-

CENTRES

Progammes & Centres

Location

Historically India’s energy concerns have been dominated by external supply risks, particularly oil supply risks – because these were closely linked to two of India’s key strategic interests – national security and rapid development through economic growth. India’s response consisted of traditional policy interventions to increase domestic energy production for self-sufficiency, stockpiling for energy security and development of non-fossil alternatives such as nuclear power and renewable energy for increasing diversity.

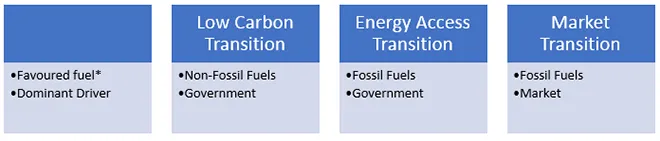

India’s current energy interventions centre around three energy transitions that are rapidly transforming India’s traditional energy landscape. The first is the energy access transition that is enabling millions of poor households to shift to modern energy sources such as electricity and liquid petroleum gas (LPG). The second is the transition to the market initiated in the 1990s that is opening up a larger role for market forces to mediate supply and demand for energy. The third is the low carbon transition initiated about a decade ago to increase the share of low carbon fuels, particularly renewable energy sources in India’s energy basket.

In both the low carbon transition and the energy access transition, the government is the agent of change. Government interventions to facilitate energy access and to increase the share of low carbon energy fuels are justified as the market has failed to (i) provide equitable access to energy and (ii) prevent negative environmental externalities of high carbon energy production and use. While the rationales for each of the three transitions cannot be contested, there are inherent contradictions.

Past and present programmes for universal energy access are dependent on grid-based supply of electricity for lighting and petroleum-based fuels for heating (primarily liquid petroleum gas or LPG for cooking). This means an increase in the use of fossil fuels. But this goes against the low carbon transition that aims to shift India’s energy basket away from fossil fuels particularly away from coal by increasing the share of renewable energy sources. In the context of the transition to electricity for lighting and other household uses, historically distribution companies (discoms) were the channel through which the government delivered access to electricity to even the most remote village. These discoms are now expected to operate as commercial entities turning a profit under India’s market transition. In theory this means that discoms need not provide access to electricity when the tariff for electricity does not cover the cost of supply or when electricity loads are not sufficiently large (as in rural areas) to justify continuous high quality electricity supply.

The shift from biomass to LPG by poor households is a shift to cleaner fuels but this is a contested claim. Particulate matter emitted during the incomplete combustion of biomass in rudimentary cook stoves causes indoor pollution (smoke) in households and the local environment. LPG is a cleaner burning alternative. While this is true at the household and local level, LPG is a fossil fuel which means it is associated with the emission of carbon-di-oxide (CO2) during its production and use. Under long time horizons biomass is considered a renewable fuel and also a carbon neutral fuel as the CO2 emitted by plant matter in the process of burning is only the amount of CO2 absorbed in the growing.

Enabling provisions of the Electricity Act 2003 and Petroleum & Natural Gas Regulatory Act of 2006 are yet to unravel fully but their influence in shaping a market-oriented energy sector cannot be denied. But the market transition and the consequent influence of commercial considerations may have a negative impact on the transition to a low carbon economy. The levelized cost of electricity (LCOE) of solar and wind energy prices have reached parity with traditional coal-based power at the ‘bus-bar’ level (whole-sale or plant level) but these energy sources are yet to reach parity at the ‘system’ or ‘retail’ level. Until then renewable resources would remain dependent on financial and non-financial subsidies. The private sector that accounts for 95 percent of renewable energy capacity today welcomes these subsidies (capital subsidy, cheap credit, priority access to transmission, ‘must-run’ status, feed-in-tariff, waiver of interstate transmission charges etc) as it is a profitable business model that guarantees despatch of renewable electricity and cost recovery through stable tariff over several decades. But the presence of the private sector is not the same as the presence of a ‘market’. There is no transparent and vibrant market for primary fuels or for the supply of electricity. The market transition will sustain the low carbon transition only when solar and wind energy with storage back up emerge as commercial competition to grid based electricity in providing 24-hour uninterrupted electricity supply or when a carbon price is introduced to make fossil fuels uncompetitive.

In the absence of a price for environmental externalities such as CO2 emissions, the market transition will continue to favour fossil fuels, especially domestic coal to meet growth demand for electricity and petroleum-based fuels for transport and household use (LPG and natural gas). In the context of the low carbon transition, discoms alone may not be able to bear the system level cost of accommodating intermittent renewable energy sources. The ‘must-run’ status accorded to electricity generated from renewable energy sources often runs counter to market forces of demand and supply. High feed-in tariff for renewable energy is an additional cost that cannot be easily passed on to consumers under the existing regulatory framework. The draft national energy policy released in 2017 observes that discoms cannot be burdened with the social and system cost of accommodating renewable energy sources and recommends finding alternative mechanisms for meeting additional costs.

Provisions for prioritising renewable energy also go against federal incentive schemes for financial restructuring of discoms such as the government’s ujwal discom assurance yojana (UDAY) scheme. Ironically one of the incentives that the UDAY scheme offers to discoms for adopting market discipline in their operations is greater access to low-cost domestic coal. The rationale is that this would enable discoms to increase electricity access.

Optimistic projections for penetration of renewable energy in the future often ignore broader macro-economic costs such as balancing costs for managing intermittency of renewable energy, the cost of stranded assets (e.g. the capital and finance costs associated with existing power stations in the context of transitioning to renewable energy sources or the capital and finance cost of refineries and refinery upgradation in the case of transitioning to electric vehicles [EVs]), and the policy costs associated with regulating and enforcing future policy, behavioural impact of lower comfort levels in buildings that depend on renewable energy, inconvenience of travelling less or that of using public transport if fossil fuel use is banned and research and development (R&D) costs. Implications such as revenue loss on account of fuel shifts (such as taxes on petrol and diesel and levies on coal that support government spending) and social consequences of job displacements are also not taken into account.

An intriguing prospect is that the entrenched role of the state in the Indian energy sector that has until now been seen as one of the key weaknesses of the sector, may prove to be a strength in accelerating the transition towards a low carbon economy. The uncertainty here is whether this transition would involve a compromise on other broader policy goals of the government such as rapid economic growth through industrialisation and the provision of universal access to energy.

Overall, India’s three simultaneous transitions appear to be working at cross purposes in the broader context. The energy access and market transitions seek to increase the quantity of energy supplies and the low carbon transition seeks to improve the quality of energy supplies. If both quantity and quality improvements are achieved, it may come at the cost of providing equitable access to energy. It may also involve a trade-off on the market transition. If quantity is prioritised quality may be compromised and if quality is compromised quantity (especially energy for the poor) may be compromised. How India balances these trade-offs will decide the nature and direction of India’s energy trajectory in the future.

The juxtaposition of a technological transition (low carbon) with political, social and economic transitions makes it difficult to determine where policy will end and politics will begin. The economic transformation requires the state to exit the energy sector so that the market can mediate supply of and demand for energy. The social transformation requires the state to continue its presence in the energy sector to correct market failure in providing universal access to energy. The environmental transformation also requires the state to correct market failure in providing a clean environment.

Looking back into history there is a case for optimism over India ‘leap-frogging’ into low carbon energy sources that also increases energy access. Global energy transitions in the past were not driven by cost competitiveness. Diffusion of technologies at the demand end with consumers wanting convenience and cleanliness drove the shift to refined petroleum and grid-based energy forms (natural gas and electricity). India’s low carbon transition could also be driven by consumer preference for decentralized clean energy rather than by substitution at the supply end as it is envisaged today.

The first major global energy transition (industrial revolution 1500-1900) was both a quantitative and qualitative transition when UK made the first transition from traditional biomass to fossil fuels. Development of technologies at the supply and demand end drove the transition. The second significant transition (1900s to fossil fuel era) was also quantitative and qualitative energy transition when the share of coal in global energy supply peaked. Diffusion of steam engines, internal combustion engines (ICEs) and electric motors drove quantitative changes in the supply and relative shares of fossil fuels. The share of oil and gas increased at the expense of coal but it was not the scarcity of coal that led to the introduction of more expensive oil. It was technological shifts at the demand end with consumers wanting convenience and cleanliness (for use in cars, radios, other appliances) that drove the shift to refined petroleum and grid-based energy forms (natural gas and electricity). The cost to consumers was above those of alternatives.

In this context the ‘solar is cheaper than coal’ narrative that dominates the current energy transition in India must be revisited. The low carbon transition is unlikely to be driven by change at the level of primary energy supply. The driver of change is likely to be at the demand end dominated by decentralized devices that use small packs of (batteries or equivalent) energy and the consumers preference for quality energy sources.

Transitions in the Energy Sector

In the last four years the UP (Uttar Pradesh) government has succeeded in increasing transmission capacity by 53 percent to 25,000 MW (megawatt). Two sub-stations of 220 kilovolt (kV) and nine sub-stations of 132 kV constructed at a cost of ₹13.47 bn were inaugurated. Several transmission works costing ₹61 bn are currently being executed through public private partnership mode in the state. The sub-stations launched will improve power distribution in Bulandshahr, Muzaffarnagar, Ayodhya, Chitrakoot, Sitapur and Mirzapur. The substations for which foundation stones were laid are in Lucknow, Varanasi, Fatehpur, Gonda, Jhansi, Farrukhabad, Agra, Saharanpur,Meerut, Maharajganj, Bhadohi, Firozabad, Basti, Banda, Baghpat and Kushinagar.

The Maharashtra State Transmission Company Ltd (MSETCL) recorded the highest ever power transmission of 25,800 MW due to the use of latest technology and preventive maintenance. This is the highest ever power transmission recorded in the history of the MSETCL. This record was achieved without any load-shedding. It is to be noted that 9 March, Maha-Genco set up a new record of highest power generation in the history of the state. The power demand in the state is on the rise as the state economy is now returning to normalcy. MahaVitaran recorded demand of 22,339 MW. Earlier, the MSETCL recorded power transmission of 24,200 MW on 22 October 2018.

Maharashtra Electricity Regulatory Commission (MERC) granted a transmission licence to Adani Electricity Mumbai Infra Ltd for 25 years, enabling the firm to bring 1,000 MW, or 33 percent more electricity, to Mumbai to cater to increasing demand. Mumbai consumes 2,500-3,000 MW during peak load, which goes up to 3,500 MW in summer. While the cost for consumers will rise by ₹0.06-0.07/kWh (kilowatt hour) with the demand set to increase in the coming months, it will help the city to have more power. Adani to set up high-voltage DC link of 80 km. Since 1981, the city has been protected by ‘islanding’ system, for which citizens pay ₹4.5-5 bn each year through electricity bills. This is to ensure Mumbai gets constant supply even if there is power outage in MMR or elsewhere in the state. While Tata Power generates 1,337 MW, Adani generates 500 MW in Dahanu.

Adani Transmission Ltd (ATL) won an intra-state power transmission project in Madhya Pradesh for ₹13 bn in the tariff-based competitive bidding held by REC Power Transmission Company Ltd (RECTPCL). The other bidders in the race were Sterlite Power, Dilip Buildcon, Power Grid Corp of India Ltd (PGCIL), and Torrent Power. The tender was floated by RECTPCL, an arm of Rural Electrification Corporation of the power ministry. The project aims at boosting power transmission infrastructure in Madhya Pradesh. Adani Transmission will set up 16 new sub-stations and strengthen system in the existing power supply network. RECTPCL has offered two packages for ‘development of intra-state transmission work in MP through tariff-based competitive bidding’. Adani quoted the winning bid for the first package. For the second package, same companies have submitted their bids. As per the tender offered, RECTPCL expects power demand of Madhya Pradesh to grow up to 18,000 MW by 2022-23 and reach about 21,000 MW by the end of 14th Plan. It is 14,555 MW as of the financial year 2019-20.

The Cabinet Committee on Economic Affairs (CCEA) approved the revised cost estimate of scheme for strengthening of transmission and distribution (T&D) in Arunachal Pradesh and Sikkim to ₹91.29 bn. The scheme, being implemented through Power Grid Corp in association with Sikkim and Arunachal Pradesh, is targeted to be commissioned in phased manner by December 2021 for awarded scope of works and 36 months for un-awarded packages. After commissioning, the created transmission and distribution system will be owned and maintained by the respective state utilities. Implementation of this scheme will create a reliable power grid and improve States’ connectivity to the upcoming load centers, and thus extend the benefits of the grid connected power to the villages and towns including the remote and border areas and all categories of consumers of beneficiaries in Arunachal Pradesh and Sikkim. The scheme shall also increase the per capita power consumption of these States, and shall contribute to the total economic development. The scheme was initially approved in December, 2014 as a Central Sector Plan Scheme.

Siemens has commissioned a high voltage direct current link having voltage-sourced converter technology between Pugalur in Tamil Nadu and Thrissur in Kerala. The 2,000 MW electricity transmission system, consisting of two links between Pugalur in Tamil Nadu and Thrissur in Kerala, supports Power Grid Corporation of India Ltd (PGCIL) to counter power deficit in the southern region and improve the grid stability. The ±320 kV HVDC system has been done by Siemens Ltd in association with a consortium of Siemens Energy (Germany) and Sumitomo Electric Industries Ltd, Japan. It features for the first-time the integration of HVDC XLPE cable with overhead lines in India. The link has now been put into commercial operation and enables the exchange of electricity in both directions.

Power consumption in the country grew 16.5 percent in the first 12 days of March at 47.67 bn units over the corresponding period a year ago, showing a revival in the economic activities, according to power ministry data. Power consumption during March 1-12 last year was recorded at 40.92 bn units. On the other hand, the peak power demand met, which is the highest supply in a day, during this 12-day period of March 2021 remained well above the highest record of 170.16 GW in the entire March 2020. Till 12 March 2021, peak power demand met touched the highest level of 186.03 GW on 11 March 2021, and recorded a growth of 9.3 percent over 170.16 GW a year ago. The highest daily peak power demand met of 170.16 GW was recorded on 3 March 2020. Power consumption and demand could record a double-digit growth during March this year in view of rising mercury and perk-up in commercial and industrial requirement of electricity. Power consumption in this entire month is expected to be higher than 98.95 bn units recorded in March 2020. Power consumption recorded a 4.6 percent year-on-year growth in September and 11.6 percent in October 2020. In November 2020, the power consumption growth slowed to 3.12 percent, mainly due to the early onset of winters. In December, power consumption grew by 4.5 percent while it was 4.4 percent in January 2021. Power consumption in February this year recorded higher at 104.11 bn units compared to 103.81 bn units last year despite the fact that 2020 was a leap year. India’s power consumption grew 0.88 percent in February at 104.73 bn units due to a slight rise in temperature in the month, official data showed. Power consumption in February 2020 was 103.81 bn units, according to the power ministry data. However, the peak power demand met, which is the highest supply in a day, recorded a growth of 6.7 percent at 188.15 GW in February 2021 compared to 176.38 GW in February 2020. After a gap of six months, power consumption recorded a 4.5 percent year-on-year growth in September and 11.6 percent in October. In November 2020, the power consumption growth slowed to 3.12 percent, mainly due to the early onset of winters. In December, power consumption grew by 4.5 percent while it was 4.8 percent in January 2021. Peak power demand met grew at 1.7 percent in September, 3.4 percent in October, 3.5 percent in November and 7.2 percent in December.

Essar Power Gujarat Ltd (EPGL) has decided to shut down its 1,200 MW imported coal-fired power at Salaya near Jamnagar citing financial viability issues. The company approached the state government and informed about its decision to stop power supply to Gujarat Urja Vikas Nigam Ltd (GUVNL) after a revised supplemental power purchase agreement (PPA) with the state electricity company is pending clearance by the state government. The state power regulator, Gujarat Electricity Regulatory Commission (GERC) had last year approved a supplemental PPA between EPGL and GUVNL with some conditions. EPGL is a subsidiary of Essar Power Ltd (EPL).

Consolidated debt of state power distribution companies is estimated at ₹6 tn in FY2022, highest post implementation of debt restructure scheme under Ujwal Discom Assurance Yojna (Uday), according to the credit rating agency ICRA. This is in addition to ₹1.27 tn pending discom payables to power generators as of December 2020, 30 percent higher on a year-on-year basis. The credit profile of the state-owned distribution utilities continues to remain stressed due to higher level of technical and commercial (AT&C) losses compared to regulatory norms, inadequate tariffs in relation to their cost of supply and inadequate subsidy support from the respective state governments.

Uttar Pradesh Power Corp Ltd (UPPCL) announced the one-time settlement (OTS) scheme for domestic and private tubewell consumers. The scheme entails waiver of surcharge on arrears which will have to be paid by the end of the month to avoid any action by authorities. The scheme is applicable in both urban as well as rural areas. The Dakshin Haryana Bijli Vitran Nigam (DHBVN) has taken a major step to recover outstanding bills from consumers in Gurugram district, who have not paid their electricity bills despite repeated notices sent to them. Nearly 100 consumers’ meter connections — who did not pay bills even after repeated notices — were disconnected. The disconnection of the electricity connections stirred the defaulters. Nearly 472 consumers reached the electricity department and deposited nearly ₹4.2 million. This is the largest amount to be deposited in a single day at the electricity corporation. Consumers of the Badshahpur sub-division are yet to pay ₹90 mn as outstanding bills. The Badshahpur Power Corp has planned to run a special recovery campaign in March this year against such defaulters. Under the supervision of the Junior Engineer and Foreman, 10 teams have been formed for the recovery drive in different areas.

Power discoms in Delhi have proposed to regulator DERC (Delhi Electricity Regulatory Commission) that there should be a cost-reflective, progressive tariff rationalisation as their combined standalone revenue gap in 2019-20 is nearing ₹30 bn. BRPL, BYPL, and TPDDL have filed their separate petitions for truing-up up to 2019-20 and aggregate revenue requirement (ARR) and tariff for 2021-22, ahead of tariff rationalisation by DERC this year. The Commission has sought comments and suggestions from consumers and other stakeholders on the petitions by 26 March. The Commission may hold a public hearing later on and will issue its tariff order considering views of all stakeholders.

Nearly four years after signing the ambitious ‘Power for All’ agreement with the Centre, the UP government has electrified over 121,000 hamlets having population of 250 and above. According to state government data, the number of newly-electrified villages rose from 128,000 in 2017 to 2.49 lakh in 2021. This is besides over 12 mn consumers, mainly in rural areas, being covered under Saubhagya Scheme envisaging free electricity connection. UP provided the greatest number of connections under the Saubhagya scheme in last four years. Power supply to rural areas increased by 54 percent in four years. Data shows that the number of electricity connections increased by around 63 percent between 2017 and 2020 (till December). UP had 18 mn registered consumers in 2017 and the number has now gone up to 29.3 mn. The number of consumers grew by over 10 percent, from 25.9 mn in 2019 to 29.3 mn in 2020. According to UP Power Corp Ltd (UPPCL) the revenue recovery was very important for the maintenance of power distribution system. At the same time, the state government has expedited separation of rural feeders to reduce load and increase the quantum of power supplied. Data show that the number of rural feeders increased from 8,760 in 2017 to 11,794 in 2021. This has ensured around 18 hours of power supply to rural areas. As per the power supply roster, tehsils and districts are scheduled to get 21 hours and 24 hours of power supply. The state government has also managed to bear the peak load demand which increased from 18061 MW in 2017 to 23867 MW in 2020.

EESL arm Convergence Energy Services Ltd (CESL) launched the Gram Ujala programme under which high quality energy efficient LED (light emitting diode) bulbs will be given for ₹10 per piece in certain villages of five states in the first phase. In the first phase of this programme, 15 mn LED bulbs will be distributed across villages of Aarah (Bihar), Varanasi (Uttar Pradesh), Vijaywada (Andhra Pradesh), Nagpur (Maharashtra), and villages in western Gujarat. The programme will be financed entirely through carbon credits and will be the first such programme in India. The Gram Ujala programme will be implemented in villages of the five districts only and consumers can exchange a maximum of five LED bulbs. These rural households will also have metres installed in their houses to account for usage.

Load shedding in the national capital has dropped to 0.03 percent of the total consumption, the lowest in the last two decades, according to the Delhi Economic Survey report. The development comes even as the number of electricity consumers in the city grew by 81.74 percent during the decade. Delhi, being an urban place with high load density, has seen the electricity consumption increasing from “25,668 mn units in 2010-11 to 33,082 mn units in 2019-20”. The total power purchase in Delhi has grown by 21.37 percent during the last ten years (from 2009-10 to 2019-20). The power purchased in Delhi has increased from 32,744 mn units in 2010-11 to 35,419 mn units in 2019-20. While 14.72 percent of total power purchase is sourced from own generation by the Delhi government power plants, 85.28 percent is purchased from the central government and other sources. Delhi, where electricity prices have not been increased since 2015, also saw about 4.2 million households (more than 83 percent of the total domestic electricity consumers) getting electricity subsidy. The Delhi government’s zero power bill scheme is for consumers using up to 200 units of electricity every month. Apart from this, a subsidy of ₹800 is given to consumers whose monthly consumption ranges from 201 to 400 units.

With the onset of summer, several residents of Hyderabad have started facing the heat of power cuts for varied durations. As the Telangana State Southern Power Distribution Company Ltd (TSSPDCL) saw an 8 percent rise in power consumption in the Greater Hyderabad Municipal Corp (GHMC) limits over the last one month, power cuts in few areas have left residents sweating. With mercury levels inching closer to the 40°C residents are sweating it out with power cuts becoming a regular affair in areas such as Old City, Alkapur Township, Somajiguda and Manikonda, to name a few. The social media account of TSSPDCL is flooded with complaints of power disruptions from residents across the city.

Facing protests over high power bills and the Maharashtra’s drive to recover electricity dues the government assured that there would be no disconnection of power for both domestic and agricultural consumers until the state assembly held a discussion on the issue. Across Maharashtra, the electricity bill arrears had mounted to ₹485 bn of which ₹2.42 bn was pending in Mumbai metropolitan region. Nearly 200,000 consumers in the metro region had not paid monthly bills of ₹2.42 bn in the past ten months. 342,000 farmers in Maharashtra have paid pending electricity bill arrears to the tune of ₹3.12 bn in the past four months.

Punjab government announced that free power to farmers and subsidised power to the industry will continue in the state in his government. Benefits such as free power to farmers and subsidised power to the industry will continue, as will the 200 free units of power to Scheduled Castes (SC), Below Poverty Line (BPL), Backward Castes (BC) households, and freedom fighters in the state as the government was totally committed to the welfare of all sections of the people, with focus on the development of key sectors, including Agriculture and Industry.

Average spot power price at Indian Energy Exchange (IEX) rose over 16 percent to ₹3.39/kWh in February in the day ahead market (DAM), over the same month a year ago. The average spot power price was ₹2.91/kWh in DAM at IEX in February 2020. The term-ahead market (TAM) comprising intra-day, contingency, daily and weekly contracts traded 432 mn kWh volume during February’21 recording a significant 90.84 percent year-on-year (y-o-y) increase. The electricity market at IEX trades 6,769 mn kWh in February and registered 50 percent y-o-y growth in the month.

VinaCapital, one of the largest investment and asset management firms in Vietnam, will jointly invest up to $3 bn in a LNG-to-power complex in the country with its South Korean strategic partner GS Energy. The first phase of the 3,000 MW complex in the southern province of Long An should be operational from the end of 2025. Vietnam plans to raise the proportion of gas-fired electricity in its power mix to 21 percent by 2030 and to 24 percent by 2045 from 13 percent currently, according to a draft of the government’s master power development plan expected to be officially released later this year.

Thai oil and gas giant PTT Exploration and Production Pcl plans to expand midstream investments to have new businesses account for 20 percent of its profits by 2030, with a focus on gas-to-power. PTTEP, the upstream arm of state-owned PTT Pcl, received approval from Myanmar’s former government in December for a $2 bn gas-to-power project.

Britain’s National Grid broadly accepted a price control proposal from regulator Ofgem and would invest around 10 bn pounds ($13.9 bn) in the power transmission network that it operates by 2026. In December, Ofgem gave the go-ahead for 40 bn pounds ($53.4 bn) in spending on utility networks between 2021-2026 to prepare for more renewable power, including a higher-than-planned limit on grid operators’ returns. National Grid was pleased to see the increase in allowances and accepted the overall package for its role as electricity system operator, while broadly accepting the package for electricity and transmission businesses. The price controls take effect from April 2021. National Grid would submit a technical appeal to the Competition and Markets Authority (CMA) regarding Ofgem’s proposed cost of equity and downward adjustment to allowed returns in expectation of future outperformance. SSEN Transmission, part of utility SSE, willalso appeal these issues with the CMA, in addition to areas relating to new exposure to transmission charges and the loss of appeals right relating to total expenditure. If accepted, the six-month appeal process would begin from April and final determinations could be expected in October.

Cyprus, Greece and Israel signed an initial agreement to build the world’s longest and deepest underwater power cable that will traverse the Mediterranean seabed at a cost of about $900 mn and link their electricity grids. The project, called the Euro-Asia interconnector, will provide a back-up power source in times of emergency. The cable will have a capacity of 1,000-2,000 MW and is expected to be completed by 2024. With a length of about 1,500 km and a maximum depth of 2,700 metres, it will be the longest and deepest subsea electricity cable to have ever been constructed. The European Union has recognised the cable as a “Project of Common Interest” and willing to partly fund it.

26 March: The Goa government may reduce the state’s share of Value Added Tax (VAT) imposed on fuel prices, Chief Minister (CM) Pramod Sawant said, amid a sustained spike in prices of petrol and diesel over the last few months. The price of diesel and petrol in Goa is approximately ₹85.68 and ₹88.27 respectively.

Source: The Economic Times

26 March: The Delhi High Court (HC) set aside a single judge order directing the Centre to extend till 2030 its production sharing contract (PSC) with Vedanta Ltd and ONGC (Oil and Natural Gas Corp) to produce oil from the Barmer oil field in Rajasthan. The central government had claimed that the PSC with Vedanta will fall under the new policy for such contracts. The contention was opposed by the company. The single judge had held that Vedanta was entitled to extension of its contract, which was to expire in 2020, for a further period of 10 years on the same terms and agreements when it was first entered into in 1995. While the government’s appeal was pending, the PSC was being extended from time to time for brief periods since May 2020. The 31 May 2018 order had come on Vedanta’s plea for extension of the PSC which the company and the ONGC have with the government to extract oil from the Barmer block in Rajasthan. ONGC had communicated its approval for extension of the PSC in July 2016, after which the Centre had assured the court it would positively take a decision by October of the same year.

Source: The Economic Times

26 March: A fall in crude oil price and Aramco’s $75 bn annual dividend commitment may have delayed Saudi company picking a stake in Reliance Industries Ltd (RIL)’s oil-to-chemical unit (O2C), research firm Jefferies said. The deal was to conclude by March 2020 but has been delayed for reasons not disclosed by either company. Besides refineries and petrochemical plants, the O2C business also comprises a 51 percent stake in the fuel retailing business. It, however, does not include the upstream oil and gas producing assets such as the flagging KG-D6 block in the Bay of Bengal.

Source: The Economic Times

25 March: Karnataka is expected to oppose the proposal to bring petrol and diesel within the ambit of Goods and Services Tax (GST), arguing that such a move will lead to substantial revenue loss for states. It will share its opinion at the forthcoming GST Council meeting. The council comprises representatives of all states and decides on policy and indirect tax rates. Currently, both state and central governments impose taxes on fuel. High retail prices have prompted discussions about whether including petrol and diesel in the GST structure can make them more affordable. The highest GST rate is 28 percent, much lower than the applicable rates of state and central taxes on fuel. Union Finance Minister Nirmala Sitharaman said that she would be glad to discuss the suggestion. States are concerned that the switch to GST will take away their power to levy tax on fuel. Currently, petrol and diesel cost consumers ₹94.2 and ₹86.3, respectively. If a 28 percent GST rate is applied, the retail price of petrol may come down to ₹47.2 and diesel to ₹48.3. But this will mean huge revenue loss for the Centre and states.

Source: The Economic Times

24 March: The next leg of the Pradhan Mantri Ujjwala Yojana (PMUY) is going to focus on affordability of liquefied petroleum gas (LPG) or cooking gas refills. According to the oil ministry, this will be in line with the government’s efforts to increase adoption of LPG through behavioural shifts among lower income households. There is a fresh target to add another 10 mn more PMUY beneficiaries to the existing 80 mn. This will take the total number of LPG consumers in the country closer to 300 mn by March 2022. This new disbursal target was announced by Union Finance Minister Nirmala Sitharaman in the latest Union Budget. Indian Oil Corp (IOC) said the modalities for the release of 10 mn more PMUY connections were under finalization by the oil ministry. Currently on a per kg basis, the LPG in a 14.2 kg domestic cylinder costs around ₹60 a kg. But it costs roughly ₹75 a kg in a 5 kg FTL (free trade LPG) cylinder. The higher cost per kg dissuades consumers that are anyway price sensitive. These issues are soon expected to be addressed. PMUY beneficiaries buy LPG cylinders at full cost and oil companies recover the loaned amount from the subsidy that is accrued on domestic (14.2 kg) LPG cylinders. On an average, the PMUY beneficiaries use three cylinders in a year. This is less than half the usage of non-PMUY cooking gas connection users. The low number of cylinder refills makes it difficult for the oil companies to recover the loan amounts. To improve affordability of cylinders, the oil companies deferred recovery of loans for up to six-cylinder refills from March 2018. Under the present domestic LPG cylinder pricing regime, there is negligible subsidy on cooking gas but higher freight costs, for customers located away from depots, continue to be subsidised by the centre. This results in a subsidy of around ₹20 to ₹30 per domestic cylinder that costs upwards of ₹800 a piece in the country.

Source: Business Standard

24 March: Bharat Petroleum Corp Ltd (BPCL) announced it has started doorstep delivery of diesel for industrial and bulk consumers in Faridabad and adjoining areas in Haryana. The service uses mobile application Humsafar. BPCL has started delivery of the fuel from Auto Grit, a BPCL fuel pump on Delhi-Badarpur border. The service can be used by housing societies, malls, hospitals, banks, large transporters and construction sites, mobile towers and industries. Customers can book diesel through the Fuelkart or Humsafar app and have it delivered to a given location. The fuel-delivery vehicle comes fitted with a mobile dispenser and fuel tank. The company plans to add six diesel-at-doorstep units by end 2021. The service was launched by Midha and Goel. It will cover multiple areas including Tigaon, Ballabgarh, Prithla, Faridabad NIT and Badhkal.

Source: The Economic Times

24 March: Central taxes on petrol and diesel rose by over 307 percent in the last six years, allowing the Union government to mop up a sum of ₹2,940 bn through taxes on fuel between April 2020 and January 2021. Even when global crude prices went down, central excise duty maintained an upward trajectory touching 12.2 percent in 2020-21, up from 5.4 percent in 2014-15. Cumulatively, central taxes on petrol, diesel and natural gas as a percentage of the budget estimates of gross total revenue increased by nearly 126 percent since 2014-15. Global crude oil prices had touched a two-decade low during the pandemic. junior Finance minister Anurag Thakur said the amount of tax collected as a percentage of the gross tax revenue had increased over the years. Data given by the government showed that in the last six years, overall collections through central excise duty on petrol and diesel rose by a 307.3 percent with collections from petrol alone growing at 206 percent and diesel by 377 percent. In actual terms, excise duty on petrol has gone up from ₹9.48 per litre in 2014 to ₹32.90 a litre at present. For diesel, the increase is from ₹3.56 a litre to ₹31.80 during the same period.

Source: The Economic Times

30 March: Torrent Gas annonced it has signed a Share Purchase Agreement (SPA) with the promoters of Sanwaria Gas for the takeover of the company to provide Compressed Natural Gas (CNG) and Piped Natural Gas (PNG) service in the geographical area of Mathura. With this acquisition, it has now authorization to set up City Gas Distribution (CGD) network across 17 geographical areas spread over 33 Districts in seven states and one union territory. The transaction is subject to approval from the Petroleum and Natural Gas Regulatory Board (PNGRB) and fulfillment of other conditions. The company said it plans to invest over ₹80 bn for development of CGD network in these districts over five years, of which ₹15 bn has already been invested. Torrent Gas has been authorized to set up CGD infrastructure and sell CNG to vehicle users and PNG to industries and households in 33 districts across Uttar Pradesh, Gujarat, Maharashtra, Rajasthan, Punjab, Tamil Nadu and Telangana and Puducherry.

Source: The Economic Times

25 March: GAIL Gas and Confidence Petroleum India Ltd (CPIL) signed an agreement for setting up 100 CNG (compressed natural gas) stations in Bengaluru as they looked to strengthen the network supplying clean CNG to automobiles in the IT capital of the country. The new CNG stations will be located in core areas of the city or at CPIL’s auto LPG retail outlet sites. To optimise uptake of CNG and improve the accessibility of CNG fuel for Bengalureans, GAIL Gas has been adopting various models of CNG dispensing in the city. GAIL Gas has extended its network through company-owned company-operated CNG Station model and CNG stations at petrol pumps of oil firms. With this agreement, GAIL Gas will increase CNG Stations in the city on dealership model. In the current scenario, CNG presents an affordable and environment-friendly alternative. CNG at present is priced at ₹51.50 per kg in Bengaluru. Currently, GAIL Gas has installed 55 CNG stations in the city.

Source: The Economic Times

30 March: Coal India Ltd (CIL) loaded 372.5 rakes on 19 March, the highest single day loading this fiscal. Of this, power sector accounted for 90 percent at 335 rakes, the company said. It said that till 26 March, CIL loaded an average of 312 rakes per day recording 24.6 percent growth compared to the same date of March last year when the loading was 250.3. The average loading for the power sector also clocked 22.7 percent growth in March with 269.2 rakes compared to 219.4 rakes in the same period last year, the company said. CIL’s supplies in terms of volume shrunk marginally compared to last year, primarily due to less lifting of committed quantity by power sector and reduced despatch through road mode during the pandemic lockdown resulting in a fall of around 32 percent. Non-regulated sector customers have lifted 38.2 million tonnes (mt) of coal in the current financial year till 26 March as against 28.6 mt lifted in the same period last fiscal.

Source: The Economic Times

26 March: As many as 14 coal blocks from Odisha are set to go under the hammer with the Centre launching its second tranche of auction of 67 coal blocks for commercial mining. The Machhakata, Mahanadi, Nuagaon Telisahi, Ramchandi promotion block, the Alaknanda, Bartap, Burapahar, Dip extension of Belpahar, the Dip side of Chatabar, Kardabahal-Brahmanbil, Kosala West, Phuljhari east and west, the Saradhapur north and Tentuloi are the 14 blocks from Odisha, which have been picked by the Centre for auction. These blocks are located in the Talcher and Ib valley of the state. The Centre had listed nine blocks from Odisha for commercial mining in the first phase, while two blocks — Radhikapur East and Radhikapur West — were successfully auctioned by the Centre in November last. While Aditya Birla Group’s EMIL Mines and Mineral Resources Ltd had bagged the Radhikapur East block, Vedanta Ltd had bagged the Radhikapur West block. The decision to allow commercial coal mining was announced by the Centre in June last year as part of its Atmanirbhar Bharat Abhiyan, which aims to make India self-reliant in the energy sector and to boost industrial development. The move also aims to end the monopoly of the Coal India Ltd (CIL). Commercial coal mining allows anyone, including the foreign players, to bid for coal blocks, explore coal and sell it in the open market as the concept of end-use has been scrapped by the Narendra Modi government.

Source: The Economic Times

25 March: India has proposed to adopt a ‘rolling auction’ mechanism for conducting coal auctions under which a pool of coal blocks will always remain available for auctions, Coal Minister Pralhad Joshi said. Coal is the first mineral resource where rolling auction mechanism is being implemented. The country launched second tranche of auction for commercial coal mining offering 67 mines for sale of coal. The coal mines on offer are a mix of mines with small and large reserves, coking and non-coking mines and fully and partially explored mines spread across six states Chhattisgarh, Jharkhand, Odisha, Madhya Pradesh, Maharashtra and Andhra Pradesh. He said the government is also looking at reforming the existing e-auction mechanism of Coal India Ltd (CIL) and considering clubbing different e-auction windows of CIL into one.

Source: The Economic Times

30 March: As part of its summer action plan, the government is now focusing on providing uninterrupted power supply. Andhra Pradesh (AP) Energy Minister Balineni Srinivasa Reddy said that the state was currently meeting its energy demand of 220.6 mn units/day as on 27 March and that this demand is likely to go up to 222 mn units/day over the coming days. The Minister said the government’s decision to supply nine hours of free power to the agriculture was one of the reasons behind the increase in energy demand. He directed officials to place special focus on effective implementation of free power to the sector. In view of the huge demand, power utilities will have to utilise multiple sources to meet expected higher daily grid demand. Energy Secretary Srikant Nagulapalli told the minister that demand for electricity had been increasing in the state for various reasons. The consumption of energy was recorded as 185 mn units in 2018 which increased to 218 mn units in 2020-21.

Source: The Economic Times

29 March: Last year, amid complaints about hefty electricity bills, some residents moved the Madras high court saying TANGEDCO (Tamil Nadu Generation and Distribution Corp Ltd)’s methodology to calculate power consumption during the Covid-triggered lockdown was arbitrary and unjust. Now, a study by Citizen Consumer and Civic Action Group (CAG) and CEEW (Council on Energy, Environment and Water) suggests that TANGEDCO’s white meter card for electricity bills provides inadequate information on consumption and tariffs when compared to bills in other states. There is a dire need to redesign power bills to provide detailed billing information, it said. Electricity bills are key tools for enabling consumers to interact with the utility and various stakeholders in a transparent manner, it adds. TANGEDCO had argued that the huge bills were due to people spending more time at home. The study, which collected data from 250 respondents in nine Tamil Nadu districts, found that most consumers have low awareness of billing information as they primarily rely on white meter cards, which offer less information than online account summaries.

Source: The Economic Times

27 March: The all-India energy demand is expected to be higher in March quarter of 2020-21 compared to same period a year ago despite the partial lockdown in some states due to a surge in COVID-19 cases, India Ratings and Research (Ind-Ra) said. Ind-Ra has published the March 2021 edition of its credit news digest on the power sector. The report highlights the trends in the power sector, with a focus on capacity addition, generation, transmission, merchant power, deficit, regulatory changes and the recent rating actions by Ind-Ra. The short-term power price at Indian Energy Exchange continued its improving trend on a year-on-year basis with the prices breaching ₹4/unit in March 2021 for the first time since October 2018.

Source: The Economic Times

26 March: Power Grid Corp said it has acquired Bikaner-II Bhiwadi Transco Ltd (BBTL) which would implement a power transmission project. BBTL is the project SPV to establish transmission system strengthening scheme for evacuation of power from solar energy zones in Rajasthan (8.1 GW) under Phase-II, on build, own, operate and maintain (BOOM) basis from the bid process coordinator – PFC Consulting, it said.

Source: The Economic Times

24 March: The North Eastern Electric Power Corp Ltd (NEEPCO) has lifted the regulation of power supply to Meghalaya after MeECL (Meghalaya Energy Corp Ltd) assured to clear the outstanding dues in three instalments, Power Minister James K Sangma said. The Power Minister also declared that there will be no more load shedding. The decision was taken after MeECL has paid an amount of ₹1.27 bn of ₹5.04 bn to NEEPCO on 19 March, towards partial liquidation of the outstanding dues. The MeECL vide an e-mail has also given a commitment to pay the amount due and payable to NEEPCO in three equal instalments on or before 30 April, 31 May and 30 June on best effort basis.

Source: The Economic Times

30 March: India is unlikely to bind itself to a net-zero greenhouse gas emissions goal by 2050, despite diplomatic pressure from the United States (US) and Britain to do so to help slow global warming. India is the world’s third-biggest carbon emitter after China and the US and thus is vital in the fight against climate change currently focused on reaching zero emissions by mid century or thereabouts. But India’s energy demand is projected to grow by more than any other nation over the next two decades and the worry is that it may have to cut back on consumption if it were to tie itself to a hard emissions deadline. India will instead stick to the Paris pledge to reduce its carbon footprint by 33-35 percent from its 2005 levels by 2030 and is aiming to outperform those goals. Prime Minister Narendra Modi has set a target of generating 450 GW of renewable energy by 2030 which is five times current capacity and two and half times the Paris pledge.

Source: Reuters

30 March: Tata Power, country’s largest integrated power firm, said it is set to develop a 60 MW solar power project in Gujarat and has received a Letter of Award from Gujarat Urja Vikas Nigam Ltd (GUVNL) for the same. Tata Power had won this capacity in a GUVNL bid in January this year. According to the company, the project would generate 156 mn units of energy per year and would annually offset about 156 mn kg of carbon dioxide.

Source: The Economic Times

30 March: India can hold its greenhouse gas emissions from the electricity sector at 2018 levels by increasing its clean power capacity, according to a Berkeley Lab-led team of researchers. A new study recently published in the Proceedings of the National Academy of Sciences from researchers at Berkeley Lab, University of California, Santa Barbara, and University of California, Berkeley, shows India can aim even higher with its renewable energy goals. The costs, the researchers demonstrated, would be comparable to those of a fossil fuel-dominated grid, the report said, noting that India had set ambitious targets for renewable power, with plans to quintuple its current wind and solar energy capacity by 2030. India’s transition away from fossil fuels will have a significant impact on global climate efforts since it is the world’s third-largest greenhouse gas emitter, although its per capita emissions are below the global average, it said. Using computer models, the research team, which also included Duncan Callaway of UC Berkeley, examined the electricity and carbon mitigation costs needed to reliably operate India’s grid in 2030 for a variety of wind and solar targets. Under current goals, two-thirds of India’s added renewable electricity would come from solar and the rest from wind. But because of India’s weather and electricity demand patterns, a target that leans more heavily on wind power will lead to lower costs, the study found. India will still need resources to meet electricity demand during times when both sun and wind levels are too low, the researchers noted.

Source: The Economic Times

27 March: In a first, power users in the state have the option to go for 100 percent renewable energy supply by paying an extra 66 paise a unit for ‘green power tariff’ which was approved by MERC (Maharashtra Electricity Regulatory Commission). MERC’s order said all users (extra high voltage, high voltage and low voltage) will be eligible to opt for 100 percent renewable energy (RE).

Source: The Economic Times

26 March: ReNew Power, India’s leading renewable energy firm, said it has commissioned a 300 MW wind power generation facility at Kutch, Gujarat. The project would provide clean power to Haryana and Orissa at a rate of ₹2.44 per unit. According to the company press release, the project would also provide direct employment to over 200 people. The project was awarded to ReNew’s subsidiary ReNew Wind Energy in an e-reverse auction conducted by the Solar Energy Corp of India.

Source: The Economic Times

26 March: To promote solar energy in Haryana, the Dakshin Haryana Bijli Vitaran Nigam announced a scheme with subsidy of 40 percent for a three kilowatt plant in homes as per the guidelines of the Ministry of New and Renewable Energy (MNRE). A subsidy of 20 percent subsidy will be for four to 10 kilowatt (kW) for installing solar system from listed firms. Dakshin Haryana Bijli Vitaran Nigam Managing Director Balkar Singh said by installing a solar system of one kW, the consumer can save up to ₹6,000 in a year and the expenditure done for installing this solar system could be retrieved in five-six years. He said the rates have been set to install solar systems on the rooftop. The consumer is required to pay only the remaining amount after adjusting the rebate amount to the firm. The consumers can reduce their electricity bills by installing solar systems as per their requirement.

Source: The Economic Times

25 March: As much as 170.14 GW of renewable energy capacity, excluding large hydropower units, has either been installed or under various stages of development or bidding at February-end this year, Parliament was informed. The statement assumes significance in view of India’s ambitious target of having 175 GW installed renewable energy capacity by December 2022. Power and New & Renewable Energy Minister R K Singh said that the government has set a target of achieving 175 GW installed renewable energy capacity (excluding large hydro) by December 2022.

Source: The Economic Times

24 March: To reduce the cost of electricity in the government schools of the state, the Punjab government would install 3 kW solar panels in 183 primary schools at a cost of ₹27.4 mn. Education Minister Vijay Inder Singla said that the Education Department is making continuous efforts to further strengthen the infrastructure in the government primary schools. He said that solar energy projects were being set up in 3214 schools at a cost of ₹975.5 mn. According to an official release, 183 more government primary schools of Ferozepur district would get solar energy with this new initiative. Singla said that solar energy is the need of the hour.

Source: The Economic Times

24 March: Pakistan raised objections to the designs of Pakal Dul and Lower Kalnai hydropower plants in Jammu and Kashmir and sought more information on the projects in Ladakh sanctioned after the abrogation of Article 370 as the Indus Commissioners of the two countries met. On its part, India justified its stand on the designs. The Pakal Dul Hydro Electric Project (1,000 MW) is proposed on the Marusudar river, a tributary of the Chenab river, in Kishtwar district in Jammu and Kashmir. The Lower Kalnai project is proposed in Kishtwar and Doda districts. The two sides also discussed a host of other issues under the Indus Waters Treaty during the annual Permanent Indus Commission meeting. India has since cleared several hydropower projects for the region. According to the treaty, India has been given the right to generate hydroelectricity through run-of-the-river projects on the western rivers subject to specific criteria for design and operation. The treaty also gives right to Pakistan to raise objections on design of Indian hydroelectric projects on the western rivers.

Source: The Economic Times

24 March: Adani Green Energy (AGEL), said it is set to acquire 75 MW operating solar projects of Sterling & Wilson, a Shapoorji Pallonji group company, for ₹4.46 bn. It said that AGEL has signed definitive agreements with Sterling & Wilson for the acquisition of 100 percent stake in two special purpose vehicles (SPVs) that own 75 MW operating solar projects at Telangana. According to the company, the projects were commissioned in 2017. With this acquisition, AGEL will increase its operating renewable capacity to 3,470 MW with a total renewable portfolio of 15,240 MW. AGEL had announced that was set to acquire 50 MW solar asset in Telangana from Toronto-headquartered SkyPower Global. The firm had said that it has signed definitive agreements with SkyPower to acquire 100 percent stake in a SPV.

Source: The Economic Times

30 March: Saudi Arabia is prepared to support extending oil cuts by OPEC (Organisation of the Petroleum Exporting Countries) and allies into May and June and is also ready to extend its own voluntary cuts to boost oil prices amid a new wave of coronavirus lockdowns. With oil prices making steady gains earlier this year, OPEC and allies, known as OPEC+, had hoped to ease output cuts. The cuts involve OPEC led by Saudi Arabia as well as non-OPEC producers led by Russia. Together their cuts currently stand at just over 7 mn barrels per day (bpd) plus an additional 1 mn bpd voluntary reduction by Saudi Arabia. Last year, cuts touched a record 9.7 mn bpd, or about 10 percent of world output. OPEC+ had already surprised the market on 4 March by deciding to hold output broadly steady. Russia and Kazakhstan were allowed to slightly raise production. Industry benchmark Brent crude futures, which this month reached their highest since before the pandemic at $71 a barrel, have since fallen to about $65. Another reason for caution is rising Iranian oil exports, which have also weighed on prices. Iran has managed to boost shipments in recent months despite US (United States) sanctions.

Source: Reuters

25 March: Crude oil producers from Europe, Africa and the United States faced difficulties selling to Asia, especially China, as buyers took cheaper oil from storage while refinery maintenance has reduced demand. Chinese independent refiners, which account for a fifth of the country’s imports, have slowed imports in the second quarter because of refinery maintenance, strong Brent prices and a large influx of supplies, including Iranian oil, in first quarter. These buyers and others in Asia are lapping up cheap oil offered by traders under pressure to clear storage after Brent crude flipped into backwardation, with prices for prompt delivery higher than those for future months, traders said. As a result traders were forced to sharply reduce prices for spot cargoes loading in April and May from Europe, Africa and the United States for delivery to Asia. Lockdowns in Europe have also reduced demand, they said.

Source: Reuters

30 March: China was the only G20 country that saw a large increase in coal generation in the pandemic year, a research published by energy think tank Ember said. India, on the other hand, saw a decline of five per cent. Globally there was a record fall in coal generation in 2020, which was mirrored in India and other top coal power countries. China is now responsible for more than half (53 percent) of the world’s coal-fired electricity. China bucked this trend, standing out as the only G20 country that saw a large increase in both electricity demand and coal power in 2020. The four largest coal-generating countries after China all saw coal power decline in 2020: India (minus five percent), the United States (minus 20 percent), Japan (minus one percent) and South Korea (minus 13 percent). Coal remained the world’s single largest power source in 2020. Global coal generation was only 0.8 per cent lower in 2020 than in 2015 and gas generation was 11 percent higher.

Source: The Economic Times

30 March: Italian refiner Saras plans to spin off its renewable energy business and bring on board a partner to help fund future development. Saras, which operates one of Italy’s biggest refineries in Sardinia, is developing a clean energy business that includes wind and solar plants, biofuels and hydrogen. It is looking to reach 200 MW of wind capacity this year and build new renewable capacity of up to 400 MW in 2024 to reach an overall 500 MW to navigate the energy transition.

Source: Reuters

29 March: China’s internet industry has seen robust growth in recent decades, but its data centres, large-scale servers and cellular base stations are consuming energy at a faster pace. Hence, China’s tech firms have started to work on green solutions. According to a report by China’s State Grid Energy Research Institute, the electricity consumption by data centres alone in 2020 is estimated to exceed 200 billion kWh, accounting for 2.7 percent of the country’s electricity consumption. By 2030, the data centre electricity consumption in China will exceed 400 bn kWh, accounting for 3.7 percent of the country’s total electricity consumption, the report said. Wang, a carbon emission reduction expert and an advocate of green development, said that enterprises in the sector should act quickly to build greener internet infrastructure. China’s tech giants, such as Huawei and Tencent, have been trying to build a zero-carbon internet industry. In Mobile World Congress Shanghai 2021 held in February, Huawei unveiled its solution for zero-carbon network, including minimalised base stations, server rooms, data centres and wide use of green electricity. Vice President of Huawei and President of its Digital Power Product Line Zhou Taoyuan said Huawei can reduce energy consumption by using high-performance, low power-demand and highly-integrated servers, and minimising the room occupation of base stations.

Source: The Economic Times

26 March: The Biden administration set a goal to cut the cost of solar energy by 60 percent over the next decade as part of an ambitious plan to decarbonize the United States’ power sector by 2035. The US (United States) Department of Energy (DOE) said the goal accelerates its previous utility-scale solar cost target by five years. For the US power grid to run entirely on clean energy within 15 years, a key pillar of President Joe Biden’s climate change agenda, solar energy will need to be installed as much as five times faster than it is today, DOE said. To get there, the agency committed to spending $128 mn on technologies including perovskite solar cells, which are regarded as a promising cheap alternative to the silicon cells that dominate the market. Funds will also support research on cadmium telluride and concentrating solar technologies. Part of the funding will also seek to extend the lifetime of existing photovoltaic solar plants by improving components like inverters, cables and racks. The cost of generating power from the sun has dropped more than 80 percent in the last decade, making it competitive with plants powered by fossil fuels like coal and natural gas. Solar energy now accounts for the largest share of annual new generating capacity in the United States, according to government data. DOE has set ambitious targets for solar in the past. In 2017, the agency said the cost had hit its goal three years ahead of schedule due to a drop in the cost of solar panels tied to expanded production in China.

Source: The Economic Times

25 March: The world’s wind industry installed a record 93 GW of new capacity last year but at least double that amount is needed every year to limit global warming, a report by the Global Wind Energy Council (GWEC) showed. New wind capacity rose by 53 percent last year from the year before despite challenges due to the COVID-19 crisis. However, the world needs to install at least 180 GW of new wind energy every year to limit global warming to well below 2°C above pre-industrial levels, and up to 280 GW annually to meet net zero emissions by 2050, the industry group said. Total global wind power capacity is now at 742 GW, helping the world to avoid over 1.1 billion tonnes of carbon dioxide annually, which is equivalent to the annual CO2 (carbon dioxide) emissions of South America. But the current rate of wind power deployment will not be enough to reach net zero emissions by the middle of this century.

Source: Reuters

25 March: High-skilled oil and gas workers and the supply chain will not be left behind in the transition to a low carbon future, the Britain government vowed as a landmark North Sea Transition Deal is agreed with industry. The sector deal between the UK (United Kingdom) government and oil and gas industry will support workers, businesses, and the supply chain through this transition by harnessing the industry’s existing capabilities, infrastructure and private investment potential to exploit new and emerging technologies such as hydrogen production, carbon capture usage and storage, offshore wind and decommissioning. Not only will the deal support existing companies to decarbonise in preparation for a net zero future by 2050, but it will also create the right business environment to attract new industrial sectors to base themselves in the UK, develop new export opportunities for British business, and secure new high-value jobs for the long-term. Extracting oil and gas on the UK Continental Shelf is directly responsible for around 3.5 percent of the UK’s greenhouse gas emissions. Through the package of measures, the deal is expected to cut pollution by up to 60 million tonnes (mt) by 2030, including 15 mt from oil and gas production on the UK Continental Shelf — the equivalent of annual emissions from 90 per cent of the UK’s homes — while supporting up to 40,000 jobs across the supply chain.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.