-

CENTRES

Progammes & Centres

Location

[Iran Nuclear Framework Agreement: Impact on India's Energy Calculations]

“With the lifting of sanctions on Iran, Indian refineries will once again be in a position to freely source crude in a manner that optimises product yield and simultaneously also maximise the profitability of the refinery. Latest news reports show that Indian imports of Iranian crude has increased after some relief in sanctions on Iran at the end of 2013. What is important to note here is that rationalisation of crude sourcing happens at the refinery level and not at the Ministry of External Affairs level…”

Energy News

[GOOD]

The unexpected gift of the longest oil glut since 1997 should be put to good use!

Aggressive coal bidding is likely to add to non performing assets of the power sector!

[UGLY]

Consumers should not be expected to pay the price of congestion in power supply networks!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Are Coal Import Statistics Reliable?

ANALYSIS / ISSUES…………

· Iran Nuclear Framework Agreement: Impact on India's Energy Calculations (part I)

· India’s Energy Future: Black Fractured by Green

DATA INSIGHT………………

· Crude Oil: India & Iran

[NATIONAL: OIL & GAS]

Upstream…………………………

· India to seek rights for developing Iranian gas field

· Protest affects ONGC's production in Assam

· BG commences oil production from Mukta-B Platform in India's Bombay basin

Downstream……………………………

· IOC books 1 mtpa capacity at new LNG terminal

· BPCL to expand Bina oil refinery

· GSFC plans ` 100 bn petrochemical-urea complex at Dahej

· MRPL to acquire ` 64 bn petrochemical plant in Karnataka

Transportation / Trade………………

· Great Eastern Shipping arm incorporates Greatship Oilfield

· Essar Oil signs pact to sell 49 percent stake to Russia's Rosneft

· RIL completes 49.9 percent stake sale in US pipeline venture for $1 bn

· Delhi HC orders govt to resume gas supply to Deepak Fertilisers

Policy / Performance…………………

· CNG stations to triple in NCR: Oil Minister

· ‘Surrendering of LPG subsidy will not be made mandatory’

· Oil Ministry sees 2015/16 upstream subsidy at ` 50-60 billion

· India may save $24 bn on longest oil glut since 1997

· LNG project key for development: Kerala CM

· India invites Canadian firms to invest in energy infrastructure

· New subsidy formula to boost ONGC, OIL earnings in Q1

[NATIONAL: POWER]

Generation………………

· ‘Delay in coal allocation has stalled work on Ferozabad power plant’

· Telangana to set up power projects

· BHEL commissions second 500 MW unit at Tuticorin power station

Transmission / Distribution / Trade……

· Gangotri Dham to be connected with main grid

· Consumers paying for congestion in power supply network

· Thermal coal imports soar 23 percent at 12 major ports

· Sterlite Grid bags ` 4 bn Maheshwaram transmission project

· JSW in talks to buy Monnet Ispat's Odisha power plant

· AP will invest a whopping ` 300 bn on power T&D

· There is no problem of availability of power: DERC Chairman

· India will export more power to Bangladesh on completion of SAARC grid

· ICRA warns against aggressive coal bidding, says may hurt projects

Policy / Performance…………………

· AERB grants licence for regular operation of Kudankulam's 1 GW unit

· CIL to give up three-fourths of Mozambique mine

· Reliance Power writes to Coal Ministry seeking withdrawal of mining restrictions

· AP, Telangana seek Centre's intervention over water and electricity sharing issue

· Discom Tata Power offers 50 percent discount on 5-star ACs in Delhi

· Govt puts 22 stalled power projects on watch list

· Delhi govt asks for coal block to set up power plant

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Mexico battles bad timing in 1st sale of oil fields since 1930s

· Russian oil and condensate production hits post-soviet record

· WPX Energy enters oil-rich Permian basin with $2.3 bn buy

· OGDCL commences gas production from reti-2 well in Pakistan's Guddu Block

· PetroVietnam to work with Murphy, ExxonMobil on oil, gas projects

Downstream……………………

· Oil refiners' 'mini golden era' will end soon: IEA

· China to let independent refiners import more crude

· Petrobras plans 62 percent Abreu e Lima crude-oil processing boost

Transportation / Trade…………

· BHP says will take $2 bn charge on US onshore energy business

· Shale gas supply held hostage by oil to drop by most in a year

· Marathon to buy gas-rich MarkWest for $15.8 bn

· BG sends first LNG cargo from newest Australian plant to China

· Consortium lead for $10 bn TAPI pipeline project to be selected in September

· Turkmenistan faces falling gas exports to Russia

· Gas pipeline web sought to reduce Russia’s grip on EU supplies

Policy / Performance………………

· Low oil price domino effect to shut more North Sea fields early

· Indonesia's Pertamina to roll out higher-grade petrol

· Argentina plans up to $784.3 mn in bonds for oil companies

· Peru delays bids for country's most productive oil block

· Dutch Govt bans shale gas explorations for next 5 yrs

· Bangladesh plans to build two additional land-based LNG terminals

· OPEC sees more balanced oil market in 2016

· Oil prices rise on China stocks rebound, Greek deal hopes

· US crude exports would help Europe, Czech Republic says

· Ukraine will create US$1 bn energy reserve fund by year-end

· Spain fines Repsol $24.9 mn over petrol price fixing

[INTERNATIONAL: POWER]

Generation…………………

· Pak, China working on 120 MW power plant in Muzaffargarh

· China Power will invest in JAKS's 1.2 GW power project in Vietnam

· TNB, partners sign deal to build coal-fired power plant

· Kyushu Electric starts loading fuel at Sendai nuclear plant

Transmission / Distribution / Trade……

· Kenya, Tanzania seeks bidders for power interconnection project

· Enel signs $3 bn PPA with Endesa Chile

Policy / Performance………………

· World countries reach nuclear deal with Iran

· Shenhua wins federal approval for coal mining project

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· India calls for end to extravagance as it works on climate plan

· Canadian JV plans 500 MW solar park in Maharashtra

· BHEL commissions 10 MW solar power plant in Karnataka

· Indian and Pacific oceans hiding global warming: NASA

· India's wind power capacity to double by 2020: CRISIL

· Aditya Birla Nuvo enters solar power business

· IREDA launches loan scheme for rooftop solar power projects

· India feels the heat in WTO solar dispute with US

GLOBAL………………

· Brazil's high power cost to boost distributed solar generation

· EU carbon market reserve seen absorbing 85 percent of glut by 2021

· Carbon-trading program generates $1.3 bn in US Northeast

· RWE lignite plants may form half of German power reserve

· ArcelorMittal to use microbes to make fuel from waste gas

· Wind farms now off limits for $7.5 bn fund in Australia

· Oman’s first commercial solar project starts power generation

· UK renewable funds drop on Osborne’s climate levy changes

· Ghana invites investment from Indian power firms

· New Zealand commits to 30 percent GHG emission cut between 2005 and 2030

[WEEK IN REVIEW]

COMMENTS………………

Are Coal Import Statistics Reliable?

Ashish Gupta, Observer Research Foundation

|

I |

n October 2014 when Mr. Anil Swarup was appointed as an Officer on Special Duty (OSD) at the Ministry of Coal (Moc), the first message he received from the Prime Minister’s Office was to ‘revive the coal sector so that the entire economy can rebound’. As a result Coal India Ltd (CIL) has shown a tremendous improvement in production. The data for the core sector in May, 2015 shows the coal sector as one of the best performing sectors, with 7.8 percent growth on a year to year basis. In the month of May 2015, CIL produced 40.9 Million Tonnes (MT), registering a growth of 11.8 percent and in June, 2015, growth continued at 12 percent. While operational success was really impressive a major contributor to this growth was the easing of land acquisition and environmental hurdles. However import of coal has not been reduced significantly and it is anticipated by many analysts that imports are likely to grow in the near future.

Import of Coal from 2009 to 2014:

|

Coal |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

|

Coking |

24.69 |

19.48 |

31.80 |

32.56 |

37.19 |

10.87 |

|

Non Coking |

48.56 |

49.43 |

71.05 |

105.0 |

131.25 |

38.59 |

|

Coke |

2.35 |

1.49 |

2.36 |

3.07 |

4.19 |

1.17 |

|

Total |

75.6 |

70.40 |

105.21 |

140.63 |

168.44 |

49.45* |

Figures are in MT (* Import up to June, 2014)

Source: Ministry of Coal

The country is importing more coal but power plants are reluctant to lift that coal. Another much touted achievement in the power sector was the reduction of energy and peak energy deficits to a record low at 2.1 percent and 2.6 percent in 2015-16. Unfortunately, this improvement is the result of low demand from the State Electricity Boards (SEBs). Consumption at coal-based power plants also remained unchanged at 219 MT on a year-on-year basis. Many think that it is a temporary phenomenon which will be corrected in future. The question which remains unanswered is who is using imported coal?

Another inconsistency concerning coal import statistics is the situation of distribution utilities in the country. The country’s largest lender, State Bank of India (SBI) has red flagged the power sector as a fast ticking time-bomb that could escalate the banking system’s non-performing assets to an alarming level over the next couple of months. Till March 2014, the accumulated losses of discoms were over ` 3 lakh crores (around $ 50 bn) and owe over ` 2 lakh Crores to Banks ($ 33 bn). The Reserve Bank of India stated in last June that ` 53,000 Crore ($ 8.8 bn) of loans to seven SEBs are most likely to turn into non-performing assets this month after several rounds of restructuring and three year moratorium on principal repayment. The SBI, Chairperson also conveyed banks anxiety to the officials of Power and Finance ministry. Despite a record generation of trillion units of power in 2014-15, the electricity sector is turning into ’problem child‘.

Interestingly, the report on the performance of the state power utilities which showed Delhi discoms as a profit making utilities with an estimated profit of ` 939 Crores ($ 157 mn) have actually defaulted on money payment to the power producer on many occasions. The six loss making distribution utilities (on subsidy received basis), Andhra Pradesh (` 16,668 Crores or $ 2,778 mn), Uttar Pradesh (` 13,155 Crores or $ 2,193 mn), Rajasthan (` 12,510 Crores or $ 2,085 mn), Tamil Nadu (` 11,827 Crores or $ 1,971 mn), Madhya Pradesh (` 4,474 Crores or $ 746 mn) and Haryana (` 3,834 Crores or $ 639) were all reluctant to buy expensive power. This led to lowering of coal demand in the country, pushed power plants to low utilisation rates and threated to render generation capacities worth millions unviable. In such a situation, who is buying imported coal based electricity? It is necessary to answer this question. Without an answer, the persistent argument that the centre must reformulate tariff policy to allow mandatorily pass-through fuel costs and inflation into tariffs on timely basis will continue.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Iran Nuclear Framework Agreement: Impact on India's Energy Calculations (part I)

Akhilesh Sati, Observer Research Foundation

Introduction

|

I |

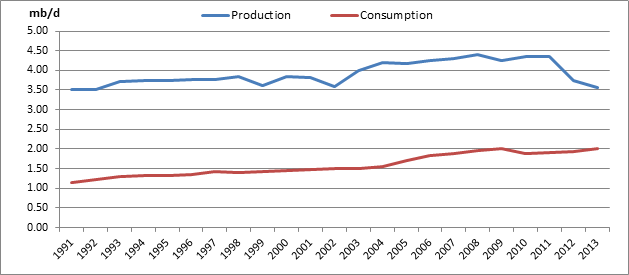

ran is one of the most hydrocarbon resource rich countries in the world and thus holds an important position in energy space. It has the world’s largest conventional natural gas reserves estimated at 33.8 trillion cubic meters (tcm) which is more than 18 percent of world’s proved gas reserves and the 4th largest crude oil reserves estimated at 157 billion barrels which is more than 9 percent of world’s proved oil reserves at the end of the year 2013. Despite its geopolitical isolation, Iran has managed to increase both oil and gas reserves year by year. Iran produced around 3.56 million barrels per day (mb/d) of oil and around 166 billion cubic meters (bcm) of gas in 2013. Oil production fell by around 6 percent from the level of 3.75 mb/d in 2012 which is the lowest level in last twenty years while the oil consumption increased by around 4 percent for the same period (Chart 1).

Chart 1: Iran- Crude Oil Production and Consumption

Source: BP Statistical Review 2014.

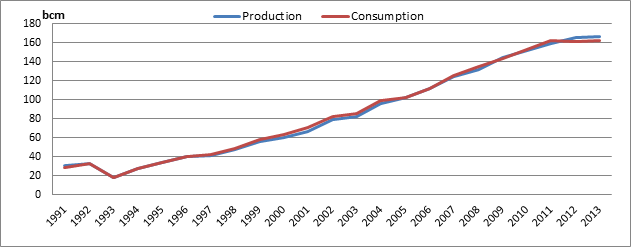

On the other hand both gas production and consumption for the same period grew at a slow pace 0.8 percent and 0.7 percent respectively (Chart 2).

Chart 2: Iran- Gas Production and Consumption

Source: BP Statistical Review 2014.

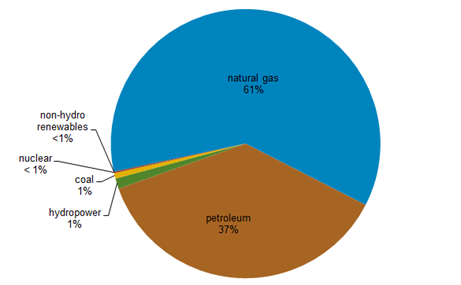

Despite its abundant resource endowment, Iran’s domestic oil and gas sector has suffered due to the international sanctions imposed on the country over the over the last several years because of sanctions targeting its nuclear programme. Foreign investment was restricted; many international oil companies (IOCs) divested their interest in the upstream sector; access to technical expertise and equipment for mature oil and gas fields was not available; many key green field oil and gas projects were cancelled or delayed. Simultaneously, other factors such as rising domestic demand for oil and gas along with declining production growth of oil and gas affected its ability to export oil and gas. As shown in Chart 3, Iran’s energy consumption is dominated by oil and gas and the share of other fuels in its primary energy consumption mix is insignificant.

Chart 3: Iran’s Total Primary Energy Consumption Basket- 2012

Source: Energy Information Administration.

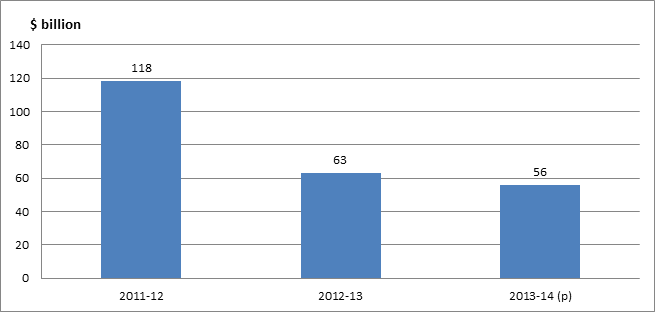

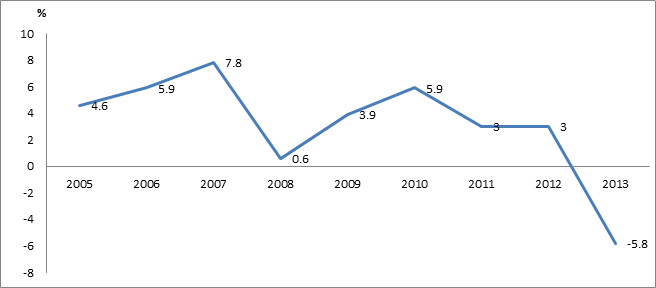

Although Iran’s export of gas increased slightly in past two to three years (refer to Chart 2), the small increase did not make a difference to its rapid decline in oil and gas export revenue (Chart 4). In 2010, Iran got 80 percent of its export revenues from oil and gas, but in 2013 it declined to 60 percent. This also had an impact on its GDP growth (Chart 5).

Chart 4: Iran’s Oil and Gas Export Revenues

Note- Years as per Iranian financial years (ending March 20); (p)- provisional

Source: Energy Information Administration.

Source: World Bank

India and Iran in the Context of Crude Oil

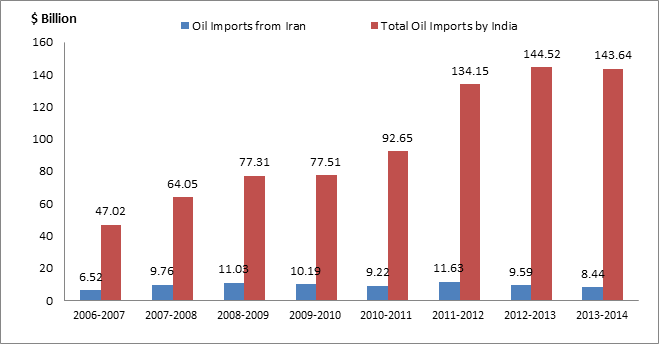

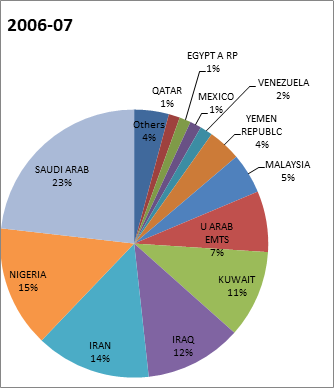

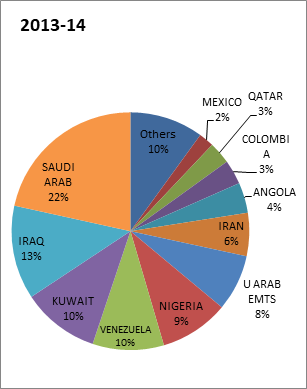

India’s close ties to Iran in the context of oil can be traced back to the Asian Clearing Union (ACU) that was established with its head quarters at Tehran, on December 9, 1974 at the initiative of the United Nations Economic and Social Commission for Asia and Pacific (ESCAP), for promoting regional co-operation. The main objectives of a clearing union were to facilitate payments among member countries for eligible transactions on a multilateral basis, thereby economising on the use of foreign exchange reserves and transfer costs, as well as promoting trade among the participating countries.[1] The members of the ACU included Iran, India, Bangladesh, Bhutan, Nepal, Pakistan, Sri Lanka, Myanmar and Maldives. India and Iran were the largest economies in the union and the link between them was oil trade. Indian imports of crude oil from Iran grew since the ACU was initiated and in the last decade India was among Iran’s top five oil export destinations (Chart 6).

Chart 6: Oil Imports (in Value) by India

Source: Ministry of Commerce and Industry.

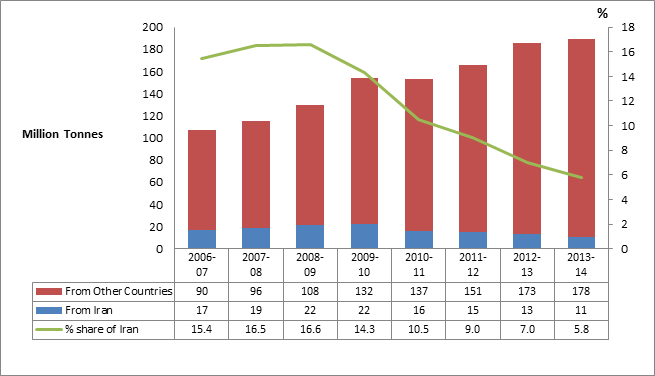

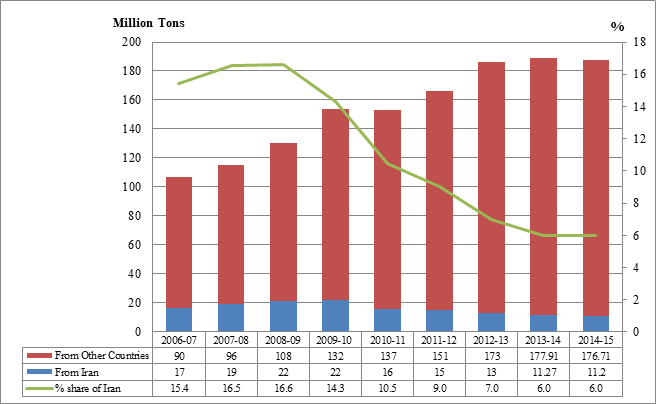

The share of Iranian crude oil in India’s imports has declined from 16.5 percent in 2007-08 to 5.8 percent in 2013-14 (Chart 7). The problem with import of crude from Iran started when the Reserve Bank of India (RBI) snapped the ACU mechanism in December 2010. Other options for settling payment to Iran such as routing it through a bank in Turkey or making payments in Indian rupees were investigated, but none could withstand the pressure from the United States which controlled vital channels of financial flows globally.

Chart 7: Share of Iran Oil in India’s Total Oil Imports

Source: Ministry of Commerce and Industry.

Chart 8: Direction of India’s Oil Imports

Source: Ministry of Commerce and Industry.

While India was able to substitute Iranian crude from other Middle Eastern and South American crude (Chart 8), the specific payment terms, discounts and the product yield that Iran crude offered were vital for Indian refineries, such as Mangalore Refineries and Petrochemicals Limited (MRPL) that had met more than 50 percent of its crude needs through Iranian crude.[2] In December 2011, MRPL, a unit of state explorer Oil and Natural Gas Corporation (ONGC), was the largest buyer of Iranian crude at 142,000 barrels per day (bpd). Essar, a private refiner imported 110,000 bpd, state-owned Hindustan Petroleum Corporation Ltd imported 65,000 bpd and Indian Oil Corp imported 50,000 bpd. At that point in time, India was Iran’s second largest customer after China, accounting for over 12 percent of Iranian crude exports.

With the lifting of sanctions on Iran, Indian refineries will once again be in a position to freely source crude in a manner that optimises product yield and simultaneously also maximise the profitability of the refinery. Latest news reports show that Indian imports of Iranian crude has increased after some relief in sanctions on Iran at the end of 2013.[3] What is important to note here is that rationalisation of crude sourcing (i.e., which crude is bought at what price) happens at the refinery level and not at the Ministry of External Affairs (MEA) level. Under ideal conditions, it is a commercial decision and not a foreign policy decision. Sanctions against Iran disrupted this environment and allowed foreign policy of the United States to have an impact on economic and commercial decisions of the Indian refineries which made the MEA a party to the decision. In other words, India in general and some Indian refineries in particular were unintentionally subsidising the foreign policy of a much richer country.[4] The lifting of sanctions will retrieve economic and commercial decision making of refineries in India from the distortions caused by New Delhi’s foreign policy.

to be continued.......

The article has appeared on June 25, 2015 as a chapter in Global Policy Journal (Durham University) e-book on "Iran Nuclear Deal: Implications of the Framework Agreement".

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

India’s Energy Future: Black Fractured by Green

Thomas Elmar Schuppe, Senior Fellow at Observer Research Foundation (ORF), CIM Integrated Energy Expert

|

T |

he year 2015 is going to be critical for the energy and climate story that unfolds over the decade to come. The global community has to agree on a successor to the dated Kyoto protocol that has committed its parties by setting internationally binding carbon emission reduction targets. In the run-up to the 2015 Climate Conference (COP21) there is an ongoing brainstorming process of what India might promise in Paris in December 2015 as their intended national determined contribution (INDC) in order to support the collective effort to get a grip on the global carbon footprint. India’s energy future is likely to emerge on the thin line between green and black.

First and foremost the Modi government has kicked off the new energy policy that aims for a trendsetting albeit ambitious target to almost increase the renewable energy power generation capacities fivefold to 175 GW within the next seven years. Due to the fact that renewable energy tends to be relatively capital intensive while Indian Banks are struggling under debts the funding of the renewable initiative will undoubtedly become a challenging task. Nevertheless, some first auspicious announcements, besides the government, for funding are already in the pipeline to take the plunge into the vast and promising Indian market for renewable energy in near future. India’s largest bank, the State Bank of India, has announced to extend US‑$ 12 bn of loans to support 15 GW of clean energy projects over the next five years. A loan of US‑$ 1.1 bn for rooftop solar power projects is said to be in the making with the German development bank KfW, which would come on top of already arranged loan of about € 1.38 bn to develop a “green corridor” of power lines crossing through nine Indian states. The recently established joint-venture SBG Cleantech - comprising Japan's telecom and Internet major SoftBank as a principal investor as well as Indian Bharti Enterprises and Taiwan-based Foxconn Technology Group – is willing to invest US‑$ 20 bn in the next 10 years into green energy projects across India.

Moreover, the Minister for Coal, Power and New and Renewable Energy has announced that the GoI would like to establish India as manufacturing hub for renewables and research in accordance with the “Make in India” campaign that is designed to transform India into a global manufacturing hub. However, even if there are a number of quality suppliers and developers in India that are keen to invest and contribute significantly, it is said that, for example, domestically manufactured solar modules are not only expensive but also uneconomical due to outdated technology. The sheer size of planned capacity additions at issue in India and restricted domestic manufacturing capacity should make India as a promising business opportunity for any industry player whatsoever.

Nevertheless, beyond the limelight hogging renewable energy revolution one should not lose sight of the big picture, as coal has historically been the backbone of Indian power supply and remains on track so far with a current share of about 60 % of India’s total power generation capacities. India’s government has repeatedly reinforced the importance to make use of its abundant domestic coal reserves to drive the economic development that is important for India to eradicate poverty and provide electricity to all Indian population by the end of the decade.

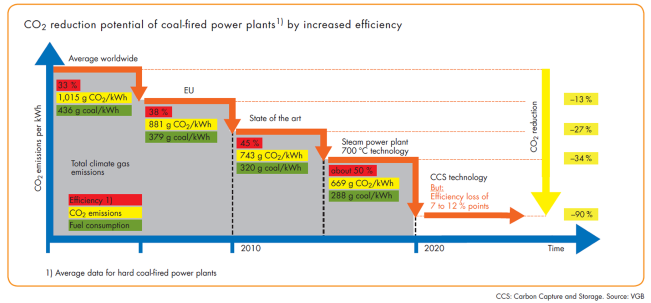

Based on the huge capacity additions that might come into play the potential on carbon emissions that can be saved only by improved coal plant efficiencies are indeed remarkable. Actually the scale of sustainability in coal power generation tends to be determined by its efficiency. According to VGB PowerTech, the European technical association for power and heat generation, the average worldwide efficiency was at about 33 % in 2010, India being far below that with a mere 28 % efficiency rate. In contrast, state of the art technology provides already efficiency rate of more than 45 %, best technology actually provides efficiency rates of more than 50 %. The consistent replacement of old sub-critical plants with low efficiency with super-critical power plants with high efficiency would clearly decrease the global amount of CO2 emissions and coal use. Figure 1 demonstrates the impact of different efficiency rates in hard coal-fired power plants with respect to the specific carbon emissions, specific coal use and the overall reduction potential.

Figure 1: Carbon Reduction Potential of Coal-Fired Power Stations

Source: VGB Facts and Figures – Electricity Generation, 2013/2014.

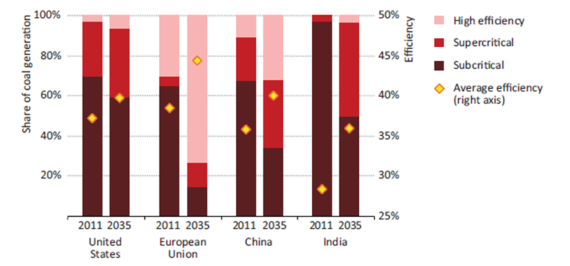

Figure 2 gives an overview of how the OECD’s intergovernmental energy think tank IEA expects the average efficiency rates of coal units to develop between 2011 and 2035. Since the average efficiency of coal-fired generation worldwide improves to about 40 % by 2035 as old plants are retired and are increasingly replaced by supercritical and other technologies, such as ultra-supercritical, integrated gasification combined-cycle (IGCC) and comb heat and power (CHP) plants, however, India remains far behind. Its current low efficiency due to heavy reliance on an ageing subcritical fleet and the use of low quality coal is expected to improve from 28 % to 36 %, indeed, but even in about two decades time period to go Indian’s coal-fired power generation fleet efficiency is expected to be on a lower level than that of the European Union as of today.

Figure 2: Development of Coal-Fired Power Stations by Technology and Efficiency

Source: International Energy Agency, World Energy Outlook 2013.

The chief economist of the IEA, Fatih Birol, has recently stated that the emissions that could amount to be equal to all those from the EU's INDC for 2030 by only increasing the efficiency of all sub-critical coal-fired power plants in the world from 35 % to about 37 %. Knowledge and technology transfer as well as financial support can be assumed to be vital. Nevertheless, tapping the significant carbon reduction potential of coal power plants cannot only be realized by plant substitution processes but also by optimisation of running coal units. One striking example of international collaboration as to that is the Indo-German Energy Programme IGEN that was launched in 2003 between partners like GIZ and KfW with BBE and CEA, MoP and MNRE. In a recently finished program a hundred Indian power plant engineers were trained in the use of a special software tool for the optimisation of thermal power plants. This resulted in an average improvement in operating efficiency of 1.2 %-age points that was achieved from 27 coal units (with a total capacity of 6.6 GW). This refers to annual saving of 1.6 mt CO2 or 1.2 mt of coal per year, corresponding to an overall annual saving of about ` 500 crore (€ 70 million). Since these results were achieved only by 4 % of the total installed capacity of India’s coal fired power plants an upscaling to all plants would lead to a significant and lasting reduction of carbon emissions provided by a low-cost investment.

The bottom line is that going green and black (for the time being) for India’s energy future both involves a huge knowledge and technology transfer as well as financial support. On the other hand, both green and black opens up wide options to enter into a market with incredible investment opportunities.

A shorter version of the article is available at http://www.maiervidorno.com/indias-energy-future-is-green-and-black/

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Crude Oil: India & Iran

Akhilesh Sati, Observer Research Foundation

|

Year |

Oil Imports from Iran by India (in $ Billion) |

Total Oil Imports by India (in $ Billion) |

||

|

Value |

Y-o-Y % Growth |

Value |

Y-o-Y % Growth |

|

|

2006-2007 |

6.52 |

47.02 |

||

|

2007-2008 |

9.76 |

50 |

64.05 |

36 |

|

2008-2009 |

11.03 |

13 |

77.31 |

21 |

|

2009-2010 |

10.19 |

-8 |

77.51 |

0 |

|

2010-2011 |

9.22 |

-10 |

92.65 |

20 |

|

2011-2012 |

11.63 |

26 |

134.15 |

45 |

|

2012-2013 |

9.59 |

-18 |

144.52 |

8 |

|

2013-2014 |

8.44 |

-12 |

143.64 |

-1 |

|

2014-2015 |

7.04 |

-17 |

116.44 |

-19 |

Y-o-Y- Year on year

Source: Ministry of Commerce & Industry

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

India to seek rights for developing Iranian gas field

July 14, 2015. India will ask Tehran for rights to develop ONGC-discovered Farzad-B gas field in the Persian Gulf even as it prepares to pay USD 6.5 billion in past oil dues. Indian firms have so far shied away from investing in Iran for the fear of being sanctioned by the US and Europe. The same was deterring New Delhi from claiming rights to invest nearly USD 7 billion in the biggest gas discovery ever made by an Indian firm abroad. India is making a renewed pitching for rights to develop 12.8 Trillion cubic feet of gas reserves ONGC Videsh Ltd (OVL) had found in 2008. Also, the easing of sanctions would mean India can freely buy crude oil from Iran. Sanctions had meant that New Delhi could import no more than 9 million tonnes of oil this fiscal, the same volume it had shipped from Iran in 2013-15. The oil ministry said lifting of sanctions would also mean oil refiners will have to clear USD 6.5 billion in past dues on purchase of Iranian oil. Since February 2013, Indian refiners like Essar Oil and Mangalore Refinery and Petrochemicals (MRPL) have been paying in rupees to UCO Bank 45 percent of their payment due on purchase of crude oil from Iran. The remaining has been accumulating, pending finalisation of a payment mechanism. OVL had in 2008 discovered the Farzad-B gas field in its Farsi exploration block in the Persian Gulf. (zeenews.india.com)

Protest affects ONGC's production in Assam

July 13, 2015. Production at all oil fields of Oil and Natural Gas Corp (ONGC) in Assam was affected following a 100-hour 'ONGC bandh' called by All Assam Students Union to press for their various demands. According to industry estimates, ONGC will incur a production loss of at least ` 10 crore every day if its output goes down to nil in the state. An ONGC vehicle carrying its staff to a drilling site in Sivasagar district was damaged in stone pelting by supporters of All Assam Students Union (AASU). The strike will also affect other industries dependent on ONGC's output. The Lakwa Thermal Power Station, which gets gas from ONGC and OIL, would be directly affected. The student union called the bandh demanding that ONGC set up of a super speciality hospital, fill up vacant posts and give preference to locals while floating tenders. In the last couple of days, a series of discussions took place with AASU by ONGC and district administration to avert the strike, but no solution could be found. The total production capacity of ONGC in Assam stands at 1.02 million tonnes (MT), which is down from around 3 million tonnes in 90's decade. Most of the oil fields of ONGC in Assam are older than the average age of 25-30 years of a well, resulting in dropping of output. (profit.ndtv.com)

BG commences oil production from Mukta-B Platform in India's Bombay basin

July 9, 2015. BG Group reported that its subsidiary BG India has commenced oil production from the Mukta-B (MB), a 4 legged Wellhead Unmanned Platform in the offshore Bombay basin, India July 1. BG has a 30 percent interest in the Panna-Mukta oil and gas fields alongside our partners, ONGC and Reliance Industries Ltd. The MB and MA pipelines have also been successfully completed as part of the project, enabling a restart of production from the MA platform, which had been shut-in due to pipeline integrity issues for the last 2.5 years. Incremental development of the existing fields via well intervention and infill drilling campaigns, as well as evaluating new projects and further development opportunities, is being planned. BG India has upstream interests in three offshore producing fields, two exploration licences and has contracted long-term liquefied natural gas (LNG) sales into the fast growing Indian gas market. (www.rigzone.com)

Downstream………….

IOC books 1 mtpa capacity at new LNG terminal

July 13, 2015. Indian Oil Corp (IOC) has booked 1 million tonnes per year capacity at a new liquefied natural gas (LNG) terminal on the Gujarat coast as the share of gas in the overall energy mix jumps, its chairman B. Ashok said. He expects gas to contribute 15 percent to the energy mix in 5-7 years from 8 percent now as the country moves to the cleaner fuel. (in.reuters.com)

BPCL to expand Bina oil refinery

July 13, 2015. Bharat Petroleum Corp Ltd (BPCL) plans to expand its Bina oil refinery in Madhya Pradesh by 30 percent to 156,000 barrels per day at a cost of about $472 million, its chairman S. Varadarajan said. The expansion of the refinery, operated by a joint venture of BPCL and Oman Oil Co in Madhya Pradesh, will be completed by 2018, he said. Oman Oil, which has a minority stake in the venture, is not participating in the ` 30 billion expansion as of now, Varadarajan said. (in.reuters.com)

GSFC plans ` 100 bn petrochemical-urea complex at Dahej

July 9, 2015. Gujarat State Fertilizers and Chemicals (GSFC) is planning to set up a petrochemical complex at Dahej with an investment worth about ` 8,000-10,000 crore. The status of this complex at present is at the feasibility study/DPR as well as search/selection of technology suppliers, it said. The company is planning to set up an urea-ammonia plant of 1.3 million tonnes capacity of an estimated investment of ` 5,000 crore. (www.business-standard.com)

MRPL to acquire ` 64 bn petrochemical plant in Karnataka

July 9, 2015. Mangalore Refinery and Petrochemicals Ltd (MRPL) said it will take over a $1 billion petrochemical plant adjacent to its refinery in Karnataka in an all-share deal. MRPL had recently raised its stake in ONGC Mangalore Petrochemicals Ltd (OMPL), which is setting up an aromatic complex adjacent to the Mangalore refinery at a cost of ` 6,400 crore, to 51 percent. OMPL is a green field petrochemical project at the Mangaluru Special Economic Zone, adjacent to MRPL's own 15 million tons a year refinery, and comprises an aromatic complex for production of Para-xylene and Benzene. It is to use naphtha produced at the Mangalore refinery to make raw material for manufacture of Polyester. (profit.ndtv.com)

Transportation / Trade…………

Great Eastern Shipping arm incorporates Greatship Oilfield

July 9, 2015. Country's largest private shipping company Great Eastern Shipping said its arm has incorporated a new wholly-owned subsidiary Greatship Oilfield Services Ltd. The private shipping player has two main business -- shipping and offshore. While the shipping business deals in transportation of crude oil, petro products, gas and dry bulk commodities, offshore services cater to oil companies carrying out offshore exploration and production activities through its subsidiary, Greatship (India) Limited. A sizeable part of company's tankers has secured approval from oil giants like Shell, BP, Exxonmobil, Chevron, Texaco and Totalfina. (www.business-standard.com)

Essar Oil signs pact to sell 49 percent stake to Russia's Rosneft

July 9, 2015. Russian oil firm Rosneft will buy 49 percent stake in Essar Oil, the firm that owns India's second biggest oil refinery, for an undisclosed amount, the Russia-owned firm said. A Long Term Crude Oil Supply Agreement by the two firms in was signed in Ufa, Russia for import of 10 million tonnes a year of crude oil for a period of 10 years. This contract has been signed in pursuance to the Key Terms executed between the two companies in December 2014 at New Delhi. Essar Oil hoped that the agreements will give a boost to increased cooperation in the hydrocarbon sector between India and Russia. (businesstoday.intoday.in)

RIL completes 49.9 percent stake sale in US pipeline venture for $1 bn

July 8, 2015. Reliance Industries Ltd (RIL) said it has closed the deal to sell its entire 49.9 percent interest in a US shale oil and gas pipeline joint venture to New York-listed Enterprise Products Partners for $1.073 billion. The company along with its partner Pioneer Natural Resources Company had agreed to sell their respective ownership interests (of 49.9 percent and 50.1 percent) in EFS to an affiliate of Enterprise Product Partners L.P. for an aggregate consideration of $2.15 billion. Under the terms of the definitive agreements, Reliance Industries received gross cash consideration of $574 million towards the first tranche of sale proceeds. EFS Midstream venture was formed in 2010 to construct, own and operate facilities providing gas gathering, treating, and transportation services in the Eagle Ford Shale in South Texas. The Midstream system consists of 10 gathering plants and about 460 miles of pipelines. The system gathers and separates produced condensate from produced gas. RIL holds 45 percent interest in the Eagle Ford upstream joint venture and the rest 9 percent is with Newpek LLC. It is being speculated that RIL may be looking at selling this stake as well. RIL bought 45 percent interest in Pioneer Natural Resources Co's Eagle Ford shale formation of south Texas for $1.3 billion. Under the terms of the agreements, the Pioneer and Reliance can use the EFS Midstream for moving condensate and gas for 20 year on fee-based arrangement. (businesstoday.intoday.in)

Delhi HC orders govt to resume gas supply to Deepak Fertilisers

July 8, 2015. The Delhi High Court (HC) ordered the government to resume supply of gas to Deepak Fertilisers and Petrochemicals Corp Ltd’s plant in Maharashtra that was stopped in May 2014. The order came in response to a petition by Deepak Fertilisers against the government’s order to Reliance Industries Ltd and GAIL (India) Ltd stopping the supply to its plant in Raigad district, calling it arbitrary and unfair. The firm also challenged letters written by the department of fertilizers and ministry of petroleum and natural gas issued in May 2014 directing that the supply of gas to Deepak Fertilisers be discontinued and diverted to urea-manufacturing units facing a shortfall of natural gas. Terming the government’s policy “arbitrary,” the court held that the suspension of gas supply was due to the fault of the department of fertilizers not framing related guidelines. The court also ruled that the supply of gas to the company be resumed until the government unveils a new policy; it said all phosphatic and potash (P&K) fertilizer-manufacturing companies should be treated equally. The court ordered the government to unveil a comprehensive policy for allocation of gas within six weeks and implement it uniformly. The court also warned the government against “piecemeal” implementation of the policy. (www.livemint.com)

Policy / Performance………

CNG stations to triple in NCR: Oil Minister

July 13, 2015. The government plans to triple the current CNG stations in the national capital region (NCR) for boosting use of the clean fuel, Oil Minister Dharmendra Pradhan said. The green corridors being planned would go along in all four directions from Delhi, to Jaipur, to Chandigarh, to Haridwar and to Agra. There will be many more CNG stations en route, the minister said. Other such corridors being envisaged are the "triveni" of Allahabad, Kanpur and Lucknow and Mumbai-Pune in the west. A Hyderabad, Andhra Pradesh southern corridor is very much a possibility. Andhra Pradesh is showing great interest, while Bangalore has already started laying CNG pipelines, he said. Pradhan said bio-fuels would contribute to the composition of the green energy corridors. (www.business-standard.com)

‘Surrendering of LPG subsidy will not be made mandatory’

July 13, 2015. The Centre is confident that people with sufficient income will give up their LPG subsidy and is not considering making it mandatory for certain income groups, Oil Minister Dharmendra Pradhan said. The Minister said that talks are on with the State Governments to identify the people who require kerosene subsidy in order to work out a plan similar to Direct Benefit Transfer of LPG. Pradhan said that his Ministry is also working on a programme to increase CNG stations for providing clean fuel along key highways near the national capital region of Delhi. (www.thehindubusinessline.com)

Oil Ministry sees 2015/16 upstream subsidy at ` 50-60 billion

July 13, 2015. India expects a subsidy burden of ` 50 billion-60 billion ($788 million-$946 million) for state-run oil and gas producers this fiscal year if world oil prices stay at current levels, the oil ministry said. Upstream companies like ONGC, Oil India and GAIL (India) typically sell crude and fuels like cooking gas at discounted rates to partly compensate retailers for losses they incur on selling fuels at government-set rates. But the government is now planning to ease the subsidy burden. The oil ministry had set a new subsidy formula for the April-June quarter that would exempt upstream companies from discounting sales of crude oil and refined products if global oil prices are up to $60 per barrel. The oil ministry said the previous formula has been junked and the finance ministry will pay a cash subsidy of ` 12 for a litre of kerosene sold while ONGC and Oil India will share the remainder of the burden. It was not immediately clear how much subsidy the upstream companies paid last year. (in.reuters.com)

India may save $24 bn on longest oil glut since 1997

July 11, 2015. The longest global oil glut is expected to save India close to ` 1.50 lakh crore in 2015-16. To put that sum in perspective, it would be enough to cover the Centre's school education, health, women and child development budgets and pay for the rural jobs scheme. India, which ships in nearly 80% of its oil requirement, is projected to save over $24 billion in 2015-16 as global supply exceeds demand for the fifth quarter in a row and keeps crude prices down. The savings could swell further because even though fears over Greece and Iran continue to weigh on the oil market, there is no sign oil producers will pull back. The International Energy Agency, a Paris-based inter-government energy tracker, has projected that the excess supply situation will continue into the third quarter. This will make it the longest glut since the Asian economic crisis of 1997, when the surplus situation lasted for some six quarters. The sustained oversupply has brought down the average cost of India's crude import to $61.50 per barrel in the April-June period this year from $84.10 a barrel in 2014-15. No wonder the oil ministry's market tracker, Policy Planning and Analysis Cell, has pegged the country's oil import bill for this fiscal at $88.20 billion, or nearly 22% lower than $112.70 billion in 2014-15. Even at an exchange rate of ` 62 to a dollar - though this is likely to be higher by at least ` 2 at final count - this would make for a saving of about ` 148,800 crore in the oil import bill. In comparison, budget allocations for school education, health, Mahatma Gandhi National Rural Employment Guarantee Act as well as women and child development schemes come to roughly ` 120,452 crore. Of course, the savings won't be available to fund these schemes, because it is not the government which will save all this money, but largely crude oil importers like Indian Oil or Reliance Industries. But the government gains too, since low oil prices mean its subsidy bill becomes lower. No surprise then that the budget for the current year has provided subsidy for the oil sector - essentially on cooking gas and kerosene - of just ` 30,000 crore against the revised estimates of ` 60,270 crore for 2014-15. (timesofindia.indiatimes.com)

LNG project key for development: Kerala CM

July 10, 2015. Terming that the LNG project was critical to the development of the state, Chief Minister (CM) Oommen Chandy said the government would overcome all the difficulties in laying down the pipeline from Kochi to Mangalore and Coimbatore. He said this while inaugurating the Liquefied Natural Gas (LNG) Storage and Regasification facility of HLL Lifecare Limited. Chandy mentioned that the state had exempted LNG from Value-Added Tax (VAT) in last year’s budget. The Chief Minister also expressed his concern that only not many industries have come forward to make use of such facilities. The 39.5m3 capacity LNG Storage and Regasification facility at the factory at Peroorkada has replaced the furnace oil with the cleaner LNG for fueling burners. (www.newindianexpress.com)

India invites Canadian firms to invest in energy infrastructure

July 8, 2015. India has invited Canadian financial institutions to invest in its energy infrastructure. Petroleum Minister Dharmendra Pradhan met Canadian officials and businessmen, during his visit to the country from July 4-6 to participate in the second India Canada Energy Dialogue, and "offered to jointly underwrite large-scale energy projects such as LNG (liquefied natural gas), refinery and petrochemical plants". Oil marketer Indian Oil Corp has invested of $1 billion, which will go up to $4 billion, in an integrated LNG project in Canada's British Columbia province, the petroleum ministry said. (www.newindianexpress.com)

New subsidy formula to boost ONGC, OIL earnings in Q1

July 8, 2015. Oil and gas producers Oil and Natural Gas Corp ONGC and Oil India Ltd (OIL) are set to report strong numbers during April-June 2015, owing to better realisations from crude oil sales. This is because the government-owned companies would have to fork out meagre funds towards compensating PSU oil-marketing companies post the government’s new subsidy sharing formula. The Indian basket of crude oil averaged at $61.47/barrel in the quarter. The Narendra Modi government has rolled out a subsidy sharing mechanism according to which upstream players such as ONGC and Oil India would have to bear no subsidy if the average crude oil price during April-June remains below $60/barrel. If the price is between $60 and $100/barrel, they would have to shell out 85% of the incremental price towards oil subsidy. The sharing would be 90% if crude crosses $100/barrel. In Q1 FY15, ONGC sold every barrel of crude oil at $109.48. However, after discounting OMCs, its net realisation fell to $47.15/barrel, while OIL realised crude price of $52.35/barrel against gross of $108.35/barrel. (www.financialexpress.com)

[NATIONAL: POWER]

Generation……………

‘Delay in coal allocation has stalled work on Ferozabad power plant’

July 12, 2015. Minister for Energy D.K. Shivakumar has said work on the proposed 1,320 MW Super Critical Thermal Power Plant at Ferozabad has been stalled by the delay in allocation of coal. He said the government had completed all formalities on its part, including acquisition of 1,601.13 acres of land in Ferozabad, Kiranagi and Nadisinnur villages in Kalaburagitaluk. He said the government had also completed the process of getting permission for allocation of 2.06 tmcft of water from the Krishna. The Minister said the project required an estimated 6.3 million tonnes per annum of coal and the government had submitted a proposal for coal linkage in July 2008. The technical committee of the Union Ministry of Coal recommended coal linkage from Brahmanbil mines. However, the Ministry was yet to take a final call on the recommendation, he said. (www.thehindu.com)

Telangana to set up power projects

July 11, 2015. Chief Minister K Chandrasekhar Rao said his government will set up power projects totalling 25,000 MW by investing over ` 90,000 crore in the next four years. Rao asserted that Telangana would become a power surplus state and suffer no power cuts in future. (www.ptinews.com)

BHEL commissions second 500 MW unit at Tuticorin power station

July 10, 2015. Bharat Heavy Electricals Ltd (BHEL) has commissioned a second 500 MW unit at the Tuticorin Thermal Power Station (TPS) in Tamil Nadu. The first unit was commissioned on March 10. Recently, the capital goods major commissioned a second unit of NLC’s 250 MW circulating fluidised bed combustion (CFBC) based power plant in Neyveli. The other project being executed by the company for NLC is the 2x500 MW pulverised lignite fired thermal power plant, also coming up at Neyveli. Notably, BHEL commissioned 8,230 MW in the power sector utility segment during the financial year 2014-15, surpassing by 19 percent the Government’s capacity addition target of 6,914 MW set for it. In all, BHEL commissioned and synchronised 11,941 MW in the domestic and international markets in the last fiscal besides making a major contribution to another 1,600 MW by commissioning two boilers of 800 MW each. Significantly, BHEL’s installed capacity has crossed 155 GW, including 132 GW of domestic utility sets. The company has joined the elite club of international manufacturers to have supplied power generating equipment of more than 150 GW. (www.thehindubusinessline.com)

Transmission / Distribution / Trade…

Gangotri Dham to be connected with main grid

July 14, 2015. To provide permanent power supply at the Gangotri Dham, the Uttarakhand Power Corporation Limited (UPCL) is working to connect it with the main grid. At present, an 11-KV line is being laid between Mukhba and Bhairoghati on a stretch of 15 km. The department has sent a proposal to extend the same line for another 8 km to Gangotri. Besides, the authorities are also mulling to relocate the 33-KV sub-station of NTPC located at Dabrani. The corporation hopes to provide power supply before the commencement of the Char Dhamyatra next year. At present, the Dham meets its power demand through solar panels set up by the Uttarakhand renewable energy department. (timesofindia.indiatimes.com)

Consumers paying for congestion in power supply network

July 14, 2015. The congestion in the power network of the country, owing to demand-supply mismanagement, has cost both consumers and utilities dear. In past three years, power consumers across the country paid ` 2,996 crore as additional cost to source power due to lack of network. Also, congestion has accumulated in five regional grids, to around 80 percent of the supply time, hurting electricity availability and revenues. A calculation done by the Indian Energy Exchange (IEX), one of the largest power trading platforms, reveals the state power distribution companies (discoms) could not source cheaper available power as there was no robust transmission network to evacuate it, thereby loading the consumer with costlier alternatives. The total cost of congestion, it goes on to calculate, to the state utilities in Southern region have been to the tune of ` 4,858 crore. The expected transmission network by the end of the 12th Plan period (2017) should be 3,60,000 circuit kilometres (Ckm) though the current status is 37,140 Ckm. Around 113 GW of generation capacity is likely to be added in the remaining period of the 12th Plan and about 100 GW during the 13th Plan. According to the latest data, in 2014-15, 3.1 billion units of electricity were lost on power trading platforms due to transmission congestion. (www.business-standard.com)

Thermal coal imports soar 23 percent at 12 major ports

July 12, 2015. Import of thermal coal jumped 23 percent to 24.08 million tonnes (MT) at 12 major ports in the first quarter of the fiscal, even as the government continues to push for boosting domestic production of the fuel. Handling of coking coal, which is used mainly for steel-making, however remained nearly stagnant with less than 1 percent increase in the period at 8.17 MT, according to the Indian Ports Association. These 12 major ports had handled 19.62 MT and 8.10 MT of thermal and coking coal, respectively, in the first quarter of the previous fiscal. Altogether, they handled 32.25 MT coal during the April-June quarter of the current fiscal as against 27.72 MT in the same quarter of the previous fiscal. Coal is the mainstay of India's energy programme as 70 percent of power generation is dependent on the dry fuel, while Coal Minister Piyush Goyal has been emphasising the need to increase the production by Coal India. India is the third-largest producer of coal, after China and the US, and has 299 billion tonnes of resources and 123 billion tonnes of proven reserves, which may last for over 100 years. India has 12 major ports -- Kandla, Mumbai, JNPT, Marmugao, New Mangalore, Cochin, Chennai, Ennore, V O Chidambarnar, Visakhapatnam, Paradip and Kolkata (including Haldia) which handle approximately 61 percent of the country's total cargo traffic. (www.business-standard.com)

Sterlite Grid bags ` 4 bn Maheshwaram transmission project

July 11, 2015. Sterlite Power Grid Ventures Limited has bagged the Maheshwaram power transmission project in Telangana by quoting the lowest levellised annual tariff among three qualified bidders. The company outbid Power Grid Corporation of India Limited (PGCIL) and Kalpataru Power Transmission Limited (KPTL). Sterlite’s bid for an annual tariff of ` 55 crore for the project was 17 percent lower than the second-best bid quoted by PGCIL. Sterlite Grid is a wholly owned subsidiary of Pune-based Sterlite Technologies and the largest private operator of independent transmission systems in India. PGCIL is a state-owned power transmission giant with around 95 percent of market share. Of the six qualified bidders for this project, Essel Infra, China Light & Power and a consortium of Tata group companies had pulled out from the bidding. The Maheshwaram project, with an estimated cost of ` 400 crore, is one of the four projects tendered by the power ministry as a major investment call after bidding for ultra mega power projects failed last year. The bid was called by REC Transmission Projects Company Ltd (RECTPCL), a subsidiary of Rural Electrification Corporation. (www.business-standard.com)

JSW in talks to buy Monnet Ispat's Odisha power plant

July 10, 2015. JSW Energy announced the signing of a non-binding agreement with Monnet Ispat for initiating due diligence for acquisition of majority stake in Monnet Ispat and Energy’s 1,050 MW power plant in Odisha. The plant is being developed by group subsidiary Monnet Power Company Ltd. The deal will help Monnet Ispat reduce its debt. (www.business-standard.com)

AP will invest a whopping ` 300 bn on power T&D

July 9, 2015. Andhra Pradesh (AP) authorities have decided to invest around ` 30,000 crores to strengthen transmission and distribution (T&D) network in the next four years to meet energy demands. The power demand in the state is expected to increase with investments and capital region development. Andhra Pradesh Power Generation Corporation (APGENCO) has drawn a plan to increase the state's installed capacity from the existing 11,037 MW to 29,800 MW by March 2019. (www.businessinsider.in)

There is no problem of availability of power: DERC Chairman

July 9, 2015. Buying cheaper electricity from power exchange is not a long term solution for Delhi and power purchase agreement with the generators cannot be wished away, Delhi Electricity Regulatory Commission (DERC) Chairman P D Sudhakar said. Sudhakar said that power is cheap in power exchange because the distribution companies are not financially sound and they are not purchasing power from the generator in spite of there being demand for it and resorting to power cut. Sudhakar emphasised that power purchase agreements are long term for 25-30 years. There is no clause in power purchase agreement for its cancellation. The only way to get rid of agreement is if there is another buyer and the generator is able to send his generation to the buyer then the agreement can be made and power can be sent to the third buyer. The DERC chairman highlighted that there is no problem of availability of power, the installed capacity is 2,70,000 MW but daily consumption at national level is never beyond 1,50,000 MW so there is no shortage of at national or state level. (economictimes.indiatimes.com)

India will export more power to Bangladesh on completion of SAARC grid

July 8, 2015. India will begin to export additional power to an extent of 500 MW to Bangladesh as soon as work on the SAARC Grid is completed, VK Agrawal, Executive Director, NLDC, Power System Operation Corporation said. India already exports 500 MW of power to Bangladesh. The additional gas-fired 500 MW will be provided after the completion of the SAARC grid. Agrawal said that the work on the SAARC grid is expected to be completed in a year or so and after that India too will draw considerably higher volumes of hydro power from Bhutan and Nepal. (www.thehindubusinessline.com)

ICRA warns against aggressive coal bidding, says may hurt projects

July 8, 2015. Power sector now stares at higher risk of significant underrecovery and concerns on the viability of projects after the generators bid for coal aggressively, ICRA said in a report. The rating agency said that the recent bid for coal blocks that were earlier de-allocated saw negative price bids ranging from 300-1,100 per tonne by winners, which could translate into underrecovery of 40 paise to 1.20 per unit of power for projects totalling 6,000 MW, creating concerns over their viability. ICRA said that the sector's credit profile continues to be weighed by issues such as falling thermal plant load factor, increasing coal import dependence and domestic gas deficit that may continue in FY15, uncertainty on implementation of tariff compensation, significant cost over-run in projects, aggressive bidding seen in auction of coal blocks and rising subsidy and weak cost coverage ratio for distribution utilities. The report said that almost 35,000 MW of projects have seen cost over-run of 35% due to delays in land acquisition, lack of fuel and other problems. The report said that there was a sharp decline in thermal plant load factor from 75% in FY 2011 to 65% in FY 2015, led by low demand from distribution utilities and rising fuel shortages. (economictimes.indiatimes.com)

Policy / Performance………….

AERB grants licence for regular operation of Kudankulam's 1 GW unit

July 14, 2015. Atomic Energy Regulatory Board (AERB) has granted licence for regular operation of the Kudankulam nuclear plant unit 1 (1,000 MW), currently operated by Nuclear Power Corporation of India Ltd (NPCIL) in Tamil Nadu. Besides, AERB has also issued consent for siting of four more indigenous 700 MW each of Pressurized Heavy Water Reactors (PHWRs) units. AERB said the safety review of Kudankulam's VVER (Russian origin) pressurized water reactors (PWRs) has confirmed that they satisfied the requirements specified by it and the current international safety standards. AERB's reviews had included checks to ensure that quality assurance norms have been followed and the commissioned systems meet the acceptance criteria for safe operation. NPCIL was earlier allowed to raise reactor power at the Kudankulam plant in steps for completing the specified commissioning tests and to synchronise the unit with the southern grid at various power level up to 100% full power. The construction of unit 2 of 1,000 MW is complete and it is currently undergoing initial commissioning activities. (www.business-standard.com)

CIL to give up three-fourths of Mozambique mine

July 14, 2015. Coal India Ltd (CIL) said it has decided to relinquish about three-fourths of a coal mine it was allotted in Mozambique. Coal India Africana Limitada, a fully-owned subsidiary of the state-owned firm, was allotted two leasehold licences for extraction of coal of about 224 square kilometre in Tete province of Mozambique. The decision to relinquish was taken based on Interim Geological Report prepared by CMPDIL, a 100 percent planning subsidiary of CIL, it said. (profit.ndtv.com)

Reliance Power writes to Coal Ministry seeking withdrawal of mining restrictions

July 14, 2015. Reliance Power has written to the coal ministry against the latter's decision to restrict coal mining from two blocks attached to the company's Sasan ultra mega power project (UMPP) in Madhya Pradesh. The company said it requires permission to mine up to 20 million tonne coal annually from the Moher and MoherAmlohri blocks as a backup to geographical surprises affecting mineable quality and quantity of coal.

Reliance Power asked the ministry to withdraw a letter dated June 3 asking the company to submit a revised mining plan downsizing the UMPP's requirement to 16 mtpa from the two blocks for the UMPP. It was earlier permitted to mine 20 million tonne per annum (mtpa). The company had in 2007 told the government that it would be able to mine 20 mtpa of coal from the Moher and MoherAmlohri blocks and another 5 mtpa from Chhatrasal through use of latest mining technologies. The total 25 mtpa was 9 mt more than the UMPP's requirement and was sought for use in the company's other power plant at Chitrangi. The company in its recent letter said it had earlier assumed that Sasan would require 16 mtpa but after commencing mining operations, it felt the requirement would be 19 mtpa. The UPA government had in 2010 allowed diversion of the coal as a special dispensation to Reliance Power, but the current NDA government in May issued an extraordinary gazette notification to cancel allocation of the Chhatrasal coal block and withdrew the dispensation to use excess coal in Moher. In its letter to the coal ministry, Reliance Power said the company has signed power purchase agreements covering the entire capacity of the Sasan project, which depends on coal supply from the Moher blocks. The company said the UMPP may consume coal beyond 16 mtpa and the present mine plan permits mining 20 mtpa. (economictimes.indiatimes.com)

AP, Telangana seek Centre's intervention over water and electricity sharing issue

July 13, 2015. Andhra Pradesh (AP) and Telangana have asked for the Centre's intervention over sharing of water and electricity, and presented their cases to Union Minister for Water Resources, River Development and Ganga Rejuvenation Uma Bharati. AP wants Telangana to stop power generation because continued power generation would lead to problems in supply of drinking water in the Rayalaseema region but Telangana has refused to stop power generation as it is needed to cater to the power requirements of farmers in the state. Telangana's Irrigation Minister T. Harish Rao met Uma Bharati. He said that the state government has decided to present a strong argument before the Centre over the contentious issues of generation of power at the Srisailam reservoir as well as sharing of the funds and assets of the institutions which have not been divided between the two states. (www.newkerala.com)

Discom Tata Power offers 50 percent discount on 5-star ACs in Delhi

July 12, 2015. Aiming to bring down power consumption in national capital, Tata Power Delhi Distribution Ltd (TPDDL) has launched a scheme offering up to 50 percent discount on energy-efficient air conditioners. The scheme would be available for 20,000 customers on first-come-first-serve basis. Only the customers having an average monthly consumption of up to 1,200 units per month during April to September 2014 can avail this scheme, TPDL said. Under the scheme, TPDDL consumers in North and North-West Delhi can get discount of 50 percent on BEE 5-star rated ACs, Inverter ACs in exchange of their non-star ACs. It is applicable for both window and split ACs of 1 & 1.5 tonnes. The scheme is available on various models of ACs from leading Brands such as Voltas, Hitachi and Godrej. The scheme has been targeted at households as the domestic sector accounts for almost 50 percent of energy consumption in Delhi and ACs power consumption is a key component of the same. TPDDL consumers can avail the scheme against their CA numbers (one AC per CA Number) mentioned in the electricity bills. (economictimes.indiatimes.com)

Govt puts 22 stalled power projects on watch list

July 11, 2015. The government has identified 22 stalled power projects promoted by GVK, Lanco, Essar, Tata Power and GMR, among others, for addressing various hurdles in project execution. These projects had come up for discussions during a series of meetings chaired by Power Minister Piyush Goyal and steered by the Department of Financial Services (DFS) under the finance ministry. Private project developers made presentations on the projects selected by the government, to discuss the problems faced by them in execution. Of the 22 projects, 17 are coal-based, three are gas-based and two are hydro projects. The criteria of selection was not disclosed but priority was given to those facing fuel supply crunch and having mounting debt. (www.business-standard.com)

Delhi govt asks for coal block to set up power plant

July 9, 2015. To keep the power tariff low in Delhi, AAP government is working on getting coal block to set up power plant and has proposed to surrender 2,255 MW electricity it buys at a high rate from Central Public Sector Undertakings (CPSUs), Delhi Power Minister Satyendra Jain said. Power Minister said that Delhi's peak load is 6,000 MW and the lowest demand is 1,500 MW during the winters. Average comes around 3,000 MW but power purchase agreement is more than 6,000 MW which is not logical. (www.ibnlive.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Mexico battles bad timing in 1st sale of oil fields since 1930s

July 14, 2015. Mexico waited 77 years to invite foreign oil producers back into its borders. That was one year too many. The move to lure tens of billions of dollars from the likes of Exxon Mobil Corp. will be put to the test for the first time at an oilfield auction. With oil prices down by about half since last year, five of 38 potential bidders, including Glencore Plc, Noble Energy Inc. and even Mexico’s state-owned oil producer, have pulled out. President Enrique Pena Nieto moved to end the state monopoly after poor drilling infrastructure and technology failed to reverse a decade-long production decline that reduced government revenue. In the first attempt to bring foreign producers back into the country since the industry’s nationalization in 1938, Mexico will offer exploration rights to 14 shallow-water blocks to bidders including Exxon and France’s Total SA. The day of the auction, the government will disclose the minimum percentage of profits it will keep on each contract. The producers who offer the government the highest returns win. (www.bloomberg.com)

Russian oil and condensate production hits post-soviet record

July 14, 2015. Russian oil and condensate production reached a new post-soviet record of 10.7 million barrels a day in 2015, according to the latest analysis from Wood Mackenzie. The research firm claims that condensate production will increase by 50 percent by 2018, compared to 2014 levels, although Wood Mackenzie warns that Russia could face a sizeable production gap after 2020, when the impact of Western sanctions kick in. (www.rigzone.com)

WPX Energy enters oil-rich Permian basin with $2.3 bn buy

July 14, 2015. Natural gas producer WPX Energy Inc agreed to buy privately held RKI Exploration & Production LLC for $2.35 billion, snapping up oil-rich assets in the Permian basin on the cheap amid a steep drop in crude prices. WPX's Permian deal is the largest shale acquisition since Noble Energy Inc announced its $2 billion deal for Rosetta Resources Inc in May. WPX said it planned to increase the number of rigs in the Permian to six at the end of the year from four. With crude prices steadying at about the $50 mark, several oil producers including EOG Resources Inc, Concho Resources Inc and Devon Energy Corp are putting rigs back to work. WPX said the deal would increase its exposure to oil. The company expects oil to account for nearly a third of its output in 2016, compared with about 20 percent currently. The assets being acquired produce about 22,000 barrels of oil equivalent per day, the company said. (www.reuters.com)

OGDCL commences gas production from reti-2 well in Pakistan's Guddu Block

July 13, 2015. Canada-based Jura Energy Corporation (Jura) provided an update on its operations in the Zarghun South and Guddu Blocks in Pakistan. After provisional notification of tight and conventional gas prices by the Government of Pakistan, the operator of the Zarghun South Block has issued gas sales invoices relating to sales during the period from August 2014 through April 2015. Jura’s share of these gas sale invoices is approximately $4 million, payment of which is expected to be received in late July.

Current production from the Zarghun South Block is approximately 14.3 million standard cubic feet per day (MMcf/d) (Jura share 5.7 MMcf/d). Based on current daily production, and assuming crude oil priced at $70 per barrel, Jura’s share of monthly revenue from the Zarghun South Block is approximately $0.70 million. Jura holds a 40 percent working interest in the Zarghun South Block, which is operated by Mari Petroleum Company Limited. After tie-in with the existing gas pipeline infrastructure, production from development well Reti-2, in the Reti Lease, has commenced. Currently, the well is producing gas at the rate of approximately 3.1 MMcf/d (Jura share 0.33 MMcf/d). Current production from the Guddu Block, including production from Reti-2, is approximately 15.5 MMcf/d (Jura share 1.65 MMcf/d). Based on current daily production, and assuming crude oil priced at $70 per barrel, Jura’s share of monthly revenue from the Guddu block is approximately $0.13 million. Jura holds a 10.66 percent post commerciality working interest in the Guddu Block, which is operated by Oil and Gas Development Company Limited (OGDCL). (www.rigzone.com)

PetroVietnam to work with Murphy, ExxonMobil on oil, gas projects

July 13, 2015. Vietnam's national oil company (NOC) Vietnam Oil and Gas Group (PetroVietnam) signed agreements with two U.S. oil companies to strengthen cooperation in oil and gas projects in the Southeast Asian country. Murphy Oil, which sees the Vietnamese market as an area with long-term development potential and PetroVietnam as a credible local partner, is especially interested to participate in the development of the Block B gas project in the Malay-Tho Chu basin as well as a number of blocks in Cuu Long basin offshore Vietnam, while inviting the Vietnamese NOC to take part in its projects in U.S. Gulf of Mexico.

In June, PetroVietnam acquired full interest in Chevron Corp.'s companies in Vietnam, giving the firm operatorship of two offshore production sharing contracts (PSCs) and a stake in a gas development project, including Chevron Vietnam (Block B) Ltd., which is the operator of Block B where Chevron found gas in the PSC located off the coast of south western Vietnam more than a decade ago. ExxonMobil is currently working on preparations to draw up plans for the Ca Voi Xanh gas field development project by 2021, PetroVietnam indicated. (www.rigzone.com)

Downstream…………

Oil refiners' 'mini golden era' will end soon: IEA

July 10, 2015. A brief period of high profitability for the world's oil refineries is likely to come to an end as quickly as it began, the International Energy Agency (IEA) said. Weak crude oil and relatively high prices for gasoline, diesel and petrochemical feedstock have pushed up refining profits sharply over the last six months, helping oil companies cope with much lower profits from upstream production. In the first quarter of this year, combined profits for the likes of BP, Royal Dutch Shell, Exxon Mobil, Total and Eni from refining and trading represented 60 percent of total earnings, compared with 18 percent last year. Crude oil prices collapsed from $115 a barrel in June 2014 to a low near $45 in January. They have since recovered some ground but are still close to half their peak last year. But the IEA, which advises the world's biggest economies on energy policy, says this mini golden era will soon end. New refineries coming on stream this year and next, along with upgraded units at existing refineries, are set to reverse those gains. The bulk of the new capacity is coming in the United States, where refineries are adding pieces of equipment to enable them to process more oil from the shale boom, and also from China. In the Middle East, ADNOC's Ruwais refinery in Abu Dhabi is set to join two 400,000 barrels per day (bpd) mega units that officially launched in Saudi Arabia in 2014. The IEA estimates that global refining capacity will rise by 1.1 million bpd per year in 2015 and 2016, bringing worldwide capacity to just over 97 million bpd – a 2 percent increase. (www.reuters.com)

China to let independent refiners import more crude

July 9, 2015. China is opening its crude oil imports to buyers outside of the state-owned sector, and independent refiners could get approvals for up to 600,000 barrels per day (bpd) in shipments this year. The volumes that could go to the independents are 50 percent higher than what was expected when the policy was announced in February as more of the private refineries qualify for quotas, trading sources with independent and state refiners said. This could lead to the world's second largest oil consumer buying more crude in a market where values have been cut in half since mid-June last year by oversupply. Energy consultancy FGE expects China's crude imports to rise by 10 percent in the second half of 2015 versus the first six months, with shipments to be up by 7 percent both this year and next. China's crude imports hit a record 6.17 million bpd in 2014, a gain of nearly 10 percent. In the first five months of this year, the imports then rose more than 4 percent compared with a year ago to reach 6.5 million bpd. China's largest independent refiner Shandong Dongming Petrochemical won approval this week to import 150,000 bpd of crude, and Beijing has given an initial nod to Panjin Beifang Asphalt Fuel Co Ltd to import 140,000 bpd. (www.reuters.com)

Petrobras plans 62 percent Abreu e Lima crude-oil processing boost

July 8, 2015. Brazil's state-run oil company Petroleo Brasileiro SA (Petrobras) hopes to boost the crude processing capacity of its newest refinery 62 percent to as much as 120,000 barrels per day (bpd) in the second half of this year, the company's refining chief said. Petrobras plans to start testing higher processing levels at the Abreu e Lima, or RNEST, refinery near Recife, Brazil, this month, giving the company a chance to convince the local government to end environmental limits on production, the company said.

When RNEST began output in November, the state government of Pernambuco restricted crude throughput to 45,000 bpd, later raised to 74,000 bpd, on the first of two planned 115,000 bpd production lines, or "trains." The $20 billion refinery, one of the most expensive ever built, began operations four years behind schedule in late 2014. A second 115,000-120,000 bpd train was supposed to be operating by the end of 2018. (www.reuters.com)

Transportation / Trade……….

BHP says will take $2 bn charge on US onshore energy business

July 14, 2015. BHP Billiton said it will take a $2 billion impairment on its U.S. shale operations - the third writedown in three years. The gas-focused Hawkville field in Texas accounts for the substantial majority of the charge to be included in results for the fiscal year that ended on June 30, which BHP estimates will be around $2.8 billion on a pre-tax basis. BHP announced a $328 million write-down on the Permian field in February and a $2.84 billion impairment on the gas component of the shale division in 2012. BHP said efficiency gains in onshore drilling have reduced costs, which should help offset future price volatility in oil and gas prices. (www.reuters.com)

Shale gas supply held hostage by oil to drop by most in a year

July 14, 2015. After four years of record supply, America’s natural gas output is showing signs of weakness as producers retreat amid tumbling oil prices. Gas production from the seven largest U.S. shale basins will fall 0.6 percent to 45.1 billion cubic feet a day in August from a month earlier, the biggest drop since March 2014, the U.S. Energy Information Administration (EIA) said. EIA estimates have shown supply declines since June. The government’s forecasts signal the collapse in crude oil prices, which have plunged by about half over the past year, is reverberating in the natural gas market. As drillers shut wells in liquids-rich deposits from North Dakota to Texas, they’re also curtailing gas output from those reservoirs. That may prevent further price declines for gas, which has slid almost a third over the same period. The forecast drop in August gas output was led by the Eagle Ford shale, the biggest oil reservoir in the U.S., EIA data show. Gas supply there will slide 1.7 percent, while output from the Utica deposit in the U.S. Northeast, where propane and ethane help to subsidize gas drilling, is poised to climb 0.8 percent. (www.bloomberg.com)

Marathon to buy gas-rich MarkWest for $15.8 bn

July 13, 2015. The pipeline unit of refiner Marathon Petroleum Corp. plans to buy MarkWest Energy Partners LP for about $15.8 billion in stock and cash, the latest example of consolidation among companies that move and process fuel. Marathon rose to the highest since it debuted in 2011. The $15.8 billion transaction represents a major expansion for Marathon, which created its pipeline unit MPLX LP in 2012, the year after it was spun out of producer Marathon Oil Corp. The refiner has more than doubled in value since then as processors reap the rewards from low crude prices brought on by the shale revolution. (www.bloomberg.com)

BG sends first LNG cargo from newest Australian plant to China

July 13, 2015. BG Group Plc will send China its first liquefied natural gas (LNG) from its second Australian facility, with full output expected by the middle of next year. The LNG was loaded onto the Maran Gas Posidonia tanker at the Queensland Curtis site, BG said. The vessel is heading to Cnooc Ltd.’s Ningbo terminal, according to ship-tracking data. BG started the second production unit at Queensland Curtis LNG (QCLNG) on schedule, the first of seven projects set to turn Australia into the biggest producer of the fuel by 2018. QCLNG is the first LNG plant supplied with gas from coal seams. At full capacity the plant will produce enough LNG to load 10 vessels a month, or about 8 million tons a year, according to BG. All of the second train’s output will go into BG’s global portfolio. BG plans to supply as much as 8.6 million tons of LNG to China a year. The additional supply comes as LNG prices in Asia, the key consuming market for the Pacific producer, trade near a five-year low. Spot LNG for northeast Asia was at $7.40 per million British thermal units the week ended July 6, according to assessments by New York-based World Gas Intelligence. Prices dropped 31 percent in the past year as new supply combined with weakened demand in key markets such as Japan, Korea and China. (www.bloomberg.com)

Consortium lead for $10 bn TAPI pipeline project to be selected in September