-

CENTRES

Progammes & Centres

Location

cIL may witness de-growth in production during the current fiscal as its output is likely to fall below 600 mt amid subdued demand. The miner could end the current year with the production of around 580 mt of coal as against its revised target of 650-660 mt. Analysts of brokerage firm Motilal Oswal projected production of 582 mt for CIL and off-take of 565 mt in FY21 while ICICI Securities had estimated an output of 580 mt and sales of 550 mt this year. However, the miner is hopeful of achieving a 10 per cent growth in 2020-21 over 602 mt of coal produced last year, notwithstanding the disruptions caused by the Covid-19 pandemic, CIL said. The brokerage firms projected a lower EBITDA of 17-18 percent for CIL in the current fiscal. The coal procured under the “special spot e-auction scheme 2020 for import substitution” will be for use within the country.

WCL, a subsidiary of CIL has offered additional quantity of coal to various power generation companies of central, west and south regions at a cheaper landed price, according to WCL. WCL said the move will not only help power gencos minimise their cost to cut power tariffs, but will also reduce import of thermal coal. The company has the advantage of having its mining operation in central India, it said. This helps consumers of central, west and south India to get cheaper landed coal due to advantage in lesser railway freight in comparison to other coal companies of CIL located in the eastern part of the country. WCL said that in a series of detailed discussion during the past two days with WCL and state gencos of Maharashtra, Madhya Pradesh, Karnataka, Gujarat, followed by NTPC Ltd and IPPs, all parameters of existing linkage and future swapping have been discussed along with financial benefit to gencos. It said that the additional quantity offered for swapping ranges from 3-6 mt to various gencos depending on their requirement. CIL envisions to be a commercially viable company and its vision is to ensure that there is no shortage of coal in the country and to make the country self-reliant in coal. According to CIL coal is India’s irreplaceable prime energy source, notwithstanding the projections over renewables displacing coal, it will continue to dominate India’s electricity generation for few more decades. CIL is committed to increase its production and supplies to the mandated required levels.

Given the excessive coal stock available with CIL the coal ministry has approved the company’s plan to supply 100 percent of the normative requirement to thermal power units. The ministry has recommended increasing the ACQ of coal to 100 percent of the normative requirement of a non-coastal plant. It was 90 percent earlier. For coastal plants, the ACQ has been increased to 70 percent. The decision of the coal ministry pertains to coal supply both under long-term agreement signed with CIL and coal supply linkage via the auction route. CIL periodically holds auction of coal for the power and non-power sectors for short-term and medium-term coal supply contracts. The company informed the ministry that around 700 mt of coal would be available with CIL in the current financial year. It further said that production from next financial year will be in accordance with the plans to achieve the 1 bt coal production target by 2024.

Mining company Thriveni Earthmovers has bagged a contract worth ₹314.28 bn from NTPC Ltd to develop and operate Talaipalli coal mine in Chhattisgarh alloted to the state-owned power giant. Earlier, NTPC had terminated the contracts it had awarded to BGR Mining & Infra for development of its coal mines in Jharkhand and Chhattisgarh over allegations of corruption against senior officials of the private mining company. NTPC had terminated the contracts for development and operation of Chatti-Bariatu coal mine in Jharkhand and Talaipalli coal mine in Chhattisgarh, according to two separate letters dated 4 July 2019 by NTPC. NTPC had awarded mine development and operation contract of the Chatti-Bariatu mine to BGR in November 2017. Talaipalli coal mine has a production capacity of 18 mt of coal per annum. The block was reallocated by the coal ministry to NTPC in 2015.

Coal prices are likely to be subdued in the current financial year on the back of low power demand and piling inventory at power stations. Domestic coal production remained subdued for the third consecutive month in June. Accordingly, the coal offtake reduced but improved month-on-month with the gradual relaxation in Covid-19 lockdown norms. Overall, domestic coal imports are likely to have been lower in July due to low domestic demand from end-user industries amid the Covid-19 outbreak. Also, the government has mandated CIL to replace at least 100 mt of avoidable imports in FY21. Hence, overall coal imports declined for the third consecutive month and were down in June. The share of imports in total domestic consumption reduced to 22 percent in June from 28 percent in FY20. Non-coking coal imports reduced 34 percent; coking coal imports declined by 41 percent. While non-coking coal import prices have shown signs of recovery as the power demand picked up over May, coking coal import price is yet to catch up because the steel sector demand remains subdued. Commercial coal mining and the associated reforms announced by the government will go a long way in shaping the coal sector towards a more deregulated and competitive scenario.

CIL said it has sought 15 percent distance-based freight concession from Indian Railways for transportation of domestic coal to customers located at a distance of 701 to 1,400 km from its mines. The move is aimed at broadening the client base and bring in more customers under import substitution plans. Out of 126 coal-based thermal plants linked with CIL, 14 plants located over 1,400 km distance are eligible for the freight concession presently. Close to 70 percent of CIL’s overall supply consists of “G9 to G13” grades of coal for which the freight price is around 40 to 45 percent of the total landed cost at consumption point. CIL’s coal would then be competitive with the landed price of imported coal and customers may opt for domestic coal. The price of CIL’s coal is considerably low compared to imported coal. But statutory levies and rail freight makes the landed cost of its coal less competitive compared to imported coal, particularly in the western and southern parts of the country, the company said. CIL accounts for over 80 percent of domestic coal output.

CIL is implementing a ₹150 bn project for mechanised transportation and automatic loading of dry fuel in 49 major mines. Altogether 650 mt of coal will be transported and loaded without manual intervention after the project is completed by 2024. The miner seeks to reduce manual intervention to overcome the perennial problems of overloading and underloading of coal when it is supplied to consumers.

NTPC said it will soon reduce the cost of coal supplies at Kudgi plant by using a newly constructed rail infrastructure. The newly constructed 670-meter bridge in South Western railway is beneficial to NTPC Kudgi as it will help in reducing the cost of electricity generation.

WCL, an arm of CIL has prepared an ambitious road map to almost double its coal despatch capacity through the rail mode. WCL has set ‘Mission 100 Days’ agenda to streamline activities to reach peak despatch of 50 rakes per day from January next year with support from railways. The coal ministry said that WCL has drawn up an ambitious road map to meet additional demand of consumers of power sector. On discussion with state gencos of Maharashtra, Gujarat, Karnataka, Madhya Pradesh as well as NTPC and independent power producers, WCL expects additional coal demand of around 25 mtpa from these consumers after getting swapped from other subsidiaries of CIL and SCCL. With expected substantial increase in demand, WCL has taken pro-active steps to gear up for additional coal crushing, transporting and loading facility for increasing coal despatch through rail to a level of 50 rakes per day from next January. Current year average is 19 rakes per day due to less coal demand till now. WCL despatches about 90 percent coal through the central railway. WCL produced 57.6 mt of coal and despatched 52.5 mt of coal during 2019-20. With a coal stock of over 14 mt in the beginning of 2020-21 and a production target of 62 mt this year, the company will have more than 75 mt of coal available for its consumers. WCL has planned to reach a production of 75 mt by 2023-24 and 100 mt by 2026-27.

SBI is creating a policy to lend to coal miners before landmark auctions that would end decades of state monopoly on the fuel. The planned policy suggests SBI is open to providing some of the financing required to put 41 coal mines with a combined annual production capacity of 225 mt into private hands. Lenders are also wary about sustained demand for coal, which is seen globally as a dirty fuel but is still the biggest source for electricity generation in India. In Japan and Europe, several banks have announced plans to cut down lending to coal projects. India’s coal-fired power plants, the biggest users of the fuel, operated at an average 46.2 percent of their capacity during the three months ended June, compared with 63.2 percent a year earlier. MSTC Ltd will hold the final online auctions from 19 October to 9 November, allowing private companies to mine and sell coal for the first time in nearly five decades. The price at which the coal will be sold to potential buyers will also be important to appraise the viability of the loans. SBI will determine a cap on how much exposure it will have to the sector.

Global and Indian NGOs have asked India to stop the use of coal for reviving the country’s economy as coal mines are mostly concentrated in the lands of indigenous people who have been “bearing the brunt” of the Covid-19 pandemic. The Denmark-based International Work Group for Indigenous Affairs and the New Delhi-based Indigenous Lawyers’ Association of India, besides National Campaign Against Torture, made the appeal ahead of the auctioning of 41 coal blocks slated for 29 September.

A study conducted by the CSE has raised serious questions about the rationale behind the central government’s move to auction more coal blocks. The government announced that 41 new coal blocks would be opened for auction to the private sector. Since 1980, when the Forest Conservation Act was enacted, India has diverted 0.53 mn hectares of forestland for mining – the bulk of it for coal. Since 2015, 49 coal mining projects have been cleared. According to CSE, every time the government offers newer opportunities for mining coal, it targets denser forests. Since 2015, of the 49 blocks cleared for coal mining, nine were in No-Go areas.

Operational activities of Talcher Fertilizers Ltd coal gasification project are to expedited. Talcher Fertilizers Ltd is a joint venture between GAIL (India) Ltd, CIL, Rashtriya Chemicals and Fertilizers Ltd and Fertilizer Corp of India Ltd. The coal gasification-based ammonia-urea project, a first of its kind in the country, would have a design capacity of 2,200 tonnes per day of ammonia and 3,850 tonnes per day of urea.

India’s coal import declined by 34.9 percent to 12.46 mt in August on account of subdued demand for the dry fuel from consuming sectors like power and cement. The country imported 19.14 mt of coal in August last year, according to provisional compilation by mjunction, based on monitoring of vessels’ positions and data received from shipping companies. Also, the first five months of the current fiscal saw 32.51 percent decline in coal import at 73.08 mt, over 108.29 mt during the year-ago period, it said. Of the total imports in August, non-coking coal’s shipment was at 8.87 mt and coking coal at 2.18 mt. CIL which accounts for over 80 percent of domestic coal output, has been mandated by the government to replace at least 100 mt of imports with domestically-produced coal in the ongoing fiscal. The Centre had also announced several relief measures for CIL consumers, including the power sector. The country imported 247.1 mt of coal in 2019-20, about five percent higher than 235.35 mt imported during 2018-19.

In yet another reprieve for the state, the Centre has given GIDC additional time to pay the performance security and appoint a transaction advisor for the Dongri Tal II coal block at Singrauli, in MP. Due to the Covid-19 pandemic, GIDC had written to the Union coal ministry seeking more time to complete the formalities. GIDC has been unable to appoint a transaction advisor and obtain the funds, equivalent to a year’s royalty, required to formally develop the coal block. The Dongri Tal II coal block at Singrauli in MP has been allocated to Goa as part of the fifth tranche of allotment by the coal ministry. The coal block had been earlier allotted to MPSMC but was taken back after MPSMC failed to exploit the mine in due time. Coal mines have been allotted to state governments for sale of coal under the Coal Mines (Special Provisions) Act, 2015.

Among China’s generally strong imports of major commodities in August there was one standout area of weakness – the large drop in coal. China’s coal imports fell to an eight-month low of 20.66 mt in August, down 20.8 percent from July’s 26.1 mn and a massive 33 percent below the level recorded in August last year, according to customs data. The lack of growth in coal imports in the January to August period contrasts with a 12.1 percent rise in imports of crude oil, an 11.8 percent gain in iron ore and a 34 percent surge in unwrought copper. The problem for major coal exporters, such as Indonesia and Australia, is that the drop in top importer China’s demand removes a key pillar of support, and adds to an increasingly bearish narrative for the polluting fuel. Asia’s total imports of coal from the seaborne market have slumped this year amid the economic fallout from lockdowns in many countries as they battle to contain the novel coronavirus pandemic. In the first eight months of the year, Asia’s seaborne coal imports were 612.82 mt, down 7.1 percent from the same period last year, according to vessel-tracking and port data. China’s customs data is for total coal imports, including those that come overland by rail and truck from neighbouring countries such as Mongolia.

Indonesia has set the coal benchmark price at the lowest level on record amid subdued demand from big buyers, while the country’s miners group said a global oversupply of coal was worsening. The government set its coal benchmark price (HBA) COAL-HBA-ID at $49.42/t down from $50.34/t last month. September marked a sixth consecutive month of decline in the benchmark price, which is used in spot trading in Indonesia, the world’s top thermal coal exporter. Indonesia is increasingly looking to diversify markets for its coal and is targeting Vietnam as potential growth market. ICMA estimated that Indonesia’s coal output in January-July was 323 mt or around 59 percent of the government’s 550 mt target. ICMA said in July their members would cut their 2020 production by 15-20 percent of their targets, amid low prices.

The Polish ministry in charge of state assets has postponed talks with coal mining unions over restructuring of the sector because one of the participants at meeting tested positive for Covid-19. Poland’s coal industry, already under pressure from climate campaigners and falling demand, has been hit hard by the Covid-19 crisis as many miners caught the disease and mining operations were closed. The ministry and management of PGG – Poland’s biggest coal producer – had planned to close two mines, but unexpectedly scrapped the project after opposition from trade unions. PGG has faced rising production costs and falling demand for coal on the back of a slump in demand for electricity following the pandemic lockdown in March and April. Also, trade unions have blamed the government for allowing state-run utilities to import coal instead of forcing them to buy domestic fuel. A New South Wales state regulator gave the green light for Australian miner Whitehaven Coal Ltd to proceed with the expansion of a controversial coal mine, in a blow to local farming communities. Whitehaven applied in 2018 to expand the Vickery project, asking for approval to increase coal extraction by nearly 25 percent, increase the peak annual extraction rate more than three-fold and also expand the so-called disturbance area.

Greece will spend €5 bn ($5.9 bn) to offset the impact of ditching coal in power generation by 2028 and cutting carbon emissions in line with European Union climate targets by 2050. The total will include state money, funds from the European Union and loans from the European Investment Bank. Greece’s conservative government, which took over last year, has pledged to switch off 80 percent of state utility Public Power Corp’s coal capacity by 2023 to reduce its carbon footprint. Another plant it is building in Ptolemaida, northern Greece, will operate using coal until 2028, after which it will switch to a different fuel.

The British government has refused to allow an open cast coal mine to be built in northeastern England. Northumberland County Council agreed in 2016 that developer The Banks Group could extract 3 mt of coal by cutting an open cast, or surface mine, near Druridge Bay, Highthorn. Environmentalists had criticised the plan, saying the mine would destroy an area of natural beauty and that extracting more coal is at odds with international pledges to reduce greenhouse gas emissions. Supporters of the project had said it could bring much-needed jobs to the region, and help to reduce Britain’s reliance on coal imports. Britain imported around 6.5 mt of coal in 2019, government data showed, with more than a third of this coming from Russia.

Three miners who were trapped in a coal mine for five days have been rescued and are recovering at a hospital near Colombia’s capital city. The group was working in the coal mine when a carriage came loose and crashed into one of its walls causing the main entrance to collapse.

| CIL: Coal India Ltd, FY: Financial Year, mn: million, bn: billion, mt: million tonnes, WCL: Western Coalfields Ltd, gencos: generating companies, IPPs: independent power producers, ACQ: annual contracted quantity, mtpa: million tonnes per annum, km: kilometre, SCCL: Singareni Collieries Company Ltd, SBI: State Bank of India, GIDC: Goa Industrial Development Corp, MP: Madhya Pradesh, MPSMC: MP State Mining Corp, ICMA: Indonesia Coal Miners Association, EU: European Union, UK: United Kingdom |

QuIck CommentReducing cess on domestic crude will improve prospects for producers! Good! |

29 September. The government may give a ‘Make in India’ push to oil and gas explorers, as it is considering a proposal to halve cess on domestic crude oil to encourage exploration activity and allow Covid-hit oil producers to protect their margins at a time when a glut in the market and suppressed demand is pushing down prices. Cess on domestic crude is currently levied at the rate of 20 percent of the value of oil. This may come to 10 percent if a proposal given by the industry and the oil ministry is accepted by the finance ministry. The oil ministry said that they are looking at extending tax concessions, along with reduction in oil cess and the finance ministry has been apprised of the matter for action. Though the larger view is in favour of halving the cess, the exact quantum would be worked out later. The reduction in the levy has huge revenue implications as ONGC (Oil and Natural Gas Corp) alone pays cess in excess of ₹100 bn annually. The finance ministry had revised oil cess in the FY17 Union Budget, shifting it from specific charge of ₹4,500 per tonne of crude to an ad valorem rate of 20 percent. The government is looking to reduce tax burden on oil companies to push up domestic production that has stagnated for past several years at around 30-34 million tonnes (mt). The reduction in oil cess would benefit upstream companies such as ONGC and Cairn India whose production is subjected to the oil industry development cess levied on an ad valorem basis. But under the new open acreage licensing policy (OALP), which provides pricing and marketing freedom to operators along with the power to select the block for exploration, does not attract oil cess. Currently, ONGC and Oil India Ltd pay a cess on crude oil they produce from their allotted fields on a nomination basis. Cairn India has to pay the same cess for oil from the Rajasthan block.

Source: The Economic Times

29 September. Indian refiner Bharat Petroleum Corp Ltd (BPCL) will continue to import gasoline for the next few months as its crude processing is hit due to lower demand for diesel that accounts for 40 percent-45 percent of its product slate, its head of marketing A K Singh said. BPCL is operating refineries at an average of 80 percent capacity, he said. By design BPCL refineries make 2.5 tonnes (mt) of diesel for every 1 tonne of gasoline produced, he said. India’s recent spot demand provided support to the Asian gasoline market. India’s gasoline demand in September recovered to last year’s level as passenger cars sales surged last month and motorists are relying on personal vehicles for commuting amid rising cases of coronavirus. Slowing industrial activity has delayed a recovery in diesel consumption, largely used by commercial vehicles. Diesel demand this month is 8 percent-9 percent lower than year-ago levels, he said. He hoped India’s diesel sales would recover next month during the festival season. BPCL will completely stop importing gasoline from April next year when it would start new units at its Kochi refinery to upgrade naphtha into gasoline, he said. He hoped BPCL will go back to its pre-Covid product slate in next two-three months, notwithstanding lower demand of jet fuel which is just 4 percent-5 percent of its overall output, he said.

Source: The Economic Times

28 September. Bharat Petroleum Corp Ltd (BPCL) has been forced to pay for its defaulting partner Videocon Industries Ltd after it had relied on a rarely used model to acquire stake in five oil blocks in Brazil. In September 2008, BPCL and Videocon Industries had formed a 50:50 joint venture to acquire a Brazilian oil exploration firm for $283 mn.

Source: The Economic Times

24 September. Crude oil processed by Indian refiners slipped 26.4 percent from a year ago in August, the most in four months, as fuel demand remained subdued on skyrocketing coronavirus cases that hindered industrial and transport activity. Indian refiners processed 3.82 mn barrels per day (bpd) or 16.15 million tonnes (mt) of crude last month, 8.7 percent lower than in July, government data showed. Crude oil throughput in August recorded its largest year-on-year contraction since April, when it posted its steepest decline since 2003. Weaker refining margins and a slide in fuel consumption have prompted refiners to cut crude processing and lower output. Indian refiners operated at about 76.1 percent of their overall capacity in August compared to 83.3 percent in July, the data showed. Top refiner Indian Oil Corp (IOC) operated its directly owned plants at 66.7 percent capacity, as per the data. The refiner expects local gasoline and gasoil demand to reach pre-pandemic levels in the first half of fiscal 2021 and sought to expand its petrochemical capacity to off-set weaker fuel refining margins. Reliance Industries Ltd, owner of the world’s biggest refining complex, operated its plants at about 75.8 percent capacity.

Source: Reuters

24 September. The Nagaland government has decided to withdraw the steep Covid-19 cess on petrol and diesel, State Minister Neiba Kronu said. The decision was taken at a cabinet meeting at Choumukedima in Dimapur district, he said. Considering the need to give a boost to economic activities and the woes of the people, the decision to rollback the cess was taken, Kronu, who is also the government spokesperson on Covid-19, said. The Nagaland government imposed the Covid-19 cess of ₹5 per litre on diesel and ₹6 per litre on petrol and other motor spirits on 28 April, amid a crunch in the state’s finances in the wake of the lockdown following the Covid-19 outbreak. Opposition parties, tribal bodies, civil society groups and student bodies have been demanding a rollback of the cess. Besides, the Dimapur Naga Students’ Union on 19 September had threatened to close down all the petrol pumps in the state if the cess was not withdrawn.

Source: The Economic Times

24 September. Activities for development of Crude Oil Import facility of Assam based Numaligarh Refinery Ltd (NRL) have started in Paradip Port, Odisha. Land filling activity will soon be started by Dredging Corp of India (DCI) by way of dredging and reclaim. A tripartite Memorandum of Understanding (MoU) was entered into by NRL with Paradip Port Trust and DCI for reclamation of the 200 acres of land allotted to NRL for setting up its crude oil import terminal at Paradip Port.

Source: The Economic Times

23 September. Taking advantage of low prices in major oil-producing centres in Saudi Arabia and UAE (United Arab Emirates), India has filled up its strategic crude oil reserves to meet its energy needs in times of emergency and saved a neat $685.11 mn in the process. It bought crude oil at an average price of $19 per barrel to fill its reserves in April and May when prices reached an all-time low while the US oil touched negative price levels in futures market. The state-funded reserves are meant to tide over short-term supply disruptions and will take care of India’s oil needs for 9.5 days. The country was already holding half of its total 5.33 million tonnes (mt) oil reserves capacity when the government decided to take advantage of the low crude prices. India’s three petroleum reserve caverns at Visakhapatnam (1.33 mt), Mangaluru (1.5 mt) and Padur (2.5 mt), managed by India Strategic Petroleum Reserves Ltd (ISPRL), are now full. Another 6.5 mt facility is coming up at Padur in Karnataka, and Chandikhole in Jajpur. The oil ministry has also told the ISPRL to identify new sites so that the storage facility is increased to ensure oil stock of 90-100 days for use in an emergency at all times.

Source: The Economic Times

29 September. Bharat Petroleum Corporation (BPCL) has tied up a 15 year long term contract for 1 million tonne per annum (mtpa) LNG from its much awaited Mozambique project. BPCL owns 10 percent in the 12.88 mtpa project offshore the Mozambique basin where ONGC Videsh Ltd and Oil India Ltd are the other consortium partners, while French energy giant Total is the operator. BPCL said that the production from one of the largest gas resources in Africa is expected to start from the second half of calendar year 2024, while the full production is expected by 2025.

Source: The Financial Express

25 September. Oil Minister Dharmendra Pradhan discussed ‘Strategic Energy Partnership’ with Kenneth Juster, the US (United States) Ambassador to India, and invited the US companies to engage more intensely in developing the gas infrastructure in India. Pradhan invited US companies to engage more intensely in developing the gas infrastructure in the country and reviewed the strategic petroleum reserves’ cooperation initiated in June this year.

Source: The Economic Times

25 September. India is considering a floor price for natural gas produced from local fields to shield explorers like Oil & Natural Gas Corp (ONGC) as tariff slumps. The proposal being considered by the oil ministry pegs the price to the popular benchmark Japan-Korea Marker that is used for LNG tariff in North Asia with a discount. India’s oil ministry has formed a panel to study the plan and explore other options to make gas production remunerative. Price of natural gas produced from domestic fields that were handed over to ONGC and Oil India Ltd have fallen to the lowest in a decade and are below the imported price of the fuel. ONGC’s average cost of gas production is about $3.7 per million British thermal unit (mmBtu), the company said on 30 June while the current regulated price of natural gas is $2.39 mmBtu, which is estimated to further decline to about $1.9 per mmBtu for the next six months beginning 1 October. Prime Minister Narendra Modi aims to increase the share of natural gas in India’s energy mix to 15 percent by 2030 from about 6 percent. The government has announced several reforms, including the freedom to price and market natural gas from new production, to attract investments in gas production. India will phase out price controls in natural gas and make it market-linked, Oil Minister Dharmendra Pradhan said.

Source: Bloomberg

24 September. Indian gas transporter GAIL (India) Ltd has cut supplies by about 40 percent to customers, mainly power and fertiliser companies, after a pipeline rupture led to a fire in an Oil and Natural Gas Corp (ONGC) plant. GAIL supplies about 60 million standard cubic meters of gas through its northwestern pipeline grid to customers in the states of Gujarat, Uttar Pradesh, Madhya Pradesh, Rajasthan and Goa.

Source: Reuters

28 September. Coal India Ltd (CIL) has floated a global tender for setting up the country’s first coal to methanol plant in West Bengal at an investment of ₹60 bn. The project envisaged to be set up through a surface coal gasification route will be based on the Build-Own-Operate (BOO) model. Through the tender CIL proposes to select the BOO operator for the life span of the plant, which is expected to be 25 years. The proposed coal-to-methanol plant would be set up at CIL-owned Dankuni Coal Complex (DCC) in West Bengal, currently run by its subsidiary South Eastern Coalfields Ltd. CIL would allocate the land, power, water to the operator for the proposed plant which targets 6.76 lakh tonnes of methanol per annum to be used for blending with petrol up to 15 percent. The plant is expected to cater to methanol requirement of four eastern states of the country – West Bengal, Odisha, Jharkhand and Bihar. CIL would supply low-ash coal of Ranigunj coalfields for the production of 2,050 metric tonnes of methanol per day. CIL would meet around 1.5 million tonnes (mt) of coal requirement annually.

Source: Reuters

28 September. Power plants located in the southern part of the country and non-regulated sector (NRS) consumers, including steel and cement, of Mahanadi Coalfields Ltd (MCL) have agreed to substitute imported coal with the dry-fuel produced by the Coal India Ltd (CIL) subsidiary. The development assumes significance in the wake of government’s thrust on reducing coal import dependency of the country under the ‘Aatmanirbhar Bharat’ initiative. Southern India power plants and NRS consumers, who are importing coal at present, have been approached based on the logic that MCL’s coal is quite comparable with imported coal as per Gross Calorific Value land cost analysis, the CIL arm said in a report. CIL has also introduced a new category of spot e-auction for importers only and aimed at replacing 150 million tonnes (mt) of fuel sourced from abroad with domestic supply.

Source: The Economic Times

23 September. The Odisha government requested the Central government to defer the coal block auction process by three months in view of the unfavourable market situation due to the Covid-19 outbreak. Nine of the total 41 coal mines listed by the Central government for auction for Commercial Mining are from Odisha and around 10,750 million tonnes (mt) of coal are reserved in these blocks. The last date for the submission of the bid is 29 September and the e-auction will be held from 19 October to 9 November 2020, for coal mines.

Source: The Economic Times

29 September. UP (Uttar Pradesh) Power Minister Shrikant Sharma ordered serving of show cause notice to directors of Madhyanchal and Paschimanchal power distribution companies and chief engineers of 10 districts, including Lucknow and Noida, over poor consumer service, failure to curb line losses and not providing power as per schedule. Presiding over a review meeting to assess the power supply situation, Sharma ordered the officials to bring down the line losses in 2,442 electricity feeders (1,232 in Madhyanchal and 1,010 in Paschimanchal) in 30 days. He said the state government could ensure round the clock power supply only by bringing down line losses. He expressed displeasure over a large number of complaints related to wrong billing and delay in redressal of complaints. He said such instances were denting the image of UP Power Corp Ltd. He asked the managing directors of the distribution companies to dispatch special teams to get the issues examined. He reiterated FIRs be lodged against agencies issuing wrong bills and asked UPPCL chairman Arvind Kumar to supervise the whole exercise.

Source: The Economic Times

29 September. India’s electricity demand in September increased about 3 percent year-on-year, signalling improved economic activity albeit on a low base. Demand in August was 2 percent lower than that a year ago. Power demand on several days of September was higher than that a year ago, data available with grid operator Power System Operation Corp (POSOCO) showed. Demand in industrial states such as Gujarat and Maharashtra improved over last year’s but was lower than in September 2018. India had registered a slump in power consumption for five months from August 2019 till January this year. In Gujarat, power demand improved 4 percent year-on-year while in Maharashtra it was down 1 percent. In Maharashtra and Gujarat, electricity demand was about 9 percent lower than in August 2019. In July this year, Maharashtra had reported a 12 percent slump in its power demand year-on-year while demand in Gujarat was down 17 percent. Electricity demand from northern states such as Punjab, Uttar Pradesh and Jammu & Kashmir continued to be high. In September, demand in Goa was about 17 percent lower, in Daman & Diu 2 percent and in Dadra Nagar Haveli 5 percent from that a year ago. The other states to have reported reductions in electricity demand year-on-year in September are Karnataka (13 percent), Odisha (5 percent) and Delhi (about 3 percent). Electricity consumption in Tamil Nadu was 2 percent lower year-on-year, while in Telangana it fell 3 percent. Demand improved more than 20 percent in Madhya Pradesh, 6 percent in Bihar and 12 percent in Jammu & Kashmir. India’s power demand grew at the slowest pace of 1.1 percent in 2019.

Source: The Economic Times

28 September. NTPC Ltd said it has successfully synchronised a 660 MW unit of its supercritical thermal power plant in Bihar with the grid, which would help the commercial generation of electricity from it. The power producer has been setting up five units with 660 MW capacity each, spread across 3,200 acres of land at Barh in Patna district. The construction of the Barh stage-I was initially awarded to the Russian firm but the contract was later terminated due to delay of the work schedule given by the NTPC. The remaining two units of stage-I of NTPC-Barh would be made operational by the end of March 2022. Under the synchronisation process, the 660 MW unit was connected to the grid to see the load factor and to ensure that all other aspects of it were working correctly. Presently, Bihar is getting 1,198 MW of power from the two units of stage-II and will get additional 1,025 MW from three plants of stage-I. NTPC is supplying 4,248 MW of power to Bihar from its various plants.

Source: The Economic Times

28 September. In a first-of-its-kind project in the country, over 70 hot springs — around 40 in Uttarakhand and 30 in Himachal — have been identified which have the potential to produce electricity. The springs were identified by scientists at Dehradun-based Wadia Institute of Himalayan Geology (WIHG). WIHG director Kalachand Sain said that as part of the initiative to tap these springs for power generation, WIHG inked an MoU (Memorandum of Understanding) with Jaydevm Energies Pvt Ltd, a private firm, to generate 5 MW electricity from Tapovan hot springs in Chamoli’s Joshimath area.

Source: The Economic Times

27 September. Niti Aayog has been working on a State Energy Index that is set to foster healthy competition in the states’ power distribution space, the think tank’s vice-chairman, Rajiv Kumar, said. The tool will be designed to assess and further improve the performance of states to efficiently manage their energy resources.

Source: The Economic Times

27 September. West Bengal will invest ₹200 bn in the power sector over the next five years, Power Minister Sobhandeb Chattopadhyay said. The state has been upgrading its power infrastructure, especially in the aftermath of cyclone Amphan, and adopting renewable energy, he said.

Source: The Economic Times

25 September. The power ministry has begun deliberations on bringing electricity under Goods and Services Tax (GST), as a recent study it conducted showed that this would reduce per unit cost of power to generation, distribution and transmission companies by 17 paise per unit, leading to big savings for consumers. The report suggests that the cumulative per unit input costs will be reduced by 17 paise per unit for generation, transmission and distribution companies, as input tax credit will be available to them. Electricity prices for Indian industries are one of the highest in the world as states charge high tariffs to subsidise agricultural and residential consumers. States also impose large levies on spot market power purchases by their industrial consumers to deter them from purchasing electricity from anywhere other than distribution companies. All power companies have been supporting GST on electricity, citing lower tariffs to end consumers including industrial units, which in turn may boost the demand for power in the country. The study shows that there will be a decline in the revenue of state and central governments due to levying of GST on electricity, but it would lead to increase in economic activity. At present, electricity is not subject to GST and power companies pay multiple taxes on capital goods and other inputs like excise duty, customs duty, countervailing duty, special additional duty, education cess, water cess, local area development tax, entry tax and stamp duty, besides state electricity duty. This effect increases the price of power to domestic and industrial consumers.

Source: The Economic Times

29 September. India underscored the need to ensure that the nations take their obligations seriously to combat the climate change with the urgency it deserves. India’s permanent representative to the UN (United Nations) ambassador TS Tirumurti said India was doing its part to combat the climate change with determination and focus, and in the spirit of South-South cooperation. Tirumurti addressed the “historic” handing over of Palau Global Village conference facilities inaugurated by President of Palau Thomas Remengesau. India partnered with Palau in establishing this facility. The renovated Palau Civic Hall and the Palau Community College will provide critical institutional support to the Ocean Conference 2020 slated to be held in Palau on 7-8 December 2020. Tirumurti said India was committed to tackle the impact of climate change and supports Palau’s efforts to achieve their goals through necessary developmental and technical assistance.

Source: The Economic Times

QuIck CommentLow demand is the biggest Risk for Solar Projects! Bad! |

28 September. Solar power projects which are currently under construction in India are facing a higher risk now due to multiple uncertainties and their financial closure is likely to be delayed, research and ratings agency India Ratings said. The uncertainties have been caused by Covid-19 related lockdowns, change in duties for solar panels and consequent difficulties in importing panels, constraints in mobilizing labor for implementation, delays in signing of power purchase agreements after bidding, delays in tariff adoption and changes in module prices. It said that the number of acquisitions in renewable energy projects has kept the investor interest in the sector high, thus encouraging developers to bid for projects.

Source: The Economic Times

27 September. Damodar Valley Corp (DVC) will focus only on solar projects to add capacity. It has already mooted 1776 MW floating solar projects in four of its dams in West Bengal and Jharkhand, the two states that jointly own the corporation along with the Union government. DVC has finalised a 50 MW solar project at Panchet (West Bengal), the tender for which has been floated.

QuIck CommentProtective tariff is not likely to benefit solar sector! Ugly! |

Source: Business Standard

27 September. Chennai airport lags behind in harnessing solar energy while smaller airports have installed more generating capacity in the past few years. The city airport does not have adequate land to install solar panels to lean more on clean energy. The airport now has capacity to generate 1.6 MWp solar power from rooftop panels, while smaller airports in Chandigarh and Jaipur have more installed capacity, shows statistics presented by aviation minister Hardeep Singh Puri in the Lok Sabha. Chandigarh has 3 MWp capacity from ground-mounted panels while Jaipur has 1.9 MWp capacity, 1.8 MWp of which is from ground-mounted panels. Trichy, also smaller, generates 1.1 MWp — 1 MWp from ground-mounted panels. Kolkata tops AAI-run airports in harnessing solar power, with 17 MWp. As an alternative, AAI has brought in third party power purchase, from Karur, to increase use of solar power in Chennai airport. However, private airports have made better progress in increasing solar power generation.

Source: Business Standard

26 September. JSW Energy said its solar power subsidiary has bagged 810 MW blended wind energy projects under an auction conduced by the SECI (Solar Energy Corp of India). The SECI had conduced an auction for setting up 2,500 MW ISTS (inter state transmission system) projects under tariff based competitive bidding. The tender was floated in June. Solar power constitutes up to 20 percent of a blended wind energy project.

Source: The Economic Times

26 September. The Ministry of New and Renewable Energy (MNRE) has asked solar manufacturers to provide a list of machinery and capital goods that should be exempted from basic customs duty (BCD), indicating that the duty may soon be imposed. Domestic manufacturers have been anticipating the duty on solar equipment for a long time. Power and renewable energy minister told reporters in June that basic custom duty was likely to be imposed from 1 August to prevent the dumping of Chinese goods and protect national interests, where 80 percent of solar equipment is sourced from.

Source: The Economic Times

25 September. The West Bengal cabinet approved a 5 MW grid-connected floating solar project at Sagardighi Thermal Power Project (SgTPP) in Murshidabad. State Power Minister Sovondeb Chattopadhyay raised the issue at the cabinet meeting chaired by Chief Minister Mamata Banerjee. It was later approved by the cabinet. West Bengal Power Development Corp Ltd will commission the plant that will have solar modules afloat on the Hydrolio floating platform, made by French company Ciel & Terre. The project is to be developed in raw water pond number 3 of SgTPP on a turnkey basis.

Source: The Economic Times

24 September. NTPC Ltd will not set up greenfield coal-fuelled power projects as part of its pivot towards green energy, the company’s chairman and managing director (CMD) Gurdeep Singh said. NTPC plans to make total capital expenditure of ₹1 tn between 2019 and 2024 to become a 130 GW power producer by 2032. NTPC has around 4 GW of renewable capacity, mostly solar, and plans to add at least 5 GW solar capacity in two years. It will acquire at least 1 GW of operational solar projects as part of its strategy to have a 32 GW clean energy portfolio. India has been trying to rejig its energy mix in favour of green energy sources and has become one of the top renewable energy producers globally, with a plan to achieve 175 GW by 2022 and 500 GW by 2030 as part of its climate commitments.

Source: Livemint

23 September. The Indoor Sports Arena in MVP Colony of Vizag city, which is in the midst of construction, will be a green building. The structure is being constructed, combining modern looks and green standards such as a solar plant, water treatment plant and no smoke system to obtain GRIHA (Green Rating for Integrated Habitat Assessment) rating. According to the GVSCCL, a solar plant of 15 kW (kilowatt) capacity is being set up on the top of the building to meet the energy demands of the sports complex. Estimated to generate an energy of 24000 KWh (kilowatt hour)/year, it would save about ₹1.5 lakh per annum to the exchequer of the Greater Visakhapatnam Municipal Corp. The solar plant saves 10.5 tonne coal and reduces carbon emissions by about 21 tonnes a year, summing up to the impact equal to 945 mature trees.

Source: The Economic Times

23 September. Tata Power said it has signed a power purchase agreement (PPA) with Apollo Gleneagles Hospitals, Kolkata to commission a solar carport in the city. The solar carport will have a capacity of keeping 125 -150 vehicles. The capital expenditure for the project will be borne by Tata Power and the electricity will be sold to the hospital at an agreed price. The hospital will buy entire power generated from the carport at ₹6.5 per unit, which will be about 20-25 percent lower than the grid electricity price. The project will also help get green building certification for Apollo.

Source: The Economic Times

23 September. The India chapter of science-based non-profit Nature Conservancy has launched a geospatial tool for helping decision-makers, investors, and financiers to make better choices in selecting land for siting solar and wind projects. The free and publicly accessible geospatial decision-support tool called SiteRight can support the siting of new renewable energy projects in places with viable resource potential but away from land areas rich in biodiversity and on which local communities depend. It has been developed by Nature Conservancy India, the Centre for Science, Technology, and Policy, the Foundation for Ecological Security, and Vasudha Foundation. Rapid expansion of renewable energy is critical to meeting India’s energy needs and addressing climate change. However, new solar and onshore wind energy projects cannot be poorly sited, for there could be unintended impacts on ecosystems and local communities. Such consequences can come in the way of further growth of renewable energy in the country, Nature Conservancy India said.

Source: The Economic Times

29 September. Output of liquefied petroleum gas (LPG) in the east of Russia is expected to increase by 1.0-1.2 million tonnes (mt) next year, according to producers’ plans, although exports to energy-hungry Asia could be limited by a lack of infrastructure. Production of LPG from eastern Russia will account for up to 15 percent of the country’s total output in the next few years. LPG production in Russia totalled 16.9 mt in 2019, while exports, mainly via the Baltic Sea port of Ust-Luga to Europe, stood at 5.7 million tonnes, according to Refinitiv Kortes data. Independent company Irkutsk Oil Company is one of the producers in eastern Siberia expected to contribute to Russia’s LPG output growth. It plans to launch the Ust-Kut gas processing plant, with annual capacity of 800,000 tonnes, next year. Gazprom plans to make its Amur gas processing plant operational in the second quarter of 2021. The plant is set to reach full capacity of 1.5 mt in 2025.

Source: Reuters

26 September. Russia expects its oil production to increase after the current OPEC+ deal on output curbs runs its course in April 2022, the economy ministry data showed. Russia, which the ministry expects to produce 507.4 million tonnes (mt) of oil this year, is seen increasing its production over the next three years to 560 mt, or 11.2 mn barrels per day (bpd), in 2023. Ministry data forecasts an increase in oil exports to 266.2 mt by 2023, slightly lower than last year’s exports. The ministry forecast oil exports of 225 mt this year, down from 269.2 mt in 2019.

Source: Reuters

25 September. Canada will spend C$320 mn ($238.56 mn) to support its offshore oil industry in Newfoundland and Labrador, which has struggled as coronavirus pandemic travel restrictions reduced demand, the government said. Newfoundland and Labrador is Canada’s third-largest oil-producing province, pumping 5 percent of the country’s crude in 2018. Low prices have forced producers to cut spending globally. The province, whose economy depends on oil, fishing and tourism, has the country’s highest unemployment rate.

Source: Reuters

25 September. Russia plans to launch a programme to part build oil wells this year so it can quickly ramp up production when the global deal on output curbs expires in 2022. To ensure Russia does not lose market share when the production cut agreement ends, Moscow has worked out a programme to start drilling the wells, which can be quickly completed and start operating once the deal expires and as oil prices recover.

Source: The Economic Times

23 September. Nigerian President Muhammadu Buhari has signed a long-awaited oil-reform bill and it will be formally presented in the Senate. The legislation has been in the works for the past 20 years, and the main laws governing Nigeria’s oil and gas exploration have not been fully updated since the 1960s because of the contentious nature of any change to oil taxes, terms and revenue-sharing within Nigeria. But reforms and regulatory certainty became more pressing this year as low oil prices and a shift towards renewable energy made competition for investment from oil majors tougher.

Source: Reuters

23 September. Some 324 Norwegian offshore oil workers plan to go on strike from 30 September if annual pay negotiations with employers fail, trade unions Safe, Industri Energi and Lederne said. At Equinor’s Johan Sverdrup field, the largest oil-producing field in Western Europe, 88 workers from Norway pumps more than 4 mn barrels of oil equivalents per day (boed), half in the form of crude and other liquids and half from natural gas, making it a major global energy supplier. The unions are negotiating on behalf of a combined 7,300 workers, while the Norwegian Oil and Gas Association (NOG) represents oil firms.

Source: Reuters

29 September. Brazilian oil producer Petroleo Brasileiro SA (Petrobras) said it will review liquefied natural gas (LNG) company Golar Power’s participation in an ongoing tender to lease an import terminal of the super-chilled natural gas in Bahia state. Petrobras said it also requested information from its former subsidiary and fuel distribution company Petrobras Distribuidora SA on its current partnership with Golar Power for LNG distribution.

Source: The Economic Times

26 September. China is building its largest liquefied natural gas (LNG) reserve base in its eastern Jiangsu province. The first phase will consist of four storage tanks with capacities of 220,000 cubic metres each, and an annual receiving capacity of 3 million tonnes (mt) when operations start in 2022. A second phase will see the building of six tanks with a capacity of 270,000 cubic metres each. In the long term, the reserve base will have a total capacity of 20 mt.

Source: The Economic Times

24 September. Southern Guangdong became the first province to transfer its natural gas pipeline network to China’s newly formed oil and gas pipeline giant PipeChina. PipeChina and Guangdong government officials signed a strategic alliance in Beijing that allocates to PipeChina future investment and operation of trunk natural gas pipelines in Guangdong. PipeChina plans to lay six new trunk gas lines in Guangdong, with a total length of 751 km (467 miles). Guangdong is China’s second-largest gas consuming province after eastern Jiangsu.

Source: Reuters

24 September. Royal Dutch Shell PLC is looking to sell its 45 percent stake in the Malampaya gas-to-power project in the Philippines, a key power source for the country’s main island of Luzon, its local unit said. The decision comes as Shell is looking to slash up to 40 percent off the cost of producing oil and gas in a major drive to save cash so it can overhaul its business and focus more on renewable energy and power markets. Malampaya’s natural gas, discovered in 1991 by Shell, fuels four power plants that deliver about a fifth of the country’s electricity requirements. Malampaya’s gas supply is expected to run dry by 2027, based on the latest projection of the Department of Energy, which is looking at imported liquefied natural gas (LNG) as a replacement.

Source: Reuters

23 September. Austrian utility OMV said it will sell a majority stake in its gas pipeline subsidiary to rival Verbund, a deal that will help OMV reduce debt and finance its acquisition of a leading plastics maker. In early March, OMV had said it would make divestitures worth $2.3 bn to finance a multi-billion dollar deal to buy one of the world’s leading polymer producers, Borealis.

Source: Reuters

27 September. Hundreds of anti-coal activists staged protesters in and around a mine in western Germany, demonstrating against the continued extraction and use of fossil fuels by Europe’s biggest economy. Environmentalists oppose the German government’s decision to allow the mining and burning of coal in the country until 2038, a deadline the activists say is too late to effectively tackle climate change.

Source: The Economic Times

27 September. Sixteen people were killed in a southwest China coal mine accident, the latest accident in a country with a poor history of industrial safety. China’s mines are among the deadliest in the world. The accident occurred at the Songzao coal mine, which belongs to a local energy company.

Source: Reuters

23 September. Around 200 miners at mines owned by Poland’s biggest coal producer PGG who are protesting at government plans to restructure the industry refused to return the surface, trade unions and the company said. The unions said that more than 200 miners were protesting underground. The protests in Poland’s southern coal region were triggered by a lack of progress in talks between the unions, the government and PGG management on the restructuring of the PGG, which is running out of money because of falling demand and rising costs. The unions were also angered by the climate ministry’s update of Poland’s energy strategy by 2040, which contained a faster than expected departure from coal. Poland’s ruling Law and Justice party has repeatedly said coal will remain Poland’s main energy source and has been cautious in dealing with the powerful union leaders following violent protests in the past.

Source: Reuters

28 September. Vietnam will need to invest up to $133.3 bn in new power plants and transmission networks over the next decade to meet the country’s rising demand, the government said. Of the total, $96 bn is needed to build new power plants and $37.3 bn to expand its power grid, the government said. The Southeast Asian country’s demand for electricity is forecast to annually rise 8.6 percent during the 2021-2025 period, and 7.2 percent in the 2026-2030 period, the government said. The investment will boost the country’s total installed power generation capacity to 138 GW by 2030, the government said. Its current capacity is around 56 GW. The Ministry of Industry and Trade is drafting a new master power development plan that it will submit to the government for approval next month. Facing an imminent electricity shortage, Vietnam is becoming more and more reliant on imported energy to support its economic growth, one of the fastest in Asia, as hydropower has been almost fully tapped while oil and gas production has peaked.

Source: Reuters

23 September. The mayors of 12 big cities in North America, Europe and Africa pledged to shift their money out of fossil fuels and into green energy, buildings, transport and other investments to help them recover from the pandemic and tackle climate change. The group of cities, which signed up to a declaration committing them to divest from coal, oil and gas, are home to more than 36 mn residents and hold over $295 bn in assets. Led by London and New York City, they agreed to take all possible steps to divest from fossil fuel companies the assets that they control directly, while also calling on pension funds managing their money to do the same.

Source: The Economic Times

23 September. Germany is planning stricter controls to ensure it reaches targets in its expansion of renewable energy sources, according to the most recent draft to be discussed by the government. The latest version of the law, which is still subject to change, includes annual quotas for solar, biomass and onshore and offshore wind. In addition, expansion targets will be reviewed once every two years to make sure Germany can achieve its target of generating at least 65 percent of electricity via renewables by 2030. The latest draft also includes higher expansion targets for biogas stations. Onshore wind capacity is to be expanded by an average of 4 GW annually over the next years, the law said. Germany is currently hammering out a fresh version of its landmark renewable energy law, as key subsidies for the country’s oldest wind and solar stations are being phased out next year.

Source: Reuters

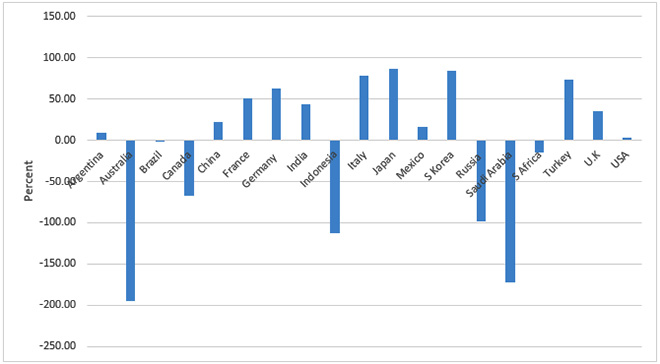

Share of Imports (%) in Primary Energy Basket G 20 Countries

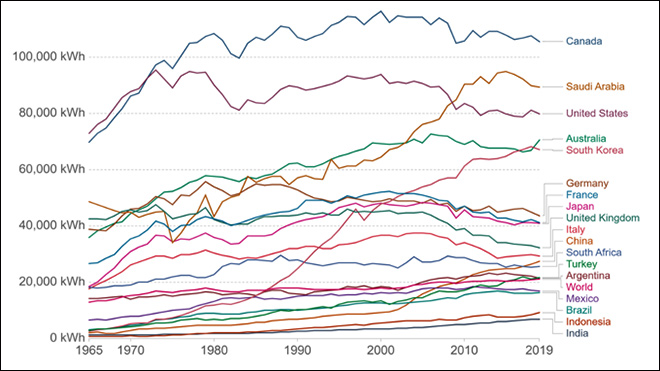

Per person energy consumption G 20 Countries

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2020 is the seventeenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.