< style="color: #0069a6;letter-spacing: 0.9pt">RENEWABLES CONTINUE TO ADD CAPACITY DESPITE GLUT

Non-Fossil Fuels News Commentary: April 2019

India

India is looking at a mammoth $500 bn worth of investment in creating renewable energy generation capacity with tendering of 500 GW by 2028 in addition to $250 bn investment in grid expansion and modernisation required for uptake of green energy capacity, according to the Institute of Energy Economics and Financial Analysis. The institute said that 75 GW of renewable capacity has been installed across India, 28 GW has been auctioned and 37 GW of capacity is under various stages of tendering and bidding. If all of this comes to fruition, this amounts to a total of 141 GW of renewable capacity, relative to the government’s target of 175 GW by 2022. Provided the 37 GW of tendered capacity is awarded in the next six to nine months, it will mandate developers to commission this capacity before March 2022. In general, the deadline for commissioning solar and wind power projects is 24 months. India exited the last financial year (2018-19) with 22.5 GW of renewable capacity auctions awarded but yet to be built. Of this, 21.6 GW was awarded at below ₹3/kWh with zero indexation for 25 years – locking in real electricity sector deflation for decades to come. In the last quarter of the year alone 32 GW of new tenders were announced.

India emerged as the third-largest solar PV market in the world, with the country's top 10 companies accounting for over 60 percent of all large-scale project installations in the 2018 calendar year. According to green energy market tracker Mercom Capital’s latest report, India installed 8.3 GW of solar PV capacity in 2018 against 44.3 GW by China and 10.6 by the US. Japan and Germany, however, trailed India to the fourth and fifth-largest solar markets in the world. The report said there were over 300 utility-scale project developers in India with projects of at least 5 MW or more in operation. Currently, there are around 80 large-scale project developers with a pipeline of 5 MW or more in India. ACME Solar was the top developer in terms of utility-scale solar installations in 2018. It also had the largest project pipeline at the end of the year, closely followed by SB Energy (SoftBank) and Azure Power. The Adani group maintained its position as the largest project developer in terms of total cumulative installations through the end of 2018. It was also the second largest utility-scale solar installer in 2018. CleanMax Solar emerged as the top rooftop solar installer in 2018 followed by Fourth Partner Energy, whereas Tata Power still has the largest cumulative installations in the solar rooftop segment. The Mercom report said the top 10 rooftop solar installers covered just 30 percent of installed capacity in India in 2018. Other rooftop developers constituted 70 percent of the market. In the EPC segment, Sterling and Wilson emerged as the top player.

In terms of cumulative installations, Adani maintained its position as the top project developer, while Acme Solar was the developer with the most large-scale solar installations in 2018. Adani was the second largest developer in 2018. According to an earlier study, the Mercom India Solar Market Update, rooftop installations grew by a whopping 66 percent year-on-year with cumulative installations totalling nearly 3.3 GW at the end of 2018. Rooftop solar installations for 2018 amounted to 1.7 GW.

The pace of adding renewable generation capacities slowed down in FY19 with just 8.6 GW of solar and wind power plants getting commissioned in the fiscal. The country had added 11.3 GW and 11.8 GW of renewable capacities in FY17 and FY18, respectively. The installed renewable capacity now stands at 77.6 GW. Experts have attributed the situation to devaluation of the rupee, rising finance costs, government-mandated tariff caps in reverse auctions and cancellation of renewable project tenders as the reasons behind slowing down capacity installation. As much as 41 GW of renewable energy projects have been tendered in the first three quarters of FY19, while nearly 17 GW of tenders have been cancelled at the same time, mostly due to muted response from project developers. At the end of Q3FY19, nearly 18 GW of solar projects were under various stages of development. The country plans to have 175 GW of installed renewable power capacity by FY22. The target, however, now seems achievable as 45 GW of hydro power plants would now be counted as renewable energy after a recent Cabinet decision. Overall, the country’s installed power generation capacity stands at 356 GW, rising only 3.5 percent year-on-year in FY19, the slowest growth rate since FY09. The net capacity addition of thermal power plants in FY19 on a net basis — the difference between the plants commissioned and retired — is a meagre 3.4 GW, one of the lowest in history.

India’s solar power capacity addition is set to grow by about 15 percent to a range between 7,000 MW and 7,500 MW in the current financial year (2019-20) based on the tendering activity and awards of projects in the past 12-15 months. By contrast, last financial year’s solar capacity addition is estimated to have remained subdued in a range between 6,000 MW and 6,500 MW because of weak trend in award of solar projects in calendar year 2017. Nearly, 56 percent of the capacity auctioned in 2018 has been accounted for by central agencies such as SECI and NTPC Ltd with the balance by state nodal entities or discoms under various state level programmes. Apart from the projects awarded through the bid route, around 1 GW capacity is expected to be added through open access or group captive route and grid-connected rooftop, with these additions being facilitated by favourable solar policies for open access route in a few states.

SECI extended bids submission deadline for the third time for manufacturing-linked 3 GW solar power. SECI had floated the fresh tender for the 3 GW manufacturing linked solar power tender in January this year. The capping of tariff has been an issue as it led to failure of a 10 GW manufacturing linked solar power tender last year also. The tender also witnessed many extensions of bid submission deadline and finally junked.

Cancellation of auctions for renewable energy projects because of high bids has saved central and state governments ₹34.05 bn according to MNRE. Companies have sharply criticised the practice as anti-investor. Industry experts have maintained that such cancellations were dampening investor sentiment and would make it difficult for the country to achieve its target of 175,000 MW of renewable energy capacity by 2022. According to solar consultancy Bridge to India, 5,300 MW of valid winning bids were cancelled in 2018.

In a bid to ensure standardization of solar components across India’s solar power ecosystem, MNRE has floated a draft quality control order for Solar Thermal Systems, in accordance with the BIS guidelines. The MNRE has already announced the quality control order for SPV Systems. According to the draft order, a manufacturer or seller of solar thermal systems will now have to register with BIS to obtain a Standard Mark. The order has also prohibited storage, sale, import or distribution of solar thermal systems by manufacturers or by any person on behalf of a manufacturer which does not bear the Standard Mark. However, the manufacturers of solar thermal systems meant for exports are exempted from the requirement of applying for a Standard Mark from BIS. The Order -- Solar Thermal, Systems, Devices and Components Goods (Requirements for Compulsory Registration) Order, 2019 – will come into force a year after its publication in the Official Gazette. In order to ensure compliance of the guidelines, MNRE can seek information along with sample of goods from the manufacturers on the systems any time. The MNRE can also inspect the systems at any point in time. In cases of contravention, the ministry can also search and seize goods. In cases where the solar thermal systems are of varying size and rating, the goods will be grouped and granted series approval. A sample of solar thermal systems of a registered user will be drawn from his manufacturing unit or from the market for ascertaining their conformity to the standards. The samples will be drawn at least once in two years for a product or series of products covered under the scope of registration granted. The MNRE has invited comments from the general public and the relevant stakeholders by 8 April 2019.

The MNRE has proposed making it mandatory for solar power developers to follow glass recycling procedure for solar PV panels under a new framework. The NGT had on 4 January 2019 directed the MNRE to prepare a policy for the management of Antimony present in solar glass panels. Antimony Containing Solar Panel Glass is used globally to improve the stability of the solar performance of the glass upon exposure to ultraviolet radiation and sunlight. The ministry has given several recommendations regarding the use of Antimony. The note mentions that generators might set up facilities for safe dismantling of used solar panels or should tie-up with an authorised dismantling facility. The end-of-life solar panels are required to be collected and stored safely until the option for recycling is available. It should never be disposed or dumped in open landfills as it may release Antimony into the environment, MNRE said. India has witnessed large solar PV installations in the past five to six years. These panels will turn into waste over the next 15-20 years. As the glass in the PV panels is reusable at the end of its life, improper disposal may result in the loss of this recyclable material. The ministry said other countries including Germany have developed PV recycling technology and Antimony containing glass may be recycled without affecting its properties. The recycling process of a tonne of PV panels is likely to produce 686 kg of clean glass and 14 kg of contaminated glass. The recycled glass can be used to produce new panels with Antimony containing glass. However, in case recycling facilities are not available, the concept note stated that the industry should look at the option of disposal in secured landfills or their safe storage.

India has imposed anti-dumping duty of up to $1,559/tonne on imports of a certain type of sheet used in solar cell making from China, Malaysia, Saudi Arabia and Thailand for five years to safeguard domestic players against cheap shipments. In a notification, the Department of Revenue has said that after considering the recommendations of the commerce ministry’s investigation arm DGTR, it is imposing the duty, which is in the range of $537 to $1,559 per tonne, on imports of "Ethylene Vinyl Acetate sheet for solar module" being exported by these four nations. Imports of components used in solar industry have increased as India launched an ambitious national solar policy named Jawaharlal Nehru National Solar Mission in January 2010. Under this, the country has a target of generating 20,000 MW of solar power by 2022. Several countries are interested in supplying solar equipment to tap into the growing sector in India.

Tamil Nadu’s first solar-powered boat will soon operate at the Manimuthar Dam in Tirunelveli district. According to sources at the Kalakkad Mundanthurai Tiger Reserve, the boat will begin operations in the next 10 days. Called Mahindra Odyssea, the 26-seater (including two crew members) boat is 11.8 m long and 4 m wide. One of its unique aspects is that it has a German motor (20 kW).

Trichy international airport got a 1 MW solar power plant to power its campus. Established under the National Solar Mission at ₹46.4 mn, the ground-based solar power plant in Capex model has commenced operation three months after work began on the project. The unit will produce 1.54 mn units a year, which is approximately 25 percent of its annual energy consumption. It is expected to save the airport ₹12.3 mn by way of electricity expenditure per year. The payback period expected of the plant would be three years and nine months. The electricity sourced from the plant would light up the airport premises throughout the day while regular electricity supply will take care of the consumption at night. AAI said that it was looking forward to effectively minimizing greenhouse gas emissions thereby contributing to India’s goal of minimizing environmental degradation.

Soon, a part of the daily operations at Nanganallur Road and Meenambakkam stations will be on solar power, as CMRL has installed and commissioned a 428 kWp solar power plant on the roof of the two elevated stations. The solar plants, with a capacity to generate around 57,780 units per month, is expected to save metro rail around ₹2.634 mn per year. While a major portion of the operations at the stations is planned to be powered by solar panels in the future, CMRL is also working towards using solar power for operation of trains eventually. The generated solar power will be utilised for lighting systems and to operate electrical equipment required for the maintenance of the stations. So far, CMRL has a total installed capacity of 4.1 MWp solar power including those installed at its head office in Koyambedu and a few other metro stations. CMRL had already installed 1 MW solar panels at its depot and 125 kW at its car park area generating a total of 135,000 units a month saving CMRL ₹2.16 mn for CMRL on power charges. Another 2.5 MWp roof top solar power installation is under progress and is expected to be completed by end of this year.

Delhi Metro is now a step closer to powering all its operations with solar energy. DMRC started receiving solar power from MP’s Rewa Solar Power Project, kick-starting an initiative to be the world’s first 100 percent green energy rail network. DMRC said the Metro received 27 MW power from the MP-based project and will gradually increase it to 99 MW. At present, DMRC uses solar energy for almost 60 percent of its electricity needs. It plans to run all its operations on solar by 2021. Once this is done, it would become the world’s first 100 percent green energy metro rail network. DMRC on an average would receive 345 million units of power from Rewa every year. Delhi Metro expects to save over ₹410 mn with the shift to solar energy.

Mahindra Susten, the renewable business arm of Mahindra group, has launched a formal process to sell around 160 MW of solar assets. The company offers diversified services within the renewable energy and cleantech space, such as turnkey solar engineering, procurement and construction services, both utility-scale solar and rooftop solar products, solar car charging stations, telecom tower solarization, operations and maintenance. ReNew Power Ltd and NTPC Ltd have shown interest in the ongoing sale process of PTC India Ltd’s wind power business, which includes 290 MW of wind assets. Fotowatio Renewable Ventures also plans to exit its only investment in the Indian solar power space and Edelweiss Infrastructure Yield Plus Fund is in talks with Engie SA to pick up a significant stake in the French energy firm’s Indian solar business.

MERC has asked the MSEDCL to procure wind energy from projects whose EPAs have expired, to fulfil its non-solar RPO. The MERC was going through submissions made for a petition filed by MSEDCL seeking its approval to procure power from wind projects whose EPAs have expired. In the petition, MSEDCL had asked the commission to allow it to procure power from the wind generators of group II, III, and IV whose EPAs with MSEDCL have expired at the tariff of ₹2.52 (~ $0.036)/kWh for its balance of useful life. It had also requested that these power procurements be counted towards the fulfilment of RPO of MSEDCL. MSEDCL had submitted this request as it could not attract the interest of bidders when it had floated a tender for procuring power from such wind projects keeping ceiling tariff at ₹1.97 (~$0.028)/kWh. The ceiling tariff had been set by the MERC. While going through the submissions made by MSEDCL, MERC was of the view that wind power generators with expired EPA’s are free to sell the energy they produce to any buyer including MSEDCL. It said, the same generators also have the option of selling wind energy to MSEDCL under short-term route at a higher rate of ₹2.25 (~$0.032)/₹2.52 (~$0.036)/kWh.

Distributed solar rooftop company Fourth Partner Energy announced commissioning of eight solar power projects with a capacity of 3,116 kW in Telangana. The projects have been set up under the 1,000 MW grid-connected rooftop solar PV system scheme of SECI. The projects have been implemented across multiple institutions including National Institute of Technology-Warangal, Jayashankar Telangana State Agricultural University, Central Research Institute for Dryland Agriculture and select BSNL and CRPF offices. The scheme provides for government offices to switch to solar power at zero capital costs and avail electricity at a flat rate of ₹3.14/kWh for 25 years. The company said it has so far commissioned 40 projects in Telangana with an installed capacity of 9,000 kW. Overall, under SECI’s 1,000 MW rooftop scheme, the company has executed projects of 13 Mw across 32 sites in Rajasthan, Maharashtra, Delhi, Madhya Pradesh and Odisha. The company currently has an installed capacity of 160 MW across 23 states and is targeting scaling its capacity to 400 MW this financial year.

Telangana will add another 1,000 MW of solar energy capacity in next six to eight months taking the total installed capacity to over 4,500 MW in solar power segment. Telangana stands at second position with a generation capacity of over 3,500 MW commissioned through solar energy. Another 1,000 MW are in the pipeline which will be commissioned likely in the next six to eight months, TSREDCO said. Telangana has a total installed capacity of 4,036 MW renewable energy power including solar energy (ground mount) at 3,583 MW and wind energy of 128 MW besides contribution from other renewable energy sources, Janaiah said. With regard to solar rooftop, he said from 2 MW commissioned in June 2014 it has grown to 60 MW and another 40 MW was in the pipeline. TSREDCO is the state designated agency, nominated by the Telangana government for implementing all new and renewable energy programmes and energy conservation activities in Telangana state.

The RE capacity Telangana State increased from less than 50 MW during the State formation to about 3,873 MW currently. The current installed solar capacity in the State is about 3,602 MW, the largest installed solar capacity in the country. Another 150 MW renewable capacity addition are planned to be added by the end of 2019. Overall, the State is targeting a capacity of 5 GW from all forms of renewable energy by 2020.

Delhi-based Okaya Power Group announced it has launched a solar power generation system in order to cater to the increasing demand from customers for such products. The company said it is already engaged in augmenting the solar energy storage technology to facilitate the mass use of solar energy but did not share the price of the new product. It said that the product meets all statutory compliances for off-grid and on-grid applications and the modules range comes with several features like Potential Induced Degradation, low light performance and Anti-Reflective coating glass.

In a bid to augment solar power generation, KMRL has devised plans to utilise depot tracks to install a solar power plant which will enable it to generate an additional 5445 kWp. The new project is expected to go on stream in 2020 and once completed the energy neutrality will touch 60 percent. Additionally, KMRL commissioned a 2,719 kW ground-mounted solar plant, spread across four hectares at Muttom Depot, which will help KMRL achieve 44 percent energy neutrality. With the commissioning of the new plant, the total capacity will be 5,390 kWp.

Tata Power and IGL announced signing of a pact to jointly set up electric vehicle charging stations, battery swapping stations and rooftop solar power plants among other focus areas. The MoU provides for setting up of rooftop solar projects with customized structure for IGL establishments under CAPEX and RESCO mode and exploring rooftop solar projects for residential, commercial and Industrial establishments.

India is likely to install 54.7 GW of wind capacity by 2022 against the 60-GW target set by the government, Fitch Solutions Macro Research has said in a report. The country has set an ambitious target of installing 175 GW of renewable energy capacity by the year 2022, which includes 100 GW from solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydropower. According to MNRE the country seeks to tender a total 20 GW of wind capacity by March 2020, with two-year implementation deadlines, in order to facilitate enough growth to meet the expansion targets.

The Union Cabinet gave ex post facto approval to an agreement signed between India and Denmark for cooperation in the field of renewable energy with focus on offshore wind energy. The agreement was signed in March 2019 in New Delhi. The areas of cooperation would include technical capacity building for management of offshore wind projects, measures to develop and sustain a highly efficient wind industry -- onshore as well as offshore, measures to ensure high quality of wind turbines, components and certification requirements, forecasting and scheduling of offshore wind. The Indo-Danish Centre of Excellence in Integrated Renewable Power would work on renewable energy resource assessments with focus on onshore and offshore wind, hybridisation of wind, solar, hydro and storage technologies, testing and R&D, and skill development/capacity building.

Siemens Gamesa Renewable Energy, the second biggest manufacturer of wind turbines in the world, expects India to add between 7,000 and 10,000 MW of wind energy capacity in 2021 despite a slump in projects over the last two years. In early 2017, India transitioned from a feed-in tariff regime (where tariffs were set by the power regulator) to a reverse auction regime. The transition, however, took time and not enough auctions were held, leading to a fall in new projects. German conglomerate Siemens and Spanish wind power producer Gamesa merged their wind businesses two years ago to form Siemens Gamesa Renewable Energy, but the merger coincided with the new tariff regime in India, and new installations that year, at around 260 MW, were modest. In 2018-19, however, projects worth 10,000 MW were auctioned by the SECI, with strong participation by wind developers. Siemens Gamesa, which only trails Denmark’s Vestas among global wind power companies, recently installed India’s first solar-wind hybrid project of 78.8 MW in Karnataka. For the company, India is the fastest growing market for such hybrid plants. Tacke said wind tariffs had stabilized, and were not likely to fall further. The latest wind power auction held by SECI in February saw tariffs in the range of ₹2.82/kWh.

TANGEDCO has started measuring wind power generation real time with the help of GPS over the last few months. GPS system has been installed in all windmills across the state and discom has been able to measure the power generation from a windmill without going to the spot. TANGEDCO has also set up smart meters in all high tension consumers and this has prevented assessors from visiting the consumer and recording the consumption. Tamil Nadu is the first state to have used GPS in windmills. Other states like Karnataka, Gujarat and Maharashtra are also likely to opt for this route shortly. Tamil Nadu has a total wind power capacity of 8,322 MW. The GPS scheme will also help the discom to know how many windmills are actually generating power during the wind season, as many are old and not generating at all.

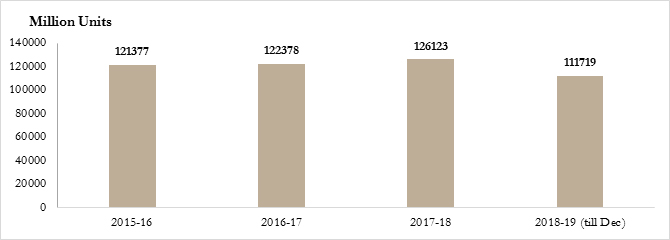

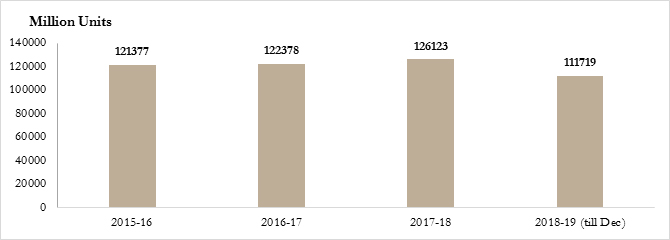

The country’s hydropower generation would be good this season despite varying forecasts by the IMD and Skymet. While Skymet expects a below-normal rainfall, IMD sees near-normal rains this year. With more than 6,900 MW of capacity, NHPC is the largest hydropower producer in the country. 50 percent of NHPC’s hydro production in rainfall-dependent, while the rest is snowfall-driven. JSW is the country’s largest private power producer after its acquisition of two hydro assets from Jaypee Group in 2016 in Himachal Pradesh. The private power producer operates 1,391 MW of hydropower capacity. According to CEA in the April-February 2019, about 126.2 bn units, 5.96 percent higher from 119.1 bn units in the same period a year back. India's total installed hydropower capacity was at 45,399.22 MW as of February 2019.

Rest of the World

China added 5.2 GW of new solar power capacity in the Q1, the NEA said, which includes 2.4 GW from solar farms and 2.8 GW of new distributed solar projects. The country also added 4.78 GW of wind power between January and March, the NEA said. Total installed wind power capacity reached 189 GW by the end of March, the NEA said.

China will give priority to the construction of wind and solar projects that can operate without subsidies this year, and will cap new subsidized capacity, the energy regulator said, part of efforts to ease a subsidy payment backlog. After a rapid fall in manufacturing costs, China has been gradually cutting the amount of subsidies to renewable energy providers. It said last year that it would take action to ensure wind and solar generators can achieve “grid price parity” with traditional energy sources such as coal. China has already promised to launch a series of solar and wind projects that can provide electricity at the same price as coal-fired power, after a surge in capacity left the finance ministry with a subsidy payment backlog of at least 120 bn yuan ($17.9 bn). After studying local conditions, regional energy bureaus should give priority to the construction of wind and solar plants with grid price parity, and rationally control the scale of new projects that still require subsidy, China’s NEA said in new draft rules. The NEA plans to improve the management of solar power subsidy by imposing differential policies for large solar stations, distributed solar projects, solar plants designed to help alleviate poverty and government-led pilot schemes. Total subsidies for solar projects in 2019 have been set at 3 bn yuan. Of that, 750 m yuan will be allocated to “distributed” rooftop power projects with a combined capacity of 3.5 GW, with the rest going to solar stations, the NEA said. China added 20.59 GW of wind capacity in 2018, bringing the country’s total to 184 GW, according to NEA data. It remains shy of its 2020 target of 210 GW.

China has approved the construction of 3,961 village solar power plants with a total capacity of 1.67 GW, part of a programme aimed at alleviating rural poverty and promoting clean energy. The NEA said in a notice that the projects, the second batch of a "photovoltaic poverty relief" programme, should be completed by the end of this year. Those not completed on time will be declared ineligible from the scheme. China is committed to reducing the amount of subsidies granted to its solar power sector, but projects also designed to relieve rural poverty will remain eligible for state support, it said in a new policy guidelines.

Chinese companies have expressed great interest in bidding for Bangladesh’s proposed second nuclear power plant. Two Chinese companies – Dongfang Electric Corp and China State Construction Engineering Corp – have started huge lobbying with the Bangladesh Atomic Energy Commission to bag the deal. They said that the government conceived the second nuclear power plant in 2014, but was yet to seek any expression of interest from foreign companies or finalise a site. The country’s first nuclear power plant is under construction at Rooppur in Pabna with over $12 bn in financial and technical assistance from Russia. For the first nuclear power plant at Rooppur, nearly 1,750 cubic metre of water would be fetched everyday from the nearby Padma River to cool the reactors, they said.

Sunny weather boosted solar power generation in nuclear-dependent France to a record level, covering 10.7 percent of its 59.5 GW electricity consumption, French power grid operator RTE said. The record output of 6.3 GW was due to a sunny spell and an increase in France’s installed solar power capacity, which rose 12.7 percent in 2018 to 8.5 GW compared with the previous year, RTE said. The output placed solar power generation second behind France’s main source of electricity, nuclear generation from 58 reactors operated by state-controlled utility EDF, which accounts for around 75 percent of the country’s electricity needs.

France needs to raise the minimum for wind power projects to 1,000 MW per year to boost the development of the sector, if the country wants to reach its targets for renewable energy use. The French Renewable Energy Association and France Energie Eolienne said the government should launch two supplementary tenders of 750 MW capacity each between 2021 and 2022, and three other tenders of 250 MW capacity, and another 500 MW tender. These will boost French fixed and floating offshore wind capacity to around 7,750 MW by 2025 from zero currently. Below the 1,000 MW per year target, investments in the sector could be at risk because of the lack of a sufficient domestic market. The current target of around 4,700 MW to 5,200 MW of tenders, or 540 MW to 665 MW per year by 2024 in France’s long-term energy plan known as the PPE, was insufficient. Although France has 15,100 MW of onshore wind capacity as it races to increase the share of renewables in its energy mix, offshore wind generation is still to take off with no single turbine on its coastline connected to the grid. After several years of administrative delays and local opposition to projects, the nuclear-dependent nation is set to make a new push on offshore wind following reforms aimed at removing hurdles. A tender for a 600 MW project in Dunkirk has attracted a number of international energy companies. Energy market regulator CRE will publish its recommendations for the project in May.

South Korea plans to boost the share of its energy output generated from renewable sources to as much as 35 percent by 2040, a draft revision to government policy showed, over four times the current amount. Asia’s fourth-largest economy has been pushing to shed its heavy reliance on coal and nuclear power, with the latest target coming on top of a 2017 plan to increase the amount of renewables in its energy mix to 20 percent by 2030. Renewable power currently makes up around 8 percent of South Korea’s energy production. A South Korean advisory group said in November that the government should plan to expand the share of renewable power generation in the country’s generating mix between 25 percent and 40 percent by 2040 to keep up with global trends. Research firm Wood Mackenzie said that South Korea was likely to just miss its 2030 renewable energy target, although its renewables capacity was expected to triple from 2019.

Swedish power producer Vattenfall has commissioned a plant to test the storage in salt of electricity from solar plants and wind turbines, hoping to overcome the stop-start nature of green energy which is one of its main disadvantages. Efficient energy storage is vital in increasing the appeal of renewable power and Vattenfall’s pilot program will use a technique developed by another Swedish firm, SaltX Technology. SaltX’s system uses salt crystals coated in a nano material, which can be heated up with electricity, then release the heat when they are discharged. Vattenfall’s pilot project, set to run to the end of summer, will be located at the Reuter thermal power plant in Berlin and will have a storage capacity of 10 MW, the company said.

The Megalim solar thermal power plant, a joint venture of BrightSource, GE Renewable Energy and the Noy Fund, said it has begun commercial operation in Israel’s Negev desert. The 3 bn shekel ($839 mn) project was announced in 2008 and construction began at the end of 2014 under the leadership of GE Renewable Energy. The technology uses 50,600 mirrors spread over a 3 square kilometre site. Megalim’s thermo-solar station will provide electricity to supply about 50,000 households at peak. It is one of three facilities in Ashalim that are expected to produce about 2 percent of Israel’s electricity capacity.

Sovereign wealth funds from oil-rich countries in the Middle East are moving to diversify into renewable energy, pushed by regulators and pledges on climate change, but are stopping short of following Norway in shedding some oil and gas investments. Total sovereign wealth fund investments within the oil and gas industry have dwarfed those within renewable energy in the past decade. But data on private equity investments with sovereign wealth fund participation suggests this balance might be shifting. In 2018, $6.36 bn went into hydrocarbons, compared to $5.81 bn in renewable energy, one of the narrowest margins in the past decade, according to PitchBook, a data and research firm.

Uzbekistan plans to build 25 solar power plants with a capacity of 100 MW by 2030, with the first one to be completed in two years. Uzbekistan will start construction of the country's first 100 MW solar power plant in the Navoi region this year. The country plans to complete the construction within two years, and that another 24 such power plants are planned to be built by 2030. The government of Uzbekistan and SkyPower Global announced in 2018 the signing of a landmark solar power purchase agreement under which SkyPower Global will invest $1.3 bn to build 1,000 MW of solar energy generation capacity throughout the country. The country will produce 67.5 bn kWh of electricity this year and expects the figure will reach 120 bn kWh in 2030. The total potential of solar energy in Uzbekistan exceeds the equivalent of 51 billion tonnes of oil, according to expert estimates. Uzbekistan reached a deal with Russia in 2018 to build the country's first nuclear power plant. In power generation, Uzbekistan remains heavily dependent on coal- and natural gas-burning power plants, but the country aims to increase the share of renewable energy generation in the coming years.

Croatian state-owned power utility HEP said it had kicked-off a decade-long investment plan to add 350 MW of new solar capacity by 2030. HEP will invest 750 mn kuna ($113.48 mn) over the next five years, adding 20 MW of new solar capacity each year. HEP has taken over an existing solar plant in the northern Adriatic and will begin construction of three new plants in southern Croatia this year. HEP is aiming to boost the proportion of renewable energy in its total capacity to 50 percent from the current 35 percent by 2030. Besides new solar plants, the drive includes wind farms, cogeneration plants and hydropower plants.

Belgium’s parliament has passed two bills aimed at spurring investment in gas-fired power generation and building 4,000 MW of new offshore wind farm capacity by 2030 to replace its aging nuclear power reactors. The bills were approved by a wide majority. When completed, the wind farms will cover around 20 percent of Belgian electricity consumption. Belgium has decided to phase out nuclear power by 2025, which means the country needs to develop new capacity to replace its seven nuclear reactors operated by Engie unit Electrabel. The reactors have capacity of around 6,000 MW and generate around 50 percent of the country’s electricity.

State-controlled French utility EDF has been warned of a 24-hour strike at its hydropower plants in France from 10 April, the RTE grid operator said. France’s CGT trade unions have been calling for strikes at hydropower stations to protest against European Commission demands for France to privatise its hydropower concessions, which are mostly operated by EDF. The French government made proposals to the Commission last year to resolve the long-standing demand by Brussels for it privatise the hydropower concessions. Hydropower represents about 19 percent of France’s installed electricity capacity and accounted for about 12.5 percent of its electricity generation in 2018, RTE data shows.

A US biofuels trade group asked a federal court to stop the EPA from giving refiners new waivers from the country’s biofuels law until the agency reverts to the tougher criteria it used to assess applications before Donald Trump’s presidency, according to court papers. The waivers can exempt small refineries — those with a production capacity of 75,000 barrels per day or less - from the requirements of the Renewable Fuel Standard, which mandates US refiners blend biofuels into the fuel pool or buy compliance credits from those who do. The US RFS is meant to help farmers by requiring refiners to blend certain volumes of biofuels into their fuel each year or purchase credits from those that do. But the RFS also allows small refineries to apply for exemptions to the regulation if they can prove that compliance would cause them financial harm.

New Jersey regulators voted to approve $300 mn in customer-funded subsidies for the state’s nuclear industry despite finding the plants are financially viable. The decision means that all residential utility customers in the state will see their bills go up by about $40 a year under some estimates. Large businesses have said their bills could go up by about 50 percent. In return for the bailout, the state's biggest utility, Public Service Enterprise Group, is expected to keep the three southern New Jersey nuclear plants that supply an estimated two-fifths of the state's electricity supply in operation. The plants provide carbon-free energy and employ up to 2,000 people, the company said.

China aims to complete and start generating power from an experimental nuclear fusion reactor by around 2040, a senior scientist involved in the project said, as it works to develop and commercialize a game-changing source of clean energy. China is preparing to restart its stalled domestic nuclear reactor program after a three-year moratorium on new approvals, but at a state laboratory in the city of Hefei, in China’s Anhui province, scientists are looking beyond crude atom-splitting in order to pursue nuclear fusion, where power is generated by combining nuclei together, an endeavor likened by skeptics to “putting the sun in a box”.

China will fall short of its nuclear power generation capacity target for 2020, according to a forecast from the China Electricity Council. Total nuclear capacity is expected to reach 53 GW next year, below a target of 58 GW. China is the world’s third-biggest nuclear power producer by capacity, with 45.9 GW installed by end-2018 and 11 units still under construction, but its reactor building program has stalled since the 2011 Fukushima nuclear disaster in Japan. No new approvals have been granted for the past three years, amid spiraling costs, delays for key projects and safety concerns about new technologies. Environmental impact assessments for two new projects in southeast China were submitted to regulators last month, however, paving the way for a resumption of its atomic energy program. Capacity should reach 137 GW by 2030 if China raised the pace of nuclear construction to six to eight reactors a year from 2021 to 2030, and could hit 200 GW by 2035. China’s electricity consumption is expected to keep rising until at least 2035, allowing room for nuclear power to serve as an effective replacement for coal-fired power plants, Wei said. China’s power pricing policies have left many nuclear reactors operating at less than full capacity in recent years, with tariffs for electricity from nuclear power plants more expensive than coal-fired power. Nuclear power has been cheaper than wind power, but a rapid fall in construction costs for wind and solar facilities over the past two years has improved their competitiveness. China is also backing new advanced reactor technologies, but costs for third generation nuclear reactors, are expected to be considerably more expensive than the earlier generation of reactors, according to a recent study by China Nuclear Energy Association.

Saudi Arabia plans to issue a multi-billion-dollar tender in 2020 to construct its first two nuclear power reactors and is discussing the project with US and other potential suppliers. The world’s top oil exporter wants to diversify its energy mix, adding nuclear power so it can free up more crude for export. But the plans are facing Washington’s scrutiny because of potential military uses for the technology. US, Russian, South Korean, Chinese and French firms are in talks with Riyadh to supply reactors, a promising deal for an industry recovering from the 2011 Fukushima nuclear disaster. Riyadh needs to sign an accord on the peaceful use of nuclear technology with Washington to secure the transfer of US nuclear equipment and expertise, under the US Atomic Energy Act. US Energy Secretary Rick Perry said that the negotiations which began in 2012 were continuing. The King Abdullah City for Atomic and Renewable Energy, tasked with developing the nuclear programme, has brought in an executive from oil giant Saudi Aramco to help manage the pre-tender consultancy process.

| MW: megawatt, GW: gigawatt, kW: kilowatt, FY: Financial Year, mn: million, bn: billion, kWh: kilowatt hour, PV: photovoltaic, US: United States, SECI: Solar Energy Corp of India, discoms: distribution companies, MNRE: Ministry of New and Renewable Energy, BIS: Bureau of Indian Standards, NGT: National Green Tribunal, kg: kilogram, CMRL: Chennai Metro Rail Ltd, kWp: kilowatt peak, MWp: megawatt peak, DMRC: Delhi Metro Rail Corp, MP: Madhya Pradesh, MERC: Maharashtra Electricity Regulatory Commission, MSEDCL: Maharashtra State Electricity Distribution Company Ltd, EPAs: energy purchase agreements, Q1: first quarter, CEA: Central Electricity Authority, RPO: renewable purchase obligation, TSREDCO: Telangana State Renewable Energy Development Corp Ltd, RE: renewable energy, KMRL: Kochi Metro Rail Ltd, IGL: Indraprastha Gas Ltd, MoU: Memorandum of Understanding, TANGEDCO: Tamil Nadu Generation and Distribution Corp Ltd, IMD: Indian Meteorological Department, RFS: Renewable Fuel Standard, EPA: Environmental Protection Agency, NEA: National Energy Administration |

NATIONAL: OIL

Kerosene subsidy bill builds up 21 percent to Rs58 bn in FY19

7 May. The next government at the Centre would have around Rs133 bn left in its petroleum subsidy provisioning for the current financial year — 2019-20, or FY20 — as 2018-19 closed with a Rs370 bn requirement. The kerosene subsidy provision for 2019-20 has been subsumed entirely by the requirement last year. In fact, the government would have to provide Rs13.11 bn more for last year when a full Budget is presented in June. The subsidy bill on liquefied petroleum gas (LPG) for FY19 saw a 49.4 percent increase, to Rs312 bn compared to Rs208.80 bn in FY18. The kerosene subsidy bill last year saw a 21 percent increase, from Rs47.85 bn in FY18 to Rs58 bn. The rise in subsidy burden on LPG was because of an increase in consumption and a rise in international prices during the period. The subsidy estimate for LPG for FY20 is expected to be Rs358.80 bn, and Rs27.30 bn for kerosene. The government had provisioned Rs329.89 bn for LPG and Rs44.89 bn for kerosene in the 1 February interim Budget to meet the requirement of both the years. The three oil marketing companies — Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL), and Hindustan Petroleum Corpn Ltd (HPCL) — have together added 45.5 mn customers by the end of 31 March. Of this, 36.3 mn come under the Pradhan Mantri Ujjwala Yojana (PMUY) scheme, through which cooking gas connections are allotted to poor families. In contrast, kerosene subsidy had remained under control because those getting LPG connections and power were no more entitled to kerosene given through the public distribution system. Based on the latest data available with the Petroleum Planning and Analysis Cell (PPAC), the LPG consumption recorded a growth of 10.2 percent during March 2019 and a cumulative growth of 6.8 percent during FY19. Under the flagship Ujjwala Yojana, the government has added 71.9 mn connections since the launch of the scheme on 1 May 2016. During March 2019, of the five regions, north had the highest share in LPG consumption of 33.3 percent followed by south at 26.8 percent, west at 22 percent, east at 15.4 percent and northeast at 2.6 percent. In 2017-18, India became the second largest consumer of LPG in the world by taking 22.5 million tonnes (mt). According to the government estimates, this is likely to increase to around 30.3 mt by 2025 and 40.6 mt by 2040. For 2019-20, the PPAC has estimated the country's import bill to be around $112.72 bn, as against $111.95 bn during FY19. This is despite imports from Iran coming to "zero" in May, after the United States lifted waivers to India on Tehran sanctions. The imports were estimated at the average price of Indian basket crude oil at $66 a barrel and average exchange rate for Rs71 per dollar. In terms of quantity, the crude oil imports for FY20 is expected to go up 233 mt compared to 226.6 mt in FY19.

Source: Business Standard

RIL regains market share in petrol, diesel sales

7 May. Eleven years after Reliance Industries Ltd (RIL) began shuttering its fuel retail outlets, it has regained market share in petrol and diesel sales to pre-2006 levels. While petrol and diesel sales nationwide grew 9 percent and 3 percent, respectively, in 2018-19 from a year ago, RIL outperformed the industry with figures of 21 percent and 16 percent, respectively, the company said. Till 2006, when RIL’s fuel sales were at its peak, it had a market share of 14.3 percent in diesel and 7.2 percent in petrol. RIL, which enjoyed an overall 12 percent market share in fuel retailing till 2006, saw it slip to less than 0.5 percent in 2014, by when it had shut most of its fuel retail outlets due to spiralling crude oil prices. RIL spent ₹50 bn in setting up 1,470 retail outlets in 2004 and 2006. In 2008, however, it started shutting outlets, and later reopened some. In 2018-19, it reopened or added 59 stations, reaching 1,372 fuel retail outlets now. Under regulations issued in October 2016 by the International Maritime Organization, ships must shift to fuel oil with sulphur content below 0.5 percent January 2020, against the present 3.5 percent. With this impending shift, demand for low-sulphur fuel oil is expected to rise. According to analysts, RIL’s gross refining margin stands to gain from expansion in middle distillate cracks, including liquefied petroleum gas (LPG), diesel, fuel oil, kerosene and marine bunker fuel. RIL has also outperformed the

industry in sales of aviation turbine fuel and bulk diesel, and is preparing to on-board Air India for diversifying its portfolio and reinforce its industry position.

Source: Livemint

India’s oil import dependence jumps to multi-year high of 84 percent in 2018-19

5 May. Prime Minister (PM) Narendra Modi may have set a target to cut India’s oil import dependence by 10 percent but the country’s reliance on foreign oil for meeting its energy needs has jumped to a multi-year high of nearly 84 percent, government data showed. He had said that India needs to bring down its oil import dependence from 77 percent in 2013-14 to 67 percent by 2022 when India will celebrate its 75th year of independence. Further, the dependence can be cut to half by 2030, he had said. But with consumption growing at a brisk pace and domestic output remaining stagnant, India’s oil import dependence has risen from 82.9 percent in 2017-18 to 83.7 percent in 2018-19, according to the oil ministry’s Petroleum Planning and Analysis Cell (PPAC). Import dependence in 2015-16 was 80.6 percent, which rose to 81.7 percent in the following year, PPAC said. The country’s oil consumption grew from 184.7 million tonnes (mt) in 2015-16 to 194.6 mt in the following year and 206.2 mt in the year thereafter. In 2018-19, demand grew by 2.6 percent to 211.6 mt. According to PPAC, India spent $111.9 bn on oil imports in 2018-19, up from $87.8 bn in the previous fiscal year. The import bill was $64 bn in 2015-16. For the current fiscal, it projected crude oil imports to rise to 233 mt and foreign exchange spending on it to marginally increase to $112.7 bn. Oil and Natural Gas Corp (ONGC)’s output fell to 19.6 mt in 2018-19 from 20.8 mt in the previous year. ONGC's oil production was 20.9 mt in 2016-17 and 21.1 mt in 2015-16. Output from fields operated by private firms has dropped from 11.2 mt in 2015-16 to 9.6 mt in 2018-19.

Source: Business Standard

India could cut US shale import to offset Iran loss

4 May. India is becoming increasingly uncomfortable with the idea of buying more American shale oil, which the US (United States) has been pushing to counterbalance the impact of sanctions on Iranian oil exports. India’s main problem with US shale is that it will be more expensive for Indian refineries to process it, effectively increasing the price of the output. Once the US sanctions on Iranian oil kicked in, India’s future purchases from alternative energy suppliers will be finalised keeping in mind the country’s energy and commercial security. The US sanctions will disrupt supplies from Iran, which accounted for 10 percent of India’s energy imports in 2018-19. Only a handful of new refineries, such as Indian Oil Corp (IOC)’s Paradip Refinery, can process shale oil as its composition and properties are different from crude oil. India imported oil and gas worth close to $4 bn from the US last year, and India’s envoy to Washington, Harsh Shringla, said in January the country is committed to buying American oil and gas worth $5 bn per annum. IOC executives confirmed the company imported 3.8 million tonnes (mt) of shale oil from the US during 2018-19 for Paradip Refinery.

Source: Hindustan Times

IOC plans to shut units at northeast refineries to upgrade fuel

1 May. Indian Oil Corp (IOC), the country’s top refiner, plans to shut units in phases at its northeast plants from August to produce cleaner fuels. Domestic refiners have lined up upgrade plans ahead of full-scale roll-out of Euro VI-compliant fuels in the country from April 2020. IOC’s refineries in the state of Assam are very old and small in size. These refineries get incentives from the government to protect their gross refining margins and cater to fuel demand in the land-locked region. IOC will shut a delayed coker, hydrotreater and gasoline units for about 15 days for catalyst replacement at its 13,000 barrels per day (bpd) Digboi refinery. At the 48,000 bpd Bongaigaon refinery, it will shut one of the two crude units, a delayed coker, diesel hydrotreater and hydrogen generation unit for three months from September. The second crude unit at the Bongaigaon refinery will be idle as most units at the plant will be shut. The refiner will also shut gasoline units at the plant for 20 days in September to install a new naphtha hydrotreater. It will fully shut its 20,000 bpd Guwahati refinery in the first quarter of 2020 to modify the plant for producing Euro VI-compliant fuels. Apart from revamping the units, IOC aims to raise the capacity of Guwahati refinery to 24,000 bpd.

Source: Reuters

India, China set up joint working group to tackle crude volatility

1 May. India and China, two most sought-after customers of the Organization of the Petroleum Exporting Countries (OPEC), have put in place a mechanism to figure out ways to fight crude oil volatility and teamed up for other energy issues in global markets. The two countries have set up a joint working group that would identify subjects of cooperation in the energy sector, including ways to rein in global oil prices. China and India, second- and third-largest oil consumers, respectively, have been meaning to form a joint front for more than a decade to assert their weight in the oil market, dominated by a producers’ cartel, OPEC. In 2005, then Oil Minister Mani Shankar Aiyar had proposed the idea but it didn’t make much headway. The countries, however, partnered in some upstream projects in the last decade after engaging in fierce competition for oil and gas blocks in Africa and Asia. Oil Minister Dharmendra Pradhan revived cooperation talks with China last year. He also mooted the idea of Japan, South Korea, China and India — the top four Asian oil importers — forming a buyers’ bloc. A big cooperation opportunity exists in swapping oil and LNG, making it commercially advantageous to both. India can potentially swap its share of oil and gas from Russia with China that has easy access to Russian energy pipeline. Bringing Russian oil to Indian refineries is expensive due to long distance.

Source: The Economic Times

NATIONAL: GAS

GAIL eyes GSPC LNG’s Morbi stronghold

6 May. GSPC LNG, the trading arm of Gujarat State Petroleum Corp (GSPC) group is likely to face stiff competition from India’s largest natural gas marketer GAIL (India) Ltd that is looking to enter Morbi for selling natural gas. The country’s biggest ceramic manufacturing cluster at Morbi is regarded as a stronghold for Gujarat Gas that sells nearly half of its total natural gas. Gujarat Gas buys its entire LNG (liquefied natural gas) requirement from GSPC that is banking on gas supplies from the newly built LNG terminal at Mundra to meet the growing demand from Morbi. The terminal project by GSPC LNG is likely to receive its first cargo in the next two months. A large number of ceramic tile makers are switching over to natural gas following the order of National Green Tribunal (NGT) for closure of ceramic units running on coal-gasifiers. Gujarat Gas earlier supplied about 2.5 million metric standard cubic meter per day (mmscmd) to Morbi. However after the NGT order, its supply has almost doubled. Gujarat Gas’ five-year long marketing exclusivity for city gas distribution in Morbi ended recently, but it still has network exclusivity for a 25-year period. GAIL has offered to supply gas at rates that are linked to Henry Hub natural gas prices. To start with GAIL is looking to sell 0.5 mmscmd for a period of two months at about $7.50 per million metric British thermal units.

Source: The Economic Times

NATIONAL: COAL

Singareni targets 70 mt coal production in FY20 Hyderabad

3 May. Singareni Collieries Company Ltd has set a target of 70 million tonnes (mt) of coal production for the current fiscal (2019-20). SCCL CMD (Chairman and Managing Director) N Sridhar said Singareni Coal has high demand in Telangana State as well as from other States and to meet this demand apart from increasing coal production, construction of new Coal Handling Plants (CHPs) enabling coal transport and modernisation of old ones are to be taken up immediately. SCCL produced about 65 million tonnes of coal in FY 18.

Source: The Economic Times

CIL April output rises 1 percent to 45.29 mt

1 May. Coal India Ltd (CIL) said its coal production in April 2019 rose by 1 percent to 45.29 million tonnes (mt) as compared with 44.86 mt year ago. Coal offtake during April rose 2.6 percent to 52.35 mt as compared with 51.02 mt in the year-ago period, CIL said. South Eastern Coalfields and Mahanadi Coalfields, subsidiaries of the company, were the major contributors to the monthly production by generating 11.11 mt and 11.74 mt of coal, respectively.

Source: Business Standard

NATIONAL: POWER

SAIL supplies electric poles for restoration work in Odisha

7 May. SAIL (Steel Authority of India Ltd) said it is supplying parallel beam electric poles for restoration works in the cyclone-affected areas of Odisha. The Ministry of Steel has directed Steel Authority of India Ltd (SAIL) to ensure all-out efforts to meet the requirements of cyclone-hit Odisha, SAIL said. The company has assured to move a total of 15,000 such poles in a time-bound manner, it said. Restoration of electricity is a priority and for this purpose, SAIL said it is mobilising all resources from various locations of the country to move the electric poles on an urgent basis to the affected areas.

Source: Business Standard

JERC directs Chandigarh electricity department to conduct energy audit

5 May. The Joint Electricity Regulatory Commission (JERC) has once again directed the UT electricity department to conduct energy audit of its T&D (transmission & distribution) system. The power regulatory authority had issued similar directions in the past but to no avail. In the petition before the power regulatory body, the department had also submitted that they will also take up with the Chandigarh administration to get all the government buildings, schools and colleges audited so that energy conservation steps may be taken. The department had also submitted that they have planned to bring down T&D losses to 12.65 percent by financial year 2021-22. In the multi year tariff (MYT) petition, the department had also submitted that the T&D loss for the financial year 2016-17 was 13.65 percent, which will be reduced to 13.05 percent (2019-20), 12.85 percent (2020-21) and 12.65 percent (2021-22). As per the directions of the commission, T&D losses of Chandigarh should not be more than 13.25 percent. The electricity department caters to 2.28 lakh consumers divided into nine different categories. As per the official figures of total consumers 1.99 lakh are domestic, which accounts to more than 87 percent of total consumers. Remaining 23 percent belongs to other categories namely commercial, small power, medium supply, large supply, bulk supply, public lighting, agriculture power and temporary supply

Source: The Economic Times

BHEL commissions 232 MW pump sets under Telangana LIS

2 May. Bharat Heavy Electricals Ltd (BHEL), the country’s largest power equipment manufacturer, announced it has commissioned two pumping units of 116 MW capacity each as part of the 812 MW Kaleshwaram Lift Irrigation Scheme (LIS) Package-6 in Telangana. The equipment for the project has been supplied from BHEL’s manufacturing units at Bhopal, Rudrapur and Bengaluru, while the supervision of erection and commissioning at the site was carried out by the company’s Power Sector Southern Region divison in Chennai. BHEL has so far commissioned 27 pump-motor sets of various ratings cumulatively aggregating to 753 MW in Telangana.

Source: The Economic Times

CEA issues draft guidelines on cross-border power trade

1 May. While the CEA (Central Electricity Authority) proposes to allow Indian entities to import electricity from neighbouring countries only through bilateral agreements, export of power can now be done through spot power markets as well. The CEA has framed the draft procedural guidelines for firms to participate in cross-border electricity trade, a move that could open up an annual potential market of additional 5-6 billion units of electricity. While the CEA proposes to allow Indian entities to import electricity from neighbouring countries only through bilateral agreements, export of power can now be done through spot power markets as well. The ‘draft conduct of business rules of the designated authority for facilitating the cross border trade of electricity’ clarified that plants with Coal India Ltd (CIL) fuel linkage or captive mines cannot sell power outside India. Only the power plants which generate electricity using coal sourced through import, spot e-auctions (at premium rates) or commercial mining can export electricity. The Cabinet has recently allowed the sale of 25 percent produce of captive coal mines to the open market on a commercial basis. The power ministry had removed restrictive riders which discouraged neighbouring countries to buy power from India’s spot power markets last December. The earlier guidelines allowed cross border trade only through the ‘term ahead’ market and did not allow trading in the more attractive ‘day-ahead’ market. After that the Central Electricity Regulatory Commission had also revised the regulations to ease trading norms.

Source: The Financial Express

Numaligarh Refinery inks pact with AEGCL for importing 120 MW Power

1 May. Assam based Numaligarh Refinery Ltd (NRL) inked an MoU (Memorandum of Understanding) with Assam Electricity Grid Corp Ltd (AEGCL) for construction of facilities for importing of 120 MW Power from 220 kV (kilovolt) Grid owned by AEGCL. The project includes drawing of 220 kV Overhead power transmission lines of 15 kilometre (km) length and setting up of 220 kV Sub-Station (S/S) near Numaligarh Refinery. According to NRL the MoU will facilitate un-interrupted power supply for seamless refinery operations. It will also help meet the additional power requirement of almost 74 MW for NRL’s upcoming mega Refinery expansion project from existing 3 million metric tonnes per annum (mmtpa) to 9 mmtpa.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

India considers new solar tender with focus on factories

7 May. India is considering a new tender to develop solar power equipment manufacturing that doesn’t include a requirement to also generate electricity, a move aimed at sparking investor interest, according to people with knowledge of the plan. In addition to separating manufacturing of solar cells and modules from generation, the government may also offer some form of financial aid. There has been little interest from solar equipment makers in the previous manufacturing tenders, a hurdle to Prime Minister Narendra Modi’s ambitious plans of building 100 GW of solar power capacity by 2022. India has been struggling to spur its nascent domestic manufacturing industry, which the government estimates can currently only meet just 15 percent of the country’s annual needs. The South Asian nation has been seeking to boost its capabilities through both manufacturing tenders as well as a safeguard duty on cheaper Chinese imports. India’s efforts to develop its own solar equipment industry will be challenged by both domestic policies and overseas competition.

Source: Bloomberg

Rooftop solar power must for India to meet 175 GW energy goal by 2022

7 May. India needs faster implementation of roof-top solar projects to meet the 175 GW of renewable energy target by 2022, according to 'Vast Indian Potential of Rooftop Solar' released by the Institute for Energy Economics and Financial Analysis (IEEFA) said. The country has set an ambitious target of installing 175 GW of renewable energy capacity by the year 2022, which includes 100 GW from solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydropower. Out of 100 GW solar capacity target, 40 GW is likely to be achieved by installation of rooftop solar projects. India has installed 28 GW of solar capacity, a four-fold increase in less than three years, Vibhuti Garg, IEEFA energy analyst and co-author of the released report, said. According to IEEFA estimates, for the next three years, solar rooftop installation will grow at a compound annual growth rate (CAGR) of 50 percent, suggesting a cumulative 13 GW of installed capacity by FY 2021-22. At the moment, Garg said, around 70 percent of the market growth in the solar rooftop market is driven by commercial and industrial consumers. Residential consumers and state governments are lagging behind. The government's recent 20-40 percent financial subsidy for new residential rooftop solar installations should accelerate the pace at the local level, Garg said. Earlier, a survey revealed that several power-consuming small and medium enterprises (SMEs) in India are hesitant to install rooftop solar panels due to perceived performance risks.

Source: Business Standard

Solar safeguard duty is “change in law”, allows compensation for ACME: CERC

6 May. In a landmark judgment, Central Electricity Regulatory Commission (CERC) has held that the imposition of safeguard duty on imports of solar cells and modules amounts to a “change in law” event for the developers who must be compensated for the increased expenditure. The order came on two similar petitions filed by ACME Solar Holdings subsidiaries – ACME Rewa Solar Energy and ACME Jodhpur Solar Power – against Solar Energy Corp of India (SECI) and three discoms (distribution companies) of Jaipur, Ajmer and Jodhpur. SECI had issued a tender for setting up grid-connected Solar PV (photovoltaic) Projects in Bhadla Phase III Solar Park in Rajasthan for an aggregate capacity of 500 MW and the ACME subsidiaries were selected as developers for the setting up a solar power project of 100 MW capacity in Rajasthan. The ACME firms entered into power purchase agreements (PPAs) in September 2017 with SECI for the setting up the 100 MW project. ACME submitted that the duty resulted in an increase in recurring and non-recurring expenditure and has adversely impacted its business.

Source: The Economic Times

Gujarat energy firm seeks protection to complete wind power project

3 May. A Gujarat-based energy company which has signed a Memorandum of Understanding (MoU) with the Tamil Nadu government to set up wind power plants in Tuticorin district has moved the Madurai bench of the Madras High Court to direct the authorities to provide adequate police protection to complete the project in time as locals are objecting to it. Suzlon Gujarat Wind Park Ltd moved the court seeking protection to erect electric polices and laying of electric lines in terms of the MoU entered on 24 January 2019 to establish a 200 MW wind power plant for supplying wind power to the Tamil Nadu Generation and Distribution Corp (TANGEDCO).

Source: The Economic Times

Solar power plant inaugurated at Naval establishment in Kochi

3 May. The Naval Armament Inspectorate (NAI) has taken the green route by harnessing solar power to meet its energy requirements. Director General of Naval Armament Inspection (DGNAI) Rear Admiral Sanjay Misra inaugurated the complete roof top solar power plant at the NAI. The green initiative is also aimed at protecting the environment. According to him, operationalisation of the solar power plant, which can generate 14,400 Units of power per year, will decrease energy costs and carbon footprint and increase the energy efficiency.

Source: Business Standard

Bengaluru’s waste to energy plan in limbo as 10 of 13 biogas plants remain defunct

2 May. The Bruhat Bengaluru Mahanagara Palike (BBMP) often lists out its ambitious plans to convert mountains of waste generated in the city into energy on a large scale. But 10 of the 13 biogas plants installed to create energy out of waste on a smaller scale are not functioning. Biogas plants work on the principle of biomethanation where biodegradation of organic waste under anaerobic conditions yield methane-rich biogas.

Source: The Economic Times

Karnataka halts new solar energy projects

2 May. Karnataka, India’s top state in terms of installed solar capacity, has stopped the building of new solar energy projects. This was done in order to balance its renewable power purchase obligations and financial health of the power distribution companies (discoms). The decision was communicated by the commission to the Karnataka Renewable Energy Development -- body that issues tenders for bulk renewable energy procurement for its discoms -- in a letter dated 7 March. The commission, in the letter, observed that the state will have to restrict procurement from high-cost sources, given Karnataka’s power-surplus situation. It said that the discoms have already contracted to procure adequate power from solar energy sources, which has enabled them to meet their renewable purchase obligations not only for financial year 2019-2020 but for another couple of years as well. Karnataka, with 2,800 MW of solar projects in the development pipeline, is known for housing the Pavagada solar park in Tumkur district. The mega project is expected to house solar projects with about 2,000 MW capacity at an investment of Rs148 bn. Of this, over 600 MW has already been commissioned. The state has a total installed renewable energy generation capacity of 13,577 MW.

Source: The Economic Times

CERC extends validity of 1.2 lakh renewable energy certificates as prices rise

2 May. The Central Electricity Regulatory Commission (CERC) has extended the validity of 1.2 lakh renewable energy certificates (RECs) which were scheduled to expire by 31 October. These RECs will now be valid till 31 December. This development comes at a time when the prices of RECs are increasing with rising demand as states are gradually becoming more stringent about following renewable purchase obligation (RPO). Till September 2018, solar RECs were being traded at their minimum floor price of Rs1,000/REC. However, the prices started rising since then, trading at Rs2,000/REC in March and April this year. RECs are an alternative market-based instrument to promote renewables and facilitate RPO compliance. RPO mandates that all electricity distribution licensees should purchase or produce a minimum specified quantity of their requirement from renewable energy sources. One REC is treated as equivalent to 1,000 units of green electricity. Out of the total installed grid connected renewable energy capacity of 77,642 MW, about 4,620 MW is accredited under the REC framework.

Source: The Financial Express

Gujarat solar projects get bids of 600 MW despite low ceiling tariffs

2 May. Gujarat’s fresh attempt to auction 700 MW of solar projects at Raghanesda Solar Park has attracted techno-commercial bids of 600 MW despite having an aggressive ceiling price of Rs2.70 per unit. The state’s renewable energy agency Gujarat Urja Vikas Nigam Ltd (GUVNL) had cancelled the first auction for the same projects held in January, because it found the lowest discovered tariff of Rs2.84 per unit to be too high. The January auction had attracted bids of 1,250 MW, while the new auction has been under-subscribed by 100 MW. One solar developer deplored that the auction attracted this much bid. GUVNL had in March last year also cancelled the results of another auction of 500 MW, for the same reason, when the winning tariff reached was Rs2.98 per unit. As a result, solar developers have been wary of Gujarat tenders. GUVNL’s recent tender for projects at Dholera solar park had met with much poorer participation.

Source: The Economic Times

Jamia Milia makes smart solar inverters to tackle rural power crisis

1 May. Many Indian villages are still reeling under darkness, and the traditional inverter is expensive and also not environment-friendly. Looking at the need for solar inverters, Ahteshamul Haque from the Department of Electrical Engineering in Jamia Milia Islamia (JMI) along with his 25 students plans to change this through his 'smart solar inverter' model. The team is still working on making the product user-friendly. It will take at least 2-3 years to make it ready for the market. The project recently won Switzerland's Typhoon HIL and will receive a HIL-402 real-time simulator, which is used in power electronics, microgrid and renewable energy applications, worth Rs20 lakh as an award. The machine will help them take his research further. The JMI team beat competitors from America, Europe, Asia and Africa at this international competition named '10 for 10 Programme'. The HIL-402 machine will help the researchers to simulate the actual power system in any setup to conduct hardware testing of the solar inverter.

Source: The Economic Times

MNRE to hold brainstorming session on renewable energy

1 May. The Ministry of New and Renewable Energy (MNRE) is holding a brainstorming session for all stakeholders in the renewable energy sector amid a slowdown in commissioning of such projects mainly due to differences between the government and developers over issues such as ceiling tariffs and land acquisition. The ‘chintan baithak’ — the first of its kind organised by the ministry — will be held on 7 May at the FICCI auditorium in Delhi, MNRE secretary Anand Kumar said. Development issues relating to solar, wind, biomass and small hydro segments of renewable energy would be discussed, he said.

Source: The Economic Times

INTERNATIONAL: OIL

Egypt spent $3.5 bn on fuel subsidies in first nine months of FY 2018-2019: Petroleum Minister

7 May. Egypt spent 60.1 bn Egyptian pounds ($3.51 bn) on fuel subsidies in the first nine months of the 2018-2019 financial year, Petroleum Minister Tarek El Molla said, a drop of 28.45 percent from the same period the previous year. Egypt has been reducing fuel subsidies as part of an IMF-backed reform programme that began in 2016, and is due to remove subsidies on most energy products by June. The government spent 84 bn Egyptian pounds on fuel subsidies in the first nine months of the 2017-2018 financial year.

Source: Reuters

South Sudan agrees oil exploration deal with South Africa

6 May. South Sudan and South Africa signed a six-year production-sharing agreement for an untapped exploration block in the East African country, where production has been hit by civil war. South Sudan became the world’s youngest country after it split from Sudan in 2011. It has one of the largest reserves of crude in sub-Saharan Africa, only a third of which have been explored. But production plummeted when civil war broke out two years after independence. In April, the petroleum ministry said production was expected to reach around 195,000 barrels per day (bpd) by the end of the year, from 175,000 at present, and rise to 220,000 bpd by early 2020. The government has said production would reach pre-war levels of 350,000 to 400,000 bpd by mid-2020.

Source: Reuters

China’s Hengli boosts Saudi oil buys as new refinery ramps up

6 May. China’s privately owned Hengli Petrochemical has increased its Saudi Arabian crude imports for April and May as it prepares to bring a new refinery in north-eastern China to full capacity. The purchases have kept Saudi crude exports to China elevated so far in the second quarter despite lower global demand during peak refinery maintenance season. Saudi oil exports to China averaged at 1.37 mn barrels per day (bpd) in the first four months this year, up from 1.01 mn bpd in the same period of 2018, Refinitiv trade flow data showed. Hengli is expected to lift 6 mn to 8 mn barrels of Saudi crude in May (194,000 bpd to 258,000 bpd), after loading about 8 mn barrels in April, the highest monthly intake since it started trial runs at its 400,000 bpd refinery in December. From June onwards, Hengli’s Saudi oil intake will average around 4 mn to 6 mn barrels per month, while the remaining supplies will be made up of Iraq’s Basra Light crude and Brazil’s Marlim grade, the company said. Hengli has signed on to buy 130,000 bpd of crude from Saudi Aramco, a deal that started in the second-half of 2018.

Source: Reuters

Protesters block Aiteo’s Nembe oil facility in Nigeria

6 May. Protesters in Nigeria’s Nembe region barricaded the logistics base of oil company Aiteo and briefly disrupted its operations, the company said. Aiteo had just reopened its Nembe Creek Trunkline, which exports Bonny Light crude oil, earlier in the week after a fire sparked by theft from the pipeline forced its closure. Protests are common in the populous Niger Delta area, inhabited by impoverished communities who complain they do not see the benefits of the crude pumped in their backyard. They often protest at oil facilities since the companies are typically more responsive to their demands than the government.

Source: Reuters

Russia delivers clean oil to Mozyr refinery in Belarus

4 May. The Russian energy ministry said that clean Russian crude oil meeting all quality requirements had arrived at the Mozyr refinery in Belarus, after contaminated crude led it to halt flows in the pipeline. Belarus state oil company Belneftekhim said it had started receiving new supplies of Russian oil at its pipeline service station and was planning to start refining it on 6 May. Russia halted oil flows along the Druzhba pipeline to Eastern Europe and Germany after some crude was contaminated. The news lifted global oil prices to a six-month high and left refiners in Europe scrambling for supplies. The Russia energy ministry said the quality of oil at the Baltic Sea port of Ust-Luga was expected to return to normal on 7 May.

Source: Reuters

European diesel markets rally on Russia pipeline shutdown

3 May. The European diesel market is finding unexpected support from disruption in the refining sector after the shutdown of Russia’s Druzhba pipeline due to contaminated oil. Diesel refining margins, a measure of the profitability of making diesel from crude, hit a six-week high of nearly $15 a barrel and were trading close to this level. Oil in the 1 mn barrel per day (bpd) Druzhba pipeline running from Russia to eastern Europe via Belarus was contaminated by chemical compounds which made it unusable by several European refineries that rely on its supply. Poland, Hungary and the Czech Republic are making available to their domestic refiners around 8 mn barrels of crude from strategic stocks to tackle the Russian Druzhba pipeline shutdown. Traders said that Total’s 240,000 barrel per day Leuna refinery in Germany had slashed runs because of the contamination by around 30 percent but exact details could not be immediately confirmed. German industry Group MWV said that Leuna and PCK’s 240,000 bpd Schwedt refinery were arranging to receive crude from tankers coming to the Baltic Sea. It was not immediately clear how the crude would then be transported to the refineries. Traders said the rally in the diesel market follows a bearish April where European demand eased and stock levels fell less than expected. Traders said imports of diesel from the United States were expected at around 900,000-950,000 tonnes in May, compared with 850,000 tonnes in April. Imports of diesel from the east were expected to top 2 million tonnes (mt) in May, traders said.

Source: Reuters

INTERNATIONAL: GAS

US natural gas output, demand seen rising to record highs in 2019

7 May. US (United States) dry natural gas production will rise to an all-time high of 90.27 billion cubic feet per day (bcfd) in 2019 from a record high of 83.40 bcfd last year, the Energy Information Administration (EIA)’s Short Term Energy Outlook (STEO) said. The latest May output projection for 2019 was down from EIA’s 91.00 bcfd forecast in April. EIA also projected US gas consumption would rise to an all-time high of 84.07 bcfd in 2019 from a record high 82.08 bcfd a year ago. The 2019 demand projection in the May STEO report was down from EIA’s 84.61 bcfd forecast for the year in April. In 2020, EIA projected output would rise to 92.19 bcfd and demand would rise to 84.78 bcfd. The US became a net exporter of gas for the first time in 60 years in 2017.