Coal News Commentary: September – October 2016

India

The Coal Ministry was reportedly opposed to NITI Aayog’s draft Energy Policy as the draft policy threatens to take away CIL’s monopoly on pricing. The draft National Energy Policy has recommended aligning domestic coal prices with international rates. While there is some truth in the observation that there is reluctance on the part of CIL to let go of control one must also keep in mind that power tariff is regulated which limits CIL’s ability to set prices. The power sector consumes most of the coal produced by CIL and so if coal prices are de-regulated, power tariff must also be freed of all formal and informal controls.

Other news that was reported this week betrayed the lack of demand for coal. Not only was coal import declining, off-take of domestic coal too appeared to be below expectations. The onset of winter in the Northern part of the country may increase demand as people begin to turn on their heaters.

Coal beneficiation was also in the news which is a good sign. If the coal sector wants to remain competitive in a challenging environment the focus must shift from quantity to quality. Though India is ranked third in the world in coal production in terms of quantity it slips to fifth place in terms of quality. For every 1 tonne of coal mined in Australia, India has to mine 1.5 tonnes of coal to obtain the same energy content. India cannot afford to sustain this inefficiency.

Increase in domestic tax on coking coal was also reported widely this week. Apart from regular taxes, mining now involves the payment for DMF, payment of NMET, both as a percentage of royalty, and clean energy cess that has been increased to ` 400 per tonne for FY17 in addition to auction commitments. Unless there is some change in tax policy Indian coking coal may lose out to competition from imports. This is not necessarily in national interest.

Rest of the World

China reportedly imported 24.26 MT of coal in September, up more than a third from a year ago according to Reuters. The reason behind this is said to be government-enforced mine closures which forced coal users to turn towards imported coal. For the year to date, imports increased 15.2 percent to 180 MT. China’s coal import behaviour has traditionally been based on price arbitrage. In 2009, China, a traditional net exporter of coal, suddenly imported a record breaking 126 MT of coal which accounted for 15 percent of globally traded coal. As per a study, China’s sudden coal import behaviour did not represent a structural shift in the global market but rather a cost-minimisation strategy that would involve both buying and selling coal in the international market to take advantage of the arbitrage opportunities in the price of domestic and globally traded coal.

China’s coal imports also betrayed its geopolitical clout as it imported coal from North Korea ignoring western sanctions. China reportedly imported 2.465 MT of coal from North Korea in August, the highest on record, and 61 percent above what was bought in April, the month sanctions were supposed to take effect. Coal from North Korea is anthracite, a high grade coal used in steel and other industries. Mongolia has reportedly recorded a 50.1 percent increase in coal exports to China and Indonesia an increase of 18 percent.

NATIONAL: OIL

Safety concerns loom over LPG scheme for BPL homes

October 25, 2016. The Pradhan Mantri Ujjwala Yojana (PMUY), which envisages providing liquefied petroleum gas (LPG) connections to families below poverty line (BPL), has run into trouble as distributors have pointed out serious safety loopholes in the scheme and have threatened a long drawn protest. The protest has been triggered by a recent incident in Saharanpur, Uttar Pradesh, where an entire Ujjwala beneficiary family perished after an LPG leakage and the distributor has been booked under Indian Penal Code (IPC) sections. The oil ministry has said that the government has been acting on the inputs and has taken adequate steps to ensure safety of users. Federation of LPG Distributors of India has pointed out that 90% of the BPL households with LPG connections are unsafe and do not fulfil the basic safety criteria including separate kitchen and living space, pucca house and concrete slabs for cooking. In case of any mishap, the distributor, who is the end link in the chain, can be held liable under IPC provisions, marketing discipline guidelines of oil marketing companies (OMCs) and Essential Commodities Act.

Source: The Economic Times

Four-day old strike by IOC tanker lorries ends

October 25, 2016. The four-day old indefinite agitation by a section of tanker lorries, demanding modification of tender conditions and hike in transport charges, ended following talks initiated by the government. The strike by lorries carrying fuel of Indian Oil Corp (IOC) had badly affected movement of petroleum products in Kerala, leading to petrol pumps going dry in some parts of the state. Even supply of aviation fuels from Irumpanam depot in Kochi to three international airports in the state had been hit due to the strike. Transport Minister A K Saseendran said the strike has been called off and further discussions would be held later. Tanker lorries transporting fuel to retail outlets from Kochi and Kozhikode depots of IOC, had demanded a hike in fare from ` 2.02 per km to ` 3.50 per km, which was not agreeable to IOC, as it would result in escalation of fuel costs. The strike began, following which the lorries did not collect fuel from Irumpanam in kochi and Kozhikode plants.

Source: Business Standard

Cabinet may take a call on Cairn India’s Barmer extension

October 24, 2016. A decision on the 10-year-extension for production sharing contract (PSC) of Barmer oil and gas block of Cairn India and Oil and Natural Gas Corp (ONGC) in Rajasthan beyond 2020 is likely to be taken by the Cabinet. The government is likely to take up a group of 28 pre-new exploration licensing policy (NELP) exploratory blocks for clearance soon, including the Barmer block. The block, which is also known as Rajasthan block, includes the Mangala, Bhagyam, Aishwariya and Raageshwari oil and gas fields. It is the biggest onshore oil producing project in India and produces about 166,000 barrels of oil equivalent per day, accounting for about 27 percent of the country’s overall oil production. In March this year, the Cabinet had cleared the extension of 28 small- and medium-sized discovered fields.

Source: Business Standard

RIL to seal ethane ship deal

October 24, 2016. Reliance Industries Ltd (RIL) is set to buy six very large ethane carriers (VLEC) from South Korea’s Samsung Heavy Industries Co Ltd for $600 million. The deal is to be signed in Mongolia’s capital Ulan Bator. These bespoke carriers -the largest such ships to be built -will carry liquefied ethane, a key feedstock for petrochemicals, from the US to RIL’s refinery in Jamnagar off the coast of Gujarat. A very large ethane carrier is a hybrid of a liquefied natural gas (LNG) carrier and a liquefied petroleum gas (LPG) carrier. RIL had entered into a strategic association with Japanese shipping powerhouse Mitsui OSK Lines for the ethane carriers in December 2014. Mitsui is supervising construction and will operate and manage the fleet for RIL with deliveries commencing in December.

Source: The Economic Times

Oil Minister launches Ujjwala LPG scheme in Amethi

October 24, 2016. Oil Minister Dharmendra Pradhan attacked Amethi MP Rahul Gandhi for turning down the government’s formal invite to attend the inauguration of the Rajiv Gandhi Petroleum Technology Institute (RGPTI). Launching the NDA government’s ambitious Ujjawala liquefied petroleum gas (LPG) scheme, the minister gave away 1,000 free gas connections to Amethi’s poor.

Source: The Economic Times

RIL forays into LPG retailing

October 23, 2016. Reliance Industries Ltd (RIL), operator of the world’s biggest oil-refining complex, has forayed into cooking gas retailing, launching a 4-kg liquefied petroleum gas (LPG) cylinder on pilot basis. LPG consumption is growing by over 10 percent and private refiners RIL and Essar Oil want a pie of it. Currently, public sector retailers Indian Oil, Bharat Petroleum and Hindustan Petroleum control retail LPG market, selling cooking gas in 5-kg, 14.2-kg and 19-kg cylinders. They sell 12 cylinders of 14.2-kg or 34 bottles of 5-kg per year to households on subsidised rates and any requirement above that on market price. The 19-kg cylinder is for commercial use.

Source: The Economic Times

Oil Minister asks states to help bring petro products under GST

October 23, 2016. Oil Minister Dharmendra Pradhan nudged the states to agree on bringing all petroleum products under the Goods and Services Tax (GST) regime. He said petroleum is currently under ‘state list’ for the purpose of taxation under GST. As per the GST Constitutional Amendment Bill, petroleum products like LPG, kerosene and naptha would attract GST. However, other products — crude oil, natural gas, petrol, diesel, high speed diesel and aviation turbine fuel — have been excluded from GST for initial years. Hence, these products will continue to be taxed in the hands of the states as they are being taxed at present. The GST Council will decide on the date of inclusion of these products in the GST basket and rates thereon. Pradhan asked Madhya Pradesh Chief Minister Shivraj Singh Chouhan to support bringing all petroleum products under the GST regime. With two different kinds of taxation structure, in the new regime the oil and gas industry would have to comply with both the current tax regime as well as GST.

Source: The Times of India

Cooking gas scarcity hits Mizoram

October 20, 2016. People in Mizoram are facing a harrowing time due to acute scarcity of cooking gas. Things have come to such a pass that people are willing to pay up to Rs 3,000 for one cylinder in the black market but to no avail. Residents of Aizawl said a cylinder, which used to last for a month earlier, now don’t even last for even 15 days. A number of families in Aizawl and other towns are using firewood and stoves for cooking. The scarcity of cooking gas, which is going on since July, started after a non-tribal contractor refused to transport LPG cylinders to Mizoram in the wake of Young Mizo Association (YMA) volunteers launching a crackdown on drivers and their accomplices for tampering with LPG cylinders. The YMA volunteers have seized over 600 cylinders which were tampered with on NH-54. State food, civil supplies and consumer affairs department said the contractor’s bid for Indian Oil Corp’s (IOC) tender was too low and unworkable which prompted the drivers, who were underpaid, to resort to tampering with cooking gas cylinders to get extra money. Officials at the Mualkhang gas bottling plant in Kolasib district said they are no trucks to transport gas cylinders. Minister for food, civil supplies and consumer affairs John Rotluangliana, said the scarcity will soon be over as the IOC has allowed coking gas distributors to hire trucks for transporting cylinders.

Source: The Times of India

RIL gross refining margins to moderate in September quarter

October 19, 2016. Reliance Industries Ltd (RIL) is expected to see its gross refining margins (GRM) decline in the September quarter after repeating a seven-year high in the June quarter, even as analysts expect its petrochemical margins to remain healthy and offset the fall in GRMs. In a poll, five analysts estimated a consolidated net profit of ` 7,268 crore and revenue of ` 62,920 crore. In the September 2015 quarter, the company reported a consolidated net profit of ` 6,720 crore and turnover of ` 75,117 crore. RIL will announce its financial results for the July-September 2016 quarter on October 20.

Source: Business Standard

NATIONAL: GAS

Govt wins $1 bn price dispute with RIL, BG

October 25, 2016. The Centre has won an international arbitration involving potential claim of more than $1 billion, initiated six years ago by Reliance Industries Ltd (RIL) and the Indian arm of BG (formerly British Gas) following a gas price and royalty dispute in the PannaMukta and Tapti fields off the Mumbai coast. The London-based arbitration panel rejected RIL-BG’s main demands for higher cost recovery limit and certain deductions while calculating wellhead price of gas, all of which have a direct impact on their revenue. The arbitration tribunal has by majority issued a final partial award (FPA), and separately, two dissenting opinions in the matter. RIL is in the process of reviewing the FPA and the dissenting opinions in detail and shall be taking the appropriate next steps based on legal advice. The tribunal has scheduled a procedural hearing on December 18-19 where the procedural timetable of the arbitration going forward is likely to be decided.

Source: The Times of India

Adani Petronet gets green nod for Rs 4.6 bn Dahej port expansion

October 24, 2016. Adani Petronet has received green clearance for the third phase expansion of its Dahej port in Bharuch district of Gujarat that will entail an investment of about Rs 464.32 crore. Adani Petronet (Dahej) Port Pvt Ltd (APPPL), a joint venture of Adani Enterprise and Petronet LNG, has developed the Dahej port in a phased manner. The third phase expansion will entail raising cargo-handling capacity to 23 million tonnes per annum (mtpa) from 11.7 mtpa and development of other supporting infrastructure.

Source: The Economic Times

KINFRA sets-up petrochemical park in Kochi

October 22, 2016. The Kerala government has accorded an in-principal approval to the Kerala Industrial Infrastructure Development Corp (KINFRA) to set up a petrochemical park in Kochi. The project cost estimated to be ` 1,864 crore, including land cost and cost of internal infrastructure. KINFRA intends to set up the park in 600 acre of land to be procured from FACT at Ambalamugal, Kochi, the company said. The proposal assumes significance in view of the expansion proposal of Bharat Petroleum Corp Ltd (BPCL), proximity to the port and natural gas infrastructure at the location, KINFRA said.

Source: The Hindu Business Line

CCI to probe GAIL for unfair business ways

October 19, 2016. The Competition Commission of India (CCI) has ordered an investigation against GAIL (India) Ltd for indulging in alleged unfair business practices with regard to supply and distribution of gas to industrial players. CCI considered ‘supply and distribution of natural gas to industrial consumers’ as the relevant market. For three complaints, Gurgaon district was taken as the relevant one while it is Rewari district for the remaining two cases. Terming GAIL’s activities as “unexpected business behaviour”, CCI said the company did not come forward for amicable settlement for the dispute as provided in the Gas Supply Agreement (GSA).

Source: Business Standard

NATIONAL: COAL

JSW Energy inks MoU to set up power plant in Swaziland

October 25, 2016. JSW Energy said it has signed a binding Memorandum of Understanding (MoU) with Swaziland Electricity Company (SEC) and the Swaziland government to set up a thermal power plant in the Kingdom of Swaziland. The capacity of the power plant to be set up will be decided by JSW Energy in consultation with SEC based on the coal resources found during the exploration of an area of approximately 16,000 hectares to be prospected by JSW Energy under a prospecting licence granted to them. In addition to meeting the total power demand of Swaziland which currently stands at around 300 MW, JSW Energy and SEC shall also explore the possibility of exporting power to the neighbouring countries that are connected through a common transmission network, it said. The MoU provides for setting up a thermal power plant and undertaking of mining activities pursuant to execution of definitive agreements – a long term Power Purchase Agreement (PPA) to be guaranteed by the Kingdom of Swaziland and fuel supply agreement from captive coal resources, among others.

Source: The Economic Times

CIL to start spot e-auction

October 19, 2016. Coal India Ltd (CIL) will begin a special spot e-auction of coal and will put on offer 20 million tonnes (MT) of the fossil fuel for various sectors, including power, amid the government’s efforts towards 24×7 power for all. The auction will be conducted for four days beginning on October 20. The total validity for lifting of coal under the special spot auction window will be up to March 2017. The reserve price will be limited to the upper cap of 20 per cent add-on over the notified price of coal for the non-power sector. The rake size shall be as per prevalent railway rules. The quantity of coal in a rake will be as indicated in the notice of e-auction of coal companies. CIL had announced a one-time offer of 20 MT of coal under a special spot e-auction in the ongoing fiscal year. The coal ministry had earlier said power producers being supplied coal through the MoU (Memorandum of Understanding) route by CIL will have to take it via special e-auction being conducted for the power sector. CIL, a major supplier of coal to the power sector, is eyeing production of one billion tonne by 2020.

Source: NDTV

National: Power

Maharashtra state power utility launches amnesty plan

October 25, 2016. The state power utility has appealed defaulter consumers whose electricity supply has been disconnected permanently due to non-payment of dues, to take benefit of fresh amnesty scheme starting from November 1. Aurangabad circle of Maharashtra State Electricity Distribution Company Ltd (MSEDCL) has jurisdiction over Aurangabad and Jalna districts where dues worth whooping ` 258.25 crore are pending towards 2,15,715 defaulter consumers. The consumers whose power supply has been disconnected permanently before March 2016 are eligible for the scheme named as Abhay Yojna. The defaulter consumers paying bill during the amnesty scheme till November 30 will have to just pay their outstanding dues with 5% discount as the interest charges, penalty and late payment charges would be waived off, power utility has said. While the amnesty scheme is going to run till April next year, the defaulter consumes paying their pending bills after November 30 will be given only 75% waiver in interest charges. The consumers paying their outstanding dues during amnesty scheme can immediately claim for resumption of power, MSEDCL has said. The amnesty scheme will not be applicable for agricultural pumps and public water supply schemes. As per official record, Aurangabad urban area has 29,902 consumers whose power supply has been snapped permanently, while rural parts of the district has total 81,334 such defaulters. In Jalna district, power supply of total 1,04,479 consumers have been disconnected over non-payment of dues. The further details about the amnesty scheme are available on the official website of the state power utility. The MSEDCL has appealed for contacting designated helpline numbers 1912, 18002003435, 18002333435 in case any difficulties.

Source: The Economic Times

Role of technology in improving power generation efficiency in India

October 25, 2016. India, like any other developing country, cannot overlook the pivotal role of the power sector in fuelling its overall development. All other sectors require a constant and reliable supply of electricity for the economy to function and grow. What sets the country apart though is the fact that it is the fifth largest producer and consumer of electricity with a capacity of 302 GW. From a meagre 1,743 MWh in 1950-51, the gross electricity generation boomed to 278,733 MWh in 2015, yet India is not a power surplus country even in the present coverage where around 1/4th of its total population is still deprived of access to electricity. The distribution of power generation through different sources, however, is uneven. The thermal power contribution to this is around 63%, followed by hydropower contributing around 25%. The share of nuclear power is the smallest with 3%, and the power generation through renewable sources contributes the remaining 9%. The distribution of power generation amongst various states and regions in India is also highly uneven.

Source: The Economic Times

SBI-led consortium seek investor for 600 MW power project

October 25, 2016. A lenders’ consortium led by SBI is looking for a strategic investor for an under-construction 600 MW power plant at Raigarh in Chattisgarh. The consortium comprising SBI, State bank of Bikaner & Jaipur, L&T Infrastructure Finance and PTC Financial Services has proposed to conduct a Swiss Challenge auction for the under construction 600 MW (2×300 MW) thermal power project located in Raigarh, Chattisgarh, according to the bid document. IDBI Capital has been appointed as advisor for the transaction. The consortium has already received an offer from an interested party. As per the bid document, a company is in the process of constructing a coal-fired thermal power plant of 1200 MW capacity Independent Power Plant in Raigarh District of Chhattisgarh in two phases of 600 MW each; of which Phase-I 600 MW is currently under implementation along with entire required infrastructure for 1200 MW project. The original cost of the project was appraised at ` 3,787.20 crore by the lenders in the debt-equity ratio of 75:25. But due to delay it has over-run to ` 5,673.2 crore. Commissioning dates were revised to March 2016 and June 2016 for Unit 1 and 2 respectively in July 2015 and were accepted by the lenders also. However, the company has again submitted their request for extension for commissioning date till December 2016 to the lenders.

Source: The Economic Times

Tata Power CEO says to buy stranded power assets in India

October 25, 2016. Tata Power Company Ltd plans to expand capacity by acquiring some of the country’s numerous underutilized plants instead of investing in expensive new facilities, the utility’s chief executive officer (CEO) Anil Sardana said. Tata in June bought 25 percent of Singapore-based Resurgent Power Ventures Ptd Ltd which is tasked with seeking such assets in India, he said. Domestic acquisitions are part of Tata’s plan to nearly double its global power capacity to 20,000 MW by 2025. Of that, 30 percent to 40 percent will come from unconventional sources including hydropower rather than coal, he said. But distributors are still a weak link in India’s power sector as they struggle to profit, he said. Their plight is exacerbated by the high price they pay for solar power – about 9 U.S. cents per kilowatt hour compared with 4 to 5 U.S. cents for conventional energy, he said. He said Tata was studying the design ships, with a view to transporting compressed natural gas from the Middle East to India for power generation or to distribute directly to end users.

Source: Reuters

Power sector debt worth Rs 1.34 tn at high risk: Crisil

October 23, 2016. Nearly Rs 1.34 lakh crore worth of debt on operational and under-construction power projects is at risk, ratings agency Crisil said. As per Crisil estimates, around 17,000 MW of operational power projects with a debt of Rs 70,000 crore and additional 24,000 MW under-construction projects with a debt exposure of around ` 64,000 crore are at high risk. Crisil said over the period, the credit growth to the sector will moderate to 5 percent over the next three years as compared to an average of 18 percent witnessed in the last five years. Crisil further observed that in the discoms space banking sector debt is expected to come down significantly over the next 3 years with UDAY scheme making increasing impact.

Source: Business Standard

Subsidized LED tubelights for Bengaluru

October 23, 2016. The government’s energy efficiency scheme is all set to be tweaked for Bengaluru: Instead of LED (light-emitting diode) bulbs, the authorities will distribute LED tubelights at highly subsidized prices. An LED tubelight, which costs around ` 750 in the open market, will be supplied at ` 250. The price will vary according to the wattage and distribution will be through Energy Efficiency Service Ltd (EESL), a joint venture of public sector undertakings of the Union power ministry.

Source: The Times of India

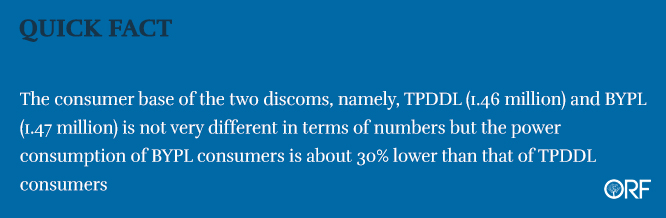

MERC announces revised tariff for Tata Power, Reliance Energy consumers

October 23, 2016. A 31 percent hike in electricity tariff is in store for Tata Power low-end residential consumers in 101-300 units consumption category for this fiscal year, but there will be a drop in tariff of 12% in 2019-20. In comparison, Reliance Energy consumers in suburbs will witness a maximum hike of 9 % for low-end residential consumers this fiscal year and there will be a dip of 17% in 2019-20. Tata Power’s energy charges still continue to be the cheapest in Mumbai despite the huge percentage in average hike for this fiscal year. The revised electricity tariffs were announced by the Maharashtra Electricity Regulatory Commission (MERC). The revised tariff will be charged with effect from October 1. As for the Reliance customers, the tariff is 48% higher as compared to tariff for Tata Power for 101-300 unit consumption category for this fiscal year. The only consolation for Reliance consumers comes for the high-end users in the 301-500 category and the 500+ category as the tariff is cheaper than Tata.

Source: The Economic Times

Rajasthan discom pulled up on ‘unofficial’ power cuts

October 19, 2016. Following a spike in ‘unofficial’ power cuts in the name of maintenance, the district administration directed distribution company Ajmer Vidhyut Vitran Nigam Ltd (AVVNL) to immediately stop all maintenance and underground cable laying work. Over the last one month, power outages have become common in the city, with AVVNL blaming maintenance and cable laying for frequent power failures. The city as a whole is suffering six- to eight-hour-long power cuts during the day.

Source: The Economic Times

Haryana discoms looking at strengthening network, power supply

October 19, 2016. Haryana discoms have signed power purchase agreements (PPAs) with 70 power generators in and outside the state as part of efforts to provide quality and uninterrupted supply to all consumers. Haryana power utilities are utilising the cheapest electricity available in the country and have tied up with various sources outside the state to procure electricity at low cost. The average generation cost from units of Haryana Power Generation Corp Ltd is Rs 5.24 per unit whereas the average generating cost of generating units near coal sources is Rs 3.39 per unit for financial year 2015-16.

Source: The Financial Express

NATIONAL: NON-FOSSIL FUELS/CLIMATE CHANGE TRENDS

India’s renewable target optimistic: IEA

October 25, 2016. The share of renewables in India’s power generation is expected to touch 19 percent in 2021 as the country has set a more optimistic target of having a 175 GW renewable capacity by 2022, International Energy Agency (IEA) said. IEA said the renewable capacity is expected to grow by almost 76 GW over the medium term versus 66 GW in the Medium-Term Renewables Market (MTMR) report in 2015. Hydropower capacity is expected to expand by over 10 GW alongside solar photovoltaic (PV) and onshore wind, driven by the government’s 5 GW small hydropower target by the end of the country’s 12th Five-Year Plan (FYP) in 2022. India’s agreement with Bhutan to co-develop over 2 GW of mostly large hydropower projects should also contribute, the report said. The weak grid infrastructure in India is seen posing challenges to renewable deployment over the medium term, but the grid integration of variable renewables remains an important focus of the government with its green corridor programme and the national smart-grid mission, it said. Overall, the share of renewables in power generation is expected to grow from 16 percent in 2015 to 19 percent in 2021.

Source: The Economic Times

Tata Power to invest in renewable energy sector in India

October 25, 2016. Tata Power will invest in renewable plants in India as it plans to increase its clean energy footprint to 30-40 percent by 2025. Tata Power currently runs 3,300 MW on non- fossil fuel out of 10,500 MW in operation. The company will increase its renewable energy footprint to 30-40 percent of the total 20,000 MW capacity it aims to build and operate by 2025. Tata Power has spread its net across emerging economies which offers 14-15 percent rate of return on investments. Tata Power’s international operations include 235 MW wind farm in South Africa, 120 MW Hydro project in Zambia and 54 MW coal-based plant along with four coal mines in Indonesia.

Source: The Hindu

Kerala to cash in on renewable energy resources

October 25, 2016. With the Centre doling out subsidies on renewable energy, Kerala is trying out newer models of windmills and also a solar-windmill hybrid system. One such unit of 300 watt micro windmill set up at the Kerala State Electricity Board (KSEB) headquarters in the capital city has become the cynosure of all eyes, with even Chief Minister Pinarayi Vijayan taking a look at it. This unit has been set up just as a demonstration piece, besides the one that we set up to study the efficacy, before taking it to the people, KSEB said. These units have been developed using the Innovation Fund by a start-up firm in Kochi. The entire unit, including the batteries, cost Rs 2.38 lakh. Likewise, the KSEB Renewable Energy Department is also working on a solar-windmill hybrid system.

Source: The Economic Times

India renews talks on building nuclear power plants

October 25, 2016. The Indian government has put renewed vigour into nuclear power plans as part of its infrastructure development programme, with negotiations on to unlock long-standing agreements with French, Russian and US companies, according to the report by the World Nuclear Association a report said. The government gave in principle approval for new nuclear plants at 10 sites in nine states, according to the report.

Source: India Today

IDFC Alternatives buys 3 Punj Lloyd solar projects

October 24, 2016. The India infrastructure fund of IDFC Alternatives is buying three solar projects in Punjab and Rajasthan from Punj Lloyd Infrastructure as part of the parent’s plans to establish a presence in the renewable energy space through acquisitions -as much as 1,000 MW in a year or so. The deal on the three solar projects with a total capacity of 45 MW was signed. IDFC paid about Rs 100 crore to wholly acquire the three projects from the Punj Lloyd unit. IDFC, which plans to float a platform to hold its renewable energy assets, is creating an in-house team to manage them, said some of those cited above.

Source: The Economic Times

A week before Diwali, Delhi’s air quality goes into red zone

October 24, 2016. Diwali is a week away but the capital’s air quality has already plunged to “very poor” levels, breaching the hazardous “red zone” for the first time this season – a level, if sustained for three straight days, prompts Beijing authorities to shut factories and curb outdoor activities. Delhi’s air quality index (AQI), separately calculated by CPCB and SAFAR, showed a common reading of 318. An AQI of more than 300 is considered “very poor”. While the city’s air quality falls to even more hazardous levels during the winter, it’s unusual for levels to rise this early in the season. Even US embassy’s air quality monitoring stations, located at the relatively clean Chanakyapuri, showed “unhealthy” levels as per their AQI measurements. Delhi was the worst among all cities monitored by CPCB. Air quality was visibly poor with a light smog over the city. Contributing to the pollution were weather conditions, heavy pre Diwali traffic and smoke from crop fires. “Diwali traffic has been a factor and it won’t improve soon,” Centre for Science and Environment said.

Source: The Times of India

UDAY success to bring huge benefits for solar sector in India

October 24, 2016. The Ministry of Power’s Ujjwal DISCOM Assurance Yojana (UDAY), a financial and operational reform scheme for distribution companies (discoms), will bring several important benefits for the solar sector, solar sector research agency Bridge to India said in a report. Second, availability and cost of private capital is expected to improve significantly with a cascading impact on competitiveness of solar power, it said. The report said the Indian government has addressed two very critical challenges for the renewable sector. The solar parks policy has already addressed the issue of land acquisition to a large extent. The UDAY scheme aims to address debilitating financial health of most state power discoms leading to offtake concerns for private power generators and stress in the overall banking sector. So far, 18 states including some of the most distressed states – Uttar Pradesh, Bihar, Rajasthan, Haryana, Punjab and Jammu & Kashmir – have signed up for the scheme with Tamil Nadu also expected to sign up shortly.

Source: The Economic Times

Coimbatore police turn to solar power to save on electricity bills

October 23, 2016. In a bid to curb high spending on electricity bills, the city police have installed solar power panels with a capacity to produce 45 kilowatt electricity at the police commissioner’s office to achieve self-sufficiency in energy production and save the exchequer’s money. The plan is to supply the solar power energy to the state power utility Tamil Nadu Generation and Distribution Corp Ltd (Tangedco) and save on the electricity bill. Presently, the city police pay anywhere between 1.20 lakh and 1.40 lakh a month in electricity bills. After commencing the solar energy production, the bill amount is likely to come down to anywhere between 50,000 and 60,000 a month. The solar energy will be supplied to the Tangedco.

Source: The Economic Times

13 villages near Indo-China border to get electricity facilities

October 23, 2016. Thirteen remote villages that lie near the border of China on the 61km-long Milam-Munsiyari trek route are set to get electricity and communication facilities by next year. Under the programme, Uttarakhand Renewable Energy Development Agency (UREDA) and Uttarakhand Power Corp Ltd (UPCL) will provide solar energy to these villages. A proposal will also be sent to the state government to provide satellite phones for communication.

Source: The Times of India

PM inaugurates country’s second green airport in Vadodara

October 23, 2016. Prime Minister (PM) Narendra Modi inaugurated the new integrated airport terminal, which is now the country’s second green airport after Kochi, and said such projects will encourage people to take up environment-friendly constructions. Modi said the airport will add another bright spot to the city. He said the airport is constructed on the principle of green infrastructure using bricks of fly ash.

Source: The Times of India

Solar boat to sail on Ganga boosting trust in clean energy

October 22, 2016. To bolster public trust in clean energy using environment friendly transport, an international team of a journalist and a filmmaker will set sail down the Ganga in a solar powered boat. The team of American journalist, traveller and adventurer Thomas Tomczyk and Guatemalan filmmaker Ana Cosenza will aim for a world record for the longest solar boat travel down a river.

Source: Business Standard

NTPC plans 50 MW solar power plant for the Andaman & Nicobar

October 21, 2016. NTPC will be setting up solar power projects of 50 MW capacity with Battery Energy Storage System (BESS) at different locations at Port Blair in the Andaman & Nicobar Islands. A Memorandum of Understanding (MoU) was signed between NTPC, the Andaman & Nicobar Administration and the Ministry of New and Renewable Energy (MNRE). Presently, the electricity needs of the Andaman & Nicobar Islands are met by 42 power houses. Some of these are hydro-electric power plants while the remaining generate electricity from solar energy.

Source: The Times of India

MNRE to seek cabinet nod to classify hydro power as renewable energy

October 20, 2016. Ministry of New and Renewable Energy (MNRE) will seek cabinet approval to reclassify large hydro power plants in the renewable category to help India achieve renewable power capacity of 230 GW by 2022. The central government has set a target of adding 175 GW of renewable energy capacity by 2022. New and Renewable Energy Minister Piyush Goyal said that of the country’s 306 GW installed power generation capacity, 43 GW comes from large hydro projects and around 44 GW from other renewable power generation capacities.

Source: The Financial Express

Suzlon inaugurates blade manufacturing facility in Madhya Pradesh

October 20, 2016. Suzlon Group said the company inaugurated its aerodynamic technology rotor blade manufacturing facility at Badnawar in Dhar district, Madhya Pradesh. The facility, inaugurated by Chief Minister Shiv Raj Singh Chauhan, is spread across 19 acres and has an annual production capacity of 400 MW and will manufacture rotor blades for its latest S111 2.1 MW turbine. The latest in its 2.1 MW fleet, the S111 has a blade length of 54.8 meters, making it one of the largest rotor diameter WTGs in India. The facility at Badnawar is Suzlon’s 14th manufacturing facility in India and has been brought into operation in less than one year, the company said.

Source: The Economic Times

India, Myanmar agree to enhance ties in a range of areas

October 19, 2016. As Myanmar embarks on a journey of democracy and development, India assured it of unstinted support as the two traditionally close neighbours agreed to enhance ties in a range of areas, including security and trade, during talks between Prime Minister Narendra Modi and Myanmar’s top leader Aung Sung Suu Kyi. The two sides signed three agreements to boost cooperation in power, banking and insurance sectors, besides deciding to step up ties in areas of oil and gas, agriculture, renewable energy and health care. Modi said the two countries agreed to enhance engagement in several areas, including agriculture, power, renewable energy and power sector.

Source: The Hindu

Kerala will go ahead with Athirappilly project: Power Minister

October 19, 2016. Power Minister Kadakampally Surendran said that the Athirappilly hydro-electric power project hasn’t been abandoned by the state government. He said efforts are on to reach a consensus on the project. The 163 MW project, planned in the water resource bed of the Chalakudy river in Thrissur district, was pending for the past several years due to protest from environmentalists. He said the time for the execution of the project has been extended, based on the strict stipulations from the Union forest and environment ministry.

Source: The Times of India

India’s rooftop solar power capacity crosses 1 GW mark

October 19, 2016. India’s rooftop solar energy capacity has crossed 1 GW mark this year with 513 MW generation capacity added over the past 12 months, Bridge to India report said. India has added 513 MW of rooftop solar capacity over the past 12 months, growing at 113 percent over previous 12 months, reaching total installed capacity of 1,020 MW, according to the report. The rooftop solar market growth is directly linked to improving economics of rooftop solar. Most commercial and industrial consumers can reduce their power bills by 20-30 percent with rooftop solar power. It said this growth is expected to continue in the years to come and the market is expected to reach a total capacity of 12.7 GW by 2021. Tamil Nadu, Maharashtra and Gujarat are leading in terms of total installed capacity. The government rooftop solar segment has grown to over 10 percent in total installed capacity.

Source: NDTV

Chandigarh, Himachal, Uttarakhand to get cheapest power, Gujarat to costliest

October 19, 2016. Residents of Chandigarh, Himachal Pradesh, Puducherry and Uttarakhand will be able to buy solar power at ` 3 per unit – the lowest tariff in India – from panels installed on their rooftops without having to shell out a penny. The solar panels will be set up by third parties, which will sell power at these prices in the two states and two Union Territories. The Solar Energy Corp of India, a government-owned company that has the mandate to develop the renewable energy sector, had sought bids for setting up 200 MW of solar panels on rooftops in the country to sell power to residents of buildings. Bids in Himachal and Uttarakhand and the Union Territories of Chandigarh and Puducherry were the cheapest, while they were the costliest in Gujarat. The electricity generated from rooftop solar panels in these four regions would cost less than the power sold by the respective state distribution companies. The highest tariff of ` 6.12 per unit was quoted for Gujarat, followed by ` 5.92 per unit for Chhattisgarh and ` 5.55 per unit for Tamil Nadu. The government plans to set up 18 MW of solar rooftop capacity in Uttar Pradesh, the largest state, where the lowest tariff inclusive of subsidy was quoted at ` 5.47 per unit.

Source: The Economic Times

Hartek Power bags 460 MW solar orders in first half of FY17

October 19, 2016. Chandigarh-based Hartek Power, announced that it has bagged orders for commissioning of 460 MW solar projects in the first half of the current financial year, registering an increase of 373 percent over last year when the company had secured 123 MW orders. The 460 MW orders received by the company include 16 substation projects of up to 132 KV spread across six states, including Punjab, Bihar, Karnataka, Madhya Pradesh, Uttar Pradesh and Maharashtra, the company said.

Source: The Economic Times

International: Oil

UK regulator seeks to spur North Sea oil firms into working harder

October 25, 2016. The head of Britain’s new oil regulator, Andy Samuel, told oil industry executives he would not hold back using new powers to fine companies or even revoke their licenses if he thinks they are too slow in squeezing more oil out of North Sea fields. Samuel, chief executive of the Oil and Gas Authority (OGA) which officially became a government company, is tasked with setting the right regulatory framework to encourage oil and gas companies to extract as much of the 20 billion barrels of oil equivalent still estimated to be trapped beneath the UK North Sea. High costs, ageing infrastructure and the two-year long slump in oil prices have meant fewer new fields than ever are being found offshore Britain as companies prefer other prospective areas like Brazil to spend money on exploration. Despite this, Samuel says Britain’s North Sea has more to give, with unit costs in the area now expected to fall to an average of 13 pounds a barrel this year, down from 18 pounds in 2014. In this environment, North Sea oil operators need to do their part to tap the remaining resources.

Source: Reuters

Mexico, Brazil vie for Big Oil’s cash in offshore auctions

October 25, 2016. Two Latin American countries in need of massive investments to boost drained state coffers have become locked in an escalating competition to attract Big Oil’s interest in their deep-water oil reserves. Mexico and Brazil, the region’s two biggest economies, each want a slice from a shrinking pie as international drillers limit their investments during a time of depressed oil prices. Exploration spending by major explorers in 2015 dropped by half from a year earlier to $7 billion, according to a Wood Mackenzie Ltd report that also predicted industry spending would continue to be curtailed through the end of the decade. Mexico will hold its first-ever deep-water auction December 5, offering up 10 areas in the Perdido area, near its maritime border with the US, and in the southern gulf’s Cuenca Salina, as well as a separate bid for the joint-venture with Pemex in the Trion field. Brazil’s tender, set for 2017, will be the second since the country unveiled tens of billions of barrels of recoverable reserves nearly a decade ago.

Source: Bloomberg

Angola becomes China’s biggest oil supplier in September

October 24, 2016. Angola became China’s largest crude supplier for the second time in September, taking the top position from Russia, customs data showed. China imported 4.19 million tonnes of oil from the southern African nation last month, up 45.8 percent from a year ago. That meant Angolan shipments stood at 1.02 million barrels per day (bpd), below 1.11 million bpd seen in August, the last time the country was the top exporter to China.

Source: Reuters

Foreign firms to increase spending on Iraqi oil fields in Basra: SOC

October 24, 2016. Foreign oil companies will increase their investments to increase output in Basra, the main producing region of Iraq, South Oil Company (SOC) said. The companies’ investment budget increased to $7.29 billion in 2017, from $6.6 billion in 2016, SOC said. Iraq’s oil ministry has just launched a new round of bidding to develop 12 small to medium-sized oil fields straddling three provinces – four in Basra, five in Misan and three in the Central province.

Source: Reuters

Russia, Qatar, OPEC discuss possible action to shore up oil market

October 24, 2016. Energy Ministers from Russia and Qatar along with OPEC’s secretary general discussed possible joint action to stabilize the oil market, Russian Energy Minister Alexander Novak said. Russia is the world’s largest oil producer but not a member of the OPEC and its budget has been hit by low oil prices, the same as for many OPEC nations. Novak said sharp falls in the price of crude threatened to trigger an oil deficit and unpredictable volatility in prices. OPEC agreed modest output cuts that are due to be set in stone in the coming weeks. The goal is to trim production to a range of 32.50-33.0 million barrels per day (bpd). Russia is ramping up its oil output amid weak oil prices, as weak rouble and investments made in previous years are helping its oil sector. In September, Russian oil output hit another post-Soviet high of 11.1 million barrels per day (bpd).

Source: Reuters

Oil investors ease back as market steadies before OPEC talks

October 24, 2016. Oil investors are playing it safe as OPEC (Organization for Petroleum Exporting Countries) hammers out the details of a deal to trim output. Money managers reduced bets on falling prices to the lowest since May as oil held above $50 a barrel, prolonging a rally that began when the OPEC announced a deal to cut production to between 32.5 million and 33 million barrels a day. The group plans to finalize the agreement at a meeting in Vienna on November 30.

Source: Bloomberg

Iraq says should be exempted from OPEC output freeze

October 23, 2016. Iraq’s Oil Minister Jabar Ali al-Luaibi said his country should be exempted from output restrictions as it was fighting a war with Islamic State. Falah al-Amiri, head of Iraq state oil marketer SOMO, said Iraq’s market share was compromised by the various wars it fought since the eighties. Luaibi said Iraq would make its case at OPEC “in a pleasant environment” to avoid tension.

Source: Reuters

Libya’s oil output at 580k-600k bpd, seeks more from western areas

October 23, 2016. Libya’s oil production is 580,000 to 600,000 barrels per day (bpd) and officials are negotiating with western municipalities to return another 380,000 bpd output from those areas, Prime Minister Fayez Serraj said. Libya’s production has been battered by port shutdowns, strikes and protests closing pipelines since the fall of Muammar Gaddafi in 2011. Output has increased recently since the reopening of major oil export terminals.

Source: Reuters

Oil producers close to output cap deal: Venezuelan President

October 22, 2016. Venezuelan President Nicolas Maduro said that OPEC and non-OPEC nations were “very close” to an agreement on oil production curbs. Maduro visited Azerbaijan and Iran as part of an international trip that also includes visits to Saudi Arabia and Qatar and is aimed at pushing a deal to stabilize oil markets. The OPEC agreed in Algiers to reduce production to a range of 32.5 million to 33.0 million barrels per day, which would be its first output cut since 2008.

Source: Reuters

Petrobras approves settlements for four New York-based lawsuits

October 21, 2016. Brazil’s state-run oil company Petrobras said its board approved settlements for four lawsuits sought by investors in New York federal court and it currently estimates a provision of $353 million to cover the costs. Petrobras said the settlements include lawsuits led by Allianz SE’s Pimco Total Return Fund, Dodge & Cox International Stock Fund, Janus Overseas Fund and Al Shams Investments. The oil company said Pimco is one of the largest holders of its bonds and that Dodge & Cox is one of its largest shareholders after the Brazilian government.

Source: Reuters

Asia’s oil markets are tightening as China cuts output, fuel stocks dwindle

October 21, 2016. From sharp cuts to Chinese oil production to falling inventories of refined fuel products, signs are mounting that Asia’s oil markets are slowly returning to balance. Global inventories of refined products – made up from light and middle distillates like gasoline and diesel, as well as residual fuel such as fuel oil – have all fallen since the beginning of the month. The drawdowns come after China, Asia’s biggest oil consumer and a top-5 global producer, reported a 9.8 percent fall in output for September, amounting to one of the deepest cuts on record. The falling stocks in most oil trading hubs, including Singapore, Europe’s ARA (Amsterdam, Rotterdam, Antwerp), and in the United States, as well as China’s declining production, are signs of a market coming closer into balance following two years of consistent crude and refined product oversupply. Despite a slight increase over the past week, Singapore’s refined product stocks have fallen from over 58 million barrels last May to below 50 million barrels, according to government data.

Source: Reuters

Singapore firm to launch new funds, boost oil trade in yuan

October 21, 2016. Singapore investment firm New Silkroutes Group Ltd is set to launch two new China-focused funds worth $1.6 billion in total and is looking to expand its oil trading business with Chinese customers following a restructure. New Silkroutes’ energy business, the International Energy Group, currently contributes about 90 percent of group turnover and is expected to generate revenue for the year ending June 2017 of $225 million, up four fold from a year earlier. The unit, which started as a gas oil and fuel oil trader, is branching into crude oil. The company aims to work with more Chinese customers, expanding trades in renminbi, the Chinese currency, to attract new business in oil and coal.

Source: Reuters

Sunoco Logistics pipeline spills gasoline in Pennsylvania

October 21, 2106. A Sunoco Logistics Partners LP pipeline spilled about 1,300 barrels of gasoline into the Susquehanna River in Lancaster County, Pennsylvania. The pipeline breach was caused by heavy flooding in Lycoming County, which lies in the north-central region of Pennsylvania. The 8-inch pipeline began leaking in Gamble Township, Lycoming County. The line was reportedly shut down after detecting a drop in pressure. The report of the leak comes as the Standing Rock Sioux tribe and environmental activists have been protesting construction of the 1,100-mile (1,886-km) pipeline in North Dakota for several months saying it threatens water supply and sacred sites.

Source: Reuters

South Korea’s GS Caltex buys North Sea Forties crude for January arrival

October 21, 2016. South Korea’s GS Caltex Corp has bought a cargo of Forties crude oil from Europe’s North Sea, indicating that the arbitrage window for crude from the United Kingdom to Asia has opened. GS Caltex, equally owned by Chevron Corp and GS Energy, purchased 2 million barrels of Forties for January arrival, the company said. The narrowing of Brent’s premium to Dubai swaps, or Brent-Dubai Exchange of Futures for Swaps (EFS) DUB-EFS-1M, to below $3 a barrel has prompted Asian refiners like GS Caltex to turn their attention to arbitrage crude from Europe. Cash Dubai has held above $48 a barrel for most of October, significantly higher than Platts’ September average for the crude at $43.33 a barrel.

Source: Reuters

China diesel exports rise to record as refiners boost output

October 21, 2016. China’s fuel exports rebounded in September, with diesel hitting a record, as refiners increased output following seasonal maintenance. The world’s largest energy consumer exported 1.6 million metric tons of diesel last month, according to data released by the General Administration of Customs. Shipments averaged almost 397,900 barrels a day, more than 50 percent higher from a month earlier. Domestic diesel production gained 3 percent from August to 3.58 million barrels a day, the National Bureau of Statistics data show.

Source: Bloomberg

Woodside quarterly sales drop 9 percent amid declining energy prices

October 20, 2016. Woodside Petroleum Ltd, the Australian oil and gas producer, posted a 9 percent drop in third-quarter revenue amid the worst energy price slump in a generation. Sales slid to $988 million from $1.09 billion a year earlier, the Perth-based company said. Output was little changed at 25.2 million barrels of oil equivalent. The producer narrowed its 2016 production guidance to a range of 92 million to 95 million barrels of oil equivalent from the previous band of 90 million to 95 million barrels.

Source: Bloomberg

Gabon oil workers strike cuts output from Onal field

October 20, 2016. A strike in Gabon by oil workers at French company Maurel and Prom has cut production from the Onal field to 10,000 barrels per day from 28,000 bpd normally, according to the oil ministry. The strike, which started and began affecting oil production, was related to staff being laid off for missing work during a period of unrest after the presidential election, the Gabon oil workers union ONEP said. Work has also been impacted at the Coucal oil field, the ministry and ONEP said. ONEP has threatened a general oil strike if the eleven workers were not allowed to return to work. Gabon is an OPEC member and Africa’s fourth largest producer with an output of around 220,000 barrels per day, dominated by international oil majors Total and Royal Dutch Shell.

Source: Reuters

US refinery margins fall in four of five regions: Credit Suisse

October 19, 2016. Refining margins fell in four of the five US regional petroleum districts in the week ended October 14, Credit Suisse said. Margins in the Midwest region fell the most, falling $4.76 to $11.68 per barrel, followed by the Gulf Coast region, with a decrease of $1.40 to $11.36 per barrel. Margins in the East Coast (Brent) region were down 92 cents at $9.87 per barrel. West Coast region margins were down 28 cents at $20.35 per barrel, while Rockies region margins rose 87 cents to $24.92 per barrel.

Source: Reuters

Iran talking with 16 investors to bid on O&G projects

October 19, 2016. Iran is negotiating with 16 international energy companies to help operate and manage 50 oil and gas (O&G) projects around the country to boost production after years of international sanctions. The projects are feasible even with oil at $40 a barrel, the National Iranian Oil Co. (NIOC) said. The South Azadegan field on Iran’s southwestern border will be the first deal announced, and probably needs $10 billion to add 600,000 barrels a day of output, NIOC said.

Source: Bloomberg

International: GAS

Russia says ready to subsidize gas supplies to Belarus

October 25, 2016. Russia will subsidize natural gas supplies to Belarus after Minsk settles an outstanding debt for past supplies, Russia’s Deputy Finance Minister Sergei Storchak said. The two countries have been at odds since the start of the year over how much Belarus should pay Gazprom for its gas after a slump in global energy prices. Belarus said that it was poised to give Russia $280 million to cover shortfalls. Gazprom has previously charged Belarus $132 per 1,000 cubic meters of gas.

Source: Reuters

US O&G producers stir from hibernation

October 24, 2016. United States (US) oil and gas (O&G) drillers are reporting the biggest and most sustained upturn since oil prices began slumping in the middle of 2014. The number of rigs drilling across the country has risen by 149, or 40 percent, since hitting a cyclical low at the end of May, according to oilfield services company Baker Hughes. The active rig count has risen in 18 of the last 21 weeks confirming that a sustained upturn in drilling is occurring. Most of the extra rigs are targeting oil-rich formations (127) rather than gas-bearing formations (21) though most wells will produce a mix of hydrocarbons.

Source: Reuters

Macquarie closes its London O&G investment desk

October 21, 2016. Australia’s top investment bank Macquarie Group has closed its London-based upstream oil and gas (O&G) advisory after a sharp drop in global deal making in recent years. The business, which oversaw the oil and gas production sector in Europe, Middle East and Africa, and which consisted of eight employees, was closed. Three members of the upstream team will move to the Macquarie Capital’s midstream oil and gas investment service under Ed Winter, which focuses on energy infrastructure such as pipelines and storage. Macquarie continues to have exposure to the oil sector through its commodities and financial markets team that runs hedging programs and reserves based loans for companies.

Source: Reuters

Indonesia considers Inpex request to boost Masela LNG output again

October 21, 2016. Indonesia expects to decide within “one or two weeks” on a plan by Inpex Corp to increase proposed output from the Masela natural gas field to nearly four times the level originally slated. President Joko Widodo in March rejected a $15 billion plan by Inpex and Shell to develop the world’s largest floating liquefied natural gas (LNG) facility to process gas from Masela, saying an onshore plant would benefit the local economy more. The move was a blow to both companies and pushed the anticipated start of production from the field into the late 2020s. Indonesia gets priority on a large portion of domestically produced LNG, but development of infrastructure to absorb the fuel has been slower than hoped both locally and abroad, putting pressure on gas prices. Inpex is also working with BP, Mitsubishi Corp, China Natinoal Offshore Oil Co and other companies on an $8 billion expansion of the Tangguh project in West Papua province that will boost the project’s annual LNG production capacity by 50 percent. Questions remain on how quickly Indonesia can develop infrastructure to absorb gas from these projects, with at least 60 uncommitted cargoes this year and next.

Source: Reuters

PetroChina said to mull raising gas prices as NDRC urges supply

October 20, 2016. PetroChina Co. is considering raising non-residential natural gas prices, while China’s top economic planner has urged major suppliers to raise output, as the country seeks to avoid shortages during the peak winter season. The country’s biggest gas producer and distributor plans to boost prices for industrial and commercial users from as soon as November 20, the earliest possible date it’s allowed to under regulations issued by the National Development and Reform Commission (NDRC). PetroChina plans to raise prices by between 10 percent and 20 percent. The NDRC called on China’s major natural gas producers, including China National Petroleum Corp, China Petrochemical Corp and China National Offshore Oil Corp, to increase output to alleviate tight supplies in the north and northwest regions. PetroChina’s planned price increase is partially designed to alleviate gas shortages in the northern provinces, where PetroChina expects to see tight supplies because of high winter-heating demand. China’s natural-gas imports surged to a record last month. China imported 5.73 million metric tons of the fuel in September, the General Administration of Customs said.

Source: Bloomberg

Shell selling 16 upstream assets worth more than $500 mn

October 19, 2016. Royal Dutch Shell is currently offering 16 assets worth more than $500 million for sale as part of its vast $30 billion three-year asset sales program, the oil and gas company’s head of upstream Andy Brown said. The Anglo-Dutch company launched the program to reduce its debt following the acquisition of BG Group.

Source: Reuters

International: Coal

China will postpone new coal-fired power plant construction

October 24, 2016. The National Energy Administration (NEA) of China has announced new restrictions on the construction of coal-fired power plants, postponing the construction of some projects that have already secured approval, or simply cancelling them. The agency will also stop projects having started construction in 2016 and will reassess the schedule for those whose construction started in 2015.

Source: Enerdata

CEZ sells 296 MW Tisova coal-fired plant in the Czech Republic

October 24, 2016. Czech energy group CEZ has reached an agreement with coal mining group Sokolovska uhelna, putting an end to their long commercial disputes and paving the way for further cooperation in future generation of power and heat from the brown coal extracted in the Sokolov region (Czech Republic). Under the terms of the agreement, CEZ will sell its 296 MW Tisova coal-fired power plant to Sokolovska uhelna, which consists of two units commissioned in 1958 and 1960, respectively.

Source: Enerdata

China’s utilities beg for coal as supply expansions yet to kick in

October 21, 2016. China’s electric power utilities are scrambling to get coal from anywhere they can, but are coming up short as efforts to boost supply take time to come into effect. China’s government in September ordered miners to boost thermal coal output by 1 million tonnes per day, but it will take months before new supplies from the recent reopening of mines hits the market. Additionally, new rules on trucking have caused logjams in deliveries and transportation price spikes while suppliers at home and abroad are digging in for ever-higher prices. Beijing’s steps to boost coal supplies have done little to derail the months-long price rally. South China coal futures prices hit record highs this week above $85 per tonne, up by 21 percent since the start of the month.

Source: Reuters

US coal industry hopes for respite after perfect storm

October 20, 2016. US coal producers have been struck by a range of structural and cyclical factors that hit consumption hard and forced many of them to seek bankruptcy protection during 2015 and 2016. The problem of excess coal production and stocks built up gradually throughout 2014 and 2015 but the warm winter of 2015/16 pushed the industry into a crisis.

Source: Reuters

International: Power

New York announces $3.5 mn funding for electricity grid modernization projects

October 24, 2016. The New York State Energy Research and Development Authority (NYSERDA) has announced $3.5 mn in funding to projects which help in modernization of the electricity grid and cut costs. The funding is part of $140 mn grid modernization initiative, which aims to help private sector to modernize New York’s electric grid while making it both smarter and more efficient. The NYSERDA’s grid modernization initiative will focus on the development of an advanced, digitally managed electric grid.

Source: Energy Business Review

Australian electricity distributor Ausgrid sold to investor consortium

October 24, 2016. The government of New South Wales (Australia) has approved the sale of a 50.4% interest of the regional electricity distribution system operator Ausgrid to an Australian consortium of IFM Investors and superannuation fund AustralianSuper for A$16,189 mn (US$12,322 mn). The NSW government will retain 49.6% in the company.

Source: Enerdata

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

China to have world’s largest nuclear capacity in 15 yrs: WNA

October 25, 2016. China is set to overtake the United States to have the world’s largest nuclear capacity over the next 10 to 15 years as it races to build new reactors to combat pollution, the World Nuclear Association (WNA) said. It will overtake France to have the second-highest number of nuclear reactors by 2020, Agneta Rising, the WNA said. In Asia, 134 operable reactors generated 400 terawatt-hours of electricity in 2015, making up 16 percent of global nuclear generation, the WNA said. Another 39 reactors comprising 47.4 GW are currently under construction in Asia, which comprises nearly two-thirds of global reactor construction. China makes up the bulk with 20 reactors under construction. New reactor construction is mostly led by industrializing countries which have enjoyed high levels of economic growth with an accompanying increase in energy demand, the WNA said. Four countries are expected to account for 70 percent of reactors commissioned in the period to 2030, which are China, Russia, India and South Korea.

Source: Reuters

Humanity enters ‘new era of climate change’ as CO2 levels break all records: WMO

October 25, 2016. The world has now entered a new climate reality era, with average concentration of carbon dioxide (CO2) expected to remain above the threshold level of 400 parts per million throughout 2016, according to the World Meteorological Organization (WMO). According to the Guardian, WMO bulletin reveals that in 2015, for the first time, CO2 levels in the atmosphere were at 400 parts per million (ppm) on average across the year as a whole. World’s longest established greenhouse gas monitoring station at Mauna Loa in Hawaii estimates CO2 concentrations in atmosphere will stay above the symbolic 400ppm for the whole of 2016 and reach new highs. It will not dip below the 400ppm mark again for many generations, the experts said.

Source: Zee News

Masdar to build 200 MW solar project in Jordan

October 24, 2016. Abu Dhabi’s renewable energy company Masdar has signed an agreement to supply power from the proposed 200 MW photovoltaic (PV) solar plant in Jordan to National Electric Power Company (NEPCO). The new solar plant, which will be linked to Al Muwaqqar substation located approximately 10 km outside Amman, is expected to generate electricity required to power around 110,000 homes annually. The project is also expected to reduce about 360,000 tons of CO2 emissions annually. In December 2015, Jordan Wind Project Company has commissioned the 117 MW Tafila wind farm in the country. The solar plant and Tafila project are expected to contribute to the country’s goal to generate 15% of its total power from renewable sources by the end of this decade.

Source: Energy Business Review

Climate change may trigger next financial crisis: Fisher

October 24, 2016. Climate change could spark the world’s next financial crisis, according to Paul Fisher, who retired this year as deputy head of the Bank of England body which supervises the country’s banks. Signs that governments are growing increasingly serious about tackling climate change suggest that businesses need to be ready for greater regulation, Fisher said. A paper presented to the Hangzhou G-20 meeting by the UK’s Cambridge Centre for Sustainable Finance urged financial institutions to improve the way they assess climate risks. Fisher said there’s a possibility of unexpected moves in financial markets as a result of climate change.

Source: Bloomberg

Omaha Public Power District Fort Calhoun nuclear power plant shut

October 24, 2016. Omaha Public Power District’s 479 MW Fort Calhoun nuclear power plant in Nebraska was closed after 43 years of service. The public electric utility said that personnel would power down the plant for the last time and begin the defueling process. In May, the utility said that continued operation of the aging reactor was not in the company’s long-term financial interests due in part to weak power prices related to low cost renewable and natural gas-fired generation resources.

Source: Reuters

France suspends carbon floor price planned on 1 January 2017

October 24, 2016. The French government has decided not to introduce a carbon price floor of around €30 per tonne as of 1 January 2017. That carbon price floor was proposed in the 2017 finance bill, that was due to be adopted by the Parliament in November 2016. It would have applied on the basis of CO2 emissions, but operators of gas-fired power plants such as Engie claimed that the measure would raise production costs and make French plants less competitive compared with foreign plants. In the summer 2016, the carbon price floor proposal was thus restricted to coal-fired power plants, which account for less than 2% of power generation. The United Kingdom has already introduced a domestic carbon floor price of around €258 per tonne, while Germany and several other European countries are considering a floor price for carbon emissions, an option that is increasingly supported by investment funds and companies. Since 2008, carbon prices under the European Emissions Trading System have fallen from around €30 per tonne to €6 per tonne due to a glut in emission permits.

Source: Enerdata

Exxon heads for courtroom faceoff with New York in climate probe

October 21, 2016. Exxon Mobil Corp is headed to a courtroom in New York for the first time to try to block the state’s demand for accounting documents about how climate change will affect its finances. New York Attorney General Eric Schneiderman, probing whether the company and its accountants tried to hide the risk from investors and the public, sued Exxon and PricewaterhouseCoopers LLP (PwC) in a bid to force them to comply with a subpoena issued in August. Schneiderman seeks files related to PwC’s audits of Exxon, including documents about accounting and reporting of oil and gas reserves, evaluation of assets for potential impairment charges or write-downs, energy price projections and projected carbon cost estimates, according to court papers.

Source: Bloomberg

DATA INSIGHT

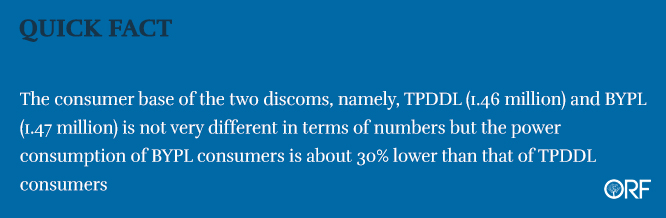

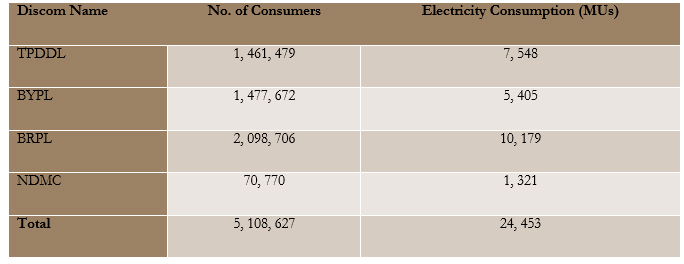

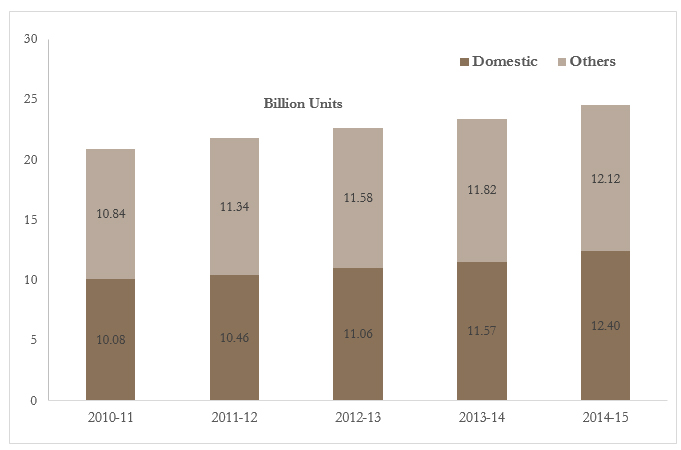

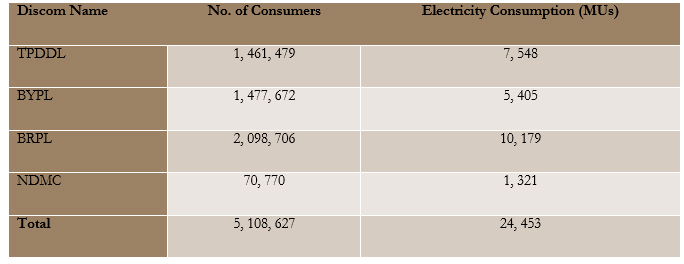

Delhi Electricity Consumption Scenario and Consumer Base

Total Households in Delhi (as per Census 2011): 3.34 Million

Delhi Electricity Consumer Base by Discoms

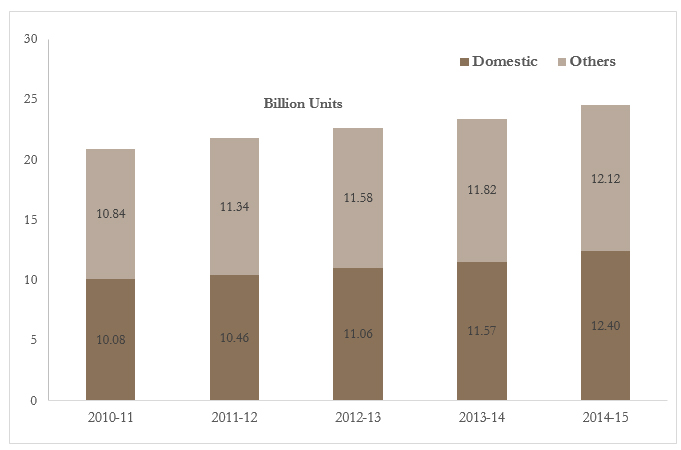

Trends in Electricity Consumption of Delhi

Source: Ministry of Power

Publisher: Baljit Kapoor

Editorial adviser: Lydia Powell

Editor: Akhilesh Sati

Content development: Vinod Kumar Tomar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV