SIGNS OF VITALITY IN THE GAS SECTOR

Gas News Commentary: March – April 2019

India

India’s LNG imports fell 9.1 percent y-o-y to 68 mmscmd in February 2019, India Ratings said in a report. This happened despite a reduction in Henry Hub prices. According to the research and ratings agency, the marginal improvement in domestic natural gas production in the past few months coupled with a reduction in consumption demand was likely responsible for the trend of LNG imports. Henry Hub prices again increased in March 2019, which could have further led to a reduction in LNG imports in the month. LNG prices moderated in January and February 2019, owing to a reduction of the winter season demand which generally peaks in the months of November and December. In February 2019, crude oil production in India decreased 6.1 percent y-o-y. During the same month, the production volumes of ONGC and OIL declined 5.1 percent y-o-y and 6.5 percent y-o-y, respectively, and that of fields under production-sharing contracts fell 8.3 percent y-o-y. According to the report, in February 2019, LNG production increased 3.3 percent y-o-y. During the same month, ONGC registered an 8.5 percent y-o-y rise in NG production volume, while OIL and private/joint venture fields recorded a fall of 2.7 percent y-o-y and 14.0 percent y-o-y, respectively.

India’s leading gas importer Petronet LNG expects its LNG imports to rise by up to 15 percent this fiscal year from a year ago once an expansion at its largest terminal is completed, the company said. Natural gas is projected to double as a share of India’s energy mix by 2030 as oil-fired power plants convert to natural gas, while pipelines are being built to expand the fuel’s use in the residential and transportation sectors. Petronet’s LNG imports are expected to rise to around 22-23 mtpa in the fiscal year ending March 2020, up from just under 20 mtpa last year, the company said. In February, Petronet LNG inked an initial deal with Tellurian Inc to invest in its proposed Driftwood project in Louisiana in the US. The capacity of Petronet’s Dahej terminal in western Gujarat state is being expanded to 17.5 mtpa from 15 mtpa. The company operates a 5 mtpa terminal at Kochi in southern Kerala state.

Natural gas is projected to double as a share of India’s energy mix by 2030 as oil-fired power plants convert to natural gas, while pipelines are being built to expand the fuel’s use in the residential and transportation sectors.

Giving a boost to producers such as ONGC and RIL the price of domestic natural gas in India has increased by 10 percent to $3.69 per mmBtu for the April-September period, compared to $3.36 per mmBtu during October to March period. Producers will be able to charge a maximum of $9.32 per mmBtu for difficult fields, posting an increase of about 22 percent from $7.67 a unit during October-March. This includes gas produced from discoveries in deepwater, ultra deepwater and high-pressure-high temperature areas. The price of domestic natural gas is decided after every six months, based on a formula, taking into account average rates from international trading hubs. A bulk of the company’s output in the 2018-19 financial year came from fields that were given to ONGC on a nomination basis. Gas output from these rose to 24.683 bcm against 23.43 bcm in the 2017-18 fiscal. The growth in output was largely contributed by C-26 Cluster fields, Daman and Vasai East fields in the western offshore as well as sub-sea well S2AB in the eastern offshore. ONGC has charted out a plan to double the gas production at 42.7 bcm by 2021-22. The firm is investing ₹570 bn — one of the highest investments in the world in gas projects — in the high potential KG-DWN-98/2 project in the Bay of Bengal as well as in developing other discoveries on and off the west coast. First gas production from the KG-DWN-98/2 project is targeted for end-2019 and peak output is envisaged at 16.56 mmscmd by 2022. IOC will soon set up at least 150 stations for supply of compressed natural gas CNG across the state. The decision was made after the IOC was chosen for distribution of CNG at the 10th CGD Bidding Round conducted by the PNGRB. The project of supplying CNG and PNG in the state is part of the Jagdishpur-Haldia-Bokaro-Dhamra pipeline project under the Pradhan Mantri Urja Ganga Yojana which will connect the eastern and north-eastern states with the national gas grid. According to IOC, apart from supplying CNG to vehicles and piped natural gas to more than one lakh households for domestic purposes across the state, the corporation will also supply these gases to industries and factories.

India produced 30,057 mmscmd of natural gas in the first eleven months (April-February) of the current financial year (2018-2019), the highest output recorded in the past three years in the same period, oil ministry data showed. The country produced 29,867 mmscm of natural gas in the corresponding period last fiscal. In February, gas production rose 3.29 percent to 2,565 mmscm from 2,484 mmscm in the corresponding month last fiscal. ONGC’s natural gas production in February 2019 increased 8.54 percent to 1,954 mmscm mainly on the back of increased output from fields in Tripura, Eastern Offshore and Western Offshore. Cumulatively, the firm’s gas production in the April-February period of the current fiscal increased 5.25 percent to 22,540 mmscm. Natural gas production by OIL fell 2.69 percent to 204 mmscm in February. This was due to reduced output from fields in Assam and Arunachal Pradesh. Cumulatively, OIL’s gas production in the 11 months period dropped 6 percent to 2,487 mmscm. According to the oil ministry, the firm’s gas production witnessed a dip due to loss of production potential in Deohal area in Assam and also due to bandh and miscreant activities in operational areas. Natural gas production from fields operated by private players or joint ventures decreased 14 percent to 408 mmscm in February mainly due to drop in production from Rajasthan blocks, a CBM block in West Bengal apart from Eastern Offshore and Western Offshore fields. Cumulatively, production by private and joint venture firms in the first 11 months period decreased 13.25 percent to 5,031 mmscm. According to the ministry, this is attributed to decreased production from RIL’s Sohagpur West CBM block due to increase in number of wells requiring work-over. Also, 36 development wells in the block are still under de-watering phase awaiting gas breakout. Another reason for reduced gas production was delay in upgrade of Cairn Oil and Gas’ Mangala Processing Terminal and delay in drilling, completion and hooking up online of 45 infill wells.

ONGC has charted out a plan to double the gas production at 42.7 bcm by 2021-22. The firm is investing ₹570 bn — one of the highest investments in the world in gas projects — in the high potential KG-DWN-98/2 project in the Bay of Bengal as well as in developing other discoveries on and off the west coast.

IOC is set to receive a second LNG cargo for its new Ennore terminal in south India in May. The 5 mtpa import facility at Kamarajar port on the outskirts of Chennai discharged its commissioning cargo more than a week ago, with the next due in two months. It was not immediately clear if the company will issue a tender for the cargo. IOC bought a partial LNG cargo for delivery in late February from Swiss trader Gunvor. The commissioning cargo was delivered through the LNG tanker ‘Golar Snow’ from Qatargas. The company said that the terminal had received all necessary clearances to start commissioning. The ₹51.5 bn ($741 mn) terminal is India’s fifth, and the first to be located on the east coast in south India. Currently, there is limited gas infrastructure in Tamil Nadu. The terminal is expected to spur industrial growth in the area with the re-gasified LNG to be distributed to power generation plants, fertiliser plants and other industrial units.

IOC is set to receive a second LNG cargo for its new Ennore terminal in south India in May…The terminal is expected to spur industrial growth in the area with the re-gasified LNG to be distributed to power generation plants, fertiliser plants and other industrial units.

The downstream regulator has scrapped its plan to force LNG terminals to reserve a share of their capacity for common use after industry opposed the move arguing the proposal was premature and would hurt local gas demand. In March 2018, the PNGRB had published a draft regulation for LNG terminals in the country, requiring them to register with the board, follow certain safety standards and, most contentiously, offer some common carrier capacity. The draft provoked strong reaction from industry players, who felt proposed rules could upset the economics of LNG terminals as they may have to make additional investment for the capacity that will have to be reserved for common use. India has added about 10 mtpa LNG regasification capacity in the past six months to about 37 mt. This is expected to rise to 50 mt a year by 2022. The capacity explosion and the government’s aim to push up gas usage in India’s primary energy mix to 15 percent from 6 percent had triggered temptation to regulate LNG terminals.

The PNGRB has approved a 37 percent rise in tariff from 1 April for the pipeline that transports Reliance Industries’ eastern offshore KG-D6 gas to customers. In its final tariff order, the PNGRB said transporting natural gas on the East-West pipeline would cost ₹71.66 per mmBtu on GCV basis from 1 April as compared to ₹52.33 per mmBtu tariff charged for 1 April 2009, to 31 March 2019, period. The tariff approved is almost half of the tariff sought by East West Pipeline Ltd – the operator of the pipeline. It had sought the tariff to be raised to ₹151.84 per mmBtu with effect from 1 April 2018. A rise in tariff would lead to increase in the price of fertiliser as well as city gas like CNG that uses gas brought through the pipeline starting from Kakinada in Andhra Pradesh and running up to Bharuch in Gujarat. The pipeline primarily transports KG-D6 gas, which has steadily dipped from 69.43 mmscmd achieved in March 2010 to under 3 mmscmd. PNGRB in a 49-page order went into cost calculations and other parameters to fix the tariff. The tariff, it said, will be subject to revision based on the audit of information and data.

Full storage tanks of LNG in India have prompted GAIL (India) Ltd to sell a US cargo bound for the Asian nation to northwest Europe. The sale of a cargo already on the water is the latest example of an oversupplied LNG market that has resulted in Asian spot LNG prices falling to an almost three-year low of around $4.30 per mmBtu. It also signals that India’s LNG demand, considered substantial compared to northeast Asia, is weaker than expected. The cargo on board of the Meridian Spirit that loaded at the US Cove Point plant on 20 March was offered in a tender on 25 March when it was crossing the Atlantic Ocean. GAIL has 20-year deals to buy 5.8 mt a year of US LNG, split between Dominion Energy’s Cove Point plant and Cheniere Energy’s Sabine Pass site. The Meridian Spirit is expected to be used by GAIL to load a new cargo in the US Gulf in mid-May. IOC is looking to buy a mid-May delivery cargo. Petronet is looking for three cargoes for delivery between July and December. Regasification capacity has constrained LNG imports in India in recent years. India has four terminals receiving LNG on the West coast. India’s first East coast terminal Ennore was commissioned by IOC this month. Two more terminals, GSPC’s Mundra and H Energy’s Jaigarh, are expected to start up this year.

Full storage tanks of LNG in India have prompted GAIL (India) Ltd to sell a US cargo bound for the Asian nation to northwest Europe…It also signals that India’s LNG demand, considered substantial compared to northeast Asia, is weaker than expected.

The price of CNG in Mumbai will be hiked by ₹1.96 per kg to touch ₹51.57 per kg, while piped cooking gas rate will go up by ₹2.13 per unit. The piped gas price will rise from ₹29.40 per unit to ₹31.53 for slab 1, and from ₹35 per unit to ₹37.13 per unit for slab 2 consumers. More than 560,000 vehicles run on CNG in Mumbai region, which includes 257,000 private cars, 238,000 autos and more than 61,000 cabs. Auto and taxi union leaders said there have been no fare hikes despite increasing fuel costs. The present hike of nearly ₹2 per unit in CNG rates will increase operational costs and unions are likely to petition the state transport department for a rate hike. While the auto union is demanding a minimum ₹2 hike in basic fares, the taxi union wants the minimum fare to increase from ₹22 to ₹25. The rates are being hiked after six months. The price will be uniform across Mumbai, Thane, Navi Mumbai, Kalyan and Mira Road.

The price of CNG in Mumbai will be hiked by ₹1.96 per kg to touch ₹51.57 per kg, while piped cooking gas rate will go up by ₹2.13 per unit.

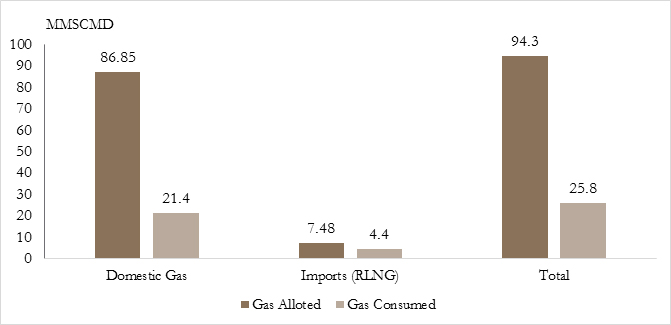

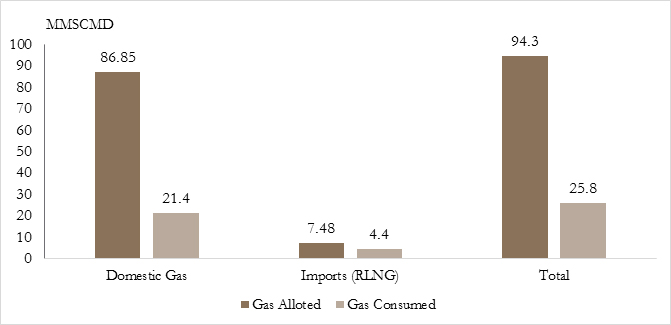

With softer gas prices propping up CNG and piped cooking gas consumption, CGD entities will continue to see robust margins but any adverse change in the policy of gas allocation is a key risk for the industry’s profitability, ratings agency ICRA said. The volume consumption of CNG by automobiles and PNG in domestic kitchens has been witnessing an increasing trend, supported by softer gas prices in the last 2-3 years, ICRA said it has prepared on the domestic CGD sector. Currently, CGD entities get first priority in the allocation of cheap domestically produced natural gas. According to ICRA, CGD projects are exposed to large execution risks and the construction period involved is long and needs a host of approval from multiple agencies. ICRA said most existing CGD players enjoy strong parentage, track-record and have high financial flexibility.

The volume consumption of CNG by automobiles and PNG in domestic kitchens has been witnessing an increasing trend, supported by softer gas prices in the last 2-3 years.

The recent award of CGD rights to OMCs such as IOC and BPCL will help them diversify and maintain their market shares in the domestic cooking and auto fuel markets over the long term, according to Fitch Ratings. IOC and HPCL won CGD rights in nine geographical areas each last month, and BPCL got rights to two areas. BPCL won the rights to 11 geographical areas in a previous auction in September 2018 as well. Fitch said it expects the state-owned oil marketing companies’ increased presence in city gas distribution to help them diversify from their oil refining and marketing business and reinforce their existing strong positions in the auto fuel market, with PNG usage gradually competing with auto fuels and replacing LPG in the domestic cooking fuel market. Natural gas consumption increased by about 3 percent in the April 2018-January 2019 period and 4.5 percent in the financial year ended March 2018.

To explore shale gas reserves in the region, EOGEP plans to drill two pilot wells in the Raniganj CBM block by the end of 2019. The number of wells will later be increased to 20 at an investment of ₹5.51 bn. The exploratory arm of Essar Group has already received the environmental clearance for 20 wells. According to estimates, the Raniganj CBM block has a potential shale reserve of 8 tcf of gas, and a recoverable potential of 1.6 tcf. To establish the shale potential in the Raniganj Coalfield block on an urgent basis, the DGH has requested all operators in the region – ONGC, Great Eastern Energy Corp, Essar and Central Institute of Mining and Fuel Research to collaborate and establish a synergy in shale development, EOGEP said. Exploration of shale gas and development of CBM blocks have a potential to produce 8.5 mmscmd of gas from five-six CBM blocks in India.

Rest of the World

Asian spot prices for LNG broke below the $5 per mmBtu mark following a 13-week price slide that reflects the absence of growth in demand or any major outages. Spot prices for May delivery to Northeast Asia dropped 80 cents to $4.65 per mmBtu according to traders although there were few actual transactions with Asia’s biggest buyers, Japan, Korea or China. Asian LNG spot prices are now at their lowest level since May 2016 and close to the lowest point in Refinitiv records going back to 2010 of $4.00 per mmBtu, which was reached in April 2016. The market has been inundated with supplies coming onstream from the US, Russia and Australia. In addition Egypt, which has had to import LNG in previous years due to gas shortages, has started to ramp up its exports.

Shipments of LNG from the US to China will increase over the long term despite ongoing trade tensions, Cheniere Energy, the biggest US exporter of the super-chilled fuel, said. Cheniere has delivered 62 cargoes of LNG to China since first starting exports from February 2016. So far this year only three cargoes of US LNG have been delivered into China, compared with 16 cargoes in the first quarter of last year, Refinitiv Eikon ship tracking data shows. As the spat heated up from mid-2018, China added LNG to its tariff list in August and imposed a 10-percent duty on LNG in September. The US is the world’s fastest-growing exporter of LNG, while China is the fastest-growing importer as Beijing weans the country off coal to reduce pollution.

China’s imports of LNG could reach 110 bcm or about 80 mtpa by 2025, CNPC said. China’s LNG imports last year were about 54 mt. CNPC accounts for about 60 percent of China’s overall gas imports and 70 percent of domestic production. And that will become even more important with the startup of a gas pipeline between China and Russia – expected later this year – that could threaten LNG imports. Deliveries of gas to China via the Power of Siberia pipeline were due to begin at the end of December 2019, but the project is only expected to reach full capacity in 2025. China’s gas demand will reach 360 bcm in 2020 and rise to 480 bcm by 2025, China National Offshore Oil Corp said. China has put itself under pressure by signing too many long-term supply contracts at relatively high prices.

France’s Total said it has signed a 10-year sales and purchase deal with China’s independent gas company Guanghui for annual supply of 0.7 mt of LNG. The super-chilled fuel will be sourced from the French company’s global portfolio and supplied into Guanghui’s regasification terminal in Qidong in East China, Total said. The Chinese firm said the new gas purchases will serve a growing gas market in Jiangsu province, where demand for the cleaner-burning fuel is forecast to reach 35 bcm in 2020.

Russian President Vladimir Putin ordered an allocation of budget funds in 2021-2022 for the construction of the Utrenny LNG terminal in the Russian port of Sabetta on the Northern Sea route, the Kremlin said. The budget money will also be used to reconstruct a navigable channel in the Gulf of Ob in the Kara Sea. The Utrennee gas field is developed by Russian gas giant Novatek and serves as a resource base for the Arctic LNG-2 project.

Iran formally inaugurated four new phases of South Pars, the world’s largest gas field. Iran has invested $11 bn to complete the four phases and they will increase the country’s gas production capacity by up to 110 mcm per day, the oil ministry said. Iran, which share South Pars with Qatar, expects to operate 27 phases by next March. Gas production at South Pars will exceed 750 mcm per day by late 2019. Iran produced 841 mcm per day on average in the current Iranian calendar year, which began in March 2018. Iran expects to produce 880 mcm per day in the next year and 950 mcm per day the following year.

Japan’s Tokyo Gas Co Ltd said it has signed a heads of agreement with Shell Eastern Trading for 500,000 tonnes per annum LNG for 10 years from April 2020. The two companies have come up with an innovative pricing formula based on coal indexation, which is included in the agreement, it said. Under the deal, Royal Dutch Shell will supply LNG to Tokyo Gas from the Shell Group’s global LNG portfolio, rather than from specific LNG projects, it said.

Chevron Canada Ltd and Woodside Energy Ltd have applied for a new license for their Kitimat LNG plant in northern British Columbia that could see it nearly double in size to produce 18 mtpa, Chevron said. The companies submitted the application to Canada’s National Energy Board, with a revised plant design that may include up to three LNG trains, instead of two. The Kitimat LNG application follows the approval last October of the massive LNG Canada project, also located in Kitimat. That project is led by Royal Dutch Shell and will initially produce 14 mtpa, with the option to increase to 28 mtpa. A growing LNG industry in northern British Columbia would be a boon for western Canadian natural gas producers that would supply the projects, analysts said.

Royal Dutch Shell and its partners building a massive LNG export terminal in Western Canada will decide by 2025 whether to double its capacity. The $31 bn LNG Canada project last October became the first major project in five years to be approved, with first exports of the super-chilled fuel planned for 2025. The second phase of the project will include two new processing lines known as trains that will double the plant’s capacity to 28 mtpa of LNG. The final investment decision on phase 2 will happen before the plant’s initial production starts. Since LNG Canada was approved, LNG projects were approved in the US Gulf Coast and off the coast of Mauritania and Senegal as producers expect a sharp rise in gas demand, particularly in Asia.

The liquefaction-export project that Sempra Energy’s ECA LNG subsidiary is developing in Baja California, Mexico has won two key authorizations from the US DOE. Sempra said that the DOE has authorized ECA to export US-produced natural gas to Mexico and to re-export LNG to countries that do not have free trade agreements with the US. The pair of DOE authorizations apply to Phases 1 and 2 of the project, Sempra said. Since 2008, Sempra has operated the existing ECA regasification facility north of Ensenada, Baja California – the first LNG receipt terminal on the west coast of North America. The facility can process up to 1 bcf of natural gas per day, Sempra said. ECA aims to add liquefaction capability over two phases. Phase 1 would add a single LNG train adjacent to the LNG receipt terminal and would use existing LNG storage tanks, marine berth and associated facilities, stated Sempra. Phase 2 would add two trains and an LNG storage tank. According to Sempra, the DOE authorizations allow ECA to export 636 bcf per year of US-sourced LNG from the infrastructure projects.

Hungary has struck an agreement with Gazprom to buy and store its 2020 gas supplies earlier than usual this year to offset the risk of Russia failing to agree transit terms with Ukraine. Hungary’s recently expanded 6.3 bcm storage capacity can guarantee safe supply through 2020. Gas supplier Russia and Ukraine, which have been embroiled in conflict over breakaway regions in Ukraine’s east, postponed gas talks in January until May. Their transit deal expires this year and there is a risk that Russia will be unable to supply gas to Europe at all through Ukraine from 2020.

Romania’s new energy regulations risk undermining plans by companies to develop big offshore gas projects in the Black Sea, putting billions of dollars of revenue at risk and squandering a chance to challenge Russia’s Gazprom in the region. OMV Petrom, which is developing a Romanian gas field with ExxonMobil, said key conditions for the project were still not in place while Black Sea Oil & Gas, controlled by private equity firm The Carlyle Group, warned it could pull out of another project if the rules remain. The European Commission also told Romania in March that gas export restrictions and regulated prices probably contravene EU rules and could be challenged by Brussels. The government made a last-minute concession, eliminating a cap on gas prices for industrial consumers. That means producers only have to sell about a third of their output at a fixed price – to households and heating plants – rather than more than half. Romania now risks delaying offshore gas projects and playing into the hands of Russia, which blocked Ukraine from exploring its Black Sea resources by occupying Crimea, analysts said. Romania’s Black Sea gas has the potential to challenge Gazprom’s dominant role in central and eastern Europe, diversify gas supplies and bring the Romanian government revenue of $26 bn by 2040, according to the consultancy. Romania’s offshore gas reserves are estimated at 200 bcm. Russia, meanwhile, has proven reserves of 35 tcm, according to BP’s statistical review. But while German consumption alone would empty the Romanian gas fields in two years, they could cover the combined 2017 demand of Romania, Bulgaria, Serbia, Hungary and Moldova for more than six years. Several gas producers have spent upwards of a decade and billions of dollars preparing to tap Romania’s Black Sea gas, but they were blindsided by the government decree. Lawmakers also approved export restrictions on offshore gas producers. The ruling Social Democrats, gearing up for four elections this year and next, have said the gas price cap was designed to keep tariffs low for domestic users. Black Sea Oil & Gas decided earlier this year to press ahead with plans to extract an estimated 10 bcm of gas from shallow waters – given the amount of money it has already invested.

Noble Energy and partners will build a pipeline linking Equatorial Guinea’s offshore gas fields to an onshore LNG plant to boost exports, the African nation’s government said. Under a deal with the government the 70 km pipe will have capacity for 950 mcf per day from fields operated by Noble and will be ready in the first quarter of 2021. Once liquefied at the export plant, which is run by Marathon Oil, the gas will be shipped to markets across the globe. Sonagas GE will increase its stake in the project to 30 percent from 25 percent. The gas will come from a joint venture called the Alen Unit, located in two offshore blocks, and is expected to contribute between $1.5 bn and $2 bn to state revenues over the course of the project, the government statement said. Equatorial Guinea hopes to create a gas export hub from its offshore fields after revenues were hit by a dip in oil prices and production since 2014.

Indonesia’s state-controlled gas utility company PGN, in cooperation with state port companies, is building a small terminal for LNG distribution in East Java, the company said. The terminal is targeted to start operation in the fourth quarter this year. For the early phase, the East Java LNG terminal will have a regasification capacity of just 30 bn British thermal units per day, or about 30 mcf per day although the company plans to expand that “based on energy demand growth in East Java and surrounding areas”. The terminal is expected to improve PGN’s distribution network in East Java for both its industrial-based and household customers, as well as for power generators.

Bangladesh’s LNG import terminal is expected to start commissioning in mid-April, a month later than initially expected. Summit Corp, a subsidiary of Singapore-based Summit Power International, and partner Mitsubishi Corp are expected to start commissioning at their FSRU off the country’s coast on 20 April. The FSRU will be named “Summit LNG” and will pick up its commissioning cargo from Ras Laffan in Qatar before sailing to Bangladesh. It is currently dry docked in Ras Laffan Nakilat NKOM yard. The cargo will be supplied by Qatargas. Operations at the FSRU were expected to start in mid-March, ahead of schedule. The new timeline still puts the arrival of the FSRU ahead of schedule. The FSRU start-up date had also been partially hampered by construction delays on a pipeline that will carry regasified gas from the coastal city of Chattogram, near where the FSRU will be anchored, to the capital Dhaka. The planned LNG import volume of the project is about 3.75 mtpa which will double the country’s LNG import capacity to 7.5 mtpa once fully operational. Bangladesh has scrapped plans to build additional floating LNG terminals in favour of land-based stations after the start-up of the country’s first FSRU was delayed by several months due to technical problems and bad weather.

Australia will face a gas shortage from 2024 unless new reserves are developed, pipeline capacity is increased or eastern states start importing liquefied natural gas, the country’s energy market operator warned. The AEMO’s annual gas outlook was more dire than in June last year, when it forecast no shortage before 2030. Since then, companies have cut reserve and production estimates, AEMO said. In the near term, government pressure on three LNG exporters in Queensland, led by Royal Dutch Shell, Origin Energy and Santos, to boost gas supply to the domestic market has succeeded in averting potential shortfalls, AEMO said. Longer term, as gas output dwindles in the ageing Gippsland Basin fields off Victoria, which have long fed demand centres in Melbourne, Sydney and Adelaide, more gas will be needed from Queensland in the north or LNG will have to be imported.

Germany’s cabinet approved a plan that will make it easier for LNG project companies to invest in new LNG terminals as part of efforts to diversify the country’s sources of gas. Under the legislation, LNG companies will only pay a 10 percent share of the connection costs for LNG, giving them more scope to invest in LNG projects. At the moment, pipeline companies have to put up the initial cost of the pipelines and then recoup this over the long term via network usage fees that are part of customers gas bills. The government wants to complement gas arriving from Russia, Norway and the Netherlands with other origins to give consumers more choices, while LNG suppliers like Qatar and the US are seeking more business. Germany also expects additional gas import volumes from the Russian Nord Stream 2 pipeline which will be under construction by the end of this year.

The Russian-led Nord Stream 2 gas pipeline company expects to receive approval from Danish authorities for a 180 km stretch of the pipeline under the Baltic Sea in time to finish the pipeline by the end of 2019 as planned. The pipeline, which would carry gas straight to Germany under the Baltic Sea, has also been criticized in some quarters because it would deprive Ukraine of lucrative gas transit fees. Four countries – Finland, Sweden, Germany and Russia – have approved the pipeline’s construction, but Denmark has been holding out. Nord Stream 2 in August 2018 proposed an alternate route that would route the pipeline through Danish exclusive economic zone waters, but avoid its territorial waters.

Turkey plans to increase imports of Iran’s natural gas, the head of Iran’s National Gas Company. Based on previous agreements, Iran is currently Sinopec Corp, China’s biggest shale gas operator, said it plans to develop a new field this year able to produce 1 bcm of shale gas annually. The company said the field will tap a proven reserve equivalent to 124.7 bcm of gas at Weirong in the southwestern province of Sichuan. This marks its second major shale gas discovery after a flagship development at Fuling in the Chongqing region, situated in the same geological basin of Sichuan. The company is drilling for shale gas in a 20,000 square kilometre area in southern Sichuan, as well as western Chongqing. It earlier set a target to produce 10 bcm per year of shale gas by 2020. China’s shale gas output accounts for only a small part of the country’s total gas production, at about 6 percent. Separately, Sinopec reported high volumes of gas flows in an exploration well Dongye-1 in the Dingshan-Dongxi block, close to Chongqing.

Israel’s Delek Drilling said it was exploring options to boost natural gas exports to Egypt, including the possibility of buying into a LNG terminal on the northern Egyptian coast. Delek is a partner in offshore gas fields in Israel and Cyprus and has already signed export deals to Egypt.

Egypt indicated it’s ready to rejoin the club of major exporters of LNG making its biggest offer to supply the market in at least five years. The state gas company EGAS tendered to sell four cargoes of LNG for loading in April. The bids are due and valid until 25 March. The company is also marketing four cargoes for loading in May and three for June. For Egypt, the tender marks a revitalizing of its gas industry, where sagging domestic production forced it to halt most exports of LNG in 2014. The North African nation has regained self-sufficiency with the help of major discoveries including the giant Zohr gas field. LNG is exported from the Damietta and Idku plants, which were largely left idle five years ago.

| LNG: liquefied natural gas, mmscmd: million metric standard cubic meter per day, y-o-y: year-on-year, OIL: Oil India Ltd, ONGC: Oil and Natural Gas Corp, mtpa: million tonnes per annum, US: United States, mmBtu: million metric British thermal units, bcm: billion cubic meters, KG: Krishna-Godavari, CNG: compressed natural gas, IOC: Indian Oil Corp, CGD: city gas distribution, PNG: piped natural gas, CBM: coal-bed methane, PNGRB: Petroleum and Natural Gas Regulatory Board, mn: million, bn: billion, mt: million tonnes, GSPC: Gujarat State Petroleum Corp, kg: kilogram, OMCs: Oil Marketing Companies, BPCL: Bharat Petroleum Corp Ltd, HPCL: Hindustan Petroleum Corp Ltd, EOGEP: Essar Oil & Gas Exploration and Production, tcf: trillion cubic feet, DGH: Directorate General of Hydrocarbons, CNPC: China National Petroleum Corp, mcm: million cubic meters, ECA: Energia Costa Azul, DOE: Department of Energy, bcf: billion cubic feet, tcm: trillion cubic meters, mcf: million cubic feet, PGN: Perusahaan Gas Negara, FSRU: floating storage and regasification unit, AEMO: Australian Energy Market Operator |

NATIONAL: OIL

FY19 oil import bill could be highest under Modi

15 April. A late surge in oil prices is expected to increase India’s oil import bill to its five-year high. As per estimates, India could close 2018-19 with crude import bill shooting to $115 bn, a growth of 30 percent over 2017-18’s $88 bn. The latest estimates are based on increase in global crude oil prices from the second half of March, when prices reached a new high in 2019. Crude is hovering around $70 a barrel on the back of extended production cuts from the Organization of the Petroleum Exporting Countries (OPEC) and Russia, and expectation of demand pick-up. However, contradicting apprehensions, the oil ministry’s Petroleum Planning and Analysis Cell (PPAC) in its latest assessment has made a conservative estimate of import bill growing by 27 percent from $88 bn in 2017-18 to $112 bn in 2018-19. Interestingly, PPAC’s estimates are based on the Indian basket of crude oil price at $57.77 a barrel and exchange rate at Rs70.73 against the dollar. This estimate has long been breached with price of Indian basket of crude hovering at $70 a barrel. On the rupee front, however, there is some relief as the currency gained a bit in March after running over Rs70-71 to a dollar for most of January and February. The oil import bill at over $115 bn will take it closer to FY13 and FY14 levels, when international oil prices had skyrocketed and hovered around $100 a barrel for most of the year. This will push the FY19 crude import bill to the highest in five years of the Modi government, and very close to the UPA II level when the prices had breached all records to touch $140 a barrel.

Source: Business Standard

IOC sets up trading desk at Delhi office to buy crude on real-time basis

15 April. Indian Oil Corp (IOC) has set up a trading desk at its office to buy crude oil from international market on a real-time basis, helping it cut import price by locking in best price and quality, its Director (Finance) A K Sharma said. IOC, which buys 30 percent (15 mt) of its oil requirement from spot or current market, had set up a trading office in Singapore in 2017 but has now developed in-house software and trading team to buy crude oil on a real-time basis. It made the first purchase through the desk on 25 March when it bought 1 mn barrel of Nigeria’s Agbami crude, he said. While private sector firms like Reliance Industries Ltd (RIL) have had a local trading desk for buying of crude and exporting fuel it produces, IOC would be the first state-owned refiner to set up such a desk. He said the Singapore desk was used to buy crude oil on a short-tender basis where the purchase was decided in two-hour time after receipt of offers from an international seller. But with a trading desk at its office in the national capital, IOC is deciding on purchases on a real-time basis, he said. IOC plans to transfer the trading desk once it stabilises in Singapore to do the real-time purchase of quantities of crude oil it buys from the spot market. Also, it could trade on fuel its refineries would export, he said. Currently, one cargo of 1 mn barrels are bought through trading desks at Singapore or at New Delhi. The trading desk is part of progression IOC has seen in crude procurement policy since 2016 when the government gave flexibility to state refiners to devise their own crude import policies. Prior to that, IOC used to take 26 hours to decide on a tender for import of crude oil from spot or current market. In April 2016, after the Cabinet gave state-owned oil refiners freedom to devise their own crude import policies, the time has been shrunk to 12 hours.

Source: Business Standard

RIL, Royal Dutch Shell may not seek extension of Panna-Mukta fields’ contracts

15 April. Reliance Industries Ltd (RIL) and Royal Dutch Shell plan to exit the Panna-Mukta oilfields when their contracts with the government expire this year. This would likely leave the task of managing these depleting fields with Oil & Natural Gas Corp (ONGC). RIL and Shell each own a 30 percent participating interest in the Panna, Mukta and Tapti (PMT) fields, located close to the Bombay High offshore facility of ONGC, which holds the balance 40 percent. The two companies have conveyed to the government that they don’t want their production-sharing contract for PMT extended beyond December 2019 when the 25-year term ends. Panna and Mukta produced 1.08 mn barrels of crude oil and 13.5 bn cubic feet of natural gas in the October-December quarter, as per RIL’s earnings report. Tapti stopped producing three years ago. Some of its facilities have been handed over to ONGC. Last year, the oil ministry ordered RIL, Shell and ONGC to together pay $3.8 bn as the increased share of the government’s earnings from the PMT fields, following an arbitration award in the government’s favour. India’s crude oil production has been falling for seven straight years, making it hard to abandon declining fields.

Source: The Economic Times

ONGC arrests fall in oil output from onshore wells, posts higher growth despite vintage fields

14 April. Oil and Natural Gas Corp (ONGC) has arrested a declining crude oil production trend in its onshore fields and registered a 1.25 percent rise in output in the fiscal year ended March 2019. ONGC produced 6.141 million tonnes (mt) of crude oil from its onshore fields despite majority of them being more than 50 years old and facing a natural decline. India’s largest oil and gas producer has in recent times faced immense pressure from the government, which has blamed it for the continuing decline in the country’s output. ONGC raising output is critical to meeting Prime Minister Narendra Modi’s target of cutting oil imports by 10 percent by 2022. ONGC has already reversed years of decline in natural gas output, posting a record 6.5 percent jump in production to 25.9 bn cubic metres in 2018-19. However, oil production from offshore fields continues to be on a decline and will only reverse next year when Krishna Godavari basin field KG-DWN-98/2 comes onstream. ONGC has monetised five out of the total 13 discoveries during 2018-19 on a fast-track mode which helped contribute to the growth in production from onshore fields. In order to sustain production and achieve higher onshore growth, ONGC drilled 303 wells during the last fiscal, which is the highest since 2014-15. The company has also engaged reputed international oil and gas consulting firm Gaffney Cline & Associates for high level review of two major fields of largest onshore producing asset, Mehsana in Gujarat and a few other onshore fields for enhancement of production.

Source: Business Standard

MRPL to shut crude unit, other facilities for maintenance from mid-April

11 April. Mangalore Refinery and Petrochemicals Ltd (MRPL) plans to shut a 60,000 barrels per day (bpd) crude unit and some secondary units for maintenance from mid-April for about a month. MRPL, a subsidiary of the country’s top explore Oil and Natural Gas Corp (ONGC), operates a 300,000 bpd refinery in southern India. MRPL will be commissioning gasoline treating units to maximise production of Euro-VI compliant petrol. India has set a target for a country-wide roll out of Euro VI compliant fuels from April 2020.

Source: Livemint

NATIONAL: GAS

H-Energy plans to commission West Bengal LNG terminal by May 2021

11 April. Bengal Concession Pvt Ltd (BCPL), an arm of H-Energy, is planning to commission its upcoming West Bengal LNG Re-gasification terminal by May 2021 at the cost of Rs15 bn, the company said. BCPL intends to develop a small scale LNG (liquefied natural gas) storage and regasification terminal on the banks of Hooghly River, Matriramchak village, East Medinipur, West Bengal. The LNG terminal will have an initial regasification capacity of 1.5-3 million metric tonnes per annum (mmtpa), which will be expanded to 5 mmtpa in the future. As part of the project the company plans to set-up two jetties on the bank of the Hooghly river to receive LNG, which will be stored at two onshore storage tanks with a total capacity of 60,000 cubic meter each and a provision to expand it by an additional 30,000 cubic meter. The company said in the application it plans to lay multiple pipelines from the site to end-users and will also house LNG truck loading facility to transport natural gas. The LNG truck loading facility will initially have 4 to 10 truck loading bays, with each loading bay designed to export 50 cubic meter per hour of LNG. H-Energy plans to develop a 24-inch, 250 kilometre (km) natural gas pipeline from Kanai Chatta, East Medinipur to Shrirampur, near Bangladesh border of West Bengal. The pipeline is expected to supply natural gas to major power customers in West Bengal and Bangladesh, with a targeted dated of commissioning by first quarter of 2021. H-Energy is at an advanced stage to start full commercial operations at its 4 mmtpa LNG terminal at Jaigarh, Maharashtra.

Source: The Economic Times

NATIONAL: COAL

NTPC tempers growth in coal-fired capacities, meets under 25 percent of FY19 goal

12 April. The country’s sagging growth in new capacity additions in coal-fired power seemed to have rubbed on state controlled NTPC Ltd, the largest power generator. Between 2012-13 and 2015-16, the country had added as much as 20 GW of coal-fired power each year. The growth has subsided over the past three years, with last fiscal adding a net capacity of only 1.2 GW. According to a study by US (United States)-based research organisation, Institute for Energy Economics & Financial Analysis (IEEFA), NTPC too has jumped on the bandwagon of tepid additions in coal-based power. In 2018-19, NTPC signalled intentions of abandoning coal-based projects amounting to 9.3 GW in Andhra Pradesh (Pudimadaka & Simadhri), West Bengal (Katwa) and Odisha (Gajamara). As per IEEFA’s calculations, NTPC could manage just 1,160 MW capacity addition, less than a quarter of its envisaged target of 4,740 MW for 2018-19. NTPC’s subdued growth betrays its robust balance sheet and operational prowess to risk building new thermal power capacities. NTPC’s growth, though, was punctuated by the retirement of its 705 MW Badarapur plant in Delhi during October 2018 and this meant addition of only 455 MW of net coal-based power capacity added during FY19. In line with India’s National Electricity Plan 2018, 49 GW of end of life coal-fired plants are proposed to be retired through FY2026-27 to curb emissions from older, polluting units.

Source: Business Standard

NATIONAL: POWER

CERC’s Adani order has set precedent for Mundra tariff hike: Tata Power

16 April. Tata Power Company is confident of getting regulatory approvals for higher tariff for its loss-making Mundra ultra mega power project after the Central Electricity Regulatory Commission (CERC) has set a precedent by allowing Adani Power’s power plant in Mundra to pass through imported coal cost to power consumers. While Tata Power can expect a favourable outcome since its plea for higher tariff in also based on the same issue of escalation in coal prices, the company still has to get on board all the five state power distribution companies (discoms) it sells power to. Only once it has a consensus with the customers, can it file a petition with the regulator. CERC approved higher tariff for 2,000 MW of power that Adani Power’s Mundra power unit sells to Gujarat Urja Vikas Nigam, to allow the pass through of higher cost of imported coal to run this plant. Tata Power is currently incurring a loss of Rs15 bn on its Mundra power plant, which it hopes to reduce by half upon tariff revision by increasing the tariff to Rs3.10 a unit from the contractual tariff of Rs2.80. The Gujarat discom has approved the proposal, and the company now needs approvals from other four discoms in Maharashtra, Haryana, Rajasthan and Punjab. The CERC order highlighted the need to look at contribution by each stakeholder for mitigating hardships faced by these projects. Tata Power’s 4,150 MW-ultra mega power plant in Mundra can cater to 2 percent of India’s total power needs.

Source: The Economic Times

Sates provided wrong data to avoid transmission charges

12 April. States have been providing misleading data to save on transmission charges of electricity, the CERC (Central Electricity Regulatory Commission) report said. Poor data-management of the state electricity departments have been a longstanding issue. States have been providing misleading data to save on transmission charges of electricity, the report said. A CERC task force formed to review the methodology of computing charges for using inter-state transmission systems (ISTS) pointed out that under the existing system, states have been manipulating their load and power generation projections to reduce ISTS charges. However, the report did not provide any figure on the estimated savings the states might have made by producing faulty data.

Source: The Financial Express

In Madhya Pradesh, pay power bills at your doorsteps soon

12 April. The successful implementation of on-spot billing and payment in rural areas of Indore has prompted Madhya Pradesh Paschim Kshetra Vidyut Vitaran Company Ltd to introduce it for city consumers. Discom (distribution company) said that this would be introduced in four zones of city division including Goyal Nagar, GPH zone, Mechanic Nagar zone and Daly College zone. There are around 21000 consumers in Goyal Nagar, 26000 in GPH zone, 24000 consumers in Mechanic Nagar zone and around 29000 consumers in Daly College zone. Discom said that this system was at first introduced for nearly 18000 consumers of rural areas of Indore. This system would be introduced on trial basis and will be managed discom’s meter reading staff. Discom has already arranged for at least 20 handheld devises and printers. There would a team of some 10-15 meter readers, who would visit each and every house of respective zones on specific dates to collect reading and issue bills to consumers on spot. Discom’s managing director Vikas Narwal said that consumers, who have been paying bill offline would no longer have to visit zone offices for bill payment.

Source: The Economic Times

India develops pan nation electricity mobile app for ensuring 24X7 supply

11 April. In what will help ensure round-the-clock electricity across India, the union government has developed a crowd sourcing mobile app for accessing real time consumer feedback on quality and availability of power from across the country. This comes in the backdrop of a need for data integrity, with many a states claiming to have achieved 24X7 power for all, despite outages. Electricity availability has been a contentious issue as India goes to polls for the 17th Lok Sabha. The app named Jagruk or ‘aware’ developed by the National Informatics Centre (NIC) will also have an automatic mode wherein electricity supply data will be collected during the charging of the phone. The pilot project for the app will shortly be launched in all the union territories and the states such as Odisha, Uttarakhand, Assam and Bihar. With electricity being on the concurrent list, it is for states to ensure quality, reliable and affordable electricity to consumers. All states and union territories had inked memorandum of understandings providing details of the ‘Power for All’ road map. Interestingly, of India’s installed capacity of 349 GW, the peak demand is only 177 GW.

Source: Livemint

India’s weak power demand points to more slowdown pain ahead

11 April. India is witnessing a listless growth in electricity demand, possibly signaling more slowdown in Asia’s third-largest economy. Electricity requirement from distribution utilities in February rose 1.3 percent from a year earlier and barely changed from January’s 1.1 percent, the weakest growth in two years, according to the power ministry’s Central Electricity Authority. Data for power generation, a proxy for demand, showed the weakness continued into March. The weakening demand and generation hurts an electricity distribution reform that sought to revive ailing power retailers. That move was critical to fulfilling the government’s promise of providing electricity to the masses. The utilities, which had piled up more than Rs4 tn ($58 bn) of debt as they were forced to sell electricity at subsidized rates to farmers and poor households, depend on commercial users for revenue to maintain financial health. With that demand teetering, retailers may cut purchases, leaving power plants running below capacity.

Source: Bloomberg

TANGEDCO action on factory for energy theft upheld

10 April. The Madras High Court has upheld Rs170 mn fine imposed by power utility TANGEDCO (Tamil Nadu Generation and Distribution Corp Ltd) on a factory in Erode district for theft of energy. A division bench comprising Justice M Venugopal and Justice S Vaidyanathan passed the order dismissing an appeal by the company. It said consumers getting electricity were governed by the terms and conditions of such supply and it was their bounden duty to ensure prevention of theft of energy or loss. Rejecting the appeal, the bench said the action of TANGEDCO was not violative of any right as it penalised only an unauthorised user of electricity. The bench said a glance of the Tamil Nadu Electricity Supply (Amendment) Code, 2007 reveals it has been amended with the sole objective of removing difficulties and misconceptions.

Source: Business Standard

Power bill defaulters get time till 30 April for settlement scheme: UPPCL

10 April. Uttar Pradesh Power Corp Ltd (UPPCL) has offered one last chance to consumers who have failed to clear their pending bills by extending the last date of the one-time settlement scheme (OTS) from 4 April to 30 April. However, the benefits of the scheme can only be availed by those who had got themselves registered under the scheme on or before 25 March but could not proceed due to default in billing. The state government had launched the scheme in January this year, under which UPPCL offered to waive 100 percent of the surcharge for farmers, commercial and residential consumers having maximum sanctioned load up to 2 kW. The scheme was introduced for benefiting the poor and farmers who failed to pay their power bills on time. To facilitate power consumers, UPPCL had earlier extended the last date of registration under OTS from 15 February to 25 March 2019. According to the power department, approximately 11 lakh consumers across the state have so far been benefited by OTS.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Agreement between India-Denmark on renewable energy approved by Cabinet

16 April. The Union Cabinet gave ex post facto approval to an agreement signed between India and Denmark for cooperation in the field of renewable energy with focus on offshore wind energy. The agreement was signed in March 2019 in New Delhi. The areas of cooperation would include technical capacity building for management of offshore wind projects, measures to develop and sustain a highly efficient wind industry — onshore as well as offshore, measures to ensure high quality of wind turbines, components and certification requirements, forecasting and scheduling of offshore wind. The Indo-Danish Centre of Excellence in Integrated Renewable Power would work on renewable energy resource assessments with focus on onshore and offshore wind, hybridisation of wind, solar, hydro and storage technologies, testing and R&D, and skill development/capacity building.

Source: Business Standard

India 3rd largest solar market after China, US

15 April. India emerged as the third largest solar market in the world after China and the United States (US). India’s solar installations reached 8.3 GW, including large-scale and rooftop solar units, according to a report by Mercom Communications India. The country’s cumulative solar capacity is 28 GW as of 2018. In terms of cumulative installations, Adani maintained its position as the top project developer, while Acme Solar was the developer with the most large-scale solar installations in 2018. Adani was the second largest developer in 2018. According to an earlier study, the Mercom India Solar Market Update, rooftop installations grew by a whopping 66 percent year-on-year with cumulative installations totalling nearly 3.3 GW at the end of 2018. Rooftop solar installations for 2018 amounted to 1.7 GW.

Source: The Hindu Business L ine

India will have 227 GW of renewable energy capacity by 2022: Vice President

15 April. India has set an ambitious target of deploying 175 GW of renewable energy capacity by 2022 which is now further raised to 227 GW considering that the country is well on its way to exceeding the previously set target, Vice President Venkaiah Naidu said. He said economic growth must take environmental protection into consideration and dependence on fossil fuel must be reduced while exploring new forms of energy sources such as solar. He said that according to a recent report, implementing a circular economy globally makes the Paris Agreement target achievable and the world requires circular economy strategies like increasing the share of renewables in the countries’ energy mix and improving energy efficiency measures.

Source: The Economic Times

UP village becomes renewable energy model with 100 percent solar power use

14 April. A village in Uttar Pradesh (UP)’s Amroha district is presenting itself as a model for renewable energy usage with complete dependence on solar power for all its needs. The solar-powered village in Chakanwala Panchayat named ‘Mandironwala Bhuddi’ has no electricity poles but is completely lit up using solar power. Solar panels have been installed at every house in the village as part of government’s scheme. A couple of villagers also talked about how solar power has helped to bring brightness into their area. The children of the village can be seen using the solar-powered lights to study in groups during night hours. Solar panels have been installed at every house in the village as part of government’s scheme.

Source: The Economic Times

Tamil Nadu’s first solar-powered boat to begin operations soon

13 April. Tamil Nadu’s first solar-powered boat will soon operate at the Manimuthar Dam in Tirunelveli district. According to sources at the Kalakkad Mundanthurai Tiger Reserve, the boat will begin operations in the next 10 days. Called Mahindra Odyssea, the 26-seater (including two crew members) boat is 11.8 m long and 4 m wide. One of its unique aspects is that it has a German motor (20 kW).

Source: The Hindu

MSEDCL to buy wind power from projects with expired agreements through reverse auction

11 April. Maharashtra Electricity Regulatory Commission (MERC) has asked the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) to procure wind energy from projects whose energy purchase agreements (EPAs) have expired, to fulfill its non-solar renewable purchase obligation (RPO). The MERC was going through submissions made for a petition filed by MSEDCL seeking its approval to procure power from wind projects whose EPAs have expired. In the petition, MSEDCL had asked the commission to allow it to procure power from the wind generators of group II, III, and IV whose EPAs with MSEDCL have expired at the tariff of Rs2.52 (~ $0.036)/kWh (kilowatt hour) for its balance of useful life. It had also requested that these power procurements be counted towards the fulfillment of renewable purchase obligation (RPO) of MSEDCL. MSEDCL had submitted this request as it could not attract the interest of bidders when it had floated a tender for procuring power from such wind projects keeping ceiling tariff at Rs1.97 (~$0.028)/kWh. The ceiling tariff had been set by the MERC. While going through the submissions made by MSEDCL, MERC was of the view that wind power generators with expired EPA’s are free to sell the energy they produce to any buyer including MSEDCL. It said, the same generators also have the option of selling wind energy to MSEDCL under short-term route at a higher rate of Rs2.25 (~$0.032)/Rs2.52 (~$0.036)/kWh.

Source: Mercom India

Fourth Partner Energy sets up 3 MW solar projects in Telangana

10 April. Distributed solar rooftop company Fourth Partner Energy announced commissioning of eight solar power projects with a capacity of 3,116 kW in Telangana. The projects have been set up under the 1,000 MW grid-connected rooftop solar PV (photovoltaic) system scheme of Solar Energy Corp of India (SECI). The projects have been implemented across multiple institutions including National Institute of Technology (NIT)-Warangal, Jayashankar Telangana State Agricultural University, Central Research Institute for Dryland Agriculture (CRIDA) and select BSNL and CRPF offices. The scheme provides for government offices to switch to solar power at zero capital costs and avail electricity at a flat rate of Rs3.14 per unit for 25 years. The company said it has so far commissioned 40 projects in Telangana with an installed capacity of 9,000 kW. Overall, under SECI’s 1,000 MW rooftop scheme, the company has executed projects of 13 Mw across 32 sites in Rajasthan, Maharashtra, Delhi, Madhya Pradesh and Odisha. The company currently has an installed capacity of 160 MW across 23 states and is targeting scaling its capacity to 400 MW this financial year.

Source: The Economic Times

INTERNATIONAL: OIL

Russia’s Gazprom Neft sees global oil deal ending in mid-2019

16 April. Gazprom Neft, the oil arm of Russian gas giant Gazprom, expects the global oil deal between OPEC (Organization of the Petroleum Exporting Countries) and its allies to end in the first half of the year. Vadim Yakovlev, first deputy CEO (Chief Executive Officer) of Gazprom Neft, said the global oil alliance should still remain in place, at least in the form of coordination between the world’s top global oil producers. The OPEC and other large oil producers led by Russia agreed to cut their combined oil output by 1.2 mn barrels per day (bpd) from 1 January for six months in order to support oil prices and balance the market.

Source: Reuters

Iran’s oil exports hit new 2019 low so far in April

16 April. Iran’s crude oil exports have dropped in April to their lowest daily level this year, tanker data showed, suggesting buyers are curbing purchases before Washington clamps down further on Iranian shipments as expected next month. The United States (US) reimposed sanctions on Iran in November after pulling out of a 2015 nuclear accord between Tehran and six world powers. Those sanctions have already more than halved Iranian oil exports, the country’s main source of revenue. Shipments are averaging below 1 mn barrels per day (bpd) so far this month. That’s lower than at least 1.1 mn bpd as estimated for March.

Source: Reuters

Venezuela oil output plummets to 870k bpd on outages, sanctions: IEA

11 April. Global oil supply dropped in March as US (United States) sanctions and power outages pushed Venezuela’s crude output to a long-term low of 870,000 barrels per day (bpd), the International Energy Agency (IEA) said, even lower than OPEC (Organization of the Petroleum Exporting Countries) reported the day before. The IEA, which coordinates the energy policies of industrialized nations, said the output decline of 270,000 bpd was Venezuela’s second largest month-on-month drop and put the country’s production at 600,000 bpd less than a year earlier. Venezuela told the OPEC that the nation pumped 960,000 bpd last month, a drop of almost 500,000 bpd from February, OPEC said. The IEA said the voluntary curbs of that deal and reduced output by Venezuela had caused OPEC production to fall 550,000 bpd in March. The IEA maintained its forecast of growth in global oil demand for 2019 at 1.4 mn bpd.

Source: Reuters

INTERNATIONAL: GAS

Turkmen gas flows to Russia again after three-year standoff

15 April. Turkmenistan has resumed natural gas exports to Russia after a three-year suspension, Russian gas giant Gazprom said. Russia was the number one buyer of Turkmen gas until 2010, when the Central Asian nation began exports to China. Russia then cut back imports and halted them completely in early 2016, contributing to a drop in Turkmenistan’s hard currency revenue. Both sides have since been discussing new gas supply terms, with the last round of talks held. Before diverting some flows to China, Turkmenistan used to pump up to 50 billion cubic meters (bcm) of gas a year to Russia. It exports up to 40 bcm a year to the east, while producing about 70 bcm.

Source: Reuters

Qatar petroleum invites three groups to bid for North Field LNG train construction

15 April. Qatar Petroleum has invited three groups to bid for engineering procurement and construction packages on liquefied natural gas (LNG) mega-trains as it expands production at its North Field reservoir, the company said. The first group invited is a joint venture between Chiyoda Corp and Technip France S.A., the second comprises JGC Corporation and Hyundai Engineering and Construction Co. Ltd and the third Saipem S.p.A, McDermott Middle East Inc. and CTCI Corp19.

Source: Reuters

Greece’s Energean discovers natural gas reserve offshore Israel

15 April. Greek energy firm Energean has made a vast discovery of 28-42 billion cubic meters (bcm) of natural gas at the North Karish field off Israel’s northwest coast, the company said. The discovery is located not far from the company’s floating production storage and offloading unit, which aims for a total export capacity of 8 bcm per year.

Source: Reuters

Saudi Aramco team in Pakistan for talks on first LNG deals

12 April. A delegation from the world’s largest crude oil producer, Saudi Aramco, is in Pakistan for discussions on what would be its first ever liquefied natural gas (LNG) shipments. Pakistan is facing an energy crisis with repeated power blackouts and gas supply outages that led to the sacking of the heads of two of its main gas distribution utilities in January. Aramco doesn’t currently produce LNG, and any such sale would be first of its kind. Saudi Aramco Chief Executive Amin Nasser said in February that Saudi Arabia aims to export 3 bn cubic feet per day of gas before 2030 via both pipelines and LNG tankers. Pakistan’s demand for LNG could more than triple in the next three to five years. Last year, Pakistan imported nearly 7 tonnes of LNG, Refinitiv Eikon data shows. This year, that could grow to as high as 15 million tonnes (mt) and to up to 25 mn to 30 mt over the next three to five years, Adnan Gilani, managing director and chief executive of Pakistan LNG, said.

Source: Reuters

PetroChina International launches its first gas station in Myanmar

12 April. PetroChina International started its first gas station in Myanmar by late March, marking the energy firm’s entry into the Southeast Asian country’s retail fuel market, parent company China National Petroleum Corp (CNPC) said. The gas station in Yangon is a joint venture between PetroChina International’s Singapore unit and a local Myanmar firm, while gasoline is being supplied by PetroChina International’s Singapore operation, CNPC said. The Chinese state energy firm annually supplies more than 1 million tonnes (mt) of refined fuel to Myanmar, and also started running a fuel storage in Yangon last September

Source: Reuters

BP latest oil major to exit China’s shale gas after poor drilling results

11 April. European oil major BP plans to exit from two production sharing contracts for projects drilling for shale gas in the southwestern Chinese province of Sichuan. BP is the last of the international oil majors, including Royal Dutch Shell, Exxon Mobil, ConocoPhillips and ENI, to quit exploring for shale gas in China because of poor drilling results. Its departure leaves the sector firmly in the hands of domestic companies. In March 2016, BP agreed with China National Petroleum Corp to explore and produce natural gas from shale rock formations in the Neijiang-Dazu block in Sichuan, its first such contract in China. China is only just beginning to develop its vast shale gas resources with production last year making up only 6 percent of total natural gas output, because of geology that makes gas extraction difficult and a challenging operating environment.

Source: Reuters

Toshiba gets notice from China’s ENN to scrap US LNG deal

11 April. Toshiba Corp said it had received a notice from China’s ENN Ecological Holdings Co that it would scrap a deal to transfer Toshiba’s US (United States) liquefied natural gas (LNG) business to ENN. Toshiba said it might need to review a loss estimate related to its LNG business due to be booked in the year ended 31 March. Toshiba in November agreed to pay ENN more than $800 mn to take over its LNG business in the US as part of a plan to shed money-losing assets.

Source: Reuters

INTERNATIONAL: COAL

Mongolia coal exports surge 15 percent in Q1 after China Australia ban

15 April. Mongolia’s coal exports rose 15 percent on the year to 7.8 million tonnes (mt) in the first quarter (Q1), with the country benefiting from customs delays impeding imports from Australia during the period. Landlocked Mongolia is heavily dependent on demand for coal and copper from China, its southern neighbour and the buyer of more than 90 percent of its exports. China has sharply reduced purchases of Australian coal after clearing times through China’s customs doubled to more than 40 days amid growing tensions between Beijing and Canberra over issues ranging from cyber security to Beijing’s influence in Pacific island nations. Naranbaatar Lundeg, an economist and member of the Australian Institute of Mining and Metallurgy, said the problems faced importing coal from Australia had “opened up opportunities” for Mongolian suppliers. Mongolia’s export earnings from coal over the first three months of the year reached $644 mn, up 25 percent compared to a year earlier, the country’s statistics office said. The rise in coal exports helped drive up Mongolia’s total industrial output from coal mining by 64.9 percent over the period.

Source: Reuters

China’s March coal imports fall 12.1 percent from a year ago on import curbs

12 April. China’s coal imports in March fell 12.1 percent from a year ago, according to the General Administration of Customs data, as the country has enacted policies to slow imports of the fuel at various ports. Coal imports last month were 23.48 million tonnes (mt), up from February’s 17.64 mt. For the first three months of 2018, coal supplies were at 74.63 mt, down 1.8 percent from a year ago, data showed.

Source: Reuters

Glencore wins $520 mn deal to sell coal to Mexico

10 April. Global trader Glencore has won contracts worth around $520 mn to supply 4.94 million tonnes (mt) of coal to Mexico, state-run power utility the Federal Electricity Commission (CFE) said. The utility said that by offering the best price, Glencore won all 12 auctions held to supply a CFE plant in the southwestern state of Guerrero with the coal, for delivery between May and December of this year. The contracts were worth around $519.6 mn in total, CFE said.

Source: Reuters

INTERNATIONAL: POWER

Bosnian utility EPBiH issues a tender for baseload power surplus

12 April. Bosnia’s biggest power utility EPBiH issued a tender to sell nearly 221 GWh (gigawatt hours) of baseload power surplus it will produce in the second half of 2019. EPBiH invited both domestic and international bidders to place their bids by 19 April. Unlike its Balkan neighbours, which rely on imports to cover part of their energy needs, Bosnia is able to export power thanks partly to hydropower generation, which provides 40 percent of its electricity. The rest comes from coal-fired plants.

Source: Reuters

French energy giant Total targets growth with merged retail electricity units in France

11 April. French energy giant Total has merged its Direct Energie and Total Spring retail subsidiaries to become France’s biggest alternative electricity supplier, as it takes on former monopolies EDF and Engie. State-controlled utility EDF remains the dominant force in the French retail power market with around 28.4 mn residential and non-residential clients, while alternative suppliers have 9.3 mn as of the end of last year, according to data from French energy market regulator CRE data. Total has said it would also look at expanding in other European retail electricity markets once it has consolidated its position in France. It has a small presence in the Belgian, Netherlands, Spanish and British retail power markets.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Renewables industry urges France to raise wind project targets

16 April. France needs to raise the minimum for wind power projects to 1,000 MW per year to boost the development of the sector, if the country wants to reach its targets for renewable energy use. The French Renewable Energy Association and France Energie Eolienne said the government should launch two supplementary tenders of 750 MW capacity each between 2021 and 2022, and three other tenders of 250 MW capacity, and another 500 MW tender. These will boost French fixed and floating offshore wind capacity to around 7,750 MW by 2025 from zero currently. Below the 1,000 MW per year target, investments in the sector could be at risk because of the lack of a sufficient domestic market. The current target of around 4,700 MW to 5,200 MW of tenders, or 540 MW to 665 MW per year by 2024 in France’s long-term energy plan known as the PPE, was insufficient. Although France has 15,100 MW of onshore wind capacity as it races to increase the share of renewables in its energy mix, offshore wind generation is still to take off with no single turbine on its coastline connected to the grid. After several years of administrative delays and local opposition to projects, the nuclear-dependent nation is set to make a new push on offshore wind following reforms aimed at removing hurdles. A tender for a 600 MW project in Dunkirk has attracted a number of international energy companies. Energy market regulator CRE will publish its recommendations for the project in May.

Source: Reuters

China to give priority to subsidy-free renewable projects in new plan

12 April. China will give priority to the construction of wind and solar projects that can operate without subsidies this year, and will cap new subsidized capacity, the energy regulator said, part of efforts to ease a subsidy payment backlog. After a rapid fall in manufacturing costs, China has been gradually cutting the amount of subsidies to renewable energy providers. It said last year that it would take action to ensure wind and solar generators can achieve “grid price parity” with traditional energy sources such as coal. China has already promised to launch a series of solar and wind projects that can provide electricity at the same price as coal-fired power, after a surge in capacity left the finance ministry with a subsidy payment backlog of at least 120 bn yuan ($17.9 bn). After studying local conditions, regional energy bureaus should give priority to the construction of wind and solar plants with grid price parity, and rationally control the scale of new projects that still require subsidy, China’s National Energy Administration (NEA) said in new draft rules. The NEA plans to improve the management of solar power subsidy by imposing differential policies for large solar stations, distributed solar projects, solar plants designed to help alleviate poverty and government-led pilot schemes. Total subsidies for solar projects in 2019 have been set at 3 bn yuan. Of that, 750 m yuan will be allocated to “distributed” rooftop power projects with a combined capacity of 3.5 GW, with the rest going to solar stations, the NEA said. China added 20.59 GW of wind capacity in 2018, bringing the country’s total to 184 GW, according to NEA data. It remains shy of its 2020 target of 210 GW.

Source: Reuters

Sunny spell boosts French solar generation to record level

12 April. Sunny weather boosted solar power generation in nuclear-dependent France to a record level, covering 10.7 percent of its 59.5 GW electricity consumption, French power grid operator RTE said. The record output of 6.3 GW was due to a sunny spell and an increase in France’s installed solar power capacity, which rose 12.7 percent in 2018 to 8.5 GW compared with the previous year, RTE said. The output placed solar power generation second behind France’s main source of electricity, nuclear generation from 58 reactors operated by state-controlled utility EDF, which accounts for around 75 percent of the country’s electricity needs.

Source: Reuters

China targets nuclear fusion power generation by 2040

12 April. China aims to complete and start generating power from an experimental nuclear fusion reactor by around 2040, a senior scientist involved in the project said, as it works to develop and commercialize a game-changing source of clean energy. China is preparing to restart its stalled domestic nuclear reactor program after a three-year moratorium on new approvals, but at a state laboratory in the city of Hefei, in China’s Anhui province, scientists are looking beyond crude atom-splitting in order to pursue nuclear fusion, where power is generated by combining nuclei together, an endeavor likened by skeptics to “putting the sun in a box”.

Source: Reuters

Croatia seeks to triple renewable energy output

11 April. Croatia should see a big boost in renewable energy output in the next three decades, with solar power the immediate focus, an expert shaping the new national energy strategy said. The government is expected to approve the new strategy, spanning until 2050, later this quarter. According to European Union data, in 2017 Croatia produced nearly 30 percent of energy needs from renewable sources, mostly in hydropower plants. Goran Granic, head of a local energy think-tank tasked with preparing guidelines for Croatia’s future energy development, said future funding of renewable energy in Croatia would not, unlike in past years, need any state incentives, with the possible exception of geothermal sources where investment is initially expensive.

Source: Reuters

Vattenfall to test salt-based power storage technology

11 April. Swedish power producer Vattenfall has commissioned a plant to test the storage in salt of electricity from solar plants and wind turbines, hoping to overcome the stop-start nature of green energy which is one of its main disadvantages. Efficient energy storage is vital in increasing the appeal of renewable power and Vattenfall’s pilot program will use a technique developed by another Swedish firm, SaltX Technology. SaltX’s system uses salt crystals coated in a nano material, which can be heated up with electricity, then release the heat when they are discharged. Vattenfall’s pilot project, set to run to the end of summer, will be located at the Reuter thermal power plant in Berlin and will have a storage capacity of 10 MW, the company said.

Source: Reuters

Israel’s Megalim solar thermal power plant starts operations

10 April. The Megalim solar thermal power plant, a joint venture of BrightSource, GE Renewable Energy and the Noy Fund, said it has begun commercial operation in Israel’s Negev desert. The 3 bn shekel ($839 mn) project was announced in 2008 and construction began at the end of 2014 under the leadership of GE Renewable Energy. The technology uses 50,600 mirrors spread over a 3 square kilometre site. Megalim’s thermo-solar station will provide electricity to supply about 50,000 households at peak. It is one of three facilities in Ashalim that are expected to produce about 2 percent of Israel’s electricity capacity.

Source: Reuters

DATA INSIGHT

State-wise Natural Gas Availability for Gas Power Plants

| State/UT |

Domestic Gas Allotted (MMSCMD) |

Gas Consumed/Supplied (MMSCMD) |

| Domestic Fields |

RLNG

(Long Term) |

Domestic Fields |

RLNG (Long Term) |

RLNG (Spot) |

Total |

| Haryana |

2.12 |

0.2 |

0.6 |

0 |

0 |

0.6 |

| Uttar Pradesh |

6.56 |

1.3 |

1.47 |

0 |

0 |

1.47 |

| Tripura |

4.8 |

0 |

4.42 |

0 |

0 |

4.42 |

| Rajasthan |

5.07 |

0.5 |

1.07 |

0 |

0 |

1.07 |

| Puducherry |

0.2 |

0 |

0.19 |

0 |

0 |

0.19 |

| Tamil Nadu |

4.17 |

0 |

1.94 |

0 |

0 |

1.94 |

| Delhi |

5.89 |

0.8 |

1.5 |

0.49 |

0 |

1.99 |

| Uttarakhand |

0 |

0 |

0 |

0 |

0.75 |

0.75 |

| Gujarat |

19.47 |

1.93 |

2.08 |