-

CENTRES

Progammes & Centres

Location

Will Pumped Storage Revive Hydropower in India?

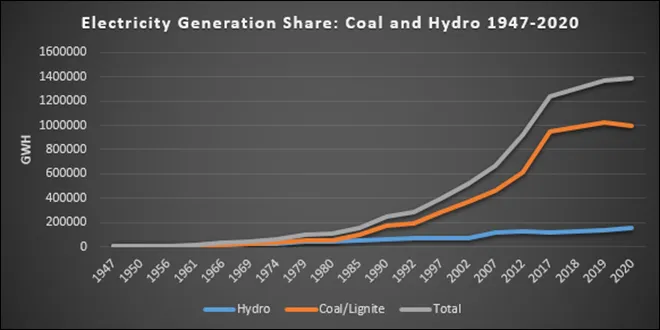

In 1947, the hydropower capacity in India was about 37 percent of the total power generating capacity and over 53 percent of power generation. In the late 1960s, coal-based power generation started displacing hydropower in India and hydropower’s share in both capacity and generation fell dramatically. In 2019, hydropower accounted for roughly 12 percent of power generation capacity and 11 percent of power generation in India. India had 50 GW (gigawatts) of hydropower (including pumped storage) capacity in 2019 which is the 5th largest in the world.

Globally, hydropower is the dominant renewable energy source to date, providing over two-thirds of all renewable electricity. Hydropower accounted for about 17 percent of global installed power generating capacity and roughly 15 percent of power generation in 2019. Clean electricity generation from hydropower achieved a record 4,306 terawatt hours (TWh) in 2019 which was the single greatest contribution from a renewable energy source in history. Global growth in hydropower generation capacity was just over 1 percent in 2019 which is much lower than the 2 percent annual average growth required to meet targets set by the Paris Agreement.

Large storage hydro-power projects produce low carbon electricity, but they also impose huge environmental and social costs. They displace thousands of people, disrupt river ecology, result in large scale deforestation, initiate loss of aquatic and terrestrial biodiversity, negatively alter food systems, water quality and agriculture. These environmental and social costs have led to dam removals in North America and Europe that used to be big dam builders until the 1970s. Now more dams are being removed in North America and Europe than are being built. Even in developing countries where dam building continues, the pace is slowing down because most of the best sites have been taken and also because other sources of renewable energy such as solar and wind are monopolising policy attention and investment.

In the fragile Himalayan mountains where most of India’s new hydro-power projects are being developed, devastating floods and landslides have raised risk levels for hydro-projects. The most recent illustration of this challenge is the sudden flooding in the Dhauliganga, Rishiganga and Alaknanda rivers in Uttarakhand’s Chamoli district in early February 2021 that took more than 70 lives and severely damaged NTPC (National Thermal Power Corporation)’s 520 MW (megawatt) Tapovan-Vishnugad hydel project, the Uttarakhand Jal Vidyut Nigam’s 13.5 MW Rishiganga Hydel Project, THDC (Tehri Hydropower Development Corporation)’s 444 MW Pipal Koti project (which received world bank assistance) and Jaiprakash Power Ventures’s 400 MW Vishnuprayag project. Though there is disagreement over the cause (glacier crash, avalanche, landslide), there is general agreement that carrying out development projects including hydropower projects, highways, railway lines and mining without adequate appraisals and the disregard for cumulative impact and disaster potential assessments contributed to the scale of the loss. Widespread indifference for environmental concerns among project developers and the absence of credible monitoring and compliance from regulatory bodies have considerably increased exposure to risks. But this does not mean hydropower projects must be abandoned. There are examples of hydropower projects in India that have met the best international standards. The Teesta-V hydropower station, located in Sikkim was rated as an example of international good practice in hydropower sustainability in 2019. The 510 MW power station, owned and operated by NHPC (National Hydropower Corporation) Limited, met or exceeded international good practice across all 20 performance criteria. For hydropower planning to become sustainable in India the government and industry must prioritize transparency by engaging the civil society, especially those who are directly affected by the project. Research suggests that modular solutions that combine wind, solar, and hydropower to provide alternative energy sources that are environmentally, socially, and financially desirable. Instream turbine parks are much less disruptive alternative to dams and produce energy at much lower cost. Large, ‘smart’ hydropower projects may be developed, taking into account the economic, environmental and social concerns of local and downstream communities, in addition to national economic benefits. Technical provisions in smart projects can minimize the impacts on aquatic life and terrestrial ecosystems. To support hydropower projects, the government of India has recently included large projects above 25 MW under renewable energy category and has notified hydropower purchase obligation (HPO) as a non-solar renewable purchase obligation (RPO). To facilitate viability, tariff rationalization with back loading of tariff after increasing project life to 40 years, increasing debt repayment period to 18 years and introducing escalating tariff of 2 percent, budgetary support to building enabling Infrastructure such as roads and bridges and also for flood moderation services have been introduced.

The most important advantage of hydropower in contrast to other renewable energy sources, like wind and solar, is that it can be dispatched quickly at any time, enabling utilities to balance load variations on the electric distribution system. In India hydropower’s flexibility was best demonstrated on 5 April 2020 when the country’s operators restored grid stability following a 31 GW (gigawatt) plunge in demand when most households switched off electrical lights for 9 minutes from 21.00 hours to 21.09 hrs. As the event unfolded, generation from hydropower was decreased by over 68 percent in a short period without which grid stability would have been compromised.

Pumped hydro storage (PHS) facilities store energy in the form of water in an upper reservoir, pumped from another reservoir at a lower elevation. During periods of high electricity demand, power is generated by releasing the stored water through turbines in the same manner as a conventional hydropower station. During periods of low demand, the upper reservoir is recharged by using lower-cost electricity from the grid to pump the water back to the upper reservoir. PHS projects are unlike traditional hydroelectric stations in that they are a net consumer of electricity, due to hydraulic and electrical losses incurred in the cycle of pumping from lower to upper reservoirs. However, these plants are typically highly efficient and can prove very beneficial in terms of balancing load within the overall power system. Pumped-storage facilities can be very economical due to peak and off-peak price differentials and their potential to provide critical ancillary grid services. Globally, about 161 GW of PHS acts as the world’s largest ‘water battery’ accounting for over 94 per cent of installed global energy storage capacity. It supports grid stability, reduces overall system costs and sector emissions. India has nine PHS plants with a combined capacity of 4785 MW, and two PHS plants of 1080 MW are under construction. Currently out of the total 4785 MW capacity, only five plants with combined capacity of around 2600 MW, are being operated in pumping mode. 63 sites have been identified for PHS with total potential of about 96,500 MW. In 2020 the Solar Energy Corporation of India (SECI) concluded the world’s largest renewable-cum-energy storage power purchase tender through a reverse auction method. Greenko Group won the auction with a peak power tariff rate of ₹6.12/kWh pairing solar power with PHS.

No energy solution can exist outside of the real and competitive pressures of the market. Though a market for electricity does not exist in India in the strictest sense, PHS cannot count on technical viability and environmental benefits to succeed in the longer term. The traditional revenue source for PHS is arbitrage: making the most of generating when the price is high, and pumping when the price is low. But this relies on a certain level of predictable variability in the electricity market, and for that variability to continue into the future. PHS provides network support services such as frequency control, inertia and fault level control that have increasing value in a grid with significant amounts of non-synchronous solar and wind generation. As of now there are no markets for these network support services but, in the future, the need for such services is likely to increase to the point where market is willing to pay for it.

Coal demand in the current fiscal may be lower than the initial estimate of 1,085 MT due to the impact of COVID-19, Parliament was informed. Domestic supply of coal during the April-December period of the ongoing financial year stood at 489.89 MT. The demand of coal is higher than the current level of domestic supply of the fossil fuel. In FY20, the actual demand of coal in the country was 955.26 MT while the supply was 706.72 MT. The gap between demand and domestic supply of coal cannot be bridged completely as there is insufficient availability and reserves of prime coking coal in the country. Further, coal is imported by power plants designed on imported coal and high-grade coal required for blending purposes is also imported in the country as this cannot be fully substituted by the domestic sector which has limited reserves of high-grade coal. The focus of the government is on increasing domestic production of the dry fuel through allocation of more coal blocks, pursuing with state government for assistance in land acquisition and coordinated efforts with Railways for movement of coal. In order to enhance domestic production, 25 percent of coal production has been allowed for sale in open market for newly allocated captive coal blocks. CIL’s coal production declined by 4.1 percent to 60.5 MT last month. CIL had produced 63.1 MT of dry-fuel in January last fiscal. The company’s output in the April-January period was at 453.3 MT over 451.5 MT in the corresponding period of the previous fiscal. CIL accounts for over 80 percent of domestic coal output. Coal India-arm Northern Coalfields Ltd will achieve and surpass the production target of 113.25 MT for the current fiscal. Northern Coalfields Ltd (NCL) has set the new benchmarks in the field of production, productivity and integration of research and innovations. NCL contributes about 15 percent to the domestic coal production which is equivalent to more than 10 percent of power generation of the country. As far as demand of domestic coal is concerned, it will increase in upcoming decades in order to bridge the gap between demand and supply of the dry-fuel, subsequent reduction in coal import of the country, improving the PLF of existing thermal power plants (TPPs) and to feed upcoming new TPPs. NCL is aiming 130 MT production by 2023-24 in order to contribute in 1 BT output target of Coal India and to make the country self-reliant in the coal sector. Coal rose to the occasion when India’s power demand peaked at a new high of 187.3 GW, helping meet supply for the record single day surge in electricity consumption by supporting 78.6 percent of the total power generation. The previous high for the country’s power demand occurred on 20 January when consumption rose to 185.82 GW. Around 67 percent of the total coal fired power generation in the country is fuelled through CIL supplies. Of the 199 GW of coal-based power programmed for generation, per day during the ongoing fiscal 133 GW is scheduled from CIL linked coal.

Chowgule & Company Private Ltd (CCPL) is all set to start commercial coal mining in the Shahpur (East) coal mine in Shahdol district, Madhya Pradesh after it signed an agreement with the Union ministry of coal, mines and parliamentary affairs. The Goan conglomerate won the bid for the coal mine in the e-auctions conducted in November last year. The Chowgule Group currently has mining operations in Goa and Karnataka, and three plants with the capacity to produce and export over 5 MT of the finest iron ore and pellets every year.

Goa opposition MLAs wore black armbands and raised black placards on the inaugural day of the state legislative assembly, amid fears of increased coal transportation through Goa. The coal issue has gripped Goa over the last few months, with the opposition — across party lines — and civil society groups opposing three central government-backed projects in protected forest areas, which they claim would facilitate increased transportation of coal from Goa’s Mormugao port to steel mills in Karnataka’s Bellary district.

The Government is considering opening up coal marketing. Currently, production by CIL is allocated through a number of different methods, including multiple sector-based auctions and coal linkages based on recommendations by the Union government, and Fuel Supply Agreements (FSAs). India produced about 729 MT of coal and imported about 248 MT in the previous fiscal.

IIT (BHU), with the support of the Northern Coalfields Ltd under an MoU with them, will establish a new research centre at the oldest mining engineering department in the country which came into existence in 1923. The Coal Quality Management and Utilisation Research Centre will be the first of its kind in India under an academia-industry MoU. It will be equipped with a state-of-the-art facility for conducting research on clean coal technology to enhance the quality of coal, with the facility for determining the quality and grade of coal for stakeholders and traders.

Japan and Japanese trading houses are speeding up their efforts to shift away from coal and other fossil fuel assets amid a growing decarbonisation push worldwide and to match an ambitious pledge by government of becoming a carbon neutral by 2050. The move comes as the trading houses are re-thinking their long-term strategies around upstream investment. For example, Itochu will offload its stake in a Colombian coal mine, shedding 80 percent of its thermal coal assets, and will sell the remaining stake in two Australian mines “as soon as possible.” Mitsui is also pulling out from a coal mine in Mozambique after impairment losses reduced the book value of the stake to zero. Japanese trading companies have already stopped investing in new coal-fired power plants, but Marubeni is expediting its plan to halve its stakes in coal-fired power stations by 2030. Mitsubishi has already exited from thermal coal mines, but coking coal and LNG remain key profit drivers.

Anglo American has hired RMB, Morgan Stanley and Rothschild & Co to advise on the separation and listing of its South African thermal coal assets, as it aims to cut exposure to the polluting fuel. Anglo, listed in London and Johannesburg, is expecting to list its coal within two years. Anglo’s overall market capitalisation is around $47 bn. The value of its coal assets is unclear, as coal prices have surged in recent months and the COVID-19 pandemic has impacted previous estimates. Anglo American preferred separating and listing its thermal coal operations on the Johannesburg Stock Exchange. For years, coal assets were seen as an easy way to generate cash and selling them was always sensitive in South Africa where they employ many people and provide for most of the country’s power needs.

Poland adopted an energy strategy to 2040, which would provide a compass as the country seeks to navigate away from coal. The document has been subject to numerous changes and delays as the government sought to align it with EU climate policies and fend off opposition from powerful coal unions. But rising carbon emission costs and the impact of COVID-19 have forced the government to focus on strategic allocation of state funds to kickstart the economy. Poland gets the bulk of its electricity from carbon-intensive coal and it is the only EU state that has refused to pledge climate neutrality by 2050, saying it needs more time and money to complete the shift to zero emissions. Environmental campaigners said that the government’s strategy was inadequate and to prevent further temperature rises, the EU and Poland should stop burning coal before 2030. The French central bank will exit from coal and limit exposure to gas and oil in its investment portfolio by 2024 as part of a shift towards more environmentally friendly assets. By the end of this year, it would no longer invest in companies which generate more than 2 percent of their revenues from coal and reduce the threshold to zero by the end of 2024. Currently the threshold stands at 10 percent.

China’s coking coal futures slumped to their lowest level in two months, dragged by weakening demand for the raw material and easing concerns over supply in the world’s top steel producer. The most-active coking coal contract with May expiry on the Dalian Commodity Exchange fell as much as 2.7 percent to 1,488.50 yuan ($230.48)/tonne, its lowest level since 1 December, stretching losses to a 10th consecutive session. The pressure on Dalian coking coal emerged from 19 January, following a report that China was considering allowing some stranded Australian coal shipments at its ports to be unloaded. China, which has a strained relationship with Canberra over trade, politics and the origins of the new coronavirus, did not allow any coal cargos from Australia to pass customs clearance in December. About 70 ships containing an estimated 6 MT of Australian thermal and metallurgical coal were sitting off the coast of China waiting to unload, according to ANZ commodity strategists.

China did not allow any coal cargos from Australia to pass the customs clearance in December as it targeted various Australian products with unofficial import restrictions, but inflows from other countries rose. Both thermal coal, mainly used as fuel at power generation plants, and metallurgical coal for steelmaking from Australia fell to zero in December. But coal arrivals from other sources, such as Indonesia and Russia, increased last month as Beijing granted approval to power plants to import coal from various countries without clearance restrictions, except Australia. Relations between Beijing and Canberra have come under increasing strain amid a series of disputes over trade, politics and the origins of the COVID-19 pandemic. The customs data also showed that the share of Australian thermal coal slipped to 34.19 percent of China’s total imports of the fuel in 2020 from 39.72 percent in 2019. China has granted new quotas in 2021 allowing for coal imports to pass customs clearance, but there is no sign that restrictions on Australian products are being lifted, according to trading sources. At least 62 cargos carrying 6.14 MT of coal from Australia are waiting to discharge near Chinese ports, some of which have been waiting since June, according to Refinitiv’s trade flows data. China is planning to buy $1.467 bn worth of thermal coal from Indonesia in 2021.

Japanese trading house Mitsubishi Corp expects the recent rally in coking coal prices to continue as long as China keeps an unusual suspension of customs clearance of coal cargoes from Australia. The company, which is involved in food production and distribution business and development of an industrial park in Myanmar, expects any immediate impact from the recent coup to be limited. Germany’s imports of hard coal in 2021 could drop 18.6 percent year-on-year to 26.7 MT lobby group VDKi forecast, citing lower usage by steelmakers in the COVID-19 crisis and price competition with gas and renewables in power generation. The coal importers group also published preliminary data for the past year. It said imports had dropped to 32.8 MT in 2020, a 24 percent decline from 2019.

US coal exports fell to a four-year low 62.66 MT in 2020, down 25.6 percent from 84.23 MT exported in 2019 and the second-lowest figure in the last 11 years, only higher than the 54.68 MT shipped out in 2016, according to US Census Bureau data. In December, roughly 2.63 MT of thermal coal was shipped out of the US, down from the 18-month high 2.98 MT in November, but up from the 1.98 MT exported in the year-ago month. India received the largest volume of thermal coal at 989,102 MT in December, up from 923,271 MT in November and 211,342 MT in the year-ago month.

Prodeco, a wholly-owned subsidiary of Glencore, will hand back its Colombian mining contracts after a review found restarting the unit’s operations would not be economical. The unit had sought permission to keep its mines on care and maintenance, but the request was denied by Colombia’s National Mining Agency in December. Glencore’s coal production in 2020 fell 24 percent to 106 MT with Prodeco’s output plummeting 76 percent to 3.8 MT. The ministry of mines and energy in Colombia – which is the world’s fifth-largest coal exporter – estimates national coal output dropped 30 percent in 2020 to around 54.1 MT. It hopes output will rise to 62 MT in 2021.

The most coal-dependent US utilities plan to keep around 75 percent of their coal-fired power plants running for another decade, according to an analysis by the environmental group Sierra Club, posing a threat to the climate. The Sierra Club analysis of utility public filings found that the companies, which together account for 43 percent of the nation’s power production, have committed to retiring just a quarter of their coal capacity by 2030. Sierra Club has been a major force in pushing for the retirement of US coal plants. Since 2010, 63 percent of the nation’s coal plants have been retired or have committed to retire by 2030. Yancoal Australia Ltd said it expects a rebound in demand for coal-fired electricity generation in 2021 as global economic conditions are set to improve. Following China’s unofficial ban on coal imports from its major supplier Australia in the second half of 2020, Yancoal has been diversifying its customer base with sales made into India, Pakistan and South America which it intends to widen. It is believed that China, the world’s biggest coal importer, imposed the ban in retaliation for Canberra’s call for an international probe of the origins of the coronavirus pandemic. Yancoal warned that the influence of weather on both supply and demand along with regional trade settings would likely contribute to uncertainty regarding the direction of coal prices during the first half of 2021. The company, which has mines and projects in New South Wales and Queensland, posted annual saleable coal production of 38 metric tonnes, which met its full-year target.

MT: million tonnes, BT: billion tonnes, CIL: Coal India Ltd, MoU: Memorandum of Understanding, US: United States

16 February: India’s refiners are turning to spot oil from Africa and North America as long-term suppliers in the Middle East cut output and as demand for gasoline jumps amid the COVID-19 pandemic. Spot crude imports into the world’s third-largest oil market will rise by 10 percent to 15 percent this year from 2020, according to industry consultant FGE. The increased purchases are coming as India’s top suppliers, including Saudi Arabia and Iraq, curtail output as part of the OPEC+ pact. Bharat Petroleum Corp Ltd (BPCL), India’s second biggest state-owned refiner, has increased the proportion of spot crude purchases to about 45 percent from about 30 percent normally, according to Finance Director N Vijayagopal. The company plans to keep spot about 40 percent of supply in at least the medium term. BPCL boosted refinery runs to 113 percent in January, and the other major state-owned refiners, Indian Oil Corp (IOC) and Hindustan Petroleum Corp (HPCL) are also operating above capacity. While demand for gasoline and liquid petroleum gas for cooking has surged, diesel’s rebound has been slower and jet fuel consumption is still half of what it was a year ago as most international routes remain shut. That’s leading to a shift in where India is sourcing its barrels. Middle East oil tends to yield more diesel, while crude from the North Sea, West Africa and US (United States) shale fields usually produce more LPG and gasoline. Crude imports from Nigeria in December jumped 68 percent from the previous year, while US oil purchases surged almost 77 percent, according to government data. India, one of the biggest buyers of OPEC (Organization of Petroleum Export Countries) crude, has already expressed displeasure at the cuts.

Source: The Economic Times

16 February: The sustained strength of marketing margins and recovering demand for petroleum products is supporting the profitability of India’s oil marketing companies against weak gross refining margins (GRMs), thereby lowering downside risks for their credit metrics, according to Fitch Ratings. Petroleum product sales at Indian Oil Corp Ltd (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) surged by 22 to 23 percent in the third quarter of the financial year ending March 2021 (3Q FY21) from the previous quarter with domestic transportation fuel demand recovering to near-normal levels, barring aircraft fuel, and marketing margins on auto fuel sustained at above pre-pandemic levels. However, reported GRMs dropped due to lower inventory gains, and the improvement in underlying GRMs was limited by weakening product cracks and increasing crude oil prices. Fitch expects BPCL’s net leverage including full consolidation of Bharat Oman Refineries Ltd to be lower over FY21 to FY22 than its previous estimates, albeit slightly above the level where it will consider revising the standalone credit profile downwards. Fitch said the capacity to reduce taxes will be supported by the recovery in fuel sales and other government income sources, like the GST, to almost pre-pandemic levels.

Source: The Economic Times

16 February: Diesel price here has gone up by a record ₹20 a litre in 10 months, while petrol escalated by ₹19, leaving motorists and transporters fuming. The city witnessed hikes for the seventh consecutive day as petrol touched a new all-time high of ₹95.46 a litre, while diesel went up to ₹86.34. Parbhani’s petrol price broke records to retail at ₹97.63 a litre ₹2.37 shy of the ₹100-mark. The rate of premium petrol (with additives) at pumps in Parbhani crossed ₹100. The price of fuel in neighbouring Thane and Navi Mumbai was higher than Mumbai. Petrol was hiked to ₹95.58, while diesel was revised to ₹86.46. The highest price of diesel in the state was in Amravati (₹87.73). Aurangabad followed at Rs87.51. For petrol, apart from Parbhani, at Nanded pumps dispensed the fuel at ₹97.46. Transporters said there was growing resentment and if the government did not roll back duties and taxes on fuel by the month-end many would be “compelled to shut down operations”. The hikes will pinch pockets of motorists, as car and bike sales have risen in the city for the past few months. The cost per km to drive during peak hours is now over ₹6 for petrol vehicles. Shiv Sena, MNS and Aam Aadmi Party (AAP) activists had recently protested against the hikes in Mumbai metropolitan region.

Source: The Economic Times

16 February: Former Petroleum Secretary S C Mishra said the economic situation has improved since 2020 and the central government should have given a relief of ₹12 per litre on petrol and ₹14 per litre on diesel to the common man. He underlined the fact that the government had raised the taxes on petrol by ₹12 per litre and on diesel ₹14 per litre, twice in March and May 2020, to garner extra revenue. Elaborating about the taxes levied on petrol and diesel, Mishra said the actual refinery rate price for petrol or diesel is between ₹30 to ₹31 per litre. He said that the effective rate of tax comes to about 150 percent to 200 percent on both petrol and diesel.

Source: The Economic Times

15 February: Congress leader Rahul Gandhi took a dig at the Central government over the liquefied petroleum gas (LPG) or cooking gas domestic cylinder price hike in Delhi and said that the government is ‘looting’ from the public. The price of LPG domestic cylinder in Delhi has been increased by ₹50 per unit. The new price of ₹769 per 14.2 kg (kilogram) LPG cylinder is applicable in the national capital. This is the second price hike in the month of February. The Oil Marketing Companies (OMCs) had increased the price of non-subsidised LPG cylinders by ₹25 in metro cities on 4 February. The rise in the price of LPG comes at a time when petrol and diesel prices in India have touched an all-time high. The cooking gas is derived from crude oil and natural gas.

Source: The Economic Times

15 February: India’s top oil and gas producer ONGC said it will scale up natural gas production from a KG (Krishna-Godavari) basin block to 2.5-3 mmscmd (million metric standard cubic meter per day) by May this year and will hit the peak output sometime in 2023-24. Oil and Natural Gas Corp (ONGC) last year started gas production from the $5.07 bn KG-DWN-98/2 project in the Krishna Godavari basin, off the east coast of India. The output in the fiscal year beginning April (2021-22) is projected to average 3.4 mmscmd and 8.5 mmscmd in the following year. ONGC is investing $5.07 bn in bringing to production a clutch of discoveries in the deep-sea block, also known as KG-D6. The block sits next to the KG-D6 discovery area of Reliance Industries Ltd (RIL) and BP Plc. The project will cumulatively produce around 25 million tonnes (mt) of oil and 45 billion cubic meters (bcm) of gas with peak production of 78,000 barrels per day (bpd) of oil and 15 mmscmd. ONGC started gas production from the project on schedule in early 2020 but the start of oil production has been delayed due to the outbreak of pandemic which disrupted global supply chains. The project KG-DWN-98/2 involves some of the most advanced oil field technologies in drilling and completion of 34 subsea wells, laying about 425 km of pipeline and 150 km of control umbilical in water depths varying from 300 to 1,400 meters. ONGC will produce 22.97 mt of crude oil in the next fiscal as compared to 22-22.5 mt in the current financial year ending 31 March.

Source: The Economic Times

15 February: Vedanta Ltd invited bids for the sale of natural gas from its prolific Rajasthan block at rates equivalent to the price of imported LNG (liquefied natural gas) from the spot market or Brent oil price. Cairn Oil & Gas, Vedanta’s oil and gas arm, produces about 3.5 mmscmd (million metric standard cubic meter per day) of gas from its largely oil-bearing block in Rajasthan, the firm said in a notice. The output is being ramped-up to more than 5 mmscmd. It invited bids for 4.5 mmscmd of gas for two years from the RJ-ON-90/1 block. The price of gas will be lower of the previous month’s average of DES West India spot LNG prices or 14 percent of the average Brent crude oil price. Platts West India Marker (WIM) is the LNG price assessment for spot physical cargoes of delivered ex-ship (DES) into ports in India and the Middle East region. The rate currently is $6.2 per mmBtu (million metric British thermal units). The government every six months announces a price for the gas produced by ONGC (Oil and Natural Gas Corp) and Oil India Ltd. That rate currently is $1.79 per mmBtu for the period up to 31 March 2021.

Source: The Economic Times

13 February: Petronet LNG, India’s top liquefied natural gas (LNG) importer, plans a 29% increase in its Dahej terminal’s capacity to 22.5 million tonnes per annum (mtpa) to meet rising demand, its chief executive officer (CEO) A K Singh said. Indian companies are investing billions of dollars to build infrastructure, including pipelines and a new LNG import terminal, as Prime Minister Narendra Modi wants to raise the share of gas in energy mix to 15 percent from 6.2 percent to help curb emissions. Capacity at the 17.5 mtpa Dahej terminal in western Gujarat state will be increased in two phases, he said. It will add 2.5 mtpa in the first phase within three to four years, followed by another similar expansion. The International Energy Agency (IEA) in its latest report said India’s LNG imports are expected to quadruple to 124 billion cubic meters, or about 61 percent of overall gas demand by 2040. To meet the country’s growing gas demand Petronet is looking for flexible gas import contracts of 10 years or less instead of the standard long-term contract of 25 years, he said. Petronet operates a 5 mtpa terminal at Kochi in Southern India. He said the terminal would operate at about 30 percent by the end of this year compared to the current 20 percent as more customers are linked to the gas pipeline. He said capacity use at the terminal would rise to over 80 percent when a pipeline linking Petronet’s project to the national grid is ready.

Source: The Economic Times

11 February: India’s natural gas production has risen above the pre-COVID level following the start of output from a KG-D6 field operated by Reliance Industries Ltd (RIL) and its partner BP Plc, upstream regulator DGH (Directorate General of Hydrocarbons) said. Natural gas production in the country in February 2020 was 80 mmscmd (million metric standard cubic meter per day) and in January this year it reached 82 mmscmd, DGH said. DGH said production levels are likely to be higher in the 2021 calendar year. While Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) continue to produce at almost the same levels as of November, the total gas production has risen because of R-Series fields in the KG-D6 block commencing production. Peak production from R-Cluster will be 12.9 mmscmd, according to the operators. Satellite fields in the same KG-D6 block, which are supposed to begin output from the third quarter of the 2021 calendar year, would produce a maximum of 7 mmscmd. MJ field will start production in the third quarter of 2022 and will have a peak output of 12 mmscmd. According to the oil ministry’s Petroleum Planning and Analysis Cell (PPAC), India’s gas imports (in LNG form) were almost flat during April-December. According to DGH, gas makes up for 6.23 percent of all energy consumed in the country. The government wants the share of natural gas in the energy basket to be raised to 15 percent by 2030. Achieving that share would mean India’s consumption of gas would have to rise to 500 mmscmd by 2030 from 150 mmscmd now, DGH said.

Source: The Economic Times

10 February: GAIL (India) Ltd expects to end overseas sales of the liquefied natural gas (LNG) it secures from the United States (US) from 2023, as local demand rises with the commissioning of new fertiliser plant. GAIL buys 5.8 million tonnes per annum (mtpa) of LNG from the US-based projects. It has signed time and destination swap deals for some of these volumes to cut the landed cost for Indian customers and trade the remainder in overseas markets. Last year GAIL sold 2.5 million tonnes (mt) of its US supplies in global markets, its executive director Rajeev Singhal said. He said GAIL hopes to trade less than 2 mt of its US volumes this year, and in 2022 this could shrink to about 1 mt. The Ramagundam fertiliser plant in southern India is expected to reach full capacity by March, requiring 0.75 mtpa of LNG. Fertiliser plants at Durgapur in eastern India and at Gorakhpur in the north, requiring about 1.25 mtpa and 0.75 mtpa LNG respectively, will be commissioned later this year. Two more plants at Sindri and Barauni in eastern India will come on line next year, each requiring 0.75 mtpa of LNG, Singhal said.

Source: Reuters

16 February: India’s use of coal may have peaked in 2018, according to a new report by according to UK-based clean energy group Ember. That’s sooner than many experts have forecast. The share of the dirtiest fossil fuel in India’s power mix fell for the second year in a row in 2020, according to the report, due to an economic slowdown in 2019 followed by a pandemic-induced recession. There’s a chance coal power never has to breach 2018 levels again if the Indian government meets its renewable energy goals, according to the report. India could speed up the transition by placing a moratorium on new coal power plants and incentivizing the closure of old, inefficient facilities, according to the report. That would require the government to shift its current policies, which saw the government auctioning new coal mines as recently as November.

Source: Livemint

12 February: Coal is projected to remain the largest single source of electricity in India in 2040, according to World Coal Association chief executive officer (CEO) Michelle Manook. She said that coal will continue to play a vital role in supporting intermittent renewable energy sources to underpin infrastructure development and industrialization. The association represents industry leaders, committed to building a sustainable future for coal and playing an active role in achieving our worldwide economic and environmental aspirations.

Source: The Economic Times

16 February: Electricity bills in the state are all set to go down as Assam Electricity Regulatory Commission approving a reduction in energy charges by 15 to 20 paise per kWh (kilowatt hour) for both domestic and commercial connections from April onwards. According to the order from Assam Electricity Regulatory Commission energy charges of low tension domestic and low tension commercial (up to 25 kW) categories have been reduced by 20 paise per kWh, while the energy charges of all other categories have been reduced by 15 paise per kWh. The fixed charges, which vary for different categories of connections, have not been changed though. The Assam cabinet approved free electricity in all households for consumption of up to 30 units a month for three months till March.

Source: The Economic Times

15 February: Power cuts in Andhra Pradesh dropped by nearly 35 percent, 1.4 lakh, in the 2020–21 financial year compared to the 2019–20 fiscal. A total of 2.5 lakh power outages were reported in 2020–21, a steep fall from 3.91 lakh in 2019–20. In a bit to reduce interruptions in power supply, power utilities have laid special focus on augmenting the power infrastructure in the state. Among such augmentation attempts are upgrading electricity substations, strengthening distribution networks and providing additional infrastructure for agricultural requirements during the day. According to APTransco, achieving 100 percent excellence in uninterrupted power supply at par with international standards is the ultimate objective of the state government. Meanwhile, APTransco has recently deployed a day-ahead electricity forecast model which uses artificial intelligence and machine learning to forecast the next day’s electricity consumption in units.

Source: The Economic Times

15 February: The All India Power Engineers Federation (AIPEF) has demanded that the Electricity (Amendment) Bill, 2021 must be put out in the public domain before starting the discussion on it in Parliament. AIPEF Chairman Shailendra Dubey said that the Bill is not available on the power ministry website. He said the Electricity (Amendment) Bill 2021 is included in the list of 20 new Bills to be placed in the current Budget session of Parliament. AIPEF has threatened a lightning strike against any unilateral move to rush through the Bill in Parliament. Dubey said that the reported matters in the Electricity (Amendment) Bill 2021 are un-authenticated and deserve to be discarded, particularly as they are tantamount to introducing a drastic policy of separating carriage and content which was earlier rejected by as many as 20 states. The outcome of the various suggestions of the stakeholders on the Bill 2020 remains undisclosed and a new draft Bill 2021 has been leaked to the selected few. The present approach of the ministry of power is non-transparent and secretive, and seems that the government is trying to hide secret critical facts, he said.

Source: The Economic Times

11 February: From 1 April, all the cash counters of the MP (Madhya Pradesh) Madhya Kshetra Vidyut Vitaran Company Ltd which caters to energy consumers of 16 districts including state capital Bhopal will be closed. Consumers will have to pay online monthly bills online only from 1 April onwards. As an alternate for cash counters consumers will have the option to pay from MP Online kiosks, common service centres, ATP machines and from the portal of the discom as well the Upay App launched by the discom (distribution company), the company said. Apart from this, agencies will be authorised at certain designated places for collection of bills, the company said. The company said that the online payment will enable users save between ₹5 and ₹20 on each payment, they will get information regarding payment instantly and at the same time payment could be done from anywhere and at anytime. The discom has said that for the current month of February-March, meter readers have not been authorised for receiving payments, thus no payments should made to the meter readers.

Source: The Economic Times

16 February: India will need to deploy $500 bn in investments to reach its 450 GW capacity target by 2030, according to a recent report by the Institute for Energy Economics and Financial Analysis (IEEFA). It said that this would include the cost of adding more than 300 GW of new renewables infrastructure, firming low-cost renewable power generation, and expanding and modernising grid transmission and distribution. Of the $500 bn investment, $300 bn would go for wind and solar infrastructure, $50 bn for grid firming investments, and $150 bn on expanding, modernising transmission, according to IEEFA report. The report said that the country has received more than $42 bn in investment since 2014. According to the report, a huge global capital pool is mobilising to invest in renewable energy (RE) and grid projects in India, with pull factors including solar power tariffs hitting record lows, plunging solar module costs, record low interest rates, and the security of government-backed, 25-year power purchase agreements. The report said that the Indian renewables sector is increasingly dominated by the major independent power producers such as ReNew Power, Greenko, Adani Green, Tata Power, ACME, SB Energy, Azure Power, Sembcorp Green Infra and Hero Future Energies, and that each has invested strongly in building capacity in international debt and equity markets.

Source: The Economic Times

15 February: None of the thermal power plants (TPPs) in Maharashtra has installed flue-gas desulfurization (FGD), a system used to remove sulphur dioxide (SO2) from emissions, claimed Sunil Dahiya, a research analyst working with independent organization Centre for Research on Energy and Clean Air (CREA). Dahiya said state owned and private sector TPPs lag behind even the plants of NTPC Ltd, which has at least awarded contracts for phasing of FGD facility in its units in Maharashtra. NTPC-owned TPPs at Mouda and Solapur, having capacity of 2980 MW, have awarded contracts for installation of FGDs. However, no contracts have been awarded for entire capacity of 9250 MW of Mahagenco TPP and 7140 MW capacity of private sector TPPs in Maharashtra, he said. The data gathered by CREA suggests that bids have been opened for installation of FGD at five units of Chandrapur super thermal power station, three units at Koradi TPS and two units of Bhusawal TPS. All the TPPs in Maharashtra have the deadline of installing FGD units ranging from 31 March 2021 to 31 December 2022. With the time frame of nearly three years needed for installation of the FGD units, all the TPPs in the state are likely to miss their deadline, he said.

Source: The Economic Times

15 February: A day after the Uttarakhand High Court (HC) upheld the state’s right to tax the hydropower projects in the Himalayan state for using the state’s river waters for electricity generation, the firms operating these plants have said that they will challenge the order before the division bench of the HC. Counsels appearing for two of the 11 power projects said that they will file a special appeal soon before the division bench.

Source: The Economic Times

14 February: Amara Raja Batteries Ltd (ARBL) is setting up a solar power plant in Chittoor district of Andhra Pradesh at a total outlay of ₹2.20 bn to support its sustainability initiatives. This will further reduce cost of power and simultaneously bring down the company’s carbon footprint, it said. Besides, as part of the overall lead procurement strategy, ARBL will set up a greenfield lead recycling unit with a capacity of one lakh tonnes. The government has also announced many initiatives and Production Linked Incentive (PLI) schemes, which will accelerate the growth of e-mobility and renewable energy markets.

Source: The Economic Times

13 February: Pitching for promoting clean fuel in India, Union Minister Nitin Gadkari said there is a potential for setting up at least 5,000 bio CNG manufacturing units in India. Launching India’s first-ever diesel tractor, converted to CNG and registered in his name, Road Transport, Highways and MSMEs Minister Nitin Gadkari also said that not only it will change the rural economy but result in huge employment creation. Oil Minister Dharmendra Pradhan said the country is likely to see huge investments for setting up about 5,000 compressed bio-gas (CBG) units across the country. Farmer can make huge income by converting CBG into ethanol, he said.

Source: The Economic Times

10 February: Prime Minister (PM) Narendra Modi said the road to fighting climate change is through climate justice and called for giving developing countries enough space to grow. The remarks come amid a continuing tug of war between developed and developing countries on who needs to do more to save the environment by reducing emissions. Noting that the sad reality is that environmental changes and natural disasters impact the poor the most, Modi said climate justice is inspired by a vision of trusteeship where growth comes with greater compassion for the poorest. Asserting that India’s intent is supported by concrete action, Modi said the country, powered by spirited public efforts, is on track to exceed its commitments and targets set at the Paris Climate Change Conference in 2015.

Source: The Economic Times

15 February: Iraq is in advanced talks with state-run Chinese companies to discuss building crude oil storage facilities in China as part a plan to boost oil sales to Asia, Iraq’s Oil Minister Ihsan Abdul Jabbar said. Iraq is also discussing plans proposed by Pakistan for building crude oil storage facilities, Jabbar said. Iraq’s oil ministry has further plans to build storage facilities in some other states to “serve Iraq’s interests in marketing its oil”, Jabbar said.

Source: The Economic Times

14 February: The global oil market is on a recovery path and the oil price this year could average $45-$60 per barrel, Russian Deputy Prime Minister Alexander Novak said. Novak said the Nord Stream 2 undersea gas pipeline from Russia to Germany was 95 percent complete and would be completed despite attempts by the United States “to block it”. Brent oil is currently trading above $62 per barrel. Novak said that global oil demand had been at its lowest during the pandemic-related crisis in April-May, when it fell by around 20-25 percent from its usual level. Global oil demand had stood at around 100 mn barrels per day before the coronavirus-related lockdowns. The Organization of the Petroleum Exporting Countries (OPEC) has said global oil demand in 2021 would rebound more slowly than previously thought as the impact of the pandemic lingers.

Source: Reuters

12 February: New Mexico’s Democratic senators spoke with White House National Climate Advisor Gina McCarthy to discuss ways Washington can compensate oil-dependent states for potential revenues lost during a pause on new federal oil and gas leasing, the senators said. The discussions are a sign President Joe Biden’s administration has begun studying the financial and political cost of halting new federal oil leases, a key element of Biden’s sweeping plan to decarbonize the US (United States) economy by 2050 to fight climate change. New Mexico is by far the biggest beneficiary of the federal drilling program because it hosts vast federal acreage overlying a share of the Permian Basin, the world’s most productive oil field. Biden signed an executive order pausing new oil and gas leasing on federal lands and waters that account for around 25 percent of the nation’s petroleum production pending a review of its impacts, a move widely seen as a first step to the permanent ban he promised during his campaign. US states last year collected some $1.8 bn in revenues from federal lands drilling to support publics schools and other social programs, according to the Interior Department.

Source: Reuters

13 February: Virginia natural gas company RGC Resources Inc’s chief executive officer (CEO) said that the joint venture building the $5.8 bn-$6.0 bn Mountain Valley gas pipeline from West Virginia to Virginia expects to complete the project by the end of 2021. That matches what other companies involved in the project have said since they decided in January to give up on a nationwide permit that covers all stream crossings and instead seek individual permits to cross the remaining roughly 430 streams. MVP (Mountain Valley Pipeline) is one of several oil and gas pipelines delayed in recent years by regulatory and legal fights with states and environmental groups that found problems with permits issued by the Trump administration. When construction started in February 2018, MVP was expected to cost about $3.5 bn and be completed by the end of 2018.

Source: Reuters

12 February: Royal Dutch Shell’s LNG Canada export project in British Columbia has won approval from health officials for construction to ramp back up with improved coronavirus protection measures. Work at the site was curtailed by an order from the Provincial Health Officer which applied to five major industrial projects in British Columbia, including LNG Canada. LNG Canada said the coronavirus restart plan includes additional coronavirus testing for workers. LNG Canada is the only big LNG export plant under construction in Canada. It is set to cost about C$40 billion ($31.4 bn), and is designed to produce about 14 million tonnes per annum (mtpa) of LNG or 1.8 billion cubic feet per day of natural gas. Before coronavirus delayed the project, it was expected to start producing LNG in 2024. Many analysts however now say they expect the project to enter service in the second half of 2025.

Source: Reuters

10 February: British authorities announced that they will review plans for a controversial new deep coal mine in northwest England to assess its environmental impact more accurately. The coastal project, whose developer is Australian-owned West Cumbria Mining, would be located near the town of Whitehaven and supply European and UK steelmakers with metallurgical coal. The news comes a month after Prime Minister Boris Johnson’s government opted to leave approval of the country’s first new deep coal mine in decades with the local authority.

Source: The Economic Times

16 February: Japan’s overstretched electricity grid is likely to receive another Arctic blast in the coming days, which is already pushing up wholesale prices and may stress generators as they struggle to keep units running after a powerful quake. While the world’s third-biggest economy is unlikely to see millions plunged into blackouts as in the United States (US) currently, the country narrowly avoided power cuts only last month in another wintry spell. Utilities and independent power providers got another jolt at the weekend when a 7.3-magnitude earthquake struck off the coast of Fukushima, northern Japan, and sent plants into automatic shutdown, briefly knocking out power for nearly 1 mn people. Power companies restarted some units after checks for quake damage. Wholesale electricity prices for peak-hour delivery reached a three-week high of 38.80 yen (37 cents) per kilowatt hour, up more than 40 percent.

Source: Reuters

15 February: Myanmar security forces fired to disperse protesters outside a power plant in the northern state of Kachin, footage broadcast live on Facebook showed, although it was not clear if they were using rubber bullets or live fire. Hundreds had gathered outside a power plant that soldiers had occupied in the city of Myitkyina. As darkness fell, riot police accompanied by soldiers arrived to drive away the crowds, the footage showed.

Source: The Economic Times

10 February: US (United States) power consumption will rise 1.6 percent this year as state and local governments ease coronavirus lockdowns, the US Energy Information Administration (EIA) said. The EIA projected power demand will rise to a two-year high of 3,864 bn kilowatt hours (kWh) in 2021 and 3,931 bn kWh in 2022 from a coronavirus-depressed, 11-year low of 3,803 bn kWh in 2020. That compares with an all-time high of 4,003 bn kWh in 2018. EIA said natural gas’s share of power generation will slide from 39 percent in 2020 to 37 percent in 2021 and 35 percent in 2022 as gas prices increase, while coal’s share will rise from 20 percent in 2020 to 21 percent in 2021 and 22 percent in 2022. EIA projected 2021 power sales would rise to 1,489 bn kWh for residential consumers, which would be a record high as continuing lockdowns cause more people to work from home, 1,293 bn kWh to commercial customers and 945 bn kWh to industrials. That compares with all-time highs of 1,469 bn kWh in 2018 for residential consumers, 1,382 bn kWh in 2018 for commercial customers and 1,064 bn kWh in 2000 for industrials.

Source: The Economic Times

16 February: The European Commission is expected to propose reforms to an international energy treaty as early as, EU (European Union) said, after some governments have said the bloc should consider quitting the agreement because it could threaten climate goals. Signed in 1994 to protect cross-border investment in the energy sector, the Energy Charter Treaty has faced growing criticism from environmental groups and governments that say it impedes countries’ efforts to phase out fossil fuels. The agreement enables foreign investors to seek financial compensation from governments, if changes to energy policy negatively affect their investments. Some countries are growing impatient, after three rounds of negotiations last year failed to yield progress. Spain said this weekend it had written to EU leaders calling for the bloc to consider quitting the treaty if it cannot be redesigned to support Europe’s plans to curb greenhouse gas emissions.

Source: Reuters

10 February: The New Zealand government has extended additional support to clean up the environment with the approval for 22 new low-emission transport projects, Energy and Resources Minister Megan Woods said. A community electric bike and car share scheme, additional EV (electric vehicle) charging stations, as well as five hydrogen trucks and a demonstration electric truck, are some of the latest projects to get government co-funding. Projects include Otautahi (Christchurch) Community Housing Trust’s initiative, which is giving its tenants the opportunity to share, rather than own transport through community car or e-bike share scheme. In total, the LEVCF has co-funded over 600 public EV chargers, of which more than 450 are operational.

Source: The Economic Times

10 February: China will force regional grid firms to buy at least 40 percent of power from non-fossil fuel sources by 2030 in order to meet the country’s climate targets, according to a new government document. Grid companies will steadily increase the amount of power purchased from clean generation sources from 28.2 percent in 2020 to 40 percent by 2030, according to a draft policy from the National Energy Administration (NEA). President Xi Jinping pledged last year to make China “carbon neutral” by 2060, and said in December it would boost the share of non-fossil fuels in primary energy consumption to around

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.