< lang="EN-US" style="color: #0069a6">VIRUS INFECTS OIL MARKETS

Oil News Commentary: January - February 2020

India

Global Oil Price Trends

Coronavirus scare and continued flat demand for oil has pushed down the global crude price that has fallen sharply by over 24 percent to $53/bbl over last one month, there has been less than proportional decrease in retail price of petrol and diesel with oil companies building a cushion for possible increase in oil prices later this year. The high retail price of petrol and diesel continues to impact the common man even though global market has thrown enough cues for a sharp cut in the price of auto fuels. While the Petrol is retailed at Rs72.98/litre while diesel at Rs66.04/litre in Delhi when crude oil price of Indian basket is about $55/bbl. At this level of crude in September-October 2017 (crude price between $ 54-56/bbl), petrol was being retailed between Rs69 and Rs70/litre and diesel between Rs57 and Rs58/litre in Delhi. Again on a crude price of $57-59/bbl in December-January FY19, petrol prices remained close to Rs71/litre while diesel at Rs64/litre.

Budget outlays

The Budget has proposed a capital outlay of Rs985.2 bn for oil and gas companies for 2020-21, a four percent increase over the revised estimate for 2019-20. According to the Expenditure Budget document, the E&P segment’s overall capital outlay is seen increasing 7.40 percent to Rs520.19 bn in 2020-21 from Rs484.31 bn in the Revised Estimate for current fiscal. The Refining and Marketing segment has witnessed a 2.49 percent decline in capital outlay at Rs416.54 bn as compared to the revised estimate of Rs427.22 bn for 2019-20. The capital outlay for ONGC, the biggest spender among oil and gas PSUs, increased 2 percent to Rs325.02 bn for 2020-21 from Rs318.96 bn likely to be spent this fiscal. For IOC the country’s largest fuel retailer and the second-biggest spender among oil and gas PSUs, capital outlay is budgeted to increase to Rs262.33 bn in 2020-21 from the revised estimate of Rs248.95 bn for current fiscal. Also, the capital outlay for HPCL has been flat at Rs115 bn for 2020-21. The government has also budgeted for a 14 percent increase in the capital outlay for BPCL at Rs90 bn in the next financial year, as against the revised estimate of expenditure at Rs79 bn for 2019-20. Capital expenditure by OIL the second-largest state-owned petroleum explorer, has been pegged at Rs38.77 bn for FY21, a 5.4 percent increase. Similarly, GAIL (India) Ltd, the state-run natural gas utility, is expected to spend Rs54.12 bn, a marginal increase over Rs53.81 bn to be spent in the current fiscal. The government has allocated Rs409.15 bn as petroleum subsidy for the next financial year, a 6 percent increase from Rs385.69 bn allocated for the current fiscal.

After exempting foreign companies, the Budget 2020-21 has exempted the income of ISPRL from taxes on transaction of crude oil stored in the underground caverns it built as country’s strategic stockpile. In 2017, the government had exempted foreign companies from paying income tax on the sale of oil they store in India’s strategic oil reserves. According to a budget 2020-21 document, the income of ISPRL will be exempt from taxes on the transaction of crude oil stored in its strategic caverns, provided the company replenishes the removed fuel within three years. The Budget also abolished import tax on VLSFO used by ships to reduce costs for local shipping companies. This relief is in line with exemptions offered to other bunker fuels. In a bid to insulate the country from volatility in the global oil market, India has built underground storages in rock caverns at Visakhapatnam (1.33 mt), Mangalore (1.5 mt) and Padur (2.5 mt). Two more underground crude oil storages at Chandikhol in Odisha and Bikaner in Rajasthan, with a combined capacity to stock 12 mt of oil, are planned to be built. The storage at Chandikhol will be an underground rock cavern while the one at Bikaner will be an underground salt cavern. ADNOC and Saudi Aramco have signed agreements to hire capacity in India’s maiden strategic oil storages. India is 83 percent dependent on imports to meet its crude oil needs. Under the agreements, India will have the first right to use the stored oil in case of an emergency, while ADNOC and Aramco would use the facility to store oil for trading purposes.

In a big relief to the oil sector, government may allow producers of petroleum and natural gas to claim credit for GST on all inputs, input services and capital goods being paid by them even though the output petroleum products including petrol, diesel, ATF remain outside the new indirect tax framework. The government is looking at an industry proposal to amend CENVAT rules that will allow petroleum producers to claim credit on all taxes paid on inputs under the GST system and get a set-off on these duties against output excise duty paid on five petroleum products that continue to remain outside GST. As of now, five petroleum products viz. petroleum crude, motor spirit (petrol), ATF, high speed diesel and natural gas are included in GST, but is governed under existing Central Excise Act as well as State VAT and Central Sales Tax Act, till GST Council recommends the same for coverage under GST. In the absence of a consensus among states, the five products remain outside the GST fold. Accordingly, input tax credit of GST paid on procurements is not allowed against the output tax liability to the supplier of the said products and is an additional cost for the producers of oil and gas. The oil ministry has been pushing for inclusion of petroleum products in the indirect tax system for some time now as it feels that this would bring down volatility in its retail pricing that is constantly under pressure on rising global oil prices. Industry body FICCI has also pitched for provision of credit of GST against excise duty on petroleum products as a temporary measure till all products get into the indirect tax system.

Petrol and petroleum products are already under GST and the states have to decide when they want petrol and petroleum products to be taxed under GST. Industry body Indian Auto LPG Coalition sought reduction of GST on auto LPG as well as on conversion kits for gaseous fuels as part of measures to promote the adoption of clean automotive fuels. It said auto LPG is among the cleanest alternative fuels with a global warming potential of 'zero' and currently taxed at a high GST slab of 18 percent. On the other hand, the GST rates on auto LPG and CNG conversion kits stand at 28 percent. The global consumption of auto LPG has risen by over 40 percent over the past 10 years, fuelled by environmental concerns. More than 26 m vehicles run on auto LPG globally, supported by close to 71,000 LPG filling stations with global auto LPG consumption exceeding 26 million tonnes. Emissions of harmful nitrogen oxides and harmful particulate matter 2.5 are almost negligible for auto LPG.

Exploration & Production

India’s crude oil and natural gas production is expected to decline in financial year 2019-2020 (FY20), according to calculations and projections made by the Economic Survey 2019-2020. Oil production is projected to decline 5 percent to 32.6 mt in the current financial year as compared to 34.2 mt produced in 2018-19. This would be the lowest recorded production in more than eight years, according to oil ministry data. The survey noted that the proven reserves of crude oil have decreased since 2014, with steeper fall in onshore reserves. However, the decline in reserves till 2018 has seen a reversal in 2019, with reserves rising to 619 mt in 2019 from 594 mt in 2018. The surge in reserves of crude oil in 2019 is accompanied by corresponding increase in onshore and offshore reserves, with onshore reserves rising at a steeper rate. According to the survey, the share of private and JVs in onshore crude oil reserves were falling till 2018, but has seen an uptick in 2019. In case of offshore reserves of crude oil, the participation of private sector is seen steadily rising, with the share of private and JV companies reaching 19.5 percent in 2019.

Oil and gas production by ONGC and OIL suffered a hit in December 2019 owing to the ongoing protests over Citizen Amendment Act apart from technical issues, fresh data published by the oil ministry’s statistical arm PPAC showed. The country’s total crude oil production in December dropped 7.37 percent to 2.651 mt import dependence to a historic high of 86.9 percent in the month. ONGC accounts for 65 percent of the country’s domestic oil production. It recorded a marginal 1 percent decline in oil production last month at 1.749 mt. Cumulatively in the April-December 2019 period, the company’s oil production declined 3.28 percent to 15.387 mt. The company’s oil production from projects in Assam and Tripura declined 5.37 percent to 8.123 mt in December. Cumulative crude oil production from both the states declined 2.65 percent to 733,000 during the April-December 2019 period.

Indian oil explorer ONGC Videsh Ltd has sold one cargo of Russian Sokol crude loading 12-18 March at a premium of around $8.40/bbl to Dubai quotes, higher than the spot premium seen earlier this month, traders said. The cargo was likely sold to a Korean buyer. ONGC sold one cargo of Russian Sokol crude loading 27 February - 4 March at a premium of around $8.20 a bbl to Dubai quotes, likely to trading house Vitol.

Vedanta is looking to sell a minority stake in Cairn India to a strategic partner as the diversified oil-to-metals conglomerate looks to cut its mammoth $6.6 bn (Rs465 bn) debt and revive cash flows amid economic uncertainty. Cairn is the country’s largest private sector oil and gas producer accounting for nearly a quarter of India’s total domestic crude oil production and Vedanta may look to dilute up to 25 percent to raise a minimum of $1.5-2 bn (Rs10,500-14,100) through this “value unlocking” exercise. Cairn has produced 189,000 boe per day in the last fiscal year and has gross proved and probable resources of 1195 mn boe. A large portion of the hydrocarbon production of Cairn in India comes out from the inland field in Barmer, Rajasthan, its crown jewel. The Rajasthan field had 11 developing drilling rigs at the end of March 2019, and 99 drilled wells. The production sharing contracts of Rajasthan and Ravva block have been extended for 10 years, subject to conditions.

Imports

With the government’s aim of reducing India’s oil import dependence by 10 percent by 2022 not picking up pace the oil ministry is developing a new strategy to achieve the target. India’s oil import dependence has steadily increased to 85 percent during the April-December period of 2019-2020 as compared to 78.3 percent in financial year 2014-2015, according to data sourced from the ministry. The increase in oil import dependence is mainly attributed to the decline in domestic oil production, which fell to 34.2 mt in 2018-2019 from 37.5 mt in 2014-2015. In the April-December period of the current financial year (2019-20), the country’s domestic crude oil production declined 6 percent to 24.4 mt. The oil ministry expects natural gas production to increase significantly from the current levels. However, domestic oil production is expected to plateau. In a bid to curb the country’s rising dependence on imported crude, the oil ministry has been trying to push for higher adoption of natural gas and alternative fuels to displace the demand of crude oil. India has overhauled its crude import rules to give state refiners more flexibility to buy oil swiftly from varied regions, taking advantage of price differences between them. Pricing of the crude will be linked to a ‘complex’ formula, with reference to Brent and freight among other elements.

Indian state refiners are close to signing their first annual deals to buy Russian oil. However, its imports from that region slid to a four-year low last year. Its acquisitions from Russia had typically been low, as transportation costs for its crude tend to be higher than those for Middle Eastern grades, and were made through the spot market rather than under contract. However state refiners – IOC, HPCL & BPCL - are now moving towards signing deals for Russian oil. The country’s top refiner IOC has already told Russia’s Rosneft that it intends to buy as much as 40,000 bpd of Russian crude, some 2.5 percent of its total refining capacity. BPCL and HPCL are also planning smaller deals. IOC has signed a deal with Russian oil major Rosneft giving it an option to buy up to 2 mt or 40,000 bpd of crude in 2020. India has been diversifying its sources of crude oil imports, in order to hedge political risks that threaten to choke off supplies from a particular region or country. India’s top refiner will exercise its option to buy Urals crude under this first annual deal with Rosneft whenever the price is low enough to compensate for freight costs, IOC said. The contract gives IOC has the option to take as much as 40,000 bpd of oil this year. Indian state refiners typically buy Russian oil via the spot market rather than under contract. The nation’s crude imports from Russia have typically been low since the freight costs tend to exceed those for Middle East supplies. India is the world’s third-biggest oil consumer and importer. It ships in more than 80 percent of its crude needs, usually relying on the Middle East for most of its supply. Last year, however, the Middle East’s share of India’s crude imports shrank to 60 percent, down from 65 percent in 2018 and its lowest since 2015, as record output from the US and countries like Russia offered alternatives for importers to tap.

India plans to more than double its oil imports from the US next year and would negotiate concessional terms for oil supplies during the visit of US President. A discount of $2-4 per bbl on American oil to Dubai crude makes it cover higher freight costs. The India side would also negotiate for a higher credit period of 60-90 days that would bring import cost of US oil at par with Iranian oil. If this level of oil imports is doubled in FY21, the US will reach close to meeting India’s 10 percent oil import needs, the same what Iran was meeting prior to the supply squeeze post the sanctions. In the current fiscal (FY20), oil imports from Iran have dipped to 1.97 mt down from 23.9 mt in FY19. Iran used to meet more than 10 percent of country’s total oil imports. The US could offer concessions on such oil exports that could be at par with the terms India enjoyed with Iran, which offers cheaper freight and a 60-day credit period to Indian importers such as the IOC, MRPL and Nayara Energy. Though Indian oil companies have started importing oil from the US for past couple of years, the quantity remains miniscule and forms just about 3 percent of country’s total oil imports. But the quantity can grow with US shale oil market becoming relevant again at current crude levels and an increase in total rig count again in December-January period in the world’s largest oil-guzzling nation.

Subsidies

According to MoPNG there are about 275 mn LPG or cooking gas connections in the country and the coverage has reached 96.9 percent as on 1 January this year. Bihar achieved 22-23 percent coverage when the scheme was launched. The penetration has increased to 75 percent in the last five years according to the MoPNG. The average penetration of LPG connections in these Chhattisgarh and Bihar was 20-25 percent. However in the last five years, it has increased to 75 percent in Chhattisgarh and 77 percent in Jharkhand. Kerosene distribution is a state subject and the state governments can take a decision on mandatory stamping of ration cards to mark the existence of a LPG connection, for Direct Benefit Transfer of kerosene to a ration cardholder. Subsidised cooking gas prices have risen by Rs62/cylinder, or 13 percent, in six months — a fact gone unnoticed as oil companies stopped publishing prices — following a government drive to cut fuel subsidy. The decision to cut gas subsidy would leave the government with more resources to spend elsewhere in a year when revenue collections are behind targets, but would hurt households facing a five-year-high inflation. State oil companies raised prices of subsidised cooking gas by nearly Rs30/cylinder in August and raised it by another Rs32/cylinder in the five months that followed. The current hike appears steep compared to the total increase of Rs82/cylinder in five years to mid-2019. The government had directed the sharp hike in August and a subsequent Rs4/cylinder rise every month, but monthly consumer price increases appear to be steeper than that. The government has also divided customers in two categories with those who obtained gas connection under Ujjwala scheme getting about Rs20/cylinder more in subsidy than others. In Delhi, the market rate for a 14.2 kg gas cylinder is Rs714 while the subsidy offered is Rs179 to an Ujjwala customer and Rs158 to others. So, the effective consumer price is Rs535 for Ujjwala customer and Rs556 for others. Of the total 276 m cooking gas customers in the country, about 20 m do not receive the subsidy. Out of those receiving subsidies, 80 m, or a little less than one third, are Ujjwala beneficiaries. Recent hikes in consumer prices have gone unnoticed as oil companies have stopped publishing subsidised gas prices on their websites. Customers pay market rates and get subsidy directly into their bank accounts a few days later. Both market rates and subsidy vary every month, leaving customers with little sense of how much they have actually paid for gas. At current fuel prices, a Rs4 per month price escalation can eliminate entire gas subsidy in about 3-4 years for both Ujjwala and other customers. The government, in its last term, too had launched subsidy reduction programme, first by Rs2/month for ten months and then by Rs4/month for another five months, but stopped following feedback that rising prices were making gas unaffordable for poor families.

Ghana plans to replicate India’s success at near-universal cooking gas or LPG access and has sought its expertise in doing so. IOC and National Petroleum Authority of Ghana signed an initial agreement that would set-off cooperation between the two countries on increasing cooking gas penetration in the African nation. Ghana is aiming to increase cooking gas access to at least 50 percent of its households from the current 23 percent by 2030. IOC would provide support to the National Petroleum Authority of Ghana in several areas such as development of Health, Safety, Security and Environment Standards, development of licensing, permit and legal framework, development of economics for LPG bottling plant, pricing structure, and communication strategy, as per the statement. IOC will also assist in areas of infrastructure development for the new LPG Value chain, support for upgrading capacities of institutions along with policy development and review, it said.

Refining

IOC’s Mathura refinery completed the revamp of its all units to produce BS-VI grade fuels ahead of the deadline for roll out of newer emission norms from April 2020. The refinery had undertaken projects to upgrade its diesel and gasoline units for bringing down sulphur level by nearly 80 percent. With the commissioning of these facilities, Mathura Refinery is now supplying 100 percent of its MS (Petrol) and HSD (diesel), meeting BS-VI norms. A deadline was also set for rolling out cleaner (BS-VI compliant) fuel across the National Capital Territory by 18 April and National Capital Region by 19 April, however Mathura Refinery completed the task, ahead of stipulated time.

With the export of its first parcel of 15,000 tonnes of IMO 2020 grade VLSFO from by tanker MT Alnic MC Kochi to Singapore, BPCL has become the first oil marketing company to export this cleaner shipping fuel from the country. BPCL plans to raise its crude processing in 2020/21 by 1 mt as operations at its Kochi and Bina refineries stabilise after an upgrade.

PPT has alloted 200 acres of land to NRL on long-term lease basis to set up a crude oil terminal within the port premises. The facility will enable NRL to import crude oil via the major port at Paradip to cater to its requirement post ramp up of its refinery from 3mtpa to 9 mtpa. In April 2017, NRL had signed an MoU with PPT and IOC for imports of crude oil through the major port. Under NRL’s proposed refinery expansion project, a 28 inch diameter, 1400 km crude oil pipeline of one mtpa capacity will be laid for transporting 6 mtpa of imported crude oil from Paradip Port in Odisha to Numaligarh in Assam. The MoU provides for utilizing IOC’s spare capacity of existing Single Point Mooring at Paradip. PPT will extend land space for installation of crude storage tanks, pump house and township at Paradip.

Retailing

The Department for Promotion of Industry and Internal Trade said it has launched paperless licensing process for petroleum service stations such as retail outlets storing and dispensing petrol/diesel for motor conveyances. It was launched through PESO under the Petroleum Rules, 2002. Paperless application and grant of licence process for road tankers for transportation of petroleum under the rules has already been launched. Taken together, it said, licences for petroleum service stations and road tankers for transportation of petroleum account for more than 85 percent of total licences under the rules. It said an added advantage of this move is that the authenticity of the licence may be verified on PESO’s portal. Applicants, at each stage of processing of the application, will be intimated via SMS and e-mail, in case of discrepancy or grant of licence or approval. These details will also be reflected in the applicant’s profile. The entire process will not require any printing and physical dispatch of licence. The licence will be dispatched electronically.

RIL has outpaced industry in clocking double digit sales growth in petrol and diesel from its nearly 1,400-odd petrol pumps in the third quarter ended 31 December 2019. In an investor presentation post announcing earnings for October-December 2019, RIL, operator of the world’s largest oil refining complex, said it registered an 11 percent growth in diesel sales and 15 percent growth rate in petrol sales from its 1,394 fuel retail outlets. This is compared to industry growth rate of 0.2 percent for diesel and 7.1 percent for petrol. Its per outlet throughput at 342,000 litres/month was also nearly double that of petrol pumps operated by public sector firms such as IOC and BPCL. RIL said its petro retail sales revenues were up 5 percent at Rs37.25 bn in the third quarter. As much as 538 mn litres of fuel was sold in the three month period. Of the 1,394 petrol pumps that RIL operates, 518 are company owned and the remaining dealer operated. In April last year, RIL agreed to sell 49 percent in its petro retail business to UK’s BP plc for Rs70 bn. RIL-BP joint venture agreed to expand the network to 5,500 in the next five years. The country currently has 66,817 petrol pumps, with public sector retailers owning 59,716. PSU retailers have plans to double this network and have already starting appointing dealers. Russia’s Rosneft-backed Nayara Energy, formerly Essar Oil, has 5,525 petrol pumps and has plans to scale them up to more than 7,000 in two-three years.

Environmental Regulations

Concerned about the adverse impact of petrol pumps on the environment, the country’s apex pollution control body has directed oil marketing companies to ensure fuel stations are at least 50 metres away from schools, hospitals and residential areas. In a new set of guidelines issued by the CPCB in pursuance to the directions of the NGT, the oil companies have been directed to also install vapour recovery systems at new fuel stations which have a sale potential of 300 kilolitres motor spirit per month. An expert committee comprising members from IIT Kanpur, National Environmental Engineering Research Institute, TERI, MoPNG and CPCB has framed the guidelines for setting up of new petrol pumps in the country. The expert committee was set up on the directions of the NGT which is seized of a plea seeking a cap on the number of petrol pumps so as to avoid their adverse effects on environment. The authorities have also directed the oil companies that all multi-product dispensers at the petrol pumps shall have emergency stop button to stop the dispensation in case of any exigency. The CPCB said that if contamination of ground water and soil occurs due to leakage of fuel, the oil marketing company will be held liable for environmental compensation to be imposed by the SPCB.

Oil spill from the underground pipeline of ONGC carrying natural oil has damaged a fertile land cultivated with black gram crop in Tiruvarur district. Due to the oil leakage, a portion of the land is inundated with the crude oil. ONGC had installed pipeline to carry the crude oil extracted from ONGC’s oil wells in Kamalapuram locality to one Early Production System near Moolangudi, where the crude oil will be collected for further processing. ONGC Cauvery asset managing the natural oil and gas exploration in Cauvery delta districts including Tiruvarur said that a study will be done in the pipeline running below the Moolangudi village in Tiruvarur district to prevent such incidents in future. Tamil Nadu has requested the Centre to maintain status quo on the requirements for environment impact assessment for off-shore and on-shore oil and gas exploration, under which it would require to conduct public consultation prior to such explorations, for Cauvery Delta region. As per a notification in September 2006, the off-shore and on-shore oil and gas exploration, development and production project was categorised under Category A, mandating public consultation for mandatory environmental clearance for such projects. Tamil Nadu has earlier highlighted the strong opposition to Hydrocarbon extraction projects in the delta area and the imperative need for adequate consultation with stakeholders and to ensure that the interest of farmers are fully safeguarded.

Rest of the World

Crude Price Trends

The brief spike in Middle East tensions as the US and Iran faced off has served as a reminder of the havoc disruptions in supply from the key oil producing region could wreak on the global economy, the IEA said. But it said ample stocks and production elsewhere mean the world is relatively well placed to react to a crisis. Washington and Tehran are currently in a standoff after tit-for-tat military actions over the past two weeks that had sparked fears of a large-scale confrontation that could choke off the Strait of Hormuz through which 20 percent of global oil supplies flow. It said that oil prices have receded after jumping $4/bbl, much as they did in September when a series of attacks on Saudi oil facilities briefly knocked out part of the production of the key exporter. The oil market has been driven in recent years by a surge of non-OPEC production that has outstripped demand, with OPEC and its allies moving to restrain production to support prices. The IEA’s forecasts see faster growth in demand for oil this year thanks to expectations that global growth will pick up as trade tensions diminish. However, the 2.1 mn bpd growth in non-OPEC supplies will far outpace the increased demand of 1.2 mn bpd, putting further pressure on OPEC and its allies to further cut production. During 2019, falls in OPEC production nearly completely offset a rise in production from countries outside the cartel. OPEC and allied countries that include Russia agreed in December to curb crude oil production by an additional 0.9 mn bpd from January. Oil prices rose, propelled higher by the long-anticipated signing of an initial trade deal between Washington and Beijing that sets the stage for a potentially huge increase in energy supplies from the United States to China. Under the so-called Phase 1 deal to call a truce in a trade war between the world's two biggest economies, China committed to buying over $50 bn more of US oil, LNG and other energy products over two years. However, traders and analysts said China would struggle to meet the target and gains in oil are likely to be limited ahead of more detail on how the commitments will be achieved. More recently Barclays said oil prices will be impacted by $2/bbl on the potential economic fallout from the coronavirus outbreak in China. More than 100 people have died and over 4,000 cases of the new virus have been confirmed in China, leading authorities to increase preventive measures, impose travel restrictions and also extend the Lunar New Year holidays to limit the spread of the virus. The bank sees a $2/bbl downside to their full-year Brent and WTI forecasts of $62/bbl and $57/bbl, respectively. Compounding the effects of the spill over to economic growth from China and the region, Barclays expects transitory oil demand erosion of about 0.6-0.8 mn bpd in the first quarter of this year, or 0.2 mn bpd for the full year. Oil prices have been down for the last six sessions, but the bank said that the market reaction was likely overdone. The bank said the geopolitical risks to global supplies remain high as US-Iran tensions could continue to gradually escalate and oil production in Libya could fall further if the blockade of key infrastructure facilities continues.

Middle East

Iran said that the spread of China’s new coronavirus had hit oil demand and called for an effort to stabilize oil prices. Iran would agree to an earlier OPEC meeting if the rest of the group’s members agreed to oil production cuts. OPEC and its allies, a group know as OPEC+, are considering meeting in February instead of March. The oil market is under pressure and prices have dropped to under $60 a barrel and efforts must be made to balance it. Iran supports deeper crude oil cuts by the OPEC if a majority of members agreed with it. A technical panel, known as the JTC, that advises OPEC and its allies led by Russia, a grouping known as OPEC+, proposed a provisional cut of 600,000 bpd. OPEC producers in OPEC+ are currently discussing whether to meet earlier than their scheduled gathering in Vienna on 5-6 March. Iraq’s Basra Oil Company will cut crude oil output at the Nahr Bin Omar field to a minimum because of pollution and gas emissions. Iraq’s Al-Ahdab oil field resumed production about a week after operations halted there due to protests by security guards amid unrest in one of OPEC’s biggest producers. Output resumed at Al Ahdab at full capacity, or 70,000 bpd. The security guards had blocked access to employees into the production site on 19 January, prompting a halt in production at the field developed by China National Petroleum Corp. Iraq pumped about 4.65 mn bpd of crude in December, putting it second behind Saudi Arabia among members of the OPEC. Oman fully supported Saudi Arabia’s readiness to react to any impact the new coronavirus could have on the oil market. Saudi Arabia was closely monitoring developments in global oil markets resulting from “gloomy expectations” over the impact of the new coronavirus on the Chinese and global economy and oil market fundamentals, saying it was primarily driven by “psychological factors”. Saudi Aramco Energy Ventures has bought into blockchain-based trading platform Vakt with $5 mn in new shares. The Vakt platform specialises in post-trade processing. It has been live since the end of 2018 with a focus on the key North Sea crude oil grades used to set benchmark dated Brent.

Russia

Russia’s current tax system may pose risks to the country’s ability to maintain its oil output. Russia has been producing oil and gas condensate at a record-high pace of around 11.26 mn bpd. The government has been tweaking the tax regime, including gradually eliminating export duties and introducing profit-based taxation.

China

China announced it will cut retail ceiling prices for gasoline by 420 yuan ($60.07) per tonne and diesel by 405 yuan, in the first price reduction this year to track falling global oil prices. The cuts will represent about 5 percent on both gasoline and diesel prices.

USA

Royal Dutch Shell, which plans billions of dollars in spending on shale drilling projects, boosted output in the top US shale field to 250,000 bpd in December. Shell plans to spend about $3 bn per year for the next five years on shale projects. Its Permian Basin production rose more than 100,000 bpd in the last year. Shell and rival oil majors Exxon Mobil, Chevron and BP are spending billions in the Permian Basin of Texas and New Mexico. The companies see shale as a short-cycle asset that complements projects such as deepwater wells that take years to bring into production. The Permian has 30 years of so-called “tier one” high quality drilling inventory and will remain at the heart of US oil growth. The US drilling industry flared or vented more natural gas in 2019 for the third year in a row, as soaring production in Texas, New Mexico, and North Dakota have overwhelmed regulatory efforts to curb the practice, according to state data and independent research estimates. US refiners are scooping up cheap high-sulfur fuel oil for processing from Russia and the Baltic states as they take advantage of new shipping rules that have cut demand for the dirtier marine fuel, according to oil traders and shipping data. US refiners Valero Corp, Chevron Corp and Phillips 66 have been buying HSFO, traders said, taking advantage of their complex operations to turn HSFO blended with crude oils into products like diesel, gasoil and gasoline. This month, 2.2 mt of fuel oil, largely from Russia and the Baltic states, will arrive in the US, highest in at least three years, according to oil analytics firm Vortexa Ltd. Two-thirds of the total is Russian in origin, its data shows. A crude oil spill near Baytown, Texas, has restarted after earlier being contained, US Coast Guard said. About 630 gallons of diesel fuel spilled in Tabbs Bay and approximately one mile (1.6 km) of shoreline has been affected. The cause of the spill is under investigation.

S America

Average daily oil production in Colombia rose 2.4 percent to 885,851 bpd in 2019, pushed higher by an increase in developed wells. Average daily crude production in 2018 was 865,127 bpd and the number of producing wells in the Andean country rose 6.6 percent to 773, from 725 in the prior year. Boosting its energy industry is a priority for Colombia. Last year it awarded 31 contracts to oil companies that is expected to bring radical change to the sector. The country has around six years of oil reserves, which the government wants to see increase to 10 years. The government expects crude production to rise to between an average of 890,000 and 900,000 bpd in 2020. Colombia is Latin America’s fourth largest crude producer, with proven reserves of almost 2 bn bbl of oil, which it hopes to raise via new discoveries and better extraction in existing fields. Brazil produced 1.018 bn bbl of oil in 2019, marking the first time the South American nation passed the bn-bbl mark for annual production, the regulator, known as the ANP, said. ANP said 2019 output increased 7.78 percent over the previous year. Brazil produced 3.106 mn bpd of oil in December, up 0.52 percent from the previous month and up 15.44 percent from December 2018. Brazil has been quickly ramping up its oil and natural gas production over the last year, as state-run oil firm Petroleo Brasileiro SA and foreign competitors put more production online in a prolific seabed formation known as the pre-salt. In 2019, total oil production in the pre-salt area reached 633.98 mn bbl, ANP said, up 21.56 percent from 2018. Mexico is playing a risky game of hide and seek with the oil market. To frustrate speculators and contain an annual bill of more than $1 bn, Mexico is going to new lengths to mask its attempts to insure its revenue from oil sales against falling prices - no mean feat for a hedging program known as Wall Street’s biggest oil trade. Once an enigmatic agreement between a handful of finance industry officials and Wall Street banks, the hedge is now the most anticipated deal in the oil futures market, making it harder, and more costly, for Mexico to arrange. For its 2020 hedge, however, Mexico has adopted a different strategy than in previous years. For the 2009 deal, for example, Barclays, Deutsche Bank, Goldman Sachs and Morgan Stanley hedged 305 mn bbl of crude using Maya and only 25 m with Brent. The options give Mexico the right to sell oil at the predetermined price, so if the actual market price is lower, the options pay out and make up the difference - acting effectively as an insurance policy. Exxon Mobil Corp raised its Guyana oil estimates by 2 bn bbl with disclosure of a new discovery, as it continues to develop one of the world’s most important new oil and gas blocks in the last decade. The new find continues an Exxon-led consortium’s long string of discoveries in Latin America’s newest crude producing nation and underscores the importance of Guyana to Exxon for increasing its future oil output. Exxon and partners Hess Corp and CNOOC started production at the Stabroek block ahead of schedule in December. The latest discovery, the 16th by the group, brings total recoverable oil and gas resources to more than 8 bn bbl. Recoverable oil is accessible by existing drilling technologies and is profitable to pump at current prices. The new discovery would be added to official resource estimates at a later date, Exxon said. Guyana is aiming to complete talks with the Exxon Mobil Corp-led consortium producing oil off its coast over crude pricing, lifting costs, and scheduling before the government exports its first cargo. Exxon Mobil and partners Hess Corp and CNOOC inaugurated oil output in December at the prolific offshore Stabroek block, aiming to ramp it up to 120,000 bpd this year. Guyana had no prior history of crude production. The government plans to export its first cargo of 1 mn bbl, following two shipments chartered by Exxon. The Liza-1 field, the first to produce in the massive 26,800 square km concession, has produced more than 2.7 mn bbl of crude since output began. The ramp-up of Guyana’s nascent oil industry comes ahead of 2 March presidential elections. The opposition has pledged to review oil deals signed under current regime if it wins the vote. The Cuban government is warning citizens to prepare for shortages of cooking gas due to US sanctions on the island. Cylinders of LPG would be scarce for Cubans who buy state-subsidized gas at about 30 cents per cylinder as well as for customers who buy gas at market prices more than 10 times higher. Many homes in Cuba depend on bottled gas because they are not connected to municipal gas lines. The government said that a Trump administration sanction announced in November against Cuban state energy company Corporacion Panamericana had forced the cancellation of planned purchases of liquid petroleum gas.

Central Asia

Kazakhstan has contained the spread of contaminated oil within its borders by reducing exports to China and altering the schedule of supplies to domestic refineries. Kazakhstan suspended its oil exports to China after organic chlorides contamination was found in crude supplied by a Kazakh producer less than a year after the “dirty oil” crisis in neighbouring Russia. Unlike the Russian Druzhba pipeline problems in April last year, when 5 mt of oil were contaminated with organic chlorides, the origin this time was Kazakh oilfields and the volumes were much less, at around 150,000 tonnes. Oil exports to China had not yet been restored. The authorities have also been working on plans for dirty oil utilization. Kazakhstan and Belarus will discuss an oil supply deal shortly. Belarus, having failed to agree terms with its main oil supplier Russia this year, has sent proposals to Ukraine, Poland, Kazakhstan, Azerbaijan and the Baltic states to buy oil from them. Russian oil companies including Rosneft Gazprom Neft, Lukoil and Surgutneftegaz have suspended deliveries to Belarus since 1 January as Moscow and Minsk argue over contract terms.

Eastern Europe

Belarusian state oil firm Belneftekhim said it had taken oil for its refineries from the non-transit part of the Druzhba oil pipeline to Europe from Russia and that transit would not be affected. A dispute between Moscow and Minsk over oil supply led the traditional suppliers to Belarus — Rosneft, Lukoil, Gazprom Neft and Surgutneftegaz — to halt oil exports to the state on 1 January.

Europe

An Oslo appeals court approved Norway’s plans for more oil exploration in the Arctic, dismissing a lawsuit by environmentalists who had said it violated people’s right to a healthy environment. The verdict upheld a ruling made by a lower court, rejecting arguments by Greenpeace and the Nature and Youth group that a 2015-2016 oil licensing round that gave awards to Equinor and others had breached Norway’s constitution. Italian energy group Eni said oil production at the El Feel oilfield in Libya had been partially reduced due to a valve closure. El Feel is operated by Mellitah Oil and Gas, a joint venture between Libya’s National Oil Corp and Eni.

| FY: Financial Year, bbl: barrel, mn: million, bn: billion, ONGC: Oil and Natural Gas Corp, PSUs: Public Sector Undertakings, bpd: barrels per day, IOC: Indian Oil Corp, HPCL: Hindustan Petroleum Corp Ltd, OIL: Oil India Ltd, BPCL: Bharat Petroleum Corp Ltd, ISPRL: Indian Strategic Petroleum Reserves Ltd, E&P: Exploration and Production, VLSFO: very low sulphur fuel oil, ADNOC: Abu Dhabi National Oil Company, GST: Goods and Services Tax, ATF: aviation turbine fuel, LPG: liquefied petroleum gas, mt: million tonnes, CNG: compressed natural gas, JVs: joint ventures, PPAC: Petroleum Planning and Analysis Cell, boe: barrels of oil equivalent, US: United States, MRPL: Mangalore Refinery and Petrochemicals Ltd, MoPNG: Ministry of Petroleum and Natural Gas, kg: kilogram, PPT: Paradip Port Trust, NRL: Numaligarh Refinery Ltd, MoU: Memorandum of Understanding, mtpa: million tonnes per annum, km: kilometre, PESO: Petroleum and Explosives Safety Organisation, RIL: Reliance Industries Ltd, UK: United Kingdom, CPCB: Central Pollution Control Board, NGT: National Green Tribunal, IEA: International Energy Agency, OPEC: Organization of the Petroleum Exporting Countries, US: United States, LNG: liquefied natural gas, CNOOC: China National Offshore Oil Corp |

NATIONAL: OIL

India’s petroleum demand suffered marginal fall in January 2020

17 February. India’s petroleum demand in January 2020 fell 0.57 percent to 18,413 thousand metric tonne (tmt) as compared to the corresponding month a year ago primarily due to lower demand of diesel, bitumen and fuel oil, fresh data published by the oil ministry’s statistical arm Petroleum Planning & Analysis Cell (PPAC) showed. An overall slowdown in Gross Domestic Product (GDP) growth, subdued industrial activity and extended monsoon impacted the country’s cumulative petroleum demand, data showed. Cumulative petroleum demand declined 1.39 percent to 1,78,667 tmt during the April-January period of 2019-20. Rating agency ICRA said in a report the country’s petroleum demand is projected to remain below 3 percent in the current fiscal. Demand for diesel, which accounts for 39 percent of the overall demand of petroleum products in the country fell 2 percent to 6,938 tmt in January 2020. Cumulative demand for diesel during the April-January period of FY20 increased marginally (0.55 percent) to 69,714 tmt. Data showed the demand for petrol rose 3.45 percent to 2,456 tmt in January. Overall, demand for petrol during the April-January period increased 8 percent to 25,306 tmt. Also, the demand for liquefied petroleum gas (LPG) and aviation turbine fuel (ATF) increased 6 percent and 2.63 percent, respectively, during January 2020, as compared to the same month last fiscal year.

Source: The Economic Times

India in talks with Russia on mega deal for long-term import of crude oil

16 February. India and Russia have finalised the broad contours of an ambitious government-to-government agreement for long-term import of crude oil by India from Russia’s Far East region. The pact is likely to be inked during Russian President Vladimir Putin’s visit in October for the annual summit talks with Prime Minister Narendra Modi. The pact is set to help the two countries achieve their target of taking the volume of annual bilateral trade to $25 bn from current $11 bn. Russian Deputy Chief of Mission Roman Babushkin said Indian oil and gas companies are positively considering to participate in exploration of oil and gas in Russia's Far East region. India meets more than 80 percent of its oil needs through imports. It has been scouting new markets for import of oil after the US (United States) in May last year ended exemptions it had granted to India and several other countries to buy oil from Iran. After summit talks between Modi and Putin in September, India and Russia finalised a roadmap for cooperation in the hydrocarbons sector and decided to explore joint development of oil and gas fields in both countries.

Source: Business Standard

RIL, Shell liability to government may drop in PMT case

15 February. Reliance Industries Ltd (RIL) and partner Shell’s liability to the government may fall in the Panna, Mukta and Tapti (PMT) case after an English court passed an order favouring the two companies on some aspects of the ongoing arbitration proceedings. The order is one step — but not the final one — toward the conclusion of a decade-old dispute between the government and joint venture partners RIL and Shell (formerly BG Exploration) over the state’s share of income from the PMT fields. In October 2016, the arbitration tribunal pronounced a final partial award that went largely in favour of the government, following which the oil ministry computed the three oil companies’ liability and directed them in May 2017 to pay $3.9 bn. The companies refused to pay, saying the award had been challenged in an English court and the liability not yet quantified by the tribunal. The government, which went to the Delhi High Court to enforce the award, has also urged the court to restrain the sale of assets by RIL until the money needed to pay up its liability in the PMT case is secured.

Source: The Economic Times

LPG price hiked by Rs144.5 per cylinder

12 February. Cooking gas or LPG (liquefied petroleum gas) price was hiked by a steep Rs144.5 per cylinder due to spurt in benchmark global rates of the fuel. But to insulate domestic users, the government almost doubled the subsidy it provides on the fuel to keep per cylinder outgo almost unchanged. LPG price was increased to Rs858.50 per 14.2 kg cylinder from Rs714 previously, according to a price notification of state-owned oil firms. Domestic LPG users, who are entitled to buy 12 bottles of 14.2 kilogram (kg) each at subsidised rates in a year, will get more subsidy. For Pradhan Mantri Ujjwala Yojana (PMUY) beneficiaries, the subsidy has increased from Rs174.86 to Rs312.48 per cylinder. After accounting for the subsidy that is paid directly into the bank accounts of LPG users, a 14.2 kg cylinder would cost Rs567.02 for domestic users and Rs546.02 for PMUY users. The government gave out 80 mn free LPG connections to poor women under PMUY to increase coverage of environment-friendly fuel in kitchens.

Source: Business Standard

NATIONAL: GAS

Plans redrawn to end city gas distributors’ monopoly

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Common carrier principle for CGD will increase competition!

< style="color: #ffffff">Good! |

17 February. The downstream regulator is planning to end marketing monopoly of Indraprastha Gas, Mahanagar Gas, Gail Gas, Gujarat Gas and more city gas distributors in at least 30 license areas by declaring their network as ‘common carrier', which would force them to reserve a part of their capacity for third party. In the next few months, the Petroleum and Natural Gas Regulatory Board (PNGRB) will likely be ready with a regulatory framework for elimination of monopolies. Several CNG (compressed natural gas) and piped cooking gas distributors have enjoyed exclusive marketing rights far longer than the usual 3-5 years that licenses permit. Introducing competition was necessary for market efficiency and increased consumer benefit. PNGRB is unlikely to terminate all eligible monopolies in one go. Once a network is declared a common carrier, the distributor will have to reserve a fifth of its capacity for third parties, including suppliers and customers, as per the draft. Existing CNG stations will continue to be exclusively operated by the licensee. But third-party entities can install new CNG stations, which will be permitted firm access by licensees. CNG stations shall receive natural gas only through the city gas network of the authorised entity. The license holder shall declare on its website its own requirement and the capacity allocated on a firm contract basis which may be verified by the PNGRB every month or at any other intervals the board desires, as per the draft.

Source: The Economic Times

$60 bn investment lined up in natural gas sector: Pradhan

16 February. India is likely to witness investments to the tune of a whopping $60 bn in the natural sector as part of efforts to transform the country into a gas-based economy using natural gas a transition fuel, Oil Minister Dharmendra Pradhan has said. He said the government is actively encouraging use of LNG (liquefied natural gas), among others, for long-haul trucking along expressways, industrial corridors and inside mining areas, marine applications, apart from making natural gas easily available at doorsteps for users through mobile dispensing. The government is trying to “Reform, Perform and Transform” the sector through policy and market reforms in key areas including exploration and production, refining, marketing, natural gas and global cooperation, the minister said.

Source: The Economic Times

NATIONAL: COAL

India’s annual coal power output falls for first time in a decade

17 February. India’s annual electricity generation from coal-fired utilities fell in 2019 for the first time in a decade, government data showed. India is the second largest consumer, importer and producer of coal behind China. The world’s third largest greenhouse gas emitter consumed nearly 1 billion tonnes (bt) of the fuel in 2018/19, with utilities accounting for over three-quarters of the total demand. While greater adoption of renewable energy contributed to lower output from coal-fired utilities, weak economic growth added to a slowdown in overall demand for electricity, economists said. Electricity generation from coal-fired utilities fell about 2.5 percent to 965.53 bn units in 2019, an analysis of fuel-wise electricity generation data by the Central Electricity Authority (CEA) showed.

Source: Reuters

India aims to be self-sufficient in coal production by 2024: Joshi

17 February. Union Minister Pralhad Joshi has said the Centre aims at self-sufficiency in the coal sector by 2024 and the changes in the coal mining policy have been effected to achieve the same. Joshi said India stood fifth in terms of coal reserves and the Centre was working towards achieving self-sufficiency in coal production. Adding that the move is likely to create an efficient energy market and bring in more competition as well as reduce coal imports. In 2018, the government allowed commercial mining by private entities and set a mining target of 1.5 billion tonnes (bt) by 2020. Out of this, 1 bt was set to be from Coal India Ltd (CIL), while 500 million tonnes (mt) was to be from non-CIL entities. This target has now been revised to 1 bt by 2023-24, Joshi said.

Source: Business Standard

CIL production drops 4 percent in current fiscal

14 February. Coal production by Coal India Ltd (CIL) has dropped 4 percent to 451.5 million tonnes (mt) in the current financial year so far, latest data shared by the coal ministry for the April-January period showed. Production stood at 469.6 mt in the same period last fiscal. Coal dispatch by the company also dropped 5 percent in the April-January 2019-20 period. Offtake, too, declined 4.8 percent to 473.3 mt. Overall coal production of the country, including Singareni Collieries Company Ltd (SCCL) and captive production, also registered a drop of 2.2 percent at 555 mt from 567 mt recorded during the same period last year. Overall coal offtake registered a downfall of around 4 percent to 576 mt.

Source: The Economic Times

NATIONAL: POWER

Punjab government to renegotiate PPAs with private players

18 February. Amid mounting criticism over electricity charges, Punjab Chief Minister (CM) Amarinder Singh said his government will renegotiate power purchase agreements with private players. Given the shortfall in production by state-owned power plants in Lehra Mohabbat and Ropar, the CM said his government would work around the existing arrangements with the private players to make power affordable while ensuring that the peak demand of 13,000 MW was effectively met.

Source: The Economic Times

Chandigarh administration directs electricity department to prepare 10-year plan for power infrastructure

18 February. The UT (Union Territory) administration has directed the electricity department to prepare a 10-year plan for improving power infrastructure in the city. The electricity department was asked to submit the plan at the earliest. The UT has also sought JERC (Joint Electricity Regulatory Commission)’s nod for Rs8.42 bn for power purchase for next financial year 2020-21. Peak power demand is estimated to reach 404 MW in 2020-21. In 2021-2022, it will increase to 448 MW in Chandigarh. Given the high rate of population growth, UT electricity department is already finding it difficult to provide uninterrupted power supply to city residents. The department also plans to improve its power infrastructure. According to official records, there are five 33 kilovolt (kV) sub-stations and 13 66 kV sub-stations across the city. One sub-station has a life of 25 years and six 66 kV sub-stations have exceeded their life-. According to the plan, 12 new 66 kV grid sub-stations will be established and all existing 66kV sub-stations will be upgraded in the coming years. The overhead transmission line of 2,037 kilometre (km) in the city will be converted into an underground line. Besides, funds are also required for installation of smart meters in the city. The electricity department have already started the work on installation of smart meters under its smart grid project. In the first phase, the UT electricity department has allotted a work to a firm for replacing 30 thousand existing power meters into smart meters in Sectors 29, 31, 47, 48, Industrial area phase 1 and 2, and villages Faida, Ram Darbar, Hallo Majra, Raipur Kalan, Makhan Majra and Daria. The work is likely to be completed within the next few months. For the project, the power department will also set up a control room in Sector 18, from where they will keep a tab on all consumers.

Source: The Economic Times

Tamil Nadu: Farmers demand free electricity

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Demand for free electricity is a demand for no electricity!

< style="color: #ffffff">Bad! |

18 February. The Tamil Nadu Farmers Association, associated with the All India Kisan Sabha (AIKS), petitioned the collector demanding free power to farmers. President of the association S Palanisamy petitioned collector K Rajamani said that the government has not given connection to any farmer, who had applied for free power, since 2000. Free power will truly be free only if it requires no advance payment or no one-time fee, Palanisamy said.

Source: The Economic Times

UP Energy Minister sets 31 March deadline for proper power supply

17 February. Uttar Pradesh (UP) Energy Minister Shrikant Sharma set 31 March deadline for senior officials to improve the functioning of department, ensuring adequate availability of electricity to consumers and creating a conducive atmosphere for investors. In a series of interactions with state government, national and international companies have shown interest in launching their projects in the state, hence our services and facilities should match the required standards and expectations. Before the onset of summers, the department should gear up to ensure that consumers in rural as well as urban areas get adequate and uninterrupted power supply, the Minister said. The collection of revenue and installation of smart meters should be intensified, while all pending applications for new connections should be disposed of.

Source: The Economic Times

JSW Energy to purchase GMR’s Kamalanga power project for Rs53.2 bn

17 February. JSW Energy will acquire GMR’s Kamalanga power project (1,050 MW) in Odisha for Rs53.21 bn. In a notice to exchanges, JSW said it had entered into a ‘share purchase agreement’ with GMR Energy for acquiring 100 percent shares in its subsidiary GMR Kamalanga Energy. Post-acquisition, the total installed power generation capacity of JSW Energy will increase to 5,609 MW. Kamalanga is one the 36 identified stressed power assets that was undergoing debt resolution. The project was commissioned in 2014 and ran into trouble because of lack of coal supply. The coal block allotted to the project was cancelled by a Supreme Court judgment in the same year. The project has power purchase deal with Haryana, Odisha and Bihar. GMR Group has been selling its assets to offload debt. It recently sold one of its power projects to Adani Power. Lenders to GMR Chhattisgarh Energy (1,370 MW) approved the bid by Adani Power for the project in a bidding outside the National Company Law Tribunal.

Source: Business Standard

Now, monthly reports on Distribution Transformers in Andhra Pradesh

17 February. The Andhra Pradesh power distribution companies (discoms) have decided to put a real-time monitoring system in place to gauge agriculture power consumption. The proposal was mooted by the discoms after the Union government directed to arrange metering system to measure energy supply from agriculture Distribution Transformers (DTRs) which helps in real-time monitoring of agriculture supply. The Union government has also directed the discoms to send monthly reports on metering status of DTRs, feeders and consumers to Central Electricity Authority. The energy department said that with the real time monitoring system, supply interruptions and overload of DTRs can be detected in real time so that necessary measures can be initiated instantaneously.

Source: The Economic Times

AIPEF hails Bihar government’s stand against privatisation of power sector

17 February. All India Power Engineers Federation (AIPEF) has hailed the stand of Bihar government that the power sector should remain in the state sector and the state government is not in favour of any kind of private participation in the energy sector. Bihar Energy Minister Bijendra Prasad Yadav has written a letter to the Union Power Minister R K Singh against the privatisation of the power sector and advocating in favour of the continuance of electricity in the state sector. The letter states that the Bihar model of improving the power sector through state discoms (distribution companies) should be followed everywhere in the country. The experiment of giving franchise of power distribution in three districts of Gaya, Muzaffarpur, and Bhagalpur failed completely and even the position worsened. He claimed that Bihar has improved tremendously on the power front and achieved its targets before the time due to the hard work of employees and all the parameters regarding per capita consumption, peak demand and number of consumers have risen manifolds in the last seven years. The transmission losses have been brought down drastically from 60 percent to 29 percent. AIPEF said that electricity is a concurrent subject implying that both central and state governments can make laws.

Source: The Economic Times

Assam CM asks power department to set up control room to check faults

16 February. Assam Chief Minister (CM) Sarbananda Sonowal directed the state power department to set up a central control room to monitor technical faults, in an effort to bring in efficiency and plug disruption in supply. A central control room needs to be established to quickly zero in on faults and take corrective steps for the restoration of power, the CM said while reviewing schemes and services of the Assam Power Distribution Company Ltd (APDCL) and the Assam Power Generation Company Ltd. He also asked the APDCL to put up transformers on high raised platforms especially in the flood-prone areas and to design innovative measures to save these from incessant rain-induced problems. He also reviewed the 'Mukhya Mantri Akashdeep Yojana', and asked the department to expeditiously distribute LED (light emitting diode) bulbs to all the beneficiaries in the state.

Source: The Economic Times

UP won’t follow Delhi’s free power model: UP Energy Minister

15 February. The Aam Aadmi Party (AAP) may have romped home with flying colours in the recently held assembly elections riding on free electricity plank, UP (Uttar Pradesh) is unlikely to follow the model. State elections in UP would be held in 2022. UP Energy Minister Srikant Sharma submitted in the house that the structure of power tariff in UP was totally different from Delhi and hence there was no question of any decrease in power tariff in the forthcoming financial year. The AAP government in Delhi had provisioned zero bill up to a consumption of 200 units, which has not been the case with UP where urban domestic consumers saw a raise of 15.29 percent in September last year. The average power tariff hike has been to the tune of around 12 percent. He said that the process of government assistance and its adjustment in the power sector is different in case of UP and Delhi. He said that the state government gave an assistance of over Rs91 bn to the UP power sector in 2019-20.

Source: The Economic Times

Industries in Aurangabad oppose proposed power tariff hike

13 February. Industrial associations in Aurangabad district have voiced their opposition to the proposed hike of electricity tariffs by state utility Mahadiscom from 1 April, saying that the increase in rates would be detrimental to the industry. Chamber of Marathwada Industries and Agriculture (CMIA) raised the concerns before the Maharashtra Electricity Regulatory Commission (MERC). It said that although the Mahadiscom claims that the hike would be two to four percent, its impact in the five- year period would be around 15-20 percent. The fixed charges will increase by over 63 percent from the current Rs391 per unit to Rs638 till 2025, which is a burden to industries. Marathwada Industries of Small Scale Industries and Agriculture and some local companies also objected to the proposed tariff hike.

Source: Business Standard

Gadkari invites industry players for Delhi-Mumbai Expressway electric lane

13 February. Union Minister Nitin Gadkari urged industry players to join hands with the government for the proposed electric lane on Rs1.03 tn Delhi-Mumbai Expressway while promising to provide policy support to serious players. He said while a stretch of the Delhi-Mumbai Expressway is planned as electric lane, the Delhi-Jaipur part of the 1,320 kilometre (km) expressway will be completed before Diwali.

Source: Business Standard

UPCL caps use of subsidized electricity by staffers at 9k units

12 February. Uttarakhand Power Corp Ltd (UPCL) informed the high court that its employees, and those working for the Uttarakhand Jal Vidyut Nigam Ltd (UJVNL) and Power Transmission Corp of Uttarakhand Ltd (PTCUL) will not be able to use more than 9,000 units of electricity at subsidised rates. In a compliance report, the UPCL informed the court that a decision had been taken to make the new cap applicable on all employees of the three corporations responsible for generation, management and distribution of electricity in the state. The UPCL informed the court that it had sustained losses of more than Rs830 mn in the last two financial years to make up for supplying electricity at highly subsidised rates to employees.

Source: The Economic Times

Adani Transmission, Tata Power in talks with Essel Group to buy its power line

12 February. The Subhash Chandra-led Essel Group is in talks with Adani Transmission and Tata Power to sell its under-construction Warora-Kurnool transmission line in an attempt to lower debt. The Warora-Kurnool transmission line was the biggest inter-regional transmission project awarded under inter-state tariff-based competitive bidding in July 2016. The 765 kilovolt (kV) project, which included laying of transmission lines in central India from Warora in Maharashtra and Kurnool in Andhra Pradesh, was supposed to facilitate distribution of power to the southern region. However, it has been hit by delays as the timeline for the scheduled commissioning of the project is past its November 2019 deadline. The transmission line covers the districts of Warora, Warangal, Hyderabad, Kurnool and Chilakaluripeta with a sub station at Warangal. The initial contract period for the project was 35 years post commissioning of the project. It is also unclear whether the delays in commissioning will lead to any changes in the contract.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

MNRE likely to expand duty relief for domestic solar equipment industry

18 February. To boost domestic solar equipment manufacturing, the Ministry of New and Renewable Energy (MNRE) is planning to also include components under exemption from basic customs duty (BCD). This comes after the ministry clarified that BCD over imported solar cells, modules, and panels will remain zero. The move is in line with the Centre’s efforts to promote domestic solar manufacturing which faces stiff competition from imports, especially from China. Indian solar equipment manufacturers had in the past requested the Centre to clamp down imports and suggested the government to impose duties on the same. There is an existing 15 percent safeguard duty on Chinese solar panels.

Source: Business Standard

3 GW of Indian solar projects worth Rs160 bn at risk

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Coronavirus exposes import dependence risk of the solar sector!

< style="color: #ffffff">Ugly! |

17 February. The Coronavirus outbreak in China continues to disrupt India’s renewable energy sector with about 3 GW of solar projects worth Rs160 bn at risk of penalties for missing their commissioning deadlines, according to CRISIL Ratings. It said that the developers might choose to implement projects with more expensive modules sourced from locations other than China in a bid to meet the commissioning timelines. But, this could erode returns as the modules may be 15 percent to 20 percent costlier, shaving as much as 3 percentage points off their returns. About 90 percent of solar modules and panels used in Indian solar projects are imported from China and Malaysia.

Source: The Economic Times

ENGIE fully commissions 250 MW Kadapa solar project in Andhra Pradesh

17 February. French electric utility firm ENGIE said it has fully commissioned its 250 MW solar project in Andhra Pradesh. The 200 MW phase was commissioned ahead of schedule in May 2019 and this milestone supports ENGIE’s ambition to be a major renewables development partner as India becomes one of the fastest growing countries in global energy transition, the company said. The remaining 50 MW was recently commissioned in order to provide power to about 400,000 people, it said. The signing of the 25-year power purchase agreement with state-run power giant NTPC Ltd was announced at the inauguration of the Mirzapur solar power plant in the presence of Prime Minister Narendra Modi and French President Emmanuel Macron in March 2018. ENGIE has been present and active in India for over 40 years and has a total installed capacity of more than 1.5 GW in renewables, and employs around 1,000 people in power generation, engineering and energy services.

Source: The Economic Times

India to take initiative towards green economy, focus on renewable energy: PM Modi

17 February. Mentioning that India has a population of almost 2,970 at present, Prime Minister (PM) Narendra Modi said that the country would take a leading role in promoting green economy including conservation of mountain ecology with people’s participation. The PM continued that the international solar alliance, the coalition for disaster-resilient infrastructure and industries transition leadership have seen encouraging participation from countries worldwide. The PM said that the Government of India has launched the National Conservation Strategy for the Indian one-horned rhinos, which are found in Assam, Uttar Pradesh, and West Bengal, in 2019.

Source: The Economic Times

Green energy parks of 50 GW planned in Rajasthan, Gujarat

17 February. The government will set up ultramega renewable energy parks of a total of 50 GW in Gujarat and Rajasthan in what could be the world’s largest renewable energy investment programme. Industry majors such as Tata Power called it a quantum leap for green energy while experts also said the initiative poses a formidable threat to thermal power plants. In a letter to all solar and wind developers, the new and renewable energy ministry said land would be made available for setting up solar, wind and wind hybrid plants and that the proposed parks have necessary clearances from state governments and the defence ministry. The ministry has identified Khavada in Gujarat and Jaisalmer in Rajasthan for renewable energy parks of 25,000 MW each. The ministry said that the power ministry will be requested to strengthen transmission to these locations within 24 months for evacuation of power from these parks. The government is already working on a 50 GW battery storage manufacturing plan. Renewable energy firms have hailed the move and said setting up of such large capacity in phases is possible.

Source: The Economic Times

Plans afoot to replace coal–based furnaces with PNG in Moradabad brass units

16 February. In an attempt to curb air pollution due to emissions of toxic fumes from brass furnaces in UP (Uttar Pradesh)’s Moradabad, the Pollution Control Board in collaboration with Moradabad’s district administration and civic authorities is chalking out a plan to replace use of coal to fire furnaces with piped natural gas (PNG). According to the Pollution Control Board in Moradabad, there are approximately 5,000 big and small metal manufacturing units operating in the city and some are running in residential areas. Recently, residents of Rehmat Nagar under Katghar police station limits had lodged a complaint with district administration regarding air pollution from metal furnaces in residential areas and had demanded closure of such units. So far, around 80 metal manufacturing units flouting pollution board norms have been shut down by Moradabad Pollution Control Board.

Source: The Economic Times

Rajasthan needs more solar power capacity, better ecosystem to cement its edge

15 February. In the past one year, Rajasthan has regained some of the lost ground to become the second largest producer of solar power in the country, but to reclaim the top position, the state needs to have an investor-friendly tariff and policy regime. In its budget recommendations to the state government, Rajasthan Solar Association (RSA) drew attention to a number of areas, focusing not only on adding more generation capacity but also building an entire solar power ecosystem that would yield multiple benefits for the state. For commercial and industrial consumers, net metering cap of 1 MW has been a concern.

Source: The Economic Times

UP government to promote e-vehicles, targets 10.7 GW of solar energy

14 February. Uttar Pradesh (UP) Energy Minister Shrikant Sharma said the state government was keen to promote e-vehicles as a non-polluting medium of mass mobility. He said the state was targeting solar energy generation of 10,700 MW by 2022 in the private sector to conserve environment and curb pollution. He said the Yogi Adityanath government would collaborate with the private sector to promote the use of green energy and non-polluting vehicles. He said the government was already in the process of introducing online system in the renewable energy wing UP New and Renewable Energy Development Agency (UPNEDA) to facilitate the private entrepreneurs in the solar energy sector. In fact, the Adityanath government had set the target of attracting investment to the tune of Rs500 bn in the solar sector by 2022, when the solar energy policy was announced in December 2017. Under the policy, the state had proposed to develop a Green Energy Corridor in Bundelkhand at an investment of Rs40 bn with part funding by the central government.

Source: Business Standard

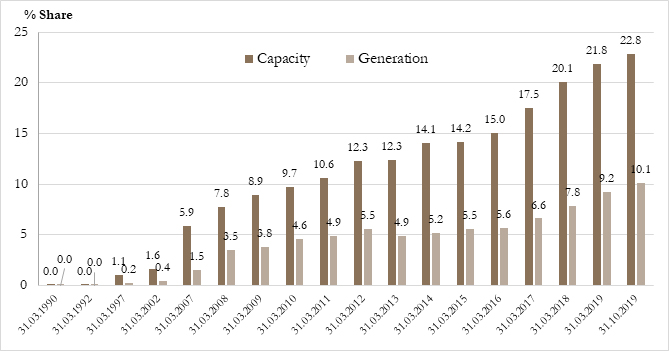

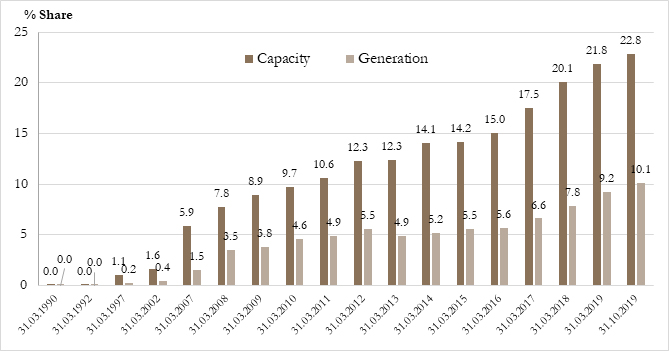

India’s serious shortfall in renewable energy against its target

13 February. India’s renewable energy (RE) sector seems to have lost its mojo, even as the total capacity has reached almost 86 GW by December 2019, the latest State of India’s Environment Annual report said, released by Rajasthan Chief Minister Ashok Gehlot. India has set itself a target of 175 GW RE capacity by 2022 -- mainly in the form of 100 GW solar (60 GW utility-scale and 40 GW rooftop) and 60 GW wind. Between 2014 and 2018, the RE sector grew from 2.6 GW to 28 GW -- an aggregated growth rate of around 18 percent. Annual additions to solar capacity have dipped drastically to 6.5 GW in 2018-19, from 9.4 GW in 2017-18. In wind energy, against a sizeable 5.4 GW added in 2016-17, less than 2 GW was added annually in the following two years. The capacity auctioned to developers has remained almost constant at 2-3 GW. The share of RE in India’s power generation in 2018–19 was 10 percent, a far cry from the national goal of 40 percent share by 2030. The slowdown, naturally, raises doubts about India’s capability to meet the 175 GW target. To catch up, the country is now required to install 37.8 GW of solar rooftop, 32.1 GW of solar utility and 23.3 GW of wind power capacity in a short of just two and half years.

Source: The Economic Times

NGT directs thermal power plants to take prompt steps for scientific disposal of fly ash

12 February. The National Green Tribunal (NGT) asked thermal power plants to take prompt steps for scientific disposal of fly ash, warning that the failure to do so would entail a penalty. A bench of NGT Chairperson Justice Adarsh Kumar Goel and Justice S P Wangdi said difficulties pointed out by the plants are of no relevance as the same are to be resolved by the administration and not by the victims of pollution whose rights are being affected. The bench said there is no discretion available with this tribunal to dispense with the mandate of law and statutory provisions are binding on every thermal power plant without any exception. The tribunal said the non-compliant plants will have to pay environmental compensation which would be determined from the cut-off date of 31 December 2017 as stipulated in the notification issued by the Union environment ministry.

Source: The Economic Times

Air pollution from fossil fuels costs India $150 bn annually, 5 percent of GDP

12 February. Air pollution from burning fossil fuels cost India an estimated $150 bn annually, the third highest worldwide. According to the latest report by environment organisation Greenpeace Southeast Asia with inputs from the Centre for Research on Energy and Clean Air (CREA), the cost of air pollution borne by India from fossil fuels is 5.4 percent of the country’s annual GDP (Gross Domestic Product). Researchers from Greenpeace said air pollution is a threat to human health and world’s economies. Greenpeace India’s senior campigner Avinash Chanchal said the country spends around 1.28 percent of the GDP on health while air pollution from burning fossil fuels costs an estimated 5.4 percent of India’s GDP. He said that coal fired power plants in India have repeatedly missed the emission deadline set by the Union environment ministry.

Source: Business Standard

INTERNATIONAL: OIL

Saudi Arabia’s crude oil stockpiles fall in December

18 February. Saudi Arabia’s crude stockpiles fell by 11.8 mn barrels in December, despite steady shipments by the world’s biggest oil exporter, the Riyadh-based JODI (Joint Organisations Data Initiative) data showed. The kingdom’s oil inventories declined to 155.199 mn barrels in December, from 167.013 mn barrels in November, according to the data. Crude exports in December were unchanged at 7.373 mn barrels per day (bpd), from the previous month, despite a drop in production. The top OPEC (Organization of the Petroleum Exporting Countries) exporter pumped 9.594 mn bpd in December, down from 9.890 mn bpd in November. Saudi Arabia has been drawing from its huge oil inventories after attacks on its oil facilities in September temporarily knocked out more than half of its output. Saudi’s local refineries processed 2.228 mn bpd in December, steady from 2.211 mn bpd in November, according to the data. Exports of refined oil products in December fell to 1.052 mn bpd, from 1.173 mn bpd the month before, the data showed. Saudi Arabia used 374,000 bpd of crude oil to generate power in December, up from 342,000 bpd the month before, while Saudi demand for oil products in December was 2.043 mn bpd, down slightly from 2.102 mn bpd in November, according to the data.

Source: Reuters

Mexico’s Pemex signs contracts for new oil projects: CEO

17 February. Mexican national oil company Pemex has begun signing contracts with oilfield service firms specifically invited to submit bids for a new batch of priority exploration and production projects, CEO (Chief Executive Officer) Octavio Romero said. Romero, a close confidant of President Andres Manuel Lopez Obrador, has previously said Pemex aims to discover and develop 20 new oil and gas fields each year, targets viewed as extremely optimistic by industry analysts. Only three of the 20 priority projects selected last year reported crude production as of last December, according to data from Mexican oil regulator CNH.

Source: Reuters

Indonesia plans state firm to handle upstream O&G business