NO COAL WOES THIS SUMMER

Coal News Commentary: April - May 2019

India

CIL supplied 488 mt of fuel to the power sector in the 2018-19 fiscal, registering an increase of 7.4 percent over the previous year. The world’s largest coal miner had dispatched 454.2 mt of coal to the power sector in 2017-18, as per the latest government data. CIL supplied 46.1 mt coal to the power sector in March as against 42.7 mt in the same month of the previous fiscal. The supply of fuel by SCCL to the sector in 2018-19 went up to 55.4 mt, from 53.5 mt in the previous year. SCCL is a government coal mining company jointly owned by the Centre and Telangana. The March supply was almost flat at 5.4 mt, against 5.3 mt in the year-ago month.

CIL said its coal production in April 2019 rose by 1 percent to 45.29 mt as compared with 44.86 mt year ago. Coal offtake during April rose 2.6 percent to 52.35 mt as compared with 51.02 mt in the year-ago period, CIL said. South Eastern Coalfields Ltd and MCL, subsidiaries of the company, were the major contributors to the monthly production by generating 11.11 mt and 11.74 mt of coal, respectively.

SCCL has set a target of 70 mt of coal production for the current fiscal (2019-20). Singareni Coal has high demand in Telangana State as well as from other States and to meet this demand apart from increasing coal production, construction of new Coal Handling Plants enabling coal transport and modernisation of old ones are to be taken up immediately. SCCL produced about 65 mt of coal in FY 18.

CIL’s coal allocation under spot e-auction scheme declined by 37.7 percent to 34.34 mt in the last fiscal (2018-19). The country’s top dry-fuel miner had allocated 55.17 mt of coal in FY 2018, according to government data. However, the coal allocated by CIL under the scheme in March increased by 10.2 percent to 4.18 mt, compared to 3.79 mt in the corresponding month of FY 2018, it said. Coal distribution through e-auction was introduced with a view to provide access to coal for such buyers who are not able to source the dry fuel through the available institutional mechanism, as per the information available on CIL website. The purpose of e-auction is to provide equal opportunity to purchase coal online through single window service to all intending buyers. CIL accounts for over 80 percent of domestic coal output. The company reported a growth of 7 percent in coal production to 606.9 mt in 2018-19, a shade below the MoU target of 610 mt with the coal ministry. The coal production stood at 567.4 mt in FY 2018.

Privately-owned thermal power units have complained about coal price increase in the SFeA by CIL and its subsidiary companies. The thermal companies have alleged that coal firms have increased reserve price in the range of 10-32 percent. In 2016, SFeA was introduced for those power units that do not have a long-term fuel supply agreement with CIL. CIL declares reserve price for every round of monthly auction, which is 10 percent above the notified price of coal in India. Power units participate in a competitive auction process and offer premium of 30-40 percent over the notified prices to bag the coal supply. During April 2018-March 2019 period, 27.14 mt of coal was offered under SFeA. In July 2018, power units had complained about falling coal amount in SFeA and increasing prices. South Eastern Coalfield Ltd and MCL are the two main SFeA suppliers. Power generators had alleged that the supply from these two mines dwindled. Power units are now complaining that Mahanadi, Northern & Western Coalfields Ltd are increasing reserve price arbitrarily.

Fitch Solutions said India’s thermal coal output is projected to grow at an average annual rate of 4.3 percent by 2028. It further said the surge in Chinese imports that occurred over 2015-2017 as a result of dramatic domestic production curbs was a temporary phenomenon. It further estimates that production by CIL which accounts for around 90 percent of domestic output will underwhelm the government expectations. Along with weaker Chinese and Indian demand, South Korea and Japan will also see coal consumption slowing down in 2019 due to heightening environmental concerns, it said.

After surpassing coal output of 600 mt last fiscal, CIL is banking on space technology and mobile apps to control pilferage and illegal mining. The company has come up with the CMSMS portal, developed by the coal ministry in coordination with Bhaskaracharya Institute for Space Application and Geo-informatics and the Ministry of Electronics & Information Technology. Under the CMSES framework, the maps of the coal blocks and coalfield boundaries have been geo-referenced and superimposed on the latest satellite remote sensing images. The system can scan a region of 100 meters around the existing coalfield boundary to identify any unusual activity that may be illegal coal mining.

All such identified activities are deemed suspicious and a trigger is generated with a reference number. In the recent past, CIL was able to identify an incident of pilferage in the Eastern Coalfields Ltd area with the help of CMSMS. These triggers are studied by specialist groups identified by the coal ministry and the result is transmitted to the concerned nodal officials for field verification. A manual check is then conducted and reported back to the system. The complaint originating from coal mines allotted to CIL are reported straightaway to this Maharatna company while those originating from coal blocks not allotted to CIL are fed directly to the state government officers in the states where the mine is located. Besides, for each complaint an alert is also sent to the district magistrate and the police of the district. The CMSMS is also designed to provide other important information like reclamation work which is being monitored by CMPDI – a CIL subsidiary, using satellite data. The status of environmental and forest clearances are also linked for information in this system.

CERC has allowed compensation to GMR Group for running its power plant on imported coal in the event of coal shortage. The order issued late will have significant impact on the power generation industry that is grappling with stressed assets. Power plants will now be able to run their plants on imported coal if CIL is not able to meet its commitments and claim the extra costs in electricity tariffs. The dispensation was available to power companies till March 2017. This order of CERC sets the precedence for all generators who were unable to recover the full costs of coal to be compensated. This is first such order where compensation for shortfall in coal from CIL has been allowed for a period beyond March 2017 recognising that shortfall in supply of coal is a continuous cause of action.

The Supreme Court allowed transportation of 75,050 mt of coal from Meghalaya for 15 days beginning 17 May but asked the state government to ensure that no other coal should be transported or mined. The court, however, imposed some criteria for transportation of the specified coal. It asked the state government to take “necessary precaution” that no other kind or category of coal is permitted to be transported or mined under the guise of the permission. It said only those who have transport challans, after the order of the court dated 4 December 2018, should be permitted to transport the 75,050 mt coal. The actual transportation, after due verification and issuing of a verification certificate by an officer not below the rank of deputy commissioner, will be permitted from 17 May till 31 May, after which no transportation will be allowed.

Mining giant Vedanta Ltd has said that coal output from the mine located in Chhattisgarh will be increased to 1 mtpa as it looks to secure 90 percent of its requirement from linkage and captive block. BALCO, part of Vedanta, had bagged Chotia block during the first phase of coal mine auctions held in 2015. The output from the captive mine stood at 0.45 mt in the fourth quarter of last fiscal, it said. The mine has a capacity of 1 mtpa. Known for its high quality coal reserves, BALCO had bid a price of ₹3,025 per tonne during the auctions.

The Supreme Court sought the Centre’s response on a plea of Essar Power MP Ltd seeking to surrender the coal mines won by it in the 2015 auctions and refund of money paid to the government. A bench issued notice to the Centre on the appeal of Essar Power which has challenged the Delhi High Court’s decision disallowing its plea. Essar had won Tokisud North coal mine in Jharkhand in the auctions carried out by the Centre in 2015-16. The company had submitted that it wanted to surrender the coal block and hence, its deposit be returned.

Rest of the World

Britain, the birth place of coal power, has gone seven days without electricity from coal-fired stations for the first time since its 19

th century industrial revolution, the country’s power grid operator said. Britain was home to the world’s first coal-fuelled power plant in the 1880s, and coal was its dominant electric source and a major economic driver for the next century. However, coal plants emit almost double the amount of CO

2 - a heat-trapping gas blamed for global warming - as gas-fired power plants, and were moved out of Britain’s cities from the late 1950’s to reduce air pollution. As part of efforts to meet its climate target to cut greenhouse gas emissions by 80 percent compared with 1990 levels in the next three decades, Britain plans to wean itself completely off coal-fired power generation by 2025. Low power prices and levies on CO

2 emissions have also made it increasingly unprofitable to run coal plants, especially when wind and solar power production are high. The National Grid, Britain’s power transmission network, said coal-free runs like the one would become a regular occurrence as more renewable energy entered the system. Britain’s last deep-cast coal mine closed in North Yorkshire in 2015, marking the end of an era for an industry once employing 1.2 mn people in nearly 3,000 collieries.

China’s state planner NDRC will ramp up closures of small coal mines to boost safety and reduce pollution, shutting down more mines with annual capacity of less than 300,000 tonnes. The total number of such mines will fall to less than 800 by 2021, the NDRC said. It will also close all mines producing less than 300,000 tonnes a year in China’s top coal-producing regions, including Inner Mongolia, Shanxi, Shaanxi and Ningxia, by the end of this year. Beijing is also seeking to close mines that have low reserve quality and have been less competitive in regions such as Heilongjiang, Hubei and Hunan, the NDRC said.

China’s April coal imports rose from the same month last year, customs data showed, as power plants stockpiled supplies ahead of peak demand for electricity over the summer. China imported 25.3 mt of coal in April, the data from the General Administration of Customs showed. That was up 13.6 percent from 22.28 mt a year earlier. For the first four months of 2019, imports were 99.93 mt, up 1.7 percent from a year ago, according to the data.

China stepped up purchases of Australian steelmaking coal in March after customs delays, Australian government data showed, but exports of thermal coal to the world’s biggest consumer continued to fall. Chinese traders had cut back on purchases of both thermal and metallurgical coal from Australia in February due to lengthy quality checks on supplies from there that lasted as long as two months at some ports. Australia’s hard coking coal exports to China rose by 42 percent in March from February, making it the second biggest customer for the commodity after India, data from Australia’s statistics bureau showed. The total value of Australia’s hard coking coal exports rebounded in March by 58 percent to A$1.066 bn ($748.6 mn). The data comes after numbers issued by Chinese customs showed China’s imports of Australian coking coal nearly doubled in March from a month earlier. While Australia’s total exports of thermal coal climbed by 9 percent due to bigger purchases by South Korea and Japan, thermal coal shipments to China continued to fall, the Australian data showed. China is importing less thermal coal as it shores up its domestic market, hitting top supplier Australia the hardest.

China’s imports of Australian coking coal nearly doubled in March from a month earlier, the General Administration of Customs data showed, as a flurry of shipments were accepted after being delayed at customs clearance for more than a month. Arrivals of Australian coking coal were at 2.23 mt last month, up 92 percent from 1.16 mt in February, according to data. That compares to 1.33 mt in March 2018. Traders reported extended inspections of Australian supplies, including a ban on Australian coal vessels docking at port, in the past two months. Meanwhile, lengthy customs clearances remain across ports in the country. Prices of Australian coking coal are currently 200 yuan ($29.67) cheaper per tonne compared to Chinese equivalents, according to data from Mysteel consultancy. The coal mining heartlands of Shaanxi, Shanxi and Inner Mongolia are carrying out safety inspections, which may disrupt operations at coal mines in the regions.

Top Polish government officials will meet to discuss a threat by Australia’s Prairie Mining to sue Warsaw over difficulties it faced in developing two coal projects, the government said. Prairie Mining has said it has struggled to get permission to develop the Jan Karski and Debiensko mines and warned the Polish government it could take the case to international arbitration if it could not be resolved amicably. Prairie’s mining projects include coking coal as well as thermal coal. Thermal coal, used for power, is struggling to attract investment because of environmental concerns, but coking coal - which is used in steelmaking - is still viewed as a strategic mineral. The two projects are near mines belonging to state-run Polish mining companies Bogdanka and JSW respectively. JSW, the European Union’s biggest coking coal producer, plans to bid for a controlling stake in Prairie in an attempt to boost future output. That plan, however, is opposed by the energy minister, who is reluctant to let foreign investors have any access to coal deposits considered strategic assets for Poland’s energy security.

Poland’s JSW, the European Union’s biggest coking coal producer, does not expect coal orders from major client ArcelorMittal to fall following the steelmaker’s decision to halt operations at its blast furnace and steel plant in Krakow. ArcelorMittal Poland said it plans to temporarily stop production its furnace and steel plant in southern Poland in September, citing rising carbon emission costs and surging power prices.

Privately held Pembroke Resources won approval from Australia’s Queensland state to develop a $700 mn coking coal mine, as it pushes to tap strong demand for the steelmaking ingredient in Asia. Construction is due to start next year, with the company looking to begin negotiating contracts soon for supplies of coal from the mine. Pembroke has been talking to potential customers in Japan, South Korea and India, and is also open to selling a stake in the mine that will eventually produce 15 mt of nigh-quality coking coal a year out of the state’s developed Bowen Basin. Tudor said Pembroke had seen a lot of “inbound interest” in the project and that he saw advantages in selling a stake.

The Indonesian government has set the coal benchmark price (HBA) for May at $81.86 per tonne, energy ministry document showed. The benchmark price dropped for a ninth month, down from $88.85 per tonne set for April. The drop for May’s pricing is due to coal import restriction in China and India as well as competition with Australia and Russia in markets such as Japan and South Korea.

French utility Engie has agreed to sell some coal-fired power plants in the Netherlands and Germany, as Engie continues its strategy of disposing of non-core assets to focus more on the renewable energy sector. The assets represent a total installed capacity of 2,345 MW, it said. After the sale, coal will represent 4 percent of Engie’s global generation capacities, down from 13 percent at the end of 2015 when it announced plans to gradually close or dispose of its coal assets.

Japan’s Osaka Gas Co Ltd said that it will pull out of a plan to build a coal-fired power plant in Yamaguchi, western Japan, citing changes in the electricity market and future business risk. Osaka Gas had planned to build a 1.2 GW coal-fired power station in the city of Ube in Yamaguchi prefecture, aiming to start operations around 2026. Electric Power Development (J-Power) and Ube Industries Ltd are partners in the project. J-Power said it and Ube Industries have agreed to continue the plan to build a coal-fired power plant, but they will halt an environment access process to revise the plan. The move by Osaka Gas comes after other Japanese companies have withdrawn from new coal-fired power projects amid growing global pressure for companies to divest coal assets due to environmental concerns.

| Coal India Ltd, FY: Financial Year, mn: million, bn: billion, tn: trillion, mt: million tonnes, MW: megawatt, GW: gigawatt, SCCL: Singareni Collieries Company Ltd, MCL: Mahanadi Coalfields Ltd, MoU: Memorandum of Understanding, SFeA: spot forward e-auction, CMSMS: Coal Mining Surveillance & Management System, CERC: Central Electricity Regulatory Commission, mtpa: million tonnes per annum, BALCO: Bharat Aluminium Company Ltd, CO2: carbon dioxide, NDRC: National Development and Reform Commission |

NATIONAL: OIL

IIT-Madras develops ways to recover oil from ageing offshore wells

28 May. IIT (Indian Institute of Technology)-Madras researchers are developing indigenous processes for efficient recovery of oil from mature offshore wells. Collaborating with research laboratories in Australia, IIT-Madras researchers are studying the efficacy of an emerging enhanced oil recovery method called ‘Low-Salinity Enhanced Oil Recovery’. At present, domestic crude oil production in India is insufficient to meet the nation’s energy demands. Last year, the Union government approved fiscal incentives for enhancing oil and gas recovery from ageing and new fields, which can potentially raise the production of oil by 120 million tonnes (mt). In line with this expectation, Oil and Natural Gas Corp (ONGC) has been looking at enhanced oil recovery (EOR) techniques to boost oil and gas output from old and matured fields. Research conducted at Sangwai’s laboratory can help understand and optimise the technique. Sangwai said the research aims to develop indigenous methods for recovery of crude oil from geological reservoirs, which is “a complex process”.

Source: The Economic Times

No subsidy burden could trigger OIL and ONGC re-rating

27 May. Subsidy-sharing risks have lately dented valuations of ONGC (Oil and Natural Gas Corp) and Oil India Ltd (OIL), which trade at book value multiples that are less than half of what is accorded to fuel retailers. The ruling combine’s emphatic poll victory could cause a rerating at these oil producers, which rank among the world’s cheapest upstream companies. In the past three years, ONGC and OIL have not financed subsidies, which New Delhi has been funding though the budget. If the zero-burden upstream contribution continued in the March quarter for ONGC, its realisation could touch a record $70 per barrel, compared with $47-57 per barrel in the past 12 quarters, CLSA said. New Delhi has provisioned Rs330 bn for oil subsidy in FY20, up 62 percent, according to the interim budget. Kerosene and subsidised LPG (liquefied petroleum gas) are currently sold below economic prices, resulting in subsidies. Furthermore, the subsidy burden is expected to be lower after continuous monthly increases in kerosene prices. The break-even rate of kerosene has risen to $45 per barrel after gradual increases, compared with $18 per barrel three years ago. The government has also indicated that it would take more action on curtailing LPG subsidies that now account for 80 percent of total federal support on energy consumption.

Source: The Economic Times

India’s ATF consumption drops for the first time in 4 yrs

24 May. The consumption of aviation turbine fuel (ATF) in India fell 5.7 percent to 668 thousand tonne in April this year, the first drop in over four years, after passenger traffic took a hit due to the grounding of Jet Airways and Boeing 737 Max planes apart from a sharp rise in fares. ATF consumption, after 52 months of positive growth, recorded a drop of 5.7 percent in the month of April 2019 as compared to April 2018, the oil ministry’s technical wing Petroleum Planning and Analysis Cell (PPAC) said in its monthly report industry consumption. Domestic airlines carried 10.9 mn passengers in April this year as against 11.5 passengers in the same months last year, a drop of 4.5 percent. Jet Airways had started grounding its planes in a staggered manner.

Source: The Economic Times

India stopped purchasing Iranian oil after US waivers expired

24 May. India has stopped importing oil from Iran after American waivers granted to eight buyers expired early this month, New Delhi's envoy has said, becoming the latest country to comply with the US (United States) sanctions on Tehran over its nuclear programme. The US reimposed sanctions on Iran in November after pulling out of a 2015 nuclear accord between Tehran and six world powers. To reduce Iran's crude oil export to zero, the US ended on 2 May waivers that had allowed the top buyers of Iranian oil, including India, to continue their imports for six months. Indian Ambassador to the US Harsh Vardhan Shringla said India has stopped importing oil from Iran after the US refused to extend exemption from sanctions. Iran earlier used to supply 10 percent of India's oil needs. India joins Greece, Italy, Taiwan and Turkey which have stopped importing Iranian oil.

Source: Business Standard

Re-election of NDA will be credit neutral for O&G sector: ICRA

23 May. The re-election of National Democratic Alliance (NDA) will be credit neutral for the domestic oil and gas (O&G) sector, research and retaings agency ICRA said. It said that even though the government’s initiatives should help companies in the sector going forward, clarity on pricing freedom on sensitive products and adequate subsidy provision will be critical for the financial profile of the Public Sector Undertakings (PSUs). Oil and Natural Gas Corp (ONGC) had last fiscal acquired Hindustan Petroleum Corp Ltd (HPCL), the government-owned fuel retailer at a cost of Rs369.15 bn. While, the acquisition helped the government meet its disinvestment target for the fiscal, it impacted the oil explorer’s working capital and cash reserves during the fiscal. Also, Oil Marketing Companies (OMCs) had to face the ire of the consumers when they had last year initiated a 19-day price freeze on petrol and diesel before the Karnataka elections. Petrol and Diesel prices at retail pumps operated by Indian Oil Corp (IOC), HPCL and Bharat Petroleum Corp Ltd (BPCL) remained unchanged for 19 straight-days from 24 April 2018 even as the benchmark international fuel prices had increased on the back of surge in crude oil prices. The government had during its previous tenure revamped O&G bidding framework and the O&G exploration policy.

Source: The Economic Times

NATIONAL: GAS

India’s natural gas production decreases marginally in April

28 May. India’s natural gas production decreased marginally to 2,656 million metric standard cubic meter (mmscm) in April 2019, as compared to the corresponding month a year ago. The country had produced 2,663 mmscm of natural gas in April 2018. Oil and Natural Gas Corp (ONGC), the country’s largest upstream player’s, standalone natural gas production in April 2019 increased 3.34 percent to 2,038 mmscm, as compared to 1,972 mmscm produced in the corresponding month a year ago. The company’s natural gas production increased in April, primarily due to increased production from Eastern and Western offshore fields. Oil India Ltd (OIL), the country’s second largest oil and gas explorer’s natural gas production in April 2019 increased 1.39 percent to 224 mmscm, as compared to 221 mmscm produced in the corresponding month a year ago. The company’s natural gas production increased primarily due to better performance of fields in Assam, Arunachal Pradesh and Rajasthan. Natural gas production from PSC (Production Sharing Contract) fields in April 2019 declined 16 percent to 394 mmscm, as compared to 470 mmscm produced in the corresponding month a year ago. Production from PSC fields declined primarily due to nil production from MA field in the eastern coast of India, closure of two wells in D1D3 field.

Source: The Economic Times

GAIL aims to import 75 LNG cargoes in FY20

27 May. GAIL (India) Ltd sold 100 percent US (United States) LNG till 2020, and about 80-90 percent beyond 2020, Chairman B C Tripathi said. GAIL aims to import 75 LNG cargoes in FY20 Vs 62 in FY19. GAIL aims to borrow Rs50 bn in FY20. GAIL has signed MoU (Memorandum of Understanding) with ExxonMobil to explore use of LNG for transportation and bunkering

Source: Reuters

Torrent Power, GSPC seek LNG cargoes for July

23 May. Torrent Power and Gujarat State Petroleum Corp (GSPC) are seeking liquefied natural gas (LNG) cargoes for delivery in July. Torrent Power is seeking a cargo for late July in a tender that closed while GSPC is seeking a cargo for mid-July in a tender closing. Both cargoes are to be purchased on a delivered ex-ship basis (DES).

Source: Reuters

Government stops issuing RIL-BP penalty notices for KG-D6 gas output shortfall

22 May. The government has stopped issuing penalties on Reliance Industries Ltd (RIL) and its partner BP plc for natural gas production from eastern offshore KG-D6 fields not matching the targets after the matter went into arbitration. The government had between 2012 and 2016 disallowed RIL from recovering the cost of $3.02 bn for KG-D6 output lagging targets, but no notice was issued after that even though production has plummeted to a fraction of the projections. The Directorate General of Hydrocarbons (DGH) said that in all, four notices were issued that disallowed recovery of a part of the cost incurred by RIL-BP in producing gas from Dhirubhai-1 and 3 (D1&D3) fields; the last one being on 3 June 2016. The cost recovery disallowance notices to RIL-BP were issued as gas output lagged targets, a phenomenon that oil ministry and DGH have insisted was because of the company not drilling the committed number of wells on the fields. The total penalty slapped till 2016, which was in the form of disallowing recovery of cost incurred for missing the target during six years beginning 1 April 2010, was $3.02 bn. The Production Sharing Contract (PSC) allows RIL and its partners BP PLC of the UK (United Kingdom) and Canada’s Niko Resources to deduct all capital and operating expenses from the sale of gas before sharing profit with the government. Gas production from Dhirubhai-1 and 3 gas field in the KG-D6 block in the Bay of Bengal was supposed to be 80 million metric standard cubic meter per day (mmscmd) but actual production was only 35.33 mmscmd in 2011-12, 20.88 mmscmd in 2012-13 and 9.77 mmscmd in 2013-14. The output has continued to drop in the subsequent years and is now below 4 mmscmd. RIL-BP challenged the cost disallowance of the past years and have initiated international arbitration seeking dropping of the same on grounds that the PSC does not provide for any such punishment. It had blamed unanticipated sand and water ingress for shutting down of one well after the after, leading to drop in production. RIL holds 60 percent interest in block KG-DWN-98/3 or KG-D6 in the Bay of Bengal. BP has 30 percent and Niko the remaining 10 percent.

Source: Business Standard

NATIONAL: COAL

CIL urges power producers to substitute imports with domestic coal

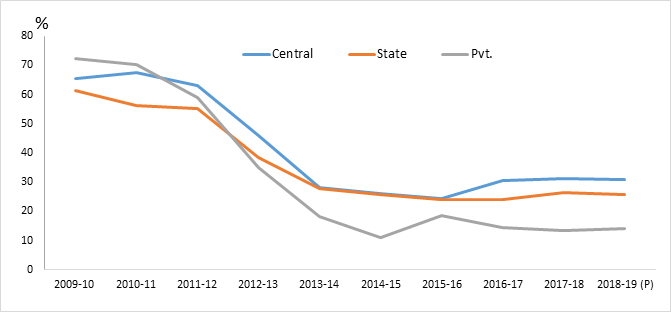

28 May. In order to further reduce use of imported coal by power producers, state-run miner Coal India Ltd (CIL) urged power utilities, which are importing the fuel for blending, to avail higher grade of coal from its subsidiaries as a mean of import substitution. According to the miner, it is offering state power generation companies, which are major importers of coal, 4.5 million tonnes (mt) of high GCV (gross calorific value) coal from Eastern Coalfields Ltd (ECL). According to it, coal imports by power sector were 79.44 mt in 2013-14, mainly on account of "less availability of domestic coal". It claimed that "outcome-oriented" production plans, daily monitoring of production and despatch and other concerted efforts were "put in place" to meet requirements of power sector through domestic coal. CIL's despatch to power sector had increased by 134 mt between the financial year 2013-14 to FY 2018-19.

Source: Business Standard

India’s coal imports rose 13 percent to 21 mt in April

26 May. India’s coal import increased by 13.4 percent to 20.72 million tonnes (mt) in April compared to 18.27 mt in the same last year. Of the total imports during April 2019, non-coking coal or thermal coal shipments were at 15.08 mt, according to provisional data by mjunction services. Imports of coking coal, used in iron and steel making, were 3.52 mt in April while metallurgical coke imports during the month were at 0.22 mt. Mjunction, a joint venture between Tata Steel and SAIL, is a B2B e-commerce company that also publishes research reports on coal and steel verticals. Coal and coke imports during 2018-19 increased by 9.66 percent to 235.35 mt as compared to 214.61 mt imported in FY2017-18, data showed. The government has set a target of 1 billion tonne of coal production by 2019-20 for the mining major, but is considering relaxing the timeline.

Source: The Economic Times

New Mangalore Port gets mechanised coal-handling facility

22 May. New Mangalore Port Trust has added a new facility for mechanised handling of coal at the port. Chettinad Mangalore Coal Terminal Pvt Ltd has executed the mechanised common user coal terminal project at a cost of ₹4.69 bn at New Mangalore Port. V Chandramoleeswaran, Director of Chettinad group, said the capacity of the fully automated coal terminal is 10 million tonnes (mt) per annum (mtpa) of common user coal. Now the port is handling around 4 mtpa of common user coal. The facility has two ship unloaders with designed discharge rate of 4,000 tonnes per hour (tph). Two stacker-cum-reclaimers with capacity of 4,000 tph for stacking and 4,000 tph for reclaiming are part of the coal terminal. He said the coal would be transported from storage yard to wagon yard in fully enclosed conveyor belt system. The wagon loading system can load seven rakes per day. A rake includes 59 wagons. He said a wagon can be loaded in a minute.

Source: The Hindu Business L ine

NATIONAL: POWER

FY20 electricity generation seen rising 5-6 percent

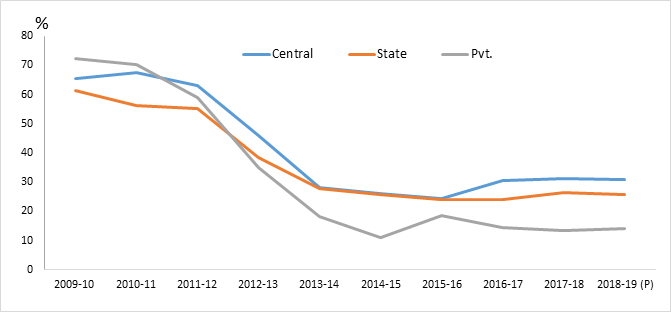

28 May. Electricity generation in India is expected to grow by 5-6 percent in FY20, analysts at CARE Ratings said. The country had generated 1,307 bn units of electricity in FY19, recording an annual growth of 5.3 percent. Care Ratings also projected that coal production to grow steadily by 6-7 percent during the ongoing fiscal. Domestic coal production grew by 7.3 percent to 739.4 million tonnes (mt) in FY19, much faster than the 2.6 percent growth rate seen in FY18. The rating agency’s forecast are much lower than that of the Central Electricity Authority (CEA), which expects generation to touch 1,330 bn units from the conventional power sources (excluding renewables) in FY20. Though the estimates sound positive for private power plants running at low plant load factors, actual generation from private power plants in FY19 has risen only 2.2 percent annually.

Source: The Financial Express

Power department not doing enough to cope with growing demand: JERC

28 May. The Joint Electricity Regulatory Commission (JERC) has directed the state electricity department to increase its efforts towards augmenting and maintaining infrastructure to meet growing demand and to avoid any kind of supply constraints to consumers. It has also directed the department to upload area-wise interruption details on its website. The commission issued this direction in its latest tariff order after receiving complaints regarding the department’s capital expenditure. A stakeholder informed the commission that the quality and reliability of power supply in the state is very poor and requested it to direct the department to upload details about feeder-wise interruptions along with steps it is taking to improve reliability. The electricity department in its defence submitted to the commission that it is undertaking a lot of schemes and that capital expenditure is being incurred to improve reliability of the system. Area-wise interruption details are available on the national power portal, the department said.

Source: The Economic Times

Power turns costlier in Punjab, energy tariff goes up by 2.14 percent

27 May. Power consumers in Punjab will have to shell out more for electricity as the State Electricity Regulatory Commission announced an average tariff hike of 2.14 percent across categories for 2019-20. Besides, the state power regulator also raised fixed charge for the domestic category of consumers by Rs10 per kilowatt (kW), according to the new power tariff. In the tariff order which was released, the Punjab State Electricity Regulatory Commission has assessed the net aggregate revenue requirement of the Punjab State Power Corp at Rs323.27 bn, including Rs13.29 bn for Punjab state transmission corporation for 2019-20. The new tariff will be effective from 1 June. The combined average cost of supply for 2019-20 worked out to be 662.98 paise per kilowatt hour (kWh) as against 655.49 paise per kWh during last fiscal. In the new tariff order for domestic consumers, the per unit cost of electricity for 100 units has been increased from Rs4.91 to Rs4.99 per kWh; from Rs6.51 to Rs6.59 for 101 to 300 units and from Rs7.12 to 7.20 for 301 to 500 units for supply up to 2 kW. The fixed charges for 2 kW load have been increased from Rs25 to 35 per kW, Rs35-45 for 2-7 kW and Rs40-50 kW for 7 kW-50 kW. For agricultural pumpsets, tariff has been increased from Rs5.16 per kWh to Rs5.28 per kWh. For industrial category, the power tariff has been increased by 8 paise per unit, as per the order. The fixed charges for non-residential category and industrial category have been hiked in the range of Rs5 per kilovolt ampere hours (kVAh) and Rs20 per kVAh, as per the order. Any consumption in excess of threshold limit of the last two financial years shall continue to be billed at a reduced energy charge of Rs4.45 per kVAh to encourage use of surplus power by the industry, as per the tariff order.

Source: Business Standard

Government order asks KSEB to bypass NOC rules

27 May. An order issued by the state government directing Kerala State Electricity Board (KSEB) Ltd to provide power connection to all commercial buildings without the mandatory no-objection certificate (NOC) from the revenue department in eight villages of Munnar has kicked up a controversy. The government order issued by the power department secretary B Ashok directed the KSEB officials to provide power connection in Kanan Devan Hills (KDH) village, Bison Valley, Chinnakanal, Santhanpara, Vellathooval, Anaviratty, Pallivasal and Anavilasam without revenue department’s NOC. However, the order adds that the connections should be provided subject to the condition that the KSEB shall remove electric installations at its own cost when revenue authorities declare that possession of the property as unlawful. Meanwhile, Idukki district collector H Dineshan said that revenue department will initiate strict action if KSEB provides power connections to constructions in these villages without NOC.

Source: The Economic Times

Power demand in Delhi surges by 22 percent in April-May

27 May. The power demand in the capital has been soaring this year with the month of April-May recording a 22 percent growth over the corresponding period in 2018. The peak power demand in April 2018 was 5,200 MW. This year, the demand in April crossed the 5,200 MW mark five times, peaking at 5,664 MW on 30 April. The power demand in April 2019 has been higher on 19 occasions than the corresponding days last year. On 22 April, it was 3,828 MW in 2018 and 4,588 MW in 2019 - an increase of 20 percent. Again on 25 April, it was 4,438 MW in 2018 and 5,552 MW in 2019 - an increase of 19 percent, the discom (distribution company) said. The trend continues in May 2019. Of the first 24 days of this month, the power demand has been higher than on 13 corresponding days of last May, increasing by up to 22 percent on 10 May 2019, when it touched 5,985 MW as against 4,899 on 10 May 2018, the discom said. However, the power demand between 15 and 24 May 2019, has been marginally less than the power demand on the corresponding days last year as temperatures remained relatively pleasant because of the western disturbances. The peak power recorded in May 2018 was 6,442 MW on 30 May. The capital's peak power demand during the summers of 2019 may clock 7,400MW. Last summer, peak demand breached 7,000 for the first time - peaking at 7,016 MW. This expected peak power demand of 7,400 MW in Delhi is an increase of over 250 percent over the peak power demand of 2,879 MW in 2002. It is interesting to note that Delhi’s peak power demand is substantially more than that of several cities and states.

Source: The Economic Times

15k government schools get electricity connections in rural Madhya Pradesh

26 May. The just-concluded general elections came as a boon for primary schools in Madhya Pradesh’s rural areas. As per the state Chief Election Commissioner (CEO)’s report, 15,000 government primary schools, which were made polling stations in far-flung areas, got permanent electricity connections during the Lok Sabha polls. Not just electricity, repair works were also undertaken and some schools provided water connections. Some primary schools in Jhabua, Ratlam, Betul, and Bhind and other areas of rural Madhya Pradesh were made polling centres for the first time. These schools either did not have electricity connections or had temporary arrangements for power supply. Power connections are necessary at polling booths as Electronic Voting Machines (EVMs) and other equipment need continuous power supply. The education and power departments worked on a war footing to provide electricity connections in these schools.

Source: Business Standard

58 percent increase in power transmission capacity of Uttar Pradesh in past 3 yrs

22 May. If power situation has seen a marked improvement in the past two years, it is because of relentless effort of the state government to fulfill its promise to provide 22-hour supply to rural areas and 24-hour supply to urban centres. Its effort to strengthen the power supply infrastructure in all 75 districts has resulted in 58 percent increase in total power transmission capacity in the past three years. In the same period, the total transfer transfer capacity has seen a jump of over 95 percent. Ahead of the peak summers, the Uttar Pradesh Power Transfer Corp Ltd (UPPTCL) has managed to achieve 12,850 MW total transfer capability (TTC) of electricity. Northern Regional Load Dispatch Center (NRLDC), Delhi has approved the increased capacity of transmission in UP. After coming to power in 2017, improving the power situation was among its top priorities. The party had promised to ensure every household in the state has an electricity connection and access to 24-hour supply. For this, the transmission capacity of the state was enhanced on the war footing. State Power Minister Shrikant Sharma has directed the UPPTCL to complete pending works related to construction of substations, laying transmission lines and other works related to up-gradation of power supply infrastructure in time bound manner. The minister has set target to increase the power transmission capacity up to 30,000 MW by 2024.

Source: The Economic Times

ADB to provide $750 mn loan to India for railway track electrification project

22 May. Multilateral funding agency Asian Development Bank (ADB) said it has signed an agreement to provide $750 mn equivalent in Indian rupee long-term financing to electrify railway tracks in India. It is the largest single non-sovereign loan ever committed by ADB to Indian Railway Finance Corp (IRFC) to fund the railways track electrification project, ADB said. As part of a broad modernisation programme that will help India's railway sector transition to electric power and away from dependence on fossil fuels, it said. IRFC will use the proceeds from the loan to install electric traction equipment along about 3,378 kilometres of existing railway lines to enable migration of passenger and freight traffic from diesel to electric traction. The electrification assets will be leased to Indian Railways, the country's national railway system, under a long-term lease agreement, ADB said.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

CREST plans to promote solar energy

28 May. Chandigarh Renewable Energy and Science & Technology Promotion Society (CREST) has come up with a plan to promote solar energy and transfer its benefit to all the stakeholders. According to CREST director Debendra Dalai, the residents will be given the option to permit Renewable Energy Service Company Model (RESCO) companies to install the solar photovoltaic (SPV) power plant on their rooftops and, in lieu of this, the residents will be charged much lesser tariff for the solar-produced electricity in the tariff bills as compared to the normal tariffs. In a period of a maximum of 25 years, the house owner will be given the power plant.

Source: The Economic Times

EV journey to begin with hybrid technology in India: Honda

26 May. Japanese auto major Honda will use hybrid vehicles as intermediates in the next two years in India before going for full electric vehicles (EVs) as it expects setting up of supporting infrastructure such as charging stations to take time. The company, which is present in India through a wholly-owned subsidiary, aims to follow the government’s push for environment-friendly vehicles by driving in models with green technologies. A hybrid car has more than one source of power. Usually, it combines a conventional combustion engine with an electric motor to run the vehicle. Globally, Honda has been at the forefront of technology development for environment-friendly vehicles. As per its Vision 2030, the company strives to electrify two-thirds of its global automobile unit sales in 2030 with its range of hybrid electric vehicles, plug-in hybrid electric vehicles, battery electric vehicles and fuel cell vehicles.

Source: Business Standard

India restricts bio-fuel imports

26 May. The government has restricted the import of bio-fuels including ethyl alcohol, bio-diesel and petroleum oils for all purposes and their import will require import licence from the Directorate General of Foreign Trade. So far, import was allowed only for non-fuel purposes subject to actual user condition. The restriction will affect the import of ethyl alcohol and other spirits, denatured, of any strength, petroleum oils and oils obtained from bituminous minerals (other than crude, through an amendment in import policy) and bio-diesel.

Source: The Economic Times

MNRE cancels 438 MW hydro power proposals of 50-odd private companies

25 May. The Ministry of New and Renewable Energy (MNRE) has cancelled proposals submitted by 50-odd private companies seeking Central Financial Assistance (CFA) for their small hydro power projects. The MNRE has closed the files pertaining to 53 such projects on the back of non-compliance of provisions in their schemes. The 53 proposals with a combined capacity of 438 MW were submitted for projects across multiple states. Some of the big companies whose project proposals stand cancelled as a result of the decision include Meenakshi Power, SRS Energy, Trident Power, Krishna Hydro Energy, Venika Hydro, Ramky Enviro subsidiary Chhatisgarh Energy Consortium.

Source: The Economic Times

Hyderabad students strike, ask government to act on climate change

25 May. Over 200 students and parents protested on the issue of climate change at the ‘Love Hyderabad’ installation, along Necklace Road. The protest was part of strikes across the globe planned for 24 May. The strike was supported by Citizens for Hyderabad, a group promoting sustainable development. While the larger aim of the youth-led strike across countries was to build pressure on governments to cut greenhouse gas emissions, protesters here raised local issues too.

Source: The Economic Times

CERC orders tariff settlement for a 1.5 GW hydro project in Himachal Pradesh

24 May. The Central Electricity Regulatory Commission (CERC) has settled a dispute regarding the tariff determination of a hydro project in Himachal Pradesh. The CERC was hearing a petition filed by Sutlej Jal Vidyut Nigam Ltd (SJVNL) for a 1,500 MW (6 units of 250 MW each) Nathpa Jhakri hydro-electric power project for the revision of tariff for the period between 1 April 2009 and 31 March 2014, including truing up of tariff determined by the commission’s order dated 20 June 2014. The commission has asked the petitioner to calculate the difference between the annual fixed charges it has already recovered, and the charges determined by the commission’s current order, and then settle it as per the 2009 Tariff Regulations.

Source: Mercom India

Renewable energy industry expects government to sharpen focus on policy stability

23 May. As India seems to have voted for a majority government for yet another term, the renewable energy industry wants the government to continue with a sharp focus on policy stability to spur growth, gaining from the likely continuity in administration. Waaree Energies director Sunil Rathi said that while the sector has witnessed some positive movement in the last year, with the implementation of safeguard duty, de-linked manufacturing tender and introduction of the KUSUM scheme, the government is expected to continue its support with primary focus on domestic manufacturers. Based on the overall direction of recent policy initiatives, the industry believes the government’s primary focus would be on reducing the import of solar equipment from foreign countries including Thailand, China and Vietnam, thus strengthening rupee denomination and contributing to the nation’s gross domestic product.

Source: The Economic Times

Tata Power Renewable Energy wins Gujarat solar auction

22 May. Tata Power’s subsidiary, Tata Power Renewable Energy Ltd, emerged winner in an auction conducted by Gujarat for 1000 MW of projects to be built at Dholera solar park. Tata Power and Gujarat Industries Power Company Ltd (GIPCL) were the only bidders who bid for 250 MW and 50 MW respectively at a tariff of Rs2.75 per unit. Tata Power was chosen as the winner through draw of lots since Gujarat Urja Vikas Nigam Ltd (GUVNL) will be allotting only 250 MW. Developers have turned reluctant to auctions conducted by Gujarat because it had, earlier this year, cancelled the results of a solar auction held for 700 MW of projects to be constructed at Raghanesda solar park because the state felt tariffs quoted were too high. The auction was conducted again for the second time last month. Earlier, it also cancelled a 500 MW auction held in March last year at which the lowest price reached was Rs2.98 per unit.

Source: The Economic Times

INTERNATIONAL: OIL

Tanzania, Zambia plan $1.5 bn oil products pipeline: Tanzania’s Energy Minister

28 May. Tanzania and Zambia plan to build a refined products pipeline to transport petroleum between the two countries at a cost of $1.5 bn, Tanzania’s Energy Minister Medard Kalemani said. Zambia, Africa’s top copper producer, imports most of its petroleum requirements, mainly from the Middle East, through the port of Dar-es-Salaam in Tanzania. Kalemani said the pipeline would also have take-off points at Morogoro, Iringa, Njombe, Mbeya and Songwe regions on the Tanzanian side. Tanzania and Zambia already have a crude oil pipeline between them transporting oil to Zambia, where it is refined in Ndola for local use.

Source: Reuters

Norway’s oil industry eyes 17 percent growth in 2019 investments

28 May. Oil and gas companies working in Norway have hiked their 2019 and 2020 investment forecasts as they add more field development plans, a survey by the country’s statistics agency (SSB) showed. The Norwegian central bank in March said it expected investment in the oil sector, the country’s most important industry, to grow by 12.5 percent in 2019. After falling by a third from 2014 to 2017, Norway’s oil and gas investments rose 2 percent year-on-year in 2018 to 151.8 bn crowns as rising crude prices boosted activity. Equinor is Norway’s largest oil company, competing with Aker BP, Lundin Petroleum, Total, ConocoPhillips, ENI and Shell, among others. Key suppliers to the industry, which rely heavily on oil firms’ investment plans, include Aker Solutions, Subsea 7, Kvaerner and TGS.

Source: Reuters

Kuwait’s Oil Minister sees balanced oil market toward end 2019

27 May. The oil market is expected to be in balance toward the end of 2019, as global inventories fall and demand remains strong, but OPEC (Organization of the Petroleum Exporting Countries)’s job is not done yet, Kuwait’s Oil Minister Khaled al-Fadhel said. There are still uncertainties around oil demand growth due to concerns about the impact of the United States (US)/China trade dispute on global economy, while US shale oil production is still rising, Khaled al-Fadhel said. This uncertain outlook is making it tough for OPEC and its allies to have a clear oil supply plan for the second half of the year. Fadhel said it was too early to say now if the oil producers will extend their current output targets after June. The OPEC, Russia and other non-OPEC producers, known as OPEC+, agreed to reduce output by 1.2 mn barrels per day (bpd) from 1 January for six months, a deal designed to stop inventories building up and weakening prices. US President Donald Trump has called on OPEC and the group’s de facto leader Saudi Arabia to boost output and lower oil prices. Russia also wants to increase supply after June when the OPEC+ pact is due to expire, but Riyadh fears a crash in oil prices and a build-up in inventories.

Source: Reuters

Shell sees significant oil discovery in Albania

24 May. Shell Upstream Albania B.V. said initial tests showed “a flow potential of several thousand barrels of oil per day” from its Shpirag 4 well in central Albania, and it needed more work to determine its commercial volume. The Shpirag 4 well west of Berat had confirmed the flow potential of a significant light oil discovery. More appraisal work was needed to assess commercial volumes in Shpirag, in an equivalent geological setting to the large Val D’Agri and Tempa Rossa fields in Italy, Shell Albania said.

Source: Reuters

Oil situation still manageable: German economy ministry

24 May. Germany’s economy ministry said there was not threat to supply security of oil products as a result of the ongoing technical problems with crude supply on Russia’s Druzhba pipeline. Refineries, according to information held by the ministry, were able to use oil from inventories to keep operations running. The ministry is continuing to monitor situation carefully but currently there is no consideration to release oil from strategic stocks. Contaminated oil got into in the Druzhba pipeline, forcing Russia to stop eastbound flows to customers in Belarus, Ukraine, Poland, Germany and a number of central European countries.

Source: Reuters

Kazakhstan ready to supply oil to Belarus

23 May. Kazakhstan is prepared to supply oil to Belarus, but the countries need to agree such deliveries with Russia across whose territory they would pass. Belarusian President Alexander Lukashenko proposed at a meeting with the Kazakh envoy that Kazakhstan enter into talks with Minsk to deliver oil to Belarus.

Source: Reuters

Russia’s Transneft agrees oil clean-up plan with Belarus

23 May. Russian pipeline monopoly Transneft has agreed a technical plan with Belarus to clean up contaminated Russian oil in the country and Belarus has indicated it approves of the plan, senior Transneft executive Sergei Andronov said. Belarus is a transit country for Russian oil shipments to Poland and beyond. Poland will receive clean oil on 9-10 June if the plan is successfully implemented, Andronov said.

Source: Reuters

BP nears sale of stake in Egyptian oil firm to Dragon Oil

23 May. BP is nearing the sale of its stake in a major Egyptian oil and gas company to Dubai-based Dragon Oil for over $600 mn. Dragon Oil, a subsidiary of Dubai’s Emirates National Oil Company (ENOC), has said it plans to expand its international operations and boost its production to 300,000 barrels of oil equivalent per day by 2025. GUPCO (Gulf of Suez Petroleum Company) produces over 70,000 barrels per day of oil and 400 million cubic feet per day of gas. The GUPCO sale has received the initial approval of Egypt’s petroleum ministry after it had objected to an agreement BP had reached last year with North African-focused oil and gas company SDX Energy to buy the asset.

Source: Reuters

Iran stores more oil on land and at sea as exports slump

23 May. Iran’s oil storage on land and at sea is on the rise as US (United States) sanctions on exports bite and Tehran battles to keep its aging fields operational and crude flowing. Washington announced in May the end of sanctions waivers for foreign countries importing Iranian oil, hitting Tehran’s biggest source of income. It is vital for Tehran to keep oil flowing as any disruption would damage its future activities due to the high costs and complexities of restarting production. Data from Kayrros, a company which tracks oil flows, showed onshore storage in Iran was 46.1 mn barrels, from total capacity of 73 mn barrels, its highest since mid January. Iranian oil exports fell in May to 500,000 barrels per day (bpd) or lower, more than half the level seen in April. Data based on AIS tracking by shipping intelligence platform MarineTraffic showed 16 Iranian tankers, holding some 20 mn barrels, were estimated to be used for floating storage after being stationary between two to four weeks. Ten of those tankers with nearly 11 mn barrels had been stationary for four weeks. This compared with 12 Iranian tankers holding at least 13 mn barrels of oil in March, which had been stationary from two to four weeks, MarineTraffic data showed. Analytics company GlobalData said Iran had planned investment of around $900 mn in capacity additions on new build storage projects between 2019 to 2023. Iran plans to increase storage capacity from 69.1 mn barrels in 2019 to 79.9 mn barrels in 2023 at an average annual growth rate of 3.6 percent, according to GlobalData estimates. Analysts have estimated that over 50 percent of Iran’s oil production comes from fields that are over 50 years old with billions of dollars needed to develop additional capacity.

Source: Reuters

Mexico’s Pemex aims for 1 mn bpd rise in crude output by 2024

22 May. Mexican state oil company Pemex is striving to increase oil production by 1 mn barrels per day (bpd) by the end of 2024 by developing existing oilfields and others yet to be discovered, CEO (Chief Executive Officer) Octavio Romero said. If the target is met, the heavily indebted company will surpass President Andres Manuel Lopez Obrador’s goal of ending his term with oil production of 2.4 mn bpd, well above the current level of 1.7 mn bpd. Romero said the company is developing 20 new fields, including Ixachi, in the southeastern state of Veracruz, which could yield 1.3 bn barrels of potential reserves. Analysts and experts have said the company needs to increase its spending on exploration and production to discover reserves and develop them, halting the firm’s long-running decline in output.

Source: Reuters

China not signing deals to buy US crude oil: Enterprise CEO

22 May. Chinese companies looking to sign long-term agreements to buy crude oil from US (United States) oil exporters have virtually disappeared, Enterprise CEO (Chief Executive Officer) Jim Teague said. The trade war has all but shut down shipments of US crude to China, and it is unlikely Chinese buyers will sign long-term offtake agreements with US crude exporters right now, Teague said. The Obama administration ended a 40-year ban on US crude exports in 2015 and they have risen sharply ever since. The country now routinely exports more than 3 mn barrels per day (bpd) of crude. In the first half of 2018, China was the biggest importer of US crude, averaging 377,000 bpd. In the six months ended February, the most recent data available, it has dropped to 41,600 bpd, according to the US Energy Information Administration. Teague said demand for US crude will shift to other countries as US producers pump additional volumes.

Source: Reuters

INTERNATIONAL: GAS

Construction of Tanzanian LNG facility set to begin in 2022

28 May. Tanzania expects a consortium of international oil companies to start building a long-delayed liquefied natural gas (LNG) project in 2022, Energy Minister Medard Kalemani said. Construction of an LNG export terminal near huge offshore natural gas discoveries in deep water south of the East African country has been held up for years by regulatory delays. The government said in March it planned to conclude talks in September with a group of foreign oil and gas companies led by Norway’s Equinor on developing the LNG terminal. Equinor, alongside Royal Dutch Shell, Exxon Mobil and Ophir Energy and Pavilion Energy, plan to build the onshore LNG plant in Lindi region. The international oil companies will develop the project in partnership with the Tanzania Petroleum Development Corp. Kalemani said that the government launched a new round of talks in April with each company in order to speed up the process. Tanzania has estimated recoverable reserves of over 57.54 trillion cubic feet (tcf) of natural gas. Tanzania already uses some of the gas for power generation and running of manufacturing plants.

Source: Reuters

ConocoPhillips, Woodside see weak LNG prices as short-term issue

28 May. Liquefied natural gas (LNG) producers ConocoPhillips and Woodside Petroleum expect prices for the commodity to pick up in the short term, pulling away from three-year lows that were hit after a mild northern hemisphere winter. But Australia’s Woodside CEO (Chief Executive Officer) Peter Coleman said he was worried about companies approving new LNG projects without lining up long-term contracts, potentially weighing on prices when they start producing in the mid-2020s. In the near term, ConocoPhillips CEO Ryan Lance said growing demand would soak up excess supply in the market. ConocoPhillips operates the 3.7 million tonnes (mt) a year Darwin LNG plant in northern Australia and the 9 mt a year east coast Australia Pacific LNG plant. Woodside’s Coleman does not expect the current weak prices to affect the timing of the company’s Browse gas project off northwest Australia, for which the company aims to make a final investment decision in late 2020. Coleman said that timetable for a final investment decision was “safe” as Woodside’s partners include LNG buyers Mitsui & Co, Mitsubishi Corp and PetroChina. But what could weigh on the market in the mid-2020s is that a number of new LNG projects elsewhere could go ahead without having pre-sold all their volumes, as Shell has done with a project in Canada. ConocoPhillips expects to make a final investment decision later this year or in early 2020 on whether to develop the Barossa gas field to fill the Darwin LNG plant when supply runs out around 2022 from the Bayu Undan field in the Timor Sea. Lance said LNG buyers are taking advantage of weak spot LNG prices, now at three-year lows below $5 per million metric British thermal units (mmBtu), to demand shorter term contracts and more pricing latitude from suppliers.

Source: Reuters

Algeria discovers new gas field in southwest

27 May. Algeria has made an important gas discovery in the southwest province of Tindouf, Energy Minister Mohamed Arkab said, which could help the country boost exports and maintain its market share abroad. Algeria is a major gas supplier to Europe but rising domestic consumption and a failure to increase production in recent years have threatened its export volumes. Arkab said state energy firm Sonatrach would make further evaluations of the field’s capacity. Algeria, which produces about 135 billion cubic meters (bcm) of gas a year, has started to renew supply contracts with European clients as current contracts are due to expire by the end of this year or in early 2020. Algeria’s economy relies heavily on gas and crude oil, and the government has drafted a new energy law offering incentives to investors in a bid to attract foreign firms.

Source: Reuters

Bangladesh’s floating LNG terminal conducts first ship-to-ship gas transfer

23 May. Bangladesh’s second liquefied natural gas (LNG) floating facility is set to receive its first ship-to-ship transfer of gas from an Algerian cargo, Summit LNG Terminal said. ‘Summit LNG’, the floating storage and regasification unit (FSRU), will receive 159,000 cubic metres of LNG from Oman Trading International, with the transfer expected to be completed. The LNG tanker, Creole Spirit, loaded gas from Bethioua, Algeria. A second LNG tanker is expected to arrive on 3 June. The FSRU started to feed gas to Bangladesh’s national grid in late April after picking up its commissioning cargo from Qatar. Summit Power International, which owns power generation assets in Bangladesh and is owned by Bangladeshi conglomerate Summit Group, has chartered the vessel, which is able to regasify 500 million cubic feet of LNG a day from US (United States)-based Excelerate Energy for 15 years.

Source: Reuters

PetroChina raising gas prices ahead of pipeline reshuffle

23 May. PetroChina is bucking normal practice and raising its wholesale natural gas prices during the weak-demand spring season, preparing for the coming consolidation of China’s pipeline assets and trying to recoup huge fuel import losses. The increases from PetroChina - which supplies more than 70 percent of China’s gas - come as spring brings warmer temperatures, when demand and prices typically fall. PetroChina is also under pressure to recoup continuing losses from its gas import business due to high input costs versus government-capped domestic prices. PetroChina lost 3.3 bn yuan ($480 mn) on its gas imports in the first quarter of this year due to high fuel costs. Over 2018, the Chinese major incurred a net loss on its gas imports of nearly 25 bn yuan. Beijing plans to launch this year a national oil and gas pipeline company that will combine assets from PetroChina, China National Offshore Oil Corp (CNOOC) and Sinopec, a move aimed at spurring private and foreign exploration investment. The price increases sought would apply to wholesale rates that PetroChina charges provincial piped-gas distributors, power plants and big industrial users such as fertilizer producers. PetroChina expects to agree with buyers to prices about 6.4 percent above government-set city-gate prices for gas from conventional domestic fields and imports by pipeline from Central Asia, which together make up more than 60 percent of PetroChina’s total gas supplies. PetroChina normally prices gas at a discount or flat to city-gate levels in the spring as demand ebbs in warmer weather. For supplies of higher-cost LNG imports and domestic shale gas output, PetroChina still aims to raise prices by up to 30 percent above city-gate levels, said the three sources. With a goal to sign up annual supply deals with buyers by end of June, PetroChina, the listed arm of China National Petroleum Corp (CNPC), started raising prices with some customers of LNG or shale gas in April. Shaanxi Gas Group, a provincial utility, said it had reduced its gas intake because of a PetroChina price hike.

Source: Reuters

Saudi Aramco signs US LNG deal with Sempra

22 May. Saudi Aramco has entered into a 20-year agreement with US (United States)-based Sempra Energy to purchase liquefied natural gas (LNG) from its subsidiary Sempra LNG, the two companies said. The Saudi state oil giant plans to become a major global gas player while the US market is undergoing a shale boom. Aramco has been developing its own gas resources and eying gas assets in the US, Russia, Australia and Africa. The two companies are also finalizing a 25 percent equity investment in the phase 1 of Port Arthur LNG, they said. The sale-and-purchase agreement is for 5 million tonnes per annum (mtpa) of LNG from phase 1 of the Port Arthur LNG export project under development, the firms said. The proposed Port Arthur LNG Phase 1 project is expected to include two liquefaction trains, up to three LNG storage tanks and associated facilities which should enable the export of about 11 mtpa on a long-term basis. Aramco’s trading arm sold its first LNG cargo on the spot market in late March to an Indian buyer. Aramco plans to boost its gas production to 23 bn standard cubic feet (scf) a day from about 14 bn scf now.

Source: Reuters

INTERNATIONAL: COAL

China imports of US coking coal rise five-fold in April on trade deal bets

27 May. China’s imports of US (United States) coking coal rose more than five times in April from a month earlier, the General Administration of Customs data showed, on traders’ earlier bets that trade tensions between Beijing and Washington were easing. Shipments of coking coal from the US rose to 308,789 tonnes last month, up from 60,585 tonnes in March, according to data. China imposed imports tariffs of 25 percent on $34 bn in US goods effective from July of last year, including on thermal coal and coking coal, in response to US tariffs on Chinese goods. Vessel-tracking and port data compiled by Refinitiv show that nearly half of the US coal brought into China in April was discharged at Jintang port. It typically takes around six weeks for US coking coal to arrive in China and some extra days for customs clearance. Refinitiv data shows no cargo carrying coal has been departed from the United States for China since 2 April. China’s imports of Australian coking coal, meanwhile, continued to increase in April despite persistent prolonged customs clearance times at Chinese ports, supported by cheaper prices and firm demand from the country’s steel mills. Arrivals of Australian coking coal were at 2.72 million tonnes (mt) in April, up from 2.23 mt in March, according to customs data. China imported a total of 7.43 mt coking coal in April, up 21 percent from March and 64 percent from same month last year.

Source: Reuters

Turkey will offer 500 coal mines to investors

27 May. Turkey’s Ministry of Energy and Natural Resources will offer 500 coal mines across the country to potential investors in public tenders. Details of the various sales will be released in a minimum of 15 days, along with information on the conditions of participation and the scope of the licenses on offer, according to the ministry. Coal-fire power production meets about one-third of Turkey's electricity needs and covers a quarter of Turkey's primary energy consumption, according to the ministry data. The Turkish government is seeking to support an expansion in the production of power with local coal and is promoting new coal-fired power plants. Turkey is seeking to tighten supervision of coal production as it increases supply. It has had a poor reputation for labour safety in mines and for illegal mining. Between 2000 and 2018, there were more than 21,000 workplace accidents in coal mines in Turkey, resulting in 534 deaths and 11,000 injuries.

Source: Ahval

French bank SocGen further reduces business with coal industry

23 May. French bank Societe Generale said it was further reducing its servicing the coal industry, as financial companies and banks around the world gradually withdraw from fossil fuel industries to protect the environment. SocGen said it would stop offering financial services and products to client companies whose current activity in thermal coal represents 50 percent or more of their business. It would also stop offering services and products to client companies whose current activity in thermal coal represents between 30 percent and 50 percent of their business have no strategy to reduce the share to 30 percent by 2025. In March, the Cardif insurance division of France’s largest bank BNP Paribas also outlined new targets to reduce its exposure to coal.

Source: Reuters

Colombia coal production up 6.5 percent in first quarter

23 May. Colombia, the world’s fifth-largest exporter of coal, produced 20.9 million tonnes (mt) of the fuel in the first quarter, up 6.5 percent from the same period in 2018, government figures showed. Coal production in the South American country was 19.6 mt between January and March last year. Colombia produced 84.3 mt over the course of 2018, 7.4 percent less than the previous year as heavy rains disrupted operations at major mines. Coal is the second-largest generator of foreign exchange in Colombia, behind oil. Leading coal companies have forecast that production and exports are likely to remain stable in 2019.

Source: Reuters

Top miner BHP sees an end to the era of coal

22 May. BHP Group, the world’s biggest miner, sees the outlook for thermal coal as challenged and won’t add production as it prioritizes growth in commodities tied to the shift to renewable energy and electric transport. BHP follows its biggest competitors Rio Tinto Group and Glencore Plc in questioning the future role of coal used for power generation, as investors press for more action to tackle climate change and tighten restrictions on holding companies that produce the fuel. Rio sold its final coal mines last year, while Glencore said in March it would seek to limit production. The producer is also unlikely to add major capacity in iron ore or metallurgical coal, according to Chief Financial Officer Peter Beaven.

Source: Bloomberg

INTERNATIONAL: POWER

Canadian Utilities agrees to sell Canadian power business for $835 mn

27 May. Canadian Utilities Ltd said it has agreed to sell its entire Canadian fossil fuel-based electricity generation portfolio for about $835 mn, ending a strategic process for the assets that the company began last year. The agreement with Heartland Generation Ltd, an affiliate of Energy Capital Partners, includes 11 partly or fully owned natural gas-fired and coal-fired electricity generation assets located in Alberta, British Columbia, and Ontario, with a combined generating capacity of about 2,100 MW. Following the closing of the agreements, Canadian Utilities will have about 250 MW of electricity generation assets located in Canada, Mexico and Australia.

Source: Reuters

Greece’s PPC pushes back power plants bid deadline because of snap elections

27 May. Greece’s electricity utility PPC has pushed back by more than a month a deadline for binding bids for three coal-fired power plants it is selling under a post-bailout agreement, it said. PPC, which is 51 percent owned by the state, had set a 28 May deadline for six investors that expressed initial interest in the plants and a license to build a new one in northern Greece.

Source: Reuters

Egypt mulling Blackstone unit’s offer to take over power plants

27 May. Egypt is considering offers from a Blackstone Group unit and Edra Power Holdings Sdn Bhd of Malaysia to take over three power plants co-built by Siemens AG -- a move that could cut the North African nation’s debts while bringing in much-needed foreign investment. Both Blackstone’s Zarou Ltd and Edra have voiced interest in the state-owned facilities, according to Egypt’s Electricity Minister Mohamed Shaker. The plants, which have a total capacity of 14.4 GW, were inaugurated in July as the latest in a series of large-scale infrastructure projects under President Abdel-Fattah El-Sisi. The plants cost €6 bn ($6.7 bn) to build and were mainly financed by a consortium of lenders led by Deutsche Bank AG, HSBC Holdings Plc and KfW-IPEX Bank AG. If a deal went ahead, a power-purchasing agreement would be signed with either Edra or Zarou and the company would sell the electricity produced to the government while working alongside Siemens, Shaker said.

Source: Bloomberg

Greek grid operator launches tenders for Attica-Crete power link

24 May. Greek grid operator ADMIE launched two tenders to build two undersea cables linking the island of Crete to mainland Attica, the energy ministry said. The €915 mn ($1.02 bn) project will be completed within 2022, the ministry said. Greece has said that the power link is key to the energy security supply of Crete which is now relying on three oil-fired plants that will need to ramp down production in the coming years.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

After coal, forest-rich Finland will need to import biomass to keep warm

28 May. Finland faces having to import biomass because, despite being Europe’s most densely forested country, it will be unable to meet an expected 70 percent rise in demand for the fuel after it phases out coal. Finland approved in February banning the use of coal in energy production by May 2029, which means utilities will have to find alternatives to keep Finns warm as coal currently accounts for around 20 percent of the energy used for household heating. Poyry consultancy - which advises the government on energy, industry and infrastructure needs - calculate that Finland will need 64 terawatt hours (TWh) worth of biomass in 2030 just for energy production, up from 38 TWh currently. Domestic supply of biomass on the other hand, is forecast to grow by only 8 TWh between now and 2030, according to Poyry. Poyry said the country will have to import biomass as well as improve forest management and ensure greater utilization of harvest residues. Finland’s largest energy lobby group Energia also projects large increases in the use of biomass in coming years.

Source: Reuters

Fossil fuel subsidies are wrecking the world: UN chief

28 May. Subsidies that promote the use of fossil fuels are helping “to destroy the world”, and are a bad way to deploy taxpayers’ money, the UN (United Nations) chief said. He said that pollution should be taxed, and subsidies for oil, gas and coal should be ended. According to the International Energy Agency, global fossil-fuel consumption subsidies in 2017 were more than $300 bn, up from about $270 bn in 2016. He believed taxpayers would prefer to see their money returned to them rather than used to wreck the planet. He has convened a summit in New York on 23 September aimed at spurring governments, businesses and others to step up their efforts to curb climate change. Teenage Swedish activist Greta Thunberg, whose weekly school strikes about climate change have sparked a global youth movement over the past nine months, said the general public had not been well-informed about the risks of a warming planet.

Source: Reuters

IEA rings alarm bell on phasing out nuclear energy

28 May. A steep decline in nuclear energy capacity will threaten climate goals and power supply security unless advanced economies find a way to extend the life of their reactors, the International Energy Agency (IEA) said. Nuclear is currently the world’s second-largest source of low-carbon electricity, behind hydropower, and accounting for 10 percent of global electricity generation. But nuclear fleets in the United States (US) and Europe are on average more than 35 years old and many of the world’s 452 reactors are set to close as cheap gas and tighter safety requirements make it uneconomical to operate them. Over the past 20 years, wind and solar capacity has increased by 580 GW in advanced economies. Despite that, however, IEA estimates that the 36 percent share of clean energy sources in global power supply in 2018 was the same as two decades ago because of the decline in nuclear. In order to offset the expected decline of nuclear in the next two decades, renewables investment would have to grow fivefold, but that would not only be hugely expensive, but would also hit public resistance and require major power grid investment, IEA said. IEA director Fatih Birol said that the agency is not asking countries who have exited nuclear to reconsider, but said that countries who did decide to keep nuclear should do more to support the industry. Birol said the low-carbon nature of nuclear and its role in energy security are currently not sufficiently valued for existing nuclear plants to operate profitably and that new nuclear projects have been plagued by cost overruns.

Source: Reuters

Spain proposes EU carbon tax on energy imports

27 May. Spain’s acting government has called on the European Union (EU) to assess a potential carbon tax on power imports to protect the bloc’s interests and help it to pursue its environmental targets amid growing public concern over climate change. In a letter sent to their counterparts in the European Commission, Energy Minister Teresa Ribera and Budget Minister Maria Jesus Montero said the EU should take advantage of the negotiations for the bloc’s long-term budget to open a “proper debate” on such a border levy. Spain, which usually exported its renewable power to its north African neighbour, became a net importer of Moroccan energy produced by thermal plants at the end of 2018. The EU has plans in place to curb carbon dioxide emissions by 40 percent below 1990 levels by 2030.

Source: Reuters

Poland utility Tauron confirms coal mine sale in green push