Quick Notes

Coal Shortage in India: Beyond Supply and Demand

Status

Coal stock shortage and the consequent power outages are dominating energy headlines in India. The widely cited cause is that logistical issues are holding up the transport of coal to power plants, whilst demand for power is growing with the summer heat. On 25 April 2022, coal stocks in 155 non-pithead thermal power plants were said to be 26 percent of their normative level, while 18 pithead power plants accounting for about 39 gigawatt (GW) generation capacity had adequate stocks. News reports quoting Coal India Limited (CIL) said that an adequate amount of coal was available at washeries, sheds, and sidings, and power generators can transport coal by road as railway rakes are not available. Another report quoting the Secretary of the Ministry of Coal (MOC) said that the cause of the crissis in the power sector was not the supply of coal, but a sudden fall in power generation in many plants.

Logistics

In September-October 2021 there was a similar ‘coal crisis’ and media reports suggested almost the same causes: revival of demand following the lifting of pandemic-related restrictions, coal inventories going below critical levels in many thermal power plants, problems in availability of rakes to transport of coal by rail, and challenges in transporting coal during monsoon rains. The question that comes to mind is why these relatively straightforward managerial and administrative issues were not resolved in the last six months. Rake availability and transport are managerial and administrative issues that can be sorted out by the government, especially because both CIL and the Railways are publicly owned.

CIL is contractually obliged to deliver coal at the stockyard of thermal power generators and the excuse that rakes are inadequate is not sufficient to breach contractual obligations. Even if thermal power plants transport coal by road as demanded by CIL, power generators will not be able to pass on the additional cost to consumers immediately through an increase in tariff. Financially stressed discoms (distribution companies) would prefer outages to spot purchase of expensive power from power exchanges.

Some measures to address frequent coal stock shortages have been announced recently. In April 2022, the Ministry of Power (MOP) allowed private power generating stations to secure coal supplies for up to three years instead of current norm of one year to address the crisis in the power sector. The duration of independent power producers (IPPs) to bid for coal was reduced to 37 days from 67 days and duration of supply was increased from one year to three years.

Demand

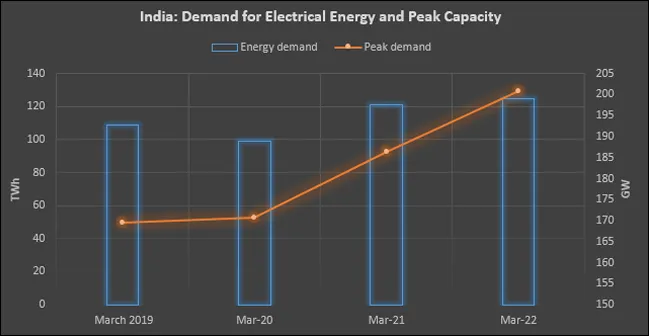

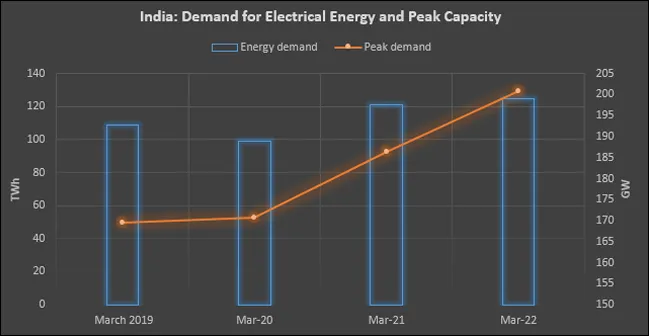

The observation that demand for power is growing needs to be looked at carefully. In March 2021, the electrical energy requirement was 121.205 TWh (terawatt hour), energy supplied was 120.635 TWh and the deficit was 0.5 percent. The peak demand in March 2021 was 186.389 GW and the peak met was 185.892 GW recording a deficit of 0.3 percent.

In March 2022, the energy requirement was 125.039 TWh and the energy supplied was 124.272 TWh with a deficit of 0.6 percent. In March 2022 the peak demand was 200.727 GW and the peak met was 199.288 GW recording a deficit of 0.7 percent. In March 2019, before the pandemic, the energy requirement was 108.665 TWh and the demand met was 108.196 TWh recording a deficit of 0.4 percent. The peak demand was 169.454 GW and the peak met was 168.75 GW. Compared to the pre-pandemic month of March 2019, demand for electrical energy in March 2022 has increased by over 15 percent and peak demand has increased by over 18 percent. Though this is a substantial increase, indications of substantial growth in energy demand were clear in 2021. Another key observation is that peak demand has increased substantially. This is a commercial challenge for power generators as it will require investment in capacity that is used only during relatively short durations of peak demand.

Global Headwinds

On 24 April 2022, roughly 8430 MW (megawatt) of thermal power generation capacity reported coal shortage as the reason for shut down (or forced maintenance). Thermal plants of about 22,057 MW capacity reported technical reasons for shut down, whilst thermal plants of capacity 4834 MW reported scheduled maintenance work as reason for going out of operation. This included nuclear power plants of total capacity 1220 MW. Thermal plants of capacity 5585 MW cited lack of power purchase agreements (PPAs) as the reason for not being operational and thermal plants of capacity 2110 MW reported reserve shut down (RSD) as scheduled generation fell below the technical minimum. Thermal power generators holding 4 percent of total power generation capacity reported coal shortage as the reason for going offline, whilst over 10 percent cited technical reasons. Out of these many were designed for using imported coal. It is likely that these generators chose to go offline rather than use imported coal for which the price increase was substantial.

During the September 2021 coal crisis, the price of seaborne coal increased by over 950 percent compared to the price in September 2020 and the price of Asian LNG (liquefied natural gas) increased by over 420 percent driven by growth in demand for coal and LNG in Europe. In India, the price of high-quality imported coal increased 100 percent to INR14,600/tonne. Most of the imported coal-based power plants either went offline or started using higher quality domestic coal. The result was a similar coal-stock crisis in September 2021. In 2022, the revival of demand for energy followed by the crisis in Ukraine has pushed up imported thermal coal prices to over US$100/tonne. This is a challenge for thermal power generators in India that depend on imported coal. It is very likely that these generators are choosing to go offline rather than use expensive imported coal. What is clear is that the increase in the share of imported coal for power generation is exposing India to global headwinds of coal prices. This is affecting the marginal demand for domestic coal which is driving the coal ‘coal crisis’ in India. Ironically, the government is suggesting the use of imported coal, most probably the key cause of the coal crisis in India, as the solution to the crisis. The more sustainable option is to allow electricity tariff to reflect the cost of fuel. The right price signal can increase supply and decrease demand for coal more efficiently than administrative interventions.

Source: Central Electricity Authority

Source: Central Electricity Authority

Monthly News Commentary: Oil

India Diversifies Crude Oil Import Sources

India

Demand

India’s oil imports from the United States (US) will rise by 11 percent this year, as the severely energy-deficient country looks to secure supplies from producers around the world, including heavily sanctioned Russia. The surge in oil prices following Russia’s invasion of Ukraine in late February threatens to fan Indian inflation, stretch public finances, and hurt growth just when it was emerging from a pandemic-induced slowdown. New Delhi faces criticism from the West for its long-standing political and security ties with Moscow, with some saying that engaging in business with Russia will help fund its war. India has urged an end to the violence in Ukraine, but abstained from voting against Russia in the UNSC. India buys most of its oil from the Middle East, but the US has emerged as the fourth-biggest source and this year supplies will rise substantially.

India’s state-run fuel retailers are increasing their ethanol storage capacity by 51 percent as the nation targets to double the biofuel’s blending with gasoline to 20 percent by 2025, Indian Oil Corp (IOC) said. India is the world’s third biggest oil importer and relies on foreign suppliers to meet more than 80 percent of its demand. India is close to achieving its target of 10 percent ethanol blended gasoline in this fiscal year ending 31 March. Last year, India brought forward its target of selling 20 percent ethanol blended fuel across the country by five years to 2025, with sales beginning in some parts of the country from April 2023. State-run companies IOC, Hindustan Petroleum Corp (HPCL), and Bharat Petroleum Corp (BPCL) own storage to hold 178 million litre of ethanol.

LPG

In a significant update, prices of 19kg commercial LPG cylinders increased by INR 105 in Delhi and by INR108 in Kolkata. Additionally, the price of 5kg commercial LPG cylinders also rises by INR 27. Earlier the price of 19kg commercial LPG cylinder was INR 1,907 (US$25.05). This has led to the price of 19kg commercial gas in Delhi to INR 2,012 (US$26.43) while in Kolkata it has spiked to INR 2,095 (US$27.52).

Retail Prices

The Kerala High Court (HC) refused to stay the state-owned Oil Marketing Companies' (OMCs) decision to increase price on bulk diesel purchases. The Court also declined to restrict the companies from further increasing the rates. However, it has sought an explanation from the companies about their pricing mechanism. The Court issued the order based on a plea by Kerala State Road Transport Corporation (KSRTC) challenging the decision to hike price by the OMCs. The Court also told companies like IOC, BPCL and HPCL that the OMCs should have given a concession to public services like KSRTC. The Court further observed that KSRTC chose to be considered as a 'bulk purchaser' and had been using the option to purchase diesel in bulk at discounted prices, as it was providing a public service.

Petrol and diesel prices were hiked by 80 paise a litre each while domestic cooking gas LPG rates were increased by INR50 per cylinder as state oil firms ended an over four-and-a-half month election-related hiatus in rate revision. Petrol in Delhi will now cost INR96.21 per litre as against INR95.41 previously, whilst diesel rates have gone up from INR86.67 per litre to INR87.47, according to a price notification of state-owned fuel retailers. In Mumbai, the petrol price has been hiked by INR0.84 per litre to INR110.82 per litre, and diesel by INR0.86 to INR95 per litre. The rates, which differ from state to state depending on the incidence of local taxes such as VAT (Value Added Tax), are likely to continue to rise over the next few days as state oil firms recoup losses from keeping prices on hold for a record 137 days. According to CRISIL Research, a hike of INR15-20 per litre is required to fully pass through a US$30 per barrel increase in the cost of raw material (crude oil).

Amidst skyrocketing oil prices, as per the Ministry of Petroleum, the government will take all required measures in the coming months to ensure that consumers get relief from high fuel prices. India relies on overseas purchases to meet about 85 percent of its oil requirement, making it one of the most vulnerable in Asia to higher oil prices. Observing that oil prices had shot up from US$19.56 cents a barrel to US$130 a barrel at one stage and are currently hovering around US$109 a barrel, the Ministry said it is emanating from a war-like situation, apparently referring to the ongoing Russia-Ukraine conflict. Though the government has deregulated petrol and diesel prices, rate changes have been in the past put on hold by public sector oil companies IOC, BPCL, and HPCL for reasons that appear to be non-commercial.

According to Union Finance Minister (FM) , the current spike in international oil prices may upset provisions of her Union Budget for the fiscal year beginning 1 April as she voiced concern over the impact of spiralling oil rates on the Indian economy. International crude oil prices shot up to 14-year high of US$140 per barrel before retracting to near US$129. However, even this rate is 50 percent higher than the US$80-87 range of January when most of the Budget 2022-23 would have been prepared. India relies on overseas purchases to meet about 85 percent of its oil requirement, making it one of the most vulnerable in Asia to higher oil prices. The twin blows of oil prices, already up more than 60 percent this year, and a weakening rupee may hurt the nation’s finances, upend a nascent economic recovery and fire up inflation.

Refining

Adani Ports and Special Economic Zone IOC towards augmentation of the latter’s crude oil volumes at Mundra. APSEZ said IOC shall expand its existing crude oil tank farm at APSEZ's Mundra Port, thus enabling it to handle and blend additional 10 million metric tonnes per annum (mmtpa) crude oil at Mundra. This will support IOC’s expansion of its Panipat refinery in Haryana. IOC is raising the capacity at its Panipat refinery by 66 percent to 25 mmtpa to meet India’s rapidly growing energy requirements. IOC is operating a crude oil tank farm in an exclusive area in Adani’s Mundra Special Economic Zone, consisting of 12 tanks with a total capacity of 720,000 kilolitres.

Production

India’s ONGC Videsh Limited (OVL) failed to get bids in its tender to sell 700,000 barrels of Russian Sokol crude in a growing backlash against Moscow for its invasion of Ukraine. This was the first tender by OVL, since the war in Ukraine began on 24 February. OVL, the overseas investment arm of India’s top explorer Oil and Natural Gas Crop (ONGC), has a 20 percent stake in Russia’s Sakhalin-1 project and sells its share of oil through tenders. The tender for the sale of May loading cargo closed. OVL has an option to bring the cargo to India for processing at refineries owned by its subsidiary HPCL and Mangalore Refinery and Petrochemicals Ltd (MRPL). No Indian company has publicly withdrawn from Russia and New Delhi has declined to condemn Moscow’s invasion of Ukraine despite pressure from the United States to do so.

India will take "appropriate" steps to calm the rise in oil prices, triggered by Russia’s invasion of Ukraine, as per the Oil Ministry, indicating the country could release more oil from national stocks if required. India, the world’s third biggest oil consumer and importer, imports about 85 percent of its oil needs. India said it was prepared to release additional crude from its national stocks in support of efforts by other major oil importers to mitigate surging global prices. In November the federal government had joined other major consumers to release five million barrels of oil from its strategic petroleum reserves to contain inflationary pressures. India buys only a fraction of its oil from Russia, but has been hit hard by a spike in global oil prices due to Western sanctions against Moscow, the world’s second largest crude exporter. The Indian basket of crude oil had jumped to US$112.59/barrel by 11 March, after averaging US$84.67/barrel in January and US$94.07 in February. Indian oil companies have not raised fuel prices since 4 November to shield the customers from higher costs. However, to ease the import cost for companies, India is considering a Russian offer to sell its crude oil and other commodities at a discount.

Transport

The project of supplying cooking gas through pipeline has been launched in Latur city of Maharashtra’s Marathwada region by the local civic body. Maharashtra Medical Education Minister, who is Latur’s guardian minister, inaugurated the project, under which 101 houses in the city are being supplied piped cooking gas on a pilot basis. The project, which has been initiated by the Latur Municipal Corporation, is being rolled out by Ashoka Gas (Unison Enviro Pvt Ltd).

Rest of the World

World

Oil prices jumped US$3, with Brent above US$110 a barrel, as European Union (EU) nations consider joining the US in a Russian oil embargo, while a weekend attack on Saudi oil facilities caused jitters. Prices moved higher ahead of talks between the EU governments and the US for a series of summits that aim to harden the West’s response to Moscow over its invasion of Ukraine. EU governments will consider whether to impose an oil embargo on Russia.

Middle East/OPEC+

British Prime Minister (PM) Boris Johnson is set to visit Saudi Arabia and meet with its Crown Prince for talks on oil supplies, as he stressed that the West must end its dependence on Russian energy. Johnson’s government announced that the UK (United Kingdom) will phase out the import of Russian oil and oil products by the end of the year.

USA & N America

Reflecting growing animosity across the US towards Russia after its invasion of Ukraine, lawmakers in New Jersey’s largest city have voted to suspend the licenses of gas stations branded with the name of a major oil company based in Moscow. The Newark City Council passed a resolution 8-0 urging the city to suspend all licenses of two local Lukoil gasoline stations to show support for Ukraine.

The US and other member states of the International Energy Agency (IEA) agreed to release 60 million barrels of oil reserves to compensate for supply disruptions following Russia’s invasion of Ukraine. Russian oil trade is in disarray after many nations imposed sanctions on Russian companies, banks and individuals. Oil trade is exempt from sanctions, but buyers are shunning Russian oil to avoid unwittingly violating sanctions. Brent crude rose US$7 per barrel to close at US$104.97, the highest since 2014. As per the IEA, the current situation in energy markets is "very serious and demands our full attention". The precise share of member countries in the release will be determined in coming days, while some IEA members agreed to provide petrochemical products to Ukraine. Further disruption of exports from Russia could send prices even higher. Russia, which calls its actions in Ukraine a "special operation," is one of the world's top oil producers, exporting around 4-5 million barrels per day (bpd) of crude. Russia also exports 2 to 3 million bpd of fuel. The 60 million barrels represent 4 percent of the 1.5 billion barrels of emergency stockpiles held by IEA members, the agency said, and is equivalent to 2 million bpd for 30 days.

The US Sanctions

The US is willing to move ahead with a ban on Russian oil imports without the participation of allies in Europe. Germany, the biggest buyer of Russian crude oil, has rejected plans to ban energy imports. Germany is accelerating its plans to expand its use of alternative energy sources but cannot halt imports of Russian energy overnight. Oil prices have soared to their highest levels since 2008 due to delays in the potential return of Iranian crude to global markets and as the US and European allies consider banning Russian imports. Europe relies on Russia for crude oil and natural gas, but has become more open to the idea of banning Russian products. The US relies far less on Russian crude and products, but a ban would help drive prices up and pinch US consumers already seeing increasing prices at the gas pump.

South America

According to Canadian Prime Minister (PM) the government plans to ban imports of Russian crude oil into the country, as part of efforts to ramp up pressure on Russian President. Canada hasn’t imported any crude oil from Russia since 2019.

Asia Pacific

Japan unveiled a raft of measures to help small and midsize firms cope with surging global fuel prices amidst the Ukraine crisis, with an increased subsidy ceiling on oil and the extension of corporate funding. Japan Prime Minister’s cabinet approved the measures including lifting a subsidy ceiling on gasoline, diesel, and kerosene to 25 yen a litre to help companies cope with rising energy prices. Concern about Russian oil supplies, which at 4 million to 5 million bpd are second only to Saudi Arabia in volume, have pushed up oil prices to levels not seen in a decade. However, some critics were sceptical the oil subsidy, which is rarely seen in other countries, will do any good to the economy, saying it will serve as nothing but politically popular gesture ahead of the looming upper house elections this summer.

Sri Lanka’s already dire economic crisis has deepened as oil prices hover near US$110 a barrel. Vehicles are stranded with empty tanks, power cuts are depriving students of study time for exams and shopping mall air conditioners are being switched off to conserve energy. The South Asian island nation already was so short of hard currency that authorities had restricted imports of cars and fertilizer. It's now having to scrape into dwindling reserves to pay for ever more costly oil needed to keep the economy running. Bus services vital for many workers are also in trouble, unable to find diesel and sometimes stranding passengers mid-route. The higher oil prices are just an extra burden in what really is a foreign exchange crunch. Stations also are rationing fuel to stop people from stockpiling diesel at home for their vehicles and power generators.

EU & UK

British Prime Minister held talks about energy security with the de facto leaders of Gulf oil exporters Saudi Arabia and the United Arab Emirates (UAE) but secured no public pledge to ramp up production. British Prime Minister’s trip to Abu Dhabi and Riyadh was aimed at securing oil supplies and raising pressure on Russian President over Russia’s invasion of Ukraine, which led to sweeping Western sanctions on Moscow and soaring world energy prices. After his talks in Riyadh with Saudi Arabia’s Crown Prince, British Prime Minister was asked whether the kingdom would increase oil production.

Norwegian state oil company Equinor said it will stop trading in Russian oil as the company shuts down operations in Russia following its invasion of Ukraine. Equinor had contractual commitments which it struck prior to Russia’s invasion of Ukraine, under which it was to receive four oil cargoes in March. Equinor joins oil and gas majors, including Shell, BP, France’s TotalEnergies and Italian energy group ENI, in stopping purchases of oil from Russia.

News Highlights: 23 – 29 March 2022

National: Oil

India’s ONGC sells Russia’s Sokol oil to Indian refiners

29 March: India’s ONGC Videsh Ltd (OVL) has sold at least one cargo of Russian Sokol oil to India refiners Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp LTD (BPCL) after failing to draw interest in a tender. Indian companies are snapping up Russian oil as it is available at a deep discounts after some companies and countries shunned purchases from Moscow due to sanctions against Russia for its Ukraine invasion. India, the world’s third-biggest oil consumer and importer, has not banned Russian oil imports. OVL has a stake in Russia’s Sakhalin-1 project and sells its share of the oil from the project through tenders. HPCL and BPCL had been able to offer a discounted price for the cargo. This marks the first purchase of Sokol crude by HPCL. BPCL had previously purchased the grade in 2016. Western sanctions against Russia for its invasion of Ukraine have hit Russian oil sales, making it possible for Indian and Chinese refiners to buy Russian Urals crude at a deep discount.

Petrol crosses INR100 in Delhi after 80 paise hike, diesel up 70 paise

29 March: Petrol price, 29 March 2022, crossed INR100 a litre mark after rates were hiked by 80 paise a litre and 70 paise in case of diesel, taking the total increase in rates in one week to INR4.80 per litre. Petrol in Delhi will now cost INR100.21 per litre as against INR99.41 previously while diesel rates have gone up from INR90.77 per litre to INR91.47, according to a price notification of state fuel retailers. Rates have been increased across the country and vary from State to State depending upon the incidence of local taxation.

Goa cabinet decides to provide 3 cooking gas cylinders free to households

29 March: The Goa government has said it will provide three cooking gas cylinders free of cost to households in the coastal state, as promised by the BJP in its election manifesto. Chief Minister Pramod Sawant made the announcement after chairing the first meeting of the new cabinet, comprising him and eight other ministers.

98 percent of India’s population will be covered with piped cooking gas: Government

28 March: More than 82 percent of India’s land area and 98 percent of the population will be covered with piped cooking gas after the latest round of expansion work, the government informed the Rajya Sabha. Bids for the expansion work will be opened on 12 May this year. Minister of Petroleum and Natural Gas Hardeep Singh Puri said once the award of bidding is done, it typically takes a certain number of years for the infrastructure to be laid.

National: Coal

India leans toward continued import of Russian coking coal

27 March: India is leaning toward continuing to import coking coal from Russia, Steel Minister Ramchandra Prasad Singh said, seeming to buck a global trend to shun Moscow over its invasion of Ukraine. India plans to double imports of Russian coking coal, a key ingredient in making steel, the Minister said. He said the country had imported 4.5 million tonnes (MT) but did not indicate the period he was referring to. Vessels carrying at least 1.06 MT of coking coal, mainly used for steelmaking, and thermal coal used primarily for electricity generation, are set to deliver the fuel to Indian ports this month, the most since January 2020, data from consultancy Kpler showed. Russia, typically India’s sixth-largest supplier of coking and thermal coal, could start offering more competitive prices to Chinese and Indian buyers as European and other customers spurn Russia because of sanctions, traders said.

National: Power

Delhi met peak power demand of 7.3 GW between April and December

26 March: The Delhi government’s power department met the peak demand of 7323 MW from April to December last year, according to the Outcome Survey status report 2021-22. It stated that out of 52 indicators for assessment, 83 percent are on track. The survey said 1,160 rooftop solar photovoltaic plants were installed in government buildings till December 2021 as against the target of 1,150. Also, 4519 such plants were installed in private buildings against a target of 4,500, it noted. Delhi met the peak demand of 7,323 MW successfully during April-December 2021, the survey mentioned. It said the power department has subsidized 100 percent of the energy charges for domestic consumers consuming up to 200 units per month and provided subsidies up to INR800 per month for consuming between 201 to 400 units monthly.

National: Non-Fossil Fuels/ Climate Change Trends

India to build nuclear power plants in "fleet mode" from 2023

27 March: With the first pour of concrete for a 700 MW atomic power plant in Karnataka’s Kaiga scheduled in 2023, India is set to put in motion construction activities for 10 'fleet mode' nuclear reactors over the next three years. The first pour of concrete (FPC) signals the beginning of construction of nuclear power reactors from the pre-project stage which includes excavation activities at the project site. The Centre had approved construction of 10 indigenously developed pressurised heavy water reactors (PHWR) of 700 MW each in June 2017. The 10 PHWRs will be built at a cost of INR1.05k bn. It was for the first time that the government had approved building 10 nuclear power reactors in one go with an aim to reduce costs and speed up construction time. Under the fleet mode, a nuclear power plant is expected to be built over a period of five years from the first pour of concrete. Currently, India operates 22 reactors with a total capacity of 6780 MW in operation. One 700 MW reactor at Kakrapar in Gujarat was connected to the grid on January 10 last year, but it is yet to start commercial operations.

NTPC commissions third part capacity of 42.5 MW of 100 MW Ramagundam Floating Solar PV Project

25 March: NTPC announced that successful commissioning of third part capacity of 42.5 MW of 100 MW Ramagundam Floating Solar PV Project at Ramagundam, Telangana with effect from 24 March 2022. With this, standalone installed and commercial capacity of NTPC has become 54494.68 MW. Further, group installed and commercial capacity of NTPC has become 68609.68 and 67949.68 MW respectively.

Centre’s nod for 3 solar parks in Odisha

23 March: The Centre has approved three solar parks with a cumulative capacity of 340 MW for Odisha under the solar park scheme, Union New and Renewable Energy Minister R.K. Singh said. For the Landeihill village park, NHPC Ltd has already acquired 176 acres and finalised the EPC contractor to implement the project. Odisha Renewable Energy Development Agency is the nodal body of the state government to implement the power plants. At present, the state produces over 430 MW solar power from different sources. The Minister said a 10 MW solar power project has been sanctioned as part of the project for solarisation of Konark temple and town in Kalahandi district’s Tentulipada village. The move to solarise the sun temple and Konark town is part of the state’s efforts to make it India’s first zero-emission city by the year-end. To promote production and use of renewable energy in the state, the government in 2016 had unveiled the Odisha Renewable Energy Policy that offered a wide range of incentives to those who are planning to set up renewable energy production units.

International: Oil

Russia plans ESPO Blend oil sea exports at record high for May

29 March: Russia’s ESPO Blend crude oil exports from Kozmino have been set at 3.3 million tonnes (MT) for May - a record monthly high to be loaded from the port - up from 3.1 MT in the April plan, the schedule showed. On a daily basis ESPO Blend oil loadings will rise some 3 percent in May compared to April. Record loadings planned for May is yet another issue for Russian oil sellers, which are struggling to place their volumes after Western sanctions on Moscow made many regular buyers to turn away from the market. The ESPO Blend trading cycle for May volumes has started slowly with many cargoes still on offer, traders said. Russia plans to increase its oil exports as it struggles to avoid building up oil storage and keep Transneft's pipeline transportation system working smoothly.

Saudi Aramco petroleum storage site hit by Houthi attack, fire erupts

26 March: Yemen's Houthis said they launched attacks on Saudi energy facilities and the Saudi-led coalition said oil giant Aramco’s petroleum products distribution station in Jeddah was hit, causing a fire in two storage tanks but no casualties. The Iran-aligned Houthis have escalated attacks on the kingdom’s oil facilities in recent weeks and ahead of a temporary truce for the Muslim holy month of Ramadan.

UAE will work with OPEC+ to stabilise oil market: Energy Minister

28 March: The United Arab Emirates (UAE) will work with OPEC+ to make sure the energy market is stable, UAE Energy Minister Suhail al-Mazrouei said. He said the UAE was doing its best to raise capacity to 5 million barrels per day (bpd), but that did not mean it wanted to act on its own or leave OPEC+, a group that includes the Organization of the Petroleum Exporting Countries (OPEC), Russia and others. The oil market has been volatile, buffeted by Russia’s invasion of Ukraine and the expansion of COVID-related lockdowns in China, the world's largest crude importer.

Storm brews over Kazakh oil as Russia cites port damage

23 March: Russian officials announced sea storms had caused major disruption to Kazakh oil flows to global markets, leaving traders scrambling to find out the extent of the damage. The Caspian Pipeline Consortium line that runs from fields in Kazakhstan and terminates in the Russian port of Novorossiisk on the Black Sea coast ships 1.2 percent of global oil to world markets. That includes oil produced in Kazakhstan by the US (United States) majors Chevron and Exxon Mobil, and European companies Shell, Total and Eni at three major fields operated by them. Any major disruption to CPC flows will add to the strain on a global oil market facing one of the worst supply crunches since the Arab oil embargo in the 1970s. The US has imposed sanctions on Russian oil, but said flows from Kazakhstan through Russia should run uninterrupted. But the 1,510-km pipeline running from giant fields in Kazakhstan, developed by the US oil majors, as well as Shell, Eni and Total, is effectively under Russia’s control as it crosses Russian territory and has loading facilities on Russia's Black Sea coast.

International: Gas

China moderates 2022 gas output growth, ups power generation target: NEA

29 March: China’s National Energy Administration (NEA) is targeting a 4.2 percent rise in the country’s natural gas production this year to 214 billion cubic metres (bcm). The world’s top energy user and the biggest emitter of greenhouse gases sees natural gas as a key bridging fuel on the way to eventually reaching its carbon-neutral goal by 2060. Natural gas production grew 8.2 percent last year to 205.3 bcm.

Japan’s Eneos plans to withdraw from Myanmar’s Yetagun gas project

25 March: Japanese energy company Eneos Holdings aims to withdraw from Myanmar’s Yetagun gas project in response to "social issues". In January, TotalEnergies and Chevron Corp, partners in a major gas project in Myanmar, said they were withdrawing from the country, citing its worsening humanitarian situation after the coup.

Russia’s Gazprom continues to export gas to Europe via Ukraine

24 March: Russian energy giant Gazprom said that it was continuing to supply natural gas to Europe via Ukraine in line with requests from European consumers. The company said requests stood at 104 million cubic metres for 24 March, down from 106.5 million cubic metres the previous day.

US promises to deliver 15 bcm more of LNG to Europe in 2022

24 March: President Joe Biden promised the United States (US) would deliver at least 15 billion cubic metres (bcm) more of liquefied natural gas (LNG) to Europe this year than planned before. The deal would be announced and would also include higher US LNG exports to the European Union in 2023.

EU seeks answers to energy supply crunch, US LNG deal

24 March: The EU (European Union) leaders are expected to agree at a two-day summit starting to jointly buy gas, as they seek to cut reliance on Russian fuels and build a buffer against supply shocks, but the bloc remains unlikely to sanction Russian oil and gas. The invasion of Ukraine by Russia, Europe's top gas supplier, pushed already-high energy prices to records and has prompted the European Union to attempt to slash reliance on Russian fossil fuels by hiking imports from other countries and quickly expanding renewable energy. The European Commission said it was ready to lead negotiations pooling demand and seeking gas ahead of next winter, following a similar model to how the bloc bought COVID-19 vaccines. The US exporters have shipped record volumes of LNG to Europe for three consecutive months, as prices have jumped to more than 10 times higher than a year ago. Europe is competing in global markets for tight LNG supply, and analysts have warned a jump in demand could inflate prices further and leave poorer nations struggling to afford supply.

International: Coal

Polish Cabinet approves law to ban Russian coal imports

29 March: The Polish government has adopted draft legislation that will allow a ban on imports of Russian coal. Sanctions in the EU as a rule have to be agreed by the whole trading bloc, and Brussels could potentially punish countries acting unilaterally. Russia dominates Polish coal imports, accounting for about 20 percent of domestic use. Some 9.4 million tonnes (MT) of Russian coal was imported to Poland in 2020 and used mostly to heat individual households.

Anglo American completes exit from South African coal miner Thungela

25 March: Global mining giant Anglo American Plc announced the sale of its remaining shareholding in Thungela Resources, completing its exit from the South African coal business. Under pressure from investors to exit coal businesses worldwide, the owner of gold, platinum and diamond mining companies, Anglo American hived off its entire stake in its South African coal mines into Thungela and distributed most of the shares to its shareholders through an initial public offering in June, barring 8 percent.

EU’s biggest economy Germany blocked Russian coal ban

25 March: In the early stages of sanctions drafting against Moscow, one idea gained traction in Brussels - a ban on the import of Russian coal - until the European Union (EU)’s biggest economy Germany struck it down. However, it included a ban on coal. The measure would also have been in line with EU climate policy, which has long targeted coal as among the most polluting energy sources that must be phased out. However, Germany, the EU country most reliant on coal imported from Russia, objected. Germany’s Economy Minister Robert Habeck said that Berlin had reduced its dependence on Russian coal and hoped to cease all coal imports by the autumn. In 2020, Berlin was by far the EU's largest importer of coal from Moscow, especially thermal coal used to generate electricity, data from the EU think tank Bruegel based on statistics from Eurostat show.

International: Power

Pakistan power sector bankrupt, Chinese partner companies call for immediate release of money

25 March: Pakistan’s power sector has gone bankrupt but the country lavishly spends its resources on secretly funding terrorist activities and fails to honour its payment obligations to the Chinese partners in the power projects who have expressed concerns to Islamabad for the immediate release of the money. Pakistan’s power sector is bankrupt and the real culprit is the government’s gross mismanagement, which shows up as circular debt. The Pakistani Prime Minister Imran Khan’s government has also grossly mismanaged the power sector.

Italy’s Terna to invest in power grid as Ukraine crisis drives renewables

24 March: Italy's Terna is planning to spend €10 billion (US$11 billion) over the next four years to upgrade the country’s power grid, to meet energy security and climate change demands. That means power transmitters like Terna will need to invest more money to modernise grids to cope with the less predictable flows from solar and wind power. In its 2021-2025 plan, Terna saidits investments would help strengthen connections between the south of the country, which produces increasingly more electricity from renewable sources, and the industrial north. The group will also ramp up connections with neighbouring countries like Greece, France, and North Africa to boost its role as a European and Mediterranean power transmission hub. Terna, which makes most of its money from running the domestic grid, said it was looking to sell its assets in Latin America which could be worth €250-270 million.

International: Non-Fossil Fuels/ Climate Change Trends

EU launches first WTO challenge against Britain over green subsidies

28 March: The European Union (EU) has launched its first ever challenge against Britain at the World Trade Organization (WTO) over its former member's green subsidy scheme. The European Commission, which oversees trade policy for the EU's 27 members, said that criteria used by the British government in awarding subsidies for offshore wind power projects favoured British content. It also said the practice would increase the cost of production and risk slowing down the deployment of green energy.

Mitsui invests US$631 mn in Aker’s Mainstream Renewable

24 March: Japanese trading house Mitsui has agreed to invest €575 million (US$631 million) for a 27.5 percent stake in Mainstream Renewable Power, a company controlled by Norway’s Aker Horizons, the companies said. Mitsui's investment and global business network will help Mainstream to speed expansion of its portfolio of wind and solar energy in the Americas, Africa, Asia-Pacific, and Europe.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV