-

CENTRES

Progammes & Centres

Location

According to the International Energy Agency (IEA), the use of energy for space cooling is growing faster than any other form of energy use in buildings tripling since 1990. The sale of air conditioning (AC) systems has quadrupled to 135 million units in the last three decades. Roughly 2 billion AC units are now in operation around the world as per IEA data. Space cooling is now the leading driver of electricity demand in buildings and of new capacity to meet peak power demand. Households account for 68 percent of total ACs, one for every five people.

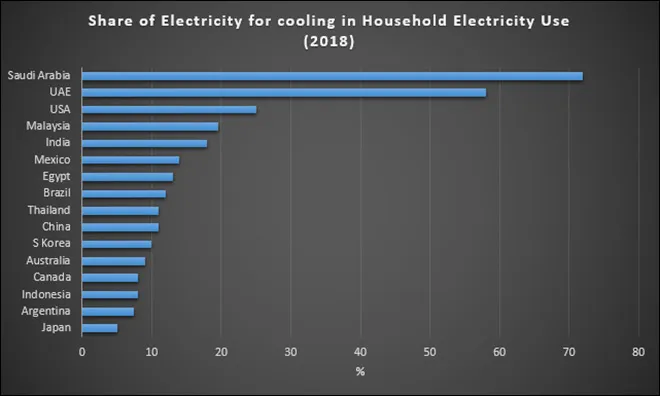

ACs consume over 2000 terawatt hours (TWh) of electricity every year, which is two and a half times the total electricity use of Africa and nearly 8.5 percent of total final electricity consumption in 2019. CO2 (carbon dioxide) emissions from space cooling has tripled since 1990 to over 1 giga tonnes of carbon-di-oxide (GtCO2), equivalent to the total emissions of Japan. According to estimates, a 1°Celsius (C) increase in temperature in the future will increase electricity consumption for cooling by around 15 percent.

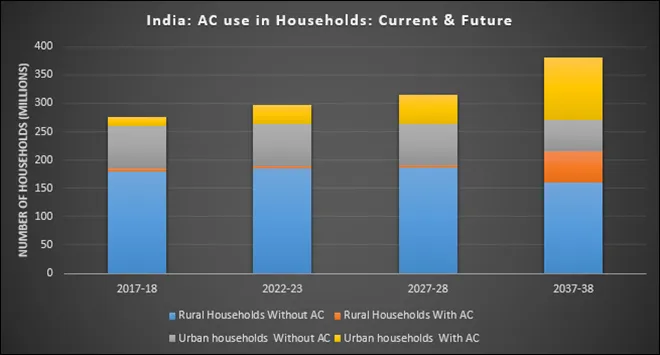

China currently dominates the market for cooling equipment with 40 percent of global cooling equipment purchases in 2019. Though more than 500 million units were sold in China in the last decade, relative AC demand rose more quickly in India and Indonesia, with average yearly installations increasing at a rate of more than 15 percent in India and 13 percent in Indonesia. India, along with China and Indonesia, are projected to account for most of the growth in energy use for space cooling by 2050.

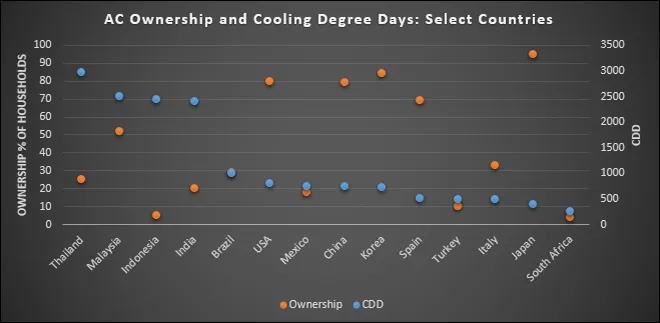

Researchers have concluded that room ACs alone are set to account for over 130 GtCO2 between now and 2050. That would account for 20-40 percent of the world’s remaining “carbon budget” (the most CO2 we can emit while keeping global warming to less than 2˚C above pre-industrial levels). Many parts of the world experienced record-high temperatures in 2019, and the global average number of cooling degree days (CDDs, number of degrees that a day’s average temperature is above 18°C), was 15 percent higher than in 2000.

There are enormous disparities in access to space cooling across the world with the poorest countries located in tropical parts of the world having the lowest share of space cooling technologies. Out of the 35 percent of the world’s population living in countries where the average daily temperature is above 25°C, only 10 percent own an AC unit. India, which has more than 3000 CDDs consumes just 70 kilowatt hours (kWh) for space cooling compared to 800 kWh in South Korea that has only 750 CDDs. This disparity is mainly on account of low affordability of AC use in India. Currently only about 6 percent of India households own ACs but demand is growing rapidly with a 15-fold increase since 1990. Ironically, the correlation between wealth and AC use is stronger than the correlation between climate and AC use.

As global average temperatures increase, AC use in India and elsewhere is likely to become more of a necessity than a luxury. Most of the detailed analysis of space cooling needs conclude that technology is the answer for improving the efficiency of AC systems to substantially reduce electricity consumption and consequently GHG (greenhouse gas) emissions. The average efficiency of ACs in India is relatively low given the cost sensitive nature of the Indian market. Many of the suggestions from expert organisations propose stringent efficiency standards for ACs and incentives for purchase of efficient ACs. Better building design, increased renewables integration and smart controls are other measures that could reduce space cooling energy use and emissions and limit the power capacity additions required to meet peak electricity demand.

Other solutions that are commonly recommended are increasing minimum energy performance standards closer to those of best-in-class ACs, which are typically twice as efficient as the market norm. Government procurement agencies and large private-sector buyers (like real estate developers) leveraging their buying power in the form of advance market commitments and bulk procurement programmes for super-efficient ACs is a workable solution. Simple financing solutions can encourage people to buy more efficient ACs. Forward thinking distribution companies (discoms) can offer ‘on-bill’ financing, which allows consumers to pay for energy-efficient appliances on their electricity bills and in instalments—effectively enabling them to realise cash savings from the very first day.

Technology experts point out that the compressor technology at the heart of most AC units has barely reached 14 percent of its theoretical maximum efficiency (with most AC units in the 6-8 percent range). This is remarkably low compared to solar panels which have reached 40 percent of their theoretical efficiency potential and LED (light emitting diode) lighting which has reached 70 percent of its theoretical efficiency. Because consumers care about price, brand, and appearance more than anything else, and regulators fail to apply much pressure over efficiency standards; AC manufacturers typically spend more on advertising and aesthetics than they do on research and development. The challenge for policymakers and regulators is to push manufacturers to invest in improving efficiency and convince consumers that efficient ACs are better for them and for the planet.

India’s flagship oil and gas producer ONGC (Oil and Natural Gas Corp) said it is seeking foreign partners for yet-to-be-developed fields in lesser prospective areas but is shackled by uneconomic gas prices and tax structure. The petroleum ministry has asked ONGC to sell stake in producing oil fields to private firms, get foreign partners in KG basin gas fields, monetise existing infrastructure, and hive off drilling and other services into a separate company to raise production. Indian sedimentary basin is divided into three categories— Category-I includes producing basins such as Krishna Godavari, Mumbai Offshore, Assam and Rajasthan; Category-II basins are less prospective and contain contingent resources to be developed and produced (example Kutch, Mahanadi, Andaman-Nicobar, Saurashtra Vindhyan); Category-III are ones with only prospective resources to be explored and discovered (example Kerala-Konkan, Ganga Punja, Bengal-Purnea, Narmada, Himalayan Foreland, etc.). All the fields identified by the ministry letter are in Category-I basins and are producing. But ONGC wants foreign firms to share exploration risk. ONGC also has a plan of acquiring a much larger acreage through open acreage licensing policy (OALP). ONGC has continuously been reviewing its engagements to move up higher in the value chain to concentrate on areas where the expected risk-reward payoff offers better business opportunities for growth. The ministry has set the target of domestic production of 40 million tonnes (MT) of crude oil and 50 billion cubic metres (BCM) of natural gas by 2023-24. The bulk of the targeted domestic production for 2023-24 is expected to come from ONGC which is required to contribute 70 percent of the domestic production—28 MT of oil and 35 BCM of gas by 2023-24. ONGC produced 20.2 MT of crude oil in the fiscal year ending 31 March (2020-21), down from 20.6 MT in the previous year and 21.1 MT in 2018-19. It produced 21.87 BCM of gas in 2020-21, down from 23.74 BCM in the previous year and 24.67 BCM in 2018-19.

RIL (Reliance Industries Ltd) and its affiliates have picked up more than three-fourths of the new gas volumes from the firm’s eastern offshore KG-D6 block which at current government dictated price will cost it less than half of the imported rate. RIL and its partner UK’s BP Plc last week auctioned 5.5 million metric standard cubic meter per day (mmscmd) of incremental gas from the newer discoveries in the KG-D6 block, benchmarking it to a gas marker. RIL’s oil-to-chemical (O2C) business unit picked up 3.2 mmscmd gas in the auction. India Gas Solutions (IGS)—a gas sourcing and marketing joint venture of Reliance and BP—picked up another 1 mmscmd. The remaining volume was picked by Adani Gas (0.15 mmscmd), IRM Energy (0.10 mmscmd), GAIL (30,000 cubic meters per day) and Torrent Gas (20,000 cubic meters per day). The price discovered in the e-auction came at a US $0.06 discount to the JKM (Japan-Korea Marker) liquefied natural gas (LNG) price. At current prices, this translates into a price of US $8-9/mmBtu (million metric British thermal units) but the buyers will end up paying less than half of this rate. The government sets a cap or ceiling rate at which natural gas from difficult fields like deepsea can be sold. This cap for the period 1 April 2021 to 30 September 2021 is US $3.62/mmBtu.

ONGC has agreed to do away with charging users a marketing margin on the gas it plans to produce from its KG basin field but refused to lower the minimum rate, according to tender documents. ONGC sought bids for sale of initial 2 mmscmd of gas from its KG-DWN-98/2 block (KG-D5). The company asked bidders to quote a rate linked to prevailing Brent crude oil prices. It fixed the floor or minimum rate at 10.5 percent of the three-month average Brent crude oil price. On top of it, the firm sought US $0.20/mmBtu. Potential bidders, however, opposed the levy of the marketing margin as well as the “high” floor price. At the current Brent crude oil price of close to US $70, the minimum price comes to US $7.3/mmBtu. This price, however, will be subject to the ceiling or cap fixed by the government for deep sea fields every six months. The cap for six months, beginning 1 April, is US $3.62/mmBtu. ONGC in the tender offered to sell 2 mmscmd of gas for a duration of three to five years at Odalarevu in East Godavari district of Andhra Pradesh, which is connected to state gas utility GAIL’s KG basin pipeline network as well as PIL’s East West Pipeline which is connected to KG basin network and further to Gujarat gas grid. Bid prices starting from 10.5 percent of dated Brent price must be revised downwards so as to account for cheaper alternatives available from other LNG terminals, according to a bidder query posted on the ONGC tender document. In the bid document, ONGC stated that the marketing margin was to cover the cost of marketing and it does not form a part of the ceiling gas price. Gas supplies from the block, which sits next to RIL’s KG-D6 block in Bay of Bengal, is to start from June-end. RIL and its partner BP Plc of UK sold 5.5 mmscmd of additional natural gas from KG-D6 at a rate linked to Platts JKM (Japan Korea marker)—the LNG benchmark price assessment for spot physical cargoes. ONGC’s KG-DWN-98/2 or KG-D5 block is expected to have a peak production rate of 15.25 mmscmd of natural gas and 80,000 bpd of oil. The company is likely to come out with another tender later this year for the sale of 5 mmscmd of gas from next year.

India lost the ONGC Videsh Ltd (OVL)-discovered Farzad-B gas field in the Persian Gulf after Iran awarded a contract for developing the giant gas field to a local company. The field holds 23 (TCF) trillion cubic feet of in-place gas reserves, of which about 60 percent is recoverable. It also holds gas condensates of about 5,000 barrels per billion cubic feet of gas. The buyback contract signed envisages daily production of 28 MCM (million cubic metres) of sour gas over five years. OVL, the overseas investment arm of ONGC had in 2008 discovered a giant gas field in the Farsi offshore exploration block.

India’s gas demand is being hit by state-level restrictions aimed at stemming a rampant second wave of coronavirus infections. The decline in gas consumption was slower than last year when there was a nationwide lockdown. Adani Total, which is part-owned by French major Total, supplies gas to small industries and households in parts of the country. Gas demand has declined from all sectors—industry, households, and automobiles running on compressed natural gas. Adani Total would be investing INR 12-14 billion in this fiscal year to March 2022.

Some LNG cargoes were diverted away from ports in India. Six LNG tankers diverted away from India since 20 April, changing the destination to Northeast Asia, Europe, and Kuwait instead. India’s LNG imports dropped to about 1.86 to 2 MT in April, down 11 to 14 percent from March’s 2.16 to 2.21 MT. This is still well above the 1.43 to 1.48 MT of LNG imports seen into the country in April, last year after India’s gas demand was hit by a nationwide lockdown.

Rajasthan State Gas Ltd (RSGL) will participate in the bidding for piped gas distribution lines in nine districts of the state. RSGL said that the PNGRB is soon going to open bidding process for domestic gas distribution through pipelines to many cities of the country, including Rajasthan. At present, different institutions are working in 19 districts of the state for distribution of gas through pipelines. RSGL is doing the work of distribution of gas pipes in Kota city and Gwalior and Sheopur in Madhya Pradesh.

The Indian Gas Exchange (IGX) has commenced gas trade from two new hubs at Dabhol and Jaigarh in Maharashtra. Currently, IGX operates three gas hubs—Dahej and Hazira in Gujarat and KG Basin in Andhra Pradesh. The introduction of the two new hubs in Maharashtra will allow the exchange to operate from five physical gas hubs. All the existing contracts offered by IGX—monthly, fortnightly, weekday, weekly, and daily is available at the new gas hubs from 20 April 2021. The move is aimed at increasing the availability of natural gas from additional sources on the exchange platform for the benefit of end-consumers. The Dabhol terminal is owned by GAIL (India) Ltd and has an operational capacity of 5 MTPA. The exit point of the terminal has been declared as the Dabhol Hub. The terminal’s current supplies are largely to the western and southern states through two pipelines—Dabhol-Uran-Dahej-Panvel Pipeline (DUDPL) and Dabhol-Bengaluru Pipeline, connecting the terminal to the National Gas Grid. Energy through its wholly owned subsidiary, Western Concessions Pvt Ltd will shortly commence operations of India’s first floating storage and re-gasification unit-based LNG terminal project at the Jaigarh Port. The Jaigarh Gas Hub is at the interconnection point of the tie-in connectivity Jaigarh-Dabhol pipeline to DUDPL located in Dabhol. Despite being closer to each other, the two new gas hubs would operate independently which will help avoid layering up of the transportation tariff. Additionally, with the implementation of unified tariff, the customers will be able to avoid multiple tariffs for transportation of gas, further adding to gas-to-gas competition in the country. More recently, IGX introduced open auction mechanism on its platform allowing buyers to compare gas prices across the hubs, enabling them make bidding decision basis the most competitive gas price for the required duration.

The national average gas prices in the US (United States) have increased above US $3 a gallon for the first time since 2014 amid the six-day shutdown of a major fuel pipeline following a cyber security attack. On an average, Americans paid US $3.008 for a gallon of gas, up from US $2.985 the previous day and US $2.927 one week ago. The US auto club had forecasted gas prices to climb in reaction to the shutdown of the Colonial Pipeline, which delivers approximately 45 percent of all fuel to the East Coast. 28.2 percent of all gas stations in North Carolina, 17.45 percent in Georgia and 17.09 percent in Virginia were without gasoline, according to the latest data from GasBuddy, which tracks fuel demand, prices, and outages.

Exxon Mobil Corp will reinstall a gas compressor at its Liza Destiny platform off Guyana’s coast in June, after an equipment failure last month prompted the company to slash output. Its Liza-1 project was currently producing between 100,000-110,000 bpd (barrels per day) while flaring less than 15,000 standard cubic feet per day. The compressor failure prevented Exxon from producing at full capacity without flaring more than Guyana’s government guidance. The company, which operates the project in a consortium with New York-based Hess Corp and China’s CNOOC Ltd, initially slashed production to 30,000 bpd after the outage down from nameplate capacity of 120,000 bpd. Gas flaring emits significant amounts of planet-warming carbon dioxide and has been a source of tension between Exxon and Guyana’s government since Liza-1 began production in December 2019, making the impoverished South American country the world’s newest energy hotspot.

US natural gas producer EQT Corp will buy Blackstone-backed Appalachian basin rival Alta Resources for US $2.93 billion in cash and stock, making an entry in the Northeast Marcellus shale play. Deal making in the oil and gas space has been heating up as crude prices have jumped on a vaccine-led recovery in travel demand. Natural gas hit record highs earlier in February when a winter storm swept parts of the US. The deal, which adds around one billion cubic feet equivalent gas production to EQT’s portfolio, is expected to be accretive to free cash flow and net asset value per share. EQT will pay US $1 billion to Alta in cash and the rest in stock. It expects to fund the cash portion partly by drawing on its credit facilities and new debt.

The US Interior Department is cancelling oil and gas lease sales from public lands through June amid an ongoing review of how the programme contributes to climate change. According to the petroleum industry and its Republican allies in Congress, the oil and gas moratorium will harm the economies of Western states without putting a significant dent in climate change. The federal government took in about US $5 billion last year in royalties and other payments on oil and gas from federal lands, according to the Office of Natural Resources Revenue.

Oil and gas supplier Enterprise Products Partners sued CPS Energy, a San Antonio gas and power utility, alleging failure to pay nearly US $100 million for natural gas delivered during a February winter storm. The lawsuit is the latest to emerge from a severe cold snap that drove prices and demand for natural gas and electricity to hundreds of times their pre-storm levels. Enterprise is suing CPS Energy, a long-time customer, over payment disputes for sales during the freeze. The suit, filed in a state court in Harris County, Texas, claims CPS owes US $99.7 million for gas after paying US $36.5 million towards the month’s fuel bill.

The French energy firm Total has halted all operations on its US $20 billion investment in an LNG project in northern Mozambique because of the extremist rebel insurgency there. Total’s declaration of force majeure casts doubt on the future of the gas project, which had been expected to bring large and sustained economic growth to Mozambique’s struggling economy. Total agreed with the Papua New Guinea government to proceed with an LNG project in the country, which had been delayed due to the pandemic, with a final investment decision due in 2023. Total will re-mobilise teams involved in the project. Total and its partners ExxonMobil Corp, and Oil Search Ltd had initially planned to develop Papua LNG in tandem with an expansion of Exxon’s PNG LNG in a US $13 billion project adding three new production units at the PNG LNG plant, to help save billions of dollars. However, Exxon has not agreed to terms sought by the Papua New Guinea government for the P’nyang gas development that was going to help feed the expansion, as Papua New Guinea pushed for bigger benefits for the country from the deal. Instead, Totals ‘Papua LNG project will go ahead with two new production units to be built at the PNG LNG site, fed by the Elk Antelope gas fields.

Ukraine has started pumping natural gas into underground storage facilities, Naftogaz energy firm data showed. The data show 5.7 MCM of gas were put into storage on 1 May and that the total volume of stored gas reached 15.5 BCM. Ukraine ended the 2020/21 winter with record gas volume of 18 BCM in underground facilities, 13 percent more than a year earlier. It continued to use gas from reserves in spring due to cold weather. The country’s gas reserves reached a record 28 BCM at the beginning of the 2020/21 heating season, the highest level for 10 years. China will grant a refund of 70 percent of VAT (Value Added Tax) on long-term natural gas imports signed before 2014 in an effort to help national oil firms narrow losses in their gas import businesses. The firms have racked up billions of dollars in losses due to multi-year gas supply deals signed with exporters from Qatar and elsewhere nearly a decade ago, when oil-linked prices were much higher and China badly needed the fuel to combat air pollution. The ministry will also give VAT refunds for other imported natural gas if the import cost exceeds certain benchmarks. The ministry also exempted some equipment used in onshore and offshore oil and gas exploration, including coal-bed methane development, from import tariffs and VAT. The refunds and exemptions will be in force from 1 January 2021 until 31 December 2025.

Myanmar’s military has received hundreds of millions of dollars from gas sales through a financial scheme linked to a pipeline exploited by French energy giant Total. Total and the military-controlled Myanmar Oil and Gas Enterprise hold stakes in Moattama Gas Transportation Company (MGTC), which owns the pipeline linking the Yadana gas field and Thailand. MGTC, which was created in 1994 and incorporated in Bermuda, has set exorbitant prices for the transport of gas. The scheme reduced the amount of royalties received by the state since transporting gas is taxed at a lower rate. This allowed the military to directly receive money from gas transport via its oil and gas company, with turnover of US $523 million in 2019 against just US $11 million in charges. Creation of separate companies to exploit the pipeline and transport the gas was not unusual; similar arrangements exist in the North Sea and other countries.

South Korean steelmaker POSCO does not believe its unit POSCO International’s gas projects in Myanmar have a direct link to the military which seized power there in February. The unit’s gas business had existed for about 20 years, persisting through regime change, and related payments were paid to the Myanmar finance ministry. About 20 percent of the Myanmar gas business was used for local consumption including electricity production, contributing to the lives of ordinary people.

Australian gas producer Santos Ltd said it will explore sharing infrastructure to develop gas fields around the Barossa and Evans Shoal projects with Italian energy group Eni SpA. The move comes after Eni called off the sale of its Australian gas assets earlier this year, as it failed to attract strong bids. Along with Barossa and Evans Shoal, the companies will assess synergies in sharing infrastructure around the Darwin LNG plant. In March, Santos gave the final go-ahead for its US $3.6 billion Barossa gas project off northern Australia, the biggest new gas project in the country in nearly a decade.

One of Israel’s biggest energy companies plans to sell its share of a large offshore gas field to a firm based in the United Arab Emirates (UAE) for an estimated US $1.1 billion, the biggest such deal since the two countries normalised ties last year. Delek Drilling signed a Memorandum of Understanding with Mubadala Petroleum, part of a conglomerate owned by the government of Abu Dhabi. Delek Drilling is required to sell its 22 percent share of the offshore Tamar gas field by the end of this year as part of a 2015 gas framework agreement aimed at introducing more competition to the Israeli gas sector, which has grown in recent years with the discovery of large offshore reserves. The Tamar field, which went online in 2013, is believed to hold more than 300 BCM of gas. Chevron and the Israeli American company Isramco, each own around a third of Tamar, with the remainder held by smaller firms.

Pakistan’s Khyber Pakhtunkhwa (KP) and Sindh provinces have rejected monopoly to centralise transmission lines of gas companies in the country terming it as a violation of the 18th constitutional amendment and warned of approaching the court against the Imran Khan government in this connection. According to The News International, both the provinces have rejected the monopoly to centralise the transmission line of Sui Southern Gas Pipelines and Sui Northern Gas Pipelines by the federal government and termed it as a violation of the 18th constitutional amendment of Pakistan.

25 May: Petrol price inched towards the INR 100-mark in Mumbai after fuel rates were hiked again. Petrol price was increased by 23 paise per litre and diesel by 25 paise a litre, according to a price notification of state-owned fuel retailers. The hike—13th this month—pushed petrol and diesel prices to record-high levels across the country. Petrol price in Delhi rose to INR 93.44 a litre and diesel to INR 84.32 a litre. In Mumbai, petrol price climbed to INR 99.71 a litre and diesel to INR91.57 per litre. Rates had already crossed the INR100-mark in several cities in Rajasthan, Madhya Pradesh, and Maharashtra and with the latest increase, the price in Mumbai too was inching towards that level. Fuel prices differ from state to state depending on the incidence of local taxes such as VAT (Value Added Tax) and freight charges. Rajasthan levies the highest VAT on petrol in the country, followed by Madhya Pradesh and Maharashtra. Oil companies revise rates of petrol and diesel daily based on average price of benchmark fuel in the international market in the preceding 15 days, and foreign exchange rates.

Source: The Economic Times

22 May: Police has formed two teams to nab the oil mafia involved in the pilferage of several thousand litres of oil from the Mathura-Jalandhar Pipeline. A leakage in Indian Oil Corp (IOC)’s pipeline was detected at Ranwari village under Chhata tehsil of Mathura district on 16 May following which an FIR was filed by chief operations manager. The miscreants had fixed a valve to the pipeline for taking out oil. In 2017, a major theft of petroleum was detected on the Mathura-Jalandhar Pipeline in R K Puram colony under Highway police station where oil mafia had virtually installed a parallel filling station by constructing a big tunnel for operation.

Source: The Economic Times

21 May: India’s domestic production, consumption and exports of petroleum products declined 11.0 percent, 8.7 percent and 13.3 percent, respectively, last financial year ended March 2021 owing to the impact of the COVID pandemic. On a cumulative basis, a fall of 4.7 percent year-on-year in domestic crude production was registered during 2020-21. Natural gas production was down 7.9 percent during FY21. LNG imports declined 1.6 percent, credit rating agency, India Ratings and Research (Ind-Ra), said. Ind-Ra said in March 2021, domestic consumption of petroleum products declined 1.8 percent month-on-month to 4.4 million barrels per day (bpd) after achieving FY21’s peak level of 4.5 million bpd in February 2021. Ind-Ra expects continued subdued crack spreads in both gasoil and gasoline will impact the overall gross refining margins of oil marketing companies though they have healthy complexity and low operating costs per barrel. Gasoil and gasoline are the two key products of Indian refiners, accounting for around 65 percent of their product slate.

Source: The Economic Times

21 May: India’s crude oil imports in April were little changed from the previous month as a second COVID-19 wave forced several states to impose mobility restrictions, stemming fuel demand and leading to larger stockpiles. Crude oil imports in April were at 18.26 million tonnes (mt), although on a yearly basis they rose about 10.3 percent, data on the website of the Petroleum Planning and Analysis Cell (PPAC) showed. India’s top state oil refiners reduced processing runs and crude imports in April as the pandemic took a toll on fuel consumption, leading to higher product stockpiles at the plants. The country is also trying to cut its dependence on the Middle East for oil, as continued production cuts by the Organisation of Oil Exporting Countries and Major Producers led to higher crude prices.

Source: The Economic Times

19 May: Indian refiners, anticipating a lifting of US (United States) sanctions, plan to make space for the resumption of Iranian imports by reducing spot crude oil purchases in the second half of the year. The world’s third=largest oil consumer and importer halted imports from Tehran in 2019 after former US President Donald Trump withdrew from a 2015 accord and re-imposed sanctions on the OPEC (Organisation of the Petroleum Exporting Countries) producer over its disputed nuclear programme. US President Joe Biden’s administration and Iran have been involved in indirect talks to revive the pact for Tehran to curb its nuclear activities in exchange for lifting of sanctions. Analysts expect Iran to ramp up crude exports to 1.5 million barrels per day (bpd) in the fourth quarter when sanctions are lifted. India, used to be Iran’s second biggest oil client after China, buying as much as 480,000 bpd in the fiscal year beginning April 2018. Several Indian state refiners, whose refineries are suited to the crude, have committed to buy Iranian oil once sanctions are lifted. Bharat Petroleum Corp Ltd (BPCL), which plans to tap the spot market for 45 percent of its overall imports, will buy Iranian oil if sanctions are lifted. Hindustan Petroleum Corp Ltd (HPCL) said it would buy Iranian crude if the price is right and it is suitable. Top refiner Indian Oil Corp (IOC) is also expecting to reduce spot purchases and can easily process about 2 million tonnes (14.6 million barrels) of Iranian oil this fiscal year. The IOC plans to buy 56 percent of its imports through term contracts this fiscal year. Indian refiners have raised the share of spot purchases versus term contracts to gain from cheaper barrels available in a surplus market. After the halt in Iranian oil, Indian had diversified its imports and raised its share of US oil.

Source: The Economic Times

24 May: Just four months in a year are available for construction in Bay of Bengal. Even that window got complicated with constantly changing restrictions on movement of people and material across the globe because of the pandemic. But work bubbles for over 4,000 persons at peak of the project alongside navigating restrictions to source material and people globally helped deliver two deep sea gas fields. Since 2017, Reliance Industries Ltd (RIL) along with its JV Partner BP had embarked on concurrent development of three deep water fields in the Krishna Godavari basin block, KG-D6, to monetise 3 trillion cubic feet of resources with an overall capital investment of INR 350 billion. But the outbreak of pandemic early last year disrupted global supply chains and impaired movement of personnel who are essential for executing a complex project that involved installing equipment and pipelines in water depths of almost 2 km. RIL said that to execute these complex deep water projects, teams have been working across 34 countries and at peak more than 4,000 persons were deployed offshore and onshore. RIL is on course towards reaching 30 million metric standard cubic meter per day (mmscmd) of gas production by 2023 catering to 20 percent of India’s gas demand.

Source: The Economic Times

21 May. The Delhi High Court (HC) has put on hold ONGC (Oil and Natural Gas Corp)’s notice inviting tender (NIT) and the consequent e-auction with regard to sale of natural gas from its block in the Krishna-Godavari (KG) basin in Kakinada, Andhra Pradesh. Under the NIT, ONGC had invited bids in respect of 2.0 million metric standard cubic meter per day (mmscmd) of gas from its KG-basin in Kakinada, Andhra Pradesh. The companies have sought a stay on any further allocation on the ground that the Centre and ONGC failed to deliver the gas allocation assured to them. With the observation the court listed on 4 June, the pleas by GMR Vemagiri Power Generation Ltd and GMR Rajamundhry Energy Ltd challenging the NIT and seeking a stay on any new allocation or allotment of gas from the KG-basin of ONGC.

Source: The Economic Times

19 May. India’s liquefied natural gas (LNG) importers are asking suppliers to defer deliveries as measures to curb the spread of the deadly COVID-19 virus have cut demand for the fuel. At least three companies, including Indian Oil Corp (IOC), have asked to delay shipments slated for May and June delivery, traders said. Inventories at import terminals in western India, such as Dahej, are near full capacity, traders said. The deferrals illustrate the extent of the natural gas glut in India, which has worsened over the past several weeks. While Indian firms have been accepting most contracted LNG deliveries, they have disappeared from the spot market since the virus worsened and shipments became too pricey. To make matters worse for suppliers, a cyclone in the vicinity of several import terminals in western India has also forced diversions and rearranged delivery schedules, traders said. More deferral from India could result in an oversupply of prompt cargoes in the spot market, which will weigh on prices that have rallied to the highest seasonal level in seven years.

Source: The Economic Times

19 May: The Central government said the second tranche of commercial coal mines’ auction has received tremendous response which is reflected in around 50 mine specific tender documents being purchased by bidders till date. Many other prospective bidders are in the process of registration and purchase of tender documents from the auction portal, the coal ministry said. The ministry launched the auction process for coal mines under the Coal Mines (Special Provisions) Act and the Mines and Minerals (Development and Regulation) Act earmarked for sale of coal on 25 March 2021. According to the ministry, this tranche paves the way for liberalisation of Indian coal sector enhancing efficiency, competition and private sector participation leading to development of a vibrant coal market, boosting economic growth and employment generation.

Source: The Economic Times

24 May: Andhra Pradesh has saved around INR 23.5 billion by purchasing electricity in spot markets at cost effective prices in the last two years, i.e., 2019–20 and 2020–21. The power utilities procured 3,393 million units in 2019-20 and 8,890 million units in 2020-21 from the open market at cheaper prices. The average cost of procurement, including transmission charges, was INR 3.12 per unit against the approved weighted average procurement cost of INR 4.55 per unit. Apart from depending on power purchases in the spot market, for the first time in India, the state power utilities deployed day-ahead electricity forecasting model using artificial intelligence and machine learning. This could forecast the next day’s electricity consumption on every 15-minute basis. This would in turn enable taking right decisions on electricity demand and supply, grid management, and minimising power purchase cost. Andhra Pradesh Energy Minister Balineni Srinivasa Reddy said that the state has emerged as a champion of cost effective power at the national level. State Energy Secretary Srikant Nagulapalli said that the cost-effective power would benefit every consumer in the state and boost industrial and economic development.

Source: The Economic Times

20 May: Despite the steep rise in COVID cases, the NTPC Barh has claimed to ensure uninterrupted power generation in its plant while implementing various precautionary measures for workplace safety. Despite internal challenges, the NTPC Barh management implemented several social welfare initiatives.

Source: The Economic Times

19 May: The Union Territory (UT) administration has written to the police department for providing security to the electricity department staff while installing smart electricity meters in Raipur Khurd and Makhan Majra villages. Recently, some residents of these villages had opposed installation of smart meters. Apprehending threat to the lives of their staff, the electricity department through the administration has asked for police protection. Recently, the Joint Electricity Regulatory Commission (JERC) had directed the administration to ensure faulty meters are replaced in a timely manner. The department has already started work on smart grid project. In the first phase, the department has allotted a work to a firm for replacing 30,000 existing power meters into smart meters in sectors 29, 31, 47 and 48 and Industrial Area, phases 1 and 2, and Faida, Ram Darbar, Hallomajra, Raipur Kalan, Makhan Majra, and Daria villages. The JERC in its latest order had reduced power tariff by 9.58 percent and ordered to stop recovery of fuel and power purchase cost adjustment (FPPCA) from 1 April. The electricity department caters to 2.47 lakh consumers divided into nine different categories.

Source: The Economic Times

19 May: Cyclone Tauktae disrupted power supply to 46.41 lakh consumers in Thane, Raigad, Palghar, Ratnagiri, Sindhudurg and other districts of Maharashtra, the state government said. The electricity supply of 34.14 lakh consumers has been successfully restored. Thane district was the worst hit as the cyclone snapped the power supply of 7.85 lakh consumers. Supply of 5.50 lakh of the 7.85 lakh consumers was restored in Thane, it said. In Raigad, 7.73 lakh consumers were affected by the power outage. Electricity supply of 5.10 lakh of these 7.73 lakh consumers was restored, it said. Similarly, the storm disrupted the power supply to 5.88 lakh consumers in Palghar, it said. The electricity supply of 2.44 lakh consumers was restored. It said the power supply of 4.18 lakh consumers of the 5.45 lakh affected was restored in Ratnagiri district by evening. In Sindhudurg, 3.66 lakh consumers faced power outage due to the cyclone and the electric supply for 67,166 of them was restored. It said the electricity supply of 4.08 lakh of the 4.36 lakh affected consumers from Satara was restored. Similarly, the power supply of 1.3 lakh consumers of the affected 1.5 lakh has been restored in the Marathwada region. In the Vidarbha region, 53,392 consumers faced a power cut. The electricity supply of around 50,000 affected consumers has been restored. A total of 5,500 electricity poles fell, transmission cables got snapped, and feeders tripped due to heavy rains coupled with high-speed winds. Maharashtra Energy Minister Nitin Raut earlier said 13,172 staffers are working tirelessly to restore the supply of the remaining consumers.

Source: The Economic Times

25 May: Indian Renewable Energy Development Agency (IREDA) invited applications for setting up manufacturing capacities for high-efficiency solar photovoltaic (PV) modules under the production-linked incentive (PLI) scheme. The last date for application submission is 30 June 2021 and bids will open on 1 July 2021, it said. On 11 November 2020, the Cabinet approved introduction of the PLI scheme for 10 key sectors, for making India self-reliant. One of these sectors was high-efficiency solar modules for which the financial outlay under the scheme over a five-year period was set at INR 45 billion. According to IREDA, applicants would be required to submit their response by indicating the yearly PLI values based on their expected sales of solar PV modules in megawatt, base case PLI for which their product is eligible, expected local value addition, and tapering factor as per the scheme guidelines. It said that manufacturers setting up any solar PV technology-based production facilities would be eligible for applying for the incentive assistance, provided the capacities it sets up achieves the minimum level of integration of cells and modules, the minimum manufacturing capacity requirements and the minimum threshold module performance parameters of module efficiency, as per the scheme guidelines. The company may form a special purpose vehicle (SPV) for setting up the manufacturing facility after the issue of Letter of Award (LoA) by IREDA. However, such SPV should be formed within 90 days from issue of LoA. In case of any delay beyond 90 days for formation of the SPV, the LoA issued would be withdrawn and capacity would be allocated to entities in the waiting list, IREDA said.

Source: The Economic Times

22 May: SJVN Ltd said it has bagged a 75 MW grid-connected solar project in Jalaun, Uttar Pradesh. The power generated from the project will be procured by Uttar Pradesh New and Renewal Development Agency (UPNEDA) for 25 years at a quoted tariff of INR 2.68/kWh (kilowatt hour), SJVN said. JVN said it has received a letter of intent (LoI) for a 75 MW grid-connected solar power project at Parasan in Jalaun district of Uttar Pradesh through tariff-based competitive bidding by UPNEDA.

Source: The Economic Times

20 May: In FY2021 (April 2020-Mar 2021), about 3.5 GW of new utility-scale solar capacity was added in India. Compared to previous year (FY2020), installations were about 39 percent lesser, JMK Research has said in a recent report. Gujarat, Rajasthan, Tamil Nadu, Uttar Pradesh and Andhra Pradesh were the leading states with most of the large-scale solar installations during this period. In the wind segment, in FY2021, about 1.5 GW of new wind capacity was added. This is about 28 percent lower than the previous year’s installation. Gujarat, Karnataka, and Tamil Nadu contributed maximum wind capacity addition during this period. As per JMK Research estimates, about 10 GW of new utility-scale solar capacity and 3.5 GW of new wind capacity are expected to be installed in this financial year, 25 percent less than its previous estimate.

Source: The Economic Times

20 May: Okaya Power has commissioned 100 kWp (kilowatt peak) hybrid solar plant at its manufacturing unit at Baddi in Himachal Pradesh. The plant will generate more than 144 megawatt hour (MWh) energy annually reducing its power consumption from the grid to 40 percent. The commissioned hybrid solar plant makes the unit self-sufficient for its daily energy requirement and also supports the uninterrupted production process with continuous power supply even in the scenario of unanticipated power cuts happening due to grid failure. Hybrid solar systems generate power in the same way as a common grid-tie solar system but use special hybrid inverters and batteries to store energy and operate as a backup power supply. This is a great solution for conserving energy sources by reducing wastage.

Source: The Economic Times

25 May: Venezuela’s state-run oil company PDVSA has restarted crude blending at its Petrolera Sinovensa facility after a gas supply outage to the Jose oil export terminal halted operations. The resumption comes as a very large crude carrier (VLCC) set sail after delays loading at Jose and a second VLCC prepared to leave, partly alleviating a bottleneck of vessels that had built up due to the gas outage, low inventories and quality issues, the internal PDVSA document showed. Both supertankers are carrying crude cargoes bound for Asia and a third vessel of the same size is set to depart by the end of the month to cover a similar route. As of 23 May, Petrolera Sinovensa’s blending plants, operated by a joint venture between PDVSA and China National Petroleum Corp for converting extra-heavy crude from Venezuela’s Orinoco oil belt into exportable Merey crude, were processing 139,000 barrels per day (bpd), the document showed. The Petropiar crude upgrader, a facility near Jose that is part of a joint venture between PDVSA and Chevron Corp and which also halted output due to the gas outage, had not yet restarted, the document showed. The temporary gas outage at Jose resulted from a fire at PDVSA’s Amana Operating Centre (COA) in eastern Monagas state that authorities blamed on lightning.

Source: The Economic Times

25 May: Japan’s JX Nippon wants to sell its British North Sea oil and gas assets including stakes in some of the basin’s biggest fields in a deal that could fetch up to US $1.5 billion. The sale is the latest deal in the North Sea marking the handover of assets from oil majors to private companies, which say they can better exploit remaining reserves than huge companies focusing on the energy transition. Culzean, with its 300 million barrels of reserves, can cover 5 percent of Britain’s gas needs alone, according to Total. The fields produced a net 6,500 barrels of oil equivalent per day for JX Nippon in 2018, before the start of Mariner and Culzean in 2019.

Source: The Economic Times

22 May: A gradual oil demand recovery is largely on track as economies re-open, British bank Barclays said, adding that it remained constructive on oil prices despite rising coronavirus cases across Asia and potential return of Iranian supplies. It cut demand estimates for the Emerging Markets Asia (ex-China) region, flagging the risk of further downside if the recent surge in infections persisted. If the United States lifted sanctions on Iran, the Middle East nation could boost oil shipments, adding to global supply. Global oil inventories could largely normalise over the next two or three months, given a recent drawdown in inventories and a projected deficit of about 1.5 million barrels a day in the second half, the bank said.

Source: The Economic Times

19 May: Royal Dutch Shell is in talks with the Nigerian government to sell the Anglo-Dutch company’s stake in onshore oilfields, CEO (Chief Executive Officer) Ben van Beurden said. Shell, the operator of the West African country’s onshore oil and gas joint venture SPDC, has struggled for years with spills in the Niger Delta as a result of pipeline theft and sabotage as well as operational issues. The spills have led to costly repair operations and high-profile lawsuits. CEO said that Shell can no longer be exposed to the risk of theft and sabotage. Nigerian Oil Minister Timipre Sylva confirmed the government was in talks with Shell on how to divesting its onshore stakes. Shell’s Nigerian onshore joint venture SPDC has sold about 50 percent of its oil assets over the past decade. Shell’s stake in SPDC gave it 156,000 barrels per day of oil equivalent in 2020, of which 66,000 barrels were oil.

Source: The Economic Times

25 May: Mitsubishi Power, a subsidiary of Mitsubishi Heavy Industries, said it has established a new gas turbine business in Dubai. The gas turbine combined cycle unit will focus on the sale of J-Series Air Cooled gas turbines, which are capable of operating on a mixture of 30 percent hydrogen and 70 percent natural gas. The company said this technology can play a role in helping countries across Europe meet net zero emissions targets.

Source: The Economic Times

21 May: Thousands of Australian students skipped school and gathered with climate activists to call on the government to stop funding the gas industry, taking aim at Prime Minister Scott Morrison’s plans to fund a new gas plant. Australia’s conservative government has promoted gas to help fuel the economy’s recovery from a COVID-induced recession, despite calls from climate experts, green groups and the International Energy Agency to stop new fossil fuel investments. Gas is also seen by the government as key to Australia’s energy transition, as it is cleaner than coal and can fuel flexible power plants to back up wind and solar generation.

Source: The Economic Times

20 May: Royal Dutch Shell has agreed to sell its stake in an offshore gas field in the Philippines for US $460 million as part of its strategy to narrow its oil and gas operations. Shell sold its 45 percent stake in Service Contract 38 (SC38), a deep water licence which includes the producing Malampaya gas field, to a subsidiary of the Udenna Group which already holds a 45 percent stake in the project. The deal is due to complete by the end of 2021. The Philippines’ Malampaya gas field, discovered in 1991, currently supplies fuel to power plants that deliver about a fifth of the country’s electricity requirements, based on energy ministry data. Malampaya’s output is declining, with the Philippines’ energy ministry expecting it to run dry by 2027. Aside from gas reserves, Malampaya’s assets include undersea pipelines and other facilities that could be tapped by future sellers and users of imported liquefied natural gas. The Philippines will need to import LNG (liquefied natural gas) before Malampaya runs dry. The government has approved several LNG import terminal projects near the Malampaya platform.

Source: The Economic Times

25 May: The Czech government has sent back a recommendation to phase out coal by 2038 to a state commission to examine an earlier exit, the industry ministry said, after a split over the target in the ruling coalition. The Central European country uses coal for just under half its electricity production but is seeking to cut that sharply in coming decades as part of a decarbonisation drive. The country’s largest utility, majority state-owned CEZ, announced a plan to shut most of its coal-fired power plants by 2030, cutting the proportion of coal in its production mix to 12.5 percent from 36 percent in 2020. The ministry said that in light of soaring emission allowance prices, the commission should look at alternatives for an earlier exit than the recommended 2038 date and assess the impact on the domestic energy market.

Source: The Economic Times

25 May: Australia’s New South Wales (NSW) state said it has awarded a AUS $3.2 billion (US $2.5 billion) 10-year power supply contract to Royal Dutch Shell PLC, which includes supplying battery back-up power for wind and solar energy. A 100 MW two-hour battery will be built and run by privately owned partner Edify Energy. The battery is slated to be switched on by early 2023, and will help fill a supply gap when AGL Energy Ltd’s coal-fired Liddell power station closes in the same year. Under a deal with Edify, Shell has contracted to take 60 percent of the battery’s power. The decision comes just days after the federal government decided to build a taxpayer-funded AUS $600 million gas-fired power plant in NSW to offset a looming power shortfall once the Liddell power station shuts in 2023. The new power contract would begin in July 2022, when its existing contract with Shell expires, and run for 10 years. Shell won the deal to supply the state government, the second-largest power consumer in New South Wales, through its Shell Energy arm, the former ERM Power business, which the oil major bought in 2019.

Source: The Economic Times

19 May: Germany’s energy regulator said that planning for the country’s power transmission networks was keeping up with the need for new lines to send increasing amounts of renewable power to centres of consumption. Network infrastructure is becoming crucial for keeping the lights on, for example to transport offshore wind power to the industrial south and to integrate hundreds of thousands of fragmented solar photovoltaics plants. The network authority recorded a total planning volume of 7,783 km of electricity grid expansions at the end of 2020, of which it said 3,500 km are at final planning stage. Some 1,600 km are completed, 734 km have been approved and the remainder is at earlier planning stages. Transmission grid firms have presented plans to the regulator to invest up to 102 billion euros (US $124.56 billion) up to 2030, of which 55 billion will go into high-voltage networks and 47 billion into local distribution grids. Costs to refinance their spending are shared as part of energy customers’ final bills under the regulator’s oversight.

Source: The Economic Times

24 May: Pakistan Prime Minister Imran Khan has inaugurated the largest Chinese-built nuclear power plant, as the country tried to stretch itself away from dependency of fossil fuels for its energy needs. The Karachi Nuclear Power Plant Unit-2 (K-2), established with the cooperation between Pakistan and China, is a coal-fired power production unit, which would be the country’s sixth nuclear power plant and is expected to bring dramatic increase the nuclear energy capacity. Prime Minister Khan, who virtually inaugurated the K-2 nuclear power plant, said the unit would generate at least 1,100 MW of clear energy. The PM said that the country would not pursue any more power based on coal, as their construction would come with an environmental cost.

Source: The Economic Times

20 May: China has ordered power transmission firms to connect a minimum of 90 GW of wind and solar capacity to the grid this year, the National Energy Administration (NEA) said, as part of a new policy initiative aimed at meeting its low-carbon targets. The NEA said it will set targets for the transmission of renewable power rather than the construction of new capacity in a bid to avoid waste and ensure that wind and solar plants can sell all their electricity on the market. China, the world’s biggest greenhouse gas emitter, has vowed to increase its non-fossil fuel energy consumption to around 20 percent of primary energy use by 2025 and to around 25 percent by 2030. The new guideline will put more pressure on grid firms to increase the availability and market access for clean energy, as the country has been striving to avoid a rise in the rate of curtailment, an industry term for the electricity capacity that is wasted because not all of the output cannot be delivered to customers. Beijing has targeted to step up power generation from solar and wind plants to around 11 percent of total power consumption in 2021, from 9.7 percent in 2020. As of end 2020, China had total installed solar and wind capacity of 535 GW.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.