The week's news, trends and analyses from India's energy sector.

COLD WEATHER BOOSTS LNG DEMAND

Gas News Commentary: February — March 2018

India

India is poised to lift its domestic natural gas price to the highest in at least two years, boosting earnings of producers like ONGC, according to a survey of analysts and industry participants. The federal government will increase the price to $3.2/mmBtu for April to September, almost 11 percent more than the current price of $2.89/mmBtu, according to an average of 10 estimates. Higher gas prices may encourage producers to boost investment and production, helping the country meet its goals of cutting energy imports and more than doubling the share of gas in the energy mix. The increase will boost the earnings of India’s largest gas producer ONGC and Oil India Ltd. This will be the highest gas price since $3.82/mmBtu for the six months ended March 2016. In October, India raised the domestic gas price for the first time in nearly three years to $2.89. The forecasts in the latest survey ranged from $3.05 to $3.30/mmBtu. ONGC produced about 64 mmscmd of natural gas in the first 10 months of the financial year that began in April, comprising about 72 percent of India’s total gas output. Companies producing gas from some deep-water fields with high pressure and high temperature areas are allowed a higher tariff of about $6.30/mmBtu. That price is also due to be revised from 1 April.

Higher gas prices may encourage producers to boost investment and production, helping the country meet its goals of cutting energy imports and more than doubling the share of gas in the energy mix.

GAIL (India) Ltd. proposes swapping seven LNG cargoes across May-October 2018, according to the tender document and traders. The Indian importer has 20-year deals to buy 5.8 mtpa of US LNG in total, split between Dominion Energy’s Cove Point plant and Cheniere Energy’s Sabine Pass. With few tankers to ferry the fuel to India, GAIL has already struck swap deals for a chunk of its Sabine Pass volumes, and is extending that programme to cover Cove Point output. Under the swap, GAIL sells its share of output from US export plant Cove Point on a free-on-board basis in return for taking delivery of equal amounts of LNG to India’s Dahej/Hazira import terminal.

India's 20-year deal on import of natural gas from the US would be a "milestone" in bilateral ties and go a long way in strengthening and reinforcing trade relations between the two countries said US officials. GAIL has contracted 3.5 mtpa LNG from Cheniere Energy's Sabine Pass liquefaction facility in Louisiana. Cheniere Energy Inc. has dispatched its first shipment of US LNG to India through its Sabine Pass LNG terminal in Louisiana. GAIL had signed a SPA with the US LNG exporter Cheniere Energy in December 2011. The SPA went into effect 1 March. Under terms of the agreement, Cheniere will sell and make available for delivery to GAIL about 3.5 mtpa of LNG. International relations experts commented that sale and purchase of energy should follow commercial rather than geo-political rationales.

The deal would generate more than a billion dollars for the US company, which began exporting in 2016. US Energy Association has worked with the US Agency for International Development in India for more than 25 years promoting energy security through increased trade, investment and access to clean sources of power and fuel. India currently imports LNG from Qatar and Australia under long-term contracts at Petronet LNG's Dahej terminal in Gujarat. Shell, too, imports LNG at its Hazira terminal from across various geographies.

The IEX, the country’s largest power trading platform, is looking at launching a spot gas exchange for trading of natural gas produced by marginal fields. The company was in discussion with stakeholders on the proposal. A higher price would help operators produce gas from the marginal fields. Since output from these fields was less, gas production did not make commercial sense at a lower rate, he said. Currently, natural gas derivatives are being traded on commodity platforms such as the NCDEX. If the IEX’s plan succeeds, this will be the first spot gas market in the country. The move comes at a time when gas-based power generation is facing fuel crisis. Of the 24,150 MW of gas grid-connected power generation capacity in the country, 14,305 MW has no supply of domestic gas. The remaining (9,845 MW) is working at a sub-optimal level. The Centre recently conveyed to private power producers that natural gas would no longer be allocated, and that they would have to bid to buy the fuel.

GSPC has launched tender for a LNG for the end of March. The tender was launched, as per GAIL seeks two April cargoes via a parallel tender. Indian LNG demand is on an upswing with Essar Energy also seeking spot supply and Torrent Power Ltd. discussing purchases bilaterally for 2018.

RIL will likely stop producing from its MA field in the KG-D6 block by October following continuous decline in output for years. MA is one of the three fields currently producing in RIL-BP's KG block and the only one that produces both oil and gas. D1 and D2 are the other two fields producing only gas. MA will be the first of the three fields to be shut that initially generated big expectations but began disappointing within years of starting production. RIL, the operator of the KG-D6 block, has presented the possibility of shutting the MA field by October 2018 in the annual work programme submitted to the government recently. The lease of floating production storage and offloading unit, which processes output from the MA field, is coming to an end by October. RIL owns 60% in the KG block while BP owns 30% and Niko the balance 10%. The MA field began producing in September 2008 while the D1, D3 fields went onstream in April 2009. The average production from the KG block has fallen to 4.9 mmscmd during October-December of 2017 from a peak of 69.43 mmscmd in March 2010. The peak production included 66.35 mmscmd from D1and D3 and 3.07 mmscmd from MA. The gas output from MA field peaked in January 2012 to 6.78 mmscmd. The MA field produced 2,042 barrels per day of crude oil and condensate during October-December of 2017. About 70% of the gas reserves from D1, D3 and MA fields have been recovered so far.

A government oversight panel headed by DGH approved $4 billion investment plan of RIL and BP plc for developing three sets of natural gas discoveries in the KG-D6 block in the Bay of Bengal. The finds will add around 20 mmscmd of peak production, according to BP. RIL is the operator of block KG-DWN-98/3 or KG-D6 while UK's BP Plc has 30 percent interest and Niko Resources of Canada the remaining 10 percent. The three set of discoveries are ones that the partners are focusing on reviving the flagging output at KG-D6. Management Committee is the final approving authority after which the companies start investing. RIL and BP had in mid-June last year announced investing ₹400 billion in the three sets of finds to reverse the flagging production in KG-D6 block.

Petronet LNG has planned to launch around 20 LNG fuel stations on a 4,000 km route running from Delhi to Thiruvananthapuram as part of its larger scheme in association with oil marketing companies and state roadways of Rajasthan, Gujarat and Kerala. The company has also purchased four buses from Tata Motors for its office use in Cochin that will run on gas. It is expected that around 200,000 trucks that join the fleet every year could run on LNG, as it would bring nearly 30-40% price advantage compared to other fuels. India has committed under the Paris Convention to reduce its carbon emissions by 33% to 35% by 2030. It is believed if India shifts to these many LNG vehicles, it could help India meet at least 2.5% of this commitment. India’s target is to raise the use of gas in its energy mix to 15% in three to four years from 6.5% now, to curb emissions and cut its dependence on imported oil. According to Petronet, out of the total 78 mt of diesel that the country consumes every year, the share of trucks and buses comes to around 28 mt and hence a shift to cleaner gas fuel may turn advantageous for the environment.

Petronet LNG has planned to launch around 20 LNG fuel stations on a 4,000 km route running from Delhi to Thiruvananthapuram as part of its larger scheme in association with oil marketing companies and state roadways of Rajasthan, Gujarat and Kerala.

Rest of the world

More than $200 billion of investment in LNG is needed to meet a boom in demand by 2030, Royal Dutch Shell, the world’s top LNG trader, said. The LNG market is set to continue its rapid expansion into 2020 as facilities approved for construction in the first half of the decade come on line, in a development expected easily to meet sharp growth in consumption of the super-chilled fuel. But a decline in spending in the sector since 2014 as a result of weaker energy prices will create a supply gap from the mid-2020s unless new investments emerge, Shell said. LNG plants are complex and expensive, requiring large processing units, known as trains, that cool natural gas to around minus 160 degrees Celsius (minus 260 Fahrenheit). The liquefied fuel is then shipped to demand centers and converted back into gas. While LNG demand is expected to grow from 293 mtpa in 2017 to around 500 mtpa by 2030, supplies are seen slipping to 300 mtpa due to a lack of new projects and natural declines in existing production. The cost of developing the required capacity is roughly $1 billion/mtpa. That does not include investments in the development of the gas fields associated with LNG plants. Shell is considering moving ahead on new projects such as LNG Canada and Lake Charles on the US Gulf Coast. The Anglo-Dutch company is expected this year to launch the Prelude floating LNG plant in Western Australia, one of the largest and most complex gas projects in history. LNG demand is set to grow twice as fast as gas power plants in China, South Korea and India switch from coal and governments move to reduce carbon emissions, Shell said.

Royal Dutch Shell could boost its share of natural gas production to triple that of oil in order to meet self-imposed goals to halve carbon emissions by 2050. Shell is even rolling out a program charging customers 1 to 2 cents at the gasoline pump to be used to plant trees around the world to offset carbon emissions. The energy sector will need gas production operations to reduce emissions of methane, a potent greenhouse gas, or the case for the fuel as a lower carbon alternative would be “fatally undermined.” Shell, the world’s top trader of LNG, currently produces around 3.7 mboe of which roughly half is natural gas.

Royal Dutch Shell is planning to build a truck loading facility at its Hazira LNG terminal on India’s west coast as it looks to meet demand from industrial users, the company said. The facility, which could be ready by next year, will be used to supply industrial demand through trucking in places that can’t access supply from the grid. Shell Gas B.V, a unit of Royal Dutch Shell Plc, holds a majority stake in the Hazira LNG Terminal and Port in a venture with a unit of France’s Total SA. LNG trucking works well for locations off-grid, with China and India the two obvious markets. Gas hauled by trailers is seen growing to a tenth of China’s total gas consumption of around 240 bcm in 2017, from 5.6 percent in 2014, but is a new development in India. Shell expects LNG demand to rise again in China this year as the world’s second-largest importer of the super-chilled fuel extends a program to switch from coal to cleaner gas beyond the capital Beijing to large industrial cities.

Dominion Energy Inc. said the first vessel carrying LNG from its newly constructed Cove Point LNG export terminal in Maryland left the facility, another sign of growing US prowess as an oil and gas producer. The LNG tanker Gemmata left fully loaded, according to energy data provider Genscape, which said it observed the loading of the vessel through its cameras set up to watch the facility. Dominion said it spent about $4 billion to add export facilities at Cove Point, long an LNG import terminal on Chesapeake Bay. The facility is still undergoing final commissioning, the company said. Cove Point is the second big LNG export terminal in the Lower 48 US states after Cheniere Energy Inc’s Sabine Pass terminal in Louisiana, which exported its first cargo in February 2016. After decades of importing massive amounts of gas, the US became an exporter of the fuel in 2017 for the first time in 60 years due to record US gas production from shale fields. The US is expected to become the world’s third-biggest LNG exporter by capacity in 2018, furthering President Donald Trump’s goal of American energy dominance by exporting US oil and gas to help create jobs at home and provide more security to the nation’s allies around the world. US LNG export capacity is expected to rise to 286 mcm/day by the end of 2020 from 107 mcm/day. Cove Point is designed to liquefy about 21 mcm of gas. 28 mcm can power about 5 million homes.

Exxon Mobil is planning to build a Mozambique LNG export project and is looking to expand operations at its Papua New Guinea and Qatari LNG projects, the company said. The company is also concerned by the lack of new LNG project approvals over the past two years even as many projects were canceled.

Chevron Corp is exploring options including the sale of a minority stake in its Canadian LNG project as it pushes ahead. Among the parties in talks with Chevron for a possible stake in Kitimat LNG are Petroliam Nasional Bhd, or Petronas, which scrapped its own $36 billion LNG project in British Columbia last year due to challenging market conditions. Canadian companies Seven Generations Energy Ltd and Tourmaline Oil Corp are in discussions to supply natural gas to Chevron’s project, the people said. Seven Generations may also consider buying a stake in the project by partnering with other gas producers. While any possible deal with a financial investor would be strictly a cash infusion to help support the cost of building the project, a deal with a producer could be structured as a commitment to supply natural gas to the plant for a period of 20 to 25 years. The project in British Columbia, a 50/50 joint venture with Australia’s Woodside Petroleum Ltd, has a 20-year, 10 mtpa export license for LNG and is expected to cost tens of billions of dollars to build.

Angela Merkel’s government is seeking to build a LNG industry in Germany basically from scratch to reduce the nation’s dependence on supplies arriving by pipeline from Russia and Norway. With gas reservoirs depleting from the UK to the Netherlands, Germany is becoming increasingly reliant on Russia for its energy needs at a time when political tensions are mounting with Vladimir Putin’s government in Moscow. That’s prompting Merkel to think again about LNG as an option, building terminals on the North Sea and Baltic Sea that could import the fuel and bypass facilities in the neighbouring Netherlands, Poland and Belgium. Her newly formed coalition has a “coalition contract” that among other policies sets out an energy agenda including LNG for the next four years. Gas consumption rose 5 percent last year, the AGEB industry group said. And since Germany currently has no terminal for importing the fuel in its liquid form and turning it into gas, those supplies arrived by pipeline. Russian gas made up more than 60 percent of Germany’s total imports for most of last year. Across Europe, LNG use is on the rise. Imports to the 28 member states increased an annualised 22 percent at the end of the third quarter, with nations such as the UK and Spain in the lead in developing import capacity. Still, most terminals in northwestern Europe are underused. Merkel also is allowing German companies to promote the Nord Stream 2 pipeline, an expansion of an existing route for gas to flow from Russia to Europe under the Baltic Sea.

Angela Merkel’s government is seeking to build a LNG industry in Germany basically from scratch to reduce the nation’s dependence on supplies arriving by pipeline from Russia and Norway.

Iran has nearly doubled gas production at South Pars, the world’s largest gas field, in the past year. Gas production at South Pars increased from 285 mcm to 555 mcm in the past Iranian calendar year, which started in late March 2017. Total signed a deal with Tehran last July to develop phase 11 of Iran’s South Pars field with an initial investment of $1 billion. Total will be the operator with a 50.1 percent stake, alongside Chinese state-owned oil and gas company CNPC with 30 percent and National Iranian Oil Co subsidiary Petropars with 19.9 percent.

Golar LNG said it had started production at its FLNG platform in Cameroon, the world’s second working example of the nascent technology and a milestone likely to boost its Fortuna project in Equatorial Guinea. As the cost of land-based LNG plants more than tripled in the decade to 2013, Golar pioneered the conversion of aging LNG tankers into giant refrigerators capable of chilling gas into its liquid form at minus 162 Celsius. By starting up the pilot floating plant in Cameroon, Golar is removing uncertainty about the risks associated with squeezing equipment into a fraction of the space occupied by an LNG plant on land. Success in Cameroon could speed up Golar’s progress in Equatorial Guinea, where a final investment decision on Fortuna FLNG was delayed after three Chinese banks pulled out last year.

Russia and Serbia have revived an idea of building a gas pipeline in the Balkan country, a project that would enable Gazprom to step up its gas supplies to Europe, bypassing Ukraine. The Serbian pipeline will be linked to Bulgaria and Hungary via two interconnectors to ship Russian gas from the TurkStream pipeline. Serbia, which had given Russia’s Gazprom Neft majority stake in its oil company in exchange for its inclusion in the South Stream project, imports more than 90 percent of its annual gas needs from Russia via Ukraine. The EU candidate country, together with its traditional ally Russia is looking now for ways to secure gas supplies bypassing Ukraine. Gastrans, in which Gazprom holds a 51 percent stake and Srbijagas the remainder, invited parties interested in using the pipeline, to submit non-binding capacity reservation bids by April 15. The public call was issued to determine demand for natural gas and characteristics of the pipeline more precisely, Gastrans said. The EU halted the South Stream project saying the owner of the pipeline and gas supplier need to be separated.

Russia’s energy ministry said that gas giant Gazprom’s intention to terminate contracts with Ukraine poses no immediate threat to natural gas supplies to Europe through Ukraine. The issue of gas transit has intensified after the Russian group said it would end the contracts after a Stockholm arbitration court ordered it to pay more than $2.5 billion to Ukrainian energy firm Naftogaz. Gazprom said it had started moves to terminate gas supply contracts with Naftogaz, though Kiev said there had so far been no impact on supplies through its pipelines to Europe. Gazprom’s announcement marked an escalation in a long-running dispute between Moscow and Kiev, which has left Ukraine struggling to stay warm and which the EU has said could threaten gas flows across the continent. Russia said that gas transit would not be at risk until Gazprom and Naftogaz fully terminated their agreement. Ukraine’s state-owned gas pipeline operator Ukrtransgaz said it had had to take additional measures to ensure gas transit to European customers. Ukraine saw an increase in gas supplies from Poland, Slovakia, and Hungary, which has fully offset the impact of Gazprom’s decision. But analysts said it wanted to prevent Russia from shipping gas to Europe bypassing Ukraine, downgrading its geopolitical significance.

Russia’s energy ministry said that gas giant Gazprom’s intention to terminate contracts with Ukraine poses no immediate threat to natural gas supplies to Europe through Ukraine.

Poland’s law on natural gas storage violates the EU rules on security of gas supplies, the EU said, giving Warsaw two months to address its concerns. Poland amended a bill on obligatory oil and gas reserves in the summer of 2017 to set conditions requiring private gas companies that want to import gas to maintain some reserves. Under the bill, gas importers with inventories abroad will have to book transmission capacity at cross-border links to be able to send gas to Poland in case of emergency. Poland’s energy ministry played down the Commission’s concerns, saying they were part of a “routine analysis” of compliance of national laws with EU regulations. Some smaller Polish players in the gas market have criticised the bill, saying it is unfair and will result in gas prices rising in Poland.

Israel expects a decision to go ahead with the construction of a 2,000 km pipeline linking vast eastern Mediterranean gas resources to Europe to be made by early 2019. The pipeline, which will cross from Israel and Cyprus into Greece and Italy in deep waters, would mark a major milestone for the rapidly developing gas industry in the Levantine Basin in the east corner of the Mediterranean, offering access to a large market. The European Union considers the pipeline, estimated to cost $7 billion, as “extremely competitive” as the four partner countries continue construction plans for the technically complex line. The pipeline, known as East Med, will be able to transfer between 9 to 12 bcm annually. The project owners are IGI Poseidon, a joint venture between Greece’s natural gas firm DEPA, and Italian energy group Edison. More than 900 bcm of gas have been discovered offshore Israel while Cyprus’ Aphrodite gas field holds an additional 128 bcm. Both areas are expected to hold more reserves. Israel, where gas consumption has risen sharply over the past decade, will have 400 to 500 bcm available to export. The vast amounts of gas discovered since the early 2000s in Israel have transformed the region’s economic reality as it signed a number of deals to sell natural gas to neighbours Jordan and Egypt. Israel is also considering the construction of a pipeline to Turkey, where gas demand is rapidly growing, although the project appears to have stalled in recent years amid political tensions between the two countries. Israel plans to launch this summer a new auction for 20 to 30 exploration offshore blocks to trigger the development of further gas resources, Steinitz said.

Falling industrial demand and mild weather have turned China’s energy giants into sellers of LNG in Asia for the first time since last year’s massive import spree. Chinese players were on the receiving end of last year’s doubling of LNG prices, largely driven by their rapid shift to gas to combat coal smog as well as elevated regional demand for the fuel. LNG producer profits soared in tandem with spot prices hitting three-year highs above $11/mmBtu as China’s buying spree peaked in December and January. But a slump set in as milder weather settled over Japan and other major gas consumers in the region and expectations that Chinese buyers returning from the Lunar New Year break would take up the slack fell through. Plunging demand turned national oil companies like CNOOC, Sinopec and PetroChina into sellers and they are now offering cargoes for late March and April delivery. Meanwhile, spot LNG prices have sunk to the mid $8/mmBtu range.

Falling industrial demand and mild weather have turned China’s energy giants into sellers of LNG in Asia for the first time since last year’s massive import spree.

At least 10 of China’s domestic LNG plants have resumed output in the past week after the government cut off their supply, providing the first signs that the country’s gas supply crunch is starting to ease. The return of the plants, which liquefy domestically produced gas that is then trucked to end-users, has raised LNG supply in China’s interior, pushing nationwide LNG prices lower. These restarts are also a sign that state-owned gas producers Sinopec and China National Petroleum Corp have resumed piping gas to the facilities after the government ordered them to divert shipments from the plants to residential users to make up a supply shortfall during the winter heating season. Yangcheng Shuntianda Gas Corp, based in China’s Shanxi province, southwest of the capital Beijing, has restarted its plant, with the capacity to liquefy 500,000 cubic meters of gas, after shutting in December.

State oil giant Saudi Aramco signed a preliminary deal to pursue international gas opportunities with Royal Dutch Shell as part of top crude exporter Saudi Arabia’s diversification drive before the listing of Aramco. The Memorandum of Understanding would include gas upstream and liquefaction projects. Last year, Saudi Arabia and international oil companies had discussed gas venture opportunities inside the kingdom and abroad. The kingdom has a long-term goal of increasing the use of gas for domestic power generation, thus reducing oil burning at home and freeing up more crude for export. Expanding its gas portfolio inside the kingdom as well as abroad could help increase Aramco’s valuation as it generates more revenue from exports than selling oil at lower domestic prices — Saudi Arabia is the world’s fifth-biggest oil consumer despite being only the 20th-biggest economy. Aramco was interested in investing in international upstream ventures, particularly gas, and could invest in importing gas into the kingdom.

Australia’s Woodside Petroleum has dropped plans to build a liquefied natural gas export plant at Grassy Point on Canada’s west coast, choosing to focus on another Canadian LNG project, Kitimat, run by Chevron Corp. Woodside’s rights to develop the Grassy Point LNG site, about 30 km north of Prince Rupert, expired on January 15, and the company said it had decided not to renew the agreement. The company had done little work on the Grassy Point project to export up to 20 mtpa of LNG, and did not mention it in growth plans outlined last May. The decision to scrap Grassy Point adds to a string of LNG projects that have been delayed or shelved in Canada due to a global LNG supply glut. Woodside flagged last year that Kitimat, which has a 20 year, 10 mtpa export license, was part of its growth plans for beyond 2026.

Global natural gas markets were roiled as an earthquake in Papua New Guinea caused a large-scale supply disruption of LNG while a late winter blast in Europe triggered unprecedented price spikes. ExxonMobil Corp has declared force majeure on exports from its Papua New Guinea LNG project, which has been shut since a powerful earthquake. As a result, Asian spot LNG prices jumped by 5 percent, to $8.80/mmBtu. Exxon is having trouble gauging the extent of the earthquake’s damage, given the remoteness of the gas field, in the mountainous jungles of Papua New Guinea, 700 km from the export terminal. Spot LNG prices for May were already $1 lower than April’s, at around $7.75/mmBtu. The market situation has also been eased by increasing supplies from Malaysia’s Bintulu LNG export facility, which had seen disruptions in recent weeks. While the winter in North Asia is showing signs of tapering off, most of Europe has been caught by a wave of extreme cold late in the season, which pushed up British spot natural gas prices to record highs of 275 pence per therm on 1 March, the equivalent of over $30/mmBtu, and up 130 percent from the last close in February, and up 400 percent since the end of December. European importers were vying with bids from Asia for spot LNG cargoes from Qatar and the United States.

A consortium including Japan’s JERA and Marubeni Corp is aiming to ship LNG to Australia’s east coast, looking to supply industrial gas users and possibly a new power plant, the group said. This is the second proposed LNG import terminal for Australia, the world’s no.2 LNG exporter, as the country grapples with a supply gap at a time when its gas producers have locked in long-term contracts to sell LNG to Japan, China and South Korea. A final investment decision is expected this year on the project to import up to around 2 mtpa of LNG starting in 2020. The LNG receiving terminal would be able to meet up to three-quarters of the gas needs of Australia’s most populous state, New South Wales, where manufacturers like BlueScope Steel and Orica have major operations. The consortium would charter an existing LNG import vessel, at an estimated cost of around $30 million to $35 million a year, rather than building a new floating storage and regasification unit. That is a fraction of the billions of dollars that would be needed to develop a new gas field and pipelines to supply the equivalent volume of gas, 100 petajoules a year. The proposed new LNG import terminal would be located at either Port Botany, Port Kembla and Newcastle, all of which are close to existing gas pipelines, helping to keep down costs.

Regional leaders launched construction work on the Afghan section of an $8 billion natural gas pipeline that will link the energy-rich Central Asian nation of Turkmenistan through Afghanistan to Pakistan and India. Ex-Soviet Turkmenistan holds the world’s fourth-largest natural gas reserves but has been heavily dependent on gas exports to China after Russia cut back gas imports in the past few years. The project is expected to transport 33 bcm of natural gas a year along an 1,800 kilometer route from Galkynysh, the world’s second-biggest gas field, to Fazilka near the border with Pakistan in northern India. While the pipeline will allow Turkmenistan to find new consumers in Asia and cut its dependence on Beijing, which buys about 35 billion cubic meters of gas annually. It is also being seen as a central plank in ambitious regional development goals. The TAPI project, supported by the United States and the Asian Development Bank, has been touted by Turkmenistan since the 1990s. But the start of work was delayed because of the problem of crossing Afghanistan. The pipeline will run for hundreds of kilometers through areas of southern Afghanistan largely controlled by Taliban insurgents fighting the Western-backed government in Kabul but the movement has signaled that it will not hinder the project. The Taliban issued a statement, pledging its cooperation with TAPI, which it said would be an important element in building up Afghanistan’s economic infrastructure. Afghanistan, which suffers from chronic energy shortages, is expected to take 5 bcm of gas itself, with the rest divided equally between Pakistan and India. In addition, Kabul will earn hundreds of millions of dollars in transit fees.

Regional leaders launched construction work on the Afghan section of an $8 billion natural gas pipeline that will link the energy-rich Central Asian nation of Turkmenistan through Afghanistan to Pakistan and India.

NATIONAL: OIL

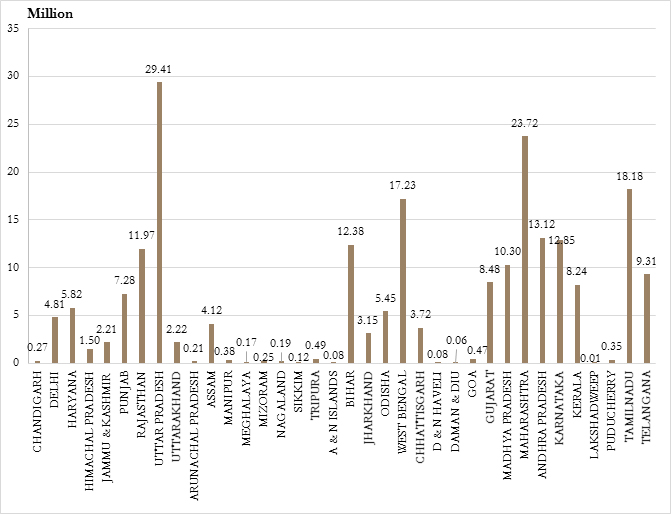

Diesel use in India set for record in 2018

27 March. Demand for diesel in India is set to hit a record in 2018 as the government targets massive infrastructure spending in the fiscal year that starts April 1, with Prime Minister Narendra Modi seeking a second term in elections in 2019. Diesel consumption growth in calendar 2018 may be more than double last year, analysts and traders said, aided by an expected regular monsoon this year that should boost demand in the world’s third-largest oil consumer for diesel used in harvesting and other farming, leading to higher rural spending. India’s average monthly diesel consumption was about 6.6 million tonnes, or about 1.6 million barrels per day (bpd), in 2017. That was up about 3.1 percent from 2016, when average monthly consumption was 6.4 million tonnes. Meanwhile India’s diesel exports in February were up 32 percent to 2.31 million tonnes year-on-year.

Source: Reuters

India's oil import bill to jump by 25 percent in FY'18

26 March. India's oil import bill is likely to jump by a quarter to $87.7 billion in the current fiscal year which ends this weekend as international oil prices have surged. India had imported 213.93 million tonnes (mt) of crude oil 2016-17 for $70.196 billion or ₹4.7 lakh crore. For 2017-18, the imports are pegged at 219.15 mt for $87.725 billion (₹5.65 lakh crore), according to the latest data available from oil ministry's Petroleum Planning and Analysis Cell (PPAC). India relies more than 80 percent on imports to meet its oil needs. During first 11 months of current fiscal (April 2017 to February 2018), the country imported 195.7 mt crude oil for $63.5 billion. The basket of crude oil that India imports averaged $55.74 per barrel in the April-February period as compared to $47.56 a barrel in 2016-17 and 46.17 in 2015-16. Every dollar per barrel change in crude oil prices impacts the import bill by ₹823 crore ($0.13 billion).

Source: Business Standard

SC asks Centre to consider BS-VI fuel in 13 metros from April 2019

26 March. The Supreme Court (SC) asked the Centre to look into the possibility of rolling out the BS-VI fuel in 13 metro cities by April 2019, besides introducing it in the national capital from the beginning of the next month. The Centre had earlier informed the top court it had advanced by two years the deadline for supply of the Euro-VI petrol and diesel and would start it in Delhi from April 1, considering the "serious pollution levels" in the national capital and adjoining areas. On February 21, the Centre had informed the apex court that it will introduce Euro-VI fuel in Delhi by 1 April. The top court had earlier directed the Centre to clear its stand on the availability of Bharat Stage (BS)-VI emission standard compliant fuel in Delhi.

Source: The Times of India

Ahead of polls, LPG loan repayment deferred

23 March. Ahead of polls, government-owned companies decided to defer recovery of loans that free-LPG (liquefied petroleum gas) connection beneficiaries had taken for buying cooking gas refills. Over 3.6 crore poor women have been given free LPG connections since June 2015. While the ₹1,600 cost of LPG connection is borne by the government, the cost of buying LPG stove and refill (gas cylinder) was to be borne by the beneficiaries. To help poor, oil firms provided interest-free loan to fund the cost of LPG stove and refill to beneficiaries. Indian Oil Corp (IOC) said about 70 percent of the PMUY (Pradhan Mantri Ujjwala Yojana) customers availed interest free loan facility provided by OMCs (Oil Marketing Companies) towards financing LPG stove and/or first LPG cost. To recover the loan, the oil companies were pocketing the subsidy government gives to all LPG consumers. Giving details of the deferment of loan recovery, IOC said the scheme shall be applicable for all the existing PMUY LPG connections who have taken loan for stove and/ or first LPG cost from OMCs. All PMUY customers who have outstanding loan as on March 31, 2018 will have a deferred recovery of the outstanding amount up to 6 LPG refills. The government raised the target of providing free cooking gas connection to poor women households to 8 crore from previously stated 5 crore.

Source: Business Standard

Myanmar, India mull building cross-border oil pipeline

23 March. India has proposed to build a pipeline from the country’s east coast to deliver oil products, mainly diesel, to Myanmar. A working group has been formed by Myanmar and India to look at issues such as security, land and oil storage, and how to price the fuel and the oil’s specification. Myanmar currently imports about 100,000 barrels per day (bpd) of diesel and gasoline mainly from Singapore, and produces only 12,000 bpd of oil locally. The country has invited investors to build refineries but high land cost is one of the main issues to overcome. The country has also held its first round of talks with China and Bangladesh to discuss building an electricity transmission grid across borders to ease power shortages.

Source: Reuters

Overtime at LPG bottling plants raises safety concerns in the industry

March 23, 2018. Almost six months after a massive fire broke out at an LPG (liquefied petroleum gas) bottling plant of Hindustan Petroleum Corp Ltd (HPCL), at Cherlapally in Hyderabad, the government's decision to give a go-ahead for night shifts at such plants has raised safety concerns in the industry. This decision came after LPG demand increased considerably on the back of government schemes such as the Pradhan Mantri Ujjwala Yojana (PMUY) over the past two years. LPG consumption in India increased 10 percent from 19.62 million tonnes (mt) in 2015-16 to 21.54 mt in 2016-17. It is expected to touch 23.5 mt in 2017-18. The higher number of hours has helped bring down waiting time for a refill. It was as high as 15 days earlier in the Northeast and in Kerala but has come down to four or five days.

Source: Business Standard

OMPL seeks heavy naphtha in rare move

March 22, 2018. ONGC Mangalore Petrochemicals Ltd (OMPL) is seeking heavy cut naphtha through an import tender in a rare move and coming at a time when overall naphtha supplies are tight, traders said. The petrochemical firm, owned by Mangalore Refinery and Petrochemicals Ltd and parent company Oil and Natural Gas Corp (ONGC), is looking to buy a total of 105,000 tonnes of the fuel for May to August delivery. It is looking to import two 15,000 tonne cargoes for May, followed by another two cargoes of the same size for June. But it needs only one 15,000 tonne cargo for July arrival and another two cargoes at 15,000 tonnes each for August. It was unclear why OMPL was looking to import the feedstock required for its paraxylene plant which has a capacity of more than 900,000 tonnes. The tender closes on April 3, with offers to stay valid until 4 April. OMPL had issued an import tender for heavy naphtha in 2015.

Source: Reuters

NATIONAL: GAS

Hiranandani family to invest ₹35 billion in oil and gas

26 March. Niranjan Hiranandani’s family is investing around ₹3,500 crore to build liquefied natural gas (LNG) terminals in Maharashtra and West Bengal, in a diversification for the Mumbai developer who built the iconic 250-acre Hiranandani Gardens township in suburban Powai. Led by Darshan Hiranandani, Niranjan’s son, H-Energy (formerly known as Hiranandani Energy) expects to start commercial operation of its first LNG terminal at Jaigarh in Maharashtra by October. The Hiranandanis are spending around ₹1,700 crore in setting up the terminal and laying down a 60 km pipeline from Jaigarh to Dabhol that is expected to be ready by May 2018. The energy venture operates as a subsidiary of Niranjan’s realty firm Hiranandani Communities, which primarily focuses on building large townships across Maharashtra. Darshan Hiranandani said, H-Energy has devised plans to ramp up the energy business and is looking to bring in more professionals at the senior level. It also expects to provide gas to retail outlets in the long term, he said.

Source: Livemint

Punjab cabinet clears policy for laying of CGD gas pipelines

22 March. The Punjab cabinet approved policy guidelines to facilitate laying of gas pipelines across the state. The move is in line with a High Court directive to the state government to frame a uniform policy for laying of such pipelines. The policy was drafted after examining the policy of Gujarat as suggested by the Petroleum and Natural Gas Regulatory Board (PNGRB), and in consultation with the concerned departments. At a meeting chaired by Chief Minister Amarinder Singh, the State Cabinet gave its nod to the new guidelines for grant of permission, levy of restoration charges and determination of compensation for Right of Use of Way for laying of City Gas Distribution Network (CGDN) on land belonging to State Government Departments/Urban Local Bodies/State Authorities.

Source: The Economic Times

NATIONAL: COAL

CIL's competitive edge under scanner over rising output cost, ageing mines

27 March. In the coming years, though government-owned Coal India Ltd (CIL) is poised to maintain leadership in a liberalised regime for the commodity, the world’s largest coal miner is also threatened with losing its competitive edge, primarily for technical reasons. An internal assessment by the company in formulating a vision for the year 2030 reveals the strip ratio across its major mines is increasing substantially, which would lead to increased production cost. This ratio refers to the volume of waste material required to be handled to extract every one tonne of ore. By the assessment, the weighted average strip ratio for Mahanadi Coalfields Ltd (MCL), the largest CIL subsidiary, would increase from 0.9 to 1.4 by 2020. For Northern Coalfields, from 2.8 to 4. At South Eastern Coalfields, the second largest subsidiary, from the current 1.2 to 1.9. Analysts are sceptical about Indian coal faring against the black diamond from Australia, Indonesia, South Africa and others. For, Indian coal has a lower gross calorific value and more of impurities. The Centre recently allocated 11 mines to CIL and these are expected to add about 225 million tonnes (mt) of coal every year to its production capacity. Leaving the recent allocation aside, the current production capacity of CIL with other miners is 1,500 mt yearly.

Source: Business Standard

CIL eyes road route to augment supply to customers

27 March. In order to overcome supply hurdles, Coal India Ltd (CIL) is looking at effective utilisation of road network to deliver dry fuel to customers, specially power plants. With the rail network at its best carrying 320 rakes of fuel from coal pitheads to power plants every day, the road network can help boost supplies to power producers as a short-term measure. According to the company data, offtake during the April-February period was at 525 million tonnes (mt) against the target of 541 mt. Coal dispatches to consumers in various sectors, including power, were 12 mt through road network in April-October 2017-18. Coal is transported from mines to power plants by railways and road network. Besides, it is also transported using merry-go-round train and belt conveyor system. The country is heading towards becoming a power surplus nation. The demand for coal from power plants is also rising but due to the limited source of supply the plants at long distances from mines are facing supply issues which need to be addressed. It is the roads which can be built earlier than the other three ways and CIL is eyeing this mode to supply coal.

Source: Business Standard

Adani Enterprises signs coal mining pact with NLC India

26 March. Adani Enterprises said it has signed a coal mining agreement with NLC India Ltd for development and operation of Talabira II and III coal block. Talabira (Odisha) Mining Pvt Ltd (TOMPL) has become a successful bidder for mine developer and operator (MDO) tender of Talabira II and III coal block issues by NLC India Ltd, it said. The coal ministry has allocated the block to NLC India for development, mining and captive consumption of the dry fuel from the blocks in its various end use power plants. NLC had floated a tender for selection of mine developer and operator (MDO) for development and operation of the two Talabira blocks in November 2017 and reverse auction was conducted in January, wherein TOMPL became the successful bidder.

Source: Business Standard

CIL to adopt more transparent, customer-friendly pricing system

26 March. Coal India Ltd (CIL) will adopt a new pricing system from April 1, which the company’s chairman

Gopal Singh said will be more customer friendly, transparent and aligned with global norms. CIL will start charging prices determined on the basis of paise per unit of energy for various grades of coal to be sold from next month. The company has called a meeting of stakeholders in the power and non-power sectors to brief them about the new pricing system, to be notified, and clarify any doubts. The grading system based on total energy content per kilogram remains, but the price of each consignment will be determined by a rate fixed for each unit of energy for that particular grade and the total energy contained in 1 kilogram (kg) of coal for the consignment. This means that the price of each tonne of coal will be based on its total energy content. Under the present system, the price used to be the same for a range of energy content, which was categorised as grades. CIL, however, has reduced the number of grades from 17 earlier to 10 under the new system. Each grade, under the new system, will now have a pricing coefficient which would be in paise per kilocalorie or paise per unit of energy. This coefficient, when multiplied with the energy content in each consignment in gross calorific value (GCV) terms, will determine the price of one tonne of coal for that consignment. According to CIL, coal of grades between G10 and G14 –mainly used by power generators – have been grouped as one. The energy content of this grade will range between 3,101 GCV and 4,600 GCV. It would have a price coefficient of 23 paise per kilocalorie. The price of power grade coal within this band would vary between ₹713 per tonne on the lower side and ₹1,058 per tonne on the higher side. Under the old system, the prices of these grades varied between Rs 748 per tonne and ₹1,024 per tonne. Grade G9 with calorific value ranging between 4,601 GCV and 4,900 GCV, also used by power companies, is likely to have a pricing coefficient of 24 paise per kilo calorie. Its price would vary between ₹1,104.24 per tonne and Rs 1,176 per tonne, depending on the actual energy content in each consignment. Under the existing system, this grade was priced at ₹1,140 per tonne. However, each consignment will need to be tested for the exact quantum of energy content in each kg of coal and CIL has been putting in place systems and the infrastructure to support the new system.

Source: The Economic Times

Wani coal mines gates now open to public

25 March. Tourism got a shot in the arm as the gates of coal mines in Yavatmal district were recently opened to public, which were otherwise restricted to those working in the field. The tourists will now have access to as deep as 200 metres below the ground so that they could see the stockpile in Ukani open cast and Bhandewada coal mines situated near Wani. This is the second mine in the region after Saoner to have opened doors to the people. With the initiative of Maharashtra Tourism Development Corporation (MTDC) and Western Coalfields Ltd (WCL), people can see mining operations and visit the workshop division. They also will be taken to Tipeshwar Wildlife Sanctuary and Sahasrakund waterfall, among other places of tourists’ attraction. The mines are located around 134 kilometres from Nagpur and MTDC has clubbed the tour with a package that also includes a visit to Tadoba forest and Tipeshwar Wildlife Sanctuary. The tourists will also be shown old and decaying buildings which were once used for mining.

Source: The Times of India

NTPC starts coal production from second mine

23 March. NTPC Ltd, the country’s largest power generator, announced it has started production of coal from its second coal mine as part of a larger strategy to secure local fuel supply for its generation stations. The government has allotted the state-owned firm ten coal blocks to meet fuel requirements. Its first coal block, Pakri Barwadih in Jharkhand, has been in operation since June 2017. NTPC is currently working on five coal blocks — including Pakri Barwadih, Chatti Bariatu, Kerandari, Talaipalli and Dulanga – with total geological reserves of 3.8 billion tonne and mining capacity of 56 million tonne per annum.

Source: The Economic Times

Tuticorin Port creates new record in coal handling

23 March. V O Chidambaranar Port Trust said it has created a new record by handling 48,701 tonnes of thermal coal in a single day on March 20. Earlier, the port had handled 42,508 tonnes in a single day on January 14 last. Neyveli Thermal Power Plant, too, handled 3.28 million tonnes of coal during 2016-17 and 3.11 million tonnes during this financial year upto February. Chairman of the port trust I Jeyakumar said the port was continuously striving to achieve improvement in performance and productivity in order to attract more volume of traffic.

Source: Business Standard

Meghalaya assures all efforts to ensure resumption of coal mining

23 March. The Meghalaya government will put in all efforts to ensure resumption of coal mining in the state in accordance with environmental rules and regulations. Public Works Department Minister Prestone Tynsong said that the state had incurred loss of ₹416 crore in terms of revenue following the NGT (National Green Tribunal)'s 2014 ban on coal mining. Tynsong said that the government will leave no stone unturned to ensure that the NGT lift its ban, and may even form a delegation to meet the Prime Minister and President to apprise them on this matter. The NGT had ordered an interim ban on "rat-hole" coal mining in Meghalaya from April 17, 2014, after the All Dimasa Students' Union and the Dima Hasao District Committee filed an application before the tribunal alleging that the water of the Kopili river was turning acidic due to coal mining in Jaintia Hills.

Source: Business Standard

India's coking coal imports jump 12 percent in April-February 2017-18

21 March. The country's coking coal import increased to 43.53 million tonnes (mt) from 38.83 mt during the period April 2017 – February 2018, a jump of 12.10% over same period last year, according to mjunction, a leading e-commerce company. The trend highlights India’s dependence on imported coking coal that has been the concern for steel and power sectors. These sectors essentially depend on low ash content coal, which is not abundant in India. Low ash coal, which is used in blast furnaces and Basic oxygen furnaces of steel plants is thus largely imported from Indonesia, Australia and South Africa. However, the fluctuations in prices of imported coking coal often eats into the profit margin of steel industry players. Given the problem, the steel industry has been groping for a dependable solution to meet the growing demand for coking coal.

Source: The Economic Times

CIL to set up plants for coal gasification: Goyal

21 March. To promote environment-friendly uses of coal, Coal India Ltd (CIL) is planning to set up plants for coal gasification. To promote cleaner and alternate use of coal, CIL is pursuing initiatives for setting up plants for gasification of coal and its further processing into downstream chemicals, Coal and Power Minister Piyush Goyal said. He said the government has already taken several initiatives to improve the efficiency of coal based power plants and to reduce carbon footprint. All new, large coal-based generating stations have been mandated to use the highly efficient supercritical technology, he said.

Source: Business Standard

NATIONAL: POWER

No power tariff hike in Andhra Pradesh next fiscal

27 March. Power consumers in Andhra Pradesh will not face any power tariff hike in 2018-19. Andhra Pradesh Electricity Regulatory Commission Chairman G Bhavani Prasad, releasing the tariff order, said 100 percent of the consumers in 2018-19. He indicated that power consumers would get more relief in future. While 92 percent of the power consumers in 2015-16, 96.6 percent in 2016-17 and 90.5 percent in 2017-18, were spared from tariff hike, there will be total exemption next fiscal. The free or concessional supply of power to agriculturists of all descriptions will continue in 2018-19. Sharing insights into power purchase cost, which was as high as ₹ 33,626 crore in 2014-15, the Regulator said it was gradually brought down to ₹24,565 crore in 2018-19. While the distribution licensees have projected a deficit of ₹7,983 crore, the Commission estimated the deficit to be ₹6,030 crore, thus limiting the burden by ₹ 1,953 crore. The government has enhanced the subsidy from ₹3,700 crore in 2017-18 to ₹6,030 crore. The commission accepted a long pending demand of industries for incentivising power usage during off peak hours from 10 pm to 6 pm, where they get concession of ₹1 per unit. Earlier, 15 lakh consumers of 1.59 crore consumers were affected by 3 percent to 3.6 percent increase in charges, which the regulator said was less than the inflation in 2016-17.

Source: The Hindu Business Line

Kalpataru Power Transmission bags orders worth ₹9 billion

27 March. Engineering, procurement and construction firm Kalpataru Power Transmission Ltd (KPTL) has bagged three orders worth ₹901 crore. The company has bagged a turnkey order from Tamil Nadu Transmission Corporation for the construction of 765 kilovolt (kV) D/C transmission lines and a ₹64 crore contract from Power Grid Corp and state electricity boards for a GIS substation and transmission line, it said. The third contract worth ₹195 crore was awarded by the Central Organisation for Railway Electrification (CORE) for design, supply, erection, testing and commissioning for railway electrification, including overhead equipment and traction substation works.

Source: The Hindu Business Line

TPDDL launches super-efficient “Gorilla” fans at 40 percent discount

27 March. Tata Power Delhi Distribution Ltd (TPDDL), the private power distributor in the national capital, announced it has launched super-efficient “Gorilla” ceiling fans at a 40 percent price discount for consumers. The company said the country’s most energy-efficient fans use a super-efficient Brushless DC motor to deliver 63 percent more efficiency than non-star rated fans. The fans have been designed by Atomberg Technologies, a start-up by the alumni of Indian Institute of Technology (IIT), Mumbai. The motor of the fans consumes only 28 Watt power as compared to 75 Watt consumed in a non-star rated fan. TPDDL claimed the Gorilla fans do not produce any humming noise and do not heat on operation and also come with a smart remote with sleep mode and timer mode. TPDDL is offering two modes for purchase of the fans. Consumers can visit nearby TPDDL customer care centre with latest electricity bill or any authorised identity proof. They can also buy the fans online through the TPDDL website. The fan is priced at ₹2,200 per unit when purchases offline. For online purchase, the fan is priced at ₹2,300 per unit. The fans are available in 3 colour options and carry 3 year on-site warranty.

Source: The Economic Times

Power men across UP strike work against government's privatisation bid

27 March. Power employees across Uttar Pradesh (UP) struck work to protest against the state government's decision to privatise electricity in Varanasi, Lucknow, Meerut, Gorakhpur and Moradabad. Unions of the power employees also warned the state government that after this token one-day strike, they will be forced to go for a longer agitation in case there was no immediate roll back on the decision. The strike called by the Vidyut Karmachari Sanyukt Sangharsh Samiti saw engineers and employees abstaining from work throughout the day. The association said that normal work will resume but on April 9, all power men, engineers will go on a three day strike. Protests and demonstrations would be held at all district headquarters and project offices during this three-day protest, it was announced. Association General Secretary Ashok Kumar said that be it revenue collection or plugging in line losses, the government power officials and employees have been working very hard to improve the situation. The power employees also said that other than directly affecting them, privatisation will also punch in a hole in common man's budget as the power tariff would also witness a steep hike. Employee associations have also warned the state government against any punitive action against them like arresting them and said this if this happened, it would be responsible any further escalation of matters. Protests were witnessed outside the gates of the Pipri, Panki, Obra, Aanpara, Harduaganj and Parischa power plants and Power Department offices at Lucknow, Mirzapur, Faizabad, Ghaziabad, Noida, Meerut, Saharanpur, Jhansi, Banda, Allahabad, Agra, Kanpur, Aligarh, Bareily and Moradabad.

Source: Business Standard

J&K suffers ₹48 billion yearly power losses

26 March. Jammu and Kashmir (J&K) suffers losses of around ₹4,800 crore in a year in the power sector, state Finance Minister Altaf Bukhari said. Bukari said state suffers approximately ₹4,800 crore yearly loss against the procurement of electricity which can be brought down if the society develops the habit of resource conservation. None other than teacher can help to bring this change as they are architects of an emancipated and progressive society, the Minister said and sought the cooperation of teachers to take this message to every home. Our state needs to develop a habit of judicious use, conservation and generation of resources to make them long lasting for posterity. Teachers through their grit of patience and untiring teaching capabilities can make children understand about the importance of developing these good habits, the Minister said while addressing a huge gathering of teachers on the occasion of Lecturers Day.

Source: Business Standard

UP opposition slams BJP's government's go ahead to power privatisation

26 March. The Uttar Pradesh (UP) assembly witnessed an uproar as opposition legislators protested against the Yogi Adityanath government's recent decision to privatise electricity in five major cities of the state. The state government however justified its decision, saying that this would lead to better and adequate power supply to the people. Power Minister Shrikant Sharma said that the move stemmed from the commitment of the Bharatiya Janata Party (BJP) government to provide better power supply to the people, while clarifying that private companies would only be involved in revenue collection and minimising line losses. He also categorically denied that production and transmission of power was being passed on to private players. The Minister also assured the house that the power arrears of state government departments would be cleared and deposited within one year and informed that a process of installing prepaid meters in all government offices and buildings has been initiated.

Source: Business Standard

Chandigarh set to get more power in summer from central pool

25 March. The UT electricity department has sought enhancement of its share of unallocated electricity quota from 4% to 14%. The electricity department is hopeful of getting additional 100 MW of power to meet the peak-hour demand — period of high consumer demand — which it can draw from central generating stations around the clock. The electricity department caters to more than 2 lakh consumers with an annual energy consumption of around 1,600 million units. The department is facing peak-hour power shortage of around 130 MW in 2018-19. The projected annual average peak demand is 496, while available power is 366 MW. The peak demand in the month of April is 338 MW, while the power available during the period is 226 MW. Similarly, in May, the department would have 283 MW of power against the projected peak demand of 461 MW with a shortfall of 178 MW, the highest in the year. In June, the power available during peak hours is 366 MW against the projected demand of 489 MW. In July, 338 MW power would be available against the peak demand of 466 MW. The second highest gap that is of 143 MW in the month of September. The available power is 294 MW against projected peak demand of 437 MW. Peak hour is a period in which the consumer demand is highest. The gap between the projected peak power and available power reaches maximum during the summer season. UT superintending engineer M P Singh said they will start getting additional power after getting approval from the ministry. He further said it will be of great help to meet the peak-hour power demand. Power demand has steadily risen in the last few years and the non-availability of additional supplies has pushed the peak hour deficit.

Source: The Economic Times

Power crisis looms in Gujarat as Adani, Essar stop supply

24 March. A power surplus state till recently, Gujarat may witness a scorcher of a summer, with private power producers —Adani and Essar — discontinuing supply on account of paucity of coal. The situation forces the state to meet demand by procuring expensive power from energy exchanges and other sources. Gujarat Urja Vikas Nigam Ltd (GUVNL) has invited bids for procurement of 2,000 MW of power for April, May and June to meet rising demand. GUVNL has PPA (power purchase agreement) of 2,000 MW with Adani Power, 1,000 MW with Essar Power Gujarat and 1,805 MW with Tata Power. Essar discontinued supply from December 15 while Adani stopped supply from January 20 without any prior notice to GUVNL or the Gujarat Electricity Regulatory Authority (GERC). During March, power demand has increased by 640 MW to about 14,890 MW per day and it will increase more when temperature rises further in coming months. At present, Gujarat is depending on central sources for power as its own power production is not sufficient to match the demand. About 53% of power supply comes from central sector sources. The state government has served notices to Adani and Essar for resumption of power supply. It may be mentioned that as per the terms of the PPAs, if any supplier discontinues supply for over a year, it would be declared a defaulter. Energy experts maintain that Essar and Adani have violated terms and conditions of the PPAs and have also violated the Supreme Court order by discontinuing supply. With present installed capacity of about 27,236 MW in the state, GUVNL can easily manage and cater power demand up to 20,000 MW. But due to stoppage of supply by Adani and Essar, GUVNL is being compelled to purchase more than 2,500 MW from the Indian Energy Exchange (IEX) at a higher rate of nearly ₹5 per unit. At present, GUVNL is managing supply to consumers with major contribution from the central sector. Moreover, GUVNL has to purchase power from the IEX at ₹5.01 per unit during peak hours with an average cost of ₹4.25 per unit.

Source: The Financial Express

NTPC's Lara plant starts generating power in Chhattisgarh

23 March. NTPC Ltd said its first unit of 2x800 MW Lara Super Thermal power station in Chhattisgarh commenced generating electricity, which took the group's total capacity to 52,991 MW. The company is currently building an additional capacity of over 19,000 MW at multiple locations in the country, it said. After the first unit of Lara plant starts generation, the total commissioned capacity of the NTPC and the NTPC group has become 46,100 MW and 52,991 MW, respectively, it said. Located at Raigarh, the first unit has gone on-stream just ahead of the summer season and will help meet additional power demand for states in western region, including Chhattisgarh.

Source: Business Standard

Power tariff remains unchanged in Odisha

22 March. Rejecting appeal of various distribution companies to hike power tariff, Odisha Electricity Regulatory Commission (OERC) announced that it will remain unchanged for 2018-19 fiscal. The OERC said the power tariff hike will put extra burden on common people. OERCs Director (Regulatory Affairs) Priyabrat Patnaik said 1 percent rebate over and above the normal rebate will be given if consumers pay bills online. He said the power tariff for domestic consumers having consumption upto 50 units has remained unchanged at ₹2.50 paise per unit. Two state-owned power generation companies, Odisha Hydropower Corp (OHPC) and Odisha Power Generation Corp (OPGC), earlier urged the OERC to hike power tariff. Power distribution companies such as Gridco, OPTCL, CLDC, Cesu, Cesco, Nesco, Wesco, Southco too had been demanding tariff hike citing increase in infrastructure cost. Instead of hiking the power tariff, the Commission, however, stated that distribution companies should take steps to reduce the aggregate technical & commercial (AT&C) losses which will help them reduce losses. The OERC last year hiked of 10 paise per unit in electricity tariff for 2017-18. The Commission has fixed the tariff at ₹2.50 per unit for the first 50 units, ₹4.30 per unit for consumption above 50 units upto 200 units, ₹5.30 per unit for consumption above 200 to 400 units and ₹5.70 per unit for consumption above 400 units.

Source: Business Standard

EESL floats second tender for procuring 5 million smart meters

22 March. Energy Efficiency Services Ltd (EESL) has floated its second tender for procuring five million smart meters to be installed on a pan-India basis, reports Nishtha Saluja. The new smart meters tender is based on international competitive bidding process like the company’s previous tenders. In a pre-bid meeting conducted, the tender elicited response from over 40 companies from across the country. Some of these players include Secure Meters, Landis Gyr, Genus, HPL and L&T. A JV (joint venture) of PSUs (Public Sector Undertakings) under the power ministry, EESL had last year invited bids for five million smart meters to be deployed across Uttar Pradesh (UP) and Haryana.

Source: The Economic Times

GE Power bags ₹2.3 billion order from NTPC

March 21, 2018. GE Power India said it has bagged a ₹230 crore order for upgrading three 660 MW super critical steam generators at Barh Stage-I project of NTPC Ltd. As part of the contract, the company will perform the pressure part metallurgy upgradation for three 660 MW super critical steam generators. The upgradation scope includes primary super heater, convection super heater and low-pressure re-heater. This will help NTPC to commission the 3x660 MW plant which was started 12 years ago, it said.

Source: Business Standard

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

Vikram Solar commissions 350 KW rooftop solar project for Ordnance Factories unit

27 March. Solar power developer Vikram Solar Ltd announced it has commissioned a 350 KW rooftop solar power plant for Gun and Shell Factory (GSF) in Cossipore, Kolkata. GSFCossipore is a unit of the Ordnance Factories Board that manufactures special equipment for the Indian Army. The project is spread across 4,180 square meter of roof top area that has 1,130 modules powering five buildings. The solar installation is expected to save 430 tonnes of Carbon Dioxide emissions, the company said. The company has a rooftop Engineering, Procurement and Construction (EPC) portfolio of around 60 MW comprising government clients. Vikram Solar’s annual Photo-Voltaic module production capacity stands at 1,000 MW.

Source: The Economic Times

Badarpur thermal power plant likely to close by deadline

27 March. The Supreme Court-appointed Environment Pollution (Prevention and Control) Authority (EPCA) reviewed the status of the closure process of Badarpur thermal power plant and asked agencies to increase production at the Bawana gas plant from 250 MW to 500 MW by April 15. In a meeting with government officials and power agencies, EPCA was informed that the process to shut down the Badarpur unit is ahead of schedule and is likely to meet the July 31 deadline. EPCA said it was important to utilise the Bawana plant to avoid wastage of public resources. EPCA member Sunita Narain further asked the authorities to ensure that the Bawana plant generates 500 MW from April 15, if not April 1. On February 28, EPCA allowed resumption of operations at the Badarpur plant, but set a deadline of July 31 for its closure. Power department said its closure won’t affect Delhi’s power supply.

Source: The Times of India

Surat becomes first district to have 100 percent solar powered health centres

26 March. At a time when global warming is mounting with each passing day, Gujarat's Surat district has switched to solar power to combat the issue. Surat has become the first district in the country to have 100 percent solar powered Primary Health Centers (PHC). There are a total of 52 PHCs in the district and all of them are now powered by solar system. This initiative will not only bring down the electricity bill by 40 percent but also help fight global warming.

Source: Business Standard

BHEL wins its largest solar PV plant order for 75 MW in Gujarat

26 March. Bharat Heavy Electricals Ltd (BHEL) said it has won its largest solar photovoltaic (PV) power project for setting up a 75 MW power plant in Gujarat. BHEL said the order has been placed by Gujarat Industries Power Company for setting up a plant at the Gujarat Solar Park in Charanka. With this order, BHEL's solar portfolio has risen to 545 MW, it said. The company is currently executing over 150 MW of ground-mounted and rooftop solar PV projects across the country. The company said it offers EPC (engineering, procurement and construction) solutions both for off-grid as well as grid-interactive solar plants.

Source: Business Standard

Government ends anti-dumping probe on solar cells from China, Taiwan and Malaysia

24 March. The commerce ministry's investigation arm DGAD (Directorate General of Anti-Dumping and Allied Duties) said it is terminating its anti-dumping probe on imports of solar cells from China, Taiwan and Malaysia. The Indian Solar Manufacturers Association has made a request to terminate the present investigation, it said. The probe was initiated by the DGAD on July 21 last year following complaints of dumping of the product by the association. Imposition of anti-dumping duty is permissible under the World Trade Organisation (WTO) regime. Both India and China are members of the Geneva-based body. The duty is aimed at ensuring fair trading practices and creating a level-playing field for domestic producers vis-a-vis foreign producers and exporters.

Source: Business Standard

India, UK have launched joint research projects for clean water, energy

23 March. India and the UK (United Kingdom) have launched joint research projects on water quality and energy demand reduction. Minister of State for Environment Mahesh Sharma said that the research projects aim to deliver mutual benefits and research solutions to the two countries. He said the projects also aim to address shared global sustainable development goals in the areas of clean water and clean energy. He said that these projects will be supported by India's Department of Science and Technology in collaboration with UK's Natural Environment Research Council, Engineering and Physical Sciences Research Council and Social Research Council.

Source: Business Standard

RB commissions first solar powered facility

23 March. Consumer health and hygiene RB India, (erstwhile Reckitt Benckiser) commissioned its first solar powered factory in Mysore as part of project Greenathon. The factory, running on 'green power' forms an extension to RB's continuous efforts to reach its worldwide sustainability targets, the company said. The factory meets 75 percent of the energy needs with solar energy and aims to be the first factory running on 100 percent green power in India within couple of years. This marks RB's first power purchase agreement (PPA) in India, which forms a landmark in its sustainability journey. This initiative will enable reductions in carbon emissions by 80% for the Mysore site over the next 10 years. The company has signed a 10 year 2.4 MW power purchase agreement (PPA) with Amplus Energy solutions. Amplus has developed 42 MW solar park called as Nayaka in Chitradurga, Karnataka that supplies energy to the Mysore plant.

Source: Business Standard

Work on Brahmapuram waste plant to start in April

22 March. The waste-to-energy project proposed to be set up at Brahmapuram that had been mired in controversy will be on track soon. The foundation stone of the first phase of the project will be laid in April. The construction of the first phase of the project, which is to treat garbage will be completed by January 2019. In the first phase, a plant to process the garbage and produce refuse derived fuel (RDF) which is in the form of bricks would be set up. In the second phase, the gasification plant to generate energy from the RDF will be constructed. Following Kochi corporation’s difficulty in implementing the waste-to-energy plant proposed at Brahmapuram, the state had entrusted overall monitoring of the project to district collector. The government had viewed that the district collector use powers of revenue department and that of the district magistrate for speedy implementation of the project. Kochi corporation had handed over 20 acres in Brahmapuram to GJ Eco Power Private Ltd for starting the construction of the plant. The construction of the project designed in 2015 had been stuck in controversies and lack of various clearances. The total cost of the project, which will generate 10 MW of electricity, is 295 crore. The promoters of the project envisage that 85% of the total revenue can be generated from electricity produced at the plan

Source: The Economic Times

Schneider Electric keen to tap EV charging market

22 March. Schneider Electric said it is keen to tap the electric vehicle (EV) charging infrastructure market in India. Given the huge potential in the EV charging space, the company displayed its EV charging infrastructure named EVLinks during an innovation summit on March 19-20, Schneider Electric said. The company's technologies are powering businesses and key government programmes, including Make in India, Smart Cities Mission and Electric Mobility, and around 15 percent of India's solar capacity is based on its technology, Schneider Electric India Managing Director Anil Chaudhry said.

Source: Business Standard

Government proposes to reduce reliance on fossil fuel based power generation: Delhi Budget

22 March. In its Budget for 2018-19, the Delhi government has proposed to encourage renewable energy initiatives to reduce fossil fuel-based power generation. A host of renewable energy initiatives have been lined up for the power department in 2018-19 that will reduce reliance on fossil fuel-based power generation in Delhi, Deputy Chief Minister Manish Sisodia said presenting the Budget in Delhi Assembly. The budgetary allocation for the energy sector ₹2,190 crore in 2018-19, is four percent of the total budget expenditure of ₹53,000 crore. The total capacity of renewable energy in Delhi until February 2018 was 133.13 MW, which included 81.13 MW of solar power and 52 MW of electricity generated from waste-to-energy plants. In addition 74 MW of solar power is under progress, he said. The government has already committed to purchase 1,000 MW of green power, solar and wind, in the coming year. The government will bring out a Group Net Metering policy to enable utilisation of huge solar potentials by roping in state-run schools, markets and other buildings of government, he said. The government will pilot a scheme named agriculture-cum-solar farm scheme to incentivise installation of solar panels on raised structures without affecting farming activities, he said.

Source: Business Standard

Cabinet apprised of India-Guyana MoU on renewable energy

21 March. The Union Cabinet was apprised of an MoU (Memorandum of Understanding) between India and Guyana on bilateral cooperation in renewable energy. The MoU was signed on 30 January here by Power and New & Renewable Energy Minister R.K. Singh and Carl B Greenidge, 2

nd Vice President and the Foreign Minister of the Co-operative, Guyana. Both sides aim to establish the basis for a cooperative institutional relationship to encourage and promote technical bilateral cooperation on new and renewable energy issues on the basis of mutual benefit, equality and reciprocity.

Source: Business Standard

Solar auctions in Maharashtra & Karnataka put off on lack of bidders

21 March. In a reversal of the upbeat sentiment prevailing in solar energy last year, two recent solar auctions – one in Maharashtra and the other in Karnataka – have failed to attract enough bidders, leading to their repeated postponement. Though India added a record 7,295 MW in 2017-18 until February end, and bid out another 10,500 MW through the year, Maharashtra’s latest 1,000 MW solar auction received bids of only 530 MW and thus had to be postponed for the fourth time. The auction, first announced by the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) in December last year, had been put off three times earlier already. Its third deadline of February 23, received only two bids, while the fourth for 9 March, again drew bids of just 530 MW. Similarly, Karnataka’s 1,200 MW auction for projects at the Pavagada Solar Park drew bids of only 550 MW at the second effort. The Karnataka Renewable Energy Development Ltd (KREDL), which is holding the auction, initially set the last date for bid submission at 21 February but attracted only two bids of 100 MW each. The second deadline was set for March 2, and drew bids of just 550 MW. In KREDL’s last solar auction for 860 MW, conducted across different talukas of Karnataka, winning tariffs had varied between ₹2.94 and ₹3.54 per unit. KREDL set the ceiling tariff at ₹2.93 per unit in the subsequent auction in a bid to drive prices further down, but clearly developers feel prices have already reached their limit.

Source: The Economic Times

INTERNATIONAL: OIL

Iraq may build oil storage in Japan, South Korea to drive Asian sales

27 March. Iraq is studying the possibility of building crude oil storage facilities in South Korea and Japan as part of a plan to increase sales to Asian clients, the head of the Iraqi state-oil marketer SOMO, Alaa al-Yasiri, said. SOMO received offers from Exxon Mobil, Total, Japan’s Sumitomo and China’s Unipec, to take part in marketing Iraqi crude, he said. Iraq plans to stop loading crude from its southern port of Basra for three to four days in early April due to maintenance, he said. Iraq has 10 million barrels in oil storage capacity in the southern region, he said. Iraq’s crude output should not exceed 4.360 million barrels per day in compliance with a deal between oil exporting nations to curb supply in order to lift prices, he said. March oil exports won’t exceed 3.426 million bpd, he said.

Source: Reuters

Chevron's Venezuela oilfields operating normally