-

CENTRES

Progammes & Centres

Location

In the past few years, media headlines have suggested that communication devices such as smartphones use as much electricity as refrigerators or that the carbon foot print of video streaming is the same as that of taking a transatlantic flight. These headlines have provoked strong responses from the communication and energy industries. Using robust academic studies, these industries have shown that the carbon footprint of communication devices is definitely not as high as suggested by the sensational headlines.

The comparison between the carbon footprint of video streaming and transatlantic flights were challenged by studies (quoted by Ericsson) that concluded that a smartphone needs to be used for 50 years to cause the same level of emissions as the fuel combustion of one transatlantic return flight. The fact that information and communication technology (ICT) sector’s carbon footprint of 730 million tonnes (MT) of carbon-di-oxide equivalent (CO2e) is close to the 800 MT CO2e emissions from burning fuel across the aviation industry, 80 percent of this associated with travelling may have led to the comparison between video streaming and flying. In its rebuttal Ericsson also highlighted the fact that 70 percent of people globally use ICT, while only 10 percent of the global population use air travel, with only the wealthiest 1 percent being frequent flyers. This means that even if the footprints of the sectors were of a similar magnitude (a small percentage of global overall carbon emissions at current usage levels, as in the unbalanced comparison), the impact per user would still differ a lot. This is effectively the same as the per person argument that India uses to counter the charge of affluent countries that India’s carbon emissions are high.

The carbon footprint of using any communication or entertainment device depends first on the electricity usage by the device (TV, Laptop, mobile, game console etc) and then on the CO2 emissions associated with each unit of electricity (generated with coal, gas, nuclear, renewables etc) that the device uses. According to the international energy agency (IEA), streaming video on a 4G phone for an hour consumes about 0.009 kWh (kilowatt hour) of electricity while the same on a laptop (wifi & high definition or HD) consumes wile 0.018 kWh of electricity and on a 50-inch light emitting diode (LED) television (wifi & HD) video streaming consumes 0.120 kWh of electricity. Effectively the TV consumes 100 times more electricity than a smart phone and a laptop 5 times more. Currently roughly 70 percent of entertainment viewing (such as Netflix content) occurs on TVs, which are much more energy-intensive than laptops that account for 15 percent of viewing followed by tablets at 10 percent and smartphones 5 percent. Because phones are extremely energy efficient, data transmission accounts for more than 80 percent of the electricity consumption when streaming. On average one hour of streaming video in 2019 had a carbon footprint of 36 grams of CO2 equivalent per hour (gCO2e, based on global average electricity mix) which is equal to the carbon foot print of driving in a conventional car for 200 metres. In France, where around 90 percent of electricity comes from low-carbon sources (nuclear power), carbon emissions from one hour of video streaming would be around 2gCO2e, equivalent to 10 metres of driving. In India carbon emissions would be much higher as about 80 percent of electricity generation is fossil fuel based. The carbon emissions from using a communication device for viewing in India is almost twice the global average and higher than using the same device in China.

Small screens need less energy than large ones so four persons watching a movie over their smartphones use less electricity than one person watching the same movie on the TV screen. In a rough comparison, streaming 400 two-hour movies on a laptop connected to an external screen would consume as much electricity as a modern fridge does in a year. If the streaming was on a smartphone, 2,900 films could be streamed using the same amount of electricity. In emissions, one year of smartphone usage could be compensated for by driving 2 hours less on the highway in a petrol car (or less if energy involved in the production of fuel and the car, and the maintenance of the roads is included). Currently viewing devices account for majority of energy use (about 72 percent) followed by data transmission (about 23 percent) and data centres (about 5 percent). But in the future, data centres and transmission services are projected to consume more electricity than viewing devices. Overall, the average carbon footprint per ICT subscription was 81 kg CO2e which is not high compared to the global average total carbon footprint of about 7000 kgCO2e per person.

The entire ICT sector, including the data centres that store and process data, the transmission networks that transfer data through fixed or mobile networks, and the connected devices such as computers and smartphones that exchange information accounts for about 4 percent of global electricity consumption (just over 1000 TWh) and 1.4 percent of global carbon emissions. Out of this roughly 66 percent of the electricity consumption is due to consumer devices (home and office products), including television. This may not seem like much but the electricity consumption of communication devices worldwide is equal to the total electricity generation in countries like Poland or Sweden. In terms of lifecycle carbon emissions of user devices, about half of the emissions are related to usage and the other half to the rest of the life cycle. Desktop personal computers (PC) usage and smartphone manufacturing represent the most substantial impact, followed by customer premises equipment such as laptops and monitors.

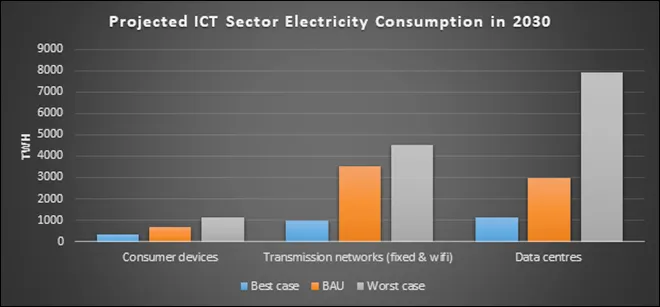

The number of annually produced desktops and monitors peaked in 2010 and their number is expected to decline by 2030 due to changed consumer behaviour and competition from other types of personal computers. The number of laptops produced is expected to peak by 2020 and decline thereafter due to competition from mobile devices. The number of annually produced smartphones is expected to increase substantially to more than 3 billion units by 2030 while the number of ordinary phones is expected to decrease. The number of tablets produced is also expected to increase but it is not expected to match the number of smart phones. The number of mobile broadband modems is expected to increase to more than 1 billion by 2030. The number of produced TVs of different sorts is expected to increase slightly with majority of TV panels featuring network connectivity as a standard feature. TV peripherals such as set-top boxes, game consoles, audio and video players, printers etc are also expected to increase proportionally. Notwithstanding the substantial increase in the number of communication and entertainment devices, their total electricity consumption is expected to fall in all scenarios (business as usual (BAU), best case and worst case) by 2030 because of substantial gains in efficiency of electricity use by the devices. In the worst-case scenario, the peak electricity consumption of about 1200 TWh (terawatt hour) by communication devices is expected around 2022 after which electricity consumption is expected to fall below current levels. The projected peak electricity consumption by communication devices in 2030 is little more than the total electricity generated in the Russian Federation in 2019. However, the total electricity consumption of communication devices along with the networks and data centres that support the devices is projected to touch 30,715 TWh by 2030 in the worst-case scenario (limited efficiency gains and exponential growth in devies) and 8265 TWh in the BAU scenario. The projected electricity consumption by the ICT sector in the worst-case scenario is more than the global electricity generation in 2019 and the projected electricity consumption in the BAU scenario is more than the total electricity generated in North America and Europe in 2019.

Video traffic over mobile networks is growing at 55 percent per year. Phones and tablets already account for more than 70 percent of the billion hours of youtube streamed every day. Moreover, emerging digital technologies, such as machine learning, blockchain, 5G, and virtual reality, are likely to further accelerate demand for data centre and network services. The ease of accessing streaming media is leading to a large rebound effect, with overall streaming video consumption rising rapidly. But the complexity of direct and indirect effects of digital services, such as streaming video, e-books, and online shopping, make it immensely challenging to quantify the net environmental impacts, relative to alternative forms of consumption.

In absolute terms, the GHG (greenhouse gases dominated by CO2) emissions of smart phones grew from about 17 MTCO2e in 2010 to 125 MTCO2e in 2020, representing a 730 percent increase in the span of 10 years. This impact is clearly driven by the fact that the production energy makes up 85-95 percent of its lifecycle annual foot- print, driven by the short average useful life of smart phones of 2 years, which is driven by the telecom membership business model. Clearly this business model, while highly profitable to the smart phone manufacturers and the telecom industry, is unsustainable and quite detrimental to the global efforts in GHG emission reductions. Furthermore, the contribution of the ICT infrastructure makes up the lion share of the overall industry impact, growing from 61 percent in 2010 to 79 percent in 2020. Most of that relative growth comes from the data centre industry whose contribution to the overall footprint increased from 33 percent in 2010 to 45 percent in 2020. In absolute terms, it shows an almost 3-fold increase from 159 to 495 MTCO2e in the 10-year span.

Most concerning however is the continued growth of the ICT sector relative to all the other sectors and relative to the total worldwide footprint beyond 2020. The exponential growth has a midpoint of 7.3 percent annual growth which, if unchecked through 2040, will bring ICT total footprint to amount to about 14 percent of the total global footprint. This is equal to the total carbon emissions of USA in 2019.

Two factors behind the projections for energy consumption by the ICT sector are growth in demand for ICT products and services and improvement in efficiency in energy use across the sector. The ICT sector has phenomenal gains in energy efficiency. The gains in energy efficiency of computing that underpins the ICT sector is described by “Koomey’s Law”. This law describes trends in the energy efficiency of computing, which has doubled roughly every 1.6 years since the 1940s, and every 2.7 years since 2000. The unequalled improvement in computing energy efficiency (if defined as computations per kWh) has been the precondition for the extraordinary importance of ICT in today’s society. Indeed, had the improvement rate been only half as large, but the diffusion of ICT unchanged, just Switzerland’s (current) stock of installed computers would need more electricity than produced globally today.

While for the carbon footprint of ICT, infrastructure is primarily driven by its operating electricity consumption, the smart phones footprint on the other hand is primarily driven by its production energy and its short use life of 2 years. The production energy includes both the material extraction from the mining activities as well as the energy consumed during its manufacturing. Mitigating actions that could significantly reduce this inordinate carbon footprint should include at the very least the switching to renewable energy for the manufacturing process, and even more importantly extending the use life of smart phones to 4 or more years.

The energy intensity of data networks has halved every two years since 2000 which is likely to continue. In addition, the shift to renewable and low-carbon energy is expected to account for the majority of the ICT industry’s GHG emission reductions over the 2020-2030 timeframe. ICT companies will also continue to achieve greater energy efficiency, incentivized by associated cost savings as well as revenue-generation opportunities stemming from ICTs’ increasing ability to improve energy efficiency in other industry sectors. A new international telecommunications union (ITU) standard highlights that compliance with the Paris Agreement will require the ICT industry to reduce GHG emissions by 45 per cent from 2020 to 2030. The standard will support ICT companies in reducing GHG emissions at the rate necessary to meet the United Nations Framework Convention on Climate Change (UNFCCC) Paris Agreement’s goal of limiting global warming to 1.5°c above pre-industrial levels. The recommended emission-reduction targets are the first targets specific to the ICT industry to be approved by the Science Based Target Initiative (SBTi).

India’s natural gas production has risen above the pre-COVID level following the start of output from a KG-D6 field operated by RIL and its partner BP Plc. Natural gas production in the country in February 2020 was 80 million metric standard cubic meter per day (mmscmd) and in January this year it reached 82 mmscmd. According to DGH (Directorate General of Hydrocarbons) production levels are likely to be higher in the 2021 calendar year. While ONGC (Oil and Natural Gas Corp) and OIL (Oil India Ltd) continue to produce at almost the same levels as of November, the total gas production has risen because of R-Series fields in the KG-D6 block commencing production. Peak production from R-Cluster will be 12.9 mmscmd. Satellite fields in the same KG-D6 block, which are supposed to begin output from the third quarter of the 2021 calendar year, would produce a maximum of 7 mmscmd. MJ field will start production in the third quarter of 2022 and will have a peak output of 12 mmscmd. According to the oil ministry’s Petroleum Planning and Analysis Cell (PPAC), India’s gas imports (in LNG form) were almost flat during April-December. According to DGH, gas makes up for 6.23 percent of all energy consumed in the country. The government wants the share of natural gas in the energy basket to be raised to 15 percent by 2030. Achieving that share would mean India’s consumption of gas would have to rise to 500 mmscmd by 2030 from 150 mmscmd now.

India’s top oil and gas producer ONGC will scale up natural gas production from a KG basin block to 2.5-3 mmscmd this year and will hit the peak output sometime in 2023-24. ONGC last year started gas production from the $5.07 bn KG-DWN-98/2 project in the Krishna Godavari basin, off the east coast of India. The output in the fiscal year beginning April (2021-22) is projected to average 3.4 mmscmd and 8.5 mmscmd in the following year. ONGC is investing $5.07 bn in bringing to production a clutch of discoveries in the deep-sea block, also known as KG-D6. The block sits next to the KG-D6 discovery area of RIL and BP Plc. The project will cumulatively produce around 25 MT of oil and 45 BCM of gas with peak production of 78,000 barrels per day (bpd) of oil and 15 mmscmd. ONGC started gas production from the project on schedule in early 2020 but the start of oil production has been delayed due to the outbreak of pandemic which disrupted global supply chains. The project KG-DWN-98/2 involves some of the most advanced oil field technologies in drilling and completion of 34 subsea wells, laying about 425 kilometre (km) of pipeline and 150 km of control umbilical in water depths varying from 300 to 1,400 meters. ONGC will produce 22.97 million tonnes (MT) of crude oil in the next fiscal as compared to 22-22.5 MT in the current financial year ending 31 March.

Vedanta Ltd invited bids for the sale of natural gas from its prolific Rajasthan block at rates equivalent to the price of imported LNG (liquefied natural gas) from the spot market or Brent oil price. Cairn Oil & Gas, Vedanta’s oil and gas arm, produces about 3.5 mmscmd of gas from its largely oil-bearing block in Rajasthan. The output is being ramped-up to more than 5 mmscmd. It invited bids for 4.5 mmscmd of gas for two years from the RJ-ON-90/1 block. The price of gas will be lower of the previous month’s average of DES West India spot LNG prices or 14 percent of the average Brent crude oil price. Platts West India Marker (WIM) is the LNG price assessment for spot physical cargoes of delivered ex-ship (DES) into ports in India and the Middle East region. The rate currently is $6.2/mmBtu (million metric British thermal units). The government every six months announces a price for the gas produced by and OIL. That rate currently is $1.79/mmBtu for the period up to 31 March 2021.

Essar Oil and Gas Exploration and Production Ltd (EOGEPL), India’s leading coal seam gas producer, has signed a pact with IIT Dhanbad (Indian School of Mines) to jointly carry out research and development on CBM technologies. The MoU for collaboration provides for finding an effective solution for various technological and operational challenges faced during CBM exploration and production. EOGEPL, an investee company of Ruia-family owned Essar Global Fund Limited (EGFL), operates West Bengal’s Raniganj CBM block, producing over 1 mmscmd of gas. EOGEPL has already invested over ₹40 bn in the Raniganj East CBM Block towards drilling wells, setting up supply infrastructure, and laying customer pipelines to Durgapur and nearby industrial areas. Raniganj has 1.1 trillion cubic feet of certified CBM (coal-bed methane) reserves. EOGEPL aims to double its reserve base in the next few years.

RIL has sought bids for gas from its CBM block in Madhya Pradesh. Bids have been invited for sale of 0.82 mmscmd of gas for a period of one year. Bidders are expected to quote a price in terms of percentage of the Dated Brent, which would be the average of Platts’s benchmark rates for three months preceding the supply month. Bids cannot be lower than 9.5 percent of the Dated Brent. The actual price gas buyers pay will be the higher of the bid price or the domestic formula price published every six months by the oil ministry’s petroleum planning and analysis cell. The minimum volume one can bid for is 0.01 mmscmd. RIL has appointed CRISIL Risk and Infrastructure Solutions Ltd to manage the auction.

Indraprastha Gas Ltd (IGL) has raised prices of CNG (compressed natural gas) by ₹0.70/kg (kilogram) and PNG (piped natural gas) by ₹0.91/SCM (standard cubic meter) in Delhi and adjoining areas. Prices have been raised to partially offset the impact on account of increase in its operational, manpower and fixed costs during COVID-19 pandemic. The new CNG prices would be ₹43.40/kg in Delhi and ₹49.08/kg in Noida, Greater Noida & Ghaziabad. For PNG, households will have to pay ₹28.41/SCM in Delhi and ₹28.36/SCM in Noida, Greater Noida and Ghaziabad.

Petronet LNG, India’s top LNG importer, plans a 29 percent increase in its Dahej terminal’s capacity to 22.5 million tonnes per annum (MTPA) to meet rising demand. Indian companies are investing billions of dollars to build infrastructure, including pipelines and a new LNG import terminal as India wants to raise the share of gas in energy mix to 15 percent from 6.2 percent to help curb emissions. Capacity at the 17.5 MTPA Dahej terminal in western Gujarat state will be increased in two phases. It will add 2.5 MTPA in the first phase within three to four years, followed by another similar expansion. According to the IEA (International Energy Agency) India’s LNG imports are expected to quadruple to 124 BCM, or about 61 percent of overall gas demand by 2040. To meet the country’s growing gas demand Petronet is looking for flexible gas import contracts of 10 years or less instead of the standard long-term contract of 25 years. Petronet operates a 5 MTPA terminal at Kochi in Southern India. The terminal would operate at about 30 percent by the end of this year compared to the current 20 percent as more customers are linked to the gas pipeline. Capacity use at the terminal would rise to over 80 percent when a pipeline linking Petronet’s project to the national grid is ready.

GAIL (India) Ltd expects to end overseas sales of the LNG it secures from the US (United States) from 2023, as local demand rises with the commissioning of new fertiliser plant. GAIL buys 5.8 MTPA of LNG from the US-based projects. It has signed time and destination swap deals for some of these volumes to cut the landed cost for Indian customers and trade the remainder in overseas markets. Last year GAIL sold 2.5 MT of its US supplies in global markets. GAIL hopes to trade less than 2 mt of its US volumes this year, and in 2022 this could shrink to about 1 MT. The Ramagundam fertiliser plant in southern India is expected to reach full capacity by March, requiring 0.75 MTPA of LNG. Fertiliser plants at Durgapur in eastern India and at Gorakhpur in the north, requiring about 1.25 MTPA and 0.75 MTPA LNG respectively, will be commissioned later this year. Two more plants at Sindri and Barauni in eastern India will come on line next year, each requiring 0.75 MTPA of LNG.

Kolkata Port Trust rechristened as Syama Prasad Mookerjee Port, has entered into an agreement with Mumbai based Hiranandani Group to build a jetty based LNG terminal at east Midnapur for storage and re-gasification of LNG with a maximum capacity of 5 MTPA. The proposed project entails an investment of around ₹39 bn and has an economic value of about ₹60 bn. Apart from the onshore LNG storage and regasification terminal, the project envisages the development of a 125 km long pipeline from Kukrahati to Itinda in Bangladesh and 225 km long pipeline from Kanaichatta to Shrirampur.

Global LNG demand is expected to almost double to 700 MT by 2040 according to Royal Dutch Shell’s annual LNG market outlook. Demand was 360 MT last year, up slightly from 2019’s 358 MT despite volatility caused by lockdowns during the coronavirus pandemic. Global LNG prices hit a record low early in 2020 but reached record highs at the start of this year due to high winter demand, supply outages and infrastructure bottlenecks. Asia is expected to drive nearly 75 percent of LNG demand growth to 2040 as domestic gas production declines and LNG substitutes higher emission energy sources. Last year, China and India led the recovery in demand for LNG following the outbreak of the pandemic. China increased its LNG imports by 7 MT to 67 MT in 2020, an 11 percent increase from the year before. China’s target to become carbon neutral by 2060 is expected to continue driving up its LNG demand. India also increased imports by 11 percent in 2020 as it took advantage of lower-priced LNG to boost its domestic gas production. Globally, the number of LNG-fuelled vehicles and demand from the marine sector for LNG is also growing. Shell expects the gap between supply and demand is expected to open in the middle of this decade with less new production coming on stream than previously projected and LNG demand expected to rebound. Lockdowns around the world have delayed construction and timelines for new LNG liquefaction plants which could have an effect on the market in the medium term. Only 3 MT of new LNG production capacity was announced in 2020, down from an expected 60 MT.

Oil trading firms, including Trafigura, are supplying Mexico with emergency cargoes of LNG to overcome a power crisis caused by interrupted US natural gas supplies. Mexico’s power company Commission Federal de Electricidad (CFE) resorted to LNG imports as natural gas supplies from the southern US, especially neighbouring Texas, were hit by frozen pipelines and rocketing prices caused by a cold snap. The trading companies were able to divert LNG cargoes going to Asia while offering Mexico unsold cargoes that were anchored off the US Gulf Coast, even though the Texas Governor restricted out-of-state gas supplies, primarily affecting Mexico. The first two LNG cargoes bought by CFE discharged at Mexico’s Manzanillo and Altamira ports on tankers Flex Courageous and Seri Balhaf, respectively, according to Refinitiv Eikon vessel tracking data. At least two more cargoes were purchased to address the emergency, but the company has not revealed the names of the suppliers or terms agreed. Mexico ended up paying less for the LNG it bought than imports that could have been made through pipelines amid the US gas price spike. Mexico was asked to pay up to $100/mmBtu for piped gas from the US.

Venezuela will propose supplying natural gas to Mexico, which experienced disruptions to its supplies from Texas, though energy experts dismissed the plan as unrealistic. Texas banned out-of-state exports during an unprecedented cold snap, prompting Mexico to import LNG under emergency conditions. Venezuela does not have a liquefaction plant to convert natural gas into LNG, which would be necessary to send the gas via sea. Cash-strapped Venezuela, under heavy US sanctions, would struggle to finance such a project. Venezuela has vast gas reserves and could in theory export gas to neighbouring Trinidad and Tobago, which has several LNG plants, but there is currently no pipeline linking the two countries.

Virginia natural gas company RGC Resources’ the joint venture building the $5.8 bn-$6.0 bn Mountain Valley gas pipeline from West Virginia to Virginia expects to complete the project by the end of 2021. That matches what other companies involved in the project have decided in January to give up on a nationwide permit that covers all stream crossings and instead seek individual permits to cross the remaining roughly 430 streams. MVP (Mountain Valley Pipeline) is one of several oil and gas pipelines delayed in recent years by regulatory and legal fights with states and environmental groups that found problems with permits issued by the Trump administration. When construction started in February 2018, MVP was expected to cost about $3.5 bn and be completed by the end of 2018.

Royal Dutch Shell’s LNG Canada export project in British Columbia has won approval from health officials for construction to ramp back up with improved coronavirus protection measures. Work at the site was curtailed by an order from the Provincial Health Officer which applied to five major industrial projects in British Columbia, including LNG Canada. LNG Canada’s coronavirus restart plan includes additional coronavirus testing for workers. LNG Canada is the only big LNG export plant under construction in Canada. It is set to cost about $31.4 bn and is designed to produce about 14 MTPA of LNG or 1.8 billion cubic feet per day of natural gas. Before coronavirus delayed the project, it was expected to start producing LNG in 2024.

Romania-based Black Sea Oil & Gas (BSOG) will begin extracting natural gas from its $600 mn offshore Romanian project in November but added further progress hinged on scrapping a disputed tax. BSOG, controlled by private equity firm Carlyle Group LP, has pressed ahead with its project to extract an estimated 10 BCM of gas, believing the new centre-right government will scrap the tax before November. Meanwhile, OMV Petrom, majority-controlled by Austria’s OMV, has delayed a final investment decision on its much larger Neptun Deep offshore project. Parliament will amend the offshore law and remove the additional tax before the summer recess. OMV Petrom could start extracting gas from Neptun Deep by 2025.

Lithuanian energy company Ignitis Group will start supplying LNG to Poland next year when a new pipeline between the two countries comes online. The pipeline between Poland and Lithuania, called GIPL, is due to be completed by December 2021 and will also give Finland, Estonia and Latvia access to pipeline gas from continental Europe. The region currently imports pipeline gas from Russia and LNG via an import terminal at Lithuania’s Klaipeda port. Some of the LNG could be supplied via Poland to other markets, such as Ukraine. According to Lithuania’s energy ministry the new pipeline would also be used to supply LNG from Klaipeda to a planned gas-fired power station to be built in northeast Poland. Poland’s LNG import terminal in Swinoujscie imported 39.9 TWh. In 2020, Poland signed deals to expand the terminal’s capacity by 66 percent by 2023, as the country prepares to cease imports of Russian pipeline gas in 2022. Russia’s Gazprom lost a third of its share of the Finnish gas market last year, after a new pipeline made it possible to import LNG via the Baltic States.

According to Gazprom, Russia should ensure its natural gas and LNG supplies do not compete in international markets amid signs a local LNG rival is becoming increasingly important in the European market traditionally dominated by Gazprom. Moscow has for years said its pipeline gas, which only Gazprom has a right to export, and LNG, would never compete, with its LNG targeting mainly Asia and parts of Europe not served by natural gas pipelines. However, Yamal LNG, led by Russia’s top private gas producer Novatek, shipped 33.5 MT of LNG to Europe between 2018 and 2020, Refinitiv Eikon data showed, compared with 8.8 MT sent to Asia. Russia, home to the world’s biggest gas reserves and the second largest gas producer globally after the US aims to boost LNG output nearly threefold to 140 MT in 15 years, to add to the gas it supplies the pipelines. Gazprom’s new LNG facility, to be built by the Baltic Sea in Ust-Luga, will not target pipeline gas buyers.

Israel and Egypt have agreed to build a pipeline to connect Israel’s offshore Leviathan natural gas field to LNG terminals in northern Egypt. The Palestinians signed an agreement with Egypt’s energy minister, who visited Israel and the occupied West Bank, on developing a gas field off the coast of Gaza. Israel’s Leviathan field, located 130 km off Israel’s coast, already supplies the Israeli domestic market and exports gas to Jordan and Egypt. Leviathan’s partners have been exploring options to expand the project, including a floating LNG facility or a subsea pipeline to link up with LNG terminals in Egypt that have been idled or run at less than their potential capacity. Gaza Marine sits about 30 km off the Palestinian enclave’s coast and is estimated to hold over 1 trillion cubic feet of natural gas.

China National Offshore Oil Corp (CNOOC) has recorded proven gas geological reserves of more than 101 billion cubic meters (BCM) at Linxing gasfield in one of the country’s major coal mining province Shanxi. Located at the east-edge of Ordos basin, Linxing tight gas field produced an average of more than 5 MCM gas in 2020. CNOOC aims to establish annual gas production capacity of 3.3 BCM and raise annual output to 2.7 BCM at Linxing, which is managed by its coalbed methane subsidiary, within three years. The proven reserves at Linxing were certified by the Ministry of Natural Resources. CNOOC has vowed to accelerate the exploration and development of natural gas, including deepwater reserves in the South China Sea, shallow water resources in Bohai Bay and unconventional resources onshore.

Atlantic Gulf & Pacific Company (AG&P)’s Philippines subsidiary has received the green light to develop an LNG import and regasification terminal in Batangas Bay, south of Manila. The firm, part owned by Osaka Gas and the Japan Bank for International Cooperation has issued it a notice to proceed to develop the terminal, known as Philippines LNG, which will provide the fuel to power plant, industrial and commercial customers and other consumers. Philippines LNG will be the fifth planned LNG import terminal in the Southeast Asian nation, which is seeking the fuel as the Malampaya gas field in western Philippine waters is expected to run dry this decade. Four other terminals worth about 65 bn pesos ($1.34 bn) are at various stages of approval or financial closure. Philippines LNG will have an initial capacity to deliver up to 3 MTPA of regasified LNG, with additional capacity for liquid distribution. It will also have scalable onshore regasification capacity of 420 million metric standard cubic feet per day (mmscfd) and almost 200,000 cubic metres of storage. The company has completed its pre-development work for the terminal which is expected to be commissioned by mid-2022.

Pakistan’s landmark, new deal with Qatar for LNG at lower rates will save Islamabad a total of about $3 bn over the next 10 years. The agreement, signed, will save the state $317 mn annually due to the reduced price of the gas compared to the 2015 agreement between the two countries. Under the agreement, which comes into effect in January 2022, Pakistan will import liquefied natural gas – or LNG – from Qatar at a reduced price of about 31 percent, compared to the previous agreement signed in 2015 for 15 years. At the time, Islamabad’s agreeing to pay a higher price had drawn criticism from experts. Many Pakistanis have been rallying, angry over long power cuts in the summer and shortages of natural gas in winter, to demand an uninterrupted supply of electricity and gas.

16 March: Indian state fuel retailers’ diesel sales rose 7.4 percent to 2.84 million tonnes (mt) in the first fortnight of March from a year earlier, preliminary industry data showed. Petrol sales rose 5.3 percent to 1.05 mt in the same period from a year earlier, the data showed. This is the first annual rise in gasoil sales in the country since October. Fuel sales in India took a hit in March last year as the government imposed a nationwide lockdown to curb the spread of the novel coronavirus. India’s economy returned to growth in the three months to December and the recovery is expected to gather pace as consumers and investors shake off the effects of the COVID-19 pandemic. The rise in gasoil sales, which account for about two-fifths of the country’s overall fuel demand, comes despite record-high local retail prices and points to rising industrial production in the country. State companies Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL) own about 90 percent of India’s retail fuel outlets. State retailers sold 3.3 percent less cooking gas in the first half of March than a year ago to 1.01 mt as a significant reduction in subsidies curtailed demand for the fuel, the data showed.

Source: Reuters

16 March: Minister of State for Finance Anurag Thakur said both the Centre and the states need to think about reducing taxes on petrol and diesel as their prices have risen sharply in the recent weeks. Thakur said that the government was ready to discuss the issue of bringing petroleum products under the ambit of Goods and Services Tax (GST). The Centre levies excise duty on petrol and diesel, while the states levy VAT (Value Added Tax). Thakur said that in March 2020, the price of crude oil was around $19 per barrel. AT present, the price of crude oil is around $65 per barrel. Union Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das had said the Centre and the states should talk to each other and look for a “coordinated action” to reduce taxes on diesel and petrol.

Source: The Economic Times

12 March: Only half of the urban slum households in the states of Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Rajasthan, and LPG (liquefied petroleum gas) Uttar Pradesh use exclusively, according to the Council on Energy, Environment and Water (CEEW) study. The company in its report marked that 86 percent of households in these six states have an LPG connection. These states also account for a quarter of India’s slum population. Further, the report said that 16 percent of the households are still using firewood, dung cakes, agriculture residue, charcoal, and kerosene as their primary fuel and over a third are also stacking LPG with these polluting fuels. This also increases exposure to indoor air pollution for such households. The study, done by CEEW also found that 45 percent of households in these six states use LPG as their primary fuel in winter. Also, three-fourth of households using polluting fuels, cook inside the main house and two-thirds do not have a ventilation system. CEEW analysis suggests leveraging platforms like LPG Panchayats to increase awareness regarding the process of subsidy calculation and disbursement of households.

Source: The Economic Times

11 March: Liquefied petroleum gas (LPG) cylinders consumption has improved amongst Pradhan Mantri Ujjwala Yojana (PMUY) customers despite the recent price rise in LPG prices, Indian Oil Corp (IOC) said. According to IOC a surge of 23.2 percent in LPG consumption was noted in the initial quarter of this fiscal, which was attributed to the three free LPG refills given to the PMUY beneficiaries. IOCL noted that improvement in the overall LPG consumption has continued for the three-month period December 2020 to February 2021 and has registered a growth of 7.3 percent for all domestic LPG customers (PMUY+non-PMUY). LPG consumption amongst PMUY customers registered a growth of 19.5 percent, from 8,45,310 million tonnes (mt) in the comparable period in the last fiscal to 10,10,054 mt in the current fiscal for the said three-month period. Compared year-on-year, the overall domestic LPG sales have registered a handsome growth of 10.3 percent during the current fiscal (till Feb2021), IOC said. Driven by the vigorous thrust of the central government on making accessible the clean energy to all Indians, LPG has emerged as the preferred kitchen partner for almost every Indian. This is evident from the fact that the LPG penetration in India has improved from 55 percent in 2014 to more than 99 percent as of 10 March 2021. Moreover, to alleviate the problems faced by the marginalized during the Covid 19 Pandemic, PMUY beneficiaries were provided with three free LPG refills. A total of ₹96.7 bn was transferred to the bank accounts of the beneficiaries directly. Oil Minister Dharmendra Pradhan refuted reports that claimed that the central government has stopped providing subsidies on LPG cylinders.

Source: The Economic Times

16 March: India Oil Corp (IOC) has sought a rate of ₹14.59 per million metric British thermal units (mmBtu) for its Dadri-Panipat natural gas pipeline in its tariff revision plea filed with the Petroleum and Natural Gas Regulatory Board (PNGRB), which will take a final call after wider consultation. The 132-km-long pipeline has an economic life of 30 years extending to 2040 and a capacity of 9.5 million metric standard cubic meter per day (mmscmd). The tariff proposed by the company is lower than the pipeline’s current tariff of ₹16.46 per mmBtu, which the PNGRB had determined for three years ending March 2021. The current tariff is much lower than ₹38.45 the company had proposed to the regulator. For the period between July 2010 and March 2018, IOC had proposed a tariff of ₹18.25 while the regulator approved just ₹10.20 per mmBtu. PNGRB has sought comments from all stakeholders by 27 March on IOC’s new tariff proposal.

Source: The Economic Times

16 March: The Parliament’s Public Accounts Committee (PAC) has pulled up the oil ministry for vague replies on encashing bank guarantees of Reliance Gas during the Congress-led UPA rule after authorisation for laying four pipelines was cancelled over failure to adhere to timelines. The PAC said the petroleum ministry, despite repeated reminders, did not give reasons for not forfeiting bank guarantees given as assurance for completing the project. PNGRB (Petroleum and Natural Gas Regulatory Board) had in May 2012 asked the government to cancel licence granted to Reliance Gas Transportation Infrastructure (RGTIL) to lay four gas pipelines, saying the company has been dragging its feet on implementation of the 2,175 km pipelines. Relogistics Infrastructure Limited, the special purpose vehicle to which the 2007 authorisation for laying the Chennai-Bangalore-Mangalore, Kakinada-Basudepur-Howarh, Kakinada-Vijayawada-Nellore and Chennai-Tuticorin pipeline was transferred, had cited uncertainty about the availability of gas for not building the lines. The PAC said while the authorisation for the four gas pipelines was rescinded on 24 September 2012, it “is unclear and vague on the aspect of forfeiture of performance bank guarantees from the contracting entity and initiating appropriate legal action.”

Source: The Economic Times

16 March: The government has dropped its plan to split gas transportation utility GAIL (India) Ltd into two by unbundling its marketing and gas transportation operations. Oil Minister Dharmendra Pradhan said that no such proposal was under consideration at present. He said that GAIL is executing projects related to expansion of gas infrastructure in the country involving setting up pipeline, LNG (liquefied natural gas) terminals, City Gas Distribution & Compressed Natural Gas retail network in the country. Pradhan informed the house that GAIL has taken a number of steps to enhance its profitability. GAIL currently has the monopoly both in terms of marketing and transportation of gas. This creates conflict of interest and affects discovery of competitive gas pricing. One of the reasons for unbundling was that some industry players alleged that GAIL was not giving them access to its 11,000-km pipeline network to transport their gas. But government is now setting up an independent gas transport system operator that will facilitate and coordinate of booking of common carrier capacity in all natural gas pipelines on a non-discriminatory, open-access basis.

Source: The Economic Times

15 March: Adani Welspun Exploration Ltd (AWEL), a joint venture between Ahmedabad-based Adani group and Welspun announced its first-ever gas discovery in Mumbai’s offshore Tapti-Daman sector. The company said that the gas discovery is made in an area spread over 714.6 sq. km in the NELP-VII clock MB-OSN-2005/2. AWEL was awarded the block under the New Exploration Licensing Policy VII bid round. Early indications have pointed to the occurrence of gas-bearing reservoirs of the Mahuva and Daman formations.

Source: The Economic Times

12 March: The Rajasthan State Gas Ltd (RSGL) will further expand the gas pipeline network of 161 km and provide 8,000 new connections in Kota. RSGL said that seven CNG (compressed natural gas stations) have already been set up in the coaching town of the country. Currently, around 15,700 households in Kota have piped natural gas connections and RSGL is trying to cover the whole city with the expansion of the new pipeline network. Couple of years ago, RSGL set up two CNG stations having one mother station in Neemrana, Alwar and another at Kukas to cater to the vehicles plying on Jaipur-Delhi highway and also meet the needs of the industry in Neemrana. RSGL is also developing a network of urban gas distribution system in Gwalior and Sheopur in Madhya Pradesh.

Source: The Economic Times

11 March: India’s largest energy trading platform, Indian Energy Exchange (IEX), announced the strategic divestment of 26 percent of its equity in Indian Gas Exchange (IGX) to the National Stock Exchange (NSE) of India through its wholly-owned subsidiary NSE Investments Ltd and additional 5 percent equity holding to Oil and Natural Gas Corp (ONGC). The company said the agreement was signed by representatives of IEX, NSE, and ONGC in the presence of Tarun Kapoor, Secretary, Ministry of Petroleum and Natural Gas (MoPNG).

Source: The Economic Times

16 March: The Centre said it is trying to “consult and convince” the Jharkhand government about benefits of commercial coal mining policy which is designed to boost domestic production and reduce imports. Union Coal Minister Pralhad Joshi said that it is a “big sin” that India despite having the largest coal reserves is dependent on import of thermal coal used in power generation. The dependence on imports was due to restriction on allocation of coal blocks, which has been eased out after deep consultation with the state governments, he said. After consultations with states, the central government has brought a commercial coal mining policy under which coal blocks are opened to private investors through auction for commercial purpose, he said. The coal ministry on a day-to-day basis monitors and is changing the norms to withdraw such blocks which are not operational, he said, adding that the Centre is continuously interacting with state governments including Odisha on this issue. He said that it takes 2-3 years to start actual production after allocation of coal or mine blocks. However, many measures have been taken to speed up and begin the production at the earliest.

Source: The Economic Times

16 March: Meghalaya Chief Minister (CM) Conrad K Sangma said 95 persons have been arrested and 250 cases registered so far over illegal mining and transportation of coal in the state. Speaking during the question hour in the assembly, the chief minister said the state government will not allow illegal activities such as mining and transportation of coal. The National Green Tribunal banned coal mining in the state in 2014, making it illegal. According to the CM, cases of illegal mining are being registered under section 21 of the Mines and Minerals (Development and Regulation) Act, 1957. Deputy commissioners and superintendents of police have been instructed to control illegal coal mining and enforce the ban imposed by the NGT, he said.

Source: The Economic Times

10 March: To enhance coal production and reduce imports, Coal India Ltd (CIL) has identified 15 new projects with a capacity to produce 160 million tonnes per annum (mtpa), Parliament was informed. CIL aims to achieve 1 billion tonnes of coal production by 2023-24. In order to enhance domestic production, 25 percent of coal production has been allowed for the sale of coal for the newly-allocated captive coal blocks, Coal and Mines Minister Pralhad Joshi said. In order to enhance coal production and achieve coal production targets, CIL has initiated a number of steps, including introduction of mass production technology in underground coal mines. Another coal producing company Singareni Collieries Company Ltd (SCCL) is planning to open 11 new mines, including two in Talcher in Odisha, he said. To reduce coal imports, the Annual Contracted Quantity (ACQ) of the power plants have been increased up to 100 percent of the normative requirement in those cases where the ACQ was earlier reduced to 90 percent of normative.

Source: The Economic Times

16 March: The Cabinet Committee on Economic Affairs (CCEA) approved the revised cost estimate of scheme for strengthening of transmission and distribution (T&D) in Arunachal Pradesh and Sikkim to ₹91.29 bn. The scheme, being implemented through Power Grid Corp in association with Sikkim and Arunachal Pradesh, is targeted to be commissioned in phased manner by December 2021 for awarded scope of works and 36 months for un-awarded packages. After commissioning, the created transmission and distribution system will be owned and maintained by the respective state utilities. Implementation of this scheme will create a reliable power grid and improve States’ connectivity to the upcoming load centers, and thus extend the benefits of the grid connected power to the villages and towns including the remote and border areas and all categories of consumers of beneficiaries in Arunachal Pradesh and Sikkim. The scheme shall also increase the per capita power consumption of these States, and shall contribute to the total economic development. The scheme was initially approved in December, 2014 as a Central Sector Plan Scheme.

Source: The Economic Times

16 March: Siemens said it has commissioned a high voltage direct current link having voltage-sourced converter technology between Pugalur in Tamil Nadu and Thrissur in Kerala. The 2,000 MW electricity transmission system, consisting of two links between Pugalur in Tamil Nadu and Thrissur in Kerala, supports Power Grid Corporation of India Ltd (PGCIL) to counter power deficit in the southern region and improve the grid stability. The ±320 kV (kilovolt) HVDC (High Voltage Direct Current) system has been done by Siemens Ltd in association with a consortium of Siemens Energy (Germany) and Sumitomo Electric Industries Ltd, Japan. It features for the first-time the integration of HVDC XLPE cable with overhead lines in India. On 19 February, Prime Minister Narendra Modi officially inaugurated the link that has now been put into commercial operation and enables the exchange of electricity in both directions.

Source: The Economic Times

15 March: The Dakshin Haryana Bijli Vitran Nigam (DHBVN) has taken a major step to recover outstanding bills from consumers in Gurugram district, who have not paid their electricity bills despite repeated notices sent to them. Nearly 100 consumers’ meter connections — who did not pay bills even after repeated notices — were disconnected, DHBVN said. The disconnection of the electricity connections stirred the defaulters. Nearly 472 consumers reached the electricity department and deposited nearly ₹42 lakh. This is the largest amount to be deposited in a single day at the electricity corporation. DHBVN said consumers of the Badshahpur sub-division are yet to pay ₹90 mn as outstanding bills. The Badshahpur Power Corp has planned to run a special recovery campaign in March this year against such defaulters. Under the supervision of the Junior Engineer and Foreman, 10 teams have been formed for the recovery drive in different areas.

Source: The Economic Times

15 March: Power discoms (distribution companies) in Delhi have proposed to regulator DERC (Delhi Electricity Regulatory Commission) that there should be a cost-reflective, progressive tariff rationalisation as their combined standalone revenue gap in 2019-20 is nearing ₹30 bn. BRPL, BYPL, and TPDDL have filed their separate petitions for truing-up up to 2019-20 and aggregate revenue requirement (ARR) and tariff for 2021-22, ahead of tariff rationalisation by DERC this year. The Commission has sought comments and suggestions from consumers and other stakeholders on the petitions by 26 March. The Commission may hold a public hearing later on and will issue its tariff order considering views of all stakeholders, DERC public notice said.

Source: The Economic Times

14 March: Power consumption in the country grew 16.5 percent in the first 12 days of this month at 47.67 bn units over the corresponding period a year ago, showing a revival in the economic activities, according to power ministry data. Power consumption during March 1-12 last year was recorded at 40.92 bn units. On the other hand, the peak power demand met, which is the highest supply in a day, during this 12-day period of March 2021 remained well above the highest record of 170.16 GW in the entire March 2020. Till 12 March 2021, peak power demand met touched the highest level of 186.03 GW on 11 March 2021, and recorded a growth of 9.3 percent over 170.16 GW a year ago. The highest daily peak power demand met of 1701.16 was recorded on 3 March 2020. Experts are of the view that the rise in power demand and consumption indicates that the impact of pandemic-induced lockdown and sluggish economic conditions have tapered off. They exuded confidence that power consumption and demand could record a double-digit growth during March this year in view of rising mercury and perk-up in commercial and industrial requirement of electricity. They expect power consumption in this entire month to be higher than 98.95 bn units recorded in March 2020. The government had imposed a nationwide lockdown on 25 March 2020, to contain the spread of COVID-19. After a gap of six months, power consumption recorded a 4.6 percent year-on-year growth in September and 11.6 percent in October. In November 2020, the power consumption growth slowed to 3.12 percent, mainly due to the early onset of winters. In December, power consumption grew by 4.5 percent while it was 4.4 percent in January 2021. Power consumption in February this year recorded higher at 104.11 bn units compared to 103.81 bn units last year despite the fact that 2020 was a leap year.

Source: The Economic Times

12 March: Adani Transmission (ATL) won an intra-state power transmission project in Madhya Pradesh for ₹13 bn in the tariff-based competitive bidding held by REC Power Transmission Company (RECTPCL). The other bidders in the race were Sterlite Power, Dilip Buildcon, state-owned Power Grid Corp of India Ltd (PGCIL), and Torrent Power. The tender was floated by RECTPCL, an arm of Rural Electrification Corporation of the power ministry. The project aims at boosting power transmission infrastructure in Madhya Pradesh. Adani Transmission will set up 16 new sub-stations and strengthen system in the existing power supply network. RECTPCL has offered two packages for ‘development of intra-state transmission work in MP through tariff-based competitive bidding’. Adani quoted the winning bid for the first package. For the second package, same companies have submitted their bids. In the tender offered, RECTPCL said power demand of Madhya Pradesh is expected to grow up to 18,000 MW by 2022-23 and reach about 21,000 MW by the end of 14th Plan. It is 14,555 MW as of the financial year 2019-20.

Source: Business Standard

11 March: The Maharashtra State Transmission Company Ltd (MSETCL) recorded the highest ever power transmission of 25,800 MW at 11.16 am due to the use of latest technology and preventive maintenance, Energy Minister Nitin Raut said. This is the highest ever power transmission recorded in the history of the MSETCL, he said. This record was achieved without any load-shedding. It is to be noted that 9 March, Maha-Genco set up a new record of highest power generation in the history of the state. Raut said soon after assuming the office, he had asked the MSETCL to use latest technology and preventive maintenance to improve availability of transmission network. The power demand in the state is on the rise as the state economy is now returning to normalcy. MahaVitaran recorded demand of 22,339 MW. Earlier, the MSETCL recorded power transmission of 24,200 MW on 22 October 2018.

Source: The Economic Times

10 March: Consolidated debt of state power distribution companies is estimated at ₹6 tn in FY2022, highest post implementation of debt restructure scheme under Ujwal Discom Assurance Yojna (Uday), the credit rating agency ICRA said. This is in addition to ₹1.27 tn pending discom (distribution company) payables to power generators as of December 2020, 30 percent higher on a year-on-year basis. The credit profile of the state-owned distribution utilities continues to remain stressed due to higher level of technical and commercial (AT&C) losses compared to regulatory norms, inadequate tariffs in relation to their cost of supply and inadequate subsidy support from the respective state governments, ICRA said.

Source: The Economic Times

16 March: Chhattisgarh’s Health Minister T S Singh Deo said their department has committed to achieve net-zero carbon emissions by 2050. With this, it becomes the first Indian health system to endorse UNFCCC’s Race to Zero Campaign. He said that the state has developed a plan to tackle the health impacts of climate change through its State Action Plan for Climate Change and Human Health.

Source: The Economic Times

16 March: India has achieved 92.97 GW of renewable energy (RE) capacity till February this year, while 50.15 GW is under various stages of implementation, Parliament was informed. India has set an ambitious target of achieving 175 GW of installed RE capacity (excluding large hydropower) by 2022. RE projects are being implemented throughout the country based on various factors such as RE potential, availability of land and transmission etc, Power and New & Renewable Energy Minister R K Singh said. According to the reply, India has the potential of 10,97,465 MW of RE including 7,48,990 MW of solar, 3,02,251 MW of wind energy and 21,133.62 of small hydro (with the capacity of up to 25 MW each).

Source: The Economic Times

16 March: Climate finance of $100 bn a year and green technologies for mitigation actions promised in 2009 under the Paris agreement are still “not on the table” for developing countries, Environment Minister Prakash Javadekar said. At the 15th Conference of Parties (COP15) of the United Nations Framework Convention on Climate Change (UNFCCC) in 2009, developed countries had committed to mobilising jointly $100 bn a year in climate finance by 2020 to address the needs of developing countries. This commitment has, since then, been a key element of the international climate negotiations. Responding to a supplementary question on efforts made to achieve the target of 175 GW generation of renewable energy by 2022, the minister said India is in a leadership position as far as renewable energy is concerned. The Prime Minister Narendra Modi had declared a target of 175 GW of renewable energy to be achieved by 2022.

Source: The Economic Times

16 March: The tariffs for solar power could increase between 25-45 paise per unit (kWh) due to Basic Customs Duty (BCD) on imported solar cells and modules, according to a rating agency. The Ministry of New and Renewable Energy (MNRE)’s announcement of the BCD implementation on imported solar cells (25 percent) and modules (40 percent) starting 1 April could increase the solar power tariff, it said. CARE Rating said that solar power prices could rise between 25-30 paise per unit if only cells are imported while the cost will rise further to 40-45 paise if modules are imported. The cheapest solar tariffs discovered in the auctions in 2020 was ₹1.99 per unit which was possible due to imports and cheap overseas funds, analysts had said. India has set an ambitious target of achieving 175 GW of installed renewable energy capacity, including 100 GW of solar power by 2022. The long-term renewable energy capacity target stood at 450 GW by 2030, wherein solar power will have the lion’s share. The BCD will give impetus to create a self-sustaining ecosystem for solar equipment manufacturing in India. But, solar makers located in the Special Economic Zones (SEZs) had urged the government to exempt BCD applicable on them.

Source: The Economic Times

16 March: Nuclear energy is the long term source of green energy, which will be required in future to achieve low-carbon footprint and drive long-term industrial requirement of the nation. While scientists and academicians have been aware of this, people should be sensitised to the wide ranging ‘peaceful and beneficial applications’ in power generation, medicine, industry, agriculture, space, water resources and food preservation. This was the common theme among scientists and academicians at a one-day seminar on ‘Radiation and Environment’ organised under the aegis of Indian Nuclear Society (INS) at Atomic Minerals Directorate for Exploration and Research (AMD), complex. Mass awareness of the societal benefits of nuclear energy will have a cascading effect on its acceptance, especially in rural India, which can catalyse the economic growth of the country.

Source: The Hindu

16 March: Wind power tariffs dropped to two-and-half year low to ₹2.77 per unit with Adani Renewables Energy Holding emerging as the lowest bidder in auction conducted by Solar Energy Corp of India (SECI). Adani Renewable Energy Holding quoted ₹2.77 per unit for 300 MW capacity, while Ayana Renewable Power quoted ₹2.78 per unit for a similar capacity. Evergreen Power Mauritius quoted ₹2.78 per unit for 150 MW. JSW Future Energy quoted the same bid for 450-Mw, data available with MSTC showed. Other bidders who participated in the auctions are Azure Power India, O2 Power SG PTE, Shirdi Sai Electricals, AMP Energy Green, Tunga Renewable Energy, ReNew Vyan Shakti, AMP Energy Green and Halvad Renewable. SECI had last year issued the request for selection of wind power developers for setting up of 1200 MW inter-state transmission system-connected wind power projects in India (Tranche-X). It will enter into power purchase agreements with the selected for a period of 25 years. In the last tranche –IX of wind auctions conducted by SECI, JSW Solar placed a winning bid of ₹3.01 per unit for 1,000 MW, Vena Energy Vidhyut bagged 160 MW at ₹3.17 per unit tariff and Inox Wind Infrastructure won 50 MW with ₹3.41 per unit bid.

Source: The Economic Times

15 March: A farmer in Mayurbhanj has built a four-wheeled electric vehicle that runs on a solar-powered battery. Sushil Agarwal from Karanjia subdivision of Odisha’s Mayurbhanj district built the car, powered by 850 Watts motor, 100 Ah/ 54 Volts of battery and can run 300 km on a single charge. He said the battery can be charged fully within 8 and a half hours. The idea to build his own car hit him during the boring lockdown days and he started assembling the parts one by one to construct his vehicle. He has built the vehicle just by reading some books and watching youtube videos.

Source: The Economic Times

13 March: Bihar Chief Minister (CM) Nitish Kumar said that the Dagmara multipurpose hydro power project, which would come up on Kosi River in Suapul district, would provide several additional benefits to flood-prone districts of north Bihar, besides generating low-cost electricity for the state. While reviewing an energy department’s presentation on the multipurpose 130 MW hydro power plant, at the CM residence, Nitish also said that hydro power and solar energy have become more useful these days in view of the environment protection. Energy Minister Bijendra Prasad Yadav said, the overall cost of electricity in the state would be reduced once the Dagmara project begins generation of hydro power.

Source: The Economic Times

11 March: It’s the largest floating solar power project in the country, and perhaps in the world when it is commissioned. The 100 MW project, being set up at NTPC Ltd’s Ramagundam thermal power plant reservoir near Peddapalli in Telangana, is slated to be commissioned by May this year. Coming up at a cost of ₹4.23 bn, the project will have 4.5 lakh photovoltaic (PV) panels floating on a 450-acre area on the reservoir, with room for further capacity addition in the future, NTPC said. The world’s largest floating solar power plant to be mooted so far is the 600 MW project to be set up on the Omkareshwar dam on river Narmada in Khandwa district of Madhya Pradesh. However, this ₹30 bn power project will commence power generation only by 2022-23. The largest dam-based floating power project in the world (41 MW) is coming up at Hapcheon dam in South Korea, even as Singapore has taken the plunge with a 5 MW floating solar project in Johor Strait off its coast. NTPC said the Ramagundam floating solar project is part of plans to set up a 217 MW floating solar power capacity in south India.

Source: The Economic Times

10 March: The northeastern state of Assam has a renewable energy potential of 14,487 MW with solar energy taking the largest share, New and Renewable Energy Minister R K Singh said. According to the data provided in Parliament, solar energy has the highest potential in the state with 13,760 MW capacity, followed by biomass with 279 MW, wind energy with 246 MW, and small hydro projects with 202 MW capacities. It showed that geothermal energy and tidal energy had no potential in the state.

Source: The Economic Times

10 March: NTPC Southern Region is likely to commission about 217 MW floating solar capacity, including one of the largest floating solar power plants of 100 MW at Ramagundam, by May-June this year. A 230 MWac (megawatt alternating current) ground Solar project is also being established at Ettayapuram near Tuticorin in Tamil Nadu, NTPC said.

Source: The Economic Times

16 March: Swiss-based trader Proton Energy Group SA, Rosneft’s exclusive supplier of diesel and LPG (liquefied petroleum gas) to Ukraine, will suspend shipments to Ukrainian buyers from April. Proton Energy Group SA decided to terminate cooperation and stop supplying petroleum products to the Ukrainian market from 1 April 2021. Pipeline and rail exports of diesel oil of Rosneft origin to Ukraine totalled some 1.75 million tonnes (mt) in 2020, according to traders’ estimations. LPG exports from Rosneft’s plants to Ukraine reached 496,900 tonnes in 2020, while supplies in January-February 2021 totalled 78,900 tonnes, statistical data showed.

Source: The Economic Times

12 March. Mexican President Andres Manuel Lopez Obrador said a “very large” oil discovery had been made in Tabasco, his home state in southern Mexico, as the government tries to revive crude output at state oil company Petroleos Mexicanos (Pemex). Lopez Obrador revealed the discovery during a regular morning news conference, but gave no further details. In 2019, Pemex announced the discovery of a separate large oil field also in Tabasco.

Source: Reuters

10 March. US (United States) senators said they have introduced a bipartisan bill aimed at boosting taxpayer returns from federal oil and gas leasing, the latest in a string of moves in Washington seeking to reform drilling on public lands. The Biden administration said it would launch a review of federal oil and gas leasing to address widespread criticism that the program is not yielding adequate public revenue as well as contributing to climate change. While the bill proposed would not deliver on President Joe Biden’s campaign promise to stop issuing new leases to fight global warming, it could be applied to existing leaseholders if passed into law. Oil and gas production on public lands accounts for nearly a quarter of all US greenhouse gas emissions.

Source: Reuters

10 March. The oil and gas industry in Australia launched an effort to work on ways to cut the costs of dismantling offshore oil and gas facilities at the end of their lives, a task estimated at A$50 bn ($38 bn). Backed by BHP Group, Chevron Corp, Exxon Mobil Corp’s Esso Australia, Santos Ltd and Woodside Petroleum and others, the Centre of Decommissioning Australia (CODA) aims to help the industry build local expertise, come up with dismantling plans, and cut costs. More than half of that work needs to begin within the next 10 years, according to a study done for NERA (National Energy Resources Australia).

Source: The Economic Times

16 March: Qatar Petroleum, the world’s top liquefied natural gas (LNG) producer, is cranking up the pressure on high-cost rivals with bold expansion plans that will boost supplies over the coming decade and potentially push prices down further. As competitors struggle to break even due to lower prices, the Qatari firm announced it will boost LNG output by about 40 percent to 110 million tonnes per annum (mtpa) by 2026 in phase one of its expansion of North Field LNG, the largest single LNG project ever sanctioned. The company is expected to announce second phase expansion plans this year which will lift LNG capacity by 2027 to 126 mtpa, enough to meet the total import needs of both Japan and South Korea – the world’s top and third largest LNG importers respectively. Qatari marketing has the potential to undercut competing suppliers and has already helped put downward pressure on LNG contract prices over the last two years, Credit Suisse analyst Saul Kavonic said. Qatar, which accounts for a fifth of global LNG supplies, is already by far the lowest cost LNG producer.

Source: The Economic Times

15 March: Kazakh state energy firm KazMunayGaz will retain ownership of gas shipping and trading unit KazTransGas despite handing over its management to the sovereign wealth fund, the company said. KazMunayGaz is the oil-exporting nation’s biggest borrower on the Eurobond market, and some analysts had expressed concerns that the government’s plan to hive off the gas unit would weaken KazMunayGaz’s credit profile. KazMunayGaz and its parent company, sovereign wealth fund Samruk-Kazyna, signed an “agreement of transfer to discretionary management,” making KazTransGas a direct subordinate of the fund. Like other upstream companies, KazMunayGaz’s core revenue is vulnerable to oil price fluctuations, with the gas unit’s more stable income helping smoothen out the parent company’s cash flow.

Source: The Economic Times

11 March. British power generator Drax is evaluating its options after a British power capacity auction and could sell four open-cycle gas turbine (OCGT) projects, it said. Drax provisionally secured 15-year backup power agreements worth a total 230 mn pounds ($321 mn) for three new 299 MW OCGT projects at sites in England and Wales.

Source: Reuters

15 March: The US (United States) Congress is investigating a multibillion-dollar subsidy for chemically treated coal that is meant to reduce smokestack pollution, after evidence emerged that power plants using the fuel produced more smog not less. Over the past decade, a who’s who of American companies have reaped at least several billion dollars in benefits from investing in refined coal operations. Just last year, some 150 million tonnes (mt) of refined coal was burned in the US, according to the US Energy Information Administration. Producers get a tax credit of $7.30 for each ton burned. The Internal Revenue Service, which oversees the tax credit program, allows the companies to qualify by testing relatively small amounts of refined coal in a laboratory once a year, in lieu of real-world emissions measurements at power plants.

Source: Reuters

13 March. Britain has ordered a public inquiry into a planned deep coal mine, Prime Minister (PM) Boris Johnson confirmed, with the government performing a U-turn before hosting a key climate summit. The PM said the coal mine plan “is something that needs to be looked at very carefully”. The PM, who will host the COP26 climate summit in Glasgow in November, ran into fierce criticism from environmental campaigners over his January decision to delegate approval for the carbon-intensive facility to the local authority. The proposed coastal project, whose developer is Australian-owned West Cumbria Mining, would be located near the town of Whitehaven in northwest England and supply European and UK (United Kingdom) steelmakers with metallurgical coal.

Source: The Economic Times

16 March: Thai oil and gas giant PTT Exploration and Production Pcl said it plans to expand midstream investments to have new businesses account for 20 percent of its profits by 2030, with a focus on gas-to-power. PTTEP, the upstream arm of state-owned PTT Pcl, received approval from Myanmar’s former government in December for a $2 bn gas-to-power project.

Source: The Economic Times

16 March: Solar installations in the United States(US) are expected to quadruple by 2030 thanks to the extension of a key industry subsidy late last year and booming demand for carbon-free power. The sector will install 324 GW of capacity over the next decade, more than three times the nearly 100 GW installed by 2020, the US Solar Energy Industries Association (SEIA) said. The 324 GW of solar energy would produce enough electricity to power about 60 mn homes, or around 40 percent of homes in the country. Just 3 percent of US electricity is generated from the sun, but SEIA hopes that will rise to 20 percent over the next decade. Installations rose 43 percent last year to 19.2 GW, an annual record for the industry. Utility-scale projects, which account for most of the market, experienced only minor disruptions due to coronavirus pandemic-related shutdowns. Residential installations took a large hit in the second quarter due to the pandemic, but ended the year up 11 percent at a record 3.1 GW.

Source: Reuters

12 March. French renewable energy producer Neoen announced plans to more than double its capacity by the end of 2025, by rapidly expanding its presence in the countries where it already operates. The group, which owns Australia’s “Victorian Big Battery” project, is targeting capacity of at least 10 GW in operation or under construction by the end of 2025, up from 4.1 GW at end of December – by adding at least two gigawatts every year. Neoen, which mainly generates electricity from wind and solar plants, produces the bulk of its electricity in Australia and Europe, but has also been expanding in Latin America.

Source: The Economic Times

12 March. Italy’s Eni and state lender Cassa Depositi e Prestiti (CDP) have formed a joint venture (JV) to invest around €800 mn ($957 million) over five years in solar and wind energy production, they said. GreenIT, which is 51 percent owned by Eni and 49 percent by CDP unit CDP Equity, will target an installed capacity of approximately 1,000 MW by 2025, they said. The move is aimed at stepping up Italy’s efforts to increase renewable energy generation, in line with the objectives set by the 2030 Integrated National Energy and Climate Plan submitted to the European Union (EU) Commission at the end of 2019. Italy’s new Ecology Minister Roberto Cingolani is working on a new plan for energy transition that is expected to be ready by May. Cingolani said Rome plans to cut its carbon emissions by around 60 percent by 2030, and to use €80 bn of EU funds for energy transition in the next five years.

Source: The Economic Times

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.