OIL DEMAND GROWTH FALTERING

Oil News Commentary: October 2019

India

India’s fuel oil demand fell to its lowest in more than two years in September, data from the PPAC showed. Consumption of fuel oil totalled 16.01 mt – its lowest since July 2017 – down about 0.3 percent compared with the same month last year. Meanwhile, consumption of diesel, which is widely used for transportation as well as for irrigation needs in India, slipped more than 3 percent year-over-year to 5.83 mt, its lowest since January 2017. Sales of petrol, were 6.3 percent higher from a year earlier at 2.37 mt. Cooking gas or LPG sales increased nearly 6 percent to 2.18 mt, while naphtha sales slumped 26 percent to 0.84 mt.

Petrol and diesel prices across the country remained unchanged, staying at 10-month high levels on the back of oil price volatility in the global market. The price of petrol and diesel in the national capital remained unchanged at ₹74.61/litre and ₹67.49/litre, respectively. The price in Mumbai also remained same at ₹80.21/litre and ₹70.76/litre. OMCs fix the price of petrol and diesel at retail outlets based on an average of the past 15 days of the benchmark prices of petrol and diesel in the Middle East. OMCs have hiked the price of petrol and diesel by ₹2.64/litre and ₹2.12/litre in the national capital since 14 September, the day of the historic drone attack on Saudi oil facilities. Oil prices are now below the levels reached during the attacks as Saudi Arabia has restored its full oil production and capacity. Market research agencies have projected that Indian refiners may increase prices of both the automobile fuels by ₹5-6/litre.

Paving the way for the entry of new players in the fuel-marketing space, the government scrapped a rule that mandated a company to commit at least ₹20 bn investment in the petroleum sector. With this, newer players like Total, Adani, and Saudi Aramco — and even super markets — can open outlets for selling automobile fuel. Entities seeking authorisation will now need to have a minimum net worth of ₹2.5 bn only. Authorised entities will, however, have to meet certain conditions such as setting up a minimum 5 percent of their retail outlets in the notified remote areas within five years of grant of authorisation. The Cabinet Committee on Economic Affairs approved the changes under the Review of Guidelines for Granting Authorisation to market Transportation Fuels. While Total has tied up with Adani for fuel marketing, BP and RIL have announced a new venture for marketing automobile fuel and electric charging. The deregulation of petrol and diesel has enabled private retailers to compete with government-owned OMCs, but the current differentiator is only services being offered at the outlets. These companies charge almost the same rates linked to the global price. Entities seeking market authorisation for petrol and diesel are allowed to apply for retail and bulk authorisation separately or both. Companies have been given flexibility of setting up a joint venture or subsidiary for market authorisation. In an attempt to cater to the demands of petroleum products including Petrol, Diesel, Kerosene and LPG from north Karnataka, IOC is planning to open another terminal in the state. According to IOC, the 92 acre terminal situated on the outskirts of Bengaluru caters to 30 percent of the Karnataka’s demand for petroleum products. During 2019-20, IOC has released new connections to the tune of 238,000 out of which 147,000 were under Ujjwala scheme, which is highest for the industry, the company said. With Supreme Court directing union government to implement Bharat Stage VI (BS VI) emission norms before April 2021, the IOC said that they are going to replace BS IV with BS VI from early 2020 to make the petroleum products more eco-friendly.

India net import of petroleum products is growing. China’s PetroChina International Co Ltd shipped a cargo of 92 octane gasoline to India, marking the company’s first direct refined oil shipment to the country, its parent company CNPC said. A tanker, departing from Qinzhou Port in China’s south province Guangxi, will deliver the gasoline to India’s HPCL according to CNPC. PetroChina International clinched its first long-term contract to provide gasoline to HPCL in March, CNPC said. India signed three pacts with Bangladesh, including one for importing LPG. The MoU for supply of LPG will involve export of the fuel by Omera Petroleum and Beximco LPG to IOC, which will bottle and sell it to consumers.

India’s domestic crude oil production in August declined 5.44 percent to 2.750 mt on the back of output drop in fields operated by ONGC, Oil India Ltd and JVs. Cumulative oil production in the first five months (April-August) of the current financial year (2019-2020) declined 6 percent to 13.726 mt as most onshore and offshore fields across the country recorded slump in production. Production by ONGC in August declined 3.73 percent to 1.717 mt mainly due to decrease in production from fields in Andhra Pradesh, Assam, Gujarat, Tamil Nadu and fields in eastern offshore. Cumulatively, the company’s production in the first five months (April-August) dropped 4 percent to 8.585 mt. Oil India reported a 4 percent decline in crude oil production in August at 274,000 t due to fall in production from fields in Assam. Cumulatively, the company’s oil production in the first five months declined 4 percent to 1.355 tmt. Crude oil production by private players and JVs declined 9.51 percent to 759,000 t in August. The fall was attributed to decline in production from fields situated in Andhra Pradesh, Rajasthan, Tamil Nadu, eastern offshore, western offshore and Gujarat offshore. Cumulatively, production by JVs during the first five months declined 10.61 percent to 3.786 mt.

India’s top sources of crude oil have gone through a marked change over the last year, primarily due to the US sanctions on Iran. With oil supplies from what had been India’s third-largest supplier mostly cut off, other countries have begun climbing up the list. Not least of these is the US itself, with crude oil imports from the country nearly doubling. According to data from the DGCIS, crude oil imports from the US stood at 4.49 mt during the April-August period of this year, a 72 percent jump from the 2.6 mt imported during the same period last year. The country is now India’s sixth-largest oil supplier by volume. Iran, on the other hand, is no longer among India’s top ten crude oil suppliers with just 1.97 mt shipped during the period, an 85 percent decline from last year’s 13.3 mt. Other countries that have increased crude oil supplies to India include Nigeria and Russia. Data from DGCIS for this fiscal year shows that Nigeria has taken Iran’s erstwhile spot on the list, becoming India’s third-largest oil supplier with a 22 percent increase in crude oil shipments from 5.8 mt in April-August 2018 to 7.17 mt this year. Imports from Russia have also risen significantly. The period saw India buying around 2.13 mt from the Eurasian powerhouse, a two-fold increase from 973,389 tonnes it supplied during the same period last year. Iran used to be India’s third-largest oil supplier behind Iraq and Saudi Arabia. Iran supplied 18.4 mt of crude oil during April 2017 and January 2018 (first 10 months of 2017-18 fiscal). Indian refiner RIL is scheduled to resume loading Venezuelan crude in October after a four-month pause, according to sources and internal documents from PDVSA, a move that could help Venezuela’s state-run company drain its large oil inventories. The US in January imposed the toughest sanctions yet on Venezuela’s oil industry, depriving the OPEC member of the main destination for its crude exports. China National Petroleum Corp and its units stopped taking Venezuelan oil in August. Others, including RIL, have recently been buying Venezuelan crude from Russian major Rosneft. RIL needs the type of heavy sour crude that Venezuela sells because its refineries are configured to process it. US sanctions on both Venezuela and Iran have made it harder for the refiners to find supplies of these crude grades. The Indian firm is sending at least two vessels, the very large crude carriers Antonis I. Angelicoussis and Maran Castor, to Venezuela’s Jose port for loading in late October, according to the PDVSA documents. The tankers are currently passing the Suez canal.

Rest of the World

The OPEC and its allies are committed to sustaining oil market stability beyond 2020 with global physical supplies currently relatively tight. Compliance with production quotas among OPEC and its allies was at 136 percent this month (October 2019). At least seven Asian refiners will receive the full crude volumes they requested from Saudi Arabia for November loading, a sign that Saudi production has stabilized after disruptions last month. Most of the refiners are getting the crude grades that they want, adding that there was no request from oil company Saudi Aramco for them to change grades. Saudi Aramco’s oil processing facilities at Abqaiq and Khurais were attacked by missiles and drones on 14 September, shutting down 5.7 mn bpd of its production, or more than 5 percent of global supplies. At the height of the disruption, Saudi Aramco asked customers to switch their crude grades for loadings in the second half of September and early October and pushed back crude and oil product deliveries to customers by days. The kingdom’s output has bounced back to 11.3 mn bpd and the country was on track to regain its maximum oil production capacity of 12 mn bpd by the end of November. Dubai’s Dragon Oil Ltd said it had completed the purchase of BP’s oil concessions in Egypt’s Gulf of Suez and will invest $1 bn over five years to boost and extend their production. Dragon, owned by Emirates National Oil Company, said it had replaced BP as the partner of state-owned Egyptian General Petroleum Corp in the GUPCO, which has 11 offshore oil exploration and production concessions. GUPCO’s target had been to increase the concessions’ combined production to 75,000 bpd of oil by 2021 from the current 60,000 bpd. But Dragon said it plans to boost production to above 75,000 bpd and maintain this level for 10 years by further drilling and investing $1 bn over the next five years.

Russia’s Rosneft has announced the first tenders to sell oil products from its refineries for delivery in 2020, the company said. The buyers were invited to bid for gasoline, vacuum gasoil, naphtha and fuel oil from Rosneft’s refineries. The tenders will close on 25 November. Russia will find ways to help Cuba secure supplies of oil and petroleum products. A flotilla of shipments from Venezuela gave Cuba some respite. But the support from two of its closest allies looks unlikely to resolve Cuba’s pressing fuel problems, which have seen the government extend many of the energy-saving measures it has introduced over the past month. Cuba’s oil production currently meets an estimated 40 percent of its needs. Russian oil producer Lukoil and Hungarian energy company MOL are set to sign a settlement deal over contaminated oil during Russian President Putin’s visit to Budapest. A high level of organic chloride was found in late April in Russia’s Druzhba pipeline, which connects Siberian oilfields with Belarus, Ukraine, Poland, Germany, Czech Republic and Hungary. Russia and Kazakhstan reached a preliminary deal over compensation for tainted oil, though the final agreement is yet to be signed.

Exxon Mobil Corp banned the use of vessels linked to oil flows from Venezuela in the last year, putting new pressure on the US sanctioned country and on global crude freight rates. Some measures have led tanker operators to stop carrying oil for Venezuela’s state-run PDVSA oil firm. The decision by world’s largest publicly-traded oil producer to ban the Venezuela-linked tankers should affect about 250 vessels. A lack of vessels willing to carry Venezuelan oil exports is hurting Cuba, the crisis-torn country’s main political ally, which imposed fresh austerity measures last month due to power cuts and an acute shortage of fuel.

South Sudan will kick-start an auction of licenses to develop eight oilfields around the country, the oil ministry said. South Sudan’s oil production has reached 178,000 bpd and the country aims for output to reach 200,000 bpd within the next two years. Long-term, South Sudan aims to ramp up production to 350,000 bpd. South Sudan made a small oil discovery in Northern Upper Nile State in August, its first since independence in 2011. South Sudan plans to offer 14 oil blocks to exploration companies in a licensing round by the first quarter switching from its previous method of direct negotiations with explorers. The country gets almost all its revenue from oil and has boosted output, now at 180,000 bpd as it struggles to rebuild its shattered economy after a five-year civil war. The blocks to be offered for licensing will be blocks A1 to A6 and at present data was being collected on them. The government is keen to reach pre-war oil production levels of 350,000 to 400,000 bpd by mid-2020. In August, South Sudan made a small oil discovery in Northern Upper Nile State, its first since independence in 2011 when exploration was disrupted by war. Royal Dutch Shell and Exxon Mobil have paid $1.7 mn to Somalia to lease offshore blocks for 30 years. In June, the oil ministry announced that the two companies were looking to return to Somalia ahead of an oil block bid round later this year.

China’s top oil and gas producer, PetroChina, aims to produce 25 mt of crude oil per annum and 42 bcm of natural gas at its Changqing field by 2020. Changqing field also set a target of churning out 28 mt per annum of crude and 45 bcm of gas by 2025. Changqing, in the Ordos basin in Inner Mongolia, is China’s biggest gas field. PetroChina in September said that it found additional proved original oil in-place of 358 mt at the Qingcheng oilfield in Gansu province.

US President Donald Trump’s suggestion that Exxon Mobil or another US oil company operate Syrian oil fields drew rebukes from legal and energy experts. Exxon Mobil Corp and Chevron Corp, the two largest US oil companies operating in the Middle East, declined to comment on his remarks. Syria produced around 380,000 bpd before the country’s civil war erupted. Carlyle Group said it had dropped out as a stakeholder in Lone Star Ports LLC, which proposed a $1 bn crude oil export terminal near Corpus Christi, Texas. The project was one of at least nine crude oil export terminals proposed for the US Gulf Coast to load US shale oil onto supertankers that carry around 2 mn barrels apiece. The US shale boom has prompted a surge in oil exports, which hit 3.25 mn bpd and continued to fuel a race to build new export terminals. Enterprise signed long-term agreements with oil major Chevron Corp that advanced its proposed offshore crude export project near Houston, it said in late July, making it the first to make a final investment decision on a proposed deepwater port.

Mexico’s finance ministry has completed a majority of its annual oil hedging program, working with at least four top investment banks and oil major Royal Dutch Shell, after challenges slowed the world’s largest oil financial deal this year. JPMorgan Chase & Co, Citigroup Inc, Goldman Sachs Group Inc, BNP Paribas SA and Shell are among those the finance ministry tapped to execute the hedge. Over the past two-three years, oil majors Shell and BP began participating in the highly coveted program, challenging the traditional role of banks in the operation. The oil hedge program runs from December to November the following year. In it, Latin America’s second-largest economy buys as much as $1 bn worth of financial positions, mostly options, in a series of highly anticipated oil trades.

Brazil’s Petrobras could take over marketing of the government’s share of crude from offshore oilfields, adding significantly to the state-run oil firm’s trading operations. Pre-Salt Petroleum, better known by its Portuguese acronym PPSA said it is close to inking a deal in which Petrobras’ trading desk will manage the oil that Brazil’s government receives from private sector firms. The potential deal, being discussed ahead of a blockbuster season for oil bidding rounds in the South American nation, would significantly boost the volume of crude traded by Petrobras as the firm is formally known. Following significant exploration work in the area, the fields are known to hold billions of barrels of untapped crude. All winners will hand a significant chunk of that oil over to the government, via the PPSA, as is standard practice within Brazil’s so-called “pre-salt” oil producing region. Due mainly to the upcoming rounds, the oil that the PPSA manages could soar from just a few thousands bpd last year to around 500,000 bpd by 2028 according to preliminary estimates. That compares with Petrobras’ current exports of 583,000 bpd in the September quarter. Last year, the PPSA sold its oil on the spot market and via auctions. With the oil it receives set to skyrocket in the coming years, the PPSA is also set to grow. Brazil has collected more 600 tonnes of oil from its northeastern beaches since 12 September, the government said, more than double an estimate of oil and sand collected by state-run oil company Petrobras. Oil has been washing up on the shores of northeastern Brazil for two months, but its origin has remained a mystery so far. More than 200 locations along the coast have been affected, threatening marine life, authorities said. Petrobras said it had collected 280 tonnes of oil and sand from the beaches. Brazil’s government has said the oil spill is Venezuelan in origin, but has mostly stopped short of blaming their socialist government for the incident. Venezuela has denied it is to blame. A consortium of Royal Dutch Shell Plc, Chevron Corp and Qatar Petroleum won oil exploration and production rights in the C-M-713 block off the coast of Brazil, paying the government a signing bonus of roughly 551 mn reais ($133 mn). Shortly before, Petronas won a separate offshore block, C-M-661, with a signing bonus of roughly 1.116 bn reais.

Libya’s internationally recognised government said it was sharply increasing the price of kerosene for industrial and commercial use as a first step to reform costly fuel subsidies and tackle smuggling. The price will rise to 0.85 Libyan dinars ($0.6) /litre, which is also the production cost, the economy ministry of the Tripoli-based government said. The Tripoli ministry noted that kerosene was distributed through the Brega fuel distribution unit, a subsidiary of the NOC, but made no reference to a row over control of Brega. Libya’s oil and gas industry, which earns almost all the North African country’s income, is run by the NOC in Tripoli, an institution that key foreign powers see as crucial to preventing Libya’s divisions from deepening.

| PPAC: Petroleum Planning and Analysis Cell, mt: million tonnes, mn: million, bn: billion, bcm: billion cubic meters, LPG: liquefied petroleum gas, OMCs: Oil Marketing Companies, RIL: Reliance Industries Ltd, IOC: Indian Oil Corp, CNPC: China National Petroleum Corp, HPCL: Hindustan Petroleum Corp Ltd, MoU: Memorandum of Understanding, JVs: joint ventures, ONGC: Oil and Natural Gas Corp, tmt: thousand metric tonne, DGCIS: Directorate General of Commercial Intelligence and Statistics, US: United States, PDVSA: Petróleos de Venezuela, OPEC: Organization of the Petroleum Exporting Countries, bpd: barrels per day, GUPCO: Gulf of Suez Petroleum Company, Petrobras: Petroleo Brasileiro SA, NOC: National Oil Corp |

NATIONAL: OIL

Refinery project to be completed by 2022: Rajasthan CM

5 November. Rajasthan Chief Minister (CM) Ashok Gehlot said construction of the Pachpadra refinery in Barmer was his government’s top priority. The project is a joint venture of the state government and HPCL (Hindustan Petroleum Corp Ltd). Around 25 percent of the work has been completed and a tender of Rs100 bn has been floated for further work. The project is expected to be completed by 2022, he said. HPCL CMD (chairman and managing director) M K Surana apprised the delegation via a model about crude oil coming to the refinery and the refining process.

Source: The Economic Times

GPS system for LPG tankers in Vattappara

4 November. Aiming at a permanent solution for the tanker vehicle accidents at Vattappara on NH 66, the district administration is planning to make a GPS system mandatory in all tanker vehicles passing through the route. A meeting convened by district collector Jafar Malik to discuss the issue of frequent accidents, has decided to introduce the GPS system in tanker vehicles which are carrying LPG (liquefied petroleum gas). The meeting has observed that the system will help police personnel deployed at the aid post in Vattappara receive prior information on the approaching LPG tanker vehicles, as they can track vehicles. Indian Oil Corp (IOC) authorities have sought a time of one month for the implementation of the system in their LPG tanker vehicles.

Source: The Economic Times

Private players stay away from India’s latest oilfield auction

QuIck Comment

Private players staying away from oilfield auctions is a sign of problems above and beneath the ground!

Bad!

|

1 November. The private players stayed away from the latest oilfield auction while the government received a total of eight bids, from ONGC (Oil and Natural Gas Corp) and Oil India Ltd (OIL), for seven blocks on offer. ONGC has submitted bids for seven blocks and OIL for one in the fourth round of the Open Acreage Licensing Programme (OALP), where bidding closed, according to the Directorate General of Hydrocarbons (DGH), the oil ministry arm that oversees oilfield auctions. No other company participated in the auction. This means ONGC will automatically get six blocks for lack of competition. For one block, it will have to compete with OIL. The fourth round offered the lowest number of blocks and also received the least bids, among all the auction rounds of OALP. In the second round, 14 blocks attracted 33 bids while in the third round, 23 blocks received 42 bids. In the first, 110 bids were received for 55 blocks on offer. In three rounds together, 87 blocks have been awarded. Under OALP, a company has the freedom to carve its own blocks and let the government know about its interest in the block, which would then put that up for auction. The company, which has initially shown interest in the block, gets some preferential points during bid evaluation. The government has recently reformed the policy regime for exploration licenses to attract private capital.

Source: The Economic Times

India signs deal with Saudi Arabia for strategic oil reserves & retail matters

30 October. India’s energy partnership with the world’s biggest oil producer that will enable energy security in the long term took a leap forward with a bilateral deal to build emergency crude reserves as a buffer against volatility in oil prices and supply disruptions for Asia’s third largest economy. Indian Strategic Petroleum Reserves Ltd signed an agreement with Saudi Aramco to lease part of the 2.5 million tonnes (mt) Padur storage in Karnataka. India has already built 5.33 mt of underground reserves in three locations, which can meet about 10 days of the country’s oil needs. Delhi plans two new reserves with a combined capacity of 6.5 mt, sufficient to cover for an additional 12 days. The deal with the Saudi Aramco was signed on the occasion of the visit of Prime Minister Narendra Modi. UAE (United Arab Emirates) has also contributed to the petroleum strategic reserves in India. The deal on strategic oil reserves was not the only outcome. The Middle East unit of India’s top refiner and fuel retailer, Indian Oil Corp (IOC), signed a preliminary deal with Saudi Arabia’s Al Jeri Transport Company for

QuIck Comment

Natural gas under GST will give it an advantage against polluting fuels!

Good!

|

cooperation in the downstream sector, including setting up fuel stations in the kingdom. Saudi Arabia has also expressed interest in picking up the government’s stake in Bharat Petroleum Corp Ltd (BPCL). Aramco is currently evaluating its Indian investments and views buying out BPCL as a good opportunity.

Source: The Economic Times

India’s crude oil production falls 5.41 percent in September

30 October. India’s crude oil production in September declined 5.41 percent to 2,6470 thousand metric tonne (tmt) on the back of output drop in fields operated by Oil and Natural Gas Corp (ONGC) Oil India Ltd (OIL) and joint venture (JV) companies. Oil production in the first six months (April-September) of the current financial year also declined 6 percent to 16,372 tmt. Production by ONGC in September declined 2.55 percent to 1,668 tmt due to decrease in production from fields in Andhra Pradesh, Assam and fields in western offshore. Cumulatively, the company’s production dropped 4 percent to 10,252 tmt in the first six months of the current fiscal. OIL, the other oil and gas explorer, reported a 5.4 percent decline in oil production in September at 260 tmt due to fall in production from fields in Assam. Cumulatively, the company’s oil production in the first six months declined 4.24 percent to 1,614 tmt mainly due to less than planned contribution from workover and drilling wells. Crude oil production by private players and JV declined 11.43 percent to 719 tmt in September. The fall was attributed to decline in production from fields situated in Rajasthan, Tamil Nadu, Assam, western offshore, eastern offshore and Gujarat offshore. Cumulatively, production by JVs during the first six months declined 10.74 percent to 4,505 tmt.

Source: The Economic Times

NATIONAL: GAS

PNGRB bats for bringing natural gas under GST

5 November. Inclusion of natural gas in the goods and services tax regime, pipeline tariff reform and pricing freedom for all domestic gas would be necessary to make the proposed gas trading hub a success, the chief of Petroleum and Natural Gas Regulatory Board (PNGRB) has said. India is aiming to build a gas trading hub to help develop the domestic gas market, and the downstream regulator, PNGRB, is working out regulations for the proposed hub. Natural gas, crude oil, jet fuel, petrol and diesel were not included in GST when it was rolled out two years ago as states, heavily dependent on petroleum taxes, resisted.

Source: The Economic Times

ONGC issues tender to supply 750k scmd of natural gas

5 November. Oil and Natural Gas Corp (ONGC) has issued a tender to supply 750,000 standard cubic meter per day (scmd) of natural gas beginning 26 December 2019 for three years from its eastern offshore gas field in Andhra Pradesh. The pricing basis for the tender is linked to Platts LNG DES West India price assessments. The reserve gas price for the tender would be calculated based on the simple average of daily Platts DES West India price for three months preceding the relevant month in which gas supplies are made plus a $1 per million metric British thermal units (mmBtu) constant, Platts said. The bids are required to be quoted as a premium over the reserve gas price, which will be published by ONGC on a monthly basis in $ per mmBtu. Based on the above formula, the reserve price for November would be $5.93 per mmBtu, Platts data showed. In comparison, the Reliance Industries Ltd (RIL) and BP domestic gas tender’s reserve gas price — priced at 8.4 percent of Brent — for November would be around $5.08 per mmBtu. Natural gas produced from discoveries in deep-water, ultra-deep-water and high pressure-high temperature areas can be priced independently, but has a price ceiling of $8.43 per mmBtu for October 2019 to March 2020. The government sets the price ceiling bi-annually. The ceiling price would be the lowest of imported prices of LNG, fuel oil or weighted average price of coal, fuel oil and naphtha. The price of domestic natural gas was set at $3.23 per mmBtu for October 2019 to March 2020 from regular gas fields.

Source: The Economic Times

RIL draws government ire by monopolising sale of its own CBM

30 October. The government is weighing options of terminating the production-sharing contract (PSC) or invoking arbitration to penalise Reliance Industries Ltd (RIL) for selling to itself all the coal-bed methane (CBM) it produces, allegedly in violation of policy. The government has informed RIL of its objection to the gas sale, but the company asserted it had acted transparently and correctly. RIL said that the gas sale had also maximised government benefits because it won the auction by bidding a higher price, which, in turn, increases the state share of profit from the output, apart from increasing tax revenue. According to policy, a producer can sell CBM to an affiliate if it fails to find a buyer in an open and transparent auction. The government felt RIL didn’t act in line with policy by not waiting to find a buyer, and participating in the auction along with other bidders. The oil ministry took a view late last year that RIL was wrong in buying all the CBM it would produce in Madhya Pradesh until March 2021. RIL had bid highest in an auction held in September 2017, which was preceded by two similar but shorter CBM auctions that year, in both of which RIL emerged winner.

Source: The Economic Times

India’s gas production dropped 4 percent in September

30 October. India’s natural gas production declined 4 percent to 2,568 million metric standard cubic meter (mmscm) in September due to drop in fields operated by Oil and Natural Gas Corp (ONGC) and joint venture (JV) companies. Gas production in the April-September 2019 period registered a marginal 1.5 percent drop at 16,005 mmscm. ONGC posted a 4.6 percent decline in gas production at 1,913 mmscm in September due to fall in output from fields in Andhra Pradesh, Assam, Gujarat, Tamil Nadu, Rajasthan and western offshore. Oil India Ltd (OIL), another oil and gas explorer, posted only a marginal increase in gas production at 232 mmscm in September due to decline in production from fields in Assam.

Source: The Economic Times

NATIONAL: COAL

India’s coal imports rise 9 percent to 127 mt in April-September

4 November. India’s coal imports increased by 9.3 percent to 126.91 million tonnes (mt) in the first six months of the ongoing fiscal, industry data showed. The country had imported 116.04 mt of coal in April-September period of FY2018-19, according to a provisional compilation by mjunction services, based on monitoring of vessels’ positions and data received from shipping companies. India’s coal and coke imports in September 2019 through the major and non-major ports are estimated to have decreased by 2.71 percent over August 2019. Imports in September 2019 stood at 18.62 mt (provisional) as compared to 19.14 mt (revised) imported in August 2019. The provisional figure for the month of August 2019 was 19.91 mt. Earlier, coal and coke imports in September 2018 stood at 17.79 mt. Of the total imports in September 2019, non-coking coal was at 12.23 mt against 12.38 mt imported in August 2019. Coking coal imports were at 4.59 mt in September 2019, almost unchanged from 4.58 mt imported a month ago.

Source: The Economic Times

Jindal Steel & Power wins coal block in auction

4 November. Naveen Jindal’s Jindal Steel & Power has won Gare Palma IV/5 coal block in the lastest round of auctions. JSPL emerged as the highest bidder for the coal block with a bid price of Rs230 per tonne, a premium of 53 percent over reserve price. The coal block was owned by the company before the Supreme Court in 2014 cancelled all captive mine allocations. The Gare Palma IV/5 mine in Chhattisgarh was closed since deallocation. In the first tranche of coal block auction in 2015, the coal ministry had rejected Jindal Power’s best bids for Gare Palma IV/2&3 block and Tara block that received low bids as compared to other blocks. The two Gare Palma blocks were given to Coal India Ltd (CIL) for operation and the high court later upheld the decision.

Source: The Economic Times

CIL advances target for 1 bt production by 2 yrs to 2024

2 November. Coal India Ltd (CIL) has decided to advance its target year for achieving an annual production capacity of 1 billion tonnes (bt) by two years — 2024. The company was earlier planning to achieve the target by 2019-20. However, lack of adequate demand and a plethora of issues with respect to raising production levels had forced the company to push back the deadline to 2025-26. Minister of Coal & Mines, Pralhad Joshi said CIL will produce 1 bt coal by 2023-24 and the company has to produce 750 million tonnes (mt) in the next fiscal. This year its production target is 660 mt which, analysts believe, may not be achieved due to a series of issues.

Source: The Economic Times

NATIONAL: POWER

Average monthly power price at IEX touches 2 year low

5 November. Indian Energy Exchange (IEX) traded 3,391 mn units of power at an average price Rs2.71 per unit, lowest in the last two years. Average market clearing price was down by 54 percent vis-à-vis price of Rs5.94 per unit in October’18 and 2 percent on month-on-month basis. All India peak demand at 164 GW in October’19 declined 4 percent over demand of 171 GW in October’18 and the energy met at 99 bn units declined 13 percent yoy (year-over-year), according to the NLDC (National Load Dispatch Centre) data. Extended monsoon was also one of the key reasons for decline in the demand for power. In the day-ahead-market, total monthly sell bids were 9,771 mn units while buy bids were 3,923 mn units. With sell side liquidity at three times of the buy bids coupled with lower clearing pries, the market helped save on high cost of power for discoms (distribution companies) as well as commercial & industrial consumers.

Source: The Economic Times

Tata Power arm to set up 10k microgrids, help electrify 5 mn homes

4 November. Tata Power said it will create an arm, TP Renewable Microgrid, to set up 10,000 microgrids to provide power to five millions homes across the country. The TP Renewable Microgrid would be set up in collaboration with Rockefeller Foundation, which will provide technical support to the offshoot for achieving its objective. The TP Renewable Microgrid represents important scaling up of efforts to provide access to affordable, reliable and clean electricity in India, and will serve as a model for expanding access to more than 800 mn people who are without power worldwide, Tata Power said.

Source: Business Standard

Anti-power theft campaign fetches Jaipur discom Rs910 mn

2 November. Jaipur discom (distribution company) has busted over 28,000 cases of power theft and misuse in the last five months and earned Rs910 mn in fines and revenues. The discom had launched an intense vigilance campaign against power theft and misuse at the feeders from June where the highest pilferage of power was reported under municipal areas. Jaipur discom managing director AK Gupta said under the anti-power theft campaign in all the 13 circles, they unearthed 28,657 cases of power theft from June to October. He said a penalty of Rs680 mn had been imposed on consumers found stealing power and Rs231.8 mn recovered in revenue. Recovery of remaining penalty and legal action was being taken against guilty individuals/consumers, he said. Gupta informed that power theft prevention police stations had registered 4,527 FIRs during the same period and 131 persons had been arrested. He said vigilance anti-power theft campaign would continue in a more effective manner in the coming days.

Source: The Economic Times

UP tops list of states on power dues with Rs130 bn unpaid bills

1 November. Uttar Pradesh (UP) government departments owe more than Rs130 bn in electricity bills to the state power utilities, which also makes the state top ranked among peers in this regard. While UP has emerged as the chart topper with its various government departments, state agencies and urban local bodies (ULB) collectively owing Rs133.61 bn in power arrears till September 2018-19, Telangana and Andhra Pradesh stood distant 2nd and 3rd with corresponding figure of Rs67.37 bn and Rs49.13 bn respectively. Recently, the 15th Finance Commission had also red-flagged the burgeoning losses of UP power utilities, which currently stand at Rs180 bn even after the implementation of Ujwal Discom Assurance Yojana (UDAY). The Yojana was aimed at financial restructuring of Indian power distribution companies (discoms) that were struggling under collective losses of Rs3.6 tn. In Uttar Pradesh, UDAY was projected to accrue savings of Rs330 bn for the state discoms and help them raise fresh capital for future investments. However, the discoms have continued to grapple with challenges due to high AT&C (aggregate technical and commercial) losses, low bill realisation and rampant power theft. Meanwhile, in the pecking order of the top 10 power defaulter states, Maharashtra, Chhattisgarh, Kerala, Tamil Nadu, Punjab, Bihar and Haryana trail top ranked UP, Telangana and Andhra Pradesh, with the collective dues amounting to Rs372.11 bn. Interestingly, UP government departments with Rs133.61 bn outstanding, comprise almost 36 percent of the total power dues pertaining to the top 10 states. However, the Yogi Adityanath government is now ready to bite the bullet and pare the losses of state power companies to keep them afloat, especially in the backdrop of the ambitious target to provide 24 hour uninterrupted electricity supply to all households going forward. Recently, the state had announced to install pre-paid smart meters at the premises of government departments to ensure timely payment of dues and spur economic use of energy. UP Power Consumers Council president Awadhesh Kumar Verma had submitted a memorandum to State Energy Minister Shrikant Sharma demanding urgent corrective measures, so that the benefit also percolates to the common power consumers.

Source: Business Standard

UP government plans prepaid smart electricity meters from 15 November

30 October. The Uttar Pradesh (UP) government is planning to install prepaid smart meters for electricity consumption from mid-November. Energy Minister Shrikant Sharma said that the state government will begin this exercise from the residence of officials, elected representatives and Ministers.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Gujarat sets 30 GW renewable energy generation target by 2022

5 November. Gujarat government has set a target of 30,000 MW of renewable energy generation by 2022 from the current 9,670 MW. At present, the state has a total of 9,670 MW production of renewable energy which includes 6,880 MW wind energy and 2,654 MW solar energy. Gujarat has overtaken Maharashtra as its contribution in the country in industrial production increases 16.81 percent compared to 14.21 percent of latter.

Source: The Economic Times

AEC former chairman wants government to follow France, China on nuclear power addition

5 November. AEC (Atomic Energy Commission) former chairman Anil Kakodkar has called for emulating France and China to add nuclear power capacity so that we become self-sufficient in energy. The noted nuclear scientist while appreciating the ongoing efforts to augment nuclear power capacity, said the pace in which it needs to go forward is lacking. The Department of Atomic Energy has set a target of 63 GW of installed nuclear power capacity by the turn of 2032. But the 22 operational nuclear power plants currently produces only 6,780 MW. Of this, 18 reactors are PHWRs (pressurised heavy water reactors) which all have 95 percent value addition done indigenously. The government has set a target of 175 GW from renewables by 2022, of which nearly 100 GW are expected to come from solar. As of end June, 80.46 GW of renewables has been installed.

Source: The Economic Times

Air pollution heading towards Rajasthan, request Centre to consider it as top priority: Gehlot

4 November. Rajasthan Chief Minister Ashok Gehlot has opined that the central government should not simply leave the issue of air pollution to the Delhi government and consider it as “top priority” which should be resolved permanently. Stating the “pollution is now heading towards Rajasthan” after engulfing the rest of the Northern states, Gehlot said. Gehlot stated closing schools and factories is not going to be enough to tackle the situation. Air pollution levels in the national capital escalated to hazardous and visibility dropped significantly as a thick blanket of smog engulfed several parts of the city despite mild showers. Notably, for the first time in this season, the Air Quality Index (AQI) docked as high as 625. An AQI between 0-50 is considered “good”, 51-100 “satisfactory”, 101-200 “moderate”, 201-300 “poor”, 301-400 “very poor”, and 401-500 “severe”. Above 500 is “severe-plus emergency” category. Looking at the worsening air quality in the national capital, Arvind Kejriwal-led Delhi government has brought back its Odd-Even scheme. It will go on till 15 November.

Source: The Economic Times

India taking continuous initiatives to develop clean energy: Vardhan

4 November. Union Minister Harsh Vardhan said that India has continuously taken initiatives and shown leadership qualities for developing clean energy and counter climate change. Vardhan said that India has invested in around eight areas involving biofuels, smart grids and other related subjects.

Source: The Economic Times

Want to check possibility of tidal power plant in Goa: Cabral

4 November. Power Minister Nilesh Cabral said that Goa, which is dependent on the central grid for power, is exploring the possibility of setting up a tidal power plant. He said that the state government is keen on sending a delegation to Israel to examine the feasibility of such a plant. The official delegation will comprise four to five members who will go to Israel and study the concept of tidal energy to be adopted in Goa, he said. Goa’s maximum demand for power is around 550 MW for the 5.8 lakh consumer base.

Source: The Economic Times

Inox Wind secures 38 MW order from ReNew Power

4 November. Leading wind energy solutions provider Inox Wind said it has bagged an order for a 38 MW wind power project to be developed at Anjar town in Kutch district of Gujarat. The project from ReNew Power Ltd is under the Solar Energy Corp of India (SECI) second regime. It is scheduled to be commissioned by January 2020. The order comprises of supplying 19 units of Inox Wind’s 2 MW 113 metre rotor diameter turbine combined with 92 metre hub height. ReNew Power is already an existing customer of Inox Wind with an installed capacity of 236 MW supplied by Inox Wind spread across multiple wind-rich states. India has set an ambitious target of having 175 GW of clean energy capacity by 2022, including 100 GW solar and 60 GW of wind energy.

Source: The Economic Times

India needs $30 bn yearly investment in renewables

4 November. India ideally needs $30 bn investment per year in the renewable sector, backed by a strong regulation to preserve contract sanctity. Arunabha Ghosh, chief executive officer of Council on Energy, Environment and Water, said the sanctity of contracts means the authority cannot change terms and conditions of the contract and if done so, the investor or project operator is compensated as per original contract. He highlighted the council’s study on financing of de-risked project, which showed that 60-75 percent of the cost of tariff of electricity is the cost of finance. It is not the cost of solar panels or turbines.

Source: The Economic Times

MNRE planning review of 5 GW solar power scheme under JNNSM

4 November. The Ministry of New and Renewable Energy (MNRE) is planning to review a programme that aims to set-up 5,000 MW of solar power generation capacity under the Jawaharlal Nehru National Solar Mission (JNNSM). MNRE has invited bids from consultants for evaluation of the scheme under batch-IV of the phase-II of JNNSM. According to the document of the proposed study, proposals have been invited from the eligible parties within three weeks from the date of notification inviting bids i.e. by 20 November. The government has been implementing this scheme since February 2016 with the objective of implementation of at least 5,000 MW grid-connected solar projects with viability gap funding. The solar power procured from the projects is being sold to discoms (distribution companies) and state utilities at a pre-defined tariff or tariff discovered through competitive e-bidding, with a trading margin of 7 paisa per kilowatt hour assigned by the Solar Energy Corp of India. The ministry said that the detailed study report on the evaluation of the scheme would be prepared by the bidder to determine the extent to which it has been implemented during the period between 2015-2016 and 2018-2019 by random sample selections of the solar projects out of the total projects commissioned under the scheme. The evaluation must be done by the bidders on the need for continuation of the scheme along with the period of further continuation. The Central Financial Assistance provided under the scheme for the solar projects also need to be reviewed and recommendations should be suggested in the same. According to the ministry, other areas of evaluation would include assessment of tariffs for solar projects under the scheme, constraints and roadblocks under the current model, especially, if it has to be extended to the northeast regions of the country, and ways to increase the involvement of state governments in the implementation of the scheme.

Source: The Economic Times

Merkel visits Delhi Metro station fitted with Germany-funded solar panel

3 November. German Chancellor Anjela Merkel visited the Dwarka Sector 21 metro station, which is fitted with solar panels funded by the KfW, a state-owned development bank of her country. Merkel visited the terrace of the metro station where she was briefed by officials of the Delhi Metro Rail Corp (DMRC) about the solar project. The Frankfurt-based bank has also offered soft loans for other projects in India, including the Clean Ganga Mission. The visit to the metro station, the first-solar fitted one in the mammoth Delhi Metro network, was the last leg of Merkel’s trip to India.

Source: Business Standard

IIT-Kharagpur implements micro solar dome project to provide affordable clean energy

2 November. IIT-Kharagpur said 44,000 micro solar domes will be provided to poor households in rural areas of ten states under a project to provide clean energy at an affordable price. Poor families are often unable to afford the grid- connected electricity while others may find disruption of power supply due to natural disasters. The project intends to provide 44,000 micro solar domes in households of marginalised (SC and ST) communities in rural areas in West Bengal, Chhattisgarh, Madhya Pradesh, Kerala, Assam, Odisha, Tripura, Manipur, Rajasthan, and Bihar.

Source: The Economic Times

BHEL to commence work on floating solar plant at NTPC

2 November. Bharat Heavy Electricals Ltd (BHEL) is all set to commence construction of the 25 MW floating solar power plant at NTPC Simhadri Super Thermal Power Station in Deepanjalinagar, 40 km from the city. Once completed, the floating solar power plant would be the largest in Andhra Pradesh. This also marks the second largest initiative taken by NTPC towards adopting renewable energy, after the 100 MW floating solar photovoltaic power plant at Ramagundam in Telangana. BHEL has the largest portfolio in the green initiative segment for generation of renewable energy by offering engineering solutions for off-grid and grid-interactive solar photovoltaic power plants, rooftop, floating solar and canal-top solar projects.

Source: The Hindu

Government agency, L&T among 9 penalised for pollution in Greater Noida

2 November. Dedicated Freight Corridor Corp of India Ltd (DFCCIL) and engineering major Larsen & Toubro (L&T) are among nine entities penalized for causing pollution by construction works in Greater Noida. A total penalty of Rs5.25 lakh was slapped on the nine entities by the regional office of Uttar Pradesh Pollution Control Board (UPPCB), amid a health emergency being declared in Delhi-NCR as pollution levels deteriorated to the “severe plus” category. The EPCA, a Supreme Court-mandated panel, declared a public health emergency in the Delhi-NCR and banned construction activity till 5 November. The EPCA also banned the bursting of crackers during the winter season and directed that all coal and other fuel-based industries, which have not shifted to natural gas or agro-residue, will remain shut in Faridabad, Gurugram, Ghaziabad, Noida, Bahadurgarh, Bhiwadi, Greater Noida, Sonepat, Panipat till the morning of 5 November.

Source: Business Standard

Puducherry Legislative Assembly gets solar power plant to reduce power bills

1 November. The Legislative Assembly Secretariat in Puducherry inaugurated its rooftop solar power project. The 20 kW solar plant will generate 100 units of power per day. The solar panels costing ₹11.32 lakh are mounted on to three buildings in the Legislative Assembly complex. They are expected to generate around 30,000 units of electricity every year and will reduce electricity bills by₹1.68 lakh per year. Under the Solar City Project, the Renewable Energy Agency of Puducherry (REAP) has entered into an agreement with an agency for installing roof-top panels on 22 government buildings. The project aims to generate 950 kWp (kilowatt peak) of power per day from the panels. This will reduce power bills by ₹15 lakh per year.

Source: The Hindu

Andhra Pradesh problems could hurt India’s renewables target: ReNew Power

QuIck Comment

Reneging of RE contracts by Andhra Pradesh may just be the first of more in the future!

Ugly!

|

1 November. Investors could be put off India by Andhra Pradesh state’s difficult relationship with renewable energy companies, Sumant Sinha, chair of Goldman Sachs-backed ReNew Power, said. India, the world’s third-largest emitter of greenhouse gases, wants to raise its renewable energy capacity to 500 GW, or 40 percent of total capacity, by 2030. The southern state of Andhra Pradesh is among the largest adopters of renewable energy and ReNew Power, about 49 percent owned by Goldman Sachs, is India’s largest renewable energy company. But the state has been curtailing power procurement from renewable energy companies, citing high prices, and pushed to renegotiate its supply contracts with them. Foreign investment is central to India’s green energy ambitions, and a slowdown in overseas funding could hurt Prime Minister Narendra Modi’s commitment to increase adoption of renewable energy. ReNew has an installed capacity of over 5 GW and plans to add another 3 GW by mid-2021. Andhra Pradesh, which accounts for about a 10th of India’s renewable energy capacity, owes green energy generators Rs25.1 bn ($353.5 mn).

Source: Reuters

1.5 mn more people may die in India by 2100 due to extreme heat by climate change

31 October. Around 1.5 mn more people may die in India each year due to extreme heat by 2100, a new study has found. The study conducted by Tata Centre for Development (TCD) at the University of Chicago, USA, which was released at UChicago Centre, said that continued high emissions of greenhouse gases are projected to lead to a four degree celsius rise in average annual temperature in India by 2100. The study said that the average number of extremely hot days around the country, presently over 35 degree Celsius, are likely to increase by more than eight times per year to 42.8 degree Celsius. Six states of Uttar Pradesh, Bihar, Rajasthan, Andhra Pradesh, Madhya Pradesh and Maharashtra are estimated to contribute 64 percent of the total excess deaths — more than 1.5 mn deaths each year in all — due to temperature rises caused by climate change, the study said. The study is the first in a series of findings estimating the human and economic costs of climate change and weather shocks in India, conducted by the Climate Impact Lab in collaboration with the TCD. According to the study, while Delhi is projected to experience 22 times more extremely hot days by 2100, Haryana will be 20 times hotter, Punjab and Rajasthan will be 17 seven times hotter, respectively.

Source: Business Standard

Himachal CM lays stone for 240 MW Kuthed Hydro Electric Project

30 October. Himachal Pradesh Chief Minister (CM) Jai Ram Thakur inaugurated and laid foundation stones for developmental projects of Rs2.09 bn in Bharmour and Pangi areas of Chamba district. He laid the foundation stone for 240 MW Kuthed Hydro Electric Project to be constructed at a cost of Rs27.50 bn. He also inaugurated 15 MW Kawarsi and 9 MW Salun Hydro Electric Projects at Hiling village in Holi constructed at a cost of Rs1.5 bn and Rs900 mn, respectively.

Source: The Economic Times

INTERNATIONAL: OIL

Saudi Arabia raises December crude oil prices to Asia

4 November. Saudi Arabia has raised its December official selling price (OSP) for its Arab Light grade for Asian customers by $0.40 a barrel versus November to a premium of $3.40 per barrel to the Oman/Dubai average, state oil company Aramco said. The world’s top oil exporter was expected to raise prices of light crude grades it sells to Asia in December amid higher Middle East benchmarks, while a slump in fuel oil margins could lead to a deep price cut for its heavy grade, a survey showed.

Source: Reuters

Abu Dhabi approves new pricing mechanism for ADNOC’s Murban crude

4 November. Abu Dhabi’s Supreme Petroleum Council (SPC) approved the launch of a new pricing mechanism for Abu Dhabi National Oil Co (ADNOC)’s flagship Murban crude. ADNOC is seeking to emulate the success of rival oil majors and bolster its regional influence. The SPC, Abu Dhabi’s highest governing body for the oil and gas industry, also announced a rise in the UAE’s oil and gas reserves, ADNOC said. ADNOC’s Murban crude would be listed as a futures contract on an internationally recognized exchange and ADNOC will engage with customers and other stakeholders in coming months for the implementation of its new forward pricing mechanism, it said. ADNOC said it expected to implement its new Murban crude forward pricing mechanism between the second and third quarters of 2020. Murban light crude production is around 1.6-1.7 mn barrels per day, and is exported from Fujairah on the Gulf of Oman.

Source: Reuters

Kosmos Energy finds oil off Equatorial Guinea: Oil ministry

3 November. US (United States) oil company Kosmos Energy has made an oil discovery at its S-5 well offshore of Equatorial Guinea, hitting 39 metres of net oil play, the Ministry of Mines and Hydrocarbons said. The oil ministry said the well was drilled at a depth of 4,400 metres and was located in the Santonian reservoir offshore in the Rio Muni basin. Equatorial Guinea, a small West African member of the Organization of the Petroleum Exporting Countries (OPEC), derives more than 90 percent of its foreign revenues from its oil and gas industry and is hoping further exploration will help bolster dwindling reserves.

Source: Reuters

INTERNATIONAL: GAS

Japanese-backed Australian LNG import project faces delay

4 November. Plans for a Japanese-backed project to import liquefied natural gas (LNG) to Australia have hit a hurdle as the group struggles to lock in customers, including Australia’s top gas retailer, Origin Energy. Potential buyers are holding off signing contracts after a drop in local gas prices, industry observers and sources said, leaving the A$250 mn ($171 mn) project well behind its initial schedule of delivering gas in late 2020. The delay risks Australian Industrial Energy (AIE)’s aim of opening a gas terminal in Port Kembla in New South Wales state ahead of a rival project by Australia’s AGL Energy, while both projects are racing to meet a looming gas shortage. AIE, backed by Japan’s JERA, the world’s biggest LNG buyer, trading house Marubeni Corp and Australian mining billionaire Andrew Forrest’s Squadron Energy, is one of five projects aiming to bring gas to southeast Australia. It had hoped its Port Kembla Gas Terminal would start delivering imported gas to industrial users, such as chemicals and brick makers, in late 2020, making it the first off the rank.

Source: Reuters

Israel-Egypt gas pipeline deal seen imminent

3 November. A deal that would transfer control of a natural gas pipeline between Israel and Egypt is expected to be closed in the next few days, the companies said. Texas-based Noble Energy, Israel’s Delek Drilling and Egyptian East Gas Co have partnered in a venture called EMED, which last year agreed to buy a 39 percent stake in the subsea EMG pipeline for $518 mn that will carry Israeli gas exports to Egypt. Partners in Israel’s Leviathan and Tamar offshore gas fields had agreed to sell $15 bn worth of gas to a customer in Egypt — Dolphinus Holdings — but the deal was amended to boost supply by 34 percent to about 85 billion cubic meters (bcm), or an estimated $20 bn. The supply deal with Egypt is expected to start in January.

Source: Reuters

Growth in China’s LNG imports tumbles as economy slows

1 November. Growth in Chinese imports of liquefied natural gas (LNG) is set to slow sharply this year reflecting a slowing economy and record high coal imports, according to analysts. Beijing since 2017 has pushed households to convert to gas or electric heating from coal and this year has set its highest yet target for conversions at 5.24 mn households. However, growth of LNG demand in China in 2019 is expected to slow to 14 percent-17 percent from 41 percent-42 percent in 2018, according to analysts from Wood Mackenzie and IHS Markit. China bought 9.47 mn cubic metres of LNG in October, its lowest intake since April and down 2.5 percent from a year earlier despite adding LNG terminals and storage, vessel-tracking and port data compiled by Refinitiv showed. Gas faces competition, however, with more than half of the 5.24 mn households due to ditch coal expected to switch to non-gas heating such as electricity and geothermal, according to the Ministry of Ecology and Environment, which drafts and implements China’s winter anti-pollution campaigns. Gas is five times more expensive than coal. China’s economy grew at its slowest pace in almost 30 years in the third quarter, putting Beijing under increasing pressure to lower costs for industry. Benchmark LNG prices in China rose 19 percent to 4,178 yuan a tonne in October from a month earlier, according to Sublime China Information Co, a China-based consultancy.

Source: The Economic Times

Russia’s Sakhalin-2 LNG plant’s expansion put on hold

1 November. Plans for the expansion of Russia’s Sakhalin-2 liquefied natural gas (LNG) plant have been put on hold, according to three sources involved in the project, a potential setback to Russia’s ambition to lift its global LNG market share. The main reasons for the hold-up are the lack of gas resources and international sanctions, the sources said, but plans of Russian gas giant Gazprom to boost its pipeline gas supplies to China, have also had an impact. Russia plans to raise its global LNG market share from less than 10 percent now to 20 percent by 2035, mainly thanks to cranking up of output by non-state producer Novatek and its partners in the Arctic. Gazprom, Russia’s sole exporter of natural gas via pipelines, has been slower in its LNG plans, focusing on pumping the fuel via pipes instead. Sakhalin-2, off the country’s eastern shores, is Russia’s first LNG producing plant with a capacity of over 10 million tonnes per year. Its two production units, or trains, were launched in 2009 in strategic proximity to Japan, the world’s largest consumer of the sea-borne LNG. The consortium, Sakhalin Energy, has plans to expand and build a third train with a capacity of 5 million tonnes per year. Gazprom had said the expansion could happen in 2021. Yet, Sakhalin-1, where the state oil company Rosneft is also a shareholder, is aiming for its own LNG plant. The talks about usage of Sakhalin-1 gas for the Sakhalin-2 LNG plant’s expansion have dragged on for years.

Source: Reuters

UK sends record LNG volumes to gas system amid cargo influx

31 October. The amount of liquefied natural gas (LNG) sent to the UK (United Kingdom) gas system jumped to the highest level since Refinitiv Eikon data began five years ago, as the country accommodates ample cargo arrivals amid oversupplied global LNG market. With a total of nine cargoes expected at the Isle of Grain and South Hook terminals by the end of next week, Britain’s third terminal, Dragon, has started to send gas to the system after being idle for more than three months, the data showed. British terminals are expected to send around 110 million cubic meters (mcm) of LNG to the country’s gas system, equivalent to 40 percent of Britain’s gas demand, expected at around 275 mcm according to National Grid data.

Source: The Economic Times

Ukraine parliament approves break-up of state gas behemoth in nod to EU

31 October. Ukraine’s parliament passed a law to establish an independent gas transit operator, a move aimed at creating a competitive domestic gas market and helping the country’s position in trilateral gas transit talks with the EU (European Union) and Russia. To comply with European energy rules, Ukraine has committed to split its Naftogaz energy firm into production and transportation companies.

Source: Reuters

INTERNATIONAL: COAL

Court dismisses appeal against Australia’s New Hope’s Acland coal project

1 November. Australian coal producer New Hope Corp Ltd said it welcomed a court’s decision dismissing an appeal against the granting of licenses for its New Acland Coal Stage 3 project. An activist group, Oakey Coal Action Alliance, had appealed court decision in September in favour of the stage 3 Acland Coal project. Due to the delays, the coal producer said in September it was laying off 150 workers at the project. The company said the New Acland Stage 3 Project will create about A$7 bn ($4.8 bn) in economic activity over the expected 15-year life of the project.

Source: The Economic Times

South Korea to close 6 older coal-fired power plants by 2021, from planned 2022

1 November. South Korea’s six older coal-fired power plants will be retired by 2021, a year earlier than previously planned, as part of the country’s ongoing efforts to curb air pollution, the prime minister’s office said. South Korea, Asia’s fourth-largest economy, runs some 60 coal-fired power plants, generating around 40 percent of the country’s electricity, but coal has been blamed for worsening air quality in the country. The six older coal-fired power plants account for 7 percent of the total installed coal power capacity, or 2.6 GW, according to data from Korea Electric Power Corp. South Korea stops operations at some ageing coal-fired power plants from March to June every year to reduce air pollution levels and put a cap on coal power operations when an air pollution advisory is issued.

Source: Reuters

INTERNATIONAL: POWER

Belgium at odds with the Netherlands over power plant plans

5 November. The Belgian Federal Minister for Energy Marie Christine Marghem (MR) has received a letter from her Dutch counterpart Eric Wiebes, in which he is opposed to the Maasbracht (Netherlands) power station, currently shut down, being used in the future to supply Belgium alone with electricity. The power station has a 1,304 MW capacity, the equivalent of the amount consumed by 3 mn domestic users, and is located near the Belgian-Dutch border at Maasbracht in the Netherlands. Its owner, the energy consortium RWE, and the Luxembourg company Nuhma have already given notice of their project to deploy an underground high-voltage power line to link the power station to the Belgian grid by 2020.

Source: The Brussels Times

South African union threatens power shutdown over Eskom split

30 October. South Africa’s National Union of Mineworkers (NUM) threatened to shut down the country’s power sector over the government’s decision to forge ahead with a plan to break up struggling state power firm Eskom. NUM, one of the largest unions at Eskom, fears that the government’s plan to split Eskom into different units for generation, transmission and distribution will lead to job losses.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

OPEC fully supports Paris climate pact: Barkindo

5 November. OPEC (Organization of the Petroleum Exporting Countries) Secretary-General Mohammad Barkindo said that the oil producer group fully supports the Paris Agreement on climate change, a day after the Trump administration said it had filed paperwork to withdraw the United States (US) from the pact. The US move is part of a broader strategy by President Donald Trump to reduce red tape on American industry, but comes at a time scientists and many world governments urge rapid action to avoid the worst impacts of global warming.

Source: Reuters

Norway working on new plans to speed up wind projects after framework scheme fails: Energy Minister

5 November. Norway is working on a new licensing system to speed up the construction of onshore wind farms after a public backlash forced it to abandon a previous plan to develop the sector, Energy Minister Kjell-Boerge Freiberg said. The government shelved a wind power framework proposed by the Norwegian Water Resources and Energy Directorate (NVE), casting uncertainty on applications for new wind farms amid an existing moratorium on licenses. The NVE stopped approving new wind power projects in April after a raft of protests to give the government time to work on a new framework for developments.

Source: Reuters

ADB signs $60 mn private sector deal to build hydropower plant in Nepal

3 November. The Asian Development Bank (ADB) has signed a $60 mn financing package with Nepal Water and Energy Development Company (NWEDC) to help build and operate a 216 MW run-of-the-river hydropower plant on the Trishuli River near the capital Kathmandu. The project is one of the largest private sector investments in Nepal to date. It will enhance the country’s energy security by helping to utilise its renewable hydro resources and reduce imports of electricity. Once operational, the plant is expected to provide over 1,200 GWh (gigawatt hour) of clean electricity annually to the national grid.

Source: The Economic Times

Dutch climate plans will miss targets

1 November. The Netherlands – one of the European Union (EU)’s biggest polluters – looks set to miss its own target for reducing greenhouse gas emissions in the next decade, its main environmental advisory body said. A recent raft of environmental initiatives would cut emissions to 43-48 percent below 1990 levels by 2030, if the plans are all rolled out on time, research institute PBL said. But that would be less than the 49 percent target that Dutch authorities have set for 2030. The EU-wide goal for CO2 (carbon dioxide) emissions over the next 10 years is a 40 percent cut. The Netherlands – home to many large industries, Europe’s main seaport and an abundant supply of cheap natural gas – was fifth in the rankings of the bloc’s top CO2 emitters per capita in 2017, ahead of Germany and Poland. The government presented a range of measures in July to reach its climate goals – which ultimately aim to make the Dutch economy almost completely carbon neutral by 2050.

Source: Reuters

Spain to host UN climate talks in December after Chile cancels

1 November. Spain will host UN (United Nations) climate change talks in December after Chile withdrew, the UN said, a last-minute switch which raises big logistical challenges and has left activist Greta Thunberg stranded on the wrong side of the Atlantic. The UN climate change talks, known formally as COP25, will be held 2-13 December, as originally planned, but in Madrid – over 10,000 km (6,000 miles) away from Chile’s capital Santiago where it was initially meant to take place. The conference comes amid calls for swift action from environmental groups and climate protesters, with recent scientific reports urging sweeping measures to keep global temperatures from rising more than 1.5 degrees Celsius.

Source: Reuters

US solar firms see growth in fire-stricken California

1 November. Solar companies expect a run of California wildfires that triggered power outages across vast swathes of the state will fuel demand for panels and battery storage systems from homeowners seeking to avoid blackouts. The fires, driven by howling seasonal winds, have forced California power utility PG&E to cut electricity to millions of people to prevent its transmission lines from touching off new blazes. Solaria, a California-based solar panel manufacturer, has also introduced a discount of 2 percent to 5 percent for California installers who put up its product.

Source: Reuters

Europe’s carbon market emissions fell 4 percent in 2018

31 October. Emissions regulated by Europe’s carbon market fell by 4 percent in 2018, the European Commission said, as renewable power generation increased. About 45 percent of the European Union’s output of greenhouse gases is regulated by the Emissions Trading System (ETS), the bloc’s flagship policy to tackle global warming by charging for the right to emit carbon dioxide (CO2). The Commission said that emissions from power stations and industrial companies covered by the scheme fell 4.1 percent last year, representing about 73 million tonnes (mt) of CO2 equivalent. The figure was in line with forecasts made earlier in the year by analysts at Refinitiv, examining provisional raw data.

Source: Reuters

Southeast Asia may become net fossil fuel importer in coming years: IEA

30 October. Southeast Asia could become a net importer of fossil fuels in the next few years, raising the financial burden on governments and increasing carbon emissions in the region, the International Energy Agency (IEA) warned in a report. Southeast Asia was already a net oil importer at 4 mn barrels per day (bpd) in 2018, while strong growth in demand for natural gas has reduced the surplus of gas for export. For coal, output from the region’s top producer, Indonesia, remained well above 400 million tonnes of coal equivalent last year but increases in domestic demand and exports to China and India could reduce its surplus, the IEA said. Renewable energy is set to play a larger role, but without stronger policy frameworks the share of renewables in power generation would rise only to 30 percent by 2040, from the current 24 percent, the IEA said.

Source: Reuters

Germany’s RWE looks to enter Japan offshore wind power market

30 October. German utility RWE is looking to invest in Japan’s offshore wind power projects and is in talks with potential Japanese partners as it aims to expand its global renewable portfolio. RWE has transformed itself by taking over the renewables activities of subsidiary Innogy and peer E.ON, which was part of a major reshuffle of Germany’s power sector. RWE is now the world’s No.2 operator of offshore wind farms behind Denmark’s Orsted, with a total installed offshore wind capacity of 2.5 GW. Japan’s offshore wind power market is expected to take off as the government enforced a law to enhance development of wind farms.

Source: Reuters

Israeli investment firm to raise $89 mn for Spanish wind project

30 October. Israeli investment firm Novasec said it has partnered with Enlight Renewable Energy to raise €80 mn ($89 mn) to help fund a 312 MW onshore wind farm in Spain. The Gecama wind project, located in the Castilla La-Mancha region in central Spain, is owned by renewables developer Enlight and is expected to start construction in the first quarter of next year and will cost up to €330 mn to complete. Novasec, which finances renewable energy projects, said Gecama will be Spain’s largest onshore wind farm. The total revenue of the project will be around €2 bn over its lifetime.

Source: Reuters

DATA INSIGHT

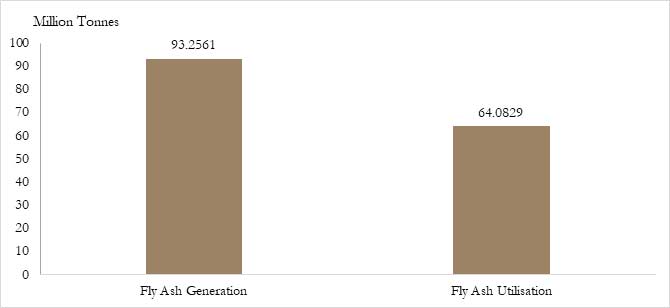

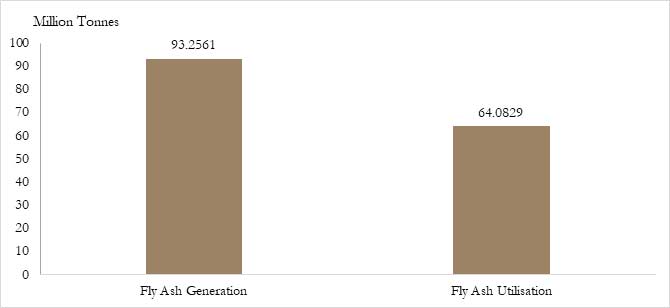

Scenario of Fly-ash Generation & Utilisation by Thermal Power Stations in India

|

Number of TPS |

Installed Capacity |

% Utilisation of Fly Ash

[2018-19 (April-September)]

|

| Andhra Pradesh |

9 |

12270 |

88.75 |

| Assam |

1 |

500 |

20.83 |

| Bihar |

3 |

4270 |

38.11 |

| Chhattisgarh |

21 |

19035 |

58.22 |

| Delhi |

2 |

840 |

94.44 |

| Gujarat |

11 |

14442 |

109.69 |

| Haryana |

3 |

2840 |

87.64 |

| Jharkhand |

7 |

4897.5 |

86.6 |

| Karnataka |

6 |

8680 |

68.65 |

| Madhya Pradesh |

9 |

12460 |

41.88 |

| Maharashtra |

19 |

18736 |

66 |

| Odisha |

7 |

7588 |

61.84 |

| Punjab |

4 |

3620 |

116.95 |

| Rajasthan |

5 |

4850 |

107.5 |

| Tamil Nadu |

10 |

8740 |

83.59 |

| Telangana |

5 |

3022.5 |

73.38 |

| Uttar Pradesh |

16 |

18690 |

54.76 |

| West Bengal |

18 |

14142 |

79.25 |

|

156 |

159623 |

68.72 |

All India Fly Ash Generation & Utilisation by TPS, 2018-19 (April-September)

Source: Central Electricity Authority

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2019 is the sixteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV