-

CENTRES

Progammes & Centres

Location

India’s commitments to the Paris Agreement (PA) are to (i) reduce the emissions intensity of gross domestic product (GDP)

By most estimates, India is well on its way to meet its energy related Paris commitments by 2030. India’s energy intensity of GDP has improved at an average rate of 3 percent per year during the last three decades according to the International Energy Agency (IEA). Between 1990 and 2019, India’s GDP increased more than six-fold, while total final energy consumption increased only by a factor of 2.5 (or GDP grew more than twice as fast as energy consumption). This means that India has required less energy to produce an additional unit of economic output over the years. This has contributed towards the first goal of reducing the carbon intensity of GDP.

According to the IEA, three main factors contributed to this rapid improvement in the final energy intensity of GDP. The first was the structural shift away from traditional biomass (firewood, animal dung etc) as a fuel for cooking in households. Although millions of Indian households continue to use biomass as their primary fuel for cooking, the share of energy derived from biomass in final energy consumption in India fell from 42 percent in 1990 to 18 percent in 2019 as households shifted to LPG (liquid petroleum gas) or piped natural gas. The switch from biomass that has a very low conversion efficiency (5-10 percent) to high efficiency petroleum-based fuels enabled growth in economic activity without commensurate growth in energy consumption. The IEA estimates that the decline in the share of biomass in India’s energy basket was responsible for 60 percent of the decline in energy intensity.

The second driver of improvement in energy intensity was the structure of India’s economic growth model that was dominated by the service sector rather than more energy intensive sectors such as manufacturing. Nearly 90 percent of total value‐added growth in India in the period 1990‐2017 came from sectors in the lowest energy intensity category that include but not limited to large retail service sectors, business and financial services. The third driver of the improvement in energy intensity in India is technical efficiency of production and consumption processes. Relatively high energy prices, price sensitivity among consumers and a young capital stock contributed to technical efficiency. For example, the average on‐road fuel efficiency of a new passenger car in India is around 5.7 litres/100 km, comparable with cars in the European Union. The general wave of economic efficiency improvements that occurred after liberalisation in the early 1990s also contributed to the improvement in technical efficiency in manufacturing processes in India. Progress in the three factors listed (shift away from biomass, growing share of service sector in GDP and technical efficiency) are likely to continue in the coming decade and this means that India’s carbon emission intensity is likely to be 40 percent lower than its level in 2005. This exceeds India’s Paris commitment.

The second commitment is to increase the share of non-fossil fuels in cumulative installed power generation capacity to 40 percent by 2030. As of January 2021, India’s non-fossil fuel power generating capacity of 145,389 megawatts (MW) was about 38.5 percent of the total installed power generating capacity of 377,259 MW. Out of the total non-fossil fuel installed capacity, new renewables such as solar, wind, small hydro-power, biomass and others accounted for over 63.6 percent of capacity while large hydropower at 31.7 percent and nuclear at 4.6 percent account for the rest of capacity. With continued addition of solar power generating capacity, the non-fossil-based power generation capacity is likely to exceed 40 percent well before 2030.

Meeting and exceeding energy related commitments to the PA is commendable but it is likely that these targets would have been achieved even under a “business-as-usual” course in the absence of the PA. The 40 percent decrease in India’s emission intensity is a manifestation of the declining trend of India’s energy intensity over the last three decades. Non-fossil fuel-based power generation capacity could have increased even in the absence of the commitments to the PA. The Jawaharlal Nehru National Solar Mission (JNNSM), or the National Solar Mission, inaugurated in January 2010, five years before the PA, had set a target of 100 GW of solar PV by 2022. The nuclear and hydro power sectors also had ambitious target for capacity addition. Another concern is that generation shares may not be proportional to capacity shares. According to the projection for optimal generation capacity mix for 2030 carried by the Central Electricity Authority (CEA) in 2020, non-fossil fuel-based power generation capacity is likely to increase to roughly 64 percent of a total installed capacity of 817,254 MW. As per CEA’s projections, solar will have the largest power generation capacity of over 280 gigawatts (GW) accounting for over 34 percent of power generation capacity in 2030 while coal-based power generation of about 266 GW will account for about 32 percent of total installed capacity. The CEA analysis takes a capacity of 476,431 MW for 2021-22 projected by the draft national energy policy (NEP) as its base. The NEP estimated a capacity of 100 GW from solar alone in 2021-22. In January 2021, grid connected solar power generation capacity was 38,794 MW.

The CEA also used peak electricity demand of 339 GW in 2029-30 assessed by the 19th electric power survey (EPS) using a CAGR (compound annual growth rate) of 4.4 percent to calculate optimum fuel mix for power generation in 2030. If total installed capacity in 2030 is about 817 GW, the average PLF (plant load factor) of all power generating plants is likely to be about 40 percent. This will increase variable cost of power.

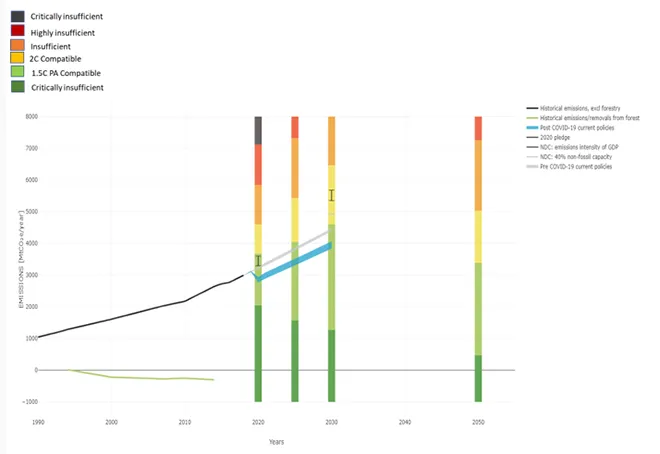

Despite the optimism over achievement of commitments to the PA, the collective effort of all signatories to the PA is not likely to curtail average increase in temperature to less than 2°C, the most important objective of the PA. An assessment of commitments by countries based on equity (including historic responsibility), capability (capacity to pay), equality (emission rights per person), and cost effectiveness classifies India’s commitments as “2°C compatible” and within the country’s fair share but still not fully consistent with goals of the PA.

The PA hailed as a diplomatic success of industrialised powers consolidated a bottom-up approach to mitigation targets. The bottom-up approach in the PA was an inevitable consequence of the removal of the fire wall between Annex I (industrialized countries that were expected to reduce CO2 emissions under Kyoto Protocol) and non-Annex I countries (less developed poor countries that were exempted from such commitments) in 2009 at Copenhagen. Though a price was extracted from industrialised countries (Annex I) in the form of a promise to fund mitigation and adaptation activities in developing countries with at least $100 billion a year by 2020, the blurring of the distinction between industrialised and industrialising countries meant that all countries would be expected to contribute to mitigation action (reduction of CO2) irrespective of their economic status. The PA merely brought these developments to their logical conclusion by codifying bottom-up voluntary commitments to mitigation action from all countries. More importantly the PA sidestepped distributional conflicts inherent in the post Kyoto negotiations with careful wording of legal language that limited obligations to procedural issues. “Ratcheting up” of ambitions of countries was tied to economic growth which meant that wealthier the countries become, the greater will be their contribution to climate change mitigation. The PA promised mobilization of climate finance from a variety of sources, instruments and channels (article 9<3>). This means that commercial investments by the private sector for renewable energy and other projects could now be counted as financial assistance to developing countries.

India’s Climate Pledge Assessment

Source: Climate Action Tracker

Source: Climate Action TrackerA survey has said that 69 percent respondents want the Government to cut excise duty on petrol and diesel to bring down the fuel prices that have touched record highs. As central excise is one of the two major components of the prices of fuel, moderation in the duty will provide succour to people who are facing the heat of economic slowdown and income disruption due to the Covid-19 pandemic, according to the survey conducted by Local Circles, a community social media platform. If done, it will reduce the price of petrol to ₹78/l and diesel to ₹68/l in Delhi and similarly across India where the impact to the citizens is even higher. Delhi has one of the lowest prices of diesel and petrol in the country. The survey had 9,326 responses from citizens residing in 201 districts of India. Of this, 71 percent respondents were men while 29 percent respondents were women.

Fuel prices in Rajasthan shot up to record high. Rajasthan has the highest VAT (Value Added Tax) rate on fuel in the country with petrol and diesel attracting 38 percent and 28 percent respectively. The price hike forced transporters and the retailers to appeal to the government for reducing VAT which is the highest in the country. During the lockdown period, the state government had increased VAT on petrol and diesel by 10 percent each. Taxes, which the government raised steeply last year, comprise about 60 percent of the fuels’ retail prices. Rising prices have triggered a strong demand for reduction in taxes on fuels whose sustained high rates can induce inflation in the broader economy.

India, the world’s third biggest oil importer and consumer, complained that recent output cuts by some OPEC nations had created uncertainty for customers and led to a surge in prices. Top exporter Saudi Arabia has pledged additional voluntary output cuts of 1 mn bpd in February and March under a deal between the OPEC and its allies including Russia, a group known as OPEC+. The steps taken were within the framework of last year’s deal to cut output by about 9.7 mn bpd, and were aimed at keeping oil markets stable on a sustainable basis.

To fund infrastructure development work in the State, the Punjab cabinet gave a go ahead to levy of ‘Special Infrastructure Development (ID) Fee’ to be deposited in the development fund of the Punjab Infrastructure Development Board (PIDB). The special ID Fee would be imposed at the rate of ₹0.25/l each on sale of petrol and diesel within the state. Likewise, special ID Fee of ₹0.25/l will also be levied for every one hundred rupees of the value of purchase of immovable property within the State. The special fee imposed would lead to creation of additional revenue streams of ₹2.16 bn annually into the Punjab Infrastructure Development Fund.

In a step towards self-reliance, IOC has supplied specialised fuel, lubricants and Marine Gas Oil (MGO) for India’s 40th Antarctic scientific mission. The move to locally produce and procure fuel and lubricants that can sustain the harsh temperatures of the Antarctic region comes after 22 years. The National Centre for Polar and Ocean Research (NCPOR), used to procure the specialised fuel and lubricants from international suppliers, but turned to IOC for aviation Jet A1 fuel. The bulk fuel and some packed in barrels were loaded on to a Russian ice-class ocean-going vessel. IOC is also the first oil company in the country to produce BS-VI compliant winter-grade HSD capable of withstanding extremely low temperatures of up to -33 degree centigrade in winter in the Himalayan region and supply of NATO-grade HFHSD (High Flash HSD) for the Indian Navy from Paradip and Haldia refineries.

ONGC’s plan to complete the merger of its refining subsidiary MRPL with recently acquired HPCL to align its upstream and downstream operations into two verticals has got delayed. The process is now expected to be completed by FY24 as ONGC has decided to consolidate its refining and petrochemicals business around MRPL first before pushing for its merger. The process of merging ONGC’s two oil refining subsidiaries HPCL and MRPL, will start only after the company completes merging ONGC Mangalore Petrochemical Ltd (OMPL) with MRPL.

IOC, the country’s top refiner, has loaded its first cargo of Iraq’s newly introduced Basra Medium crude grade, according to ship tracking data from Refinitiv Eikon. IOC loaded the cargo onto Minerva Kalypso, a suezmax-sized vessel. IOC is seeking to build a pipeline to supply aviation turbine fuel at the upcoming Jewar airport in Uttar Pradesh. IOC has submitted an expression of interest to the PNGRB in this regard. The board has launched a public consultation and will accept comments from everyone on IOC’s proposal until 18 February. IOC plans to build 36 km pipeline from its supply centre at Palwal in Haryana to Jewar airport. The fuel will be sourced from IOC’s refinery at Mathura. The company expects the planned pipeline to meet an estimated ATF demand of 0.7 MTPA by 2029-30, and 1.8 MTPA by 2039-40. IOC currently operates around 15,000 km of hydrocarbon pipelines in the country.

Linking the supply of ‘costlier’ LPG during the lockdown and the spread of coronavirus infection, a study by PGI scientists has recommended reducing the price of the clean fuel to prevent insufficient access to clean energy, especially in the rural areas, which may aggravate the Covid-19 situation. In the study, published in a high-impact journal — Environment International, the researchers have reasoned that exposure to solid biomass fuels is associated with respiratory problems, such as reduced lung function and increased prevalence of respiratory symptoms, that could lead to exacerbation of respiratory diseases. The study mentions that in June this year, when ‘Unlock 1’ was announced, the rates of LPG cylinder were hiked nationwide after a consecutive price cut for three months.

Iraq has reduced annual supplies of Basra crude oil to several Indian refiners by up to 20 percent for 2021, industry sources said, in a rare move by OPEC’s second-largest producer, which is trying to meet its obligations under the group’s production deal. Iraq was the top oil supplier to India in 2020 and a reduction in long-term Basra crude supplies could erode Baghdad’s market share in the world’s third largest oil importer and consumer. Iraq’s Oil Marketing Company (SOMO) has reduced the 2021 Basra term volumes to several Indian refiners by between 10 percent and 20 percent. SOMO told Indian refiners that it had reduced annual contracts for all Asian buyers to compensate for higher volumes produced in the previous year. India complained that recent output cuts by some OPEC countries had created uncertainty for customers and led to a surge in global oil prices. SOMO is planning to cut the oil contract of BPCL by about a quarter from last year’s 100,000 bpd. The discussions with BPCL are still ongoing as the Indian company’s annual contract begins from April. HPCL, which buys Basra Light oil, has asked SOMO to reduce its term supplies to about 50,000 bpd in 2021, down from about 80,000 bpd in 2020. Iraq has agreed to HPCL’s request for lower supplies, while the companies are in talks about additional supply of Basra Medium grade. The annual oil contract for RIL, operator of the world’s largest refining complex, has also been changed. Reliance will get 33,000 bpd of Basra Medium grade instead of 66,000 bpd of Basra Light. The supply cuts to India followed a $2.5 bn oil prepayment deal between SOMO and Chinese state oil trader Zhenhua Oil Corp for 48 mn barrels of Basra crude.

Ethanol production, which was less than 1 percent of demand in 2014, was set to reach 9 percent this year. Ethanol blending in petrol will cross 8 percent in 2020-21 after reaching 5 percent in the previous year despite the pandemic. State OMCs received 1.73 bn litres of ethanol for blending with petrol during ethanol supply year that ran between December 2019 and November 2020. The volume was lower than 1.89 bn litres of 2018-19 but the share in petrol blending was the same at 5 percent due to the overall decline in fuel sales due to the pandemic, which also curbed the availability of ethanol. The rise in ethanol supply offers has come on the back of the government widening the basket of raw materials that could be used to produce the green fuel. The government has set a target of 10 percent ethanol blending in petrol by 2022 for state-run oil companies. Blending is being promoted to help cut expensive oil import and reduce air pollution.

India’s overall petroleum demand in 2020 fell for the first time in more than two decades as the Covid-19 pandemic shuttered businesses and factories, crimping the appetite of one of the world’s biggest consumers. Demand for total petroleum products -- including diesel, gasoline and jet fuel -- slid 10.8 percent from a year earlier, the first annual contraction in data going back to 1999. Consumption was also at a five-year low of 193.4 MT. Fuel demand from Asia’s second-biggest oil importer collapsed by as much as 70 percent after it embarked on one of the world’s most stringent lockdowns in March. The drop resulted in a sharp cutback in crude processing and operations at petrochemical plants. Demand is picking up as restrictions are eased. While monthly consumption of petroleum fuels in December was about 1.8 percent lower than a year earlier, it was still at an 11-month high. Gasoline consumption last month rose 9.3 percent year-on-year, the highest since May 2019, on increased use of personal vehicles. Diesel demand was 2.8 percent lower than a year earlier.

Oil prices rose on expectations that OPEC and allied producers may cap output at current levels in February at a meeting later in the day as the coronavirus pandemic keeps worries about first-half demand elevated. Broader macro momentum trends including a weaker dollar and investors positioning for a recovery in the oil sector this year could be supporting oil prices. While crude demand is expected to rise by 5.9 mn bpd this year, the group sees plenty of downside demand risks in the first half of 2021. Prices ended 2020 about 20 percent below 2019’s average, still recovering from the impact of global economic lockdown measures imposed to battle Covid-19 that slashed fuel demand, even though the world’s major producers agreed record output cuts through the year. OPEC and allied producers including Russia, a grouping known as OPEC+, decided at a meeting last month to raise output by 500,000 bpd in January, anticipating a boost in demand, and agreed to meet every month to review production. In the United States, crude oil production stayed under pressure from weak prices and tepid demand, down more than 2 mn bpd in October from earlier this year, a government report showed on 1 January. Pressured by strict US sanctions, Venezuela’s oil exports plunged by 376,500 bpd in 2020, according to Refinitiv Eikon data and internal documents from PDVSA. The US also put curbs on PDVSA’s main trading partners, the owners of tankers still transporting Venezuelan oil and on fuel supply to the gasoline-thirsty nation. Venezuela’s exports of crude and refined products fell 37.5 percent in 2020 to 626,534 bpd, the lowest in 77 years. The decrease was even larger for fuel imports, which fell 51 percent compared with 2019, to 83,780 bpd. The drop in the crude oil offer was several times that of the global market, which fell about 9 percent last year from Covid-19 constraints. Venezuela’s oil exports swung wildly during the year, plummeting after Washington imposed sanctions on two units of PDVSA’s main trade partner, Russia’s Rosneft, and bouncing back when the Venezuelan state oil company found new customers and vessels to ship its oil.

Oil demand recovery will take a hit from a spike in new coronavirus cases before vaccine roll-outs and stimulus measures help in the second half of the year according to the IEA. Noting that an improvement to global oil demand went into reverse in December, the Paris-based watchdog lowered its forecast for the first quarter by 580,000 bpd and its outlook for 2021 by 300,000 bpd. Both supply and demand are on track for recovery this year, and efforts by top producers to balance the market by reining in output helped lower stockpiles of crude and oil products worldwide, though oil stocks remained stubbornly close to a May peak. Cold Asian and European winters along with supply discipline by the OPEC and its allies boosted crude prices while the US shale industry was expected to keep production flat.

Saudi Arabia’s voluntary oil production cut is expected to bring the oil market into deficit for most of 2021 even as new lockdowns to contain the spread of the coronavirus batter oil demand. Saudi Arabia, the world’s biggest oil exporter, surprised the market with a voluntary output cuts of 1 mn bpd in February and March. The move came as the OPEC and allies - a group known as OPEC+ - agreed most producers would hold output steady in February and March, while allowing Russia and Kazakhstan to raise output by a modest amount. With coronavirus infections spreading rapidly, producers are wary of new blows to oil demand which could lead to rising inventories. OPEC was cautiously optimistic the oil market would recover this year from the slump in demand brought on by the coronavirus pandemic. Monthly meetings of the OPEC and allies led by Russia - a group known as OPEC+ - are there to stop an imbalance from re-emerging.

The new US administration’s plans for large fiscal spending and little urgency to lift sanctions on Iran are constructive for oil and gas prices according to Goldman Sachs. US President Joe Biden’s proposed $1.9 tn stimulus package aims to jump-start the economy and accelerate vaccines distribution to control COVID-19, which has hammered global oil demand.

US refiners are girding for a painful slate of fourth-quarter earnings, reflecting the pressure of rising crude prices, weak demand due to renewed COVID-19 travel restrictions, and higher costs of associated with blending of renewable fuels into their products. Seven US independent refiners are projected to post an average earnings-per-share loss of $1.51, down from a loss of $1.06 in the third quarter of 2020, according to IBES data from Refinitiv. In the fourth quarter, independent refiners including Marathon Petroleum, Valero Energy and Phillips 66 coped with uneven demand due to a resurgence of coronavirus cases worldwide. Consumption of liquid fuels globally is estimated to have fallen by 9 mn bpd in 2020, according to the US Energy Information Administration. Crude oil benchmarks rallied more than 20 percent in the quarter, which squeezed US refining margins to less than $10 a barrel on average - the threshold for which most refiners make money - for the majority of the fourth quarter.

US shale producers are taking advantage of the oil market’s rally to levels not seen in nearly a year by locking in prices for future sales. US crude futures this month jumped above $50/barrel to the highest since February. The rally has sparked optimism among shale companies, but after a bracing year of pandemic-induced demand destruction, they are not ready to ramp up production. Instead, they are using futures markets to lock in higher sale prices. Shale producers buy and sell contracts in the futures and options markets in a process known as hedging to secure cash flows for later-dated sales. US oil production peaked at nearly 13 mn bpd in late 2019, but is now around 11 mn bpd after the coronavirus lockdowns crushed fuel demand and oil prices. Output is not expected to rise much in 2021, but those that hedged now are guaranteed sales of barrels at more than $50 even if prices drop again.

Venezuelan officials have met in recent months with small domestic oilfield contractors to propose letting them operate fields owned by PDVSA while pocketing part of the proceeds. The country is seeking to attract investments to the OPEC nation by offering even sweeter terms than a 2018 plan that walked back elements of the country’s nationalist oil industry platform. The government recently passed an “anti-blockade” law allowing oil deals to be signed confidentially, due to the risk of sanctions. In addition, members of the ruling socialist party - which recently gained control of the National Assembly in a disputed vote - have pledged to reform laws to allow greater private participation in the oil industry. The OPEC nation’s crude output has plunged to the lowest level in decades due to years of underinvestment and mismanagement, as well as US sanctions. The drop has exacerbated a humanitarian crisis in which some 5 mn people have emigrated. The government has also been focusing on fields owned solely by PDVSA for the new arrangements, rather than its joint ventures with private companies, such as Chevron Corp and China National Petroleum Corp Ltd. However, PDVSA has recently informally granted its minority partners at the joint ventures operational control of their fields.

Oil production in Russia declined last year for the first time since 2008 and reached its lowest level since 2011 following a global deal to cut output and sluggish demand caused by the coronavirus. Russian oil and gas condensate output declined to 10.27 mn bpd last year. Oil and gas condensate output dropped to 512.68 MT in 2020 from a post-Soviet record-high of 560.2 MT or 11.25 mn bpd, in 2019. The 512.68 MT reading for 2020 was the lowest since 511.43 MT in 2011, and the first annualised decline since 2008 amid the global financial crisis and falling oil prices. Russia agreed to reduce its oil production in April last year by more than 2 mn bpd, an unprecedented voluntary cut, along with other leading oil producers and the OPEC. The move was designed to bolster the oil market beset by the fallout from the Covid-19 pandemic. Since the April agreement, a record for global supply reductions, the group known as OPEC+ has progressively reduced the cuts and is expected to release an extra 500,000 bpd into the market in January. Russia has been expected to increase its oil output by 125,000 bpd from the New Year. Russia said it would support a gradual increase of the group’s output by another 500,000 bpd starting in February.

China's Sinopec Corp boosted crude oil output at a comparatively newly discovered oil field in the northwestern Xinjiang region by nearly 30 percent last year to about 1 MT. Though small compared with Sinopec's overall output, the increase represents progress for the state oil giant as it taps geologically more challenging oil and gas deposits to compensate rapid reserve declines at its largest, but aging Shengli field in east China. The Shunbei field, discovered in 2016, has proven geological oil reserves of more than 130 MT or about 950 mn barrels. Sinopec also produced about 350 mn cubic metres of natural gas in the same field, 32 percent more than 2019. China appears to have drawn on its crude stockpiles in December, the second time in three months, as the world's biggest oil importer uses some of the massive surplus it built up last year. China processed 1.24 bpd more crude oil in its refineries in December than was available from imports and domestic production, according to calculations based on official data. China doesn’t disclose the volumes of crude flowing into strategic and commercial stockpiles. But an estimate can be made by deducting the amount of crude processed from the total amount of crude available from imports and domestic output. Refinery throughput was 14.13 mn bpd in December, just shy of November's record 14.2 mn bpd, according to data from the National Bureau of Statistics. December crude imports were 9.06 mn bpd, the lowest on a daily basis since September 2018 and well below the 11.03 mn bpd in November. Refinitiv Oil Research estimates that January's imports will be around 11.38 mn bpd, which includes some 706,000 bpd of crude that arrived in December, but wasn't discharged because refiners had run out of import permits.

Japanese trading house Sumitomo Corp will stop investing in new oil development projects as it shifts away from fossil fuels businesses amid a global push to cut greenhouse gas emissions. The move comes as global miners and Japanese trading companies cut their exposure to coal operations, including mining and power generation to trim harmful carbon dioxide emissions and to slow climate change. Sumitomo will no longer participate auctions for new oil projects, though it will continue its existing oil projects including those in North Sea. In energy and natural resources, Sumitomo will focus its management resources on renewable energy such as offshore wind farms and base metals, including copper and nickel used in electric vehicles.

Indonesia said its coast guard seized the Iranian-flagged MT Horse and the Panamanian-flagged MT Freya vessels over suspected illegal oil transfer in the country’s waters. Coast guard said the tankers, seized in waters off Kalimantan province, will be escorted to Batam island in Riau Island Province for further investigation. The International Maritime Organization requires vessels to use transponders for safety and transparency. Crews can turn off the devices if there is a danger of piracy or similar hazards. But transponders are often shut down to conceal a ship’s location during illicit activities. Both the supertankers, each capable of carrying 2 mn barrels of oil, were last spotted earlier this month off Singapore, shipping data on Refinitiv Eikon showed. Iran, which has not commented on the seizure, has been accused of concealing the destination of its oil sales by disabling tracking systems on its tankers, making it difficult to assess how much crude Tehran exports as it seeks to counter US sanctions.

Norway is proceeding with plans to award oil and gas exploration permits in frontier regions of the Arctic later this year. The government in November said it would offer drilling permits in nine offshore regions containing 136 blocks, mostly in the Arctic Barents Sea, as it seeks to pave the way for a major expansion of exploration.

Nigeria’s state oil firm NNPC is in talks to raise around $1 bn in a prepayment with trading firms to refurbish its largest refining complex at Port Harcourt. If the financing is concluded, the long overdue rehabilitation of the refinery should reduce Nigeria’s hefty fuel import bill. It would also mark Nigeria’s second oil-backed financing since the COVID-19 pandemic that has added to the difficulty of finding investors as fuel demand is sapped by lockdowns and renewable energy is gaining ground over fossil fuels. The money would be repaid over seven years through deliveries of Nigerian crude and products from the refinery once the refurbishment is complete.

OPEC: Organization of the Petroleum Exporting Countries, mn: million, bn: billion, MT: million tonnes, bpd: barrels per day, MTPA: million tonnes per annum, km: kilometre, IOC: Indian Oil Corp, ONGC: Oil and Natural Gas Corp, ATF: aviation turbine fuel, LPG: liquefied petroleum gas, IEA: International Energy Agency, US: United States

2 February: The budget levy of new agriculture infrastructure and development cess on petrol and diesel did not have an impact on retail prices of both the products as Oil Marketing Companies (OMCs) took cognizance of the fact that additional duty has been offset by an equal cut in excise duty rates. The OMCs also ignored the signals given by the international market where oil prices rose sharply by over 1 percent nearing $57 a barrel. This would have normally pushed OMCs into raising petrol and diesel prices to reduce their under recovery. With prices on hold, petrol continued to be available at new record high of ₹86.30 a litre in Delhi while diesel is available at ₹76.48 a litre. This is the sixth consecutive day when fuel prices have remained static. The fuel prices remained unchanged across the country as well. In Mumbai, petrol was priced at ₹92.86 a litre while in Chennai it was at ₹88.82 a litre and in Kolkata ₹87.69 a litre. Diesel on the other hand is at ₹83.30 a litre in Mumbai, ₹81.71 per litre in Chennai and ₹80.08 a litre in Kolkata. Though firm global crude and product price is the reason for the increase in retail price of petrol and diesel, with crude hovering just over $55 a barrel for some time, OMCs have gone in for both a pause in price of auto fuels as well increase in its retail prices on consecutive days.

Source: The Economic Times

31 January: Every morning, Tsering Angmo leaves her two-year-old son with neighbours and commutes 20 km (kilometre) through a frozen landscape from her home in Choglamsar, a settlement near Leh, to work at Ladakh’s only LPG (liquefied petroleum gas) bottling plant near Leh. Angmo is part of a 12-member all-women crew making sure that the 50,000 Indian soldiers eyeballing the People’s Liberation Army in Arctic temperatures do not have to march on empty stomachs. The plant, built by state-run Indian Oil Corp (IOC), is Ladakh’s only source of cooking gas and a lifeline once snow snaps road connectivity with the rest of the country. About 40 percent of the refills produced at the plant go to the defence establishment. It is also the country’s only LPG unit to be operated by women. The women work the production line, check quality of seals etc and manage security. All the crew members, except security officer Tsetan Angmo, are contract workers. Only loading, involving heavy lifting, is handled by five men.

Source: The Economic Times

29 January: The Rajasthan government has reduced the value-added tax (VAT) by 2 percent both on petrol and diesel, announced Chief Minister Ashok Gehlot. For the last three days, petrol is being sold at ₹93.94 Per Litre and diesel at ₹86.02 Per Litre in Jaipur. A Value Added Tax (VAT) is a type of indirect tax levied on a product whenever value is added at each stage of the supply chain, from production to the point of sale. Rates differ from state to state depending on the incidence of VAT.

Source: The Economic Times

29 January: It’s set to be a slow crawl back to pre-virus levels for Indian energy demand with diesel, the most-used fuel, holding back the recovery. While demand for diesel, which accounts for around 40 percent of Indian fuel use in a normal year, rebounded quickly after the world’s biggest lockdown was imposed in March, the recovery has since slowed. The annual growth rate for diesel consumption won’t get back to pre-virus levels until the year ended March 2022, Hindustan Petroleum Corp Ltd (HPCL) chairman Mukesh Kumar Surana said. Used in factories, construction and agriculture as well as powering the truck and bus fleets, diesel is a bellwether of industrial activity in India and its tepid recovery reflects an economy still struggling to shake off the crippling effects of the pandemic. Gasoline demand, by contrast, is being buoyed by people opting to use private cars and motorcycles to avoid being exposed to COVID-19. The year got off to a shaky start with fuel sales falling in the first two weeks of January from a month earlier and diesel showing the biggest drop. Farmer protests have affected the movement of vehicles in some states and damped consumption, while record high fuel prices have also dented demand.

Source: The Economic Times

2 February: The Centre has announced a maiden gas pipeline project for the Union Territory of Jammu and Kashmir. In her Budget speech, Finance Minister Nirmala Sitharaman said a gas pipeline project will be taken up in Jammu and Kashmir. She also announced setting up of a central university in Leh district of Union Territory of Ladakh for accessible higher education. The Centre has provisioned ₹307.57 bn budget for the Union Territory of Jammu and Kashmir, while Ladakh has been allocated ₹59.58 bn in the Union Budget for 2021-22.

Source: The Economic Times

1 February: The government is planning to set up an independent operator to manage common carrier capacity for all natural gas pipelines, which would give all gas marketers a level playing field going forward. The government was planning to set up such an independent operator to meet the longstanding demand from industry to separate content and carriage and therefore remove the advantage that state-run gas marketer GAIL (India) Ltd enjoys due to its overwhelming control of the country’s gas pipelines. With the establishment of an independent operator, all gas marketers will have equal and transparent access to the common carrier part of the gas pipelines and will be able to book capacity depending on its availability. Most gas pipelines are mandated to permit a part of their capacity for common usage. The government also plans to monetise three oil and gas pipelines owned by GAIL, Indian Oil Corp (IOC), and Hindustan Petroleum Corp Ltd (HPCL), Finance Minister Nirmala Sitharaman said.

Source: The Economic Times

29 January: Essar Oil and Gas Exploration and Production Ltd (EOGEPL), an investee company of Essar Capital, announced it has dispatched the first compressed coal-bed methane (C-CBM) natural gas cascade truck for Bengal gas company’s maiden CNG (compressed natural gas) station to be supplied by GAIL (India) Ltd. The company said Essar Capital’s investments in EOGEPL are focused on clean energy and CBM gas is seen as a key green fuel. The Kolkata city gas distribution network is being developed by Bengal Gas Company which is a joint venture between GAIL and Greater Calcutta Gas Supply Corp.

Source: The Economic Times

2 February: Coal India Ltd (CIL)’s coal production declined by 4.1 percent to 60.5 million tonne (mt) last month. Coal India (CIL) had produced 63.1 mt of dry-fuel in January last fiscal, the company said. The company’s output in the April-January period was at 453.3 mt over 451.5 mt in the corresponding period of the previous fiscal, it said. CIL accounts for over 80 percent of domestic coal output.

Source: The Economic Times

2 February: The government’s proposed plan to improve the operations and finances of state-owned distribution companies (discoms), the weakest link in India’s power supply value chain, will help mitigate cash flow stress observed in rated power generation companies over time, according to Fitch Ratings. The $41 bn plan intends to trim electricity losses, gradually narrow discoms' cost-revenue gap, improve the reliability and quality of power supply, and promote more sustainable competition in the sector through 2024-25. The pandemic has aggravated the discoms' difficulties due to the fall in electricity demand from higher-paying commercial and industrial customers, payment concessions, and delay in cash collections. The extended payment cycles of discoms put pressure on the working capital of generation companies, weakening their cash flows available for debt servicing.

Source: The Economic Times

1 February: Out of the 3.35 lakh electricity consumers in Gautam Budh Nagar, disconnection exercise has been initiated by the power department on about 25,000 consumers whose bills are pending since over a year. These are largely rural consumers from Dadri, Dankaur, Rabupura etc. areas, who are either out of town or have changed addresses. Notices are being sent to them to ensure part payment which will enable reconnection. There are also about 80,000 rotational soft arrear consumers from mostly urban areas with bills pending up to three months. They are being given door-to-door notices to clear payment dues. According to Pashchimanchal Vidyut Vitran Nigam Ltd, there are many such defaulters from Dujana village in Dadri and other villages from Dankaur, Jewar, Rabupura, etc.

Source: The Economic Times

1 February: Tata Power said it has received a letter of intent from the Odisha Electricity Regulatory Commission (OERC) for distribution and retail supply of electricity in five circles of North Eastern Electricity Supply Company of Odisha (NESCO) constituting areas of Balasore, Bhadrak, Baripada, Jajpur and Keonjhar. Tata Power will hold 51 percent equity with management control and the Grid Corp of Odisha (GRIDCO) will have the remaining 49 percent equity stake in the company, according to conditions of the bid documentation. With inclusion of additional distribution utility of Odisha, Tata Power will now serve the entire population of Odisha with nearly 90 lakh consumers experiencing uniform processes and synergies in operations. The expansion will enhance Tata Power's consumer base to nearly 12 mn from the present 96 lakh across Mumbai, New Delhi, Ajmer, central, southern and western parts of Odisha. With this takeover, the company’s distribution circles will expand to NESCO with geographical spread of more than 27,500 square kilometre (km) and serve over 19 lakh consumers with annual input energy of 5,450 mn units. It will manage a network of more than 90,000 circuit km for a license period of 25 years.

Source: The Economic Times

1 February: Finance Minister (FM) Nirmala Sitharaman announced that the Government will soon put in place a framework to allow electricity consumers choose service providers or discoms. At present, a large number of power distribution utilities (discoms) across the country are state-owned. They are unable to ensure 24-hour 'power for all' as envisaged by the central government because they are cash strapped. She said that during the last six years, 139 GW of power generation capacity has been added and 2.8 crore households were provided electricity connection. She noted that 1.41 lakh circuit kilometres of power transmission lines were added in the last six years.

Source: The Economic Times

1 February: The Government may announce a new scheme for cash-strapped and loss-making electricity distribution utilities to reduce stress in the sector and achieve the goal of '24X7 Power for All'. The Centre in November 2015 introduced the UDAY (Ujjwal Discom Assurance Yojana) scheme for the revival of the debt-laden discoms (distribution companies). Under the scheme, discoms were envisaged to turn around financially within three years from signing agreements under it. In September 2019, Power Minister R K Singh had said that the power ministry was working on UDAY 2.0 scheme. There were expectations that the scheme would be announced in the General Budget for 2020-21. Though Finance Minister Nirmala Sitharaman in her budget speech last year had said that taking electricity to every household has been a major achievement but the distribution sector, particularly the discoms, were under financial stress. Further measures to reform discoms would be taken, she had said.

Source: The Economic Times

31 January: Odisha Power Transmission Corp Ltd (OPTCL) has signed an MoU (Memorandum of Understanding) with Indian Institute of Technology, Bhubaneswar for the establishment of OPTCL Chair in the premier engineering institute. It is indeed a historic moment for Odisha to collaborate with a premier institute like IIT for development of Odisha power sector, Energy Minister D S Mishra said. The MoU was signed. He said this cooperation will enhance the technical knowhow. OPTCL chairman Sourav Garg said IIT would be a troubleshooter for various technical issues surfacing in the power sector.

Source: The Economic Times

31 January: Uttar Pradesh Power Corp Ltd (UPPCL)’s plan to file a fresh Annual Revenue Requirement (ARR) for fiscal 2021-22 with the power regulatory body has raised curiosity about the possibility of a hike in power tariff, which was untouched last year. ARR is a projection of power tariff, which UPPCL seeks to recover in a new financial year. UPPCL said ARR would be filed with the power watchdog, UP Electricity Regulatory Commission (UPERC), in the next few days. While UPERC asked UPPCL to file the ARR by month-end, sources said, the corporation sought more time to conduct an audit before moving the commission for tariff revision. An urban domestic consumer, for instance pays at the rate of ₹5.50 per unit for first 150 units, followed by ₹6 per unit on consumption of 150-300 units. Likewise, for the slab between 301-500 units, a consumer pays at the rate of ₹6.50. Consumption of electricity above 500 units will require the consumer to shell out ₹7 per unit. The consumer shells out Rs 110/KW/month as fixed charge. The possible power tariff revision comes months after UPPCL initiated a proposal to privatize loss-making power distribution companies like Purvanchal Discom.

Source: The Economic Times

31 January: Energy Efficiency Services Ltd (EESL) has entered into agreements with two Bihar utilities for installation of 23.4 lakh smart prepaid meters in Bihar. This is the first time that smart prepaid meters are being installed at this scale, and are set to have a transformative impact on the state’s energy landscape, EESL said. The agreements were signed in the presence of Bihar Energy Minister Bijendra Prasad Yadav. The smart prepaid meters will optimise the discom (distribution company) operational performance by increasing the billing and collection efficiency, reduce the operation and maintenance cost, and enhance the quality of service, along with providing the consumers with demand side management (DSM) options. The smart prepaid meters are connected through a web-based monitoring system, which will help reduce commercial losses of utilities, enhance revenues and serve as an important tool in power sector reforms. EESL's smart metering initiative is revamping the current manual system of revenue collection, which suffers from low billing and poor collection efficiencies. The implementation of these meters will also enable considerable energy and monetary savings for consumers, who will have an avenue to track their power usage in real time. The prepaid functionality of the smart meters is also an added advantage, as it provides discoms with an option to switch to prepaid mode, wherein the consumers pay upfront for the electricity. The utility of this feature was quite apparent during the lockdown, as discoms in Bihar were able to generate a daily revenue of ₹5,00,000, with consumers on an average recharging their prepaid smart meters with a credit balance of ₹20 daily. The Smart Meter National Programme aims to replace 250 mn conventional meters with smart meters in India.

Source: The Economic Times

31 January: Power Grid Corp of India (PGCIL) has won two electricity transmission projects in Rajasthan under tariff-based competitive bidding. PGCIL has been declared as the successful bidder under tariff-based competitive bidding to establish two transmission systems, the company said. The firm bagged a "transmission system strengthening scheme for evacuation of power from solar energy zones in Rajasthan (8.1 GW) under phase II - Part A" on build, own operate and maintain basis. The transmission system comprises establishment of a new 400/220 kV (kilovolt) Substation, 400 kV D/C Transmission lines and associated Substation extension works in Rajasthan. The transmission system comprises establishment of 765 kV D/C Transmission line and associated substation extension works in Rajasthan.

Source: The Economic Times

30 January: India’s transmission and distribution (T&D) losses in the power sector are "substantial" and are very high compared to peer nations, flagged the Economic Survey for 2020-21. The T&D losses represent electricity that is generated but does not reach intended customers. India’s T&D losses have been over 20 percent of generation, which is more than twice the world average. The ideal level of T&D losses ranges between six to eight percent. According to the Central Electricity Authority (CEA)’s latest report of October, 2020 the T&D losses had declined to 20.66 percent in 2018-19, from 21.04 percent in 2017-18, and 21.42 percent in 2016-17.

Source: The Economic Times

27 January: The Centre sanctioned ₹66 bn to the state power utilities as Atmanirbhar loan, according to Andhra Pradesh state energy secretary N Srikath. The government released ₹33 bn to the state under the second trench of the loan and already released an amount of ₹33 bn so far. The power utilities saved ₹10.23 bn by procuring power at power exchanges. The power utilities reduce AT&C (Aggregate Technical and Commercial) losses to 13.36 percent in in the year 2019-20 from 16.36 previous year. The state also saved fixed cost payments of ₹8.50 bn per annum by surrendering 625 MW of coal power from Central Generating stations. The power utilities procured 6,320 mn units of power from the open market during the current financial year. The average cost of procurement, including transmission charges is ₹3.12 per unit against the approved weighted average procurement cost of ₹4.55 per unit.

Source: The Economic Times

1 February: Adani Green Energy said that its arm ASE4PL has commissioned a 100 MW solar power project at Jalalabad in Uttar Pradesh. Both the plants have power purchase agreements (PPAs) with Uttar Pradesh Power Corp Ltd (UPPCL) at ₹3.22/kWh (kilowatt hour) and ₹3.19/kWh, for a period of 25 years. The AGEL’s Energy Network Operation Centre (ENOC) platform will also embrace these two commissioned solar power plants for delivering consistent performance. With this, we have added a capacity of 700 MW capacity since the beginning of challenging COVID-19 pandemic crisis, the company said. This places AGEL’s total renewable portfolio of 14,815 MW well on track to reach its vision of 25 GW capacity by 2025, it said. Adani Green Energy, a part of India-based Adani Group, has one of the largest global renewable portfolios over 14,815 MW of operating, under-construction and awarded projects catering to investment-grade counterparties.

Source: The Economic Times

1 February: Finance Minister (FM) Nirmala Sitharaman in her Budget speech has put emphasis on the solar energy sector as part of the government’s larger focus on renewable energy. She announced a customs duty hike on solar inverters and lanterns which would have an impact on the rooftop, ground-mounted projects and distributed renewable energy sector. She said that to build up domestic capacity, the government would notify a phased manufacturing plan for solar cells and solar panels. Apex solar body, National Solar Energy Federation of India (NSEFI), welcomed the move for the increase of duty on inverters. Regarding duty hike on solar lanterns, he added that the announcement was a necessary step to place Indian manufacturers in a comfortable position and also to enable India in becoming a global leader in supply of solar lanterns. According to a recent study by GOGLA and C-kinetics, India is one of the largest markets in the world for solar lanterns and has a potential to be a $300 mn market for lanterns. Apart from this, the FM announced fund allocation to the Solar Energy Corp of India (SECI) and Indian Renewable Energy Development Agency (IREDA).

Source: The Economic Times

1 February: The record low tariff of ₹1.99 per unit reached at a solar auction in Gujarat in December has had an immediate fallout, with the State cancelling the results of two previous auctions where the discovered tariffs were much higher. Gujarat’s main power distribution company, Gujarat Urja Vikas Nigam Ltd (GUVNL), has now obtained permission from the state power regulator to hold the auctions again for the 700 MW Dholera Solar Park and the 100 MW Raghanesda Solar Park. In the previous auctions conducted in August-September last year, the discovered tariff for Dholera was between ₹2.78 and ₹2.81 per unit with five winners who were allotted 100-200 MW each. At Raghanesda, there was only one bidder, SJVN Ltd, which got the entire 100 MW quoting a tariff of ₹2.73 per unit. Industry analysts attribute the steep fall to a global decline in the cost of solar modules, development of modules with improved capacity utilisation factor, and the fact that the projects did not have to be set up in a solar park, where fixed costs are higher.

Source: The Economic Times

31 January: Green fuel biodiesel will be produced from cooking oil under solid waste management during the Kumbh. This initiative, the first of its kind, will start during the Haridwar Kumbh Mela, the officials said. According to them, the effort to generate biofuel from cooking oil will also reduce the related health hazards. Urban Development Minister Madan Kaushik has asked the officials to prepare a detailed action plan. R S Rawat, the designated officer for food safety during the mega fair, will be looking after the process of preparing biofuel. A company authorised by the government, which also has a plant in Haryana’s Bhiwani, is working to collect reused cooking oil from hotels, restaurants and traders in Haridwar. The company will buy the used cooking oil at ₹25 per kg (kilogram). The oil will be recycled and used for industrial purposes. It is reported that on an average 8 to 10 litres of biofuel can be prepared from 10 litres of used cooking oil. Along with protecting the environment, the initiative will also prove beneficial for people’s health.

Source: The Economic Times

30 January: India is among the frontline nations in implementing the Paris Agreement on climate change, President Ram Nath Kovind said, reiterating that environment protection is one of the topmost priorities of the government. He also highlighted that India’s renewable energy capacity has grown two-and-a-half times while solar energy has increased 13 times. The work on setting up the world’s largest hybrid renewable energy park in the desert of Kutch has commenced recently. In the last six years, India's renewable energy capacity has grown two-and-a-half times, whereas the solar energy capacity has increased 13 times.

Source: The Economic Times

30 January: Convergence Energy Services Ltd (CESL), a wholly owned subsidiary of Energy Efficiency Services Ltd (EESL), said it has commissioned one MW of Goa’s first solar energy project. This is CESL’s and Goa’s first milestone in 100 MW solar project. The project integrates the delivery of clean, renewable, decentralised energy from solar feeders with energy efficient pump sets and LED lamps for rural homes. Of Goa’s total 600 MW power demand, 100 MW from solar energy is a big move towards energy independent and Green Goa. The commissioning of this project also sets the state on the path of self-reliance as nearly all of Goa's current power requirement was met by other states. Under this project, the CESL will implement 100 MW decentralised solar energy projects on government lands and the energy generated would be used for agricultural pumping.

Source: The Economic Times

29 January: Maharashtra’s New Renewable Energy Policy will attract ₹750 bn investments, the state’s Power and New & Renewable Energy Minister Nitin Raut said. Raut said the policy aims to implement 17,000 MW of renewable power projects in the next 5 years. It is expected to create direct and indirect employment for one lakh people, along with giving priority to hybrid power projects. Maharashtra has been leading in terms of renewable energy deployment with push on electric mobility where RE (renewable energy) deployment will have greater potential in future. The industrial and commercial segments with strong base in Maharashtra will have great potential for offtake of RE.

Source: The Economic Times

28 January: Vikram Solar, Kolkata-based renewable energy firm, said it has commissioned a 140 MW solar plant project for NTPC Ltd at Bilhaur, Kanpur, Uttar Pradesh (UP). It said that the project is spread across 700 acres of land and its expected energy yield in UP was 319 mn units -- enough to power 1,45,662 houses per year. NTPC developed the project after it won a competitive bid from the Uttar Pradesh New and Renewable Energy Development Agency, according to the company.

Source: The Economic Times

2 February: Prime Minister Imran Khan led-government increased the price of petrol by up to Pakistani ₹2.70 per litre. Prime Minister Imran Khan approved ₹2.70 per litre increase on petrol and ₹2.88 per litre on diesel. Meanwhile, the price of kerosene oil is increased up to ₹3.54 per litre while the rate of light diesel was jacked up to ₹3 per litre. The new petroleum prices from 1 February will be - petrol: ₹111.90, diesel: ₹116.07, kerosene oil: ₹80.19, and light diesel: ₹79.23.

Source: The Economic Times

28 January: Colombia aims to sign 15 oil exploration contracts in 2021, Mines and Energy Minister Diego Mesa said, while setting the country's crude production target for the year at 865,000 barrels of oil per day. Colombia’s oil output slowed in 2020 amid declining demand, high supply and low prices during the coronavirus pandemic, which prompted temporary field shutdowns and caused the government to cut its production outlook.

Source: The Economic Times

2 February: France urged Germany to scrap a major gas pipeline project with Russia in protest over the detention in Moscow of opposition leader Alexei Navalny, but the plea fell on deaf ears in Berlin. Nord Stream 2 is a €10 bn ($11 bin) pipeline that will run beneath the Baltic Sea and is set to double Russian natural-gas shipments to Germany, Europe’s largest economy. The United States and several European countries such as Poland have criticised the project, saying it will increase German and European Union dependence on Russia for critical gas supplies. German Chancellor Angela Merkel has stood by the project, and work resumed on it in December after an almost year-long pause due to American sanctions.

Source: The Economic Times

29 January: Woodside Petroleum inked a deal with the Western Australian government to supply gas from its Pluto field to the North West Shelf (NSW) liquefied natural gas (LNG) project through a pipeline, the state government and company said. Woodside said it would feed gas from Pluto through the construction of an interconnector pipeline along the Dampier to Bunbury Natural Gas Pipeline corridor to the NWS project’s Karratha gas plant. Woodside will now supply an additional 45.6 petajoules of domestic gas from its existing share of the NWS project from 2025, Australia's top independent gas producer said. The agreement follows a deal in December between Woodside’s Burrup Hub and the NWS Project partners to process about 3 million tonnes (mt) of LNG and 24.7 petajoules of domestic gas at the Karratha gas plant. Western Australia’s government said the new interconnector would create 320 construction jobs, adding that Woodside has agreed to make gas equivalent of 15 percent of its LNG exports available to the domestic market.

Source: The Economic Times

27 January: Global gas demand is expected to grow by 2.8 percent this year, or about 110 billion cubic meters (bcm), recovering towards 2019 levels, the International Energy Agency (IEA)’s senior natural gas analyst Jean-Baptiste Dubreuil said. Global gas markets posted their largest drop on record last year, with consumption falling by an estimated 100 bcm as milder weather at the start of the year and the COVID-19 pandemic slammed energy demand, he said. Still, gas demand proved more resilient than that for other energy sources such as oil, he said. He said that while global gas demand is expected to recover this year, no major rebound is expected and more mature markets will see only a gradual recovery, with some still not returning to their 2019 levels. He expected new opportunities and challenges against a backdrop of uncertain medium-term LNG (liquefied natural gas) demand, with about one third of active LNG contracts due to expire by 2025, while liquefaction capacity is set to grow by 20 percent, quadrupling the amount of current uncontracted volumes.

Source: The Economic Times

27 January: Greece ratified an agreement with Bulgaria for the operation of a €200 mn gas pipeline that seeks to help both countries and Europe diversify their energy resources. The Interconnector-Greece-Bulgaria (IGB), a 182 kilometre pipeline (113 miles), is being constructed by a joint venture of Bulgaria’s state energy company BEH and Greece’s gas utility DEPA and Italy’s Edison. The pipeline, with an initial annual capacity of 3 billion cubic metres, is key to Europe’s plans to cut its reliance on Russian gas, as it will be linked to the Trans Adriatic Pipeline (TAP), the final leg of a $40 bn project named the Southern Gas Corridor, that will carry Azerian gas to Europe. Greek parliament also ratified the charter for the East Mediterranean Gas forum, an intergovernmental organisation set up by Egypt, Israel, Cyprus, Italy, Jordan, Greece and the Palestinian authorities in September, that seeks to promote natural gas exports from the eastern Mediterranean.

Source: The Economic Times

2 February: Poland adopted an energy strategy to 2040, which the Climate Minister Michal Kurtyka said would provide a compass as the country seeks to navigate away from coal. The document has been subject to numerous changes and delays as the government sought to align it with European Union (EU) climate policies and fend off opposition from powerful coal unions. But rising carbon emission costs and the impact of COVID-19 have forced the government to focus on strategic allocation of state funds to kickstart the economy. Poland gets the bulk of its electricity from carbon-intensive coal and it is the only EU state that has refused to pledge climate neutrality by 2050, saying it needs more time and money to complete the shift to zero emissions. Environmental campaigners said that the government’s strategy was inadequate and to prevent further temperature rises, the EU and Poland should stop burning coal before 2030.

Source: Reuters

1 February: China’s coking coal futures slumped to their lowest level in two months, dragged by weakening demand for the raw material and easing concerns over supply in the world’s top steel producer. The most-active coking coal contract with May expiry on the Dalian Commodity Exchange fell as much as 2.7 percent to 1,488.50 yuan ($230.48) a tonne, its lowest level since 1 December, stretching losses to a 10th consecutive session. The pressure on Dalian coking coal emerged from 19 January, following a report that China was considering allowing some stranded Australian coal shipments at its ports to be unloaded. China, which has a strained relationship with Canberra over trade, politics and the origins of the new coronavirus, did not allow any coal cargos from Australia to pass customs clearance in December. About 70 ships containing an estimated 6 million tonnes (mt) of Australian thermal and metallurgical coal were sitting off the coast of China waiting to unload, according to ANZ commodity strategists.

Source: Reuters

28 January: Anglo American has hired RMB, Morgan Stanley and Rothschild & Co to advise on the separation and listing of its South African thermal coal assets, as it aims to cut exposure to the polluting fuel. Anglo, listed in London and Johannesburg, is expecting to list its coal within two years. Anglo’s overall market capitalisation is around $47 bn. The value of its coal assets is unclear, as coal prices have surged in recent months and the COVID-19 pandemic has impacted previous estimates. The diversified miner said in May it preferred separating and listing its thermal coal operations on the Johannesburg Stock Exchange. For years, coal assets were seen as an easy way to generate cash and selling them was always sensitive in South Africa where they employ many people and provide for most of the country’s power needs.

Source: Reuters

29 January: Germany may need to double its renewable energy capacity by 2035 as Europe’s biggest economy goes electric in heating, transport and other sectors, grid operators said. Presenting their capacity planning through to 2035, the four high voltage transmission grid firms said that Germany will need to have renewable power capacity of between 233 GW and 261 GW by 2035, compared with just under 130 GW recently forecast for end-2021. Germany needs to meet a target of renewable energy sources contributing at least 65 percent of power output in 2030 as part of the country’s overall goal to cut CO2 (carbon dioxide) emissions by at least 55 percent compared with 1990 levels by that date.

Source: Reuters

29 January: Italy’s Enel sees more opportunities for its renewable energy business in the US (United States) where prospects have improved with the arrival of the Biden administration, Enel Green Power Chief Executive Salvatore Bernabei said. Enel aims to add a further 1 GW of green capacity in the US this year and opportunities could include new power purchase agreements with corporations, he said. Since taking office, President Joe Biden has signed a raft of measures to combat climate change, as he pursues green policies he bills as a boon for job creation. Bernabei said Enel Green Power was also planning to grow in Europe, especially in Italy, Spain and Romania. The group is monitoring Germany and France but there are no short-term plans there. Enel is planning to spend around €70 bn ($85 bn) on renewable energy by 2030, almost tripling its fully-owned capacity.

Source: Reuters

27 January: Inpex Corp, Japan’s biggest oil and gas producer, said it is targeting net zero carbon emissions by 2050 through the expansion of renewable and hydrogen energy as well as the use of carbon capture technology. The move comes after Japanese Prime Minister Yoshihide Suga pledged to make Japan carbon-neutral by 2050 and with global oil and gas companies shifting away from fossil fuel to green energy. Inpex plans to fully offset carbon emissions from its own oil and gas production and the energy it uses by 2050. It also aims to reduce its net carbon intensity by 30 percent by 2030 compared to the level in 2019. Mitigation would rely on offsetting emissions such as tree planting or carbon capture technology, which has not yet reached commercial scale. At the same time, Inpex will its expand green energy assets such as renewable energy and hydrogen.

Source: Reuters

27 January: Spain has chosen 32 bidders out of 84 hopefuls to supply more than 3 GW of renewable power in projects that will generate over 2 billion euros in investments, its energy and environment ministry said. In the country’s first clean energy auction since 2017, home-grown power group Naturgy was picked to supply 235 MW. Madrid-based market newcomer Capital Energy was awarded 620 MW of wind capacity, a company source said, grabbing the lion's share of the one gigawatt reserved for wind. Italian renewable firm Falck clinched 40 MW of solar capacity. Naturgy’s allocation consists of 38 MW of wind power and 197 MW of solar photovoltaic capacity. Under its version of the national energy and climate plan required from all European Union countries, Spain aims to install 60 GW of capacity by 2030, reaching 74 percent of electricity generation from renewable sources and thereby cutting greenhouse gas emissions by a third from current levels.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.