CAPACITY GROWS DESPITE FINANCIAL CHALLENGES IN THE RE SECTOR

Monthly Non-Fossil Fuels News Commentary: December 2019

India

RE Policy and Market Trends

India is set to cross the 100 GW renewable energy capacity mark in 2020 and can make rapid strides towards the ambitious 175 GW clean energy target by 2022 provided the government keeps a close eye on key issues and deals with those well in time. The government, however, needs to promote storage to ensure 24×7 clean energy supply as coal fired thermal power still remains the base load in the country. Presently, the issues hampering growth of renewables in India are lack of interest of financial institution to fund renewable energy projects, safeguard duty on imported solar panels, ambiguity over GST on solar equipment and low investor sentiment due to delayed or non-payment by discoms to clean energy developers. India’s installed renewable energy generation capacity touched around 86 GW by November-end. Around 30 GW renewable capacity, including 18 GW solar and 10 GW wind energy, is under implementation. Besides, around 40 GW including 36 GW solar and 3.4 GW wind energy, is being tendered. The government said a total of 47.86 GW of renewable energy capacity has been installed in the past six years. The government has set a target of installing 175 GW of renewable energy capacity by 2022, which includes 100 GW from solar, 60 GW from wind, 10 GW from biomass and 5 GW from small hydropower projects. The initiatives taken by the government to explore new and renewable energy sources in the country include permitting FDI up to 100 percent under the automatic route, waiver of inter-state transmission system charges and losses for inter-state sale of solar and wind power for projects to be commissioned up to December 2022. However the MNRE has continuously failed to achieve its yearly targets of clean energy capacity addition, which may hamper the mission of having 175 GW of renewables by 2022, a Parliamentary panel said. The Parliamentary Standing Committee on Energy has also asked the ministry to take up the issue of ambiguity and disputes related to GST on renewable energy devices with the finance ministry at the earliest. On the issue of GST on renewable devices, it noted that there are many disputes and ambiguities regarding applicable rate of GST on solar power generating system. The committee thinks that such a situation will lead to increase in generation cost and pose a threat to the viability of the ongoing projects, ultimately hampering achievement of the targets. The panel wants that the bank should separate loan basket and limit of renewable energy sector from that of conventional power sector. It has also recommended simplification of the process of subsidy disbursement and wide publicity of benefits of having rooftop solar projects and the incentives. It noted that India achieved 1826 MW of rooftop solar capacity till 15 October 2019. India has set a target of achieving 40 GW of rooftop solar power generation capacity by 2022. The panel suggested to formulate a dedicated programme to support solar manufacturing in the country.

C&I consumers in India can cut their electricity bills in a range between 30 percent and 60 percent by replacing grid power supply with renewable energy, according to World Wildlife Fund-India. C&I consumers account for 51 percent of total electricity consumption but only 3 percent of the total renewable power consumption in India. The country has made a commitment to increase its installed renewable power capacity base to 175 GW by 2022 and 450 GW by 2030, as part of its climate action plan. A bulk of the power demand from the C&I segment of consumers is met through captive power plants fired by coal and “brown” power supplied by discoms 90 percent of which consists of Conventional power and 10 percent renewable power. C&I consumers currently source renewable power from rooftop solar plants, open access wind and solar power and RECs. However, many new options including Virtual Power Purchase Agreements Green Tariffs, Internationally-tradable RECs have been tried in other countries. The IEX, India’s leading energy exchange, is hopeful of being able to introduce a trading platform for wind and solar power, early next fiscal. When this happens, wind and solar energy companies who put up plants in future, or those who have some surplus capacity not committed under long-term PPA could sell their electricity on the IEX — which is expected to fetch them a better price. Wind energy companies are reeling under what it believes to be unviable, low tariffs. These tariffs, determined through competitive bidding processes — where the company that offers to sell power the cheapest gets to sign long-term power purchase agreement — had fallen as low as ₹2.43/kWh, before firming up slightly to ₹2.93/kWh. India has set up a team to certify all solar power generation equipment makers who want to do business in the world’s largest green energy market. The move aims to boost domestic manufacturing and protect its domestic companies from cheap and sub-standard imports. Manufacturers are lining up for certification as the implementation of the new solar power generation equipment sourcing guidelines will start on 1 April. At play is India’s renewable energy programme, which would require $80 bn in investments till 2022. This figure will grow more than three-fold to $300 bn during 2023-30. India imported $2.16 bn worth of solar PV cells, panels, and modules in 2018-19. Only manufacturers and solar modules who are approved by the Bureau of Indian Standards and the MNRE and are on the ALMM will be eligible for government supported schemes, including projects from where electricity distribution companies procure solar power for supply to their consumers, according to the Centre’s directive. The fast-growing domestic market for solar components is dominated by Chinese companies because of their competitive pricing. The MNRE team will inspect the manufacturing facility and conduct the production and sale audit before it includes modules and manufacturers in the ALMM list for two years. A similar scheme, the Registered List of Models and Manufacturers, exists for the Indian wind energy sector. India has a domestic manufacturing capacity of 3 GW for solar cells and 10 GW for wind power equipment. The power ministry has invited bids from companies for setting up transmission infrastructure to evacuate power from renewable energy projects of 2,500 MW capacity in Tamil Nadu and 2,000 MW projects in Gujarat. The transmission system is to be set up for renewable energy sources in Karur-Tiruppur wind energy zone in Tamil Nadu through tariff-based competitive bidding. The ministry has selected PFC Consulting as bid process coordinator and the selection will be on the basis of build, own, operate and maintain. The transmission project in Gujarat will provide connectivity to 2,000 MW green energy projects in Lakadia, Gujarat.

Egged on by government incentives, the SOEs are diversifying into green energy and building renewable energy portfolios. In October this year, the MNRE urged all SOEs to prioritise renewable projects in their investment plans to cut carbon emissions. Many SOEs are now venturing into the clean energy space, including grid-connected renewable energy projects and behind-the-meter solar rooftop. CIL has announced plans to develop 20 GW of solar capacity over 10 years at an estimated investment of ₹1 tn. NTPC Ltd is adding more renewable energy to stay profitable in the long run. Currently, thermal power plant developers in India are under huge pressure. Even equipment major BHEL diversified its engineering portfolio by venturing into new areas like solar power and electric vehicle charging in FY19.

IREDA is planning to set up a $100 mn (₹ 7 bn) green window for financing renewable energy projects. An allocation of approximately $20 mn is being considered for the green window, with plans of leveraging $80 mn from other agencies to establish a facility of $100 mn. IREDA is planning to set up a dedicated green window to serve the unserved segments of renewable energy. The green window would be set up to dedicatedly support underserved clean energy markets and support scaling up of new clean energy technologies. Achieving the 175 GW goal would increase green energy access for millions of Indians and, additionally could create up to 1 mn job opportunities for over 300,000 workers in the country by 2022.

The Andhra Pradesh High Court directed power discoms to pay ₹14.5 bn to solar and wind power producers towards arrears to be paid to them for the power supplied by them. A division bench of the high court issued interim orders on a petition filed by various renewable energy developers. These developers had said that the state government had not been paying their dues for the power supplied to the discoms in the past. The bench directed the discoms to make the payment to these power producers within four weeks. The producers brought to the notice of the high court that despite the court orders, the discoms had not been purchasing power and clearing their previous dues. The hard-found compromise reached last month to end the impasse over Andhra Pradesh’s decision to relook at renewable energy contracts has floundered. The government has upped the ante by raising doubts on the capability of the committee headed by the Union power secretary to resolve the problem. The issues assumes importance as the Andhra Pradesh government’s move has the potential to dent India’s image as a clean energy champion and comes at a time when new solar tenders of around 15,000 MW are in the pipeline.

Solar Projects

More than 181,000 solar power pumps have been installed in the country over the past three years for meeting the electricity demand for irrigation under the PM-KUSUM scheme being implemented by the MNRE. Under the scheme priority would be given to small and marginal farmers for installation of solar water pumps up to 7.5 HP capacity for which central financial assistance of 30 percent of the benchmark cost of the stand-alone solar pump will be provided. MNRE had issued approval for implementation of PM-KUSUM scheme throughout the country in March. The scheme has three components providing for; installation of 10,000 MW capacity through renewable energy-based small power plants of 2 MW capacity each in the rural areas; installation of 1.7 mn off-grid solar water pumps; and solarization of 1 mn existing grid-connected agriculture pumps. The scheme is targeted to meet the desired targets by 2022. The ministry recently issued guidelines for existing 1 mn grid-connected solar power pumps under the “Component C” of the scheme. Under this component, 1 mn agriculture pumps of 7.5 HP capacity each are planned to be solarised by 2022. As per provisions of the scheme, initially 100,000 grid-connected pumps are targeted to be solarised on pilot basis and further scale-up will be carried out after the evaluation of the pilot phase. After the solar-powered airport, the Kerala state government is planning to use solar energy to power spinning mills since power has been a major area of concern for textile mills in the country. A feasibility study by textile mills — the sector is one of the biggest consumers of power — found that switching to solar energy will significantly slash operational costs. Cannanore Cooperative Spinning Mills Ltd and Malabar Cooperative Textiles Ltd (Malcotex) in Kannur have sought the government’s formal nod for switching to solar power. Agency for Non-Conventional Energy and Rural Technology will be the implementing agency. But the agency for implementing the solar power project at Cannanore Cooperative Spinning Mills is yet to be finalised. The Rajasthan Government has fine-tuned the rates for developer contributions towards the REDF for solar projects in the Solar Energy Policy 2019. Industry players expressed dissatisfaction over the contribution demanded under the draft policy at between ₹250,000 and ₹500,000/MW per year as cess for supplying power to utilities other than discoms in Rajasthan. The Rajasthan Renewable Energy Corp said in its Solar Energy Policy 2019 that large-scale integration of wind and solar power into the grid requires upgradation of transmission and distribution infrastructure of power utilities, leading to increase in system-level cost. To meet this requirement, the government has come out with a REDF. In case of solar power projects developed in Rajasthan for sale of power to parties other than discoms of Rajasthan, developers will have to contribute towards the fund.

Even as the state’s power department is finding it a challenge to identify open land on which to set up solar panels, the Goa University has written to the state government offering its vast open spaces to install solar panels. As part of its mission to make its campus a green one, the varsity has already given its nod for setting up solar panels on rooftops of all its buildings. The work of installing the panels is currently on and once completed, will meet 40 percent of the university’s power requirement. By also offering its open spaces to set up solar panels, Goa University is hoping to meet 80 percent of its power requirement through renewable energy sources in the future. Goa University being located on a plateau, it is ideal for solar panel installations. Goa has set a target to generate 23 MW of solar power till March 2020 and 150 MW by 2022. The Kerala district panchayat is said to become the first district panchayat in India that is self-sufficient in electricity generation. The installation of solar panels has been completed and electricity production started in the district. Kozhikode district panchayat achieved the dream by installing solar panels at 42 schools under its jurisdiction. The district panchayat has also installed rooftop solar panels at the district panchayat complex. The installation work was started in the beginning of 2019. The district panchayat authorities expect that they will not need to pay the electricity bill at least for the coming 25 years as the solar system of the district panchayat is connected with the KSEB. The electricity generated using the solar panels will be stored by the KSEB using on- grid and off-grid system to reduce the expense for batteries for each institution. Rooftop solar panels generating 5 MW of electricity are in the offing at various locations of the city, Noida Authority said. A request for proposal has already been prepared to invite tenders for the work, which is estimated to be completed in 12 months at a cost of around ₹4.3 mn, the Authority said. The decision is yet to be made through e-tendering process for finalisation of contractor for installation, operation and maintenance for 25 years of the 5 MW solar photovoltaic plants, the Authority said. To increase state’s production of renewable energy Madhya Pradesh will set up a 2,000 MW Solar Power Park in the Bundelkhand and Chambal regions. Areas have been identified for the project and the process has been initiated. The 750 MW Rewa Ultra Mega Solar Power Project has nearly been completed over the past one year. The state government over the past one year has installed solar rooftop in 291 government colleges, 126 engineering colleges and ITI, 13 medical colleges, 107 police department buildings, central government offices and 14 universities. A 500 kW of solar plant has been set-up near Upper Lake in Bhopal. MSEDCL had a target of installing 100,000 solar farm pumps by March 2020 under Mukhyamantri Saur Krishi Yojana. So far, it has been able to install only 12,500 pumps. In view of the target for the financial year, the MSEDCL should have installed over 8,334 pumps a month and in the eight months that have passed, over 66,000 pumps should have been installed. Going by this rate, MSEDCL will need 64 months or over five years to complete the target. MSEDCL’s performance in Vidarbha is as bad as other regions. It had received 49,956 applications for solar pumps of which 15,108 were rejected due to various reasons. Quotations were issued to the remaining 32,469, of which 15,718 applicants paid the required charges to the MSEDCL.

A year after SDMC installed rooftop solar panels on its buildings to save energy, it earned nearly ₹10 mn by exporting surplus power to a distribution company BSES Rajdhani Power Ltd. Over the last year, SDMC generated 6,615 kW solar power from the panels installed at 152 corporation buildings. Irumbai, a village in Vanur taluk in Villupuram district would soon become the country’s first fully solar-powered village. The Tamil Nadu Energy Development Corp plans to complete the work within two to three months. Once the solar farm is established, the village would be off the TANGEDCO power grid. The excess solar energy generated by the pilot project would be sold to TANGEDCO, and the revenue generated from it would be utilized for research work. The unit has been designed to generate 150 percent of the actual power requirement of the village. The village was shortlisted after a detailed energy audit survey five years ago.

Clean energy firm ReNew Power said it has joined hands with South Korea-based GS E&C for execution of its 300 MW solar power plant in Rajasthan. ReNew Power announced a joint venture partnership with South Korea based GS E&C in this regard, the company said. The project is part of the capacity auctioned by SECI under its tranche-IV auctions concluded. GS E&C, is South Korea’s leading construction and development firm and is part of the GS Group, with an asset base of over $58 bn. This partnership will mark the entry of GS E&C in the Indian renewable energy sector. ReNew Power recently crossed the 5 GW renewable energy generation milestone with the commissioning of a 250 MW solar plant in Bikaner. It has assets valued at over $6.5 bn.

NTPC has nearly 29 percent of its installed solar capacity in Andhra Pradesh. In order to reduce the cost of solar-based generation, NTPC is planning to invite separate tenders through which it will buy solar modules and construct solar parks through different contracts. NTPC has more than 900 MW of solar and wind generation units in its portfolio. By 2030, it plans to have a total power production capacity of 130,000 MW, out of which, solar would comprise 30,000 MW. Currently, the total installed capacity of the power behemoth stands at 57,356 MW. Apart from its own green projects, NTPC acts as an aggregator of renewable energy through which is it supplies power to a number of states from solar and wind plants owned by other developers. The MNRE has identified NTPC as the nodal agency for setting up 20,000 MW solar and wind power capacity through this mode. Recently, the CERC granted trading licence to the company to facilitate such transactions. NTPC earns a trading margin of ₹0.07/unit from such transactions. However, in the light of recent developments like non-payment of dues to renewable energy plants by Andhra Pradesh, NTPC is planning to gradually shift away from such trading-margin based business. Solar projects of even the central government-run SECI and NTPC were not spared by the Andhra Pradesh government’s recent decision of revising renewable energy tariffs. NTPC Ltd is planning to add 10 GW of solar energy generation capacity by 2022, which entails an investment of around ₹500 bn, to be funded mainly by green bonds. At present, NTPC has installed renewable energy capacity of 920 MW, which includes mainly solar energy. It has formulated a long term plan to become a 130 GW company by 2032 with 30 percent non-fossil fuel or renewable energy capacity. NTPC’s plans to add 10 GW solar energy capacity assumes significance in view of India’s ambitious target of having 175 GW of clean energy by 2022.

SB Energy, a sister company of Soft Bank of Japan, has announced that it will invest $4 bn (₹300 bn) in renewable energy sector in Gujarat. The investment will be in solar energy, wind energy and other unconventional renewable energy sources, it said. The present installed capacity of renewable energy in Gujarat is 8,885 MW and the state government aims to ramp it up to 30,000 MW by 2022. In a bid to save on electricity usage, the management of Badrinarayan temple in Gujarat’s Surat district has switched to using solar power for managing shrine’s energy consumption and are utilising the money thus saved to promote education in the region. 50 kw capacity solar panels have been installed on the terrace of the temple with an expense of ₹2.5 mn.

Green energy provider Vikram Solar announced commissioning of three solar plants for Airports Authority of India in Assam, Bihar and Maharashtra. The cumulative capacity of the three projects is 1.1 MW, Vikram Solar said. While the capacity of the solar plant at Dibrugarh, Assam airport is 725 kW, the plants at Gondia (Maharashtra) and Gaya (Bihar) are of 220 kW in capacity each.

Wind Projects

By October 2019, 37,090.03 MW capacity of wind power has already been installed in the country. Further, MNRE has hitherto issued bids for 15,100 MW of wind power projects and projects with a cumulative capacity of 12,162.50 MW have been awarded. In its “Guidelines for Development of Onshore Wind Power Projects” released on 22 October 2016, the ministry has provided detailed guidelines to aid the development of wind power projects in a cost-effective and environmentally friendly way. The guidelines have been devised keeping the requirements of project developers, states’ and national imperatives in mind. Some of the factors the guidelines cover include site feasibility, micrositing criteria, type and quality certified wind turbines, compliance of grid regulations, real-time monitoring, online registry and performance reporting, health and safety provisions, decommissioning plan, etc. To facilitate the growth of wind power production in the country, several fiscal and financial incentives such as Accelerated Depreciation and exemption of concessional customs duty for procuring certain components of wind electric generators are being provided by the government to private sector investors. Ladakh has a wind power potential of 100 GW and preliminary studies have indicated the region holds tremendous promise for setting up commercial scale wind energy projects, according to Chennai-based National Institute of Wind Energy. Ladakh, a Union Territory under the administrative control of the central government, has good wind resource due to its valley terrain and temporal variation with an estimated potential of 5,311 MW at a hub height of 50 meter. The potential goes up to 100,000 MW at a height of 120 meter.

Although Gujarat has agreed to provide land to winners of auctions conducted by central agencies, developers feel it is too little too late. Considered one of the best wind producing states, Gujarat had been reluctant to lease land to winners of auctions conducted by central agencies such as the SECI, the nodal agency of the renewable energy ministry through which it conducts wind and solar auctions. Out of the 7,000 MW of wind projects auctioned by SECI last year, government land was expected to be provided by the Gujarat government for 3,500 MW. But because of fast approaching commissioning deadlines, winners of those auctions ended up buying expensive private land in the state and elsewhere.

Biomass / Biogas Projects

The OMCs under the SATAT scheme have issued over 500 LoIs, as of date, to private developers to set up CBG plants across the country. The OMCs have also extended the last date for EoI to March 2020 as it failed to generate satisfactory response from developers initially. The SATAT Scheme launched in October under which oil & gas marketing companies including BPCL, IOC, HPCL, GAIL and Indraprastha Gas Ltd have invited EoI from potential entrepreneurs to set up around 5,000 CBG plants, and produce over 15 mn metric tonne of CBG annually by 2023. The developers will set up the plant in an year’s time from the date of LoI and OMCs will procure the gas at ₹46/kg plus ₹2.5 as GST. The minimum plant size has been fixed at 2 tonne per day and is expected to cost between ₹20 mn to ₹60 mn. Majority of the LoIs have been issued in Uttar Pradesh, Chandigarh, Maharashtra, Haryana and Punjab. India is planning to set up more than 100 biogas plants and provide thousands of farmers with machines to dispose of crop stubble in a bid to halt the choking crop-burning pollution that blights the country every winter. A major source of the smog that engulfs vast swathes of northern India, including the capital New Delhi, is the burning the straw and stubble of the previous rice crop to prepare for new planting in October and November. New Delhi is regularly judged to be one of the world’s most polluted major cities. Government-backed IOC will invite private companies to apply to set up 140 biogas plants that will use rice stubble as feed stock. The plants would cost ₹35 bn ($487.67 mn) and each would require two tonnes of crop residue every hour for at least 300 days to produce “an optimum amount” of CNG. The government would earmark funds for the project that would make it attractive for farmers to sell their waste rather than burn it. Other than helping farmers sell their residue to the new biogas plants, the government would provide 100,000 new machines every year to farmers to dispose of the farm waste in their fields. India can generate around 18,000 MW of renewable energy using biomass and an additional 7000-8000 MW from bagasse cogeneration in sugar mills. The MNRE has launched a scheme to support biomass-based cogeneration in sugar mills and other industries up to March 2020. MNRE invited bids for conducting an independent evaluation of the implementation of the ‘New National Biogas and Organic Manure Programme’ (NNBOMP), to be implemented across 13 states of the country. The ministry has been implementing the programme for deployment of small biogas plants in the remote rural, semi-urban areas of the country facilitating the beneficiaries to convert cattle dung, organic wastes into clean gaseous fuel for cooking and lighting.

Hydro Projects

BHEL said it has commissioned the first renovated 60 MW unit of NHPC Ltd’s 180 MW Baira Siul hydro project in Himachal Pradesh. Baira Siul is the first hydro station of state-run hydro power giant NHPC to have been taken up for comprehensive R&M. BHEL had won the order for R&M of three units of the hydro power station located in Chamba district of Himachal Pradesh amidst stiff competitive bidding. The R&M of the other two units is under various stages of execution. BHEL is also the Original Equipment Manufacturer of these hydro units. The company is currently executing hydroelectric projects of more than 6,000 MW, which includes 2,910 MW of projects within the country and 3,224 MW abroad. BHEL is also carrying out comprehensive R&M of more than 699 MW hydro projects across the country.

International Cooperation

The Union Cabinet gave ex post facto approval to a pact with Saudi Arabia for cooperation in the renewable energy sector. The MoU between Saudi Arabia and India aims at setting up a framework for cooperation between the two countries in renewable energy, including upgrading the level of technologies and their applications in the sector. The framework would also focus on contributing to renewable energy to raise its efficiency in the national energy combination in Saudi Arabia. The framework also includes developing renewable energy projects in solar, wind, biogas, geothermal and other fields of clean energy and development and localisation of value chain in the field. India has donated solar powered study lamps to Palestinian elementary school children from a marginalised Bedouin community to spread the principles of self-sufficiency and raise awareness towards the adverse effects of climate change. The solar powered study lamps supplied by IIT Bombay as part of the initiative on Mahatma Gandhi’s 150th birth anniversary also aims at making the student beneficiaries the future propagators of renewable energy.

Rest of the World

China

China’s solar module exports rose to the equivalent of 58 GW of capacity in the first three quarters of the year, compared to 41.6 GW for all of 2018, as a slowdown at home pushed panel sales overseas, the China Photovoltaic Industry Association said. The Association said that the value of the country’s solar component exports hit $17.74 bn over the first three quarters of 2019 and could exceed $20 bn for the whole year, an increase of 25 percent over 2018. The US administration implemented a four-year tariff regime on solar panels in 2018, an opening salvo in a trade war aimed at helping US manufacturers rebound from years of decline due to foreign competition.

Middle East and Africa

Egypt signed an agreement with the UAE’s Al Nowais Investments for the construction of two renewable power plants. Al Nowais will build a 200 MW solar plant in the southern governorate of Aswan and a 500 MW wind power plant in the Red Sea city of Ras Gharib. Egypt will pay 2.48 cents per kilowatt of solar power and 3.1 cents for each kilowatt of wind power. Namibia’s electricity generation has dropped to below 40 percent of its capacity as the worst drought in almost a century has hit the country’s own hydropower plant and others in the region reliant on water from dams and rivers. The drought, plus power blackouts at South Africa power company Eskom, on which Namibia relies for 70 percent of its energy requirements, has put the security of the country’s electricity supply at risk. State power firm NamPower said that electricity generation at Namibia’s only hydropower plant currently ranges between 90 MW and 160 MW, compared to an installed capacity of 374 MW. NamPower managing director Simson Haulofu said the company had reduced generation at the plant during peak hours to save water. Namibia can also fall back on renewable energy from independent power producers, one coal power station and an emergency diesel station, but its hydropower plant its biggest domestic power source. The Kariba hydroelectric plant, which serves Zimbabwe and Zambia and is fed by the Zambezi river, has also been hit by a substantial fall in water levels.

Europe and UK

The EU imposed five-year tariffs on biodiesel from Indonesia to counter alleged subsidies to producers in the country, a move that could prompt the Indonesian government to retaliate. The EU duties on Indonesian exporters of this type of biofuel, which is made from vegetable oils and animal fats for use in diesel engines, range from 8 percent to 18 percent, the European Commission, the bloc’s executive arm, said. The five-year import taxes are the latest twist in a long-running EU trade dispute with Indonesia over biodiesel and mirror a fight the bloc has had with Argentina. Renewable-energy trade tensions between Europe and Indonesia have also grown as a result of a separate EU decision this year restricting the types of biofuels from palm oil that may be counted toward the bloc’s renewable-energy goals. In Indonesia, palm oil is the main raw material for making biodiesel. A consortium of 19 hydropower companies and organizations said it will receive EU funding of €18 mn ($20 mn) to research the green energy form’s role, as the 28-member bloc seeks to become carbon neutral by 2050. The deal will be announced on the sidelines of the United Nations climate conference in Madrid, a day before the new European Commission lays out its “European Green Deal” policy to make Europe the first climate-neutral continent. The consortium includes EDF, Voith, and General Electric Hydro, as well as universities across Europe. Hydropower can serve as a giant battery, providing a store of energy to balance intermittent renewable energy sources. As big business grapples with reducing emissions, metal processors, such as Norsk Hydro are using hydropower to make products they can market as green. Some environmental campaigners have warned against any expansion of hydropower because of its impact on biodiversity and river systems.

France’s EDF is targeting around 30 percent of the French solar power market by 2035 and aims to develop around 1 GW of solar capacity per year from next year, the company said. EDF aimed to complete around 30 GW of installed solar generation capacity by 2035, in line with France’s long-term energy plan. France depends on nuclear power from its 58 reactors operated by EDF for around 75 percent of its electricity needs. It plans to cut the share of atomic power to 50 percent by 2035, while boosting renewables. In a long-term energy plan announced in January, France will increase renewable energy capacity – including hydro power – from 52.3 GW to 74 GW in 2023 and 113 GW in 2028, mainly by boosting wind and solar. EDF currently has around 300 MW of installed solar capacity, while its onshore wind capacity is at 1.6 GW. It has won the contract to build France’s first offshore wind project, the 480 MW Saint Nazaire wind farm expected in 2022, and the 600 MW Dunkirk offshore project. The company said the business was expected to record strong growth, faster than the 10 percent annual growth of the French renewables market. The company said that for France to meet its renewables objectives, the development of projects would have to move much faster. EDF had secured around 2,000 hectares in 2019 for its solar projects, seven times what it had two years ago. Poland’s energy regulator launched a major wind and solar electricity auction, which may help the coal-reliant country speed up investment in new clean energy sources and bring it closer to the EU’s renewables targets. Poland, which generates most of its electricity from coal, has struggled to meet an EU 2020 target of 15 percent of energy from renewables in gross final energy consumption. The ruling Law and Justice (PiS) party has supported the coal industry and in 2016 launched legislation which significantly slowed down investment in onshore wind, putting Warsaw off target for meeting the EU goals. But last year, as part of a wider policy to ease tensions with the EU, Warsaw changed direction and is the government is promoting investment in offshore wind projects and has strongly supported solar energy. Poland had a capacity of 8.8 GW installed in renewables as of the end of June 2019, the energy market regulator data shows. Italy’s biggest regional utility A2A has signed a deal with China’s Talesun to acquire a pipeline of solar power projects with an overall capacity of around 1,000 MW. A2A said the deal would make it one of the leading solar power players in Italy. A2A currently has a solar capacity of around 100 MW.

Greece’s PPC will switch off its coal plants sooner than expected and expand its renewable capacity by 2024 to boost profits and help cut the country’s carbon emissions footprint. Under a 2020-2024 business plan approved by the utility’s board last week, PPC plans to switch off at least 12 coal-fired units by 2023, instead of 2028 as initially planned. PPC wants to shut down 3.4 GW of its coal fired capacity by the end of 2023 and boost its green power by 1 GW by 2024 via joint ventures, to take a 10-20 percent share of Greece’s green energy market from 2.5 percent currently. The government aims for wind, solar and hydroelectric power to account for at least 35 percent of Greece’s energy consumption by 2030, more than double the current level. Norwegian power company Statkraft signed a 10-year deal to purchase power from five solar parks owned by Spain’s Solaria Energia, the companies said. The projects under construction in Castilla y Leon and Castilla La Mancha will have a combined installed capacity of 252 MW and generate enough energy for more than 150,000 Spanish homes per year, it said. Statkraft, which generates most electricity from hydropower plants, mainly in Norway, is also aiming to boost its own solar power capacity to 2 GW by 2025. In October, it acquired nine Irish solar projects with a combined capacity of 320 MW.

Germany will take another step toward completing its withdrawal from nuclear power when EnBW pulls the plug on the Philippsburg 2 power station on New Year’s Eve, leaving half a dozen plants still to close over the next two years. The government decided to shut down the 17 reactors in operation at the time of Japan’s Fukushima nuclear disaster in 2011, when a tsunami flooded the coastal facility and knocked out its backup generators. Critics of Germany’s energy strategy said that phasing out nuclear power leaves it excessively reliant on nuclear or coal-fired power imported from neighbouring countries to cover shortfalls in environmentally friendly wind and solar power. Industry association BDEW estimates that nuclear reactors accounted for about 12 percent of German power generation in 2019, down from 30 percent in 2000. Over the same period, the share of power from renewable sources has risen to 40 percent.

Switzerland’s Muehleberg nuclear power station went off the grid after 47 years, marking the end of an era as the shutdown starts the country’s exit from atomic power. The 373 MW capacity plant which opened in 1972 has generated enough electricity to cover the energy consumption of the nearby city of Bern for more than 100 years. The closure is the first of Switzerland’s five nuclear reactors to be shuttered following the 2011 nuclear accident in Fukushima, Japan, which triggered safety concerns about nuclear power around the world. Neighbouring Germany is due to abandon nuclear power stations by 2022, while Switzerland’s government has said it would build no new nuclear reactors and decommission its existing plants at their end of their lifespan. The Swiss decision to quit nuclear power was upheld in a 2017 referendum which also supported government plans to push forward sustainable energy with subsidies to develop solar, wind and hydroelectric power. As recently as 2017, Switzerland’s nuclear power stations generated a third of the country’s power, compared with around 60 percent from hydroelectric and 5 percent from renewable.

BP Plc said it would supply renewable energy to Amazon.com Inc’s European data centres that drive the technology giant’s cloud platform. BP will begin supplying Amazon Web Services (AWS) with renewable energy from more than 170 MW of new wind and solar projects in Sweden and Spain starting in 2021. That is enough renewable energy each year to supply over 125,000 European homes and the expectation is to grow the relationship with AWS to more than double the capacity in excess of 400 MW, BP said. The world’s top oil and gas companies are under pressure from environmental groups as well as institutional investors to fall in line with targets set in the 2015 Paris climate agreement to limit global warming. BP will provide AWS with 122 MW of new renewable power capacity from one of the largest onshore wind farms being built in Europe, in Vasternorrland, Sweden. A new solar farm in Spain, which is expected to deliver 50 MW to AWS from 2021, will also support the deal.

| MNRE: Ministry of New and Renewable Energy, mn: million, bn: billion, tn: trillion, MW: megawatt, GW: gigawatt, RE: Renewable Energy, GST: Goods and Services Tax, discoms: distribution companies, FDI: foreign direct investment, C&I: commercial and industrial, RECs: Renewable Energy Certificates, IEX: Indian Energy Exchange, PPA: power purchase agreement, kWh: kilowatt hour, PV: photovoltaic, ALMM: approved list of modules and manufacturers, SOEs: state owned enterprises, CIL: Coal India Ltd, BHEL: Bharat Heavy Electricals Ltd, FY: Financial Year, OMCs: Oil Marketing Companies, SATAT: Sustainable Alternative Towards Affordable Transportation, LoIs: letter of intents, CBG: compressed biogas, EoI: Expression of Interest, IREDA: Indian Renewable Energy Development Agency, PM-KUSUM: Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan, HP: horsepower, REDF: Renewable Energy Development Fund, KSEB: Kerala State Electricity Board, ITI: Industrial Training Institutes, MSEDCL: Maharashtra State Electricity Distribution Company Ltd, SDMC: South Delhi Municipal Corp, kW: kilowatt, TANGEDCO: Tamil Nadu Generation and Distribution Corp Ltd, CERC: Central Electricity Regulatory Commission, SECI: Solar Energy Corp of India, R&M: Renovation & Modernisation, MoU: Memorandum of Understanding, US: United States, UAE: United Arab Emirates, UK: United Kingdom, EU: European Union, PPC: Public Power Corp |

NATIONAL: OIL

Government expresses concern over tension in oil-producing region

6 January. Amid rising tensions between the US (United States) and Iran, Oil Minister Dharmendra Pradhan expressed concern over the turmoil in the crude-producing region and said efforts are under way to raise domestic production and wean the economy away from oil. Oil provides 30 percent of India’s primary energy and gas about 6 percent. Due to low prospects and domestic output, India meets 83 percent of its crude requirement through imports. As the world’s third largest buyer of oil, India’s vulnerability to West Asian flare-ups come as two-thirds of the oil and half the LNG (gas carried in ships) imported by India come through the narrow shipping lane between Iran and Oman. So any tension in West Asia pinches consumers in India as global oil price spike drives up domestic pump prices. This squeezes household budgets and dampens consumption as consumers turn cautious over non-essential spending. Higher oil prices limits government’s ability to offer freebies or spend on social sector schemes.

Source: The Economic Times

HPCL refining margins to fall by one-third in current fiscal: Fitch

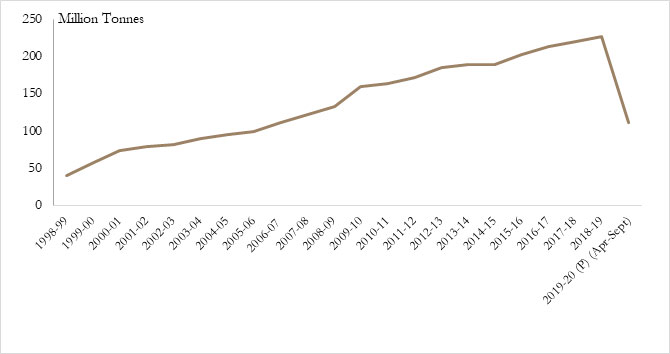

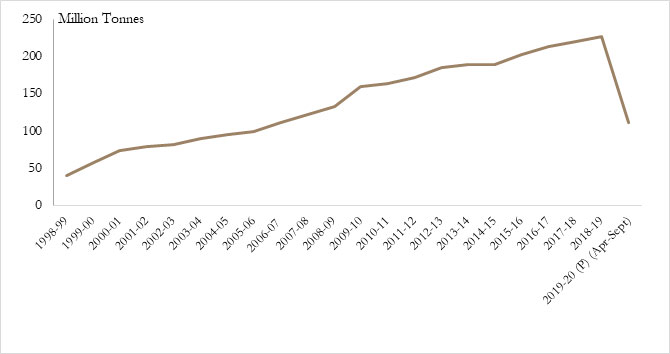

6 January. Fitch Ratings said it expects Hindustan Petroleum Corp Ltd (HPCL)’s refining margins to fall by one-third during the current fiscal due to volatility in crude prices leading to inventory losses. Fitch affirmed HPCL’s rating ‘BBB-‘ with stable outlook, in line with the credit profile of its largest shareholder Oil and Natural Gas Corp Ltd (ONGC). HPCL is highly strategic to ONGC’s vertical integration strategy, and its refining capacity, along with its large fuel retail network, increases ONGC’s downstream integration, making the company India’s third-largest oil-refining and fuel-marketing company. HPCL has about one-fourth market share of India’s fuel marketing, and the second-largest number of retail fuel outlets. With its refining capacity of 27 million tonnes per annum (mtpa), including 11 mtpa of capacity in its joint venture, HPCL-Mittal Energy Ltd is set to increase it to 36 mtpa within the next 12 months, and accounts for over 10 percent of the country’s refining capacity. HPCL marketed about 19.5 million tonnes (mt) of fuel in the six months ended September 30, 2019 and refined 8.5 mt. Fitch expected HPCL to incur around Rs600 bn in capex over FY20-FY23 to expand and upgrade its refineries, while also enhancing its retail and pipeline infrastructure. HPCL’s Mumbai refinery capacity will increase from 7.5 mtpa currently to 9.5 mtpa by end-January 2020, and that at the Visakhapatnam refinery will rise from 8.3 mtpa at present to 15 mtpa in July 2020.

Source: Business Standard

Oil options sellers in the US said to hold key to prices in India

6 January. India’s energy markets would take pricing cues from crude-oil options sellers on the US (United States)-based ICE Brent Oil Complex amid mounting concerns over global energy costs in the aftermath of the latest US-Iranian standoff, especially at a time of tepid economic growth. India’s net imports of crude oil and products totalled $55.99 bn until November in FY20. In FY19, the net import figure was $90 bn, according to the government’s Petroleum Planning & Analysis Cell.

Source: The Economic Times

ATF price hike could force airlines to avoid refuelling in Chennai

3 January. An increase in price of aviation turbine fuel (ATF) has made Chennai the second most expensive city to buy jet fuel, which can force airlines to avoid refuelling in the city airport. This will also lead to a hike in air fares. ATF fuel prices were increased by 2.6 percent on 1 January. This makes the one kilo litre of ATF to cost ₹65, 619 in Chennai airport while it costs ₹70,588 in Kolkata, the highest in a metro airport. Prices are lower in Mumbai and Delhi. The price was ₹63,830 per kilolitre in Chennai as of 1 December 2018. Now, airlines will have to pay ₹1,789 more. An A320 type plane uses around six tonnes of fuel for a short domestic flight. The fuel price varies from one airport to the other because state governments charge a tax. The tax is higher in Tamil Nadu. There was a call to make prices or taxes uniform across all airports.

Source: The Economic Times

HPCL begins supply of IMO-compliant marine fuel

3 January. Hindustan Petroleum Corp Ltd (HPCL) said it has commenced delivery of fuel for ships that are compliant with International Maritime Organisation (IMO)’s low sulphur mandate. The new global IMO rules require the maximum sulphur content in marine fuel oil to be reduced to 0.5 percent from the previous levels of 3.5 percent, effective 1 January 2020. Vessels that use higher-sulphur fuel oil must have special pollution control systems in place to reduce sulphur emissions. The first batch of VLSFO (very low sulphur fuel oil) was produced in HPCL’s Visakh refinery in early December 2019, and was formally launched. Market leader Indian Oil Corp (IOC) began producing IMO specified bunker fuel from October last year. Indian refiners currently supply around 15,000 barrels per day of bunker fuel. HPCL Chairman and Managing Director Mukesh K Surana said that the company has always been in the forefront of providing cleaner and sustainable solutions. HPCL owns and operates refineries at Visakhapatnam on the east coast and Mumbai on the west coast. India plans to switch over to Euro-VI or Bharat Stage (BS) VI, emission norm compliant petrol and diesel from 1 April 2020, from current Euro-IV fuel. HPCL has the largest lube refinery in India at Mumbai and owns the second largest cross country petroleum pipeline network and vast marketing infrastructure in the country.

Source: Business Standard

Oil ministry allows Vedanta to explore hydrocarbon in Shahjahanpur, Kheri districts

1 January. The Oil ministry has granted permission to Vedanta Ltd to explore hydrocarbon in 14 villages of Shahjahanpur and Lakhimpur Kheri districts. ONGC had done a survey in the said villages nearly 30 years ago and a recently concluded lab test in Russia has suggested that there is 95 percent chance of the presence of hydrocarbon there. If this turns out to be a commercial discovery, it will be the first time for the land-locked state. A team of experts from Vedanta recently met the villagers in Nahil village of Shahjahanpur district after which they have agreed to give their land on lease for exploration. The villagers have agreed to give their land for exploration and sign a contract. The villagers have been promised payment for their losses. Vedanta has spotted 10 villages in Kheri while four villages in Shahjahanpur district where they would be exploring the possibility of the presence of natural oil or gas. Nahil, Hardua, Bilsi and Billauri village fall in Shahjahanpur where Vedanta would dig oil wells. In 2013, Oil India Ltd (OIL) had found presence of hydrocarbons in the first exploratory well drilled by it in Uttar Pradesh under its Ganga Valley Project. The well was being dug near Bilaspur in close-by Rampur district.

Source: The Economic Times

NATIONAL: GAS

Cabinet to consider marketing rights for pre-NELP gasfields

7 January. The oil ministry has prepared a Cabinet proposal to offer gas marketing freedom to pre-NELP (New Exploration Licensing Policy) fields, which would help operators such as Vedanta and Focus Energy extract market price for their output. These operators already have pricing freedom for natural gas they produce but don’t have marketing rights, which means they must negotiate price with a government-nominated gas buyer. This proposed policy change is expected to immediately benefit Vedanta, which has begun producing natural gas from its Barmer block in Rajasthan, but has been locked in a protracted negotiation with GAIL (India) Ltd, the government-nominated buyer, for the sale of its gas. Vedanta and GAIL have been unable to strike a deal even after nearly two years of negotiations. This had prompted Vedanta to lobby the government for a relief from the current marketing restriction. Not all pre-NELP fields produce gas and therefore the Cabinet proposal will benefit only operators with gas producing fields. Gas production averaged 51 million metric standard cubic feet per day (mmscfd) in 2018-19 at Vedanta’s Barmer block, whose contract has been extended until 2030. The target is 150 mmscfd. The proposed changes will be the latest in a slew of measures the government has taken in recent years to free up gas pricing. Pricing of locally-produced natural gas has been a contentious topic in India that imports about half of its consumption.

Source: The Economic Times

ONGC extends deadline to accept bids for 64 fields to 17 January

3 January. Oil and Natural Gas Corp (ONGC) has further extended to 17 January the deadline to accept bids for its 64 small producing fields, its chairman Shashi Shanker said. The original deadline was 20 December, which was extended to 3 January. ONGC had invited bids from private players in June for its 64 small fields, clubbed in 17 contract areas. The company has altered some tender conditions to encourage increased participation by potential bidders. ONGC wants private operator to bear all new costs and receive a share in the additional production beyond the baseline output. The bidder seeking the least share of revenue from the incremental production would win.

Source: The Economic Times

NATIONAL: COAL

Coal ministry to issue NIT for commercial mining auctions by March-end

6 January. The coal ministry aims to issue the Notice Inviting Tender (NIT) documents before the end of the current financial year to begin the process of commercial coal mining auctions. In a bid to boost production, the Centre decided to allow private companies to mine coal for commercial use in February 2018. The Centre had also planned to begin auctioning coal mines with no end use restrictions by December 2019. But a change in law needs to be effected to allow private players sell coal in the open market. After this, coal can be commercially mined and sold in the country by all entities. The earlier timeline to begin offering blocks for 100 percent commercial coal mining was December 2019. The bidding of coal mines for commercial purposes was also delayed as issues such as base price for the auctioning of mines is yet to be finalised. Till now, coal mines were auctioned with a pre-specified end-use for the coal to be mined. These auctions are based on the price per tonne of coal that the bidders would offer to States. The base price for auctions was defined based on the Coal India Ltd (CIL) notified price for the particular grade of coal that dominates the geology of the mine on offer. But industry watchers said that the CIL notified price builds in the inefficiencies in production that the public sector undertaking is criticised for. After an inadequate response in bid rounds for end-use linked mining, the Centre decided to offer an added incentive and the winners have been allowed to sell up to 25 percent of the total coal produced in the open market. For mines being auctioned till now, it is still mandatory to use at least 75 percent of the total coal production for the specified end-use.

Source: The Hindu Business L ine

Centre deallocates Odisha coal block allotted to PFC arm for power project

5 January. The Centre has deallocated a coal block in Odisha allotted to a wholly-owned arm of Power Finance Corp (PFC) for a 4000 MW power project on account of delays in the development of the mine. The coal ministry had in 2010 allocated the coal block in Odisha for a 4000 MW power project to be set up by Sakhigopal Integrated Power Company Ltd. As per the allocation letter, one of the conditions of the allocation was that allocation/mining lease of the coal block may be cancelled on the grounds, including unsatisfactory progress in the development of coal mining project. Due to the long delay in development of the mine, show-cause notices were sent by the coal ministry in 2013 and 2019.

Source: Business Standard

Government deallocates coal block allotted for power project in Jharkhand

1 January. The government has cancelled the allotment of a coal block for a power project in Jharkhand, as even after a decade of allotment no significant progress was made to operationalise it. The coal block was allotted in 2009, to Karanpura Energy Ltd — an SPV of erstwhile Jharkhand State Electricity Board (JSEB). Due to long delays in development of coal block, show cause notices were served by the coal ministry to the company in December 2013, and September and October, 2019. The company in its reply to the ministry in November, 2019 cited non-availability of land, water and resistance from the local inhabitants as impediments in development of the coal block. As per the allocation letter, the ministry said, the mining lease of the block may be cancelled on the grounds, including unsatisfactory progress in the development of coal mining project and breach of any of the conditions of allocation. In 2009, the ministry had conveyed ‘in principle’ approval to the working of Mourya coal block, in the state of Jharkhand, for power project to be set up by Karanpura Energy Ltd.

Source: Business Standard

Mahanadi Coalfields sets ‘record’ production of 6.97 lakh tonne in a day

1 January. Mahanadi Coalfields Ltd (MCL) said it has achieved a “new record” in production with an output of 6.97 lakh tonne in a day. The Coal India Ltd (CIL) subsidiary registered a production of 6,96,641 tonne and over burden (OB) removal of 5,90,168 cubic metres, MCL said. The “record” production will go a long way in meeting the energy demand of the nation, MCL said.

Source: The Economic Times

NATIONAL: POWER

BESCOM proposes 9-13 percent hike in power tariff

7 January. Consumers may see a hike in their monthly electric bills this year as BESCOM (Bangalore Electricity Supply Company) has proposed a 9-12.8 percent hike in retail supply tariff for low-tension, domestic consumers in areas falling under BBMP, other municipal corporations and urban local bodies. The utility submitted its proposal to the Karnataka Electricity Regulatory Commission (KERC). BESCOM plans to recover Rs58.72 bn revenue deficit from the proposed tariff revision. KERC is expected to take a call after a public hearing. While last year, KERC announced an average hike of 4.8 percent across four slabs for domestic consumers within BESCOM limits, this year, the utility has sought for an increase in two slabs — 101 to 200 units and above 200. For both these consumption slabs, BESCOM proposed a hike of Rs1 each — Rs6.75 to Rs7.75 and Rs7.8 to Rs8.8. The fixed charges payable per month have also been proposed to go up from Rs60 to Rs85 for 1 kW (kilowatt) and Rs70 to Rs95 for those using beyond that. As per the tariff order announced by KERC last year, the average increase, including a hike in fixed charges, was 33 paise per unit for domestic consumers in BBMP and other urban local body limits.

Source: The Economic Times

Saubhagya power scheme brings electricity to 20k households in Rajouri

5 January. Thousands of houses in far-flung areas of Rajouri district in Jammu and Kashmir are experiencing a positive difference in their lives after receiving electricity connection under the Soubaghya Electricity scheme. Over 20,000 houses have received the power and people here expressed happiness and said without electricity the children were facing a lot of problems. Pradhan Mantri Sahaj Bijli Har Ghar Yojana – ‘Saubhagya’ a new scheme was launched by Prime Minister Narendra Modi on 25 September 2017. Under Saubhagya free electricity connections to all households (both APL and poor families) in rural areas and poor families in urban areas will be provided.

Source: Business Standard

Chandigarh not to get chance to save on power bills

4 January. The UT (Union Territory) electricity department has refused to implement monthly billing system under which nearly 2.40 lakh power consumers residents could have ended up paying less in the city. Shortage of staff and software requirements were cited as the reasons for the rejection. This after the Joint Electricity Regulatory Commission (JERC) had directed the department to shift to the new billing system. The department further said the work for installation of smart meters is in progress and far from completion — a step that will help in monthly billing. In the petition, the department had also not proposed any hike in power tariff for 2020-21. The department submitted before the JERC as there would be a total surplus of Rs72.3 mn with the department, it has not proposed any power tariff hike. According to the last orders of the JERC, the new tariff would be applicable from 1 June 2019 and remain valid till further orders of the commission. Last time, there was hike in power tariff for 2018-19 financial year. At that time, the JERC had marginally increased rates in domestic and commercial categories and reduced them in the industrial category. In the domestic category, rates were increased in 2018-19 from Rs2.55 to Rs2.75 in the slab of 0-150 units, while there was no change in the rate of Rs4.80 in the slab of 151-400 unit. In the slab of above 400 units, the rate was increased from Rs5 to Rs5.20 per unit. Along similar lines, a small increase in the commercial consumer category was also made in 2018-19. In the commercial category, there was no change in the rate of Rs5 in the slab between 0-150, while in slab of 151-400, the rate was increased from Rs5.20 to Rs5.30 per unit. In above 400 slab, the rate was increased from Rs5.45 to Rs5.60 per unit.

Source: The Economic Times

India’s power distribution sector facing debt pile of over Rs4k bn: ADBI

QuIck Comment

Distribution sector debt pile of ₹4 trillion is a huge barrier for reform and low carbon transition!

Ugly!

|

4 January. The distribution segment of India’s power sector is experiencing a huge financial stress with debt amount touching a gigantic Rs4.3k bn, largely due to delayed payments, issues around tariff rationalization, and constraints emanating from subsidy disbursement, according to a working paper from Asian Development Bank Institute (ADBI). According to the paper, the sector continues to suffer from problems of poor quality of power and reliability of the supply, with provisioning of six hours of power supply becoming the norm rather than the exception in rural areas of the country. A recent government survey has highlighted that more than 50 percent of households in the country receiving less than 12 hours of electricity in a day as well as the poor per capita electricity consumption in the country stands at a meagre 1,149 kWh (kilowatt hour)— which is one-third of the global average. According to ADBI, a critical evaluation of the Indian electricity sector policy and legal pronouncements indicates that the regulatory objectives in the power sector affect the achievement of sustainable development outcomes, structured around three dimensions — economic, environmental and social.

Source: The Economic Times

Power rate hike in Uttar Pradesh, UPPCL raises tariff to 66 paise/unit

3 January. The Uttar Pradesh Power Corp (UPPCL) increased the electricity tariff to 66 paise per unit with effect from 1 January. The sudden change is being attributed to the increase in the price of coal. UPPCL decided to pass on the increase in the power purchase cost due to hike in coal prices to the consumers. It therefore hiked the energy cost from 04 per paise to 66 paise per unit across various categories. This was done by invoking the fuel and power purchase cost adjustment (FPPCA) clause under the National Tariff Act. However, following a petition filed by UP power consumers forum, the state’s Electricity Regulatory Commission (ERC) took cognisance of the matter and found that the calculation for the hike was incorrect. It has thus sent back the matter to UPPCL for correction. UPERC said that the matter is under consideration and would be taken up after the computation is corrected and placed before it for approval. Giving details of the matter, UPPCL said that as per the National Tariff Act, licencees have the right to increase the tariff by 10 percent in case of an increase in fuel cost price on a quarterly basis by invoking the FPPCA till 31 March 2020. UPERC had in September last year approved 8-15 percent tariff hike for different categories of rural and urban consumers. While a hike of 8-12 percent in power tariff had been approved by the UPERC for domestic consumers, electricity prices in industrial areas had increased by 10 percent.

Source: The Financial Express

Spot power market trade up 51 percent in December 2019

3 January. Spot power market witnessed a 51 percent surge year-on-year in electricity trading in December 2019 at 4,768 mn units due to surge in power demand from cold wave-hit northern states. The electricity trade on India Energy Exchange was up 25 percent over November 2019. The increase in traded volumes on the Exchange was largely due to surge in demand from the northern states as well as the southern States. The northern states experienced intense cold wave this month leading to an increase in peak demand in several states. The day-ahead market traded 4,333 mn units with an average market clearing price at Rs2.93 per unit vs Rs3.3 in December 2018, an 11 percent decline in price. In the day-ahead market, total monthly sell bids were 10,195 mn units while buy bids were 5,260 units. Sell bids at nearly two times of the buy bids coupled with lower clearing prices signified that the market remained attractive for both the distribution utilities as well as open access buyers. One Nation One Price prevailed for 21 days during the month. The congestion was mainly towards import of power by the southern States specially during the peak hours since high voltage Bhadrawati transmission line was under outage leading to import capacity reduction.

Source: The Economic Times

UPPCL extends last date of registration under ‘easy installment scheme’ till 31 January

2 January. Power consumers can now get registered under the ‘easy installment scheme’ till 31 January. The Uttar Pradesh Power Corp Ltd (UPPCL) had launched easy installment scheme in November under which domestic power consumers in urban areas with up to 4 kW (kilowatt) load were able to pay their dues in 12 easy installments while rural consumers can pay pending bills in 24 installments after registration. UP Energy Minister Shrikant Sharma had introduced the easy installment scheme in November 2019, with an aim to tackle the problem of power dues which is a major issue in UP. Under the scheme, LMV-1 (domestic/residential) category electricity consumers in urban and rural areas (having a load of up to 4 kW) can avail the scheme by simply paying 5% of the dues or minimum Rs 1,500 (whichever is higher)as first installment. Domestic consumers of urban areas will get the benefit to pay entire dues in 12 monthly installments and domestic consumers of rural areas will get the benefit to pay entire dues in 24 monthly installments and during the period, late payment surcharge penalty on the dues till 31 October will be waived.

Source: The Economic Times

Maharashtra, Madhya Pradesh and Bengal pay most for power

1 January. Rural and urban domestic consumers drawing around 400 units or more of electricity a month in Maharashtra, Madhya Pradesh and West Bengal pay the highest rates in the country, the Central Electricity Authority (CEA) has estimated. Utilities in Maharashtra, including those in Mumbai, and Madhya Pradesh have witnessed regular tariff revisions by their respective power regulators in comparison to other states as increased costs were passed on. However, in other states, rising costs are not always fully passed on to consumers resulting in suppressed tariffs. Moreover, unlike southern states, utilities in Maharashtra and Madhya Pradesh do not have ready access to cheap hydel power.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

MNRE’s 40 GW rooftop solar target “unrealistic”

7 January. The government’s rooftop solar target of 40 GW by 2022 is unrealistic and it is highly unlikely that it will be met on time, Parliamentary standing committee on energy has said. The Committee said in its latest report that as per the year-wise targets set to install 40 GW by 2022, there should have been an installed rooftop solar capacity of 16,000 MW by 2018-19 but as of October 15, 2019, only 1,826 MW capacity has reportedly been installed, which means that the achievement is only 11.50 percent of the target. The panel noted National Institute of Solar Energy (NISE) has estimated a rooftop solar potential of 42.8 GW and accordingly, a target of 40 GW of installed capacity by 2022 has been set by the government. The Cabinet Committee on Economic Affairs has now revised the yearly rooftop solar targets, according to which 3,000 MW capacity has to be commissioned during 2019-20. The Committee said MNRE (Ministry of New and Renewable Energy) should give this programme a serious relook otherwise it will derail the entire National Solar Mission. The panel recommended that the process of subsidy disbursement should be made simpler and faster and the ministry needs to proactively advertise the benefits of having rooftop solar installations and the incentives provided by the government for the same. The Committee expressed concern about the lack of domestic solar manufacturing capacity in the country and said it is necessary for India to support domestic solar manufacturing as over-reliance on any foreign country puts Indian solar sector at a risk of disruption in supply chain.

Source: The Economic Times

Adani, NTPC sought extension of deadlines to curb coal plant emissions

7 January. Top Indian coal-fired power generators Adani Power and NTPC Ltd have sought two-to-three-year extensions of deadlines to install emissions-cutting equipment at some plants, according to documents reviewed, even as the country battles rampant pollution. The requests mean the two biggest power producers in India are pressuring the government to delay emissions targets for a second time, citing costs and technical difficulties, even as the country chokes on some of the worst smog on the planet. India already extended its original December 2017 deadline for utilities to meet tighter new emissions standards, after extensive lobbying by the coal-fired power industry. The country now has a has a phased timetable – from end-2019 to end-2022 – and many coal-fired plants around New Delhi are operating despite missing deadlines, and want a further extension. Adani Power wants to extend the timeline for stricter emissions rules at two units in a central Indian plant by about three years to March 2023, citing a change of ownership, the documents show. Adani bought the assets from the GMR group last year. Thermal power companies like Adani, which produce three-quarters of the country’s electricity, account for some 80 percent of India’s industrial emissions of gases linked to lung diseases, acid rain and smog. But more than half of the coal-fired power plants ordered to retrofit equipment to cut emissions are set to miss deadlines. NTPC Ltd, India’s largest electricity generator, has sought to extend the deadline by up to two years at its Bongaigaon eastern Indian plant, according to the documents reviewed. India’s Central Electricity Authority (CEA), which advises the federal power ministry, recommended that NTPC’s request be passed on the environment ministry. The power ministry already wants to extend deadlines for some economically stressed power plants. The CEA has also asked the power ministry to request the environment ministry to extend timelines for captive power plants.

Source: Reuters

Punjab government approves waste to energy power plant project at Mohali

6 January. The Punjab government decided to build a 7 MW waste to energy plant at Simgauli village in Mohali district. Chief Minister Amarinder Singh gave the go-ahead for the project of building the plant in over 50 acre area under the Build Own Operate (BOO) model. The project will be completed within the next two years and the waste to energy plant would generate power from 600 tonnes per day waste collected from Mohali and Patiala. He said the project would contribute to the implementation of the State Action Plan on Climate Change (SAPCC) and also the Swachh Bharat Abhiyan. He said the Municipal Solid Waste (MSW) had always posed a major challenge to urban local bodies but with this project, it could now be effectively used as a source of renewable energy. He said that MSW had not been harnessed systematically on a significant scale and hoped that the project would pave the way for more such initiatives. During the meeting, General Manager, Waste to Energy, NTPC, Amit Kulshreshtha apprised the chief minister that the new state-of-the-art plant, complying with the latest environmental norms, would be installed as a pilot project in the state.

Source: Business Standard

Government may extend safeguard duty on Chinese solar power equipment

QuIck Comment

Safeguard duty on Chinese solar power equipment will make RE industry uncompetitive!

Bad!

|

6 January. The government is planning to extend the safeguard duty imposed on imported solar power equipment from China. Domestic solar equipment manufacturers have met Union Commerce and Industry Minister Piyush Goyal and suggested the duty be retained. This comes at a time when the safeguard duty impacted addition in solar power generation capacity over the past two years. The domestic manufacturing industry has argued China was actively looking to divert major export flows en-route to India after major buyers from the US (United States) cancelled bulk orders. The Donald Trump administration has ratcheted up tariffs on Chinese imports, especially in the electronics space, with Washington DC threatening in December that more restrictions might follow soon. In 2018, the government announced imposition of safeguards duty on solar cells and modules for two years — 25 percent in the first year, 20 percent for six months and, thereafter, 15 percent. Apart from Malaysia, the duty specifically impacted the exports coming from China, as more than 85 percent of India’s solar capacity is built on Chinese panels. For 2018-19, the tendering target set by the ministry of new and renewable energy was 30,000 MW. Ongoing tenders total up to 26,000 MW and none has been closed yet due to lack of bids. India has set target of 100,000 MW of solar power production by 2022. The current solar power capacity stands at 30,000 MW.

Source: Business Standard

Proposed carbon tax waiver on coal may pose risks to India’s renewables growth: Fitch

6 January. Fitch Solutions said that the centre’s proposed carbon tax waiver on coal may pose substantial downside risks to India’s renewable sector growth. In a bid to alleviate significant debt levels in the power industry, India has proposed to waive carbon taxes on coal (Rs400/tonne), it said. It expects coal to continue dominating India’s power sector, making up a share of slightly under 70 percent of the total power generation mix by 2029, with non-hydro renewables at 15.6 percent. Most notably, Tamil Nadu, one of India’s largest renewable energy states, has decided to cease wind and solar auctions for the time being due to undersubscription in the previous two.

Source: Business Standard

SECI invites EoI to purchase power for blending with renewable sources

5 January. Solar Energy Corp of India Ltd (SECI) intends to blend inherently unsteady renewable power with power from steady generation sources including coal-fired thermal plants. Blending, according to SECI’s EoI (Expression of Interest) document, would allow it to provide round the clock supply to consumers to meet their baseload and enhance renewable penetration at discom (distribution company) and other consumers. It is also expected to cater to the requirements of consumers by providing them round the clock firm power by blending RE power with the power from hydro, gas, pumped storage, thermal sources of energy. It will also allow commercial and industrial consumers who have captive plants to meet their renewable power purchase obligation through the purchase of renewable power through long or medium-term open access. SECI may sign power purchase agreements with generators, the validity of which may vary from one to 25 years as per consumer requirements and shall be for those blocks in a day where renewable power falls short in meeting the conditions of round the clock firm power.

Source: The Economic Times

Study conducted in India reveals air pollution can affect bone health

5 January. A recent study in India has found an association between exposure to air pollution and poor bone health. Osteoporosis is a disease in which the density and quality of the bone are reduced. Globally, it is responsible for a substantial burden of disease and its prevalence is expected to increase due to ageing of the population. The new study was published in Jama Network Open. It analysed the association between air pollution and bone health in over 3,700 people from 28 villages outside the city of Hyderabad, in southern India. The authors used a locally-developed model to estimate outdoor exposure at residence to air pollution by fine particulate matter (suspended particles with a diameter of 2.5 mm or less) and black carbon. The participants also filled a questionnaire on the type of fuel used for cooking. The authors linked this information with bone health assessed using a special type of radiography that measures bone density, called dual-energy x-ray absorptiometry and measured bone mass at the lumbar spine and the left hip. The results showed that exposure to ambient air pollution, particularly to fine particles, was associated with lower levels of bone mass. No correlation was found with the use of biomass fuel for cooking.

Source: The Economic Times

Railway station in Hyderabad gets solar roof

4 January. In a first-of-its-kind initiative by South Central Railway (SCR), a new booking office with a solar panel roof has been constructed at Kamareddy railway station under the Hyderabad railway division. These types of structures are very useful for small establishments and wayside railway stations in terms of both energy and revenue savings, while ensuring uninterrupted power supply, SCR said.

Source: The Economic Times

IOC veers towards solar power

4 January. The Indian Oil Corp (IOC) will soon have all its retail outlets in the state run on solar energy. Work on two outlets is complete, while eight more stations are being readied, and is expected to be ready by June. The executive director (in-charge), Maharashtra and Goa state office, Murali Srinivisan, recently said the company will also rollout CNG (compressed natural gas) stations in the state.

Source: The Economic Times

Eden, Adani to invest Rs20.7 bn in renewable power projects in Rajasthan

3 January. Eden Renewables and Adani group have proposed to invest Rs20.72 bn in the renewable power sector and both the projects have been given 100 percent exemption from stamp duty and conversion charges under the new RIPS (Rajasthan Investment Promotion Scheme). As per the proposals, Eden Renewables will set up 300 MW solar energy project with an investment of Rs15.72 bn in the 3716 bigha. Similarly Adani Group has proposed a 50 MW project for wind energy having investment of Rs5 bn.

Source: The Economic Times

India extends $75 mn line of credit via Exim Bank for solar parks in Cuba

3 January. India has extended a line of credit of $75 mn (over Rs5 bn) to Cuba for financing solar parks. An agreement signed between Export-Import Bank of India (Exim Bank) and Banco Exterior De Cuba in July last year came into effect from 12 December, the RBI (Reserve Bank of India) said.

Source: Business Standard

No net billing for solar rooftop consumers in Pune: MERC

2 January. The demand to make net billing compulsory for solar rooftop consumers has been rejected by the Maharashtra Electricity Regulatory Commission (MERC) after it considered all the suggestions and objections to the proposal. According to MERC (Grid Interactive Rooftop Renewable Energy Generating Systems Regulations) 2019, it is up to the consumer to decide whether he wants net metering or net billing. The net billing system proposed by Maharashtra State Electricity Distribution Company Ltd (MSEDCL) would have made solar rooftop impractical for residents and had been opposed by all consumers including Maharashtra Solar Manufacturers Association (MASMA). Under the current system, consumers who generate solar power, utilise their share and sell the remaining power units to MSEDCL in exchange for no charge on its regular consumption of electricity supplied by MSEDCL.

Source: Hindustan Times

MNRE issues draft policy for RTC supply of bundled renewable power

2 January. The Ministry of New and Renewable Energy (MNRE) has proposed a draft policy for the supply of round-the-clock (RTC) power to discoms (distribution companies) which would be a mix of renewable energy and electricity generated in coal-based plants. The idea is to address the biggest issue with large scale uptake of clean energy – intermittency. Solar and wind energy are not available throughout the day severely limiting their use in modern grids. According to the draft, a generator has to supply power such that at least 51 percent of the annual energy supplied corresponds to RE and the balance is drawn from thermal sources. The generator will supply RE power complemented with thermal power, in RTC manner, keeping at least 80 percent availability on an annual basis.

Source: The Economic Times

Adani Green Energy sizzles after commissioning wind power project

1 January. Commercial sale of power from the project is expected to commence from 1 January 2020. Adani Renewable Energy, a step down subsidiary of Adani Green Energy (AGEL), has commissioned its 75 MW wind power project having power purchase agreement with Maharashtra State Electricity Distribution Company Ltd (MSEDCL) at Rs2.85 per kWh (kilowatt hour) for 25 years. Commercial sale of power from the project to MSEDCL is expected to commence from 1 January 2020.

Source: Business Standard