the two main power distribution corporations in the national capital, BSES Rajdhani Power Limited (BRPL) and BSES Yamuna Power Limited (BYPL). NTPC plants provide 1,800 MW to Delhi, with 1,500 MW going to BSES.

9 April: The state cabinet cleared a proposal to allow Maharashtra State Electricity Distribution Company Ltd (MSEDCL) to purchase additional power from private players till at least 15 June, when the power generation situation is expected to improve. At present, there is a shortfall of 1,000-1,500 MW in power demand and supply during peak hours owing to the sweltering heat and coal shortage. 400-500MW electricity is being saved through 'load relief' in areas where distribution losses are high. Energy Minister Nitin Raut said the electricity available with the power exchange is costly, so they will purchase it from private players at half the cost.

7 April: NLC India Ltd said it has registered an 18.64 percent rise in power generation at 29.20 bn units in FY22. A new record has been created in terms of electricity generation, with the power stations of NLC India Ltd and its subsidiaries together generating 29.2 bn units of electricity (29.20 billion units) during 2021-22, it said. The company and its subsidiaries have also exported 25.89 bn units of power during the year under review, which was 19.75 percent higher than the preceding year.

6 April: The average power purchase price on India's largest electricity exchange, Indian Energy Exchange Limited, surged in March to the highest level since April 2009, the company data showed, reflecting a steep rise in electricity demand. Power demand during March rose at the fastest pace in three months, with electricity shortages the worst since October due to soaring temperatures and a sharp uptick in economic activity. The number of buy bids, reflecting demand on the day-ahead market, exceeded sell bids, indicative of supply, by 35 percent, data showed, pushing the average purchase price to INR8.23 Indian (US$0.1087) per kilowatt hour (kWh), over double the average price in March 2021. India’s power regulator capped prices at INR12 (US$0.1580) per kWh, saying in an order dated 1 April that "abnormally high prices" at power exchanges hurt consumers' interests and eroded buyers' confidence in the market.

12 April: The Odisha Government and Bharat Petroleum Corporation Limited (BPCL) signed a Memorandum of Understanding (MoU) to take vital steps towards the proliferation of green energy in the state. BPCL plans to spend INR250 bn to build a renewable energy capacity of 10 gigawatt (GW) comprising a mix of solar, wind, small hydro and biomass by 2040.

9 April: The Meghalaya government has successfully installed solar-powered devices in 100 health centres in remote villages. The state government said it plans to cover all rural health centres under the solar power scheme to improve the functioning of these centres and ensure that last mile delivery in the health sector is achieved using solar technologies. In a pilot programme, the National Health Mission has successfully powered 100 sub-centres in the 11 districts with solar devices.

12 April: OPEC (Organization of the Petroleum Exporting Countries) cut its forecast for growth in world oil demand in 2022 citing the impact of Russia’s invasion of Ukraine, rising inflation as crude prices soar and the resurgence of the Omicron coronavirus variant in China. In a report, the OPEC said world demand would rise by 3.67 million barrels per day (bpd) in 2022, down 480,000 bpd from its previous forecast. The invasion in February sent oil prices soaring above US$139 a barrel, the highest since 2008, worsening inflationary pressures. Crude has since fallen as the United States (US) and other nations announced plans to tap strategic oil stocks to boost supply, but remains over US$100. Even so, world oil consumption is expected to surpass the 100 million bpd mark in the third quarter, as OPEC has predicted. On an annual basis according to OPEC, the world last used more than 100 million bpd of oil in 2019.

11 April: Russian petrochemical producer Sibur has diverted cargoes of liquefied petroleum gas (LPG) to Turkey because of it was unable to offload them in the Amsterdam-Rotterdam-Antwerp region. The Refinitiv Eikon ship tracking system shows four tankers from the Baltic Sea port of Uts-Luga carrying in total 48,000 tonnes of LPG were destined for ARA in the second half of March. Traders said that Navigator Luga and Navigator Libra have been diverted to the Turkish port of Dortyol. The cargoes were bought by Aygaz, Turkey’s largest importer and distributor of LPG. Although, Sibur has not been placed under Western sanctions following the Ukraine crisis, one trader said offloading had become complicated because banks are refusing to facilitate payments for products from Russia. Whilst the sanctions do not restrict purchases of Russian oil products, including LPG, restrictions on the Russian financial system have complicated payments, insurance, and freight.

11 April: Kuwait has raised the official selling prices (OSPs) for two crude grades it sells to Asia in May to record levels. The producer has set May Kuwait Export Crude (KEC) price at US$9.30 a barrel above the average of Oman/Dubai quotes, up US$4.50 from the previous month. It also raised the May Kuwait Super Light Crude (KSLC) OSP to US$9.65 a barrel above Oman/Dubai quotes, up US$3.70. The price hike for KEC was 10 cents more than that for Saudi’s Arab Medium crude in the same month.

8 April: Brazilian state-run oil company Petrobras said it will cut liquefied petroleum gas (LPG) or cooking gas prices by about 5.6 percent at the refinery gate starting. Petrobras, as the company is formally known, said that its price for LPG, used as cooking gas, will fall to 4.23 reais ($0.8942) per kilogram from 4.48 reais per kilogram previously.

7 April: China’s oil demand is estimated to rebound to 14.26 million barrels per day (bpd) in the second quarter of 2022 after the country’s zero-COVID policy dampened consumption in the first quarter, China National Petroleum Corp (CNPC) researcher said. Oil consumption was assessed at 13.9 million bpd in the first quarter to 31 March, down 3 percent from a year earlier. The reduced oil demand followed stringent mobility restrictions across China, including a two-stage lockdown in financial hub of Shanghai which could reduce fuel demand by 200,000 barrels per day, having recorded thousands of daily COVID-19 cases since March.

6 April: The Canadian government approved a US$12 billion offshore oil project proposed by Norway’s Equinor ASA, after an environmental assessment concluded it would not cause significant adverse effects. The Bay du Nord project would involve building a floating platform to drill an estimated resource of 300 million barrels of light crude oil in the Atlantic Ocean, about 500 km (310 miles) off the coast of Canada’s Newfoundland and Labrador province.

12 April: The US (United States) natural gas production and demand will both rise in 2022 as the economy grows, the US Energy Information Administration (EIA) said. EIA projected that dry gas production will rise to 97.41 billion cubic feet per day (bcfd) in 2022 and 100.86 bcfd in 2023 from a record 93.57 bcfd in 2021. EIA’s April supply projection for 2022 was bigger than its March forecast of 96.69 bcfd, but its demand projection was smaller than its March forecast of 84.59 bcfd for 2022.

12 April: The price of Russian gas for Moldova more than doubled to US$1,193 per thousand cubic metres in April, the head of the state energy company Moldovagaz Vadim Ceban said. The former Soviet republic paid US$547 in March. Moldova and Russian gas giant Gazprom last October extended a contract that had expired in September for five years starting from 1 November. Аccording to the contract, the gas price is determined every month and it depends on spot prices of gas and oil. Ceban said that from May 1, Moldovagaz would pay Gazprom only in Russian roubles and euros, whereas previously it also paid in US (United States) dollars.

11 April: TotalEnergies said it would step up its liquefied natural gas (LNG) activities in the United States (US) by expanding production at the Cameron site in Louisiana. The move comes as European countries seek to reduce their dependency on gas flows from Russia by importing more LNG via tankers. TotalEnergies it had signed an agreement with its partners for the expansion of Cameron LNG and that under the terms of the deal, it will offtake 16.6 percent of the projected fourth train’s production capacity, and 25 percent of the projected debottlenecked capacity. The firm said that in recent years it has become the leading exporter of US LNG, most of which has been exported to Europe. It added that it aims to further expand its presence in the United States to meet the growing need for LNG. The Cameron LNG expansion is subject to obtaining the necessary permits and all partners reaching a final investment decision planned for 2023.

10 April: Russian gas producer Gazprom is supplying natural gas to Europe via Ukraine in line with requests from European consumers, it said. Requests stood at 79.6 million cubic metres (mcm) for 10 April, slightly higher than the 78.3 mcm requested a day earlier, Gazprom said.

10 April: Algeria is expected to supply Italy with an additional 4 billion cubic meters (bcm) of natural gas per year at the most. Italian Prime Minister Mario Draghi is due in Algiers to discuss with Algerian President Abdelmadjid Tebboune energy and bilateral relations. Algeria has exported 21.2 billion cubic meters of gas to Italy in 2021.

8 April: French gas transport network operator GRTgaz said it has put in place measures that can be invoked to limit gas supply to customers in the event of shortages, and called on shippers to fill underground storage ahead of next winter. So-called load shedding is the deliberate shutdown of consumption to help cover supply deficits, usually determined through contracts with industry in the event of excess demand. The measures allow the company to issue orders to reduce or interrupt gas consumption within two hours to large consumers connected to its network, and ask distribution system operators to do the same in the event of a shortage.

8 April: Argentina’s new deal with Bolivia to up natural gas imports will bring savings of US$769 million in foreign-exchange reserves and replace 14 vessels of increasingly expensive liquefied natural gas (LNG), Energy Secretary Dario Martinez said. Argentine President Alberto Fernandez and his Bolivian counterpart Luis Arce reached a deal for Bolivia to export 14 million cubic meters of natural gas per day to Argentina, a boost but not as high as hoped. Bolivia will also give priority to Argentina for further supply if it is able to increase its production. Martinez said Argentina agreed to pay Bolivia an average US$12.18 per million British thermal units of natural gas, adding that international LNG prices were more than three times that and diesel prices were over twice as high.

7 April: The European Union (EU) envoys are set to approve a ban on Russian coal that would take full effect from mid-August, a month later than initially planned, following pressure from Germany to delay the measure. The phase-out of EU imports of Russian coal is the cornerstone measure in a fifth package of sanctions against Russia that the EU Commission proposed this week, as a reaction to civilian killings in the Ukrainian town of Bucha. The EU Commission had initially proposed a wind-down period of three months for existing contracts, meaning that Russia could effectively still export coal to the EU for 90 days after sanctions were imposed.

7 April: Vietnam’s coal imports in the first quarter fell sharply from a year earlier due to a surge in global prices of the fossil fuel, with shipments from Russia seeing the largest decline, government data showed. The Southeast Asian country's coal imports in the January-March period fell 24.5 percent year-on-year to 6.43 million tonnes (MT), but the value of those imports more than doubled to US$1.48 billion, the Customs Department said in a report. Vietnam, a regional manufacturing powerhouse, has been increasingly reliant on imported coal for power generation in recent years. Its key suppliers include Australia, Indonesia, and Russia. Vietnamese authorities have said the country is facing an imminent power shortage because of a supply crunch at some of its coal power plants, and that it seeks to import more of the fuel from Australia. Coal imports from Russia in the first quarter fell 31 percent from a year earlier to 804,000 tonnes, according to the report. The value of coal imports from Russia in the January-March period, however, rose 60 percent to US$202.5 million. Traders said a surge in global coal prices have prompted buyers to cut their imports, while some are facing logistics and payments difficulties in trading with Russia due to the Russia-Ukraine conflict.

12 April: The US (United States) power consumption will rise in 2022 and 2023 as the economy grows, the US Energy Information Administration (EIA) said. The EIA projected power demand will climb to 3,995 billion kilowatt-hours (kWh) in 2022 and 4,040 billion kWh in 2023 from 3,930 billion kWh in 2021. That compares with a coronavirus-depressed eight-year low of 3,856 billion kWh in 2020 and an all-time high of 4,003 billion kWh in 2018. EIA projected 2022 power sales would ease to 1,468 billion kWh for residential consumers, but rise to 1,358 billion kWh for commercial customers as more people return to work in offices and 1,022 billion kWh for industrials. That compares with current all-time highs of 1,477 billion kWh in 2021 for residential consumers, 1,382 billion kWh in 2018 for commercial customers, and 1,064 billion kWh in 2000 for industrials.

9 April: Nigeria’s national electricity grid has collapsed for the second time in a month, the Federal Ministry of Power said, leaving the parts of the country it serves, including capital Abuja and Africa’s biggest city Lagos, without power. The Power Ministry said the outage had occurred overnight. It gave no estimate of when the grid, which serves around 117 million people, would be back in operation. While power outages in Nigeria, Africa’s biggest economy, are common, a total system collapse is not. Nigeria has installed capacity of 12,500 megawatt (MW) but on a good day produces only a quarter of that, leaving many Nigerians and businesses reliant on diesel-powered generators. The nation’s sclerotic power grid, and its precarious energy supply, are often cited by businesses as a key issue hindering growth in Africa's most populous country.

7 April: Mexico’s Supreme Court upheld contentious changes to electricity legislation championed by President Andres Manuel Lopez Obrador that strengthen the power utility at the expense of private firms, sparking the US (United States) concerns. Debating a challenge against a March 2021 law, the court narrowly failed to reach the two-thirds majority needed to declare unconstitutional a provision in the law mandating that national power company Comision Federal de Electricidad (CFE) should take priority on dispatch, or when plants come online.

10 April: The European Union (EU) may set more ambitious targets for its transition to renewable energy as it seeks alternatives to imports of oil and gas from Russia, EU climate policy chief Frans Timmermans said. The EU’s 27 member-states have agreed to collectively reduce their net greenhouse gas emissions by 55 percent from 1990 levels by 2030, a step towards "net zero" emissions by 2050. The Commission is due to propose a "Repower EU" plan in May for how the bloc can quit Russian fossil fuels. Under existing plans, the EU would raise the share of renewable energy to 40 percent of final consumption by 2030.

8 April: Portugal’s EDP Renovaveis (EDPR), the world’s fourth largest renewable energy producer, said it plans to install 1.3 gigawatt (GW) of new hybrid solar-wind projects at existing parks and dams in Iberia by 2025. EDPR won the right to build and operate 70 megawatt (MW) in Portugal’s first auction of floating solar plants on dam reservoirs, combining the capacity with a wind farm. EDPR Chief Financial Officer Rui Teixeira said that despite having agreed to pay the Portuguese electricity system 4.13 euros ($4.50) per megawatt-hour for that solar generation, the company bet on the combination, which "allows the project to be economically viable". He said EDPR planned to install 900 MW of hybrid capacity in Spain by 2025, and 400 MW in Portugal. EDPR is studying equipping other Iberian dams with floating solar parks and combining them with wind turbines, as well as installing solar panels on wind farm land and vice versa.

7 April: Britain set out plans to expand nuclear and offshore wind power to bolster its energy independence, but a failure to target improved energy efficiency even as heating costs surge was attacked for lacking ambition. With energy prices hitting record highs this year, driven in part by Russia’s invasion of Ukraine, Britain set targets to increase wind, nuclear and solar generation, while supporting domestic production of oil and gas. However, options that could have delivered a more immediate impact, such as targets to expand onshore wind and improve home insulation, were lacking. Prime Minister Boris Johnson said the plan would scale up domestic sources of affordable, clean, and secure energy.

7 April: The US (United States) Environmental Protection Agency (EPA) will announce decisions on 36 refineries that are seeking exemptions to biofuel blending mandates, according to a government notice. The EPA has accumulated a backlog of more than 60 requests for the so-called Small Refinery Exemptions, sought by refineries that argue that the cost of blending biofuels like ethanol into their fuel could put them out of business.

6 April: Ingka Group, the owner of most IKEA stores worldwide, has bought nine solar photovoltaic (PV) park projects in Germany and Spain for a total of €340 million euros (US$373 million) in its push to generate more renewable energy than it consumes. The world’s biggest furniture retailer said it was buying the projects, which would have a combined capacity of 440 megawatt (MW), from German developer Enerparc. IKEA operates through a franchise system with Ingka Group the main franchisee to brand owner Inter IKEA. IKEA as a whole, aims to be climate positive, or reduce greenhouse gas emissions by more than its entire value chain emits, by 2030. The group owns 547 wind turbines in 14 countries, 10 solar parks, and 935,000 solar panels on the roofs of IKEA stores and warehouses, which together produce more than 4 Terawatt hours of electricity.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.