-

CENTRES

Progammes & Centres

Location

Rising retail price of petrol and diesel prices has led to tempering the policy of market-determined retail pricing of petroleum products that were hitherto being revised on a daily basis based on international prices. The move has been made to prevent any consumer outrage that could erupt if there are frequent increases in retail price of petrol and diesel that may have adverse fallout for the ruling party during the elections. State-owned OMCs have been told by senior government functionaries to keep the daily price movement of the two petroleum products in check between now and end of elections. This could be done by absorbing a portion of the price rise if the increase is consistent in view of global factors. Though OMCs have not been issued any written order on retail prices the government, being its largest shareholder, has exercised its control to make sure that consumers are prevented from paying abnormally higher prices. Between 1 January and now, there have been 10 instances when retail prices of petrol and 12 occasions when diesel prices have been left unchanged by OMCs – between two days at a stretch to a week. Oil sector experts said this is impossible given that oil prices change by the minute and hour and there is no question it would remain static for days. In fact, since 9 February, there has been a consistent increase in the retail price of the two petroleum products on global cues, but OMCs have held back any increase on six occasions, the longest being for four days between 5-8 March. Petrol prices rose Rs0.7 paise per litre in Delhi to Rs72.31 per litre while diesel remained at the earlier level of Rs67.54 per litre on 9 March. The product prices are dependent on global oil and product prices, refinery margins and currency exchange rates, all of which are highly volatile. Global oil prices have stabilized over the last month or so hovering between $65-66 a barrel. If this price level is maintained or even if there is a minor spike, OMCs would well be a position to absorb the loss without the government having to take any other measure. State-run fuel retailers IOC, BPCL, HPCL and IOC switched to daily price revision from a fortnightly pricing system in June 2017 as the government sought to further the pricing reforms in the sector when prices remained subdued.

With oil prices on the boil just as general elections are announced, India’s Oil Minister has asked world’s largest oil exporter Saudi Arabia to play an active role in keeping rates at a reasonable level. Petrol and diesel prices have risen by over Rs2/litre in last one month as international rates have risen on hopes of the US and China ending a trade war that has slowed down the global economic growth and OPEC ally Russia saying it would ramp up its crude supply cuts. Saudi Arabia is the second largest supplier of crude and LPG to India. In 2017-18, India’s crude oil imports from Saudi Arabia were 36.8 mt, accounting for 16.7 percent of its total imports.

The government may not pay around Rs320 bn of kerosene and LPG subsidy dues for FY19 before March end, in a bid to meet the revised fiscal targets. The total bill for LPG subsidy under direct benefit transfer and kerosene for the current financial year has come to Rs365 bn. Of this, Rs40 bn is on account of kerosene and the rest Rs325 bn is due to LPG. After adding the carried forward amount from last year, the total subsidy demand for the current year comes to around Rs485 bn. However, the petroleum ministry has received just Rs165 bn for the year to settle the subsidy amounts payable to the oil marketing companies and may not get any more before the fiscal end. The revised estimate for the petroleum subsidy bill for FY19 is Rs249.43 bn. LPG subsidy has gone up substantially this year mainly because of the PMUY programme. The country at present has around 262 mn LPG consumers, of which more than 70 mn have been added under PMUY since May 2015. The per-cylinder subsidy has also gone up from around Rs173 per unit to around more than Rs200 per unit during the most part of the current financial year. To bring the subsidy bill under control, the petroleum ministry, on insistence of the finance ministry, is exploring the option to reduce the ceiling for households that can avail subsidy from the current Rs1 mn per year to Rs5 mn per year. The petroleum ministry has asked the income tax department to provide details of people who fall in the Rs5-10 mn income category. The huge arrears from the current financial year are bound to have an impact during the next financial year as well as a Budget provision for fuel subsidy in FY20 is only Rs374.78 bn, which will be too little to settle arrears of PSU oil retailers IOC, BPCL and HPCL.

India’s diesel consumption may rise to a record this year on increasing infrastructure spending by the current government as it tries to hold off challengers in general elections that will be held over April and May. Surging diesel consumption in India, the world’s third-largest oil user, underscores the country’s importance as a driver of global oil demand. Amid increasing concerns that crude demand growth may slip in 2019 because of slowing economic growth, India’s burgeoning fuel consumption may help underpin oil and fuel prices. Analysts at Fitch Solutions and consultants Wood Mackenzie forecast India’s diesel demand to rise in 2019 by 5.7 percent and 6.4 percent, respectively, from 2018. The country consumed a record 6.9 mt of diesel a month in 2018, or about 1.7 mn bpd data from the Ministry of Petroleum showed. India’s economy is expected to grow by 7.2 percent in the 2018/2019 financial year, which runs from April to March, versus 6.7 percent the previous year, according to government data. Election rallies, the deployment of polling officers and security officers will add to the diesel demand boost from infrastructure projects that the ruling party has planned ahead of the polls. The country’s interim budget unveiled earlier this month allocated Rs190 bn ($2.67 bn) for building roads in the countryside, where two-thirds of Indians live. During the last general elections in 2014, monthly diesel sales averaged 6.2 mt during the polling months, 7 percent higher than the monthly average sales that year. The implementation of a nationwide GST has also been beneficial for diesel demand. Indian sales of commercial vehicles, which largely run on diesel, rose to a record last year, and January 2019 sales climbed to 87,600, a record high for this time of the year, according to data on Refinitiv Eikon. India’s diesel expansion will likely continue despite rising air pollution concerns, especially in the capital of New Delhi. The country’s fuel standards have improved, removing much of the sulfur from the diesel pool.

Indian state refiners will lift 8 mn barrels of Iranian oil in April, a decline of about 12 percent from the previous month, as the nation is in talks with the US to renew the waiver from US sanctions against Tehran. The US introduced sanctions aimed at crippling Iran’s oil revenue-dependent economy in November but gave a six-month waiver to eight nations, including India, which allowed them to import some Iranian oil. India has been allowed by Washington to continue to buy about 300,000 bpd oil or 9 mn barrels in a month till early May. New Delhi, Tehran’s biggest oil client after China, has decided to lift lower volumes in April as a ‘precautionary measure ahead of renewal of waiver’. The US will likely renew waivers to sanctions for most countries buying Iranian crude, including the biggest buyers China and India, in exchange for pledges to cut combined imports to below 1 mn bpd. That would be around 250,000 bpd below Iran’s current exports of 1.25 mn bpd. It is not yet clear if reduced volumes of 8 mn barrels a month is the new condition imposed by Washington for granting a second waiver to New Delhi from sanctions against Tehran. For March, IOC had placed an order for 5 mn barrels, MRPL for 2 mn, and HPCL and BPCL for 1 mn each. In April, IOC would lift 4 mn barrels, while there is no change in volumes to be loaded by other companies.

India wants to keep buying Iranian oil at its current level of about 300,000 bpd, as it negotiates with the Washington about extending a sanctions waiver past early May. India has reduced its purchases of Iranian oil but has been in talks on extending its sanctions waiver. New Delhi is asking to be allowed to still buy Iranian oil at current levels of around 1.25 mt per month, or about 300,000 bpd. Iran was India’s seventh biggest oil supplier in January compared with its position as third biggest a year ago before the reimpostion of sanctions.

The US is pressing India to stop buying oil from Venezuela. The Trump administration has given the same message to other governments and has made a similar argument to foreign banks and companies doing business with Venezuela. The Indian market is crucial for Venezuela’s economy because it has historically been the second-largest cash-paying customer for the OPEC country’s crude, behind the US. The talks over Venezuela come as trade tensions rise between Washington and New Delhi, and when the US is also pushing India to cease buying Iranian oil. The US is planning to end preferential trade treatment for India that allows duty-free entry for up to $5.6 bn worth of its exports to the US. Venezuela’s exports to India remained relatively stable in the month since the Trump administration slapped sanctions on Venezuela’s oil company PDVSA , meaning shipments were not nearly enough to make up for the fall in US sales. Venezuela directly exported 297,000 bpd of crude to India in February, according to Refinitiv Eikon data, which does not include barrels first shipped to other ports such as Singapore or Rotterdam. India imported 342,000 bpd of Venezuelan crude in January, and an average of 340,000 bpd last year. Venezuelan oil made up just 4.2 percent of India’s total imports in January, data show.

India produced 31.349 mt of crude oil in the first eleven months (April-February) of the current financial year (2018-2019), the lowest output recorded in the past nine years during the same period, according to fresh data sourced from the oil ministry. The declining trend in the country’s domestic crude oil production is coming at a time when the country’s oil import bill has already ballooned 29 percent to $102.9 bn during the April-February period of the current fiscal. Also, the decline in domestic crude oil production has pushed India’s oil import dependence to 83.8 percent, the highest recorded in the April-February period in the last five years for which data is publicly available. The government had earlier said it is working towards a plan to reduce the country’s crude oil import dependence by 10 percent by 2022. India’s crude oil production in February 2019 declined 6.4 percent to 2 mt as compared to 2.731 mt produced in the corresponding month a year ago, primarily due to fall in production from fields operated by ONGC private players and fields operated under a Joint Venture, data showed. Cumulatively India’s crude oil production in April-February period declined 4 percent to 31.349 mt, as compared to 32.643 mt recorded in the corresponding period a year ago. India’s oil production has declined over the past nine years mainly due to ageing fields leading to fall in output from nearly all the offshore and onshore blocks, data shows. ONGC’s crude oil production during February 2019 declined 5 percent to 1.599 mt mainly due to decreased production from Western Offshore fields. Cumulatively, the firm’s oil production during the first 11 months of the current fiscal dropped 5.38 percent to 19.274 mt. Oil India’ crude oil production during February 2019 declined 6.45 percent to 24.4 mt mainly due to fall in production from Assam fields. Cumulatively, the company’s oil output during the April-February period declined 3 percent to 3.015 mt.

ONGC has received just one bid from US oilfield-service company Schlumberger Ltd for its ambitious pilot to raise output from ageing oilfields through the infusion of technology. India’s top oil and gas producer plans to hire international oil service companies for the first time to raise output from its mature oilfields. Last year, it had shortlisted Schlumberger, Halliburton and GE subsidiary Baker Hughes for raising output from Kalol field in Gujarat and Geleki field in Assam. At the close of bids, only Schlumberger made a financial bid for Geleki field. The service providers will be paid a fee for raising output beyond an agreed baseline production. Schlumberger has sought certain deviations from the tender conditions, and ONGC is discussing them with the company. Based on experience of the Geleki bidding, the company plans to bring out similar bidding for few other ageing oilfields. ONGC is looking to raise domestic output to meet the target of cutting import dependence by 10 percent by 2022. India currently imports over 83 percent of its oil needs. Originally, ONGC had on 7 December 2016, signed a Summary of Understanding to give Kalol field to Halliburton and Geleki field to Schlumberger for raising production above the current baseline output. ONGC rescinded the contracts in 2017 on fears of courting controversy for handing fields on nomination basis.

Oil India Ltd announced that it won two blocks in DSF round-II bidding. Oil India Ltd’s net profit for the nine months ended December increased as much as 55 percent over the same period last year to nearly ₹28 bn. During this time, crude price realizations increased by 34 percent year-on-year to $70.66 a barrel. Oil India’s financial performance was also helped by strong growth in other income. Crude oil production declined by almost 1 percent whereas gas production decreased by 3 percent.

India’s total exports of petroleum products, which account for over a tenth of the gross value of outbound shipments, are set to drop below the 1.2 mn bpd mark in the current calendar year, the lowest level of annual exports in the past 8 years. The worrisome trend for export earnings is attributed to a robust rise in domestic demand coupled with a mega maintenance-led refinery shutdown slated for 2019. The country exported petroleum products – mainly petrol, diesel, naphtha, fuel oil and lubricants — worth $35 bn last financial year (2017-18). Domestic refinery upgradation will be required as India plans to shift to Bharat-VI standard fuel in April 2020 coupled with the upgradation required to meet the International IMO 2020 bunker fuel specifications, according to S&P Global Platts. Refiners with planned maintenance in 2019 include RIL, BPCL, HPCL and IOC according to Platts. IOC, the largest refiner, will complete its refinery upgradation activity by the second half of next fiscal (2019-20). According to Platts, India’s domestic petroleum product consumption reached 210 mt in 2018 and is expected to rise 4.8 percent in 2019 on the back of increased demand for petrol, diesel and LPG. Data on exports sourced from PPAC, an arm of the oil ministry, shows the country’s petroleum products exports in January 2019 slumped 25 percent to 4.5 mt as compared to 6 mt exported in the corresponding month a year ago. Overall, in the April-January period of 2018-19, the country’s petroleum products exports have suffered a drop of 8.70 percent at 51.4 mt, as compared to 56.3 mt exported in the same last fiscal. PPAC attributes the hit suffered by petroleum product exports to a drop in out-bound shipments of petrol, naphtha, diesel, LOBS/lube Oil, Fuel Oil, bitumen and Vacuum Gas Oil due to increased domestic consumption of petrol, naphtha and diesel recorded this fiscal year. However, in value terms, petroleum exports increased 14 percent to $32.6 bn during the April-January period of current fiscal as against $28.7 bn worth of exports recorded in the corresponding period of 2017-18. Largest export destinations for India’s petroleum products include Singapore, UAE, Netherland, Malaysia, US, Israel and Nepal, according to data sourced from the Directorate General of Commercial Intelligence and Statistics, an arm of the commerce ministry. India exported 8.96 mt of petroleum products to Singapore in the first ten months (April-January) of 2018-2019, as compared to 10.55 mt exported in the corresponding period last fiscal. During the same period, petroleum Products exports to UAE increased to 8.18 mt from 6.72 mt while exports to Netherland rose to 5.68 mt from 3.03 mt.

The three public-sector OMCs, IOC, HPCL an BPCL have approached the petroleum ministry to seek exemption from the election commission for going ahead with the allotment of at least 31,800 petrol pumps, at a time when the model code of conduct is already in place. Though bids were invited for 78,493 locations, only 31,800 places were finalised prior to the election notification. During the current round, only 3,885 areas were left unbid, while 30,490 areas got single bids and 44,118 locations got multiple interests. States that have got the maximum number of areas include Rajasthan and Uttar Pradesh with 9,621 and 9,027 areas, respectively. On the other hand, areas in states like Madhya Pradesh, Maharashtra and Tamil Nadu got maximum number of takers.

Diversified natural resources company Vedanta said it has made an oil discovery in KG basin of Andhra Pradesh. Vedanta has notified the Management Committee, DGH and Ministry of Petroleum and Natural Gas of an oil discovery in the second exploratory well H2 located in the block KG-OSN-2009/3, KG basin, East Coast of India, the company said. Vedanta holds 100 percent participating interest in the block. Multiple reservoir zones were encountered in the well H2 within the Mesozoic sequence between the depths of 3,310 metres to 4,026 metres with hydrocarbon indications during drilling and downhole logging, it said. Vedanta’s oil and gas operations comprise the assets of Cairn India, which is India’s largest private sector crude oil producer. It contributed about 25 percent to the country’s domestic crude oil production in 2017-18.

Nayara Energy, integrated downstream oil company, said it has operationalised its rail-fed Petroleum Oil Lubricant depot at Wardha in Maharashtra. According to the company, the depot, spread over 50 acres, has a capacity of handling over 16,000 kilolitres of oil products, which will be supplied from the company’s refinery at Vadinar in Gujarat. The company which is called Nayara Energy post-acquisition, owns India’s second largest single site refinery at Vadinar, Gujarat with a current capacity of 20 mtpa. Also, the company has over 5,000 retail outlets across the country.

The US will drive global oil supply growth over the next five years, adding another 4 mn bpd to the country’s already booming output, the IEA said. US oil output, including natural gas liquids and other hydrocarbons, will climb to 19.6 mn bpd by 2024 from 15.5 mn last year, the IEA said. Gross crude exports will double, leading to greater competition especially in the Asian market. Crude output in the US will rise nearly 2.8 mn bpd, growing to 13.7 mn bpd in 2024 from just under 11 mn bpd in 2018, the IEA said. The outlook points to pressure on demand for crude from the OPEC as the US and other rivals expand supplies. However, in a boost for the producers, the IEA does not see a peak in global demand yet. US crude exports will surpass shipments from Russia and nearly catches up to Saudi Arabia by 2024, diversifying global supplies, the IEA said. Global oil demand growth is set to ease as China slows, but will still rise by an annual average of 1.2 mn bpd to 2024 when it will reach 106.4 mn bpd. The IEA forecasts demand for OPEC crude will drop in 2020 and then rise to average 31.3 mn bpd in 2023. The 2023 figure is up by just 600,000 bpd from this year and less than the previous forecast.

US President Donald Trump and the Saudi government have closely aligned views on most issues but they disagree significantly on the desirable level for oil prices, which could become a source of volatility in 2019/2020. He has normally restricted himself to generalized criticism of the OPEC when prices have been below $75 per barrel. However, when prices have moved above that level, Trump has sharpened his criticism, singling out Saudi Arabia and other Gulf states, and noting that they benefit from an expensive US security umbrella. The US is increasingly both a major producer and consumer of petroleum, so the main impact of changing prices is no longer felt through the external balance of payments but the internal distribution of income. Rising prices transfer income from consumers, motorists and the industrial Midwest to oil drillers and producing states such as Texas, Oklahoma, North Dakota and Alaska.

Saudi Arabia plans to cut its crude oil exports in April to below 7 mn bpd while keeping its output well below 10 mn bpd. Saudi Aramco’s oil allocations for April are 635,000 bpd below customers’ nominations, which are the requests made by refiners and clients for Saudi crude. Oil prices have been supported this year by output cuts by the OPEC and its allies. US sanctions on the oil industries of OPEC members Iran and Venezuela have also tightened supplies.

Saudi Arabia said there has been a build-up in oil inventories despite a decline in output from Iran and Venezuela. Compliance for an OPEC + deal in March would be “above 100 percent”. Saudi oil output would not continue indefinitely to compensate for other producers. The oil market will flip into a modest deficit from the second quarter of this year, with OPEC possessing a hefty supply cushion to prevent any price rally in case of possible supply disruptions, the IEA said. The IEA, which coordinates the energy policies of industrialised nations, kept its forecast of growth in global oil demand this year unchanged at 1.4 percent, or 1.4 mn bpd. Solid growth in non-OPEC oil output led by the US should ensure demand is met, the IEA said. The IEA said the market could show a modest surplus in the first quarter of 2019 before flipping into a deficit in the second quarter by about 0.5 mn bpd. In 2019, US seaborne oil trade will move into surplus with net exports rising to nearly 4 mn bpd by 2024. Malaysia’s state energy firm Petronas expects to start offering oil products from its new refining-petrochemical complex in April as the project moves toward full commercial production in October, the company said. The $27 bn Pengerang Integrated Complex was completed in five years, the company said. Petronas and Saudi Aramco jointly own the refining complex which has a capacity of 300,000 bpd. Petronas’ refining capacity will reach 700,000 bpd after including its equity stake in the Pengerang complex, while its petrochemical production will grow to 14.6 mtpa from 12.7 mtpa currently, the company said. The petrochemical complex is expected to start up by late March. Fuel production from the new refinery will balance Malaysia’s gasoline supply and demand, and will allow it to export diesel from the new refinery, the company said. The company also is prepared to do “a lot more blending” of oil to meet demand for low-sulphur oil from shippers when new fuel regulations by the IMO start in 2020.

Russian oil output stood at 11.34 mn bpd in February, down some 75,000 bpd from the October level, the baseline for a global deal, but still missing the accord target, energy ministry data showed. All the Russian majors reduced their output. Russia’s largest oil producer Rosneft and No.2 Russian oil company by output, Lukoil, cut their output by 0.6 percent and 0.5 percent month-on-month, respectively. Production at Gazprom Neft, the oil arm of gas giant Gazprom, slipped by 1.9 percent last month. Russian oil pipeline exports in February stood at 4.480 mn bpd, up from 4.313 million bpd in January. The OPEC and other large oil producers led by Russia agreed to cut their combined oil output by 1.2 mn bpd starting from 1 January to evenly balance the market and prop up weak oil prices. Of that, Russia undertook to cut 228,000 bpd from October 2018, the baseline for the agreement. Russia cut its oil output by 97,000 bpd in February from October. Russia would reach its reduction target during the first quarter. Crude oil has risen to $66 a barrel after a dip below $50 in December, boosted by the output curbs in the OPEC countries and the prospect of lower supply from Venezuela after US President Donald Trump imposed sanctions on its oil industry.

US crude prices rose to a four-month high above $60 a barrel after US government data showed tightening domestic oil supplies, but gains were capped by concerns over global economic growth due to the ongoing US-China trade war. International Brent crude rose 89 cents, or 1.32 percent, to settle at $68.50 a barrel. Prices rose after the US Energy Information Administration posted a large and unexpected drop in crude inventories due to strong export and refining demand. Rating agency S&P Global raised its Brent oil price assumptions back up to $60 a barrel, on the back of the production cuts by OPEC and Russia. However, an eight-month trade war between China and the US has worried global markets already concerned by signs of a slowdown in economic growth this year. Mexico invited a host of international firms, including three US companies, to bid on the construction of an $8 bn oil refinery to fast-track projects. The facility would be owned by Mexico’s national oil company, Pemex (Petroleos Mexicanos), becoming its seventh domestic refinery, and built near the Dos Bocas port on Mexico’s southern Gulf coast. It is intended to help wean the country off growing fuel imports. To be located in the Gulf Coast state of Tabasco the refinery has already been granted all required government permits, including for construction. Mexico’s oil safety regulator ASEA, however, fined a contractor in January for clearing protected mangrove from the site without the correct permits. The facility will include 17 processing plants and 93 storage tanks, as well as access to highways, a rail line and docking for ships. The 2019 budget for Pemex calls for spending almost $2.5 bn on Dos Bocas, which aims to be able to process 340,000 bpd of heavy crude. That processing capacity would make the new refinery Pemex’s biggest.

The US has instructed oil trading houses and refiners around the world to further cut dealings with Venezuela or face sanctions themselves, even if the trades are not prohibited by published US sanction. The US imposed fresh sanctions on Venezuela’s oil industry earlier this year but some companies have continued to supply the country with fuel from India, Russia and Europe. Washington is particularly keen to end deliveries of gasoline and refined products used to dilute Venezuela’s heavy crude oil to make it suitable for export. Jet fuel and diesel would be exempt for humanitarian reasons. The US Treasury’s Office of Foreign Assets Control announced a ban in early February on the use of its financial system in oil deals with Venezuela after April.

Japan has extended state-backed insurance to cover imports of oil from Iran, potentially allowing the country’s refiners to continue loading crude cargoes from the Middle Eastern nation. The rollover of the insurance was approved by parliament and takes effect from April for one year. While the rollover provides insurance cover for imports that Japanese shippers cannot otherwise obtain, refiners are unlikely to load Iranian cargoes from April unless they get a waiver from the US on sanctions re-imposed on Iran last year. Japanese refiners have been pushing the government to seek an extension of the US sanctions waivers after an initial 180-day exemption period expires in early May.

Global commodities trader Trafigura Group sees Brent oil staying around current levels, about $66-$67 per barrel, or slightly higher for the rest of the year, and rising to the $70s in 2020. After the US re-imposed sanctions on Iranian oil in November, Washington then issued waivers to a number of key importers. Several factors could still throw predictions off balance such as whether Iranian waivers are renewed and the stability of Libyan and Venezuelan output. A tighter market in the second half of the year but gains would be capped by weaker macro indices. Looking ahead to next year when a new, lower sulfur cap on shipping fuels is due to take effect, Trafigura expects a deficit in diesel capacity of around 350,000 bpd which could be met by China. The new rules imposed by the IMO mean that shippers cannot use fuel with a higher sulfur content than 0.5 percent unless the vessel installs a sulfur filter, known as a scrubber. As a result, demand for high sulfur fuel oil, the main fuel on ships, is expected to drop sharply in favor of diesel and very low sulfur fuel oil, a new type of fuel that is starting to be produced in various different blends. Trafigura expects 25 out of the 35 new crude and product tankers that it has leased to be delivered by end of the first quarter.

Colombia’s government said it signed two exploration and production contracts with Shell in offshore areas of the Caribbean Sea that will require the company to make initial investments of $100 mn. Colombia recently modified contractual terms for offshore exploration and launched a Permanent Area Allocation Process so companies can apply to explore in areas of interest, offering 20 blocks as part of a strategy to boost the oil sector. The investment could surpass $650 mn if exploration continues, National Hydrocarbons Agency (ANH) said. Shell will explore blocks COL 3 and GUA OFF 3, which cover about 880,000 hectares. Its investment adds to almost $400 mn recently announced by Brazil’s Petrobras in Colombia’s Tayrona block and state oil company Ecopetrol in block COL-5. Colombia has proven reserves of 1.78 bn barrels of oil, equivalent to 5.7 years of consumption, according to the ministry of mines and energy. The government wants to boost its hydrocarbon reserves to guarantee its self-sufficiency.

North American energy traders are reluctant to take up long-term positions on Canadian crude price moves, preferring to stick to spot deals, as uncertainty around government intervention in the market grows following delays to a critical pipeline project. Enbridge Inc unexpectedly said its Line 3 oil pipeline will be delayed until the second half of 2020, dealing another blow to the oil-rich province of Alberta, which is struggling with long-running congestion on export pipelines. Severe pipeline bottlenecks depressed Canadian heavy oil prices to the weakest on record last year, prompting the Alberta government to order mandatory production cuts effective 1 January, a move that sent prices sky-rocketing and traders scrambling to cover positions. While some producers welcomed the government cuts, others including Suncor Energy and Imperial Oil criticized the move for causing uncertainty and unintended consequences, such as disrupting rail shipments of crude.

Bahrain plans to commission its expanded oil refinery by early 2023, allowing it to sell and trade more petroleum products in the Gulf region and Asia, BAPCO said. The expansion will boost the capacity of its Sitra oil refinery to 360,000 bpd from the current 267,000 bpd. BAPCO currently receives 220,000-230,000 bpd of crude from state oil company Saudi Aramco and will import the same volume during the refinery’s expansion, with commissioning scheduled for late 2022 or early 2023. In October 2018 Aramco and BAPCO announced the commissioning of the AB-4, a new phase of the Saudi-Bahrain crude oil pipeline, capable of transporting up to 350,000 bpd, which would serve Bahrain’s planned refinery expansion. The Bahrain field produces around 50,000 bpd. Bahrain and top oil exporter Saudi Arabia split revenues from the 300,000 bpd Abu Safah field, where production is overseen by Aramco. Around 88 percent of the crude that BAPCO refines comes from neighbouring Saudi Arabia, and the rest from Bahrain’s field. The refinery’s expansion project financing – which is over $4 bn in size – will be finalised in March. Bahrain announced last year its largest ever oil discovery, off the coast, estimated to have at least 80 bn barrels of tight oil, and deep gas resources in the region of 10-20 bn cubic feet.

Libya’s biggest oil field resumed production, adding another complication to OPEC’s effort to trim a global supply glut. Sharara resumed production and is expected to reach 80,000 barrels in one day. Regular output will be fully restored in the coming days, now that the site has been re-secured after a three-month occupation at the site, state energy producer National Oil Corp said. The field in southern Libya has a capacity of 300,000 barrels of crude a day. Plans are also in place to repair 20,000 barrels per day of production capacity destroyed by looting and vandalism during the blockade. Oil rallied this year as the OPEC and allies agreed to reduce output by 1.2 mn barrels a day in the first half of 2019 to avert a supply glut. Libya was exempt from the cuts because of its internal turmoil but its oil production disruptions along with US sanctions on OPEC members Venezuela and Iran restricted supplies further.

| OMCs: Oil Marketing Companies, IOC: Indian Oil Corp, BPCL: Bharat Petroleum Corp Ltd, HPCL: Hindustan Petroleum Corp Ltd, MRPL: Mangalore Refinery and Petrochemicals Ltd, RIL: Reliance Industries Ltd, mn: million, bn: billion, OPEC: Organization of the Petroleum Exporting Countries, LPG: liquefied petroleum gas, FY: Financial Year, mt: million tonnes, PMUY: Pradhan Mantri Ujjwala Yojana, PSU: Public Sector Undertaking, bpd: barrels per day, GST: Goods and Services Tax, US: United States, ONGC: Oil and Natural Gas Corp, DSF: discovered small field, PPAC: Petroleum Planning and Analysis Cell, UAE: United Arab Emirates, KG: Krishna-Godavari, mtpa: million tonnes per annum, IEA: International Energy Agency, IMO: International Maritime Organization, BAPCO: Bahrain Petroleum Company |

9 April. Indian refiners are holding back from ordering Iranian oil for loading in May pending clarity on whether Washington will extend a waiver from US (United States) sanctions against the OPEC (Organization of the Petroleum Exporting Countries)-member. Washington, however, gave a six-month waiver to eight nations including India, allowing them to import some Iranian oil until early May. India, Iran’s top oil client after China, was allowed to buy about 9 mn barrels a month. India hopes to get clarity in seven to 10 days on any extension of the waiver, as well as the amount of oil that could be purchased if an extension is given. Under the current waiver, India can buy about 300,000 barrels per day (bpd) of Iranian oil – about half the amount before the sanctions were imposed – and New Delhi wants to keep buying Iranian oil at that level. Since November only state-run Indian Oil Corp, Bharat Petroleum Corp, Hindustan Petroleum and Mangalore Refinery and Petrochemicals have been buying Iranian oil.

Source: Reuters

8 April. The government has again deferred the last date for bidding for oil and gas (O&G) exploration blocks offered under the Open Acreage Licensing Policy (OALP) by over a month to 15 May. Last date for OALP bid round II and III, which are running almost concurrently, was 10 April but has been pushed back. The government had in January offered 14 blocks in OALP-II bid round and a month later offered another 23 O&G blocks and coal-bed methane (CBM) blocks in third round. Bids for the 14 blocks offered in OALP-II bid round, covering an area of 29,333 square kilometres, were to close on 12 March but the deadline was extended to April 10, according to the Directorate General of Hydrocarbon (DGH). April 10 was also the bid deadline for the 23 O&G and CBM blocks offered in the third round, which was launched on 10 February. OALP-II bid round was delayed by six months and its launch came barely a month before the third round. Oil Minister Dharmendra Pradhan had at the time of launch of OALP-II bid round on 7 January stated that an investment of about Rs400 bn is expected in the prospecting of O&G in blocks offered. In the first round of OALP last year, as much as Rs 600 bn was committed in the exploration of O&G in 55 blocks or areas. In the third round, the government is expecting up to $700 mn (Rs490 bn) of investment that it hopes will help raise domestic output and cut imports. Prime Minister Narendra Modi has set a target of cutting oil import bill by 10 percent to 67 percent by 2022 and to half by 2030. Import dependence has increased since 2015 when Modi had set the target. India imports 83 percent of its oil needs.

Source: Business Standard

7 April. Aviation turbine fuel (ATF) should be brought under the Goods and Services Tax (GST) regime as it will ensure a level playing field for the domestic airline industry, Civil Aviation Minister Suresh Prabhu said. He said input costs should be competitive for any sector and the ministry has been of the strong view that the fuel should be brought under the GST regime. Different rates of taxes in states pushes the price of ATF, he said. Airlines have been demanding inclusion of ATF in the new indirect tax regime. Airlines could expect an annual relief of up to Rs50 bn by way of input tax credit if ATF is brought under GST. The move could cushion them from the burden of increased jet fuel prices, besides providing relief to customers.

Source: Business Standard

6 April. Casting the vote could fetch you a 50-paise-perlitre discount on your fuel bill on the election day. The offer will be available from 8 am to 8 pm at the fuel stations participating in the campaign for customers who have the voting mark on their fingers. A consumer can avail of the discount for a maximum of 20 litres of fuel on that day, AIPDA (All India Petroleum Dealers Association) president Ajay Bansal said. He expects at least 90 percent of about 58,000 dealer members of the association will participate in the campaign. Dealers will bear the financial burden of the discount, not the oil companies, he said. Petrol pumps will also have some staff promoting voting among customers, using pamphlets and other campaign material. The general elections are scheduled to be held in seven phases from 11 April to 19 May, in which about 900 mn people are eligible to vote. India has about 64,000 petrol pumps of which around one-fourth are in rural areas. State-run companies control 90 percent of fuel pumps.

Source: The Economic Times

5 April. Oil Marketing Companies (OMCs), including Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL), are likely to deliver robust financial results for the fourth quarter ended March on the back of elevated marking margins and large inventory gains due to increase in crude oil prices. The firm also expects a sharp sequential decline in profitability for upstream firms due to a $5 per barrel fall in global crude oil prices and a $8-8.5 per barrel of subsidy discount due to the shortfall in budgeted provision for Kerosene subsidies.

Source: The Economic Times

5 April. The country’s largest oil marketing company (OMC) Indian Oil Corp (IOC) resumed fuel supply to Jet Airways within hours of effecting a cut on it, thus preventing further disruption of services of the airline that is already running with a depleted fleet. According to IOC, the OMC had stopped fuel supply to Jet Airways for some time but restarted the same after receiving assurances over payment of dues from the airline.

Source: Business Standard

9 April. India’s liquefied natural gas (LNG) imports fell 9.1 percent year-on-year (y-o-y) to 68 million metric standard cubic meter per day (mmscmd) in February 2019, India Ratings said in a report. This happened despite a reduction in Henry Hub prices. According to the research and ratings agency, the marginal improvement in domestic natural gas (NG) production in the past few months coupled with a reduction in consumption demand was likely responsible for the trend of LNG imports. Henry Hub prices again increased in March 2019, which could have further led to a reduction in LNG imports in the month. LNG prices moderated in January and February 2019, owing to a reduction of the winter season demand which generally peaks in the months of November and December. In February 2019, crude oil production in India decreased 6.1 percent y-o-y. During the same month, the production volumes of ONGC and Oil India Ltd (OIL) declined 5.1 percent y-o-y and 6.5 percent y-o-y, respectively, and that of fields under production-sharing contracts fell 8.3 percent y-o-y. According to the report, in February 2019, LNG production increased 3.3 percent y-o-y. During the same month, Oil and Natural Gas Corp (ONGC) registered an 8.5 percent y-o-y rise in NG production volume, while OIL and private/joint venture fields recorded a fall of 2.7 percent y-o-y and 14.0 percent y-o-y, respectively.

Source: The Economic Times

4 April. The price of CNG (compressed natural gas) in Mumbai will be hiked by Rs1.96 per kg (kilogram) to touch Rs51.57, while piped cooking gas rate will go up by Rs2.13 per unit. The piped gas price will rise from Rs29.40 per unit to Rs31.53 for slab 1, and from Rs35 per unit to Rs37.13 per unit for slab 2 consumers. More than 5.6 lakh vehicles run on CNG in Mumbai region, which includes 2.57 lakh private cars, 2.38 lakh autos and more than 61,000 cabs. Auto and taxi union leaders said there have been no fare hikes despite increasing fuel costs. The present hike of nearly Rs2 in CNG rates will increase operational costs and unions are likely to petition the state transport department for a rate hike. While the auto union is demanding a minimum Rs2 hike in basic fares, the taxi union wants the minimum fare to increase from Rs22 to Rs25. The rates are being hiked after six months. The price will be uniform across Mumbai, Thane, Navi Mumbai, Kalyan and Mira Road.

Source: The Economic Times

9 April. Indian energy giant Adani has taken a step closer to the construction of its controversial coal mine in Australia after the federal government gave a green light to the billion dollar project’s groundwater management plans. Adani group entered Australia in 2010 with the purchase of the greenfield Carmichael coal mine in the Galilee Basin in central Queensland, and the Abbot Point port near Bowen in the north. The massive coal mine in Queensland state has been a controversial topic, with the project expected to produce 2.3 billion tonnes of low-quality coal. The project requires further approvals from the Queensland Government prior to construction commencing.

Source: The Financial Express

9 April. The coal ministry plans to give special attention to private captive coal block operators to help increase output, which has frequently failed to meet targets. This has put tremendous pressure on Coal India Ltd, which has been struggling to meet the nation’s demand for coal. Captive blocks have suffered because of delay in land acquisition and various clearances as well as issues such as rehabilitation and resettlement. In 2018-19, captive mines produced an estimated 33 million tonnes (mt). In the previous years, they produced about 36 mt, including 18 mt by Sasan Power Ltd and 6.2 mt by Tata Steel.

Source: The Economic Times

7 April. India’s coal import increased by 7.8 percent to 212.11 million tonnes (mt) in the April-February period of FY19, according to the report by mjunction services. This comes at a time when the government is looking at relaxing the timeline for the 1 billion tonne coal production target it had set earlier for Coal India Ltd (CIL), which accounts for over 80 percent of the domestic coal output. The country produced 196.59 mt of coal in April-February period of fiscal 2017-18, according to the report. Coal imports in the month of February was at 18.31 mt (provisional) as compared to 21.15 mt (revised) in January 2019, it said. Of the total imports during February 2019, non-coking coal was at 13.86 mt, against 14.59 mt imported in January 2019, it said. Coking coal imports were at 2.93 mt in February 2019, down against 3.32 mt a month ago.

Source: Business Standard

6 April. The Supreme Court (SC) issued a notice to the Centre on a public interest litigation (PIL) seeking cancellation of coal block allocation in Chhattisgarh to Rajasthan Rajya Vidyut Utpadan Nigam Ltd (RRVUNL) and the mining operations by the Adani Enterprise Ltd (AEL) for violating the environmental clearance granted by the Ministry of Environment and Forests. The petitioner has also sought the Central Bureau of Investigation (CBI) probe into it. The petitioner urged the court to ask the RRVUNL to cancel its joint venture and coal mining delivery agreement with AEL and Parsa Kente Collieries Ltd (PKCL), a joint venture between the RRVUNL and the AEL, with AEL being the majority stakeholder. The petition sought the apex court’s directions to the Centre to cancel allocation of the Parsa East and Kanta-Basan (PEKB), Parsa and Kente Extension coal blocks to the RRVUNL. The mine operations, it alleged were violating the conditions of environmental clearance granted to the RRVUNL by the Ministry of Environment and Forests with regard to the PEKB open-cast coal mine project.

Source: Business Standard

6 April. Average spot power price fell 22 percent at Rs3.12 per unit in March at Indian Energy Exchange (IEX) compared to Rs4.02 per unit in the same month last year due to lower demand. The total traded volume in day ahead market (DAM) last month declined 15 percent to 3,356 million units (MU) as against 3,955 MU in March 2018, according to IEX. The term ahead market (TAM) traded 246.34 MU in the reported month, registering a surge of 78 percent over 138 MU traded in March 2018. However, the traded volume in DAM in March was up 20 percent from 2,794 MU in February 2019. According to IEX, DAM experienced transmission congestion mainly towards import of power by southern states which led to volume loss of 120 MU representing 3 percent of the total traded volume on the exchange. All India peak demand touched 169 GW on March 29, 2019, registering 5 percent increase over highest peak demand of 160 GW registered in March 2018 (as per National Load Dispatch Centre report). The percentage time congestion was 35.6 percent. ‘One Nation, One Price’ was realised only for 3 days during the month. On daily average basis, 735 participants traded in the market during the month. In fiscal 2018-19, the DAM cumulatively traded 50,063 MU as compared to 44,842 MU in 2017-18. On all India basis, the energy supplied in March 2019 registered increase of 4 percent at 110 billion units (BU) from 106 BU in the year-ago month.

Source: The Economic Times

5 April. The new draft regulation on Market Based Economic Dispatch (MBED) of power proposed by the regulator Central Electricity Regulatory Commission (CERC) will have mixed outcomes and requires clarity on compensatory tariff payments, according to research firm India Ratings. MBED will help reduce the cost of power purchase across discoms, enable flexibility in grids to facilitate renewable energy generation, and might also improve the payment track record of discoms (distribution companies). The discussion paper on MBED floated by CERC proposes that the scheduling of power should be carried out through nation-wide participation in the day-ahead market by both discoms and generators to discover the marginal clearing price based on variable tariff of plants with PPA and quoted tariff of plants selling un-requisitioned surplus or uncontracted power. At present, discoms follow self-scheduling within their own tied-up power sources as against the market-based scheduling covering all thermal plants across the country that has been proposed under MBED. Under the new regulation, the fixed charge under PPAs (power purchase agreements) will be paid as in the present mechanism. Clearing of bills for variable tariff will be at the marginal cost of power (MCP), and the surplus received by the generator.

Source: The Economic Times

5 April. Power demand in the state has crossed 16,000 MW for the first time. It touched 16,151 MW, surpassing the previous high of 15,847 MW on 13 March. TANGEDCO (Tamil Nadu Generation and Distribution Corp Ltd) said the increased demand was mainly from domestic users, due to the increasing temperature and that they expected it to rise continuously in the coming days. In cities like Chennai, Coimbatore and Trichy, many multi-storey buildings have come up and the power load in these areas was rather high. Only a few states have recorded power demand exceeding 16,000 MW. The states which witness such high demand include Maharashtra, Gujarat and Uttar Pradesh.

Source: The Economic Times

3 April. The Power Finance Corp (PFC) plans fresh resolution of eight stressed power projects, including Essar Mahan’s 600 MW plant and GMR Raikheda’s 1,370 MW plant following the Supreme Court (SC) decision annulling an earlier RBI (Reserve Bank of India) circular. The top brass of the power sector lender held a meeting to assess the situation arising from the apex court’s order. The issue of re-starting work on finalizing a resolution plan for few stressed assets was also discussed. The eight stressed power assets have a total generating capacity of close to 9,000 MW and banks, including the PFC, have a total exposure of about Rs220 bn. The projects also include the 1350 MW RattanIndia Nashik, 550 MW RKM Powergen, 700 MW Bharat Utkal, 2,400 MW KSK Mahanadi, 600 MW Jhabua Power, and 120 MW Jal Power. In few other cases such as KSK Mahanadi, RattanIndia Nashik, and Jhabua too, one-time settlement offers were given to the PFC by the promoters. However, with confusion over the RBI circular remaining, the matter faced delays and some of the projects sources said got referred to the National Company Law Tribunal (NCLT). Apart from one-time settlement, the resolution plan for some of the stressed power assets would be finalized by bringing in a strategic partner. In cases like Jal Power, the project could be considered for transfer to the Sikkim government, if the state is willing to take over the debt.

Source: Business Standard

3 April. Power discom (distribution company) Dakshin Haryana Bijli Vitran Nigam (DHBVN) has completed the bifurcation of over a dozen feeders in New Gurugram circle to ease burden on the power infrastructure in the city ahead of the summer season. A feeder is usually a 11 kilovolt (kV) power line emanating from a power sub-station and delivered to local transformers from which individual connections are drawn. Gurugram has over 900 feeders, out of which over 400 are in New Gurugram. He said that the steps were taken to ensure that the city does not have numerous power cuts this year.

Source: The Economic Times

9 April. India emerged as the third-largest solar PV (photovoltaic) market in the world, with the country’s top 10 companies accounting for over 60 percent of all large-scale project installations in the 2018 calendar year. According to green energy market tracker Mercom Capital’s latest report, India installed 8.3 GW of solar PV capacity in 2018 against 44.3 GW by China and 10.6 by the US (United States). Japan and Germany, however, trailed India to the fourth and fifth-largest solar markets in the world. The report said there were over 300 utility-scale project developers in India with projects of at least 5 MW or more in operation. Currently, there are around 80 large-scale project developers with a pipeline of 5 MW or more in India. ACME Solar was the top developer in terms of utility-scale solar installations in 2018. It also had the largest project pipeline at the end of the year, closely followed by SB Energy (SoftBank) and Azure Power. The Adani group maintained its position as the largest project developer in terms of total cumulative installations through the end of 2018. It was also the second largest utility-scale solar installer in 2018. CleanMax Solar emerged as the top rooftop solar installer in 2018 followed by Fourth Partner Energy, whereas Tata Power still has the largest cumulative installations in the solar rooftop segment. The Mercom report said the top 10 rooftop solar installers covered just 30 percent of installed capacity in India in 2018.

Source: The Economic Times

8 April. Siemens Gamesa Renewable Energy, the second biggest manufacturer of wind turbines in the world, expects India to add between 7,000 and 10,000 MW of wind energy capacity in 2021, its global CEO (Chief Executive Officer) Markus Tacke said, despite a slump in projects over the last two years. In early 2017, India transitioned from a feed-in tariff regime (where tariffs were set by the power regulator) to a reverse auction regime. The transition, however, took time and not enough auctions were held, leading to a fall in new projects. German conglomerate Siemens and Spanish wind power producer Gamesa merged their wind businesses two years ago to form Siemens Gamesa Renewable Energy, but the merger coincided with the new tariff regime in India, and new installations that year, at around 260 MW, were modest. In 2018-19, however, projects worth 10,000 MW were auctioned by the Solar Energy Corp of India (SECI), with strong participation by wind developers. Siemens Gamesa, which only trails Denmark’s Vestas among global wind power companies, recently installed India’s first solar-wind hybrid project of 78.8 MW in Karnataka. For the company, India is the fastest growing market for such hybrid plants, Tacke said. Tacke said wind tariffs had stabilized, and were not likely to fall further. The latest wind power auction held by SECI in February saw tariffs in the range of Rs2.82 per unit.

Source: The Economic Times

6 April. Soon, a part of the daily operations at Nanganallur Road and Meenambakkam stations will be on solar power, as Chennai Metro Rail Ltd (CMRL) has installed and commissioned a 428 kilowatt peak (KWp) solar power plant on the roof of the two elevated stations. The solar plants, with a capacity to generate around 57,780 units per month, is expected to save metro rail around Rs26.34 lakh per year. While a major portion of the operations at the stations is planned to be powered by solar panels in the future, CMRL is also working towards using solar power for operation of trains eventually. The generated solar power will be utilised for lighting systems and to operate electrical equipment required for the maintenance of the stations. So far, CMRL has a total installed capacity of 4.1 megawatt peak (MWp) solar power including those installed at its head office in Koyambedu and a few other metro stations. CMRL had already installed 1 MW solar panels at its depot and 125 kW at its car park area generating a total of 1.35 lakh units a month saving CMRL Rs21.6 lakh for CMRL on power charges. Another 2.5 MWp roof top solar power installation is under progress and is expected to be completed by end of this year.

Source: The Economic Times

4 April. The Ministry of New and Renewable Energy (MNRE) has proposed making it mandatory for solar power developers to follow glass recycling procedure for solar photovoltaic (PV) panels under a new framework. The National Green Tribunal (NGT) had on 4 January 2019 directed the MNRE to prepare a policy for the management of Antimony present in solar glass panels. Antimony Containing Solar Panel Glass (ACSPG) is used globally to improve the stability of the solar performance of the glass upon exposure to ultraviolet radiation and sunlight. The ministry has given several recommendations regarding the use of Antimony. The note mentions that generators might set up facilities for safe dismantling of used solar panels or should tie-up with an authorised dismantling facility. The end-of-life solar panels are required to be collected and stored safely until the option for recycling is available. It should never be disposed or dumped in open landfills as it may release Antimony into the environment, MNRE said. India has witnessed large solar PV (photovoltaic) installations in the past five to six years. These panels will turn into waste over the next 15-20 years. As the glass in the PV panels is reusable at the end of its life, improper disposal may result in the loss of this recyclable material. The ministry said other countries including Germany have developed PV recycling technology and Antimony containing glass may be recycled without affecting its properties. The recycling process of a tonne of PV panels is likely to produce 686 kilogram (kg) of clean glass and 14 kg of contaminated glass. The recycled glass can be used to produce new panels with Antimony containing glass.

Source: The Economic Times

4 April. Delhi-based Okaya Power Group announced it has launched a solar power generation system in order to cater to the increasing demand from customers for such products. The company said it is already engaged in augmenting the solar energy storage technology to facilitate the mass use of solar energy but did not share the price of the new product. It said that the product meets all statutory compliances for off-grid and on-grid applications and the modules range comes with several features like Potential Induced Degradation, low light performance and Anti-Reflective coating glass.

Source: The Economic Times

4 April. Cancellation of auctions for renewable energy projects because of high bids has saved central and state governments Rs34.05 bn, MNRE (Ministry of New and Renewable Energy) Secretary Anand Kumar although companies have sharply criticised the practice as anti-investor. Kumar disagreed with industry experts who have maintained that such cancellations were dampening investor sentiment and would make it difficult for the country to achieve its target of 175,000 MW of renewable energy capacity by 2022. According to solar consultancy Bridge to India, 5,300 MW of valid winning bids were cancelled in 2018.

Source: The Economic Times

8 April. The rising tide of light US (United States) shale oil has largely swept away comparable grades of Nigerian oil from American shores and is putting them under pressure in Europe. But steady Indian and Indonesian demand has helped lift price indications for two of Nigeria’s top grades to near five-year highs, according to traders and shipping data. A projected rise in buying from European refineries, which supply fuel to the US, is offering some support for now. Light Nigerian oil is easily processed into higher octane gasoline increasingly used in the US, where the summer driving season looms. Sellers of Nigerian crude are still learning to live with the surge in US shale output, which has turned the US into the world’s top crude producer and dampened demand for imports in what had been a reliable market for Nigeria. Nigerian exports of crude and petroleum products to the US plunged from 36.4 mn barrels in July 2010 to just 5.6 mn barrels in January 2019, according to the US Energy Information Administration.

Source: Reuters

6 April. Egypt will remove subsidies on most energy products by 15 June, it told the International Monetary Fund (IMF) in a January letter released by the IMF as part of a review of Cairo’s three-year, $12 bn loan programme with the lender. This will mean increasing the price to consumers of gasoline, diesel, kerosene and fuel oil, which are now at 85-90 percent of their international cost, the letter said. Fuel prices have increased steadily over the past three years. LPG (liquefied petroleum gas) and fuel oil used for electricity generation and bakeries are not included in the commitment to reaching full cost recovery through subsidy cuts, the letter said. The government said in its letter that after starting to link less-used Octane 95 petrol to international prices – which it accomplished in April – it would introduce similar indexation mechanisms for other products in June, with the first price adjustments expected in mid-September. It also committed to fully eliminating arrears held by the Egyptian General Petroleum Company (EGPC) by the end of June this year. The arrears stood at $1.043 bn at the end of 2018.

Source: Reuters

5 April. Russian oil production may increase again this year if a global oil deal to cut output is not extended once it expires before 1 July, Energy Minister Alexander Novak said. Russian oil production has been on the rise over the past 10 years thanks to launch of new fields and introduction of new technology. Moscow has signed up to a global deal with members of the Organization of the Petroleum Exporting Countries (OPEC) and other producers to curb oil production and prop up crude prices. Russian oil output reached a record high of 556 million tonnes (mt), or 11.16 mn barrels per day (bpd), last year. Novak said it might reach 556 mn to 560 mt this year if the deal is not extended. OPEC and other producers led by Russia agreed to cut their combined oil production by 1.2 mn tonnes for six months starting from 1 January, an extension of cuts that were first implemented from January 2017. The participants in the deal meet in Vienna in June to decide on any further action.

Source: Reuters

5 April. Democratic Republic of Congo plans to launch a licensing round this year for more than 20 onshore oil and gas blocks, the oil ministry said, its first since adopting a new hydrocarbons code in 2015. Congo, Africa’s leading copper miner, has pumped just 25,000 barrels of oil per day for years despite sitting on up to 5 billion barrels of reserves. Anglo-French oil and gas company Perenco is Congo’s only active producer. France’s Total also holds an exploration permit near the eastern border with Uganda. Government efforts to ramp up oil exploration have met resistance from environmentalists, who have objected to exploration inside protected national parks.

Source: Reuters

5 April. Australia’s Woodside Petroleum WPL.AX has signed a Heads of Agreement (HOA) to supply liquefied natural gas (LNG) to China’s ENN Group for 10 years from 2025, both companies said. Woodside, Australia’s biggest listed oil and gas explorer, said the volume covered by the HOA is 1 million tonnes per annum (mtpa), to be sourced from Woodside’s portfolio of gas supply. Signed at the LNG 2019 conference in Shanghai, the HOA follows a cooperation agreement sealed last October. ENN is aiming to increase its market share in China’s gas distribution and retailing sector, as well as internationally, Woodside said. Woodside in January pledged between $1.6 bn and $1.7 bn towards projects this year, with most of that flowing into early work on the Scarborough and Browse gas developments, and expansion of its Pluto LNG plant in Australia. The company aims to double LNG production by 2027.

Source: Reuters

5 April. Japan’s Tokyo Gas Co Ltd said it has signed a heads of agreement (HOA) with Shell Eastern Trading for 500,000 tonnes per annum of liquefied natural gas (LNG) for 10 years from April 2020. The two companies have come up with an innovative pricing formula based on coal indexation, which is included in the agreement, it said. Under the deal, Royal Dutch Shell will supply LNG to Tokyo Gas from the Shell Group’s global LNG portfolio, rather than from specific LNG projects, it said.

Source: Reuters

4 April. Lebanon’s government has approved a second offshore energy licensing round with bids to be submitted early next year, Energy Minister Nada Boustani said. Lebanon awarded a first license for offshore oil and gas exploration and production last year to a consortium comprising France’s Total, Italy’s Eni and Russia’s Novatek, which aims to drill its first well by the end of this year. One of the blocks awarded last year in the first licensing round was located on the maritime border with Israel, but the consortium said it was not drilling near the disputed waters. Lebanon is on the Levant Basin in the eastern Mediterranean where a number of big sub-sea gas fields have been discovered since 2009 in Cypriot, Israeli and Egyptian waters. Bids for the second licensing round are due on 31 January 2020, Boustani said.

Source: Reuters

4 April. Shipments of liquefied natural gas (LNG) from the United States (US) to China will increase over the long term despite ongoing trade tensions, Cheniere Energy, the biggest US exporter of the super-chilled fuel, said. Cheniere has delivered 62 cargoes of LNG to China since first starting exports from February 2016. So far this year only three cargoes of US LNG have been delivered into China, compared with 16 cargoes in the first quarter of last year, Refinitiv Eikon ship tracking data shows. As the spat heated up from mid-2018, China added LNG to its tariff list in August and imposed a 10-percent duty on LNG in September. The US is the world’s fastest-growing exporter of LNG, while China is the fastest-growing importer as Beijing weans the country off coal to reduce pollution.

Source: Reuters

4 April. Chevron Canada Ltd and Woodside Energy Ltd have applied for a new license for their Kitimat LNG plant in northern British Columbia that could see it nearly double in size to produce 18 million tonnes per annum (mtpa), Chevron said. The companies submitted the application to Canada’s National Energy Board, with a revised plant design that may include up to three LNG trains, instead of two. The Kitimat LNG application follows the approval last October of the massive LNG Canada project, also located in Kitimat. That project is led by Royal Dutch Shell and will initially produce 14 mtpa, with the option to increase to 28 mtpa. A growing LNG (liquefied natural gas) industry in northern British Columbia would be a boon for western Canadian natural gas producers that would supply the projects, analysts said.

Source: Reuters

3 April. France’s Total said it has signed a 10-year sales and purchase deal with China’s independent gas company Guanghui for annual supply of 0.7 million tonnes (mt) of liquefied natural gas (LNG). The super-chilled fuel will be sourced from the French company’s global portfolio and supplied into Guanghui’s regasification terminal in Qidong in East China, Total said. The Chinese firm said the new gas purchases will serve a growing gas market in Jiangsu province, where demand for the cleaner-burning fuel is forecast to reach 35 billion cubic meters (bcm) in 2020.

Source: Reuters

3 April. China’s imports of liquefied natural gas (LNG) could reach 110 billion cubic meters (bcm), or about 80 million tonnes (mt) a year, by 2025, China National Petroleum Corp (CNPC) said. China’s LNG imports last year were about 54 mt. CNPC accounts for about 60 percent of China’s overall gas imports and 70 percent of domestic production. And that will become even more important with the startup of a gas pipeline between China and Russia – expected later this year – that could threaten LNG imports. Deliveries of gas to China via the Power of Siberia pipeline were due to begin at the end of December 2019, but the project is only expected to reach full capacity in 2025.

Source: Reuters

3 April. A consortium led by Saudi Arabia’s Arkad Engineering has won a tender to build a pipeline that will carry Russian natural gas across Bulgaria, state network operator Bulgartransgaz said. The group, which also includes a Milan-based joint venture between Arkad and Swiss-based ABB, offered to complete the project by the end of 2020 for €1.1 bn ($1.24 bn), or within eight months for €1.29 bn. Bulgartransgaz said the Saudi-led group had filed the lowest bid to build the pipeline.

Source: Reuters

3 April. China’s gas demand will reach 360 billion cubic metres (bcm) in 2020 and rise to 480 bcm by 2025, Li Hui, vice head of China National Offshore Oil Corp (CNOOC) said. China has put itself under pressure by signing too many long-term supply contracts at relatively high prices, he said.

Source: Reuters

9 April. China will produce an additional 100 million tonnes (mt) of coal in 2019, creating a glut of the fuel in the world’s top consumer of the commodity. China produced 4 billion tonnes of coal in 2018, according to the National Bureau of Statistics. The market will see oversupply in the near future, the China National Coal Association said.

Source: Reuters

9 April. Major Chinese coal miner Yancoal is working with leading utility Huaneng Group to launch an international energy trading centre in June on China’s southern Hainan island, Li Wei, general manager at Yancoal Mining Group, said. The trade centre will initially focus on physical coal trading and introduce other energy products, such as oil and gas, and futures trading at a later stage, Li said.

Source: Reuters

5 April. Australian thermal coal prices registered their biggest weekly fall since the financial market turmoil of a decade ago as demand plunged with the end of winter and amid worries over the strength of the global economy. Coal prices for prompt loading at Australia’s Newcastle terminal have lost almost 20 percent, dropping to $72 a tonne. Coal has slumped by 40 percent from a mid-2018 peak of more than $120 a tonne. Japan is the biggest buyer of Australian thermal coal. The contract to March 2020 was 14 percent lower than the price for a year-long deal for supplies through September this year. The coal slump also follows a 60 percent crash in Asian prices for liquefied natural gas (LNG), coal’s most direct competitor as a power generation fuel. Trade data on Refinitiv Eikon showed a sharp weekly fall in thermal coal imports from Australia’s biggest buyers of China, India, Japan, South Korea and Taiwan. These countries’ overall imports fell to 11.8 million tonnes (mt) from 16.1 mt between weeks 12 and 13 of this year.European coal demand has fallen with the end of the heating season but also because its biggest economy and coal user, Germany, is teetering on the edge of recession. Power sector demand for coal has been quite weak in northwest Europe owing to strong wind power generation.

Source: Reuters

4 April. German Finance Minister Olaf Scholz has agreed to provide €240 mn (205 mn pounds) in assistance to four states affected by government plans to phase out coal-powered energy. Germany wants to phase out coal by 2038 and the four states that are home to the mining industry want government assistance to limit the economic impact of the transition to renewables. A commission set up to draft a phaseout strategy said in January that the government should inject some €2 bn a year over two decades in Germany’s three mining belts.

Source: Reuters

3 April. The French government is sticking to its previously announced target of shutting down France’s remaining coal power plants by 2022 as a report by grid operator RTE confirmed it could do without the coal generators under certain conditions. The French government plans to halt the remaining coal power plants with a total capacity of around 3,000 MW, operated by state-controlled utility EDF and Germany’s Uniper, as part of its efforts to curb carbon emissions.

Source: Reuters

9 April. China expects its installed power generation capacity to be about 2,000 GW in 2019, with coal-fired power capacity at 1,040 GW, the China Electricity Council (CEC) said. Consumption by coal-fired plants is expected to increase by 80 million tonnes in 2019 versus 2018, the CEC said. The CEC also sees installed new power capacity at 110 GW in 2019, including 62 GW coming from non-fossil fuel, the CEC said. The CEC expects first-quarter power consumption to increase about 6 percent from a year earlier.

Source: Reuters

9 April. A university power plant in Alaska is scheduled to go online in May, six months behind its original target date. The combined heat and power plant at the University of Alaska Fairbanks will begin commercial operations by mid-May. The plant’s safety record to date ranks above the national Occupational Safety and Health Administration average.

Source: US News & World Report

8 April. Symbion Power has signed an agreement with the Rwandan government for the construction of a 56 MW power plant on Lake Kivu in the Eastern African nation. The 56 MW power plant will be operational in fourteen months with a cost estimated at $200 mn. The construction of the plant is part of the Rwandan government’s strategy to increase national capacity from 221 MW to 512 MW by 2024, the year in which Rwanda hopes to increase access to electricity for all its inhabitants to 100 percent. The energy produced by the plant will be injected directly into Rwanda’s national electricity distribution grid. The Rwandan government has mobilized $491 mn for a series of projects including the construction of the 56 MW power plant on Lake Kivu. In Rwanda, the number of households connected to electricity increased from 10 percent in 2010 to 51 percent as of February 2019, according to the Rwandan Energy Group (REG). Among the households, which have access to electricity, 37 percent are connected to the national grid while 14 percent are connected through off-grid solution, mainly solar energy and mini-grids.

Source: The North Africa Post

8 April. The Lebanese government approved a plan to reform its electricity sector, vowing to provide power 24 hours a day from a grid notorious for blackouts. The decision is the most significant by the cabinet since it was formed in late January and is a step toward unlocking billions in aid pledged to Lebanon in exchange for slashing public spending and overhauling the electricity sector. Prime Minister Saad Hariri said the cabinet unanimously approved the plan which would improve power supply, raise electricity tariffs and reduce fiscal deficit resulting from government transfers to Electricite du Liban (EDL). A dated electricity grid, rampant corruption and lack of reform has left power supply lagging way behind rising demand since Lebanon’s 1975-1990 civil war. According to the McKinsey & Company consulting firm, the quality of Lebanon’s electricity supply in 2017-2018 was the fourth worst in the world after Haiti, Nigeria and Yemen.

Source: Arab News

8 April. French utility EDF has been warned of a 24-hour strike at its hydropower plants in France from 10 April, the RTE grid operator said. France’s CGT trade unions have been calling for strikes at hydropower stations to protest against European Commission demands for France to privatise its hydropower concessions, which are mostly operated by EDF. The French government made proposals to the Commission last year to resolve the long-standing demand by Brussels for it privatise the hydropower concessions.

Source: Reuters

8 April. Croatian state-owned power utility HEP said it had kicked-off a decade-long investment plan to add 350 MW of new solar capacity by 2030. HEP’s CEO Frane Barbaric said that the company would invest 750 mn kuna ($113.48 mn) over the next five years, adding 20 MW of new solar capacity each year. HEP has taken over an existing solar plant in the northern Adriatic and will begin construction of three new plants in southern Croatia this year.

Source: Reuters

5 April. Belgium’s parliament has passed two bills aimed at spurring investment in gas-fired power generation and building 4,000 MW of new offshore wind farm capacity by 2030 to replace its aging nuclear power reactors. The bills were approved by a wide majority, Energy Minister Marie-Christine Marghem said. When completed, the wind farms will cover around 20 percent of Belgian electricity consumption, she said. Belgium has decided to phase out nuclear power by 2025, which means the country needs to develop new capacity to replace its seven nuclear reactors operated by Engie unit Electrabel. The reactors have capacity of around 6,000 MW and generate around 50 percent of the country’s electricity.

Source: Reuters

5 April. Germany is considering introducing a new carbon emissions tax to help reduce production of greenhouse gases that contribute to climate change. The advisers have long called for some form of carbon emissions pricing and had in the past advocated introducing a form of harmonised pricing for carbon used in electricity generation, transport and heating.

Source: Reuters

4 April. Saudi Arabia plans to issue a multi-billion-dollar tender in 2020 to construct its first two nuclear power reactors and is discussing the project with US (United States) and other potential suppliers. The world’s top oil exporter wants to diversify its energy mix, adding nuclear power so it can free up more crude for export. But the plans are facing Washington’s scrutiny because of potential military uses for the technology. US, Russian, South Korean, Chinese and French firms are in talks with Riyadh to supply reactors, a promising deal for an industry recovering from the 2011 Fukushima nuclear disaster. Riyadh needs to sign an accord on the peaceful use of nuclear technology with Washington to secure the transfer of US nuclear equipment and expertise, under the US Atomic Energy Act. US Energy Secretary Rick Perry said that the negotiations which began in 2012 were continuing. The King Abdullah City for Atomic and Renewable Energy, tasked with developing the nuclear programme, has brought in an executive from oil giant Saudi Aramco to help manage the pre-tender consultancy process.

Source: Reuters

Million Units

| Sr. No. | State/Utility | 2018-19 (till February) |

| 1 | Andhra Pradesh | 8328.22 |

| 2 | Bihar | 12.28 |

| 3 | Gujarat | 9685.39 |

| 4 | Karnataka | 9380.54 |

| 5 | Kerala | 103.40 |

| 6 | Madhya Pradesh | 4215.40 |

| 7 | Maharashtra | 6960.51 |

| 8 | Odisha | 46.13 |

| 9 | Rajasthan | 5551.66 |

| 10 | Tamil Nadu | 12368.22 |

| 11 | Telangana | 257.06 |

| 12 | PSUs/Central Utilities | 352.76 |

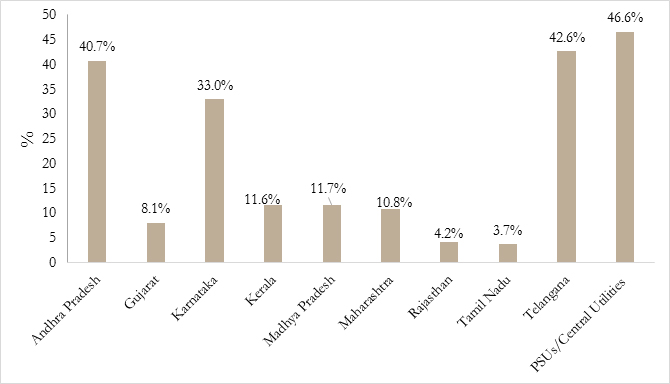

Increase /Decrease (%) in Wind Generation in 2018-19 w.r.t. 2017-18

Source: Central Electricity Authority

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2018 is the fifteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Advisor: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar