-

CENTRES

Progammes & Centres

Location

[Privatising Power Sector NPAs]

“Mistakes can be made by anyone and a capitalist system does accommodate mistakes. But the rate at which the private sector in India is making mistakes by creating energy assets that quickly turn into stranded assets leaves one wondering if this is part of their business model? The private sector routinely blames poor governance of the sector by the government and asks for bailouts making it seem like a penalty for lack of reforms…”

Energy News

[GOOD]

Finding and quantifying the latent demand for power in India is the first step in making surplus meet deficit!

To blend or not to blend ethanol should not be decided by the sugar industry but by energy and environment policy!

[UGLY]

Scaling up solar target to buy clean image and scaling it down to signal reality to UN is an undesirable double act!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Privatising Power Sector NPAs

· Coal Needs Priority

DATA INSIGHT………………

· Small Hydro Power Projects: Exploited & Exploitable Potential

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC sees oil output rising 11 percent in 3 yrs

Downstream……………………………

· Chennai Petroleum to migrate to gas fuel to power refinery

· PRTC to get cheaper diesel from IOC

Transportation / Trade………………

· Oman-India gas pipeline needs to be expedited: CII

· Essar Oil fetches higher price on August naphtha cargo due to easing glut

· AP laying two pipelines to meet its gas needs

· RBI to facilitate oil payments of $6.5 bn to Iran

Policy / Performance…………………

· 10 percent ethanol blending to be made mandatory from next year

· CNG is safe, as clean as Euro-VI compliant diesel

· House panel chides Ministry for delay in NELP-X launch

· New price formula for non-shallow gas coming soon: Oil Minister

· Govt caps kerosene subsidy at ` 12 per litre, LPG at ` 18 per kg

· Oil Minister launches bio-diesel blended fuel for diesel consumers

· Oil regulator seeks penalty on companies breaking safety rules

· GGCL to provide 2 lakh new domestic gas connections: Saurabh Patel

· Jet fuel prices at 5-yr low, but airlines won’t cut fare

[NATIONAL: POWER]

Generation………………

· Lanco Infratech subsidiary starts 371 MW unit in AP

· REC lends ` 160.7 bn for Telangana power project

· Bankers’ consortium opts for loan recast in 500 MW Lanco Teesta hydel project

· BHEL commissions 500 MW thermal unit at Vindhyachal STPS

· NTPC plans to cut coal share in power capacity to 56 percent by 2032

Transmission / Distribution / Trade……

· Gujarat, Punjab top electricity distribution utility ratings

· AP to provide 7 hour quality power supply to farming sector

· NTPC under pressure to expand, sell cheap power: Roy Choudhury

Policy / Performance…………………

· OMC may get commercial coal mine from Centre

· Power Ministry should find out latent demand of electricity: Parliamentary Panel

· India plans to start 2nd phase of Kudankulam nuclear project in 2015

· PMO asks Coal Ministry to increase fuel linkages to sectors

· Govt to offer 6 CBM blocks for bidding in 5th round

· DERC to declare new power tariff in September

· CIL to invest ` 139 bn to raise output to 908 mn tonnes by 2020

· Himachal decides to award 960 MW project to RInfra

· Govt approves stake divestment in NTPC, NHPC

· India to change one billion light points with LEDs

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Brazil offshore Subsalt holds 176 bn barrels of oil, gas

· Dragon Oil to maintain production rate of 100k bopd for 5 yrs

· US oil and natural gas rig count up 10 to 884

· EBRD lends Lukoil US$500 mn for Azerbaijan gas field

· BP plans US$1 bn investment in North Sea oil fields

· Shell eyes new Brazilian assets ahead of BG deal

· Sound Oil agrees Italy gas deal with Shell

· East Java's Banyu Urip oil field resumes production after labor unrest

· O&G exploration takes seismic shift in Gabon to Somalia

Downstream……………………

· US refiners find the oil market's sweet spot

Transportation / Trade…………

· China strengthens hold over oil market as price maker

· Kenyan oil-pipeline accord with Uganda paves way for exports

· Italian-Thai to develop $500 mn LNG terminal in Myanmar's Dawei

· Shell declares force majeure on Nigerian gas supplies to NLNG

· Japan's Hokkaido Gas signs non-binding, three-year LNG import deal

Policy / Performance………………

· Indonesia authorities approve Sumatra's Akatara field development plan

· China grants independent refiners licenses to import crude oil

· US sanctions sour earnings surprise for biggest gas producer

· In hunt for missing billions, Buhari targets Nigeria oil company

· US gas prices fall alongside crude oil

· Russia approves draft agreement with Pakistan for North-South gas pipeline

· Saudi tempers oil price hikes in Asia to defend market share

· PetroChina said to offer flexible gas prices to larger users

[INTERNATIONAL: POWER]

Generation…………………

· JPS overhauls generating unit at Old Harbour Power Plant

· Rosatom and EVN sign agreement on nuclear project in Vietnam

· Gemma Power to build 200 MW West Medway II power plant in US

· NZ coal power generation gone by 2018

Transmission / Distribution / Trade……

· Ghana signs power purchase agreement with Turkey’s Aksa Enerji

· Japan to loan ` 26 bn to upgrade Sri Lanka power grid, cut system losses

· Libya will import electricity from Egypt and Tunisia to avoid shortage

· E.ON sells 527 MW of hydropower plants in Italy to ERG for €950 mn

· Iran, Armenia sign 3rd power transmission line contract

· Eskom will continue load shedding until late 2016

· Turkey's thermal coal imports rose by 29 percent in the 1st half of 2015

Policy / Performance………………

· Japan restarts first reactor since Fukushima disaster

· TEPCO completes 89 percent of smart meter roll-out

· ADB expresses willingness to finance power projects in Pakistan

· Australian Federal Court rejects Adani's Carmichael coal project

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Mytrah Energy secures additional funding for new projects

· Australian solar firm sign agreements with 2 Indian power companies

· ‘More R&D needed for self-sufficiency in power technologies’

· IFC plans big investment in India’s renewable energy space

· Kolkata to be part of league working to save climate

· NTPC plans solar power push

· India's report to UN sets solar target at 20 GW

· Tata Power keen to generate more from renewables

GLOBAL………………

· Australia pledges 26 percent emissions cut ahead of climate talks

· Abengoa will build 299 MW biomass-fired project in the UK

· Iran signs renewable energy technical cooperation agreement with Spain

· Kengen plans 700 MW geothermal project by 2018

· Germany's 2nd auction for 150 MW solar PV projects oversubscribed

· Canadians pull the plug on renewable energy scheme

· Forewind gets approval from UK for 2.4 GW Teesside A&B offshore wind project

· SunEdison closes financing for 300 MW wind project in Texas

[WEEK IN REVIEW]

COMMENTS………………

Privatising Power Sector NPAs

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

T |

he laws and policies on electricity enacted in the early 2000s following the liberalisation of the economy renewed hope of greater private sector participation, higher levels of efficiency and consequently lower costs. The land mark electricity act 2003 (EA 2003) was passed a decade ago. Within the framework of the EA 2003, progressive policies enshrined in the National Electricity Policy 2005, the Tariff Policy 2006, Rural Electrification Policy 2006 and the National Electricity Plan 2012 have been introduced.

Some of the achievements of the new policy regime include de-licensing of power generation, de-licensing of rural power generation and distribution, permission for trading electricity, liberal provision for captive generation, extended powers for regulatory commissions, unbundling of transmission & distribution, promotion of renewable energy and the formation of the Appellate Tribunal for Electricity.

The Central Electricity Authority (CEA) lists its achievements under the new policy regime in its comprehensive data publication for 2015. According to the publication March 2015 registered a record capacity addition of 6630.9 MW. In total 22,566 MW of capacity was added between April 2014 and March 2015 exceeding the target of 17,830 MW. 68.9 percent of the generation target for the 12th plan has already been achieved with two more years to spare. Apart from this the booklet from CEA gives a long list of achievements where targets have not only been met but also surpassed in adding transmission lines, increasing transformation capacity, increasing peak generation and so on. While these are commendable achievements, one should keep in mind that these are measured against planned targets in increasing electricity supply and related infrastructure. A more qualified measure of achievement would compare advances in efficiency in the system and in the delivery of electricity. Towards this end, let us take a closer look at the data from the CEA.

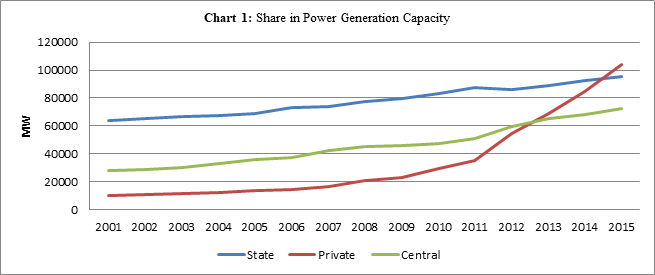

As per the data, the share of the private sector in generation has increased exponentially after the enactment of the electricity act of 2003. The share of the private sector in generation capacity overtook the share of central sector generation capacity in 2013 and it overtook state sector generation capacity in 2015 (Chart 1). Capacity addition by the private sector grew at a compounded annual average growth rate (GAGR) of a phenomenal 37.25 percent (albeit from a smaller base) between 2003 and 2015 against 13.5 percent for the central sector and 5.5 percent for the state sector. As of March 2015 power generating capacity in the hands of the private sector accounted for over 38 percent of generation capacity compared to roughly 34 percent for the state sector and 27 percent for the central sector.

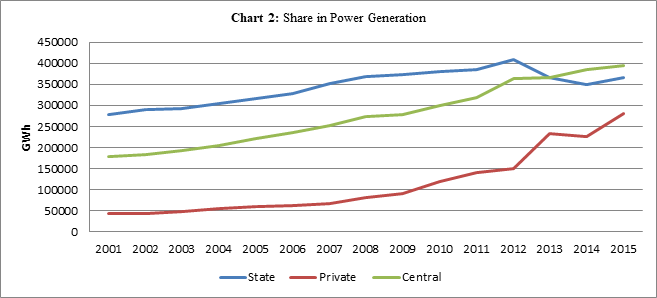

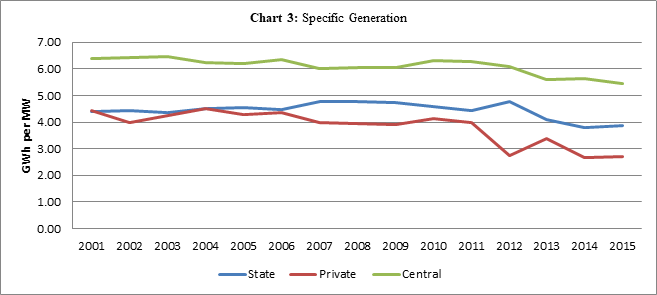

If we look at the data for actual generation we get a more interesting picture. The central sector dominates with a share of about 38 percent in generation followed by the state sector with 35 percent and private sector with 27 percent as of March 2015 (Chart 2). The private sector led with CAGR in generation of 29 percent followed by 11 percent for the central sector and 3 percent for the state sector. Before we come to conclusions let us also look at some other parameters. If we look at specific generation or the giga watt hours of electricity generated per mega watt of capacity, a measure of economic efficiency (in terms of capacity utilisation), there is an overall reduction of the from 7.59 in 2001 to 6.01 in 2015 (Chart 3). The reduction is most dramatic for the private sector for which the ratio fell from 4.43 to 2.71 between 2001 and 2015 compared to a fall from 6.37 to 5.45 for the central sector.

Between 2001 and 2015 growth in consumption and capacity addition were balanced. Power generation capacity grew by about 7 percent between 2001 and 2015 and consumption grew by about 6 percent. However, if we look at the period between 2011 and 2015 a mismatch between growth in capacity addition and growth in consumption is revealed. Between 2011 and 2015 capacity addition grew by about 12 percent (led by the private sector which recorded a CAGR of about 31 percent) while consumption grew by about 7.5 percent. Did the private sector actually contribute to reducing the overall economic efficiency of the system?

In the last two months credit rating agencies as well as the Reserve Bank of India have raised concern over Non Performing Assets (NPAs) with Public Sector Banks (PSUs). A significant share of these NPAs concerns the power sector, especially the distribution segment. However many generation assets of the private sector are also in the list of ‘stranded assets’ which are likely to turn into NPAs. There are media reports of private generators queuing up to pass on their stranded assets to NTPC, a public sector company and a bench mark for efficiency in the sector (a detail account of success story of NTPC can be found in The Bloom in the Desert: The Making of NTPC by D.V. Kapur)

Few issues can be raised at this point. First is a question over why the private sector is generating NPAs. Should not the superior knowledge of the private sector enable it to make better investment decisions than that of the public sector? Given the state of the distribution companies why did private generators decide to invest in generation? Were they led by media stories of infinite demand for electricity in India and not by any considered thought on where the demand is and how it can be monetised? Some may respond saying that the private sector is a victim of an unequal playing field that favours the public sector. The public sector generators are able to finalise power purchase agreements (PPAs) with state distribution companies (which have a monopoly) while the private sector is not. Then the question arises as to why banks lend to private generators that do not have PPAs?

The period when the private sector was investing in generation assets we were bombarded with stories on coal shortages, inefficiency in coal production and the poor governance of CIL. Such stories have disappeared from the headlines in the last one or two years. Clearly CIL has not changed in terms of efficiency or governance. Then what has changed? Is it the private sector interest in generation assets that has changed?

Mistakes can be made by anyone and a capitalist system does accommodate mistakes. But the rate at which the private sector in India is making mistakes by creating energy assets that quickly turn into stranded assets leaves one wondering if this is part of their business model? The private sector routinely blames poor governance of the sector by the government and asks for bailouts making it seem like a penalty for lack of reforms (that favour the private sector). The government rushes in with tax payer money and the cycle goes on.

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

Coal Needs Priority

Ashish Gupta, Observer Research Foundation

|

T |

he long term technology and fuel scenario clearly shows that the coal is to remain a key fuel for Indian economy in general and power sector in particular. Until any technological breakthrough is achieved in power generation the coal option will continue to be the main component of India’s energy basket. Therefore what are the possible ways through which coal can be made more sustainable? The possible solution needs to be one which has long term vision and planning and an efficient implementation strategy, reliable monitoring and review mechanism. The solution has to take care of the concerns of all the stakeholders in the total value chain.

Transport Infrastructure

The inland transport and waterways infrastructure needs to be enhanced in a planned way so as to facilitate the uninterrupted coal supply.

Blending of Coal

Coal blending can be used to improve the overall quality of the coal fired in boilers by properly mixing high ash coal with low ash or high calorific value coal like imported coal. Tata Mundra is a real-time example where imported coal is blended with the Indian coal in the ratio of 30:70.

Supercritical Technologies

Indian coal is used more efficiently with the use of supercritical and ultra-supercritical steam parameters. These technologies are proven and are deployed commercially worldwide. India has already ventured into supercritical technology. NTPC Sipat Stage-I will be 660 MW Supercritical technology units. Bharat Forge Ltd and Alstom announced on 10th November, 2008 to create a joint venture to manufacture state-of-the-art supercritical power plant equipment in India. Bharat Heavy Electrical Ltd is developing the 800 MW supercritical boilers.

Oxyfuel Combustion & Fluidized Bed Combustion (FBC)

The oxyfuel combustion process uses oxygen instead of air for combustion and recycles the flue gases. The high CO2 concentrated flue gas facilitates carbon capture. On the other hand, FBC technology has been developed for burning lower-quality, high-sulphur and high moisture-content coal. Given the low quality of Indian coal the FBC process can be of great importance. In India, Circulating Fluidized Bed Combustion (CFBC) boilers for unit size upto 250 MW are commercially available whereas in China and Europe proven designs of CFBC boilers for 600 MW are easily available.

Some of the important FBC processes are: Bubbling Fluidized Bed Combustion (BFBC) and Pressurized Fluidized Bed Combustion (PFBC).

Gasification of Coal

In general, Indian coal is not responsive to the “standard” gasification process. Most proven technologies such as slagging, entrained-flow gasifier is not compatible with most Indian coals because of high ash and ash fusion temperature. The best way to gasify Indian coal is through using fluidized-bed and moving-bed gasifiers.

In addition to combustion, coal gasification followed by combined cycle operation (Integrated Gasification and Combined Cycle (IGCC)) is expected to be deployed commercially with the goal of achieving increased efficiency and easier capture of CO2. Some of these technologies will capture significant market shares worldwide in the next 20 to 30 years.

Coal Beneficiation

A study conducted by Central Mine Planning & Design Institute Ltd in 1998 and Central Mine Planning & Design Institute Ltd / Bharat Heavy Electrical Ltd / Maharashtra State Electricity Board in 1999 found that washing of Indian Coal can give 34-25 percent ash after washing with yield of 81-60 percent and the average ash content in the reject is about 63 percent. Beneficiation of coal is a proven technology which can improve its quality and consistency. A study conducted by Railways on the beneficiation on thermal coal transportation showed that it would considerably improve the loading capacity of wagons, their life and also “release” carrying capacity on the saturated rail network[1].

Moving on to UCC

The use of Ultra Clean Coal (UCC) and Ultra Super Clean Coal in direct carbon conversion fuel cells can give more than 80-85 percent efficiency. It can reduce greenhouse gas emissions from power generated by 10 percent to 20 percent[2].

Road ahead for India

In future efficient use of coal resource needs to be given top priority. This is the only in which we can extend the life of our coal reserves. The whole planning needs to be done in such a way that there is an operational and strategic fit and the long term interest of various stakeholders in the entire system is protected.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

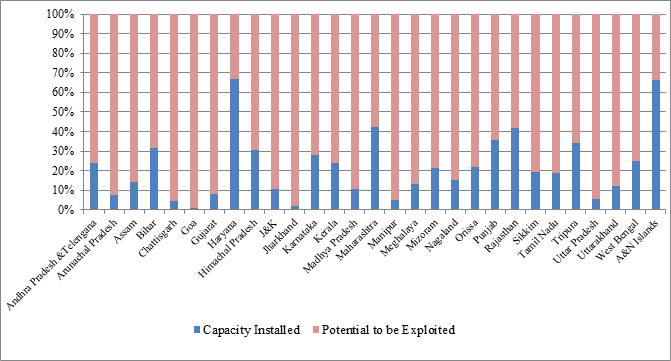

Small Hydro Power Projects: Exploited & Exploitable Potential

Akhilesh Sati, Observer Research Foundation

|

State |

Potential SHPs |

Already Installed SHPs |

|

Nos. |

Nos. |

|

|

Andhra Pradesh |

387 |

70 |

|

Telengana |

||

|

Arunachal Pradesh |

677 |

152 |

|

Assam |

119 |

6 |

|

Bihar |

93 |

29 |

|

Chhattisgarh |

200 |

9 |

|

Goa |

6 |

1 |

|

Gujarat |

292 |

6 |

|

Haryana |

33 |

9 |

|

Himachal Pradesh |

531 |

171 |

|

J&K |

245 |

39 |

|

Jharkhand |

103 |

6 |

|

Karnataka |

834 |

160 |

|

Kerala |

245 |

27 |

|

State |

Potential SHPs (Nos.) |

Already Installed SHPs (Nos.) |

|

Madhya Pradesh |

299 |

11 |

|

Maharashtra |

274 |

59 |

|

Manipur |

114 |

8 |

|

Meghalaya |

97 |

4 |

|

Mizoram |

72 |

18 |

|

Nagaland |

99 |

11 |

|

Orissa |

222 |

10 |

|

Punjab |

259 |

48 |

|

Rajasthan |

66 |

10 |

|

Sikkim |

88 |

17 |

|

Tamil Nadu |

197 |

21 |

|

Tripura |

13 |

3 |

|

Uttar Pradesh |

251 |

9 |

|

Uttarakhand |

448 |

101 |

|

West Bengal |

203 |

24 |

|

A & N Islands |

7 |

1 |

SHPs Installed Capacity and Remaining Potential (as on 30-06-2015)

Source: Lok Sabha Unstarred Question No. 1781 for 30.07.2015

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC sees oil output rising 11 percent in 3 yrs

August 9, 2015. After arresting a seven-year decline in crude oil production, Oil & Natural Gas Corp (ONGC) will see an 11 percent rise in output over the next three years as it brings newer fields in production. ONGC had in fiscal year 2014-15 broken a seven-year jinx of dipping crude oil production by recording a marginal rise in output to 22.262 million tonnes, from 22.247 million tonnes in the previous year. In fiscal year 2016-17, the output will further rise to 24.80 million tonnes and 24.81 million tonnes in the following year. The company had produced 23.71 million tonnes of crude oil in 2011-12, which declined to 22.56 million tonnes in the following year. ONGC's fields are as old as 50 years. Its prime Mumbai High, which accounts for nearly 60 percent of its oil production, is 40 years old. The company's focus on developing small and marginal fields is now paying off. The increase in output will primarily come from offshore fields, particularly off the west coast. In FY15, offshore production had risen to 14.74 million tonnes from 13.71 million tonnes a year ago. Natural gas production will see a steeper rise - from 64 million standard cubic meters per day (mmscmd) output in 2014-15 to 66 mmscmd in the current fiscal year (2015-16) and to 102 mmscmd in 2018-19. ONGC is investing ` 24,188 crore in six major field developments and another ` 17,490 crore in redevelopment of three currently producing fields including Mumbai High and Heera fields. These investments do not include the over $8 billion that the company is planning to spend on the Krishna Godavari basin gas block of KG-DWN-98/2 or KG-D5. KG-D5 is likely to begin producing oil and gas from 2018-19. (profit.ndtv.com)

Downstream………….

Chennai Petroleum to migrate to gas fuel to power refinery

August 10, 2015. Crude oil refining company Chennai Petroleum Corporation Ltd will be migrating towards cleaner gas fuel to power its refinery at an outlay of around ` 500 crore in couple of years time. The company closed the first quarter of the current fiscal with a net profit of ` 924 crore as compared to Rs.510 crore posted during the corresponding quarter of 2014-15. The company is waiting for the Indian Oil Corp Ltd's (IOC) LNG terminal being set up. Chennai Petroleum is currently using low sulphur fuel to run its refinery and once the fuel is changed to gas based, then there will be handsome saving in the fuel cost. According to IOC, the LNG terminal is expected to be ready by 2018. The ` 5,000 crore project has three major components - setting up of refrigerated tanks, re-gasification facilities and marine facilities (for LNG import). According to Chennai Petroleum, the gross refining margin (GRM) during the quarter ended June 30, 2015 was USD 10.99 per barrel as against USD 1.88 per barrel during the corresponding period of last fiscal. The blended average price of crude for Chennai Petroleum is around USD 61 during the first quarter of the current fiscal. Meanwhile IOC will be investing around ` 1,000 crore in Chennai Petroleum in the form of preference share capital. (www.newkerala.com)

PRTC to get cheaper diesel from IOC

August 10, 2015. Indian Oil Corp (IOC) will supply diesel at cheaper rates to PEPSU Road Transport Corp (PRTC). The IOC has given exemption of 0.25 paisa per litre to PRTC. The transport department said a Memorandum of Understanding (MoU) has been signed in this regard. An MoU has been signed for three years and PRTC would save ` 2.10 crore during the next three years. Due to signing of this MoU, the PRTC could save ` 19,000 per day. PRTC buses are covering 2.5 lakh km area with the consumption of 75,000 litre diesel daily. (www.hindustantimes.com)

Transportation / Trade…………

Oman-India gas pipeline needs to be expedited: CII

August 10, 2015. In the wake of last month's Iran nuclear deal with world powers, Indian industry called for expediting the proposed undersea pipeline project that would bring Iranian gas to India via the Arabian Sea, bypassing Pakistan. The project, also known as the Middle East to India Deepwater Pipeline (MEIDP), was formulated a decade ago but could not take off due to western sanctions on Iran. The proposed gas pipeline project by South Asia Gas Enterprises (SAGE) could see over 31 million cubic metres of gas per day delivered to India. The SAGE pipeline would originate at Chabahar on the southern coast of Iran and Ras Al-Jafan on the Oman coast, and after traversing deep in the Arabian Sea, would bring gas to Porbandar in south Gujarat. The pipeline construction would take two years to complete, according to the project. With the Iran-Pakistan-India (IPI) pipeline still stuck and the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline yet to take off, the SAGE project holds promise of seeing gas delivered to India in about five years. Oman is a key trading partner of India in the Gulf region with bilateral trade exceeding $5.7 billion in 2013-14. The Confederation of Indian Industry (CII) official called for reviving the bilateral mechanisms to boost business. The previous 7th session of the joint business council was organised in September 2010 in Muscat. India's Jindal Steel and Power has acquired the Oman-based Shadeed Iron and Steel Co. for $464 million from Abu Dhabi's Al Gaith Holding and is at present operating a 1.5 million ton per annum gas-based iron plant at the Sohar industrial port area of Oman. Bharat Oman Refineries, a company promoted by Bharat Petroleum Corporation and Oman Oil Company, has set up a 6 million tonnes per annum refinery with crude supply system at Bina in Sagar district of Madhya Pradesh. (www.business-standard.com)

Essar Oil fetches higher price on August naphtha cargo due to easing glut

August 6, 2015. India's Essar Oil has sold an August naphtha cargo to Japan's Petro-Diamond at about $16.50 a tonne above Middle East quotes on a free-on-board (FOB) basis, up at least 10 percent from a previous deal, traders said. Essar Oil sold up to 35,000 tonnes of the fuel for Aug. 27-31 loading from Vadinar late, coming at a time of stronger fundamentals for sellers as the supply glut was seen easing. The Indian refiner had previously sold a July cargo to an undisclosed buyer at premiums of $14 to $15. So far, India has offered some 510,000 tonnes of naphtha for August loading through tenders, and has sold most of it. The export volumes are similar to what India had offered for July but fewer incoming cargoes from Europe and the Mediterranean arriving in Asia in September and a lack of cheap alternative liquefied petroleum gas (LPG) to replace naphtha are helping to boost sentiment. The Asian naphtha crack, the premium/loss in refining a barrel of Brent crude into the light fuel, was near a two-month high of $98.13 a tonne, data showed. (economictimes.indiatimes.com)

AP laying two pipelines to meet its gas needs

August 6, 2015. The Andhra Pradesh (AP) government is laying two major pipelines to transport natural gas explored in the Krishna-Godavari Basin. The first pipeline is from Kakinada to Srikakulam covering 301 km spread over the four north coastal districts of East Godavari, Visakhapatnam, Vizianagaram and Srikakulam. The second pipeline is from Kakinada to Nellore covering a distance of 501 km and connecting all major power stations being developed in Krishna, Guntur, Prakasam and Nellore. Both the pipelines will be laid by the AP Gas Development Corporation (APGDC), a joint venture company of Andhra Pradesh government and GAIL Gas Limited with 50% equity each. The corporation was established to have a regional gas pipeline distribution network in various cities and towns in the state. The state government has already finalised the plan to connect the second pipeline by linking Tumkur in Karnataka with Nellore via Hindupur. Though the KG Basin has plenty of gas reserves, lack of pipelines has been a major challenge for the state to make the state economy gas-driven. The APGDC had also submitted the bid to lay a pipeline from Nellore to Ennore in Tamil Nadu so that the gas available across the east coast can be transported in the most cost-effective way. The AP government had asked the existing industries to spell out their future demand for gas so that it can tie up with national and international gas supplying companies and import gas at the Kakinada LNG terminal. Several power stations, ceramic, cement, chemical, paper, glass and heavy machinery companies have submitted their requirement for gas in the coming year. The laying of pipelines across the 10 districts of the state is set to give a big fillip to gas-based industrial activity. The AP government has already proposed to companies in Singapore, Japan and China to provide clean and environment-friendly fuel at a reasonable price once they set up shop in the state. (timesofindia.indiatimes.com)

RBI to facilitate oil payments of $6.5 bn to Iran

August 5, 2015. The Reserve Bank of India (RBI) will assist Indian refiners to clear over $6.5 billion of past dues they owe to Iran for crude oil purchases. RBI agreed to helping create payment channels to clear the past dues when Finance Secretary Rajiv Mehrishi-led a four member delegation to Tehran last month to discuss modalities of clearing dues. The central bank, which had previously facilitated payment of oil import bill to Iran, agreed to explore options currently available. After the US and western powers in 2011 blocked payment channels in a bid to bring Iran to the negotiating table over its controversial nuclear programme, RBI had faciliated oil payments to Iran via Turkey. RBI representative was part of the four-member delegation that visited Tehran. Iran and six world powers last month sealed an accord to curb the Islamic Republic's nuclear programme in return for ending sanctions. Lifting of sanctions would open up banking channels and Tehran is likely to seek past oil dues. India is keen that the repayment of dues that have accumulated since February 2013, be done in staggered manner so as to avoid a run on the rupee. RBI will detail out the banking channels as well as payment schedule with its Iranian counterpart. Since February 2013, Indian refiners like Essar Oil and Mangalore Refinery and Petrochemicals (MRPL) have been paying 45 percent of payment due on purchase of crude oil from Iran in rupees through UCO Bank, Kolkatta. The remaining has been accumulating, pending finalisation of a payment mechanism. They had last year paid nearly $ 3 billion in six instalments through a limited payment channel following start of nuclear talks between the West and Iran. The outstanding has since climbed to over $ 6.5 billion. Essar Oil owes $ 3.34 billion, MRPL $ 2.49 billion and IOC $ 581 million to Iran. HPCL-Mittal Energy Ltd (HMEL) owes $ 97 million and Hindustan Petroleum Corp Ltd (HPCL) another $ 29 million. Besides, about ` 17,000 crore was lying in Iranian account with UCO Bank. India is keen that Iran continue to give Indian refiners favourable terms - like insurance and shipping as well as 90-day credit period, on oil it sells to India, its second biggest customer after China. Under US pressure, New Delhi has restricted import of Iranian oil at 11 million tonnes in past two fiscals. But with easing of sanctions, it will look to increase imports provided Tehran continues to extend the fiscal terms. (economictimes.indiatimes.com)

Policy / Performance………

10 percent ethanol blending to be made mandatory from next year

August 11, 2015. The government may make 10 percent ethanol blending with petrol mandatory from next year to give a boost to its production on the back of remunerative pricing declared by the centre. The prime minister’s office (PMO) wants the oil ministry to increase ethanol blending to provide alternative business model for cash-starved sugar mills, which owe over ` 14,000 crore to cane growers. At present, it is compulsory to blend 5 percent ethanol with petrol, but oil-marketing companies (OMCs) are able to do around 2 percent. This is because sufficient quantities are not available for blending. While the price given for ethanol used for blending was very low earlier, the government is now providing close to ` 49 per litre for it. For sugar mills this price is considered remunerative, as ex-mill rate of sugar has fallen below ` 20 per kg now. As per the plan, sugar mills would be asked to increase ethanol production from 2015-16 marketing year (October-September) to meet the demand of 230 crore litres for 10 percent blending with petrol. Subsequent to increased availability, the oil marketing companies would be issued orders to buy ethanol for 10 percent blending needs. There has been a weak response from sugar factories to the ethanol-blending programme. So far this year, OMCs have been able to contract 82 crore litres of ethanol against the requirement of 133 crore litres for five percent blending. The country has an installed capacity to manufacture 450 crore litres of ethanol, of which 240 crore litres of capacity are with sugar factories, while the rest is standalone. The government is moving in the direction of reducing its dependence on imported fuel. In this direction while ethanol blending was adopted a few years back, Oil Minister Dharmendra Pradhan launched bio-diesel plan where diesel blended with bio-diesel would be sold in four cities. This would also be increased in coming months. (www.mydigitalfc.com)

CNG is safe, as clean as Euro-VI compliant diesel

August 11, 2015. NGO Centre for Science and Environment (CSE) has critically analyzed a Council of Scientific and Industrial Research (CSIR) study, jointly carried out by Indian Institute of Petroleum and the University of Alberta, on presence of pollution-causing nanoparticles in CNG and diesel bus exhausts. This was in response to claims made by M O Garg, director general of CSIR, who had recently shared the findings of the study—that the number of nanoparticles released from CNG buses is higher than that from diesel buses but the mass of nanoparticles emitted from CNG buses is relatively lower. CSE's analysis, however, reveals that the CSIR study findings are different from what Garg's briefing may have conveyed. Garg had been referring to nanoparticle emissions from an Indian CNG bus and a Canada-made diesel bus meeting advanced US tier-II standards. US tier-II norms are tighter than Euro VI norms. CSE accessed the draft study by CSIR only to find that CNG buses performed way better than diesel on almost all pollution parameters—including nanoparticles. CNG's performance is close to or better than Euro VI emission standards for diesel that are yet to be implemented in India. The study involved carrying out emission tests on two Indian CNG buses and two diesel buses (when they were mobile)—one of a Canadian make that meets US tier II standards fitted with advanced particulate filters and another an Indian diesel bus without any filter or diesel trap. The results showed that nanoparticle emissions from Indian diesel buses were 600 to 2,000 times more than those from the CNG bus. But when the CNG bus was compared with the Canadian diesel bus with particulate matter traps and advanced nitrogen oxides control meeting US tier-II standard, the study found nanoparticle levels for CNG to be 12-40 times higher. The Indian diesel bus without particulate matter trap was found emitting 28,000 times more nanoparticles compared to the Canadian bus. (timesofindia.indiatimes.com)

House panel chides Ministry for delay in NELP-X launch

August 11, 2015. A parliamentary panel has criticised the delay in finalisation of the new contractual regime for the launch of the 10th round of New Exploration Licensing Policy (NELP) bidding. The panel said in its report that the finalisation of the new contractual regime is an important step for exploratory activities to gain momentum and also towards ensuring energy security. It asked the Ministry for Petroleum & Natural Gas to apprise them about the reasons for the delay and recommended that it worked towards finalisation. The panel also took serious note of the stagnant production of crude oil and natural gas in the last three years. It recommended that the Ministry should review the exploratory programme of the oil public sector units comprehensively. The Ministry said that ONGC and Oil India Ltd have made 44 discoveries under the NELP regime which are under development and to be put on production as per the timeline of the contracts. (www.thehindubusinessline.com)

New price formula for non-shallow gas coming soon: Oil Minister

August 10, 2015. The government is on the verge of announcing the premium to be paid on natural gas for all new discoveries in difficult deep-sea areas, Oil Minister Dharmendra Pradhan said. While approving a new gas pricing formula in October 2014, the government had decided that new gas discoveries in deep-water, ultra-deep sea or high-temperature and high-pressure areas will be given a premium over and above the approved price. Pradhan, who had recently met Finance Minister Arun Jaitley on the issue, said all issues are settled and an announcement can be made any day. In October 2014, the government announced an upward revision to $5.61 per unit against the industry's demand for at least doubling it to a little over $8 per unit, as per the Rangarajan Committee recommendations. However, accepting the recommendations would have meant a gas price of $8.4 per unit, instead of $5.6 effective from November 2014 for five months. The new price per unit applied for normal categories of gas. Oil Ministry said that based on the recommendations of the Directorate General of Hydrocarbons (DGH), the ministry has proposed allowing a fixed percentage of gas produced from difficult fields to be sold at the market price and the rest as per the approved price. While shallow-water blocks are at a depth of up to 100-500 metres, deep-water blocks descend to around 1,000 metres. Those at depths beyond 1,500 metres are classified as ultra-deep-water blocks. These are the areas where the Reliance Industries-led consortium has maximum discoveries. Reliance Industries will not immediately be able to avail the new price as it remains locked in an arbitration with the government over alleged shortfall in production from its Krishna-Godavari basin fields. The government has announced a new rate, effective April 1, at $4.66 a unit - lowering it by 8 percent from the earlier $5.61 owing to lower international prices. Natural gas producers, including Oil and Natural Gas Corp (ONGC), have said that it would be uneconomical to produce gas from difficult fields at the current price of $4.66. (www.business-standard.com)

Govt caps kerosene subsidy at ` 12 per litre, LPG at ` 18 per kg

August 10, 2015. Government has capped the subsidy payout on kerosene at ` 12 per litre and domestic cooking gas (LPG) at ` 18 per kg, Oil Minister Dharmendra Pradhan said. Kerosene through public distribution system (PDS) is sold at ` 14.96 per litre against the actual cost of ` 29.91. The difference between the two, ` 14.95 per litre, is termed as under-recovery or revenue loss. While the government will provide ` 12 to meet most of this, the remaining ` 2.95 will be borne by oil producers ONGC and Oil India Ltd, he said. Similarly, there is an under-recovery or loss of ` 167.18 on sale of every 14.2-kg subsidised LPG cylinder at the current price of ` 417.82. At current rates, all of the under-recovery is within the sanctioned subsidy limits. Pradhan said, at present, the state-owned fuel retailers incur under-recoveries on sale of PDS kerosene and subsidised domestic LPG only as petrol and diesel have been deregulated (market-linked) with effect from June 2010 and October 2014 respectively. For the first quarter of FY16, the government will provide ` 1,733 crore cash subsidy as per the new formula to Indian Oil Corp (IOC), ` 404 crore to Bharat Petroleum Corp Ltd (BCPL) and ` 451 crore to Hindustan Petroleum Corp Ltd (HPCL). On LPG, the subsidy support to IOC would be ` 2,506 crore, BPCL ` 1,155 crore and HPCL ` 1,183 crore, he said. At current prices, the upstream companies will have to bear about ` 5,000-6,000 crore kerosene subsidy for the full year. As many as 12 LPG cylinders of 14.2-kg are supplied to every household at a subsidised rate of ` 417.82. There is an under-recovery of ` 167.18 per cylinder, which the government will bear entirely. LPG consumers get subsidy equivalent to the under-recovery directly in their bank accounts so that they can purchase a 14.2-kg bottle at market price of ` 585. 2015-16 Budget has provided for ` 22,000 crore towards LPG subsidy and another ` 8,000 crore on kerosene. (timesofindia.indiatimes.com)

Oil Minister launches bio-diesel blended fuel for diesel consumers

August 10, 2015. Oil Minister Dharmendra Pradhan launched High Speed Diesel (HSD) blended with bio-diesel to be used by diesel consumers across retail outlets of the three Oil Marketing Companies (OMCs). The ministry had recently permitted direct sale of Bio-Diesel B100 to bulk consumers including Indian Railways, shipping and state road transport corporations. The government is also promoting Ethanol Blended Petrol (EBP) programme where ethanol blending in petrol is going up from five percent to 10 percent based on availability. (www.business-standard.com)

Oil regulator seeks penalty on companies breaking safety rules

August 10, 2015. India's oil safety regulator, Oil Industry Safety Directorate (OISD), wants powers to impose financial penalty on companies found guilty of violating norms leading to accidents, which experts say would help in lifting safety standards and dealing with incidents like that of BP's oil spill in the Gulf of Mexico. In India, companies report accidents to the regulator, which in turn undertakes probes but has no statutory powers to penalize any firm irrespective of the outcome of the probe. Based on the regulators' assessment as well as their own, companies do initiate disciplinary action against individuals, but top officials rarely get penalized. Oil giant BP recently agreed to pay a record fine of $18.7 billion (` 1.19 lakh crore) to settle legal action over the 2010 Gulf of Mexico oil spill that cost 11 lives and resulted in 4.2 million barrels of oil spewing over 87 days. In advanced economies, oil firms mostly have to follow a stricter safety code and deal with a swifter legal system. In India, big penalties are unheard of irrespective of the scale of loss. Probes into accidents are rarely made public by the government. Another key bottleneck in enforcing higher safety standards in the sector is the multiplicity of safety regulators. OISD is the safety regulator for just the offshore fields while Directorate General of Mines Safety (DGMS) and Petroleum and Explosives Safety Organisation (PESO) divide responsibilities for all onshore activities, including exploration, refineries and distribution terminals. The oil ministry wants all safety regulations to come under one institution. Its possibility is being evaluated by a panel of secretaries. Petroleum and Natural Gas Regulatory Board, the downstream regulator, recently slapped a fine of ` 20 lakh on Gas Authority of India Ltd (GAIL) for an accident last year. (economictimes.indiatimes.com)

GGCL to provide 2 lakh new domestic gas connections: Saurabh Patel

August 9, 2015. Gujarat Gas Company Ltd (GGCL) will add more than two lakh new household gas connections and install over 25 new CNG stations in the state, Energy Minister Saurabh Patel said. The GGCL, a new entity, is a merger between two state-run gas distribution companies - GSPC and Gujarat Gas Company - and has over one million customers, Patel said on the occasion of issuing 700 new piped gas connections to customers of new residential societies in Karelibag area of the city. GGCL has presence across 19 districts in Gujarat and Union Territory of Dadra Nagar Haveli, and Palghar and Thane in Maharashtra. It provides 6.5 metric million standard cubic metres per day (mmscmd) of gas to 14,000 industrial units and 10.23 lakh domestic users, he said. Presently, Vadodara Gas Ltd (VGL) operates nine CNG stations in Vadodara and dispenses more than 65,000 kg/day CNG, catering to the consumers of automobile sector comprising buses, cars and auto rickshaws. VGL supplies Piped Natural Gas (PNG) to 76,000 houses and 2,800 commercial establishments in the city. Both GAIL and VMC have equal shareholding participation in VGL. Patel said if 25 percent share of investment of GAIL is purchased by the Gujarat government, it will be easy for VGL to expand the city gas distribution network. (www.livemint.com)

Jet fuel prices at 5-yr low, but airlines won’t cut fare

August 8, 2015. Jet fuel prices may be at a five-year low but don't expect airfares to drop. Airlines say fares are already at rock bottom levels during the lean July-September travel season and rule out any further cuts. But at the same time, they promise more discount schemes in coming days. According to the Centre for Asia Pacific Aviation (CAPA), Indian carriers' collective losses from 2007 to FY 2015 are Rs 73,000 crore and their total debt on March 31, 2015, was ` 75,000 crore. With fuel cost accounting for 40-50% of an airline's cost, any fall in price could mean significant relief for airlines. CAPA estimates that in FY15 Indian airlines spent ` 15,800 crore on fuelling for domestic operations — ` 1,000 crore lower than the previous fiscal. However, travel agents complain that airlines are offering low fares by lowering their base fares and not revising fuel surcharge. (timesofindia.indiatimes.com)

[NATIONAL: POWER]

Generation……………

Lanco Infratech subsidiary starts 371 MW unit in AP

August 11, 2015. Lanco Infratech Ltd said its subsidiary has operationalised 371 MW Unit-I of third phase of Kondapalli power project at Vijayawada in Andhra Pradesh (AP). Lanco Kondapalli Power is an Independent Power Project (IPP) located at Kondapalli Industrial Development Area near Vijayawada in Andhra Pradesh, India. This Combined Cycle gas based Power Project is being developed in three phases. (economictimes.indiatimes.com)

REC lends ` 160.7 bn for Telangana power project

August 11, 2015. Rural Electrification Corp (REC) has extended a loan of ` 16,070 crore to Telangana State power utility for setting up a 4000 MW thermal power project. The loan would fund the 4,000 MW Yadadri Thermal Power Project being set up by Telangana State Power Generation Corporation Limited at Damacharla in Nalgonda district. REC handed the cheque to Chief Minister K Chandrasekhar Rao, according to the Chief Minister's office. Thus far REC has extended a loan of ` 20,391 crore for power projects in the State. The loan would come with 11 percent interest as against the normal rate of 11.5 percent. The REC had earlier outlined intent to lend up to ` 24,000 crore for power projects taken up by Telangana. (www.thehindubusinessline.com)

Bankers’ consortium opts for loan recast in 500 MW Lanco Teesta hydel project

August 10, 2015. A consortium of nine banks is set to opt for strategic debt restructure (SDR) mechanism of the much-delayed 500 MW Teesta hydel power project under execution of Lanco Infratech Ltd. This SDR will enable the banks to gain control of the project, help the infrastructure company execute the project and later pave way for stake divestment, to either the Sikkim Government or any other developer interested in the asset. The SDR mode is a new approach RBI has allowed for bankers to address financially stretched assets. This enables them to rejig debt and acquire stake. In this case, they may take up to 51 percent. The bankers include ICICI, IFCL, PNB, REC, Hudco among others. Given the macro economic conditions and low investor appetite for power sector, the stake sale initiative of the company has not progressed. As the conditions improve, Lanco would go in for stake sale. The company had divested Lanco Udipi and Budhil hydel projects to Adani Group entity and Greenko respectively. While the Lanco has a total debt of ` 36,000 crore, it concluded a corporate debt restructure for ` 9,500 crore. Its effort to divest stake and bring down debt has become tough due to current market conditions not being favourable to power sector companies. (www.thehindubusinessline.com)

BHEL commissions 500 MW thermal unit at Vindhyachal STPS

August 7, 2015. Bharat Heavy Electricals Ltd (BHEL) has added one more coal-based power plant to the grid by successfully commissioning the 500 MW Unit-13 of Vindhyachal Super Thermal Power Station (STPS), Stage-V of NTPC. The project is located in Vindhyanagar in Singrauli district of Madhya Pradesh. Significantly, BHEL has earlier commissioned six units of 500 MW rating each at Vindhyachal power station. With the commissioning of this unit, BHEL has now commissioned seven sets of 500 MW aggregating to 3,500 MW, the highest by BHEL in a power project. BHEL-make sets of 500 MW rating class form the backbone of the Indian power sector with 76 sets having already been commissioned by BHEL in the country. BHEL has already established its engineering prowess by successfully delivering higher rated units such as 600 MW, 660 MW, 700 MW and 800 MW thermal sets with a high degree of indigenisation. Notably, in the current financial year (2015-16), BHEL has already commissioned power plants with a cumulative capacity of 2,480 MW. (www.financialexpress.com)

NTPC plans to cut coal share in power capacity to 56 percent by 2032

August 5, 2015. NTPC plans to reduce the share of coal in its installed generation capacity from the current 85% (38,154 MW of coal-fired capacity, out of a total of 45,048 MW) to 79% by 2022 (68,829 MW out of a total of 86,542 MW) and to 56% by 2032. The share of gas in the capacity should remain stable until at least 2022 at nearly 6 GW (5,984 MW). NTPC plans to add nearly 10 GW of hydropower and solar capacity by 2022, from the current 910 MW to 11,729 MW in 2029. The group already has 110 MW of solar PV parks under operation with a further 250 MW under construction and 510 MW of solar PV projects under bidding. NTPC also has 800 MW of operational hydropower capacity (until the end of July 2015) with 819 MW under construction. The group will also invest in nuclear power: in January 2011, it created a joint venture with the Nuclear Power Corp of India for the development of a 1,400 MW PWHR nuclear power plant in India. (www.enerdata.net)

Transmission / Distribution / Trade…

Gujarat, Punjab top electricity distribution utility ratings

August 11, 2015. The state distribution utilities of Gujarat and Punjab have topped the latest power ministry ratings for parameters such as financial performance and reform measures. A total of 40 state distribution utilities were rated in the third year of the exercise for 2013-14. The annual exercise for state power distribution utilities developed by the Union government, along with the Central Electricity Authority (CEA), India’s apex power sector planning body, and the Central Electricity Regulatory Commission (CERC), is aimed at helping banks and financial institutions assess risk while lending to the distribution utilities. The ratings assume significance given that the state electricity boards (SEBs) are laden with a debt of ` 3.04 trillion, of which the Rajasthan utility alone accounts for ` 81,000 crore. The exercise was conducted by rating agencies ICRA Ltd and CARE as the health of the power distribution sector holds the key to the success of generation projects in a sector seen as a key bottleneck in efforts to sustain and boost economic growth. The ratings come in the backdrop of the National Democratic Alliance (NDA) government preparing a blueprint for the supply of 24x7 power that will include customized plans for each state and lays special emphasis on green power and energy efficiency. The government, which has made boosting power generation a key policy priority, is looking to supply adequate power at affordable prices. (www.livemint.com)

AP to provide 7 hour quality power supply to farming sector

August 9, 2015. In view of the enhanced 9 percent power demand in July this year compared to same month last year due to dry spell and rising temperatures during the kharif season, the Andhra Pradesh (AP) government has made foolproof arrangements for providing assured seven hours' quality power supply. The seven-hour quality power supply would benefit farming sector consisting of around 15 lakhs agricultural pump sets in AP. As per the directions of Chief Minister N Chandrababu Naidu, a special mechanism has been adopted to see that not even a single acre crop (at any cost) withers due to short supply of power and all possible steps are taken to replace failed Distribution Transformers within stipulated time of 24 hours in rural areas also. The government has also directed DISCOMs (Power Distribution Companies) to give main focus on providing assured power supply to all drinking water supply schemes to avoid any inconvenience to the public. The government is keen on implementing energy efficiency activities even in agriculture sector where there is a potentiality of around 35 percent savings of energy with effective Demand Side Management (DSM) measures. The prestigious project will ensure quality power supply to farming sector and reduction in distribution losses, avoidance of theft of energy apart from reducing distribution transformer failures in seven districts of Krishna, Guntur, Prakasam, Anantapur, Kurnool, Kadapa and Chittoor of the state. (www.business-standard.com)

NTPC under pressure to expand, sell cheap power: Roy Choudhury

August 5, 2015. NTPC is under a lot of pressure to expand and deliver cheap power but faces a big challenge as its customers, the state-owned power distribution companies, are not buying electricity due to their poor financial health, forcing the company to run plants at low capacity, NTPC chairman Arup Roy Choudhury said. But despite the obstacles, the state-run power generator is going ahead with plans to expand, organically and inorganically, even as the private sector has pulled the plug on investments in the beleaguered power sector. The company is close to making its second acquisition by buying assets of Damodar Valley Corp (DVC) as part of its strategy to buy 10,000 MW of distressed assets. Debt-laden discoms have been buying less electricity, opting for load shedding, forcing generating companies to run their units at less than full capacity. NTPC's plant load factor, a measure of electricity generated by a unit compared to the maximum it can, has declined to about 62% in the June quarter. Roy Choudhury said that the central government's decision to not offer a bailout to discoms, as has been the tradition, is a correct move and that discoms need to become commercially viable by introducing better practices. He said that the company now aims to expedite acquisition of distressed assets, especially the state-owned ones to reduce the pain in the sector. After acquiring the Patratu power plant in Jharkhand, NTPC is close to acquiring units totalling 2,520 MW from DVC. (economictimes.indiatimes.com)

Policy / Performance………….

OMC may get commercial coal mine from Centre

August 11, 2015. Odisha Mining Corp (OMC) may get to operate a commercial coal block for supply of the dry fuel to non-regulated sectors like steel, cement and sponge iron. The state government has already written to the Ministry of Coal to allocate the Patrapada coal block with reserve of 1042 million tonne to OMC. Patrapada is one of the 10 Schedule I coal blocks listed by the Ministry of Coal for non-regulated sectors. The remaining coal blocks identified are Nuagaon-Telisahi, Talabira II, Utkal, Biatarani West, Mandakini B, Rampia and dip side Rampia, Ramchandi promotional coal block and North of Arkhapal and Srirampur coal block. The minister had recently written to Coal Minister Piyush Goyal, seeking allocation of Patrapada coal block in favour of OMC. Till now, only one coal block- Jamkahni with 80 million tonne of coal reserve has been earmarked for non-regulated sector (sponge iron). The Coal ministry has already put nine coal blocks for auctions for the power sector- Utkal-C, Bijahan, Talabira-I, Mandakini, Utkal B1, Utkal B2, Radhikapur (East), Radhikapur (West) and Utkal D. Due to reverse bidding system followed for power sector end use, the state government has been deprived of substantial revenue from the coal blocks auctioned for power sector as compared to those for the non-regulated sectors. (www.business-standard.com)

Power Ministry should find out latent demand of electricity: Parliamentary Panel

August 10, 2015. The Power Ministry has not spelt out its efforts to find out the latent demand of electricity in the country, which would help government framing energy policy, a Parliamentary panel said. Latent demand is a phenomenon that after supply increases, more of a commodity or service is consumed. The committee had noted that there was energy deficit of 4.2% and peak deficit of 4.5% during the year 2013-14. The ministry said that these figures are provided by the Central Electricity Authority and they do not have figures for latent demand for energy. The committee noted that under rural electrification programme the annual outlay for the current year is ` 5,144.09 crore whereas the expenditure till August 2014 is ` 76.15 crore. (www.dnaindia.com)

India plans to start 2nd phase of Kudankulam nuclear project in 2015

August 10, 2015. The government of India has announced that construction work would start this year on units 3 and 4 of the Kudankulam nuclear power plant (KKNPP) project, i.e. before the end of March 2016. In March 2015, construction was scheduled to start in April 2016 but the new units have already secured administrative approval and financial section has been accorded to the project. The Kudankulam nuclear project consists of four reactors. The first two are rated 917 MW net: unit-1 was commissioned in 2015 and unit-2, currently under construction, is planned for 2015. Two other reactors are also planned and their construction would follow that of units 3 and 4. India and Russia have signed an agreement to build the units 3 and 4 at a cost of ` 33,000 crore (US$5.25 bn). (www.enerdata.net)

PMO asks Coal Ministry to increase fuel linkages to sectors

August 9, 2015. To ensure availability of fuel to industries, the Prime Minister's Office (PMO) has asked the Coal Ministry to increase coal linkages to all sectors, including power. The linkages of coal demand is primarily done with the objective of planning of coal supplies to consuming industries. The direction has come at a time when the government is considering coal linkage auction and has sought comments from stakeholders on the draft auction methodology. In order to conduct the auction of the coal linkages to non-regulated sector which covers cement, sponge iron, captive power and others through competitive bidding this ministry has prepared a draft auction methodology and also an approach paper has been prepared for public consultation, Coal Minister Piyush Goyal had said. He further said that an Inter-Ministerial Committee (IMC) was set up in January to consider various models, including auctioning of coal linkages/LoAs (Letter of Assurances) through competitive bidding as the selection process and to recommend the optimal structure that would meet the requirements of all the stakeholders. (economictimes.indiatimes.com)

Govt to offer 6 CBM blocks for bidding in 5th round

August 9, 2015. Government is likely to offer six coal bed methane (CBM) blocks, all in Gujarat, under 5th round of auction this fiscal, oil ministry said. CBM is a generic term used for gas that is found in adsorbed state in coal and found in coal layers. The blocks are GJ(1)-CBM-2013/V, GJ(2)-CBM-2013/V, GJ(3)-CBM-2013/V, GJ(4)-CBM-2013/V, GJ(5)-CBM-2013/V and GJ(6)-CBM-2013/V, all in Gujarat. In the previous rounds, a total of 33 CBM blocks spread over 16,613 square kilometers had been awarded. The blocks awarded hold 62.4 Trillion cubic feet (Tcf) of in place reserves, out of which 9.9 Tcf has been established so far. The government is keen to push for CBM extraction in a big way and will soon announce the 5th round of bidding. (www.business-standard.com)

DERC to declare new power tariff in September

August 8, 2015. Delhi Electricity Regulatory Commission (DERC) will be announcing new power tariff early next month. A day after the regulatory body completed the two-day public hearing, officials said that they will announce revised tariff within four weeks. Putting aside demands made by the AAP government to stall the order till CAG audit results for discoms were announced, the regulator said they had to follow rules of the Electricity Act for an annual tariff revision. The public hearing gave consumers, activists and RWAs a platform to air their views and argue against the proposed hike. Over 300 people participated in the hearing along with a few AAP MLAs. While other participants reached a consensus to reject demands by power companies for an increase in tariffs, the AAP MLAs urging DERC to wait for CAG audit results. The commission deliberately delayed the tariff process this year in anticipation of CAG audit results, but the power companies kept pressuring them to revise domestic tariff. Announcements on possible changes in open access policy as well certain penalties are expected in next month's order. Delhiites may not actually have to pay more for electricity when the tariff order is announced as DERC's preliminary assessment of the claims made by power discoms for financial year 2014-15 suggests that against their demand for up to 20% hike, not more than 2-3% is actually required to adjust the revenue gap. Even this may be brought down to nothing because the commission may impose penalties on the discoms that will adjust even the minimal revenue gaps. In their tariff petitions, the Reliance-backed BSES discoms sought a tariff hike of up to 19%, while Tata Power Delhi asked for 20%. Arguing for the increase, the discoms submitted that their combined revenue gap due to the absence of a cost-reflective tariff has gone up to ` 28,000 crore. The total under-recoveries of BRPL and BYPL have risen to ` 20,000 crore, while for Tata Power Delhi it is estimated at ` 8,000 crore, the discoms said. (timesofindia.indiatimes.com)

CIL to invest ` 139 bn to raise output to 908 mn tonnes by 2020

August 6, 2015. Coal India Ltd (CIL) will invest ` 13,900 crore to take its production to 908 million tonnes (MT) by 2019-20, the government said. CIL has prepared a roadmap for achieving a coal production level of about 908 MT in 2019-20 from the current level of production of 494.23 MT, Coal and Power Minister Piyush Goyal said. The minister further said that the domestic capital expenditure by Coal India and its subsidiaries up to June in the current financial year is ` 1,026.77 crore. CIL accounts for over 80% of the domestic coal production. The state-run firm missed the production target for the financial year 2014-15 by 3% recording an output of 494.23 million tonnes. The company's output target was 507 million tonnes for the fiscal. For the ongoing fiscal the government has set for CIL an output target of 550 MT. (www.dnaindia.com)

Himachal decides to award 960 MW project to RInfra

August 6, 2015. Nearly a decade after the Himachal Pradesh government first invited bids for the 960 MW Jhangi-Thopan-Powari hydel project, the state cabinet decided to award the project to Reliance Infrastructure (RInfra). The project was awarded to the Netherlands’ Brakel Corp in 2006 based on a competitive bid process but the state HC cancelled the allocation on the ground of misrepresentation in pre-bid documents of the firm. RInfra had secured the second spot in the bidding. After the cancellation of Brakel Corp’s bid, the state government decided to invite fresh bids for the project but the decision was challenged by RInfra in the SC. The state government has now decided to allot the project to RInfra without waiting for the outcome of the plea in the SC. (www.financialexpress.com)

Govt approves stake divestment in NTPC, NHPC

August 6, 2015. The government has approved proposals for divesting 11.36% stake in NTPC and 5% stake in NHPC Ltd, a move that it likely to fetch ` 8,247 crore to the exchequer. At the current market price, the government will fetch ` 5,592 crore from the divestment. Coal and Power Piyush Goyal said that none of the Central Power Sector Understandings (CPSUs) of the Power Ministry have made any loss during the last three financial years. He said that the present policy of the government is to divest stake in CPSUs that have been making profits in the last three years. (www.dnaindia.com)

India to change one billion light points with LEDs

August 5, 2015. Around one billion light/bulb points would be converted into energy efficient LED bulb points in three year's time in India, Ajay Mathur, director general, Bureau of Energy Efficiency said in Chennai. Queried about the outcome of the Clean Energy Ministerial held in Mexico in May, Mathur said 23 countries that attended the ministerial agreed to work towards changing 10 billion light points to energy efficient bulbs. According to Mathur, India has decided to have one billion light points with energy efficient LED bulbs in three years time. He was in Chennai to inaugurate the psychrometric lab set up by Danish group Danfoss. Mathur said the high number would make manufacturers of LED bulbs increase their capacity and production which in turn would bring down the final prices. In addition, there will be export opportunities for the Indian LED bulb makers, Mathur said. Queried about the proposed venture capital fund by Bureau of Energy Efficiency, he said the fund would be operational in a month's time. He said no project has been given the fund sanction out of the ` 75 crore corpus. Mathur said the central government is also expected to contribute towards the corpus. (www.ibtimes.co.in)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Brazil offshore Subsalt holds 176 bn barrels of oil, gas

August 10, 2015. Brazil's Subsalt Polygon, an offshore area that has already yielded some of the world's largest recent oil finds, may hold enough undiscovered petroleum and gas to supply the world's current oil needs for more than five years, researchers said. The Polygon, which covers most of Brazil's Santos and Campos offshore sedimentary basins, contains at least 176 billion barrels of undiscovered, recoverable resources of oil and natural gas (barrels of oil equivalent), according to study released by the National Institute of Oil and Gas (INOG) at Rio de Janeiro-State University. That is more than four times the 30 billion to 40 billion barrels of oil equivalent (boe) already discovered in the area. Subsalt refers to oil trapped far beneath the Earth's surface or seabed by a layer of mineral salts. The Polygon is a Brazilian legal district that covers an offshore area near Rio de Janeiro and Sao Paulo where Brazil already gets about 85 percent of its oil and gas. The INOG's estimate is the only major public assessment of the Subsalt Polygon's potential. The 2015 estimate is 54 percent bigger than the INOG's 2010 estimate of 114 to 288 billion boe. That survey put the probability of the lower estimate at 90 percent and the higher outlook at 10 percent. (in.reuters.com)

Dragon Oil to maintain production rate of 100k bopd for 5 yrs

August 7, 2015. Dragon Oil announced, in its 2015 half year results, that it will aim to maintain an average gross production rate of 100,000 barrels of oil per day (bopd), for a minimum of five years, from 2016. The company achieved a gross production rate of approximately 92,060 bopd in the first half of 2015, compared to 73,440 bopd in the first half of last year. A gross production rate of 100,658 bopd was achieved on June 9, 2015. (www.rigzone.com)

US oil and natural gas rig count up 10 to 884

August 7, 2015. Oilfield services company Baker Hughes Inc. says the number of rigs exploring for oil and natural gas in the U.S. increased by 10 this week to 884. Houston-based Baker Hughes said 670 rigs were seeking oil and 213 explored for natural gas. One was listed as miscellaneous. A year ago, 1,908 rigs were active. Among major oil- and gas-producing states, Texas gained eight rigs, Louisiana gained four, Kansas increased by three, West Virginia gained two and California, and North Dakota each increased by one. Pennsylvania lost three rigs, Colorado declined by two and Ohio lost one. Alaska, Arkansas, New Mexico, Oklahoma, Utah and Wyoming were unchanged. The U.S. rig count peaked at 4,530 in 1981 and bottomed at 488 in 1999. (www.newsobserver.com)

EBRD lends Lukoil US$500 mn for Azerbaijan gas field

August 7, 2015. The European Bank for Reconstruction and Development (EBRD) and the Asian Development Bank (ADB) have approved a US$500 mn loan to Lukoil, the second largest oil producer in Russia, for the development of the Shah Deniz gas field in Azerbaijan. The EBRD has already disbursed US$380 mn to Lukoil's subsidiary Lukoil Overseas Shah Deniz (LSD), with a first tranche of US$180 mn allocated in 2005 and a second tranche of US$200 mn in 2014. (www.enerdata.net)

BP plans US$1 bn investment in North Sea oil fields

August 7, 2015. British oil and gas major BP plans to invest US$1 bn (€918 mn or £645 mn) in the Eastern Trough Area Project (ETAP), aimed at raising the oil production level of fields located off the eastern coast of Scotland in the North Sea. The ETAP project is an integrated development of nine fields, which started production in 1998 and produce around 120,000 bbl/d; six of them are operated by BP and the remaining three by Shell. (www.enerdata.net)

Shell eyes new Brazilian assets ahead of BG deal

August 7, 2015. Royal Dutch Shell is considering investing billions in Brazil, set to become a focal point after the planned acquisition of BG Group, even as it prepares to sell huge chunks of its business to pay for the $70 billion deal. The company has announced plans to sell around $30 billion in assets between 2016 and 2018 to improve its balance sheet and focus on its core deepwater oil and LNG business. The BG deal will make Shell the largest foreign investor in Brazil's coveted deepwater oil fields. According to the company, it has earmarked up to $5 billion for new acquisitions, mainly in Brazil where state-run oil company Petrobras is selling assets worth nearly $14 billion amid a vast corruption scandal that has engulfed the company and the government. Shell, which expects oil prices to return to $90 a barrel by the end of the decade, is also looking at acquisitions in other future key regions including East Africa, which has huge reserves and where BG is developing several gas fields in Tanzania. (www.reuters.com)

Sound Oil agrees Italy gas deal with Shell

August 6, 2015. Junior energy firm Sound Oil announced that it has agreed a gas sales deal for its Casa Tonetto production concession with Shell Energy Italia. Located in northern Italy, the Casa Tonetto concession includes the Nervesa natural gas field development – which Sound declared in mid-July would produce its first commercial gas later this year following a decision by the Italian Ministry of Economic Development's decision to award the company a production concession for the project. The Nervesa field is a 21-billion cubic foot field discovered by ENI in 1985. Sound has spud two wells on the field since 2013. (www.rigzone.com)

East Java's Banyu Urip oil field resumes production after labor unrest

August 6, 2015. Normal production resumed at Banyu Urip oil field in the Cepu block, East Java, Indonesia following a disruption caused by labor unrest, the country's upstream oil and regulator said. Banyu Urip production dipped to a low of 30 barrels of oil per day (bopd) from the usual 80,000 bopd during the workers' unrest, which led to a suspension of construction at the main site of the development, where several production facilities are currently under construction. The central processing facility (CPF) for the Banyu Urip project will be equipped to have a total production of 165,000 bopd, rising to a peak production of 205,000 bopd when combined with the early production facility (EPF). (www.rigzone.com)

O&G exploration takes seismic shift in Gabon to Somalia

August 5, 2015. Not all exploration has slowed for oil and gas (O&G) in Africa. More nations not known for energy reserves on the continent are conducting seismic surveys during a drilling downturn, according to consultant PwC. Gabon, Somalia, the Seychelles, Madagascar and Guinea-Bissau are among countries that used seismic surveys in the past year, Chris Bredenhann, partner at PwC based in Cape Town, said in a report. The technique is similar to ultrasound and is used before drilling to detect where reserves may be. In 2014, 11 of the largest 20 oil and gas discoveries were in Africa, though their size decreased, according to PwC. The number of bidding rounds for oil and gas blocks has also declined, the PwC report showed. (www.bloomberg.com)

Downstream…………

US refiners find the oil market's sweet spot

August 6, 2015. Low crude prices and strong demand for gasoline are creating near-perfect conditions for oil refineries across the United States (US), especially those geared towards maximising gasoline production. Valero, the country’s largest independent refiner, made a gross margin of more than $13 on every barrel of oil processed in the second quarter, and a net margin of almost $8.50, both the highest since 2007. The volume of crude processed by U.S. refineries hit a record 17.1 million barrels per day (bpd), 680,000 bpd above the prior-year level and almost 1.5 million bpd above the 10-year seasonal average. But strong consumption has absorbed all the extra gasoline production, and motor fuel stockpiles remain moderately tight. Gasoline consumption has averaged more than 9.5 million bpd over the last four weeks, according to the U.S. Energy Information Administration, which is almost half a million barrels above the 2014 level. Stocks are just 217 million barrels, less than 3 million barrels, or 1.3 percent, above last year’s level. But if stocks are adjusted for the higher rate of consumption in 2015, they stand below both the prior-year level and 10-year average. Gasoline stocks are currently equivalent to just 22.7 days worth of consumption, the lowest seasonal level since 2008. Low stocks explain why the gross margin for turning crude into gasoline remains at 50 cents per gallon or more, some of the fattest margins in the last decade. (www.reuters.com)

Transportation / Trade……….

China strengthens hold over oil market as price maker

August 11, 2015. China's growing ability to buy and sell millions of barrels of crude oil on the Asian physical market in a matter of minutes through its main trading firms has given China so much clout that other traders are often forced to follow its agreed prices. Leading Chinese oil traders have cornered the market on several occasions since October last year. Chinaoil, the trading arm of PetroChina, bought 5 million barrels of crude in just 30 minutes through Asia's main price-finding mechanism organized by Platts, part of McGraw Hill Financial Inc. Market power is shifting towards big consumers, with oil output at record highs and global demand slowing. China's main oil traders Unipec and Chinaoil have been able to cherry-pick the best offers and take advantage of cheap oil to build strategic reserves. This year, China is challenging the United States as the world's No.1 crude buyer, with weaker oil prices lowering the cost of building China's strategic petroleum reserves. China bought nearly 11 percent more crude in the first seven months of 2015 from a year earlier. For China, the cost of importing roughly 200 million barrels of crude a month has fallen to $10 billion at current prices around $50 a barrel, from $23 billion when prices were at $115 a barrel last summer. (www.reuters.com)

Kenyan oil-pipeline accord with Uganda paves way for exports

August 10, 2015. Kenya and neighbouring Uganda agreed on the route of a planned oil pipeline, ending months of debate on the link that will export crude from companies including Tullow Oil Plc. The pipeline will pass through the Lokichar basin in northern Kenya, Manoah Esipisu. The countries had discussed building the link through southern Kenya and the capital, Nairobi. The agreed design will be the cheapest to develop, according to the Ugandan presidency. Tullow has found oil in both countries, with Uganda estimating finds at 6.5 billion barrels and Kenya at 600 million barrels. The planned $4.5 billion pipeline to the Indian Ocean will allow the U.K. company to start exports from joint ventures with Africa Oil Corp. and Total SA. China’s Cnooc Ltd. is also a partner in Uganda. While oil was discovered in Uganda in 2006 and four years later in Kenya, both are still in the planning stage of commercial development. The pipeline will run for about 1,500 kilometers from Uganda’s Hoima district through Lokichar and on to the Kenyan coastal town of Lamu. Proponents for the southern route cited security concerns in the north, where bandits and Islamist militants have carried out attacks. The export project remains subject to financing and security guarantees from Kenya, the Ugandan presidency said. (www.bloomberg.com)

Italian-Thai to develop $500 mn LNG terminal in Myanmar's Dawei