-

CENTRES

Progammes & Centres

Location

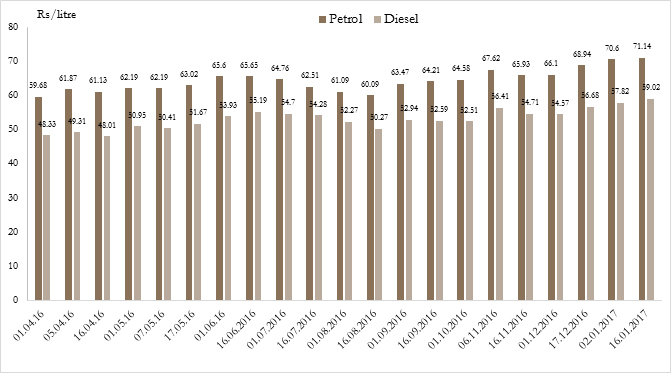

Middle class owners of personal vehicles in India, with four or two wheels, have been asking why they are paying roughly the same price for a litre of petrol even though the price of crude oil has fallen by more than half in the last few years. It appears that the question has now reached the level of policy makers. In a response to the question in the Parliament the concerned Minister has stated that the current price of petrol at Rs 73.60/litre (in Delhi) was lower than the price in FY 14 at Rs 71/litre and that the money collected through taxes on petroleum products was being used to develop infrastructure and creating educational facilities. The explanation for the insignificant reduction in retail price was that excise duty had been increased to Rs 12/litre and that the rupee had depreciated against the dollar, the currency in which crude oil is purchased. VAT and other local levies by the state governments were also included among reasons why the price of petrol in India had not fallen to the extent the price of crude oil had fallen.

Yet another gain from the oil sector to the government was the reduction in the subsidy burden. The government reported that with the termination of over 33 million illegal LPG connections, the government had saved Rs 210 billion (or roughly $3 billion) in subsidies. The government also said that the Direct Benefit Transfer scheme for LPG benefitted over 176 million consumers and over Rs 400 billion (or about $ 6 billion) of subsidy was transferred directly to the beneficiaries’ bank accounts in the last two years.

One of the ambitious initiatives announced in the budget was that of the merger of state-run energy companies to create a single company with market value of over $ 400 billion supposedly provide India the muscle to acquire assets abroad and negotiate better. According to the government this would bring the entity on par with BP, which has a market value of $115 billion. This is probably the right step if India wants to project power in the international arena but the wrong step if India wants to unleash the power of the market in the domestic arena. A single company will become monopoly producer and supplier of oil and oil derived products much in the same way Coal India Ltd is the dominant producer of coal in the country. This will distort competition and reduce efficiency as it has in the case of coal. The comparison with BP is inaccurate as BP is not a state owned company nor does it have a monopoly in Britain which is home territory. There is also the question whether the idea of acquiring oil assets outside the country is strategically that important for India so as to modify the entire structure of the industry to pursue this single goal.

There was more news on government moves in the oil sector in the budget. The government announced that it will build two more underground crude oil storages at Chandikhol in Odisha and Bikaner in Rajasthan in addition to underground storages in rock caverns at Visakhapatnam, Mangalore and Padur. The storage at Chandikhol is expected to be an underground rock cavern while the one at Bikaner is expected to be an underground salt caverns. Phase-II storage will have a total capacity of 10 MT which includes 4.4 MT storage capacity at Chandikhol and 5.6 MT at Bikaner. Abu Dhabi National Oil Company has reportedly signed an agreement to hire half of the capacity of India’s maiden strategic oil storage at Mangalore. India is 81 percent dependent on imports to meet its crude oil needs.

Now that Iran has been freed from sanctions, India’s annual oil imports from Iran have reportedly surged to a record high in 2016. According to Reuters, Iran is now the fourth largest supplier to India. In 2016 India bought about 473,000 bpd of oil from Iran to feed expanding refining capacity, up from 208,300 bpd in 2015. Indian refiners RIL, HPCL, BPCL and HPCL-Mittal Energy Ltd were said to have resumed imports from Tehran, attracted by the discount offered by Iran. Overall, India imported 4.3 million bpd oil in 2016, up 7.4 percent from the previous year. Rising imports from Iran and Iraq lifted the Middle Eastern share in India’s crude diet to 64 percent in 2016, reversing a declines in recent years, partly due to rising prices for Atlantic Basin oil tied to Brent. Saudi Arabia remained the top supplier to India last year followed by Iraq and Venezuela.

A survey by Reuters reportedly revealed that Saudi Arabia wanted oil prices to rise to $60/bbl this year. As OPEC compliance with supply constraints is reported to have improved with Iraq and UAE pledging more cuts $60/bbl does not appear to be unrealistic. OPEC already achieved close to a 90 percent compliance rate with its oil production cut, and compliance could increase as Iraq and UAE promise to accelerate their reductions. The two OPEC members were the main laggards in what was an otherwise impressive rate of compliance. Supply from the 11 OPEC members with production targets under the deal in had fallen to 29.921 million bpd. This amounts to 92 percent compliance, according to an OPEC calculation. Compliance of 92 percent comfortably exceeds the initial 60 percent achieved when OPEC’s previous deal to cut was implemented in 2009, and the OPEC figures add to indications that adherence so far has been high. The IEA said that oil production fell by around 1.5 bpd including by 1 million bpd for OPEC, leading to record initial compliance by OPEC with a six-month output-cut deal reached in December by big producers to boost prices. The IEA said if the January level of compliance were maintained, the output reductions combined with strong demand growth should help ease the record stocks overhang in the next six months by around 600,000 bpd.

Staying with the oil states of the Persian Gulf, Saudi Arabia’s King Salman and a large entourage were reported to be taking a month-long tour through Asia, hoping to bolster partnerships and increase investments in the region as they do not see USA as a dependable market. One of the first outcomes was the decision by Saudi Arabia to invest $7 billion in a petrochemical complex in Malaysia. New investment flowing into the region is increasing oil reserves at a fast pace. Iraq’s oil reserves were reportedly increased to 153 billion barrels from 143 billion barrels bringing it closer to reserves of Iran out at 158 billion barrels. Iraq is now OPEC’s second largest producer after Saudi Arabia.

Low oil prices continue to take their toll. Major oil companies are actively finding ways to deal with the problem of abundance. Shell was reportedly the third oil major to scale back ambitions in Canada’s oil sands. Last week, ExxonMobil and ConocoPhillips de-booked billions of barrels of oil reserves in Canada, admitting that they were not viable in today’s market. As for Venezuela, the geopolitical deals that it struck with China and Russia with an estimated value of $55 billion were reportedly going bad with the fall in oil prices.

February 28, 2017. The government has bailed out Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) from a potential liability of about Rs 22,000 crore in royalty dues to states like Gujarat and Assam. The central government will pay two state-owned firms’ outstanding liabilities of Rs 14,698 crore directly to the state governments, who will not insist on levy of Rs 7,223 crore interest on payments that were due from April 2008. ONGC had to pay Gujarat Rs 8,392 crore and Assam Rs 1,404 crore in royalties for the period between April 1, 2008 and January 2014. On this amount, it faced an interest liability of Rs 2,868 crore. Similarly, OIL had to pay the Assam government Rs 4,902 crore in royalty dues and another Rs 4,355 crore in interest. ONGC sold crude oil to public sector undertaking (PSU) refiners at a discount since 2003-04 on government directive so as to help partly subsidise petrol, diesel, liquefied petroleum gas (LPG) and kerosene price. Royalty payable to the state, in which oil is produced, was paid on pre-discount sale price till March 31, 2008. Subsequently, royalty was paid to states on post discount sale price with effect from April 1, 2008 in line with an oil ministry order.

Source: The Economic Times

February 28, 2017. Reliance Industries Ltd (RIL) has bought between 60,000 and 90,000 tonnes of heavy full-range naphtha for March arrival to plug a supply gap due to its growing petrochemical capacity. The purchase came at a time when Asian naphtha supplies are relatively tight due to firm demand and low volumes of Western cargoes arriving in the East. Details on price, sellers and origin of the cargoes were not clear. RIL is continuing to export lighter naphtha that typically is consumed in steam crackers for petrochemical manufacturing. It has already sold at least 160,000 tonnes of naphtha with a minimum 70 percent paraffin content for March loading from Sikka. It offered another 55,000 tonnes for late March loading. This brought its total exports of paraffinic naphtha next month to over 210,000 tonnes, making it the dominant seller among other refiners such as Indian Oil Corp, Bharat Petroleum Corp Ltd.

Source: Reuters

February 28, 2017. Prime Minister (PM) Narendra Modi will inaugurate ONGC Petro Additions Ltd (OPaL)’s mega petrochemical project at Dahej on 7 March, Oil Minister Dharmendra Pradhan said. Spread over 508 hectares with an investment of over Rs 30,000 crore, OPaL is the single-largest petrochemical complex in India producing 1.9 million metric tonnes (MMT), Pradhan said. The complex consists of a dual feed cracker unit with a capacity to produce 1,100 kilo tonnes per annum (KTPA) Ethylene, 400 KTPA Propylene along with Polymerisation Units and various Associated Units consisting of Pyrolysis Gasoline Hydrogenation Unit, Butadiene and Benzene Extraction Units. OPaL is a joint venture company incorporated in 2006 promoted by ONGC and co-promoted by GAIL (India) Ltd and Gujarat State Petroleum Corp. OPaL has set-up the mega petrochemical project in the port city of Dahej, Gujarat as part of the Petroleum, Chemicals and Petrochemical Investment Region.

Source: The Economic Times

February 28, 2017. Adani Group plans to expand its share in the ship-fuelling market by leveraging the ports it has on India’s east and west coast. The idea is to use its ports to fuel the ships passing through the country, taking away business from ports at Fujairah, Dubai and Singapore, and expanding the 1 million tonne (MT) Indian bunkering market valued at Rs 4,000 crore to 3.5 MT by 2020. Bunker or ship fuel accounts for the majority of a ship’s operating costs. Adani Group’s plan comes in the backdrop of India’s ambitious Sagarmala programme which envisages construction of new ports to harness the country’s 7,517 km coastline and set up of as many as 142 cargo terminals at major ports at an estimated cost of Rs 93,000 crore. India has 12 major ports. Adani Ports and Special Economic Zone Ltd, India’s biggest private port operator has a cargo handling capacity of 151.51 MT. APSEZ owns and operates eight ports and terminals in India at Mundra, Dahej, Kandla and Hazira in Gujarat, Dhamra in Orissa, Mormugao in Goa, Visakhapatnam in Andhra Pradesh and Kattupalli in Chennai. The company is developing terminals at Ennore in Tamil Nadu and Vizhinjam in Kerala. The global bunkering market is estimated at around 35mt, with vessels coming to India requiring around 10mt of ship fuel. According to the government, the total overseas traffic registered by the Indian ports in 2013-14 was 811.11 MT, of which 91.5% was carried by foreign flag vessels.

Source: Livemint

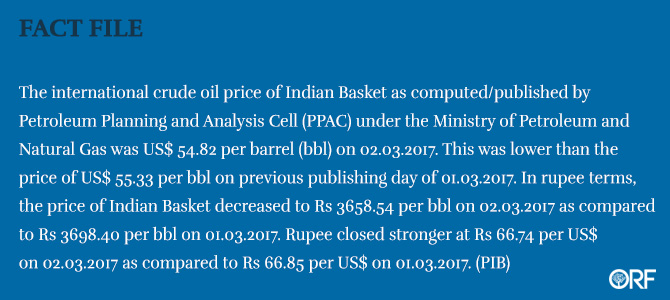

February 27, 2017. India’s crude oil import bill is expected to increase by 12.5 percent to $72 billion in the current financial year (2016-17), according to Petroleum Planning and Analysis Cell (PPAC), the oil ministry’s technical wing. In the first ten months of the current fiscal (April-January), the Indian basket of crude oil averaged $47 per barrel as compared to $49 per barrel in the corresponding period last fiscal. During April-January 2016-17, the country’s import bill increased a mere 1.59 percent to $ 57.2 billion as compared to the corresponding period last fiscal year. PPAC said any upward change in the exchange rate or increase in crude oil prices during the last quarter of 2016-17 will push the country’s crude import bill above the $72 billion mark. India’s crude oil import bill fell 21 percent to $112.7 billion in 2014-15 and 43 percent to $64 billion in 2015-16.

Source: The Economic Times

February 27, 2017. Oil and Natural Gas Corp (ONGC) will take control of Hindustan Petroleum Corp Ltd (HPCL) as part of the government’s plan to create an integrated public sector oil entity. India plans to create a giant oil company by combining state-owned firms, Finance Minister Arun Jaitley said in the budget speech as the world’s third largest oil consumer looks to better compete with global majors in acquiring foreign assets.

Source: Reuters

February 27, 2017. Several banks are still imposing the transaction fee on consumers paying by debit card for fuel despite a clear instruction from the government not to do so. Several inconvenienced customers have written to the oil ministry in the past few weeks regarding this illegal deduction, the oil ministry said. The ministry is engaged in persuading banks with the help of the finance ministry to reverse these charges. In order to boost digital payments after demonetisation, the government had said that no bank can levy fuel surcharge or transaction fee on customers paying by debit cards. An RBI order also bars banks from levying the fee on consumers; it directs them to recover it from merchants. But the petrol pump dealers have argued that their margin was too thin to pay for fuel surcharge, which is about 2.5% plus service tax. Therefore, the government clarified that petrol pumps too would not pay the fuel surcharge and left it to oil companies to sort this out with the banks. The current arrangement allows for the card issuing banks to submit information on daily fuel purchase transactions to oil retailers such as Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) and get compensated. But according to consumers and oil ministry, many banks including those from the public and the private sector are still levying fuel surcharge. Customers said it was a mammoth task to get banks to reverse these charges. Consumers paid Rs 14,000 crore digitally to petrol pumps between November 9 and December 31, according to the oil ministry data. By December end, digital transactions made up nearly 30% of total sales from 10% before the demonetisation.

Source: The Times of India

February 26, 2017. In a big jolt to Indian Oil Corp (IOC), the Odisha government has withdrawn tax incentives given to the ₹34,555 crore Paradip refinery, making the company reconsider its plans to invest another ₹52,000 crore in the State. The withdrawal will cost ₹2,000 crore to IOC this year and will progressively increase every year as more petrol and diesel as also petrochemicals are sold within the State. Besides leading to levy of sales tax on 2 million tonnes of petrol and diesel sold in the State annually, the withdrawal is threatening viability of investments in downstream petrochemical plants as products from it will be consumed by an array of synthetic fibre and plastic industries and now tax will also be levied on them.

Source: The Hindu

February 23, 2017. The Modi government is planning to launch its first major auction of oilfields within the next two months under the revamped Hydrocarbon Exploration Licensing Policy (HELP) worked out by the oil ministry. This would also be India’s first oil blocks licensing round since 2010 when acreages were awarded in such an auction under the then applicable New Exploration Licensing Policy. Significantly, the bidding round would be conducted through the newly worked out Open Acreage Licensing Policy (OALP) that will allow interested firms to bid for blocks of their choice at any time of the year. A key highlight of the process would be the simultaneous launch of National Data Repository (NDR) a comprehensive database of the country’s key sedimentary basins that will provide the bidders data on contract areas that will be bid out. The next round of auction under HELP will follow the just-concluded bidding for Discovered Small Fields (DSF) under which 31 oil blocks are to be awarded to around two dozen mostly small-sized firms. The HELP regime is expected to cut down delays in development of blocks and legal disputes with companies because of its revenue share methodology, the ministry believes. Under HELP, an upstream player will be allowed to explore both conventional and unconventional oil and gas resources including Coal Bed Methane, Shale gas and oil and gas hydrates under a single license. The new policy also stipulates a differential structure of royalty rates based on the depth of the field. The new policy and the upcoming auctions are part of the ministry’s effort to achieve the target of cutting down India’s import dependence for energy by 10 percent by 2022 set by Prime Minister Narendra Modi

Source: The Economic Times

February 23, 2017. Discovery of theft of a massive amount of petrol from a pipeline of the Mathura Refinery has sparked investigation into what police said was a highly organised racket. While the Indian Oil Corp (IOC) has estimated the amount of petrol stolen at 1 lakh litres in February, investigators said the racket had been going on since September last year and the actual amount could be much higher. The oil pilferage came into light on the night of February 16 when, during patrolling, refinery guards found an oil truck parked near a pipeline which supplies refined petroleum to Jalandhar. Mathura Refinery manager Virender Kumar filed an FIR against unidentified men at the highway police station in Mathura and mentioned an estimated “100 kilo litres” (1 lakh litres) had been siphoned off so far.

Source: The Economic Times

February 22, 2017. Rising global oil prices will not pose a serious risk to the economy if they remain within the range of $55-65 a barrel, chief economic adviser Arvind Subramanian said. After remaining fairly stable for much of the last two years, international prices of crude oil have started to trend up. Subramanian said if it starts going above $55, production will come on stream to keep crude oil prices under check. Price of basket of crude oil that India buys has increased from $39.9 last April to $52.7 in December. It is estimated that oil prices could rise by as much as one-sixth over the 2016-17 level, which could have dampening impact on the growth.

Source: The Economic Times

February 27, 2017. India produced 2,738 million metric standard cubic meter (MMSCM) of natural gas in January 2017, registering a growth of 12 percent over the same month last fiscal. Nothing unusual about it, expect that it was the highest growth recorded in the past 30 months, or two-and-a-half-years, for which data is publicly available. An analysis of fresh data released by Petroleum Planning and Analysis Cell (PPAC), the oil ministry’s technical arm, reveals the sudden surge in growth last month is not a result of increased production. Total monthly output has grown from 2,488 MMSCM in April 2016 to 2,738 MMSCM in January 2017. The historic growth is rather attributed to low base effect — a sudden dip observed in the output for January 2016. In January 2016, the natural gas production had dropped by a sharp 15.3 percent. The decline was attributed mainly to fall in output from the Oil and Natural Corp (ONGC), which alone accounts for a bulk of the domestic production, and private sector companies. ONGC’s production had dropped 19.3 percent to 1,530 MMSCM in January 2016 due to less production in Bassein field due to shutdown for reconstruction activities and closure of wells in Cauvery basin on account of less off-take by consumers. Also, natural gas production from private and joint venture (JV) fields had decreased 12 percent in January 2016 to 670 MMSCM mainly due to production fall in Krishna Godavari D6 block, Panna-Mukta, M&S Tapti and Ravva fields. Cumulatively, India’s natural gas production fell two percent in the April-January period of 2016-17 as compared to the corresponding period a year ago. This was despite ONGC and Oil India’s better performance. ONGC’s output increased 25.6 percent to 1,922 million cubic meters in January, 2017 as compared to the same month a year ago. The firm’s production rose three percent to 18,342 MMSCM for the first ten months of 2016-17. For Oil India, there was a growth in production of more than six percent to 248.79 million cubic meters for January 2017. Cumulatively, the company produced 2,460 MMSCM in the first ten months of 2016-17 a growth of four percent as compared to the corresponding period a year ago.

Source: The Economic Times

February 27, 2017. GAIL (India) Ltd CMD (Chairman and Managing Director) B C Tripathi sought waiver off customs duty on liquefied natural gas (LNG) and raised his decibel for bringing in “natural gas” into GST fold, yelling that India desperately requires “a well crafted integrated energy policy” in the absence of which, it cannot move towards gas based economy and hardly create an intense urge and addiction for mass consumption of natural gas. The CMD said that GAIL on its own way would promote campaign such as “Swachh Bijlee” for cleaner environment on lines of natural gas which is completely a cleaner fuel for mass consumption and has already set-up a Start-up fund of Rs 100 crore to promote innovation in the field of natural gas engines.

Source: The Economic Times

February 27, 2017. The villagers’ protest against ONGC prospecting for oil and natural gas in Neduvasal village is likely to intensify. The village in Pudukottai district, the centre of the contract area for small fields exploration and prospecting for hydrocarbon, has become the hub for demonstrations against the proposal by ONGC. Farmers in the primarily agricultural area fear that the environmental impact of these activities will destroy agriculture. Tamil Nadu Chief Minister (CM) Edappadi K Palaniswami who met Prime Minister Narendra Modi has conveyed that it would not be advisable for ONGC to proceed with any mining activity in Neduvasal village without clearance from the state government. The CM said the oil ministry should consult with the stakeholders and ensure that their interests are protected.

Source: The Hindu Business Line

February 24, 2017. Oil and Natural Gas Corp (ONGC) has approved signing of definitive agreements for buying debt- laden Gujarat State Petroleum Corp (GSPC)’s entire 80 percent stake in KG-basin natural gas block for $1.2 billion. ONGC will pay $995.26 million for three discoveries in the KG-OSN-2001/3 block that are under trial production since August 2014. Another $200 million will be paid for six other discoveries for which GSPC has been finalising an investment plan to bring them to production. ONGC had on December 23 last year agreed to acquire the stake of GSPC. Besides the pay-out to GSPC, ONGC will have to pay for the entire development cost of the six discoveries which may run into at least a couple of billion dollars.

Source: The Economic Times

February 23, 2017. India has the potential to become a much larger producer and consumer of natural gas by 2022 when it is expected to surpass China in terms of population, a first of its kind Congressional report on India’s natural gas said. The report said that India could see greater demand for energy with its population expected to be around 1.4 billion people by 2022, making it the world’s most populous country. India’s current assessment of total reserves resources that are economically and technically viable under existing market conditions are estimated to represent less than one percent of the global natural gas, the report said. As India attempts to shift away from coal and oil over the coming decades, natural gas production, especially from offshore resources, is seen as a way to increase domestic supply, the report said. Combined with improving infrastructure for imported liquefied natural gas (LNG), India could become a bigger natural gas consumer in the future, the report said. The report said in the past decade, India has incentivised foreign access to its upstream sector as a way to increase domestic production. Some of India’s energy companies are also investing more in US (United States) energy projects and have signed contracts to import US liquefied natural gas (LNG), the report said.

Source: The Economic Times

February 28, 2017. Private power plants can now bid for coal allotted to state utilities, a move the government feels will lead to more efficient fuel use, reduce cost of generation by 40-50 paise per unit and result in savings of Rs 25,000 crore per annum in 4-5 years. But the rules for swapping coal between state utilities and private power producers, notified by the Central Electricity Authority, lays down certain conditions such as availability of transmission lines between the state and the power plant with which the coal is being swapped. The swap will be subject to ability of the railways to transport coal to the new plant from the mine from which coal is allotted to the state utility. The swap rules comes months after the Cabinet’s May 4, 2016 decision allowing states freedom in utilising coal allotted to their power stations. The decision is expected to help states phase out old plants and energise several new power plants languishing due to fuel shortage. The plan allowed all long-term coal linkages – supply quotas from specific mines – of individual power plants in a state to be clubbed together and put under the charge of the state government or its nominated agency.

Source: The Economic Times

February 28, 2017. NTPC Ltd has invited bids from consultancy services preparing a feasibility report north-west quarry of Pakri Barwadih coal mine in Jharkhand. The coal mine, located in the north Karanpura coalfields, was allotted to NTPC in 2004 but was later cancelled during the Supreme Court ruling in 2014. The last date of submission of bids for the tender is April 4, NTPC said in its tender notice. The block was reallocated to the company in 2015 and a revised mining plan was approved by the ministry with a targeted production of 18 million tonnes per annum (MTPA) from the opencast operation by 12th year. This includes 15 MTPA from west and east quarry and 3 MTPA from north-west quarry.

Source: The Economic Times

February 26, 2017. The power ministry has finally framed new rules to get electricity supply from independent power producers in lieu of dry fuel, which is aimed at offering more freedom to states to use their allocated coal. The new arrangement will replace the rigid practice of allocation of coal to state-owned generation plants. The decision to give more freedom to states to use coal assigned to them was taken in a Union Cabinet meeting last year in May. According to the new rules, the energy generated under this arrangement will be treated as transfer of coal. It is provided that the landed cost of power from independent power producer (IPP) generating station at the buyer’s periphery should be lower than the variable cost of the state generating station whose power is to be replaced by that of IPP. The landed cost of power shall be inclusive of the transmission charges and losses. Under this arrangement, the IPP will make its own assessment about the availability of transmission corridor for the quantum of power offered and the period of supply before submitting price bids during e-reverse bidding.

Source: Business Standard

February 23, 2017. India’s power sector will continue to be dominated by coal over the coming decade despite significant growth in cleaner fuels or renewables, BMI Research said. According to the BMI Research, the country’s efforts to bolster domestic supply of coal and the loosening of the global coal market over the coming years will ensure that coal will remain the power feedstock of choice for the Indian market. India’s power sector will remain dominated by coal over our 10-year forecast period, with coal making up a share of just less than 70 percent to the total power generation mix by 2026. This is roughly the same level as it is currently, with growth underpinned by the significant and continually growing project pipeline for coal-fired power facilities in the country, it said. Coal will continue to be the feedstock of choice for the Indian power sector given its widespread supply and relatively cheap cost. Domestic coal supply is expected to increase over the course of the decade as Coal India Ltd (CIL) ramps up output, it said.

Source: The Economic Times

February 28, 2017. Tata Power announced a generation capacity increase of over 8 percent in the third quarter of the current fiscal compared to the year-ago period. According to the Tata Power, standalone generation stood at 13,022 million units in Q3 FY’17, as against 12,032 million units during the same quarter of FY’16. The company said that it is firmly on the road to generating 30-40 percent of its total generation capacity from non-fossil fuel sources by 2025.

Source: The Economic Times

February 28, 2017. The Karnataka Electricity Regulatory Commission (KERC) is mulling imposing cross subsidy surcharge for those opting out of grid power and as demanded by the electricity supply companies (Escoms). Noting that the move by industries to switch over to green power and their conviction to opt out of grid power supplied by Escoms is purely market driven, the KERC said. Averring that this move to reduce dependency on grid power is per se not a question mark on the ability of Escoms to provide quality power as demanded by the industries, the KERC said, it could be more borne out of the economics of such a decision. Besides, if bulk consumers feel they can get power in open market at rates that are competitive than what their respective Escoms offer, it is natural that they will shift to such power and reduce dependency on the grid. At present, Escoms are grappling with morning and evening load peaks. Supply peak will not address either the morning or evening supply peaks usually that Escoms experience from 6am to 8am and 6pm to 8pm. This comes between 8am and 6pm when solar power production is expected to be at its peak. Since it is not possible to store the power generated and used to manage morning and evening peaks, the power generator, Escoms will have to find consumers who can utilize this supply peak in a manner that it brings them revenue.

Source: The Economic Times

February 28, 2017. Power, Coal, Renewable Energy and Mines Minister Piyush Goyal accused the Uttar Pradesh government of partiality on the ground of religion on the issue of electrification and power supply in the state. He said that on the complaint of Moradabad MP a high level committee was constituted, which visited eight villages of the district on July 22, 2016. It is a very serious matter showing the biased temperament of the state government. However, the Uttar Pradesh government said that no discrimination is done in providing power connection, he said. The Akhilesh government is not serious about state’s development, which is evident of the fact that state did not sign the ‘power for all’ agreement. He said that the Uttar Pradesh refused to purchase power from the centre at cheap rate saying that it has surplus electricity. It shows that the UP government wants to keep people deprived of electricity.

Source: The Times of India

February 27, 2017. Increase in electricity tariffs will hit Micro, Small and Medium Enterprises (MSME) as the move will up cost of production and kill competitiveness, Association of Industries Madhya Pradesh (AIMP) said. Industries associations of the region have opposed hike in electricity tariff for the year 2017-18 and have submitted objections to the Madhya Pradesh Electricity Regulatory Commission (MPERC). AIMP has constituted a committee to protest the proposed hike in electricity. Madhya Pradesh power distribution companies have proposed a hike in electricity tariff by 10 to 33 percent for different sectors. Industrialists said that the hike in electricity rates will increase the cost of production of industries making operations difficult from the region. The committee formulated by the AIMP will protest against the hike and will register their objections to the department in coming weeks. Pithampur Industries association has also opposed Audhyogik Kendra Vikas Nigam’s (AKVN) proposed 33 percent hike in electricity tariff for the financial year 2017-18 for industries located in the Special Economic Zone (SEZ). Industry association has claimed that increased tariff will kill the competitiveness of the industries operating from SEZ and hamper exports from the region.

Source: The Economic Times

February 24, 2017. Delhi’s peak power demand may touch 6,600 MW this summer, surpassing last year’s peak of 6,261 MW which is the highest ever recorded till date. The peak power demand in the city during the summer of 2017 is expected to touch around 6,500-6.600 MW. Last summer, it was 6,261 MW, highest ever-recorded in the national capital, power distributor BSES said. The peak power demand in South and West Delhi, covered by BRPL, that had reached 2,669 MW during summer last year, is expected to touch around 2,800 MW this year. The peak demand in East and Central Delhi covered by BYPL, is also expected to rise from 1,493 MW last year to around 1,600 MW. Tata Power Delhi Distribution Ltd (TPDDL), supplying to parts of north and northwest Delhi, has also estimated a peak electricity demand of about 1,900 MW in coming summer. With summer expected to be harsh this time, peak demand is expected to be 1,900 MW, which was 1,791 MW last year, TPDDL said. BSES too has made arrangements including long power purchasing agreements (PPAs) and banking arrangements with other states besides strengthening distribution network for ensuring uninterrupted supply to its consumers. BRPL will be getting around 200 MW of power through banking arrangements and BYPL around 170 MW.

Source: The Economic Times

February 24, 2017. Power app GARV II, launched in December, to bring transparency in rural electrification programme is in its final stages in Gurgaon. The redeeming feature of the app called SAMVAD will enable rural consumers to contact discom officials to register their grievance. Officials said that the app was already accessible to the rural consumers across Guragon villages. Officials said GARV II will enable the consumers to participate in the development work and can offer their input about rural electrification programme and bring the rural electrification program in public domain.

Source: The Times of India

February 23, 2017. Bihar’s demand for power has shot up from 1,800 MW in July 2013 to 3,854 MW in November 2016, which it has been able to meet through power purchase. The flip side of it has been the high aggregate technical and commercial (AT&C) loss, says the state’s economic survey report for 2016-17. It said that the high AT&C loss was due to large scale rural electrification in Bihar. Against an AT&C loss of 59.24% in 2012-13, the same in 2015-16 had come down to 43.54%, which was still higher than the target stipulated by regulator – the Bihar Electricity Regulatory Commission. The Centre, under its Ujwal Discom Assurance Yojana (UDAY), which seeks to bring about an operational and financial turnaround of distribution companies (discoms), has proposed the reduction in AT&C loss to 15% and reduction in gap between average cost of supply and average revenue realised to zero, both by 2018-19. Transmission issues, however, continue to stymie the progress of power sector in north Bihar. Bettiah, Motihari, Gopalganj, Siwan, Chapra, parts of Vaishali, Gopalganj and Sitamarhi face a cumulative shortfall of 250-300 MW power because of transmission constraint. With 400 kV super grids coming up in Darbhanga and Motihari, the power firm would be able to tide over the crisis soon. As per the generation plan, additional capacity of 5,589 MW will be added by 2018-19 and Bihar’s total available capacity was expected to be 8,925 MW, making it a power surplus state.

Source: Hindustan Times

February 23, 2017. Power Minister Piyush Goyal accused the Samajwadi Party government in Uttar Pradesh of providing power connections to members of “one community” in the state where assembly elections are underway. He said BJP MP from Moradabad Sarvesh Kumar Singh had alleged that the state government was giving power connections to people from a “particular community” and denying it to others in some areas of his constituency. When the minister asked for a report from the state government, it denied discrimination. But the MP then approached the Prime Minister who directed the Power Ministry to send a high level committee to investigate. He claimed that later many other public representatives made similar complaints about their areas facing such problems in Uttar Pradesh. Responding to a poser on the power situation in Varanasi, Goyal said data provided by an NGO, which monitors 300 towns and cities, shows that several areas in the Prime Minister’s constituency face 8 to 10 hour-long power cuts. This, he said, belies the claims of Chief Minister Akhilesh Yadav that Varanasi gets 24 hours of power supply. Earlier, the Prime Minister had accused the UP government of discriminating in power supply on religious grounds. Goyal claimed that since August 2016, the state government had stopped sharing information regarding quantum of power supplied to different feeders in the state.

Source: The Economic Times

February 22, 2017. A team of Punjab State Power Corp Ltd (PSPCL) was allegedly attacked when it had gone to check power theft and illegal connections in Mahiana Wala village of Ferozepur district. To register their protest against the incident, the PSPCL Employees Joint Forum staged a dharna. Condemning the incident, the forum demanded strict action against the villagers. Balwinder Singh, president of PSPCL Employees Joint Forum, said in case the attackers were not arrested immediately, they would intensify their agitation. According to information, members of the PSPCL team, led by junior engineers Gurpreet Singh and Gurdev Singh, were manhandled by a group of villagers when they were making a video of illegal power connections. The villagers also forced the PSPCL team members to delete the footage of illegal power connections they had shot on their mobile phones. The PSPCL staffers managed to leave Mahian Wala after other villagers intervened. They have reported the matter to higher officials and the police.

Source: The Economic Times

February 22, 2017. Subdued demand coupled with surplus electricity availability has slowed down the addition of new capacity for generating power from conventional sources of energy such as coal and gas. The installed electricity generation capacity of non-renewable energy sources in Gujarat grew by just 0.7% in 2015-16. The growth was 6.2% and 5.2% in 2013-14 and 2014-15 respectively. According to data from the Union power ministry data, Gujarat’s installed power generation capacity from non-renewable energy sources stood at 20,765.82 MW in 2015-16 as against 20,611.30 MW in 2014-15, an annual addition of 154.52 MW. Power sector experts attribute the sluggish demand of power coupled with surplus electricity generation to slower growth in addition of new capacity for conventional power.

Source: The Economic Times

February 28, 2017. The government has set a target of generating 1,229.4 billion units in 2017-18 from thermal, hydro and nuclear sources along with imports from Bhutan, Central Electricity Authority data showed. Generation from thermal sources alone stands at 1,042.1 billion units from thermal sources, a large part of which would be fuelled by coal that would generate 958.4 billion units in the next financial year. From hydropower sources, the government looks to generate 141.4 billion units while from generation from nuclear sources has been set at 40.9 billion units for 2017-18. The government looks to import 5 billion units from Bhutan for the next financial year. Generation from central sector is seen at 440 billion units followed by states, which are seen producing 407 billion units. Private power sector is targeted to contribute 381 billion units. In an all India basis, western region is slated to have the highest generation of 431 billion units, followed by northern region which is seen generating 307 billion units. The southern region will generate 272 billion units and eastern India will have a generation of 195 billion.

Source: The Economic Times

February 28, 2017. The viability of the low tariff of Rs 3.46 per unit recently discovered through reverse auction in the scheme by the Ministry of New and Renewable Energy (MNRE) for award of 1,000 MW wind power projects would depend on a host of factors including low cost debt, ratings agency ICRA said. This tariff is much lower than the prevailing feed-in tariffs varying from around Rs 4.16 per unit to Rs 5.76 per unit for wind power projects across key states with high wind power generation potential. The low tariffs demonstrate the cost competitiveness of wind-based energy generation against conventional energy sources as well as solar power. ICRA that assuming a capital cost of Rs 6.5 crore per MW and PLF of 24 percent, the cumulative average Debt Service Coverage Ratio (DSCR) over a debt tenure of 18 years with cost of debt at 10 percent is estimated at 1.17 times and the project Internal Rate of Return is estimated to remain below 10 percent for a project with a bid tariff of Rs 3.46 per unit. Further, the DSCR and project IRR remain highly sensitive to the plant load factor (PLF) level and capital cost while DSCR remains sensitive to the interest rate. ICRA said it expects an improvement in the renewable purchase obligation (RPO) compliance with timely honouring of payments by the distribution utilities on an all-India level gradually over the period due to improved cost competitiveness of wind energy tariff and also assuming that such bidding is followed at the state level, going forward.

Source: The Economic Times

February 27, 2017. Following the record-breaking success of the recent 1,000 MW wind power auction, the sector is likely to shift entirely towards auction-based allocation route but this transition may lead to short-term hiatus on the market, renewable energy research firm Bridge to India said in a report. India’s first ever wind power auction has resulted in a record low wind power tariff of Rs 3.46 per unit, just marginally higher than the record low levelised tariff of Rs 3.29 per unit in the recent Rewa solar auction. Mytrah, Sembcorp, Inox and Ostro are the winning bidders and will be awarded 250 MW each. Successful bidders will sign 25-year power purchase agreements with PTC India, a power trading company, which will sign back-to-back power purchase agreements (PPAs) with discoms. Bridge to India said remains to be seen if investments in transmission grid can keep up with increases in renewable generation capacity and inter-state flows of power.

Source: The Economic Times

February 27, 2017. Under its welfare activities and civic action programme, 18 battalion of BSF distributed 88 solar plates, solar lanterns and other useful items at the houses in Shahgarh Bulj area of Indo-Pak border in Jaisalmer. Street solar light, solar lamp, water tanks, medicines and other items of daily use were distributed to villagers of nearby areas.

Source: The Economic Times

February 27, 2017. The government will bring out a new policy for the hydro power sector next fiscal to boost this clean source of energy, Power Secretary P K Pujari said. The new policy seeks to bring large hydro projects at par with smaller ones in terms of availing various benefits. At present, small hydro projects of up to 25 MW capacities are considered as renewable energy initiatives and are eligible for various incentives by the government. Developers of large hydro power projects would get a big boost if the distinction between small and large hydro projects is removed. Of the 314.64 GW installed power generation capacity, 44.18 GW comes from large hydro projects (above 25 MW) and 50.01 GW from other renewable power generation capacities as of January 2017. India has set an ambitious target of adding 175 GW of renewable energy capacity by 2022, which includes 100 GW of solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydro-power (up to 25 MW capacity each).

Source: The Financial Express

February 25, 2017. Armed with an approval from state cabinet for net metering policy and working out nitty-gritty, Madhya Pradesh Urja Vikas Nigam, a state public sector undertaking (PSU) promoting non-conventional sources of energy, is calling applications from interested citizens for installing rooftop solar systems. The power produced from these systems will be utilised by household and excess power will be transferred to the state government, consumers will get credits for it. Currently, Tamil Nadu, West Bengal, Karnataka, Andhra Pradesh, Rajasthan, Punjab and Uttarakhand adopted net metering. The domestic consumers can now apply on our website or contact directly for installation of these panels under net metering.

Source: The Economic Times

February 25, 2017. The South Delhi Municipal Corp (SDMC) said it plans to set up a waste-to- energy (WTE) plant at Tehkhand here at a cost of Rs 351 crore. The SDMC standing committee has approved the project under which 1,200 metric tonne of waste would be utilised to generate 15 MW power which would be sold at Rs 5.5 per unit to earn revenue of Rs 57.81 crore per year, it said.

Source: The Economic Times

February 24, 2017. India’s ambitious green energy programme took a giant leap as the country’s first wind energy auction has seen tariff dropping dramatically to Rs 3.46 per unit, mirroring the steep fall in the solar power sector and giving coal-fired plants another emission-free and competitive rival to worry about. Solar tariffs have already fallen to Rs 2.97 per unit after a series of auctions in recent years in which companies that quoted the lowest tariff were awarded projects. The auction, conducted by Solar Energy Corp of India, invited bids for 1,000 MW of wind projects that could be set up anywhere in the country. Wind energy tariffs have varied from a high of Rs 6.04 per unit in parts of Rajasthan to Rs 4.08 for some projects in Maharashtra. Most have varied from Rs 4 to Rs 5 a unit. Other states where wind energy is generated are Tamil Nadu, Gujarat, Andhra Pradesh, Telangana, Karnataka, Madhya Pradesh and Odisha. The idea of holding wind power auctions had been mooted by the Ministry of New and Renewable Energy (MNRE) nearly a year ago, though three earlier attempts to hold them — once by Karnataka and twice by Rajasthan — had proved unsuccessful, with various legal issues raised by wind power associations holding them up.

Source: The Economic Times

February 24, 2017. Officials of the Housing Infrastructure Development Corp (HIDCO) and New Town Kolkata Development Authority (NKDA) recently held a meeting with His Excellency Nadir Patel, High Commissioner of Canada to India, who visited New Town. NKDA officials mentioned in the meeting that New Town was already developing as a smart city and that it has applied for Green City certification from the Indian Green Building Council (IGBC). The authorities would also be launching a study by IIT Kharagpore on how to increase the township’s happiness index by adopting best global practices. The Canadian companies who were present made presentations and the NKDA authorities identified renewable energy and solid waste management as possible areas of future cooperation.

Source: The Times of India

February 23, 2017. Farmers in Andhra Pradesh (AP) will soon be producing electricity apart from growing crops. The State Energy Department is set to launch the scheme Solar Farming, the first-of-its-kind in the country, under which existing pump sets will be replaced with energy- efficient solar pump sets that will enable generation of power. After utilising the power required for drawing water to his field, the farmer could pump the remaining energy into the grid and thereby earn income. A farmer could generate about 9000 units of power from a solar pump set per annum, taking an average of 300 sunny days. Government of India’s Energy Efficiency Services Ltd (EESL) would be the implementing agency for this scheme. Each 5 HP solar pump set that used to cost Rs 5 lakh previously, is now available for Rs 3.2 lakh and the price is expected to drop further. The Centre would provide 30 percent subsidy for these pump sets. In the first phase, the AP Energy Department will start replacing one lakh pump sets from May this year.

Source: India Today

February 23, 2017. IDFC Bank is creating a renewable energy niche in loans, sanctioning Rs 675 crore to a Rajasthan-based solar power project owned by French company Solairedirect. The deal could be an early sign of a revival of lending in India, especially after growth in industry credit hit a 62-year low of 5.1% year-on-year in 2016, down from 10.6% in the previous year. Gaurav Sood, managing director of Solairedirect Energy India, confirmed the matter, saying funds were for the project at Bhadla in Rajasthan being developed under National Solar Mission.

Source: The Economic Times

February 22, 2017. The Cabinet has approved the doubling of solar park capacity to 40,000 MW, which will entail an additional 50 solar parks to be set up at a cost to the government of ₹8,100 crore, Minister of New and Renewable Energy (MNRE) said. MNRE said that while most of the additional 50 solar parks, to be commissioned by 2019-20, will be 50 MW of capacity, the Centre is also considering smaller parks in Himalayan and other hilly states where contiguous land is difficult to acquire. MNRE that the state governments will first nominate the solar power park developer (SPPD) and will also identify the land for the proposed solar park. The proposal will then be sent to the MNRE for approval, following which the SPPD will be sanctioned a grant of up to ₹25 lakh. Following this, the government will provide central funding assistance of ₹20 lakh per MW or 30% of the project cost, whichever is lower. The Cabinet approved a ₹5723.72 crore investment for the Arun-3 900 MW hydroelectric plant in Nepal.

Source: The Hindu

February 28, 2017. Production, capital expenditure and remaining reserves in Canada’s oil-rich province of Alberta fell in 2016, a “challenging” year with low oil prices and a wildfire that hurt the industry. Conventional crude oil production fell 16 percent to 166 million barrels and bitumen production fell 3 percent to 897 million barrels, according to the Alberta Energy Regulator’s annual report. Conventional oil and gas wells placed on production dropped 37.2 percent in 2016 from the previous year, according to the report. Canada has the world’s third-largest oil reserves, but its unconventional deposits of bitumen, a tar-like petroleum substance, are expensive to extract. The energy sector has been hit hard by low oil prices that persisted through much of last year, and a wildfire in the oil town of Fort McMurray, Alberta, wiped out 30 million barrels in lost production, according to the report. But the report said 2016 also brought positive news in the form of pipeline approvals by the federal government and the plan by the Organization of the Petroleum Exporting Countries to limit output to raise prices. Bitumen production accounted for almost half of total primary energy production in 2016, and will increase to a forecasted 60 percent in 2026, the report showed.

Source: Reuters

February 28, 2017. Iraq’s Kurdistan has increased the loans guaranteed by future oil sales to $3 billion in new deals with trading houses and Russian state oil firm Rosneft aimed at strengthening its fiscal position as the semi-autonomous region fights Islamic State. The deals increased total borrowing to around $3 billion. Trading houses have been pre-financing Kurdish oil exports for the past two years on a fairly short-term basis after the government in Erbil decided to start independent oil exports via Turkey’s Mediterranean terminals. Now traders will loan money to Kurdistan for several years. Baghdad has said it would sue buyers of Kurdish oil, arguing that the central government was the only legal exporter. The new Baghdad government has softened its stance, however, as it cooperated with Erbil against Islamic State in Mosul.

Source: Reuters

February 28, 2017. Oil prices slipped but kept trading in a tight range, as concerns about rising US (United States) crude inventories ahead of data overshadowed OPEC (Organization of the Petroleum Exporting Countries) production cuts. US crude stockpiles have risen for seven straight weeks. Forecasts for another weekly build, this time of 3.1 million barrels, fueled worries that demand growth may not be sufficient to soak up the global crude oil glut.

Source: Reuters

February 28, 2017. Royal Dutch Shell has given the go-ahead to develop its Kaikias deepwater field in the Gulf of Mexico, the first such project the oil and gas company has approved in 18 months. Oil companies around the world are emerging from one of the longest downturns in recent decades amid warnings that the drop in investment in recent years may lead to a supply deficit by the end of the decade. Shell said the Kaikias oil and gas project, located some 210 kilometers (130 miles) from the Louisiana coast, will start production in 2019 and generate profits with oil prices lower than $40 a barrel after the company slashed its costs by around 50 percent due to simplified design plans. Shell significantly increased its oil and gas production capacity following the $54 billion acquisition of BG Group a year ago.

Source: Reuters

February 28, 2017. British oil major BP lifted the outlook for its core oil and gas divisions, saying it would be able to balance its books with crude prices as low as $35 to $40 a barrel by 2021 thanks to its tough spending cuts. BP said its upstream business, which includes its main oil and gas production fields, is expected to generate free cash flow of $13 billion to $14 billion by 2021, nearly double an outlook presented last year of $7 billion to $8 billion by 2020. The refining and marketing business, known as downstream, is expected to generate $9 billion to $10 billion of free cash flow by 2021, BP said. BP lifted this year’s break-even oil price to $60 a barrel because it is investing more in new projects.

Source: Reuters

February 28, 2017. Top global oil exporter Saudi Arabia broke from the pack in the race to lock up Asian market share after agreeing to pump $7 billion into a refinery-petrochemical complex in Malaysia, analysts said. State oil giant Saudi Aramco’s investment into Malaysia’s RAPID project will secure an outlet for its crude oil for at least two decades and beefs up its downstream portfolio ahead of its initial public offering (IPO) next year. The competition in Asia among producers, including Russia and other Middle Eastern suppliers such as Iraq, Kuwait and Iran, is sharp. Asia’s growing oil demand provides the only home for the producers’ output, especially as they have lost market share in the United States to rising domestic shale oil production. Buying a share of a large oil refinery with a promise to provide crude is a time-tested producer tactic for locking up customers. Russia, the world’s largest oil producer, has bought a major stake in India’s Essar refinery and plans to build one in Indonesia with state-owned Pertamina. Under the deal with Malaysia’s Petroliam Nasional Bhd (Petronas), Aramco will supply up to 70 percent of the crude for RAPID, which will consist of a 300,000 barrel per day (bpd) oil refinery and petrochemical plants.

Source: Reuters

February 28, 2017. China will issue non-state crude oil import licenses to five refiners, including China National Chemical Corp and four independent refiners, the commerce ministry said. The four independent refiners are Shandong Shenchi Group, Shandong Jincheng Petrochemical Group, Shandong Qingyuan Group and Hebei Xinhai Group, the ministry said.

Source: Reuters

February 27, 2017. Iraq is planning to start offshore oil and gas (O&G) exploration to boost the OPEC (Organization of the Petroleum Exporting Countries) nation’s reserves, Oil Minister Jabar al-Luaibi said. Iraq announced an increase in its oil reserves to 153 billion barrels from a previous estimate of 143 billion barrels. Iraq has boosted output rapidly in recent years with the help of foreign oil companies to become OPEC’s second-largest producer behind Saudi Arabia. It agreed at the end of November to take part in an OPEC agreement to cut global supply to help to lift oil prices.

Source: Reuters

February 27, 2017. Russia has been in talks of buying oil from Iran, Energy Minister Alexander Novak said. The purchases will be carried out via Promsirieimport, a trading unit of Russia’s energy ministry, he said. Iranian Students’ News Agency reported that Iran will begin selling 100,000 barrels per day (bpd) of to Russia within the next 15 days and receive payment half in cash and half in goods and services.

Source: Reuters

February 27, 2017. The United States (US) Bureau of Ocean Energy Management (BOEM) has announced plans to offer approximately 1.09 million acres in lease sale for oil and gas (O&G) exploration and development in Cook Inlet off Alaska’s south central coast. Slated to take place in June 2017, the proposed Cook Inlet Oil & Gas Lease Sale 244 will offer 224 blocks toward the northern part of the Cook Inlet Planning Area for leasing. The blocks considered for the lease sale cover from Kalgin Island in the north to Augustine Island in the south. The sale will be the US Department of the Interior’s final Outer Continental Shelf Oil and Gas Leasing Program for 2012-2017 in Cook Inlet, BOEM said.

Source: Energy Business Review

February 27, 2017. Mexican state-owned oil company Pemex reported a much smaller fourth-quarter loss, due in large part to higher crude prices. The loss narrowed to $1.58 billion (32.6 billion pesos) from $9.8 billion a year earlier. The price of Mexico’s crude oil export mix jumped by 22 percent during the quarter to average nearly $41 per barrel. Still, Pemex has not posted a quarterly profit since 2012. The Mexican government is implementing an energy industry revamp finalized in 2014. It ended the decades-long production monopoly enjoyed by Pemex, which led to the first-ever competitive oil auctions and joint venture partnerships. Crude production in 2016 fell 5 percent to 2.154 million barrels per day (bpd), while fourth-quarter output dropped 9 percent to an average 2.07 million bpd from a year earlier. Pemex’s crude production has steadily declined from a peak of 3.4 million bpd in 2004. The government has said it expects crude output to average 1.94 million bpd this year and between 1.9 million to 2.0 million bpd in 2018.

Source: Reuters

February 27, 2017. OPEC (Organization of the Petroleum Exporting Countries)-led oil production cuts have been well supported by all participating countries despite some teething troubles for non-OPEC members, OPEC Secretary General Mohammed Barkindo said. Barkindo said OPEC remained optimistic that the “worst was over” for the oil market, almost two months into the group’s supply cut deal with Russia and other producers. He said the oil market needed every barrel which cut-exempted Iran, Libya and Nigeria could produce. Under the deal, the OPEC agreed to curb output by about 1.2 million barrels per day (bpd) from January 1, the first cut in eight years. Russia and 10 other non-OPEC producers agreed to cut around half as much.

Source: Reuters

February 27, 2017. South Africa’s Sasol will produce oil from Mozambican wells in two to three years, the first crude output from the southeast African country, joint chief executive Stephen Cornell said. This will be the first oil wells in Mozambique that go to full development, Cornell said.

Source: Reuters

February 26, 2017. Brazil’s state-controlled oil company Petróleo Brasileiro SA (Petrobras) said it will reduce prices for diesel and gasoline at its domestic refineries. Petrobras said it will cut diesel prices by 4.8 percent and gasoline values by 5.4 percent.

Source: Reuters

February 24, 2017. Lundin Norway AS, operator of production license 533, has made an oil and gas discovery in the Barents Sea, the Norwegian Petroleum Directorate announced. Preliminary estimations of the size of the discovery are between 5.5 and 16 million standard cubic metres of recoverable oil equivalents.

Source: Rigzone

February 22, 2017. The United States (US) oil major Exxon Mobil Corp has revised down its proved crude reserves by 3.3 billion barrels of oil equivalent as a result of low oil prices throughout 2016, the company said. The de-booking includes the entire 3.5 billion barrels of bitumen reserves at the Kearl oil sands project in northern Alberta, operated by Imperial Oil, a Calgary-based company in which Exxon has a majority share. In total Exxon has 20 billion barrels of oil equivalent at year-end 2016, the Securities Exchange Commission (SEC) said. The reduction reflects the number of barrels of oil equivalent that were now deemed uneconomic due to lower crude prices. Under SEC rules Exxon and other US-listed companies report reserves based on the average crude price on the first day of each calendar month during the year. Benchmark crude prices in 2017 have so far been higher than in 2016, meaning some of the volumes could be rebooked as proved reserves if these levels hold.

Source: Reuters

February 27, 2017. Total is in talks to buy a multi-billion dollar stake in Iran’s partly-built liquefied natural gas (LNG) export facility, Iran LNG, seeking to unlock vast gas reserves. The French oil major — the first of its peers to strike deals in Iran after sanctions — seeks entry into Iran LNG at a discount to the pre-sanctions price in exchange for reviving the stalled project. Iran shares the world’s biggest gas field with Qatar, which has used the reserves to build over a dozen giant liquefaction plants to chill gas into a liquid for export on ships — a move Iran is keen to replicate. The Iranian part of the field, known as South Pars, contains over 14 trillion cubic metres of gas, according to the Pars Oil and Gas Company. Iran aims to grow gas output to 1 trillion cubic metres by 2018, up from 160.5 billion cubic metres in 2012, before the latest sanctions took effect.

Source: Reuters

February 27, 2017. Liquefied natural gas (LNG) production at Chevron’s Gorgon Train Two project in Australia has resumed, the company said. Train Two production restarted, after being temporarily suspended for maintenance, the company said.

Source: Reuters

February 24, 2017. Japan in January paid nearly twice as much for liquefied natural gas (LNG) derived from US shale gas as it did for its cheapest imports, trade data showed. Shale gas from the United States (US) had been touted as a panacea to Japan’s energy crisis after the Fukushima nuclear disaster nearly six years ago. The first supplies arrived in Japan to much fanfare but the revelation of its higher cost would seem to undermine the initial euphoria. Japan, the world’s biggest importer of LNG, received 211,237 tonnes of US LNG at an average cost of $645 a ton, according to a breakdown of customs-cleared imports released by the finance ministry. By contrast, the lowest it paid was $337 a ton for 64,246 tonnes of LNG from Angola. The country paid an average of $386 a ton for all 8.3 million tonnes of LNG it imported last month, the data showed. The 428,626 tonnes of LNG imported from Brunei, at $416 per ton, were the second highest-priced supplies. Australia was Japan’s biggest supplier in January, sending 2.01 million tonnes at a cost of $384 a ton.

Source: Reuters

February 24, 2017. China’s soaring demand for liquefied natural gas (LNG) is sparking industry hopes that a supply overhang causing a slump in prices will end sooner than initially anticipated. China’s imports of LNG in January rose 39.7 percent from a year earlier to 3.44 million tonnes, data from the General Administration of Customs showed. It was the second-highest monthly import level, behind a record 3.73 million tonnes set in December. The steep growth rate in 2016 imports mean that China is challenging South Korea to become the world’s second-biggest LNG importer, after Japan. The LNG industry is banking on China’s growing demand to end a global supply overhang triggered by a wave of new production especially in Australia and the United States. The glut has driven Asian spot LNG prices down by almost 70 percent since their 2014 peak to $6.40 per million metric British thermal units (mmBtu). China’s growing demand, much of it coming from import facilities called floating storage regasification units, means that supply and demand in the LNG market could come into balance by around 2021-2022, about a year earlier than previously expected, the Australian oil and gas major Woodside Petroleum said.

Source: The Economic Times

February 23, 2017. Developers of the Leviathan natural gas field have approved a $3.75 billion investment in the first phase of the largest energy project in Israel’s history, they said. The reservoir, located 100 km (62 miles) west of Haifa, was discovered in December 2010. Its $3.75 billion budget follows $1 billion that has already been invested in exploration, appraisal and planning activities. According to a development plan approved by the government in 2016, the project will be completed in less than three years and gas will be available to the Israeli market by the end of 2019. The first stage of work will involve drilling four production wells at an average depth of around 5 km below sea level. These will produce about 12 billion cubic meters of gas annually, which will double the volume of gas available to the Israeli market. The gas from Leviathan will be transported through two underwater pipes 120 km in length to a processing and production platform situated 10 km offshore.

Source: Reuters

February 22, 2017. TransCanada Corp said it plans to offer a flat toll on its Mainline system that takes natural gas from western Canada to southern Ontario, three months after shippers balked at the previous varied toll structure that they saw as too high. After discussions with western Canadian sedimentary basin producers, the pipeline company has launched an open season to gauge interest in a “simplified” rate of 77 Canadian cents per gigajoule for a 10-year term, instead of the range of between 75 and 82 Canadian cents previously offered. The open season is expected to close on March 9.

Source: Reuters

February 22, 2017. China’s state-run Zhenhua Oil has signed a preliminary deal with Chevron to buy the United States (US) oil major’s natural gas fields in Bangladesh that are worth about $2 billion. A completed deal would mark China’s first major energy investment in the South Asian country, where Beijing is competing with New Delhi and Tokyo for influence. Bangladesh, though, holds the right of first refusal on the assets and could block the transaction. The country, via its national oil company Petrobangla, is keen to buy the gas fields and is talking to international banks to raise financing.

Source: Reuters

February 22, 2017. Construction of the Interconnector Greece-Bulgaria (IGB) natural gas pipeline will begin next year and secure the delivery of one billion cubic metres of Azeri gas a year, interim Bulgarian Energy Minister Nikolay Pavlov said. Pavlov said that financing for the 182 km, €220 million ($231 million) pipeline project had been secured. The project has received a €45 million grant from the European Union while Bulgaria has extended €110 million in state guarantees to secure loans from the European Investment Bank and European Bank for Reconstruction and Development, Pavlov said. The IGB pipeline is expected to become operational in 2020, when state gas company Bulgargaz should start receiving 1 billion cubic metres of gas per year from the Shah Deniz 2 gas field in the Caspian Sea off the coast of Azerbaijan.

Source: Reuters

February 28, 2017. China’s total energy consumption grew 1.4 percent to 4.36 billion tonnes of standard coal in 2016, according to the National Bureau of Statistics. Total energy production was down 4.2 percent compared to the previous year at 3.46 billion tonnes of coal equivalent, it said. The share of coal in China’s total energy consumption mix stood at 62 percent over 2016, it said. The figure for 2015 was 64 percent, it said. The government far exceeded its targets to eliminate 250 million tonnes of coal and 45 million tonnes of steel capacity last year.

Source: Reuters

February 23, 2017. Britain’s coal production fell by 51 percent to a record low last year as all large deep mines closed and others neared the end of their operational life, preliminary government statistics showed. Coal output fell to just over 2 million tonnes of oil equivalent last year, the Department for Business, Energy and Industrial Strategy (BEIS) said in 2016 provisional energy data. Britain’s coal production has fallen by 77 percent in the last five years. Coal accounted for 10.6 percent of electricity supplied in 2016, down from 25.8 percent in 2015, due to coal plant closures and a carbon price floor which has made coal-fired generation more expensive than gas-fired power. More detailed estimates of 2016 will be published on March 30, BEIS said.

Source: Reuters

February 28, 2017. The Philippines needs to build an additional 7,000 MW of power generation capacity over the next five years to support its fast-growing economy and wants foreign investors to help, its energy ministry said. The Philippines, with a population of more than 100 million people and one of the world’s fastest growing economies, aims to double its power generation capacity by 2030 to avoid a return to the frequent blackouts suffered during the 1990s. At the end of June 2016, installed capacity was 20,055 MW, a third of it fuelled by coal, according to government data. Power is generated 34 percent by coal, 34 percent by oil and gas and 32 percent from renewable sources. The Philippines would be technology neutral, to avoid being shackled to caps and quotas and create more competition, with the aim of slashing electricity prices for industry and consumers. With no state subsidies, prices are the highest in Southeast Asia.

Source: Daily Times

February 28, 2017. The Cambodian government has awarded Japanese-owned Toshiba Plant Systems & Services Corp (TPSC) the concession to construct a coal-fired power generation project in Preah Sihanouk province. Prime Minister Hun Sen said the new power plant would address the energy deficiency caused by the shelving of the Stung Cheay Areng Dam in Koh Kong province’s Areng Valley. The company will be working with its subsidiaries in Malaysia and Thailand in order to build the 150 MW power plant in Preah Sihanouk province for Cambodian Energy II Co., Ltd. The generated electricity will then be purchased by Electricité du Cambodge. In 2016, the total electricity production nationwide increased by 19.79 percent compared with 2015 while electricity imports from neighbouring countries decreased 22.06 percent.

Source: Khmer Times

February 26, 2017. Iraq signed a $500 million agreement with ABB to implement energy projects, Prime Minister Haider al-Abadi’s office said. Iraq continues to suffer electricity shortages, 14 years after the United States (US)-led invasion that toppled Saddam Hussein.

Source: Reuters

February 24, 2017. Electricity flows through the power link connecting Britain and France will be reduced until March 15, National Grid said. Flows through the 2,000 MW Interconnexion France-Angleterre (IFA) link, which Britain’s National Grid owns with French grid operator RTE, have been cut since last November after 4 of its 8 cables were severed in a storm. In a market notice, National Grid said the cable capacity will increase to 1,500 MW on February 26 from 1,000 MW, with full capacity not expected to be restored until March 15. The power link was previously expected to return to full capacity at the end of February.

Source: Reuters

February 24, 2017. Greece’s power market operator LAGIE and the Athens stock exchange have agreed to jointly set up a power trading exchange, that would start operations as early as mid-2018. The new power trading exchange would replace the existing mandatory pool system, where power producers may enter into bilateral contracts that are constrained within the pool. It is expected to improve power sales transparency, boost competition and lower electricity prices for end users. This new market model is part of plans to reform the Greek electricity market in line with European interconnection plans.

Source: Enerdata

February 24, 2017. The National Energy Regulator of South Africa (NERSA) announced it has allowed the state-owned power firm Eskom to increase its tariffs by 2.2% in 2017 and 2018. Previously in March 2016, the NERSA has allowed Eskom to it raise electricity tariffs by 9.4% for 2016 and 2017. Eskom, the sole South African electricity supplier, is currently trying to repair its ageing power plants and build new ones. In 2015, the company was forced to impose almost daily power cuts, or “load shedding” and this tariff increase might help the utility to cope with this issue.

Source: Enerdata

February 22, 2017. Canadian energy company Veresen has signed three separate deals to divest its power generation business for $1.18 bn. The firm, which owns energy infrastructure assets in Canada and the US, intends to use the proceeds from the sale to fund other growth projects. As per the deal, Capital Power will acquire 284 MW of generation from two natural gas-fired power plants in Canada which include the 84 MW East Windsor Cogeneration Centre and a 50% stake in the 400 MW York Energy Centre. Capital Power will operate both the natural gas-fired power plants, which have long-term power purchase agreements (PPAs) with the Ontario Independent Electricity System Operator.

Source: Energy Business Review

February 28, 2017. The European Union (EU) won backing from Europe’s second highest court for slapping hefty anti-dumping duties on Chinese solar panel imports, an issue which nearly triggered a trade war with China four years ago. The move by the European Council to impose anti-dumping and anti-subsidy duties with an average rate of 47.7 percent in late 2013 came following a two-year long investigation by the European Commission which found that Chinese solar panels were sold at below market prices. The EU said Chinese solar panel exporters to Europe also benefited from illegal subsidies. A group of 26 companies subsequently challenged the decision at the Luxembourg-based General Court. Judges rejected the appeals. The move underlines its desire to please EU solar panel makers and those benefiting from cheap imports as well as the desire to enlist China as an ally in fights against protectionism and climate change.

Source: Reuters

February 28, 2017. Warren Buffett’s Berkshire Hathaway Inc will urge shareholders to reject a proposal by a Nebraska nonprofit that it sell its investments in oil refiner Phillips 66 and other companies involved in fossil fuels over 12 years. The Nebraska Peace Foundation, which focuses on anti-war, civil rights and environmental issues, said it received a letter from Berkshire detailing the Omaha-based conglomerate’s opposition to its proposal, to be voted on at Berkshire’s annual meeting. It said Buffett should instead use his “international celebrity” to “send a message” about the threat posed by climate change, and the benefits of shifting toward cleaner energy. The proposal would not cover businesses that Berkshire owns outright, including several utilities and the chemical company Lubrizol. At last year’s meeting, a Nebraska Peace Foundation proposal that Berkshire discuss the risks that climate change posed for its insurance businesses won support from only 11 percent of the votes cast. Buffett called that proposal unnecessary. Two other shareholder proposals will be introduced at Berkshire’s annual meeting, Buffett said.

Source: Reuters

February 27, 2017. The Moroccan government has concluded a guarantee contract with the German bank KFW for the granting of a €130 mn loan. The funds, which will be delivered to the National Electricity and Water Board (NEB), will be used to finance the second phase of its integrated wind energy program. This program will enable the construction of six wind farms with a total capacity of 1,000 MW. It will be divided into two phases, the first of which will allow the installation of a 150 MW wind farm in Taza while the remaining 850 MW will be installed during the second stage. This second phase will enable the construction of the Tanger II (100 MW), Boujdour (100 MW), Toskrad (300 MW), Midelt (150 MW) and Jbel Lahdid (200 MW) wind parks. The power stations which are concerned by the current financing contract are those of Tanger II, Midelt and Jbel Lahdid. More generally, the country aims to meet 42% of its energy needs with renewable energy by 2020 and wind energy will play a significant role in it.

Source: Enerdata

February 26, 2017. China will invest $184 million dollars into a 30 kilowatt biomass power plant in Guinea Bissau, the Chinese embassy said. China will foot 93 percent of the bill for the project, while Guinea pays for the remaining 7 percent. Guinea Bissau, a former Portuguese colony, suffers chronic power shortages that often leave its seaside capital Bissau in darkness.

Source: Reuters

February 26, 2017. Bangladeshi Prime Minister Sheikh Hasina inaugurated the country’s first solar-powered food warehouse with a capacity of 25,000 tonnes of grain in the northern part of the country. The modernised, multi-storey warehouse was built with financial and technical support from Japan. Food silos are crucial for natural disaster-prone Bangladesh to keep stocks safe from water and other threats.

Source: Reuters