-

CENTRES

Progammes & Centres

Location

Quick Notes Natural gas and nuclear power in the EU: If you can’t beat them, green them

The European Union (EU) has proposed a new green taxonomy under which some natural gas and nuclear energy projects may be labelled as “green” investments if they meet specific criteria. A nuclear power plant is labelled green if the project has a plan, has secured funds, found a site to safely dispose of radioactive waste, and is in a position to receive construction permits before 2045. For natural gas, the criteria are that the plant has emission levels below 270 grams of carbon dioxide equivalent per kilowatt hour (gCO2eq/kWh), it replaces a more polluting fossil fuel plant, receives construction permit before 2030 and has a plan to switch to low-carbon gases by the end of 2035. This is part of the broader green taxonomy that the EU is developing. The first part of its taxonomy rulebook that included environmental criteria for investments in renewable energy (RE), shipping and car manufacturing is applicable from January 2022.

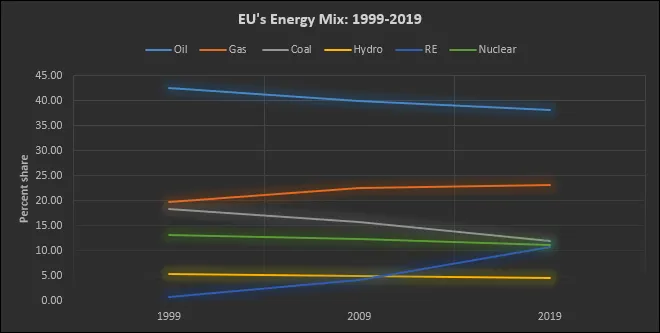

In the last two decades (1999-2019), primary energy consumption in the EU has fallen by over 4 percent from about 63 EJ to 60 EJ (exajoules). In the same period, the share of fossil fuels in the EU energy mix has fallen by about 13 percent from 51.46 EJ to 44.57 EJ. Most of the decrease in fossil fuel energy consumption was led by coal, which fell by over 37 percent in the same period. Natural gas consumption increased by over 11 percent and RE consumption increased by over 1,200 percent, although from a very small base.

In 2019, fossil fuels supplied roughly 73 percent of EU’s primary energy with oil accounting for about 38 percent, natural gas 23 percent and coal about 12 percent. Nuclear power accounted for over 11 percent of primary energy consumption, RE about 10 percent and hydro about 4 percent. Energy production in the EU in 2019 was dominated by RE that accounted for 37 percent of total production followed by nuclear energy that accounted for 32 percent, solid fossil fuels 19 percent, gas 8 percent and petroleum 4 percent. Imports accounted for roughly 60 percent of EU energy consumption and Russia was the largest source of oil, natural gas and coal imports. In 2000 fossil fuels accounted for 84 percent of energy consumption Germany. Since 2000, Germany developed 90 gigawatts (GW) of RE power generation capacity equal to its total power generation capacity. Yet in 2017, fossil fuels continued to supply 80 percent of energy consumption illustrating the energy transition challenge.

One of the key energy transition challenges is energy density of fuels, which is its ability to deliver substantial quantities of energy relative to its weight or physical dimensions. The energy density of natural gas at 40 million joules per cubic meter (J/m3) is only one thousandth of the energy density of oil but more than 10 trillion times that of solar energy. Higher the energy density of an energy source, lower is the transportation and storage costs. The energy density of nuclear power is more than 10 billion times that of oil which implies that the energy densities of solar and other RE sources is minuscule compared to that of nuclear energy. High energy and power densities of natural gas and nuclear power means that these sources of energy have lower surface or land requirement. With the shift towards RE, EU along with the rest of the world is climbing down the energy density ladder, from highly concentrated fossil fuels to more dispersed renewable sources which will require 100 or even 1,000 times more land area for energy production than today. For example, in 2010, modern RE sources (excluding hydropower) required almost 270,000 square kilometres (Km2) to deliver 130 GW, while the fossil fuel-nuclear-hydro system delivered 14.3 terawatt hours of power (more than 110 times that from RE) required about 230,000 Km2.

A natural gas combined cycle plant can emit 403-513 gCO2eq/kWh from a lifecycle perspective and anywhere between 49-220 gCO2eq/kWh with carbon capture and storage (CCS) including methane emission from the extraction and transportation phases. In comparison solar technologies emit anywhere between 27-122gCO2/kWh for concentrated solar power (CSP) and 8-83 gCO2eq/kWh for photovoltaics (PV) with thin film PV technologies emitting less than silicon-based PV technologies. Carbon emissions from nuclear power are an order of magnitude lower than that of solar energy at 5.1-6.4 gCO2eq/kWh with the fuel chain contributing most of the emissions. Expanding RE addresses one global goal, that of reducing carbon emissions but not all global goals. In the EU, unintended macroeconomic consequences of rapidly scaling RE such as energy price inflation and the consequent impact on inequality are becoming significant.

Energy price in the EU increased to unprecedented levels in 2020. The European central bank (ECB) has acknowledged that part of the reason is the ongoing energy transition. According to the ECB, the combination of insufficient production capacity of RE in the short run, subdued investments in fossil fuels and rising carbon prices risk putting the EU through a protracted transition period during which the energy prices will continue to increase. The ECB expects the green energy transition to reinforce the supply demand imbalances arising from adverse weather conditions in 2021 that constrained the production of RE pushing gas prices to record high levels. In November 2021, wholesale electricity prices in the euro area reached €196/MWh, (Megawatt hour) nearly four times as much as the average in the two years before the pandemic. The ECB has stated that energy price inflation was the prime factor behind inflation that has touched the highest level since the euro was introduced in 1999. Though the tighter carbon pricing regime has led to reduction in emissions and increase in green innovation, these have come at the cost of higher energy expenditure for poorer households. On an annual basis, a doubling of wholesale electricity prices from about €50/MWh to €100/MWh would mean an additional €150 billion to be recovered from consumers. This will affect poor households much harder than wealthy ones. The share of people who have said that they could not afford to keep their home adequately warm is as high as 30 percent in some of the less wealthy EU countries. This is despite the fact that Eastern EU states with a lower contribution of RE has lower electricity prices than Western European states, with higher percentage of RE in total energy, had higher electricity prices. In addition studies on the EU economy have concluded that a 10 percent increase of the electricity price can lead to a 2 percent reduction of firm-level employment.

The new EU green taxonomy has angered many environmental groups as it appears to be a complete departure from the EU’s role as the leader of the ideological charge against both fossil fuels and nuclear energy. They are disappointed that the new taxonomy will compromise their cherished goal of 100 percent RE. They fear that investing in gas and nuclear will lock-in these technologies and slow down adoption of RE. This may be true but not if the EUs goal is decarbonisation through hydrogen in the longer term. Both natural gas and nuclear power can be used to generate hydrogen and the infrastructure built for natural gas can eventually be used to transport hydrogen.

For India, which has simultaneously embraced RE and hydrogen as the means to decarbonisation, EU’s experience will hold valuable lessons. More importantly, EU’s new green taxonomy may become the global regulatory standard for green investments which India could potentially adopt. Under the new taxonomy, investments in natural gas and nuclear projects in India may become more attractive as the cost of capital for these projects is likely to decline with decrease in perceived risk. There is also a lesson in EU’s embrace of natural gas and nuclear power. Its realist and technology agnostic approach to decarbonisation was probably unavoidable as the unintended economic, social, and political consequences of increasing the share of RE became harder to ignore. India must take note as it is less wealthy and more unequal than the EU.

India’s crude oil production fell 2.15 percent in October as state-owned firms produced less but, natural gas output rose by a quarter on the back of output from KG-D6 fields of Reliance-BP. Crude oil production dropped to 2.51 mt in October, as output from fields operated by Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) dipped. While ONGC produced 4 percent less crude oil at 1.64 mt, OIL output dropped 1.46 percent to 2,53,000 tonnes. India is 85 percent dependent on imports to meet its oil needs and the government has been for long looking at ways to raise the domestic output so as to reduce import dependence. Crude oil is converted into fuels such as petrol and diesel in refineries. Production of natural gas, which is used to fire power plants, run fertiliser units and convert into CNG (compressed natural gas) to automobiles, rose 24.7 percent to 3.01 billion cubic metres (bcm) in October. ONGC, the nation’s largest oil and gas producer, produced 4.4 percent less gas at 1.8 bcm

India is working on ways to release crude oil from its strategic storages in tandem with other major economies to dampen prices. The US had made the unusual request to some of the world’s largest oil-consuming nations, including China, India and Japan, to consider releasing crude stockpiles in coordinated effort to lower global energy prices. India is the world’s third-largest oil consumer and importing nation and has been severely impacted by the relentless rise in international oil prices. Since the US move, global oil prices are on the decline. Brent crude was trading at USD 78.72 per barrel, down from US$81.24 a barrel 10-days back. On 26 October, it had hit a multi-year high of US$86.40. High prices are starting to produce unwanted inflation and undermine recovery from the COVID-19 pandemic. Retail petrol and diesel prices shot up to record levels earlier this month before the Indian government cut taxes, costing it INR600 bn in revenue this year. India has 5.33 mt of underground crude oil storage at two places on the east and the west coast. While China has said it is working on a crude release, Japan has also signalled its readiness.

According to Ministry of Petroleum and Natural Gas, India will have “massive additional” areas for oil exploration and production by 2025. As per the ministry, India will double its oil and gas exploration acreage in the northeast part of the countryand aims to expand its gas pipeline network to 34,000 km. According to Ministry, the government is pushing the public sector behemoth ONGC to involve private sector companies and service providers wherever possible to help raise oil and gas production. India is 85 percent dependent on imports to meet its oil needs, and a way to cut the high import bill is to increase domestic production. Discoveries that the company hasn’t been able to develop or areas that it hasn’t been able to explore are some of the examples where the ONGC can involve the private sector and foreign companies. Mumbai High, which was discovered in 1974, and B&S that was put into production in 1988 are ONGC’s mainstay assets, contributing two-thirds of its current oil and gas production. Without these assets, the company will be left with only smaller fields. In October 2017, the Directorate General of Hydrocarbons (DGH), the ministry’s technical arm, had identified 15 producing fields with a collective reserve of 791.2 mt of crude oil and 333.46 bcm of gas, for handing over to private firms in the hope that they would improve upon the baseline estimate and its extraction. A year later, as many as 149 small and marginal fields of ONGC were identified for private and foreign companies on the grounds that the state-owned firm should focus only on big ones. The first plan couldn’t go through because of strong opposition from ONGC. The second plan went to the Cabinet, which on 19 February 2019, decided to bid out 64 marginal fields of ONGC.

India’s gasoil demand contracted by about a fifth during the first 15 days of November from the pre-COVID levels, after a festive season-led brief recovery last month, preliminary sales data of state-run refiners showed. India’s gasoil consumption, which accounts for about two-fifths of the country’s fuel demand, typically rises during a month-long festival season that ended with the celebration of Diwali as diesel-guzzling trucks hit the road and industrial activity gathers pace. Gasoil consumption totalled 2.43 mt between 1-15 November, a decline of about 15.3 percent from last year and down 19.35 percent from the same period in 2019, the data showed. In contrast, gasoline sales continued to stay above pre-COVID levels, rising to 1.04 mt, as people continued to prefer using personal vehicles over public transport for safety reasons. Gasoline sales in the first half of November were up 1.2 percent from the same period in 2019 and rose by 0.5 percent from last year, the data showed. State retailers—IOC, BPCL and HPCL—control about 90 percent of the fuel stations in the country.

Noida International Airport (NIA) has awarded Indian Oil Skytanking Ltd (IOSL) a 30-year concession to design, build, and operate fuel infrastructure, including multi-user fuel farm and hydrant system for the airport. Accordingly, the partnership will help NIA provide aviation turbine fuel cost-efficiently and under an open access model to its airline partners. According to Yamuna International Airport (YIAPL), the fuel farm will provide for sustainable aviation fuel. YIAPL is a 100 percent subsidiary of Zurich Airport International AG, which has been incorporated as a ‘Special Purpose Vehicle’ (SPV) to develop the greenfield Noida International Airport. The state government of Uttar Pradesh has signed the concession agreement with YIAPL to develop Noida International Airport (NIA) at Jewar.

According to the Indian government, stepping up ethanol production can help reduce the import of crude oil and prove to be an extra means of earning for sugarcane farmers. PM claimed that before the BJP came to power, only 200 million (mn) litres of ethanol was being sent to oil companies from Uttar Pradesh, which now increased to around 1 billion (bn) litres.

The national oil marketing companies (NOMCs) have increased the price of commercial 19 kg (kilogram) LPG (liquefied petroleum gas) cylinder by INR100.50, taking the new price to INR2,101 in Delhi. This is the second-highest price of 19 kg commercial cylinder after 2012-13 when it used to cost around INR2,200 per cylinder. However, there has been no increase in the prices of other domestic cylinders weighing 14.2 kg, 5 kg, 10 kg composite or 5 kg composite cylinders. The difference between prices of 14.2 kg domestic cylinder and 19 kg commercial cylinder has been increased. Presently, a 14.2 kg domestic cylinder in the national capital costs INR899.50 while the 19 kg cylinder commercial cylinder comes for INR2,101. This may increase the diversion of 14.2 kg domestic gas cylinder into restaurants, tea stalls etc. which constitute the largest user segment of the 19 kg cylinder. LPG cylinder rate is revised monthly for all the states and Union territories in India. Earlier on 1 November, the price of 19 kg commercial cylinder saw a steep rise of INR266 taking its cost to INR2,000.50. On 1 October, the price of 19 kg commercial cylinder was increased by INR43 and then decreased by INR2.50 on 6 October. On 1 September, the price of these cylinders were increased by INR75.

The Chhattisgarh government decided to reduce Value-Added Tax (VAT) on petrol and diesel by 1 percent and 2 percent, respectively, nearly three weeks after the Centre cut excise duties on the two fuels. With the reduction in VAT, the price of petrol will come down by 70 paise and that of diesel by INR1.36 in the state. The decision was taken during a cabinet meeting. The move will cause a loss of nearly INR10 bn to the state exchequer.

According to Union Ministry for Road Transport and Highways, bringing petrol, diesel and other petroleum products under the single national GST (Goods and Services Tax) regime will reduce taxes on these products and increase the revenue of both the Centre and states.The Finance ministry will try to bring petrol and diesel under GST if it gets the support of the state governments. The GST Council had decided to continue keeping petrol and diesel out of the GST purview, as subsuming the current excise duty and VAT into one national rate will impact revenues. Including petrol and diesel under GST will have resulted in a reduction in near record-high rates. The Council discussed the issue only because the Kerala High Court had asked it to do so but felt it was not the right time to include petroleum products under GST.

Amidst increasing demands to reduce taxes after reduction in excise duty on petrol and diesel by the Centre, the state government in Rajasthan announced slashing VAT (Value Added Tax) to make petrol and diesel cheaper by INR4 per litre and INR5 per litre, respectively, from midnight. The Centre on 3 November had cut excise duty on petrol by INR5 and on diesel by INR10 to bring down fuel rates in the country. Following the excise duty cut, BJP-ruled states, Punjab and Odisha had reduced VAT on fuel to further reduce the prices. Some Congress-ruled states, including Rajasthan, however, had not cut VAT and had demanded further reduction in central excise duty. After the Rajasthan cabinet meeting, that the decision was taken to give relief to the public. The minister targeted the Centre government over the expensive petrol and diesel and alleged that the government was working to weaken states. As per the minister, there should be a one nation one rate policy for petrol and diesel and the transportation cost should be borne by the Centre. According to the minister, before BJP government came to power in 2014, the crude oil price in international market was US$111 per barrel and the rate of petrol in the country was INR61 per litre and INR59 per litre but when the crude oil price in international market is US$82 per barrel, the fuel in the country is expensive because the BJP government has increased excise duty by INR40-45 per litre in six years.

According to the Russian oil producer, Indian Oil Corporation (IOC) has renewed a deal to buy up to 2 million tonnes (mt) of crude oil in 2022 from Russia’s Rosneft IOC had in February 2020 signed a deal with Rosneft Oil Company to import up to 2 mt of oil via the port of Novorossiysk. In 2021, the deal envisaged supply of up to 1.7 mt of crude oil but IOC bought just on parcel or shipload as the cost of transporting the oil made it uneconomical, when compared to alternatives. For 2022, the deal is for the supply of up to 2 mt of oil from the Black Sea port of Novorossiysk. India has tied up supplies from Russia to the US (United States) in a bid to diversify its oil import basket, cutting reliance on the Middle East to meet its oil needs. The signing took place during the visit of Russian President to India, during which he met with Prime Minister of India and held bilateral talks in an expanded format. IOC also signed a Statement of Intent of Collaboration with Russian petrochemicals company SIBUR to explore the feasibility of setting up a dual-feed cracker along with downstream units at its 15 mt a year Paradip refinery in Odisha.

According to the Indian President India is fully committed to the timely completion of an oil refinery project in Mongolia as it will greatly increase its “spiritual” neighbour’s energy security. Speaking about the developmental projects undertaken by India in Mongolia, the president was also happy to note the progress on the oil refinery project in Mongolia.

Global jet fuel markets stayed under pressure as more countries expanded border restrictions to keep the new Omicron coronavirus variant at bay, prompting travellers to reconsider their plans. Jet fuel demand – the biggest laggard in the oil complex – had been forecast to post the strongest growth of 550,000 barrels per day (bpd) to 5.9 million bpd in fourth quarter, according to the International Energy Agency (IEA). But now Omicron pose the greatest risk to jet fuel consumption. Asian refining margins for jet fuel slumped to their lowest in more than two months at US$6.92 a barrel, while the front-month time spread for the aviation fuel in Singapore flipped to a contango for the first time since end-September.

The International Energy Agency (IEA) upped its average Brent crude oil price assumption for 2022 to US$79.40 a barrel, but predicted a rally may ease off as prices that hit a three-year high last month push up global production. As per the Paris-based IEA, much of the uptick in supply is due to come from the US. A hurricane battered the main US production and export hub in the Gulf coast in late August, but US output made up for half the increase in global oil production last month. But the IEA mentioned in its monthly report that US production, despite climbing, would not return to pre-pandemic levels until the end of next year. It is due to account for 60 percent of non-OPEC+ supply gains in 2022. The IEA’s price assumption reflects forward prices for Brent crude. The agency does not always include a reference to price assumptions in its report, but does so when it considers the assumption important to understanding its oil supply and demand forecasts, the agency said. The IEA price assumption of US$79.40 a barrel for Brent in 2022 is US$2.60 higher than in the agency’s last monthly report. The agency’s assumption for 2021 is US$71.50 a barrel. Iraq’s Oil Ministry expects oil prices to reach over US$75 a barrel. It said that OPEC is trying to “control the energy market, in a positive way” that maintains the interests of all parties, consumers and producers. It said that current oil prices are unfitting for producers and that he expects them to return to a stable level in the coming months. Oil climbed more than 4 percent on hopes that the Omicron variant of the coronavirus will have a less damaging economic impact if its symptoms prove to be mostly mild and as the prospect of an imminent rise in Iranian oil exports receded. Brent crude rose US$3.20 to settle at US$73.08 a barrel. US crude settled up US$3.23 at US$69.49 a barrel. Despite signs of a drop in consumption, OPEC stuck to its existing policy of increasing oil supply on a monthly basis because it aims at offering stable oil supplies and because it believes that the drop is unreal and that the market should witness a recovery.

Qatar Energy has sold three cargoes of al-Shaheen crude loading in January at the highest premiums in nearly two years. The average premium for the cargoes sold via a tender was at US$3.45 a barrel above Dubai quotes. The producer set the month’s term price at a premium of US$3.68 a barrel.

The Organisation of the Petroleum Exporting Countries (OPEC) will continue with its supply adjustments for the oil market, the OPEC Secretary General said. Oil prices fell after OPEC and its allies stuck to their existing policy of monthly oil output increases despite fears a release from US crude reserves and the new Omicron coronavirus variant would put renewed pressure on prices. The Secretary General said in terms of oil demand the estimate at the moment was for a growth of 5.7 million barrels per day (mbpd). He said the uncertainty and volatility on the markets was also due to extraneous factors such as the ongoing Covid pandemic and not necessarily the fundamentals of oil and gas. He said that the forecast was for oil and gas to account for more than 50 percent of the global energy mix in 2045 or even to mid century.

The OPEC pumped 27.74 million barrels per day (bpd) in November, a survey found, a rise of 220,000 bpd from the previous month but below the 254,000 increase allowed under the supply deal. The increase in OPEC’s oil output in November has again undershot the rise planned under a deal with allies, a survey found, bringing a lack of capacity in some producers into focus ahead of a policy meeting. The OPEC pumped 27.74 mbpd in November, the survey found, a rise of 220,000 bpd from the previous month but below the 254,000 increase allowed under the supply deal. OPEC and its allies, a group known as OPEC+, are gradually relaxing 2020’s output cuts as demand recovers from the pandemic. But many smaller producers can’t raise supply and others have been wary of pumping too much in case of renewed COVID-19 setbacks. A US-led release of oil stocks by consumer nations to lower prices and the appearance of the Omicron coronavirus variant have cast doubt whether a 400,000 bpd output boost planned in January will go ahead.

Oil prices rose, rebounding from recent losses, on reports that OPEC+ could adjust plans to raise oil production if large consuming countries release crude from their reserves or if the coronavirus pandemic dampens demand. Brent crude futures rose 81 cents, or 1 percent, to settle at US$79.70 a barrel. WTI (West Texas Intermediate) crude futures rose 81 cents, or 1 percent, to settle at US$76.75 a barrel. Prices of the Brent and US WTI crude benchmarks fell more than US$1 in early trading, hitting their lowest levels since 1 October.

Brazil’s state-run oil company Petrobras signed a contract to sell its Shale Industrialisation Unit (SIX) for US$33 mn to Forbes & Manhattan Resources. The refining unit is in Parana state on one of the world’s largest reserves of oil shale, a sedimentary rock with organic matter that can be converted to oil and gas by heating. It is the third refinery Petrobras has sold in its divestment strategy that will in total sell eight refineries. Petrobras said US$3 million has been paid to guarantee the sale.

Japan is considering releasing oil from its reserves for the first time to curb surging oil prices, as Prime Minister signalled his readiness to counter oil price hikes following a request from the US. However, Japan may struggle to justify such a move, as under its own laws the country can release reserves only at a time of supply constraints or natural disasters, but not to lower prices. The US administration of President Joe Biden, who faces falling approval ratings and higher gasoline prices, has pressed some of the world’s biggest economies to consider releasing oil from their strategic reserves to quell high energy prices. The requests include asking China for the first time to consider releasing stocks of crude. Tokyo was closely watching the impact of rising oil prices on the world’s third-biggest economy. Resource-poor Japan gets the vast majority of its oil from the Middle East. Recent surging oil prices and a weakening yen are driving up the cost of imports, dealing a double blow to a trade-dependent nation. Japan unveiled a record US$490 billion stimulus plan including measures to counter higher oil prices. It plans to subsidise oil refiners in the hope of capping wholesale gasoline and fuel prices to ease the pain to households and firms from rising oil costs.

Sri Lanka has temporarily shut its only oil refinery as part of efforts to manage dwindling foreign exchange reserves, the Energy Ministry said, triggering long queues at petrol stations. The 51-year old Sapugaskanda Oil Refinery, which has a capacity of 50,000 barrels per day, was closed. It said fuel imports would resume once the government was able to raise sufficient dollars but did not give details of a timeline. Sri Lanka is also attempting to negotiate a US$500 mn credit line with India to buy fuel and boost reserves, which dropped to US$2.27 bn at the end of October. During the first nine months of 2021, Sri Lanka spent US$692 mn on fuel imports, its highest import expenditure.

Royal Dutch Shell has pulled out of a controversial oil project near Scotland’s Shetland Islands, saying the project no longer makes economic sense for the company. Shell had a 30 percent stake in the Cambo project, which is opposed by environmental groups who say Britain should stop developing new oil and gas fields as part of its efforts to combat global warming. The Cambo field will produce up to 170 million barrels of oil and 53.5 billion cubic feet of natural gas over 25 years.

13 December: Petroleum and Natural Gas Minister of State Rameswar Teli said the government has agreed to release 5 million barrels of crude oil from its strategic petroleum reserves in consultation with other global energy consumers. He said India has repeatedly expressed concerns about the supply of oil being artificially adjusted below demand levels by oil-producing countries, which lead to higher prices and negative attendant consequences. As per the consumption pattern of 2019-20, the total capacity in the established Strategic Petroleum Reserves facilities of 5.33 million metric tonnes (mmt) is estimated to provide for about 9.5 days of crude oil requirement. Oil Marketing Companies (OMCs) currently have stock for 64.5 days. Hence, the total capacity storage of petroleum products is 74 days. The Centre had reduced the ‘central excise duty’ on petrol and diesel by INR5/litre and INR10/litre, respectively, on 3 November 2021.

12 December: Oil and Natural Gas Corporation (ONGC) is seeking a minimum price of US$3.5-4 for the natural gas it plans to produce from coal seams in Jharkhand and a field in Tripura. Oil and Natural Gas Corporation (ONGC) has issued separate tenders seeking buyers of 0.02 million metric standard cubic meter per day (mmscmd) of coal-bed methane (CBM) it plans to produce from the North Karanpura CBM block in Jharkhand and 0.1 mmscmd from Khubal field in Tripura. For the CBM gas, it asked buyers to quote a percentage equal to or higher than 8 percent of Dated Brent Price, according to the tender document. ONGC has been complaining that the government-notified gas price is way below cost and the company incurs a loss of production and sale of natural gas from most of its fields. Earlier this year in April, ONGC had sought bids for the sale of an initial two mmscmd of gas from its KG basin fields. It had sought bids indexed to Brent crude oil for the gas from the KG-DWN-98/2 or KG-D5 block, which sits net to Reliance Industries Ltd (RIL)-BP Plc-operated KG-D6 fields in the Bay of Bengal. In the latest tender, ONGC has mentioned a 3 to 5-year sale tenure for CBM gas, with supplies commencing with immediate effect. ONGC owns 55 percent in the North Karanpura CBM block in the Ranchi district of Jharkhand. Indian Oil Corporation (IOC) holds 20 percent and Prabha Energy Pvt Ltd the remaining 25 percent. For Khubal field, the gas supplies are to begin from April 2024 and bids have been sought for 3 to 5 years tenure. While ONGC is seeking a price benchmarked to Brent crude oil, RIL-BP sold about 13 mmscmd of new gas from KG-D6 at a price linked to Platts JKM (Japan Korea marker) – the liquefied natural gas (LNG) benchmark price assessment for spot physical cargoes.

8 December: India’s H-Energy, a natural gas company, is seeking eight liquefied natural gas (LNG) cargoes a year for delivery over four years starting from April, 2022. The tender closes on 17 December. H-Energy was expected to commission its floating storage and regasification unit (FSRU) at Jaigarh port in Maharashtra this year, though the terminal, had already been delayed on several occasions. The company is also constructing LNG re-gasification terminals on India’s east coast at Kakinada, Andhra Pradesh and at Kukrahati, West Bengal.

9 December: Coal India Ltd (CIL) said it does not foresee any shortage of dry fuel for power producers till March 2022 as it is focusing on ramping up production to secure a stock of about 70 million tonnes (mt) by end of the current fiscal. Around 100 mt of pithead stock, which was carried forward from the last fiscal, was “not desired” but it helped the miner meet requirements when coal demand went up a few months ago. Coal India chairman Pramod Agrawal said the last quarter saw “high” output, and issues related to the production of Central Coalfields Ltd and Bharat Coking Coal Ltd are also getting resolved. Jharkhand Chief Minister Hemant Soren had in July asked CIL for immediate payment of INR560 bn outstanding dues in lieu of government land allotted to it for mining.

8 December: Telangana Chief Minister (CM) K Chandrashekhar Rao has urged Prime Minister (PM) Narendra Modi to stop auctioning of four coal blocks in Singareni coal mines in Telangana as proposed by the union coal ministry. The CM stated that Singareni Collieries Company Limited (SCCL) is producing 65 million tonnes (mt) of coal every year and plays a key role in catering to the needs of thermal power plants in Telangana, Andhra Pradesh, Maharashtra, Karnataka and Tamil Nadu states. The CM urged the PM to instruct the union coal ministry to stop the auction of JBROC-3, Sravanpally OC, Koya Gudem OC-3 and KK-6 UG Block under the union ministry’s trench 13, as it would adversely impact the needs under Singareni jurisdiction for coal. He also requested the PM to allocate these blocks to SCCL.

12 December: India’s power consumption grew by 1.3 percent in the first ten days of this month from December 1 to 10 to 34.23 billion units (BU) over the same period a year ago, according to power ministry data. In 2020, power consumption was 33.78 bn units during December 1 to 10. In the entire month of December 2020, consumption was 105.62 bn units, up from 101.08 bn units in December 2019. Experts are of the view that power consumption as well as demand would grow at a steady pace in December with improvement in economic activities across the country. During the first 10 days of December this year, the peak power demand met or the highest supply in a day, touched 169.12 Gigawatt (GW) compared to 165.42 GW in the same period in 2020. The peak power demand met in December 2020 was 182.78 GW up from 170.49 GW in December 2019. Many states had imposed lockdown restrictions after the second wave of the pandemic hit the nation in April this year and affected the recovery in commercial and industrial power demand as states started imposing restrictions in the latter part of the month. Curbs were gradually lifted as the number of COVID cases fell.

9 December: Union Power Minister R K Singh has approved 23 new inter-state transmission system projects worth INR158.93 bn. The new inter-state transmission system (ISTS) projects comprise 13 projects with an estimated cost of INR147.66 bn to be developed under Tariff-Based Competitive Bidding (TBCB) and 10 projects with an estimated cost of INR11.27 bn to be developed under Regulated Tariff Mechanism (RTM), the power ministry said. These projects were approved after examining the recommendations of the National Committee on Transmission and in accordance with the National Tariff Policy 2016, notified by the central government, which provides that ISTS project is developed through TBCB, except for certain category projects, which are strategic, technical-upgradation or time-bound in nature, it said. The above transmission network expansion would augment seamless transfer of power from power surplus regions to power deficit regions and thus optimising the use of generation resources as well as meeting the demands of end consumers without any transmission constraints.

8 December: ABB India it has partnered with Indore Smart City Development Ltd (ISCDL) to deploy next-generation digital technology that enables continuous supply of electricity to homes and businesses. In the first phase of the collaboration, this technology enabled more than 2,300 connections to achieve 24/7 electricity supply with an efficient automatic response system (ARS) in case of power outages or disruption, ABB India said. Indore, the largest city in Madhya Pradesh and home to over three million people and several key industries in the state, is also part of the central government’s mission to develop 100 smart cities across the country. One of the key parameters of a smart city is 24/7 supply of electricity to enable digital transformation and the supply of key services to citizens.

12 December: BTL EPC, the engineering division of Kolkata-based Shrachi Group, is looking to diversify into renewable energy sector, particularly solar EPC (engineering, procurement and construction). The company, which has just executed the engineering and installation of a small solar power plant at Panagarh, is planning to get into tie up with NTPC, state governments and private companies for solar projects.

11 December: National Institute of Technology (NIT)-Andhra Pradesh (AP) is establishing a Common Research and Technology Development Hub (CRTDH) in renewable energy. Sponsored by the department of scientific and industrial research, this Hub will help local micro and small enterprises develop technological solutions for off-grid and on-grid renewable energy systems. The Hub would also nurture start-ups. According to NIT-AP, the infrastructure and equipment at this research centre would facilitate micro and small enterprises to conduct research and development activities, including testing of innovative products and new technologies.

9 December: The solar energy generation capacity addition rose 335 percent to 7.4 GW in the January-September period this year from 1.73 GW a year ago, Mercom India Research said. According to the update, India added 2,835 megawatts (MW) of solar in the third quarter (Q3 July-September) of the calendar year (CY) 2021, up 14 percent compared to 2,488 MW installed in Q2 2021 (April-June). Year-over-year (YoY) installations in Q3 surged 547 percent. Increased raw materials costs, severe volatility in module availability and price, curtailment of power in several states, and high freight charges have added to the difficulties for the developers, it stated. According to the report, module prices have been increasing for six consecutive quarters, a trend not seen in the past ten years. Tender announcements as of September increased 16 percent and auction activity surged 181 percent year-on-year. As of September, the top 10 states accounted for about 96 percent of the country’s cumulative large-scale solar installations. Rajasthan has been the top solar installer for three consecutive quarters by contributing about 63 percent of the total large-scale solar installations in the country this quarter, followed by Gujarat with 19 percent. Solar dominated capacity additions accounted for close to 60 percent, followed by thermal power, which contributed 21 percent.

14 December: Crude production in the Permian Basin is expected to surpass a pre-pandemic high this month as a rebound in the US (United States) shale industry fuels activity in its most prolific patch. Supplies from the Basin, which straddles West Texas and New Mexico, is projected to reach 4.96 million barrels a day in December, the Energy Information Administration said in a report. The current record of 4.91 million barrels a day was set in March 2020. The agency also sees supplies exceeding 5 million barrels a day next month for the first time in data going back to 2007. US shale oil producers will increase capital spending by nearly 20 percent to US$83.4 billion in 2022, the highest since the pandemic began, according to Rystad Energy. Still, that’s about a third lowest than forecast levels in 2019, indicating that companies are more disciplined about basing production decisions on near-term changes in crude prices.

11 December: Canada’s oil production will rise for the next decade and then start declining as countries strive to curb greenhouse gas emissions, potentially reducing revenues from the country’s biggest export. Output at the world’s fourth-largest oil producer will climb to 5.8 million barrels a day by 2032, from 5 million this year, and then decline to 4.8 million barrels daily in 2050, according to a report issued by the Canada Energy Regulator. An impending decline in oil exports poses a challenge for the Canadian economy. Canada is the largest foreign oil supplier to the US (United States) and the country has the world’s third-largest crude reserves locked in its oil sands region of northern Alberta. The oil and gas sector has accounted for about 5 percent of Canada’s economy.

10 December: US (United States) giant ExxonMobil and Qatar Energy signed a contract for oil and gas exploration and production-sharing off the divided island of Cyprus despite Turkey’s opposition to the deal. Cypriot Energy Minister Natasa Pilides, Varnavas Theodosiou, CEO of ExxonMobil Cyprus, and Ali al-Mana, director of Qatar Energy’s International Upstream and Exploration, signed the contract in Nicosia. It is the second gas exploration contract that the consortium has signed for Block 5 in the island’s Exclusive Economic Zone (EEZ). In February 2019, the consortium discovered a huge natural gas reserve off Cyprus in Block 10, the island’s largest find to date, holding an estimated five to eight trillion cubic feet. The consortium plans to drill an appraisal well on Block 10 in late December, with results expected by the end of February. Oil and gas drilling off Cyprus has been interrupted by the Covid-19 pandemic. Turkey has threatened to prevent ExxonMobil’s search for oil and gas off Cyprus after Nicosia awarded it the rights to Block 5.

10 December: Australia can phase out coal-fired power by 2043 even as electricity demand soars, the energy market operator said in a draft plan for electricity investments that will be needed to achieve net zero carbon emissions by 2050. The base case for the Australian Energy Market Operator (AEMO)’s plan sees a rapid transformation of the National Electricity Market (NEM) with major investment in renewable generation, energy storage, back-up generation and transmission as coal plants are retired. The plan would require A$12 billion (US$8.6 billion) in network investments, AEMO said in the plan. The market operator expects electricity consumption from the grid will nearly double to 330 terawatt hours (TWh) as transport, heating, cooking and some industrial processes are electrified over the next three decades.

13 December: Turkey has ranked 12th in the world and 5th in Europe in terms of renewable energy-based installed power. Turkey left 24 European countries behind in the list with its renewable energy installed capacity that was put into use in 2020 alone. Turkey is benefitting from the investments made in domestic and renewable energy resources to minimise its dependence on foreign energy. As a result of the revolutionary national energy and mining policy launched in 2017, some 74.2 percent of overall 24,718 megawatts (MW) installed power comes from renewable energy-based power plants. To date, Turkey’s renewable energy installed power constitutes 53 percent (52,930 MW) of its total installed power, which is planned to exceed 100,000 MW by the end of 2021. The contribution of domestic and renewable energy to electricity generation is evident in the figures. It was reported that the amount of electricity produced from renewable energy alone in 2020 exceeded the total electricity generation in 2002. Turkey has increased the amount of renewable energy approximately 3.7 times in the past two decades. Approximately 52 percent of the 275.7-billion-kWh electricity produced in the first ten months of 2021 came from domestic and renewable energy sources.

9 December: TotalEnergies said it will register, verify and trade renewable energy certifica

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.