COAL DEMAND INCREASES ON THE BACK OF ELECTRIFICATION

Coal News Commentary: January 2019

India

The government said CIL supplied 389.63 mt of coal to the power sector in the current financial year till up to 22 January, registering a rise of 8 percent over the previous year. CIL’s railway rake loading, including loadings from washery and good-shed siding, has increased 8 percent during the current financial year as compared to the corresponding period last year. The government said it has augmented the supply of coal to power plants to meet the country's energy demands. The coal ministry has increased the coal stock and coal supply to power plants to meet the energy demands in the country. The coal stock in power plants as on 31 December 2018, was 16.60 mt as compared with 13.20 mt on 31 December 2017, showing an increase of around 25 percent. As on 31 December 2018, the number of power plants in the critical/super-critical category was nine, compared with 13 on 31 December 2017.

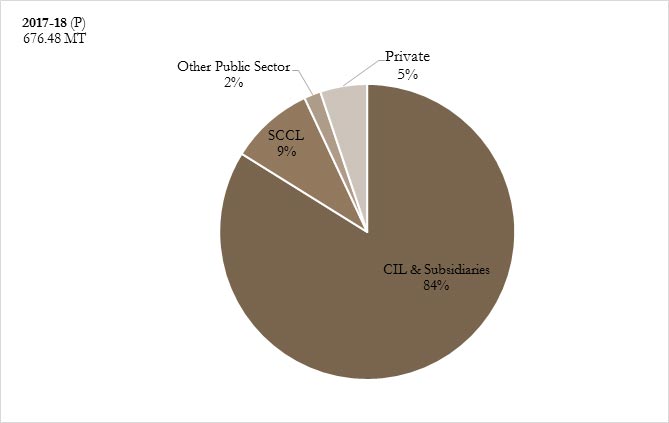

52 new coal mines have been opened since coming to power in May 2014 to fuel village and household electrification programmes without tripping the system. These 52 mines represent 86 percent growth over the number of mines added in the five-year period between 2009 and 2014, when most projects were stuck in red tape, especially pertaining to environment and forest clearances, before the NDA government took over. Structural reforms in the government's functioning since 2014 made it possible to quickly open such a large number of coal mines, a cumbersome process involving approvals and permissions from various statutory authorities. The new mines have added 164 mt to India's annual coal production capacity, marking 113% increase over capacity added during the 2009-2014 period. Since 57 percent of power is generated in India by burning coal, these mines allowed the government to rapidly move towards universal electricity access without creating shortages. All-India coal production stood at 433.9 mt during the April-November period of 2018-19 financial year, indicating a growth rate of 9.8 percent. During the same period, CIL’s production stood at more than 358 mt, marking a growth rate of 8.8 percent over the previous corresponding period.

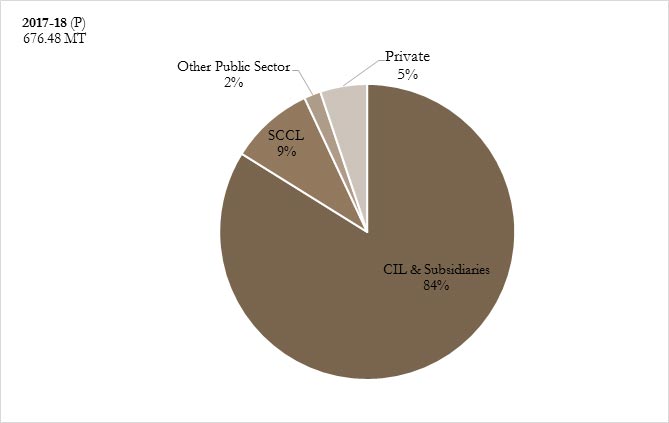

The supply from CIL to power plants as on 30 December was 357.5 mt as against 332.03 mt as on 30 December 2017, showing a rise of around 7.7 percent. Imports have declined to 208 mt from 217 mt in 2014. Coal production has witnessed an increase of 7.4 percent in April-December (nine months) period of the ongoing fiscal. CIL production increased by 104 mt in the last four years between 2014-15 and 2017-18. Besides reserves of coking coal were limited in view of the fire in Jharia and Raniganj areas for several decades. Apart from this, initial delays in environment clearances, land acquisition, etc, proved detrimental to coal production. CIL accounts for over 80 percent of the total domestic production in the country.

CIL is expected to put another 25-30 mt of coal under the hammer in the ongoing quarter. This comes after e-auction volumes dipped following the decision to pump more coal into the coal-starved power sector through FSAs. The coal behemoth has been able to book 54 mt of coal through e-auction till December (first three quarters) as against 79 mt in the similar period of the last fiscal year, registering a 31.65 percent dip. On the other hand, its offtake via the FSA route to power plants increased by over 12 percent. Coal consumers in the non-power sector have long been complaining about scarcity because most of this fossil fuel is being routed to feed coal-starved thermal power plants. CIL’s production, as well as offtake, was hit in December owing to industrial unrest in its key production zones in Jharkhand and Odisha and cyclones, which disrupted production and supply lines. Besides, the availability of rakes from the Railways also constrained the company from supplying coal. SECL, its most important subsidiary, registered a 13.1 percent fall in production in December at 12.52 mt while Mahanadi Coalfields Ltd, the second-largest subsidiary, registered a 3.2 percent dip at 13.05 mt. These two subsidiaries account for more than 45 percent of CIL’s production. Sales were low at 52.77 mt, which is a 1.2 percent fall compared to December 2017-18. However, in the next fiscal year, the e-auction volumes are expected to dip further.

CIL subsidiary NCL said the state-run power producer NTPC Ltd has urged the miner to further extend its support to the up-country power stations of it, under flexi utilisation of domestic coal scheme after "sufficient" fuel being supplied to its pithead thermal power plants by the miner. The company is supplying 250,000 tonnes of coal per month to NTPC's Mauda plant under the scheme. NCL has at present Fuel Supply Agreement with three of its pit-head thermal power stations namely Vindhyachal, Singrauli STPS and Rihand STPS and supplies more that 50 percent of its produced coal to NTPC's power plants. NCL has been entrusted with the responsibility to produce 100 mt of coal in this fiscal while its off-take target was at 100.5 mt. The company produced 77.89 mt of coal so far, up 11 percent from the last year while its coal off-take was at 79.02 mt till date, up by 7 percent from corresponding period last fiscal.

ECL, a subsidiary of CIL said it produced 32.9 mt of coal in the first three quarters of the current financial year, registering a growth of nearly 17 percent as compared to the year-ago period. ECL despatched 34.6 mt of coal during April-December, against 29.5 mt in the corresponding period of the previous financial year. ECL removed 88.3 million cubic metre overburden during the quarters, compared 82.4 million cubic metre achieved in the year-ago period. CIL contributes to over 80 percent of the total domestic coal output.

E-auctions directly add to CIL’s bottom line because the prices are often higher by at least 60 percent over the notified price. Thus, effectively while the miner spends the same amount of money to mine the coal which is either sold as linkage or put under the hammer, it earns 20 percent higher in auctions. Prices in the e-auction, however, are expected to remain stagnant in the ₹ 2,400/tonne level backed by muted global coal prices.

The central government’s plan to completely rely on CIL for domestic needs and have zero imports has faltered with states putting out tenders for importing coal. Tamil Nadu, Karnataka, Maharashtra, Gujarat along with NTPC and private units in Punjab and Madhya Pradesh have issued tenders totalling 12.5 mt. In 2017, the government announced that India does not need any imported coal and instructed states and NTPC to stop imports. Subsequent to that, several power access schemes and a weaning effect of demonetisation and implementation of Goods and Services Tax (GST) saw power demand shooting up. Domestic coal supply could not match the rise in demand. In the summer of 2018, the government allowed states to import coal as a “coal deficit would continue for 2-3 years”. States restart imports of coal after domestic supply fails to meet demand NTPC was the first to issue a tender of 5 mt of imported coal last year. Following suit were Maharashtra and Gujarat with 2 mt each, and now it’s Karnataka and Tamil Nadu. Vedanta Energy-run Talwandi Sabo power unit in Punjab and Hindustan Power’s MB Power in Madhya Pradesh have also issued tenders for imported coal. MB Power has been awaiting coal linkage for two years now.

India’s import of coking and thermal coal are likely to remain buoyant in 2019 on the back of business reforms and high industrial activity but could still fall below the highs witnessed last year, according to global consultancy WoodMac. Direct support for imported coal demand will come from improved performance at Essar’s Hazira complex, and higher utilisation at recent brownfield expansions at Dolvi (JSW), and Angul (JSPL). But it is a bit much to expect a repeat of 2018 growth, according to WoodMac. On thermal coal side, WoodMac believes Indian seaborne imports are expected to grow, although at a slower pace compared with 2018. Some of the high-energy thermal coal imports that contributed to the significant increase in 2018 could be substituted by more pet coke imports this year because pet coke prices are expected to soften in 2019.

The IEA said inadequate rise in coal production on the back of higher demand growth in India would push imports higher till 2023. India’s import of thermal coal — mainly used in electricity generation—is seen to expand 2.2% per year, from 119 Mtce in 2017 to 135 Mtce in 2023. By 2023, India to be the world’s primary importer of metallurgical coal, which is used in steel production. Metallurgical coal (coking coal) import is seen growing at a compound average annual growth rate of 7.2%, from 49 Mtce in 2017 to 74 Mtce in 2023. During the first seven months of current fiscal, India imported 136.6 mt coal, registering a year-on-year growth of 14.9%. IEA’s recently launched market report titled “Coal 2018”, said that India demonstrates the largest absolute increase in coal consumption over the forecast period, with demand rising by 146 Mtce to 708 Mtce in 2023. India is deficient in coking coal and imports of coking coal are inevitable. The IEA said that economic growth and infrastructure development in India would push up coal consumption in steel and cement production. During April-November, 2018, all India coal production was 433.9 mt recording a 9.8% year-on-year growth. The all India raw coal production has increased from 565.8 mt in FY14 to 676.5 mt in FY18. The report recognised CIL’s efforts of increasing production efficiency, noting that how the world’s largest coal miner is shutting down its low-yielding underground mines and focusing more on the more lucrative open-cast mines. The coal ministry said that the government’s effort to increase domestic coal production and power demand falling with the onset of winters are expected to put a check on coal imports.

Coal shipments handled by India's 12 major ports saw a 16.28 percent jump in the nine months ending December 2018 to 121.13 mt according to ports' body IPA. Coal shipments, comprising thermal/steam and coking coal, were up 17 percent and 15 percent respectively in the April-December period of the ongoing fiscal. These ports had handled 104.17 mt coal in April-December 2017. IPA said these state-run ports handled 78.24 mt of thermal/steam coal during the nine months against 66.87 mt in the year-ago period. IPA said the major ports handled shipments of 42.89 mt of coking coal during the nine months as against 37.30 mt in the year-ago period. Thermal coal is the mainstay of India's energy programme as 70 percent of power generation is dependent on the dry fuel, while coking coal is used mainly for steel-making. Paradip Port Trust in Odisha handled the highest thermal and steam coal shipments during the period at 24.39 mt, followed by Kamarajar Port (erstwhile Ennore) in Tamil Nadu at 18.17 mt and Deendayal Port Trust in Gujarat at 11.41 mt. As regards coking coal, Kolkata port handled 14.12 mt during the period, followed by Paradip (9.45 mt) and Visakhapatnam (5.03 mt). India is the third-largest producer of coal after China and the US (United States) and has 299 bt of resources and 123 bt of proven reserves, which may last for over 100 years. Overall, the 12 major ports recorded 3.77 percent growth in cargo traffic during April-December 2018 at 518.64 mt. The growth was on account of higher handling of shipments such as coal, containers and finished fertilisers.

CIL is expected to lose at least 3.6 mt of production and an equal amount of coal sales, estimated around ₹ 5 bn, after four central trade unions decided to join the nationwide two-day strike beginning on 8 January. Four trade unions — Congress-backed Indian National Trade Union Congress, CPI-backed All India Trade Union Congress, CPI(M)-backed Centre of Indian Trade Unions and Forward Bloc-supported Hind Mazdoor Sabha — have given a call to stop mining activities in the company, on the lines of the nationwide strike called in protest against several government policies. The BJP-led Bharatiya Mazdoor Sangh, the second-largest trade union in CIL, will abstain from the strike. This comes in the wake of at least 10 power plants in the country facing severe coal shortage at the very beginning of the new calendar year and CIL boosting its production to meet the demand from power companies. The company even liquidated its stocks in the process. Usually, despite any production levels, the state-owned miner keeps at least 30 mt of coal stock with itself for various exigencies. However, in the wake of higher demand from the power plants, CIL recently stepped up its despatches and risked its pit-head stock falling to sub-25 mt levels. The Talcher coalfields have been completely shut for the last three days owing to the indefinite strike called by the Talcher Surakshya Manch.

Flagging lower coal production in Chhattisgarh’s Korba Coalfield that contributes around 25 GW to the country's power generation capacity, the APP has urged ministries of coal and power to resolve issues to augment production, especially contractual. APP said the entire upto 100 mm sized coal production by surface miners should be dispatched through direct rail mode from SECL’s own sidings and merry-go-round train, or conveyor belt. The industry body pleaded that less than 250 mm sized coal should not be supplied through direct rail mode at the SECL sidings and should be allocated through washery or road mode, which are having the facilities to handle such run of mine coal.

The RPF said it has decided to harvest modern technology and increase coordination with GRP to reduce pilferage of coal in transit. While a loss of 0.8 percent of total movement of coal through railways is permissible during transit due to various technical reasons, the actual amount lost during transportation is as high as 1.2 percent. The 1.2 percent loss during transit includes pilferage, apart from various technical reasons. Closer coordination between RPF and GRP of different states at divisional security commissioner level will be encouraged to ensure prompter action in stopping pilferage of coal and security requires to be increased at coal sidings which are loading or unloading points.

A group of social activists released two volumes of a citizens' report urging the Supreme Court that coal mining in Meghalaya be stopped completely and other forms of energy, which are climate-friendly but need investment, be promoted. The submission of the reports is significant in the wake of 15 miners being trapped in an illegal flooded coal mine in East Jaintia Hills districts for a month now, besides the murderous attacks on social activists. The first volume of the citizens' report examines the claims about livelihood and tribal autonomy vis-a-vis coal mining. It looks at how and why unregulated and illegal coal mining in Meghalaya continues even after the orders of the NGT and the Supreme Court of India. The second volume puts together these reports in the backdrop of the murderous attack on Kharshiing and Sangma by the "coal mafia (coal mine owners that include five public representatives, bureaucrats, administration and police officials) and leaders of self-styled non-state social groups and 'NGOs' and the total state apathy towards these attacks". The report urged the apex court to act against the coal mafias who are undermining and misleading the democratic institutions such as the NGT and the courts. Noting that despite an interim NGT ban on coal mining since April 2014, the report said that fresh mining of coal has continued and illegal transportation of coal also continued as usual.

The Meghalaya government has issued a modified order allowing transportation of coal in transit through the state, before a Supreme Court hearing on the issue. The order allows transportation of coal that "originates outside the state of Meghalaya and being transported through the state for consumption by factories, general households or export". The apex court banned the transportation of coal in Meghalaya till the next hearing fixed on 19 February for its failure to curb illegal mining in the state. Thirty-three stranded Bhutanese coal-laden trucks at the Dawki Integrated Check Post in the West Jaintia Hills district, were also allowed to transit to Bangladesh. Meghalaya International Exporters' Chamber of Commerce, Secretary, Dolly Khonglah said that all the trucks have transited to Bangladesh’s Tamabil for unloading of the consignments. Bhutan is exporting coal to Bangladesh via India as per the South Asian Preferential Trade Arrangement. India has named the Dawki-Tamabil and Dalu-Nakugaon land customs stations as dedicated ports for Bangladesh-Bhutan trans-shipment export-import trade. The ban on transportation of coal was of significance in the wake of a coal mine tragedy in the state, in which 15 miners were trapped inside an illegal 370-feet deep flooded mine in Ksan village in East Jainta Hills district. The Nagaland Cabinet decided to ban illegal coal mining in the state and impose a provisional mining ban on all firms/companies which have been issued with mining licenses. The Cabinet set up a Committee to examine the issue of coal mining and the resultant damages caused to the environment. Nagaland is estimated to have a prognostic reserves of about 316.41 mt of coal.

Odisha firefighters resumed dewatering a shaft near the main shaft of a coal mine in Meghalaya's East Jaintia Hills district where 15 miners have been trapped since 13 December. But the fate of the miners remains unknown. The water level at the shaft, which had receded by 1.4 feet, had increased again. Odisha firefighters, equipped with high-tech equipment including 10 high-power pumps, were deployed at Ksan village, the accident site, by the National Disaster Management Authority. CIL was also expected to start dewatering from the shaft by operating a submersible high-capacity 100 horsepower pump. Indian Navy divers had located a wooden structure, coal lying beneath and one rat hole with coal at its mouth inside the flooded mine. They had sought dewatering the flooded mine so that the divers could dive to the bottom of the 370-feet deep coal pit. The tragedy came to light after five miners escaped the coal pit. More than 200 rescuers are taking part in the rescue operations. The accident inside the coal pit on 13 December morning occurred despite the NGT ordering an interim ban on 'rat-hole' coal mining in the state from 2014. Coal mine accidents are common in the mountainous state because of unscientific mining procedure, commonly known as "rat hole mining".

Rest of the World

China’s NEA said it has given approval for a new open-pit coal mine project in the Xinjiang region. The open-pit coal mine will have an annual capacity of 4 mt with total investment at 854 million yuan ($126 million). The energy administration said it has also given the green light for a coal mine expansion project in Xinjiang worth 1.06 billion yuan. The expansion will raise total capacity at the project to 5 mtpa from 900,000 tpa previously.

China’s December coal output climbed 2.1 percent from the year before, government data showed, hitting the highest level in at least three years as major producers ramped up production amid robust winter demand and after the country started up new mines. Miners produced 320.38 mt of coal in December, according to the National Bureau of Statistics data. That is the highest level on records going back to March 2016. China approved more than 45 billion yuan’s ($6.64 billion) worth of new coal mining projects last year, much more than 2017. However, miners and traders expect supplies to fall sharply in January following a crackdown on coal mines following a major accident on 13 January in the northwestern province of Shaanxi. Shaanxi accounts for about 20 percent of China’s annual coal production.

China’s coal imports rose to 281.5 mt in 2018, the highest annual figure in four years, data from the General Administration of Customs showed, despite a government push to cap shipments at last year’s level. Coal imports were 3.4 percent above 2017, data showed, even as December’s imports tumbled nearly 47 percent to 10.23 mt. Traders and utilities cut back sharply on purchases at the end of the year following government signals, with utilities sitting on record coal stocks, pushing down domestic prices. Traders expect imports of coal, used in China for power generation, heating and steelmaking, to remain low in January as the country continues to curb imports in order to boost domestic coal prices.

China has become a key backer for coal-fired power globally, funding more than a quarter of all new plants being developed outside its borders even as it clamps down on the polluting fuel at home, the report by the Institute for Energy Economics and Financial Analysis, a US-based think-tank, said. The top destinations are Bangladesh, Vietnam, South Africa and Pakistan, and about a quarter of the proposed capacity would use technology no longer allowed in China, the report said. China, the world’s biggest energy consumer, has been investing heavily in alternative fuels in order to cut its dependence on coal, a major source of smog as well as climate-warming carbon emissions. While overseas financial institutions like the World Bank aim to restrict new coal investments, Chinese state-owned enterprises and policy banks are becoming “lenders of last resort” for coal-fired power, the report said. China is involved in nearly 14 GW of planned coal-fired capacity in Bangladesh and 13 GW in Vietnam, the report said. This approach is replication of the strategy of industrialised countries in the past that exported outdated and banned technologies and products to poorer countries.

A coal mine roof collapse in northwest China’s Shaanxi province killed 21 miners. The accident is the deadliest reported so far this year in China’s coal industry, known for its poor safety record. It occurred at Baiji Mining Company Ltd’s Lijiagou mine in the city of Shenmu, when 87 people were underground. Some mining firms in major coal hubs in Shandong and Henan provinces and parts of northeastern China have received notices from the National Coal Mine Safety Administration asking them to halt operations for inspections that will last until June. Shanxi province, which borders Shaanxi, would also carry out inspections at high-risk coal mines.

World coal seaborne trade grew 3.7 percent last year helped by higher output in India, Indonesia and Russia, Germany’s VDKI coal importers lobby said. Imports and exports rose to 1.202 bt from 1.159 bt in 2017. Of the total, trade in steam coal used in power stations rose by 3.6 percent to 920 mt. Trade in coking coal used for steelmaking rose by 4.4 percent to 281 mt the VDKI estimated.

The price effect of Germany’s roadmap for an exit from coal mining and burning by 2038 is likely to be limited because the extent of coal plant closures was largely expected, traders and analysts said. A government-appointed commission proposed to more than halve coal-burning capacity by 2030 and to retire carbon emissions permits in tandem with plant capacity. While tighter coal power supply would be bullish, price effects will be offset by increased expansion of renewables such as solar and wind power, where production costs are falling, said the German arm of UK researchers Aurora. The proposals require the hard coal and brown coal fired capacity of a total 43 GW in 2018 to be cut to 17 GW by 2030, with 12.5 GW already closing between 2017 and 2022. Germany is expected to import 45 mt of hard coal this year, up roughly 1.4 percent from 2018 despite mounting competition from renewable energy, as the closure of domestic mines reduces domestic supply, importers said. The total would comprise an estimated 30 mt for power generation and 15 mt of coking coal and coke, products used in steelmaking, data from lobby group VDKI showed. The coal importer lobby said hard coal usage would benefit from a court ban on logging in an ancient forest, a move that will impede the mining of domestic rival lignite, or brown coal, by utility RWE. The court ruling curbs supply to RWE’s brown-coal power plants, and hard coal could cover part of the deficit. The two types of coal accounted for a combined 38 percent of German power production last year. Despite the forecast rise, there could be import losses in 2019 as a result of a long-term national plan, due within the next fortnight, on phasing out coal, VDKI said.

Greece’s PPC extended a deadline for binding bids for three coal-fired plants until 6 February to give investors more time to review data on the sale. PPC is selling the plants in northern Greece and on the southern Peloponnese under the terms of Athens’ latest international bailout after a European Union court ruled that PPC had abused its dominant position in the coal market. The bid deadline has been repeatedly pushed back since the tender was launched last year for different reasons.

Indonesia's mining ministry plans a total domestic market allocation for coal of 128 mt. The planned figures could still change. The total includes an allocation of around 96 mt for power stations, up from around 90 mt in 2018 as a result of rising demand. The total includes approximately 16 mt of coal for cement plants and 6 mt for paper mills, ministry data showed. According to the ministry, Indonesia set a domestic market allocation for coal at 121 mt in 2018, while consumption reached around 115 mt.

South African coal miner Exxaro aims to double its coal exports through the Richard’s Bay export terminal by 2023, from 8 mtpa at present.

Botswana’s first privately owned coal mine will produce its first saleable coal in March. The Masama Coal Mine aims to produce 1.2 mtpa of coal and will target the South African market as well as other countries in the region. The open cast mine and associated coal wash plant is located 60 kilometre (37 miles) northwest of Botswana’s capital Gaborone and is being developed at a cost of 400 million pula ($39 million). The Masama mine is estimated to hold 390 mt of coal reserves.

CIL: Coal India Ltd, mt: million tonnes, FSAs: Fuel Supply Agreements, SECL: South Eastern Coalfields Ltd, NCL: Northern Coalfields Ltd, ECL: Eastern Coalfields Ltd, GST: Goods and Services Tax, WoodMac: Wood Mackenzie, IEA: International Energy Agency, Mtce: million tonnes of coal equivalent, FY: Financial Year, IPA: Indian Ports Association, bt: billion tonnes, BJP: Bharatiya Janata Party, GW: gigawatt, RPF: Railway Protection Force, APP: Association of Power Producers, GRP: Government Railway Police, NGT: National Green Tribunal, NEA: National Energy Administration, mtpa: million tonnes per annum, US: United States, UK: United Kingdom, PPC: Public Power Corp

NATIONAL: OIL

PM Modi pitches for responsible oil pricing for affordable energy

11 February. With volatile oil prices in the past playing havoc on economies of importing nations like India, Prime Minister (PM) Narendra Modi made a strong case for a responsible pricing of crude oil that balances interests of both producers and consumers, saying people must have universal assess to clean, affordable and equitable supply of energy. He said the world for long has seen crude prices on a roller-coaster. For a nation dependent on imports to meet more than 80 percent of its oil needs and half of its gas requirements, the volatility last October jacked up retail petrol and diesel prices to record highs. He said the challenge before nations is to deliver affordable, efficient, clean and assured energy supplies to their citizens. Oil and gas are not only a commodity of trade but also of necessity -- whether it is for the kitchen of a common man or for an aircraft, energy is essential, he said. He said India is the fastest-growing large economy in the world and a recent report has estimated that it could be the second largest world economy by 2039. At present, India is the sixth-largest economy in the world and is the third-largest energy consumer in the world, with demand growing at more than five percent annually.

Source: Business Standard

Venezuela’s PDVSA seeks to barter its oil with India

11 February. Venezuela is open to barter payment arrangements with India as it seeks workarounds to US (United States) sanctions imposed in late January, Venezuelan Oil Minister Manuel Quevedo said. Caracas, which buys medicines and other products from India, is looking for alternative payment methods to keep oil flowing to what is now its first destination for crude exports after its US customers froze purchases due to sanctions. Quevedo said he wants to double sales to India, which last year bought more than 340,000 barrels per day (bpd) from Venezuela. Venezuela wanted to expand trade in services and technology with New Delhi. Quevedo said that Venezuela aimed to double oil supplies to India from 300,000 bpd now. Before sanctions, the US bought more than 500,000 bpd, making it Venezuela’s largest buyer. Reliance Industries Ltd (RIL) and Nayara Energy, partly owned by Russia’s Rosneft, both buy Venezuelan oil. RIL is one of PDVSA’s largest cash payers and a prominent fuel supplier to Venezuela through its US unit RIL. Last year, RIL and Nayara jointly imported 344,100 bpd of Venezuelan crude, down 13 percent from 2017, according to ship tracking data. But India last year remained Venezuela’s second largest destination for oil exports. Barter deals could help India balance its trade with Venezuela. In fiscal 2017/18, India’s imports from Venezuela were worth $5.87 billion while its exports were $79.3 million, Indian trade ministry data showed.

Source: Reuters

PM Modi dedicates Vizag petroleum reserve facility to nation

10 February. Prime Minister (PM) Narendra Modi dedicated to the nation the 1.33 million metric tonnes capacity Visakhapatnam Strategic Petroleum Reserve facility of the Indian Strategic Petroleum Reserve Ltd (ISPRL). The facility, developed at a cost of Rs 11.25 bn, has the largest underground storage compartment in the country and is expected to give a boost to the nation's energy security. He inaugurated Oil and Natural Gas Corp Ltd (ONGC)’s Vashishta and S1 development project which has come up at Amalapuram in the Krishna-Godavari Offshore Basin. The cost of the project is about Rs 57 bn. This project will contribute significantly in realising the Prime Minister's vision of reducing oil imports by 10 percent by 2020. He laid the foundation stone for setting up Bharat Petroleum Corp Ltd (BPCL) Coastal Installation Project at Krishnapatnam. The project, coming up over 100 acres, will be built at an estimated cost Rs 5.8 bn. The project will be commissioned by November 2020. Fully automated and state of the art, the Coastal Installation Project will ensure security of the petroleum products. He said these projects were important not just for Andhra Pradesh but for the energy security of the entire country. He said the government was building oil reserves at different places so that the country faces no shortage of gas, petrol and diesel in emergency situations. He said these projects would not only provide direct employment to youth but also give fillip to gas-based industry. He said the government was trying to develop all coastal areas of the country as petroleum hubs. He said the work of providing free LPG (liquefied petroleum gas) connections to the poor, Dalits and tribals was progressing at a fast space. He said that under Ujjwala scheme, 62.5 mn free connections were provided. He mentioned that LPG connections in the country started in 1955. In 60 years 120 mn connections were given but in the last four-and-half years 130 mn new connections were provided.

Source: Business Standard

BPCL seeks LPG via term deal and spot gasoline in rare move

7 February. Bharat Petroleum Corp Ltd (BPCL) is seeking liquefied petroleum gas (LPG) through a term contract and gasoline via a spot deal in a rare move as it looks to plug a supply gap. In tender documents, two separate tenders showed the refiner which operates refineries in Kochi and Mumbai was looking to buy a total of 440,000 tonnes of LPG for 1 April 2019 to March 2020 arrival at Dahej/Haldia or Dahej/Mangalore and 35,000 tonnes of 91.5-octane grade gasoline for 1-12 March arrival at Kochi. BPCL does not regularly import gasoline as India is a net exporter of petrol. Neither does BPCL seek LPG through term contracts, although it buys spot cargoes as the country is net short of the fuel. India’s import of LPG, a product used for cooking among other purposes, hit 12.15 million tonnes (mt) in 2018, up by about 2.19 percent versus 2017. India’s gasoline exports in 2018 at 13.15 mt on the other hand were at its lowest in more than five years. However the market remains flooded with gasoline supplies across regions of Singapore, the United States and Europe.

Source: Reuters

Nearly 80 percent of Ujjwala Yojana beneficiaries have come back for second refill: Oil Minister

6 February. Nearly 80 percent of Pradhan Mantri Ujjwala Yojana (PMUY) beneficiaries have come back for the second refill, Oil Minister Dharmendra Pradhan said. Under the PMUY, a beneficiary can either make an upfront payment towards the purchase of hot-plate (stove) or first refill or the both or has the option to take a hot plate or the first refill or the both on loan basis from OMCs (Oil marketing companies) at zero interest rate.

Source: Business Standard

NATIONAL: GAS

RIL to stop production at two KG fields as output falls

12 February. Reliance Industries Ltd (RIL) and its partner BP are likely to stop production at the D1 and the D3 fields of KG-D6 (Krishna Godavari Dhirubhai 6) block in six to nine months due to a decline in the output. RIL has already informed the Directorate General of Hydrocarbons (DGH) about its decision to stop gas production in the two fields. In 2018, the company had announced the initiation of decommissioning formalities, but it gave no timeline. RIL had said that adhering to the government's site restoration guidelines, the company submitted a bank guarantee for the decommissioning activity for the existing producing fields (D1, D3 and MA). The production in the MA field was about to be over by October 2018. The government said three new discoveries are expected to revive the fortunes of the companies. These new fields will likely produce 30 million metric standard cubic meter of gas per day by 2021-22. Of the 19 oil and gas discoveries made by RIL in KG-D6 block, MA had started in September 2008 and D1 and D3 fields in April 2009. BP country head and regional president Sashi Mukundan said that KG basin will be back in action soon. The companies are expecting three projects in the Block KG D6 integrated development plan — including R-Series, satellite cluster and MJ (D55) — to be the game-changers for KG basin. The three projects put together have around 3 trillion cubic feet of discovered gas resources, where the companies are investing around Rs 400 bn. BP had taken over 30 percent stake in oil and gas blocks in India operated by RIL in 2011. Since then, the two companies have invested around $2 billion. Mukundan has said that the company is working on a sustainable plan to chalk out its retail roadmap in India. BP has licences to set up 3,500 fuel retail stations in India. However, the biggest challenge for the company is the monopoly of state-run oil companies in the sector.

Source: Business Standard

IOC, Adani, HPCL biggest bidders for city gas licences

11 February. Indian Oil Corp (IOC) has emerged as the biggest bidder for city gas licences in the 10th bid round that also saw Adani Group, Hindustan Petroleum Corp Ltd (HPCL) and Indraprastha Gas Ltd as the other prominent bidders, according to the Petroleum and Natural Gas Regulatory Board (PNGRB). IOC is looking to diversify into natural gas distribution business big time, bid for licences to retail CNG (compressed natural gas) to automobiles and piped natural gas to households in 35 out of the 50 cities put on offer for the 10th round and another seven in partnership with Adani Gas. Adani Gas bid for 19 cities on its own and seven in partnership with IOC, the PNGRB said after opening of bids between 7 and 9 February.HPCL, a subsidiary of Oil and Natural Gas Corp (ONGC), emerged as the third largest bidder, putting in bids for 24 towns and cities while Gujarat-based Torrent Gas applied for 20 areas. Indraprastha Gas Ltd, which retails CNG and piped cooking gas in the national capital, put in bids for 15 areas while Bharat Gas Resources Ltd, a subsidiary of state-owned Bharat Petroleum Corp Ltd (BPCL), bid for 14 cities. GAIL (India) Ltd, which is country's biggest gas marketer and transporting company, put in bids for just 10 areas through its subsidiary GAIL Gas Ltd. In the last bid round, it had managed to bag just 5 out of the 86 Geographical Areas (GAs) put on offer. In the previous 9th round which was awarded just a few months back, Adani Gas had won city gas licences for 13 cities on its own and nine in a joint venture with IOC. IOC had won licences for seven cities on its own. Bharat Gas Resources Ltd had walked away with 11 cities while Torrent Gas had made 10 winning bids. Sholagasco Pvt Ltd bid for 9 out of the 50 GAs put on offer in the 10th round while Gujarat Gas bid for seven and Petronet LNG Ltd put in bids for five areas. PNGRB had at the close of bidding on 5 February stated about 225 bids were received for licence to retail CNG to automobiles and piped natural gas to households in 50 GAs offered in the 10th city gas distribution (CGD) bidding round. It had not revealed the names of the bidders then. Eight out of the 50 GAs received single bids, with IOC being the only applicant for six areas in Bihar and Jharkhand while other two single bidders were Bharat Gas Resources Ltd and GAIL Gas Ltd for one area each. In the 10th round, bidders were asked to quote the number of CNG stations to be set up and the number of domestic cooking gas connections to be given in the first eight years of operation. Also, they had to quote the length of pipeline to be laid in the GA and the tariff proposed for city gas and compressed natural gas (CNG), according to PNGRB.

Source: The Economic Times

India asks firms to expedite efforts to establish shale O&G potential

10 February. India is looking to expedite discovery efforts to establish the country’s shale oil and gas (O&G) potential and has asked companies to submit a plan. In late 2013, India gave rights to Oil and Natural Gas Corp (ONGC) to explore for shale O&G reserves. However, after years of exploratory reserves, it has failed to find significant resources. In January, India’s O&G regulator Directorate General of Hydrocarbons (DGH) held a meeting with representatives from various private and government companies to urge them to pursue shale resources in the O&G blocks already held by them. India is a gas-starved country and imports almost half of its annual natural gas consumption. Prime Minister Narendra Modi wants India to be a gas-based economy and increase the share of gas in the country’s energy mix to 15 percent by 2030 from 6.5 percent now. All CBM developers were invited to the meeting in January. Currently CBM gas is produced by three companies in India - Reliance Industries Ltd, Essar Oil & Gas Exploration and Production Ltd and Great Eastern Energy Corp Ltd. CBM is a kind of natural gas which is found in coal deposits. ONGC has CBM blocks. Currently the most promising region of shale deposits is around the eastern part of India called as Damodar Valley basin, where the first exploration for shale is expected to start.

Source: Reuters

Government incentives for unviable areas to unlock ONGC, OIL natural gas output

10 February. The government plan to offer PSUs (Public Sector Undertakings) special incentives for natural gas discoveries in difficult and unviable areas will help raise India’s natural gas production as it will unlock output in a dozen fields of ONGC (Oil and Natural Gas Corp) and OIL (Oil India Ltd). India currently produces about 90 million metric standard cubic meter per day (mmscmd) of natural gas and has ambitious plans to double output by 2022 to reduce its reliance on imports and replace some of the polluting liquid fuels to cut emissions. ONGC and OIL have a dozen discoveries, which are unviable at current government mandated gas price. ONGC and OIL have not been able to develop the discoveries or bring them to production as the current gas price of $3.36 per million metric British thermal units (mmBtu) is way lower than the cost of production. ONGC has about 35 billion cubic meters of recoverable reserves in discoveries in the shallow sea off Andhra Pradesh on the east and off Gujarat and Mumbai on the west coast blocks. The three blocks in Krishna Godavari basin, Gulf of Kutch and Mumbai offshore can produce about 10 mmscmd of gas and an equivalent amount can be produced from its onshore discoveries in blocks like Bantumili, Mandapeta and Bhuvanagiri. About 5 mmscmd of production can be added by making some investment in existing fields like Mumbai High South, Neelam and B-127 Cluster in the Arabian Sea. OIL has an onland discovery in the Krishna-Godavari (KG) basin in Andhra Pradesh with over 3 billion cubic meters of recoverable reserves, but needs a higher price to bring it to production. ONGC and OIL want a price of over $6 per mmBtu to help them produce the gas without suffering any losses. The BJP (Bharatiya Janata Party)-led government had in October 2014, evolved a new pricing formula using rates prevalent in gas surplus nations like United States, Canada and Russia to determine price in a net importing country. Prices using this formula are calculated semi-annually. While the government has allowed a higher rate of $7.67 per mmBtu for gas fields in difficult areas like the deep sea, ONGC’s KG basin block KG-OSN-2004/1, which has about 15 bcm of recoverable reserves, is in shallow waters and does not qualify as a 'difficult field'. Similar is the fate of Mumbai basin block MB-OSN-2005/1 on the western side. The block GK-28/42 in Gulf of Kutch is a nomination block which does not qualify for higher rates. The onland discoveries of ONGC and OIL, too, do not qualify for the higher rates. While ONGC's KG block can produce a peak output of 5 mmscmd, the same from GK-28/42 is expected to be around 2.5 mmscmd. Peak output from MB-OSN-2005/1 is expected to a little less than 3 mmscmd. Oil Minister Dharmendra Pradhan said that the cost of production of natural gas in the prolific KG basin is between $4.99 to $7.30 per mmBtu.

Source: Business Standard

GAIL sets up satellite LNG station in Bhubaneswar

8 February. GAIL (India) Ltd has set up a satellite liquefied natural gas (LNG) terminal in Bhubaneswar to supply local customers in the absence of a gas pipeline — an innovative model that may get replicated by other city gas distributors eager to quickly start supply in new licence areas where gas pipelines are yet to reach. City gas licences have proliferated lately in the country: the downstream regulator offered 86 licences last year, and the process to award another 50 is under way. Just a year ago, licences were limited to 92 geographical areas that covered just a fifth of country’s population. After the current round of licensing is complete in a month or so, 70% of the country’s population will have been covered. But taking gas to people can take much longer than distributing licences. GAIL, which has a licence to supply gas to Bhubaneswar, decided last year not to wait for the gas pipeline, which is expected to connect the city next year. It started using gas cascades to supply natural gas to homes, shops and vehicles. This involved bringing in gas cascades from Andhra Pradesh to serve local demand, which is about 3,800 kilogram a day. GAIL switched its supply method. It started operating a satellite LNG storage and regasification terminal in Bhubaneswar, which can cater to 3,000 compressed natural gas (CNG) vehicles and 1,000 homes. This is the first such operation in the country but satellite LNG terminals are quite popular in several countries to supply gas to areas where laying gas pipelines are difficult or economically unviable.

Source: The Economic Times

India’s plan to raise natural gas share in energy basket to 15 percent looks increasingly ambitious: WoodMac

8 February. India’s plan to increase the share of natural gas to 15 percent of the country’s total energy mix by 2030, from 6 percent currently, seems “increasingly ambitious”, research and consultancy firm Wood Mackenzie (WoodMac) said. Kaushik Chatterjee, senior analyst at Wood Mackenzie, said that city gas distribution (CGD) will be a major driver of natural gas demand in the country and will account for 15 percent of the overall gas market, up from 7 percent currently. WoodMac projects the CGD sector to attract over $1.3 billion in investments in the coming decade. WoodMac said that re-gasification infrastructure remains a concern as Jaigarh floating storage regasification unit (FSRU) and Mundra and Ennore regasification terminals were not commissioned as expected in 2018, reducing expectations of demand in the later part of the year. The research and consultancy firm has projected India’s LNG demand to increase to 25 million tonnes per annum in 2019, an 8.7 percent increase over 2018. On the natural gas supply front, Alay Patel, principal analyst at WoodMac said that domestic gas production failed to grow in 2018 and growth is expected to remain moderate through to 2020. Patel said that Krishna-Godavari (KG) basin will witness frenzied construction and installation activities in next two years. ONGC (Oil and Natural Gas Corp) and Reliance Industries Ltd (RIL) awarded major contracts for their deep-water fields in the Krishna-Godavari basin through 2018. This includes ONGC's KG-98/2 cluster-2 fields and Reliance's R-series and Satellite fields in the KG-D6 block. WoodMac said a majority of gas produced in the country is priced below $4 per thousand cubic feet and a move towards market-driven pricing for production of natural gas would lead to monetisation of 1.5 trillion cubic feet of shallow-water gas immediately.

Source: The Economic Times

PM Modi likely to inaugurate three CNG fuel stations in Patna on 3 March

7 February. Prime Minister (PM) Narendra Modi is likely to inaugurate three newly built fuel stations on 3 March for the supply of compressed natural gas (CNG) in the state capital. GAIL (India) Ltd said the three stations at Raja Bazar, Bypass Road and Naubatpur are almost ready to supply CNG. Around 5,000 households, commercial entities and hospitals in the city have registered for piped natural gas (PNG) supply. The areas to be covered in the first phase of PNG supply include Jagdeo Path, Boring Road, AIIMS-Patna and BIT-Patna. Transport department secretary Sanjay Agarawal said that his department was in talks with GAIL officials for using natural gas supply for public transport. CNG and PNG are economically cheaper, eco-friendly and convenient compared to LPG (liquefied petroleum gas) and petroleum products. GAIL said CNG and PNG will be 30 to 40% cheaper than normal petroleum and LPG prices. Bihar State Road Transport Corp (BSRTC) has provided 1.5 acre land to GAIL at Phulwarisharif to set up a control room. PNG and CNG supply in Patna is part of the Jagdishpur-Haldia-Bokaro-Dhamra pipeline under the Pradhan Mantri Urja Ganga Yojana, which will connect the eastern and northeastern states to the national gas grid. GAIL said people who want to get CNG-aided kit planted in their vehicles will have to pay around Rs 50,000.

Source: The Economic Times

GAIL terminates contract with IL&FS for laying pipeline

6 February. Natural gas processing and distribution major GAIL (India) Ltd has terminated a contract given to IL&FS for laying pipeline in Bokaro-Durgapur section due to poor project progress. The company said that the Bokaro-Durgapur section (124 kilometre) is now re-tendered and awarded to three different contractors to expedite construction efforts. Besides, GAIL also informed that the project consultant, Engineers India Ltd, was replaced by Metallurgical & Engineering Consultants (India) Ltd for overseeing the project activities in this crucial stretch. In a swift move to safeguard project schedule of the Pradhan Mantri Urja Ganga natural gas pipeline to eastern India states, GAIL (India) Ltd as the owner and operator of the project under execution has offloaded the pipe laying contract from IL&FS due to poor project progress driven on account of acute financial crisis, GAIL said.

Source: Business Standard

NATIONAL: COAL

Bengal to get Deocha Pachami coal block running with support from Poland

10 February. Deocha Pachami coal block in Birbhum, the largest in Asia, is set to get technical support from mining experts in Poland, who have assured to remove all operational hurdles that might come in the way of mining the black gold. West Bengal Power Minister Shobhandeb Chattopadhyay said Polish companies have expressed interest to study the coal block, which has a 500-metre-thick layer of overburden (an outer surface covering the coal seams). Bengal is the sole allottee of Deocha Pachami, which has an estimated reserve of 2.1 billion tonnes. The overburden above the coal assets turned out to be one of the key reasons for six shareholder states -- Bengal, Karnataka, Bihar, Punjab, Tamil Nadu and Uttar Pradesh -- and public sector undertaking Satluj Jal Vidyut Nigam Ltd to exit the block, questioning its viability. However, Chief Minister Mamata Banerjee recently said that despite the allotment, the Centre was reluctant in handing over the block to Bengal. According to the state government estimates, investments worth Rs 120-150 bn would be required in developing the block, which may help create 100,000 jobs and usher in rapid economic development in the area.

Source: Business Standard

Coal ministry expresses concern over delay in commissioning of CIL washeries

10 February. The coal ministry has expressed concern over delay in the commissioning of around 18 washeries by Coal India Ltd (CIL) and stressed upon the need for timely completion of the projects. Coal Secretary Sumanta Chaudhuri also stressed the need for timely completion of projects. He also called for regular monitoring of washery projects at CIL through suitable software. The washeries which were reviewed by the secretary are Dahibari, Patherdih-I, Madhuband, Patherdih II, Bhojudih, Dugda and Moonidih washreies of BCCL (CIL arm). Tapin, Kathara, Ashok, Karo and Konar washeries of CCL (CIL arm), Ib Valley, Basundhar, Hingula and Jagannath washeries of MCL (CIL arm) and Kusmunda and Baroud washeries of SECL (CIL arm) were also reviewed. Currently, CIL operates 15 coal washeries with a total washing capacity of 36.8 million tonnes per annum (mtpa). Of these 15 washeries, 11 are coking and the remaining are non-coking with capacity of 20.58 and 16.22 mtpa, respectively. The total washed coal production from these existing washeries for 2017-18 was 12.45 million tonnes. Moreover, CIL has planned to set up 18 new washeries with state-of-the-art technologies with an aggregate throughput capacity of 95.6 mtpa.

Source: Business Standard

Power ministry seeks extra coal before summer to meet demand

9 February. Given the surge in power demand during the summer season, the power ministry has asked the coal and railway ministries to ensure sufficient fuel supplies to the power plants so that they can run at full capacity utilisation levels. All pithead plants should be given full priority in coal and railway rake allotment, irrespective of the quantities they are contractually entitled to, an office memorandum from the power ministry said. As on 5 February eight pithead power plants had coal stock to last 10 days while four of them had already received coal as per their annual contracted quantity. Coal India Ltd (CIL) has supplied 407 million tonnes (mt) of coal to the power sector during current fiscal till 4 February 2019, recording an increase in annual growth of 7.3%. The average rake-loading of the power sector stands at 252.5 rakes/day, 13% higher than the same period of last year. The government expects the supply situation to improve after the reopening of the Dhanbad-Chandrapura railway line, which ferries the fuel in the coal-bearing areas in eastern India. To meet the incremental fuel demand from its upcoming 4,880 MW thermal capacity, power producer NTPC plans to import 11.9 mt in FY20, more than twice the 5 mt target set for FY19.

Source: The Financial Express

Supreme Court notice to owner of Meghalaya coal mine

8 February. The Supreme Court issued notice to the owner of a coal mine in Meghalaya where 15 people have been trapped for nearly two months saying he was responsible for the illegal mining due to which the mishap took place. The top court directed that the owner of the mine be made party in the pending petition seeking urgent steps for rescuing the miners trapped in the rat-hole mine since 13 December last year. The illegal mine is located at Ksan in East Jaintia Hills district, about 3.7 kilometre deep inside a forest and can be accessed after crossing three streams. It was flooded when water from the nearby Letein river gushed into it. The top court sought the mine owner's reply by 22 February and directed the Meghalaya and Coal India Ltd to furnish details of other illegal mines operating in the area. Meghalaya government is undertaking search and rescue operations and the Centre is supplementing the efforts by providing all necessary logistic support.

Source: Business Standard

NATIONAL: POWER

Chandigarh plans to buy additional power to meet peak summer demand

12 February. To meet the demand in peak summers, the UT (Union Territory) electricity department is in talks with different power exchanges and states to purchase additional power. According to the estimates, the peak power demand in the coming summers will touch 404 MW. Besides, the peak power demand in Chandigarh will jump to 448 MW in the financial year 2021-22. The UT electricity department in its multi-year tariff petition filed before the joint electricity regulatory commission, has submitted details about the peak hour demand - the period of high consumer demand in the coming years. With population projected to grow at a high rate, the UT electricity department is already facing a tough challenge of providing uninterrupted power supply to the city residents. The UT electricity department plans to improve its power infrastructure. The department has set a deadline of 10 years for completion of the work.

Source: The Economic Times

Industries up in arms against MSEDCL over power tariff

12 February. As one of the major industrial hubs in the country, Aurangabad is among the areas in the state that have been witnessing huge unrest over the power tariff policies of the state government. The industry players have been particularly unhappy about the revision of the power tariff by the Maharashtra State Electricity Distribution Corp Ltd (MSEDCL) in September 2018 as part of the midterm review, creating a 15% hike in power rates for industries. Besides the midterm review, industry captains also are also unhappy with the increase in tax on sale to 18 paise per unit and the decrease in power factor incentive up to 3.5%. Prasad Kokil, immediate ex-president of the Chamber of Marathwada Industries and Agriculture (CMIA), said that drawing power from the MSEDCL has become financially non-viable due to the unjust tariff and related policy decisions. Kokil said that the MSEDCL has ordered recovery of Rs 206.51 bn from industries and other commercial establishments towards the losses that it has been incurring in the generation and distribution of power. Aurangabad and its outskirts have nearly 650 industrial units, which falls in the high-tension category and along with the areas coming under the low-tension category, these two categories have been allegedly facing the consequences of government policies.

Source: The Economic Times

NTPC issues electricity regulation notice to J&K discoms

11 February. NTPC Ltd, country’s largest power generator, will regulate power supply to Jammu & Kashmir (J&K) for not clearing Rs 19.85 bn dues. The company has asked the state to clear the pending dues or face blackout. Of the 19.85 bn, Rs 16.26 bn dues are outstanding for more than 60 days, the company said. NTPC has been supplying about 940 MW power to the state from various power stations. J&K electricity demand is about 1,950 MW. The company has been following up at various levels with power department of the state for realisation of payments. NTPC had issued similar notices to Telengana, Karnataka and Andhra Pradesh. According to three separate notices issued to the power distribution companies, nearly Rs 41.38 bn is due for over 60 days and as per the power regulator Central Electricity Regulatory Commission (CERC)’s guidelines, the generators can serve notice for regulation of power to defaulters. In the notices, NTPC had asked the states to pay the total amount. These dues include bills pending for supply of solar as well as thermal power by NTPC.

Source: The Economic Times

Delhi farmers unhappy over power charges

10 February. While the Delhi government is trying woo them with a draft agricultural policy, farmers of the national capital do not seem to be very happy with the ruling Aam Aadmi Party (AAP) on the issue of high electricity charges every month. The fixed electricity charge for agriculture use in Delhi is Rs 125 per kilowatt per month as per the tariff schedule. Some farmers said that they have to give the fixed charge even when they purchase meters on their own, while some others said they have to pay this charge for the electricity they use in their homes as well. While several farmers are demanding the reduction of the fixed charge, some others demand it free. Apart from electricity, the farmers are also demanding a Delhi Agriculture Commission.

Source: Business Standard

Chhattisgarh CM slashes domestic power bills by half

9 February. Chhattisgarh Chief Minister (CM) Bhupesh Baghel announced the reduction of electricity bills of all domestic consumers for consumption up to 400 units. A provision of Rs 4 bn was made in this regard. He explained that any consumption above 400 units would be charged on normal rates. In view of re-stationing for power supply, the budget proposed a new provision of Rs 500 mn for establishment of supervisory control and data acquisition (SCADA) system in Raipur, Durg-Bhilai and Bilaspur industrial areas. This will be followed by setting-up of smart meters in four cities with an allowance of Rs 330 mn.

Source: The Economic Times

Short term power price touches Rs 3 per unit in winter season

8 February. In December last year, short-term power prices declined to Rs 3.30 per unit on a month-on-month basis owing to the ongoing winter season, during which there is subdued demand for power, particularly in northern and western states. However, power prices increased on a year-on-year basis compared with Rs 3.00 per unit in December 2017. In December 2018, all-India energy requirement increased 4.9% year-on-year and available energy increased 5.0% year-on-year, leaving a power deficit of 0.5% against 0.6% in December 2017.

Source: The Economic Times

Agra, Aligarh top performers in power scheme

6 February. Agra and Aligarh divisions, covered by state government-owned discom (distribution company), Dakshinanchal Vidyut Vitran Nigam Ltd (DVVNL), have shown high performance in one-time-settlement (OTS) scheme. Here, more than 70 percent of targeted defaulters have availed of the scheme envisaging 100 percent waiver of surcharge (fine imposed on delay in payment of electricity bill) by paying 30 percent of the pending dues to get registered. The scheme covers farmers as well as residential and commercial consumers having a sanctioned load of up to 2 kW (kilowatt) and will take into account pending dues till 31 December 2018. The scheme will come to a close on February 15. In contrast to Agra and Aligarh, areas under Jhansi, Gorakhpur, Azamgarh and Mirzapur zones have shown poor performance with target achievement of 12 percent to 18. Of the four worst performing zones in UP (Uttar Pradesh), Jhansi under DVVNL recorded only 13 percent targeted registration till 2 February. Mahoba, Lalitpur, Hamirpur, Chitrakoot and Orai circles were able to achieve 10 percent to 17 percent of the target. DVVNL managing director S K Verma has issued show-cause notices to officials of the worst performing areas with strict directives to complete the target by 15 February. DVVNL which covers 21 districts of western UP had 16,17,519 consumers with over Rs 10,000 electricity bills pending on them. The target for registration of defaulters under the OTS scheme was 8,24,815. The discom till 2 February was able to achieve only 35.54 percent of the target. DVVNL administration following strict orders from the ministry of power has directed the officials to send staff to the houses of defaulters and ask them to pay their dues. They have been asked to disconnect the power supply of defaulters if they do not register for the OTS despite formal notice.

Source: The Economic Times

Prepaid electricity meters to all consumers in 2 yrs in Bihar

6 February. All the 15 mn consumers in Bihar will be provided smart prepaid electricity meters in the next two years. Chief Minister Nitish Kumar approved ‘in-principle’ the state energy department’s plan at a meeting. State energy department’s principal secretary Pratyaya Amrit made a detailed presentation before the CM and Energy Minister Bijendra Prasad Yadav about his department’s plan to shift all the 15 mn power connections to smart prepaid meters in the next three years. But the CM, while praising the plan, asked the department to reduce the period and try to finish the work in the shortest possible period. After the CM’s instruction, the energy department is reworking on a plan to complete the task in the next two years. The department had provided pre-paid meters to 111 consumers at Maurya Lok Complex in Patna on a pilot basis two months back. The trial run has been successful. Prepaid smart meter is a pro-consumer step. Once it is installed, the consumer will not need to pay the entire month’s bill at one go. The consumer can recharge one’s electricity meter as per requirements, another official familiar with the technology said.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Andhra Pradesh targets producing 5 GW solar power by 2023

12 February. The Andhra Pradesh government has set a target of generating 5,000 MW of solar power by 2023, and has offered several incentives to the private sector to meet this target. The new solar power policy said the power distribution companies (discoms) in the state would be procuring 2000 MW of solar power in the next five years. The policy announced by the Andhra Pradesh government is among the most investment-friendly of such policies by other state governments, Anmol Singh Jaggi, founder of the Ahmedabad—based Gensol energy group, said. Among the other highlights of the policy, companies investing in solar power projects in the state would be entitled to state government incentives for 10 years. Moreover, Jaggi said that the government has also committed itself to obtaining revenue land for the solar power projects. Jaggi said that for solar parks, land lease will be prioritised by the government and will be exempted from administrative approval charges.

Source: The Economic Times

Vikram Solar bags order for floating solar power plant by Hindustan Zinc

12 February. Vikram solar, solar module manufacturer and EPC provider, announced it has bagged an order for setting up a 1 MW floating solar power project by Hindustan Zinc. The floating solar plant will be located at Ghosunda dam near Chittorgarh in Rajasthan. The project is expected to be commissioned by July 2019 and is likely to produce 1,993 MWh (megawatt hour) of electricity annually.

Source: The Economic Times

Government to start collecting used oil, convert it into biodiesel

11 February. We all know that the vendor across the street fries those delicious vadas in used cooking oil, but we choose to turn a blind eye. Taking note of how disastrous this oil can be for health, the Union petroleum ministry has decided to encourage conversion of Used Cooking Oil to biodiesel and tied up with a private firm, Muenzer Bharat. A pilot plant for the conversion has been set up in Nerul MIDC and Oil Minister Dharmendra Pradhan will launch the project. The firm will target restaurants, starred hotels and bulk sellers of vadapav and chips in Mumbai, Navi Mumbai and Thane in the first phase and provide drums to collect the used oil waste daily. It will prevent the re-entry of used oil in the food chain and also stop its dumping in rivers and sewers. According to Sanjay Shrivastaava, managing director of Muenzer Bharat, the biodiesel manufacturing facility has been set up under the 'National Used Cooking Oil Collection Mission for India'. It will convert the used oil into 100 percent water-based biodiesel-which can be used for gensets or blended with diesel to make it environment-friendly.

Source: The Economic Times

Impact of climate change more in developing countries: Vice President

11 February. Vice President Venkaiah Naidu expressed concern over the impact of climate change on developing countries and called upon all nations to collaborate and cooperate in an equally unparalleled manner to ensure sustainable development. He emphasised on the importance of sustainable agriculture as a part of sustainable development and said more efficient systems of irrigation with "more crop per drop" mantra should be used. He said sustainable development is inclusive development which includes sustainable agriculture, sustainable mobility solutions, urbanisation, energy security and clean energy, waste management and efforts in wildlife conservation. He lauded the government for initiating the International Solar Alliance with France for promoting clean energy. He said India was on the course to achieving 175 GW renewable energy target and 40 percent of the country's electricity generation is set to be from non fossil fuels by 2022. India is committed to reducing 33 to 35 percent of emission intensity of its GDP (Gross Domestic Product) during 2005 to 2030 in tune with its Nationally Determined Contributions (NDCs), he said.

Source: The Economic Times

Punjab government inks MoU with Virgo Corp for biofuel project

11 February. The Punjab government signed an MoU (Memorandum of Understanding) with a Delhi-based company for a Rs 6.3 bn project which will produce biofuel from rice husk. The technology for the project will be provided by the US (United States) giant Honeywell. The company, Virgo Corp, will use the technology to produce biofuel from rice husk to set up a rapid thermal processing plant, which will provide over 150 direct and 500 indirect jobs. The project would pave way for potential future collaborations in terms of investments, technology transfer between Punjab and the US. The MoU was signed in the presence of Chief Minister Amarinder Singh and US Ambassador to India Kenneth I Juster. The project would go a long way in containing environmental pollution due to stubble burning, besides supplementing the income of farmers by helping turn the unmanageable agro-waste into raw material for producing biofuel, Singh said.

Source: Business Standard

India to add 11.4 GW of solar capacity every year: S&P Global

11 February. India will add 11.4 GW of solar capacity annually for the next few years on the back of strong government push to achieve its targets, S&P Global Platts Analytics said in a report. According to the report, the upcoming 2019 general elections would be an important event for the sector, and as a result, little progress on the policy front was expected in the near term. Under the Jawaharlal Nehru National Solar Mission, launched as part of India’s National Action Plan on Climate Change in 2010, a target of 20 GW capacity by 2022 was set up, but was subsequently increased to 100 GW, of which 60 GW was of utility-scale.

Source: The Economic Times

Goa government notifies solar energy policy

9 February. The Goa government has notified the Solar Energy Policy to promote unconventional electricity generation in the coastal state. The policy, which was notified, came into force with immediate effect. As per the policy, the consumer and the producer of solar power will be entitled to avail benefit in the form of 50 percent subsidy from the state government. The policy provides for penalty equal to five percent of the value of energy committed every day, if power producer fails to complete and commission the project within the given deadline, he said. Under the policy, the government will provide 50 percent subsidy, including 30 percent share from the Centre, for the capital cost or the benchmark cost provided by the Ministry of New and Renewable Energy or cost arrived through tendering process by the Goa Energy Development Agency.

Source: Business Standard

Three held in Uttar Pradesh for selling fake solar power equipment

7 February. The Uttar Pradesh Police has arrested three persons from Chhatari town of Bulandshahr district for allegedly selling duplicate equipment in the name of the central government scheme Bharat Gramin Solar Mission. Acting on the tip-off, police arrested the three persons and recovered fake equipment and a banner displaying Bharat Gramin Solar Mission with a photograph of Prime Minister Narendra Modi and Chief Minister Yogi Adityanath.

Source: The Economic Times

India’s wind energy sector to benefit from US-China tariff tussle: WoodMac

6 February. India's wind energy sector is likely to benefit in the form of fresh investments as the trade tariff tussle between the US (United States) and China intensifies, according to a research report by global research and consultancy firm Wood Mackenzie (WoodMac). WoodMac Power & Renewables expects the industry to circumvent these obstacles with new transportation methods and on-site/closer-to-site manufacturing. As such, the increase in project average megawatt size across global markets will favour this trend due to economies of scale, it said.

Source: The Economic Times

INTERNATIONAL: OIL

Sentinel plans US oil export terminal off Freeport, Texas

12 February. Sentinel Midstream became the latest contender in the race to build a crude export terminal off the US (United States) Gulf Coast, announcing plans to develop a facility off Freeport, Texas that could fully load a supertanker in one day. The Dallas-based company’s announcement follows seven other proposed crude export terminals vying to build a facility capable of loading a very large crude carrier (VLCC) without relying on smaller vessels to transfer crude cargoes, a process called reverse lightering that adds several days to loading times. Some executives, traders and analysts said they believe not every proposed terminal project will get built. Sentinel’s project would include an onshore terminal with 18 million barrels of storage, an offshore pipeline, platform and single-point mooring buoys that will load VLCCs, which carry 2 million barrels, at a rate of 85,000 barrels per hour. Magellan Midstream Partners LP said it is also considering Freeport as a spot to build an offshore crude export terminal, after it began talks with companies developing crude transportation assets there. Magellan is also considering a site near Corpus Christi, Texas. The current slate of eight projects would have a combined export capacity of 12.5 million barrels per day, more than is currently produced in the US.

Source: Reuters

Venezuela pressures foreign partners on oil venture commitments

12 February. Foreign partners of Venezuela’s PDVSA (Petroleos de Venezuela) are facing pressure from the oil firm to publicly declare whether they will continue as minority stakeholders in Orinoco Belt projects following US (United States) sanctions. The sanctions on PDVSA, imposed in an attempt to dislodge Venezuelan President Nicolas Maduro, barred access to US financial networks and oil supplies for the PDVSA joint ventures, pressuring the nation’s already falling crude output and exports. PDVSA’s Orinoco Belt joint venture partners, mostly US or European companies, are facing difficulties getting cash-flow out of the country as a result of the sanctions, straining their ability to continue output and exports. France’s Total SA, Norway’s Equinor ASA, Russia’s Rosneft and US-based Chevron hold minority stakes in joint ventures with PDVSA that produce crude and operate oil upgraders capable of converting the country’s extra-heavy oil into exportable grades. The four crude upgraders are capable of converting up to 700,000 barrels per day. The oil is exported by the joint ventures and each partner receive its share of the exports.

Source: Reuters

Saudi Arabia would need oil at $80-$85 a barrel to balance budget: IMF

11 February. Top oil exporter Saudi Arabia would need oil priced at $80-$85 a barrel to balance its budget this year, International Monetary Fund (IMF) said. Riyadh’s breakeven oil price depends on several factors, including the level of oil production, how much of Saudi oil revenues are transferred to the budget, and how non-oil revenues perform this year. Jihad Azour, director of the IMF’s Middle East and Central Asia department, said the increase in Saudi Arabia’s debt was not worrying, particularly when compared to its foreign exchange reserves and in light of positive investor sentiment, as reflected by low bond spreads.

Source: Reuters

Vitol plans LPG foray in Kazakhstan

11 February. Vitol, the world’s top oil trader, plans to access liquefied petroleum gas (LPG) from the giant Kashagan field in Kazakhstan and may finance the construction of a processing and export facility. LPG is mainly a by-product of oil development at the field and at the moment there is no infrastructure for refining, storage and transportation of LPG from Kashagan. The trader has approached North Caspian Operating Co (NCOC), the field operator, and Kashagan’s shareholders with a proposal to build the LPG processing and export facility near Karabatan railway station in the Atyraus region, but no immediate reaction followed. The plant is set to be commissioned in 2021, according to the Kazakh government’s schedule. The new facility may help Vitol boost its presence in the Kazakh LPG export sector. Vitol plans to deliver propane and butane to the global market via Russia’s Black Sea terminal in Taman, where Vitol has a transhipment contract. Kashagan, one of the biggest oil discoveries in recent history, started commercial output in late 2016 after years of delays and currently produces about 350,000 barrels of crude per day.

Source: Reuters

Oil market to reach balance in first quarter: UAE Energy Minister

11 February. The oil market should reach a balance between supply and demand in the first quarter of this year, UAE (United Arab Emirates) Energy Minister Suhail Al Mazrouei said. He said he was satisfied with the implementation of an agreement to cut supply by the Organization of the Petroleum Exporting Countries and allies, including Russia. Mazrouei said it was premature to discuss compensating crude output losses in some of the exporting countries. Iran, Libya and Venezuela registered falls in output as a result of unrest and trade sanctions.

Source: Reuters

South Sudan to return to pre-war oil production levels by mid-2020: Oil Minister

10 February. South Sudan will return to producing more than 350,000 barrels of crude per day by the middle of 2020, up from current levels of just over 140,000 barrels per day (bpd) currently, Oil Minister Ezekiel Lul Gatkuoth said. Production is expected to rise to 270,000 bpd by the end of 2019, Gatkuoth said. The country lost many of its oilfields to a civil war that broke out two years after its independence. South Sudan has signed a preliminary agreement with Russia’s Zarubezhneft for exploring some of the blocks, Gatkuoth said.

Source: Reuters

Yemen aims to export about 75k bpd oil in 2019: Oil Minister

10 February. Yemen hopes to scale up its oil production to 110,000 barrels per day (bpd) in 2019, with exports touching about 75,000 bpd, Oil Minister Aws Abdullah al-Awd said. The war-torn Arabian Peninsula country produced an average 50,000 bpd oil in 2018 compared with an average of around 127,000 barrels per day (bpd) in 2014. Last year it exported some quantities of oil.

Source: Reuters

Libya’s NOC discusses Sharara oil field crisis with Repsol

9 February. Libya’s National Oil Corp (NOC) said that its chairman Mustafa Sanalla had discussed a crisis at the Sharara oil field with Repsol executives in Tripoli. The North African nation’s biggest field is a focus of the conflict between the Tripoli-based internationally recognised government and a rival administration based in eastern Libya. Protesters and tribesmen halted production at the Repsol-operated field, located in southern Libya, in December. Oil production in Libya, a member of the Organization of the Petroleum Exporting Countries (OPEC), has been disrupted since the armed uprising that toppled Muammar Qaddafi in 2011.

Source: Reuters

Saudi Arabia cuts oil output by about 400k bpd in January

7 February. Saudi Arabia, the world’s top oil exporter, cut its crude output in January by about 400,000 barrels per day (bpd), OPEC (Organisation of the Petroleum Exporting Countries) said, as the kingdom follows through on its pledge to reduce production to prevent a supply glut. Riyadh told OPEC that the kingdom pumped 10.24 million bpd in January, OPEC. That’s down from 10.643 million bpd in December, representing a cut that was 70,000 bpd deeper than targeted under the OPEC-led pact to balance the market and support prices. The OPEC, Russia and other non-OPEC producers - an alliance known as OPEC+ - agreed in December to reduce supply by 1.2 million bpd from 1 January. The agreement stipulated that Saudi Arabia should cut output to 10.311 million bpd, but Energy Minister Khalid al-Falih has said it will exceed the required reduction to demonstrate its commitment. Falih said that Saudi Arabia would export 7.1 million bpd in February, down from 7.2 million bpd in January.

Source: Reuters