-

CENTRES

Progammes & Centres

Location

India’s downstream oil sector regulator PNGRB has constituted a high-level committee for creating a draft CGD policy, which can act as a reference point for state governments to formulate their own CGD policies for streamlining the process of setting-up CGD networks. The draft CGD policy will include guidelines on setting up a nodal agency by state governments to coordinate to get single-window clearance, procedure to grant time-bound right of way permissions for CGD network, procedure for timely availability of permissions from NHAI, railways, environment approvals and timely allocation of domestic natural gas, beside others. Post the completion of the tenth CGD round, natural gas will be available in 228 Geographical Areas, covering 27 states and union territories, which will result in access to gas for 70 percent of the country’s population and 50 percent of its geographical area. Under the revised 2018 CGD policy, pre-determined penalty will be levied on players within three months from the end of each contract year, if the physical performance target provided by the player is not achieved at the end of one contract year. The regulator will impose a penalty of ₹750 for shortfall in each piped gas connection, ₹150,000 for missing each inch-kilometre of pipeline, and ₹2 mn for each natural gas station not installed.

India’s largest electricity trading platform plans to unveil the nation’s first natural gas exchange by March as it seeks to tap increasing demand for the cleanest fossil fuel. Indian Energy Exchange started putting together the infrastructure and a team of about 20 officials to run the bourse. The world’s second most populous nation has been mulling a gas exchange for several years but the move has been reinvigorated by increasing use of the fuel as a global glut damps prices. The country seeks to increase the share of natural gas in its energy mix to 15 percent by 2030 from the current 6 percent, drawing interest from global majors including Total SA and Exxon Mobil Corp. The exchange will help bring down the price of natural gas through competitive trade, boosting usage in a country that relies heavily on cheaper coal for its energy needs. A plan to allocate a certain volume of domestic gas for trading at exchanges is also waiting for government approval.

After oil, India is set to build strategic reserve of natural gas, to further strengthen country’s energy security and shield itself from supply disruptions coming from perennial political risk in the prime energy supplying countries in the Middle East and Africa. The reserve will also help the country cope with demand spike and price rise in the event of border skirmishes and war like situation that played out with Pakistan recently. For building strategic gas reserve, the plan is to inject depleted gas fields with the fuel or develop storage in large salt caverns. The plan for strategic gas reserves emerges from an official study that suggests that consumption of natural gas would grow two-folds by 2030 resulting in large gap between demand and domestic production. At present, almost of half of domestic consumption of natural gas is met from imports. The suggestion for building strategic gas reserve has also come from Niti Aayog that is finalising a national Energy Policy. The policy draft has made a case for a gas storage required, if consumers have to be assured of un-interrupted supplies. For India strategic storage of gas would work well also because the domestic gas production has remained stagnant for past few years. In the current fiscal (FY20), upto September while gas production has declined by 1.5 percent, LNG imports has risen 7.9 percent.

India’s hunger for natural gas to feed key industries in the power and fertilizer sectors is continuing to grow unabated but that demand is increasingly being met by costly imports on the back of dismal domestic production. The country consumed 174 mmscmd of natural gas in September 2019, a 6 percent increase over the consumption of 164 mmscmd in the same month last year. The over demand growth stood at 3 percent in the April-September 2019 period, according to data shared by research firm India Ratings. However, the 6 percent growth in consumption in September fuelled a massive 18 percent jump in costly imports of RLNG. Domestic natural gas contributed a mere 52 percent to the overall domestic consumption during September 2019. Additionally, the rising demand for gas is coming increasingly from the fertilizer sector rather than power plants. Consumption data for August 2019 captures that trend.

The disappointment with the July-September quarter (second quarter) performance of India’s largest gas transmission and trading company, GAIL (India) Ltd, added to the already soft Street sentiment. Even though GAIL’s performance on the volume front remained decent in second quarter, its soft operating performance disappointed investors. GAIL’s gas transmission segment, too, saw a 10 percent decline in profit, with the company taking a one-time hit for retrospective adjustment in tariffs of some pipelines, such as Hazira-Vijaipur-Jagdishpur and Dadri-Panipat. While natural gas prices continued to decline, margin in petrochemicals business, too, is under pressure, with realisations being impacted by the supply glut. The 8 percent and 25 percent fall in market price of petrochemicals and liquid hydrocarbons, respectively, coupled with lower gas prices in the international market, adversely impacted GAIL’s profits in second quarter, compared to the first quarter of 2019-20.

A massive $60 bn is being spent to expand gas infrastructure to meet such a demand. Natural gas currently makes up for 6.2 percent of all energy consumed in the country. To cut dependence on polluting coal and liquid fuels, the government is targeting its share to rise to 15 percent by 2020-30. The current consumption comprises 80-90 mmscmd of domestic output and the remaining coming by way of imports. The investment is being done in building LNG import terminals, laying pipelines and expanding city gas distribution network so that the usage of non-polluting fuel in the country rises. Natural gas, having dual advantages of being cleaner as well as a cheaper fuel (when compared with liquid fuels like diesel and furnace oil), could help steer India as a transition/ bridging fuel towards a ‘low carbon future’. India presently has 38.8 mtpa of LNG import terminal capacity. This is being expanded to 52.5 mt in next 3-4 years.

GAIL Gas Ltd will supply PNG to 300,000 households in Dehradun district under the CGD project. Work on laying pipelines for the project will begin in a month. In five to six months, the firm will start supplying piped natural gas to 5,000 households in Chakrata, Dehradun, Doiwala, Kalsi, Rishikesh, Tyuni and Vikasnagar areas of Dehradun district. The target is to cover 300,000 households spread over an area of 3,088 km2 in the district at a cost of ₹15 bn in the next eight years. Registration of PNG consumers under the project will soon get under way. As laying pipelines from Haridwar to Dehradun is likely to take some time, PNG will be supplied in the district for the time being through de-compressed units of which 4-5 will be set up in Dehradun. The initial supply of gas for 200 CNG-run buses that the NMC is planning to operate from April next year will come from Pune. The MNGL has been mandated by the civic body to supply CNG for these buses that would ply on city roads to strengthen the public transport system. The company has already decided to ferry about 16,000 kg of CNG in cascades by light motor vehicles on a daily basis once the CNG-run buses. The NMC has already earmarked land for MNGL to establish storage facility at Pathardi Phata where LNG would be converted into CNG for supply. The MNGL has planned to set up 15 CNG stations in the district by March next year. Of the 15 stations, 12 will be set up on the premises of existing fuel stations of oil marketing companies like IOC, HPCL and BPCL. The remaining three would be established on the land provided by the NMC and would be operated by the MNGL. MNGL has written to the NMC seeking its nod to allow setting up CNG stations at six locations in the city for supplying gas to autorickshaws. The six locations identified are Tapovan, Sinnar Phata, plot near Vasant Pawar Medical College at Adgaon, plot near NMC’s fire brigade station in Panchavati, near Truck Terminus at Chehedi and plot near NMC’s water treatment plant at Pathardi. The NMC has plans to operate 400 buses, including 200 CNG buses, through private agencies. MNGL’s outlets at remaining 10 existing fuel stations will also be operational by the end of March next year.

India’s natural gas production declined 5.6 percent to 2.64 bcm in October 2019 over a year ago. Natural gas output of ONGC dipped 7.4 percent to 1.95 bcm, while that of OIL‘s rose 1.6 percent to 0.24 bcm. Further, the natural gas production of private and JV companies declined 1.0 percent to 0.45 bcm in October 2019. Natural gas output fell 2.1 percent to 18.65 bcm in April-October 2019 over April-October 2018. ONGC has wound up its shale exploration programme mid-way after spending five years and hundreds of millions of rupees, concluding that India may not have enough commercially-extractable shale reserve. ONGC recently told the government that it was ending its shale exploration programme ahead of schedule as the results hadn’t been encouraging. It also told the government to get the country’s shale potential reassessed by a competent international agency. The oil ministry is considering launching a new resource assessment programme for all unconventional hydrocarbons, including shale, coal-bed methane and gas hydrate. Past estimates of India’s shale reserves vary widely from ONGC’s 187 tcf of shale gas in 5 basins to US EIA’s 584 tcf of shale gas and 87 bn barrels of shale oil in 4 basins, and oilfield services provider Schlumberger’s 300 to 2100 tcf gas. Essar Steel and GSPC won two-thirds of the natural gas RIL offered in an auction, where winning bids were $5.3-5.4/mmBtu. RIL-BP offered 5 mmscmd it plans to produce from April next year at its R-cluster field in KG-D6 block. About half a dozen companies participated in the e-auction. Essar Steel is learnt to have won 2.25 mmscmd, while GSPC got 1.2 mmscmd. HPCL is believed to have won 0.35 mmscmd, while Adani, Mahanagar Gas and GAIL won 0.3 mmscmd each. Gujarat State Fertilizer Corp is also said to have won 0.10 mmscmd. Essar Steel, which has been in news lately for its bankruptcy, will likely use the gas in its plant, while Adani and Mahanagar may feed it into their city gas network. RIL-BP sold all the gas offered. The duration of supply could not be ascertained. Buyers had the option to bid for a supply period of two to six years. Bidders were expected to quote a price as a percentage of dated Brent crude. The minimum they could quote was 8.4 percent. Bidders ended up quoting between 8.4 percent and 8.6 percent. This translates into a price range of $5.29 to $5.41/mmBtu at the current rate of $63/bbl for dated Brent. After including the pipeline tariff, the delivered cost of gas would be about $6.5 for buyers, most of which are in Gujarat. RIL-BP have the marketing and pricing freedom for all the gas they produce from the R-Cluster field. The prices, however, cannot exceed the government-set ceiling for the gas from difficult fields, which is currently $8.43 per unit. Prices during the RIL-BP’s gas auction were influenced by a collapse in the global LNG market and an expected rise in supply from domestic sources over the next few years. This meant the auction ended up with rates that were close to the floor price set by the producer.

GAIL has offered up to 10 LNG cargoes for loading in the US over early 2020 to early 2021. The cargoes are being offered on a free-on-board basis from the Sabine Pass and Cove Point LNG plants. H-Energy Pvt Ltd expects its LNG import terminal at Jaigarh to start operations in the first quarter of 2020. The terminal, which is a floating storage and regasification unit, and will be India’s first, has been delayed on several occasions, with the previous deadline the fourth quarter this year. The terminal is expected to be predominantly used for term supply, with occasional spot cargoes. The launch of the terminal is not expected to create additional spot demand in India immediately. The global LNG market has been oversupplied in the past year, with current spot prices at record lows for winter, but the low price has pushed some Indian buyers on the market to procure cheap LNG. Stable purchases from Indian buyers will continue on subdued prices, but additional demand is unlikely as Indian regasification terminals are already running at full capacity. H-Energy’s trading office in Dubai signed a sale and purchase agreement with Malaysia’s Petronas in 2018 for the delivery of LNG to the Jaigarh terminal. The terminal is planned to be capable of handling 4 mtpa. IOC and GAIL (India) Ltd will pay Adani Group 5 percent more in hiring charges for using the private firm’s upcoming LNG import facility at Dhamra in Odisha than their own similar terminal. India’s largest oil firm IOC, which recently commissioned a 5 mtpa LNG import terminal at Ennore in Tamil Nadu. IOC had in 2015 signed to use up to 60 percent of the terminal’s capacity for importing gas for its refineries at Haldia in West Bengal and Paradip in Odisha. GAIL too had signed up for 1.5 mt of the terminal’s regasification capacity. GAIL’s own Dhabhol LNG terminal in Maharashtra levies ₹49.28/mmBtu regasification charge. In addition, there are other charges such as terminal charges, vessel-related charges and port charges for utilization of the Dabhol LNG terminal. Also, Petronet LNG – a firm in which GAIL and IOC are promoters, had shelved plans to set up a 5 mt a year LNG import facility at Gangavaram in Andhra Pradesh.

Russian President Vladimir Putin and his Chinese counterpart Xi Jinping oversaw the launch of a landmark pipeline that will transport natural gas from Siberia to northeast China, an economic and political boost to ties between Moscow and Beijing. The start of gas flows via the Power of Siberia pipeline reflects Moscow’s attempts to pivot to the East to try to mitigate pain from Western financial sanctions imposed over its 2014 annexation of Ukraine’s Crimea. The move cements China’s spot as Russia’s top export market and gives Russia a potentially enormous new market outside Europe. It also comes as Moscow is hoping to launch two other major energy projects — the Nord Steam 2 undersea Baltic gas pipeline to Germany and the TurkStream pipeline to Turkey and southern Europe. The 3,000 km long Power of Siberia pipeline will transport gas from the Chayandinskoye and Kovytka fields in eastern Siberia, a project expected to last for three decades and to generate $400 bn for Russian state coffers. Flows via the pipeline are expected to gradually rise to 38 bcm per year in 2025, possibly making China Russia’s second-largest gas customer after Germany, which bought 58.50 bcm of gas from Russia last year. Moscow began supplying natural gas to western and central Europe in the 1950s and Europe has long been Russia’s major consumer of gas, supplied by Kremlin-controlled energy giant Gazprom, with total annual supplies of around 200 bcm. Russia’s gas condensate output this year is expected to reach more than 34 mt the energy ministry said. Russia is part of a global oil supply pact between OPEC and non-OPEC nations but wants to exclude gas condensate production from its overall liquids statistics when it comes to Moscow’s quotas under the deal. OPEC agreed to allow all the broader OPEC+ group to exclude condensate from oil output calculations, as OPEC does with its own figures. Condensate is a high-value light crude extracted as a by-product of gas production. Asian spot prices for LNG dropped for a second consecutive week as supply flooded the market, overshadowing demand subdued by a winter that has been milder than average. The average LNG price for January delivery into northeast Asia is estimated to be about $5.50/mmBtu, down 10 cents from the previous week. In the US, Cheniere Energy asked US energy and safety regulators to approve a process to return to service a storage tank that leaked at its Sabine Pass LNG export plant.

Middle East and Africa

Qatar topped up its expansion plan for its vast LNG production facilities after drilling and appraisal work at its gas fields and now expects to produce 126 mtpa by 2027. The announcement by the world’s biggest LNG supplier comes as prices for the super-chilled gas languish at multi-year lows thanks to a surge in production from the US, Russia and Australia. Qatar Petroleum said the rise in output estimates is a result of new drilling and appraisal work in the expanded North Field mega field that confirmed gas reserves now exceeded 1,760 tcf. The allure is cheap gas from the North Field, the world’s biggest natural gas field which Qatar shares with Iran. Qatar’s gas extraction costs are some of the lowest in the world. Qatar has dominated the LNG market for over a decade and has been able to influence its mechanisms such as bedding down inflexible supply contracts with very long-term buyers. Saudi Aramco’s shipping arm Bahri has issued an EoI to charter up to 12 LNG tankers from 2025, its first foray into LNG. According to Bahri, the national shipping carrier of Saudi Arabia has six business units dealing in oil, chemicals, logistics, dry bulk, ship management and data and owns 90 vessels, including 43 very large crude carriers and 36 chemical/product tankers. Bahri’s EoI is likely part of Aramco’s expansion into LNG trading as it boosts gas production and considers expanding its LNG investments. Algerian state energy firm Sonatrach has renewed a gas export contract with France’s Engie. Sonatrach said the contract covers the medium and long term, but did not specify how much gas it will deliver to Engie. The firm has already renewed gas export contracts this year with Enel, Galp Energia, Eni, Botas, Naturgy, and Edison. Its total gas exports in 2018 were 51.4 bcm, with Italy and Spain accounting for two-thirds of the volume. Energean Oil & Gas said it signed a $1 bn deal to sell natural gas to Israel’s MRC Alon Tavor from its offshore Karish gas field. Energean said the gas sales and purchase agreement includes the sale of about 0.5 bcm of gas a year, or up to 8 bcm in total, over 15 years. Revenue from the deal is estimated to top $1 bn over the term of the contract, the company said. Energean said it now has firm agreements for the supply of 5 bcm a year of gas into the Israeli domestic market.

A final investment decision on a $3.15 bn LNG project near Mozambique’s capital will be taken around the middle of 2020, France’s Total and its partners in the project said. The project will see a floating storage and regasification unit moored in the harbor of Matola, a suburb of the capital Maputo, and it will be connected to a new gas-fired power plant nearby and to South Africa’s gas network. Total will supply the gas. Total and its partners, including Gigajoule, a gas company focused on southern Africa, and Mozambique’s MGC, which operates a 100 km gas pipeline network in Maputo province, signed an agreement to develop the project. Mozambique is on the cusp of a gas boom as blockbuster projects by the likes of oil majors including Total and Exxon Mobil get underway in its gas-rich north. Total, Gigajoule and MGC signed a memorandum of understanding related to the project in 2017. Concessions for the development and construction of the gas infrastructure and for the design, construction and operation for the power station were awarded in July.

US natural gas futures fell over 4 percent to a near two-month low on forecasts for less cold weather and heating demand through late December than previously expected. Front-month gas futures for January delivery on the New York Mercantile Exchange fell 10.2 cents, or 4.4 percent, to settle at $2.232/mmBtu their lowest close since 11 October. Gas flows to LNG export plants rose to a record 8.2 bcfd with an increase in flows to the second train at Freeport LNG’s plant in Texas, up from 7.9 bcfd earlier according to Refinitiv data. That compares with an average of 7.6 bcfd. Separately, traders said Kinder Morgan Inc’s Elba Island LNG export plant in Georgia could send out its first cargo. Gunvor Group Ltd agreed to double the maximum amount of LNG it plans to buy from a $4 bn export project in Louisiana and said it will recruit additional customers for the terminal. The trading firm will purchase as much as 3 mtpa of LNG from Commonwealth LNG, the Houston-based developer said. Gunvor will also market the remaining volumes from the facility, which will be able to produce about 8.4 mt a year. LNG developers need to sign enough customers to secure financing, and competition is intensifying. New terminals from Russia to Australia are flooding the market with supply, while the trade war has made it all but impossible for American exporters to sign deals with Chinese buyers. Trading houses, meanwhile, are becoming bigger players in LNG project development. Cheniere Energy Inc, America’s first and biggest shipper of shale gas, struck a 15-year agreement last year to sell the fuel to Vitol Group. Gunvor is on course to lead LNG ship charters this year after seeing its trading of the super-chilled fuel jump in 2018. Gunvor had reached a preliminary agreement with Commonwealth in June to buy 1.5 mt of LNG a year for 15 years.

Chinese companies are offering to resell LNG cargoes in the spot market as they grapple with high inventory amid weak demand due to a slowing economy and a milder than usual winter. The world’s second-largest buyer of LNG is currently facing high inventory of the super-chilled fuel in some areas. About 5 to 7 LNG cargoes are being offered for resale in a month, though this could not be independently verified. China’s Sinopec has received approval from the ministry of natural resources to develop shale gas at the Weirong gas field in the southwestern province of Sichuan. The company plans to build 166 wells at the gas field with total production capacity of 3 bcm each year. The first phase of construction is underway, with two testing wells reaching daily output of 313,000 cubic meters and 253,000 cubic meters, respectively, the company said. China’s shale gas production of about 10.9 bcm in 2018 accounted for less than 7 percent of total gas output. But a top researcher at PetroChina expects shale gas output could reach 280 bcm by 2035. CNPC’s unit Liaohe Oilfield of CNPC kicked off construction of its gas storage group project in Panjin city in Liaoning province. The project, jointly invested in by Liaohe Oilfield of CNPC and the Panjin government to the tune of about $8.5 bn, is aiming for storage capacity of 11.5 bcm. The Liaohe project is expected to become the biggest underground natural gas storage centre in northeast China and the Beijing-Tianjin-Hebei region. CNPC said it planned to build 23 more gas storage facilities by 2030 and expand 10 existing ones to secure supplies of natural gas during peak demand seasons.

Total criticised the EIB’s decision to stop financing all fossil fuel projects including gas, saying companies that might switch to gas-fired power plants from heavy-polluting coal could now reconsider. The EIB said that it would stop funding fossil fuel projects at the end of 2021, a landmark decision that potentially deals a blow to billions of dollars of gas projects in the pipeline. Poland’s dominant gas firm PGNiG said it had notified Russia’s Gazprom that it will not renew their long-term deal on gas supplies when the agreement expires after 2022. Poland had said before that it did not plan to buy gas from Gazprom after 2022. Poland still buys most of the gas it consumes from Gazprom, but has taken steps to reduce its reliance on the Russian firm, as it considers the conditions of the Yamal deal unfavourable. Ukrainian state energy firm Naftogaz has pledged to press on with talks on gas transit with Russian gas exporter Gazprom and the European Union. Gazprom, which owes Ukraine around $3 bn, may repay that debt with gas supplies, Naftogaz said. Gazprom said it had sent Ukraine a letter to formally propose extending a deal supplying gas to the country either for its own use and for transit to Europe, or the signing of a new one-year agreement. The current deal is set to expire at the end of 2019. Ukraine is one of the main routes by which Russia exports gas to Europe. Moscow’s construction of new pipelines, such as Nord Stream 2 and TurkStream, will cut Russian gas transit through Ukraine. Last year, Kremlin-controlled Gazprom supplied Europe with more than 200 bcm of gas, of which 87 bcm went through Ukraine, providing Kiev with transit income of around $3 bn. Ukraine halted its own imports of Russian gas in November 2015 after a row with Gazprom over prices and payments.

Papua New Guinea is set to start talks with Exxon Mobil Corp to try to negotiate better terms from the P’Nyang Gas Project. The push to extract more benefits from the P’Nyang project is part of a wider effort by Papua New Guinea’s new government to reap more rewards from the country’s mineral and petroleum resources to lift the country out of poverty. The P’Nyang project will help feed an expansion of Exxon’s PNG LNG plant, in which Australia’s Oil Search and Santos Ltd are also stakeholders. Talks over the project were put on hold earlier this year, when the government sought to revise a separate LNG agreement it has with French energy firm Total, in which Exxon is also involved. That deal was finally endorsed in early September, with minor concessions from Total. Five companies have technically qualified for Pakistan LNG’s buy tender to import LNG cargoes for delivery in January. Trading firms DXT Commodities, Gunvor Singapore, PetroChina International, SOCAR Trading and Trafigura have “technically qualified” to supply LNG to Pakistan LNG for the period, according to the notice. A total of 19 bids were received for the tender, Pakistan LNG said. Pakistan LNG typically opens the commercial offer only for companies whose technical information is complete and fully compliant with the requirements of the tender.

| PNGRB: Petroleum and Natural Gas Regulatory Board, CGD: city gas distribution, mt: million tonnes, mn: million, bn: billion, NHAI: National Highways Authority of India, FY: Financial Year, LNG: liquefied natural gas, mmscmd: million metric standard cubic meter per day, RLNG: regasified liquefied natural gas, CNG: compressed natural gas, PNG: piped natural gas, NMC: Nashik Municipal Corp, MNGL: Maharashtra Natural Gas Ltd, IOC: Indian Oil Corp, HPCL: Hindustan Petroleum Corp Ltd, BPCL: Bharat Petroleum Corp Ltd, bcm: billion cubic meters, ONGC: Oil and Natural Gas Corp, OIL: Oil India Ltd, JV: joint venture, US: United States, EIA: Energy Information Administration, tcf: trillion cubic feet, GSPC: Gujarat State Petroleum Corp, RIL: Reliance Industries Ltd, mmBtu: million metric British thermal units, KG-D6: Krishna Godavari Dhirubhai 6, bbl: barrel, mtpa: million tonnes per annum, km: kilometre, OPEC: Organization of the Petroleum Exporting Countries, EoI: Expression of Interest, MGC: Matola Gas Company, CNPC: China National Petroleum Corp, EIB: European Investment Bank |

QuIck CommentBuying stakes in producing O&G fields abroad must be based on cost benefit analysis of past purchases! Bad! |

17 December. India aims to invest in producing oil and gas (O&G) fields abroad to compensate for falling domestic output and to help reduce the impact of oil price volatility, Oil Minister Dharmendra Pradhan said. India, the world’s third biggest oil consumer, imports about 80 percent of its oil needs, making it highly susceptible to crude price swings. He said India was negotiating with Russia’s Rosneft to invest in eastern Russia. Indian firms have invested in foreign O&G assets, but many of these assets are still under exploration or not hitting production goals. He said the acquisition by Indian investors of stakes in producing fields in the United Arab Emirates and Russia’s Vankor field had started adding to corporate revenues.

Source: Reuters

16 December. Reliance Industries Ltd (RIL) and British energy giant BP plc signed a partnership agreement to jointly grow the Indian firm’s network of petrol pumps to 5,500 from current 1,400, the companies said. RIL currently has about 1,400 operating petrol pumps and some 30-odd aviation fuel stations at airports. These will be taken over by the RIL-BP joint venture and grown in future. RIL will hold 51 percent in the new joint venture company while BP will have the remaining 49 percent. This will assume ownership of RIL’s existing Indian fuel retail network and access its aviation fuel business. In August, RIL had said BP will pay about ₹70 bn for acquiring a 49 percent stake in its existing petrol pumps and aviation turbine fuel network. The country currently has 66,408 petrol pumps, with public sector retailers owning 59,831. PSU (Public Sector Undertaking) retailers have plans to double this network and have already starting appointing dealers.

Source: Business Standard

QuIck CommentInvestment to boost production must take into account falling demand growth for power and oil! Ugly! |

13 December. India’s petroleum products demand growth is expected to stay between 1 percent and 3 percent in the current financial year ending March 2020 and is likely to stay at the same level next fiscal 2020-2021, research and ratings agency ICRA has said. The country’s crude oil production fell 6 percent in the first six months of the current financial year and is expected to rise next fiscal due to commercialisation of some of Oil and Natural Gas Corp (ONGC) fields as well as increase in production from Vedanta’s Rajasthan asset.

Source: The Economic Times

13 December. Assam and other North Eastern states may face fuel supply issues if the agitation against the Citizenship Amendment Bill (CAB) continues for another week, as it has already led to the shutdown of refineries and oil-producing facilities in the region. Indian Oil Corp (IOC) has been forced to shut down its Digboi refinery in Assam and is operating Guwahati unit at minimal throughput, while Oil India Ltd has been forced to shut LPG (liquefied petroleum gas) production and its crude oil production has dropped by 15-20 percent, the state-owned companies said. The companies said the agitation has blocked the movement of tankers and trucks, which are mostly used to supply petrol, diesel and LPG from the refineries to different parts of the North East.

Source: Business Standard

13 December. For the first time in Andhra Pradesh, an automated petrol pump or ‘e-fuel station’ is going to be installed at the Millennium Petrol station at Siripuram Junction in the city. The station is owned by Hindustan Petroleum Corp Ltd (HPCL). At this specific station, manual intervention will be eliminated completely and the speed of transactions will increase, according to HPCL. The consumer will be given a smart card and will be advised to use a mobile app called ‘HPCL Re-fuel’ in order to avail the service. In order to use this, the consumer will have to go to the pump, park the car in front of the bunks, swipe the card on a digital device affixed at the bunk and then refill the fuel into their vehicle on their own. HPCL has decided to adopt the advanced technology to assure “Good Fuel Promise” at all retail outlets across the country by 2022.

Source: The Times of India

QuIck CommentOnline clearances to coal mining will expedite production! Good! |

17 December. Indian Oil Corp (IOC) is seeking a liquefied natural gas (LNG) cargo for delivery in January. The cargo is for delivery in the first half of January into Dahej, and offers are due.

Source: Reuters

12 December. The government will acquire 2,228 square meter (sqm) of land at Marcaim village in Ponda for ₹47 lakh for the construction of the city gate station number 2 as part of the gas pipeline project. A cabinet decision in this regard was taken and was announced by Chief Minister Pramod Sawant after the meeting. As decided by the cabinet, the compensation will be paid in accordance with the policy on procurement of land under the Right to Fair Compensation and Transparency in land acquisition, rehabilitation and resettlement Act, 2013. A feasibility study showed that the proposed land was fallow and there was no plantation within the area. The land will be handed over to Goa Natural Gas Pvt Ltd, and the land owners from whom it has been procured, will be compensated.

Source: The Economic Times

16 December. NLC India Ltd said it is planning to invest more than ₹170 bn for its thermal power projects and has embarked upon afforestation programme inside and outside the coal mining area in Odisha. The company will produce 20 million tonnes (mt) of coal per annum from Talabira II and III coal blocks to fuel its 4,200 MW of thermal power projects.

Source: The Economic Times

16 December. The government proposes to give online clearances to coal mining projects. The mine online application system for the entire mining plan approval process is proposed to be made online for application, processing and approval. This system will ultimately interact with PARIVESH portal of the environment ministry and similar portals of other related ministries and organisations of the central and state governments. The coal ministry said has decided to simplify the process of clearance for coal mining projects to expedite operationalisation of already allotted coal blocks and encourage prospective investors in future auctions. The coal ministry has re-engineered the mining plan preparation and approval process, which is likely to slash the approval period from the present 90 days to about 30 days.

Source: The Economic Times

11 December. Coal’s use for power in India is set to shrink for the first time in at least 14 years as demand slows and cheaper and cleaner renewable sources of electricity erode the fossil fuel’s share. Coal generation fell for a fourth month in November, the longest such streak in government data going back to 2005. When demand is down, utilities end up reducing offtake from costlier coal plants, and buy more from other sources such as hydro, renewables and nuclear, Sambitosh Mohapatra, partner for power and utilities at PricewaterhouseCoopers India, said. Power generation from coal, the most polluting fossil fuel, slumped 11 percent from a year earlier in November. Output in the year to November fell 2.4 percent, the first ever drop for the 11-month period. India has a coal-fired generation capacity of almost 198 GW, which accounts for about 54 percent of its installed generation capacity. India’s coal fleet used barely 51.4 percent of its capacity in November, compared with 60.5 percent a year earlier, Central Electricity Authority data showed.

Source: Bloomberg

11 December. The Odisha-based Earthmovers has awarded contract to implement an ‘intelligent mine’ solution at the Pakri Barwadih coal mining project in Jharkhand to Finnish-Russian digital solutions provider Zyfra. Thriveni, through its joint venture TSMPL, operates the state-run power generator NTPC Ltd’s Pakri Barwadih coal mining project. The collaboration with Zyfra was to ensure availability of the latest technology intelligence, like IIOT and AI capabilities, Thriveni said.

Source: The Economic Times

17 December. The Delhi High Court (HC) has held that the cost incurred by power distribution companies (discoms) can be considered while fixing tariff and it would include salaries, allowances and pension of their employees. The ruling by a bench of Chief Justice D N Patel and Justice C Hari Shankar came while dismissing a PIL (public interest litigation) which had alleged that power regulator DERC (Delhi Electricity Regulatory Commission) had allowed collection of more than ₹30 bn since 2011 towards a government pension fund from consumers through their electricity bills without informing them. It also dismissed a PIL initiated by the court on its own based on a letter by a Federation of the Resident Welfare Associations of Yamuna Vihar in north-east Delhi, opposing a 3.8 percent surcharge added to the power bills of BSES and BYPL consumers towards pension of erstwhile Delhi Vidyut Board employees.

Source: Business Standard

15 December. Nearly 1.5 mn employees, including engineers, of public sector undertakings in the power sector across the country will observe a one-day strike on 8 January against the proposed amendment to the Electricity Act, 2003. The employees have alleged the amendment was aimed at facilitating the privatisation of power supply in India by segregating carriage and content. All India Power Engineers Federation (AIPEF) Chairman Shailendra Dubey said electricity employees in all the state power utilities across the country would stage a day-long strike/work boycott on 8 January to oppose the move of the Centre to introduce multiple private supply licences. The strike/work boycott programme would be held be under the banner of the National Coordination Committee of Electricity Employees and Engineers, a broad-based umbrella organisation representing 1.5 mn power workers and engineers of the power sector of India. Earlier, the Federation had termed the draft amendment to the Electricity Act 2003 “very dangerous” since it was aimed at benefitting big power companies even as Dubey also criticised the Centre for ‘unilaterally’ going ahead with the proposed amendment. According to the Federation, the amendments would be a big jolt to farmers and weaker sections as it would end all subsidies, while it would result in a steep hike in power tariff, thereby making it unaffordable even for the middle class. Dubey warned the proposed Bill would have far-reaching consequences for both, the state governments and consumers.

Source: Business Standard

14 December. Adani Transmission Ltd received letter of intent for transmission project in Maharashtra on tariff based competitive bidding (TBCB) model. Adani Transmission has received the letter of intent from Maharashtra State Electricity Transmission Company to build, own, operate and maintain a transmission project in Maharashtra for a period of 35 years. This will be first ever 400 kilovolt (kV) substation facility in the city of Mumbai, the company said. The project “Kharghar Vikhroli Transmission” comprises of approximately 34 kilometre (km) of 400 kV and 220 kV transmission lines along with 400kV GIS Substation at Vikhroli in Mumbai. The project has been awarded to Adani Transmission through tariff based competitive bidding process.

Source: Business Standard

13 December. The Madhyanchal Vidyut Vitran Nigam Ltd (MVVNL) has installed approximately 18,000 ‘smart meters’ in Bareilly city so far this year, which is roughly 10 percent of total consumers. According to information received from the power department, the city has around 1.82 lakh power consumers. MVVNL said power consumers of both commercial and domestic categories are to be given smart meters on priority, with government departments to be covered later. It will take around a year for Bareilly to completely switch to smart meters. These meters will enable power consumers to keep track of their actual power consumption, while enabling corporation officials to collect real-time data of electricity consumption. Once the corporation completely switches to smart meters, they will be converted into prepaid meters.

Source: The Economic Times

13 December. Tata Power Delhi Distribution Ltd (TPDDL), which supplies electricity to north and north west parts of the city, expects the peak power demand in its areas to touch a record high of 1,500 MW this winter. TPDDL is fully prepared to ensure adequate power availability to around 70 lakh residents in north and north west Delhi. A total of 1,700 MW of power is available from long-term sources. The peak electricity demand in the city this season is expected to touch a high of 4,800 MW.

Source: Business Standard

12 December. Declaring that there is no power crisis in the country, Union Power Minister R K Singh said India has installed power generation capacity of around 365 GW, double the peak demand. He said that states meet their demand from their own generating sources and share from central generating stations. Apart from long-term power purchase agreements, states have the option to purchase power at any time from power exchanges and meet the electricity requirements fully, he said.

Source: Business Standard

11 December. Over 15 lakh rural women associated with self-help groups would be able to substantially enhance their income after they are engaged by the government to recover power dues in vast swathes of the rural hinterland. While this will expedite dues recovery from defaulters and raise revenue for the power corporation, it will augment rural earnings in a big way. The energy department has given over 12 mn power connections to rural households in the state under the Centre’s flagship Saubhagya scheme. But realisation of bills from rural consumers was becoming a challenge for Uttar Pradesh Power Corp Ltd with 70 percent households either delaying or refusing to foot bills.

Source: The Economic Times

17 December. Even as the state’s power department is finding it a challenge to identify open land on which to set up solar panels, the Goa University has written to the state government offering its vast open spaces to install solar panels. As part of its mission to make its campus a green one, the varsity has already given its nod for setting up solar panels on rooftops of all its buildings. The work of installing the panels is currently on and once completed, will meet 40 percent of the university’s power requirement. By also offering its open spaces to set up solar panels, Goa University is hoping to meet 80 percent of its power requirement through renewable energy sources in the future. Goa University being located on a plateau, it is ideal for solar panel installations. Goa has set a target to generate 23 MW of solar power till March 2020 and 150 MW by 2022, according to Power Minister Nilesh Cabral.

Source: The Economic Times

17 December. India has donated solar powered study lamps to Palestinian elementary school children from a marginalised Bedouin community to spread the principles of self-sufficiency and raise awareness towards the adverse effects of climate change. The solar powered study lamps supplied by Indian Institute of Technology (IIT) Bombay as part of the initiative on Mahatma Gandhi’s 150th birth anniversary also aims at making the student beneficiaries the future propagators of renewable energy.

Source: Business Standard

17 December. Ladakh has a wind power potential of 100 GW and preliminary studies have indicated the region holds tremendous promise for setting up commercial scale wind energy projects, according to Chennai-based National Institute of Wind Energy (NIWE) Director General (DG) K Balaraman. Ladakh, a Union Territory under the administrative control of the central government, has good wind resource due to its valley terrain and temporal variation with an estimated potential of 5,311 MW at a hub height of 50 meter. The potential goes up to 100,000 MW at a height of 120 meter, Balaraman said.

Source: The Economic Times

16 December. With the chorus against climate change getting louder than ever, countries around the world, including India, have expressed their commitment towards reducing carbon emissions but environmental experts feel that targets will not be achieved effectively unless there is stringent legislation to deal with the issue. The experts were reacting to a recent statement issued by the Centre that it was not thinking about bringing a legislation to tackle the issue. Under the Paris Agreement, India pledged to reduce the emission intensity of its gross domestic product (GHG emissions per unit GDP) by 33-35 percent over 2005 levels by 2030 and create additional carbon sink of 2.5 -3 billion tonnes of CO2 (carbon dioxide) equivalent through additional forest and tree cover. However, India does not plan to bring a legislation to achieve this target, the environment ministry told Parliament recently, which drew opposition from various environmentalists who said having a law will bring accountability which is lacking in the country.

Source: The Economic Times

15 December. India has set up a team to certify all solar power generation equipment makers who want to do business in the world’s largest green energy market. The move aims to boost domestic manufacturing and protect its domestic companies from cheap and sub-standard imports. Manufacturers are lining up for certification as the implementation of the new solar power generation equipment sourcing guidelines will start on 1 April. At play is India’s renewable energy programme, which would require $80 bn in investments till 2022. This figure will grow more than three-fold to $300 bn during 2023-30. India imported $2.16 bn worth of solar photovoltaic (PV) cells, panels, and modules in 2018-19. Only manufacturers and solar modules who are approved by the Bureau of Indian Standards (BIS) and the Ministry of New and Renewable Energy (MNRE) and are on the approved list of modules and manufacturers (ALMM) will be eligible for government supported schemes, including projects from where electricity distribution companies procure solar power for supply to their consumers, according to the Centre’s directive. The fast-growing domestic market for solar components is dominated by Chinese companies because of their competitive pricing. The MNRE team will inspect the manufacturing facility and conduct the production and sale audit before it includes modules and manufacturers in the ALMM list for two years.

Source: Livemint

14 December. Egged on by government incentives, the state owned enterprises (SOEs) are diversifying into green energy and building renewable energy portfolios. In October this year, the Ministry of New & Renewable Energy (MNRE) urged all SOEs to prioritise renewable projects in their investment plans to cut carbon emissions. Many SOEs are now venturing into the clean energy space, including grid-connected renewable energy projects and behind-the-meter solar rooftop. Coal India Ltd (CIL) has announced plans to develop 20 GW of solar capacity over 10 years at an estimated investment of ₹1 tn. NTPC Ltd is adding more renewable energy to stay profitable in the long run. Currently, thermal power plant developers in India are under huge pressure. Even equipment major Bharat Heavy Electricals Ltd (BHEL) diversified its engineering portfolio by venturing into new areas like solar power and electric vehicle charging in FY19.

Source: Business Standard

13 December. The Indian Energy Exchange (IEX), India’s leading energy exchange, is hopeful of being able to introduce a trading platform for wind and solar power, early next fiscal. When this happens, wind and solar energy companies who put up plants in future, or those who have some surplus capacity not committed under long-term power purchase agreements (PPA) could sell their electricity on the IEX — which is expected to fetch them a better price. Wind energy companies are reeling under what it believes to be unviable, low tariffs. These tariffs, determined through competitive bidding processes — where the company that offers to sell power the cheapest gets to sign long-term power purchase agreement — had fallen as low as ₹2.43, before firming up slightly to ₹2.93.

Source: The Hindu Business L ine

12 December. Indian Renewable Energy Development Agency (IREDA) is planning to set up a $100 mn (₹ 7 bn) green window for financing renewable energy projects. An allocation of approximately $20 mn is being considered for the green window, with plans of leveraging $80 mn from other agencies to establish a facility of $100 mn. IREDA is planning to set up a dedicated green window to serve the unserved segments of renewable energy, Ministry of New and Renewable Energy (MNRE) Secretary Anand Kumar said. The green window would be set up to dedicatedly support underserved clean energy markets and support scaling up of new clean energy technologies. Achieving the 175 GW goal would increase green energy access for millions of Indians and, additionally could create up to 1 mn job opportunities for over 300,000 workers in the country by 2022. Prime Minister Narendra Modi has announced India’s commitment to go much beyond the 2022 goal and install 450 GW of renewables – more than five times the current installed renewables capacity.

Source: The Economic Times

12 December. The Kerala district panchayat is said to become the first district panchayat in India that is self-sufficient in electricity generation. The installation of solar panels has been completed and electricity production started in the district. The energy-sufficient district panchayat declaration will be made by Chief Minister Pinarayi Vijayan in January. Kozhikode district panchayat achieved the dream by installing solar panels at 42 schools under its jurisdiction. The district panchayat has also installed rooftop solar panels at the district panchayat complex. The installation work was started in the beginning of 2019.

Source: The Economic Times

12 December. The government said a total of 47.86 GW of renewable energy capacity has been installed in the past six years. The government has set a target of installing 175 GW of renewable energy capacity by 2022, which includes 100 GW from solar, 60 GW from wind, 10 GW from biomass and 5 GW from small hydropower projects, Power and Renewable Energy Minister R K Singh said. The initiatives taken by the government to explore new and renewable energy sources in the country include permitting FDI up to 100 percent under the automatic route, waiver of inter-state transmission system (ISTS) charges and losses for inter-state sale of solar and wind power for projects to be commissioned up to December 2022, he said.

Source: Business Standard

12 December. Green energy provider Vikram Solar announced commissioning of three solar plants for Airports Authority of India (AAI) in Assam, Bihar and Maharashtra. The cumulative capacity of the three projects is 1.1 MW, Vikram Solar said. While the capacity of the solar plant at Dibrugarh, Assam airport is 725 kW, the plants at Gondia (Maharashtra) and Gaya (Bihar) are of 220 kW in capacity each.

Source: Business Standard

11 December. Clean energy firm ReNew Power said it has joined hands with South Korea-based GS E&C for execution of its 300 MW solar power plant in Rajasthan. ReNew Power announced a joint venture partnership with South Korea based GS E&C in this regard, the company said. The project is part of the capacity auctioned by Solar Energy Corp of India (SECI) under its tranche-IV auctions concluded. GS E&C, is South Korea’s leading construction and development firm and is part of the GS Group, with an asset base of over $58 bn. This partnership will mark the entry of GS E&C in the Indian renewable energy sector. ReNew Power recently crossed the 5 GW renewable energy generation milestone with the commissioning of a 250 MW solar plant in Bikaner. It has assets valued at over $6.5 bn.

Source: The Economic Times

11 December. To increase state’s production of renewable energy, the Kamal Nath government will set up a 2,000 MW Solar Power Park in the Bundelkhand and Chambal regions, Renewable Energy Minister Harsh Yadav said. Areas have been identified for the project and the process has been initiated, he said. He claimed that the 750 MW Rewa Ultra Mega Solar Power Project has nearly been completed over the past one year. He said that the state government over the past one year has installed solar rooftop in 291 government colleges, 126 engineering colleges and ITI (Industrial Training Institutes), 13 medical colleges, 107 police department buildings, central government offices and 14 universities. A 500 kW of solar plant has been set-up near Upper Lake in Bhopal, he said.

Source: The Economic Times

17 December. Syria’s parliament has approved contracts for oil exploration with two Russian companies in an effort to boost production hit by more than eight years of war and Western sanctions. The deals cover exploration and production in three blocs, including an oilfield in northeast Syria and a gas field north of the capital Damascus. It said the contracts, passed in a parliament session, were signed with two Russian firms it identified as Mercury LLC and Velada LLC. Syria produced around 380,000 barrels of oil per day before the war but production collapsed after fighting hit the oil-rich east. Oil fields have largely been in the hands of Kurdish fighters who seized swathes of north and east Syria from Islamic State with US (United States) help.

Source: Reuters

16 December. China expects to add 1.2 billion tonnes (bt) to its proved petroleum reserves in 2019, 25 percent more than was added in 2018. Crude oil production is seen reaching 191 million tonnes (mt). China will accelerate ocean and deep water oil and gas exploration in 2020. Crude output in China rose 1.0 percent to 174.95 mt in the first 11 months of the year, the National Bureau of Statistics said, while natural gas output also jumped robustly to 157.5 billion cubic meters in January-November period.

Source: Reuters

12 December. Oil prices gained nearly 1 percent on hopes that the United States (US) and China were close to reaching a deal on an ongoing trade dispute that has raised concerns about global demand for crude. The outlook for oil demand has been clouded by US (United States)-China trade tensions and uncertainty over whether a fresh round of US tariffs on Chinese goods would come into effect. Oil prices have firmed after OPEC (Organization of the Petroleum Exporting Countries) and other producers including Russia agreed to rein in output by an extra 500,000 barrels per day in the first quarter of 2020. The OPEC said that it expected a small oil market deficit in the next year, suggesting the market is tighter than previously thought.

Source: Reuters

12 December. Oil prices have a massive affect on Indian airlines, as Aviation Turbine Fuel (ATF) takes around 40 percent of the total revenues of an air carrier in India. As per the IATA (International Air Transport Association) forecast, the airlines fuel bill will decline in 2020 to $182 bn, which will represent 22.1 percent of average operating costs. In 2019, the fuel spend of the world airline industry was $180 bn, which was 23.5 percent of average operating costs. In 2020, the world airline industry would consume 371 bn litres of fuel, up from 359 bn litres that was used in 2019. According to the IATA forecast, the fuel efficiency – in terms of capacity use (available tonnes kilometres) – will improve by 2.1 percent in 2020 as deliveries of new aircraft grow.

Source: The Economic Times

11 December. Rosneft CEO (Chief Executive Officer) Igor Sechin is seeking investment in the company’s $157 bn Vostok oil project in the Russian Arctic from Japanese trading houses and oil companies. Vostok Oil is a newly established company that was formed to unite Rosneft’s projects in northern Russia, including the Lodochnoye, Tagulskoye and Suzunskoye oilfields, and other projects, including the Ermak Neftegaz venture with BP. Crude oil is expected to be shipped to Asia via the North Sea Route (NSR). Sechin needs backing because of the huge amounts required to develop the fields. The Vostok project will require about 10 tn roubles ($157 bn) of investment, Russia’s Deputy Energy Minister Pavel Sorokin said. The Russian government has broadly agreed a new tax relief package to help develop the Arctic, seen as a new oil-producing region for Russia, which is among the world’s top crude exporters, Deputy Prime Minister Yuri Trutnev said. Rosneft expects to produce up to 100 million tonnes (mt) of oil per year (2 mn barrels per day), or a fifth of what Russia currently pumps.

Source: Reuters

17 December. An Israeli court issued a temporary injunction suspending trial operations of Israel’s largest offshore natural gas field, Leviathan, over environmental concerns, court documents showed. The companies leading the Leviathan development are Texas-based Noble Energy and Israel’s Delek Drilling. Noble had said it had planned to begin production at Leviathan by the end of the year. The Leviathan partners are waiting to open the wells and fill the subsea pipeline with natural gas, a process that sends emissions into the air. The court said that because concerns over public health had still not been sufficiently disproven, it was in the meantime freezing the group’s gas emission permit.

Source: Reuters

16 December. BP Plc said a three-well drilling program offshore Mauritania and Senegal encountered gas in “high quality”, bolstering its confidence in gas resources in the region. The oil and gas major said here the three appraisal wells drilled this year, GTA-1, Yakaar-2 and Orca-1, encountered 160 meters of net pay, a measure of a reservoir’s thickness. In November, the Orca-1 well offshore Mauritania, partly owned with Kosmos Energy and Société Mauritanienne Des Hydrocarbures et de Patrimoine Minier, was further deepened and encountered more gas.

Source: Reuters

16 December. Russia’s Sakhalin Energy will suspend both lines of its liquefied natural gas (LNG) plant for planned maintenance in summer 2020. Equity holders in Sakhalin Energy include Russia’s Gazprom, oil major Royal Dutch Shell, as well as Japanese firms Mitsui and Mitsubishi Corp.

Source: Reuters

12 December. New US (United States) Energy Secretary Dan Brouillette slammed New York state regulators for blocking pipelines that would bring natural gas from Appalachia to New England, but did not specify whether the Trump administration could do anything to push the projects forward. Brouillette said the government must deal with what he called threats to energy delivery. Brouillette praised the gas industry which has seen prices pushed toward a 25-year low as it is produced as a byproduct of the shale oil boom. The glut threatens to force energy companies to write off billions of dollars worth of assets.

Source: Reuters

12 December. Japan’s biggest city gas supplier Tokyo Gas Co Ltd and power utility Chugoku Electric Power Co said they plan to collaborate for the procurement of liquefied natural gas (LNG) to help cut costs. The two companies will consider collaborating in flexible LNG procurement, including possible cargo swaps and seasonal swaps, as well as help each other during an emergency, to secure stable supply and lower costs, Tokyo Gas said. Tokyo Gas, which imports about 14 million tonnes (mt) of LNG a year, aims to boost LNG trading to 5 mt by 2030 from nearly nil now, to generate 10 bn yen ($92 mn) in profit, its president Takashi Uchida said.

Source: Reuters

12 December. China’s 2020 gas consumption is expected to rise to around 320 billion cubic meters (bcm), state energy group China National Petroleum Corp (CNPC)’s research arm said. China’s gas consumption in 2019 is expected to exceed 300 bcm in 2019, up 9 percent year-on-year, CNPC’s Economics and Technology Research Institute (ETRI) said.

Source: Reuters

17 December. Global coal demand is expected to remain stable until 2024 as growth in Asia offsets weaker demand from Europe and the United States (US), the International Energy Agency (IEA) said. The IEA report is being published just after negotiators from more than 190 countries met in Madrid over the last two weeks to try to thrash out rules to meet the 2015 Paris Climate Agreement, which demands a virtual end to coal power by 2050. World coal demand is expected to expand at a compound annual growth rate of 0.5 percent, reaching 5,624 million tonnes of coal equivalent in 2024, the IEA said.

Source: Reuters

12 December. US (United States) coal mining output has declined by about 37 percent over the past decade, as the sector faced stiff competition from natural gas and renewable sources for power generation, the US Energy Information Administration (EIA) said. Coal production fell to 756 million tonnes from 679 mines in 2018 from 1.2 billion tonnes from 1,458 mines in 2008, with production in the Appalachian region nearly halving, the EIA said.

Source: The Economic Times

11 December. Indonesia is considering lowering the minimum quantity of coal required to be sold to domestic buyers to 20 percent of the production from the current 25 percent, the energy ministry said. The government is reviewing rules that require coal miners to sell a portion of their coal to local buyers as suppliers struggle to meet the requirements. Meanwhile, price cap for the coal sold to local power plant operators may stay at $70 per tonne, he told a mining conference in Jakarta. Around 124 million tonnes (mt) of coal were estimated to be sold to local buyers this year, compared with 128 mt of target, ministry data showed.

Source: Reuters

15 December. Oman’s state-owned Electricity Holding Company, also known as Nama, has sold a 49 percent stake in Oman Electricity Transmission Company to State Grid Corp of China, raising around $1 bn. A deal for Muscat Electricity Distribution Company is planned for the second quarter of 2020. Non-binding bids had been submitted for it.

Source: Reuters

13 December. South Africa’s government on Friday asked industry for the cheapest and quickest options to ease a power crunch, as cabinet held an emergency meeting to try and resolve a crisis threatening growth in Africa’s most industrialized economy. President Cyril Ramaphosa called the meeting after struggling state utility Eskom implemented the most extensive power cuts in more than a decade earlier this week, disrupting supply to businesses and households. Eskom, which cut power for a ninth straight day on Friday, is choking under a massive 450 bn rand ($30.6 bn) debt burden and struggles to meet demand because its creaking coal-fired power stations haven’t been maintained properly. It said the country desperately needs an additional 5,000 MW of generating capacity. The power crisis is one of the biggest challenges for the former trade union leader turned millionaire businessman who has promised to fix ailing state firms and reverse years of mismanagement and stagnation. Eskom, which cut 2,000 MW of power from the national grid but later scaled it back to 1,000 MW, wants a larger safety margin to do more maintenance on its plants. Eskom had almost 12,000 MW of unplanned breakdowns, versus its nominal capacity of around 44,000 MW.

Source: Reuters

12 December. Umeme Ltd, the Ugandan power distributor, said it has secured $70 mn in a syndicated loan to fund infrastructure upgrades and grid expansion. Umeme said investments will be carried out within three years and will involve revamping sections of the distribution network, increasing grid connections and boosting supply reliability. The Karuma Hydro Power plant, a 600 MW China-funded power plant on River Nile, is expected to be commissioned by next February. Uganda’s national grid currently reaches just 26 percent of the nation’s 44 mn people. When Karuma is operational, Uganda’s total power generation is expected to hit nearly 2000 MW. Umeme said the funding will also help it connect more of its customers to prepaid meters, a strategy it began rolling out in 2011 to help cut rampant customer defaults and power thefts. Last year, Umem said it plans to spend $1.2 bn over seven years to revamp and expand the grid, including extending lines and building new substations.

Source: Reuters

16 December. The German government and states have agreed to a carbon price of €25 ($27.56) per tonne in 2021 that will then increase annually and hit €55 in 2025. In November, the lower house of parliament approved a major climate protection package to help Germany meet its 2030 target for reducing greenhouse gas emissions. An initial price of €10 a tonne for carbon dioxide emissions from heating and transport, was criticized by the opposition Greens as too low.

Source: Reuters

16 December. Greece’s Public Power Corp (PPC) will switch off its coal plants sooner than expected and expand its renewable capacity by 2024 to boost profits and help cut the country’s carbon emissions footprint, its CEO (Chief Executive Officer) Georgios Stassis said. Under a 2020-2024 business plan approved by the utility’s board last week, PPC plans to switch off at least 12 coal-fired units by 2023, instead of 2028 as initially planned, Stassis said. PPC wants to shut down 3.4 GW of its coal fired capacity by the end of 2023 and boost its green power by 1 GW by 2024 via joint ventures, to take a 10-20 percent share of Greece’s green energy market from 2.5 percent currently, Stassis said. The government aims for wind, solar and hydroelectric power to account for at least 35 percent of Greece’s energy consumption by 2030, more than double the current level.

Source: Reuters

12 December. The European Union (EU) left Poland out of a 2050 climate neutrality agreement after hours of summit haggling with three poorer eastern member states that demanded more funds for economic transition and support for nuclear power. The Czech Republic and Hungary eventually dropped their resistance after winning a guarantee that nuclear energy would be recognized as a way for EU states to reduce greenhouse gas emissions. But Poland remained against. The tussle came a day after Germany’s Ursula von der Leyen, the new head of the bloc’s executive European Commission, proposed a €100 bn ($110 bn) investment plan for net-zero greenhouse gas emissions by mid-century, declaring it Europe’s “man on the moon moment”.

Source: Reuters

11 December. Europe sought to bolster the world’s faltering battle against climate change with its “Green Deal” to slash fossil fuel dependence, while teen activist Greta Thunberg rebuked global leaders for dragging their feet. With fires, floods and droughts ruining millions of lives around the world, the European Union (EU)’s new executive cast the plan as the bloc’s “man on the moon moment,” kindling hopes among campaigners that other big emitters may follow suit. Nevertheless, the chasm between the pace of action by Europe and other major economies and the kind of transformational change that scientists say is needed to preserve a hospitable climate stoked fury at UN (United Nations) negotiations in Madrid. In Brussels, European Commission President Ursula von der Leyen portrayed the Green Deal, her first major proposal since taking office on 1 December, as a major step towards committing the EU to climate neutrality by 2050. Von der Leyen’s talk of visionary action cut a sharp contrast with US (United States) President Donald Trump’s decision to begin withdrawing from global climate negotiations, but many climate activists question how quickly the bloc can embrace a low-carbon future.

Source: Reuters

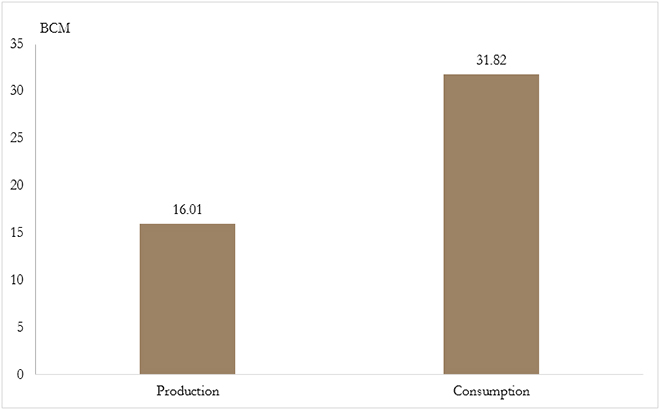

Billion Cubic Meters

| Particulars | 2017-18 | 2018-19 (P) | % Change with respect to 2017-18 |

| Production | 32.65 | 32.87 | 0.7% |

| Consumption | 59.17 | 60.75 | 2.7% |

Production & Consumption 2019-20 (April to September) (P)

|

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485. Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team). Publisher: Baljit Kapoor Editorial Adviser: Lydia Powell Editor: Akhilesh Sati Content Development: Vinod Kumar |

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.