LPG CONSUMPTION TAKES OFF

Oil News Commentary: December 2017

India

The price of the Indian basket of crude oil crashed from $113 per barrel in 2014 to $50 by January 2015. That was a bonanza for a government struggling to manage fiscal deficit and planning large social-sector spends. Oil prices tumbled to $29 by January 2016. Tightened by OPEC-led production cuts, oil is sensitive to all kinds of shocks. Prices have already touched the above-$65 mark. India's import bill has gone up and so has the current account deficit. India is heavily dependent on imports for a large chunk of the crude oil that it consumes. In 2016-17, around 82.1 percent of the oil consumed in India, was imported. The rising oil prices in the global markets have caused the oil import bill to grow 15% in the second quarter ending September 2017 to $23.7 billion from $20.5 billion in the same period. A bigger oil import bill contributed to India's current account deficit doubling to 1.2% of GDP or $7.2 billion in the September quarter from 0.6% of GDP or $3.5 billion in the same period in 2016. The current account deficit is expected to widen and end the fiscal year at 1.7-2.0% of GDP. The higher the imports, the bigger negative impact it has on the net rate. So with oil prices on the decline since 2014, it meant that the export metric in GDP calculation did not have as severe a negative hit. A 2014 report from Macquarie Capital Securities India said a $10 per barrel fall in oil prices would reduce India's import bill and the current account deficit by $9.2 billion (0.43% of the then GDP). Due to falling oil prices India’s macro-economic indicators such as inflation, CAD, and trade balance improved. On the back of contraction in the trade deficit, the CAD came down to $22.1 billion, or 1.1 percent of GDP from $26.8 billion, or 1.3 percent of GDP, in 2014-15. In the last three years, despite the fall in global crude oil prices, the average Indian consumer of petroleum products has not been a beneficiary of it. Instead, increased excise duty and VAT on petrol and diesel has meant that despite the 56 percent fall in oil prices, the prices of petrol and diesel are at most 5 percent less than what they were in May 2014. Since June 2014, when international oil prices started declining, India has increased its excise duties from ₹ 15.5 per litre to ₹ 22.7 per litre as of December 2016 for branded petrol and from ₹ 5.8 per litre to ₹ 19.7 per litre for branded diesel. In contrast, the governments of most advanced countries simply passed on the benefits to consumers. With oil prices increasing, an unchanged excise duty would mean that the end consumer would have to pay even more, while a cut in excise duty would mean that petroleum companies will not be able to reap the benefits of the revival in the industry. The government thinks the oil prices are within the range where they cannot upset the fiscal math. India is one of the major OPEC consumers. 85 percent and 94 percent of India’s crude oil and gas imports respectively come from the OPEC countries.

ONGC’s partners in six pre-NELP blocks will have to share royalty, cess and other government charges with the state firm in proportion to their stakes, ending the current practice of ONGC alone bearing state levies for entire production, according to an oil ministry proposal that would soon be sent to the Cabinet. Once the proposal gets the Cabinet’s nod, Vedanta, Essar Oil, GSPC, Focus Energy, Hindustan Oil, and UK’s Hardy Oil would have to bear the burden of government charges in their respective fields where they partner with ONGC. The DGH had recently recommended ONGC exit the contract and let other partners share the government charges in proportion to their stakes in these six blocks. But the government didn’t accept the DGH proposal of removing ONGC from the blocks while taking its recommendation of allowing shared liability. These six blocks—CB/OS-2, CBON/2, CB-ON/3, CB-ON/7, CYOS90/1 (PY3), RJ-ON/6—are located mainly in Gujarat and Rajasthan. The prolific Barmer block (RJON-90/1) too had the same royalty and cess sharing rule earlier, but about six years back Vedanta, while purchasing the field from Cairn Energy, agreed to share with ONGC the liability of paying government charges. Vedanta is the operator of the field with 70% participating interest in the Barmer block. In other six pre-NELP blocks too, partners operate fields with ONGC owning only minority interest. These are called pre-NELP blocks because they were auctioned before the NELP, was launched, which mandated proportionate sharing of government charges by all contractors of a block. The oil ministry is now planning to extend the model adopted in Barmer to other six blocks.

IOC has said that the impact of the GST would be nearly ₹ 42 billion as it would not be able to claim ITC for automotive fuels that fall outside GST. ITC allows an entity to reduce the tax on outputs by the same amount already paid as tax on inputs.

State oil companies are aiming to augment their cooking gas distribution network by nearly a third in a little more than a year to cater to the rapidly expanding consumer base, mainly in rural areas. The past three years have witnessed a spectacular rise in access to cooking gas, putting strain on the current distribution network that hasn’t grown as fast. Between April 1, 2015, and September 30 this year, the number of active domestic cooking gas consumers has risen 44% to 214 million while the number of LPG distributors has expanded just a fifth to 19,200. The government is now pushing oil companies to accelerate the process of appointing new distributors and ensure they quickly become operational, the oil ministry said. The government has already issued 2,000 new licences. In addition, nearly 600 applicants have been selected through draw of lots in recent months while another 3,400 are slated to be picked for licences by March. After obtaining licence from an oil company, it usually takes about a year for an applicant to set up a cooking gas distribution agency, which involves obtaining many local regulatory clearances as well as readying an office and warehouse. New distributors are mainly coming up in regions that have been short on distributors or places which have seen a surge in new cooking gas consumers. States like Uttar Pradesh, Bihar, Bengal, Odisha and Maharashtra are set to have a big share of new distributors. The new LPG consumers are mostly located in remote and rural areas and from underprivileged background. Big distance to gas agencies become a deterrent for consumers to seek a refill when they run out of gas. In these regions, services by distributors are relatively weak and home delivery of cylinders mostly absent, making it difficult and expensive for consumers to use cooking gas. By staying close to consumers, state oil companies can hope to overcome these consumption hurdles and increase their sales volume.

After hiking cooking gas or LPG price by ₹ 76.5 in 19 installments in 17 months, national oil companies skipped the monthly revision in rates this month ahead of elections in Gujarat. State-owned IOC, BPCL and HPCL have been since July last year raising price of LPG on 1

st of every month with a view to eliminating government subsidies on the fuel by 2018. The oil companies however skipped the hike this month. The price of subsidised LPG was last raised by ₹ 4.50 per cylinder on November 1 to ₹ 495.69, according to a price notification issued by state-owned firms. The government last year had asked state-run oil firms to raise prices every month to eliminate all the subsidies by March 2018. Since the implementation of the policy of monthly increases from July last year, subsidised LPG rates have gone up by ₹ 76.51 per cylinder. A 14.2 kg LPG cylinder was priced at ₹ 419.18 in June 2016. Every household is entitled to 12 cylinders of 14.2 kg each at subsidised rates in a year. Any requirement beyond that is to be purchased at market price. Initially, the hike in LPG rate was ₹ 2 per month which was raised to ₹ 3 from May this year. The November 1 hike in the LPG price was the sixth since the May 30 order of the oil ministry to raise rates by ₹ 4 per cylinder every month. According to the PPAC of the oil ministry, there is a subsidy of ₹ 251.31 on every 14.2 kg subsidised LPG cylinder. Incidentally, the non-subsidised or market priced LPG rates were raised by ₹ 5 per cylinder to ₹ 747 a bottle on December 1. Non-subsidised LPG rates have moved in tandem with their cost since December 2013.

The Centre has sanctioned ₹ 75 billion for setting up a LPG bottling plant in Meghalaya which will help increase the clean fuel's penetration, especially in the rural areas of the state. A Memorandum of Understanding (MoU) was inked between the oil ministry and the state government. Only 27 percent of the households in the state are linked with LPG connectivity which is much below the national average. Another 20 LPG distributors have now been added for Meghalaya. Meghalaya is the only state in the region which has no bottling plant. The new bottling plant will be constructed at an existing site located in Shillong itself.

India is set to surpass China as the biggest importer of LPG this month as a drive to replace wood and animal dung fires for cooking boosts consumption. Shipping data shows LPG shipments to India will reach 2.4 million tonnes in December, pushing it ahead of top importer China, on 2.3 million tonnes, for the first time. India’s LPG purchases have surged from just 1 million tonnes a month in early 2015 on the back of a government program to bring energy to millions of poor households relying on open fires. China, India and Japan together make up about 45 percent of global LPG purchases.

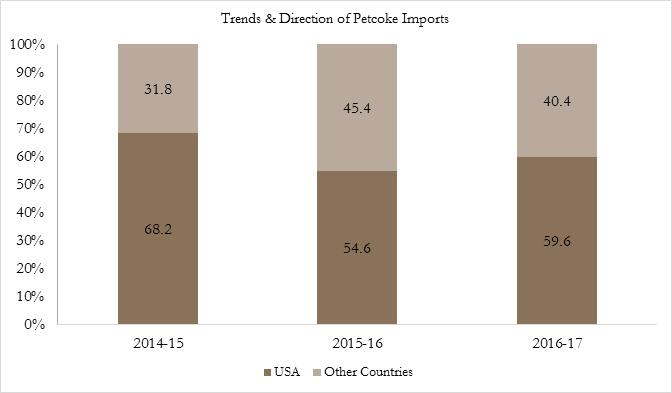

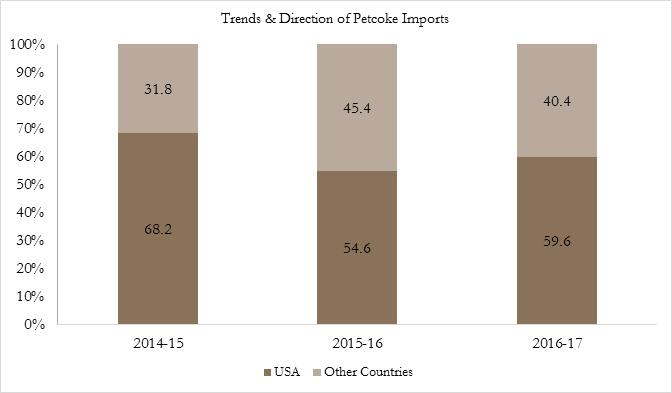

The government is planning to curb the imports of petroleum coke, which is believed to be a major polluter. Policy is being framed by various stakeholder ministries to put curbs on its imports. Petroleum coke does not cause pollution if it is used as fuel in certain industries such as cement production.

The government will be soon announcing a policy which calls for 15 percent blending of methanol in petrol to make it cheaper and also reduce pollution. Union Roads Minister Nitin Gadkari said methanol gets made from coal and costs only ₹ 22 per litre as against the prevailing price of about ₹ 80 per litre for petrol and added that China is making the coal byproduct for ₹ 17 per litre itself. Volvo has got a special engine to the financial capital which runs on methanol and using the locally available methanol. Total investment opportunity on ethanol alone if ₹ 1500 billion.

India’s refiners imported nearly half as much crude oil from Iran in November as the month before, ship tracking data showed, cutting purchases to a 21-month low in protest at Tehran’s decision to award a giant gas field to a Russian company. India, the world’s No. 3 crude oil consumer, received about 266,000 barrels per day (bpd) of oil from Iran last month, a decline of 43 percent from October and 55 percent from a year ago. For the fiscal year to March 2018, Indian refiners have opted to order about a quarter less Iranian crude as Tehran decided to award development rights for its huge Farzad B gas field to Russian rivals instead of an Indian consortium that discovered the field. For April-November, the first eight months of this fiscal year, India shipped in 19 percent less Iranian oil at about 427,200 bpd, according to the data. But India’s oil imports from Iran will likely rise in December, as vessels holding about 4 million barrels of oil sailed from the Iranian ports in end-November and discharged cargoes in early December, the data showed.

All powerful GST Council will consider bringing electricity, petroleum products and some other items under the ambit of GST in future. If petroleum products are brought under the GST regime, Bihar Finance Minister Sushil Modi said, it will attract the highest tax slab prevalent at that time and states would be at liberty to levy cess on it in order to protect their revenues. Both states and the Centre earn 40 percent of their revenue from petroleum products at present. The subsidy on kerosene is likely to be phased out by 2020. While there could be an increase in the subsidy on LPG, analysts said there would not be much net increase. For the first six months of FY18, the cumulative subsidy claims on LPG and kerosene to the petroleum ministry stood at ₹ 90.79 billion. The kerosene subsidy is expected to decline by 40 percent from ₹ 7,595 billion in 2016-17 to ₹ 45 billion this financial year. According to the PPAC, kerosene consumption fell 33.7 percent for the period April to October from the same period last year. The annual fall in kerosene consumption over the past five years has been 8.1 percent. During 2016-17, it was 5.3 million tonnes, down from 6.8 mt in 2015-16. Over the years, LPG has been replacing kerosene as a fuel in rural India. During 2016-17, its consumption rose almost 10 percent from the year before, to 21.5 mt. Under PMUY, the government has so far added 31.9 million consumers, taking the India total to 251.1 mn as of November.

ONGC has torn into regulator DGH's proposal for auctioning its discovered oil and gas fields, saying national oil companies can raise production if they are offered the same fiscal concessions as being extended to private companies. In para-wise comments on the DGH's proposal to auction 60 percent stake in some producing oil and gas fields of ONGC and OIL, ONGC said national oil companies (NOCs) should also be allowed to participate in the auction. DGH has identified 15 discovered and producing fields - 11 of ONGC and four of OIL - with a cumulative in-place reserve of 791.2 million tonnes of crude oil and 333.46 billion cubic metres of gas, for auctioning on the plea that private involvement will raise output. DGH has in the policy proposed to auction the fields to the bidder who commits the maximum investment and pledges the largest share of its net revenue to the government.

HPCL has written to Airtel and sought a reversal of subsidy amounts that have been wrongfully credited to the Airtel Payment bank accounts. ₹ 1.67 billion have been wrongfully credited to the Airtel Payment Bank interface through 310000 transactions. The OMCs and the oil ministry have been getting a large number of complaints from consumers regarding non-credit of the LPG subsidy amounts into their earlier bank accounts for the past few weeks, HPCL said. In order to link LPG subsidy to earlier bank account, HPCL has written to Airtel Bank and requested that the subsidy amounts of these consumers be immediately either transferred back to the customer’s earlier bank account or to the respective OMC’s, HPCL said.

The National Green Tribunal dismissed the application of the LPG Virudha Samara Samithi against IOC’s LPG import terminal at Puthuvypeen. In the application, the leaders of the Samara Samithi, wanted the tribunal to direct IOC not to implement the project. However, the tribunal refused to countenance the demand. The tribunal found no substance in the allegation that the project posed safety threats to the residents of the area. The tribunal upheld Indian Oil’s contention that storage of LPG is a permitted activity at the seashore under the CRZ norms and hence the project does not in any way offend those norms. However, the tribunal has observed that the company may undertake sea protection measures to arrest erosion at the project site. With this, IOC has overcome all the legal hurdles to the project. Earlier, the tribunal had also dismissed the Samara Samithi’s appeal against the extension of environmental clearance to the project. Samara Samithi preferred an appeal before the apex court against this. The Supreme Court, however, dismissed the appeal even without admitting the same. Though there was no stay against developing the project, the Samara Samithi had been obstructing the development of the project for more than 10 months now. IOC is stated to have suffered a loss of ₹ 1 billion per day on account of the delay. The project was conceived to meet the increasing demand for LPG in the country. For now, the oil major is transporting LPG by road in bulk LPG carrier trucks from a similar facility at Mangaluru.

The plan by state-run OMCs to expand its liquefied petroleum gas dealership has gathered momentum with the addition of 2,156 dealers in the past two months across 23 states. The road map is to appoint 6,149 distributors across the country through an online selection process, which might see an investment of ₹ 20 billion in the industry. However some opposition-ruled states such as West Bengal were not co-operating with the online bidding process despite several letters from the ministry of petroleum and natural gas and the OMCs — Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL). Kolkata-based MSTC is conducting the online draw for the OMCs. This is for the first time that OMCs have changed the selection process from physical to the digital mode, with the introduction of online receipts of application, processing and online draw. This initiative of the ministry is part of promoting Digital India and to bring more transparency and accountability in the selection process. The goal is to increase LPG penetration to 95 percent by 2020 from 74 percent. There are around 19,000 agencies and the government wants to increase that to 27,000 by 2019. Among the new distributors, 3,000 would be for IOC, while BPCL and HPCL would have 1,500 each. Meanwhile, the Cabinet is likely to take a call next month on a proposal to increase the reach of PMUY (Pradhan Mantri Ujjwala Yojana) schemes by adding 30 million connections. In the past two years, the BJP-led government was also successful in increasing LPG reach by more than 18 percent. To achieve this target, the Centre had launched the PMUY to provide 50 million LPG connections in three years to below-poverty-line families, with a government support of ₹ 1,600 a connection. So far, 32-million LPG users have been added under the scheme. Of the 6,149 distributors to be appointed, 1,028 would be in Uttar Pradesh, 986 in Bihar, 631 in West Bengal, 400 in Odisha, 300 in Jharkhand, 300 in Gujarat, 455 in Maharashtra, 355 in Madhya Pradesh and 298 in Tamil Nadu.

The government has withdrawn its decision to raise LPG prices by ₹ 4 per cylinder every month as the move was seen contrary to its Ujjwala scheme of providing free cooking gas connections to the poor. The government had previously ordered public sector oil marketing companies to raise domestic cooking gas or LPG prices by ₹ 4 per cylinder every month beginning June 2016 with a view to eliminating subsidies. The order was, however, withdrawn in October. IOC, BPCL and HPCL have not raised LPG prices from October.

India’s MRPL has made its first purchase of US crude oil, buying high-sulphur grade Southern Green Canyon through a buy tender for an early February delivery. MRPL bought a 1 million-barrel cargo for a Feb. 1-10 delivery,. Other Indian refiners - IOC, HPCL, BPCL and RIL - have also bought US oil in recent months. He declined to elaborate on the award of a separate MRPL buy tender for a million barrels of sour grades for January loading. MRPL bought Oman crude in the January tender. Both cargoes were sold by Royal Dutch Shell.

The oil ministry has set up a high-level committee to help frame fuel economy rules for tractors to moderate their diesel consumption that constitutes nearly 7.7 percent of India's annual diesel use. The nine-member Steering Committee, headed by an additional secretary in the oil ministry, will submit an interim report in six months and a final one on the road map for development of the norms in 15 months. Tractors are used for different applications and the average fuel consumed for each application varies. On a rotavator, they may consume 7-8 litres per house while on a trailer, they may give an efficiency of 5-7 kilometre per litre with the load. On static application like alternator or straw reaper, it could be 6-7 litres per house. Diesel is the most consumed fuel in India, accounting for over 56 percent of 82 million tonnes of petroleum products used in April-October. As much as 57 percent of diesel is used by automobiles, with trucks guzzling 28.25 percent. Tractors, agri equipment and agri pumpsets use 13 percent diesel while cars and SUVs use 13.15 percent of the fuel.

India’s crude oil production in October remained flat at 3,038 tmt as compared to the corresponding month a year ago while natural gas output grew 1.95 percent to 2,755 mmscm in the same month. The country’s gross petroleum imports in value terms increased a whopping 27.5 percent to $8.8 billion in October as compared to the corresponding month a year ago. Cumulatively, gross petroleum import bill increased 19 percent to $52.3 billion in the first seven months of 2017-18 as compared to the corresponding period last year on the back of increased international crude oil prices. Oil production dipped marginally by 0.4 percent due to poor performance of fields under Production Sharing Contracts (PSC), data shows. The growth in natural gas production is attributed to healthy performance of acreages under government-owned ONGC, data released by PPAC indicated. On a cumulative basis, the country’s crude oil production in the first seven months of 2017-2018 remained almost flat at 21,063 tmt decreasing 0.24 percent as compared to the corresponding period a year ago. Cumulative natural gas production during the period grew 4 percent to 19,222 mmscm as compared to the corresponding period a year ago. Government-owned ONGC, responsible for 62 percent of country’s crude oil production in October, witnessed a crude output growth of 0.93 percent to 1,890 tmt for the month. Cumulatively, the oil and gas behemoth witnessed a 2.25 percent increase in production to 13,192 tmt in the first seven months.

Rest of the World

US oil prices closed above $60 a barrel on the final trading day of the year, the first time since mid-2015, as the commodity ended 2017 with a 12 percent gain spurred by strong demand and declining global inventories. International benchmark Brent crude futures ended the year with a 17 percent rise, supported by ongoing supply cuts by top producers OPEC and Russia as well as strong demand from China. The spread between the benchmarks widened throughout the year, as Brent responded to the drawdown in supply from major world producers while US output continued to grow. The gains indicate that the global glut that has dogged the market since 2014 is shrinking. Earlier this year, oil prices slumped on concerns that rising crude production from Nigeria, Libya and elsewhere would undermine output cuts led by the OPEC and Russia. But prices have rallied nearly 50 percent since the middle of the year on robust demand and strong compliance with the production limits.

Saudi Arabia’s King Salman and Russian President Vladimir Putin held a telephone conversation during which they agreed to continue close cooperation to ensure stability on global hydrocarbon markets, the Kremlin said. During the call, the Saudi leader voiced his concern about a missile attack on Riyadh by a Yemen-based rebel group on December 19. The Kremlin said that Putin had condemned the attack and spoken of the need for a thorough investigation into it.

Ministers from OPEC and their allies have agreed to extend their production pact all the way to the end of 2018 but with a review in June that will take into account market conditions and progress toward rebalancing. The outcome represents a successful compromise between de facto OPEC leader Saudi Arabia (which wanted to announce an extension throughout 2018) and non-OPEC heavyweight Russia (which wanted to avoid giving such a long commitment). Saudi Arabia’s Oil Minister Khalid Al-Falih said the excess of OECD oil stocks over the five-year average had already shrunk from 280 million barrels in May to just 140 million in October. If OECD stocks were to decline to the five-year average, the market would almost certainly feel uncomfortably tight, given the enormous growth in oil consumption since 2012.

The US EIA cut its 2018 world oil demand growth forecast by 40,000 bpd to 1.62 million bpd. The EIA raised its oil demand growth estimate for 2017 by 80,000 bpd to 1.39 million bpd.

Brazil will likely limit planned cuts in local content requirements for future oil exploration and production contracts in a move aimed at appeasing local suppliers and to pave the way for an extension of customs breaks for oil companies. The measures would be a concession to some opponents of “Repetro,” a preferential customs regime for oil and gas companies, who were angered by steep cuts in local content requirements for oil contracts, according to Abimaq, a group which represents local suppliers. Famously tough requirements in Brazil have stymied investment by oil firms which had complained that complying made oil development in the country unprofitable. OPEC has started working on plans for an exit strategy from its deal to cut supplies with non-member producers. OPEC, Russia and other non-OPEC producers on November 30 extended an oil output-cutting deal until the end of 2018 to finish clearing a glut. But the market is increasingly interested in how producers will exit the deal once the excess is cleared. Oil prices have rallied this year and are trading near $64 a barrel, close to the highest since 2015, supported by the OPEC-led effort. This is above the $60 floor that sources say OPEC would like to see in 2018. Publicly, OPEC Ministers said it is too early to talk of an exit strategy. But OPEC has said producers want to continue working together beyond the end of 2018, including on supply management. While oil prices have risen to levels seen as favorable by OPEC, the stated goal of the supply cut is to reduce inventories in developed economies, which built up after a supply glut emerged in 2014, to the level of the five-year average. Non-OPEC Russia, which has been the biggest contributor to cuts from outside the group, has been suggesting a review of the deal as early as June. However, its biggest producer Rosneft said the cuts could last into 2019. Russia held on as China’s largest crude oil supplier for the ninth month in a row in November, also topping Saudi Arabia for the year so far, China’s General Administration of Customs data showed. Shipments from Russia in November reached 5.12 million tonnes, or 1.26 million barrels per day (bpd), up 11 percent from a year ago, according to detailed commodity trade data for last month from China’s General Administration of Customs. That compared to October’s 1.095 million bpd in Russian oil imports, and a record set in September at 1.545 million bpd. Saudi Arabia came in second, with November imports from there dropping 7.8 percent from a year ago to 1.056 million bpd. For the first 11 months of the year, Russian supplies expanded 15.5 percent on the year to 54.77 million tonnes, or 1.2 million bpd, overtaking Saudi Arabia by 159,000 bpd. The boost in Russian supplies was supported in part by robust demand from China’s independent refineries, and also by increases in supplies via a trans-Siberia pipeline. Iraq supplies ranked third in November with shipments at 4.21 million tonnes, or 1.023 million bpd. Year-to-date Iraq supplied 5.5 percent more oil than a year earlier at 762,900 bpd, the data showed. China’s total crude oil imports rebounded to the second highest on record last month to 9.01 million bpd, with imports partially driven by a new additional batch of import quotas released to independent refiners.

Swiss-based trading and mining giant Glencore Plc has partly completed the sale of a 51 percent stake in its storage and logistics businesses to a unit of China’s HNA Group, although transfer of some assets is pending US clearance. Glencore in March agreed to sell the stake in HG Storage International Ltd, a vehicle that carries its petroleum products storage and logistics portfolio, to HNA Innovation Finance Group Co for $775 million. HNA said that the companies had completed the deal and would operate HG Storage International Ltd’s portfolio in Europe, Africa and the Americas as a joint venture. Glencore had been looking to sell a bundle of its global oil storage stakes, following similar moves by rivals as a boom period for storage showed signs of ending. Demand for storage exploded following the oil price plunge in 2014 because the abundance of crude for immediate delivery meant traders could make millions by buying oil cheaply and storing it to resell later at higher prices.

NATIONAL: OIL

'Rajasthan to save Rs 400 bn from revised Barmer refinery plan'

January 9, 2018. Rajasthan will save nearly Rs 40,000 crore from the revised Viability Gap Funding and project plant for Hindustan Petroleum Corp Ltd (HPCL)’s Barmer refinery cum petrochemical complex. Oil Minister Dharmendra Pradhan said that the Barmer refinery will be the country’s first Greenfield Bharat Stage VI refinery cum petrochemical project. The project is expected to be commissioned by 2022-2023. The project has a total capacity of 9 million tonnes (mt). For this project, 2.5 mt crude will be sourced from the Barmer fields and the remaining 6.5 mt will be sourced through a pipeline connecting the refinery to the West Coast through Gujarat. The revised capital expenditure for the project will now be Rs 43,129 crore. This includes Rs 2,500 crore additional expenditure for laying the pipeline, according to the oil ministry. The earlier project cost stood at Rs 37,229 crore.

Source: The Hindu Business Line

No benefit to people from oil money going to government: Congress

January 4, 2018. The Congress accused the government of not passing on to consumers the benefits of revenue it has earned by hiking excise duty on oil products, saying it garnered over Rs 5.5 lakh crore and should tell the people what it has done with the money. Party leader Mallikarjun Kharge said petrol and diesel prices were not reduced in line with the falling price and instead, excise duty on diesel was hiked by 386 percent and on petrol by 126 percent.

Source: Business Standard

Madhya Pradesh cabinet approves increase in cess imposed on petrol, diesel

January 3, 2018. The cabinet, headed by Madhya Pradesh Chief Minister Shivraj Singh Chouhan, approved an increase in the cess to be imposed on petrol and diesel. The cabinet approved a 50 paise increase per litre in cess on these fuels. Earlier, the government in October slashed the Value Added Tax (VAT) on prices of petrol by three percent and diesel by five percent, following the Centre's decision to cut excise duty on fuel.

Source: The Economic Times

RIL buys largest insurance cover of 3 lakh crore for refinery

January 3, 2018. Reliance Industries Ltd (RIL) has bought one of the largest petrochemical policies in the world with an insurance cover in excess of Rs 3 lakh crore for its refinery and petrochemical plants located at Jamnagar and Hazira in Gujarat. The cover has been provided by New India Assurance and other co-insurers with support from GIC Re, which bears the bulk of the risk in this cover. The Rs 3 lakh crore policy is more than 33% higher than last year's cover for a little over Rs 2 lakh crore. The rise in sum insured follows the increase in refining capacity to 1.24 million barrels of oil per day. The premium in respect of the cover has gone up to over Rs 725 crore. When contacted, both GIC Re and New India Assurance refused to comment on the transaction on the grounds of client confidentiality.

Source: The Economic Times

NATIONAL: GAS

ONGC’s Kakinada asset to boost gas production

January 7, 2018. ONGC (Oil and Natural Gas Corp)’s eastern offshore asset based at Kakinada is enhancing its gas production substantially from February and is in a position to offer gas to more user industries, according to Executive Director and Asset Manager Alok Nandan. He said the asset, at present producing one million cubic meters daily, would hike it by an additional 5 million per day from next month. He said many units facing gas shortage and new units would benefit. Nandan said the gas from the offshore fields would be competitively priced compared with alternative fuels such as LNG (liquefied natural gas), imported naphtha, and imported coal. He said ₹35,000 crore worth off works would be taken up over the next few years to develop and exploit the offshore fields off Kakinada, and the production would go up by 15 million cubic meters per day by 2021. Tendering process was on for these works, he said. ONGC had set up a terminal for processing the gas at Vodalarevu in the Konaseema region of East Godavari district and the infrastructure was ready for supply to user industries. He urged Vizag-based entrepreneurs to make use of the opportunity and set up units in the Godavari region. A new office is being built at Kakinada for the eastern offshore asset.

Source: The Hindu Business Line

Adani raises gas prices

January 5, 2018. Natural gas consumers in Ahmedabad and Vadodara will now have shell out more for the gas they consume as Adani Gas Ltd (AGL) has increased the prices of piped natural gas (PNG) and compressed natural gas (CNG) for different segments including domestic, commercial and industrial. For residential (domestic) consumers, retail PNG price has been hiked by Rs 1.20 per standard cubic meter (scm) to Rs 21.36 per scm from Rs 20.16 per scm (exclusive of all taxes). The company has raised CNG price by Rs 1.85/kg to Rs 47.80 per kg from Rs 45.95 per kg (inclusive of all taxes). These revised prices are effective from January 2, 2018. AGL serves about 240,000 households and approximately 150,000 CNG users in Ahmedabad and Vadodara. According to the company website, as far as commercial and industrial segments are concerned, AGL has increased PNG prices (with minimum guaranteed off-take) for industrial consumers to Rs 31.81 per scm, while the rates have been hiked to Rs 45.17 per scm for commercial customers. Both these rates are exclusive of all taxes and are effective from January 1, 2018. Last year, ahead of assembly elections AGL had raised the prices of CNG and PNG (domestic) in the month of October but rolled back the hike on its own. Several city gas distribution (CGD) companies have increased natural gas prices after the central government's move to raise domestic natural gas prices from October 1, 2017. In December, Gujarat Gas Ltd (GGL), another CGD company, increased the prices of natural gas for industrial consumers.

Source: The Times of India

Government looks to split GAIL into 2 units, separate marketing ops

January 4, 2018. Amid talks of merger of public sector oil and gas companies, the government is considering a proposal to split GAIL (India) Ltd with the marketing operations spun off into a separate company. The plan is being discussed in the petroleum ministry as the Centre is unhappy with the state-run player's performance in building a pipeline network in addition to a possible conflict of interest in its role as the infrastructure provider as well as a carrier. The plan to split the company, which was set up mainly to develop gas sector infrastructure in the country, has been discussed in the past too, including by Atal Bihari Vajpayee government, but it did not materialise. Natural gas transmission and marketing are the core businesses of the PSU (Public Sector Undertaking), which has also diversified into petrochemicals and renewable energy. Last year, GAIL earned over 70% revenue from marketing operations, while over 40% of the profit came from natural gas transmission. The discussions come at a time when the government is working on completing Oil and Natural Gas Corp (ONGC) acquisition of Hindustan Petroleum Corp Ltd (HPCL) to bolster both the entities. The deal will help the government garner around Rs 35,000 crore by way of disinvestment receipts. While other merger plans will wait until the next year, Bharat Petroleum Corp Ltd (BPCL) and Indian Oil Corp (IOC) have made a pitch to take over GAIL. The government would first prefer to unbundle GAIL before deciding on consolidation.

Source: The Times of India

Cabinet approves MoU between India and Israel on cooperation in the O&G Sector

January 3, 2018. The Union Cabinet chaired by Prime Minister Shri Narendra Modi has approved the signing of the Memorandum of Understanding (MoU) between India and Israel on cooperation in the Oil and Gas (O&G) Sector. The MoU is expected to provide impetus to India - Israel ties in the energy sector.

Source: Business Standard

NATIONAL: COAL

CIL raises thermal coal prices to pay for salary rise

January 9, 2018. Coal India Ltd (CIL) has raised prices of the fuel used to fire power plants for the first time in about a year-and-a-half, as the world’s biggest coal producer shores up efforts to pay for higher salaries. The Kolkata-based state miner has increased the price of thermal coal for all consumers with effect from January 9, it said. Higher prices will boost the company’s revenue by about 19.56 billion rupees ($308 million) in the financial year ending March 31, it said. The price increase will add Rs 64.21 billion to its annual revenue. This is the first increase in thermal coal prices by the company since May 2016. It more than covers the cost of the higher salaries the company agreed to pay its non-executive workers retroactively from July 2016. The salary increase will cost CIL an average Rs 56.67 billion a year, it said. CIL rose as much as 5.4 percent to Rs 303 in Mumbai, its biggest intraday increase in a year. Thermal coal accounts for about 90 percent of CIL’s revenue. CIL’s shipments in December rose to the highest for the month in data going back to 2013, as power plants, its biggest customers, bought more to replenish their depleted inventories.

Source: Bloomberg

CIL to fund Jharia rail bypass project, bring back coal freight revenue

January 8, 2018. To bring back lost coal freight revenue, the ministry of railways has prepared a scheme for a bypass rail route near the 35-km line between Chandrapura and Dhanbad that was closed due to underground fire at the Jharia (Jharkhand) coalfields in June. This will be funded by government-owned Coal India Ltd (CIL), holding company of Bharat Coking Coal that operates the Jharia mines. Closure of the line meant an annual estimated loss for the railways of at least Rs 27.5 billion. RITES, the railways’ engineering arm, was asked to do the detailed project report and the Railway Board is expected to approve the proposal the coming week. The earlier line went through Jharia and was under threat of caving in due to underground fire. On an average, the route used to carry around 25 million tonnes of coal traffic a year, the annual loss of which was Rs 25 billion. The line also used to carry 12.4 million passengers a year, leading to annual loss of around Rs 2.5 billion. The railways had to shut the Dhanbad to Jharia route in 2007 for a similar reason. It is likely to be safe for operations from 2022 onwards. Only around 10 underground fires out of 80 have been extinguished since the government take over of coal mines in 1971.

Source: Business Standard

SCCL to invest Rs 100 bn on expansion in 5 yrs

January 7, 2018. Singareni Collieries Company Ltd (SCCL) will be investing about Rs 10,000 crore during the next five years on expansion programmes with a target to achieve Rs 34,000 crore revenues by then. SCCL said the investment involves expansion of new mines, adding 800 MW to the existing 1,200 MW power plant and setting up 500 MW solar power project. The government-owned coal mining company is poised to clock Rs 24,000 crore income this year from both selling coal and power and aims to take this figure to Rs 34,000 crore in five years. Currently, the miner has 47 coal mines spread across the northern part of Telangana with about 10 billion tonne reserves.

Source: Business Standard

CIL annual production target kept at 630 mt in FY19: Centre

January 5, 2018. The government said that the annual production target of state-owned Coal India Ltd (CIL) has been kept at 630 million tonnes (mt) for the upcoming financial year. Against the target of 408.6 mt, CIL produced 385.6 mt of coal till January 1 in the ongoing financial year, Coal Minister Piyush Goyal said. In the Annual Plan of CIL for 2017-18, the production target has been pegged at 600 mt. From the production level of 554 mt in 2016- 17, the PSU (Public Sector Undertaking) has envisaged to enhance its coal output to one billion tonnes by FY'20. CIL has identified mines with a production capacity of 908 mt so far. Considering the demand for coal from various segments, while finalising the Annual Plan of 2017-18, CIL was given the offtake target of 600 mt by the coal ministry. In a bid to achieve the annual target, CIL is required to increase its daily production to more than two mt during the remaining day of the ongoing financial year.

Source: Business Standard

‘Will strictly implement SC order on coal ban in TTZ’

January 5, 2018. The Taj Trapezium Zone (TTZ) authority, decided to strictly implement the Supreme Court (SC)'s order imposing a complete ban on the use of coal within the eco-sensitive 10, 400 square kilometer area, covering six districts, to protect the Taj Mahal. The decision was taken at a meeting chaired by TTZ chairman, K Rammohan Rao, who is also the commissioner of Agra region. The decision, however, was scoffed at by environmentalist M C Mehta who said it was not enough to protect the mausoleum. He said that making TTZ an independent body, without bureaucratic control over it, can find long-term solution to protect the monument and other historical places. The SC had earlier mandated industries using coal or coke to switch over to natural gas in order to protect the Taj from environmental pollution.

Source: The Times of India

NATIONAL: POWER

RInfra moves Maharashtra power regulator to transfer Mumbai business assets

January 9, 2018. Reliance Infrastructure (RInfra) said it has moved an application before Maharashtra Electricity Regulatory Commission (MERC) for its approval to assign RInfra's Transmission and Distribution Licenses and transfer the integrated Mumbai Power Business to Adani Transmission. The transfer will be executed through a sale of a wholly-owned subsidiary Reliance Electric Generation and Supply Ltd (REGSL). RInfra had signed a definitive binding agreement for 100 percent sale of its Mumbai power business with Adani Transmission for a total deal value of Rs 132.5 billion. The deal included RInfra’s integrated assets in power generation, transmission and distribution in Mumbai.

Source: Business Standard

Nobody can stall Bhangar power project: Trinamool Congress leader Molla

January 8, 2018. The Power Grid project will be set up in Bhangar, Trinamool Congress leader Abdur Rezzak Molla said. The agitators can talk to the administration if they want, but nobody can stall the project, he said. There was tension in the area after alleged Trinamool cadres attacked villagers a few days ago. A section of villagers have been opposing the power project.

Source: The Times of India

Delhi electricity regulator asks for feedback over power tariff revision

January 7, 2018. Delhi Electricity Regulatory Commission (DERC) recently issued a notice asking stakeholders for their feedback on the power tariff petitions filed by the three power companies by January-end. The discoms (distribution companies) have shown a combined revenue gap of over Rs 2,000 crore in their average revenue requirement (ARR) petitions for financial year 2018-19. This estimated gap would be scrutinised by DERC for tariff announcement for 2018-19 fiscal year. The power companies have been unhappy with the decision of last year's tariff order where DERC had said there was no need for a hike.

Source: The Economic Times

Haryana CM Khattar’s ancestral village owes Rs 179.7 mn in electricity dues

January 6, 2018. At the time when Haryana Chief Minister Manohar Lal Khattar is flag-bearer of the campaign, Mhara Gaon Jamag Gaon that aims to improve electricity supply and bill collection in villages, his own ancestral village has not paid electricity bills for last 20 years. Village Nindana in Rohtak district has electricity dues of Rs 17.97 crore till December 31, 2017 and these have piled up in the last two decades. CM Khattar holds the charge of Haryana's power department. As all kind of schemes have failed to impress locals in Nindana, the Uttar Haryana Bijli Vitran Nigam (UHBVN) is mulling to introduce another carrot-and-stick scheme to recover dues of Rs 17.97 crore. The electricity department officials frequently visit these villages and give them information about the Mhara Gaon Jamag Gaon campaign. In Haryana's Rohtak division, the electricity department had arrears of Rs 341 crore in rural belt and in the government departments that also have failed to clear their electricity dues. According to petitions filed before Haryana Electricity Regulatory Commission for revision of arrears in 2017-18, the UHBVN had projected a revenue gap of Rs 3,898 crore.

Source: The Economic Times

Maharashtra power utility corrects over 2k inflated electricity bills of farmers

January 6, 2018. State distribution company MSEDCL (Maharashtra State Electricity Distribution Company Ltd) has started correcting bills of farmers, who turned up at its camps. The camps started from January 1 and so far, 2,114 out of 5,395 bills have been corrected in Vidarbha. Several consumer activists had alleged that MSEDCL issues inflated power bills to farmers. MSEDCL recently launched an amnesty scheme for farmers wherein those paying the principal amount of arrears will not have to pay the interest and penalty. According to the data provided by MSEDCL, 5,395 bills having total Rs 13.45 crore amount were submitted for correction at the camps in Vidarbha. MSEDCL corrected 2,114 bills and the revised bill amount was Rs 2.23 crore. Some 560 bills were submitted for correction from rural areas of Nagpur district, of which 344 bills were corrected. The total bill amount was Rs 107.62 lakh of which bills of Rs 39.70 lakh were revised. The figure is very low for Akola district. Some 1,391 bills were submitted but only 114 were corrected. MSEDCL said that sub-divisional offices had been asked to take into account the connected load, meter reading, power consumption on the feeder concerned, hours of use etc while correcting the bills.

Source: The Economic Times

Adani, JSW & Tatas bid for stake in GMR’s Chhattisgarh power plant

January 6, 2018. Adani Power, JSW Energy and Tata Power have submitted bids to acquire a majority stake in GMR Infrastructure's 1,370 MW power plant in Chhattisgarh. State-run Neyveli Lignite did not submit its bid for the project. Neyveli had earlier held talks with the lenders for acquiring a controlling stake in the project. A consortium of lenders to the commissioned project led by Axis Bank is looking to divest its stake under the strategic debt restructuring (SDR) process. The 2x685 MW coal-based power plant achieved commercial operations in March 2017. The project is stranded as it does not have power purchase agreements with state power distribution utilities, leading to cost overruns and lenders invoking SDR. .

Source: The Economic Times

24 states under UDAY cut losses to nearly Rs 370 bn in FY'17

January 4, 2018. Government's UDAY (Ujwal Discom Assurance Yojana) scheme has helped debt laden discoms (distribution companies) of 24 states to reduce losses to Rs 36,905 crore in 2016-17 from Rs 51,590 crore in the previous fiscal. The Ujwal Discom Assurance Yojana (UDAY) was launched for the operational and financial turnaround of state-owned power discoms. The scheme aims to reduce interest burden, cost of power and power losses in distribution sector, besides improving operational efficiency of discoms. Power and Renewable Energy Minister R K Singh said the interventions under UDAY have yielded encouraging results. The participating states have achieved an improvement of one percent in Aggregate Technical & Commercial (AT&C or distribution) losses and Rs 0.17 a Unit in the gap between Average Cost of Supply and Average Revenue Realised in 2016- 17, he said.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

UP to adopt Gujarat canal solar panel project to generate power

January 9, 2018. Taking a leaf out of Gujarat’s book on generating solar power using water canals, the Uttar Pradesh (UP) government has decided to utilize its canals for this as well. It also plans to set up micro hydel plants across canals to generate electricity. The government has issued a letter of interest in this regard inviting private players to execute their plan on public-private partnership model. The canal solar power project was first launched in Gujarat by setting up solar panels across canals of the Narmada river to generate 1 MW of electricity.

Source: The Times of India

India mulls 70 percent safeguard duty on solar equipment imports

January 9, 2018. India has proposed to levy a 70 percent safeguard duty on import of solar power equipment from countries like China for 200 days to protect domestic industry from "serious injury". The safeguard duty would be levied if the finance ministry accepts the recommendations of the Directorate General of Safeguards (DGS). Before final duties or import taxes are levied, DGS will hold further investigation into the injury caused by cheap imports. It would also hold a public hearing on the issue. India has annual manufacturing capacity for solar cells of around 3 GW as against requirement of 20 GW. DGS said import of solar equipment jumped from 1,271 MW in 2014-15 to 4,186 MW in the next year and to 6,375 MW in 2016-17. Current fiscal imports are pegged at 9,474 MW as compared to domestic production of 1,164 MW. Reasoning its decision, it said while China's exports to India constituted a paltry 1.52 percent of its total global exports during 2012, this increased to 21.58 percent during 2016.

Source: Business Standard

ONGC solar chulha campaign, a step towards clean household cooking

January 8, 2018. Oil and Natural Gas Corp (ONGC) has embarked on an ambitious project on innovation towards making an "Efficient Electric Chulha (Stove)", in order to live up to the clarion call given by Prime Minister Narendra Modi to touch lives far and wide. ONGC launched a nationwide campaign to seek innovative solutions for the development of Solar Chulha. An overwhelming response with more than 1500 entries was received by ONGC in the duration of the campaign. An expert panel comprising of eminent scientists and chaired by Dr. Anil Kakodkar, Former Chairman, Atomic Energy Commission met at Mumbai to deliberate upon the proposals. The shortlisted participants shall be called for presenting their ideas followed by a demonstration of the proposed concepts. The top three entries will receive awards of Rs 10 Lakhs, Rs 5 Lakhs and Rs 3 Lakhs respectively. On successful demonstration and testing performance of the units, about 1000 units may be initially procured by ONGC for demonstration in different regions. ONGC may also provide financial support for fabrication of 1000 units, from the start up fund set up by ONGC to popularize the product amongst the masses. ONGC is working towards finding an efficient household cooking solution to ensure last-mile delivery of clean energy.

Source: The Economic Times

India rejects US solar claim at WTO, explores new defence

January 8, 2018. India hit back at Washington’s latest legal assault on its solar power policies at the World Trade Organization (WTO), rejecting a US (United States) legal claim and exploring possible new protection of India’s own solar industry. The US triggered a new round of litigation at the WTO, arguing that India had failed to abide by a ruling that it had illegally discriminated against foreign suppliers of solar cells and modules. India said it had changed its rules to conform with the ruling and that a US claim for punitive trade sanctions was groundless. It said Washington had skipped legal steps, failed to follow the correct WTO procedure, and omitted to mention any specific level of trade sanctions that it proposed to level on India, leaving India “severely prejudiced”. India would be vindicated if the proper process was followed, it said. Renewable energy has become an area of severe trade friction as major economies compete to dominate a sector that is expected to thrive as reliance on coal and oil dwindles. India unveiled its national solar programme in 2011, seeking to ease chronic energy shortages in Asia’s third-largest economy without creating pollution. But the US complained to the WTO in 2013, saying US solar exports to India had fallen by 90 percent. The WTO judges agreed that India had broken the trade rules by requiring solar power developers to use Indian-made cells and modules. In a separate move that could protect its solar industry from global competitors, not only US rivals, India told the WTO that it was considering the case for imposing temporary emergency tariffs on solar cells, modules and panels, after a petition from the domestic industry.

Source: Reuters

Adani Group among top 15 global utility solar power developers

January 8, 2018. Adani Group has been named in the top 15 global utility solar power developers that includes likes of First Solar, Total, SunEdison and Engie. Adani, ranked 12

th, is the only Indian company on the list put out by Greentech Media, a Wood Mackenzie business. Top of the list is First Solar with an operational capacity of 4,619 MW and in-development capacity of 4,802 MW. Adani has 788 MW of operational capacity and another 1,270 MW under development. Adani Renewables is targeting 10 GW of installed renewable power by 2022. The company currently has 12 MW of operational wind assets, as well as 788 MW of solar photovoltaic (PV).

Source: Business Standard

BSES launches rooftop solar single-point for apartment complexes

January 7, 2018. In an initiative to promote clean energy, BSES, one of Delhi's two electricity distribution companies (discoms), launched the country's first solar rooftop consumer aggregation programme for residential buildings to provide the installations at a single point for the entire apartment complex. The sister discom BSES Rajdhani Power Ltd's (BRPL) "Solar City Initiative", designed to maximise rooftop solar power use in south and west Delhi, was launched at an event by Delhi Power Minister Satyendar Jain. In the first phase of the programme, around 150 residential societies will be targeted in the Dwarka area. Listing the benefits for consumers, the discom said a 1 kW solar photovoltaic (PV) rooftop system is expected to generate 4-5 kilowatt hours (kWh) of electricity per day, which corresponds to an average monthly saving on bills of about Rs 750 for a period of 25 years for single-point delivery consumers. Besides, the scheme would help BRPL in meeting its renewable purchase obligation, as well as minimise overloading issues in congested areas during the peak summer months. BSES also announced that a portal has been launched as part of the initiative for online processing of rooftop solar applications, as well as a dedicated solar helpline for faster resolution of customer queries.

Source: Business Standard

Solar tariff bottoms out, may not have free fall in 2018

January 7, 2018. Solar power tariff fall seems to have bottomed out and may not drop beyond an all-time low of Rs 2.44 per unit in absence of well structured bids and rising solar panel prices on demand pressure. The solar power tariff fell to an all-time low of Rs 2.44 per unit in May last year during an auction for 500 MW capacities at Bhadla (IV) in Rajasthan. It had the viability gap funding component, as per the Ministry of New and Renewable Energy data. According to data, the solar tariff rose to Rs 3.47 per unit for 1,500 MW capacities in Tamil Nadu under a state scheme in July and then dropped again to Rs 2.66 per unit in an auction for 500 MW capacities in Gujarat. In an auction of state-run power giant NTPC for 250 MW capacity, the tariff was Rs 3.14 per unit. But it dropped again with viability gap funding to Rs 2.47 per unit and Rs 2.48 per unit for 500 MW Bhadla-III and 250 MW Bhadla-IV auctions in December 2017. Many experts are also of the view that solar tariff has bottomed out and may not fall further. During 2017, solar power tariff hovered around Rs 2.4 per unit level only in auctions for capacities, where viability gap funding component was there.

Source: The Times of India

Solar modules stuck at Indian ports due to import duty dispute

January 6, 2018. Solar modules worth more than $150 million are stuck at various Indian ports due to a dispute over their classification and the import tax applicable to them, which could delay Prime Minister Narendra Modi’s clean energy goals. Modi has set an ambitious target of nearly tripling the country’s total renewable energy capacity to 175 GW by 2022, spurring global firms including Japan’s SoftBank and Goldman Sachs to invest in solar projects in the country. Most of the solar modules come from China, but several consignments are now held up because customs officials have demanded that some of them be classified as “electric motors and generators”, attracting a 7.5 percent duty, not as “diodes, transistors and similar semi-conductor devices” with no duty. Indian Solar Association said that up to 2,000 solar module containers are now stranded at four major ports. The Indian unit of Germany’s Enerparc had 30 of its containers stuck at Chennai for three weeks as it finished some “paperwork” and paid a demurrage - a charge for failing to discharge the ship on time - of about Rs 7 million ($110,471). The renewable energy ministry has already asked the finance ministry to resolve the matter without disrupting business. Any duty is bad news for project developers such as SoftBank-backed SB Energy but good for local solar component makers such as Indosolar and Moser Baer. Indian manufacturers have struggled to compete with Chinese companies such as Trina Solar and Yingli and have sought anti-dumping duties as well as long-term safeguards. The finance ministry is examining a proposal from the renewable ministry to exempt projects bid earlier from paying the duty.

Source: Reuters

Solar companies ask regulators of Haryana, Uttarakhand to remove bottlenecks

January 5, 2018. Solar developers have moved the power regulators of Haryana and Uttarakhand to smoothen out anomalies which are impeding the growth of solar capacity in these two states. In one petition, the Distributed Solar Power Association (DISPA) has noted that the regulator, the Haryana Electricity Regulatory Commission (HERC) has yet to implement a key recommendation of the Haryana Solar Policy announced in March 2016. In another, it has appealed to the Uttarakhand Electricity Regulatory Commission (UERC) to remove the limit of 500 kW it has imposed on the size of rooftop solar plants. Haryana’s solar policy clearly states that both ground-mounted and rooftop solar projects should be exempted from “all electricity taxes and cess, electricity duty, wheeling charges, cross subsidy charges, transmission and distribution charges and surcharges”. However, HERC has not yet passed any order making these concessions effective. The petition before the UERC argues that the 500 kW limit for rooftop solar plants is entirely arbitrary. Its origins lie in the guidelines issued by the Ministry of New and Renewable Energy (MNRE) in June 2014, which imposed “a limit of 500 kW in respect of installed solar capacity for projects under net metering arrangement”. DISPA had also moved the Gujarat Electricity Regulatory Commission (GERC) to provide net metering and other incentives for putting up solar rooftop plants not only to house owners, but also to solar developers so that they can lease roofs from house owners. House owners were often reluctant to set up solar rooftop projects as they were unaware of the technicalities or could not afford the initial upfront costs. That petition is still pending.

Source: The Economic Times

ITC to invest Rs 20 bn in solar power, food processing in UP

January 5, 2018. In a meeting with Industries Minister Satish Mahana in Kolkata, ITC has expressed interest in investing Rs 2,000 crore in a food processing plant and a solar power plant in Uttar Pradesh (UP). Tractors India, too, has agreed to invest in a heavy machines and defence equipment plant in Greater Noida.

Source: The Economic Times

Haryana setting up plant in Karnal to produce gas from garbage

January 5, 2018. The Haryana government is setting up a plant in Karnal to process garbage and other waste to produce gas which would be used to generate electricity. Setting up of this plant would solve the problem of stubble burning and would also be beneficial in management of waste. Rs 1 crore has been spent on this plant by the Karnal Municipal Corp and it would start functioning from January 15. Such project would also be started in other districts of the state also. With a view to deal with the stubble burning issue, the state government has started this project which would produce about 50,000 tonnes of gas and about two lakh tonnes of bio- fertiliser.

Source: Business Standard

JSW Energy incorporates JSW Solar for clean energy biz

January 4, 2018. JSW Energy said it has incorporated a wholly owned subsidiary JSW Solar Ltd to pursue business opportunities in renewable energy and related segments. The company's board in August last year had approved the proposal of entering into electric vehicles, energy storage systems and associated business, directly or through one or more subsidiaries. The company had said that the expected capex to be incurred on these businesses over the next three years would be in the range of Rs 3,500 to Rs 4,000 crore. The company has also inked a pact with the Government of Gujarat to set up facility to manufacture electric car and storage battery.

Source: Business Standard

New Umtru Hydro Electric Project commissioned in Meghalaya

January 4, 2018. Power-starved Meghalaya added 40 MW power by formally commissioning the New Umtru Hydro Electric Project in Ri- Bhoi District bordering Assam. The commissioning of the 2x20 MW power project at Dehal is expected to ease the power deficit in the state. Meghalaya, which was once a power-surplus state, has now become power-deficit. Against the peak hour demand of 650 MW, the state generates only 186.7 MW, which is exclusively hydel-based power. Commissioning the project, Chief Minister Mukul Sangma said that the state has added substantially to its power generation capacity and encouraged the Meghalaya Power Generation Corp Ltd to further look at potential areas where small hydroelectric projects can be developed so as to improve the state's overall energy scenario, particularly in remote areas. He called for an integrated approach in optimum utilisation for the optimum benefit of the people, suggesting that the concept of water harvesting, water conservation can be integrated appropriately with power projects for optimum benefit. Till a decade ago, Meghalaya generated surplus power and sold it to neighbouring states. But today, the state shells out about Rs 20 crore for purchasing power every month. The situation may not improve in the near future as many of the hydel power projects under construction are running behind schedule.

Source: Business Standard

India consider 7.5 percent tariff on imported solar panels

January 4, 2018. India, the largest buyer of solar equipment from neighbouring China, is considering a 7.5 percent tax on imported solar panels. The finance ministry is considering the renewable-energy ministry’s request to tax panels imported for projects won under future solar auctions while exempting those already awarded. The proposed change could imperil Prime Minister Narendra Modi’s ambitious goal of installing 100 gigawatts of solar energy by 2022, especially as developers have relied on low-cost equipment from China to push tariffs to among the lowest in the world. India is planning to offer financial incentives to boost domestic manufacturing and energy security, while probing if Chinese solar-equipment makers are hurting the domestic industry by dumping inventories and driving down prices to unfair levels. Higher global module costs have already pushed up bid rates from record lows in auctions conducted by Solar Energy Corp of India late last year and the import tax could increase prices further.

Source: Bloomberg

Chennai Metro Rail to install solar streetlights at its staff quarters

January 4, 2018. Chennai Metro Rail Ltd (CMRL) will install 50 MW solar streetlights at its staff quarters in Koyambedu to maximise its use of renewable energy. CMRL has invited tenders for the purpose. This will be in addition to installation of such lights at various metro stations and solar panels to be set up to generate 6 MW power. Earlier, CMRL installed 25 such solar streetlights with similar capacity and battery backup at various stations including Koyambedu and Alandur. CMRL has already taken efforts to reduce its electricity consumption by first installing solar panels in administrative office at Koyambedu. The photovoltaic panels with a capacity of 1 MW were setup to generate power for its depot and admin office.

Source: The Economic Times

Remote villages in UP to get off-grid electricity via solar power

January 3, 2018. In an attempt to provide electricity to houses in remote and inaccessible areas of the state where electrification is not possible due to difficult geographical terrain, the Uttar Pradesh Power Corp Ltd (UPPCL) will soon be providing off-grid electricity by setting up solar power plants. According to the UPPCL, the task to identify the areas that are inaccessible and have not yet been brought under the corporation's power grid has been handed over to Non-conventional Energy Development Agency (NEDA). Small solar grids will be set up in the identified remote areas, which will cover one or more villages as per the requirement of load. Every house will be connected with it.

Source: The Economic Times

INTERNATIONAL: OIL

OPEC's cheer over 2018 oil rally tinged by shale worries

January 9, 2018. Oil’s price rally this year to its highest since May 2015 may seem a source of glee for OPEC (Organization of the Petroleum Exporting Countries), but some in the producer group fear the gains could prompt shale companies to crank open their spigots and flood the market. Benchmark Brent crude rose further above $68 a barrel, supported by oil output cuts led by the OPEC and allies including Russia that are due to run until the end of 2018. The surge comes as a welcome boost for the revenues of oil-producing nations, many still reeling from a price collapse that started in mid-2014 when crude began to fall steeply from above $100 per barrel due to oversupply. Some in OPEC are worried a prolonged rally could stimulate more US (United States) shale oil output, however, creating more oversupply that could weigh on prices and market share.

Source: Reuters

Norway's oil industry to boost staffing in coming years: Soeviknes

January 9, 2018. Norwegian oil companies and their suppliers will hire more people in the coming years as the industry recovers from a slump and the price of crude rises, Norway’s Minister of Petroleum and Energy Terje Soeviknes said. All evidence points to a significant increase in employment in the oil industry, Soeviknes said. In late 2017, oil firms presented new field development plans that will trigger billions of dollars of investment, and more plans are on the way in 2018.

Source: Reuters

Singapore uncovers large oil heist at Shell's biggest refinery

January 9, 2018. Eleven men were charged in a Singapore court in connection with a large-scale oil theft at Shell’s biggest refinery, while police said they were investigating six other men arrested in a weekend raid. Police in the island-state said they had detained 17 men, whose ages ranged from 30 to 63, and seized millions of dollars in cash and a small tanker during their investigations into theft at the Pulau Bukom industrial site, which sits just south of Singapore’s main island. Oil refining and shipping have contributed significantly to Singapore’s rising wealth during the past decades. But the case underlines the challenges the industry faces in a region that has become a hotspot for illegal oil trading. The investigation began after Shell contacted the authorities in August 2017, police said. Nine Singaporeans were immediately charged in the theft, of which eight were employees of the Singapore subsidiary of Royal Dutch Shell Plc, court documents showed. Shell said it anticipated “a short delay” in its supply operations at Bukom, its largest wholly owned refinery in the world in terms of crude distillation capacity. It declined to say the total amount of oil stolen. Singapore is one of the world’s most important oil trading hubs, with much of the Middle East’s crude oil passing through Singapore before being delivered to the huge consumers in China, Japan and South Korea. Singapore is also Southeast Asia’s main refinery hub and the world’s biggest marine refueling stop. Shell is one of the biggest and longest established foreign investors in Singapore. Its oil refinery on Bukom island can process 500,000 barrels per day.

Source: Reuters

Iraq to export Kirkuk oil to Iran before end-January: Iraqi Oil Minister

January 7, 2018. Iraq will start exporting oil from the northern Kirkuk fields to Iran before the end of January, Iraqi Oil Minister Jabar al-Luaibi said. About 30,000 barrels per day of crude will be trucked to Iran’s Kermanshah refinery in the first instance, he said. Trucking crude to Iran comes under a swap agreement announced last month by the two countries to allow a resumption of oil exports from Kirkuk. Iraq and Iran have agreed to swap up to 60,000 barrels per day of crude produced from Kirkuk for Iranian oil to be delivered to southern Iraq, Luaibi said. Kirkuk crude sales have been halted since Iraqi forces took back control of the fields from the Kurds in October. Kurdish forces took control of Kirkuk in 2014, when the Iraqi army collapsed in the face of Islamic State. The Kurdish move prevented the militants from seizing the region’s oilfields. Iraq and Iran are also planning to build a pipeline to carry the oil from Kirkuk to avoid having to truck the crude, Luaibi said. The planned pipeline could replace the existing export route from Kirkuk via Turkey and the Mediterranean.

Source: Reuters

Libyan oil firm hopes for Ras Lanuf restart in second half of 2018 after refinery ruling

January 7, 2018. The Ras Lanuf Oil and Gas Processing Company (RASCO) welcomed rulings in favor of the Libyan National Oil Corp (NOC) in international arbitration cases over the 200,000 barrels per day (bpd) Ras Lanuf refinery, and said it hoped to restart work in the second half of this year. The rulings “coincide with preparations by the Ras Lanuf company to resume operations in the second half of 2018”, the company said. The NOC earlier said it had won two rulings over the refinery and called for a restart as soon as possible.

Source: Reuters

Venezuela will issue $5.9 bn in oil-backed cryptocurrency: President

January 6, 2018. President Nicolas Maduro said that Venezuela would issue 100 million units of its new oil-backed cryptocurrency in coming days, although it is unclear whether any investors will want to purchase the “petro” at a time when the OPEC member is going through a deep economic crisis and its leftist government has little credibility. Maduro specified that each unit of the currency would be pegged to Venezuela’s oil basket, which averaged $59.07 per barrel, according to the oil ministry. That implies the total cryptocurrency issued would be worth just over $5.9 billion. Venezuela has the world’s largest oil reserves, according to OPEC, and makes some 95 percent of its export revenue from oil. Critics say the government has squandered wealth from a decade-long oil boom and that without reforms any influx of resources will also be burned through.

Source: Reuters

China says will limit oil, refined product exports to North Korea

January 5, 2018. China’s commerce ministry said it will limit exports of crude oil, refined oil products, steel and other metals to North Korea, in line with tough new sanctions imposed by the United Nations (UN) for Pyongyang’s missile tests. The statement comes after the UN Security Council unanimously voted in favour of new penalties on North Korea for its recent intercontinental ballistic missile test, seeking to limit its access to refined petroleum products and crude oil. The move by China will be effective on January 6, it said. Among the measures in the December resolution, the UN prohibits nearly 90 percent of refined petroleum exports to North Korea by capping them at 500,000 barrels a year and limits crude oil supplies to 4 million barrels a year.

Source: Reuters

Canadian oil exports to US dip in November

January 5, 2018. Canadian exports of crude oil fell 2.4 percent month-on-month in November to 3.28 million barrels per day, Statistics Canada data said, after a decline in shipments to the United States (US). The 80,000 barrels per day (bpd) drop in exports to Canada’s biggest customer came in the same month TransCanada Corp’s Keystone pipeline, which carries crude from Alberta’s oil sands to US refineries, was shut down following a leak in rural South Dakota. Keystone restarted in late November but the 590,000 bpd pipeline is still running with a 20 percent cut in pressure on the orders of US regulators. Canada exported 3.26 million bpd to the US in November, down from 3.34 million bpd in October. It also shipped 22,500 bpd to the United Kingdom, the data showed. The country’s crude oil imports from the United States rose 127,000 bpd to 413,000 bpd, while total imports climbed 51,000 bpd to 635,000 bpd. Canada also imported crude oil from Saudi Arabia, Nigeria and Norway in November. Refineries in eastern Canada often import crude from overseas because it is easier to ship barrels by tanker to the Atlantic coast than move them on congested export pipelines and railroads from western Canadian oilfields.

Source: Reuters

Trump administration aims to open nearly all US offshore to oil drilling

January 4, 2018. The Trump administration proposed opening nearly all US offshore waters to oil and gas drilling, a move aimed at boosting domestic energy production that sparked protests from coastal states, environmentalists and the tourism industry. The effort to open previously off-limits acreage in the Atlantic, Arctic and Pacific oceans comes less than eight years after BP Plc’s Deepwater Horizon oil spill in the Gulf of Mexico - the largest in American history. The disaster caused billions of dollars in economic damage and led former President Barack Obama’s to increase regulation of the industry.

Source: Reuters

INTERNATIONAL: GAS

Indonesia to open over billion dollar tender for Borneo gas pipelines

January 9, 2018. Indonesia will open a tender in 2018 for the development of three pipelines to transport and distribute gas from the Natuna area to the island of Borneo, the country’s downstream oil and gas regulator (BPH Migas) chairman Muhammad Fanshurullah Asa said. Natuna, between the Malay peninsula and Borneo, is home to several gas-producing fields. The tender will be for a Natuna to West Kalimantan pipeline worth an estimated $550 million, a West Kalimantan to Central Kalimantan pipeline worth around $516 million, and a Central Kalimantan to South Kalimantan pipeline worth about $97 million.

Source: Reuters

US natural gas output, demand seen rising to record highs in 2018

January 9, 2018. US dry natural gas production was forecast to rise to an all-time high of 80.42 billion cubic feet per day (bcfd) in 2018 from 73.57 bcfd in 2017, according to the Energy Information Administration (EIA)’s Short Term Energy Outlook (STEO). The latest January output projection for 2018 was up from the EIA’s 79.70-bcfd forecast in December and would easily top the current annual record high of 74.15 bcfd produced on average in 2015. EIA also projected US gas consumption would rise to an all-time high of 77.53 bcfd in 2018 from 74.04 bcfd in 2017. That 2018 demand projection in the January STEO report was up from EIA’s 76.85-bcfd forecast for the year in its December report and would easily top the current annual record high of 75.10 bcfd consumed on average in 2016. Both production and consumption would jump to record highs in 2019 with output hitting 83.02 bcfd and usage reaching 79.72 bcfd, the EIA forecast. The EIA projected gas’ share of generation would rise to 33.1 percent in 2018 and 34.3 percent in 2019 from 31.7 percent in 2017.

Source: Reuters

Europe to resume role as global gas sink

January 8, 2018. Europe will resume its role as a global gas sink from 2018-2020, absorbing surplus volumes of global LNG (liquefied natural gas) as supply growth outstrips demand. That is the view of oil and gas analysts at BMI Research, who stated in a recent report that the region’s ‘large and liquidly traded’ gas hubs, strong pipeline interconnectivity, extensive regasification capacity, substantial volumes of flexible supply and price responsive demand will enable Europe to adopt this position. BMI analysts highlighted that Europe's role in rebalancing the LNG market was previously established from 2009-2011, when it absorbed volumes that had been backed out of the United States (US) market by the rise in shale and released them out to Asia following the Fukushima nuclear incident.

Source: Rigzone

Angola LNG production setback prompts tender cancellation

January 8, 2018. A production issue affecting the Chevron-led Angola liquefied natural gas (LNG) export facility has prompted the cancellation of a tender to sell a spot cargo that was due to load. Angola LNG circulated a notice to the trading community advising them of the production issue. Angola LNG launched a tender to sell a cargo loading on Jan. 10-11.

Source: Reuters

Nigeria restores supply of gas on pipeline affected by fire