< style="color: #0069a6;letter-spacing: 0.7pt">BIO-FUEL PROJECTS REVIVED WITH FOREIGN TECHNOLOGY

Non-Fossil Fuels News Commentary: January - February 2019

India

The Union petroleum ministry has decided to encourage conversion of Used Cooking Oil to biodiesel and tied up with a private firm, Muenzer Bharat. A pilot plant for the conversion has been set up in Nerul MIDC. The firm will target restaurants, starred hotels and bulk sellers of vadapav and chips in Mumbai, Navi Mumbai and Thane in the first phase and provide drums to collect the used oil waste daily. It will prevent the re-entry of used oil in the food chain and also stop its dumping in rivers and sewers. The biodiesel manufacturing facility has been set up under the 'National Used Cooking Oil Collection Mission for India'. It will convert the used oil into 100 percent water-based biodiesel-which can be used for gensets or blended with diesel to make it environment-friendly. Bad quality cooking oil is one of the main causes for cardiac infarction-a leading cause of deaths in India. Biodiesel can be blended with diesel, to be used in diesel cars, trucks, buses, off-road equipment, and oil furnaces across the country.

The 'energy from waste' biodiesel plant in Navi Mumbai will convert used cooking oil into biodiesel, an innovative model of converting #Waste2Wealth and is further expected to add to India's energy security and help create alternate sources of energy. The Muenzer plant apart from meeting requirements of Bio-diesel will also be a big step in creating awareness, supply chain infrastructure and setting an example for other potential players.

The Punjab government signed an MoU with a Delhi-based company for a ₹ 6.3 bn project which will produce biofuel from rice husk. The technology for the project will be provided by the US giant Honeywell. The company, Virgo Corp, will use the technology to produce biofuel from rice husk to set up a rapid thermal processing plant, which will provide over 150 direct and 500 indirect jobs. The project would pave way for potential future collaborations in terms of investments, technology transfer between Punjab and the US. The project would go a long way in containing environmental pollution due to stubble burning, besides supplementing the income of farmers by helping turn the unmanageable agro-waste into raw material for producing biofuel.

In the late 2000s, hydroelectric power was billed as a sustainable, renewable alternative to coal and gas based electricity for India. The government drew up ambitious plans for setting up hydel plants and the private sector was keen to get in on the action. In 2008, growth in India’s installed hydel capacity outpaced the rise in India’s total power capacity. But it has been a different story since. Hydropower has slowly faded from the discourse on the future of India’s energy security, as solar and wind projects garner much of the attention. India’s installed hydro capacity at the end of 2018 was around 45,400 MW, an annual growth of just 1 percent, the lowest since 2009. What’s more, between 2008 and 2018, hydel power’s share of India’s total installed electricity capacity has halved from 25 percent to 13 percent. Beset by land acquisition troubles, uncertainty over final costs as well as estimated time for completion, and low tariffs, the hydel sector is unlikely to have a turnaround in the near future. While hydropower is renewable, its social and environmental impact — from displacement of thousands of people and adverse effects on biodiversity as a result of dams, to methane emissions from the rotting vegetation in their reservoirs — means that big hydel projects are no longer hyphenated with solar, wind and biomass energy. In 2015, the Indian government stopped categorising hydel projects larger than 25 MW as renewable. India has 4,500 MW of hydel projects with a capacity of less than 25 MW each. The government has estimated the country’s hydropower potential (more than 25 MW) at over 1,45,000 MW.

The Indian government has proposed the construction of Lower Arun Hydropower Project in Nepal with a capacity of 400 MW. The Nepal government would make a proper decision whether or not to award the construction of Lower Arun to India after seeing the progress in Arun III hydro project. The project investment is estimated to be over ₹ 100 bn. Nepal Energy Ministry has estimated that the project would be of around 1000 MW capacity if it is designed in a way to export power to India. India has put forth the proposal to build the Lower Arun project by keeping all conditions stipulated in Arun III.

BHEL said it has bagged two orders worth ₹ 970 mn from NPCIL to manufacture and supply primary side heat exchangers. The heat exchangers will be manufactured at BHEL’s Bhopal plant, BHEL said. The company has been a pioneer in the design and development of primary side products such as nuclear steam generators for NPCIL, and has, so far, supplied 40 steam generators for various nuclear power installations in the country.

The government has released ₹ 35.84 bn as CFA for implementing renewable energy schemes by the MNRE in financial year 2018-19 so far. A total of 74.79 GW of renewable energy capacity had been installed in the country at the end of December 2018 including 25.21 GW from solar, 35.14 GW from wind, 9.92 GW from biomass, and 4.52 GW from small hydro power. Installed capacity of solar rooftop systems stands at 1,279 MW in the country. The current rooftop solar programme, approved by the government in December 2015, aims at setting up 2,100 MW capacity in residential, institutional, social, and the government sectors through CFA by end of 2019-20. The government has set a target to install 40,000 MW of rooftop solar power capacity by 2022.

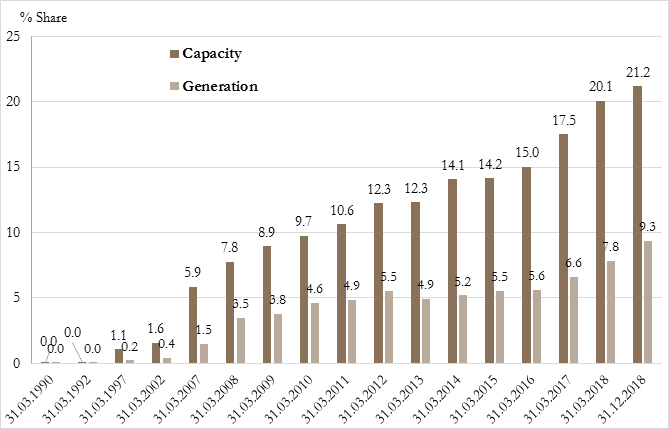

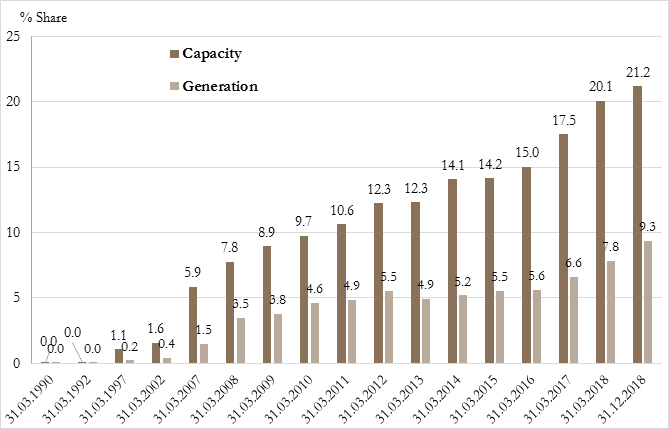

Based on implemented policies, India’s greenhouse gas emissions were expected to increase to a level of 4,469 to 4,570 MtCO2e by 2030, excluding forestry. This emission pathway was not compatible with a 2 degrees Celsius scenario. According to the India Cooling Action Plan draft, there is a plan to cut cooling demand by 20 to 25 percent by 2037, thus curbing a source of huge growth in electricity demand. The total renewable energy installations in India reached 75 GW by September 2018, representing 21 percent of total installed capacity and generating a record high of 11.9 percent of all electricity in the September 2018 quarter.

The interim budget has allocated ₹ 30 bn for development of solar power projects next financial year (2019-20) including both grid-interactive and off-grid and decentralized categories. This is a mere 1 percent increase over the likely expenditure of ₹ 29.69 bn for solar projects this fiscal. Under grid-interactive schemes, the budgeted allocation for solar is seen rising 15 percent to ₹ 24.79 bn in 2019-20 as compared to the current fiscal’s Revised Estimate of ₹ 21.57 bn, a review of budget documents tabled in Parliament show. The allocation for solar projects under off-grid and decentralized renewable power is seen declining 35 percent to ₹ 5.25 bn for the next financial year from ₹ 8.12 bn based on the revised estimate for 2018-19. Overall, the budget has allocated ₹ 49.60 bn for both grid-interactive and off-grid or decentralized renewable power for 2019-20. This is a marginal 1 percent increase over the allocation of ₹ 49 bn based on the Revised Estimate for current fiscal. Apart from solar, the budget has allocated a bulk of the funds under two other heads -- wind power and green energy corridors. Both of them fall in the grid-interactive category.

India will add 11.4 GW of solar capacity annually for the next few years on the back of strong government push to achieve its targets, S&P Global Platts Analytics said in a report. According to the report, the upcoming 2019 general elections would be an important event for the sector, and as a result, little progress on the policy front was expected in the near term. Under the Jawaharlal Nehru National Solar Mission, launched as part of India’s National Action Plan on Climate Change in 2010, a target of 20 GW capacity by 2022 was set up, but was subsequently increased to 100 GW, of which 60 GW was of utility-scale. Highlighting the Central Electricity Authority of India’s data, the report said that India’s solar capacity reached 25.8 GW at the end of 2018 -- with at least 13.8 GW under construction currently and 22.8 GW tendered under various schemes and state-level allocations.

The government is planning to re-launch 5 GW of manufacturing-linked solar tender out of the initial 10 GW that had received a single bid. With this, the earlier sole bid received from Azure Power will be cancelled and fresh bidding will start. With an aim to boost local manufacturing of solar equipment, the manufacturing-linked tender was first floated by SECI in May last year. However, due to low interest from the industry the bid submission was postponed six times. Azure Power has bid for 2,000 MW power capacity linked with 600 MW solar equipment manufacturing capacity while most of the other large industry players stayed away from the tender.

The government's ambitious plan to set up a 7,500 MW solar power project at an estimated investment of ₹ 450 bn in Jammu & Kashmir’s Ladakh region has whetted the appetite of some 50 topline companies, even as tariff emerged as the key concern. Prospective investors, including major manufacturers, raised a host of issues with the top brass of SECI, the implementing agency under the renewable energy ministry, at a pre-bid meeting. These ranged from the natural challenges to the bid structure. The project is proposed to be set up at two locations. Hanle-Khaldo area in Nyoma block of Leh district will house a 5,000 MW unit, while Kargil district will get a 2,500 MW unit at Suru in Zanskar.

Tariffs in Maharashtra's latest solar auction for 1,000 MW, held, remained almost unchanged from the last one conducted eight months ago, with mostly domestic developers participating. Shiv Solar and Acme Solar won 50 MW and 300 MW respectively at the lowest winning tariff of ₹ 2.74/kWh, while ReNew Power and Avaada Energy won 300 MW and 350 MW at ₹ 2.75/kWh. The tariff is distinctly lower than that at the last solar auction held in the country, by Gujarat in December, at which the winning price was ₹ 2.84/kWh. Unhappy with the tariff, which was higher than Gujarat Urja Vikas Nigam Ltd officials expected, they promptly cancelled the auction. A unique feature of the latest Maharashtra solar auction is that projects can be set up anywhere in the country, not necessarily in the state itself, and the power transmitted to Maharashtra.

The Andhra Pradesh government has set a target of generating 5,000 MW of solar power by 2023, and has offered several incentives to the private sector to meet this target. The new solar power policy said the power distribution companies in the state would be procuring 2000 MW of solar power in the next five years. The policy announced by the Andhra Pradesh government is among the most investment-friendly of such policies by other state governments. Among the other highlights of the policy, companies investing in solar power projects in the state would be entitled to state government incentives for 10 years. The government has also committed itself to obtaining revenue land for the solar power projects. For solar parks, land lease will be prioritised by the government and will be exempted from administrative approval charges. The new policy does not clearly spell out liability charges, project completion timeline, performance obligation, security deposit, completion time lines, renewable purchase obligations for ground mounted projects towards obligated entities.

The Goa government has notified the Solar Energy Policy to promote unconventional electricity generation in the coastal state. The policy, which was notified, came into force with immediate effect. As per the policy, the consumer and the producer of solar power will be entitled to avail benefit in the form of 50 percent subsidy from the state government. The policy also provides for penalty equal to five percent of the value of energy committed every day, if power producer fails to complete and commission the project within the given deadline. Under the policy, the government will provide 50 percent subsidy, including 30 percent share from the Centre, for the capital cost or the benchmark cost provided by the MNRE or cost arrived through tendering process by the GEDA.

The Tamil Nadu government has announced its Solar Energy Policy 2019 with the objective of achieving an installed capacity of 9,000 MW by 2023. Its earlier policy, which was unveiled in 2012, had set a target of 3,000 MW of installed capacity by 2015. But the State managed to achieve a little over 2,000 MW as of March 31, 2018. This capacity was about 10 percent of the country’s installed capacity in the solar sector. The new policy comes at a time when Tamil Nadu has lost its leadership position in rooftop solar capacity. With an installed capacity of 473 MW (as on 30 September 2018) in rooftop solar segment, Maharashtra has emerged the leader in this segment, pushing Tamil Nadu to the second position with an installed capacity of 312 MW, according to Bridge to India, a solar energy consulting firm. The policy hopes to create a framework that will help accelerate development of solar installations in the State, promoting both utility category and consumer category solar energy generation through various enabling mechanisms. About 40 percent of the target (9,000 MW) will be earmarked for consumer category solar energy systems, the policy document said. Tamil Nadu has been a pioneer in harnessing energy from renewable energy sources and it has highest installed capacity of more than 11,000 MW in the renewable energy sector with wind energy, where it leads the country, accounting for more than 8,200 MW. The State has huge potential for solar energy with around 300 clear sunny days in a year.

The UT administration has sought status report on the solar city project from the CREST, the nodal agency for installation of solar plants in Chandigarh. CREST is making efforts to achieve the target of 69 MW set by the ministry of new and renewable energy, which is to be achieved by 2022. UT administration had already approved the detailed project report of installation of 800 kW solar power plants worth ₹ 45 mn at the parking area of the new lake at Sector 42. Out of 800 kW, 90 kW solar energy would be reserved for charging e-vehicles. CREST also planned to install a 3 MW solar plant on the N-choe, a seasonal rivulet that passes through Garden of Springs, Sector 53, at the southern end of Chandigarh. It would be first of its kind solar plant on the N-choe. To encourage residents for installation of solar plants, the Chandigarh administration has already started transferring subsidy for installing solar plants on their rooftops, to residents, online. Earlier, the administration used to give cheques to residents. CREST provides 30 percent subsidy to residents for installing solar panels.

GERC has permitted GUVNL to procure 2.7 MW solar power generated by salt pan workers of SEWA during off-season period in salt pan work. As many as 3,000 salt pan workers in the Kutch desert use solar-powered pumps to draw saline water for salt production. These salt pan workers use solar panels- with an aggregate capacity to produce 2.7 MW power- for six months (October to April) for salt production at a remote location. The panels remain idle in warehouses during the remaining off-season period of six months. SEWA had requested Gujarat government to devise a suitable mechanism for purchase of power generated from these solar panels during the off-season period to optimally utilise the panels for socio-economic upliftment of salt pan workers. Subsequently, Grassroot Trading Network for Women, a SEWA entity, also received a go-ahead from the government to set up a solar power project of the same capacity. GUVNL approached GERC for the latter’s approval to procure solar power from salt pan workers during off-season period. The state regulator recently approved GUVNL’s petition as a special case considering the socio-economic upliftment of salt pan workers.

The Gujarat government has cancelled the solar auction for 700 MW it held in December on the grounds that the winning tariffs reached were too high. The decision was conveyed to the winning developers at a meeting. Foreign players had won the entire 700 MW, with Softbank-backed SB Energy getting 250 MW at ₹ 2.84/kWh, and Finland’s Fortum as well as France’s Engie getting 250 MW and 200 MW respectively at the same price of ₹ 2.89 /kWh. The previous auction for 500 MW held by GUVNL in September 2018 had seen the lowest tariff at ₹ 2.44/kWh, and officials were unhappy over the sharp rise in just three months. Developers attributed the rise mainly to the high charges levied at the Raghanesda Solar Park in the state, where the projects have to be located, unlike the ones won in September, which could be put up anywhere in the state. They had welcomed the rise in tariff, claiming tariffs were finally becoming realistic after their sharp fall in the past three years. The Gujarat government was likely to reduce the charges at the solar park, after which GUVNL would hold a fresh auction. It has already announced another auction for 500 MW to be held in end-January. This is the second auction GUVNL has cancelled due to perceived high tariffs. Earlier, it also cancelled a 500 MW auction held in March last year, at which the lowest price reached was ₹ 2.98/kWh.

Kerala will provide around 1.3-1.5 bn units of electricity to the consumers from 500 MW rooftop solar PV projects and 500 MW from floating and terrestrial solar PV projects. Kerala households have already registered for 200 MW of rooftop solar PV capacity. Agency for Non-Conventional Energy and Rural Technology, Kerala, explains that the Urja Kerala Mission by the State government is in the process of generating 1000 MW, of which 500 MW will be from solar panels installed on roof tops of houses.

Around 3,150 residents of Sushant Lok 2 Extension and Sushant Lok 3 can’t avail the grid-connected solar rooftop scheme because they are not direct DHBVN consumers. Launched in 2014, the scheme makes it mandatory for residents living in an area of up to 500 square yards or more to install solar power plant on their rooftop. Residents can use the power generated while exporting the surplus units to the discom, which in return will provide a rebate to them. The solar panels, when purchased from empanelled vendors of Haryana Renewable Energy Department, come with generous subsidies. But according to Haryana Electricity Regulatory Commission guidelines, only direct consumers of DHBVN can avail it. Sushant Lok 2 Extension and Sushant Lok 3 get power from a single point connection which the discom extends to the developer who then divides it into as many connections as number of consumers in the township. The scheme was supposed to encourage consumers to opt for alternative power sources. Gurugram has potential for generating solar power of 200 MW but only 27 MW is currently being generated.

Surat has become the first city in the country where water supply management by Surat Municipal Corp is being carried out using solar energy. Out of the total 6 MW of solar power plants, 4 MW is dedicated for water supply management. 5 MW of solar power plants are already installed and a 1 MW solar power plant will be commissioned on 30 January. Out of the 6 MW solar power plants, 4 MW is dedicated for Sarthana waterworks, Katargam waterworks, Rander waterworks, Varachha waterworks, Udhana water distribution station, Magob water distribution station and Simada water distribution station. The total solar energy generation out of 4 MW solar power plants meant for water supply is about 5.3 million units per annum.

To incentivise production of solar power the cabinet has approved amendments to the Goa State Solar Policy 2017 where small and large prosumers (consumers and producers of solar power) will receive 50 percent subsidy instead of the earlier proposed interest-free loan that was be recovered in instalments. The subsidy will be of two parts — a 30 percent central share and 20 percent state share. The central share will be credited to the prosumer as per the guidelines of the MNRE while the state subsidy will be released upon completing of six months of the solar power being injected into the grid. The subsidy will be 50 percent of the capital cost or the benchmark cost provided by MNRE or cost arrived at through tendering process by the GEDA, whichever is lower. As per the Solar Policy 2017, prosumers were to be provided grant of 50 percent of the capital cost as an interest-free loan, which was to be recovered by way of instalments after six months from the time the power flows into the grid. The state government through the electricity department has entered into agreement with the SECI for 25 years to purchase 25 MW solar power and with the NTPC Vidyut Vyapar Nigam Ltd for purchase of 6 MW solar power to meet the partial Solar Renewable Purchase Obligation.

India's wind energy sector is likely to benefit in the form of fresh investments as the trade tariff tussle between the US and China intensifies, according to a research report by global research and consultancy firm Wood Mackenzie. The research highlights the logistics challenges on the horizon for blades and towers as component sizes become longer and taller, respectively. Wood Mackenzie Power & Renewables expects the industry to circumvent these obstacles with new transportation methods and on-site/closer-to-site manufacturing. As such, the increase in project average megawatt size across global markets will favour this trend due to economies of scale, it said.

North America headquartered EDF Renewables announced its Indian arm has signed a long-term agreement to develop 300 MW of wind project in partnership with the UK-based SITAC Group. This agreement was the outcome of a competitive tender process launched by the Indian government under the fifth tender process of SECI. The award was granted in September 2018. EDF Renewables has a gross installed renewable energy capacity of 12.7 GW globally. Its development is mainly focused on wind and solar photovoltaic power and the company operates mainly in Europe and North America but is currently moving into emerging markets like Brazil, China, India, South Africa and the Middle East.

Hindustan Aeronautics Ltd said it has opened a wind energy plant in Karnataka's northwestern Bagalkot district to power its facilities in Bengaluru. The 8.4 MW wind energy power plant is near Ilkal town in Bagalkot district, about 480 km northwest of Bengaluru. The ₹ 590 mn plant comprises four wind turbines, set up along with Pune-based wind turbine supplier Suzlon Energy Ltd. The plant has the potential to generate about 26 mn units of energy per annum with an estimated annual savings of ₹ 180 mn to the company in its power consumption.

Three technology mission centres at IIT Madras will be launched to address various issues around solar energy and water treatment. The first is the DST-IIT Madras Solar Energy Harnessing Centre. Scientists from IIT Madras, IIT Guwahati, Anna University, ICT-Mumbai, BHEL and KGDS Renewable Energy Private Ltd will be engaged in the activities of the centre. Second in line is the DST-IIT Madras Water Innovation Centre for sustainable treatment, reuse and management which has been established with the aim to undertake synchronized research and training programmes on various issues related to wastewater management, water treatment, sensor development, stormwater management and distribution and collection systems. The third one would be the test bed on solar thermal desalination solutions which are being established by IIT Madras and KGDS as solution providers in Naripaaiyur, Ramanathapuram district, Tamil Nadu with the aim to deliver customized technological solutions to address prevalent water challenges in the arid coastal villages located on the shores of the Bay of Bengal.

Samsung’s R&D centre in Bengaluru has switched to solar power for its campus which houses over 3000 R&D employees, the company said. The campus will draw 88 percent of its power requirement from a solar farm in Kalburgi district in Karnataka, around 500 km away from Bengaluru. In December 2018, Samsung’s Bengaluru R&D Institute, which is the company’s largest R&D centre outside Korea, adopted the green energy solution through a method called ‘energy wheeling’. The solar farm by Bagmane Green Power LLP based in Kalburgi would power the R&D centre through energy wheeling. The farm adds the required power to the state electricity grid and the centre in turn, receives an equal amount of power from the local electricity grid. This method makes it more energy efficient.

Rest of the World

China’s renewable power capacity rose 12 percent in 2018 compared to a year earlier, with the country still rolling out new projects despite transmission capacity concerns and a growing subsidy payment backlog. China has been aggressively promoting renewable power as part of an “energy revolution” aimed at easing its dependence on coal, a major source of pollution and climate-warming greenhouse gas emissions. Total capacity - including hydro and biomass as well as solar and wind - rose to 728 GW by end-2018, the NEA said. China hooked up another 20.59 GW of new wind power capacity to its grid in 2018, the NEA said. New solar capacity reached 44.3 GW, slightly higher than a figure given by an industry association earlier this month, but still down compared to 2017 following a decision to slash subsidies. China also completed another 8.54 GW of hydropower capacity, mostly in the nation’s southwest, bringing total hydropower to 352 GW by the year’s end. China has tried to change the “rhythm” of renewable power construction to give grid operators time to raise transmission capacity and ensure clean electricity generation is not wasted. China’s “energy revolution” has also involved the installation of new emissions control technology at its coal-fired power plants, still the dominant form of energy in China.

China plans to take renewable energy and solar power to a whole new level by planning to build the first ever solar power station up in space. China’s Academy of Space Technology has revealed plans to build a solar power plant in space that would orbit the Earth at 36,000km and capture solar energy and beam it back to Earth. Since its photovoltaic array would be floating high above any terrestrial weather, the plant would be able to harness solar power even when it is cloudy on Earth. A space solar power station held the promise of providing ‘an inexhaustible source of clean energy for humans’. The construction of an early experimental space solar power plant has already begun with plans to launch a test facility before 2025, and if the launch and the energy-transmitting beam work as planned, the Chinese scientists have plans to test and launch even bigger and more powerful facilities through 2050.

Global demand for renewable power will soar at an unprecedented pace over the coming decades, BP said in a benchmark report, while China’s energy growth is seen sharply decelerating as its economic expansion slows. China’s energy demand rose by 5.9 percent over the past 20 years, but is set to grow by only 1 percent by 2040 as its economy shifts from energy-intensive industries to services and as Beijing introduces stricter rules on air pollution. Renewables are expected to be the fastest-growing energy source with an annual gain of 7.1 percent, accounting for half the growth in global energy. Compared with the level in last year’s report, BP raised by 9 percent its 2040 forecast of demand for renewable power such as solar and wind. Renewables and natural gas, the least-polluting fossil fuel, will account for 85 percent of the growth in energy demand. Solar power will increase by a factor of 10 by 2040 and wind by a factor of five under BP’s basic scenario. While the share of oil in world energy demand rose from 1 percent to 10 over 45 years in the early 20th century, renewables are set to reach the same share over 25 years.

Brazil aims to complete its third nuclear plant by 2026 with the help of private investment, Mines and Energy Minister Bento Albuquerque said, in a bid to jump-start the decades-old, corruption-tainted project. He was in favor of resuming construction of the Angra 3 nuclear plant, which has been halted since 2015, and that the estimated 15 bn reais ($3.95 bn) cost of completing the project would be money well spent. While nuclear technology should remain in the hands of the government, Albuquerque told reporters, the ministry is working with the government’s public-private infrastructure partnerships secretariat to come up with a model for allowing private enterprises to participate in the construction.

Spain aims to close all seven of its nuclear plants between 2025 and 2035 as part of plans to generate all the country’s electricity from renewable sources by 2050. Energy Minister Teresa Ribera announced the move, just as the Socialist government gears up to call an early national election in anticipation of losing a budget vote. Overhauling Spain’s energy system, which generated 40 percent of its mainland electricity from renewable sources in 2018, will require investment of €235 bn ($266 bn) between 2021 and 2030, Prime Minister Pedro Sanchez said. Ribera said the government would present a draft plan to combat climate change, which had been due to be sent to the EU for approval by the end of last year, to parliament on 22 February. Under a draft bill prepared last year, the government aims to ban sales of petrol, diesel and hybrid cars from 2040 and encourage the installation of at least 3,000 MW a year of renewable capacity such as wind farms and solar plants. Spain’s nuclear plants, which started operating between 1983 and 1988, are owned by Iberdrola, Italian-owned Endesa, Naturgy and Portugal’s EDP.

Britain’s Drax has started capturing carbon dioxide at its wood-burning power plant in North Yorkshire, a world first in technology it hopes could lead to carbon negative power plants in the future. Energy companies are seeking ways to reduce CO2 emissions while also providing constant supplies of electricity when renewable power sources, such as wind and solar are limited by the weather. The pilot bioenergy carbon capture and storage project is expected to capture a ton of carbon dioxide a day and Drax will seek to find ways to store and use the CO2 captured. Drax said the project was the first in the world to capture carbon emissions from a biomass plant. Climate scientists said the technology is likely to be needed to help meet the international Paris climate agreement to try to limit a rise in global temperatures to 1.5 degrees Celsius.

The European Commission said it had concluded that US soybeans can be used in biofuels in the EU, part of the bloc’s push to improve strained trade relations with the US. The Commission said the recognition of US soybeans for use in biofuels was valid until 1 July 2021, but could extend beyond that date as long as they met sustainability criteria set in new EU rules in the 2021-2030 period. Currently, the US exports soybeans to the EU for animal feed but the soybean oil byproduct has to be shipped back because Europe does not allow it to be used for fuel. The new rule would change that.

European companies bought a record amount of wind power capacity last year, as energy-hungry businesses like aluminum producers and IT giants look for greener ways to drive their machinery and data centers. As wind power becomes competitive on price with conventional energy in many countries, big companies have rushed to secure renewable energy to manage costs and reduce their carbon emissions, while boosting their image with customers. New wind deals through so-called corporate PPAs were signed in Europe last year for 1.5 GW of capacity, up from 1.3 GW in 2017, according to new data from industry body WindEurope. Wind power PPAs signed by companies in Europe have now reached a total capacity of 5 GW, almost the same as Denmark’s total wind energy capacity, WindEurope said. In 2018, the biggest buyers of wind power in Europe were aluminum producers Norsk Hydro and Alcoa, which both signed big deals to buy power from farms in Norway and Sweden.

The French government and utility EDF will study the possibility of converting the 1.2 GW Cordemais coal power generators to burn biomass due to its importance in guaranteeing security of supply, the energy ministry said. President Emmanuel Macron’s government plans to phase out electricity production from France’s remaining coal-fired power plants by 2022 as part of measures to curb carbon emissions and global warming. The government plans to reduce France’s dependence on nuclear power which accounts for over 75 percent of French electricity needs, while boosting the development of greener energies. French power grid operator RTE, has warned that the plan to shut down some coal and nuclear generators, could leave France, a net exporter of electricity in Europe, largely dependent on neighbours during peak demand periods, particularly in winter. Anxious to guarantee French electricity supply, the ministry and state-controlled utility EDF are studying a project to convert the power station to biomass, the energy ministry said. The ministry said the study would look at the environmental impact and economic viability, while additional analysis would be carried out by grid operator RTE on the security of supply particularly in western France.

French energy major Total is partnering with Denmark’s Orsted and renewable energy producer Elicio to submit a joint bid for the 600 MW capacity Dunkirk offshore wind project in France, the company said. The bid is the oil and gas major’s first serious foray into offshore wind in decades as it expands its presence in the renewable energy value chain. Until recently, Total’s major investments in renewables have been chiefly in the solar segment, with its $1.3 bn (£1.01 bn) acquisition of SunPower and purchase of a 23 percent stake in solar and wind energy producer Total Eren. Meanwhile European peers such as Equinor and Shell have been increasing investments in offshore wind developments. The company plans to invest $1.5-$2 bn annually in low-carbon electricity with a target of around 10 GW of installed capacity by 2022. Orsted manages more than a quarter of the world’s installed wind capacity, while Elicio is particularly active in wind power in France and Belgium.

Equinor and KNOC will explore opportunities to develop commercial floating offshore wind farms in South Korea, the Norwegian company said. South Korea aims to reduce its dependence on nuclear and coal power, targeting an increase in the share of renewable energy to 20 percent by 2030, compared with 7.6 percent in 2017, the country said last year. Equinor said this translates to a target of 49 GW of new generation capacity. KNOC plans to develop a 200 MW floating offshore wind project 58 km off the coast of Ulsan City, the company said. Equinor has built and is operating the world’s first commercial floating offshore wind farm - Hywind - off Scotland, where its five turbines have total capacity of 30 MW. Floating turbines are considered the next step in conquering wind resources in deep coastal waters where fixed turbines cannot be built, such as Japanese waters or off the coast of California. Equinor said it has submitted a bid to build an offshore wind park off New York using fixed-base turbines.

Boosting renewables to 65 percent of Germany’s power mix by 2030 could cost €20 bn more than previously planned, which will mean higher consumer energy bills, TSOs — EnBW’s TransnetBW, 50Hertz, TenneT, and Amprion said. Last year, Germany raised its target for the contribution of renewables to 65 percent by 2030 from 50 percent in a bid to reduce CO2 emissions by 55 percent over 1990 levels. It is set to miss a 2020 target aimed at cutting emissions by 40 percent. About two fifths of power needs in Europe’s largest economy are now met by renewables, but this needs to rise as it seeks to close nuclear plants by 2022 and coal power stations by 2038. As a result, power grids need to be extended to reach renewable energy sites. This will include new transmission lines to connect the industrial south with northern wind power farms.

Germany should shut down all of its coal-fired power plants by 2038 at the latest, a government-appointed commission said, proposing at least €40 bn ($45.7 bn) in aid to regions affected by the phase-out. The roadmap proposals, a hard-won compromise reached after more than 20 hours of talks, must be implemented by the German government and 16 regional states. They embody Germany’s strategy to shift to renewables, which made up more than 40 percent of the energy mix last year — beating coal for the first time — and follow a 2011 decision to halt nuclear power. Chancellor Angela Merkel’s cabinet welcomed the plan hammered out by the commission that included 28 voting members from industry, academia, environmental groups and unions, plus three non-voting members from the ruling parties. In a first step, plant operators including RWE, Uniper, EnBW and Vattenfall will be asked to shut down about 12.7 GW of capacity by 2022, equivalent to about 24 large power station units. Under the proposed plans, coal power capacity in Germany would more than halve to 17 GW by 2030. If implemented, the proposals would be the second major intervention in Germany’s energy market within a decade. The German government decided in the wake of Japan’s Fukishima disaster in 2011 to stop producing nuclear power by 2022. While the 2038 date to exit coal was in line with expectations, the report said the phase out could be completed by 2035 — a decision that would be taken in 2032.

Albania wants to make the environment a key measure of its energy policy and study whether its small hydro power plant strategy is worth pursuing. The investigation into 182 licenses issued to build 440 hydro plants stems from a plan to build a small plant on a river in southeastern Albania, which protesters said would endanger a waterfall key to tourism in a poor area. Since mid-2000 when a shortage of electricity supply caused long power cuts, successive Albanian governments have signed contracts to build, mostly small, hydropower plants, but so far only 96 plants are fully operational. The damage these small hydro power plants caused could outweigh any economic gain. The review will ascertain if contractors have built the plants as specified and to deadline, and whether they have complied with environmental requirements.

Algeria plans to issue several tenders for renewable energy projects this year as it seeks to meet growing demand for electricity and save gas for export. The OPEC oil producing member hopes to build solar plants to produce 22,000 MW, or 27 percent of its electricity needs, by 2030, up from about 350 MW now. Algeria will soon invite bids from national and foreign firms to set up a solar plant with a capacity of 150 MW, the energy ministry said. Turning to solar power is part of a drive to guarantee cheap retail energy prices. The authorities are keen to avoid social unrest, and face sporadic protests in some areas over a lack of electricity and gas supplies. Algeria is currently using gas to generate 98 percent of its power output of 19,000 MW. Increasing or maintaining the level of gas and oil exports is a top priority for the country as the two energy products make up 60 percent of the budget and 94 percent of total sales abroad.

The number of jobs in the US solar industry dropped by 3.2 percent in 2018, a second year of losses, as the Trump administration’s tariffs on foreign panels and state-level policy changes hit demand for installations, according to an industry report. The job losses reflect how changing trade and environmental policies can alter the trajectory of an industry that was among the fastest-growing segments of the US energy industry. The number of solar energy workers fell by 8,000 to 242,000 in 2018, according to the Solar Jobs Census, released annually by the non-profit research firm The Solar Foundation, following a loss of 10,000 jobs in 2017. But jobs are expected to rise next year, the report said. Policies of US states are also critical to solar growth, and changes in incentives and rates for projects in large markets led to job losses there, according to the report. In California, utility procurement slowed because power companies have fulfilled near-term renewable energy procurement requirements. The state’s commercial market slowed due to a shift to rates that are less favorable to solar. In Massachusetts, the commercial market stalled ahead of the introduction of a new incentive scheme at the end of the year. The Solar Foundation said it expects a rebound in jobs of 7 percent next year, however, due to recent declines in solar panel prices that have made them more affordable. China last year slashed subsidies for solar installations, unleashing a flood of low-cost Chinese-made panels onto the international market and pushing prices below what they were before the tariffs were imposed. Installation will receive the biggest bump, more than 9 percent, the report said, while manufacturing will rise 4 percent, the report said.

South African miner Harmony Gold is in talks to build a 30 MW solar power plant in the Free State province to supply power to some of its operations to try to reduce power costs and dependence on struggling utility Eskom. Eskom, which produces over 90 percent of South Africa’s electricity, is saddled with more than $30 bn in debt and has had to impose some of the country’s worst power cuts in years over the past few days. Eskom’s troubles are a big headache for heavy energy users in South Africa, particularly gold mining companies. Harmony said it was in talks with the state energy regulator over a licence to build a solar power plant in Welkom in the Free State province. The company, which uses around 280 MW of power at its South African operations, plans to use the solar plant to help to supply its longer life assets including its Tshepong operations in the Free State. Harmony said it had also taken action to reduce consumption during peak periods and improved efficiency of pumping operations.

The government of Bosnia’s autonomous Serb Republic awarded 50-year rights to power utility ERS to build and operate two hydropower plants with combined capacity of 95 MW on the Drina river bordering Serbia. The projects are expected to cost €200 mn (174 mn pounds) and are aimed at diversifying Bosnia’s energy sources. State-controlled ERS operates two coal-fired power plants with combined capacity of 600 MW and three large and several small hydropower plants with total capacity of 617 MW. ERS had earlier agreed to build the two new plants with Serbian counterpart EPS. Unlike its Balkan neighbours, which rely on imports to cover part of their demand, Bosnia is able to export power thanks partly to its hydropower capacity, which provides 40 percent of its electricity. The rest of Bosnia’s electricity comes from coal-fired plants.

Colombia has received bids from more than two dozen companies that want to participate in the country’s first-ever tender of renewable energy projects. The tender is part of the Andean nation’s efforts to expand and diversify its electrical energy provision. Some 70 percent of Colombia’s electricity is generated with hydropower. Bidding for 22 different solar, wind and biomass projects will take place on 26 February. Twenty-seven local and multinational companies are set to participate, the Minister said. The projects are expected to begin electricity production in 2021. The government wants to have the capacity to generate 1,500 MW of electricity from renewable sources within four years, up from the current capacity of 50 MW. Besides hydropower, some 20 percent of the country’s electricity currently comes from gas and liquid fuel, some 8 percent from coal and just 2 percent from renewables.

Google said it has signed a long-term agreement to buy the output of a 10 MW solar array, which is part of a larger solar farm, in Tainan City in Taiwan. This will be the company’s first purchase of renewable energy in Asia, the company said. The project will be located 100 km south of the company’s Changhua County data centre and connected to the same regional power grid, it said. Big companies have rushed to secure cheap renewable energy to manage costs and reduce their carbon footprint through corporate power purchase agreements which allow firms such as Google, owned by Alphabet Inc, Facebook and Microsoft to buy directly from energy generators.

| MoU: Memorandum of Understanding, MW: megawatt, GW: gigawatt, US: United States, BHEL: Bharat Heavy Electricals Ltd, NPCIL: Nuclear Power Corp of India Ltd, mn: million, bn: billion, CFA: Central Financial Assistance, MNRE: Ministry of New and Renewable Energy, MtCO2e: metric tonnes of carbon dioxide equivalent, SECI: Solar Energy Corp of India, kWh: kilowatt hour, UT: Union Territory, CREST: Chandigarh Renewal Energy, Science and Technology Promotion Society, kW: kilowatt, GERC: Gujarat Electricity Regulatory Commission, GUVNL: Gujarat Urja Vikas Nigam Ltd, SEWA: Self Employed Women Association, PV: photovoltaic, DHBVN: Dakshin Haryana Bijli Vitran Nigam, discom: distribution company, GEDA: Goa Energy Development Agency, UK: United Kingdom, km: kilometre, IIT: Indian Institute of Technology, NEA: National Energy Administration, CO2: carbon dioxide, EU: European Union, PPAs: power purchase agreements, KNOC: Korea National Oil Corp, TSOs: transmission system operators, OPEC: Organization of the Petroleum Exporting Countries |

NATIONAL: OIL

Saudi Arabia to make India regional hub for oil supply: Saudi FM

25 February. Saudi Arabia is looking at making India a regional hub for supply of crude oil and will invest billions of dollars in the country to build storage facilities and strengthen refineries, Saudi Foreign Minister (FM) Adel bin Ahmed Al-Jubeir has said. Saudi Arabia, the world's biggest oil exporter, will also invest in downstream assets in India besides helping the country boost its infrastructure in the petrochemical sector, the Minister said. The Minister said his country looked at India as a rising economic power and was very bullish about its potential to grow further. Reflecting growing energy ties, it was announced recently that Saudi Aramco, the world’s top oil exporter, will be part of a joint venture project to set up a refinery in Maharashtra at a cost of $44 bn. It will be the largest greenfield refinery in the world to be implemented in one phase. The Minister said his country was committed to meeting India's oil demand and ready to sell more crude oil to India. India is expected to increase import of oil from countries such as Saudi Arabia and the United Arab Emirates if the US (United States) does not extend the six-month-long waiver it granted to New Delhi and several other countries to buy oil from Iran. Saudi Arabia is also a key pillar of India's energy security, being a source of 17 percent or more of crude oil and 32 percent of LPG (liquefied petroleum gas) requirements of India. The energy ties between the two countries are on an upswing in the last few year.

Source: The Economic Times

PNGRB rejects HPCL review petition on ATF pipeline

24 February. PNGRB (Petroleum and Natural Gas Regulatory Board) has rejected HPCL (Hindustan Petroleum Corp Ltd)’s objections to consultations it had initiated to break stranglehold of PSUs (Public Sector Undertakings) on lucrative pipeline supplying jet fuel or aviation turbine fuel (ATF) to Mumbai airport, saying the refiner will get a formal opportunity to make its case against the move. In a 21 February order, the PNGRB said it had on 7 November 2016, received a request from Reliance Industries Ltd (RIL) seeking declaration of two pipelines emanating from Hindustan Petroleum Corp Ltd (HPCL) and BPCL (Bharat Petroleum Corp Ltd)’s refinery and terminating at Mumbai International Airport as a common carrier so that the same can be shared by any third-party on open access and non-discriminatory basis. PNGRB in its order said HPCL had given written objections in the consultation process. BPCL and HPCL built and operate two separate pipelines from their Mahul refineries in Mumbai to supply jet fuel to airlines at the Chhatrapati Shivaji International Airport at Santacruz in the city. RIL, which produces a fourth of India’s ATF, wants access to these pipelines to be able to get a pie of Rs 100 bn fuel trade that happens at one of Asia’s busiest airports. If implemented, it would allow an airline to import fuel and use the infrastructure at the refineries situated on the coast to transport it to the airport. A company like RIL can ship the fuel from its refineries at Jamnagar in Gujarat to Mumbai and use pipelines to take it into the airport. RIL said the present ATF demand at Chhatrapati Shivaji International Airport is 1.4 million tonnes per annum and it is "absolutely essential" that access to the BPCL and HPCL ATF pipelines is available to other jet fuel marketing oil companies to service this demand.

Source: Business Standard

New petrol pumps to create lakhs of jobs: Oil Minister

21 February. Oil Minister Dharmendra Pradhan said his ministry has provided 130 mn LPG (liquefied petroleum gas) connections in less than 5 years, which is equivalent to the number of connections in the first 60 years since Independence. At an event to hand over letters of intent (LoI) to eligible candidates for petrol pump dealerships of state-run oil marketing companies (OMCs), Pradhan said over 67.5 mn LPG connections have been given to poor households under the Pradhan Mantri Ujjwala Yojana (PMUY). Pradha said the opening of petrol pump dealerships has also helped create lakhs of jobs. Pradhan also briefed reporters on the new policy framework for exploration and licensing, approved by the Cabinet, which aims to boost domestic production of oil and gas by offering attractive terms to investors. Under the new policy framework, bidders of oil and gas blocks will be encouraged to invest more on exploration and start sharing revenue with the government only at the production stage. Accordingly, auction of oil and gas blocks will give 70 percent weightage to the work programme proposed by prospective bidders and 30 percent weightage to proposed revenue share against the equal weightage given at present. The new scheme will be applied for auction of unallocated or unexplored areas of producing basins. For partially explored blocks and those where no exploration has been done, bidders will not be required to bid on the basis of revenue share or production share with the government but will be awarded blocks only on the basis of work programme or the level of investment and technology to be incorporated by them. The contractor will have full marketing and pricing freedom for crude oil and natural gas to be sold at arm’s length basis through a transparent bidding process.

Source: Business Standard

Government asks ONGC, OIL to sell out 66 fields to private firms to cut imports

21 February. The government has asked Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) to sell out 66 of their small oil and gas fields to private firms as it brought in a new policy to boost domestic production and cut imports, Oil Minister Dharmendra Pradhan said. To quickly bring all sedimentary basins under oil and gas exploration, the government dumped a two-year-old model of bidding out acreage or blocks to firms offering highest share of revenue, and brought in a new system of bidding them out on the basis of work programme such as drilling of wells and shooting of seismic with the winner's only liability being payment of statutory duties like royalty and cess, he said. ONGC and OIL, who are battling stagnation in output from largely ageing fields, have a total of 184 fields. The national oil companies have been asked to provide enhanced production profile for 66 of these fields, which contribute 95 percent of the 36 mn tonnes of annual oil production in the country, and given freedom to induct private and foreign partners or technology providers. They have been allowed to retain another 52 fields (49 by ONGC and 3 by OIL) where enhanced oil recovery or improved oil recovery programmes are already under implementation and they were put on production in the last four years. For the remaining 66 fields (64 belonging to ONGC and 2 to OIL), which currently contribute about 5 percent of total output, will be bid out or privatised with revenue share going to the two firms. He said the alongside, the government has decided to award future exploration acreage based on exploration work commitment, which will replace a two-year-old method of awarding them to companies offering the highest revenue share to the government. He said the focus of the new policy is to raise output from the existing fields and bring newer areas under production quickly.

Source: Business Standard

NATIONAL: GAS

Rs 1.4k bn of O&G investments likely in Odisha: Oil Minister

24 February. Oil Minister Dharmendra Pradhan said Odisha is going to be the epicentre of petroleum and gas sector, with around Rs 1.4k bn investments proposed under various oil and gas (O&G) projects in the state. He said refinery expansion, raw material for textiles, petrochemicals, polymers, pet coke gasification, LNG (liquefied natural gas) terminal, LPG (liquefied petroleum gas) terminals and several other projects are underway.

Source: Business Standard

Leakage from Oil India’s gas well in Jaisalmer

23 February. There has been information of leakage from a gas well of Oil India in Dandewala area in Jaisalmer district adjoining India-Pakistan border, for last two days. Oil India has started efforts to control the leakage and technical experts are working on it. ONGC experts have been called to stop the leakage. The gas leakage pressure has been controlled. At the time the leakage started, production for gas supply to Ramgarh thermal project was going on. The gas was being produced at tubing pipes, when the leakage started due to technical problem in casing pipe. Pressure of gas leakage was 90 kilogram (kg).

Source: The Economic Times

NATIONAL: COAL

Government’s 'zero blackout' plan gets boost from rising coal stock at power plants

26 February. Coal stock at power stations have risen to roughly 15 days' operation and the number of plants with precarious inventory has dropped 86 percent to just four from 29 on 31 October last year when the coal and railway ministries scrambled additional supplies to meet a sudden spike in demand and prepare for summer load. The comfortable fuel stocks at generation units ahead of summer leaves no room for discoms (distribution companies) to make excuses for load-shedding and will boost the power ministry’s bid to push its 'zero blackout' plan at conference of state power ministers. Available government data shows aggregate coal stock at power plants rising to more than 23 million tonnes (mt) on 19 February, indicating an increase of 49 percent from 15.7 mt on 28 February 2018 in spite of a healthy rise in electricity demand. The number of 'critical' and 'super critical plants too has fallen to just two each, indicating a drop of over 84 percent from 25 in the same duration. According to the Central Electricity Authority, which monitors about 114 coal-fired plants, fuel stocks for less than seven and four days are tagged as 'critical' and 'super critical' for power stations away from mines. For pithead plants, the stipulation is set at five and three days' stocks. Available data indicate fuel supply by Coal India Ltd, the mainstay of coal-fired power plants, increased by over 7 percent to more than 407 mt in the April-January period against the same period of 2017-18. Despatch of railway rakes to power stations too has risen by 13 percent to 252 in the same period. The record coal supply has helped power plants to replenish dwindling stockpile even after pumping up generation as electricity demand spiked 14 percent during the October festive season and continues to grow apace at 5-6 percent. The coal ministry expect the supply situation to improve further due to re-opening of the Dhanbad-Chandrapura rail line, a key coal evacuation route, in Jharkhand.

Source: The Economic Times

Prices soar 53 percent after CIL diverts coal to power companies

26 February. Coal India Ltd (CIL)’s e-auction prices rose about 53 percent in the December quarter, when the company offered half the quantity it did a year ago after diverting supplies to power plants. It offered 14.65 million tonnes (mt) of coal during the quarter against 30.8 mt a year earlier. As a result, average prices rose to Rs 2,847 per tonne from Rs 1,859 per tonne. CIL increased supplies to power, its priority sector, at the cost of other customers. The government had asked CIL’s subsidiaries to increase supplies to the power sector.

Source: The Economic Times

Navy locates fifth body in Meghalaya coal pit

26 February. Indian Navy divers located the fifth body from inside the 370-feet deep flooded coal mine in Meghalaya's East Jaintia Hills district, where over a dozen miners remain trapped since 13 December 2018. The coal pit disaster at Ksan village took place on 13 December 2018 despite an interim ban on rat-hole coal mining in the state by the National Green Tribunal since 17 April 2014. The tragedy came to light after five miners escaped from the coal pit, flooded by water from a nearby river.

Source: Business Standard

Protests may derail MCL’s production target for FY19

24 February. Coal India Ltd (CIL) subsidiary -- Mahanadi Coalfields Ltd (MCL) -- is likely to miss its production target for the 2018-19 fiscal, as ongoing protests at some of its key mines continue to hamper output. Protests by villagers seeking employment, among other demands, have led to loss of production hours in the current fiscal, mainly impacting the Kaniha mine in Talcher coalfields and Hingula open cast mine. MCL has already revised its aspirational targets to 162.50 million tonnes (mt) of coal production and 169 mt of offtake for the fiscal ending 31 March. Even last fiscal’s production of 143 mt might not be equalled.

Source: Business Standard

Government allows sale of 25 percent coal from captive mines in open market

20 February. Union cabinet approved sale of 25 percent of coal production from captive mines in open market with payment of additional premium on such sale. The cabinet committee on economic affairs has approved the methodology for allowing allocation of coal mines for specified end use or own consumption to sell 25 percent of actual production in open market with premium of 15 percent on such sale under the (Coal Mines Special Provisions) Act, 2015 and the Mines and Minerals (Development and Regulation) Act 1957. The decision is aimed at increasing competitiveness and to make the future tranches of auction/allotment attractive and commercially viable leading to higher revenues for the government. The move will address the issue of lack of response from bidders during earlier tranches of auction and allotments.

Source: The Economic Times

NATIONAL: POWER

Centre mulls new policy for 24x7 power supply

26 February. The Centre is likely to come up with a nationwide tariff policy by 31 March to make it a legal obligation for power distribution companies (discoms) to provide 24x7 electricity supply. The discoms found indulging in load shedding without proper reasons such as natural calamity will be liable to pay penalty. Power Minister R K Singh said that power was being supplied for 22-24 hours in urban areas and 18-22 hours in rural areas across the country. He said an agreement has also been signed with all the states for 24x7 power supply. He said 25.2 mn houses in the country have been provided electricity in a record time period of 18 months under Saubhagya scheme, which has the deadline of 31 March this year. He said India has become a “surplus” country in terms of power generation and it is supplying electricity to countries like Nepal, Bangladesh, Myanmar and Sri Lanka. He said India has, in fact, become the fastest country in power capacity generation after China. The minister said ‘one nation- one grid’ target has been achieved under which power generated from places like Ladakh and Dras in Kashmir can be supplied to Kanyakumari down the south.

Source: The Economic Times

As power sector reels under bad loans, government weighs solutions to woes

26 February. A Group of Ministers (GoM) on power under Finance Minister Arun Jaitley met to seek ways to resolve the bad loan crisis in the sector. The GoM is learnt to have discussed external factors —including irregular payments from distribution companies, shortage in fuel supplies and regulators delay in raising power tariffs — that have led to the stress in the sector, and work out certain solutions. Railways and Coal Minister Piyush Goyal and Power Minister R K Singh attended the meeting along with top bureaucrats of these ministries. Power producers have been pitching for a relief from the RBI (Reserve Bank of India)’s February 2018 circular, asserting that the stress in the sector is caused by factors beyond their control. The circular stipulates a one-day default rule on term loans, which mandates treating a borrower who misses repayments as a defaulter the very next day. It requires banks to finalise a resolution plan in case of a default on large accounts of Rs 20 bn or more within 180 days (irrespective of sectors), failing which insolvency proceedings will have to be invoked against the defaulter. According to an industry estimate, promoters of most among the 34 identified stressed power projects could lose ownership. A large chunk of the 34 projects — with a combined capacity of about 39 GW and banks’ exposure of Rs 1.7k bn — would now take the insolvency route. In its report after consultations with stakeholders, the finance ministry last year said the RBI’s “one-size-fits-all approach” under the circular might not be the most suitable response to deal with stressed assets in the power sector. For its part, the RBI has stuck to its ground and refused to give any special relief to the power sector from its circular, partly due to apprehension that any such move could spur demand for similar relief from other sectors.

Source: The Financial Express

Delhi to spend Rs 46 bn on power transmission through 2022

25 February. With an aim to improve the reliability of power supply in the national capital, NCT of Delhi is planning to spend Rs 46 bn on power transmission projects for the period till 2022, according to the Economic Survey of Delhi 2017-18. Various new and augmentation transmission network projects of 400 kilovolt (kV) and 220 kV with an approximate cost of Rs 46 bn for adding 7,680 megavolt-ampere (MVA) transformation capacity at 220 kV level and 6,815 MVA including 4,000 MVA of inter-state transmission system (ISTS) substations at 400 kV level in the network are envisaged in business plan for the period up to 2022, the Economic Survey noted. For improving the power conditions in Delhi, all three companies including BSES Yamuna Power Ltd, BSES Rajdhani Power Ltd, and Tata Power Delhi Distribution are augmenting infrastructure such as power transformers, EHV cables, installation, 11 kV feeders, and shunt capacitors, etc. According to the Survey, the total capital investment made by these three distribution companies since financial year 2010-11 was Rs 57.84 bn till 2017. However, the capital investment for the financial year 2016-17 was 15 percent high at Rs 10.73 bn as compared to Rs 9.28 bn of 2015-16.

Source: The Economic Times

Delhiites pay lowest power bills among large cities: Sisodia

25 February. The Delhiites pay the "lowest" power bills among large cities of the country, Delhi Deputy Chief Minister (CM) Manish Sisodia said while tabling the Outcome Budget 2018-19 in the Assembly. The national capital has the most progressive tariff structure, rewarding low electricity consumption by providing incentives to consumers, he said. Around 50 percent of the energy charges are subsidised for domestic consumers consuming up to 400 units by Rs 2 per unit per month by the government. The AAP (Aam Aadmi Party) leader also read out the power tariff of cities like Mumbai, Pune, Nagpur and Chandigarh, adding the electricity rates in Delhi were "lowest" as compared to these large cities. The Outcome Budget of the power department was based on the assessment of a total of 171 performance indicators that included 71 critical indicators.

Source: Business Standard

In Chhattisgarh, villagers forced to pay bill despite no power supply

23 February. Residents of Jhalpi Para village of Hargawa panchayat have voiced their discontent over the absence of power supply in their village even while claiming that they are receiving electricity bills regularly. The villagers have alleged that there is no electricity connection in the houses but meters have been installed due to which they are receiving electricity bills. The district administration, however, denied the claim of villagers receiving electricity bill while assuring that power supply will be provided in the area very soon. In March last year, the Government of India had stated that out of 18,452 villages in India that were power deprived 3 years ago, 17,181 have been electrified. Others are uninhabited or classified as grazing reserves.

Source: The Economic Times

In Andhra Pradesh, no increase in power tariff for FY 2019-20

23 February. In a relief to about 40 lakh power consumers, the Andhra Pradesh Electricity Regulatory Commission (APERC) announced that there will be no hike in electricity tariff for the ensuing financial year 2019-20. It has provided a minor financial relief to the consumers by rounding off the charges to the nearest five paise or 10 paise. This will benefit all categories of consumers. The state has 39.42 lakh power consumers. The APERC released the Retail Supply Tariff Order for 2019-20. APERC chairman Justice G Bhavani Prasad said the peak-time Time of Day (TOD) charges for industry have been reduced from Rs 1.05 per unit to Rs 1 per unit. The aggregate revenue requirement (ARR) and proposal for tariff (PFT) of the two discoms in the state projected a deficit of Rs 89.62 bn. However, the APERC estimated the expected deficit to be Rs 70.64 bn. Thus, it avoided the possible burden of a further sum of Rs 18.98 bn on consumers or the state government. The APERC has also simplified the categories. The existing 16 categories, 51 sub-categories and 25 slabs are now reorganised into 5 categories, 30 sub-categories and 21 slabs. Also, there is no hike in tariff to any category of consumers due to simplification of categories. The APERC has accepted the state government’s proposal for free power to all non-corporate farmers irrespective of their land holdings, type of land and number of connections.

Source: The Economic Times

Now, apply online for electricity in Meerut

22 February. Now, the city residents of Meerut can apply online for a new electricity connection on the website of Paschimanchal Vidyut Vitaran Nigam Ltd (PVVNL). The online single window portal, which was put in place by the UP (Uttar Pradesh) Power Corp, Lucknow will now be open for the residents of Meerut. The status of the connection can be checked online. To take new electricity connections, an online single window portal has been put in place by the UP Power Corp Ltd (Lucknow). The customers can go on the website www.uppcl.org and click on ‘Apply New Connection’ to apply online. The customer will also be able to see the status of a previously applied connection, PVVNL managing director Ashutosh Niranjan said. In the online portal, the customers have also been given a chance to also finalise the spot inspection date, meter installation date, submission of fee for application of new electricity connection, and others. The applications received on the portal will be checked for feasibility of installation within three days, after which action will be taken on the application status within the stipulated time.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Bhagalpur Municipal Corp to install solar plants on rooftops

26 February. Bhagalpur Municipal Corp (BMC) is set to install solar plants on rooftops for energy generation which will be also connected to the electricity grid for lighting streets and other areas. The total cost of the solar energy project would come around Rs 200 mn, out of which Rs 150 mn would be spent on rooftop grid connected solar system and Rs 50 mn on street lights, lights in parks and high mast light on traffic junctions among other areas. BMC said that the Bihar Renewable Energy Development Agency (BREDA) will provide assistance for rooftop solar energy system installation under the grid connected programme. Bhagalpur Smart City Ltd (BSCL) will look after the installation of other solar energy system.

Source: The Economic Times

Aligarh Muslim University gets new rooftop solar panels

26 February. Aligarh Muslim University (AMU) vice chancellor (VC) professor Tariq Mansoor inaugurated new on-grid solar panels on the rooftops of Senior Secondary School-Girls, Ajmal Khan Tibbiya College, Sarojni Naidi Hall, S N Hall, Women's Polytechnic, Bibi Fatima Hall, Department of Computer Engineering, New Hall for Girls, Trauma Centre and Nadeem Tarin Hall. With the new installations, the total capacity of solar plants in the campus had reached 6.5 megawatt peak. The university is also equipped with a 3.3 MW ground mounted solar plant. AMU has the largest installation of solar power generation plants among all academic institutions in the country.

Source: The Economic Times

Erode Corp to establish 3.5 MW solar power plant

26 February. With electricity charges increasing for the Erode Corp year after year, the civic body has decided to establish a 3.5 MW solar power plant at ₹ 208.5 mn. The civic body has been selected in Phase IV of the Smart Cities Mission by the Ministry of Urban Development, Government of India, for implementing projects worth ₹ 10 bn last year. The Corp is utilising six high tension services from the Tamil Nadu Generation and Distribution Corp with a power demand of 1,745 kilovolt-ampere. The average power consumption from the services is around 12 mn kilowatt hour per annum. The proposed solar power plant is to be set up under the long-term open access method. Based on the availability of land and evacuation capacity, the Corp has proposed the 3.5 MW power plant outside the Area Based Development area as there is no space available within the area of the smart city for providing ground-mounted solar.

Source: The Hindu

Solar power tariffs see modest rise at SECI auction

26 February. Tariffs saw a modest rise at the latest auction of solar projects conducted by Solar Energy Corp of India (SECI), its first since last July. The reverse auction of 1200 MW saw four winners, each winning 300 MW. ReNew Power’s bid was the lowest, offering to supply electricity at Rs 2.55 per unit, followed by Azure Power at Rs 2.58. Eden Renewable quoted Rs 2.60 per unit and SoftBank-backed SB Energy, Rs 2.61. In the previous SECI auction held in July 2018, the lowest bid had been Rs 2.44 per unit, which remains the all-time low. In the previous SECI auction, where 3,000 MW of projects were on offer, while Acme Solar had bid the lowest at Rs 2.44 per unit, the other winners had bid substantially higher. Subsequently, SECI accepted only Acme Solar’s bid for 600 MW, cancelling the remaining 2400 MW. Developers whose bids were cancelled included ReNew Power and SB Energy.

Source: The Economic Times

Waaree Energies aims at Rs 4 bn revenue from solar rooftop business next fiscal

25 February. Mumbai-based solar PV manufacturer Waaree Energies announced it is aiming at raising its revenue from rooftop solar business to Rs 4 bn by the end of next financial year 2019-20. The company did not disclose the projection for total revenue by March 2020 but said it plans to add 100 MW to its overall capacity next fiscal.

Source: The Economic Times

Adani Green Energy arm bags tender to set up solar power project in Gujarat

23 February. Adani Green Energy said its subsidiary has been awarded a tender to set up a 150 MWac (megawatt alternating current) solar power project in Gujarat and the project is expected to be commissioned by October-December quarter of 2020-21 financial year. Adani Green Energy’s portfolio of renewable generation capacity in India stands at 4.31 GWac (gigawatt alternating current) with 1.97 GWac operational projects and balance 2.34 GWac in development stage, Adani Green Energy said.

Source: Business Standard

Solar power projects get $113 mn funding boost from KfW-Bank of Baroda tie-up

22 February. Bank of Baroda and Germany’s KfW Development Bank announced they have joined hands to extend funding of $113 mn to refinance solar power projects in India. The funding will be done as part of the scheme Solar Partnership II – Promotion of Solar PV (photovoltaic) in India, under the Indo-German Solar Energy Partnership.

Source: The Economic Times

India seeks to increase solar footprints in rural areas through KUSUM

20 February. Stepping up efforts to gradually increase solar footprints across the country, the Centre approved two schemes - one to promote use of solar power among farmers and the second to give impetus to its ongoing grid-connected rooftop solar programme. Both the schemes together will get the central financial support of over Rs 460 bn by 2022. The move on grid-connected rooftop will help India achieve its cumulative capacity of 40,000 MW of solar power from rooftop projects by 2022. It accounts for 40 percent of the country’s 2022 target of 100 GW of power from solar. The rooftop programme will be implemented with total financial support of Rs 118.14 bn. Under the scheme, group housing societies or resident welfare associations will be eligible to get financial support to install rooftop solar projects. Both the schemes were approved by the Cabinet Committee on Economic Affairs (CCEA), chaired by the Prime Minister Narendra Modi. The one for farmers - called KUSUM (Kisan Urja Suraksha Evam Utthan Mahaabhiyan) - has three components which together aim to add a solar capacity of 25,750 MW by 2022. The total central financial support provided under the scheme would be Rs 344.22 bn. Noting that the scheme has substantial environmental impact in terms of savings of CO2 (carbon dioxide) emissions, the government claimed that all three components of the KUSUM together may result in saving of about 27 million tonnes (mt) of CO2 emission per annum.

Source: The Economic Times

India’s solar capacity at 28 GW at December-end

20 February. The country’s total solar power generation capacity, including 3.85 GW rooftops, stood at 28.05 GW while 17.65 GW was under implementation as on 31 December 2018, according to a report by Bridge To India. India’s total solar installed capacity and pipeline stood at 28,057 MW and 17,658 MW as on 31 December 2018, according to the report. This capacity is split between utility scale and rooftop solar as 24,202 MW and 3,855 MW, respectively. It said only 1,446 MW capacity was added in the October-December 2018 period, 990 MW in utility scale solar and 456 MW in rooftop solar. The utility scale solar capacity addition has been sluggish since the second quarter ended 30 June 2018, and is down 46 percent over the fourth quarter of 2017. In contrast, the rooftop solar market is growing strongly and is up 47 percent over previous year, it said. In the December 2018 quarter, the highest capacity (200 MW) was added in Andhra Pradesh and Gujarat. Karnataka (5,328 MW), Telangana (3,501 MW) and Rajasthan (3,081 MW) continued to be the top-three states by commissioned capacity for utility scale solar.

Source: The Economic Times

INTERNATIONAL: OIL

Saudi Arabia to boost oil exports to China with strategy shift

26 February. Saudi Arabia is set to boost crude exports to China in 2019 as demand there grows and after Saudi Aramco shifted strategy to boost its market share in the world’s second biggest oil consumer. Saudi crude exports to China are expected to rise to about 1.5 mn barrels per day (bpd) in the first quarter, from about 1 mn bpd in 2018. Saudi Arabia, the world’s biggest oil exporter, has been surpassed by Russia in the past three years as the top crude supplier to China after a new pipeline boosted supplies and private refiners, known as “teapots”, sought more Russian oil. But Aramco has been adopting a more aggressive marketing strategy and has moved more swiftly to seal long-term supply deals in a bid to become China’s top supplier again, industry sources say. Saudi Arabia has said it plans to produce around 9.8 mn bpd of oil in March, more than 500,000 bpd below its pledged production level under the deal to cut supplies.

Source: Reuters

Trump warns Saudi Arabia on oil prices as focus turns to re-election

26 February. US (United States) President Donald Trump has warned OPEC (Organization of the Petroleum Exporting Countries) not to tighten the oil market too much and risk another spike in prices that could harm the global economy – and his re-election campaign in 2020. The president has kept up a regular commentary on oil prices over the last year and has pressed Saudi Arabia, de facto leader of the OPEC, to push them lower. The president is putting the government in Riyadh on notice that it should not cut oil production too much for too long if doing so would risk a further substantial rise in prices. The president wants a strongly growing economy and low to moderate oil prices throughout 2019 and 2020 to maximize his probability of re-election and should be expected to pull every lever to achieve them.

Source: Reuters

Brazil oil regulator to investigate Petrobras oil spill

25 February. Brazil’s oil regulator said that is has started an investigation into an oil spill at an offshore platform owned by Petroleo Brasileiro SA (Petrobras). About 188 cubic meters of oil leaked from the offshore P-58 platform, which is located in the Campos basin, some 80 kilometres of the coast of Espírito Santo state.

Source: Reuters

Azerbaijan wants stable oil price before any further output cut