-

CENTRES

Progammes & Centres

Location

The budget (2024-25) and the economic survey (2023-24) cautiously support renewable energy (RE) sources, acknowledging climate change and the need for an energy transition. The economic survey, in particular, highlighted the trade-offs involved in increasing the share of RE. Under the fitting caption “successful energy transition is an orchestra”, the economic survey listed various challenges (i) resource dependence on hostile nations for critical minerals, (ii) technological challenges such as intermittency of power generation & ensuring grid stability, (iii) the opportunity cost of tying up land in a land-scarce country, (iv) fiscal implications of additional expenditures for subsidising RE generation and for e-mobility along with the loss of tax and freight revenue from fossil fuels, (v) impairment to bank balance sheets from ‘stranded assets’ and, (vi) examination of the merits of alternative mobility solutions such as public transportation and “many more” challenges that need to be overcome. Reading between the lines of both the budget documents and the economic survey, what India seems to be saying is that it will continue with investments in RE but it is sceptical of the romantic rhetoric that promote RE, as the cheapest source of energy that does not involve expensive trade-offs.

Among the many trade-offs identified by the survey is the cost of managing RE’s intermittency challenge. The survey notes that RE is intermittent and discontinuous, impacting grid stability in the absence of battery storage. It further states that increase in RE capacity may lead to a decline in base load efficiency as the supply composition changes, and that large-scale phasing-in of RE poses several risks associated with intermittency and dispatchability in the energy system. In a footnote, the survey clarifies that risk reflects the potential inability of the energy system to deliver on its essential function – a reliable, stable, and sustainable supply of energy at affordable prices and social costs. The survey then unravels the concept of levelized cost of electricity (LCOE) of RE. Contesting the widely quoted view that solar energy is now cheaper (based on the LCOE metric) in many countries compared to fossil fuel-based alternatives, the survey observes that the LCOE metric may be useful for investors who have the narrow focus on return on investment but not necessarily for policy makers as they have to worry about total costs including social costs. LCOE represents the total cost of building and operating an RE generation asset per unit of electricity generated over an assumed lifetime. Investing in the project is viable if the LCOE is lower than the electricity tariff. But, LCOE ignores the cost of back up that is required to manage intermittency and dispatchability of RE systems. If the producer is not mandated to make the power dispatchable, then energy procurement at LCOE reflects an implicit subsidy for the producer. The survey proposes the use of round-the-clock (RTC) RE supply contracts that internalise risks related to intermittency and dispatchability.

With the use of backup, RTC-RE supply could potentially match the buyers’ energy demand curve. As pointed out by the survey, the tariff for RTC-RE is not necessarily lower than that of fossil fuel-based conventional power. Wind-solar systems connected to the interstate transmission system (ISTS), with assured peak power supply contracts signed by the solar energy corporation of India (SECI), were in the range of INR4.64/ kilowatt hour(kWh) to INR5.96/kWh. The survey notes that, in theory, combining wind and solar projects across space could produce dispatchable power, but this would mean navigating complex transaction costs, that include but not limited to long term power purchase agreements (PPAs) with many generators across states, availability of transmission, real time control of supply. The allocation for the solar sector has doubled from about INR73 billion to about INR163 billion, but roughly (about INR 62 billion) is allocated to the surya ghar programme that has to overcome significant financial, technological, and bureaucratic hurdles to succeed.

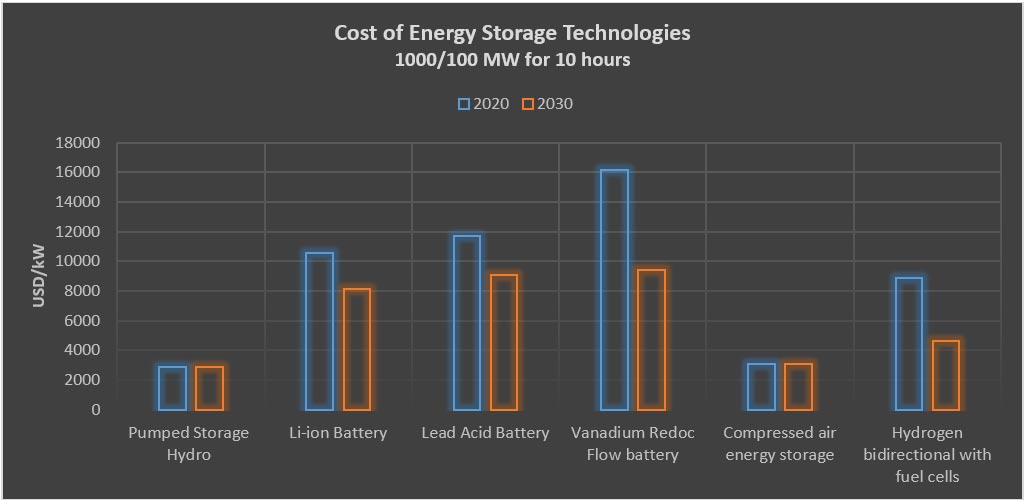

The sobering conclusion of the survey in investing in battery storage is that higher upfront costs, technology risks, longer payback periods, and limited access to critical and rare earth minerals required for battery storage technology pose serious challenges. The survey, therefore, recommends pumped storage-based energy storage solutions to reduce system costs and, in addition, have longer life than batteries. Resonating this sentiment, the budget speech stated that a policy for promoting pumped storage projects would be brought out for electricity storage, that would facilitate smooth integration of the growing share of RE, notwithstanding inherent limitations of intermittency and variability. The viability gap funding (VGF) for battery storage in 2024-25, of about INR160 billion, was roughly the same as that in 2023-24.

Many recent papers concur with the view expressed by the economic survey. An insightful analysis on the power outages experienced in the summer of 2024 shows that expansion of RE-based power at the expense of conventional thermal power generation increased peak shortages, as RE power could not meet peak demand that occurred after sunset. Another recent (2024) paper on tariff shocks arising from the increase in RE generation cites examples from Germany, the Netherlands, and Spain where the cost of grid integration of RE, that runs into several billion Euros, was passed on to retail consumers. The paper also shows that as the share of RE rises in the Indian grid, thermal plant load factors (PLFs) will fall, and fixed costs for each plant will be spread over fewer kWhs of power generation increasing the per kWh cost. With the increase in fixed costs, distribution companies (discoms) will be forced to source fewer kWhs of electricity for the same outlay for power purchases. The counter-argument made is that discoms can purchase cheaper kWhs from RE generators. Howerver, the problem is that the weighted (time and space or when and where) average variable cost of RE is not necessarily equal or lower than the weighted average variable cost of thermal power. Based on tariff orders for Andra Pradesh, Uttar Pradesh and Maharashtra, the paper shows that the variable cost of RE purchase is higher. At an all-India level, the paper estimates that additional cost of RE purchase ranges from a minimum of INR 0.80/kWh to a maximum of INR2.34/kWh. The paper lists integration costs that include (i) additional cost liabilities due to power purchase from RE sources to replace PPAs for coal-based power, (ii) greater cost of thermal flexibility and cycling, (iii) retrofit cost of grid integration such as deviation settlement mechanism and standby power, (iv) costs of additional transmission infrastructure for RE power evacuation, (v) cost of stranded assets. Overall, the conclusion of the paper, co-authored by members of state electricity regulatory commissions (SERCs), are in line with the conclusions of a 2015 paper that theoretically estimated integration costs based on the market value of electricity for balancing, flexible operation of thermal plants, and reduced use of capital stock in infrastructure, are too high to be ignored at high RE penetration levels.

Another trade-off discussed in the survey is the competition for land and water for energy production and food production. It observes that land requirement is highest for RE and quotes figures of 1-1.5 hectares of land per megawatt (MW) of solar photovoltaic (PV) capacity. Given that land availability per person is lowest in India among G20 countries, access to land for food security and energy security will be contested.

Other risks discussed in the survey include the growth in import of critical minerals, China’s control over critical mineral processing, and access to finance. In the context of import dependence, it is hard to disagree with the conclusion that when India’s high dependency on imports for petroleum shifts to high import dependency for Solar PV panels and critical minerals, the risks to supply chain disruption and geopolitics may be even trickier.

The survey quotes the study by Indian Institute of Management Ahmedabad (IIMA), with support from the Nuclear Power Corporation of India Limited (NPCIL) and the Office of the Principal Scientific Advisor to the Government of India, that coal phase-down in India, will be heavily dependent on the import of critical minerals required for RE and battery storage unless the country invests in the development of technologies based on domestically available mineral resources and those that enable the reuse, recovery, and recycling of critical minerals. The implicit suggestion is probably that a stronger focus on nuclear power would offer greater energy security and lower carbon emissions.

The war over Ukraine, which brought energy security to the forefront, the summer peak electricity demand that called for increasing coal and gas-based electricity generation despite dramatic RE capacity additions, the rhetorical flourish on RE affordability and technological simplicity that appears to be far removed from reality, the material challenge of the energy transition that imposes import dependence for critical minerals, the geopolitics of new energy supply chains, the set back for carbon emission reduction mandates in Europe, and the overall political backlash over top-down mandates for carbon reduction in many affluent countries do justify a review of carbon reduction policies that have taken precedence over development priorities. However, among the key drivers of change – policy driven incentives and disincentives, demographic change, consumer choice or behaviour and technology – technology is likely to make the fastest progress in both reducing costs and in reducing complexities as history has shown. It is wise to keep in mind that policies that appear to be the right thing to do today may appear inadequate or irrational tAFomorrow.

Source: Pumped Storage Hydropower Capabilities and Costs Capabilities, Pumped Storage Hydropower International Forum, 2021

Imports

According to B2B e-commerce company Mjunction Services Ltd, India’s coal import rose by 13.2 percent to 26.10 million tonnes (MT) in April 2024 as buyers took fresh positions amid early onset of summer. The country had imported 23.05 MT of coal in the year-ago period. Of the total import in April, non-coking coal import stood at 17.40 MT against 15.15 MT in the year-ago month. Coking coal import was 4.97 MT against 4.77 MT. Coal imports in April were up by 8.93 percent as against March when imports stood at 23.96 MT. India’s coal import rose by 7.7 percent to 268.24 MT in FY24 driven by softness in seaborne prices and likelihood of increase in power demand during summer. The country’s coal import was 249.06 MT in FY23.

The supply of the coking coal from Adani Gangavaram port to Visakhapatnam Steel Plant finally resumed. The imported coal owned by the plant was stocked at the port since 12 April due to strike by the port’s workers. Visakhapatnam Steel Plant employees take out a rally seeking release of coking coal from Adani Gangavaram Port. Another coking coal vessel will arrive from the United States to Visakhapatnam on 22 May. One more 75,000 metric tonnes of coal-laden vessel from Indonesia is yet to arrive. The non-supply of coal crippled the plant’s operations during this period.

Demand

With the summer heat reaching record highs in northern India in May, Indian Railways ferried 9.3 percent more coal than last year, and freight volumes for all commodities on the railway network grew 3.9 percent in the previous month, according to government data. A total of 139.16 MT of freight was loaded in May 2024 compared to 128.3 MT in April, up 8.46 percent month-on-month. The coal ministry has not been able to improve its volumes for most commodities over last year. It has a target of achieving 3,000 MT of freight by 2030, for which it would need to double its freight volume at a rapid pace. Meanwhile, it also saw higher passenger movement on account of the recently ended Lok Sabha elections and summer rush, for which the Railways is running 10,000 additional trains.

Coal ministry has set an ambitious target of 1,080 MT of coal production during the financial year (FY) 2024-25. As per the ministry, this target builds on the strong foundation laid in the previous two years, where production witnessed a compounded annual growth rate (CAGR) of over 13 percent. Coal India Limited (CIL), the state-owned mining giant, is expected to contribute a significant portion of the target, at 838 MT, Singareni Collieries Company Limited (SECL) is projected to produce 72 MT. Captive and other mines are anticipated to contribute the remaining 170 MT. The ministry is placing a strong emphasis on ensuring the quality of coal supplied to consumers. It has set an even more ambitious target of achieving 80 percent grade conformity in FY25. In 2023, over 76 percent of samples reportedly met the declared grade, leading to substantial revenue savings for coal companies. To enforce these quality standards, a ranking system for coal mines based on grade conformation parameters has been developed. Additionally, flying squads from the Coal Controller Organization (CCO) conduct random inspections to collect samples and verify coal quality. The ministry is also pushing for mechanised coal handling infrastructure. As of last year, only 16 percent of the total dispatch by CIL was handled through mechanised means. This year, the target will increase to 35 percent. Finally, the ministry has undertaken a digitisation initiative. This includes equipping all coal transport vehicles with GPS devices, implementing RFID technology for boom barriers, automating weigh bridges, and installing a comprehensive CCTV network connected to a central command center. The ministry achieved its target of over 1 BT for FY24, exceeding it by a week. CIL is expected to contribute a major portion of the target at 838 MT, Singareni Collieries Company (SECL) is projected to produce 72 MT.

Governance

According to a report by coal ministry, India’s coal and lignite Public Sector Undertakings (PSUs) have succeeded in transforming approximately 50,000 hectares of barren land in and around coal mining regions into green forests that have the potential to absorb 2.5 MT of carbon dioxide a year. The initiative is expected to further contribute to the augmentation of India’s green cover, thereby aiding in the fulfilment of India’s Nationally Determined Contribution (NDC) target of achieving a carbon absorption capacity of 2.5 to 3.0 billion tonnes (BT) by the year 2030.

Adani Group’s market capitalisation regained US$200 billion (bn)-mark (INR16.9k bn) after its listed firms gained INR113 bn as investors reposed faith on the company denying any wrongdoing in supply of coal to Tamil Nadu power company. The quality of the coal was independently tested at the point of loading and discharge, as well as by customs authorities and Tamil Nadu Generation and Distribution Company (TANGEDCO) officials. It went on to state that the vessel cited in the report to have carried the coal in December 2013 had in fact not been used for shipping coal from Indonesia before February 2014.

China

China’s imports of Australian coal in April rose to the highest level since July 2020, General Administration of Customs data showed, because of improving trade relations and tariff advantages. The country imported 7.19 MT of Australian coal last month, according to data. That represents a 25 percent increase from the same month of 2019, before a years-long unofficial ban on Australian coal imports.

Russia & Central Asia

Russia has announced plans to export coal to India using Iran’s railways. This announcement was made during the BRICS transport ministers’ meeting at the 27th St. Petersburg International Economic Forum (SPIEF). Russia will use the International North-South Corridor (INSTC) to send coal to India. Igor Levitin, Russia’s presidential aide, stated that the first coal shipments will travel through Iran and Bandar Abbas before reaching India. Mehrdad Bazrpash, Iran’s Minister of Roads and Urban Development, emphasized the importance of the INSTC in enhancing transportation and transit among BRICS countries. In a meeting with Iran’s Ambassador to Russia, Kazem Jalali, Levitin reiterated that the first coal wagons would transit through Iran and Bandar Abbas en route to India. Both sides discussed cooperation, particularly the Rasht-Astara Railway construction project. This project is crucial for improving transportation links between Iran and Russia. In 2023, Russia transported 600,000 tonnes of freight through Iran. This volume is expected to rise to 4 MT per year in 2024. This significant increase underscores the importance of the INSTC for regional trade and cooperation. Through these efforts, Russia aims to strengthen its trade links with India, utilizing Iran’s strategic location and railway network to facilitate efficient coal exports.

Africa & Middle East

South Africa is in talks with groups helping to fund its switch to a greener economy about delaying the closure of some coal plants as it battles to boost power supplies. Africa’s most industrialised country became the poster child for the global energy transition when developed economies including Britain, the European Union (EU) and the United States (US) together pledged US$8.5 bn at UN climate talks in 2021 to help South Africa cut emissions and move away from coal. But keeping the lights in a struggling economy while shutting down some old coal-fired plants supplying most of South Africa’s electricity needs has proven a tough task, forcing Eskom to delay commitments to shutter at least three power stations before 2030.

Rest of Asia Pacific

Lights are off and air conditioning is down at the headquarters of Vietnam’s state-run electricity provider EVN as the country's top power utility tries to "lead by example" to avoid a repeat of last year’s crippling blackouts. Vietnam is pursuing a patchwork agenda of energy-saving measures, grid upgrades, regulatory reforms and a massive increase of coal power as it seeks to avert electricity shortfalls, according to government data. In the short term, Vietnam is banking mostly on coal to provide enough reliable electricity. It may signal a blow to the country’s commitments to reduce reliance on fossil fuels. Coal use rose massively in the first five months of 2024, with coal-fired power plants accounting on average for 59 percent of electricity output, exceeding 70 percent some days, according to EVN data. That was up from nearly 45 percent in the same period last year and 41 percent in 2021, when Vietnam began drafting plans to cut coal that persuaded international donors to commit US$15.5 bn to help phase out the fuel.

North & South America

The Biden administration proposed an end to future coal leasing on federal lands in Montana and Wyoming’s Powder River Basin, the nation’s most productive coal-producing region, in part because of the sector’s emissions that worsen climate change. The two proposals from the US Bureau of Land Management (BLM) respond to a 2022 federal court order requiring the agency to analyze the climate and public health impacts of burning fossil fuels in its land use plans for the areas. The plans would not affect existing leases, and production would continue at mines in Wyoming until 2041 and in Montana until 2060, BLM said. The sharp decline in coal production in the region since its peak in 2008. Powder River Basin mines produced 258 million short tons of surface coal in 2022, down from 496 million in 2008, according to the Energy Information Administration (EIA). Wyoming accounts for most of that production. Most Powder River Basin coal is used for electricity generation. EIA projects that by 2050, US coal-fired generating capacity will be less than half of 2022 levels as the nation shifts to cleaner sources. The decision marked a win for environmental groups that sued the agency to stop new coal leasing in the region.

23 June: Retail prices of petrol in three metros — Mumbai, Kolkata, and Chennai — are ruling above INR100 a litre and in Delhi over INR90 for at least three years. Similar is the case with diesel, which is above INR90 in Mumbai, Kolkata, and Chennai, and more than INR85 in Delhi. This could be lowered to some extent if these fuels are brought under goods and services tax (GST), an idea the Centre is in favour of. However, the recently held GST Council meeting took the decision to streamline rates on certain products

19 June: India’s oil ministry made a show of record profitability of state oil marketing companies last fiscal — a performance that had more to do with geopolitics and some luck with global crude oil prices than with management or the government — but the noise generated failed to bury a poor fourth quarter and uncertain prospects moving forward. Moreover, such profits would not have been possible if state oil companies had stopped making supernormal margins on selling fuels, and had passed on lower costs from crude sourcing to Indian motorists.

24 June: Asia’s imports of liquefied natural gas (LNG) are expected to dip slightly in June from May, with strength in India holding up the top-buying region's appetite for the super-chilled fuel. Asia is on track to import 23.18 million metric tonnes of LNG in June, down a touch from May’s 23.55 million, but up 8.9 percent from the 21.28 million from June last year, according to commodity analysts Kpler data. The real action in Asia’s LNG market is in India, the continent’s fourth-largest importer, which is slated to see arrivals of 2.72 million tonnes in June, the second-highest on record and up from May’s 2.46 million. The June imports are also 54 percent higher than the 1.77 million tonnes from the same month in 2023, and first half imports of 13.71 million are almost one-third above the 10.44 million from the same period last year.

23 June: After spending close to US$1.2 billion and seven years of little success, Oil and Natural Gas Corporation (ONGC) is seeking partners to rescue the Deen Dayal gas field in the KG basin in Bay of Bengal. The field has produced negligible quantities of gas since ONGC in January 2017 acquired Gujarat State Petroleum Corporation (GSPC)’s 80 percent interest in the KG-OSN-2001/3 block off the east coast of India. The block contains the Deen Dayal West (DDW) gas/condensate field which was discovered by GSPC almost two decades back. The Gujarat government company had showcased the field as a promising prospect when it sold its stake to ONGC in order to cut its debt. The field, which was initially said to hold up to 20 trillion cubic feet of in place gas reserves - by far the biggest in any deepsea field in the country - but later trimmed to a tenth, has proved to be tougher than anticipated.

22 June: CNG (compressed natural gas) price in Delhi and adjoining cities was hiked by INR1 per kg following a drop in the supply of subsidised input natural gas. Indraprastha Gas Ltd (IGL), the firm that retails CNG automobiles and piped cooking gas to households in Delhi and adjoining cities, announced the hike in rates on its website. In New Delhi, CNG will cost INR75.09 per kg, up from the previous rate of INR74.09. In Noida, Greater Noida, and Ghaziabad, the price has increased to INR79.70 per kg from INR78.70 per kg. IGL did not give reasons for the increase but sources said the hike was warranted because the firm now has to buy more imported gas following a drop in domestic supplies. Natural gas pumped out of the ground and seabed is turned into CNG for running automobiles. But supplies from ONGC’s domestic fields have not kept pace with the CNG demand. Gas from ONGC fields make up for 66-67 percent of CNG demand of IGL. The rest has to be imported. In Ajmer, Pali, and Rajsamand in Rajasthan, CNG prices have been increased to INR82.94 per kg from INR81.94 per kg by IGL. CNG prices have also increased in Rewari, Haryana, as well as Meerut, Muzaffarnagar, and Shamli in Uttar Pradesh -- towns serviced by IGL.

21 June: Oil and Natural Gas Corporation (ONGC) and Indian Oil Corporation (IOC) have signed an agreement to set up a small-scale liquefied natural gas (LNG) plant near the Hatta gas field in Madhya Pradesh. The Memorandum of Understanding (MoU) was signed on 17 June, ONGC said. It has a gas discovery in the Vindhyan basin. Gas from it will be converted into liquefied natural gas (LNG) for transportation by trucks to consumers.

25 June: Indian imports of Russian coal have declined while US (United States) shipments have risen in the three months ending in May, data from coal consultancy Bigmint showed, which traders attributed to Russian supplies becoming less competitive. Russia’s exports of all types of coal to India over the period fell 22.4 percent from a year earlier to 6.76 million metric tonnes, Bigmint’s data showed. US exports rose 14.4 percent to 6.68 million tonnes in the same period. The decline in Indian imports of Russian coal was driven by a 67 percent plunge year-on-year in shipments of thermal coal, used mainly for power generation. Purchases of steelmaking grades such as coking coal, anthracite and pulverized coal injection (PCI) coal rose during the period, the Bigmint data showed. India is Russia’s second-largest coal market after China and the decrease follows fresh western sanctions on Russia because of the war in Ukraine.

24 June: Eastern Coalfields Limited (ECL) will conduct a pilot project for underground coal gasification (UCG) at the Kasta coal block in Jamtara District, Jharkhand. The project is expected to help in promoting the usage of coal gasification technology in the coal sector. The coal ministry said that the project will provide a significant advantage by providing access to coal resources that are not economically viable through traditional mining methods. The initiative is also expected to create employment opportunities and promote sustainable development.

22 June: The coal ministry put up 67 coal mines for auction across eight states, including Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Maharashtra, Odisha, West Bengal and Telangana. Union Minister of Coal and Mines, G Kishan Reddy, launched the 10th tranche of commercial coal mine auctions in Hyderabad. The tranche includes mines that are both fully explored and partially explored and three coking coal mines. The ministry has taken a series of reform measures to ensure that the coal sector grows at a rapid pace and meets the country’s energy needs. He emphasised the critical role of coal as the lifeline for all industries and its pivotal contribution to achieving a US$5 trillion economy. He stressed that all coal entrepreneurs should collaborate towards the nation’s development and align with the vision of Prime Minister Narendra Modi of making India ‘Aatmanirbhar’ in coal by making collective efforts and reducing the dependency on coal imports. He reiterated the importance of enhancing domestic coal production for India’s economic growth.

21 June: Rajasthan will receive 4 lakh metric tonnes (approximately 100 rakes) of coal that was stuck in the washeries of Chhattisgarh, the chief minister’s office (CMO) said. This coal will increase the reserves in the state’s power plants, ensuring adequate electricity for the public, the CMO said. The coal supply will provide temporary respite to the thermal plants in the state as 1 lakh metric tonnes are required daily to meet the power demand, the CMO said. Rajasthan State Power Generation Corporation had awarded Aryan Coal Beneficiation India Limited (ACBEL) in Korba, Chhattisgarh, a five-year contract to supply coal from SECL’s mine to the Suratgarh and Chhabra thermal power plants. However, in July 2022, ACBEL’s washeries were sealed due to joint actions by Chhattisgarh’s state tax (GST) department, mineral department, revenue department, and environment department, causing about 4 lakh metric tonnes of Rajasthan’s coal to be stuck in the washeries.

20 June: The Telangana government urged the Centre to allocate all the coal blocks located near Singareni Collieries to the state-run mining company without going through the auction process. Coal production is now going on in about 40 mines, and about 22 coal mines will have to be closed down by 2032-33 as coal would be exhausted there, Telangana Deputy Chief Minister Mallu Bhatti Vikramarka said. There are estimates that the coal production would fall to 17.28 million tonnes (MT) by 2060 from the 70 MT at present, he said. Singareni has to acquire new coal mines in the interest of its future, he said.

19 June: India will add more new coal power capacity than it has in almost a decade this year, as the country rushes to deploy generation to cope with surging electricity demand. India said last year that it plans to add close to 90 gigawatt (GW) of coal-fired capacity by 2032, lifting a forecast from just months before by more than half. The country has 28.5 GW of coal power currently being built and more than 50 GW that are planned to be awarded for construction over the next three years.

23 June: With the increasing investments in the state, the Uttar Pradesh (UP) government on the directives of Chief Minister (CM) Yogi Adityanath is planning to increase power generation by about 5,255 megawatt (MW) through 10 new thermal power plants over the next three years. The UP government is working towards making the state self-reliant in power generation. Additionally, by 2030, the expansion of three existing units in the state will add 5120 MW of additional power production. The Yogi government also aims to boost the state’s power generation capacity by 5120 MW by 2030. This summer, the state’s electricity demand exceeded 30,000 MW. Power was purchased from other states and the private sector to meet this demand and fulfil the commitment to providing 24-hour electricity.

19 June: As Delhi continues to reel under the severe heatwave, massive consumption led to the capital’s power demand hit its all-time high once again. Delhi’s peak power demand on 19 June reached a record level of 8,656 megawatt (MW) in the afternoon, discom (distribution company) said. The peak power demand of Delhi was recorded at 8,647 MW, 18 June. According to the real-time data of State Load Dispatch Centre (SLDC) Delhi, the peak power demand reached 8,656 MW. Delhi’s peak power demand clocked 8,000 MW for the first time on 22 May 2024 after which it has breached the 8,000 MW level nine times. The peak demand of the city has been above 7,000 MW for 31 days in a trot, discom said. The discom said that air conditioners accounted for the near majority of the power demand, as they account for a whopping 30-50 percent of a household and commercial establishment’s annual energy costs.

25 June: India’s nuclear power generation capacity is likely to rise by around 70 percent over the next five years, reaching 13.08 gigawatt (GW), with the installation of seven new nuclear reactors, Union Minister Jitendra Singh said. India currently has 24 nuclear reactors. He reviewed ongoing projects and issued directives for upcoming units. He said the department has been developing a 220 MW pressurized heavy water reactor (PHWR), utilising the Bharat Small Reactor (BSR), for captive nuclear power generation. He also highlighted ongoing efforts on the 220 MW Bharat Small Modular Reactor (BSMR), which seeks to replace the Calandria with a pressure vessel using light water-based reactors.

24 June: Waaree Energies said it has secured a solar module supply contract for a 412 MWp (megawatt peak) project in Rajasthan. It will supply bi-facial solar modules with capacities ranging from 540-545 Wp (watt peak) each for the project, expected to be commissioned by March 2025, Waaree Energies said. Waaree Energies is among India’s leading manufacturers of solar photovoltaic (PV) modules.

24 June: The Power Transmission & Distribution (PT&D) vertical of Larsen & Toubro (L&T) has won a domestic order to build a grid-connected 185 megawatt (MW) Solar PV (photovoltaic) Plant along with a Battery Energy Storage System (BESS) having multitudes of MWh capacity. According to the company’s project classification, the value of the order ranges between INR10 billion to INR25 billion. The Solar PV plant at Kajra in Lakshisarai district will be a key element in Bihar’s plans to harness renewable energy for sustainable energy solutions towards combating climate change and meeting demand growth.

24 June: Punjab Power Minister Harbhajan Singh ETO announced the recommissioning of the 10 megawatt (MW) biomass-based power plant in Jalkheri village of Fatehgarh Sahib, highlighting its environmental and economic benefits for the state. Owned by the Punjab State Power Corporation Limited (PSPCL), the plant was originally commissioned in June 1992 and remained operational till July 1995. It was given on lease to Jalkheri Power Plant Limited (JPPL) in July 2001. The plant was recommissioned in July 2002 and remained operational till September 2007. In 2012, efforts were made to restart the project by licensing a private developer to run it for a specific period by giving it on lease. In 2018, the plant was re-tendered to be leased out.

21 June: India’s consumption of fossil fuels increased by 8 percent in 2023, accounting for almost all of the growth in demand and representing 89 percent of total consumption, according to a report. For the first time, India used more coal than Europe and North America combined, according to an Energy Institute (EI) report. The report suggests that five major stories emerge from the data in 2023. The first one is that there will be a record amount of energy consumed worldwide, with coal and oil pushing fossil fuels and their emissions to new highs. They were at 81.5 percent of the total mix, which was slightly lower than the 82 percent they had last year. Emanations from energy expanded 2 percent, surpassing 40 gigatonnes of CO2 interestingly. Sun based and wind push worldwide renewable electricity generation to another record level. It said that renewable generation, excluding hydro, increased by 13 percent to a record-high global level of 4,748 terawatt hour (TWh).

20 June: Thermal plant load factor or capacity utilisation is expected to remain healthy at 70 percent in FY2025 on power demand growth of 6 percent, rating agency ICRA said. ICRA’s outlook for the thermal power segment is "Stable", following the improvement in the thermal plant load factor (PLF) and healthy demand growth, thereby improving visibility on signing of new power purchase agreements (PPAs), ICRA said. According to the ICRA, ICRA projects the all-India thermal PLF level to rise marginally to 70 percent in FY2025, from 69 percent in FY2024, led by the growth in electricity demand and limited thermal capacity addition. The healthy growth in electricity demand over the past three years has necessitated a rethink on thermal capacity addition, with the government looking to encourage new thermal power projects, including private sector participation, ICRA said. ICRA expects the generation capacity addition to increase to 30 GW in FY2025 from 25 GW in FY2024, with the overall installed power generation capacity surpassing 470 GW by March 2025. The thermal segment is expected to add 5.0-5.5 GW capacity in FY2025, with the balance 25 GW contributed by the renewable energy (RE) segment, ICRA said.

19 June: The Union cabinet, chaired by Prime Minister (PM) Narendra Modi, approved the Viability Gap Funding (VGF) scheme for offshore wind energy projects, with a total outlay of INR74.53 billion. The VGF scheme is a major step towards implementing the National Offshore Wind Energy Policy, which was notified in 2015. The commissioning of 1 GW offshore wind projects, upon successful completion, is expected to generate approximately 3.72 billion units of renewable electricity on an annual basis. This clean energy production will contribute to a significant reduction in greenhouse gas emissions, amounting to 2.98 million tonnes of CO2 equivalent per year, over a span of 25 years. Moreover, the implementation of this scheme will serve as a catalyst for the development of offshore wind energy in India

22 June: Nigerian energy firm Aiteo has resumed production after stopping an oil leak at its nearly 50,000 barrels per day (bpd) Nembe field in southern Bayelsa state, the company said. Aiteo, which runs a joint venture with state oil company NNPC Ltd, had said the leak was reported during routine operations in the Nembe area, a heavily polluted region after decades of spills that have hurt farming and fishing. The Nembe Creek facility is the largest of 11 fields under an oil mining lease operated by Aiteo, which also produces significant natural gas that supplies the Nigerian liquefied natural gas (LNG) plant at Bonny Island.

24 June: European Union (EU) countries adopted a 14th package of sanctions on Russia that aims to close some loopholes and hits Russia’s gas exports for the first time, EU foreign ministers said. Western powers imposed sweeping sanctions on Moscow after Russia launched a full-scale invasion of Ukraine in February 2022, which have been progressively ramped up since. The new restrictions on gas aim to reduce Russia’s revenues from liquefied natural gas (LNG) exports by banning trans-shipments - transferring cargoes from one ship to another - off EU ports and a clause allowing Sweden and Finland to cancel some LNG contracts. The measures stop short of an EU ban on LNG imports, which have risen since the start of the war. The sanctions will take effect after a nine-month transition period. The package also prohibits new investments and services to complete LNG projects under construction in Russia. Gas market experts say the measure will likely have little impact as Europe still buys Russian gas itself and trans-shipments via EU ports to Asia represent only around 10 percent of total Russian LNG exports.

19 June: Owners of a US$10 billion liquefied natural gas (LNG) project that has stalled with the bankruptcy of its main contractor are asking a court to immediately oust Zachry Industrial from the project. Zachry, which held the lion’s share of the contract to build Golden Pass LNG, filed for Chapter 11 bankruptcy after suffering enormous cost overruns, and said it was pursuing a "structured exit." Golden Pass LNG, a joint venture between QatarEnergy and Exxon Mobil asked a US (United States) bankruptcy court late on Tuesday to sever Zachry’s US$5.8 billion contract within five days, or allow it to take possession and control of the facility, which is about 75 percent complete. The project, which was expected to start processing natural gas this year, has not updated its completion schedule.

20 June: China’s coal production has slowed slightly, after rapid growth in the last two years, as the energy supply situation has become more comfortable, allowing the government to focus on long-term structural changes. China’s mines produced 1,858 million tonnes of coal in the first five months of 2024, according to the National Bureau of Statistics data. Some imports are higher-quality specialist coals used for steelmaking, while others are lower-quality coals for power generation that landed at ports along the south and east coasts, far from the main coal-producing areas. Given constraints on the domestic rail network and the relatively high cost of transporting bulky coal overland it can be cheaper to import by sea from Indonesia and Australia for power generators in the south and east. Nonetheless, there seems to have been a real decline in demand for coal, after two years in which the government ordered flat-out growth to avoid any repeat of the fuel shortages and electricity scarcity in the autumn of 2021. In 2023, Shanxi was the top coal producing province, with output of 1,357 million tonnes (MT), and has experienced the greatest increase in output in recent years, up from 778 MT in 2016.

20 June: Russia launched a new barrage of missiles and drones at Ukraine in the early hours of, causing "significant" damage to a thermal power plant and maintaining pressure on the electricity grid. The attack on energy infrastructure in four regions damaged equipment, wounded seven workers and cut off electricity to more than 218,000 consumers, the energy ministry said. National grid operator Ukrenergo said the attack would lead to an increase in scheduled blackouts.

21 June: Europe has clocked a record number of hours of negative power prices this year due to a mismatch between demand and supply as solar power generation soars, potentially helping to shift investment to much needed storage solutions. Strong hydro and nuclear power generation has played some part in the oversupply, but Europe has seen a massive expansion of solar power. Installed solar capacity in the European Union more than doubled to 263 GW between 2019 and 2023, according to SolarPower Europe data. In 2023 alone, that is equivalent to an extra 306,000 solar panels being installed every day.

20 June: Global fossil fuel consumption and energy emissions hit all-time highs in 2023, even as fossil fuels' share of the global energy mix decreased slightly on the year, the industry’s Statistical Review of World Energy report said. Growing demand for fossil fuel despite the scaling up of renewables could be a sticking point for the transition to lower carbon energy as global temperature increases reach 1.5C (2.7F), the threshold beyond which scientists say impacts such as temperature rise, drought and flooding will become more extreme. Overall global primary energy consumption hit an all-time high of 620 Exajoules (EJ), the report said, as emissions exceeded 40 gigatonnes of CO2 for the first time. The report recorded shifting trends in fossil fuel use in different regions. In Europe, for example, the fossil fuel share of energy fell below 70 percent for the first time since the industrial revolution.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2024 is the twenty-first continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.