-

CENTRES

Progammes & Centres

Location

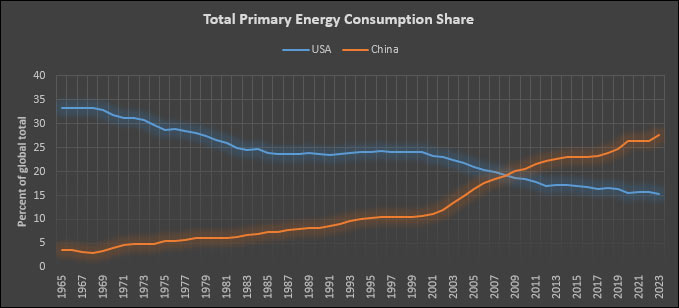

In 2003, primary energy consumption in China was 49 exajoules (EJ), the second largest, accounting for over 12 percent of total global primary energy consumption. Energy consumption in the US of just over 96 EJ, accounting for about 24 percent of the global total, making it the largest consumer. In 2023, China was the largest energy consumer with a consumption of over 170 EJ, accounting for over 27 percent of global total, followed by the US with a consumption of 94 EJ, accounting for over 15 percent of global consumption. The peak primary energy consumption of 95.4 EJ, recorded in 2022, in US which was roughly half of China’s primary energy consumption in 2023. China’s future choices in new energy (renewable energy) consumption and production will influence the energy consumption choices of the rest of the world in the future, but its geopolitical implications may be weaker than what popular narratives suggest.

Source: Statistical Review of World Energy

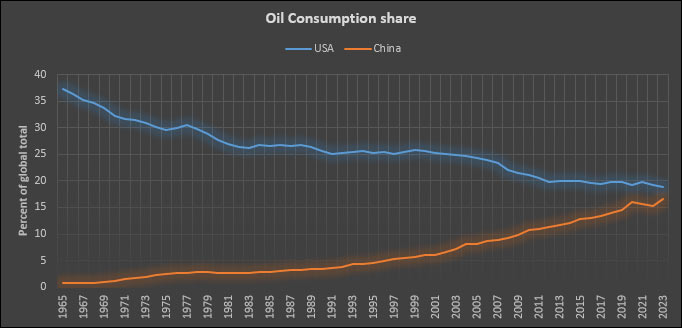

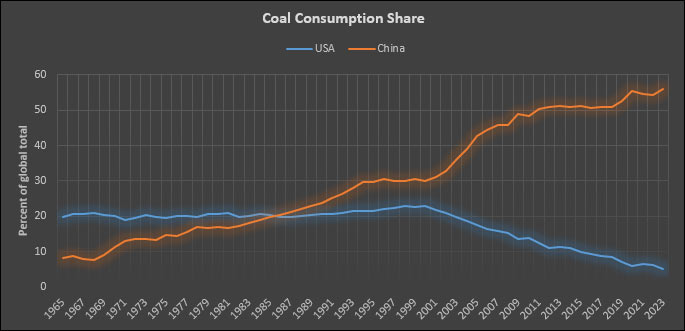

In 2003, coal consumption of 33.48 EJ accounted for about 68 percent of China’s primary energy consumption, while oil consumption of 11.52 EJ accounted for 23 percent, and natural gas consumption of 1.23 EJ accounted for about 2.5 percent of total consumption. Overall, fossil fuels accounted for about 94 percent of China’s commercial energy basket, with nuclear and hydropower accounting for the remaining 6 percent. The contribution of renewable energy (RE) was negligible. Two decades later, the share of coal in China’s primary energy consumption had fallen to about 54 percent, though coal consumption had tripled to 91.94 EJ, and the share oil consumption had fallen to 19 percent, while oil consumption had doubled to about 23.7 EJ. In the same period, consumption of natural gas had increased eleven-fold to 14.57 EJ, and its share in China’s primary energy basket more than quadrupled to about 8.5 percent. The share of nuclear energy more than tripled to over 2.2 percent, with a consumption of 3.9 EJ, and the share of RE increased from almost nothing to over 9 percent, with a consumption of 16.13 EJ, which was higher than the share of hydropower at 6.7 percent, representing a consumption of 11.46 EJ. Overall, the share of fossil fuels in China’s primary energy basket has fallen to about 82 percent in 2023.

Source: Statistical Review of World Energy

In 2023, China was the largest emitter of carbon dioxide (CO2), with energy related CO2 alone amounting to over 11 billion tonnes (BT), that was about 32 percent of global total compared to 4.6 BT by the US, the second-largest that accounted for about 13 percent of global total. This is despite the fact that China’s installed capacity of RE is an order of magnitude higher than most major economies across the world.

In 2023, RE consumption in China was 27.6 EJ, the largest globally, accounting for over 30 percent of global RE consumption. The European Union (EU) consumption was the second largest at 17.83 EJ, accounting for 19.8 percent of global total, and the US consumption of 10.99 EJ was the third largest, accounting for over 12.2 percent of global total. China’s power generation from RE, including hydro at 2894 terawatt-hour (TWh), was the largest in the world in 2023, accounting for over 32 percent of global total, while renewable power generation excluding hydro topped the list with the generation of 1668 TWh, accounting for 35.1 percent of global total in 2023. Generation of 885.9 TWh from wind accounted for over 35.6 percent of global total generation from wind in 2023, and generation of 584.2 TWh from solar accounted for 35.6 percent of global total in 2023. Installed capacity for solar and wind in China are more intimidating. In 2023, installed capacity of 441.895 GW of solar and 609.921 GW of wind energy accounted for about 43 percent of global total of each. To put this in perspective, India’s total installed capacity (fossil fuel plus non-fossil fuel based) for power generation was 446.189 GW in June 2024. According to the global energy monitor (GEM), 180 gigawatt (GW) of utility scale solar and 159 GW of wind power capacity is under construction in China. The combined capacity of 339 GW under construction is twice the capacity being installed in the rest of the World combined. If solar and wind capacity in the pre-construction and planned stages are included the total could exceed 1200 GW by 2030, fulfilling the EU call for tripling RE capacity by 2030.

Source: Statistical Review of World Energy

While aggregate quantitative figures for energy consumption by China are overwhelming, individual energy consumption figures, which are a proxy for economic status and quality of life, are underwhelming. In 2023, China’s per person energy consumption of 119.8 gigajoule (GJ) was lower than the Organisation of Economic Cooperation and Development (OECD) average of 166 GJ and lower than most countries with comparable climatic conditions in South East Asia such as Japan (141 GJ), Singapore (577 GJ) and South Korea (240 GJ). China is trying to close the gap between quantity and quality of energy consumption by pushing for continued economic growth at a time when the demographic dividend is declining sharply. In this context, returns to China’s investment in new energy technologies may be limited.

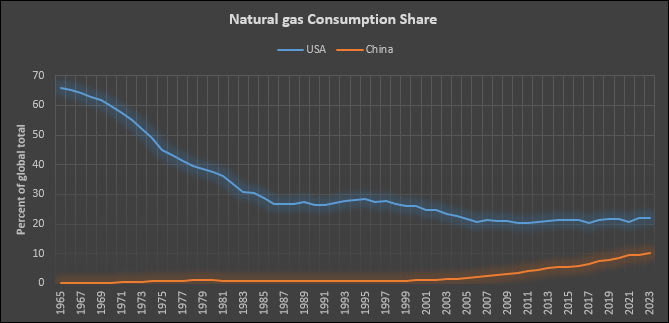

This contrasts with the time when the US became the dominant energy consumer. After the Second world war, the US population was predominantly young and the economy was going through post-war economic boom. Oil and natural gas production and consumption in US, as a share of global total when it was the dominant player, was higher than the share of production and consumption of new energy by China today. For example, in 1965, oil consumption in the US accounted for over 37 percent of global total, and most of the oil was domestically produced. Though the trade position of the US shifted from that of the largest net exporter of oil to that of the largest net importer in 1947, the US continued to produce more than one-half of the world's crude oil through the 1950s and 60s, which contributed to US energy security. Post-war availability of imported oil at nearly half the price of domestic supplies contributed to economic growth and introduced a foreign policy dimension in energy policy that gave the US unprecedented power over oil producers. In the early 1960s, the US accounted for over 65 percent of natural gas consumption, most of which was domestically produced. The domestic availability of cheap natural gas spurred industrial production and at the same time dramatically increased energy security.

In contrast, China’s dominance of the new energy value chain is driven by State policy and public funds rather than by natural resource endowment. The resource endowment that was behind the US dominance of energy production and consumption in the past could not be replicated, but China’s state led industrial policy that is behind its dominance of new energy sectors can be replicated, as illustrated by industrial policies being adopted in the US and the EU.

The geopolitical implications of China’s dominance over new energy technologies are likely to be far weaker than what dominant Western narratives suggest. On the other hand, China’s production of new energy technologies is likely to promote adoption of new energy technologies in countries that cannot afford industrial policies on the same scale as China, the US and the EU. Overall, the production of public goods (affordable new energy technologies) by China may far exceed its presumed production of public ‘bads’.

Source: Statistical Review of World Energy

Imports

India's crude oil imports increased by seven percent year-on-year (YoY) in April 2024 and the net import bill for oil and gas (O&G) hit US$12.3 billion (bn), compared to US$10.1 bn in the corresponding period last year. Out of this, the crude oil imports constituted US$13.0 bn, liquefied natural gas (LNG) imports were at US$1.1 bn and exports were US$3.7 bn during April 2024, according to the latest oil ministry’s PPAC (Petroleum Planning and Analysis Cell) data. Import dependence of crude oil was at 88.4 percent in April, slightly below from 88.6 percent in the year-ago period. India’s domestic crude oil production stood at 2.4 million tonnes (mt) in April 2024 - registering a growth of 1.6 percent compared to the year-ago period. Out of 2.4 mt, Oil and Natural Gas Corporation (ONGC) produced 1.6 mt of crude oil while Oil India Limited (OIL) and private sector producers contributed 0.3 mt and 0.5 mt, the oil ministry data showed. India’s total consumption of crude oil or petroleum products rose 0.8 percent in April to 21.6 mt. The consumption of petroleum products during April, with a volume of 19.9 mt, reported a growth of 6.1 percent compared to the volume of 18.7 mt during the same period of the previous year, PPAC data showed. Against this consumption, the production of petroleum products of the world’s third largest oil importing and consuming nation was 23.4 mt during April 2024 which is 3.9 percent higher than April 2023. Out of 23.4 mt, 23.1 mt was from refinery production and 0.3 mt was from fractionator.

Oil prices declined for a third day in a row in the international market, despite geopolitical tensions, as the US (United States) Federal Reserve is not expected to reduce interest rates any time because of the high inflation rate. Prices of the benchmark Brent crude have now come down to US$82.28 a barrel from close to US$84 a barrel. The US West Texas Intermediate (WTI) crude futures were trading at US$78.02 indicating the further softening of prices. Since India imports close to 85 percent of its crude requirement, the decline in oil prices reduces the country’s import bill and strengthens the rupee. The Government has also helped to cut the country’s oil import bill by allowing the oil companies to buy Russian crude at discounted prices despite the pressures from Western countries to stop these purchases in the wake of the Ukraine war. Russia has now emerged as the largest supplier of crude oil to India replacing Iraq and Saudi Arabia which occupied the top slot earlier. India has in fact become the largest purchaser of Russia’s seaborne oil which accounted for close to 38 percent of India’s total oil imports in April. In fact, India’s strategy of continuing to buy cheap oil from Russia has resulted in the saving of around US$7.9 bn in the country’s oil import bill during the first 11 months of the fiscal year 2022-23 and also helped the country to lower its current account deficit.

Russian crude supplies and lower international oil prices helped India to save over US$25 bn worth of foreign exchange in the year ended 31 March compared to 2022-23, although it imported almost similar quantities in the two financial years, according to government data. India imported crude oil worth US$132.40 bn in 2023-24 compared to US$157.50 bn spent in 2022-23. The country imported 232.7 mt of crude oil in 2022-23, which fell marginally by 0.08 percent to 232.5 mt, but savings in terms of value shot up about 16 percent. India’s average cost of various types of crude oil imports, called the Indian basket, in 2023-24 was US$82.58 a barrel, US$10.57 a barrel less than US$93.15 per barrel in the preceding fiscal year, the composition of the Indian basket represents an average of Oman and Dubai for sour grades, and Brent for sweet grade. Imports of petroleum products also saw a dip in terms of value from US$28.2 bn in 2022-23 to US$25.1 bn in 2023-24. Imports of petroleum products include LPG, naphtha, bitumen and fuel oil. Gross imports, which include both crude oil and petroleum products, also saw a declining trend in value terms, even as import quantities increased. While 277.3 mt of gross petroleum imports in 2022-23 were worth $184.4 bn, gross import in 2023-24 was 280.5 mt worth US$155.8 bn. India, one of the global crude oil refining hubs, exported products worth US$47.4 bn (62.2 mt) of total quantities to Africa and Europe in 2023-24 compared to $57.3 bn (61 mt) in 2022-23. With total installed refining capacity of 256.8 million metric tonnes per annum, India processed 261.5 mt in 2023-24, which was more than the target for 2023-24 (251.7) and output of 2022-23 (255.2 mt). India has about two dozen refineries owned and operated by both public and private companies. Indian Oil Corporation (IOC), Bharat Petroleum Corporation Ltd (BPCL) and Hindustan Petroleum Corporation Ltd (HPCL) are the three large state-run refineries. Private refiners are operated by Reliance Industries Ltd (RIL) and Nayara Energy. HPCL-Mittal Energy is a joint venture Hindustan Petroleum and the LN Mittal group.

Exports

After registering a drop of over 11 percent in April, India’s export of refined oil products regained momentum and rose marginally last month as the demand increased. The country exported 1.24 million barrels per day (bpd) of petroleum products in May, registering a marginal increase of 3.3 percent against 1.20 million bpd in April, ship tracking intelligence firm Vortexa data showed. Exports, however, remained largely unchanged from the corresponding period of last year at 1.25 million bpd. India primarily supplies petroleum products to countries in Europe and Asia. The country exports a variety of goods via the Red Sea including petroleum products. The country’s export of petroleum products fell by 14 percent in FY24 to US$84.14 bn compared to US$97.47 bn in FY23, according to government data. The slight uptick in the country’s exports also comes amidst rising domestic consumption of these petroleum products, majorly driven by growth in demand for diesel, aviation turbine fuel, and LPG. According to PPAC, the consumption of petroleum products grew by 6 percent to 19.9 mt in April. The country’s production of petroleum products has also seen a rise in the beginning of the current financial year, marking a rise of 4 percent to 23.4 mt in April compared with the same period of previous year. Even though India’s petroleum products exports may be marginally outpacing the overall outward shipments, imports of these items are rising. As a result, the country’s self-sufficiency in oil products has been witnessing a decline from 14.5 percent in 2011-12 to 12.6 percent in 2022-23, and further to 12.2 percent in FY24, PPAC data showed. In April, the country’s import of petroleum products registered an increase of 34.4 percent to 4.3 mt at US$2.1 bn, a 40 percent rise from April 2023. Exports, on the other hand, rose just by 9 percent on year to 4.8 MT at US$3.7 bn during the month. The country’s demand for petroleum products including jet fuel, diesel, LPG among others is likely to grow to 239 mt in the financial year 2024-25, as per estimates by PPAC. The country’s consumption of petroleum products stood at 233 mt last year.

Indian refiners' use of crude oil vessels to ship refined fuels such as diesel to key European markets has diminished in May after volumes neared two-year high levels last month, traders and analysts said. That is because rising inventories in the Antwerp-Rotterdam-Amsterdam region and shaky east-west diesel price spreads undermine the case for sellers to ship large volumes of the industrial fuel West. While more April shipments from India to Europe provided a floor for Asian margins, fewer such voyages in May will likely compel Indian refiners to shift diesel sales back to Asia, exacerbating a supply glut in the region, analysts and traders said. Traders have been among the biggest shippers of Indian-origin diesel, and they have the option for several discharge destinations and thus have room to ship using bigger vessels.

Reliance Industries Ltd (RIL) has sought access to pipelines and storages that public sector oil companies have built over the years for supplying jet fuel (ATF) from depots and oil refineries to airports, as it looks for a larger pie of fuel trade at some of Asia’s busiest airports. RIL, which produces a fourth of India’s aviation turbine fuel (ATF), wants access to storage depots outside the Delhi airport as well as to pipelines leading to Mumbai, Bengaluru, and Hyderabad airports. It currently supplies small volumes of ATF when compared with supplies made by state-owned firms. The firm made the suggestion in its comments to oil regulator PNGRB’s draft regulation calling for supply of ATF in all existing and future airports through pipelines that can be accessed by any supplier so as to bring in competition and cut fuel cost. While the fuel market is open, airplanes at the country’s busiest airports are fed by pipelines that were built by state-owned IOC, BPCL and HPCL over decades. Out of the 17.12 mt of aviation turbine fuel (ATF) produced by public and private sector refineries, 8.2 mt is consumed within the country and the rest is exported. RIL’s twin refineries at Jamnagar produce close to 5 mt of ATF, a large part of it is exported. ATF demand in India is growing in double digits as more people fly. It rose by 11.8 percent in the fiscal year ended 31 March 2024.

Production

The state-owned oil & exploration company, ONGC reported standalone net profit of INR98.69 bn (US$1.18 mn) in Q4 FY24, steeply higher than INR5.27 bn recorded in Q4 FY23. However, revenue from operations slipped 4.56 percent year on year to INR346.36 bn (US$4.15 bn) during the quarter. The company’s net crude oil price realization was US$80.81 per barrel (up 4.8 percent YoY) and gas price realization was US$6.50 per mmBtu (down 24.2 percent YoY) during the period under review. ONGC’s crude oil production grew by 2.4 percent year on year to 5.359 mt in Q4 FY24. ONGC is the largest crude oil and natural gas company in India, contributing around 71 percent to Indian domestic production. It has in-house service capabilities in all areas of exploration and production of oil & gas and related oil-field services. The Government of India held 58.89 percent stake in ONGC as of March 2023.

The government has slashed windfall tax on domestically produced crude oil to INR5,700 per tonne, from INR8,400 (US$100.6) per tonne. The tax is levied in the form of Special Additional Excise Duty (SAED). The SAED on the export of diesel, petrol and jet fuel or ATF, has been retained at ‘nil’. The new rates are effective from 16 May. India first imposed windfall profit taxes on 1 July 2022, joining a host of nations that tax supernormal profits of energy companies. The tax rates are reviewed every fortnight based on average oil prices in the previous two weeks.

Demand

According to data from PPAC, India’s oil consumption increased by 3.7 million tonnes (mt) (4.8 percent) in the first four months of 2024 compared with the same period in 2023. , Increased domestic consumption was equivalent to an extra 220,000 bpd, only slightly slower than growth of 235,000 bpd in the first four months of 2023 and 241,000 bpd in the same period in 2022. India is becoming one of the most important drivers of global petroleum consumption and expected to overtake China as the single most important source of growth by 2030. However, the switchover is still in the future. OPEC (Organization of the Petroleum Exporting Countries) predicts India will account for one-tenth of global growth this year, the second-highest share of any country, but still well behind almost one-third coming from China. Two-thirds of India’s petroleum consumption is attributable to just three products - diesel (39 percent), gasoline (16 percent) and liquefied petroleum gas (LPG) (13 percent). Households account for almost 90 percent of the country’s LPG consumption and it has almost entirely replaced kerosene in the last 20 years. Growth led by gasoline and LPG rather than diesel is consistent with other data showing the country’s economic expansion is being driven primarily by consumption rather than industrial deepening.

Two trains with petrol and diesel headed to Tripura amid a fuel crisis due to disruption in railway freight services in Assam’s Dima Hasao. The Tripura government started rationing petrol and diesel for two-wheelers, cars and commercial vehicles from 30 April.

Refining

The profit of the oil marketing companies (OMCs) will reduce in the FY25 amid the reduction in the Gross refining margin of the oil companies. The Gross Refining Margin (GRM) of Indian oil companies in FY23 was at US$16-18/ barrel (bbl), in FY24 the GRM of Indian Refiners moderated to an average of US$10 - 12/bbl. According to a report by CareEdge ratings, the GRM of oil companies will reduce further to USD 6-8 in FY25. According to the Ministry of Petroleum and Natural Gas, the combined profit of oil marketing companies for FY 2023-24 stood at INR860 bn (US$10.3 bn), over 25 times higher than the previous fiscal year.

World

The International Energy Agency (IEA) trimmed its forecast for 2024 oil demand growth, widening the gap with producer group OPEC (Organization of the Petroleum Exporting Countries) in terms of expectations for this year's global demand outlook. The divide between the IEA, which represents industrialised countries, and the OPEC sends divergent signals about oil market strength in 2024 and, over the longer term, about the speed of the world’s transition to cleaner fuels. Global oil demand this year will grow by 1.1 mn bpd, the Paris-based IEA said, down 140,000 bpd from the previous forecast, largely citing weak demand in developed OECD nations. The IEA said the lower 2024 forecast was linked to poor industrial activity and a mild winter sapping gas oil consumption, particularly in Europe, where a declining share of diesel cars was already undercutting consumption. OPEC stuck by its expectation that world oil demand will rise by 2.25 million bpd in 2024. The 1.15 million-bpd difference is about 1 percent of world demand.

Africa & Middle East/ OPEC+

OPEC+ agreed to extend most of its deep oil output cuts well into 2025 as the group seeks to shore up the market amid tepid demand growth, high interest rates and rising rival US production. Brent crude oil prices have been trading near US$80 per barrel in recent days, below what many OPEC+ members need to balance their budgets. Worries over slow demand growth in top oil importer China have weighed on prices alongside rising oil stocks in developed economies. The OPEC and allies led by Russia, together known as OPEC+, have made a series of deep output cuts since late 2022. OPEC+ members are currently cutting output by a total of 5.86 million bpd, or about 5.7 percent of global demand. Those include 3.66 million bpd of cuts, which were due to expire at the end of 2024, and voluntary cuts by eight members of 2.2 million bpd, expiring at the end of June 2024. OPEC+ agreed to extend the cuts of 3.66 million bpd by a year until the end of 2025 and prolong the cuts of 2.2 million bpd by three months until the end of September 2024. OPEC+ will gradually phase out the cuts of 2.2 million bpd over the course of a year from October 2024 to September 2025. OPEC expects demand for OPEC+ crude to average 43.65 million bpd in the second half of 2024, implying a stocks drawdown of 2.63 million bpd if the group maintains output at April's rate of 41.02 million bpd.

Iran has approved a plan to raise its oil output to four million bpd, the country’s Tasnim news agency said. An economic council headed by Iran’s interim president Mohammad Mokhber has approved a plan to raise the country’s oil output from 3.6 million barrels per day to 4 million barrels per day, Tasnim said. Iran is a major producer within the OPEC.

Saudi Arabia’s crude oil exports rose for the second straight month in March, reaching their highest in nine months, the Joint Organizations Data Initiative (JODI) data showed. Sources with knowledge of the matter have told Reuters that Saudi Arabia and its allies in the OPEC+ group could extend some voluntary output cuts if demand fails to pick up. Crude exports from the world's largest oil exporter increased 1.5 percent to 6.413 million bpd in March, up from 6.317 million bpd in February. The country’s crude production fell to 8.973 million bpd in March from 9.011 million bpd in the prior month. Data showed that Saudi refineries' crude throughput fell by 0.115 million bpd to 2.560 million bpd and direct crude burning declined by 53,000 bpd to 307,000 bpd in March.

Iraq is committed to voluntary oil production cuts agreed by the OPEC and is keen to cooperate with member countries on efforts to achieve more stability in global oil markets, Iraq’s Oil Minister Hayan Abdul Ghani said. Iraq had made enough voluntary reductions and would not agree to any additional cuts proposed by the wider OPEC+ producer group at its meeting in early June. He said that OPEC’s voluntary cuts are subject to agreement by its members.

Russia/Central Asia

Pipeline operators in Poland and Russia agreed on a solution that will allow Kazakh oil transit to Germany to continue, removing a risk that it would stop in June. Transneft warned Kazakhstan in April that its oil transit to Germany could stop due to an impasse in certifying oil flow meters in Poland, required by 5 June. Polish state-owned pipeline operator PERN had concerns it could breach Western sanctions against Russia. PERN, Russia’s state-controlled Transneft and Germany’s PCK Schwedt refinery agreed that a non-Russian company will service the oil flow meters on the Polish part of the Druzhba pipeline, sources in Poland, Germany and Russia said. Transneft operates the Druzhba oil pipeline, one of the world’s largest, capable of carrying 2 million barrels per day. Flows through Druzhba have dropped sharply since Russia’s invasion of Ukraine as the European Union refused to buy Russian oil. Kazakhstan pipeline operator Kaztransoil said that currently there are no limitations for shipping Kazakh crude oil to Adamowo base on the Polish section of the pipeline near Belarussian border.

Kazakhstan opened a thorny debate on OPEC+ production levels, saying it believed it should be allowed to pump more oil in 2025, when all current output cuts by the producer group are due to expire. Kazakhstan’s comments reported by Interfax come as OPEC+ met on 1 June. The group has also ordered a review of members' oil output capacity to set reference production levels for next year. OPEC+ has tasked three companies - IHS, Wood Mackenzie and Rystad Energy - to assess the capacities of all members to be used for reference production - the figures from which output cuts or increases are calculated - from 2025. The reviews are due to take place by end-June. As a result, the issue will not come up at the 1 June meeting, five OPEC+ sources said, allowing the group to decide policy for the rest of 2024 with more ease. But it also means the June meeting will not give the market much guidance on policies for 2025, when all current cuts expire.

North & South America

US diesel demand fell to its lowest seasonal level in March since 1998, while crude oil output rose to a multi-month high, data from the US Energy Information Administration (EIA) showed. Demand for distillate fuels, which includes diesel and heating oil, has been hit sharply this year under pressure from sluggish manufacturing activity, milder-than-expected winter weather and booming renewable fuel supply. Products supplied of distillate, EIA’s measure of demand, fell over 6 percent from February to 3.67 million barrels per day (bpd) in March, lowest for the month since 1998. The two most immediate US ultra-low sulfur diesel futures contracts settled in the steepest contango since 2020. US crude oil output rose by 0.6 percent to 13.2 million bpd in March, the highest since December, the data from EIA showed. Output from Texas, the top producing state, edged 0.7 percent higher to 5.6 million bpd in March, also the highest since December.

US weekly imports of crude oil from Mexico fell to 184,000 bpd, its lowest on record, data from the US Energy Information Administration (EIA) showed. The previous low was 208,000 bpd in the week to 12 April, after state energy company Petroleos Mexicanos cut exports to supply more to its domestic refineries.

North American pipeline operator Enbridge beat market estimates for first-quarter profit on strong demand for transporting oil. Canadian oil producers are boosting production to fill new capacity on the expanded Trans Mountain pipeline, owned by the Canadian government. The extra output benefited pipeline operators such as Enbridge in the months leading up to Trans Mountain’s expanded line opening earlier in May. Volumes on Enbridge’s Mainline - North America’s biggest oil pipeline network - rose marginally from a year earlier to 3.1 million bpd, helped by additional Canadian oil sands production and a delay in Trans Mountain’s completion to the second quarter.

Asia Pacific

Chinese refiner Rongsheng Petrochemical has bought its first Canadian crude cargo via the recently expanded Trans Mountain pipeline (TMX) from TotalEnergies through a tender, traders said. The 500,000-barrel cargo of Access Western Blend (AWB) crude will be delivered to Rongsheng’s refinery in Zhoushan in August, traders said. AWB is a type of heavy and highly acidic diluted bitumen produced by Canadian Natural Resources and MEG Energy. Separately in the tender, Rongsheng also bought 2 million barrels of Abu Dhabi Upper Zakum crude from Aramco Trading at 60 cents a barrel above July Dubai quotes before freight charges in the tender. The Chinese refiner purchased 2 million barrels of West African crude consisting of Congolese Djeno and Angolan Mostarda grades at US$2.50-$3 a barrel above July dated Brent on cost and freight basis from Unipec.

China National Offshore Oil Corporation (CNOOC) had signed oil exploration and production concession contracts with Mozambique’s energy ministry and national energy company ENH. The contract is for five offshore blocks in waters off the African nation and covers a total area of about 29,000 sq km (11,200 sq miles) with water depths from 500 m to 2,500 m (1,640 ft to 8,202 ft), it said in a statement. The first phase of the exploration period is four years, with five CNOOC subsidiaries serving as operators in the exploration and development phases, having independent operator rights and interests.

The pace at which crude oil flowed into China’s stockpiles increased in April as slower refinery processing outweighed a decline in imports. A total of 830,000 bpd was added to China’s commercial or strategic stockpiles in April, up from 790,000 bpd in March. Over the first four months of the year, China, the world’s biggest crude importer, added 700,000 bpd to storages, a significant volume that goes some way to undermining the market view that oil consumption is robust amid a recovering economy. The total crude available to refiners in April was 15.13 million bpd, consisting of imports of 10.88 million bpd and domestic output of 4.25 million bpd. The volume of crude processed by refiners was 14.3 million bpd, leaving a surplus of 830,000 bpd to be added to storage tanks. For the first four months of 2024, the total crude available was 15.26 million bpd, while refinery throughput was 14.56 million bpd, leaving a surplus of 700,000 bpd.

South Korean petrochemical producers are maximising the use of cheaper feedstock LPG at their crackers, reducing naphtha demand from the region’s top importer. Lower naphtha imports by South Korea could further depress the margins for Asian refiners in the summer months of May and June, when LPG is typically cheaper due to a fall in heating demand. The US, Asia’s top supplier of LPG, stands to benefit from rising cracker demand. South Korea’s naphtha imports slipped to about 18.13 million barrels in April and 17 million barrels this month, Kpler data showed. LSEG Research estimates April volume at about 18.59 million barrels and May imports at around 18.34 million barrels. Both April and May levels are down from the March volume of about 22 million barrels, Korea National Oil Corp data showed. LPG consumption at South Korean crackers jumped about 56 percent on-year to 7.26 million barrels in March, bringing the first-quarter use to 16.81 million barrels, up about 22 percent from the same period last year, government data provided by the Korea Petrochemical Industry Association (KPIA) showed.

The profit from turning a barrel of crude oil into fuels in Asia is at the lowest in seven months, which is leading refiners to turn away from expensive Middle East grades and seek cheaper alternatives from the Americas. Refiners are being hit by the double whammy of higher prices from Saudi Arabia, the top exporter and price-setter for much of the crude exported from Middle East, as well as soft demand for some refined products, including industrial and transport mainstay diesel. The crack spread, or profit margin, from making fuels from a barrel of Middle East benchmark Dubai crude at a typical Singapore refinery ended at US$2.27 a barrel, down from US$2.69 on 10 May and the lowest since 20 October. The margin is down 77 percent from its peak so far in 2024 of US$9.91 a barrel, reached on 13 February. Refining margins have been squeezed in Asia as crude prices have risen faster than those for refined fuels, with global benchmark Brent crude futures rising from a six-month low of US$72.29 a barrel on 13 December to a recent high of US$92.18 on 12 April, before moderating to end at US$83.45.

China’s crude oil imports rose on the previous year in April, as refiners prepared for a fully recovered Labour Day holiday travel season, according to data from the General Administration of Customs. Crude imports in April totalled 44.72 mt, or about 10.88 million bpd, data showed. That represented a 5.45 percent increase from the relatively low 10.4 million bpd imported in April 2023. Chinese consultancy JLC said ahead of the data that it forecast sea-borne oil shipments to fall 4.6 percent in April from March due to tight profit margins and the arrival of maintenance season. Natural gas imports for April rose 14.7 percent from a year earlier to 10.30 mt, data showed. Data showed exports of refined oil products, which include diesel, gasoline, aviation fuel and marine fuel, were up 21.46 percent from a year earlier at 4.55 mt.

11 June. Bharat Petroleum Corporation Limited (BPCL) is planning to set up a new 12 million metric tonnes per annum (MMTPA) refinery in the country. The oil marketing company will invest around INR500 billion in the project and is currently assessing locations in three states — Andhra Pradesh, Uttar Pradesh, and Gujarat. The company may consider Uttar Pradesh to set up the new refinery. BPCL chairman G Krishnakumar announced that the company plans to increase its refining capacity to 45 MMTPA by FY29. BPCL operates three refineries located in Mumbai, Kochi, and Bina (Madhya Pradesh), with a combined annual refining capacity of around 36 MMTPA.

6 June: India’s crude oil production for the fiscal year 2023-24 is projected to remain stable at 29.4 million metric tonnes, according to the Petroleum Planning and Analysis Cell (PPAC)’s Ready Reckoner report. The consumption of petroleum products is anticipated to increase to 233.3 million metric tonnes, up from 223.0 million metric tonnes the previous year, indicating a steady rise in domestic demand. India’s refining capacity is expected to grow from 266.5 million metric tonnes in the last fiscal year to 276.1 million metric tonnes by the end of 2024. The expansion aligns with India’s strategic objectives to enhance its refining capabilities to meet domestic and international oil demands. Significant progress has been made in oil exploration through the Open Acreage Licensing Policy (OALP), with the eighth bidding round adding 34,364.53 square kilometers to India’s exploration area, bringing the total to 2,42,055 square kilometers. The expansion aims to accelerate exploration and production activities across the country and reduce reliance on imported oil.

10 June. GAIL (India) Ltd, the country’s top gas supplier, has announced that it intends to set up 1500 KTA ethane cracker project at Ashta, district Sehore in Madhya Pradesh, having product slate of various ethylene derivatives. GAIL said that the project will entail projected investment of INR600 billion. The company said that it has submitted its request to the Madhya Pradesh government for the for providing suitable enablers for the project.

7 June: Oil and Natural Gas Corporation (ONGC) is seeking help from an internationally-proven technical service provider to raise oil and gas production from its flagship but old and maturing Mumbai field in the Arabian Sea. The firm has floated an international tender to identify the service provider who will help raise production from the field, ONGC said. Mumbai High field lies 160 kilometres off the coast of Mumbai and produces about 38 percent of India’s oil production. While it hit a peak output of 40,000 barrels per day (bpd) in 1989, the field is producing 134,000 bpd and about 10 million standard cubic metres per day of gas. The field is estimated to hold a balance reserve of 80 million tonnes (610 million barrels) of oil and over 40 billion cubic metres of gas.

6 June: Sweltering heat and policy measures are fuelling a surge in the use of gas-fired power in India, with imports of liquefied natural gas (LNG) forecast to rise sharply over the next two years, experts said. India’s gas-fired power output is expected to grow by 10.5 percent in the fiscal year ending in March 2025, following 35 percent growth the prior year. To meet that demand, LNG imports by the price-sensitive buyer swelled in May to the highest levels since October 2020, data from analytics firms LSEG and Kpler showed, despite global prices up five-fold from the pandemic-hit lows of 2020. Demand for LNG in India, the world’s fourth-largest importer of the fuel, is set to increase by 19 percent in 2024, with imports forecast to reach more than 28 million metric tonnes in 2025, up from 22.1 million tonnes in 2023, according to ICIS.

6 June: With the summer heat reaching record highs in northern India in May, Indian Railways ferried 9.3 percent more coal than last year, and freight volumes for all commodities on the railway network grew 3.9 percent in the previous month, according to government data. A total of 139.16 million tonnes (MT) of freight was loaded in May 2024 compared to 128.3 MT in April, up 8.46 percent month-on-month. The coal ministry has not been able to improve its volumes for most commodities over last year. It has a target of achieving 3,000 MT of freight by 2030, for which it would need to double its freight volume at a rapid pace. Meanwhile, it also saw higher passenger movement on account of the recently ended Lok Sabha elections and summer rush, for which the Railways is running 10,000 additional trains.

11 June: Parts of Delhi witnessed a major power cut due to a fire incident at a substation of Power Grid Corporation of India Ltd (PGCIL) in Mandola, Uttar Pradesh (UP). The disruption affected various areas of east and central Delhi resulting in power cuts of more than 30 minutes. Delhi receives 1,200 MW (megawatt) of power from the Mandola sub-station, and consequently the electricity supply was hit in the aftermath of the incident, Aam Aadmi Party (AAP) Minister Atishi said. The power restoration process has begun and electricity is now gradually returning to different areas, she said but expressed concern about the power failure occurring at a national power grid.

9 June: Power distribution in India is infamous for inefficiency and losses. Despite several financial schemes, state-owned power distribution companies (discoms) are beleaguered. In recent years, a new approach to make discoms efficient has been tried – a part of it being driven by a 2 kg square box called smart meter. Launched in 2021, the INR3 trillion Revamped Distribution Sector Scheme (RDSS) aims to improve discoms’ operations and finances. A major part of RDSS’ first phase was installing smart meters – a task for which the central government has allocated INR100 billion. The overall target is to install 250 million

9 June: The AAP (Aam Aadmi Party) government in Delhi is likely to approach the Supreme Court (SC) for its permission to process the file for appointment of pro-tem members to the city’s power regulator DERC. As Delhi Chief Minister (CM) Arvind Kejriwal is in jail, file is pending, and the Delhi government wants to seek the court’s permission so that the power minister forwards it directly for the Lt Governor’s approval. The SC in August last year appointed retired justice Jayant Nath as pro-tem chairperson of the DERC (Delhi Electricity Regulatory Commission) after the AAP government and the Delhi Lt Governor failed to come to a consensus on a candidate for the post.

11 June: The Modi government will continue to balance development with environmental protection and conservation, Union Environment Minister Bhupender Yadav said. Yadav's role as Environment Minister will be crucial as India proposes to host the international climate talks (COP33) in 2028. If accepted, it would be the next major global conference in India after the G20 Summit last year. According to Yadav, India has implemented crucial reforms in the environment sector and launched several key initiatives such as the International Solar Alliance, Coalition for Disaster Resilience and Infrastructure and International Big Cat Alliance. India achieved two quantifiable targets under its first NDCs -- reducing GDP emissions intensity by 33 to 35 percent by 2030 from 2005 levels, and achieving 40 percent installed power capacity from non-fossil fuels by 2030. Both were ahead of schedule. The country aims to reduce emissions intensity of GDP by 45 percent by 2030 from 2005 levels and achieve 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030. It has committed to becoming a net-zero economy by 2070.

11 June: Suzlon Energy said that it has secured a 103.95 MW (megawatt) order from AMPIN Energy Transition to supply 33 wind turbines with a rated capacity of 3.15 MW each. Suzlon will install 33 wind turbine generators (WTGs) with a hybrid lattice tubular (HLT) tower and a rated capacity of 3.15 MW each at the clients site in the Fatehgarh district in Rajasthan, the firm said. Suzlon Energy is engaged in the business of design, development, manufacturing and supply of wind turbine generators (WTGs). Suzlon Energy (SEL) is India’s largest renewable energy solutions provider with presence in 17 countries across six continents.

9 June: Open access solar installations rose two-fold in India to 1.8 gigawatt (GW) during January-March this year supported by several factors, including reduced module cost, US-based Mercom Capital has said. Solar power through open access is an arrangement where a power producer establishes a solar power plant to supply green energy to consumers. India added over 1.8 gigawatt (GW) of solar open access capacity in the first quarter of the calendar year of 2024, posting a two-fold increase from 909.3 megawatts (MW) in Q4 2023. As of March 2024, the cumulative installed solar open access capacity stood at 14.3 GW. Solar open access developers benefited from lower Chinese module prices and the suspension of the Approved List of Models and Manufacturers (ALMM) order for projects commissioned through March 2024. In Q1 2024, Rajasthan led solar open access capacity additions, accounting for almost 28 percent followed by Andhra Pradesh and Maharashtra with 21 percent and 12 percent of capacity additions, respectively. The pipeline of solar open access projects under development and in the pre-construction phase was over 18 GW as of March 2024. Almost 74 percent of pipeline projects were in Karnataka, Rajasthan, Maharashtra, Tamil Nadu, and Andhra Pradesh.

9 June: Prime Minister (PM) Narendra Modi, heading into his third term with a weakened mandate, wants India to embrace a new “green era” at the forefront of climate diplomacy and clean technology. Modi, who has cast himself as climate champion for much of the past decade, will be under pressure to make faster progress toward existing green targets, including pledges to hit net zero by 2070, install a mammoth 500 gigawatt (GW) of non-fossil energy by the end of the decade, and corral a global alliance on solar power that aims to secure US$1 trillion in investment. But significant expansion in clean energy — India added over 100 GW of renewable capacity during past 10 years of Modi’s government — has not been enough to satisfy steep demand growth and the limitations of the country’s transmission and distribution networks. New Delhi has expanded coal mining to a record, extended the lives of power plants and pressed for the softening of language around fossil fuels at international climate talks. Coal India Ltd (CIL), which until the pandemic was planning to diversify into solar power, is prioritizing the spending of record sums to expand fossil fuel output.

6 June: India will have to invest as much as US$385 billion to meet its target of 500 gigawatt (GW) of renewable energy by 2030, but coal will remain a key source of electricity generation for the next decade, Moody’s Ratings said. India, a major greenhouse gas emitter, has said it aims to ramp up non-fossil fuel capacity set by 50 GW each year to help meet its 500 GW target. It missed its target of 175 GW by 2022. Moody’s estimates an annual capacity addition of around 44 GW will help achieve that target. For that, India will have to spend US$190 billion to $215 billion on capacity over the next six to seven years and another US$150 billion to US$170 billion for transmission and distribution, the credit ratings agency estimates. India’s strong policy support has boosted the renewable energy share to around 43 percent in its power capacity mix in fiscal 2023-24, attracting private sector investments. Adani Group, through Adani Green Energy, aims to generate 45 GW of renewable power by 2030 as it strives to become the country’s first integrated renewable energy player. Continued policy backing will facilitate significant progress toward India’s 2030 transition and 2070 net-zero targets, Moody’s said. However, despite the steady growth in renewable energy, most of which will likely be solar power, Moody's expects coal will play a significant role in electricity generation for the next eight to ten years.

6 June: BHEL said it has secured an order worth over INR35 billion from Adani Power Limited to set up a thermal power project at Raipur in Chhattisgarh. The boiler and turbine generator will be manufactured at its Trichy and Haridwar plants, respectively, BHEL said.

5 June: Vedanta group firm Hindustan Zinc said that it has registered a 14 percent drop in greenhouse gas emission intensity in the last four years. To reduce its carbon footprint, Hindustan Zinc is increasing the quantum of renewable energy in its energy mix and improving its operational efficiency. Hindustan Zinc focuses on a two-pronged approach of mitigating and offsetting its carbon footprint. The company’s Pantnagar Metal Plant operates on 100 percent green power and it has signed a 450-mw renewable power delivery agreement poised to mitigate around 2.7 million tons of CO2 emissions annually.

11 June: Saudi crude oil exports to China will fall in July for a third straight month to about 36 million barrels amid plant maintenance and as some refiners opted for other sources of cheaper oil, several traders said. The reduction underscores the challenge the world’s top oil exporter faces in maintaining market share in the world's largest crude import market. July exports are expected to be down from about 39 million barrels in June, possibly the lowest levels for the year. One state refiner and a private refiner cut nominations for Saudi crude in July versus June. Chinese refiners are cutting imports from Saudi Arabia, China’s No. 2 oil supplier, due to high term prices for Saudi crude and weak refining margins, the sources said. Sinopec, Asia’s largest refiner and Saudi Arabia’s biggest customer in China, is keeping the volume little changed in July from the previous month but the volume is the lowest this year. China’s Saudi oil imports fell 16.5 percent in the first four months this year to 26.13 million metric tons (1.58 million barrels per day) while imports from top supplier Russia gained 16.6 percent to 37.79 million tonnes, customs data showed. Separately, Saudi Aramco will supply full contractual volumes to at least three other North Asian refiners in July.

11 June: Organization of the Petroleum Exporting Countries (OPEC) stuck to its forecast for relatively strong growth in global oil demand in 2024, despite lower-than-expected use in the first quarter, saying travel and tourism would support consumption in the second half of the year. OPEC, in a report, said world oil demand will rise by 2.25 million barrels per day (bpd) in 2024 and by 1.85 million bpd in 2025. Both forecasts were unchanged from last month. OPEC’s report is the latest to flag robust oil market conditions heading into the second half of the year. Oil rose 3 percent after Goldman Sachs said transport demand would push the market into a third-quarter deficit. OPEC said steady global economic growth has continued in the first half of 2024 and forecast that world oil demand would rise by 2.3 million bpd in the second half. OPEC+, which groups OPEC and allies such as Russia, has implemented a series of output cuts since late 2022 to support the market. The group agreed on June 2 to extend the latest cut of 2.2 million bpd until the end of September and gradually phase it out from October.

6 June: Element Fuels Holdings, a Dallas-area startup proposing to build the first all-new United States (US) oil refinery in nearly 50 years, said it was relaunching efforts to build a large plant in South Texas. The Brownsville, Texas, project has been proposed by entrepreneur John Calce at least twice before by his ARX Energy, and JupiterMLP startups, with one leading to a bankruptcy filing. Element is looking to raise funds for the first phase, which will allow the refinery to process about 50,000 to 55,000 barrels per day of naphtha feedstock into gasoline. The company estimates the initial phase will cost about US$1.2 billion, Calce said. The refinery eventually will process US shale oil from fields in West and South Texas, Calce said. In comparison, US Gulf Coast refineries largely process medium to heavy crude.

5 June: United States (US) crude oil stockpiles rose unexpectedly, while gasoline and distillate inventories also increased as refining ramped up and demand fell despite the kick-off of the summer driving season, the Energy Information Administration (EIA) said. Crude inventories rose by 1.2 million barrels to 455.9 million barrels in the week ended 31 May, the EIA said, compared with analysts' expectations in a poll for a 2.3 million-barrel draw.

5 June: Sibur Holding, Russia’s top liquefied petroleum gas (LPG) producer and exporter, will boost LPG loadings from the Baltic port of Ust-Luga by a quarter this month after securing more gas carriers, the company’s plans said. The company would increase LPG loadings to 52,000 metric tonnes from 43,000 tonnes in May. LSEG data showed Sibur’s LPG export volumes fell by 48 percent in January-May from last year. The drop reflected a shortage of tankers after a time-charter contract with a shipping company Navigator Gas expired in December. From June, Sibur has chartered two new gas carriers - Falcon and Negmar Min - capable of carrying 20,000 metric tonnes each and may increase its exports. Sibur needs more tankers because voyages to end users take longer as the company increasingly ships to Turkey and the Middle East while European demand for Russian LPG remains low because of sanctions. Ust-Luga is the main Russian port for LPG exports. It accounted for a quarter of all exports last year, with all the volumes supplied by Sibur. LPG is widely used in the petrochemical industry as an alternative to naphtha and as a raw material. It is also used for heating and cooking and as an auto gas fuel.

5 June: The Czech Republic will end its dependence on Russian oil by mid-2025 thanks to an expansion of the Transalpine Pipeline (TAL) from Italy, Prime Minister Petr Fiala said. TAL brings oil from the Italian port of Trieste to southern Germany, where it connects to the IKL pipeline taking it to the Czech Republic. The pipeline extension will double capacity for the EU and NATO member to eight million tonnes when it becomes operational next year. The country has already wean itself off Russian natural gas completely in the wake of Moscow’s invasion of Ukraine. The Czech Republic gets most of its oil via the Druzhba pipeline, launched in the 1960s when the country was part of Czechoslovakia, which was controlled by the Soviet Union. Shortly after Russia invaded Ukraine in February 2022, the European Union imposed a ban on most oil imports from Russia, but the Druzhba pipeline was exempted. In 2023, Russian oil accounted for 58 percent of all Czech oil imports, according to industry and trade ministry data. TAL, in operation since 1967, is owned by a consortium of eight oil firms, including Mero and global giants Shell, Eni and ExxonMobil.

11 June: Nigeria’s state firm NNPC has signed an agreement with Golar LNG to deploy a floating liquefied natural gas (LNG) vessel off the coast of its oil-rich Niger Delta, NNPC said. Nigeria, Africa’s top oil producer, holds the continent’s largest gas reserves of more than 200 million trillion cubic feet and is seeking investments to boost output. NNPC said the Project Development Agreement (PDA) will utilise about 500 million standard cubic feet of gas per day, producing LNG, propane and condensate. NNPC and Golar LNG have agreed to achieve a Final Investment Decision (FID) on the project before the end of the year with production expected to start in 2027. The deal is the second floating LNG accord the NNPC has signed with partners in the past year and follows two other LNG agreements with investors to increase its domestic supplies and exports. Nigeria, which still flares excess gas produced due to inadequate processing infrastructure, launched a national gas expansion programme in 2020 to end flaring by increasing local use of gas.

7 June: The flow of Norwegian gas to northern England via the Langeled pipeline resumed as repairs were completed following a June 2 outage that triggered renewed concerns over energy security in Europe. Britain’s Easington import terminal received gas from Langeled at a rate of 40.3 million cubic meters (mcm) per day at 1058 GMT, up from zero, according to flow data from Britain’s National Gas. Interruption of gas flows from Norway’s onshore Nyhamna plant via Langeled to Easington drove Europe’s benchmark gas price to €38.56 per megawatt hour (MWh), its highest since December. Europe’s benchmark gas price stood at €32.90 per MWh in early afternoon trade, down 0.8 percent from the previous day. Norwegian gas system operator Gassco had said it planned to gradually ramp up flows.

7 June: Mexican state utility Comision Federal de Electricidad (CFE) need not pay a Texas natural gas supplier’s claim for hundreds of millions of dollars stemming from the huge spike in gas pricing during a deadly winter storm, an international arbitration panel ruled. Severe cold during 2021’s Winter storm Uri pushed US (United States) natural gas prices to record highs as demand soared and wells and pipelines froze shut. Suppliers passed along the huge price increases to their customers, resulting in dozens of lawsuits.

6 June: Egypt plans to issue a buy tender seeking 15-20 cargoes of liquefied natural gas (LNG) to cover heavy summer demand that had led to a wave of rolling blackouts and forced temporary shutdowns of chemical and fertilizers plants. The most populous Arab country has returned to being a net importer of natural gas, reversing its position as an exporter in recent years as part of a plan to become a reliable supplier to Europe. The tender is expected in the second half of June or early July to cover demand for the summer season between July and October. Egypt had not imported LNG since late 2018, with only four domestically produced cargoes received at its no longer available FSRU over the 2019-2023 period, as well as an imported partial cargo that was re-exported in late 2023, according to S&P Global Commodity Insights data. In May, Egypt’s Natural Gas Holding Company (EGAS) struck an agreement with Norway’s Hoegh LNG to rent the Hoegh Galleon floating storage and regasification unit (FSRU) from June 2024 to February 2026, to support energy security. Gas production in 2023 was around 59.29 billion cubic meters (bcm), falling 11.5 percent year-on-year to the lowest production level since 2017, when it was around 50.72 bcm.

5 June: Hungarian energy conglomerate MVM will buy a 5 percent stake in Azerbaijan’s Shah Deniz gas field, it said. Hungary, a landlocked country, has been importing natural gas mainly from Russia even after its invasion of Ukraine in 2022, which led many European countries to seek alternative sources of energy supplies. The Shah Deniz field is one of the world’s largest natural gas fields, with an annual production of 29 billion cubic metres (bcm), the MVM said. The stake’s size would translate into an annual supply of 1.5 billion cubic meters (bcm) of natural gas for Hungary. Hungary has been receiving 4.5 bcm of gas per year from Russia under a 15-year deal signed in 2021. Hungary is buying 50 million cubic meters of natural gas this year from Azerbaijan for the first time.

11 June: Lights are off and air conditioning is down at the headquarters of Vietnam’s state-run electricity provider EVN as the country's top power utility tries to "lead by example" to avoid a repeat of last year’s crippling blackouts. Vietnam is pursuing a patchwork agenda of energy-saving measures, grid upgrades, regulatory reforms and a massive increase of coal power as it seeks to avert electricity shortfalls, according to government data. In the short term, Vietnam is banking mostly on coal to provide enough reliable electricity. It may be just enough - or not - but either way it may signal a blow to the country’s commitments to reduce reliance on fossil fuels. Coal use rose massively in the first five months of 2024, with coal-fired power plants accounting on average for 59 percent of electricity output, exceeding 70 percent some days, according to EVN data. That was up from nearly 45 percent in the same period last year and 41 percent in 2021, when Vietnam began drafting plans to cut coal that persuaded international donors to commit US$15.5 billion to help phase out the fuel.

10 June: Russia has announced plans to export coal to India using Iran’s railways. This announcement was made during the BRICS transport ministers’ meeting at the 27th St. Petersburg International Economic Forum (SPIEF). Russia will use the International North-South Corridor (INSTC) to send coal to India. Igor Levitin, Russia’s presidential aide, stated that the first coal shipments will travel through Iran and Bandar Abbas before reaching India. Mehrdad Bazrpash, Iran’s Minister of Roads and Urban Development, emphasized the importance of the INSTC in enhancing transportation and transit among BRICS countries. In a meeting with Iran’s Ambassador to Russia, Kazem Jalali, Levitin reiterated that the first coal wagons would transit through Iran and Bandar Abbas en route to India. Both sides discussed cooperation, particularly the Rasht-Astara Railway construction project. This project is crucial for improving transportation links between Iran and Russia. In 2023, Russia transported 600,000 tonnes of freight through Iran. This volume is expected to rise to 4 million tonnes per year in 2024. This significant increase underscores the importance of the INSTC for regional trade and cooperation. Through these efforts, Russia aims to strengthen its trade links with India, utilizing Iran’s strategic location and railway network to facilitate efficient coal exports.

6 June: Britain’s Electricity System Operator (ESO) said it expects to have sufficient supplies this winter, in an early outlook of the supply and demand balance for the period. The opening of a new power link with Denmark, new gas-fired power plants and more batteries on the system had all increased the likely amount of power available, it said. ESO said its base case for de-rated margin, which is a measure of the amount of excess capacity expected above peak electricity demand, is currently 5.6 gigawatt (GW) for winter 2024/25, or 9.4 percent of capacity, up from 4.4 GW, or 7.4 percent of capacity, last winter. In 2022, the operator warned Britain could face three-hour planned power cuts if the country was unable to import enough gas as Europe grappled with lower supplies following Russia’s invasion of Ukraine.

6 June: Germany’s government has announced it will launch tenders in 2024 for 10 gigawatt (GW) of new gas-fired power station capacity that must be ready to switch to clean hydrogen in the transition away from fossil fuels. Economy Minister Robert Habeck said that the tenders could be finalised before the summer break. Utilities aim to bid for subsidies that Berlin has committed to pay because the plants will complement volatile renewables until such time that electricity can be 100 percent green. The western Germany-focused mining and generation company has said it could build 3 gigawatt (GW) within planned government tenders. The German arm of Norwegian power utility Statkraft said it would study the government’s plan but would focus primarily on converting its existing gas-fired plants to hydrogen.

6 June: New York’s electric grid will face supply shortfalls if the rate of retiring old fossil fired power plants continues to quickly outpace the addition of clean new energy supply at the same time demand rises, the state's grid operator said. New York has set a goal for 100 percent clean energy on its grid by 2040 to reduce carbon emissions and slow the progress of climate change. The effort that will require a wide roll-out of renewable energy and the axing of power plants fueled by fossil fuels like natural gas. New York has at least 10 very large power load projects, including data centers and semiconductor factories, expected to be up and running in the next two years, New York Independent System Operator (NYISO) said. They include the Micron NY Semiconductor plant, which will require 480 megawatts of capacity, or enough to power about 400,000 homes. Increasing demand and shrinking power supply could pose a problem to New York’s grid as early as this summer if the state faces prolonged heat waves, specifically temperatures of 95 degrees Fahrenheit lasting three days or more. In the heat wave scenario, total grid supply would sit at about 34,500 megawatt (MW) and demand would rise to 33,300 MW, leaving the system well short of the 2,600 megawatts of operating reserves needed to stay reliable, NYISO said. New York can deploy emergency power supply provided by so-called peaker plants, the grid operator said, but peakers are generally fired by fossil fuels and are expensive to run.

6 June: Around 428,000 customers in Santiago, Chile, faced a significant power outage after a fallen tree severely damaged a high-voltage transmission tower at midnight, as reported by the national disaster prevention and response service (SENAPRED). The disruption caused an estimated loss of 260 megawatt (MW) of consumption, equivalent to about 10 percent of Santiago’s total demand, according to the National Electric Coordinator, an independent operator of Chile’s Electric System. Enel, Chile’s electricity distributor, confirmed the power outage and noted that the damaged tower is owned by another firm. Enel is currently collaborating with other transmission companies to restore power. The tree fell on a transmission tower in Santiago’s southeastern region, causing a failure in the 110 kilovolt (kV) Florida - Ochagavia line. This incident impacted power consumption at the Macul, Santa Elena, San Joaquin, and Club Hípico substations.

5 June: Central United States (US) power grid operator Southwest Power Pool (SPP) said that it had filed for approval to add western entities under its tariff to provide full regional transmission organization (RTO) services across both the eastern and western interconnections. Arkansas-based SPP filed tariff amendments with the Federal Energy Regulatory Commission (FERC) on 4 June, including provisions for its western members. If approved, SPP will become the first organization in the US. to provide RTO services in both of the interconnections, SPP said. The operator said the expansion was expected to provide more than US$200 million in annual benefits to new western members in Arizona, Colorado, Utah and Wyoming, adding to the current US$2.8 billion in benefits for existing members. RTO manages electricity transmission over large areas, and expanding the services enhances reliability, efficiency, and resilience, leading to significant cost savings and benefits for participants.

11 June: The World Bank has approved an additional loan of US$1 billion for cash-strapped Pakistan to support the China-backed Dasu hydropower project in the restive Khyber Pakhtunkhwa province. The Dasu hydropower project, situated approximately 300 km north of Islamabad in the unruly Khyber Pakhtunkhwa province, is being developed by China Gezhouba with funding from the global lender and has endured at least two deadly terrorist attacks targeting Chinese nationals involved in its construction. The World Bank said it has approved US$1 billion additional financing for the DASU Hydropower Stage I (DHP I) Project. The World Bank said upon completion, the hydropower plant will have an installed capacity of 4,3205,400 megawatt (MW).

11 June: The Dutch government has awarded permits for offshore wind farm development totalling 4 gigawatt (GW) off the west coast of the Netherlands, in the largest wind tender in the country so far. Swedish energy company Vattenfall and clean energy fund manager Copenhagen Infrastructure Partners (CIP), through a joint venture called Zeevonk, were chosen to develop a 2 GW wind farm called IJmuiden Ver Beta. British firm SSE Renewables, via a consortium also including Dutch pension fund ABP and its asset manager APG, can proceed with their bid for a 2 GW site called IJmuiden Ver Wind Farm Alpha, the company said.

6 June: A two-year US (United Sates) tariff holiday on solar panels from Southeast Asia expires, starting the clock ticking for American project developers to use the huge amount of equipment they stockpiled duty-free over that period by the end of this year. The dynamic could result in a mini-boom in already red-hot US solar installations, while also annoying the nascent domestic manufacturing industry which is keen to see developers make the switch to American-made gear. US solar developers accumulated around 35 gigawatts (GW) of imported panels in US warehouses since President Joe Biden lifted the duties on Malaysia, Thailand, Cambodia and Vietnam in 2022 to help speed domestic projects to fight climate change, according to energy advisory firm Clean Energy Associates. That is nearly as much solar capacity as the US will install during all of 2024, according to research firm Wood Mackenzie.

6 June: Global investment in clean energy technology and infrastructure is set to hit US$2 trillion this year, twice the amount going into fossil fuels, International Energy Agency (IEA) report showed. Total energy investment is expected to exceed $3 trillion for the first time in 2024, the IEA said in a report. Some US$2 trillion is set to go to clean technologies – including renewables, electric vehicles, nuclear power, grids, storage, low-emissions fuels, efficiency improvements and heat pumps - with the rest directed towards gas, oil and coal. Combined investment in renewable power and grids overtook the amount spent on fossil fuels for the first time in 2023. China is set to account for the largest share of clean energy investment in 2024 with an estimated US$675 billion, while Europe is set to account for US$370 billion and the United States US$315 billion. More spending is focused on solar photovoltaic (PV) than any other electricity generation technology with investment set to grow to $500 billion in 2024 due to falling solar module prices.

5 June: The United States (US) could revive some of its recently retired nuclear power plants to help meet rising demand for zero-emissions electricity, or add reactors to existing sites, Energy Secretary Jennifer Granholm said. The administration of President Joe Biden believes nuclear power is critical to meeting greenhouse gas reduction goals and decarbonizing the economy by 2050 to fight climate change, but the industry has been hindered by the high cost of new construction. The Department of Energy’s Loan Programs Office (LPO) in March issued a US$1.52 billion conditional loan to Holtec International to reopen the shut Palisades reactor in Michigan, which could become the first nuclear plant in the country to restart after being shuttered. The plant, which closed in 2022, now needs approval from the Nuclear Regulatory Commission, which oversees nuclear safety. Granholm said US nuclear energy capacity could also be expanded in a cost-effective way by building new reactors at existing sites. She said about 30 power plant sites across the US have been licensed or permitted for the construction of more reactors.

5 June: Azerbaijan is hoping to raise the share of renewables across its energy sector to almost a third with over US$2 billion in green investments, its Energy Minister Parviz Shahbazov said, as Baku plugs its environmental credentials before hosting COP29 later this year. Azerbaijan, which will host the United Nations COP29 climate summit in November, has an estimated 2.5 trillion cubic metres of natural gas reserves, according to the 2021 BP Statistical Review of World Energy, and it aims to double its gas exports to Europe by 2027. While the global warming emissions from burning natural gas are lower than those from coal or oil, they remain much higher than green energy sources. The country is keen to tout more sustainable energy projects, which include wind and solar, and efforts to construct an electric cable under the Black Sea to transfer green Azeri energy from planned Caspian Sea windfarms to Europe.

5 June: Chinese electricity company SPIC announced a 780 million reais (US$147.41 million) investment in construction of two new wind farms in Northeastern Brazil, while making its debut in the country’s solar sector, with two large parks beginning operations. The company is diversifying its portfolio and aiming to become one of Brazil’s three largest energy generators. SPIC’s new wind farms, to be built in Rio Grande do Norte state, will have a combined installed capacity of 105.4 megawatt (MW) to be sold on the free energy market. Construction work is expected to begin by January 2025 and operations should start the following year. New solar parks were inaugurated in Piaui and Ceara states, totaling 738 megawatt peak (MWp) of power.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2024 is the twenty-first continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.